warner music group

Page: 2

Warner Music Group (WMG) and Boston-based private equity firm Bain Capital are in advanced talks to form a joint venture worth around $1 billion to acquire music catalogs, according to three sources with knowledge of the talks.

Led by an equity investment from Bain, the joint venture will enable WMG to write bigger checks while spending less of its own money to acquire the catalogs it wants most.

A representative for WMG declined to comment, and a representative for Bain did not respond to a request for comment.

High interest rates and intense competition to own the rights to music from bands like the Red Hot Chili Peppers is leading major music companies to partner with outside investors to bolster their bids and assuage shareholders who may be put off by the price of a prized catalog.

Trending on Billboard

Some of the biggest catalog sales of all time occurred last year, with Sony Music acquiring Queen’s catalog and other rights for $1.27 billion. Earlier in 2024, Sony also acquired a stake in Michael Jackson‘s catalog for $600 million.

In many cases, music companies are looking to buy out an artist with whom they’ve worked for years and whose catalog they already partially own — like Sony Music did in 2022 when it bought Bob Dylan‘s master recordings. Owning more of the music’s intellectual property not only allows for more control over how the songs are used and licensed in the future, it prevents potentially embarrassing break-ups between record labels and their superstars.

The bidding wars have grown particularly pitched for master recording rights, which are more valuable today because streaming has extended the period that a song remains popular by several years, according to entertainment banking sources. Before streaming provided listeners with easy access to the entire universe of popular music and kept songs in regular rotation through playlisting, the revenue generated by a hit song’s master recording would fall off precipitously after its hype period waned.

A growing number of successful artists are also leaving major music companies to release music independently, have grown entire careers independently or have negotiated more favorable contracts with their major label partners, giving them more ownership of their master royalties. It all has some investors worried that the total addressable market of master royalties will grow more slowly in the future than in prior decades.

In early 2024, Universal Music Group (UMG) invested roughly $240 million to partner with Chord Music, a catalog investment company majority-owned by Dundee Partners, to give it similar flexibility to acquire catalogs off of its balance sheet and with financial help. The agreement gave UMG the administration and distribution business for the 60,000 music copyrights owned in Chord, and, in exchange for throwing its power as the world’s largest music company behind those assets to make them make more money, Dundee Partners became UMG’s long-term co-investment partner.

Sony Music has also partnered with institutional investors to help finance acquisitions, including Apollo, and WMG has explored investing in catalogs through outside vehicles as an early investor in both Tempo Music Group and Influence Media.

One of the financial engineers involved in structuring UMG’s deal with Chord was Michael Ryan-Southern. At the time, Ryan-Southern led Goldman Sachs’ investment banking team focused on the music industry. WMG hired Ryan-Southern last summer to serve as its head of corporate and business development, overseeing mergers and acquisitions.

Ryan-Southern’s team was key toWMG’s acquisition of Tempo Music, a $450 million deal announced on Feb. 6 that gives Warner the rights to songs by Wiz Khalifa, Florida Georgia Line and Brett James.

WMG’s ties to Bain Capital date back to 2004 when Bain was part of the investor group — also including Thomas H. Lee Partners, Edgar Bronfman, Jr. and Providence Equity Partners — to buy WMG for what was then $2.6 billion cash.

Warner Music Group CEO Robert Kyncl says the major is willing to forgo buying an indie distributor if it can achieve the same long-term gains by building in-house what would likely cost hundreds of millions to acquire.

“I’ve looked at all distribution companies over the last 18 months … and what I can tell you is that we’re not willing to grow this at all costs,” Kyncl said. “We have an incredible technology team … and they have been building features already for a year and a half. This way you get to the same outcome much more efficiently.”

The Warner Music Group (WMG) head made the comments during a wide-ranging conversation at a Morgan Stanley conference last week that touched on tech improvements and the motivations for WMG’s management overhaul last September, as well as the company’s deal with Spotify and Kyncl’s conviction that there is still room to raise streaming subscriptions prices in the U.S. and elsewhere.

Trending on Billboard

Kyncl, whose comments on mergers and acquisitions have been under a microscope since WMG abandoned a bid to acquire Believe last April, admitted that building technology in-house will take longer and doesn’t come with the immediate market share gains that accompany an acquisition.

The new hires and organizational changes Kyncl oversaw in the past two years are aimed at increasing WMG’s market share, he says. Under Ariel Bardin, who joined WMG in February 2023 as president of technology, the company has been working to fix the “boring things” in its core tech and digital supply chain to “ensure the stability of systems and [make] sure they could handle much higher volume for the future” without adding staff. It has also worked on WMG’s artist-focused tech services, like its client portal and the pipelines that can accelerate royalty payments.

Several rounds of staff cuts and a full-blown corporate reorganization removed multiple layers of management, giving Kyncl more direct contact with leaders like Alejandro Duque, president of Warner Music Latin America, and Elliot Grainge, the new CEO of Atlantic Music Group.

The company reported in February that these moves freed up money for investments — such as the $450 million acquisition of Tempo Music‘s catalog — and helped Atlantic claim a half-a-percentage point market share expansion.

Another of Kyncl’s hires, Carletta Higginson — the former Google executive who was hired as chief digital officer — was key to WMG’s direct deal with Spotify, which Kyncl says included assurances of more frequent price increases that distributors can profit from.

“In an industry where we are all tied at the hip together, it is important to approach it collaboratively and build for the future together,” he said. “We have a healthy set-up together with incentive to grow.”

Saying that WMG’s market share has improved since he joined the company, Kyncl called out promising upcoming releases from Ed Sheeran and Lizzo that are scheduled to come out later this year. Because more than half of WMG’s revenue comes from outside the U.S., Kyncl said the company’s global market share, particularly in certain countries, is as important as its U.S. numbers.

For the third straight year at the annual Morgan Stanley event, Kyncl sounded an optimistic note on streaming subscription prices thanks to “the incredible resilience of music.”

“I think there’s quite strong evidence that there’s a lot of room to grow on pricing, especially in … mature markets,” he said.

Shareholder advisory groups Institutional Shareholder Services (ISS) and Glass Lewis advised Warner Music Group investors to vote against the election of certain board members at the company’s annual meeting on Tuesday, including Val Blavatnik and Lincoln Benet.

The groups say that insider status — Val is the son of WMG owner Len Blavatnik, and he sits on the executive compensation committee — and WMG’s multiple classes of stock present risks for outside investors. WMG says its focused on creating value for all its investors and that most of its directors are independent should allay any investor concerns.

Investor opposition to these directors’ election would need the support of Len Blavatnik to succeed. His Access Industries and its affiliates own more than 70% of WMG’s stock controlling more than 97% of the voting power in WMG. Nonetheless, ISS and Glass Lewis’s concerns put a spotlight on the corporate governance requirements WMG can skirt by being a controlled public company.

Trending on Billboard

For example, WMG is listed and trades on the NASDAQ stock exchange and is exempt from NASDAQ’s requirement that companies traded on its exchange have a majority of independent board members appointed to the committee that decides executive compensation.

A spokesperson for WMG says, “We welcome input from our shareholders, with a governance structure that goes beyond what is required of controlled companies, including the majority of our directors being independent. Our board and management team are focused on creating long-term value for all investors.”

Shareholder advisory groups like ISS and Glass Lewis exist to research publicly traded companies’ proxy statements and make voting suggestions for investors ahead of annual shareholder meetings. Both groups say in their 2025 benchmark policy guidelines that they broadly support board independence, but they agree controlled companies should be exempt from certain requirements, such as having an independent executive compensation committee, because “controlled companies serve a unique shareholder … whose voting power ensures the protection of its interests,” Glass Lewis’s policy states.

Glass Lewis advises against voting for the election of Val Blavatnik, 27, in its report because of his status as an insider on the compensation committee. Val holds the title of senior director, business development of Warner Chappell Music, and he was elected to WMG’s board in April 2023.

As the chief executive of Access Industries, Glass Lewis considers Lincoln Benet, 61, an affiliate and non-independent board member, and they advise against voting for his election because WMG’s multi-class share structures gives him disproportionate voting rights.

In its report, ISS advises voting against the of seven of WMG’s 11 board members—Val Blavatnik, Lincoln Benet, Len Blavatnik, Donald Wagner, Noreena Hertz, Ynon Kreiz and Cecilia Kurzman. For Val Blavatnik, Benet and Wagner, it raises similar concerns to Glass Lewis about their seats on certain board committees as non-independent members. For the remainder of the directors, ISS raises concerns about their support for a “dual class structure that is not subject to a reasonable time-based sunset provision.”

It also advises voting against Len Blavatnik because “his ownership of the super voting shares provides him with voting power control of the company.”

ISS has advised voting against the majority of WMG’s board members for at least the past three years, and it has taken similar stances against the election of board members of Meta and Alphabet.

Five out of WMG’s 11 board members, or 55%, are independent, including its chairman, nominating and corporate governance committees.

It is worth noting that the WMG chief executive Robert Kyncl’s total compensation of $18.6 million declined 9% from the year prior.

For more than a year, record labels and publishers have seen investors pour into streaming stocks — namely Spotify — while downplaying the potential benefits rights owners will accrue from rising subscription prices. Now, Universal Music Group (UMG) and Warner Music Group (WMG) are getting some attention as analysts are optimistic about the terms of new licensing agreements Spotify reached with the companies.

WMG shares rose 10.9% to $36.20 a week after the company released fiscal first-quarter results. This week, the stock got a boost when Citi raised its WMG price target to $42 from $34 and upgraded the stock to a “buy” rating from “neutral.” As Morningstar explained last week, WMG is a “primary beneficiary of the ongoing growth” in the music industry. At $36.20, WMG shares have gained 17.0% in 2025 and are only slightly below their 52-week high of $36.64 set in February 2024. WMG shares fell 13.4% in 2024.

Trending on Billboard

At UMG, shares rose 7.1% to 28.89 euros ($30.32), the stock’s highest closing price since May 27, 2024. Morgan Stanley analysts have been making the case that UMG is undervalued given Spotify’s soaring share price and this week raised its UMG price target to 42 euros ($44.07) from 36 euros ($37.78). Recent licensing deals with Spotify and Amazon “increases our confidence that its subscription growth will accelerate” from approximately 5% at the start of 2025 to “closer to 15%” at the beginning of 2026, they wrote in a Monday (Feb. 10) investor note. After falling 4.2% in 2024, UMG shares are up 20.8% in 2025.

WMG and UMG were among the best performers on the 20-company Billboard Global Music Index (BGMI) this week. The BGMI rose 4.6% to a record 2,755.53, bringing its year-to-date gain to 29.7%. Only two stocks lost ground while one was unchanged and 17 posted gains for the week. The index outperformed the Nasdaq composite (up 2.6%), the S&P 500 (up 1.5%), the FTSE 100 (up 0.4%), China’s SSE Composite Index (up 1.3%) and South Korea’s KOSPI composite index (flat versus the previous week).

Live Nation reached an all-time high of $152.94 on Friday (Feb. 14) before closing at $153.76, up 3.7% for the week. Ahead of the concert promoter’s earnings results on Thursday (Feb. 20,) Wolfe Research increased its price target to $175 from $160 and Goldman Sachs raised it to $166 from $148.

Streaming services fared well, too. Spotify rose another 2.4% to $637.73 and reached a new all-time high of $652.63 on Thursday (Feb. 13). Fewer than seven weeks into 2025, Spotify shares have gained 36.7%. Elsewhere on the streaming front, Cloud Music rose 9.1% to 142.20 HKD ($18.01) and Tencent Music Entertainment gained 8.7% to $13.63.

Music streamer LiveOne had the week’s biggest loss after falling 20.5% to $0.93. On Thursday, the company announced that its revenue fell 6% in the fiscal third quarter. LiveOne also lowered revenue and earnings guidance for its full year, causing shares to end the day down 18.6%. The other streaming loser was Abu Dhabi-based Anghami, which fell 2.7% to $0.71.

Satellite radio broadcaster SiriusXM shares rose 6.6% to $27.11, bringing its year-to-date gain to 21.2%. This week, Deutsche Bank raised its price target to $27 from $25.

Most K-pop companies finished the week in positive territory. HYBE shares rose 5.8% and reached their highest mark since July 2023. SM Entertainment, which reported a 9% increase in revenue this week, increased 5.4%. JYP Entertainment improved 4.2% and YG Entertainment fell 1.3%.

Warner Music Group signed an expanded licensing agreement with Audiomack that covers 47 new countries including the U.K., France, Italy, Germany, the Caribbean, Mexico, Uganda and Zimbabwe. The two companies first struck a licensing deal in 2019.

Exceleration Music acquired Mack Avene Music Group, a collection of independent jazz labels that has released the works of artists including Christian McBride, Cécile McLorin Salvant and Kenny Garrett. Following the acquisition, Mack Avenue’s operations will be integrated with those of jazz label Candid Records, which Exceleration previously acquired, to form Exceleration’s overall jazz group. The group will be led by current Mack Avenue president Denny Stilwell and boast a team featuring other key executives from both Mack Avenue and Candid.

Triller Group scored a $50 million equity funding round from institutional investors, secured through a private placement consisting of common stocks and warrants, with the company’s shares priced at $2.20. The money will be used to unveil new AI tools, enhance the Triller platform’s livestreaming capabilities and revamp its video editing suite. An additional fundraise is expected later this year.

Trending on Billboard

Musical AI, a rights management platform for generative AI, raised an initial investment of $2.1 million led by Canadian VC firm Build Ventures. Select angel investors also contributed, with a seed round expected to close in the first half of this year. According to the company, its attribution model can determine what percentage of a generated output came from what data source, allowing rightsholders to “monitor, take down and sunset usage” of their works. “If we want AI training to be sustainable and ethical, we need attribution. Musical AI is the only company offering it in the audio space,” said Musical AI CEO Sean Power in a statement. “I’m thrilled that discerning investors are backing our efforts to transform how AI is trained.”

Downtown-owned distributor FUGA announced an expansion in the Asia-Pacific region via several new signings and partnerships across Indonesia, India and the Philippines. In Indonesia, FUGA partnered with Jakarta-based label Maspam Company, whose roster includes Pamungkas and Prince Husein; and label/distributor Sintesa Pro, home to Batas Senja. In India, it partnered with digital and music entities including GK Digital, whose catalog includes artists like Karan Randhawa and Max Singh; and music management platform DroomMusic, home to Gajendra Verma. And in the Philippines, it signed GMA Music and battle-rap artist Pricetagg.

Primary Wave Music expanded its relationship with The Piano Guys, with its Green Hill Productions (a member of the Sun Label Group) acquiring an additional stake in the instrumental group’s master audio catalog. Green Hill also signed a new distribution deal with the group that will see it “playing a more active role in the strategic growth of The Piano Guys’ catalog and new releases,” according to a press release.

Live Nation Urban invested in Breakr, a creator marketing and tech platform that allows record labels, creative agencies, brands and more “to discover, select, pay, and contract with independent online content creators for promoting songs, products, and services,” according to a press release. The investment will be made via a new venture fund formed by Live Nation and Live Nation Urban called the Black Lily Capital Fund, which is focused on providing capital and resources to Black founders of companies operating in or adjacent to the live music industry, with a focus on startups in pre-seed and seed round stages. Along with the investment announcement, Breakr unveiled a new instant pay system called BreakrPay that allows companies to fund campaigns instantly, allowing influencers to be paid in real-time.

Virgin Music Group Nigeria partnered with Ghanian distribution and integrated label services company RainLabs. Under the deal, Virgin will help provide comprehensive support for African artists through digital distribution, marketing, creative production and brand partnerships. RainLabs’ roster includes Joey B, Cina Soul and Baaba J.

Warner Music Group’s ADA distribution and artist services arm partnered with Berlin-based neoclassical label Aemeralds, which specializes in building composers’ brands through social media marketing, composer camps and playlists. Under the agreement, Aemeralds will have the ability to partner with the Warner Classics marketing team for local services and expertise globally.

Under an expanded naming rights partnership between the City of Bakersfield, Calif., and Dignity Health, the downtown complex previously known as Centennial Garden and then Mechanics Bank Arena will now be rebranded as Dignity Health Arena, Theater and Convention Center beginning next month. The complex features a 10,000-capacity arena, 3,000-seat theater and 17,840-square-foot convention center.

Warner Music Group (WMG) announced Tuesday (Feb. 11) that it’s completed its full acquisition of Africori, one of Africa’s leading digital music distribution, rights management and label services companies. Founded in 2009 in Johannesburg, South Africa, Africori touts itself as “one of the biggest independent songbooks in Africa,” including music by Kelvin Momo, Master KG […]

Warner Music Group has expanded its corporate development team by appointing Alfonso Perez-Soto as executive vp of corporate development, focusing on recorded music, and Michael LoBiondo as senior vp of corporate development, focusing on publishing. Both will report to Michael Ryan Southern, executive vp and chief corporate development officer, who has led WMG’s global M&A activities since August.

The company said this new structure provides WMG with dedicated dealmakers for each side of the business, enabling targeted investments and acquisitions across music rights and technology. Due to this reset, the leaders of Warner Music’s Emerging Markets territories, who previously reported to Perez-Soto, will now report directly to Simon Robson, president of Europe, the Middle East and Africa, recorded music.

Perez-Soto has spent much of the last two decades at Warner Music, having joined the company in 2005 as vp of business development for Latin America and US Hispanic markets. He was bumped up to senior vp in 2012 and in 2017 originated the position of senior vp, global business development and chief commercial officer, emerging markets. A year later he was elevated once again to executive vp of Eastern Europe, Middle East and Africa, and in 2021 was promoted to president of emerging markets. In that role, he has designed and implemented a growth strategy based on M&A, geographical expansion and organic artistic success that significantly expanded Warner’s footprint in these emerging territories. Earlier in his career, Perez-Soto held stints at Telefonica, Universal Music Group and Nokia.

Trending on Billboard

LoBiondo has been serving as head of business development for Warner Chappell Music, WMG’s music publishing arm, since 2021. In this role, he’ ha’s been responsible for identifying and executing strategic acquisitions and partnerships to benefit the publisher’s frontline songwriters and its iconic song catalog. Prior to this, he held various positions at WMG, where he had a hand in numerous major initiatives, including the acquisition of Parlophone Label Group and several Series A music technology investments. Between his tenures at Warner, LoBiondo worked at the artist development company mtheory. He began his career as an analyst at Goldman Sachs.

Southern expressed confidence in Perez-Soto and LoBiondo, calling them “tenacious and curious leaders with a deep understanding of the music industry and its key players… We’ve committed to grow WMG through a mixture of organic and M&A activity. Now we’ve got a dedicated dealmaking beacon for each set of rights that’ll enable us to continue to improve our service to artists and songwriters.”

What a difference a year can make.

Warner Music Group said on Thursday that revenue from its first fiscal quarter fell 5% to $1.67 billion from a year ago, as the company suffered tough comparisons to a period last year when it still had BMG as a physical and digital distribution client and enjoyed a $30-million boon from a digital licensing renewal deal.

But the third-biggest major music company also showed that the deep staffing cuts and wind-down of certain businesses over 2024 freed up money for investment — such as the $450-million acquisition of Tempo Music‘s catalog — and growth, like Atlantic’s half-a-percentage point market share expansion.

WMG’s quarterly results — which included a nearly 40% decrease in operating income and $27 million in restructuring costs and impairment charges — depict a company deep in transformation. Chief executive Robert Kyncl is trying to increase efficiency in legacy businesses and technology, while standardizing its sprawling global network, and striking more lucrative deals with streaming platforms.

Recorded music revenue in the first fiscal quarter, which ended Dec. 31, 2024, fell 7% to $1.35 billion from last year’s quarter, as BMG’s termination of its distribution deal created a $32 million drag (evenly split between streaming and physical revenue). Last year’s quarter also included the extension of one artist’s licensing agreement worth $75 million, and the $30-million renewal of a digital partner’s license.

Trending on Billboard

WMG says if you strip those three things out, total revenue rose 3.4%.

Overall, digital revenue and streaming revenue each fell by around 2%.

Adjusted operating income before depreciation and amortization (adjusted OIBDA)–which measures the profitability of a company’s core businesses–fell 19.5% to $363 million, and adjusted OIBDA margin fell to 21.8% from 25.8% in the prior-year quarter. If you take out the negative impacts of the licensing agreement and digital partner renewal, the company said its adjusted OIBDA fell by just 0.3% and adjusted OIBDA margin decreased 0.8 percentage point.

The company said adjusted OIBDA margin was also dragged down by the 8% rise in the value of the U.S. dollar since last year’s presidential election. (Almost 60% of Warner’s income is earned in euros and other currencies that trade against the dollar, according to the company.)

“All of these impacts will stabilize over time,” Kyncl said on a call with analysts discussing the earnings. “We’re confident about the future. Our goals are clear: increase our share of the pie, meaning market share; grow the pie itself by increasing the value of music; and become more efficient, providing greater cash flow, both for re-investment and for shareholder return.”

The company’s net income was up nearly 25% to $241 million, boosted by foreign exchange hedging activity and the sale of a $29-million of an investment. Free cash flow was up 12% to $296 million.

Other highlights from the company’s earnings and conference call:

» Within Recorded Music, digital and streaming revenue both fell by 3.9% and 3.7%, which reflects a 2% decline in subscription revenue and an 8.2%-decline in ad-supported revenue. If you strip out BMG’s termination and the digital partner’s license renewal, the company says recorded music streaming revenue was up 1.5% and subscription revenue increased 5.3%, while ad-supported revenue still fell by 7.9%. Nonetheless, physical revenue rose 7.8% thanks to the strength of releases by Linkin Park, Charli XCX, Teddy Swims, Mariya Takeuchi and Benson Boone.

» Music publishing revenue rose 6.3% to $323 million from growth in digital, performance and other revenue, partially offset by lower mechanical revenue.

» Warner completed multi-year publishing and recorded music licensing deals with Amazon and Spotify over the past year, Kyncl said, though he declined to provide much detail. The deal with Spotify notably includes a new publishing agreement with a direct licensing model with Warner Chappell Music for the United States and several other countries. “There’s more work to do with others and for all of this to cycle through, but this is a really great step in the right direction.”

» Atlantic’s market share ticked half a percentage point up, a small win Kyncl attributed to the growing investments made in A&R last year. He said the investments came as a result of money left over after it made” organizational changes and investments into technology … [and] exited some non-core businesses.” Kyncl later said, “Our goal was to reinvest the majority of those savings into strategically important initiatives that will propel our business forward. This enabled us to increase our A&R investment by double-digits last year and this year.”

» Kyncl said buying Tempo is “a great example” of the company’s acquisition strategy. “As we become more efficient, we are creating a virtuous cycle that will enable greater reinvestment that delivers accelerated growth.”

Spotify and Warner Music Group have signed a new multi-year agreement covering both recorded music and music publishing, following Spotify’s similar deal with Universal Music Group earlier this year. The partnership, announced today (Feb. 6), aims to drive innovation and increase the value of music for artists, songwriters and fans.

The agreement focuses on advancing audio-visual streaming, expanding music and video catalogs, and, notably, introducing new paid subscription tiers with exclusive content bundles. It also reinforces “artist-centric” royalty models that reward artists for attracting and engaging audiences. Additionally, the new publishing deal introduces a direct licensing model with Warner Chappell Music in several countries, including the U.S.

In a statement, WMG CEO Robert Kyncl emphasized the collaboration’s role in expanding the music ecosystem and delivering value to artists and songwriters.

Trending on Billboard

“It’s a big step forward in our vision for greater alignment between rights holders and streaming services,” Kyncl said. “Together with Spotify, we look forward to increasing the value of music, as we drive growth, impact, and innovation.”

Spotify CEO Daniel Ek highlighted 2025 as a pivotal year for Spotify’s innovation, “and our partners at Warner Music Group share our commitment to rapid innovation and sustained investment in our leading music offerings. Together, we’re pushing the boundaries of what’s possible for audiences worldwide—making paid music subscriptions more appealing while supporting artists and songwriters alike.”

During Warner Music’s August 2024 earnings call, Kyncl addressed the relationship between labels and digital service providers and refuted the notion that they are entrenched adversaries. “I know that investor attention has recently been focused on the dynamics between labels and DSPs, with some speculating that we’re adversaries playing a zero-sum game,” he said. “That’s simply not the case. We’re actively engaged with our partners around ways to drive growth for all of us.”

WMG announced its new pact with Spotify moments before reporting results for is fiscal first quarter, which saw a dip in revenue that it attributed to the termination of its distribution agreement with BMG, among other factors. The label group on Thursday also announced that it had agreed to purchase a controlling stake in Tempo Music Investment, a catalog company that owns rights to songs by Wiz Khalifa, Florida Georgia Line and others, in a deal sources say is worth several hundred million dollars.

As of January, Warner Music Group (WMG) executive vp/general counsel Paul Robinson has worked in the legal department of the company for 30 years. During that time, he has seen “three different owners, seven CEOs and we’ve gone private and public two different times,” he says. “There also have been all of these macro changes in the music business” — which is something of an understatement. What hasn’t changed much, he says, is the culture of the company: “It’s always been an artist- friendly, songwriter-friendly culture, and we’ve always had a great relationship between recorded music and publishing.”

Robinson was slated to receive the 2025 Entertainment Law Initiative Service Award on Jan. 31 at the organization’s annual Grammy Week luncheon at the Beverly Wilshire Hotel. But since the event was canceled in the wake of the Los Angeles wildfires, he will receive the honor at next year’s gathering.

Trending on Billboard

Robinson started at WMG in 1995 after working at Mayer Katz Baker Leibowitz, which at the time did a significant amount of the label group’s legal work. Robinson got the top job in 2006 and helped steer the company through the worst years of the music business, to its 2013 acquisition of Parlophone Label Group from Universal Music Group, and into the streaming-led recovery and a successful 2020 initial public offering.

Like the rest of the industry, WMG is now at a point where streaming growth in developed markets is slowing and the challenges of artificial intelligence (AI) loom — and in a way that will especially test it as the smallest of the three majors. Which is why, Robinson says, “From my point of view, it’s important to be perceived as, and to be, the most artist-friendly, songwriter-friendly company” — a message that WMG sent by being the first major to adopt artist-friendly policies on “digital breakage” in 2009 and on sharing gains from equity sales, such as with Spotify in 2016. “Jac Holzman, when he started Elektra, used to have this love-and-affection clause in his contracts that said the label will treat artists with love and affection and the artist will treat the label with a modicum of respect,” Robinson recalls. “And it’s great because it brings to mind the imbalance: Artists will not always love their labels, but we always have to love them and we hope that they at least respect us.”

Your father is Irwin Robinson, the prominent publishing executive who ran Chappell/Intersong and then EMI Music Publishing. Did you purposefully decide to follow him into the same business?

That was how it ended up, but they say there are no accidents. In some ways, I was afraid to go into the music business. There were huge shoes for me to step into. I thought I wanted to be a doctor, and then I worked at a hospital one summer and I decided, “Maybe I don’t want to be a doctor.” I was a huge music fan as well as a singer, and I thought, “I’ll just go to law school and see what happens.” Maybe I was avoiding it.

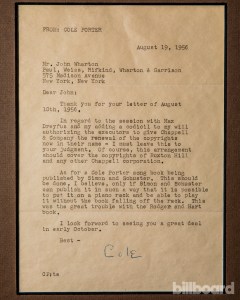

Robinson’s father gave him this 1956 letter from legendary songwriter-composer Cole Porter to his lawyer, John Wharton, at Paul Weiss Rifkind Wharton & Garrison. “I like it because in a single letter, he talks about the relatively important issue of assigning his renewal rights to Chappell and the relatively unimportant issue of a songbook being able to stay on a piano rack,” he says. “God is in the details.”

Krista Schlueter

Billboard can reveal that you were the singer in a new wave band.

I was one of the singers. We were called The Doctors. The musicians in the band all wore scrubs, and we were the hit of Williams College campus for a year. In fact, they asked The Doctors to play at my college reunion and we’re doing it.

You’re one of the few people who has been in the same department at the same company since the Napster era. Any lessons from then on how the industry should deal with AI?

Probably to lean into change. Maybe there were people in 1999 at Warner Music Group who saw peer-to-peer coming, but I feel like we were caught very much off guard, and I don’t think that’s been the case with AI. Also, with peer-to-peer, there wasn’t a great deal around until iTunes in 2003, so we’re also in a better place that way. There are services we can strike deals with now.

What are the best- and worst-case scenarios for the industry for generative AI?

[That’s] probably less of a general counsel question than [one for] business development, but I think the worst-case scenario is that somehow it’s determined that you don’t need permission to train an AI model and the market is flooded with a huge volume of content that dilutes legitimate music, in the same way services are flooded now with music that very few people listen to — but in turbo. The best case is that AI becomes an incredible tool for artists and songwriters and lets them up their game and release content in languages they don’t speak.

“This is a 1994 photo from my wedding of

my then-partners from Mayer Katz Baker Leibowitz & Roberts and their wives,” he says. “WMG was Mayer Katz’s biggest client.”

Krista Schlueter

The streaming model seems to be evolving. There’s talk of “Streaming 2.0.” What kind of terms are you looking for now in streaming deals?

Trying to lock in per-subscriber minimums and reduce discounts for family plans and so on. That’s where we are focused.

When you started in the music business, there were six major labels. Now there are three. Does that change the nature of competition?

Even though there are only three majors, it feels like it’s never been more competitive. All you have to do is look at the change in artist deals over time.

I’m assuming you mean that deals now favor artists? Is it harder to invest in them under these circumstances?

No. Every year, our A&R spend increases. When I started, we were getting eight-album deals, but we were signing artists where, because there was no internet, their following was probably their hometown and they needed a huge amount of development. Today, we hardly ever sign an artist that doesn’t have a significant social media presence, and those artists don’t need as much development.

“Believe it or not,” Robinson says, he has had the same office chair for 30 years. “It definitely looks like a chair from 1995, but I just can’t seem to let go of it.”

Krista Schlueter

Now you also compete with distribution deals.

From an artist’s point of view, there’s a trade-off. In a distribution deal, you’re getting a bigger piece of the pie, but you’re getting less development and it’s a shorter-term relationship, so there’s probably not going to be as much investment. If you sign a frontline label deal, you’re committing to more albums and you’re getting a smaller piece of the pie, but you are getting a whole team of people behind you to develop your career. The great thing is that artists have more choice than ever.

How do you make sure artist contracts feel like win-win deals?

Deals get renegotiated all the time if they’re out of sync. If there’s an artist with a small record deal that has tremendous success, the economics of their next albums are going to look different. We’re in the personal services business and we’re in the relationship business. We want to maintain the best relationships with artists and songwriters.

Is there a deal you did that you’re especially proud of?

When we bought Parlophone Label Group, that was a huge regulatory fight, and I would say it was a win-win. UMG had to sell Parlophone, we were the best buyer, and they were looking for a good price, which today looks like a really low price. We paid about $800 million, probably about a seven-and-a-half times multiple, which at the time was huge. We were much more U.S. weighted in our revenue, and we bought a bunch of European assets. So it rebalanced us in terms of geography, and we acquired great repertoire and some great artists.

What has been some of the most memorable litigation that you have overseen? The case in which Led Zeppelin was sued for copyright infringement by a trustee for the estate of Spirit frontman Randy Wolfe comes to mind.

The exciting thing about the Zeppelin case was not only winning, after having been dealt a bunch of blows — we won in trial court and we were reversed — but changing the trajectory of copyright infringement litigation. It was a beat-back of what was, I think, the bad law of the “Blurred Lines” case.

Robinson never met Prince, but he is such a big fan that two people gave him signed limited-edition lithographs of the New Yorker cover commemorating the artist’s death. “He was an incredibly distinctive artist. For his first album, Warner Records let him do everything. They basically said, ‘Go in the studio and do it.’ That didn’t happen much in 1977.”

Krista Schlueter

This story appears in the Jan. 25, 2025 issue of Billboard.

State Champ Radio

State Champ Radio