The Ledger

Page: 2

According to Live Nation CEO Michael Rapino during the company’s earnings call on Thursday (May 1), every chief executive is being asked the same question this earnings season: Are you feeling a consumer pullback?

It’s a reasonable query given the worsening state of the economy. U.S. gross domestic product decreased at an annual rate of 0.3%, the U.S. Bureau of Economic Analysis announced on Tuesday (April 30). And on Thursday, news broke that U.S. joblessness claims for the week ended April 26 surged beyond expectations. Earlier in April, the University of Michigan reported that its consumer sentiment score fell to 57.0 in March, down from 71.8 in November. That puts the closely watched measure on par with scores during the 2009 fallout of the U.S. housing crisis and in August 2011, as consumers feared a stalled recovery.

But on Friday (May 2), a reprieve from the bad news arrived in the form of a better-than-expected jobs report. And judging from comments during this week’s earnings calls, many music companies remain confident that their businesses will weather whatever storms develop in 2025.

Trending on Billboard

“We haven’t felt [a pullback] at all yet,” Rapino said. Whether it’s a festival on-sale, a new tour or a standalone concert, Live Nation has seen “complete sell-through” and “strong demand” that surpasses 2024’s record numbers, he added: “So, we haven’t seen a consumer pullback in any genre, club, theater, stadium [or] amphitheater.”

To see how Live Nation fared during the last recession, you’d have to go back to 2009. The U.S. housing crisis had shaken the economy and GDP shrank 2.0% that year, but Live Nation’s revenue increased 2.3%. Then, as the economy rebounded in 2010, the company’s revenue jumped 21.1% in 2011.

Of course, live music took a nosedive during the pandemic, but the drop-off in 2020 and 2021 was caused by a decrease in the supply of concerts, not a dip in demand for live music. When artists returned to touring, fans showed up in record numbers.

Some parts of the economy can be trusted to stumble during a downturn. Case in point: U.S. advertising revenue fell 14.6% in 2009 and dipped 5.4% in 2020. Brands are quick to cut their ad spending when they anticipate a pending sales decline. For example, car dealerships frequently advertise on TV and radio, but cut back as auto sales fell 17.6% in 2009 and 20.3% in 2020.

A decline in advertising is harmful to some parts of the music business. Radio companies have struggled with weak ad revenues in recent years, and their stock prices have taken a beating. Through Friday, iHeartMedia’s stock price is down 50% year to date, and Cumulus Media, which de-listed from the Nasdaq today, has lost 82%.

But music is a “counter-cyclical” business, meaning it doesn’t follow larger economic trends, and the popularity of subscriptions has helped insulate the music industry from economic woes. It’s widely believed that consumers simply won’t part with their favorite music service. In fact, $11.99 for a month from Spotify or Apple Music, although a few dollars higher than two years ago, is considered by top music executives to be underpriced.

During Spotify’s earnings call on Tuesday, CEO Daniel Ek said “engagement remains high, retention is strong” and the ad-supported free tier gives users a way to remain at Spotify “even when things feel more uncertain” — not that Ek is uncertain about the company’s future. “I don’t see anything in our business right now that gives me any pause for concern,” he said flatly.

Universal Music Group (UMG) is on the same page as Ek. CEO Lucian Grainge attempted to ease investors’ concerns by explaining that he has witnessed music weather numerous recessions. “Music has always proven to be incredibly resilient,” he said during an earnings call on Tuesday. “It’s low cost, high engagement and obviously a unique form of entertainment.” In addition, added chief digital officer Michael Nash, UMG’s licensing agreements include minimum guarantees that provide “very significant protection against digital revenue downside risk this year.”

There’s always a chance that unforeseen events or a particular confluence of factors will ruin music’s winning streak. With subscription prices rising, a possible “superfan” subscription tier on the horizon, ticketing prices not getting any cheaper and tariffs increasing the costs of music merchandise, consumers may reach a breaking point. MIDiA Research’s Mark Mulligan argued this week that superfans are being “pushed to the limit” and concertgoers don’t have an unlimited ability to absorb higher ticket prices.

So far, however, the evidence suggests music fans’ spending is continuing unabated. Live Nation says its various metrics — ticket sales, deferred revenue for future concerts — point to another “historic” year in 2025. Rapino added that the company’s clubs and theaters haven’t reported a decrease in on-site spending. Part of that could be that Live Nation carefully curates an array of food and beverage options that maximize per-head revenue. But a more likely explanation is that people need entertainment now more than ever.

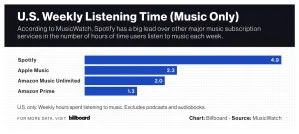

Spotify gets more engagement — much more — than its competitors in the music subscription space.

In the second quarter of 2024, the average Spotify Premium listener spent 4.9 hours per week listening to music, according to a MusicWatch survey of U.S. consumers that excluded time spent listening to podcasts and audiobooks. That easily bested Apple Music (2.3 hours), Amazon Music Unlimited (2.0 hours) and Amazon Prime (1.3 hours). These ratios have been fairly consistent over the past five years, with Spotify having an approximately 2.0 to 2.5-times advantage over its nearest competitor.

Billboard

Last year, Spotify executives described “the Spotify machine” as multiple verticals working together to give consumers more content choices and increase engagement. Podcasts, which are a natural fit for a music service built on audio advertising, offered the promise of keeping people listening longer. The same goes for audiobooks, which Spotify began streaming in the U.S. in 2023. Product features such as Spotify Wrapped and Discover Weekly are also intended to keep people listening.

Judging from statements made by Spotify’s executives, the Spotify machine is working as intended. In November, CEO Daniel Ek said that “overall, Spotify keeps bringing up engagement and bringing down churn,” the term for a subscription service’s subscriber losses. In July, Ek said the company was seeing “healthy MAU [monthly active user] engagement trends year-over-year.”

Trending on Billboard

But Spotify’s own numbers show its average global user’s listening time has remained steady over the past six years. According to data available in Spotify’s annual reports, the service had an average of 24.8 hours per monthly average user (MAU) per month in 2024, down slightly from 25.2 hours per month in 2023 and on par with the preceding four years (24.6 in 2022, 24.4 in 2021, 24.9 in 2020 and 25.5 in 2019). These listening averages cover music, podcasts and audiobooks.

Billboard

So, based on Spotify’s publicly available figures for global listening hours and MAUs, the average user’s listening time has not increased as hundreds of millions of new users have flocked to the platform.

Why the disconnect? How can Spotify executives say that engagement is growing while its own numbers show flat engagement? Perhaps engagement has increased within pockets of Spotify users. MusicWatch’s Russ Crupnick believes that in the U.S., Spotify’s late adopters are relatively light users who balance out the higher streaming activity of earlier adopters. In that scenario, if Spotify is adding listeners, it will always have new listeners to drag down other listeners’ increasing listening time.

Geographical differences could be at play, too, based on the length of time Spotify has been in each market. In July, Ek described engagement in mature markets as “high” but chose the word “different” for engagement in emerging markets. Based on his choice of words, engagement differs depending on the length of time Spotify has been in a market.

But in the U.S., at least, the time spent listening to music on Spotify has remained “reasonably” steady over the years, says Crupnick. In fact, Spotify’s weekly listening time was “actually a bit higher a few years ago,” he says. Again, the listening habits of late adopters are a reasonable explanation.

It’s worth noting that MusicWatch’s figures exclude podcast and audiobook listening. If Spotify has been able to maintain weekly music listening over the years, it stands to reason that podcasts and audiobooks have provided incremental engagement. Spotify’s lucrative, exclusive deal with The Joe Rogan Experience worked so well that Spotify became the top network for podcast listening in the U.S. in the second quarter of 2023. Last year, Spotify ranked No. 2 behind YouTube for podcast listening (26% to YouTube’s 33% and Apple Podcast’s 14%), according to Edison Research’s The Infinite Dial 2025 report.

In the subscription business, engagement is king. It leads to more subscriptions, lower subscriber churn and a better “lifetime value,” or LTV, a metric that quantifies the present value of future revenue from a subscriber. Stronger engagement gives companies the confidence to raise prices, as Spotify has recently done, and launch superfan tiers, as Spotify has teased, that offer additional bells and whistles for a higher price.

The ability to keep people listening — and be better at it than your peers — can also be a competitive advantage. One reason Spotify has a market capitalization of more than $110 billion is because investors believe Spotify is a “best in class” service that merits such a high share price.

There’s an incredible amount of product innovation going on at music subscription services. Apple Music recently launched three more live, global radio stations. Amazon Music Unlimited offers hands-free listening with Alexa. Both services provide high-quality audio at no extra cost. But Spotify has succeeded in keeping people listening longer.

Investors seeking shelter from the chaos unleashed by President Trump’s often incoherent tariff policy can find safety in companies without direct exposure to tariffs or the teetering advertising market. And music, especially digital music, will be able to weather the storm, say many analysts — with one major exception.

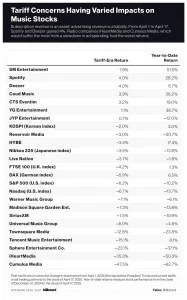

To understand what people are thinking about tariffs’ impact on the business world, look no further than stock prices. The performance of various music-related stocks reveals how investors are betting that economic uncertainty will affect various companies.

Many stocks — especially those of companies traded on U.S. exchanges — have taken a hit as investors fled for safer alternatives. The Nasdaq and S&P 500, U.S. indexes, are down 6.2% and 6.7%, respectively, since April 1, the day before President Trump announced his tariff plans. Elsewhere in the world, indexes have generally performed better. South Korea’s KOSPI is down just 2.0%. Japan’s Nikkei 225 is off 3.5%. The U.K.’s FTSE 100 is down 4.2%. Germany’s DAX has lost 5.9%.

Trending on Billboard

Within music, companies that get most of their revenue from streaming are faring relatively well. Since April 1, Spotify and Deezer have each gained 4.0%, two of the better showings for music stocks. Cloud Music improved 3.9%. Tencent Music Entertainment, on the other hand, has fallen 15.1%, although its share price remains up 8.1% year to date.

Record labels and publishers have also been holding up well, in relative terms, particularly outside the U.S. Since April 1, shares of Universal Music Group (UMG) — which is headquartered in the U.S. but trades in Amsterdam — and Warner Music Group (WMG) are down 8.0% and 7.1%, respectively. Reservoir Media lost 3.0%. K-pop companies — much like South Korean companies in general — have fared well. Since April 1, SM Entertainment has gained 7.9%, YG Entertainment is up 1.1% and JYP Entertainment has gained 0.7%. HYBE fell 3.4%.

UMG and WMG’s post-tariff declines are slightly greater than the drops in the Nasdaq and S&P 500 of 6.7% and 6.2%, respectively. But both UMG and WMG had strong starts to 2025, and their year-to-date losses of 4.5% and 6.1% are far better than the S&P 500’s 10.2% drop and the Nasdaq’s 15.7% year-to-date decline.

Some live music companies’ stocks have been resilient, too. Live Nation shares are down 3.7% since April 1, while German concert promoter CTS Eventim is up 3.2%. Sphere Entertainment Co., owner of the Sphere venue in Las Vegas, is an exception. Sphere Entertainment shares have plummeted 23.1% since President Trump’s tariff announcement, a far more significant drop than the stocks of other companies — Caesars Entertainment, Wynn Resorts, MGM Resorts — that rely on consumers’ willingness to part with their money in Las Vegas.

For many U.S. media stocks, the direct impact of tariffs is “relatively muted,” wrote Citi analysts in an April 7 report, as many of the companies rely on discretionary spending, not ad revenue. Apple and other tech companies, for example, got an exemption from the 145% tariffs on Chinese imports but must still pay the blanket 20% tariff. Companies that get much of their revenues from subscriptions — Netflix, Spotify, UMG and WMG — will be less impacted.

Music streaming, most notably subscription services, is considered by equity analysts to be safe from whatever tariff-induced economic chaos awaits the global market. “Digital goods are unaffected by tariffs,” wrote TD Cowen analysts in an April 14 investor report. Subscription services, they argued, provide enough bang for the buck, and customers have such an emotional attachment to music that subscribers are unlikely to leave in “meaningful” numbers if the economy goes south.

Streaming and subscription growth slowed in 2024, but many analysts expect improvements to come from a regular drumbeat of price increases, renewed licensing deals and super-premium tiers. That said, analysts believe that Spotify’s latest licensing deals with UMG and WMG, and upcoming deals with other rights holders, better reward labels and publishers for price increases. As a result, TD Cowen slightly lowered its estimates for Spotify’s revenue, gross profit margin and operating income in 2025. Likewise, in an April 4 note to investors, Guggenheim analysts lowered their estimate for Spotify’s gross margin in the second half of 2025.

Companies reliant on advertising revenue will also take an indirect hit. Citi estimates that $4 trillion of imports could generate $700 billion in tariffs and reduce personal consumer and ad spending by 1.9%. Tariffs have ripple effects, too. Because household net worth and personal spending are highly correlated, says Citi, the recent declines in stock prices could reduce personal and advertising spending by 3.0%.

Consumer spending is at the heart of the concert business, but analysts agree that fans’ affection for their favorite artists protects live music from economic downturns. As a result, Live Nation has “less risk than the average business that depends on discretionary spending,” according to TD Cowen analysts.

Advertising-related businesses aren’t so lucky, though. As tariffs raise prices and household wealth declines, personal spending also declines, and, in turn, brands pull back on their advertising spending. Investors’ expectations for advertising-dependent businesses were apparent before April but have become clearer since President Trump’s April 2 tariff announcement. iHeartMedia, which closed on Thursday (April 17) below $1.00 per share for the first time since June 4, 2024, has dropped 35.3% since April 1 and fallen 50.3% year to date. Cumulus Media has fared even worse, dropping 47.5% since April 1 and 62.7% year to date. Townsquare Media has fallen 12.8% in the tariff era and 23.8% year to date.

J.P. Morgan analysts believe iHeartMedia’s full-year guidance of $770 million is “somewhat optimistic” given economic uncertainties and ongoing pressures in the radio business. It forecasts full-year EBITDA of $725 million — nearly 6% lower than iHeartMedia’s guidance. If things wind up going more the way J.P. Morgan predicts than iHeart, it would be a big blow to the company and an unfortunate bellwether for the already struggling radio business. While other music industry sectors look to ride out the tariffs at least in the shorter term, the economic uncertainty introduced by the Trump administration may only hasten radio’s ongoing decline.

As Billboard has noted numerous times in recent weeks, investors are attracted to music assets because they are counter-cyclical, meaning they don’t follow the typical ups and downs of the economy. Consumers will, by and large, stick with their music subscription services and continue going to concerts. But by introducing the tariffs, the Trump regime exposed one of radio’s greatest weaknesses as a business: a greater exposure, due to its reliance on advertising, to the state of the wider economy.

Billboard

Interest in superfans and their revenue potential has become so strong that market research firms and equity analysts are digging into the topic. This week, Bernstein released a report on music streaming services’ potential moves and MIDiA Research released a new report about music streaming pricing strategy.

For the uninitiated, a music superfan has been defined by Luminate as those fans who interact with artists and their content in multiple ways, including streaming, social media, physical music purchases and buying merchandise. These superfans make up 19% of U.S. music listeners, according to Luminate, and are more likely than the average fan to buy physical music, spend more on music, discover new music, connect with artists on a personal level and participate in fan communities.

Efforts are well underway to tap into superfans. Labels and artists employ e-commerce to sell merchandise, LPs and CDs directly to consumers, circumventing traditional retail channels and building a direct billing relationship with the most valuable fans. Startups such as EVEN and Fave — Sony Music and Warner Music Group are investors in the latter — are focused on connecting artists with their most fervent supporters. Given the multi-billion-dollar size of the music streaming market, though, Spotify’s plan to launch a superfan tier could be the most impactful play.

Trending on Billboard

Bernstein’s “Superfan Economics 101” report argues that a super-premium tier will help music streaming platforms achieve “sustained success in an increasingly competitive environment.” Analyst Annick Maas sees superfan-focused products as a function of the shift from mass consumption to direct-to-consumer tactics. Reaching out to smaller subsets of a larger audience, he writes, allows a streaming platform to “create a sense of belonging for its subscribers” and increase loyalty and engagement. That an equity analyst would highlight superfans in a report to investors speaks to the revenue potential in targeting subsets of consumers and the likelihood that publicly traded companies will make superfans a larger priority.

MIDiA Research also added to the superfan knowledge base this week by releasing a report based on a survey of 2,000 U.S. consumers. The main takeaway is that MIDiA found widespread interest in paying a higher price for a streaming service with additional features: Just under three-quarters of people surveyed have “some level of interest” in paying for a super-premium tier as an add-on to the basic subscription plan.

Exactly what people are willing to pay varies greatly, though: 22% of respondents are willing to pay an additional $1.99 per month fee while 10% are willing to pay an additional $13.99, more than double the current $11.99 price for an individual subscription.

To give an idea of the amount of revenue at stake, consider that there was an average of 100 million subscribers of subscription music services in the U.S. in 2024 who paid an average of $8.91 per month, according to the RIAA. (That figure does not include limited-tier subscriptions such as ad-free internet radio.) Those 100 million subscribers generated $10.69 billion over the year, which works out to $106.87 per subscriber per year.

If 10% of those 100 million subscribers — which include student and family plans in addition to standard individual plans — paid more than double the current price, total revenue would increase 10.8% to $11.76 billion, equal to $117.56 per subscriber annually or $9.80 per month. The 10.8% revenue growth is equal to $1.15 billion of incremental royalties.

The RIAA’s average revenue per user (ARPU) of $8.91 for 2024 is lower than the $11.99/$12.99 price being charged for the most popular individual plans, suggesting the 100 million subscribers figure includes many student and family plans. So, to measure the effect of the price increase on the RIAA’s ARPU, I multiplied ARPU by the ratio of the super-premium individual plan ($12.99 + $13.99) to a standard individual plan ($12.99).

So, without an increase in the number of subscribers or a price hike, doubling the fee for a tenth of subscribers would deliver a 10.8% revenue boost. Not all of those consumers would jump to the super-premium tier at once, however, meaning a double-digit increase in subscription revenue would accrue gradually over multiple years.

Charging an additional $1.99 super-premium fee on top of a standard subscription price would result in an incremental $334 million. Total revenue would increase 3.1% to $11.02 billion and ARPU would rise from $8.91 to $9.18.

Another option to expand the subscription base is a low-priced, “subscription-light” tier that incorporates advertising into paid subscriptions. Music streaming subscriptions have kept advertising out of their paid products, but there have been suggestions — namely from Goldman Sachs analysts who prepare the influential Music in the Air report — that a subscription-light tier that includes ads could help expand the subscription market.

Paid video subscriptions used to be a respite from the advertising world, but advertising has become well established on video platforms like Netflix, Amazon Prime and Hulu. Amazon Prime now inserts ads in movies, and Netflix and Hulu offer a low-cost, ad-supported option to make their products palatable for more price-conscious consumers.

But MIDiA’s survey suggests a subscription-light option is unpopular. About three-quarters of respondents who aren’t currently subscribed to a music streaming service aren’t interested in starting. This sizeable group of consumers doesn’t listen to music often enough to pay, or they find the current prices too high. Excluding the 100 million U.S. subscribers, there are approximately 188 million Americans aged 13 or older who do not subscribe to a streaming service (there are 51.9 million people under 13). Based on MIDiA’s findings, roughly 141 million of them aren’t interested in paying for a subscription. For them, there’s also YouTube and ad-supported radio.

What’s more, a subscription-light offering could be problematic. MIDiA found that ad-supported paid streaming attracted interest only “at very low price points” and warned it could harm overall subscription revenues by cannibalizing normal subscription tiers. With paid subscriptions currently creating the majority of U.S. recorded music revenue, and with subscription growth playing a prime role in Wall Street’s expectations for music companies, both platforms and labels may be unwilling to put that revenue at risk by offering a less expensive choice to millions of consumers who may soon be looking for ways to tighten their belts.

The Trump administration’s tariff policy aims to return manufacturing to the United States is already having ripple effects throughout for the U.S. music industry and could have further consequences in the future.

Trump announced on Wednesday (April 2) a minimum 10% tariff on all trade partners, a 25% tariff on all foreign-made automobiles and additional tariffs on countries with which the U.S. has a trade deficit. No country is safe — not even Australia’s uninhabited territories near Antarctica, which got slapped with a 10% tariff despite having more penguins than people.

The tariffs are meant to protect America’s manufacturing industry and encourage businesses and consumers to purchase U.S.-made goods. But because many goods produced in the U.S. consist of raw goods and finished components imported from elsewhere, even products made at home are subject to higher costs that may be passed on to consumers. Musical instruments are likely to suffer from the tariffs, and they’re not alone.

Trending on Billboard

“Domestic vinyl pressing costs are likely to rise,” says an executive in the vinyl manufacturing business. Much of the PVC used to manufacture records comes from overseas and will be subject to tariffs, this person says. Canada supplies much of the board stock and paper for record packaging. Lacquers used to create temporary masters for vinyl pressing come from Japan.

The cost of physical music product from Europe will also become more expensive, says David Macias, co-founder of Thirty Tigers. Macias is trying to help Thirty Tigers’ labels source manufacturing in the U.S. to avoid the additional costs, but he notes that because domestic manufacturing costs will likely increase, independent record stores may still face “a chilling effect” from higher wholesale prices and financially stressed consumers. “We’re heading straight into $35 single vinyl albums,” says Macias. “In an economy where everything else costs more, vinyl will become a luxury item.”

The music business could be spared some of the pain. As the American Association of Independent Music (A2IM) noted in a message emailed to its members, the Berman Amendment to the International Emergency Economic Powers Act — which President Trump invoked to launch the tariffs — prevents the president from regulating or banning the import of “informational materials” such as phonographs and CDs. And the Free Trade in Ideas Act of 1994 expanded the Berman Amendment to include newer forms of communication. The vinyl manufacturing executive expressed uncertainty about the exemptions, however, and expects vinyl imports will be subject to tariffs “at least in the short run.”

Responses from foreign countries could heighten tensions and ensnare music companies in unexpected ways. China responded by slapping a 34% tariff on U.S. imports, and the U.K. is reportedly compiling a list of U.S. products it could hit with tariffs. A2IM told its members that countries could also respond by withholding royalty payments.

Some U.S. contingents have praised the tariffs: steel manufacturers, electrical contractors and the cattle industry, among others. “This is exactly the type of bold action America needs to restore its industrial leadership,” Zach Motti, chairman of the Coalition for Prosperous America (CPA), said in a statement. The CPA represents U.S. farmers, labor unions, manufacturers and ranchers, and it advocates for trade protections, according to non-partisan watchdog InfluenceWatch.

But the tariffs, and the Trump administration’s bellicose and often threatening statements, aren’t being well received by other countries. Not only are U.S. trading partners responding with tariffs of their own, but some foreigners are also avoiding the U.S. altogether. That presents a huge potential loss of visits to experience everything from music festivals in Southern California to the rich musical history of the Mississippi Delta.

Nashville, a city heavily dependent on tourism, is already seeing fewer visitors from the north. “Canada is our top international market, and unfortunately, we are already seeing a decrease in Canadian visitors,” Deana Ivey, president/CEO, of the Nashville Convention & Visitors Corp, said in a statement to Billboard. “We know how much they enjoy coming here for the music, and we’re hopeful they will still make the trip to CMA Fest” in June. International visitors accounted for approximately 3% of the 17 million visitors to Nashville in 2024, with about half coming from Canada, according to the Nashville Convention & Visitors Corp.

A decline in Canadian tourism would hurt more than Nashville. The U.S. Travel Association estimated the tariffs could result in a 10% decline in U.S. tourism from Canada, the No. 1 source of tourism to the U.S. with 20.4 million visitors and $20.5 billion in spending in 2024. Las Vegas would be hard-hit: Canada was the top source of foreign visitors to the city in 2024, bringing in more than 1.4 million people, according to the Las Vegas Convention and Visitors Authority.

There are already signs that Canadians are avoiding their neighbor to the south. In March, Canadian airline Flair Airlines announced it canceled flights from Canada to Nashville — a loss of 18,000 seats, according to the commissioner of Tennessee’s Department of Tourist Development. Also last month, the president/CEO of Visit Buffalo Niagara told CP24.com that cross-border visits were down 14% in February from the prior-year period. “This is a big concern for us,” he said.

The testy relationship between the governments of the U.S. and Canada prompted the Canadian Independent Music Association (CIMA) to pull out of SXSW. Back in February, CIMA president/CEO Andrew Cash became concerned that spending Canadian tax dollars on a trade mission to the U.S. might not be a good choice given the tone of political discourse. CIMA’s presence at SXSW, Canada House, is a public-facing, Canadian-branded event that hosts “vulnerable artists” and their teams, he explains. “It was hard to know what effect that was having on the attitude towards Canada,” he explains. “That was part of it. CIMA also is the custodian of a certain amount of taxpayer dollars. And I also thought about the optics of that.”

Cash isn’t alone in his unwillingness to spend money in the U.S. Rob Oakie, executive director of Music PEI, a non-profit that aids music development for Prince Edward Island, says the recent political rhetoric, combined with the increased cost of time required for Canadians to obtain a visa to tour the U.S., will result in fewer trips to a market that has always been a focus for Canadian artists.

Oakie says his music development colleagues at the other three Atlantic providences — Nova Scotia, New Brunswick and Newfoundland — have collectively decided “not to invest any money in the U.S. in the immediate future.” That affects upcoming travel to the Folk Alliance International Conference to be held in January in New Orleans and the IBMA Bluegrass Music Awards to be held in September in Chattanooga, Tenn.

“On the artist side,” Oakie adds, “I have heard quite a number of artists saying they have no intention of touring the U.S.” He points to an incident in March with Canadian folk duo Cassie and Maggie that received national attention after the musicians were pulled over by sheriff deputies in Ohio. According to reports, each sister was asked if they preferred Canada or the U.S. while the officers echoed a Trump talking point about the amount of fentanyl that comes into the U.S. from Canada.

While President Trump’s tariffs are meant to fix a deficit in the goods trade, they could end up affecting the country’s services trade surplus. The European Union’s anti-coercion instrument (ACI), introduced in 2023, allows the EU to impose penalties on countries that use trade policy to attempt to get a country to change policy. Created mainly as a deterrent, the ACI provides tools for the EU to deal with coercion, including tariffs on goods but, importantly, also trade restrictions on services, intellectual property and foreign direct investment.

That could leave American tech companies, many of which provide music services globally, vulnerable. A French government spokesperson told Reuters that digital services are likely to be a focus, and a senior European Union official told Politico a response could target intellectual property rights. In other words, Trump’s tariffs could affect not just physical goods but the digital engine that drives the modern music business.

With the recent news of slowing streaming growth in the U.S. and declining global revenue growth in recorded music, one might think the trends could have a negative impact on the market for publishing and recorded music catalogs.

Think again. For a handful of reasons, industry insiders who spoke to Billboard don’t believe the slowdown will have much — if any — effect on the continually brisk business in music intellectual property rights. Subscription revenue, which accounted for roughly 66% of U.S. revenue and approximately 51% of global revenue in 2024, according to the RIAA and IFPI, respectively, will continue to grow in mature markets and elsewhere.

“I don’t think the numbers that we’ve seen are enough to make any [music investors] worry too much,” says MIDiA Research’s Mark Mulligan. “I know that a lot of these funds have seen our numbers, and our numbers are relatively cautious about the outlook. We’re not bearish, but we’re not bullish either.”

Trending on Billboard

Numerous people pointed to Goldman Sachs’ estimates — a closely watched music forecast that remains something of a gold standard in the business — that both global recorded music and publishing revenue will grow at approximately 8% annually through 2030. What’s more, equity analysts seem comfortable with Universal Music Group’s forecast of 8-10% subscription growth through 2028.

In mature markets, future growth will come from higher prices after more than a decade of unchanged subscription fees. “We’ve all gotten comfortable with getting music at what I believe to be a subsidized rate versus its value,” says Jeremy Tucker, founder/managing member of Raven Music Partners, an investor in music catalogs. That subsidy is an underpricing of music subscriptions in order to attract new customers and help platforms achieve scale. Now that there are 818 million global subscribers, according to MIDiA Research, labels and streaming services seem intent on getting more from each subscriber.

Many streaming services raised their prices in 2022 and 2023, and Spotify raised prices in a few markets in 2024. Major labels that have renewed their licensing agreements with Spotify suggested the deals allow for higher-priced superfan tiers. Additionally, Warner Music Group CEO Robert Kyncl said at a March 10 banking conference that “there’s quite strong evidence that there’s a lot of room to grow on pricing, especially in … mature markets.” All of this means there will be more value coming to rights holders, says Tucker, who looks at a lengthy time horizon, not any single year’s results, when considering potential gains. “We think there’s going to be growth over the medium to long term. But, in any given year, the actual growth is not something I’m too worried about.”

Additionally, people expect rights holders will extract more value from catalogs through better blocking and tackling. While companies focused on subscriber growth over the last 15 years, the next era will be marked by better execution, says a person in the music investment field. Artificial intelligence, this person says, can help rights owners expand the global reach of their music by creating versions in multiple foreign languages at little cost. AI can also make royalty collection more effective and cost-efficient. These wins may not have the appeal of, say, a biopic that boosts an artist’s catalog. But from a financial point of view, expanding a song’s reach and cutting costs serve the buyer’s core mission of improving the return on investment.

While U.S. growth slows, much of the world is growing quickly, and Western companies that focus on English-language repertoire face a “bleak” future as emerging markets outpace markets where English-language music is most popular, says Mulligan. As a result, companies that failed to invest a decade ago are playing catch-up in markets dominated by local music. “What they should have done is started signing loads of artists [in emerging markets] 10 to 15 years ago,” Mulligan says.

Still, there’s opportunity in emerging countries and their local repertoire. Subscription penetration rates — the ratio of subscribers to the country’s adult population — are a good proxy for a country’s potential, explains Mulligan. Developed markets like the U.S. and U.K. have penetration rates in the high 40 percent, according to MIDiA’s latest data. Elsewhere, lower penetration rates suggest subscription revenue will increase down the road and, as a result, the local music business infrastructure will grow over time. Poland’s subscription penetration rate, in contrast, is 17%, Brazil’s is 16% and China’s is 13%. Indonesia, the world’s fourth-most populous country, has a 1.8% penetration rate. India, the world’s second-largest country, has a penetration rate of just 1.3%.

Low penetration rates correspond with growth potential, as streaming platforms help fuel infrastructure growth and subscription adoption adds more value to the market. “You get this virtuous circle of influence,” Mulligan explains, “where if you establish the infrastructure to create an audience, that creates the virtuous circle of investment, where people start setting up labels, people start being able to have their careers as artists, they create more music, more of that music exports, and the impact on the global market increases. India is maybe a third of the way along in the journey, whereas Indonesia has not even got started.”

A “datapocalypse” hit the music industry this week as both the RIAA and IFPI reported 2024 numbers, following MIDiA Research’s annual tally a week earlier — and all three agreed that growth slowed in 2024. The IFPI’s figures and rankings of top markets revealed the rise of emerging markets, while the U.S.-focused RIAA figures revealed that growth in the United States was particularly weak (although not the worst in the world).

The trends seen in these reports have consequences for the global music industry. Companies follow opportunities, and emerging markets are attractive places to put resources. In November, Billboard published a story about major labels’ pivot in investment strategy from tech startups to old-school music companies in small and developing markets. As majors face slowing growth in mature markets, they’re looking for growth elsewhere — especially China, India and Africa. Independent companies such as Believe have long pursued markets around the world, too, betting on the rise of streaming and the increasing popularity of local music.

Trending on Billboard

The trio of reports underscore that slow streaming growth in many markets will need to be addressed. To that end, labels are already working to improve payouts through super-premium tiers that carry higher prices and working with streaming platforms to ensure “professional” artists get better remuneration than hobbyists, background noise and nature sounds. Ridding streaming platforms of AI-generated tracks will also improve labels’ payouts.

The reports differ because they represent different types of income. The IFPI reports trade revenue — the money collected by distributors and record labels — while much of the RIAA’s report shows the retail value, or the money collected by streaming platforms and retailers. In addition, the RIAA numbers cover only the U.S. while the IFPI and MIDiA reports track the global business. MIDiA Research includes additional revenue streams not found in RIAA or IFPI reports: expanded rights, which includes merchandise, sponsorships and other revenue that does not originate from master rights; and production music, which is growing in importance in music licensing but is typically outside the purview of record labels.

Following are the four main takeaways from the three reports.

Emerging Markets Were the Story of 2024

The most established markets mostly kept their place in the pecking order, but there was one momentous change in 2024. In a sign of the times, Australia, which ranked No. 10 on the IFPI rankings in both 2022 and 2023, was replaced by Mexico. While Australia improved 6.1%, Mexico expanded 15.6% thanks to a huge improvement in subscription revenue. In fact, the Latin America region grew an astounding 22.5%. Brazil, the No. 9 market, grew 21.7% — the fastest rate in the top 10.

Despite having a relatively small population of approximately 27 million, Australia has historically punched above its weight in music spending. The country ranked No. 6 in both 2014 and 2015 before falling off the top 10 in 2024 for the first time in nearly three decades. Meanwhile, Mexico — which had never cracked the top 10 before now — has roughly 130 million people, a booming streaming market and a flourishing music scene.

To be fair, Mexico is more of a mid-tier market than an emerging market. In terms of IFPI rankings, the country is emerging only in the sense that it “emerged” into the top 10. But it has a lot in common with emerging markets, including high growth rates and ample room for more subscriptions. In mature markets, subscribers are becoming harder to find.

China held firm at No. 5, its same ranking as the previous two years. With the world’s largest population and a fast-growing subscription streaming market, the country has risen from No. 7 in 2019 and No. 10 in 2017. Its largest music streaming company, Tencent Music Entertainment, finished the year with 121 million subscribers — more than all the streaming subscribers in the U.S.

In terms of pure growth rate, the top regions were the smaller Middle East-North Africa (MENA) and Sub-Saharan Africa, which grew at 22.8% and 22.6%, respectively.

Prior to 2024, the same markets had appeared in the top 10 for the last decade, sometimes in a different order. In 2017, China and Brazil entered the top 10, knocking out Italy and the Netherlands. Brazil had been in the top 10 in previous years but was absent in 2016. Now, with Mexico and emerging markets surging, we may be seeing a bigger shakeup in the top 10 in the future.

U.S. Growth Underperformed Nearly Every Other Market

In a business where year-over-year growth has become commonplace, the large, mature music markets don’t have the appeal of the smaller, fast-growing ones. So, while the U.S. remained the world’s largest market — by a wide margin — its revenue growth didn’t even keep up with 2024’s 2.9% inflation rate (depending on which numbers you’re looking at).

U.S. revenue growth slowed to 2.2% according to the IFPI report, or 3.2% according to the RIAA report. Together, the U.S. and Canada, which grew 1.5% in 2024, accounted for 40.3% of global revenue but grew just 2.1%, according to the IFPI report. Japan, the world’s second-largest market, dropped 0.2% as a 5.5% increase in streaming — led by a 7.2% gain in subscription revenue — was offset by a 2.7% decline in physical revenue. South Korea, the No. 7 market, fell 5.7%. The total Asia region grew 1.3%, however, in part due to China increasing 9.6%.

Some other major markets fared better than the U.S. As Billboard previously reported, U.K. revenues increased 4.8% and Germany rose 7.8%.

Subscriptions Are Stronger Than Ever

Subscriptions are the lifeblood of the record industry, accounting for more than 74% of global streaming revenue and 51.2% of total revenue in 2024, up from 49.1% in 2023, according to the IFPI. Of the global industry’s $1.4 billion added in 2024, $1.3 billion came from subscription streaming.

That said, the U.S. subscription market slowed considerably in 2024. Global subscription revenue rose 9.5% to $10.46 billion — almost double the 5.3% growth rate in the U.S., according to the RIAA. That 5.3% gain was half of 2023’s 10.6% improvement and well under 2022’s 7.2% growth (the 22.2% subscription growth seen in 2021 was a fortunate aberration of the pandemic). While a reversion to the mean was expected in successive years, 5.3% isn’t much, especially in a year when Spotify raised prices.

Ad-Supported Music, On the Other Hand…

Global ad-supported streaming grew just 3% to $3.62 billion, according to the IFPI. That’s a paltry number given the growth of streaming in large emerging markets such as India and Indonesia. But 3% global growth outperformed the U.S., where the RIAA report showed that ad-supported streaming dropped 1.8% and hasn’t had a double-digit gain since 2021.

For all the popularity of subscription music services, consumers will continue to use ad-supported platforms — video platforms like YouTube, social media apps like TikTok and radio services such as Pandora. And for freemium services such as Spotify, the ad-supported tier is a critical gateway to the premium tiers.

But the state of the economy suggests advertising dollars could be difficult in 2025, too, as advertisers tend to pull back their spending at the first signs of an economic slowdown. SiriusXM CFO Tom Barry, speaking at a banking conference on March 11, said advertising started “to see a drop-off” in previous weeks following the Trump administration’s tariff threats. “I would say we’re cautious about where the ad industry is going right now,” he warned.

When it comes to the value of music royalties, some artists have an advantage based on where they live.

Nigerian artists earned more than $43 million from Spotify in 2024, according to the streaming giant’s latest Loud and Clear report. A “significant” portion of those royalties came from outside Nigeria, with exports of the country’s music increasing 49% over the last three years. In other words, people in other countries — many of which provide better royalties than are available in Nigeria — are listening to Nigerian artists, effectively sending their money to the West African country.

Spotify’s Loud & Clear report provides good insight into how royalties are split between superstars, merely popular artists and everybody else. In 2024, 71,200 artists earned at least $10,000 in royalties from the streaming service, up from 66,000 in 2023, while 670 artists earned more than $2 million, an increase from 570 the prior year.

Read between the lines of the Loud & Clear data and you’ll see that royalties have different values to musicians in different countries. If you’re a recording artist in India, where free, ad-supported listening dwarfs relatively cheap subscriptions, you’re better off receiving your royalties from a country like the U.S. where subscriptions are many and prices are high. If you’re an Afrobeats artist in Nigeria, a U.S. stream is worth more than a stream at home.

Trending on Billboard

Economist Will Page found that almost a third of all streams inside the U.S. in 2023 came from artists outside the U.S. The top music exporter to the U.S. was the U.K. — which has roughly the same royalty rates as the U.S. — but the No. 2 exporter was Mexico, a country where a Spotify individual subscription costs the equivalent of $6.49. Colombia, where a Spotify subscription costs the equivalent of $4.12, was No. 6. As Page wrote in his roundup of 2023 global recorded music revenues, Mexican artists’ U.S. streams were worth more than three times what they would have earned had they originated in their home country. For Colombian artists, their U.S. streams were worth more than six times what they would have earned in their home country.

In a global music business driven by streaming platforms, artists can earn more by tapping into more lucrative markets. A Nigerian artist should want more U.S. fans. A Colombian artist gets more from a U.S. stream. It’s a form of arbitrage — buying low and selling high.

In the digital era, choosing where to live is also a form of arbitrage. People with the ability to work remotely are increasingly choosing to live somewhere more affordable. Millions of Americans have moved to states with lower costs of living in recent years, with some leaving the country for safe havens in Europe as political discourse turned sour. States such as Texas, Florida and Tennessee are attractive for the (relatively) cheaper costs of living and lack of state income tax. Digital nomadism goes internationally, too, as people work remotely from faraway places — co-working spaces have sprouted on the Indonesian island of Bali, for example — with a substantially lower cost of living. Dozens of countries offer a digital nomad visa, called a remote working visa.

Musical nomadism isn’t a thing — yet. And this is more of a thought experiment than a serious proposal. Moving to a foreign country would take artists away from a large, lucrative concert market. And unless a musician plans to infiltrate the local music scene in their new home, they would be without the networking and personal connections that foster both creativity and commerce. An artist with children and a spouse would also have to pull deep roots to leave the country. But if an artist only wants to record and release music online, living elsewhere — not just Texas or Tennessee, but a country where the cost of living is far lower than in the U.S. — would improve the economics of music streaming.

Given the value of listeners in mature streaming markets, a stream in the U.S. and U.K. is worth far more than a stream in many other countries. Spotify costs $11.99 per month for an individual in the U.S. In Nigeria, an individual Spotify subscription costs the equivalent of $0.84 per month. And if Nigeria is like other developing markets, ad-supported streaming — which returns less value to artists and rights holders — is far more popular than paid subscriptions.

In Nigeria, $1 in the U.S. has the spending power of over $8, based on the difference between Nigeria’s gross domestic product in nominal dollars and purchasing power parity. In other words, goods that cost $1 in Nigeria would cost $8 in the U.S. Other countries provide similar boosts in spending power. In Indonesia, $1 feels like $3.30 in the U.S. In Colombia, $1 has the spending power of $2.70. In Mexico, having $1 is like having $1.90 up north.

Differences in costs of living would make royalties seem far more valuable. A typical 0.35-cent per-stream royalty would feel like 2.8 cents in Nigeria, 1.2 cents in Indonesia, 0.95 cents in Colombia and 0.66 cents in Mexico. An American artist who earns $5,000 from a synch placement would get more from that income by walking across the U.S.-Mexico border.

Musicians who are hesitant to become digital nomads can find solace in the slowly improving streaming economics in developing markets. Mature streaming markets are driven by subscriptions, while developing markets tend to be driven by ad-supported streaming. But it’s widely believed that subscription uptake will improve over time, making those foreign streams worth more over time. And in the U.S., artist-centric policies, rising prices and upcoming super-premium tiers will bring more value to artists and rights holders. In other words, don’t dig out your passport just yet.

Get ready for a new era of innovation by streaming services. That was the message sent by Universal Music Group (UMG) chief digital officer Michael Nash during the company’s fourth quarter earnings call on Thursday (March 6), during which he noted that the label is currently in talks with all of its streaming partners — not just Spotify — about super-premium tiers.

“There’s a continuing wave of innovation that we’ve seen really transform our business and transform the digital landscape in particular, over the last decade, and we anticipate that that’s going to continue as the market grows,” said Nash.

Not that streaming services haven’t been innovating since day one. Listeners have enjoyed new ways to discover music (the growth of playlists, personalized listening and algorithm-driven radio stations), follow their favorite artists (album pre-saves) and view concert listings and lyrics. From 2011 to 2014, Spotify allowed developers (Rolling Stone, Billboard, Tunewiki and Songkick, among others) to build apps that lived inside its platform and utilized its song catalog. Services such as Tidal and Qobuz have made high-fidelity audio a part of their brand identities. And over the years, the types of subscription offerings expanded from individual plans to encompass family plans and affordable student options.

Trending on Billboard

But the type of innovation that Nash referenced is different. Except for high-fidelity audio, streaming innovations haven’t resulted in greater revenue per user — all the features packed into streaming services haven’t cost the consumers anything extra. That’s going to change. The next wave of music streaming will have products and services that carry higher prices. After decades of providing the same service to all customers, streaming platforms will segment the market and offer premium products to a subset of their subscribers.

Super-premium streaming is one component of what UMG calls “streaming 2.0.” On Thursday, CEO Lucian Grainge explained that streaming 2.0 “will build on the enormous scale we’ve achieved thus far in streaming’s initial stage. This next stage of streaming will see it evolve into a more sustainable and growing, artist centric ecosystem that improves monetization and delivers great experiences for fans.” Offering multiple tiers rather than a single subscription plan, Grainge said, “enabl[es] us to segment and capture customer value at higher than ever levels.”

Conversations about superfan offerings have extended as far as concert promotion and ticketing. Live Nation CEO Michael Rapino revealed during the company’s fourth-quarter earnings call that streaming services are interested in pre-sale ticket offers. “We’ve talked to them all about ideas on if they wanted inventory,” he revealed on the Feb. 20 call. “There’s a cost to that, and we would entertain and look at that option if it made sense for us in comparison to other options we have for that pre sell.”

Spotify is known to be working on a superfan product — CEO Daniel Ek revealed in February that he is testing an early version — but Nash suggested other streaming services could follow suit. “We’re in conversations with all of our partners about super-premium tiers,” he said. “We think this is going to be an important development for segmentation of the market.”

JP Morgan believes the customer segmentation that Nash referenced will be a component of UMG’s growth over the next 10 to 20 years. “In a streaming 1.0 world UMG was reliant on DSPs raising retail price rises if it was to benefit from a higher wholesale price; in a streaming 2.0 environment UMG has visibility on wholesale price rises that underpin its growth algorithm, while still having potential upside should DSPs raise prices above the minimum,” analysts wrote in a March 6 investor note.

UMG’s market research suggests that 20% of music subscribers are likely to pay for a superfan streaming product, according to Nash. If Spotify reaches that threshold, it will have converted roughly 53 million of its 263 million subscribers into higher-paying customers (as of Dec. 31). It’s already worked for at least one company outside the U.S., as Tencent Music Entertainment has already proven there’s demand for a high-priced, value-added streaming product: Its Super VIP tier, which costs five times the normal subscription rate, had 10 million subscribers at the end of September — over 8% of TME’s 119 million total subscribers. If other streamers can successfully follow suit, new superfan streaming products will generate more revenue for artists, rights owners and streaming platforms — and help the music business continue to grow for years to come.

Though the RIAA has yet to release revenue numbers for recorded music in the U.S. in 2024, early returns from a handful of international markets are in — and they show that digital revenue maintained or gained momentum last year while physical sales slowed from 2023.

In Germany, the world’s fourth-largest recorded music market, total revenue grew 7.8% to 2.38 billion euros ($2.53 billion) in 2024, trade group Bundesverband Musikindustrie announced earlier this week. That was an improvement on the 6.3% gain seen in 2023 and the 6.1% gain in 2022. Notably, audio streaming, which accounted for 78% of total revenue, grew 12.6% to 1.86 billion euros ($1.98 billion), an improvement on the 7.9% gain in 2023 but below the 14.0% spike seen in 2022.

The full year ended with the same momentum Germany established in the first half of 2024. Through June, total revenue was up 7.6% and audio streaming was up 12.7%, while physical sales — which were down 11.9% through June — improved in the second half of the year, leading to a less-drastic 7.4% drop below 2023 revenue.

Trending on Billboard

On the physical front, Germany’s vinyl sales improved 9.4% to 153 million euros ($163 billion) in 2024, accounting for 6.4% of total revenue — though they cooled a bit from 2023, when sales increased 12.6%. However, CD sales fell 17.1% to 207 million euros ($220 million) last year, a markedly steeper decline than the 5.9% drop seen in 2023.

In Spain, recorded music revenue grew 9.4% to 569 million euros ($606 million), according to Promusicae, the country’s trade association for the record industry. That was down from growth rates of 12.4% and 12.3% in 2022 and 2023, respectively. Audio streaming totaled 376 million euros, up 14.1% year over year, and accounted for 66% of total revenue. But just as in Germany, physical sales plummeted. Total physical sales fell 13.3% to 54 million euros ($57 million), with vinyl sales sinking 4% after jumping 19.4% in 2023. Meanwhile, CD sales dropped 25.4%, a much sharper decline than in 2023 (when they were down 1.3%) and comparable to 2022 (down 29.2%).

The Spanish market slowed considerably in the second half of the year, leading to end-of-year gains that were six to seven percentage points lower than mid-year results. Through June, total revenue was up 16.6%, while the year finished with a smaller 9.4% gain. Digital revenue fell from an 18.8% gain at the mid-year mark to a 12.6% gain at the end of the year, and vinyl sales were up 11.9% in June but finished the year down 4% — a nearly 16-percentage point swing.

In Japan, the world’s second-largest recorded music market, physical audio sales rose 2% to 148.96 billion yen ($985 million), a worse showing than in 2023 (when they were up 8%) and 2022 (up 5%), according to the RIAJ. And physical music video sales fell 21% to 90.5 billion yen ($598 million), which brought the total physical market down 8% from 2023.

The RIAJ has not yet published year-end digital numbers, though total digital revenue was up 5% and streaming revenue was up 7% through the third quarter. Japan is unlike most music markets in that physical formats remain the dominant moneymakers. Through September, streaming revenue accounted for 35% of total revenue while physical sales — mostly audio formats — accounted for the remaining 65%.

In the U.S., another data point arrived Thursday (Feb. 27) when ASCAP announced that revenue increased 5.7% to $1.84 billion in 2024, with domestic royalties up 5.3% to $1.4 billion and foreign receipts growing 6.8% to $483 million.

As for U.S. recorded music numbers, RIAA figures are likely to be released in March, assuming the organization sticks to prior timings of its release. Mid-year RIAA data showed the U.S. market increased 3.9% to $8.69 billion, with paid streaming improving 5.1% to $5.22 billion. Physical revenue rose 12.7% and was driven by a 17% increase in vinyl sales. Year-end numbers should benefit from Spotify’s U.S. price increase in July.

The IFPI’s release of 2024 global figures, with a country-by-country breakdown, will offer a more complete picture of global trend lines and reveal how the U.S. fared against other nations. That report is typically released each March.

State Champ Radio

State Champ Radio