Streaming

Page: 9

Luminate has announced a new partnership with Epic Games that will see the entertainment data company begin tracking music usage from Fortnite’s Jam Tracks inside its Connect platform, marking a notable shift in how the music industry monitors fan engagement across gaming platforms.

Announced Wednesday (April 30), the agreement adds Fortnite Jam Tracks to Luminate’s growing “Interactive On-Demand” category, offering labels, managers, and rights holders deeper insight into how music is being experienced and consumed inside Epic Games’ massively popular title.

While the integration reflects growing industry interest in transmedia fan behaviour, particularly in the gaming space, Luminate has confirmed that Jam Tracks streaming data from Fortnite will not be counted toward Billboard charts.

Trending on Billboard

The new feature builds on Luminate’s 2024 mid-year report, which found that tracks featured in Fortnite Festival announcements saw an average 8.7% lift in on-demand audio streams the day after being announced. The company’s 2024 year-end report also highlighted streaming gains for Snoop Dogg, Eminem, Ice Spice, and Juice WRLD, following their involvement in Fortnite Remix, a month-long music activation held in November 2024.

“Luminate is committed to serving the entire entertainment ecosystem with valuable data and insights,” said Luminate CEO Rob Jonas in a statement.

“In today’s increasingly transmedia landscape, where technology is blurring the lines of content and fan experiences across platforms, it’s more important than ever to understand engagement and audience trends in the gaming space and how they overlap with music consumption.”

“We’re witnessing the rise of interconnected experiences, and understanding how audiences interact with these across games, music, and other mediums is crucial. We’re delighted that our new partners at Epic Games understand this need, and we look forward to developing this partnership as the convergence of music and gaming evolves.”

Emily Levy, director of music, talent and influencer at Epic Games, said the partnership will help creators and artists better understand the impact of in-game music experiences.

“Music in Fortnite gives players an authentic way to experience iconic songs through self-expression, creation, discovery and play,” she said. “We look forward to continuing to work with the music industry to tap into unique and immersive ways to connect with new and existing fans.”

Interactive On-Demand streams from Fortnite’s Jam Tracks are currently not a Billboard chart-eligible metric.

Apple Music has named Ole Obermann and Rachel Newman as the company’s new co-heads, Billboard has confirmed. The news was first reported by Music Business Worldwide. Obermann, who left his role as global head of music business development at ByteDance earlier this year, worked at the Chinese company for more than five years, having started […]

Deezer’s total quarterly revenue edged 1.1% higher in the first quarter of 2025, the French streaming company reported on Tuesday (April 29), as its top executive reiterated the company’s target to achieve profitability this year.

Deezer reported revenue of 134 million euros ($145.08 million) in the first quarter, driven primarily by 6.3% growth in its direct subscriber base in France, bringing the total number of subscribers there to 3.5 million.

Deezer achieved positive free cash flow and its first break-even year in fiscal 2024, and CEO Alexis Lanternier said the company will achieve positive adjusted earnings before interest, taxes, depreciation and amortization (EBIDTA) in 2025. Deezer expects total revenue for 2025 to be flat or slightly decline from fiscal year 2024, as it forecast no meaningful increase in average revenue per user (ARPU). However, the company maintained it will “generate positive free cash flow for the second consecutive year,” according to a press release.

Trending on Billboard

“We started the year with positive momentum, delivering revenue growth in line with our expectations and further increasing our direct subscriber base in France,” Lanternier said in a statement. “With confidence, we confirm our 2025 guidance and our objective of reaching profitability this year.”

Founded in August 2007, Deezer has embarked on a range of initiatives aimed at achieving profitability, including raising prices on its direct subscribers in France; doubling-down on its strategy to gain subscribers through partnerships with companies like the German broadcaster RTL, American speaker company Sonos and Latin America’s Mercado Libre; and through the introduction of new customization features for users and opportunities to directly interact with artists.

Deezer’s total subscriber base now stands at 9.4 million, down from what it said was 10 million subscribers on a like-for-like basis in the first quarter of 2024. Of those 9.4 million subscribers, 5.3 million are direct subscribers, mostly in France, while 4.1 million subscribers come from partnerships. Revenue from Deezer’s direct subscriber base contributed 86.6 million euros ($93.8 million), up from 86 million euros ($92.8 million) a year ago. Partnership subscribers contributed 39.2 million euros ($42.4 million), down from 43.3 million euros ($46.7 million) a year ago.

The decline in partnership subscriptions, which drove an overall 3.4% drop in the revenue Deezer receives from countries outside of France, was primarily due to the conversion of users who came to Deezer through its partnership with Mercado Libre called MeLi+. Some promo users converted to premium users “with higher [average revenue per user] & margins,” the company said. The decline in partnership subscriptions and revenue was partly offset by a ramp up in Deezer’s partnership with RTL+, the company said. Deezer renewed long-term partnerships with Bouygues and Orange in the first quarter.

Spotify’s first quarter revenue rose 15% as its subscriber base increased 12%, the company’s highest first quarter subscriber gains since early in the COVID-19 pandemic, the company reported on Tuesday. The music and podcast streaming giant reported total revenue of 4.2 billion euros ($4.54 billion) in the quarter ending March 31, and total paying subscribers […]

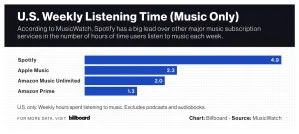

Spotify gets more engagement — much more — than its competitors in the music subscription space.

In the second quarter of 2024, the average Spotify Premium listener spent 4.9 hours per week listening to music, according to a MusicWatch survey of U.S. consumers that excluded time spent listening to podcasts and audiobooks. That easily bested Apple Music (2.3 hours), Amazon Music Unlimited (2.0 hours) and Amazon Prime (1.3 hours). These ratios have been fairly consistent over the past five years, with Spotify having an approximately 2.0 to 2.5-times advantage over its nearest competitor.

Billboard

Last year, Spotify executives described “the Spotify machine” as multiple verticals working together to give consumers more content choices and increase engagement. Podcasts, which are a natural fit for a music service built on audio advertising, offered the promise of keeping people listening longer. The same goes for audiobooks, which Spotify began streaming in the U.S. in 2023. Product features such as Spotify Wrapped and Discover Weekly are also intended to keep people listening.

Judging from statements made by Spotify’s executives, the Spotify machine is working as intended. In November, CEO Daniel Ek said that “overall, Spotify keeps bringing up engagement and bringing down churn,” the term for a subscription service’s subscriber losses. In July, Ek said the company was seeing “healthy MAU [monthly active user] engagement trends year-over-year.”

Trending on Billboard

But Spotify’s own numbers show its average global user’s listening time has remained steady over the past six years. According to data available in Spotify’s annual reports, the service had an average of 24.8 hours per monthly average user (MAU) per month in 2024, down slightly from 25.2 hours per month in 2023 and on par with the preceding four years (24.6 in 2022, 24.4 in 2021, 24.9 in 2020 and 25.5 in 2019). These listening averages cover music, podcasts and audiobooks.

Billboard

So, based on Spotify’s publicly available figures for global listening hours and MAUs, the average user’s listening time has not increased as hundreds of millions of new users have flocked to the platform.

Why the disconnect? How can Spotify executives say that engagement is growing while its own numbers show flat engagement? Perhaps engagement has increased within pockets of Spotify users. MusicWatch’s Russ Crupnick believes that in the U.S., Spotify’s late adopters are relatively light users who balance out the higher streaming activity of earlier adopters. In that scenario, if Spotify is adding listeners, it will always have new listeners to drag down other listeners’ increasing listening time.

Geographical differences could be at play, too, based on the length of time Spotify has been in each market. In July, Ek described engagement in mature markets as “high” but chose the word “different” for engagement in emerging markets. Based on his choice of words, engagement differs depending on the length of time Spotify has been in a market.

But in the U.S., at least, the time spent listening to music on Spotify has remained “reasonably” steady over the years, says Crupnick. In fact, Spotify’s weekly listening time was “actually a bit higher a few years ago,” he says. Again, the listening habits of late adopters are a reasonable explanation.

It’s worth noting that MusicWatch’s figures exclude podcast and audiobook listening. If Spotify has been able to maintain weekly music listening over the years, it stands to reason that podcasts and audiobooks have provided incremental engagement. Spotify’s lucrative, exclusive deal with The Joe Rogan Experience worked so well that Spotify became the top network for podcast listening in the U.S. in the second quarter of 2023. Last year, Spotify ranked No. 2 behind YouTube for podcast listening (26% to YouTube’s 33% and Apple Podcast’s 14%), according to Edison Research’s The Infinite Dial 2025 report.

In the subscription business, engagement is king. It leads to more subscriptions, lower subscriber churn and a better “lifetime value,” or LTV, a metric that quantifies the present value of future revenue from a subscriber. Stronger engagement gives companies the confidence to raise prices, as Spotify has recently done, and launch superfan tiers, as Spotify has teased, that offer additional bells and whistles for a higher price.

The ability to keep people listening — and be better at it than your peers — can also be a competitive advantage. One reason Spotify has a market capitalization of more than $110 billion is because investors believe Spotify is a “best in class” service that merits such a high share price.

There’s an incredible amount of product innovation going on at music subscription services. Apple Music recently launched three more live, global radio stations. Amazon Music Unlimited offers hands-free listening with Alexa. Both services provide high-quality audio at no extra cost. But Spotify has succeeded in keeping people listening longer.

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

A good streaming service deal might be tough to come across, but we found very good deep discounts with Sling TV bundles for even more premium channels, movies, TV shows, on-demand titles and music documentaries.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

Right now, you can get Sling Blue or Sling Orange + Blue for half off of your first month of service and add the streaming service Max for $5 off the monthly subscription price. This means Max starts at $4.99 per month, instead of $9.99 per month, when you bundle it with Sling TV.

Max is the home to hit movies and TV shows, as well as original Music Box documentaries, such as Yacht Rock: A DOCKumentary, Woodstock ’99: Peace, Love and Rage, Juice WLRD: Into The Abyss, DMX: Don’t Try to Understand and others.

Trending on Billboard

Max

‘Yacht Rock: A DOCKumentary’

With Sling + Max

Max

‘Woodstock ’99: Peace, Love and Rage’

With Sling + Max

Max

‘Juice WLRD: Into The Abyss’

With Sling + Max

Max

‘DMX: Don’t Try to Understand’

With Sling + Max

Alternatively, you can get a free month of AMC+ upon sign up for Sling Orange. AMC+ is the home to original programming such as Gangs of London, Interview with the Vampire, Deadstream and more.

How to Watch Sling TV Online

Here’s how Sling TV breaks down: A subscription to Sling TV gets you access to live TV from a wide range of channels, starting at $23 for the first month and $45.99 per month afterwards for the Sling Orange plan.

You can watch sports networks such as ESPN, ESPN2 and MotorTrend, while you can also watch many cable networks, including Disney Channel, AMC, BBC America, BET, CNN, Food Network, HGTV, Lifetime, Fuse, IFC, QVC, TNT, TBS and many others.

Meanwhile, you can go local with the Sling Blue plan for $25.50 for the first month and $50.99 per month afterward. The Sling TV plan comes with an assortment of local and cable channels such as ABC, Fox and NBC, as well as Bravo, Discovery Channel, Fox News, Fox Sports, MSNBC, NFL Network, National Geographic and much more.

In fact, you can combine both plans with Sling Orange + Blue, which goes for $33 for the first month and $65.99 per month after that. The Sling TV plan comes with more than 45 channels for sports, news, entertainment, lifestyle and local.

Please note: Prices and channel availability depends on your local TV market. You can learn more about Sling TV here.

Sling TV is streamable via Apple iPhone, Apple iPad, Apple TV 4K, Android smartphones and tablets, web browsers, Fire TV devices, Roku, Google TV and Google Chromecast, smart TVs, Xbox Series X/S gaming consoles and other devices. Check out a complete list of Sling TV compatible devices here.

Want more? For more product recommendations, check out our roundups of the best Xbox deals, studio headphones and Nintendo Switch accessories.

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

With more and more people cutting traditional cable, Philo remains one of the best ways to stream live TV channels and on-demand movies and TV titles for cheap.

And if you’re a new subscriber, you can sign up for a seven-day free trial to try out the streamer for yourself before you commit to monthly service. However, you can also cancel anytime, which gives you a lot of freedom.

Trending on Billboard

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

Keep reading for additional details on Philo pricing, channel availability, TV shows to watch and how to join the streaming service.

How many channels can you stream on Philo? Right now, Philo offers more than 100 channels that you can stream free of charge. No credit card required — simply sign up to test it out.

Philo

Seven-day Free Trial

Philo

$28 per month

Philo has a slate of free channels with ad-supported free-to-stream movies, TV shows and other programming. However, you can upgrade to Philo to stream more than 70 channels, including A&E, MTV, Lifetime, OWN, Nickelodeon, Nick Jr., HGTV, TLC, BET, FYI, WE tv, Logo and Discovery Channel for $28 per month. A subscription even comes with unlimited DVR cloud recording.

Currently, the most popular titles on Philo, include Tyler Perry’s Sistas on BET, Caught in the Act: Unfaithful on MTV, 90 Day Fiancé on TLC, Love & Hip Hop Miami on VH1, Love After Lockup: Crime Story on We tv and much more.

BET

‘Tyler Perry’s Sistas’

on BET

MTV

‘Caught in the Act: Unfaithful’

on MTV

TLC

’90 Day Fiancé’

on TLC

VH1

‘Love & Hip Hop Miami’

on VH1

We TV

‘Love After Lockup: Crime Story’

on We tv

You can stream Philo on the app or online via web browser at Philo.com. The app is compatible with Google TV, Chromecast, Apple TV 4K, Samsung TV, Fire TV, Roku, Apple and Android mobile devices and other streaming platforms. Learn more about Philo’s programming, channel availability, pricing and more here.

Click below to launch your seven-day free trial to Philo.

Want more? For more product recommendations, check out our roundups of the best Xbox deals, studio headphones and Nintendo Switch accessories.

Most people might not open their streaming platform of choice and play a track of wave sounds or bird calls. But on the cross-DSP page that lists “Nature” as an official artist, listeners will hear many of Mother Earth’s greatest hits, rarities and B-sides woven into songs from a growing group of musicians making nature-infused music for a good and urgent cause.

Launched in April 2024, this project, called Sounds Right, raises money for conservation efforts by generating royalties from noises credited to “nature.” On Tuesday (April 22), in honor of Earth Day, the multi-genre playlist is adding music from 36 new artists, all of whom have created original songs incorporating elements like the crashing of waves and glaciers, the delicate buzz of moth wings, running antelopes and wildlife in the dense Amazonian rainforest — all recorded out in the field.

Some of the artists involved include U.K. disco pop duo Franc Moody, Belgian techno star Amelie Lens, Indian pop artist Armaan Malik, hip-hop group KAM-BU and Swedish House Mafia’s Steve Angello. A track by I. JORDAN features the call of the U.K.’s rare Lesser Spotted Woodpecker, while London producer Alice Boyd layered vintage 1970s bird songs with present-day recordings to illustrate the natural soundscapes that have been lost to human development. Many of the project’s archival nature sounds were donated by esteemed field recording artist Martyn Stewart and his project, The Listening Planet.

Trending on Billboard

As the music industry grapples with how to mitigate climate change within the sector, Sounds Right’s expansion is another indicator that artists are keen to plug into opportunities to help. Sounds Right global program director Gabriel Smales tells Billboard that many of these artists were recruited by EarthPercent and Eleutheria Group — both Sounds Right partners who reached out to musicians with “what we think is one of the most meaningful creative opportunities in music,” he says. Other artists reached out to Sounds Right directly with a desire to contribute, raise money and, Smales says, “treat the natural world as a partner — a creative force with something urgent to say.”

While the original group of Sounds Right artists mostly remixed pre-existing songs to incorporate wind, waves, birds and more, Tuesday’s addition is largely new music, a shift that Smales says “tells us this isn’t a one-time campaign — it’s becoming a space for genuine artistic and cultural expression.” He cites an ambitious goal of “every artist” making at least one track “with Nature” and says Sounds Right will soon be announcing a way for anyone who’d like to participate to get on board.

A huge incentive to do so? The project is working. The tracks included in Sounds Right’s 2024 launch have racked up more than 100 million streams from more than 10 million listeners, with Smales citing “significant” media interest and social media engagement. In the last year, Sounds Right has raised $225,000 for Indigenous and community-led conservation in the Tropical Andes, an area famous for its biodiversity, with $100,000 coming from royalties and the rest coming from individual and institutional donations.

This money has funded organizations like Colombia’s Fundación Proyecto Tití, which protects critically endangered cotton-top tamarin monkeys and employs locals to steward more than 2,200 acres of regenerated forest. The money from Sounds Right has specifically funded the group’s restoration work with local farmers and the preservation of forest corridors. Meanwhile, money donated to Reserva Natural La Planada is being used to invest in scientific tourism and the protection of biocultural heritage across nearly 8,000 acres of land governed by 10 Indigenous communities in Colombia’s Awá Pialapí Pueblo Reserve.

As more artists contribute and Sounds Right streams grow, royalties are expected to scale “significantly,” says Smales, at which point leaders will invite more donors and match-funders to multiply funding. Smales anticipates committing “far more” funding in 2025 than in 2024 and aims to raise $5 million annually by 2028.

But he says Sounds Right leaders “are under no illusion” that $5 million a year will fix the accelerating horrors of climate change and attendant environmental degradation. Wildlife populations have dropped by an average of 69% in the past 50 years, more than 1.2 million species are currently at risk of extinction and more than two-thirds of the Earth’s land and marine ecosystems have been degraded by human activity. Meanwhile, wildfires, floods, extreme heat and other weather events are affecting delicate ecosystems and displacing humans and animals around the world.

“So far we’ve failed to address the root cause of the biodiversity crisis,” Smales says. “Our economic model doesn’t value nature properly, treating it as a resource to be optimally exploited and a place to dump our waste.” As such, a major goal for Sounds Right is getting people to see nature’s inherent value and recognizing the earth as not just something we use and live on, but as a living entity to protect.

Sounds Right is pushing this message on multiple continents. In Denmark, the project is helping send young people on artist-led nature trips and encouraging them to share 10-second field recordings as part of a #naturesings campaign. In Colombia, Sounds Right partner VozTerra is supporting teachers to train their students in acoustic ecology. A project in Kenya is forthcoming, as is additional music to be added to the playlist in conjunction with World Mental Health Day in October. Ahead of the UN Climate Change Conference in the Brazilian Amazon this November, Sounds Right will spotlight musical “collaborations” with the Amazon and Congo Basins, which together produce roughly 40% of the world’s oxygen and which are targeted to start receiving Sounds Right funding from 2025 onwards.

While climate change is daunting and the world is vast, Smales thinks Sounds Right has huge potential to effect change, given that it meets people in a very personal place: “their ears and the phones in their pockets.” The idea is to create greater interest in and love for nature by putting it in the music we all live our lives to, an awakening Smales hopes will inspire people to do more and to demonstrate the public demand for change to business and political leaders.

“We’re working,” he says, “to go beyond the headphones and build a deeper sense of agency in our collective efforts to protect the planet.”

As a festival platform, the Fyre brand doesn’t have the best reputation, to say the least. Originally billed as the ultimate FOMO event for influencers and scenesters, the high-profile collapse of the 2017 Fyre Festival in the Bahamas has become the ultimate symbol for hubris in the live music business and an unofficial synonym for any event plagued by disorganization, malaise or misery.

Now that Fyre founder Billy McFarland has tried, and once again failed, to revive the Fyre Fest name, most music fans have written off the brand as dead — but one Cleveland music and media executive has a new vision for the creatively spelled four-letter word.

Enter Fyre Music Streaming Ventures, LLC, a fan-curated on-demand music video streaming service that founder Shawn Rech hopes will become “home for the most passionate music fans and undiscovered talent around the world,” according to a release.

Trending on Billboard

“I just want people to remember the name,” Rech tells Billboard on why he chose Fyre. “It’s really that simple. It’s PT Barnum. All publicity is good publicity.”

Rech tells Billboard that shortly after the second Fyre Festival started collapsing last week, his team was on the phone with McFarland hammering out an agreement to use the Fyre name, logos and trademarks to brand the streaming venture. The agreement with Rech won’t impact McFarland’s ability to stage Fyre Festival at a future date.

Since getting out of prison in late 2022, McFarland has been hyping Fyre Festival 2 as a kind of redemption project following the disastrous 2017 event in the Bahamas that left fans stranded and resulted in a three-year sentence for the founder. Originally announced to be taking place on Isla Mujeres in Mexico, McFarland later moved the festival to Playa del Carmen before canceling it altogether after local officials in the Mexican town denied any knowledge of its existence.

Rech is a veteran entertainment executive and president/co-founder of the TruBlu Crime Network, which he launched with former To Catch a Predator host Chris Hansen in 2022. For $4.99 a month, TruBlu subscribers get access to dozens of licensed true crime shows and documentaries like A+E After Dark, Bounty Hunters and Takedown with Chris Hansen, accessible across devices via download apps and native channels built into smart TVs.

Rech says Fyre “is like a curated YouTube with an emphasis on music.” It will operate as both a subscription service and as a FAST channel, an acronym for Free Ad-supported Streaming TV, with more linear-based programming and music content submitted and upvoted by fans. Fyre will also offer audio-only capabilities for fans looking to stream content on their phones at a lower bandwidth. Metadata identification will be verified by GraceNote.

“The relationship is between the artist and the fan through a single conduit. We intend to be that conduit,” Rech says.

Fyre will use both tastemakers and fan behavior to help drive its content strategy and potentially feature McFarland in a potential talent role in the future, although nothing has been finalized.

“He was fine to deal with; I have nothing negative to say,” Rech said when asked about working with McFarland. “He’s a big dreamer.”

You can learn more about the project and sign up for notifications at watchfyretv.com.

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Don’t look now, but Lifetime is having a resurgence.

Yes, the television channel that was once home to cheesy Christmas movies and over-the-top shows is now delivering some seriously must-watch programming. From a Taylor Swift-inspired Christmas movie last year to a controversial Wendy Williams documentary, Lifetime has now become a destination for buzzed-about films, shows and specials that span music and pop culture interests.

Many musicians are now also flexing their acting chops in Lifetime movies, like Glee star Amber Riley in the Single Black Female trilogy, while Mary J. Blige, Lisa Lisa and Gloria Gaynor are featured in Lifetime’s 2025 “Voices of a Lifetime” series. And yes, we still love watching those Lifetime Christmas movies too.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

Lifetime is available as a channel in most cable packages so you can watch Lifetime on TV through your cable provider. While many people have cut the cable cord, there are still ways to watch Lifetime (and Lifetime movies) online. Here’s what you need to know.

How to Watch Lifetime Channel Online Without Cable

The best way to watch Lifetime channel live online without cable is by using a live TV streaming service, like DirecTV or Philo. Both offer a live Lifetime feed so you can watch whatever is airing on TV but from your computer, phone or tablet (and from your smart TV too).

We like Philo, which costs just $28/month for more than 70 live television channels, including Lifetime, AMC, BET, MTV, TLC, VH1 and more. Philo also includes access to the Lifetime Movie Network for even more content options. Test out Philo with a seven-day free trial here to stream Lifetime online for free.

We also like DirecTV, which is the most comprehensive live TV streamer on our list. DirecTV’s base entertainment package includes 90+ live TV channels, including Lifetime. You also get access to Bravo, E!, ESPN, MTV and more, plus most local networks like ABC, CBS, NBC and FOX.

DirecTV plans start at $84.99/month but you can test drive the service with a five-day free trial here.

Your most affordable way to stream Lifetime movies live online is through frndly TV. One of the newer streaming services to hit the market, frndly’s plans start at just $6.99/month for 50+ channels. Their channel lineup includes Lifetime, Hallmark Channel, Great American Family, ION and more. Even better: get a seven-day free trial here and use it to watch Lifetime online free.

How to Watch Lifetime Movies On-Demand Online

The live streaming services above will let you watch the Lifetime channel live online, but what if you wanted to find a favorite Lifetime movie to watch on-demand? Luckily, the same streaming services listed in the previous section will let you watch movies and specials on-demand on the Lifetime website.

Simply create a profile on the MyLifetime.com website and enter your cable provider details. Don’t have cable? You can enter your DirecTV and Philo details too to get access to all the content on Lifetime’s official site.

Another way to watch Lifetime movies on-demand? You can also sign up for Lifetime Movie Club, which has thousands of titles available to watch online. Regularly $4.99/month, Amazon Prime members can get a seven-day free trial here to watch Lifetime Movie Club online free. One of the best parts of Lifetime Movie Club is the ability to stream the movies ad-free.

Not a Prime member? Use this generous 30-day free trial to get access to the Lifetime Movie Club in addition to all the other Prime member perks, like free shipping, Prime Day deals and more.

Select Lifetime movies are also available to rent or download through Prime Video. See full details here.

State Champ Radio

State Champ Radio