Streaming

Page: 14

Growth in recorded music, publishing and merchandise helped Universal Music Group (UMG) post strong revenue growth in both the fourth quarter and full year 2024, while cost savings from layoffs helped the company produce even better earnings gains.

Driven by an 8.2% increase in recorded music subscription revenue, full-year revenue was up 6.5% (7.6% at constant currency) to 11.83 billion euros ($12.8 billion). With a lower cost base, adjusted earnings before interest, taxes, depreciation and amortization (EDITDA) improved 13.8% to 2.66 billion euros ($2.88 billion), while adjusted EBITDA margin climbed to 22.2% from 21.3% in 2023.

During Thursday’s earnings call, CEO Lucian Grainge called 2024 “a tremendously successful year for us at UMG” and cited the company’s “healthy revenue and double-digit adjusted EBITDA growth for each and every year since 2021 when UMG became a standalone public company.” He rattled off a host of UMG’s accomplishments for the year, including having four of the top five artists on Spotify and nine of the top 10 artists — and all of the top five — on the IFPI Global Artist Chart. UMG also had the two biggest new artist breakthroughs of 2024 in Chappell Roan and Sabrina Carpenter. Roan won the Grammy for best new artist in February.

Trending on Billboard

In the recorded music segment, full-year revenue increased 5.2% (6.4% in constant currency) to 8.9 billion euros ($9.63 billion). Adjusted EBITDA climbed 11.4% to 2.28 billion euros ($2.47 billion). Streaming revenue grew 5.9% to 6.04 billion euros ($6.54 billion), with subscription revenue doing the heavy lifting, rising 8.2% while other streaming revenue — namely ad-supported streaming — fell 0.8%. Downloads and other digital revenue dropped 13.0% but accounted for just 180 million euros ($195 million), or roughly 2% of recorded music revenue. Physical revenue fell 1.6% (up 1.1% in constant currency) to 1.36 billion euros ($1.47 billion). Licensing and other revenue jumped 12.9% to 1.33 billion euros ($1.44 billion).

In music publishing, full-year revenue rose 8.4% (9.0% in constant currency) to 2.12 billion euros ($2.29 billion) and adjusted EBITDA improved 8.7% to 511 million euros ($553 million). Led by strong streaming growth, digital revenue improved 12.4% to 1.27 billion euros ($1.37 billion) and accounted for 60% of total publishing revenue. Performance revenue grew 6.3% to 442 million euros ($478 million). Synch revenue fell 0.4% to 253 million euros ($274 million). Mechanical royalties dropped 4.6% to 103 million euros ($112 million).

Full-year merchandise revenue grew 19.3% to 842 million euros ($911 million), although adjusted EBITDA declined 8.5% to 43 million euros ($47 million). UMG COO/CFO Boyd Muir said the revenue growth reflected “robust superfan demand that is driving strong growth in both direct-consumer and touring revenue.” The lower EBITDA resulted from lower-margin touring merchandise sales, said Muir, though UMG expects merchandise margins to improve as the company ramps up its direct-to-consumer business.

UMG experienced 75 million euros ($81 million) of cost savings in 2024 in the first phase of a 250-million-euro ($270 million) cost savings program. Muir said the company will provide an update on the second phase of the program at a later date and added the implementation “remains on — if not slightly ahead of — schedule.” When UMG announced its cost-savings plan in February 2024, Grainge said the redesign “carefully preserves what we’re best at: creative A&R, marketing independence, unique label brand identities” and an entrepreneurial and competitive spirit.

Cash paid for catalog acquisitions grew to 266 million euros ($288 million) in 2024 from 178 million euros ($193 million) in 2023. Last year’s figure included the acquisition of the remaining stake in RS Group in Thailand and the completion of a 2023 catalog acquisition. UMG had a busy M&A year, buying the remaining share of [PIAS] and investing in Chord Music Partners, NTWRK and Mavin Global. As a result of that activity, free cash flow fell to 523 million euros ($566 million) in 2024 from 1.08 billion euros ($1.17 billion) in the prior year.

Comprehensive fourth-quarter revenue grew 7.2% to 3.44 billion euros ($3.67 billion), or 7.9% in constant currency. Adjusted EBITDA jumped 19.1% to 799 million euros ($852 million). Adjusted EBITDA margin rose to 23.2% from 21.1%. Excluding one-time items, fourth quarter revenue was up 6.1% in constant currency. That non-recurring revenue included the 20 million euros ($21 million) of DSP catch-up income and 40 million euros ($43 million) of legal settlements.

Recorded music subscription revenue climbed 7.9% (9.0% in constant currency) in the fourth quarter, safely within the company’s prior long-term guidance of 8% to 10%, though it suffered a one-percentage-point hit from a decline in revenue from fitness platforms. Ad-supported streaming revenue fell 5.1% (4.1% in constant currency). Combined subscription and ad-supported streaming revenue grew 4.6% (5.6% at constant currency).

YouTube now has 125 million subscribers across YouTube Music and YouTube Premium, according to an open letter from Lyor Cohen published on Wednesday (March 5). Cohen called this number — which includes trial users — “an incredible milestone that many laughed off as impossible when we first launched. This momentum is critical to our goal […]

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Ever since its inception in 1983, BET — or the Black Entertainment Network — has been a go-to television channel for music, movies, TV shows and specials, with no shortage of memorable moments over the years.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

Home to the annual BET Awards (and the BET Hip-Hop Awards), the NAACP Image Awards, and the Soul Train Awards, among others, BET also aired the popular 106 & Park music countdown show for 14 celebrated years. The channel was also home to original series like Being Mary Jane, ComicView, Bobby Jones Gospel, American Gangster and The Game, amassing millions of viewers each week for the drama and laughs.

These days, BET continues to be a top destination for entertainment, with hit series like Sistas, The Family Business, Tyler Perry’s Assisted Living, Ms. Pat Settles It and more. The good news: with fewer people actually owning a cable box these days, you can now watch BET online without cable.

Keep reading to find out how to stream BET and get a live feed of the television channel online.

How to Stream BET Online Without Cable

The best way to watch BET shows online is by signing up for a live TV streaming service, which lets you watch television channels through the internet, without needing cable.

Watch BET Online With Fubo

One of our favorite streamers is Fubo, which offers 150+ channels that you can stream from home, including BET. Fubo’s plans start at $64.99/month and include unlimited live streaming on up to ten devices, plus cloud DVR, but right now, you can test out Fubo with a seven-day free trial here. Use the free trial to livestream BET online free and catch your favorite shows as they air.

What we like: Fubo’s free trial includes free DVR so you can record your shows to watch back on-demand on your own time. See full details here.

Watch BET Online With Philo

Another great way to watch BET online without cable is through Philo. The streaming service costs just $28/month for 70+ channels, including BET, BET Her, MTV, VH1, Lifetime and more. This makes Philo one of the best values in streaming and an affordable way to stream BET shows and live specials. Use this seven-day free trial to test out Philo’s offerings without commitment.

Philo’s plans also include DVR and you can record and store your shows for up to one year, to watch back a replay on-demand. See the latest Philo deals here.

Watch BET Online With DirecTV Stream

We’re also big fans of DirecTV Stream, which offers all the cable channels you get on DirecTV but in an easy and convenient streaming service. Use DirecTV Stream to watch live TV online, with 90+ channels available including BET.

DirecTV Stream currently offers a five-day free trial that you can use to livestream BET online free. Continue on after your free trial is done with streaming plans starting at just 74.99/month.

Watch BET Online With Sling TV

Sling TV lets you watch BET online at home with the channel offered on both its Sling Orange and Sling Blue plans. While Sling doesn’t currently offer a free trial, it has the most affordable streaming options on our list, with a new deal getting you 50% off your first month of service. Plans for Sling Orange are the cheapest, starting at just $23 here. Sign up for watch BET online through Sling.

All of the above streaming services like you watch BET network online through your phone, tablet, computer or smart TV.

How to Watch BET+ Online

BET is not to be confused with BET+, the standalone streaming service that offers many original shows and specials that you can’t find on the conventional cable network. BET+ exclusives include Kingdom Business, All the Queen’s Men, Tyler Perry’s Ruthless and more.

Try out BET+ with this seven-day free trial, reserved exclusively for Amazon Prime members. Not a Prime member? Get a 30-day free trial to access all the perks here.

Crypto proponent Snoop Dogg is officially partnering with Tune. FM as the face of the Web3 music streaming platform, Billboard can exclusively report. The first project being streamed under the new partnership is the newly released single “Spaceship Party.”

The rapper/entrepreneur also plans to move more of his catalog, including his Death Row Records material, to Tune.FM.

In publicly announcing the switch, Snoop bluntly states in a comment given to Billboard, “I don’t f**k with Spotify anymore. I’m only on Tune.FM.”

Trending on Billboard

Tune.FM styles itself as a decentralized Web3 streaming platform focusing on transparency, security and fairness for artists through blockchain technology. The platform’s native cryptocurrency is something called JAM. Unlike traditional services, it says it provides instant micropayments per second streamed. Users can sign up and start streaming without needing blockchain knowledge. Upon registration, a JAM wallet is automatically created, allowing users to spend JAM tokens on streaming, tipping artists and unlocking exclusive content.

Tune.FM says its AI-driven discovery algorithm promotes independent artists organically, bypassing paid placements. Additionally, artists can tokenize music rights, allowing fans to invest and earn royalties.

Snoop Dogg’s decision to partner with the platform came after meeting Tune.FM founder/CEO Andrew Antar at the Crypto Ball prior to President Trump’s inauguration in January.

“We are thrilled to welcome Snoop Dogg as the face of Tune.FM,” Antar tells Billboard. “Snoop is the OG pioneer who is always on the cutting edge of technology and new ways of doing business. He totally gets it, and we are ready to take on the world together.” A classically trained musician, Antar also plays violin on “Spaceship Party.”

Tune.FM

Cordell Broadus

Beyond moving his catalog to Tune.FM, Snoop Dogg is planning to host fan experiences and giveaways such as a private event at his house and VIP prize tiers. Additional plans include integrating Tune.FM into live events and exclusive concerts, as well as bringing unique artist-fan interactions and collectibles to the platform’s marketplace.

Tune.FM is also in talks with major labels (Universal, Sony), major distributors and high-profile artists to bring more exclusive content to the platform. According to a Tune.FM spokesperson, “Tune.FM operates under non-exclusive licensing agreements, enabling us to unlock new revenue streams for under-monetized catalogs and artist IP on both our streaming platform and marketplace.”

The rep declined to disclose specifics about any deals, but added, “we can share that major distributors and labels are increasingly coming on board to upload catalogs that have long been under-monetized.”

Cloud Music’s revenue from subscriptions grew 22.2% year over year, helping the Chinese music streaming company post a 113% increase in profit, to 1.7 billion RMB ($233.4 million), as revenue increased by only 1%, to 7.95 billion RMB ($1.09 billion), the company announced Thursday (Feb. 20). Revenue from online music services increased 23.1% to 5.35 […]

For several years, the consensus has been clear: Hit singles are getting shorter. Blame for this has fallen on shrinking attention spans, an environment of endless musical abundance in which songs must impress themselves on listeners quickly or risk being discarded, and the rise of short-form video platforms, which cause users to fall in love with 15-second sound snippets, rendering a full track irrelevant.

In 2024, however, the average length of songs that cracked the top 10 on the Billboard Hot 100 actually rose by more than 20 seconds, to 3:40, according to Hit Songs Deconstructed. At the same time, the portion of top 10 hits that let over a minute pass before hammering home a chorus rose to its highest level in a decade, nearly 23%.

While a single year of data doesn’t reverse a trend, it’s clear that longer hits have not been banished permanently from the upper reaches of the Hot 100. Five top 10s last year exceeded five minutes, including two apiece from Taylor Swift and Kendrick Lamar. These are the musical equivalents of doorstops, more than twice as long as the shortest top 10, Tate McRae‘s “Greedy.” And those hits seem downright laconic next to Drake‘s “Family Matters,” released in the middle of his venomous, no-holds-barred showdown with Lamar, which ran past 7:30.

Trending on Billboard

Top songwriters and producers were cautiously optimistic about having more room to roam last year — and more freedom from the old adage, “Don’t bore us, get to the chorus.”

“The whole short-form thing has been pushed so hard,” says GENT!, who co-produced Doja Cat‘s “Agora Hills,” a hit that clocks in at 4:25. “The majority of the time, with short-form content, you need a gimmick, and I think music lovers are kind of tired of the gimmicks.”

“[An increase of] 20 seconds is significant,” adds the writer and producer Cirkut (Lady Gaga‘s “Abracadabra,” ROSÉ and Bruno Mars‘ “APT.”). “People may be tiring of the quick little TikTok thing.”

On a spectrum between succinct and long-winded, Cirkut leans toward the former. “I do like to get to the hook,” he says. But he acknowledges that “sometimes, a longer verse keeps you waiting, and if it’s well-written, then it makes the chorus that much more satisfying.”

TikTok can certainly reward brevity as users fall hard for sonic morsels, even a verse or a hook from an as-yet-unwritten song. But perhaps counterintuitively, when “any catchy part of a song could be what grabs people’s attention,” this may end up loosening the constraints binding commercial songwriters, according to Matt MacFarlane, senior vp of publishing at Artist Partner Group. “Song length becomes less relevant,” adds Olly Sheppard, also a senior vp at APG. “Listeners already like the part they found on TikTok,” so they’re locked in regardless of how peculiar or meandering the rest of the track turns out to be.

This theory also got a vote of support from Evan Blair, who produced and co-wrote Benson Boone’s theatrical, heaving ballad “Beautiful Things,” which peaked at No. 2 on the Hot 100. (At three minutes on the dot, “Beautiful Things” was shorter than the average top 10 hit last year, but it did make listeners wait more than a minute before drenching them with a chorus.) “Now that teasing tracks [on TikTok and other social media platforms] is a thing, we often don’t introduce songs to the world chronologically,” Blair says. “If we draw people into the middle of the song, the journey to get there matters much less.”

While TikTok plays a prime role in music discovery, it is not the only factor influencing what songs become popular. Vincent “Tuff” Morgan, vp of A&R at the indie publisher peermusic, points out that many of the star artists and songwriters who released albums last year are now in the second half of their 30s. They have devoted fan bases, so they don’t live or die by viral trends: Instead, they can be confident that even if they take their time, legions of listeners will linger with them.

“If you look at the chart, a lot of these are seasoned songwriters,” Morgan says. “The commonality is that the songwriters are a little more mature than the Gen-Z, TikTok generation.” Superstars like Swift, Lamar, Bruno Mars and Beyoncé, who combined for two dozen top 10 hits between them in 2024, are all 35 and up.

Data from last year offers some support for Morgan’s theory. The average length of a top 10 hit was 3:40, and the average age of the lead artists on songs that exceeded 3:40 was around 35. That’s roughly five years more than the average age of the lead artists whose hits clocked in under 3:40.

Not only that: 12 out of 18 of the top 10s that sprinted to the finish line in less than 3 minutes came from musicians under the age of 30. On the other end of the spectrum, Swift, who is 35, had seven top 10 hits longer than 3:40, and Lamar, age 37, had six.

This is all exciting for Dan Petel, who runs This Is Noise, a management company with a roster of songwriters and producers. For years, he’s been admonishing his clients, “stop sending songs that are just two verses and a chorus!” And now he believes, “happily, we’re evolving away from 15-second clip-based music.”

“If you’re gonna have a great song,” Petel adds, “why would you want it to end so soon?”

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Mufasa: The Lion King was one of the biggest movie of 2024. But, if you missed it in theaters, the prequel film is now available to stream at home.

Read on for the best way to stream Mufasa: The Lion King online.

How to Watch Mufasa: The Lion King Online

Mufasa: The Lion King is streaming for $24.99 to rent and $29.99 to buy digitally on Prime Video, Apple TV and other premium video on-demand marketplaces.

However, rentals are accessible for 30 days after purchase, and for 48 hours once you begin watching the movie.

Directed by Barry Jenkins (Moonlight, If Beale Street Could Talk), Mufasa: The Lion King is a prequel to the 2019 live-action version of The Lion King. It follows an orphaned cub named Mufasa (Aaron Pierre), who gets adopted into the royal family and becomes the brother of Taka (Kelvin Harrison Jr.), a young lion prince who later becomes Scar. The film then follows Mufasa’s journey to becoming the next king of the Pride Lands.

The movie also features a voice cast with Seth Rogen, Billy Eichner, Tiffany Boone, Donald Glover, Mads Mikkelsen, Thandiwe Newton, Lennie James, Anika Noni Rose, Blue Ivy Carter, Beyoncé Knowles-Carter and others.

Meanwhile, the soundtrack for Mufasa: The Lion King also features original songs by Lin-Manuel Miranda and a film score by Dave Metzger.

Mufasa: The Lion King is to rent for $24.99, or buy digitally for $29.99 on Prime Video. In the meantime, you can watch a trailer for the movie below, or watch The Lion King at the Hollywood Bowl featuring Jennifer Hudson, North West and other on Disney+.

Want more? For more product recommendations, check out our roundups of the best Xbox deals, studio headphones and Nintendo Switch accessories.

Not long after Lil Tecca released his fifth album Plan A last September, he visited a boisterous livestreamer named Tylil, who has more than 300,000 followers on Twitch. “We wanted to portray Tecca’s personality, which is sometimes a little too shielded,” says Giuseppe Zappala, who manages the rapper. “And streamers have been recognized at the top of the hierarchy in the digital landscape.”

Livestreaming was once dominated by gamers, which limited the ways that artists could engage with the Twitch ecosystem. But the landscape has diversified over time. When Tecca met up with Tylil, the two played paintball together; later, the streamer gave the 22-year-old rapper a driving lesson, even though Tecca didn’t have a driver’s license. (“Do not press on the gas hard… I know you play a lot of car games; this is a real car.”) Everything was captured on camera in real time, and the resulting “relatable” videos, Zappala says, remind viewers “that Tecca is a down-to-earth, funny person.”

A lot of people watch streamers like Tylil, Kai Cenat, PlaqueBoyMax, Duke and IShowSpeed when they’re live. Still, relying only on a live audience limits their reach. “Core fans will watch hours of streams,” says Rafael Rocha, CEO of the marketing agency NuWave Digital. “Everybody else will consume that content mainly in short-form video.”

Trending on Billboard

Music marketers are increasingly focused on facilitating that second wave of engagement, which they do by snipping out the highlights of livestreams — either relying on their own teams of editors; “clippers” who congregate on Discord; or AI programs — and then promoting those bite-sized videos across TikTok, Instagram, X and more.

“Twitch is, in many ways, the new live TV,” says Alec Henderson, head of digital at APG. “And the clips from the livestreams are just like TV reruns. Those highly engaged, entertaining moments can live online forever.”

Henderson saw the value of livestreams when he brought the rapper Lil Baby on to Cenat’s stream back in the fall of 2022: “It ended up one of the most fruitful parts of our rollout,” he says. Last year, livestreamers led to boosts for APG acts like BabyChiefDoit and Flawed Mangoes. A recent press release promoting DDG‘s new single “The Method” credits the rapper’s appearance on PlaqueBoyMax’s livestream with jump-starting the track: “Immediately, clips of the recording went viral across socials and garnered over 1 million views on TikTok alone.”

The clipping practice has been popular in the Twitch streaming community for some time, according to Parker Ulry, who runs the digital marketing agency Perfect Circle. “The podcast community is super on it now, and music is falling in line.”

“Ideally, someone discovers your Twitch stream or podcast interview through a 30-second clip and then goes back and consumes the whole piece,” Ulry continues. “Then they become a fan of you and start streaming your music.”

Artists have several options when they want to reach the livestreaming audience, according to Alex Falck, head of commercial at the digital marketing company Creed Media. They can get streamers to play their music and react to it on camera; let them use their music for highlight compilations; actually go on the livestream to hang out; and even produce music with the streamer. (This is how PlaqueBoyMax has built his following; Henderson predicts that “it’s just a matter of time before a hit record comes out of one of those streams.”)

Once the stream is underway, the captivating moments need to be isolated and extracted. “If you’re on a three-hour stream, that’s a content goldmine — 20, 30, 50 posts,” Ulry says.

Some digital marketers do the clipping in-house. But many find armies of capable clippers on the messaging platform Discord. “A lot of these niche underground communities are naturally congregating on Discord already,” says Vanessa Sheldon, a digital marketer at Forever Music Group who works on a lot of clipping campaigns. “Discord allows developers to build things into these servers and communities, so we created our own server, got a lot of those kids in there, and then built the tool kit for them to participate in these campaigns and get paid out.”

Clippers she works with are compensated based on the performance of their videos. Usually, the rate is between 30 cents and 50 cents per thousand views, though it can go as high as 70 cents in some cases. This means that the roughly 2,000 members of the Discord community she assembled are incentivized to make their clips as eye-catching as possible. “The more viral your video is,” Sheldon says, “the more you get paid.”

Marketers can also use AI-powered tools to create the clips for them. “OpusClip will spit out a bunch of content for you automatically with edited subtitles,” Falck explains. The results may be haphazard, but they are delivered quickly. “AI is still somewhat new, so it doesn’t necessarily get the same level of attention or amazing editing as if you use your in-house team,” Falck continues. “It’s more of a volume game, pushing out 100 assets per stream, just seeing what takes off.”

Once the clips are in hand, “Start pumping them onto TikTok, Instagram, even YouTube Shorts, these algorithmically powered platforms,” Ulry says. One natural ally in this effort is fan pages, which are dedicated to posting nonstop about a particular artist or group of artists. (These accounts can be created by the artist or their team, or run by enthusiastic civilians with lots of time on their hands.) Another is what Falck calls “community pages” — accounts dedicated to a specific genre of music, for example. They all help create what Zappala describes as “an explosion of content that’s circulating the internet” in the wake of the livestream, raising awareness and hopefully hooking potential fans.

One manager recently asked Mayor Cohen, a digital marketer, if he could organize a “tour” of five to 10 livestreamers for an artist. “That’s kind of the business: Get artists on the stream, then repurpose content,” Cohen says. “Not that many people will watch a four-hour stream. But they will go on TikTok or Instagram and watch the best clips.”

“If the clip is reactive,” Ulry adds, “it’ll find an audience.”

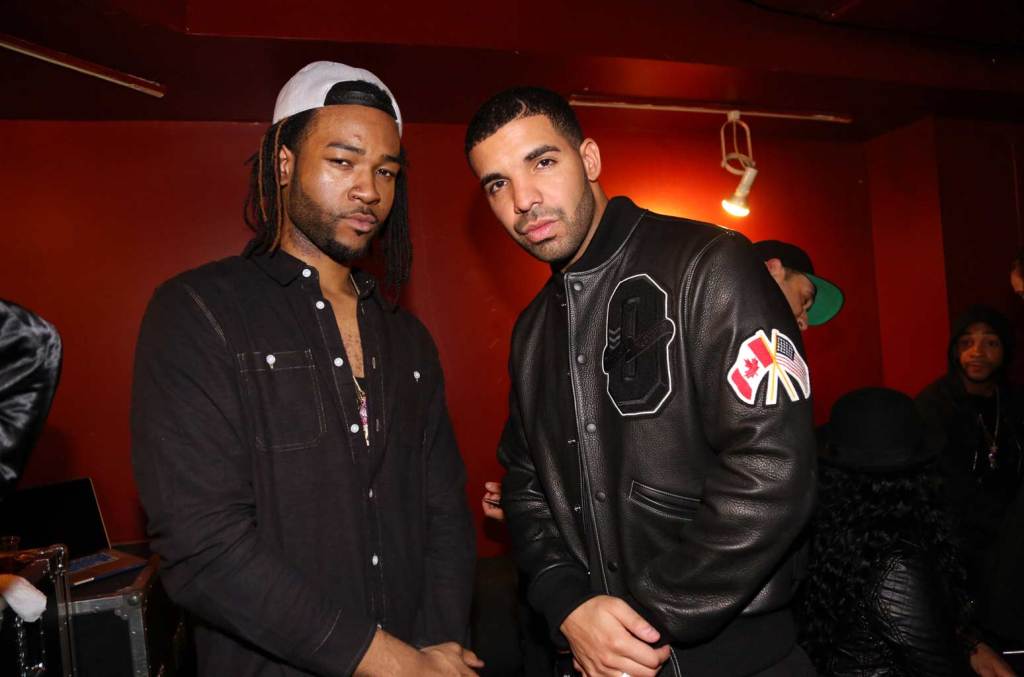

Drake and PartyNextDoor’s new album has already setting records on Apple Music following its Valentine’s Day release.

After dropping on Friday (Feb. 14), the duo’s years-in-the-making project, $ome $exy $ongs 4 U, has broken the record for the biggest R&B/soul album in Apple Music’s history by first-day streams worldwide.

Billboard has reached out to Apple Music for more details.

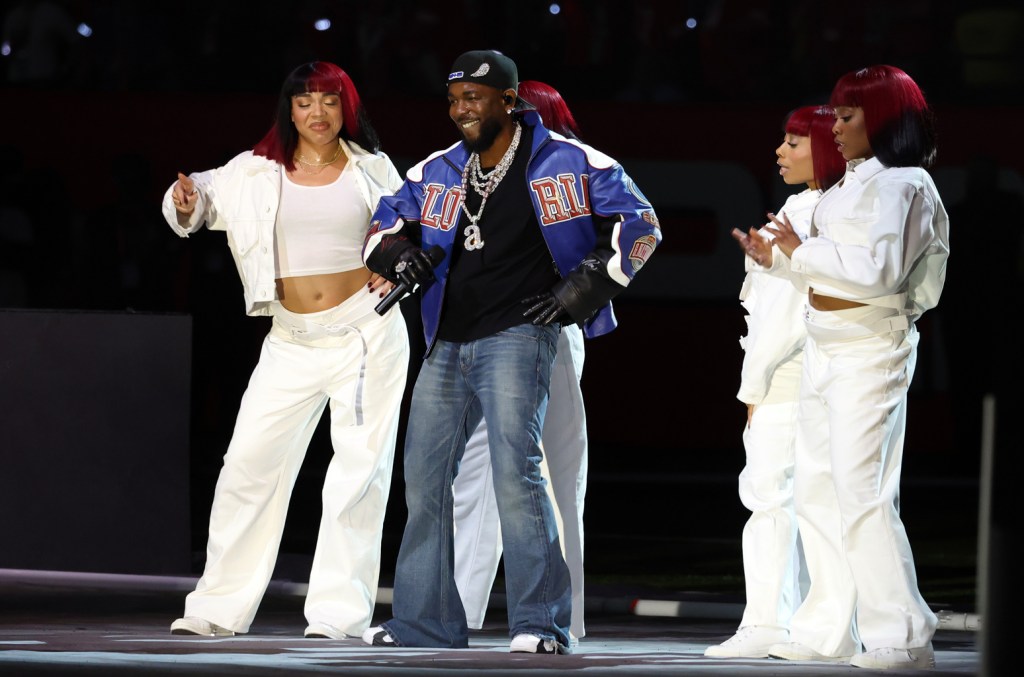

$ome $exy $ongs 4 U marks Drake’s first full album since 2023’s For All the Dogs, which spent two weeks at No. 1 on the Billboard 200. It’s also his first major project since his explosive rap feud with Kendrick Lamar, which recently saw K. Dot take aim at the Toronto superstar during the Super Bowl Halftime Show on Feb. 9, performing his Billboard Hot 100-topping diss track “Not Like Us” in front of more than 100 million viewers.’

Trending on Billboard

The 21-track album, with a 74-minute runtime, follows PartyNextDoor’s P4, released in 2024.

Earlier in the week, Drake brought out PND during a concert in Melbourne, where the OVO signee surprised the Australian crowd on Drake’s Anita Max Wynn Tour.

“I got an album coming out on Feb. 14 with my brother PartyNextDoor,” Drake told the crowd. “It’s called $ome $exy $ongs 4 U, but it’s some turned-up songs for you on there, too, and there’s some personal feelings on there for you. Hopefully, whoever you’re with on Valentine’s Day, hopefully y’all can share that experience together.”

Drake also revealed the cover art for $$$4U, which features both artists rocking fur coats in front of the Marilyn Monroe Towers in Canada.

The duo has long demonstrated their strong chemistry on tracks like “Come and See Me,” “Recognize,” “Members Only,” “Loyal,” “Preach, “Since Way Back,” and others.

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

UFC goes back home to “The Entertainment Capital of the World.” Two premiere middleweight fighters are set to go head-to-head in the octagon as the main event for UFC Fight Night. American Jared “The Killa Gorilla” Cannonier (17-8-0) faces off against Brazilian fighter Gregory “Robocop” Rodrigues (16-5-0) on Saturday, Feb. 15.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

UFC Fight Night: Cannonier vs. Rodrigues takes place at UFC Apex in Las Vegas, Nevada, with a start time of 4 p.m. ET/1 p.m. PT. The main card is expected to begin at 7 p.m. ET/4 p.m. PT.

If you want to watch UFC Fight Night: Cannonier vs. Rodrigues online, the MMA event livestreams on ESPN+ for subscribers only.

Not a subscriber? A monthly subscription to ESPN+ goes for $11.99 per month. However, you can go with an ESPN+ annual subscription for $119.99. This saves you 15% compared to the month-to-month subscription price.

Check out the complete UFC Fight Night: Cannonier vs. Rodrigues fight card below:

Main Card, 7 p.m. ET/4 p.m. PT — ESPN+

Jared Cannonier vs. Gregory Rodrigues (Middleweight) — Main Event

Calvin Kattar vs. Youssef Zalal (Featherweight)

Edmen Shahbazyan vs. Dylan Budka (Middleweight)

Ismael Bonfim vs. Nazim Sadykhov (Lightweight)

Rodolfo Vieira vs. Andre Petroski (Middleweight)

Connor Matthews vs. Jose Delgado (Featherweight)

Prelims Card, 4 p.m. ET/1 p.m. PT — ESPN+

Angela Hill vs. Ketlen Souza (Women’s Strawweight)

Jared Gordon vs. Mashrabjon Ruziboev (Lightweight)

Rafael Estevam vs. Jesús Santos Aguilar (Flyweight)

Gabriel Bonfim vs. Khaos Williams (Welterweight)

Vince Morales vs. Elijah Smith (Bantamweight)

Valter Walker vs. Don’Tale Mayes (Heavyweight)

Julia Avila vs. Jacqueline Cavalcanti (Women’s Bantamweight)

In addition, you can get the Disney Trio — which comes with ESPN+, Hulu and Disney+ — starting at just $16.99 per month for both services in one package.

What Is Cannonier vs. Rodrigues’ Walkout Music for UFC Fight Night?

While UFC has yet to announce each fighter’s walkout music for the main event of UFC Fight Night, the fighters usually go out to the octagon to the same songs during their matches. Jared Cannonier typically walks out to “TA.TA.RI.GAMI (The Demon God)” by Japanese composer Joe Hisaishi from the film Princess Mononoke, while Gregory Rodrigues prefers to walk out to “This Means War” by Avenged Sevenfold. So these songs will likely make an appearance during the MMA event.

UFC Fight Night: Cannonier vs. Rodrigues is streaming on ESPN+ on Saturday, Feb. 15, starting at 4 p.m. ET/1 p.m. PT. The main card begins around at 7 p.m. ET/4 p.m. PT on ESPN+.

Want more? For more product recommendations, check out our roundups of the best Xbox deals, studio headphones and Nintendo Switch accessories.

State Champ Radio

State Champ Radio