Business

Page: 141

Yo Gotti has welcomed another addition to the CMG family as Zillionaire Doe signs to the Memphis native’s imprint. Billboard learned on Tuesday (Jan. 21) that the ink is dry on the deal with the burgeoning Dallas-bred rapper, who looked up to Gotti growing up. “I’m really excited to work with Gotti and the CMG […]

This is The Legal Beat, a weekly newsletter about music law from Billboard Pro, offering you a one-stop cheat sheet of big new cases, important rulings and all the fun stuff in between.

This week: Drake sues Universal Music Group for defamation over Kendrick Lamar’s diss track “Not Like Us”; the Supreme Court upholds a ban on TikTok but President Donald Trump says he’ll delay it; Nelly demands punishment for a “frivolous” lawsuit over Country Grammar; and more.

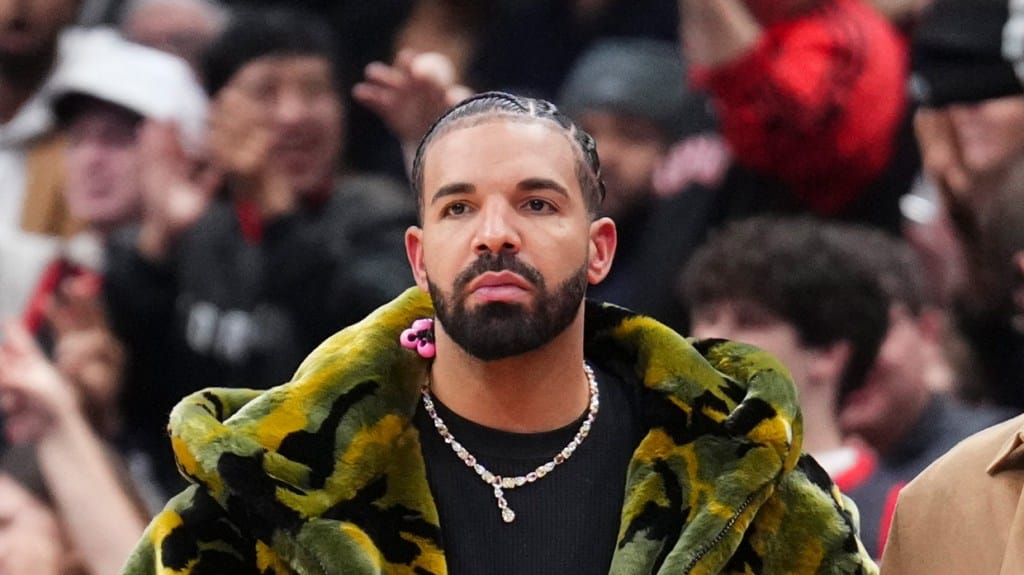

THE BIG STORY: Drake v. UMG

Two months after Drake shocked the music industry with court filings suggesting he might file a lawsuit over Kendrick Lamar’s “Not Like Us, the superstar rapper did exactly that — seemingly unswayed by public ridicule that he had hired lawyers during a rap beef.

Trending on Billboard

In a case filed in Manhattan federal court, Drake accused Universal Music Group of defaming him by promoting Lamar’s song — a brutal diss track that savaged Drake as a “certified pedophile” and became a chart-topping hit in its own right. The star claimed that his own label had “waged a campaign against him,” boosting a “false and malicious narrative” even though it knew it was false.

“UMG intentionally sought to turn Drake into a pariah, a target for harassment, or worse,” the star’s lawyers wrote. “UMG did so not because it believes any of these false claims to be true, but instead because it would profit from damaging Drake’s reputation.”

Can Drake really sue over a diss track? While the term “slander” gets thrown around a lot these days, actual legal defamation is pretty hard to prove in America. Drake would need to show that Lamar’s statements were provably false — a tricky task in a lyrical context where listeners have come to expect bombastic boasting and obvious exaggerations.

“The public … has to believe that the speaker is being serious, and not just hurling insults in a diss fight,” Dori Hanswirth, a longtime media law attorney, told me last year. “If the statements are not taken literally, then they are rhetorical hyperbole and not considered to be defamatory. The context of this song-by-song grudge match tends to support the idea that this is rhetorical, and a creative way to beef with a rival.”

That’s essentially the same argument that UMG made when it responded to Drake’s “illogical” lawsuit: That all parties involved in rap beefs, from the artist to the labels to the fans, have always known that it’s all part of a game — until now.

“Throughout his career, Drake has intentionally and successfully used UMG to distribute his music and poetry to engage in conventionally outrageous back-and-forth ‘rap battles’ to express his feelings about other artists,” UMG wrote in its response. “He now seeks to weaponize the legal process to silence an artist’s creative expression and to seek damages from UMG for distributing that artist’s music.”

For more, go read our entire story on the lawsuit, featuring a detailed breakdown of the allegations and a link to Drake’s full complaint.

THE OTHER BIG STORY: TikTok Ban

The TikTok rollercoaster continues. After the U.S. Supreme Court upheld a federal law effectively banning TikTok over national security concerns, newly-inaugurated President Donald Trump quickly claimed to have delayed the ban — a move that restored the app for users but left plenty uncertain.

In a unanimous ruling Friday, the high court said the law — set to go into effect on Sunday (Jan. 19) — was fair game because the U.S. government has valid fears about China’s control over TikTok, a service with 170 million American users that has become a key promotional tool for the music industry.

As a result of that ruling, TikTok briefly went dark for users on Saturday and vanished from Google’s and Apple’s app stores. Service was restored on Sunday after Trump announced that he was planning an executive order to delay the ban.

In an order issued Monday (Jan. 20), Trump (who once led the charge against TikTok but later reversed course) instructed his attorney general not to enforce the ban for 75 days to give his administration time to “determine the appropriate course forward.” Trump had previously said he would “negotiate a resolution,” potentially for an American company to buy TikTok — the explicit goal of the ban.

Trump’s move was a win for TikTok and its many U.S. fans, but it raises difficult legal questions.

Under the Constitution’s separation of powers, the president cannot outright ignore laws passed by Congress. In practice, enforcement priorities can sometimes be a bit discretionary — like with federal drug laws in states that legalized cannabis — but does that leeway extend to flatly refusing to enforce a national security law? The TikTok law does contain a provision allowing for a 90-day delay if a sale is imminent, but it’s unclear if Trump’s order triggered that option, or if he was even legally eligible to do so.

For now, that uncertainty has left things in limbo. Trump’s assurances clearly allayed fears, but the app remains unavailable for download on the app stores — likely because the law threatens huge financial penalties against service providers like Google and Apple that violate the ban.

What happens next? A lawsuit challenging Trump’s executive order? An act of Congress to repeal the ban? A sale of TikTok to an American firm? Stay tuned…

Other top stories…

NELLY NOT PLAYING – Nelly (Cornell Haynes) asked a judge to issue legal sanctions in a copyright lawsuit filed by his former St. Lunatics bandmate Ali over Nelly’s 2000 debut album Country Grammar. The case claims that Nelly has failed to pay his former St. Lunatics bandmate Ali for his work on the album, but the star’s lawyers argued in the new filings that those decades-old allegations are so “frivolous” that Ali and his lawyers must face penalties for filing them: “Plaintiff’s claims should never have been brought in the first place,” Nelly’s attorneys wrote.

“THOROUGHLY ENJOYED HERSELF” – Attorneys for Sean “Diddy” Combs argued in new legal filings that key evidence disclosed by prosecutors — videos of the alleged “freak off” parties at the center of case — show only consensual sex and “fundamentally undermine” the charges against him. Far from the “sensationalistic media reports,” Diddy’s attorneys wrote, the videos at issue “unambiguously” show that the alleged victim “not only consented but thoroughly enjoyed herself.”

GYM MELEE LAWSUIT – Tekashi 6ix9ine (Daniel Hernandez) filed a lawsuit against LA Fitness, claiming the gym chain is legally responsible for a 2023 “violent assault” in which he was attacked in the sauna at one of the company’s South Florida locations — and owes him at least $1 million in damages for his trouble. The lawsuit claimed the assailants were members of the Latin Kings criminal gang and that LA Fitness should have had measures in place to prevent the entry of “affiliates of violent gangs” and people with “aggressive and dangerous propensities.”

At least half a dozen distributors and record labels are frustrated with the streaming service Napster due to late royalty payments, executives tell Billboard. In some cases, rights holders say Napster is a few months behind schedule; in others, the lag on payments is well over a year.

Napster, despite its history as a pirate-disruptor to the recorded music business around the turn of the century, has long operated as a licensed streaming service, albeit a small one. But “for years, they have cited fundraising struggles as an excuse for delayed royalty payments,” according to one executive at a distributor who spoke on the condition of anonymity.

Napster’s CEO, Jon Vlassopulos, declined to comment.

Trending on Billboard

Napster is not the first streamer accused of falling behind on payouts. A lawsuit against TIDAL in 2021 revealed that the platform had $127 million in liabilities, mostly in the form of unpaid streaming fees to record labels. TIDAL CEO Jesse Dorogusker told Billboard in 2023 that the payment situation had been remedied following TIDAL’s acquisition by Block.

More recently, labels and distributors have said they are struggling to get timely payments from Boomplay, a streaming service with a large user base in Africa. In December, Sony Music pulled its catalog from the platform.

At the end of 2023, Boomplay said it had 98 million monthly active users across Africa. Napster is considerably smaller: It had a little more than 1 million monthly active users at the end of 2020, according to Music Ally.

Rights holders acknowledged to Billboard that the royalties they had received in the past from Napster account for just a small fraction — often less than 1% — of their overall streaming income. “What we earn from it as a distributor isn’t that much,” says an executive at another distribution company that is missing many months of Napster payments.

“But,” he continues, “in terms of payouts to the artists and the labels who we represent, it can be a solid sum of money.” $100,000, for example, may be a drop in the bucket for a volume distributor. However, that money can make a meaningful difference for a small indie label.

Napster launched in June 1999 as a file-sharing service that allowed users to download tracks for free. It was soon battling copyright infringement lawsuits from various heavy-hitters, including Metallica, Dr. Dre and the RIAA. “Napster is not developing a business around legitimate MP3 music files, but has chosen to build its business on large-scale piracy,” the RIAA wrote in a suit filed in 1999.

This first version of Napster shut down in 2001. The following year, Bertelsmann announced that it would acquire the service and turn it into a licensed listening platform. But a judge later blocked the sale.

In the years since, Napster has bounced from one home to another. It was first acquired by Roxio and then by Best Buy for $121 million in 2008. Three years later, Napster was scooped up by Rhapsody, an early music streaming service. Rhapsody subsequently rebranded itself as Napster in 2016.

In 2020, the virtual reality concert app MelodyVR bought Napster for $70 million. The company changed hands yet again in 2022, with Hivemind Capital Partners and cryptocurrency company Algorand becoming the new owners.

Vlassopulos took over as Napster’s CEO in the fall of 2022 following a stint as global head of music at Roblox. Two decades before, he had worked at Bertelsmann and been part of the team that put together the deal for Napster — only to have it scuttled months later. “It always stayed with me: What if we could have finished what we started?” Vlassopulos explained in an interview last year.

But first, he had to work on “cleaning up the Napster business.” “The company had been around for 20 years, and so now we’ve modernized,” Vlassopulos added. “We’re right at break even, and we’re kind of in a process now to raise material funds, or the company is maybe looking to roll us up into something bigger.”

Despite this progress, some rights holders told Billboard that they were considering pulling their catalogs from Napster, or no longer delivering new releases to the platform.

When labels and distributors are not receiving payments from streaming services, taking their catalogs off platforms is one of their only options. The other is to take legal action against the streamer.

But litigation is costly and time-consuming, which means rights holders are usually stuck sending follow-up emails over and over again. This hasn’t worked for several companies trying to get money owed to them by Napster, though. “Not only have they failed to pay royalties,” says the first distribution executive, “but they have also been unresponsive when we’ve attempted to resolve these matters.”

GRONINGEN — The Eurosonic Noorderslag Festival (ESNS) has long marked the official start of Europe’s music calendar. The festival, which just wrapped its 39th edition, looks to set the agenda for the upcoming year, with a particular focus on the live space.

From Jan. 15-18 in Groningen, Netherlands, a diverse lineup of emerging artists were presented to festival bookers, promoters, potential managers, media and other industry professionals. The goal: celebrate and champion artists and scenes throughout Europe and strengthen ties between markets.

At the heart of ESNS sits the The European Talent Exchange Program which promotes and assists festival bookings for the upcoming summer. By connecting 333 artists from 33 countries with 131 festival bookers and a number of stations within the European Broadcast Union (including the U.K.’s BBC Radio), the initiative aims to showcase artists from diverse regions and genres. The program has helped previous breakout artists, including Fontaines D.C., Idles, and English Teacher, secure bookings across Europe’s renowned festival circuit.

Trending on Billboard

“In today’s fast-evolving music industry, it’s increasingly difficult to uncover the hidden gems and truly exceptional acts,” said Tamás Kádár, CEO of Sziget Cultural Management, which runs Budapest’s Sziget Festival.

“With over 5,000 applicants every year, ESNS does an incredible job of curating a selection that not only supports artists in gaining recognition but also provides a vital resource for bookers like us,” he added. “Even if we can’t catch every performance live, the curated list allows us to discover new talent for Sziget. It’s a testament to the shared commitment to fostering quality music and supporting emerging talent.”

A number of acts made compelling cases during their appearances; unlike other showcase festivals, acts at ESNS only perform once at the event. Ireland’s Cardinals, signed to influential indie So Young records, brought intensity and bite to the city’s beloved Vera venue. The walls of the space are adorned with some of the names that went on to become international icons: Joy Division, The White Stripes, U2 and more all played early shows in the space.

Iceland’s Sunna Margrét expertly toed the line between folktronica and upbeat indie pop in her material, while Manchester-based Anthony Szmierek, who is due to release his debut album Service Station At The End Of The Universe in February, brought wit and humour to his rave-inspired bangers. Cork group Cliffords also drew a packed room on their debut show in mainland Europe, further solidifying the indie band place as ones to watch in 2025.

ESNS provides a boost for events like Focus Wales, a yearly showcase festival which takes place in Wrexham, north Wales. Andy Jones, co-founder and booker, says that their presence “ensures that Focus Wales and, more broadly, Wales as a music market, is part of the wider conversation with the European music community.”

He adds that the challenges facing the U.K.’s grassroots venues are impacting the ability for artists to level-up into festival headliners. “When I compare the current state of play to how things were even five or six years ago, it’s clear there’s a big problem that needs to be addressed,” said Jones. “I believe the good work Music Venue Trust is doing is vital, but it is time for Governments to do more, to ensure these vital cultural spaces are protected.”

Brexit brought immense challenges for many artists from the U.K. and significantly reduced the margins for profits. Jones is calling for “some real progress on simplifying the movement of artists in and out of the U.K., which will only reap benefits for all involved. This is also frankly, long overdue.”

Kádár concurs: “Artists face difficulties in standing out and reaching their audiences in a crowded market. Viral moments on platforms like TikTok can create sudden fame, but sustained recognition requires more. Added to this are rising costs – travel, accommodation, and the scarcity of funding – making it harder than ever for bands to tour successfully.”

The panel discussions and workshops held at Oosterport, the city’s cultural events center, covered a wide range of topics. In his keynote address, Alex Hardee, partner/agent of Wasserman Music in London, discussed the changing landscape for live agents and how they can react and respond. “We have to work harder for our commission and provide a bigger service,” he said, highlighting the company’s approach to securing new artists, as well as discussing the value of support slots and the “talent drain” that festivals are facing when booking headliners.

Throughout the program, the festival hosted additional discussions on the role of private equity investment into the live music space, the use of artificial intelligence in the creative and administrative process of making music, and how independent labels and boutique festivals can thrive in uncertain circumstances.

There were moments of celebration, too. The European Festival Awards celebrated honorees including Open’er Festival in Poland which scooped the best major festival prize and We Love Green for its commitment to making their event eco-friendly. In addition The Music Moves Europe Awards, a key component of the European Union’s efforts to support musicians, saw a number of acts secure grants of €10,000 ($10,321) including Yamê from France and Uche Yara from Austria.

ESNS may have highlighted the scale of the challenges ahead, but it’s one that Jones and his contemporaries are ready to meet head on. “I think it’s an exciting time, musically, with so much great new talent coming through. At the same time, it is encouraging that there seems to be a shared view, across Europe and including the major players in the industry, that there is a real responsibility now; for us all to create a more equitable industry going forward.”

Manuela Ferradas has joined SiriusXM in a senior management role, Billboard can confirm. Based out of the company’s Miami Beach studios, Ferradas will oversee the Latin artist and industry relations team for SiriusXM and Pandora. According to a press release, Ferradas will “secure talent and deliver marketing plans to external partners for various SiriusXM and Pandora opportunities […]

BERLIN — In June, the three major labels sued the generative AI music companies Udio and Suno for training their software on copyrighted music without a license. Now, GEMA, the German PRO, is also taking legal action against Suno, in a case filed today (Jan. 21) in the Munich Regional Court.

In an announcement, GEMA said that it documented that the Suno system outputs content that “largely corresponds to world-famous works whose authors GEMA represents,” including “Forever Young” by Alphaville, “Mambo No. 5” by Lou Bega and “Daddy Cool” by Milli Vanilli creator Frank Farian, among others.

“AI providers such as Suno Inc. use our members’ works without their consent and profit financially from them,” said GEMA CEO Tobias Holzmüller in the announcement. “GEMA is endeavoring to find solutions in partnership with the AI companies. But this will not work without adhering to the necessary basic rules of fair cooperation and, above all, it will not work without the acquisition of licenses.”

Trending on Billboard

This case is very different from the litigation Suno faces in the U.S., which is spearheaded by the RIAA and involves recorded music owned by the major labels. Assuming that Suno has indeed trained its software on copyrighted recordings, as seems likely, that case will involve a determination of whether this would qualify as “fair use” – the legal doctrine that allows the unlicensed use of copyrighted works in some situations, including quotation and criticism. That can be notoriously complicated and it involves both specific facts and case law. It can also involve a great deal of money, since statutory damages for willful copyright infringement can reach $150,000 per work.

GEMA’s case involves the copyrights to songs, which it represents as a PRO, rather than those of recordings. The relevant legislation would be the European Union’s AI and Copyright directives, which allow copyright owners to “opt out” of having their works scanned in order to train AI software, and require “fair remuneration” if they are used. This is one of the first big cases involving this issue in Europe, as well as the first against a big generative music company. Any damages would almost certainly be more modest than they would in the U.S., but the case could establish whether AI companies need to license copyrighted works for software training purposes. Whatever the result, it is easy to imagine it being appealed to higher courts in Germany.

In November, GEMA also sued OpenAI for using lyrics of songs to which GEMA has rights in order to train its AI software. That case, also filed with the Munich Regional Court, only involves lyrics.

In its announcement, GEMA said Suno “outputs content that obviously infringes copyrights.” However, the issue in this case is not this output, but rather the music Suno has scanned during the process of training its software. If Suno has indeed scanned music for training purposes, it would presumably be infringing the rights in the songs as well as the recordings. Although a U.S. court could determine that this is fair use, that doctrine is a feature of Anglo-American law – the UK and British Commonwealth countries have “fair dealing,” which is similar but more limited – European laws are more strict. The EU Copyright Directive lays out “exceptions and limitations” to copyright, but it also provides authors and rightsholders the ability to opt-out of having their work scanned – or, as is more likely, to opt out until a license agreement is reached.

“The lawsuit against Suno Inc. is part of an overall concept of measures taken by GEMA,” said GEMA general counsel Kai Welp in the announcement of the case, “at the end of which there will be fair treatment of authors and their remuneration.”

A British teen pleaded guilty Monday (Jan. 20) to murdering three girls and attempting to kill 10 other people in what a prosecutor said was a “meticulously planned” stabbing rampage at a Taylor Swift-themed dance class in England last summer.

Axel Rudakubana, 18, entered the surprise plea as jury selection had been expected to begin at the start of his trial in Liverpool Crown Court.

The July 29 stabbings sent shock waves across the U.K. and led to a week of widespread rioting across parts of England and Northern Ireland after the suspect was falsely identified as an asylum-seeker who had recently arrived in Britain by boat. He was born in Wales.

Trending on Billboard

The attack occurred on the first day of summer vacation when the little girls at the Hart Space, a sanctuary hidden behind a row of houses, were in a class to learn yoga and dance to the songs of Taylor Swift. What was supposed to be a day of joy turned to terror and heartbreak when Rudakubana, armed with a knife, intruded and began stabbing the girls and their teacher in the seaside town of Southport in northwest England.

“This was an unspeakable attack — one which left an enduring mark on our community and the nation for its savagery and senselessness,” Deputy Chief Crown Prosecutor Ursula Doyle said. “A day which should have been one of carefree innocence; of children enjoying a dance workshop and making friendship bracelets, became a scene of the darkest horror as Axel Rudakubana carried out his meticulously planned rampage.”

Prosecutors haven’t said what they believe led Rudakubana — who was days shy of his 18th birthday — to commit the atrocities, but Doyle said that it was clear he had a “a sickening and sustained interest in death and violence.”

Rudakubana had consistently refused to speak in court and did so once again when asked to identify himself at the start of the proceedings. But he broke his silence when he was read the 16-count indictment and asked to enter a plea, replying “guilty” to each charge.

He pleaded guilty to three counts of murder, 10 counts of attempted murder and additional charges related to possessing the poison ricin and for having an al-Qaida manual.

Rudakubana faces life imprisonment when sentenced Thursday, Justice Julian Goose said.

Defense lawyer Stanley Reiz said that he would present information to the judge about Rudakubana’s mental health that may be relevant to his sentence.

The surviving victims and family members of those killed were absent in court, because they had expected to arrive Tuesday for opening statements.

Goose asked the prosecutor to apologize on his behalf that they weren’t present to hear Rudakubana plead guilty.

He pleaded guilty to murdering Alice Da Silva Aguiar, 9, Elsie Dot Stancombe, 7, and Bebe King, 6.

Eight other girls, ranging in age from 7 to 13, were wounded, along with instructor Leanne Lucas and John Hayes, who worked in a business next door and intervened. Fifteen other girls, as young as 5, were at the class but uninjured. Under a court order, none of the surviving girls can be named.

Hayes, who was stabbed and seriously wounded, said he still had flashbacks to the attack and was “hugely upset at the time that I wasn’t able to do more.”

“But I did what I could in the circumstances,” he told Sky News. “I’m grateful to be here, and by all accounts I’ll make a full recovery, at least physically. … I’m going to be OK and others won’t be, and that’s really where I I think the focus of attention should be.”

Police said the stabbings weren’t classified as acts of terrorism because the motive wasn’t known.

Several months after his arrest at the scene of the crime, Rudakubana was charged with additional counts for production of a biological toxin, ricin and possession of information likely to be useful to a person committing or preparing to commit an act of terrorism for having the manual in a document on his computer.

Police said they found the evidence during a search of his family’s home in a neighboring village.

The day after the killings — and shortly after a peaceful vigil for the victims — a violent group attacked a mosque near the crime scene and pelted police officers with bricks and bottles and set fire to police vehicles.

Rioting then spread to dozens of other towns over the next week when groups made up mostly of men mobilized by far-right activists on social media clashed with police during violent protests and attacked hotels housing migrants.

More than 1,200 people were arrested for the disorder and hundreds have been jailed for up to nine years in prison.

Australia’s music industry is mourning the loss of Matthew Capper, the long-serving former managing director of Warner Chappell Australia, who died unexpectedly earlier this month following a surgical procedure.

Capper suffered a ruptured appendix in late December, and could not fight off the infection after the operation, reads a statement from his family.

A stalwart with more than 20 years’ service at Warner Chappell Australia, Capper led the business as managing director from 2010, until his departure in February 2024, part of a company-wide downsizing.

Trending on Billboard

Dan Rosen, president of Warner Music Australasia, remembers Capper as a top-notch executive, a good sport, and a great person. “He cared deeply about the songwriters he represented,” Rosen writes in a message to staff, The Music Network reports, “and his efforts to protect and celebrate their music made a lasting impact on Warner Chappell and the broader music community in Australia. He was above all else, in every interaction, a gentleman.”

In 2005, Capper became the youngest person ever appointed to the AMCOS board at the age of just 28. Two years later, in 2007, he became the youngest to join the APRA board, at 30. He remained a director on both boards until late February 2024, as well as serving as deputy chair of the AMCOS board from 2020-2024.

Friends, former colleagues and business rivals are paying their respects. “I’m completely shocked and saddened to hear of the passing of dear friend and colleague, Matthew Capper. I remember Matthew as an incredibly sincere, principled professional who was passionate about music publishing. He was self-deprecating, always loved a joke and enjoyed spending time with colleagues,” comments Dean Ormston, CEO of APRA AMCOS.

“He had great regard for the work of APRA AMCOS and was very proud of his long connection to the organization and staff. He will be sorely missed by us all, and our thoughts go out to his friends and family at this very difficult time.”

Jenny Morris, chair of APRA, says Capper’s death is a tough one for the industry. “We have had many losses from the music industry family in the last few years, all of which have been sources of great sadness, but Matt’s death has been a huge shock,” she remarks. “Matt was one of the most decent, wise and funny people and I feel very privileged not only to have known him, but to have had his friendship.”Capper, she continues, “worked with genuine care and a great amount of industry awareness on the APRA board, and on more than a few occasions sent supportive messages at just the right time. He was an empath as well.”

Through his career, Capper was a tireless advocate for the music publishers community. He was voted into the position as chair of the Australasian Music Publishers’ Association (AMPAL) in 2013, almost a decade after joining the trade body’s board, in 2004. Capper also represented AMPAL on the International Confederation of Music Publishers (ICMP) board, both as non-executive director and more recently as Treasurer, a position he was especially proud of. His involvement with ICMP extended to chairing its Australasia and Asia Regional Group.

“I was lucky to spend a lot of time with Matthew on the AMPAL, AMCOS and APRA boards, often travelling to Sydney together from Melbourne for meetings,” remembers Jaime Gough, chair of AMCOS. “Matthew was a true professional, a great mentor and sounding board. He was passionate about the songwriter and publisher members we represent, and a vocal advocate for their rights.”

Gough, managing director of Concord Music Publishing ANZ (formerly Native Tongue), continues, “I am still in a state of shock at Matthew’s passing. He had so much more to give to the music industry, many more meals to cook, and will be sorely missed. My thoughts go out to his family and friends.”

The late executive will not have a funeral, per his wishes.

Capper “reached some dizzying heights, and he met a lot of people that he greatly respected, even after meeting them,” reads the family statement. “We think he was quietly proud of his achievements. We certainly were. We’re also certain he thought he had a lot more work to do. Hopefully others have been inspired by him and can continue that.”

TikTok said Sunday (Jan. 19) it was restoring service to users in the United States just hours after the popular video-sharing platform went dark in response to a federal ban, which President-elect Donald Trump said he would try to pause by executive order on his first day in office.

Trump said he planned to issue the order to give TikTok’s China-based parent company more time to find an approved buyer before the ban takes full effect. He announced the move on his Truth Social account as millions of U.S. TikTok users awoke to discover they could no longer access the TikTok app or platform.

Google and Apple removed the app from their digital stores to comply with the law, which required them to do so if TikTok parent company ByteDance didn’t sell its U.S. operation by Sunday. The law, which passed with wide bipartisan support in April, allows for steep fines.

Trending on Billboard

The company that runs TikTok in the U.S. said in a post on X that Trump’s post had provided “the necessary clarity and assurance to our service providers that they will face no penalties providing TikTok to over 170 million Americans.”

Some users reported soon after TikTok’s statement that the app was working again, and TikTok’s website appeared to be functioning for at least some people. Even as TikTok was flickering back on, it remained unavailable for download in Apple and Google’s app stores. Neither Apple or Google responded to messages seeking comment Sunday.

The law that took effect Sunday required ByteDance to cut ties with the platform’s U.S. operations due to national security concerns posed by the app’s Chinese roots. However, the statute gave the sitting president authority to grant a 90-day extension if a viable sale was underway.

Although investors made a few offers, ByteDance previously said it would not sell. Trump said his order would “extend the period of time before the law’s prohibitions take effect” and “confirm that there will be no liability for any company that helped keep TikTok from going dark before my order.”

“Americans deserve to see our exciting Inauguration on Monday, as well as other events and conversations,” Trump wrote.

It was not immediately clear how Trump’s promised action would fare from a legal standpoint since the U.S. Supreme Court unanimously upheld the ban on Friday (Jan. 17) and the statute came into force the day before Trump’s return to the White House.

Some lawmakers who voted for the sale-of-ban law, including some of Trump’s fellow Republicans, remain in favor of it. Sen. Tom Cotton of Arkansas warned companies Sunday not to provide TikTok with the technical support it needs to function as it did before.

“Any company that hosts, distributes, services, or otherwise facilitates communist-controlled TikTok could face hundreds of billions of dollars of ruinous liability under the law, not just from (the Justice Department), but also under securities law, shareholder lawsuits, and state AGs,” Cotton wrote on X. “Think about it.”

The on-and-off availability of TikTok came after the Supreme Court ruled that the risk to national security posed by TikTok’s ties to China outweighed concerns about limiting speech by the app or its millions of U.S. users.

When TikTok users in the U.S. tried to watch or post videos on the platform as of Saturday night, they saw a pop-up message under the headline, “Sorry, TikTok isn’t available right now.”

“A law banning TikTok has been enacted in the U.S.,” the message said. “Unfortunately that means you can’t use TikTok for now.”

The service interruption TikTok instituted hours early caught many users by surprise. Experts had said the law as written did not require TikTok to take down its platform, only for app stores to remove it. Current users had been expected to continue to have access to videos until a lack of updates caused the app to stop working.

“The community on TikTok is like nothing else, so it’s weird to not have that anymore,” content creator Tiffany Watson, 20, said Sunday.

Watson said she had been in denial about the looming shutdown and with the space time on her hands plans to focus on bolstering her presence on Instagram and YouTube.

“There are still people out there who want beauty content,” Watson said.

The company’s app also was removed late Saturday from prominent app stores. Apple told customers with its devices that it also took down other apps developed by ByteDance. They included Lemon8, which some influencers had promoted as a TikTok alternative, the popular video editing app CapCut and photo editor Hypic.

“Apple is obligated to follow the laws in the jurisdictions where it operates,” the company said.

Trump’s plan to spare TikTok on his first day in office reflected the ban’s coincidental timing and the unusual mix of political considerations surrounding a social media platform that first gained popularity with often silly videos featuring dances and music clips.

During his first presidential term, Trump in 2020 issued executive orders banning TikTok and the Chinese messaging app WeChat, moves that courts subsequently blocked. When momentum for a ban emerged in Congress last year, however, he opposed the legislation. Trump has since credited TikTok with helping him win support from young voters in last year’s presidential election.

Despite its own part in getting the nationwide ban enacted, the Biden administration stressed in recent days that it did not intend to implement or enforce the ban before Trump takes office on Monday.

In the nine months since Congress passed the sale-or-ban law, no clear buyers emerged, and ByteDance publicly insisted it would not sell TikTok. But Trump said he hoped his administration could facilitate a deal to “save” the app.

TikTok CEO Shou Chew is expected to attend Trump’s inauguration with a prime seating location.

Chew posted a video late Saturday thanking Trump for his commitment to work with the company to keep the app available in the U.S. and taking a “strong stand for the First Amendment and against arbitrary censorship.”

Trump’s choice for national security adviser, Michael Waltz, told CBS News on Sunday that the president-elect discussed TikTok going dark in the U.S. during a weekend call with Chinese President Xi Jinping “and they agreed to work together on this.”

On Saturday, artificial intelligence startup Perplexity AI submitted a proposal to ByteDance to create a new entity that merges Perplexity with TikTok’s U.S. business, according to a person familiar with the matter.

Perplexity is not asking to purchase the ByteDance algorithm that feeds TikTok user’s videos based on their interests and has made the platform such a phenomenon.

Other investors also eyed TikTok. Shark Tank star Kevin O’Leary recently said a consortium of investors that he and billionaire Frank McCourt offered ByteDance $20 billion in cash. Trump’s former treasury secretary, Steven Mnuchin, also said last year that he was putting together an investor group to buy TikTok.

In Washington, lawmakers and administration officials have long raised concerns about TikTok, warning the algorithm that fuels what users see is vulnerable to manipulation by Chinese authorities. But to date, the U.S. has not publicly provided evidence of TikTok handing user data to Chinese authorities or tinkering with its algorithm to benefit Chinese interests.

The Music Sustainability Alliance announced Friday (Jan. 17) that its Music Sustainability Summit is being postponed amid the ongoing Los Angeles wildfires. Originally scheduled to happen on Feb. 3, the event will now be held on April 16 at L.A.’s Solotech Studios, the same location where it was originally set to take place. Programming for the […]

State Champ Radio

State Champ Radio