Streaming

Page: 7

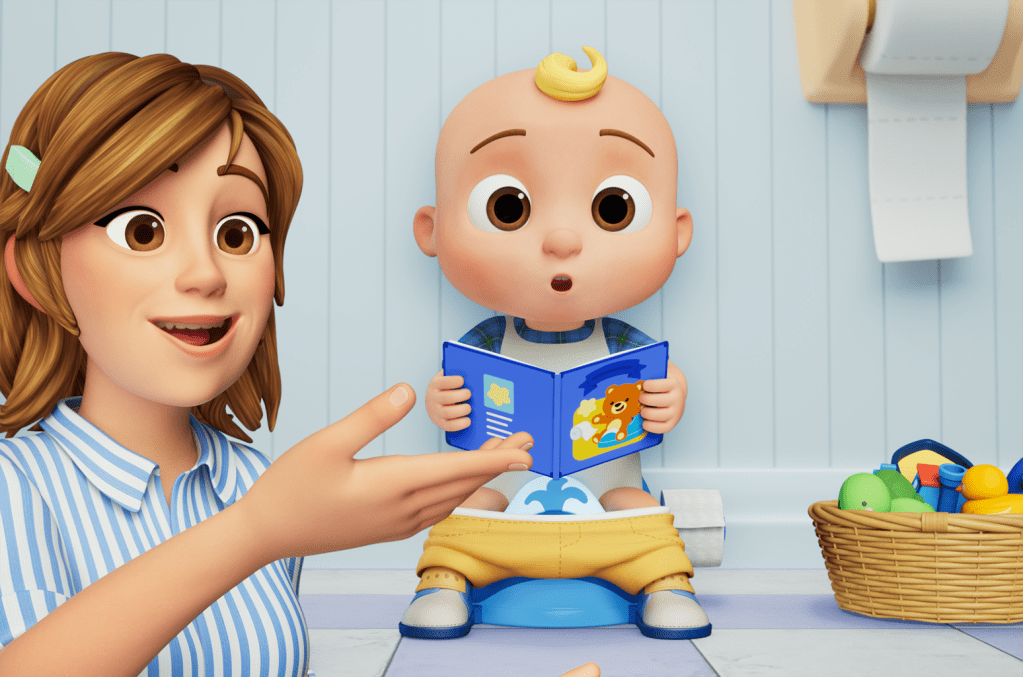

For every milestone in a kid’s life, there’s a CoComelon song — and now parents have a brand-new potty-training anthem to add to their toolkit, premiering exclusively on Billboard Family.

As part of the “CoComelon Can Help” campaign, an animated video for “When You Gotta Go, You Gotta Go!” hits CoComelon’s YouTube page on Tuesday (June 9) to help steer kids and caregivers alike through the often trying times of potty training.

JJ, the face of countless CoComelon clips, stars in the video as he figures out what to do when that moment strikes.

Trending on Billboard

“I gotta go, go/ Oh no/ When you gotta go, you gotta go!” J.J. sings in the instantly familiar CoComelon tune. “Trying something new can be hard/ And being brave is such a good start/ So come on, come on, it’s time to be smart/ ‘Cause when you gotta go, you gotta go!”

Watch the “When You Gotta Go, You Gotta Go!” video here:

In addition to the new song, CoComelon has also curated a Potty Time Songs playlist, filled with a lineup of previous CoComelon potty tunes, as well as a YouTube playlist of potty-training videos, in which JJ and his toddler buddies model real-life scenarios that kids run into when they’re potty training.

Finally, for families in Los Angeles, New York and Nashville, the Gotta Go Zone! tour is heading your way, with CoComelon Gotta Go Zones that include a family restroom designed for little ones with step stools, a soap bar and sensory play. There will also be music, kid activities, face painting, giveaways, snacks and character meet-and-greets. (You can RSVP for the events here.)

Need more CoComelon? The CoComelon: Sing-A-Long Live Tour is also currently on the road, with dates through June 29 in Louisville. You can also watch the CoComelon animated series on Netflix before it makes its way to Disney+ in 2027.

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

The BET Awards celebrates its 25th anniversary this year, and the network is going all out on performances, nostalgic moments and an all-star lineup of presenters and attendees. Kevin Hart is set to return as host while Lil Wayne, GloRilla and Playboy Carti are just a few must-see musical acts of the night. BET will also celebrate its iconic music video countdown show, 106 & Park, with a special tribute that’ll feature former hosts AJ Calloway, Free Marie Wright, Julissa Bermudez, Keshia Chanté, Rocsi Diaz and Terrence J.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

The 2025 BET Awards will premiere live on Monday, June 9 at 8 p.m. ET. To make sure you don’t miss out on culture’s biggest night, here’s everything you need to know about the awards show including how to watch it online.

Trending on Billboard

Who Is Performing At The BET Awards?

For the show’s 25th anniversary, BET called in a star-studded lineup featuring Lil Wayne, Teyana Taylor, GloRilla, Playboi Carti and Leon Thomas to perform on the big stage.

Who Has The Most BET Awards Nominations?

To no surprise, Kendrick Lamar leads all nominees with 10, including an album of the year nod for his latest album GNX and record of the year and song of the year for “Not Like Us.” There’s also a four-way tie between Drake, GloRilla, Doechii, and Future, who all have six nominations each. Metro Boomin earned five nods, while The Weeknd and SZA both received four.

How to Watch the BET Awards Online

The 2025 BET Awards will air on Monday, June 9 on BET. If you don’t have cable, the award show will be available to stream through several channels including Sling, Hulu + Live TV, DirecTV and Philo.

Sling TV

You can take advantage of half off for first month of all of Sling TV‘s streaming packages with prices starting at just $23. There are three package plans to choose from: Orange, Blue and Orange + Blue with every option including the TNT channel. After your first month is up you’ll be charged the regular subscription price based on the package you pick.

The Orange Package comes with nearly 35 channels and can be streamed on just one device at a time. Included in the Blue Package is nearly 50 channels. Can’t choose? You can combine both packages and get all channels and the ability to stream on up to three devices at once.

Please note: Pricing and channel availability varies from market-to-market.

Hulu + Live TV

For the most content offerings, you can sign up for Hulu + Live TV and get access to the Hulu library in addition to more than 95 live TV channels (including BET). The streaming platform starts at $82.99 per month.

And, for even more programming, Hulu + Live TV now comes bundled with Disney+ and ESPN+, which will give you everything within the Hulu library in addition to exclusive content on ESPN for even more sports coverage.

Philo

if you’re a new Philo subscriber, you can sign up for a seven-day free trial to try out the streamer for yourself before you commit. The service offers a slate of free channels with ad-supported free-to-stream movies, TV shows and other programming. However, you can upgrade to Philo to stream more than 70 channels, including A&E, MTV, Lifetime, OWN, Nickelodeon, Nick Jr., HGTV, TLC, BET, FYI, WE tv, Logo and Discovery Channel for $28 per month. A subscription even comes with unlimited DVR cloud recording.

DirecTV

DirecTV is offering new users a five-day free trial when you sign up. All of the signature packages include TNT, so you can stream the channels online.

If you’re a big sports fan, you can sign up for the streaming service’s “MySports” Genre Pack, which includes channels, like TNT, ESPN, NBA TV, ABC, ESPN2, Fox Sports and much more starting at $69.99 per month.

Goldman Sachs lowered its global growth expectations for the music industry for the next five years, as well as its forecast for global recorded music revenues this year, in a report published Tuesday (June 3).

The Wall Street investment bank’s Music in the Air report, which has become a closely-watched guide for music industry executives and investors, said it expects the global music industry to generate $31.4 billion in net revenues in 2025, a $2.5 billion decline from its 2024 projection of $33.9 billion.

That reflects growth of 6.8% on average from 2025 to 2030, down from the 7.6% compound annual growth rate (CAGR) analysts had previously forecast for that period last year. The primary factors driving that downward revision, Goldman says, are the slowing growth of last year’s recorded music revenues and lower ad-funded streaming growth, both of which contributed to expectations of 7.9% streaming growth on average from 2024-2030, down from the 9.8% previously forecast.

Trending on Billboard

“2024 was the first year since we began forecasting music industry trends where global music revenues fell short of our expectations,” the authors of the closely watched report wrote. “This was also the first year since we started forecasting music industry revenue where the recorded music market came well below our expectations.”

Goldman also issued new estimates for future growth, projecting that the music industry will grow at a compound annual growth rate of 4.8% for the years 2031 to 2035.

These slower growth forecasts echo findings of earlier reports this year, such as the IFPI’s March findings that global recorded music growth for 2024 was half of what it was in 2023, and the RIAA’s similar report that found that U.S. streaming revenue growth last year slowed to 3% from 7.7% in 2023.

Nonetheless, Goldman analysts said they expect the value of music rights and companies to remain “resilient” amid an uncertain macroeconomic backdrop, and that more frequent streaming subscription price increases and individualized service plans will provide support.

In 2025, Goldman says it expects global music industry revenue growth of 7.7%, down from its previous forecast of 8.3%, with growth in the live music sector and a slight improvement in recorded music revenue growth serving as the main drivers.

Goldman’s revision of its streaming growth outlook within recorded music revenues was due to significantly lower ad-funded streaming, researchers said. Ad-funded streaming growth is expected to slow to 5.7%, compared to its 2024 forecast of 11.3%.

Researchers said these “meaningful changes to our streaming assumptions” stem from a structural shift of more consumers preferring shortform as opposed to longform videos, less upside gained from emerging platforms and the impact of near-term uncertainty.

Those factors also caused Goldman to expect slightly lower subscriber and average revenue per user growth among streaming platforms.

Taylor Swift is enjoying quite the sales boost following her Friday (May 30) announcement that she had purchased the masters of her first six albums. Based on preliminary data from Luminate, we’re starting to get a sense of which albums Swifties are turning to most frequently to celebrate.

Looking at her Republic Records studio catalog, not including the Taylor’s Version re-recordings, all those albums experienced gains from Friday-Saturday (May 30-31), ranging from the slight 5.6% gain that The Tortured Poets Department experienced in sales when compared to the daily average of the preceding 11-day period, to the 21.9% increase her Evermore album enjoyed when comparing those periods, according to Billboard‘s calculations based Luminate’s on preliminary sales and streaming activity data.

Meanwhile, the Taylor’s Version albums almost all outperformed the Evermore increase, except for the 1989 re-record, which just missed out by growing 21.3% in the two-day average after the announcement versus the previous 11-day average: Red (Taylor’s Version) grew by 23.2%, Speak Now (Taylor’s Version) by 27.5% and Fearless (Taylor’s Version) by 27.9%, per preliminary data from Luminate, Billboard calculates.

Moving over to Swift’s Big Machine albums, the original 1989 album had the least amount of growth but even its percentage increase of 41.2% swamped the percentage gains posted by all the Republic albums. Leading the growth charge, Taylor Swift’s eponymous first album enjoyed a 484.4% increase, followed by Speak Now with a 343.9% increase in the two days after the announcement versus the 11 days prior; Reputation, up 328%; Red at 173.7% greater; and Fearless with a 140.4% rise when comparing the two periods, Billboard further calculates.

However, even with the original whopping percentage gains on a unit count basis for the two periods, none of those albums outperformed the Taylor’s Version albums in absolute sales for the post-announcement two-day period. For example, 1989 (Taylor’s Version) averaged a few hundred above 2,000 album consumption units for the two-day period, while the original version’s total album consumption was a few hundred over 1,000 units.

Even the original Speak Now, which saw a 343.9% increase, fell 10 units shy of Speak Now (Taylor’s Version), when looking at the average total consumption units for the two-day period.

On a unit basis, Reputation the biggest gain — nearly 6,000 units — to bring total sales on average for the two-day period to nearly 8,000 units, versus the nearly 2,000 units the album averaged in the 11 days prior to the announcement. In fact, that album was by far the best performing album in the Swift catalog over the two-day period.

A second round of Spotify price increases have come to France, the world’s sixth-largest recorded music market. Starting Monday (June 2), Spotify individual subscriptions rose 9.2% to 12.14 euros ($13.81) from 11.12 euros ($12.65), a company spokesperson confirmed to Billboard. Additionally, family plans rose to 21.24 euros ($24.15), two-person “duo” plans increased to 17.20 euros […]

Spotify has launched a new masterclass to help artists understand what artificial streaming is and how to prevent them from falling for scams related to it. Featuring Bryan Johnson, head of artist and industry partnerships, international at Spotify; Andreea Gleeson, CEO of TuneCore and member of the Music Fights Fraud Alliance; and David Martin, CEO of the Featured Artists Coalition, the executives also tell artists in the masterclass what to do if they’ve noticed abnormal and suspicious streaming activity has occurred on their accounts.

In recent years, artificial streaming (sometimes known as ‘streaming fraud’) has become a hot topic in the music business, but last year, the issue hit new heights when the first-ever U.S. streaming fraud case was brought against a man named Michael Smith in the Southern District of New York. According to the lawsuit, Smith allegedly stole more than $10 million in royalties across all streaming platforms by uploading AI-generated songs and driving up their stream counts with bots.

Trending on Billboard

A lot of artificial streaming instances, however, are not so extreme — or deliberate. It’s an issue that can impact even well-meaning independent artists, looking earnestly for marketing and promotion help. Whether it’s a digital marketer on Fiverr promising to get an artist on a playlist, or a savvy promoter DMing an artist on Instagram, promising a certain number of streams, many artists, particularly those without representation, fall for a scheme which, as Gleeson puts it, “is too good to be true.”

“It undermines the fair playing field that streaming represents,” says Johnson in the masterclass. “If left unchecked, artificial streams can dilute the royalty pool and shift money away from artists who are genuinely trying to release music and build an audience, and it can divert that money to bad actors looking to take advantage of system.”

As Johnson explains in the masterclass, whether the artificial streaming scheme was done wittingly or not, there can be real consequences. If an artist is caught with suspicious streaming activity, the track can no longer earn royalties, future streams do not count toward public metrics, future streams do not positively influence recommendation algorithms, and the activity is reported to the distributor or label. In a worst-case scenario, the song can also be removed from Spotify playlists, or the platform overall, and the artists’ label or distributor will be charged a fine.

“This is something we take seriously at every level, all around the world, and our efforts are working. Less than 1% of all streams on Spotify are determined to be artificial,” says Johnson.

Johnson, along with Gleeson, spoke to Billboard to explain why they teamed up on this masterclass, and what they hope artists take away from it.

“Our tactics are working, but this is not the time for us to pause. We have to keep going, because this is a moving target. We have to keep investing, keep educating, and keep trying to minimize the impact of artificial streaming,” says Johnson.

Why did you decide to do this masterclass now?

We have an existing video on artificial streaming from a few years ago, but we think this is a great way to update what we’ve done previously. This moves so quickly, and we will keep building on this and updating it. This masterclass now includes information that wasn’t around a few years ago. Why now? We found it’s very clear on our socials that people want to know about artificial streaming. We’ve read through a lot of comments, talked to industry partners and tried to figure out what information people want to see from this. And how can we do this in a way that will deter people from falling for this in the first place?

If artists only took one thing away from this video, what would you want them to have learned?

Gleeson: The big thing that that we really stress is that artists should know who they’re working with. If it sounds too good to be true, it probably is. So do your education up front with the marketing programs that you are utilizing. If a company is guaranteeing playlist placements or a certain number of streams or it sounds just way too good to be true, it probably is. If I can add a second thing it would be: start to open up a proactive discussion with your distributor or your label to make them aware if you see anything abnormal happen to your account. This can help you reduce any penalties, like the risk of your music getting taken down. Spotify also now has a way to submit information if you think there’s abnormal activity on your account. Reporting it is really important.

Bryan, often in these conversations about artificial streaming, it’s hard to know where the buck should stop. Is it the distributors fault? The user’s fault? The streaming service’s? How are you approaching it at Spotify?

Johnson: I think it’s an industry responsibility. There’s an industry body called Music Fights Fraud Alliance, which is a collection of digital services, like Spotify, and rights holders, like distributors and labels. And it’s an opportunity for the industry to come together and rally around the same topic and share information, share intel. And it’s been highly effective — super, super productive. We have a responsibility. We are the leading streaming service globally. We are across 184 markets with a huge audience, and we are a significant partner to the music industry. So it’s important that we come to the table, and we’re part of this conversation.

Scammers evolve quickly over time. It’s often said that there’s a danger in educating the public too much about artificial streaming, for fear that it will help the scammers evolve and better their efforts. How did you guys approach that challenge with this master class?

Gleeson: It’s always a work in progress to figure out the right balance of education and secrecy. You want to be specific to help educate, but you don’t want to give someone a playbook of how to do the fraud either.

From your vantage point, what are some of the measures that have been have implemented over the last few years that have shown really strong results in decreasing artificial streams? What has been the most effective?

Gleeson: We’ve tried to take down some of the playlists where this is happening. That can be a little bit of Whack-a-Mole, but that has been really effective. What we’ve observed also is the [streaming services] that focus on the reporting tools for artists and preventative tools have much lower abnormal stream levels than other [streaming services]. And it makes sense, right? If you’re a bad actor, you’re going to go to the path of least resistance. If a [streaming service] hasn’t invested yet in a robust reporting system, you can do your scam there and achieve more with less effort.

Johnson: We launched the very effective tool around a year ago, and it’s essentially a form that artists can go to, and they can tell us if they’ve seen abnormal activity, like in their Spotify For Artists data, and if they think they’ve been added to some sort of suspicious playlist. This born out of their feedback. We were getting requests online for a way in which they could let us know directly. Yes, they let their label and distributor know, but they also wanted to let Spotify know directly, and it’s super useful for us. We’re able to use that information effectively to stop artificial activity. So I think that playlist reporter form has been, has been really useful.

Taylor Swift’s many fans celebrated the pop superstar finally purchasing the masters of her Big Machine albums (the first six studio albums in her discography) by throwing a consumption party, flooding digital services to download more of her albums and stream more of her songs.

In the aftermath of her 11:30am ET announcement on Friday (May 30), early data reveals that the U.S. activity around her complete catalog — both the six albums released by Big Machine and her subsequent albums and re-recordings on Republic — jumped to averaging nearly 35,000 album consumption units for that day and Saturday, May 31, a 55.1% increase, from the average daily activity in the prior 12-day period, when her catalog average 20,000 units, according to preliminary data from Luminate. In fact, Saturday’s numbers were even bigger than Friday’s performance for the overall Swift catalog as the celebration apparently picked up steam among the Swifties.

Within her album consumption units, the biggest gainer was album downloads, which, according to early reports, jumped from averaging slightly over 100 units a day to over 5,000 copies. That two-day average is a whopping 3,520.6% improvement over the preceding 12-day average unit count. Meanwhile, physical albums improved to averaging just over 4,000 copies for the two days, which is 153.2% greater than the less than 2,000 copies her catalog averaged in the prior period. Overall, surging album sales — digital and physical — accounted for nearly 54% of Swift’s catalog’s album consumption unit increase.

Trending on Billboard

Over at the streaming services, Swift’s catalog on Friday and Saturday (May 30-31) averaged 32.91 million streams, a 35.6% increase over the 24.26 million streams her music accumulated as an average over the 12 days preceding the May 30 announcement.

Likewise, radio rewarded Swift fans by adding a few spins, or a 2.2% increase, to the 3,000-or-so daily plays her song catalog received in each of the 12 days before May 30.

Billboard will continue to track how Swift’s catalog performs in the coming days, as well as look at what albums are benefiting the most as more account reports are filed to Luminate.

The Billboard Summit is launching in Canada with a global superstar who made history in the country.

Diljit Dosanjh will be a special speaker at the event, which will launch at NXNE in Toronto’s TIFF Lightbox on June 11, 2025.

The record-setting artist made history with his Dil-Luminati tour last year, with his stadium concerts at Vancouver’s BC Place and Toronto’s Rogers Centre going down as the biggest ever Punjabi music events outside of India. The musician and movie star has continued to spread Punjabi culture worldwide, recently bringing historic fashion to the Met Gala.

At the summit, Dosanjh will sit down for a special interview with another influential figure in the international music industry: Panos A. Panay, president of the Recording Academy, the organization behind the Grammys.

Billboard Canada has also announced two big performers for The Stage at NXNE.

Daniel Caesar is returning to where he played his first major headlining show: The Mod Club in Toronto on June 14.

Trending on Billboard

The venue will be reverting back to its original name of The Mod Club, rebranded by owner Live Nation from the name Axis Club for the first time since 2021.

When he first played the venue, Caesar was a golden boy with a golden voice, gaining buzz with his EP Pilgrim’s Paradise and still a year away from his classic 2017 debut, Freudian.

In 2023, Caesar graduated to arenas, playing Madison Square Garden in New York and Scotiabank Arena in his hometown of Toronto. The Mod Club performance is a special, intimate show for his fans who have been with him from the beginning. A year after he played The Mod Club in 2017, Caesar also played NXNE — then an up-and-coming talent, and now, with the festival turning 30, an artist who has reached undeniable headliner status.

After the last girls have left the party for their special DJ set on June 12, The Beaches will also play a special concert at a well-known Toronto venue on June 15.

It’s a big summer for the breakout Canadian band, with a recent festival set at Coachella and another big one this summer at Osheaga in Montreal. The Beaches’ new album, No Hard Feelings, comes out Aug. 29 on AWAL.

The band has also just announced the Canadian dates on its No Hard Feelings Tour, including its first hometown arena show at Scotiabank Arena on Nov. 6. The Beaches’ special Billboard Canada Live show will be considerably more intimate, a chance to get up close and personal with the band at a surprise venue. – Richard Trapunski

Quebec to Impose Quotas for French-Language Content on Streaming Platforms

Quebec may soon be getting stricter language regulations on streaming services.

Quebec Culture Minister Mathieu Lacombe tabled a new bill on May 21 that aims to add more French-language content to major streaming platforms, as well as increase its discoverability and accessibility by establishing quotas. The bill will directly impact platforms that offer media content such as music, TV, video and audiobooks, including giants like Netflix and Spotify.

Lacombe wants to push French-language and Quebecian content to the forefront on these apps, saying it is not always readily available. He pointed out that consumption of local and French-language content is low, comprising just 8.5% of the music streamed in Quebec.

In accordance with the bill, platforms would have to display their default interfaces in French within the province, also including platforms that produce original French-language content within that selection. Companies that disobey the rules could face financial penalties, although Lacombe says that those who cannot comply due to their business model can enter a deal with the Quebec government to establish “substitute rules.”

The bill states that the Quebec government would have to establish content proportions or quotas on how much content needs to be produced or featured on these platforms, although no numbers were specified.

Bill 109 — officially titled “An Act to affirm the cultural sovereignty of Quebec and to enact the Act respecting the discoverability of French-language cultural content in the digital environment” — will be closely tied to existing Quebec legislation and institutions. All platforms will be required to register with the Minister of Culture and Communications, and the bill will amend the right to access French-language cultural content in the Quebec Charter of Human Rights and Freedoms.

While Quebec is tightening regulations, the streaming services are already pushing back against existing content policies, arguing that the Canadian Radio-television and Telecommunications Commission (CRTC) should not impose content obligations upon them. A CRTC hearing is currently underway from May 14 to 27 to outline a new definition of Canadian Content (CanCon), including regulations.

Major companies have been pushing back against the CRTC’s implementation of the Online Streaming Act in the hearing, which includes a plan to require major foreign streaming companies to invest in Canadian Content funds. – Stefano Rebuli

Ahead of the premiere of the new Apple TV+ animated special Lulu Is a Rhinoceros on Friday, Billboard Family has your exclusive first listen of the uplifting self-love anthem “The Perfect Me.”

The adorable ditty features Auli’i Cravahlo‘s Lulu, Dulé Hill’s Flom Flom and Utkarsh Ambudkar’s Hip-Hop celebrating their best and most authentic selves as they sing, “The perfect me is me/ The perfect you is you/ And when we listen to each other/ The whole world is more in tune, yeah!/ Who I am’s up to me/ Nothing I have to prove/ I’m easy to love, I’m good enough/ The perfect you is you!”

Coinciding with the premiere, Cravalho and creators Jason and Allison Flom shared exclusive statements with Billboard about the inspirational message that both kids and adults can take from “The Perfect Me.”

Trending on Billboard

“I adore Lulu for her enthusiastic spirit, and her innate wisdom of knowing exactly who she is,” the Moana star tells Billboard. “The song ‘The Perfect Me’ was a lot of fun to record; and while the message is simple, it felt meaningful to belt out! Others might say how you should look or act, but you are whole and complete without alI that outside noise. It’s honestly really catchy, and I definitely left the studio in a better mood that day.”

Meanwhile, the Floms — who penned the original children’s book together and serve as executive producers on the animated special — shared their own thoughts on the self-love anthem. “To write these lyrics, I started from, ‘The rhino of my dreams is me’ and ‘I am easy to love,’” Allison says. “In the song, Lulu, Flom-Flom and Hip-Hop each have a verse where they affirm: ‘Who I am is up to me/ Nothing I have to prove/ I’m easy to love/ I’m good enough…The perfect you is you!”

Jason adds: “Each of them reminds us that there’s much more to them than everyone else thinks and assumes. … We think everyone, not just kids, will connect to ‘The Perfect Me,’ and maybe they’ll get a boost of confidence every time they hear it.”

Once Lulu Is a Rhinoceros arrives on Apple TV+ on Friday, the special’s soundtrack will be available on Apple Music and other streaming platforms as well.

Pop songwriter LELAND serves as the special’s musical producer, and he tells Billboard: “Finding the right melodies and chords to pair with the brilliant lyrics written by Allison Flom was a challenge I welcomed. I aimed to compose melodies that felt conclusive, exciting, and easy enough for a child to sing after just a few listens. I remembered the songs I loved as a kid in my favorite musical specials or movies and how they’ve stuck with me to this day. The message of ‘The Perfect Me’ is simple and important and something we should all be reminded of whether we’re kids or adults.”

Watch the exclusive premiere of “The Perfect Me” from Lulu Is a Rhinoceros below.

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Jennifer Lopez is set to host the 2025 American Music Awards, kicking off on Memorial Day, May 26. The show will feature a star-studded list of performers, including Benson Boone, Gloria Estefan, Gwen Stefani and more.

Taking place at the Fontainebleau in Las Vegas, here’s everything you need to know about the annual fan-voted awards show, including how to stream, who’s performing, and where to buy last-minute tickets. Keeping scrolling for more info.

Trending on Billboard

When Are the 2025 AMAs?

The American Music Awards will air live starting at 8 p.m. ET/5 p.m. PT on Monday, May 26, on CBS. You can stream the event live on Paramount+ With Showtime, DirecTV or fuboTV.

How to Watch the AMAs

The annual music awards show will be airing on CBS. Don’t have cable? There are plenty of streaming options to catch the show, including Paramount+ With Showtime. The current service plan costs $12.99/month or $119.99/year, while the Paramount+ Essential Plan currently costs $7.99/month or $59.99/year. However, the awards show will only be available to watch live with Paramount+ With Showtime. The streaming service does offer a seven-day free trial, which new users can activate once signing up.

Want to watch the AMAs online for free? FuboTV offers a seven-day free trial when you sign up for one of its plans. You’ll gain access to more than 200 live TV channels, so you can watch the AMAs live for free. After your free trial is over, you’ll be charged the subscription price based on the plan you choose or you can cancel at any time.

DirecTV also offers a five-day free trial and the live TV streaming service also includes CBS as part of its channel lineup. Use the free trial to stream the AMAs online free from your phone, tablet, computer or smart TV.

Who’s Performing at the AMAs?

Janet Jackson will receive the prestigious ICON Award and deliver her first live TV performance in seven years. Rod Stewart will also be honored with the Lifetime Achievement Award and perform on the AMAs stage for the first time in over two decades. Other performers include: Jennifer Lopez, Gloria Estefan, Benson Boone, Gwen Stefani, Blake Shelton, Lainey Wilson, Reneé Rapp and more. See more of this year’s performers here.

How to Get Tickets to the American Music Awards

Want to attend the AMAs this year? You’re in luck. Fans can still score last-minute 2025 American Music Awards tickets through a variety of ticket sites, including Ticketmaster, StubHub and Vivid Seats, ahead of Monday night’s ceremony. It’s not too late to spend the long weekend in Vegas.

The American Music Awards are produced by Dick Clark Productions, which is owned by Penske Media Eldridge, a joint venture between Eldridge Industries and Billboard parent company Penske Media.

State Champ Radio

State Champ Radio