spotify

Page: 4

Miley Cyrus appears to be headed to Paris for a very special concert celebrating some of her biggest hits, with the pop star teasing Wednesday (June 11) that she’ll be performing at Spotify‘s next Billions Club Live concert later this month.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

The news comes via X, on which the streaming giant first posted a lyric to Cyrus’ “End of the World” — “Let’s go to Paris, I don’t care if we get lost in the scene” — and added, “@MileyCyrus, you coming?”

The singer then reposted the message and wrote: “I’ll meet you there. Next week. #BillionsClubLive.”

Trending on Billboard

Billions Club Live was introduced last December, with The Weeknd playing the first show in the series for about 2,000 people in Los Angeles to celebrate his long roster of songs that have surpassed a billion Spotify streams. The crowd was made up of fans selected for being in the “Blinding Lights” artist’s top percentage of listeners on the music service.

Cyrus has several songs that have reached the ten-digit milestone, including “Wrecking Ball,” “We Can’t Stop,” “Angels Like You” and “Party in the U.S.A.”

The Spotify concert comes on the heels of her new album Something Beautiful, which dropped May 30 and debuted this week at No. 4 on the Billboard 200. The LP marks her first full-length since 2023’s Endless Summer Vacation, which spawned eight-week Billboard Hot 100-topper “Flowers” — a song that has garnered more than 2 billion streams on the platform, meaning fans in Paris can almost definitely expect that she’ll perform it during her Billions Club Live show.

The upcoming show will be especially meaningful as Cyrus’ live performances are few and far between these days. When she does perform, it’s usually in an intimate setting — such as the Chateau Marmont, where she recently hosted a Something Beautiful listening party. In 2023, the Hannah Montana alum announced that she had no intention of touring for the foreseeable future.

While promoting Something Beautiful on Apple Music 1 in May, Cyrus elaborated on her decision to skip touring, noting that staying off the road is best for her sobriety and protecting her vocal cords.

See Cyrus’ post below.

Spotify’s share price surpassed $700 for the first time this week and reached a new all-time high of $717.87 on Thursday (June 5). The Swedish-based, New York-listed company ended the week up 6.9% to $712.26.

Through Friday (June 6), Spotify’s share price has increased 52.6% year to date, and its market capitalization has gained $54 billion to $145.8 billion. In an up-and-down year for most stocks, Spotify has rewarded investors with consistent subscriber growth and improved margins resulting from layoffs in 2023. The company finished the first quarter with 268 million subscribers, up 12% year over year, and total revenue of $4.54 billion was up 15%.

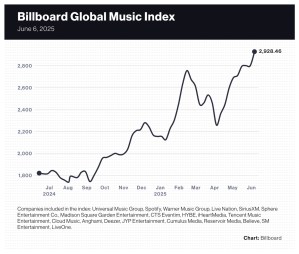

Spotify wasn’t the biggest gainer of the week, but its immense size was a major factor behind the 4.6% gain by the 20-company Billboard Global Music Index (BGMI) for the week ended June 6. The BGMI has gone nine consecutive weeks without a decline after a two-week decline in late March and early April. Behind 14 gainers and only six losers, the index reached a new high of 2,928.46 and brought its year-to-date gain to 37.8%.

Trending on Billboard

Markets finished the week strong after a U.S. jobs report on Friday showed that unemployment remained steady amidst the uncertainty caused by U.S. trade policy. The Nasdaq composite was up 2.2% while the S&P 500 rose 1.5%. South Korea’s KOSPI composite index gained 4.2%. China’s SSE Composite Index improved 1.1% and the U.K.’s FTSE 100 gained 0.7%.

Music streaming stocks performed especially well this week. LiveOne was the biggest gainer after rising 16.2% to $0.86. Tencent Music Entertainment jumped 6.8% to $17.96 and is trading at its highest mark since 2021. Netease Cloud Music rose 3.6% to 218.80 HKD ($27.88). Deezer and Anghami were exceptions, falling 1.5% and 5.3%, respectively.

Live Nation was the best-performing live music stock after gaining 5.0% to $144.15. Bernstein initiated coverage of Live Nation this week with an “outperform” rating and a $185 price target. MSG Entertainment rose 1.8% to $37.77, and CTS Eventim was up 0.5% to 107.20 euros ($122.26). Sphere Entertainment Co. fell 0.3% to $37.67, bringing its year-to-date loss to 11.3%.

iHeartMedia gained 14.5% to $1.50. The stock rose 10% on Thursday as the company announced the appointment of deputy CFO Michael McGuinness as iHeartMedia’s principal accounting officer. Previous principal accounting officer Scott Hamilton transitioned to a consultant role for the company.

Believe rose 11.6% to 17.08 euros ($19.48) after the company increased its bid to buy out remaining shareholders to 17.20 euros ($19.62), a 12.4% increase from the original bid of 15.30 euros ($17.45). The consortium that took the Paris-based company private in 2024 currently owns 96.7% of share capital.

The two standalone major music companies had mixed results. Warner Music Group rose 0.2% to $26.37, bringing its year-to-date decline to 15.0%. Universal Music Group fell 2.8% to 27.36 euros ($31.20), lowering its year-to-date gain to 14.4%.

K-pop stocks posted gains across the board. HYBE rose 7.0%, erasing the previous week’s 6.8% decline. YG Entertainment was up 7.9%. SM Entertainment rose 4.8% and JYP Entertainment improved 4.0%.

Reservoir Media fell 6.4% to $7.30, increasing its year-to-date loss to 13.7%. On Friday (June 6), B Riley lowered its price target for Reservoir Media to $11.50 from $12.50 and maintained its “buy” rating.

Billboard

Billboard

Billboard

A second round of Spotify price increases have come to France, the world’s sixth-largest recorded music market. Starting Monday (June 2), Spotify individual subscriptions rose 9.2% to 12.14 euros ($13.81) from 11.12 euros ($12.65), a company spokesperson confirmed to Billboard. Additionally, family plans rose to 21.24 euros ($24.15), two-person “duo” plans increased to 17.20 euros […]

Spotify has launched a new masterclass to help artists understand what artificial streaming is and how to prevent them from falling for scams related to it. Featuring Bryan Johnson, head of artist and industry partnerships, international at Spotify; Andreea Gleeson, CEO of TuneCore and member of the Music Fights Fraud Alliance; and David Martin, CEO of the Featured Artists Coalition, the executives also tell artists in the masterclass what to do if they’ve noticed abnormal and suspicious streaming activity has occurred on their accounts.

In recent years, artificial streaming (sometimes known as ‘streaming fraud’) has become a hot topic in the music business, but last year, the issue hit new heights when the first-ever U.S. streaming fraud case was brought against a man named Michael Smith in the Southern District of New York. According to the lawsuit, Smith allegedly stole more than $10 million in royalties across all streaming platforms by uploading AI-generated songs and driving up their stream counts with bots.

Trending on Billboard

A lot of artificial streaming instances, however, are not so extreme — or deliberate. It’s an issue that can impact even well-meaning independent artists, looking earnestly for marketing and promotion help. Whether it’s a digital marketer on Fiverr promising to get an artist on a playlist, or a savvy promoter DMing an artist on Instagram, promising a certain number of streams, many artists, particularly those without representation, fall for a scheme which, as Gleeson puts it, “is too good to be true.”

“It undermines the fair playing field that streaming represents,” says Johnson in the masterclass. “If left unchecked, artificial streams can dilute the royalty pool and shift money away from artists who are genuinely trying to release music and build an audience, and it can divert that money to bad actors looking to take advantage of system.”

As Johnson explains in the masterclass, whether the artificial streaming scheme was done wittingly or not, there can be real consequences. If an artist is caught with suspicious streaming activity, the track can no longer earn royalties, future streams do not count toward public metrics, future streams do not positively influence recommendation algorithms, and the activity is reported to the distributor or label. In a worst-case scenario, the song can also be removed from Spotify playlists, or the platform overall, and the artists’ label or distributor will be charged a fine.

“This is something we take seriously at every level, all around the world, and our efforts are working. Less than 1% of all streams on Spotify are determined to be artificial,” says Johnson.

Johnson, along with Gleeson, spoke to Billboard to explain why they teamed up on this masterclass, and what they hope artists take away from it.

“Our tactics are working, but this is not the time for us to pause. We have to keep going, because this is a moving target. We have to keep investing, keep educating, and keep trying to minimize the impact of artificial streaming,” says Johnson.

Why did you decide to do this masterclass now?

We have an existing video on artificial streaming from a few years ago, but we think this is a great way to update what we’ve done previously. This moves so quickly, and we will keep building on this and updating it. This masterclass now includes information that wasn’t around a few years ago. Why now? We found it’s very clear on our socials that people want to know about artificial streaming. We’ve read through a lot of comments, talked to industry partners and tried to figure out what information people want to see from this. And how can we do this in a way that will deter people from falling for this in the first place?

If artists only took one thing away from this video, what would you want them to have learned?

Gleeson: The big thing that that we really stress is that artists should know who they’re working with. If it sounds too good to be true, it probably is. So do your education up front with the marketing programs that you are utilizing. If a company is guaranteeing playlist placements or a certain number of streams or it sounds just way too good to be true, it probably is. If I can add a second thing it would be: start to open up a proactive discussion with your distributor or your label to make them aware if you see anything abnormal happen to your account. This can help you reduce any penalties, like the risk of your music getting taken down. Spotify also now has a way to submit information if you think there’s abnormal activity on your account. Reporting it is really important.

Bryan, often in these conversations about artificial streaming, it’s hard to know where the buck should stop. Is it the distributors fault? The user’s fault? The streaming service’s? How are you approaching it at Spotify?

Johnson: I think it’s an industry responsibility. There’s an industry body called Music Fights Fraud Alliance, which is a collection of digital services, like Spotify, and rights holders, like distributors and labels. And it’s an opportunity for the industry to come together and rally around the same topic and share information, share intel. And it’s been highly effective — super, super productive. We have a responsibility. We are the leading streaming service globally. We are across 184 markets with a huge audience, and we are a significant partner to the music industry. So it’s important that we come to the table, and we’re part of this conversation.

Scammers evolve quickly over time. It’s often said that there’s a danger in educating the public too much about artificial streaming, for fear that it will help the scammers evolve and better their efforts. How did you guys approach that challenge with this master class?

Gleeson: It’s always a work in progress to figure out the right balance of education and secrecy. You want to be specific to help educate, but you don’t want to give someone a playbook of how to do the fraud either.

From your vantage point, what are some of the measures that have been have implemented over the last few years that have shown really strong results in decreasing artificial streams? What has been the most effective?

Gleeson: We’ve tried to take down some of the playlists where this is happening. That can be a little bit of Whack-a-Mole, but that has been really effective. What we’ve observed also is the [streaming services] that focus on the reporting tools for artists and preventative tools have much lower abnormal stream levels than other [streaming services]. And it makes sense, right? If you’re a bad actor, you’re going to go to the path of least resistance. If a [streaming service] hasn’t invested yet in a robust reporting system, you can do your scam there and achieve more with less effort.

Johnson: We launched the very effective tool around a year ago, and it’s essentially a form that artists can go to, and they can tell us if they’ve seen abnormal activity, like in their Spotify For Artists data, and if they think they’ve been added to some sort of suspicious playlist. This born out of their feedback. We were getting requests online for a way in which they could let us know directly. Yes, they let their label and distributor know, but they also wanted to let Spotify know directly, and it’s super useful for us. We’re able to use that information effectively to stop artificial activity. So I think that playlist reporter form has been, has been really useful.

Camila Cabello took to social media on Friday (May 23) to mark her hit single “Never Be the Same” joining the Spotify Billions Club. “Never be the same is my 4th song to hit a BILLION STREAMS !!!!!!!,” she wrote on Instagram alongside a video of her performing the opening track from 2018’s Camila on […]

On daddy duty! MGK took to social media on Thursday (May 22) to share a selfie with his baby daughter before hitting a Spotify milestone with his new single, “Cliché.” The artist formerly known as Machine Gun Kelly posted the sweet snap, taken in what appears to be the reflection of a car door, in […]

Morgan Wallen’s I’m the Problem is off to a blockbuster start. The country superstar’s fourth studio album, released Friday (May 16) through Big Loud/Mercury, is already breaking streaming records on Spotify and Amazon Music. On Friday afternoon, Spotify announced that the 37-track album had set a new benchmark as the most streamed country album in […]

Companies frequently urge investors not to read too much into any one quarter’s results. After all, even large, diversified businesses don’t always take a neat, linear path to consistent annual gains, and any single reporting period can contain oddities that skew the results favorably or unfavorably. But most public companies report results every quarter and, for better or worse, we onlookers read as much into the results as possible.

With that caveat in mind, here are some takeaways from the earnings releases through Thursday (May 15). Note that while most music companies, including the largest ones, have already issued earnings, there are a couple more to come: CTS Eventim will release some first-quarter figures on May 22 and Reservoir Media reports on May 28.

1. Some Margins Improved from Cost Savings

Music companies — like employers across the spectrum — have thinned their headcounts to retool, refocus and ultimately cut down on expenses. Q1 results showed some notable improvements in companies’ bottom lines.

Trending on Billboard

Spotify started seeing bottom-line growth in 2024 after cutting about a quarter of its headcount in 2023. The Stockholm-based music and podcast giant’s operating margin rose to 12.1% from 4.6% in the first quarter of 2024 — an improvement of 341 million euros ($380 million) — while gross margin (gross profit as a percentage of revenue) rose to 31.6% from 27.6%. Gross margin is a good proxy for what Spotify keeps after paying for content costs (it also includes some smaller expenses such as credit card transaction fees and hosting costs). After keeping prices flat for more than a decade, gross profit improved after Spotify began raising prices in 2023.

Operating profit, not gross profit, shows the impact of layoffs (salary expenses are deducted from gross profit to calculate operating profit). Spotify’s operating profit, as a percentage of revenue, improved to 12.1% from 4.6% in the first quarter of 2024. That’s a huge improvement in 12 months, but it’s more remarkable considering the company’s operating profit percentage was negative 5.1% in the first quarter of 2023. CEO Daniel Ek’s controversial decision to make Spotify “relentlessly resourceful” by eliminating thousands of jobs has paid dividends for the company.

Lower expenses also helped the Sphere venue in Las Vegas show improvement in operating margin. Sphere’s sales, general and administrative expenses fell 12% as the company identified costs to reduce, including corporate support functions, Sphere Entertainment Co. CFO Robert Langer said during the May 8 earnings call. That helped offset a 12.8% decline in revenue due to fewer events being hosted by the one-of-a-kind venue. The opposing growth rates cancelled each other out, and Sphere’s operating income was flat in the quarter. Investors apparently liked Sphere’s ability to reduce costs: The share price of its parent company, Sphere Entertainment Co., surged 6% the day of the earnings release.

Over at Universal Music Group (UMG), which embarked on a cost savings plan in early 2024, the company’s adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin was flat at 22.8%. Though the company’s global head count rose slightly to 10,346 on Dec. 31, 2024, from 10,290 on Dec. 31, 2023, according to its annual reports, the amount spent on salaries and benefits fell 14% to 1.79 billion euros ($1.94 billion) in 2024.

As for the other two majors, Sony’s operating margin improved to 18.0% from 16.9%, while the operating income before depreciation and amortization (OIBDA) margin at Warner Music Group (WMG) fell to 20.4% from 20.9%, due primarily to a change in revenue mix (meaning there was a higher proportion of low-margin physical sales compared to the prior-year period), though it was partially offset by savings from restructuring. WMG’s operating margin jumped to 11.3% from 8.0% due in part to a decrease in restructuring charges incurred in the prior year.

2. Subscriptions Lead the Way

Two companies had impressive subscriber gains in the quarter.

Spotify’s Premium revenue was up 16% year-over-year, and average revenue per user (ARPU) was up 4%. Subscription revenue was 90% of Spotify’s total revenue, the highest mark since Q3 2020 when advertising dried up — and subscription revenue exploded — at the onset of the pandemic. In fact, subscriptions have been Spotify’s workhorse in recent years, with subscription revenue growing 39.0% over the past two years compared to 27.4% for advertising revenue. After two rounds of price increases in the U.S. and U.K., plus hikes in many other countries, ARPU grew 9.5% in that two-year span.

Meanwhile, at Tencent Music Entertainment (TME), subscription revenue was up 16.6% and ARPU was up 7.5%. TME did not provide an updated subscriber count for its Super VIP tier — it’s still listed at 10 million-plus — but the company did disclose that high-quality audio and other perks are driving Super VIP conversions. Given that Super VIP costs five times the normal subscription price, it makes sense that it was the primary driver of the 7.5% jump in ARPU.

This is a case of the spoils going to the two largest music subscription services by subscriber count. MIDiA Research’s music subscription market shares for Q4 2024 put Spotify at No. 1 with 32% and TME at No. 2 with 15%. Spotify finished Q1 with 268 million paying customers (plus another 423 million ad-free listeners), while TME had 122.9 million.

Some other subscription services have been performing well, too, although only one other publicly traded music streaming company has released detailed financial statements for Q1. A revealing comment came from UMG, which saw double-digit revenue growth from four of its top 10 streaming partners and high single-digit growth at a fifth, the company said during its April 29 earnings call. Billboard believes two of the top four partners were likely Spotify and TME. The other double-digit growth services are anyone’s guess, but it probably wasn’t Deezer — the company’s total revenue rose just 1% in Q1 as its subscriber count fell 5.4%.

3. Advertising revenue was unsurprisingly mediocre but not terrible.

With the subscription business booming, there’s less pressure on the advertising side of music streaming to deliver value for platforms and rights owners. Good thing, too, because advertising hasn’t delivered much growth lately. In the U.S., advertising-based streaming royalties’ share of total recorded music revenues fell to 10.4% in 2024 from 10.9% in 2023 and 11.4% in both 2021 and 2022.

The numbers looked better in Q1 for Spotify, whose ad revenue rose 8% year-over-year (5% at constant currency). But because Spotify’s subscription business is faring better, advertising’s share of Spotify’s total revenue fell to 10.0% from 10.7% in the prior-year period. In fact, 10.0% was the lowest share for Spotify’s advertising since the early pandemic — 8.0%, 6.9%, and 9.4% in Q1, Q2, and Q3 of 2020, respectively.

Advertising is the lifeblood of the radio business. That explains why radio companies’ stock prices have fallen sharply over the last two years. iHeartMedia revenue rose 1% on the strength of a 16% gain in digital revenue, although the multi-sector segment that houses its broadcast radio business was down 4%. U.S. tariff policy has injected uncertainty into media companies’ outlooks, but iHeartMedia CEO Bob Pittman said on Monday (May 12) that iHeartMedia was seeing “generally stable ad spend.”

The same story played out at other radio companies: Total revenue change wasn’t bad because digital gains helped compensate for losses in broadcast ad revenue. Cumulus Media’s revenue fell 6.4% as broadcast dropped nearly 11% and digital gained 6.1%. Townsquare Media’s revenue fell 1% as gains in digital advertising (up 7.6%) and subscriptions (up 4.2%) almost offset a 9.1% decline in broadcast advertising.

Though economic uncertainty lingers, some music companies’ stocks got boosts following their first quarter earnings releases this week, while a better-than-expected jobs report on Friday (May 2) lifted stocks across the board.

K-pop companies were among the top performers of the week. Led by HYBE’s 13.8% gain following its first quarter earnings report on Tuesday (April 29), the four South Korean companies had an average share price gain of 10.3%. JYP Entertainment rose 11.7% and SM Entertainment, which announces earnings on Wednesday (May 7), improved 9.0%. YG Entertainment gained 6.6%.

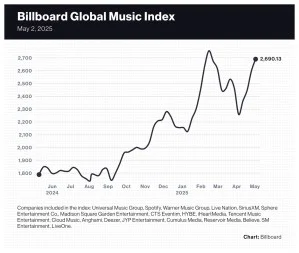

The 20-company Billboard Global Music Index (BGMI) rose 3.6% to 2,690.13, its fourth consecutive weekly improvement. At 2,690.13, the BGMI has improved 19.1% since a two-week slide and stands just 2.4% below its all-time high of 2,755.53 set during the week ended Feb. 14.

Trending on Billboard

Music stocks slightly outperformed the Nasdaq and S&P 500, which rose 3.4% and 3.1%, respectively. Foreign markets were mostly positive but more subdued. The U.K.’s FTSE 100 rose 2.2%. South Korea’s KOSPI composite index gained 0.5%. China’s SSE Composite Index lost 0.5%.

Universal Music Group (UMG) gained 4.3% to 25.86 euros ($29.23) following a quarterly earnings report showing that recorded music subscription revenue grew 11.5% and overall revenue improved 11.8%. JP Morgan analysts’ conviction on UMG “remains very high,” and the strong quarter “should help rebuild confidence and share price momentum” dented by Pershing Square’s sale of $1.5 billion in UMG shares, analysts wrote in an investor note on Tuesday.

Spotify finished the week up 3.7% to $643.73 despite its shares dropping 3.4% on Tuesday after the company’s first-quarter earnings report included guidance on second-quarter subscription additions that seemed to underwhelm investors. Gross margin of 31.6% beat Spotify’s 31.5% guidance. Loop Capital raised Spotify to $550 from $435, while Barclays lowered it to $650 from $710. UBS maintained its $680 price target and “buy” rating. Guggenheim maintained its “buy” rating and $675 price target.

Live Nation, which reported first quarter earnings on Thursday (May 1) and predicted a “historic” 2025, gained 2.3% on Friday and finished the week up 0.7%. A slew of analysts updated their price targets on Friday. Two were upward revisions: Jefferies (from $150 to $160) and Wolfe Research (from $158 to $160). Two were downward revisions: Rosenblatt (from $174 to $170) and JP Morgan (from $165 to $170).

Nearly all streaming stocks posted gains. LiveOne was the week’s top performer, jumping 18.0% to $0.72. Chinese music streaming companies Cloud Music and Tencent Music Entertainment gained 11.6% and 7.1%, respectively. French music streamer Deezer gained 1.4% to 1.44 euros ($1.63) after the company’s first-quarter earnings on Tuesday. Abu Dhabi-based Anghami fell 3.1% to $0.62.

Cumulus Media fell 33.% to $0.14. Most of the decline came on Friday as the stock ceased trading on the Nasdaq and began trading over the counter.

Created with Datawrapper

Created with Datawrapper

Created with Datawrapper

According to Live Nation CEO Michael Rapino during the company’s earnings call on Thursday (May 1), every chief executive is being asked the same question this earnings season: Are you feeling a consumer pullback?

It’s a reasonable query given the worsening state of the economy. U.S. gross domestic product decreased at an annual rate of 0.3%, the U.S. Bureau of Economic Analysis announced on Tuesday (April 30). And on Thursday, news broke that U.S. joblessness claims for the week ended April 26 surged beyond expectations. Earlier in April, the University of Michigan reported that its consumer sentiment score fell to 57.0 in March, down from 71.8 in November. That puts the closely watched measure on par with scores during the 2009 fallout of the U.S. housing crisis and in August 2011, as consumers feared a stalled recovery.

But on Friday (May 2), a reprieve from the bad news arrived in the form of a better-than-expected jobs report. And judging from comments during this week’s earnings calls, many music companies remain confident that their businesses will weather whatever storms develop in 2025.

Trending on Billboard

“We haven’t felt [a pullback] at all yet,” Rapino said. Whether it’s a festival on-sale, a new tour or a standalone concert, Live Nation has seen “complete sell-through” and “strong demand” that surpasses 2024’s record numbers, he added: “So, we haven’t seen a consumer pullback in any genre, club, theater, stadium [or] amphitheater.”

To see how Live Nation fared during the last recession, you’d have to go back to 2009. The U.S. housing crisis had shaken the economy and GDP shrank 2.0% that year, but Live Nation’s revenue increased 2.3%. Then, as the economy rebounded in 2010, the company’s revenue jumped 21.1% in 2011.

Of course, live music took a nosedive during the pandemic, but the drop-off in 2020 and 2021 was caused by a decrease in the supply of concerts, not a dip in demand for live music. When artists returned to touring, fans showed up in record numbers.

Some parts of the economy can be trusted to stumble during a downturn. Case in point: U.S. advertising revenue fell 14.6% in 2009 and dipped 5.4% in 2020. Brands are quick to cut their ad spending when they anticipate a pending sales decline. For example, car dealerships frequently advertise on TV and radio, but cut back as auto sales fell 17.6% in 2009 and 20.3% in 2020.

A decline in advertising is harmful to some parts of the music business. Radio companies have struggled with weak ad revenues in recent years, and their stock prices have taken a beating. Through Friday, iHeartMedia’s stock price is down 50% year to date, and Cumulus Media, which de-listed from the Nasdaq today, has lost 82%.

But music is a “counter-cyclical” business, meaning it doesn’t follow larger economic trends, and the popularity of subscriptions has helped insulate the music industry from economic woes. It’s widely believed that consumers simply won’t part with their favorite music service. In fact, $11.99 for a month from Spotify or Apple Music, although a few dollars higher than two years ago, is considered by top music executives to be underpriced.

During Spotify’s earnings call on Tuesday, CEO Daniel Ek said “engagement remains high, retention is strong” and the ad-supported free tier gives users a way to remain at Spotify “even when things feel more uncertain” — not that Ek is uncertain about the company’s future. “I don’t see anything in our business right now that gives me any pause for concern,” he said flatly.

Universal Music Group (UMG) is on the same page as Ek. CEO Lucian Grainge attempted to ease investors’ concerns by explaining that he has witnessed music weather numerous recessions. “Music has always proven to be incredibly resilient,” he said during an earnings call on Tuesday. “It’s low cost, high engagement and obviously a unique form of entertainment.” In addition, added chief digital officer Michael Nash, UMG’s licensing agreements include minimum guarantees that provide “very significant protection against digital revenue downside risk this year.”

There’s always a chance that unforeseen events or a particular confluence of factors will ruin music’s winning streak. With subscription prices rising, a possible “superfan” subscription tier on the horizon, ticketing prices not getting any cheaper and tariffs increasing the costs of music merchandise, consumers may reach a breaking point. MIDiA Research’s Mark Mulligan argued this week that superfans are being “pushed to the limit” and concertgoers don’t have an unlimited ability to absorb higher ticket prices.

So far, however, the evidence suggests music fans’ spending is continuing unabated. Live Nation says its various metrics — ticket sales, deferred revenue for future concerts — point to another “historic” year in 2025. Rapino added that the company’s clubs and theaters haven’t reported a decrease in on-site spending. Part of that could be that Live Nation carefully curates an array of food and beverage options that maximize per-head revenue. But a more likely explanation is that people need entertainment now more than ever.

State Champ Radio

State Champ Radio