Business

Page: 61

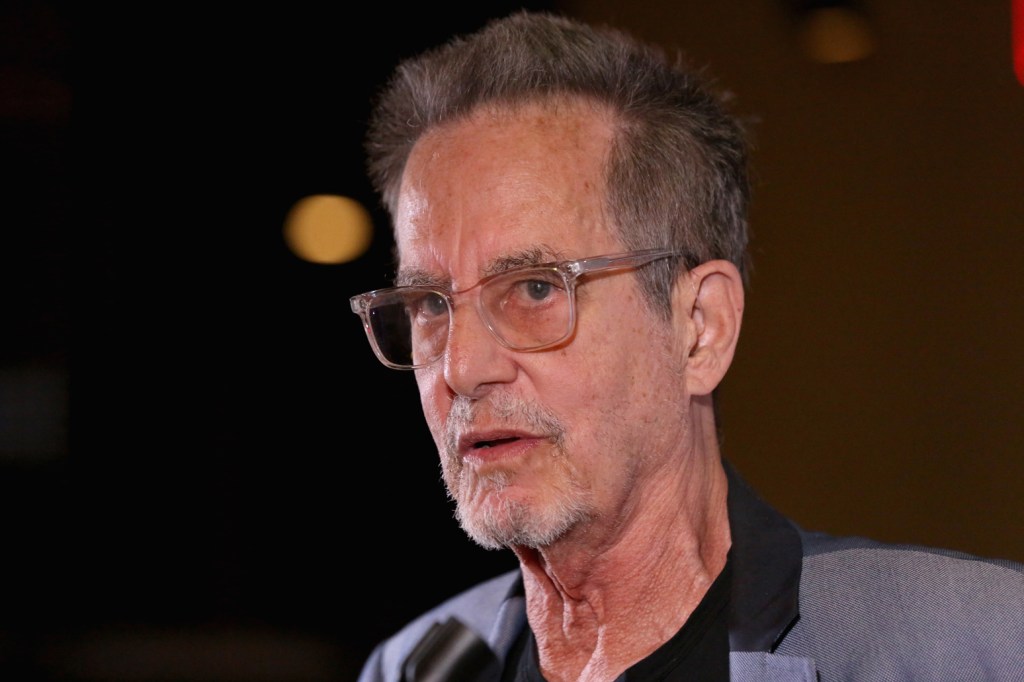

The housekeepers suing Smokey Robinson for sexual assault have now filed a police report, leading the Los Angeles County Sheriff’s Department to open a criminal investigation on top of the bombshell civil claims filed against the 85-year-old Motown legend.

Lawyers for four anonymous housekeepers, who alleged in a $50 million lawsuit earlier this month that William “Smokey” Robinson Jr. repeatedly raped them over the course of nearly two decades, confirm in a Thursday (May 15) statement to Billboard that criminal authorities are probing the claims.

“We are pleased to learn that the LA County Sheriff’s Department has opened a criminal investigation into our clients’ claims of sexual assault against Smokey Robinson,” say attorneys John Harris and Herbert Hayden. “Our clients intend to fully cooperate with LASD’s ongoing investigation in the pursuit of seeking justice for themselves and others that may have been similarly assaulted by him.”

Robinson’s lawyer Christopher Frost says in his own statement to Billboard that the housekeepers’ claims are “manufactured “ and motivated by “unadulterated avarice.” Frost notes that police did not launch a criminal probe unilaterally; rather that the Sheriff’s Department is required to investigate because the women filed a police report.

“We welcome that investigation, which involves plaintiffs who continue to hide their identities, because exposure to the truth is a powerful thing,” Frost says. “We feel confident that a determination will be made that Mr. Robinson did nothing wrong, and that this is a desperate attempt to prejudice public opinion and make even more of a media circus than the Plaintiffs were previously able to create.”

The Sheriff’s Department did not immediately return a request for comment Thursday.

Robinson, who’s currently on a legacy tour celebrating the 50th anniversary of his album A Quiet Storm, was accused in the May 6 civil lawsuit of forcing housekeepers to have oral and vaginal sex in his Los Angeles-area bedroom dozens of times between 2007 and 2024.

The singer’s wife, Frances Robinson, is also named in the lawsuit. The housekeepers say she did nothing to stop her husband’s abuse, despite knowing that he had a history of sexual misconduct and had previously struck settlements with assault victims.

The lawsuit also says the Robinsons paid their employees below minimum wage, and that Frances Robinson created a hostile work environment replete with screaming and “racially-charged epithets.”

Smokey and Frances Robinson have fiercely denied the housekeepers’ claims, saying through Frost on May 7 that the “vile, false allegations” are merely “an ugly method of trying to extract money from an 85-year-old American icon.”

A judge has quickly shut down an attempt by Justin Baldoni’s attorney to use the It Ends With Us litigation docket to accuse Blake Lively of extorting Taylor Swift, saying the filing is improper and “transparently invites a press uproar” without providing any relevant information for the federal court case.

The order, which came down from Judge Lewis J. Liman on Thursday (May 15), strikes Baldoni lawyer Bryan Freedman’s letter from just one day earlier in which he claimed that an unnamed source told him Lively had asked Swift to delete text messages and threatened to release private communications unless the pop star voiced public support for her sexual harassment and retaliation claims against Baldoni.

Lively’s legal team was quick to deny the allegations as “categorically false” and “completely untethered from reality,” saying such claims have no place on the court docket. Judge Liman agreed a few hours later, writing that Freedman’s letter “is improper and must be stricken.”

Trending on Billboard

“The sole purpose of the letter is to promote public scandal by advancing inflammatory accusations, on information and belief, against Lively and her counsel,” the judge wrote. “It transparently invites a press uproar by suggesting that Lively and her counsel attempted to ‘extort’ a well-known celebrity. Retaining the letter on the docket would be of no use to the court.”

Judge Liman wrote that under governing case law from the Second Circuit Court of Appeals, federal court dockets should not be “co-opted” to “promote scandal arising out of unproven, potentially libelous statements.”

“Counsel is advised that future misuse of the court’s docket may be met with sanctions,” Judge Liman wrote.

Lively’s representatives celebrated the decision Thursday, with a spokesperson for the actress saying in a statement, “It took the court less than 24 hours to see through Mr. Freedman’s irrelevant, improper and inflammatory accusations, strike them, remove them from the court and warn Mr. Freedman that further misconduct may be met with sanctions.”

Freedman did not immediately return a request for comment on the ruling.

Swift’s reps have not commented on the Lively extortion accusations, but they forcefully criticized Baldoni last week for dragging the pop superstar into the It Ends With Us litigation by way of a subpoena.

“The connection Taylor had to this film was permitting the use of one song, ‘My Tears Ricochet,’” said Swift’s spokesperson at the time. “Given that her involvement was licensing a song for the film, which 19 other artists also did, this document subpoena is designed to use Taylor Swift’s name to draw public interest by creating tabloid clickbait instead of focusing on the facts of the case.”

Lively alleges in the case that Baldoni, her co-star and director on the movie released last summer, sexually harassed her on set and then orchestrated a public relations smear campaign to retaliate against her after she complained.

Swift was brought into the fray when Baldoni countersued Lively for defamation and claimed that the actress leveraged her relationship with a “megacelebrity friend,” presumed to be Swift, to bully her way into more control of It Ends With Us.

Baldoni’s legal filing included text messages concerning an alleged meeting attended by “Ryan and Taylor,” seemingly referencing Swift and Lively’s husband, Ryan Reynolds. In one message sent by Lively, the actress called Swift and Reynolds her “most trusted partners” and compared them to the “dragons” in the show Game of Thrones.

“The message could not have been clearer,” Baldoni’s lawyers wrote in the countersuit. “Baldoni was not just dealing with Lively. He was also facing Lively’s ‘dragons,’ two of the most influential and wealthy celebrities in the world, who were not afraid to make things very difficult for him.”

For years, to make the Canvas Power 15, Walrus Audio has spent $95.32 per unit on parts. So the rainbow-stamped power supply device for multiple guitar pedals has rarely cost customers more than $270, a price consistency that has helped the 14-year-old Oklahoma City company earn $10 million in annual sales and employ 31 guitar players. “We were cruising, and stuff was selling, and we’re like, ‘Man, we’re having a fun year,’” owner Colt Westbrook says.

But a surge protector that resembles a small, black brick is a key part of every Canvas Power 15 package and can be made in only one country: China. Last month, when the Trump Administration raised tariffs for Chinese imports from 84 percent to 145 percent, the cost to make the Power 15 soared to $139.54. That gave Westbrook a choice: Raise Walrus’ prices, potentially alienating customers, or slash expenses. “We’d have to lose some people,” says Westbrook, whose customers include Maroon 5, the Roots, Haim and Bon Jovi. “We’d have to cut some products, because they wouldn’t be financially viable anymore. Which would be sad.”

Given the unpredictable nature of recent U.S. tariffs on China, and, to a lesser extent, other countries, Walrus is one of many music-gear manufacturers freaking out about the sudden instability of its long-steady industry. Although Trump announced a trade deal with China last week, lowering the U.S. tariffs on Chinese imports to 30 percent, Westbrook was not reassured. “Everybody’s just, ‘We’re holding onto our cash because we don’t know what’s going to happen,’” he says.

Trending on Billboard

Small music-gear companies fear the worst. In testimony Wednesday (May 14) before the U.S. Senate Committee on Small Business and Entrepreneurship, Julie Robbins, owner/CEO of EarthQuaker Devices, a 35-employee Akron, Ohio, guitar-effect pedal manufacturer, declared the tariffs are “putting us at risk of bankruptcy,” demanded they be “reversed immediately” and dismissed “offensive” suggestions that she borrow money to cover fees “abruptly imposed on me by the government with no notice and no consideration.”

Although many music instruments are manufactured in the U.S., as well as relatively low-tariffed countries like Canada, Mexico and Indonesia, John Mlynczak, CEO/president of the National Association of Music Merchandisers (NAMM), recently told Billboard: “China is the largest manufacturing hub for products worldwide.” Gear-makers big and small say circuit boards, capacitors, resistors, transistors, fret wire, tubes and, as Walrus discovered, surge protectors, are made outside the U.S. — and many come from China alone.

“Nearly all musical products imported into the world’s largest market for [these] products are affected,” Mlynczak says by email. “This could have a devastating effect not only for the companies in our industry, but also for music-makers who buy these products.”

Trump recently declared U.S small businesses would not require government relief: “They’re going to make so much money — if you build your product here,” he said. But Josh Scott, owner, creator and president of Kansas City-based JHS Pedals, which employs 40 people and releases 100,000 products annually, argues Trump’s prediction can’t come true in his industry, which relies on parts that haven’t been made in the U.S. for years, if ever. “It’s like telling someone in Detroit to make diamonds out of the ground,” he says. “It’s physically not a thing.”

“It’s not just going to affect gear prices. It’s going to put a lot of these people out of business,” adds Rhett Shull, whose YouTube guitar-tips channel has 728,000 followers. “We’re heading for a massive nationwide shortage of goods in about a month. Even if Trump said, ‘Oh, nevermind, tariffs off, we’re all good,’ the damage is already going to be done.”

Due to the tariffs — and the uncertainty surrounding the tariffs — music-business products from T-shirts and other merch to vinyl records are bracing for higher manufacturing prices. U.S. companies that specialize in music gear are already seeing the impact: Philippe Herndon, founder/chief product designer for Caroline Guitar Co., recently posted on Threads that his company was “startled” to receive a March tariff bill that was “twice as much as we were expecting”; John Snyder, owner of Electronic Audio Experiments, adds in an interview that the cost of metal enclosures used for a new pedal “basically tripled overnight,” forcing his $1 million-in-annual-sales company to discontinue the product. “You don’t want to pass that cost onto the customers,” he says. “At some point, you have to take the ‘L’ and move on, and focus on stuff where the margins are better.”

The tariffs haven’t fully kicked in for the music-gear business, in part because of Trump administration uncertainty: In addition to the fluctuating tariff rates, particularly on China, Trump has granted, without much explanation, exemptions for certain industries, like smartphones, laptops and other electronics. NAMM has lobbied U.S. senators and the Commerce Department for an exemption on the types of lumber, known as tonewoods, that are used in guitars.

Another reason consumers may not have noticed a widespread increase in guitar-gear costs: Like many aggressive U.S. businesses, some music-equipment companies began preparing when Trump won the 2024 election. Electronic Audio Experiments, according to Snyder, spent last December and January working with a longtime supplier to buy as much inventory as possible so the company could maintain prices through the end of 2025. “Our circuit-board assembly house is located in North Carolina. We loaded them up with as much raw material as we could stand and just tried to coast from there,” Snyder says. “It was a very anxious time. Nobody knew exactly what was happening. We just knew it was going to be bad.”

For now, some music-gear manufacturers detect a shift among consumers to the used market. On Reverb, which sells new and used gear, April prices dropped by about 1 percent compared to the same time in 2024. “There have been a few manufacturers who have raised prices in the last few weeks on synthesizers and pedals,” says Cyril Nigg, Reverb’s senior analytics director. “A lot of the other manufacturers are trying to hold prices where they are for now. The retailers who are selling those products on Reverb are trying to keep the prices stable.”

Used gear prices are typically about 50 percent to 80 percent of the new price, according to Herndon, whose company earns less than $500,000 in annual sales. “The used market is indexed to the price of new goods,” he says. “Somebody goes, ‘I want to buy a Stratocaster, and everything has gotten more expensive — screw this, I’m going to buy it used.’ Well, the tariffs have raised the price of the new goods, and now the used goods are going to come up.”

Elizabeth Dilts Marshall contributed to this report.

Brian Avnet, who began his long career as a road manager for Bette Midler and later managed such top acts as The Manhattan Transfer, David Foster, Josh Groban and Eric Benét, died in Los Angeles on Wednesday (May 14), after living with Parkinson’s disease for many years. He was 82.

Avnet was inducted into the Personal Managers Hall of Fame in 2017, in the same class as Sid Bernstein, Eileen DeNobile, Eric Gardner, Richard Linke, Lois Miller, Eliot Roberts, Dolores Robinson, Arthur Shafman, David Sonenberg, Rick Siegel and Jerry Weintraub.

Trending on Billboard

On hearing of his death, Linda Moran, CEO of the Songwriters Hall of Fame told Billboard, “Brian was loved by everyone who knew him. [He] was a familiar face at Atlantic and WMG over the years as most of his artists were signed there.”

Based in Los Angeles, Avnet was a personal manager for nearly 40 years. In addition to those named above, his clients also included Johnny Mandel, Herb Alpert and Lani Hall Alpert, Frankie Valli and the Four Seasons, Joshua Ledet, Cyndi Lauper, Take 6 and Jean-Luc Ponty.

Avnet worked with Midler in the early days, starting when she was playing bathhouses in New York before bursting to stardom in the early 1970s. Avnet served as general manager for Midler’s 19-show run at the Palace Theatre in New York in December 1973 for which she won a special Tony Award “for adding lustre to the Broadway season.”

He managed The Manhattan Transfer for 19 years starting in the late 1970s, including when they landed their biggest hit, “Boy From New York City.” That song made the top 10 on the Billboard Hot 100 in 1981 and won a Grammy for best pop vocal performance by a duo or group with vocal.

Avnet was a personal manager for Foster, a 16-time Grammy-winner. In that capacity, he worked on recording projects by such stars as Whitney Houston, Celine Dion, Toni Braxton, Natalie Cole, Diana Krall, Faith Hill, Brandy, En Vogue, Olivia Newton-John, The Bee Gees, Michael Bolton, All 4 One, Julio Iglesias, En Vogue and Smokey Robinson.

He played a key role in discovering Groban, whom he later managed. He found the singer through Seth Riggs, the top vocal coach, and brought him to Foster.

When Foster signed a deal with Warner Bros. in 1995, it enabled him to start 143 Records. Foster hired Avnet to run the label, with a roster that included Groban, Michael Bublé, The Corrs and Beth Hart. Bublé’s first three No. 1 albums on the Billboard 200 – Call Me Irresponsible, Crazy Love and Christmas – were released on the 143 imprint, as were Groban’s first two No. 1 albums on that chart – Closer and Noel.

The Corrs, a sibling pop band from Ireland, had three Billboard 200 albums while on the label; Hart, a Los Angeles-based singer/songwriter, had one.

Foster later sold the label back to Warner. On Sept. 20, 2001, Warner Music Group announced it was shutting down the label.

Avnet’s widow Marcia Avnet told Billboard that her husband grew up in Baltimore and started his career in theater. “He was the youngest theater manager,” she said. “Actually, he used to manage the theater in-the-round in Maryland and then he was roommates with Dustin Hoffman in New York. And Jon Voight. They were all roommates when those guys were doing summer stock. Brian was in management, he ran the ticket booth, did lots of different jobs.”

Early in his career, he served as producer of A Streetcar Named Desire starring Voight at the Studio Arena Theatre in Buffalo, N.Y.

He moved to Los Angeles in the early 1974 to work with Lou Adler on the production of the Rocky Horror Show, which played at The Roxy for nine months. It was turned into a film, The Rocky Horror Picture Show, the following year. The film has long been a cult favorite. Avnet also produced the rock opera Tommy in Los Angeles; and served as manager for the rock opera Jesus Christ Superstar at the Universal Amphitheater in Los Angeles.

He also managed the first season of the Universal Amphitheater.

Avnet worked with producer Robert Stigwood on Sgt. Pepper’s Lonely Hearts Club Band on the Road, an off-Broadway production which opened at the Beacon Theatre in New York in November 1974 and ran for two months. The show was loosely adapted into an ill-fated 1978 film version starring The Bee Gees and Peter Frampton.

Avnet frequently participated in events like Grammy Career Day. At a 2009 workshop, he served alongside such industry professionals as John Burk, Tom Sturges, Tina Davis, Rickey Minor, Harvey Mason Jr., Mike Knobloch and Javier Willis.

The Avnets were together for 36 years; married for 26 of those years.

“It was a really long career, and he was beloved,” said Marcia Avnet. “He never signed a contract with anybody. His word was his bond. And that’s really rare.”

Additional reporting by Melinda Newman.

SACEM collected a record 1.6 billion euros ($1.73 billion) in 2024, up 7.7% from 2023, the French organization announced this week, fueled largely by international expansion. In France, SACEM collected 852 million euros ($922 million, based on the average annual conversion rate for 2024), up about 2%. Internationally, though, it took in 749 million euros ($811), a gain of 15%. That means that almost half of SACEM’s revenue is international, which is significant for a CMO in a market with a strong national repertoire. Royalty distributions were up 12%, to 1.4 billion euros ($1.5 billion).

For SACEM, like other big European CMOs, it’s a whole new world, thanks to the ability to represent online rights across much of the world (although not the U.S.). As general music business growth slows, mostly due to streaming subscription saturation in big markets, this has allowed SACEM to continue to grow by signing deals with publishers and other CMOs.

Trending on Billboard

“The strategy we’ve developed over the last years is to convince publishers and other CMOs to join forces with us to be able to better deal with platforms, not from an equal position but one that’s more balanced, and to invest in tools that benefit everyone,” SACEM CEO Cécile Rap-Veber told Billboard at the Music Biz Conference in Atlanta, where she also did a keynote interview. “We’ve secured new mandates to represent more repertoire, so we can take in more money and reduce our costs.”

For most of the history of SACEM, which has operated since the 1850s, before any of its peer societies, the organization did most of its business in France. CMOs remitted money to other CMOs, but the European organizations did not really compete with one another. That changes with a 2014 European Union Directive that generally allowed CMOs to maintain their national monopolies but also to compete for online rights. Competition in the decade since allowed two giant “licensing hubs” to emerge: SACEM and ICE, a joint venture of PRS for Music (the UK CMO), GEMA (the German one) and STIM (Swedish). While direct comparisons are difficult because of the way the different organizations report their results, SACEM has become either the biggest CMO outside the U.S. (based on royalties it collects and distributes) or the biggest in the world (based on the total amount of money it takes in, some of which it passes directly to other organizations for them to distribute).

SACEM now represents 510,000 songwriters and rightsholders worldwide, in 180 territories. Its international royalties, almost all online, have grown 29% since 2023. It signed 16 new deals – mandates is the term used – this year, in addition to the 70 it already had, including with Universal Music Publishing, ASCAP, the Canadian CMO SOCAN, and the Korean CMP KOMCA.

Rap-Veber’s strategy is that this kind of expansion creates a virtuous circle: Increased scale leads to increased revenue, which allows for increased investment, which in turn leads to further increases in scale. That scale also allows for wider scaring of costs, which lets rightsholders take a higher percentage of the money SACEM collects.

The industrywide slowdown in growth is intensifying competition among societies, as limited natural growth means expansion must come from international markets, or at the expense of peer organizations. As fears of economic contraction grow in Europe and the U.S., it is hard to imagine national growth that’s significantly higher than inflation on a sustained basis. That puts the focus on other markets, where the larger international societies can compete. “We have direct license deals now in India, Vietnam and the Philippines,” Rap-Veber says. “With almost 80 partners, we have the weight to be an international player, with more penetration in more countries.”

As SACEM expands globally, it continues to prioritize local cultural investment in France, where it follows a dedicated cultural strategy. With the money it took in from the blank media levy — a copyright fee charged on blank media and computer memory — it put aside 20 million euros ($22 million) for 3,600 cultural projects in France, including 478 festivals and 185 venues.

In the middle of his Grammy Award-winning 2024 “Not Like Us” music video, Kendrick Lamar posts up with OG executives and artists from his former label, Top Dawg Entertainment, on the patchy lawn outside of the Nickerson Gardens housing projects in Los Angeles’ Watts neighborhood. “That moment for me was strong and powerful because here we are, still laughing, joking, like when we were these 16-, 17-year-old kids back in the day,” TDE president Anthony “Moosa” Tiffith recalls. “It feels good when you and all your brothers set out to do something, and then you see everybody succeed at exactly what we set out to do. We all come from one frat, and that’s TDE.”

Moosa, now 37, was introduced to not only this brotherhood but also the broader music business by watching rappers and other creatives including Lamar, ScHoolboy Q, Ab-Soul, Jay Rock, Derek “MixedByAli” Ali and Sounwave pull up to the recording studio, dubbed House of Pain, that his father, TDE CEO Anthony “Top Dawg” Tiffith, built in the backyard of their Carson, Calif., home in 1997. “Music has always been around my family,” he says, citing his great-uncle Michael Concepcion, who managed R&B singer Rome and produced the West Coast Rap All-Stars’ 1990 Grammy-nominated single “We’re All in the Same Gang.” Moosa clicked with ScHoolboy Q and became his road manager in 2011, then eventually “fell into” being his overall manager.

Trending on Billboard

Through the years, he stepped up at the label and his responsibilities increased. “Sometimes you’re getting prepped for something that’s much bigger than you,” he says. In 2022, Moosa was elevated to co-president alongside Terrence “Punch” Henderson and tasked with overseeing TDE’s day-to-day operations on top of managing some of its artists, such as Doechii, ScHoolboy Q, Zacari, Alemeda and in-house producer Kal Banx. “Sometimes I’m in my A&R bag, and then sometimes I’m in a creative bag where I’m overseeing a rollout,” he says.

TDE, which celebrated its 20th anniversary in 2024, remains committed to its artists’ long-term growth and creative autonomy — fostering groundbreaking output that’s often well worth the wait. In March 2024, ScHoolboy Q released Blue Lips, his first studio album in five years, to critical acclaim. And the following August, Doechii released her third mixtape, Alligator Bites Never Heal, which earned the fast-rising star a best new artist Grammy nod and her first Grammy trophy, for best rap album, while yielding two Billboard Hot 100 hits: “Denial Is a River” (which peaked at No. 21) and “Nissan Altima” (No. 73). When Doechii released the mixtape’s extended edition in March, she included “Anxiety,” which hit No. 10, becoming her highest-peaking entry on the chart.

Those achievements represent just some of the widespread recognition Doechii has quickly garnered, from being named Woman of the Year at Billboard Women in Music to winning outstanding music artist at the GLAAD Media Awards. And Moosa played a crucial role in the rise of TDE’s latest star: “This is a project I personally signed, curated, put producers around, put directors around. It feels that much more personal to me with her winning that Grammy,” he reflects. “I knew all the accolades would come, just not the timing of them.”

Moosa has been steadily developing Doechii for the last five years, since one of his young employees sent him a list of artists to check out that included her. He listened to Doechii’s dynamic, autobiographical single “Yucky Blucky Fruitcake” and found himself going down a “big rabbit hole” online that included discovering a video of her “doing choreo with two dancers next to her with probably 10 people in the club,” he remembers. “It let me know how serious she took herself. She had a vision right there, probably with no money.” While Doechii’s vision now occasionally demands the big bucks — like her high-concept 2025 Grammy performance — Moosa believes she’s worth banking on: “I got this little saying between me and my general manager, Keaton [Smith]: ‘She hasn’t missed yet.’ ”

Moosa and Doechii have a “super-collaborative and intentional working process,” he explains. He has also been inspired by the relationship between Henderson and SZA, who this year has already topped the Billboard 200 (when SOS’ deluxe LANA edition reinstated it at the top of the chart) and Hot 100 (with Lamar collaboration “Luther,” which she and the rapper performed at this year’s Super Bowl halftime show) and starred in her first feature film, the acclaimed buddy comedy One of Them Days. “These are the things that I want to build with me and Doechii, [putting] her in positions to have that same sort of impact,” he adds.

And even as TDE celebrates the successes of SZA and Doechii, Moosa remains dedicated to maintaining the storied label’s cultural impact and building up its burgeoning, boundary-pushing acts. Rapper Ray Vaughn released his debut mixtape, The Good the Bad the Dollar Menu, in April, and Alemeda’s 2024 debut EP, FK IT, showcased her indie/alt-pop sound, a departure from the label’s rap and R&B bedrock. “When you look across our roster, I try not to sign anybody that’s extremely similar to each other. I’m always looking beyond one or two genres,” Moosa says, adding that he also looks for “authenticity, discipline, work ethic and family dynamics” in new signees. “Every artist that we get, we treat them like family. It’s going to be a close-knit type of thing because that’s how we all came up.”

This story appears in the May 17, 2025, issue of Billboard.

Assembling a show for the technological mecca that is Las Vegas’ Sphere is a head-spinning process for any artist and their team. But CAA agent Ferry Rais-Shaghaghi and Sphere Entertainment vp of live Erin Calhoun worked side by side to help create the buzzy, boundary-pushing run by melodic techno artist Anyma, who became the first electronic act to play the venue when he kicked off a residency there in late December that ran through early March.

Booking an electronic artist had been a priority, particularly given that the right artist would, Calhoun says, “be able to leverage all of Sphere’s experiential technologies in a new, compelling way.” Anyma (born Matteo Milleri) had been on the Sphere team’s radar for years, and over time, it became clear that his international appeal, futuristic music and strong preexisting visual identity made the Italian American artist the perfect choice.

Rais-Shaghaghi says that for him and the rest of Anyma’s team, Calhoun became “the point person for us to navigate everything.” In the year or so it took to produce the show — titled Afterlife Presents Anyma ‘The End of Genesys’ — Calhoun and Rais-Shaghaghi formed, he says, “an incredible business relationship that became a friendship with someone we trusted and felt comfortable going to and having the difficult conversations we needed to have.”

Trending on Billboard

Through these conversations, the team created huge and viral moments, like the scene where a character falls through space, creating a wild, lightly dizzying effect for the audience. They also made a pair of cello-playing robots that helped bring Anyma’s melodies to life. Calhoun says such elements “highlighted the way technology combines with artistry to make for an unforgettable experience.” Milleri developed the visual feast of a show himself alongside Anyma’s longtime visual creative director/lead computer graphics artist Alessio De Vecchi and head creative Alexander Wessely.

Rais-Shaghaghi and his team leveraged their network and hype around the residency to book support acts — “We looked at them more as guests,” he says — for the run that included Peggy Gou, John Summit, Solomun, Amelie Lens, Charlotte de Witte and Tiësto, giving each night a mini-festival feel.

And when issues inevitably arose during production, Rais-Shaghaghi says Calhoun “would always help us in navigating it within her ecosystem and [figuring out] how we could get to the finish line. Erin is firm, but she knows how to get the results she needs without burning bridges. She’s also really good at being a team player, understanding the artist’s creative process and direction and being the voice between the artist and the owner of [Madison Square Garden] in finding that middle ground.”

“We were completely aligned on the overall goal here: to blow everyone away with stunning visuals, next-level sound and an unparalleled live experience,” Calhoun adds. “Every move we made was side by side, which is how we approach every artist playing our venue. The vision is led by the artist, and we do everything we can to make it happen. Ferry is so passionate and was hands-on throughout the entirety of the run.”

This shared mission was ultimately a huge success, with the 12-night residency drawing more than 200,000 fans from around the world. The first eight dates alone sold 137,000 tickets and grossed $21 million, although Rais-Shaghaghi says money is ultimately beside the point.

“Obviously, as agents, we have to look at how we make our clients win financially,” he says, “but more so, it’s about how we can do things where the promoter wins, the fans win and the artists feel that they created an experience that had a high impact.”

This show is clearly one such instance. “From the performers onstage to the fans in the crowd,” Calhoun says, “everyone wanted more, more, more.”

This story appears in the May 17, 2025, issue of Billboard.

Universal Music Group has announced the expansion of two of its most storied labels — Deutsche Grammophon and Blue Note Records — into greater China, marking a significant move to tap into the country’s rapidly growing classical and jazz music scenes.

“At UMG, we are committed to supporting the development of diverse music cultures around the world,” said Adam Granite, UMG’s executive vice president of market development. “The launch of Deutsche Grammophon China and Blue Note Records China reflects this vision in action and marks a meaningful step forward in the evolution of our multi-label operations in the market.”

Announced at an event in Shanghai this week, Deutsche Grammophon China will focus on discovering and promoting new classical talent across China, plus provide artists with access to UMG’s global resources, including recording, international promotion and touring. Chinese musicians Lang Lang, Yuja Wang and Long Yu will serve as artistic advisors, guiding the label’s artistic direction.

Trending on Billboard

DG China’s debut release, Bach: The Cello Suites by acclaimed cellist Jian Wang, is set for May 23. Additionally, DG China will collaborate with the Shanghai Symphony Orchestra to record and release the complete Shostakovich Symphonies by 2029, celebrating the orchestra’s 150th anniversary.

Dr. Clemens Trautmann, president of Deutsche Grammophon, highlighted the label’s growing presence in China over the past decade and noted that the partnership with Blue Note and the involvement of international artists underscore UMG’s global reach and creative ambition. “We are proud to co-invest in the future generation of outstanding classical performers from Greater China, together with our esteemed colleagues at UMGC to foster the success of amazing new talent across recording, touring and brand partnerships,” Trautmann said.

Stacy Yang, Timothy Xu, Dr Clemens Trautmann and Adam Granite in Shanghai.

Courtesy Photo

Blue Note Records China is set to champion original jazz talent within the country, beginning with its inaugural signing: INNOUT, an avant-garde duo known for fusing improvisation, modern jazz, and experimental soundscapes. This partnership underscores the label’s commitment to bold, boundary-defying artistry.

BNRC is also partnering with JZ Music, a key player in China’s jazz scene, to promote live performances, tours, and festivals.

Don Was, president of Blue Note Records, praised INNOUT’s visionary talent and expressed excitement about launching the label’s Chinese chapter with their music. “Xiao Jun and An Yu are two of the most talented and visionary musicians I’ve ever met,” Was said. “Their music is going to ‘blow people’s minds’ all over the world. It’s a thrill and an honor to be able to launch Blue Note Records China with their music.”

A group of legal scholars say Drake’s lawsuit against Universal Music Group over Kendrick Lamar’s “Not Like Us” is “dangerous” because it will have a “chilling effect” on hip-hop and encourage prosecutors to use rap lyrics as evidence in criminal cases.

Filed in January, Drake’s case claims that UMG defamed him by releasing Lamar’s scathing diss track, which tarred the Canadian rapper as a “certified pedophile.” He says that millions of people took that lyric literally, severely harming his reputation.

But in a legal brief filed in the case on Wednesday, a group of professors from the University of California, Irvine School of Law say that Drake’s argument is “not just faulty—it is dangerous.”

Trending on Billboard

“Drake’s complaint rests on the assumption that every word of ‘Not Like Us’ should be taken literally, as a factual representation,” professors Charis E. Kubrin, Jack Lerner, Adam Dunbar and Kyle Winnen write in the court filing. “[We] urge this court to recognize the danger that assumption poses.”

Diss track lyrics are a creative artform that are understood by listeners not as “factual arguments or a series of news reports,” the professors write, but as “hyperbole, bluster, and demonstrations of disrespect” that are “designed to entertain and impress their audience.”

The professors warn that the consequences of endorsing Drake’s literal interpretation of Kendrick’s lyrics would extend far beyond his case – including to the long-controversial practice of using lyrics as evidence in criminal cases against rappers.

“When courts ignore rap music’s history and artistic conventions, the effect is to deny rap the status of art and instead to flatten lyrics into literal confessions or statements of specific intent,” write the UCI professors. “This problematic treatment has introduced racial bias and unfair prejudice in countless criminal cases [and] has created a demonstrable chilling effect across the industry.”

The use of rap music as criminal evidence has been widely criticized, both because it threatens the right to free speech and can sway jurors by tapping into racial bias. One empirical study – authored by Kubrin and Dunbar – found that listeners who viewed violent song lyrics responded more negatively if they believed they came from a rap track than if they were told the exact same lyrics came from a country or heavy metal song.

Over the past few years, the practice has drawn backlash from the music industry and led to efforts by lawmakers to stop it, including a landmark California statute. But it has persisted in high-profile instances – including Young Thug’s gang case in Atlanta and briefly in Lil Durk’s federal murder-for-hire case.

Moving to dismiss Drake’s lawsuit, UMG has argued that Lamar’s lyrics are “rhetorical hyperbole” — the kind of statement that might sound bad but cannot actually be proven false. Since defamation only covers false assertions of fact, statements of hyperbole can’t form the basis for such cases.

In making that argument, UMG has pointed to Drake’s own public support for a 2022 petition criticizing prosecutors for using rap lyrics as evidence in criminal cases. That letter, also signed by Megan Thee Stallion, 21 Savage and many other stars, criticized prosecutors for treating lyrics as literal statements of fact.

“As Drake recognized, when it comes to rap, ‘the final work is a product of the artist’s vision and imagination,’” UMG’s lawyers write. “Drake was right then and is wrong now.”

A rep for Drake’s legal team did not immediately return a request for comment on the arguments made by the professors.

LONDON — A number of vital grassroots music venues in the U.K. are set to come under shared ownership in the second phase of a new community-led project.

The Music Venue Properties, the Charitable Community Benefit Society (CBS) created by Music Venue Trust (MVT), seeks to protect grassroots venues by placing them into community ownership and outside of commercial leases with landlords.

Seven grassroots music venue will be included in the next phase of the project: Esquires, Bedford; The Sugarmill, Stoke-on-Trent; The Joiners; Southampton, The Croft, Bristol; Peggy’s Skylight, Nottingham; The Lubber Fiend, Newcastle; The Pipeline, Brighton. The community share offer, which will open on May 15, 2025 and close on July 31, 2025.

The first phase of the Own Our Venues initiative ran in 2023, and raised £2.88m ($3.83m) to secure the ownership of a number of venues across the U.K., including The Bunkhouse in Swansea, Wales, and The Snug in Atherton, England.

Trending on Billboard

An accompanying press release says that the scheme offers a “cultural lease,” that far exceeds the traditional 18 month commercial lease that these venues must operate within. The statement adds, that these cultural leases “ensure fair, sustainable rent, annual contributions toward essential maintenance, and ongoing support in areas such as financial sustainability and operational best practice.”

Ricky Bates, venue operator of The Joiners, Southampton said of the next phase of the program, “We welcome Music Venue Properties’ ownership of our building as the only real solution to securing one of the most important live music venues in the UK. For almost 60 years, The Joiners has been a vital part of the UK touring circuit and a creative cornerstone of Southampton, but today its future is uncertain. Our lease expires this year, our landlord is retiring and, while the venue is rich in history, the building is over 200 years old and in need of care.

“In today’s economy, it simply isn’t viable for us as individuals to purchase the property but, with the support of the Own Our Venues campaign and the wider music community, we can secure The Joiners for the next 60 years and beyond. Be part of this historic moment—get involved and help protect grassroots music for generations to come.”

It’s the latest move by the U.K. music scene in the fightback against closures of independent venues and to support grassroots musicians. On Wednesday (May 14), the team behind The Leadmill in Sheffield, England said that their eviction appeal had been unsuccessful and that they have three months to vacate the premises. The building’s landlord, the Electric Group, runs a number of venues in the U.K. already, including London’s Electric Brixton, Bristol’s SWX and Newcastle’s NX. Oasis, Arctic Monkeys, Pulp and Coldplay are among the legendary artists to play The Leadmill over the years.

State Champ Radio

State Champ Radio