Business

Page: 35

After catching up on this week’s edition of Executive Turntable — Billboard’s roundup of the latest music industry moves — be sure to explore the 2025 Pride List, spotlighting 27 influential executives making a difference.

Live Nation Entertainment announced that former Liberty CEO Greg Maffei retired from its board of directors, effective following the company’s annual meeting of stockholders on June 12. During the meeting, 11 director nominees were elected to serve one-year terms, according to a filing with the SEC. Notably, directors elected include Maverick Carter, Jimmy Iovine, Rich Paul and LN CEO Michael Rapino. Missing from the list: Kennedy Center director and Trump ally Richard Grenell, who was very recently announced as joining the board. (Live Nation has not responded to requests for comment.) Voting showed strong support for most nominees, though board chair Randall Mays of Mays Family Enterprises and Chad Hollingsworth of Liberty Media received more opposition. Shareholders also approved an advisory resolution supporting the company’s executive compensation (159.8 million votes in favor and 56.7 million against) and ratified Ernst & Young LLP as the independent auditor for fiscal year 2025.

Believe named Romain Becker as chief product of operations and marketing services officer, unifying core functions to enhance its global support for independent artists and labels. Previously president of label and artist solutions, Becker brings over 15 years of experience in music and tech, including roles at Believe and YouTube’s music partnerships team at Google. Based in Paris, Becker has led distribution and marketing across 50-plus territories and will now oversee product, operations, and marketing services to strengthen Believe’s global capabilities. “Romain is the perfect candidate to connect product, operations and marketing services at Believe,” glowed Believe founder and CEO Denis Ladegaillrie. “With his extensive experience and strategic vision, I am confident that he will drive innovation across our services and help further elevate Believe’s position as a leader in artist and label development globally.”

Trending on Billboard

Kyle Loftus is the new president of Independent Artist Group (IAG), the agency formed from the 2023 merger of APA and AGI. Announced by CEO Jim Osborne, Loftus also joins the firm’s board of directors. Starting as an intern 16 years ago, he rose through the ranks to partner and eventually to executive vp and head of content development. In his new role, Loftus will continue leading key departments including Motion Picture and TV literature, alternative TV, media rights and publishing, while expanding his leadership agency-wide. He represents major clients like 50 Cent and Mary J. Blige, as well as several showrunners for hits like Ted Lasso and Gran Torino, and has helped develop production companies for stars such as Gary Oldman and Taraji P. Henson. “This company believed in me from day one, and I have so many amazing colleagues, mentors, clients and friends to thank — most importantly, my partner and friend Jim Osborne, who has been an unwavering champion,” Loftus said. “We have a fantastic team at IAG, and I am proud to step into this role, lend my support and expertise across the agency and continue amplifying the IAG story by championing the growth of our exceptionally talented clients.”

The Core Entertainment hired Kate Bowling as director of creative, where she will lead visual branding and creative direction across The Core Entertainment, overseeing photo shoots, music videos, digital content and long-term creative strategy. The Core Entertainment’s clients include Bailey Zimmerman, Nate Smith, Josh Ross, Hannah McFarland and Nickelback. Bowling joins The Core Entertainment from Warner Music Nashville, where she served as a multimedia designer. –Jessica Nicholson

Prescription Songs promoted Nick Guilmette to senior director of A&R. Based in Los Angeles, Guilmette has signed diverse talents, including songwriter Charli (Tinashe, LE SSERAFIM), producer Cooper Holzman (Mon Rovîa) and Korean-American songwriter EJAE during his three years at Prescription. He also works with artists like Ryan Ogren, Chloe Angelides, and lil aaron. Formerly general manager at Ozone Entertainment, Guilmette began his music career supporting Brockhampton in high school. Head of A&R Rhea Pasricha praised his leadership, saying, “Nick embodies exactly what we strive to accomplish here at Prescription Songs with his creative energy, boundary-pushing ideas, and genuine passion he has while working across the roster.”

444 Sounds appointed Libby Kallins as its new marketing director. Based in New York City, Kallins brings experience from her previous roles at Armada Music and Arista Records/Sony Music, where she focused on marketing, partnerships, and artist development. At Armada, she led U.S. marketing strategies and artist development for acts such as Armin van Buuren, Lilly Palmer and D.O.D, and helped organize the Armada Label Residency with Peloton. She also played a key role in catalog marketing for influential dance labels like King Street Sounds and KMS Records. In addition to her professional work, Kallins actively supports industry advocacy initiatives, including She Is The Music and Support Women DJs.

WME appointed Laura Ruiz as an agent in its contemporary music department, focusing on electronic music. Based in London, she’ll oversee the agency’s electronic music business in Spain and Portugal. Ruiz brings clients including Oguz, Joyhauser, Don Woezik, Diøn and Milo Spykers. “This appointment further strengthens WME’s commitment to the global electronic music sector, building on a foundation of strategic talent development and market-specific leadership,” the company said. Previously, Ruiz was managing director at The Bliss Office, leading operations across the Americas and representing top talent. She also founded her own agency and worked at The Bullitt Agency in Barcelona, gaining experience across European and American markets.

Musicians On Call, which brings live music to hospitals, expanded its team with nine new hires across various departments. New leadership includes Hailey Gilleland as director of development and Kathryn Bennett as director of individual giving, both bringing extensive experience in fundraising and donor engagement. Katie Trent joins as development coordinator, while Danys Coronel steps in as digital content manager, overseeing MOC’s digital presence and campaigns. Christopher Anthony, with a background in television, is now PR & talent coordinator, managing artist and media relations. Emiley Roye, Abby Tannler and Ella Hunt have been appointed as program coordinators for regions including the Northeast, Denver, Phoenix and the Mid-Southeast, bringing diverse backgrounds in healthcare, entertainment and nonprofit work. Delaney McBride joins as executive assistant to president and CEO Pete Griffin, who said, “The diverse experiences and fresh perspectives they bring will be instrumental as we grow our reach, expand our fundraising, and strengthen our programs across the country.”

Worldwide Entertainment Group (WEG) named Bruce Wheeler as president of its new Live Performance Group. Wheeler, a seasoned executive in live entertainment, has held leadership roles at Central Park SummerStage, The Capitol Theatre and The Beacon Theatre. In his new position, he will oversee WEG’s festivals, tours, corporate events and other live properties while collaborating with the Talent Management and Licensed Merchandise divisions. Reporting to WEG President Dave Lory, Wheeler is tasked with driving innovation and growth in the live sector. “Bruce is the ultimate professional and his experience in running live events and maximizing every aspect of the live event experience will be an incredible addition as we build the Worldwide Entertainment Group,” said Lory.

STURDY., a Los Angeles-based creative studio, announced a major expansion of its brand and experiential division, complete with a new leadership team: Nico Poalillo as director of development, Rikke Heinecke as director of production and development, and Myron Batsa as director of experiential. STURDY. has also partnered with VICE Media’s Pulse Films to enhance its production capabilities and global reach. This collaboration debuted with a high-profile activation at the 2025 Miami Grand Prix, featuring major brands like Apple and Formula 1. STURDY. now offers expanded services across production, media and social strategy. Heinecke has led production teams at major companies like Warner Music Group and ViacomCBS, while also playing key roles in launching and scaling several innovative production startups. Batsa has held senior positions at VICE Media and Insomniac Events, where he partnered with leading brands such as Live Nation, Festival Republic, and Tao Group. Meanwhile, Poalillo’s creative career includes work with global brands like GM and Nike, and top agencies including Leo Burnett, Doner, McCann, Pulse Films and VICE.

Last Week’s Turntable: Triples Is Best at BMI

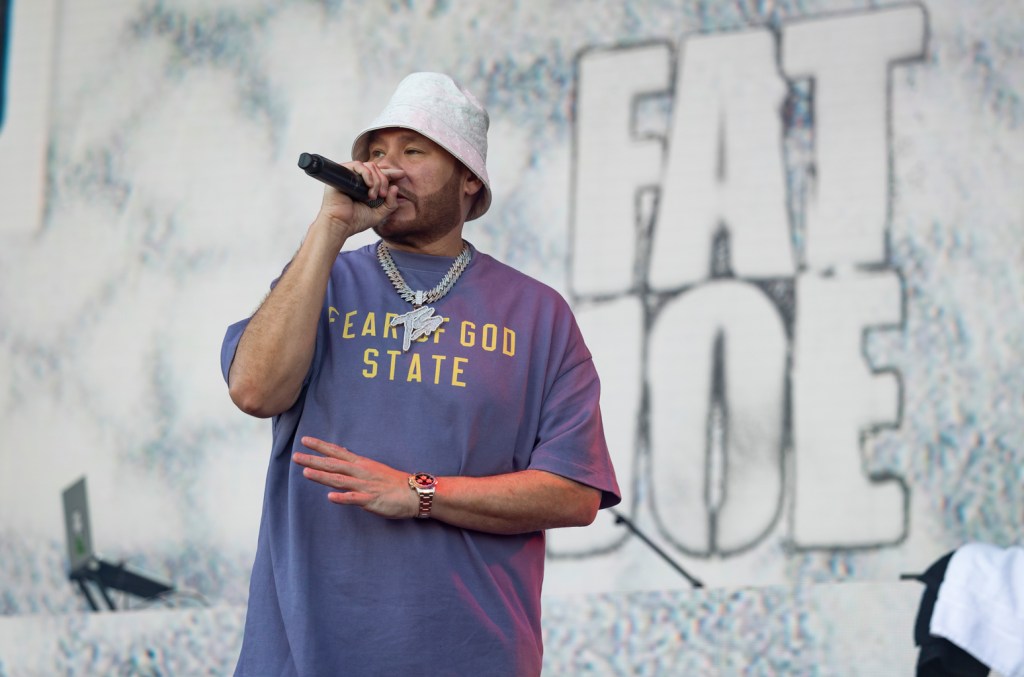

Two months after Fat Joe sued his former hypeman Terrance “T.A.” Dixon for extortion over “false and vile accusations,” the one-time employee has filed his own lawsuit accusing the rapper of having sex with two underage girls.

In a complaint filed Thursday in Manhattan federal court, Dixon accuses Fat Joe (Joseph Cartagena) of a “deliberate and sustained campaign of exploitation,” leveling claims of sex trafficking, financial fraud, and racketeering. Most seriously, Dixon claims that he “personally witnessed defendant engage in sexual relations with children who were fifteen and sixteen years old.”

“Minor Doe 1 is a 16-year-old Dominican girl residing in New York,” Dixon writes in his lawsuit, obtained by Billboard. “In exchange for cash, clothing, and payment of her cell phone bill, defendant would get oral sex and other sexual acts performed on him by Minor Doe 1.”

Trending on Billboard

Those explosive allegations come two months after Fat Joe sued Dixon and his attorney, Tyrone Blackburn, over claims that they were extorting him by making “wholly fabricated, grotesque, and scandalous allegations,” including “unspeakable acts such as pedophilia.”

In a statement responding to the new case, Fat Joe’s lawyer Joe Tacopina called them a “blatant act of retaliation” and a “desperate attempt to deflect attention from the civil suit we filed first.”

“Law enforcement is aware of the extortionate demand at the heart of this scheme,” Tacopina says. “The allegations against Mr. Cartagena are complete fabrications — lies intended to damage his reputation and force a settlement through public pressure. Mr. Cartagena will not be intimidated. We have taken legal action to expose this fraudulent campaign and hold everyone involved accountable.”

Asked by Billboard about Tacopina’s statement regarding law enforcement, Blackburn repeatedly referred to his opposing counsel by the name Joe Taco Bell: “We offered Joe Taco Bell an opportunity for his client and me to meet at the [U.S. Attorney’s Office for the Southern District of New York] to file our respective criminal complaints and he tucked his tail between his legs and never responded. We met with law enforcement. Let’s see where this goes.”

In his Thursday complaint, Dixon says he dedicated his “talent, labor, and loyalty” to Fat Joe for 16 years, serving not just as a hype man but also a “lyricist, background vocalist, security team member, and creative collaborator.” But he says the star manipulated and abused him in myriad ways, ranging from underpayment to threatening his life.

“Defendants systematically engaged in coercive labor exploitation, financial fraud, sexual manipulation, violent intimidation, and psychological coercion against plaintiff Dixon, all intended to enrich defendant Cartagena and his associates while deliberately suppressing, silencing, and erasing plaintiff’s substantial creative, artistic, and commercial contributions, which were foundational to defendant Cartagena’s professional success and personal brand,” Blackburn writes on Dixon’s behalf.

That’s a very different story from the one that Fat Joe himself told first in April, when he sued Dixon and Blackburn for defamation over “a predatory plot, built entirely on lies, to destroy Cartagena’s reputation and business for profit.”

In that case, the star says he “compensated Dixon handsomely” and the hype man “never complained or expressed any dissatisfaction.” But he says the ex-staffer recently started airing false grievances about his pay and other issues, and has published “shocking falsehoods” to social media while making “outrageous financial demands.”

The early lawsuit also names Dixon’s lawyers as a defendant, claiming Blackburn threatened to file baseless legal action. Citing a recent ruling by a New York federal judge that sharply criticized Blackburn’s litigation tactics, the suit calls his behavior “shakedown tactics masquerading as lawyering.”

“Dixon’s and Blackburn’s conduct is … a cold-blooded attempt to extort exorbitant sums from Cartagena by leveraging the specter of public disgrace and professional ruin,” Tacopina wrote in April. “His defamatory statements accusing Cartagena of heinous crimes are devoid of any factual foundation, relying instead on the power of shock, scandal and Cartagena’s high-profile status to maximize leverage.”

The allegations about Fat Joe in the newer case are certainly shocking and scandalous. The complaint is 157 pages – far longer than the typical pleadings in such a case – and comes with an unusual bright red “trigger warning” at the top. It is also replete with photos of the alleged teenage victims, and claims that Dixon faced “credible threats” to his life, including “attempts to lure him into a violent ambush.”

The lawsuit also includes claims under the Racketeer Influenced and Corrupt Organizations Act – the federal “RICO” statute often used in criminal cases against mobsters and drug cartels. Those sprawling claims allege that Fat Joe and his associates operated an illicit enterprise, and also names a number of outside groups as defendants, including Jay-Z’s Roc Nation.

Blackburn included similar civil RICO claims in a sexual assault case he filed last year against Sean “Diddy” Combs on behalf of producer Rodney “Lil Rod” Jones. While a judge has allowed the case to move forward, he dismissed the racketeering claims in March.

Senators Marsha Blackburn (R-Tenn.) and Ben Ray Luján (D-N.M.) asked the Federal Trade Commission to investigate Spotify on Friday (June 20). In a letter to FTC Chairman Andrew Ferguson obtained by Billboard, the senators accused the streamer of converting “all of its premium music subscribers into different — and ultimately higher-priced — bundled subscriptions without […]

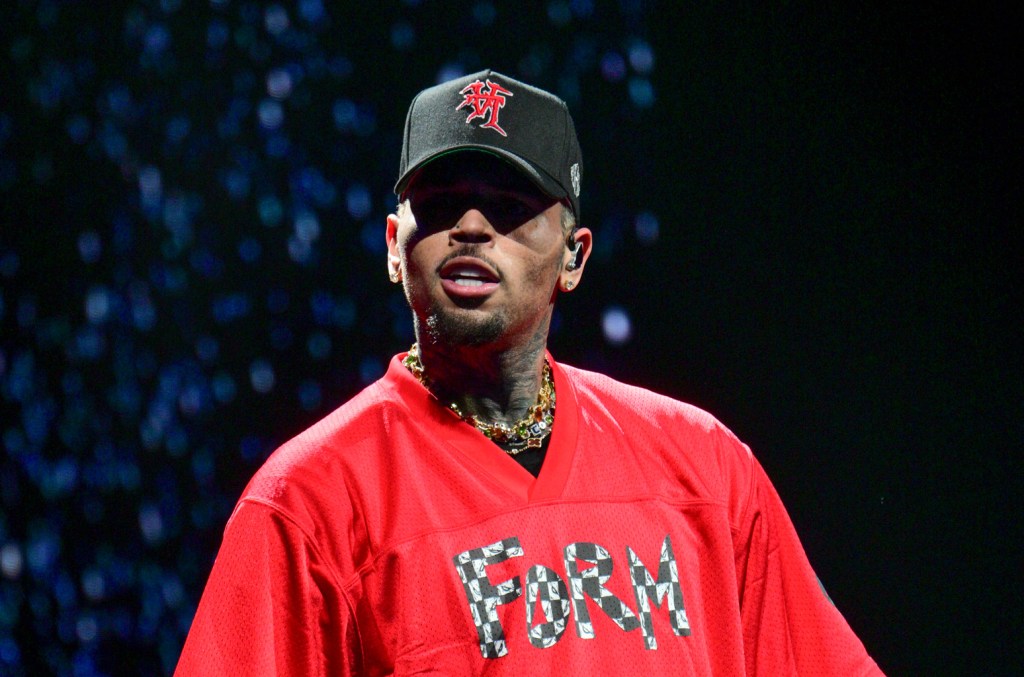

LONDON — Chris Brown appeared in a London court on Friday (June 20) to plead not guilty to a charge of serious assault. The Grammy Award-winning singer is facing multiple charges in relation to an alleged physical dispute with a music producer. The alleged incident took place in a nightclub in Mayfair, London in February […]

President Donald Trump on Thursday (June 19) signed an executive order to keep TikTok running in the U.S. for another 90 days to give his administration more time to broker a deal to bring the social media platform under American ownership.

Trump disclosed the executive order on the Truth Social platform Thursday morning.

“As he has said many times, President Trump does not want TikTok to go dark. This extension will last 90 days, which the administration will spend working to ensure this deal is closed so that the American people can continue to use TikTok with the assurance that their data is safe and secure,” White House press secretary Karoline Leavitt said in a statement on Tuesday.

It is the third time Trump has extended the deadline. The first one was through an executive order on Jan. 20, his first day in office, after the platform went dark briefly when a national ban — approved by Congress and upheld by the U.S. Supreme Court — took effect. The second was in April when White House officials believed they were nearing a deal to spin off TikTok into a new company with U.S. ownership that fell apart after China backed out following Trump’s tariff announcement.

Trending on Billboard

It is not clear how many times Trump can — or will — keep extending the ban as the government continues to try to negotiate a deal for TikTok, which is owned by China’s ByteDance. While there is no clear legal basis for the extensions, so far there have been no legal challenges to fight them. Trump has amassed more than 15 million followers on TikTok since he joined last year, and he has credited the trendsetting platform with helping him gain traction among young voters. He said in January that he has a “warm spot for TikTok.”

“We are grateful for President Trump’s leadership and support in ensuring that TikTok continues to be available for more than 170 million American users and 7.5 million U.S. businesses that rely on the platform as we continue to work with Vice President Vance’s Office,” the company said in a statement.

As the extensions continue, it appears less and less likely that TikTok will be banned in the U.S. any time soon. The decision to keep TikTok alive through an executive order has received some scrutiny, but it has not faced a legal challenge in court — unlike many of Trump’s other executive orders.

Jeremy Goldman, analyst at Emarketer, called TikTok’s U.S situation a “deadline purgatory.”

The whole thing “is starting to feel less like a ticking clock and more like a looped ringtone. This political Groundhog Day is starting to resemble the debt ceiling drama: a recurring threat with no real resolution.”

That’s not stopping TikTok from pushing forward with its platform, Forrester analyst Kelsey Chickering says.

“TikTok’s behavior also indicates they’re confident in their future, as they rolled out new AI video tools at Cannes this week,” Chickering notes. “Smaller players, like Snap, will try to steal share during this ‘uncertain time,’ but they will not succeed because this next round for TikTok isn’t uncertain at all.”

For now, TikTok continues to function for its 170 million users in the U.S., and tech giants Apple, Google and Oracle were persuaded to continue to offer and support the app, on the promise that Trump’s Justice Department would not use the law to seek potentially steep fines against them.

Americans are even more closely divided on what to do about TikTok than they were two years ago.

A recent Pew Research Center survey found that about one-third of Americans said they supported a TikTok ban, down from 50% in March 2023. Roughly one-third said they would oppose a ban, and a similar percentage said they weren’t sure.

Among those who said they supported banning the social media platform, about 8 in 10 cited concerns over users’ data security being at risk as a major factor in their decision, according to the report.

Democratic Sen. Mark Warner of Virginia, vice chair of the Senate Intelligence Committee, said the Trump administration is once again “flouting the law and ignoring its own national security findings about the risks” posed by a China-controlled TikTok.

“An executive order can’t sidestep the law, but that’s exactly what the president is trying to do,” Warner added.

Blake Lively and Taylor Swift’s text messages will have to be handed over in litigation over the movie It Ends With Us, with a judge determining that the friends’ conversations about the working environment on set are relevant to Lively’s sexual harassment and retaliation claims against co-star and director Justin Baldoni.

Baldoni and his production company, Wayfarer Studios, prevailed Wednesday (June 18) on the issue of Swift’s text messages, which have taken center stage in Lively’s It Ends With Us lawsuit over the past month. Baldoni first tried to get the texts directly from Swift herself, but then dropped his subpoena on the pop superstar, opting instead to seek the messages from Lively in the normal discovery process.

Lively’s lawyers fought that request last week, saying the actress’ texts with Swift have no place in court and Baldoni is just trying to make headlines. But Judge Lewis J. Liman says these messages are indeed relevant, citing Lively’s own discovery disclosures that identified Swift as someone who would know that Baldoni sexually harassed her on set and then orchestrated a retaliatory smear campaign after she complained.

Trending on Billboard

“Given that Lively has represented that Swift had knowledge of complaints or discussions about the working environment on the film, among other issues, the requests for messages with Swift regarding the film and this action are reasonably tailored to discover information that would prove or disprove Lively’s harassment and retaliation claims,” writes the judge.

As for Lively’s claim that Baldoni is only involving Swift in the case to prop up a public relations narrative, Judge Liman says “this concern does not justify denying the Wayfarer parties relevant discovery.”

“A motion or request may be, and in this case often has been, both a legitimate litigation tactic and an attempt to maneuver in the broader court of public opinion,” writes the judge. “The mere fact that the request has been discussed in the press does not render it illegitimate.”

A spokesperson for Lively reacted to the decision on Wednesday by noting that the actress has “produced far more documents in this case” than Baldoni. Lively’s rep also says Baldoni and his publicity team have been trying to “drag Taylor Swift” into the debacle since they launched their alleged retaliatory smear campaign last summer.

“We will continue to call out Baldoni’s relentless efforts to exploit Ms. Swift’s popularity, which from day one has been nothing more than a distraction from the serious sexual harassment and retaliation accusations he and the Wayfarer parties are facing,” adds Lively’s spokesperson.

A rep for Baldoni declined to comment on the decision.

Swift’s reps did not immediately return a request for comment on the matter. In a previous statement from May, the singer’s team said she had no involvement in It Ends With Us and that Baldoni’s subpoena against her was “designed to use Taylor Swift’s name to draw public interest by creating tabloid clickbait instead of focusing on the facts of the case.”

The exchange of documents in Lively’s harassment and retaliation lawsuit, which has also dragged in Swift’s public opponent, Scooter Braun, is geared towards preparing for a trial in 2026. Baldoni has tried to bring a countersuit accusing Lively and her inner circle of defamation, but Judge Liman threw out those claims as legally invalid last week.

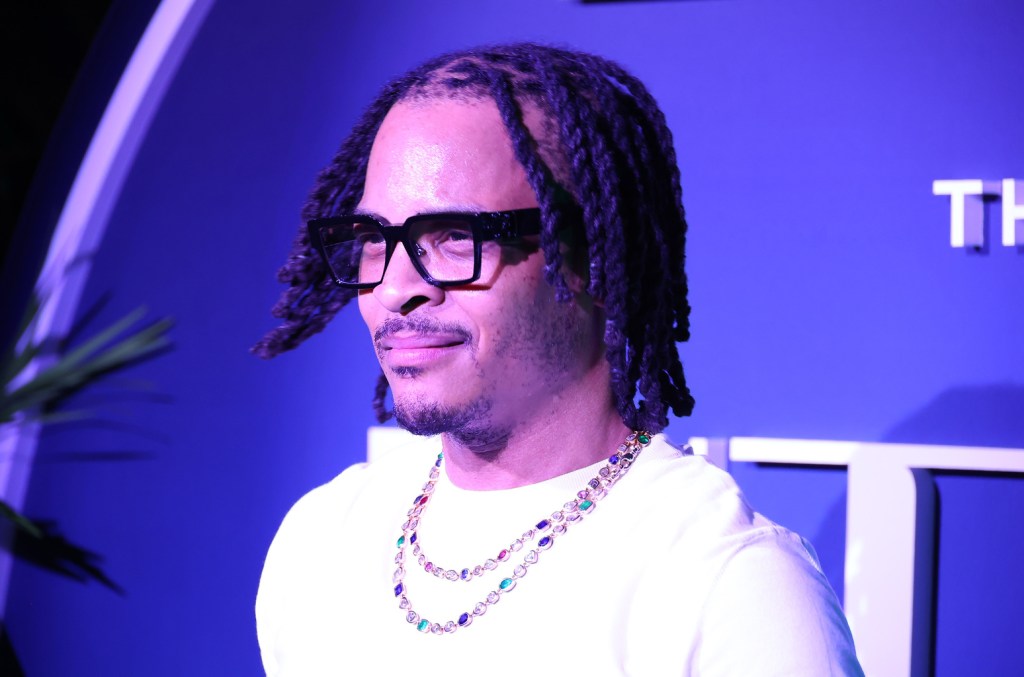

T.I. has been hit with an intellectual property theft lawsuit over his upcoming movie Situationships, with a web series producer claiming the title is lifted from her own project of the same name.

The rapper (Clifford Harris Jr.) faces trademark infringement claims in a complaint filed Wednesday (June 18) by Featherstone Entertainment, an Atlanta-based production company run by a creator named Cylla Senii.

Senii has made two seasons of the scripted web series Situationships, which chronicles the ups and downs of millennial dating. The show launched on YouTube in 2016 and has since been distributed by BET Digital, Amazon Prime and Tubi.

Trending on Billboard

According to the complaint, Senii worked between 2019 and 2024 to develop both TV show and movie versions of Situationships. But in the fall of 2024, she says, she was shocked to learn that T.I. and his company, Grand Hustle Films, were about to start filming their own comedy film called Situationships, written, directed by and starring the rapper.

“Defendants are engaging in a common scheme and effort to take advantage of the public’s association of Featherstone’s ‘Situationships’ brand by marketing their own film and entitling it ‘Situationships,’” writes Senii’s attorney.

The lawsuit claims T.I.’s alleged infringement is intentional. Senii’s lawyer notes that one collaborator she worked with to develop her Situationships show is a close friend of T.I.’s family, and that another producer with whom she discussed the project is now working on the rapper’s movie.

Senii says this behavior is “ironic” after T.I. and his wife Tameka “Tiny” Harris’ recent $71 million trial win in their long-running intellectual property battle against toymaker MGA, which took issue with dolls supposedly modeled after their teen pop group OMG Girlz.

“Unfortunately, T.I. is engaging in the same conduct he fought so vigorously to protect himself from in his own intellectual property lawsuit,” writes Senii’s lawyer.

The lawsuit says Senii sent T.I. a cease-and-desist letter in December 2024, but he never responded. Senii has also challenged T.I.’s numerous attempts to obtain a trademark for “Situationships,” with one of T.I.’s applications getting preliminarily rejected in May after an examiner found there was a likelihood of confusion with the web series mark.

Senii is now levying a slew of claims against T.I. and Grand Hustle Films for trademark infringement, unfair competition and civil conspiracy. She’s seeking an injunction that would bar him from releasing his movie under the moniker “Situationships” as well as unspecified financial damages.

Reps for the rapper and Grand Hustle Films did not immediately return a request for comment on the lawsuit.

A New York hedge fund manager linked to the SFX bankruptcy has been quietly co-managing Avant Gardner and the temporarily closed Brooklyn Mirage nightclub since late last year and leading unsuccessful efforts trying to get it reopened, Billboard has learned.

Andrew Axelrod’s Axar Capital has been a secured creditor of Avant Gardner — the Brooklyn nightclub company that books and manages the Brooklyn Mirage, Kings Hall and the Great Hall — since late 2023, sources close to the company have confirmed.

A year prior, former Avant Gardner CEO Billy Bildstein had negotiated the purchase of the Electric Zoo festival from Axelrod, whose Axar Capital was the senior creditor to media mogul Bob Sillerman’s one-time EDM conglomerate SFX — of which Electric Zoo’s parent company, Made Events, was a part. When SFX went bankrupt in 2015, Axar Capital led a takeover of the company, rebranding it LiveStyle and hiring music executive Randy Phillips to lead a selloff of its assets, which included U.S. promoters like Disco Donnie Presents and Life in Color; Europe’s ID&T, the Dutch promoter behind Tomorrowland; and EDM tech startups like Denver-based electronic music platform Beatport. The last asset to sell, in 2022, was Made Events. Axelrod wanted $15 million for the company and structured the deal so that Avant Gardner could pay Axar Capital using the proceeds from the Electric Zoo festival.

Trending on Billboard

Avant Gardner successfully ran the Electric Zoo festival in 2022 but was sidelined by multiple fiascos the following year including permit denials, gate crashers, the cancellation of the festival’s opening day and accusations of overselling the closing day by 7,000 fans. Due to the disastrous 2023 run, Avant Gardner has faced multiple lawsuits from both fans and unpaid vendors and was condemned by a one-time ally, New York Mayor Eric Adams, who had previously supported the popular Brooklyn Mirage and sided with Bildstein during his high-profile battle with the State Liquor Authority.

Sources tell Billboard that the demise of the festival, and Avant Gardner’s inability to pay Axar the reported $15 million price tag for Electric Zoo, are what led to Axar becoming a senior creditor to Avant Gardner. Terms of the Electric Zoo sale are not public, but a previous agreement between Axar and publicly traded streaming service LiveOne, which purchased Chicago’s Spring Awakening festival — another SFX asset — shows how Axelrod liked to structure some of those deals.

In that agreement, Axelrod sold Spring Awakening to LiveOne for $2.5 million in convertible loans that Axelrod could turn into equity. The deal allowed LiveOne to take over the festival immediately and pay Axelrod back over two years. There was even an option for Axelrod to accept LiveOne stock instead of cash if shares of the company hit certain price targets, but they never did. A month after the deal closed, COVID-19 hit, and Spring Awakening 2020 was canceled. After LiveOne lost $3.5 million on the 2021 event, Axelrod agreed to accept $2.4 million worth of LiveOne stock. But five months later, the value of LiveOne’s stock had fallen 70%, dropping the value of Axelrod’s LiveOne shares to approximately $700,000.

Avant Gardner is a private company, so it’s unclear how the agreement with Axar was structured. Sources tell Billboard that Axelrod made additional investments into the Brooklyn Mirage, which recently underwent extensive renovations and is now attempting to navigate New York’s Department of Buildings to secure a permit to open.

On May 22, Avant Gardner parted ways with Josh Wyatt, a hospitality executive Axelrod had hired to run the company and guide it through renovations that saw the club close for construction. The Brooklyn Mirage was supposed to open May 1 with a concert by Sara Landry, but building inspectors declined to grant the facility a permit to open. A month and a half later, the club has been forced to cancel and relocate more than a dozen shows as its permit problems persist.

Gary Richards, a promoter, touring artist and former CEO of Livestyle for Axar Capital, is now running Avant Gardner and managing day-to-day operations. Billboard reached out to Richards and Axar but was told that neither planned to comment for this story.

Artificial intelligence is a technology with profound implications — it will soon be smarter than we are! — including for the future of music. So far, though, the debate over the copyright issues involved in training AI algorithms follows a familiar pattern: Rightsholders want a licensing structure to generate royalties, while some technology companies maintain that they don’t need permission and others just proceed without it. To music executives of a certain age, it sounds a bit like the Napster battle, especially since the central issue is fair use. Technology companies seem to have the same plan: Move fast and break things, then try to change the law once consumers get accustomed to the new technology.

Could this time be different?

Trending on Billboard

Yes and no, at least to judge by the current state of affairs. In the European Union, which passed the first serious AI legislation, some lawsuits working their way through the courts now — perhaps most importantly GEMA’s case against Suno — will provide more clarity. The situation in the U.S., which seemed to depend on the result of major label lawsuits against Suno and Udio — in which the two sides are negotiating — has been complicated by President Trump’s firing of the Register of Copyrights. In the U.K., the government has been considering loosening copyright by calling for a consultation — but that effort has come under pressure from both music companies and creators.

Two weeks ago, at a party to honor the Billboard Global Power Players, Elton John and his manager and husband, David Furnish, won the first-ever Billboard Creators Champion Award for their work fighting the U.K. government’s proposed adjustments to copyright law. That initially involved an amendment to a data bill being debated in parliament that would have forced technology companies to be transparent about the content they used to train their algorithms. The bill repeatedly “ping-ponged” between the House of Commons and the House of Lords as the latter repeatedly voted for the amendment, under the leadership of Baroness Beeban Kidron. Last week, after more back-and-forth, the data bill passed without the amendment.

This bill doesn’t affect copyright, although the amendment would have, so it represents only a minor skirmish in what’s shaping up to be a serious fight. John and Furnish aren’t going away, and John’s consistent championing of upcoming artists gives them real moral authority. Other artists are with them, including Paul McCartney and the acts behind the “silent album.” There’s strength in numbers, and the days when companies like Napster could give Metallica a reputational black eye are long since over. Few artists and executives have devoted as much time to the issue as John and Furnish, but they aren’t alone. Besides artists, the entire music business is behind them.

They are also fighting a very different battle than Metallica was all those years ago. Back then, the Internet looked much cooler than major label music — more disruptive, in today’s terms — and Metallica got cast, unfairly, as trying to fight the next new thing. At this point, technology companies have grown into a new establishment, with far more political power than the media business ever had. Elton John doesn’t seem like he’s trying to stop the next new thing — he’s trying to make sure that new technology doesn’t get in the way of the next new artists. Metallica’s fight wasn’t actually all that different — people just didn’t understand it very well.

Technology companies are pushing some of the same ideas they always have, which now seem almost oddly old-fashioned. The idea is that governments need to relax copyright laws so they can “take the lead” or “get ahead” in “the AI arms race.” This sounds vital, and it is, except that the kind of AI that’s most important is general intelligence, which has very little to do with the kind that can make new songs in the style of, say, Led Zeppelin. That’s just a consumer product. Also, what exactly are governments racing toward? Since AI is expected to eliminate white-collar jobs and the tax revenue that flows from them, what exactly is the hurry?

The debate over the U.K. data bill was only just the beginning, and the way John and Furnish framed the issue could influence the debate as it develops. For the next few years, both sides will argue about how compensation will work. But without the kind of transparency that the amendment to the bill mandated, it would be very difficult for technology companies to identify and pay the right creators. Transparency is necessary but not sufficient — it won’t solve the problem, but there can’t be a solution without it. Any serious conversation about compensating artists for the use of their work in AI needs to start there, and thanks to creators, this one has. Let’s see where it goes from here.

It has been over one year since Spotify brought limited audiobook functionality to its Spotify premium products in November 2023. In March 2024, in a major shift for songwriters and music publishers, Spotify began reporting its three principal premium subscription tiers to the Mechanical Licensing Collective (MLC) as “bundled subscription services” rather than as “standalone portable subscriptions,” as they had previously done. In response, the MLC sued Spotify in May 2024 for allegedly underpaying music publishers, but a judge dismissed the case in January 2025. A motion for reconsideration filed by the MLC in February 2025 remains pending in the Southern District of New York.

Earlier this month, the National Music Publishers’ Association (NMPA) stated at its annual meeting that this change has resulted in a first-year loss of $230 million in mechanical royalties to songwriters and music publishers. Spotify’s own recent SEC filing states a loss of 205 million euros in mechanical royalties for the 13-month period between March 1, 2024, and March 31, 2025. This is actual money that should have, but did not, make it into the pockets of songwriters and music publishers. It has instead remained with Spotify.

Trending on Billboard

Spotify’s actions have already been publicly lambasted by this author, the NMPA and the songwriter and music publisher communities as perhaps the worst affront in a long line of offenses committed by Spotify against songwriters. So why am I writing about this issue again, a year after first doing so in Billboard? Because with a year’s worth of additional facts and data at hand, it is my opinion that this is one of the greatest injustices visited upon songwriters in the era of music streaming, sadly perpetuated by the company that has perhaps benefited more than any other from the creativity and labor of songwriters. All songwriters and music publishers should be aware of this critical issue and deserve to know all of the supporting facts.

When I wrote on this issue back in May 2024, I opined that Spotify’s actions would likely reduce the effective share of its U.S. subscription revenue paid to songwriters and music publishers from the agreed-upon 15.1% to 15.35% in the Phonorecords IV settlement to less than 12%. I wrote that Spotify’s timing felt engineered to partially sideline songwriters and music publishers from benefiting from price increases that were reportedly soon to take effect (and did). I wrote that the Spotify Audiobooks Access tier was seemingly not commercially viable as a standalone product and was launched in the U.S. (and nowhere else) with the primary and perhaps sole purpose of supporting Spotify’s attempt to report most of its subscription tiers to the MLC as bundles and reduce mechanical royalty payments to songwriters. And finally, I wrote that Spotify was motivated to take publishing royalties out of the pockets of songwriters in order to improve its gross margin and offset the costs of running its new audiobook initiative.

One year later, I believe that all of this has proved to be true. Let’s look at the facts.

What is a bundle?

In this context, a bundle occurs when Spotify — or another music service — is sold to consumers for a single price as part of a package which includes other goods and services. Some bundles package music with digital services such as subscription video on demand and/or physical goods such as phones, tablets and delivery services. The components of the bundle typically can be purchased on an individual basis if a consumer is not interested in purchasing the entire package, and those components typically have a clear independent commercial value to some segment of consumers.

For rightsholders, the potential value exchange is that a tech platform may package a bundle of goods and services (including music) together in a manner that could potentially bring additive revenue, users and engagement to music creators that, absent the bundle, might be less obtainable. Basically, the platform is offering a package deal to reach customers who may be less likely to pay for a music service sold on its own.

Rightsholders operating in a free market may be asked by the licensee to help offset their other costs of operating such a bundle (e.g., non-music licensing costs, other operating expenses) by agreeing to reduced royalty terms than what would typically apply to a standalone music service, which a licensee may also offer. Rightsholders are able to consider such requests, sometimes referred to as “bundle discounts,” by engaging in discussions with the licensee and utilizing pertinent data and information such as market research, reporting and revenue forecasts to inform their viewpoints and make decisions that are in the best interests of music creators.

A range of outcomes is possible in the free market. A rightsholder may refuse to license the bundled service at all, or they may license the bundled service for the same price and terms they’d grant to a standalone music service, or they may agree to some means of discounting. The Phonorecords IV settlement includes examples of such terms, including a specific definition of revenue for bundled services and other terms that are reduced relative to those that apply to standalone music services.

When this works as intended, music rightsholders may choose to effectively co-invest with a streaming service in creating a discounted bundle that they feel has the potential to earn additional revenue, even if there may be less revenue earned on a per-user basis from the bundle relative to a standalone music service. The potential benefit to music creators is that they may capture additional royalty amounts from users who might not have signed up for a music service absent the additional non-music components of the bundled offerings. The licensee is rewarded for bringing some level of added value to music creators by building, offering and marketing the bundled package to consumers.

Why Spotify’s bundle is different

But this is not what Spotify has done. Spotify has built a music subscription empire based upon the creativity and labor of songwriters and now reduced their U.S. mechanical royalties in a manner that implies that songwriters now contribute less to the success of Spotify. That could not be further from the truth. Regardless of the legal issues surrounding this matter, Spotify’s reduction of songwriters’ mechanical royalties, in my opinion, has no commercial merit.

In June 2024, a few months after Spotify began including the limited audiobook functionality (15 hours of listening time per month) in Spotify’s premium tier, it launched a tier called Spotify Basic. Spotify Basic, which is $1 to $3 less expensive than Spotify’s premium tier, depending on the number of users, is what Spotify’s premium tier was prior to November 2023 — a music subscription service without the audiobook functionality. It is the service that tens of millions of users signed up for prior to November 2023 because they acknowledged the value of unfettered access to music and are willing to pay for it. But all of those premium users, regardless of whether or not they want audiobooks, are now considered by Spotify to be bundled subscribers as of March 2024. That is, unless they manually selected to switch to Spotify Basic.

Most Spotify users probably don’t know that all of this happened, or that Spotify Basic exists. Spotify Basic is not available to new subscribers; it is only available in the U.S. to existing premium users who were subscribed as of June 20, 2024. Promotion and marketing of Spotify Basic to qualifying users has been limited. If a Spotify user cancels their Spotify Basic plan later on, it is not possible to resubscribe to it. Basic is also not available via upgrade paths. For example, a subscriber cannot upgrade from Basic Individual to Basic Duo. Instead, they are forced to pay $2 more for Premium Duo even if they have no interest in audiobooks.

Since Spotify’s November 2023 launch of the limited audiobook functionality, it has not been possible for new Spotify users to obtain a Spotify subscription that does not include audiobooks (save for qualifying student plans, which are bundled with Hulu). This is important because, absent a clearly presented and available option for a new (or existing) customer to choose between one offering that is music-only and another offering that includes audiobooks but is more expensive, the very clear conclusion is that music alone continues to drive consumer decision making around Spotify, including users’ decisions to pay for Spotify, what price they are willing to pay and what levels of price increases they are willing to endure without canceling their subscriptions.

Most Spotify users also don’t know that there’s a Spotify Audiobook Access tier. Last year, many — including this author — opined that the Audiobook Access tier was launched solely in the U.S. for the primary or sole purpose of lending legal support and a pricing benchmark to Spotify’s reduction of mechanical royalties. One year later, this appears on its face to have been true. Spotify Audiobook Access only remains available in the U.S., and there appears to be little, if any, earnest effort on Spotify’s part to promote and market it to consumers. They do not publicly report subscriber numbers for Spotify Audiobook Access, nor do they seem to talk about it much. In my opinion, it appears to be an offering that Spotify is not serious about and that was launched to prop up the reduction of songwriter’s mechanical royalty payments.

I’ve also been asked why Spotify did not declare its premium tier to be a bundled product when it began offering podcasts to subscribers many years before its introduction of audiobooks. The answer may lie in the fact that podcasts are monetized by selling advertising to businesses and brands, and there has been clear demand for Spotify to provide that service. Audiobooks, by contrast, have historically been monetized mostly via subscriptions sold to consumers by digital retailers. In Spotify’s case, it is possible that while some segment of premium subscribers might utilize limited audiobook access if they are already paying to access unlimited music, those same subscribers might not be motivated enough to pay Spotify specifically for access to audiobooks. In other words, engagement alone might not be an indicator of willingness to pay. It costs Spotify money to offer audiobooks to its subscribers, and if those subscribers aren’t willing to pay for them specifically, it’s possible that Spotify needs to offset those costs in some other manner. As I’ve opined before, I believe this has been a material driver behind Spotify’s bundling initiative that has cost songwriters and music publishers hundreds of millions of dollars in U.S. mechanical royalties to date.

Spotify’s financials post-bundling

Finally, let’s talk about how this issue has impacted Spotify’s financial performance. Spotify’s premium gross margin increased from 29.1% to 33.5% between Q4 2023 (the last full quarter unimpacted by Spotify’s reduction of mechanical royalties via bundling) and Q1 2025. The $230 million first-year loss of U.S. mechanical royalties reported by the NMPA equates to about 1.4% of Spotify’s global premium revenue of 13.82 billion euros (approximately $15.89 million) for 2024. There are a number of factors that have allowed Spotify to improve its gross margin performance, but its reduction of U.S. mechanical royalties has contributed to that improvement on a very real and material basis, as Spotify has noted on quarterly earnings calls.

Spotify’s gross margin improvement has undoubtedly been a big factor in the performance of its stock, which is up about 130% year-over-year as of this writing. It is perverse that songwriters and music publishers have contributed so meaningfully towards these recent improvements in Spotify’s financial performance and the market’s reaction, yet find themselves not only unrewarded for their contributions but on the wrong end of Spotify’s efforts to reduce its U.S. music publishing costs.

So, where do songwriters and music publishers go from here? While it has been reported that Universal Music Publishing Group and Warner Chappell have entered into direct agreements with Spotify for the U.S. as part of broader deals that include their associated record labels, the upcoming Phonorecords V process before the Copyright Royalty Board — which starts early next year — presents the entire songwriter and music publishing community with the opportunity to right Spotify’s wrong. I encourage all who depend on songwriting and publishing royalties for their livelihood to educate themselves on the facts and stay aware of new developments.

Adam Parness was the global head of music publishing at Spotify from 2017 to 2019. He currently operates Adam Parness Music Consulting and serves as a highly trusted and sought after strategic advisor to numerous music rightsholders, notably in the music publishing space, as well as popular global brands, technology-based creative services companies and firms investing in music and technology.

State Champ Radio

State Champ Radio