Business

Page: 34

Trending on Billboard

Mike Morris is one of music’s biggest new investors — and he’s placing his bets on the indies. The managing director of Chicago-based private equity firm Flexpoint Ford has overseen what Billboard estimates is more than $375 million of investments in some of music’s most influential independent companies since 2023. After initially backing the front-line music business at Nettwerk, the label that broke Sarah McLachlan and Barenaked Ladies, that same year the firm announced a “significant investment and partnership” in Goldstate Music, the catalog investment firm founded by former BMG president/COO and J Records co-founder Charles Goldstuck. Last year, Flexpoint led a $34 million equity financing round for Duetti, a music investment company that focuses on indie rights, and led a $165 million investment in Create Music, a music distribution, publishing and data analytics company.

Related

Morris, who has previously held positions at Northleaf Capital Partners, H.I.G. Capital and Moelis & Co., says that Flexpoint’s focus on high-return middle-market companies serving independent artists has resulted in “repeated success.”

“We’ve really leaned into the independent sector of the music industry — it is just growing much faster than the traditional majors ecosystem,” Morris says. “This part of the market is so large and fragmented and there is so much growth…and tremendous opportunity for innovation.”

What do you think of the maneuvers by the majors, like Universal Music Group’s proposed acquisition of Downtown Music, that target the growth of the indie segment?

They are evidence enough of the fact they have been losing share to the independent ecosystem. They wouldn’t be buying these companies if it weren’t the case. We think our platform companies — whether one or more of them ends up in a major at some point, we’ll see — can outcompete because they don’t have the legacy infrastructure that some of the majors do. And they can complement the majors in serving this vast, fragmented and growing part of the market.

Related

What are the new modes of monetization you have talked about that excite you?

I’m talking about everything outside of the traditional streaming platforms: Meta, TikTok, YouTube, which is where Create started out. YouTube rights management, if you know how to do it correctly, is a very attractive and important area. Synch placement in video games, fitness apps — all of these tangential revenue streams. Not everyone knows how to monetize those streams, and it is core to the strategy for all of our portfolio companies.

What makes Create special?

Create has only been around for about 12 years. They are a digitally native service and capital provider to the independent sector. It doesn’t have the legacy baggage around infrastructure that some of the services and labels have. Create started out as a pure-play rights management business and then went through a natural evolution, tacking on distribution, accounting systems, publishing — all built on this digitally native background. Their numbers aren’t public, but if they were, they’d speak for themselves.

Duetti was the first, but likely not the last, company to acquire the masters and publishing rights of indie artists bubbling under the mainstream radar. How are they prepped for competition?

This is something [Duetti CEO Lior Tibon] has thought a lot about. They do have a first-mover advantage. But the reason no one else is doing it is because it’s really hard to do. Buying these small catalogs involves a high degree of sophistication, data, AI [artificial intelligence] and operational discipline to acquire thousands of catalogs and thousands of individual tracks. Most music companies and other funds in the space have not set themselves up to do that in a way that’s scalable. More competition is something we’ve planned for at the board level and among the shareholder group and management team. We feel like it’s going to be very hard to replicate the strategy at this kind of scale.

Related

Goldstate Music is more traditional compared with the other companies in your portfolio. What do you like about their method of investing in music intellectual property [IP], and would Flexpoint directly acquire catalogs itself?

Charles Goldstuck is a best-in-class operator who’s proven over decades in and around the music business that he knows how to start businesses, take on institutional capital like ours, identify attractive parts of a market and use capital to create attractive returns for his investors. [He has a] sophisticated, important piece of the strategy: working on them actively to get the most juice out of those assets. Things like changing and optimizing distribution contracts, synch placements, creating remixes and derivative works, getting [name, image and likeness] rights and doing merch and working actively with those artists.

Songs by Xania Monet, an AI artist that Hallwood Media signed to a multimillion-dollar agreement, are climbing the Billboard charts. How could the commercial success of AI music affect the value of catalogs?

It’s fascinating to see AI-powered artists now being signed by labels. Yes, they’ll compete for listening time and could take some share. But in practice, I think it makes high-quality, authentic catalogs and artists even more valuable. So I don’t see AI destroying catalog value. Instead, I see it widening the gap: disposable, machine-made music on one side and enduring, human-driven catalogs on the other. The latter will continue to command attention, cultural relevance and investor confidence.

What are you currently working on?

The most interesting things I’m seeing right now [include] international opportunities in Asia, the Middle East [and Latin America], both on the catalog side and with music service providers. Music-adjacent service providers and IP businesses in music-adjacent spaces like film, TV and video games are heavy users of music. We’re looking at a business in Korea right now that is in some ways like Create. It has evolved organically in the Korean music ecosystem to provide services focused on artists’ and independent labels’ needs.

Related

How long do you plan to be involved with portfolio companies?

We’re not quick-flip investors. We’re not in the quick-hits business. We’re about partnering with entrepreneurs and founders to build enduring businesses that can compound value over a long period of time. We think exits take care of themselves, as long as we’re helping build enduring businesses. Sometimes it takes three years, sometimes five and sometimes 10.

Many companies, including Duetti and Create, are exploring raising funds through issuing asset-backed securities. Why is this a good strategy, and what are the potential drawbacks?

To me, this is just music catching up to what other asset classes have been doing for decades. When you have reasonably predictable cash flow streams, it is a more efficient form of financing — no different from bank financing. But it’s in a more regimented form and checks the boxes the buyers of these types of bonds want. It’s a clear positive for the industry. The only real drawback is it is a significantly bigger undertaking in terms of the documentation and the ratings process than going to a bank and getting a loan. So it does require time, attention and effort from management teams and us.

It’s hard to predict the staying power of songs. Do you have any concerns about very young songs being used to collateralize this type of bond or companies with high loan-to-debt rates adding to their debt this way?

I hear all the same things. The performance of these bonds — both public and the private — has been 100%: no defaults, no issues. But it’s a relatively young asset class in the securitization market. So you might see some folks use the leverage very aggressively, which would be unwise. But I think the buyers of these bonds are sophisticated enough to know what they’re getting into and to analyze these cash flows and to structure them in a way that makes sense. These investors have a lot of experience now in both music and other asset classes where the modeling isn’t very different. It’s all a function of risk/reward tolerance and pricing appropriately.

Trending on Billboard

The nonprofit Bye Bye Plastic Foundation, founded by DJ/producer Blond:ish, has announced a landmark partnership with the booking-and-tour-management platform Gigwell, opening access for artists, managers and booking agents to integrate the new Eco-Rider 2.0 sustainability toolkit into their touring plans. The move is part of a larger push to make eco-conscious touring mainstream.

The original Eco-Rider, introduced in 2019, has already been adopted by more than 1,500 DJs and performers worldwide, helping prevent more than 325,000 single-use plastic bottles and 425,000 cups from entering circulation, according to the Bye Bye Plastic Foundation. With the roll-out of Eco-Rider 2.0 via Gigwell’s platform, artists will now be able to opt in to a full-scale sustainability rider during the booking process. By doing so, they will force promoters and venues will be to shift toward greener hospitality, eliminate plastics backstage and front-of-house and embed eco-requirements contractually.

Related

“When I started using the eco rider, 100 percent of my events were using plastic,” said Blond:ish in a statement. “Now I’m down to 20 percent. And not even just in the DJ booth, but the actual entire event is single-use plastic-free.”

Gigwell’s CEO, Jeremie Habib, said his platform was uniquely poised to scale this change thanks to its integrated tour-booking tools, venue-database routing software and e-signature contract flows that help eliminate paper waste in the artist-agent-venue ecosystem.

The Eco-Rider 2.0 includes a full toolkit of resources, including educational content, networking spaces for artists and tour teams, and backend integration so that sustainability requirements become a seamless part of the booking workflow. Support for the initiative now includes artists such as Sam Feldt, Madame Gandhi, Yulia Niko and Mia Moretti, along with agencies like EMPIRE, Dirtybird and Protocol Agency.

The official launch of Eco-Rider 2.0 will take place at the Amsterdam Dance Event (ADE 2025) on Wednesday (Oct. 22), where Bye Bye Plastic and Gigwell will host a panel to open up dialogue and showcase how the toolkit can scale globally. From that date forward, the toolkit will be available to artists and agencies worldwide.

Learn more at gigwell.com.

Billboard‘s Live Music Summit will be held in Los Angeles on Nov. 3. For tickets and more information, visit https://www.billboardlivemusicsummit.com/2025/home-launch.

Billboard Canada hosted its second annual Power Players celebration at Toronto’s Illuminarium on June 11, and the event brought out many of the most influential executives in Canadian music.

All three Canadian heads of the major labels were present, including Universal Music Canada’s Julie Adam, Sony Music Canada’s Shane Carter and Warner Music Canada’s Kristen Burke. Live Nation Canada’s Erik Hoffman and Melissa Bubb-Clarke — who, along with Riley O’Connor, were this year’s Power Players of the Year — were also at the event.

Derrick Ross of Slaight Music took to the stage to present the Impact Award. The honor was presented to Remix Project co-founder and October’s Very Own CEO Derek “Drex” Jancar, who was promoted to the role last year and continues to make a lasting impact in the business world, informed by his community impact.

Trending on Billboard

In addition to the award, the Slaight Foundation and Billboard Canada also presented Drex with a cheque for $10,000, representing a proud donation to the Remix Project.

Sony Music Canada’s Carter took to the stage to present the International Management Award to Courtney Stewart, Khalid’s manager and the founder of Right Hand Co. He recalled first meeting Stewart at one of Khalid’s shows and being instantly impressed by his drive and work ethic.

“Courtney has all the qualities that it takes to be not just a good manager, but a great manager and a great parent — two roles that are actually quite similar. For those of you who are managers, you have to be patient, kind, protective and unselfish,” Carter said.

“I am truly grateful for being recognized tonight, and I want to thank Billboard for all the great work that they do in the lives of artists,” Stewart said. “I am winning an award tonight, but the real win is what we’re doing for others. Uplifting other people, being a blessing to other people, uplifting other communities — that’s the real win. This win is not just about recognizing me, it’s about recognizing my right-hand team that’s so amazing and all of you out here because we have to come together to win — not for ourselves, but for other people.”

Hoffman and Bubb-Clarke were present to accept the Power Players of the Year Award, which also went to O’Connor, Live Nation Canada’s chairman.

“This is a crazy business we work in,” Hoffman said. “A lot has changed in the world of live music, but the one thing that’s remained consistent is that it is ultimately all about the artists and their fans. If we continue to work towards collective goals with that in mind, I think the world of live music will just continue to grow.”

Earlier that day, in the same venue, Billboard Canada hosted its first Managers to Watch event.

Billboard Canada national editor Richard Trapunski introduced the Billboard Canada Manager of the Year Award, which is given to a manager who exemplifies the vital work of the profession. “It’s a very special award,” he said. “It honours a manager who really takes things to a new level.”

Trapunski introduced The Beaches to present the award to their manager, Laurie Lee Boutet. This was prefaced by a speech from band member Jordan Miller, who reflected on how Boutet helped the group navigate the major obstacle of being dropped from its label and offered a different paradigm by not telling the band the same things every label did.

“She highlighted our strengths as four strong wild women, because that’s what she is too,” Miller said. “You are so much more than a manager. You are our sister and the fifth Beach.”

Boutet was moved by the speech and walked up teary-eyed to accept the award, first giving a nod to her peers in the room. “It’s an honour to be in front of all these people that I constantly text for advice,” she said. She described her experience managing the Beaches as the honour of her life, adding that they built something “feminine, genuine and really cool as f–k.”

Find all the Billboard Canada Power Players highlights here and Managers to Watch highlights here.

Daniel Caesar, Khalid and The Beaches Stun at Billboard Canada THE STAGE at NXNE

NXNE’s 30th edition was one for the ages. The long-running Toronto festival hosted the first edition of the Billboard Summit featuring A-list talent like deadmau5 and Punjabi superstar Diljit Dosanjh, as well as Billboard Canada’s first edition of THE STAGE.

Daniel Caesar played his first major headlining show at Mod Club in 2016. Returning to the same legendary venue after having reached arena headliner status, he treated the intimate show like a true homecoming. The Billboard Canada THE STAGE at NXNE show was by far the hottest ticket in town on Saturday night (June 14), and the lucky 500-plus fans in attendance were treated to something truly special from the hometown R&B star, who now lives in New York. It felt like something that could only happen once, at this particular time and this particular place, at this particular festival.

Instead of his full arena-style concert, Caesar opted for an acoustic set, sometimes with just him and his guitar and sometimes with accompaniment on keyboards or keys and drums. There was a spontaneity and looseness that connected him deeply to the audience, who knew every word to every song. It was reminiscent of Neil Young at Massey Hall in 1971, showcasing an artist who’s reached the heights of their career reconnecting with the true spirit of their early days with just a guitar, their beautiful aching vocals and the fans who’d been with them from day one. Though Caesar had worked out a large setlist (traded around on Reddit after the show), the singer-songwriter was clearly deciding which songs to play on the fly. He took requests from the audience, including rarities he hasn’t played in years.

Caesar even debuted a new song, “Moon,” which ached with the same tender vulnerability as his best music. When he first played the venue, he was in his early 20s. Now he’s 30: “Not young anymore,” he said but happy to see all the young fans in attendance. He was worried he was going to sob on stage, but instead got it all out of his system on the way to the venue, he admitted, passing all the pivotal spots of his youth.

Khalid filled up Sankofa Square on June 12 for a concert during which his fans showed up in droves to sing along loudly to several of his biggest hits. With four dancers in tow and a set full of undeniable bangers, Khalid put on a true standout performance in the heart of downtown Toronto at Billboard Canada THE STAGE at NXNE, which doubled as the festival’s 30th birthday.

From “Location” to “Young Dumb & Broke,” Khalid excited the packed square with songs from throughout his career. He even swiftly caught a friendship bracelet that was tossed to him by a fan and proceeded to make a heart gesture back at them.

Khalid was all smiles throughout his performance and received a roaring response upon asking if there were any day one fans in the crowd who have been following him since his breakthrough debut album, American Teen.

The Beaches are about to graduate to arena status, playing their hometown Scotiabank Arena this fall. But first, they had a special concert to play for more than 500 people at the Mod Club. It was a true hometown show for the band; as Eliza Enman-McDaniel put it, “I live a seven-minute walk away.” It also served as a full circle moment for Leandra Earl, who first saw the group’s previous incarnation, Done With Dolls, at the venue well over a decade ago before joining the band herself.

The viral success of The Beaches’ 2023 hit “Blame Brett” was not a one-off. The Toronto band has used it to propel themselves towards major rock stardom, and you could tell at this show. Taking turns on a platform onstage, they flexed their arena moves and propelled their songs with a particular new wave rhythm. The band’s Sunday night (June 15) show was one of the last of the festival, and its single “Last Girls at the Party” off the upcoming album No Hard Feelings felt particularly fitting. As the fans chanted along with the countdown in the lyrics, it felt like a catharsis to the whole week of NXNE.

Find all of the NXNE 2025 highlights here.

Polo G has settled a legal dispute over a planned European tour he cancelled in 2023, ending dueling contract and intellectual property theft claims between the Chicago rapper and a Dutch concert booking agency. The rapper (Taurus Bartlett) was in the middle of exchanging evidence via the legal discovery process with booking agency J. Noah […]

As demand for concerts appears strong heading into the busy summer months, Live Nation led nearly all music stocks this week by jumping 7.7% to $148.87. On Friday (June 20), the concert gian surpassed $150 per share for the first time since Feb. 25, and its intraday high of $150.81 was roughly $7 below its all-time high of $157.49 set on Feb. 24. Earlier in the week, Goldman Sachs increased its price target on the stock to $162 from $157, implying Live Nation shares have an 8.8% upside from Friday’s closing price.

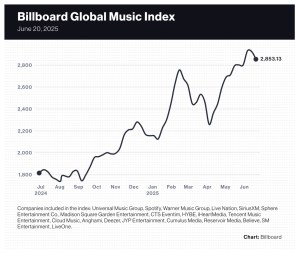

The 20-company Billboard Global Music Index (BGMI), which tracks the value of public music companies, finished the week ended June 20 down 2.4% to 2,853.13, its second consecutive weekly decline after nine straight gains. Despite large single-digit gains by Live Nation, MSG Entertainment and SM Entertainment, the index was pulled down due to losses by its two largest components: Spotify and Universal Music Group (UMG). The week’s decline lowered the BGMI’s year-to-date gain to 34.3%, though it’s still well ahead of the Nasdaq (down 0.9%) and the S&P 500 (up 0.4%) on that metric.

Markets sagged in the latter half of the week as investors expressed concerns about tensions in the Middle East and thepotential impacts on global oil supplies and gas prices. The tech-heavy Nasdaq finished the week up 0.2% to 19,447.41 while the S&P 500 fell 0.2% to 5,976.97. In the U.K., the FTSE 100 dropped 0.9% to 8,774.65. South Korea’s KOSPI composite index jumped 4.4% and China’s SSE Composite Index dipped 0.5%.

Trending on Billboard

New York-based live entertainment company MSG Entertainment rose 5.6% to $38.44, bringing its year-to-date gain to 7.1%. Elsewhere, SM Entertainment stock saw a 4.5% improvement, taking its 2025 gain to 90.4% — the best amongst music stocks save for Netease Cloud Music, which has seen a 111.2% year-to-date gain.

With streaming stocks posting the biggest gains of the year, Spotify shares reached a record high of $728.80 on Wednesday (June 18) but stumbled over the next two days and finished the week down 0.5% to $707.42. That decline took Spotify’s year-to-date gain down to 51.6%.

UMG shares fell 4.2% to 26.73 euros, marking its largest one-week decline since falling 9.2% in the week ended April 4. At the same time, Bernstein restarted coverage of UMG shares this week. Analysts believe it’s a “best in class” music company, which “implies predictability, a capital allocation framework consistent with industry trends, and steady operating leverage,” analysts wrote. Bernstein set a 33 euro ($38.03) price target, implying 23% upside over Friday’s closing price.

Shares of music streaming company LiveOne fell 6.5% on Friday and finished the week down 10.0% after the company released earnings results for its fiscal fourth quarter and year ended March 31. Fiscal fourth-quarter revenue fell 37.6% to $19.3 million due primarily to a decrease in Slacker revenue. For the full year, revenue slipped 3.4% to $114.4 million and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) fell 18.7% to $8.9 million.

Billboard

Billboard

Billboard

Given the enormous stakes at play, when business leaders talk about AI, people listen.

In May, Dario Amodei, CEO of AI firm Anthropic — who stands to personally benefit from companies’ widespread adoption of his technology — gained widespread attention after he predicted that AI will wipe out half of all entry-level jobs within five years. And in music, Sony Music CEO Rob Stringer, in an annual presentation to investors, said the company is “going to do deals for new music AI products this year” and that it has “actively engaged with more than 800 companies” on various AI-related initiatives.

Perhaps most notable, at least on the music front, are the comments made about AI in various interviews given by Spotify CEO Daniel Ek in recent years. In them, he’s provided insights into how Spotify, the most valuable and important music platform in the world, approaches the technology. Ek’s comments carry weight: While generative AI platforms such as Suno and Udio have stirred the greatest amount of fear over AI’s ability to undermine human creativity, the largest music platforms will play a huge role in how both creators and listeners engage with it.

Understanding Spotify’s approach to AI doesn’t always require reading tea leaves. Some of its products that use AI are out in the open. For example, in 2023, the company launched two major products that utilize the technology: a personalized AI-powered DJ and a voice translation tool for podcasters that can translate recordings into other languages. Still, given that the company’s attitudes and approaches to AI will affect Spotify’s 678 million monthly users and millions of creators, it’s worth examining Ek’s statements to see how Spotify intends to incorporate AI, embrace opportunities and address concerns. To that end, this author examined 10 podcast interviews, numerous online articles and a 2024 open letter Ek penned with Meta CEO Mark Zuckerberg to get a better sense of how he views the technology. The one aspect about AI that Ek has talked about most often is its ability to help Spotify deliver to listeners the right audio — whether it’s music, a podcast or an audiobook — at a particular moment. He has described a mismatch between supply and demand, and how using new innovations can help better connect listeners and creators. Right now, Spotify users can search and find what they want 30% to 40% of the time, Ek told the New York Post in May, adding that he believes AI can improve that number. “So, we still have some ways to go before we’re at that point where we can just serve you that magical thing that you didn’t even know that you liked better than you can do yourself,” he explained. Most germane to people reading this article, the interviews show that Ek has consistently voiced a respect for creators and a belief that AI should enhance creativity, not replace it. That may not reassure songwriters who are receiving fewer royalties after Spotify adopted a lower royalty rate afforded to bundles in the U.S. Ek’s stated respect for artists also contrasts with the criticism Spotify has attracted — as detailed in the book Mood Machine and news reports — for paying flat fees for music tagged with fake artist names and inserted into playlists in order to reduce its royalty obligations. (Spotify denied claims that it’s created fake artists.) But in his public comments, Ek’s support for creators doesn’t waver, and there’s no indication that Spotify will follow in the footsteps of Tencent Music Entertainment, which offers music-making generative AI tools — it incorporates Chinese AI company DeepSeek’s large language model — and allows users to upload the resulting songs to its QQ Music platform. But AI can aid the creative process without stepping on creators’ rights, and Ek has talked with excitement about how AI tools can help lower barriers to entry and help musicians bring their visions to life. Although making music no longer requires learning and mastering an instrument, there’s still some technical know-how involved in producing music on digital audio workstations (DAWs). AI tools can reduce the complexity of DAWs and increase creators’ productivity. “We’re most likely going to have another order of magnitude of simplicity,” Ek said on the Acquired podcast in 2023. At the same time, Ek admits there are some frightening potential applications for AI. In 2023, he told CBS Morning that AI can make experiences in every field “better and easier,” while admitting that the notion that AI will be smarter than any human is “daunting to think about what the consequences might be for humanity.” And despite the potential for AI to unleash untold amounts of creativity, Ek admits that the ultimate outcome for creators is difficult to ascertain. “We want real humans to make it as artists and creators, but what is creativity in the future with AI? I don’t know,” he said in May at an open house at Spotify’s Stockholm headquarters, according to AFP. Just as lawmakers and music industry groups are pushing for legislation to protect artists’ names and likenesses, Ek has revealed concern about AI’s ability to replicate a musician’s voice. “Imagine if someone walked around claiming to be you, saying things that you’ve never said,” he told Jules Terpak in 2024. Spotify wouldn’t allow it on the platform without the artist’s permission, Ek said, citing Grimes — who launched a project in 2023 allowing fans to replicate her voice to use in their songs and evenly split the royalties — as an example of permissible use of an AI-generated name and likeness. “Of course, we will let her experiment, because she’s fine with it,” Ek said. Now that Spotify is in the audiobook business, the company’s use of AI will impact a wider swath of creators than just musicians. As Ek told The New York Post, Spotify “can play a role” in getting more books converted into audiobooks using AI — specifically smaller authors who can’t afford the expense of hiring someone to read them. Such affordable text-to-voice tools already exist and are offered to authors who would otherwise be locked out of the audiobook market. It makes sense: Just as Spotify was built on providing listeners the long tail of music, it doesn’t want its audiobook selection to be limited to major titles. If Spotify builds or buys such a tool, it could vastly increase the number of audiobooks available to its listeners. In the interview with CBS Morning, Ek quoted Microsoft co-founder Bill Gates to explain how he finds inspiration in innovation. “He says that the future is already here,” Ek said during the 40-minute talk. “It’s just not evenly distributed.” What Ek means is that he looks around the world, sees what others are doing with technology and then considers how he can bring those innovations to a wider audience. And as the CEO of the world’s largest and most influential audio streaming service, how he chooses to approach AI will go a long way in determining — for better or worse — how millions of people create, consume and profit from music, podcasts and audiobooks in the future.

Trending on Billboard

On June 13, the rain was coming down on the farm in Manchester, Tenn., where Bonnaroo is held — and things weren’t looking great for the 2025 edition of the festival.

Hours after sending out an evacuation order to its tens of thousands of attendees, Bonnaroo canceled the rest of its 2025 edition entirely due to a weather forecast that — as the festival said in its announcement — called for “significant and steady precipitation that will produce deteriorating camping and egress conditions in the coming days.”

It was a heartbreaking situation for all involved, from the event’s producers — who in their announcement said they were “beyond gutted” — to the fans who’d trekked to Tennessee to the many artists who were slated to play.

Trending on Billboard

Among the latter group was Remi Wolf, who had been selected to perform at Bonnaroo’s fabled Superjam — an annual set that brings a fleet of artists together on stage. (Past Superjam leads include Preservation Hall Jazz Band and Skrillex.) Wolf had spent nearly a year preparing for the Saturday night show, formally titled “Remi Wolf’s Insanely Fire 1970s Pool Party Superjam,” recruiting fellow artists including Paramore’s Hayley Williams and Mt. Joy.

With the festival canceled, Wolf and her team were committed to making the show happen elsewhere. So on the night of June 13, Josh Mulder, the director of A&R at talent agency TBA, which represents Wolf, jumped into action, getting on the phone to secure another venue for the concert. After many phone calls, Mulder and the team locked in Nashville’s Brooklyn Bowl, where Wolf performed the following day alongside Williams and a host of other guests, performing songs like Chaka Khan’s “Sweet Thing” and “Tell Me Something Good” with Rufus, Bonnie Raitt’s “I Can’t Make You Love Me” and Hall and Oates’ “Rich Girl.”

Here, Mulder talks about pivoting from the farm to the Bowl.

When did it become clear that the Superjam at Bonnaroo wasn’t going to happen?

Looking at the weather all week going into the festival, we all knew we were in for a wet weekend. All day Friday, we were in close contact with [AC Entertainment’s] Steve Greene and his team on what was happening. He called me while I was at dinner in Nashville on Friday night, saying the show was coming down and explained the situation. I then spent the next hour outside of the restaurant on the phone gathering information and updating our teams to make our next moves.Did you and the team even make it on-site? If so, how was it looking?

Remi and her band made their way through rehearsal in Manchester with the guests on the show on Friday. TBA had people on the ground at the festival on Thursday and Friday, sending constant reports that it was absolutely dumping rain on site, and it wasn’t looking great. We were actively working through an initial wave of weather-related cancellations on Friday afternoon, with the Live Nation team trying to figure out the best course of action for those artists to make the most of their time in Tennessee for the fans.What do you recall about the moment the festival was canceled and how you and the team responded? Was it immediately obvious that a relocation would be possible?

My first call was to Remi’s management team. The word was getting out, and the consensus from us and directly from Remi out of the gate was that we had an obligation to save the Superjam. It was an important moment for Remi, but equally such an important moment for the guests who we have been working with for months. It was a tornado of information being shared as quickly as possible regarding what was happening on site and how the fans were affected as well, which informed how we responded.How did you pivot to Brooklyn Bowl? What calls had to be made, and was it the first venue you sought out?

Immediately on one of those first calls, we started exploring options to relocate the show in Nashville. Through that conversation, we asked about a handful of rooms, and after clicking through a few options, we all came to the conclusion that Brooklyn Bowl was the best space available. Before pushing the go button and officially confirming the venue, we needed to figure out how many of our guests were actually able to join, so we knew if we had a show or not. Hats off to Josh Roth from the Bonnaroo team, as well as Remi’s management. It was a tag team effort to circle the wagons and reconfirm these amazing artists to round out the show with Remi.

Remi Wolf

Patrick Maciel

How did ticketing work? Do you have any sense of how many attendees were people who’d had to leave Bonnaroo?

Right from the start, we were all aligned on making this an affordable option for fans and realized the level of devastation that everyone was feeling, given the news of the festival canceling. We landed on a $35 ticket, which just felt right given the scenario. We announced the show with no guests around 11 p.m. on Friday night, with an on-sale time of Saturday morning at 9 a.m. The show sold out in about one minute, which we anticipated happening but was also a big relief.

From my understanding, there were many fans who were able to make it off the site before the show and ended up coming to Brooklyn Bowl. The crowd was electric and brought that Bonnaroo flair with them to the room. All night long, the conversation was about how amazing it was to see their spirit continue there, which was complete with many pool floaties and more usual ‘roo style.

Did all of the special guests slated for Bonnaroo make it to the Nashville show?

Naturally, given the situation, we were prepared for a few acts to not be able to make it. But we held most of the lineup together with Hayley Williams, Mt. Joy, Gigi Perez, Grace Bowers and Brian Robert Jones. Then we were able to add Grouplove and Medium Build at the last minute, which of course ended up being incredible moments in the show.

What were the highlights of the event for you?

Anyone who knows me knows I am personally such a huge Paramore fan, so I’d have to say Hayley Williams. Seeing Remi and Hayley on stage brought some tears of joy to my eyes. Just such a special moment.

How did you and the team celebrate after it was finished?

There were many hugs and beverages shared in the green room after the show. Spirits were very high, and it was just such a special moment to share with everyone there.

GloRilla is facing a copyright lawsuit from a social media personality who says the rapper stole her viral catchphrase — “all natural, no BBL” — and used it in her 2024 song “Never Find” without permission.

Natalie Henderson — aka @slimdabodylast on Instagram — says she went viral last year with the phrase, seemingly a reference to not needing a “Brazilian butt lift” cosmetic surgery. She says she then turned it into a song with lyrics including “All natural, no BBL/ Mad hoes go to hell.”

In a case filed Wednesday (June 20) in Louisiana federal court, Henderson claims that GloRilla (Gloria Woods) violated federal copyright law by copying those lyrics into her 2024 track “Never Find,” which features the line: “Natural, no BBL/ but I’m still gon’ give him hell.”

Trending on Billboard

“There are unmistakable similarities between the two works,” Henderson’s attorney writes. “Based upon a side-by-side comparison of the two songs, a layperson could hear similarities in the lyrics, arrangement, melody, core expression, content, and other compositional elements in both songs and conclude that songs are essentially identical.”

“Never Find,” featuring K Carbon, was featured on GloRilla’s debut studio album Glorious, which peaked at No. 5 on the Billboard 200 and ended up as the top-selling female rap album last year. The song itself, a bonus track, did not chart.

It’s unclear whether the copying of such a small snippet of words amounts to infringement. Copyright law does not cover short phrases, including slogans and taglines, nor does it cover commonplace material that’s been widely used by others. Whether the allegations against GloRilla clear those thresholds will be decided by a federal judge.

A rep for GloRilla did not immediately return a request for comment.

This isn’t the star’s first tangle with copyright law. Back in 2023, GloRilla was hit with a lawsuit claiming she used unlicensed samples from a decades-old New Orleans hip-hop song in her hit songs “Tomorrow” and “Tomorrow 2.” The case was dismissed last year.

In November, the rapper Plies sued her, along with Megan Thee Stallion, Cardi B and others, over claims that the 2024 song “Wanna Be” featured an uncleared sample from his 2008 track “Me & My Goons.” But the case was voluntarily dropped in March.

Pop-rock artist Role Model has signed with Good World Management’s Brandon Creed and Dani Russin, Billboard can confirm.

Role Model joins a stacked roster of superstars at the firm, including Charli xcx, Troye Sivan, Ariana Grande and Demi Lovato.

In April, Role Model parted ways with his manager, Best Friends’ Danny Rukasin, who helped the artist become a breakout star. The singer-songwriter recently scored his first Hot 100 hit with “Sally, When the Wine Runs Out.” The song is off the deluxe edition of Role Model’s 2024 album, Kansas Anymore, which arrived in February.

Role Model signed to Interscope in 2018 and released his debut album, the more alternative-sounding Rx, in 2022. But last year’s Kansas Anymore — which featured a softer, more Americana-inspired sound — changed the course of his career and helped solidify him as one to watch.

Since the release of Kansas Anymore, Role Model has opened on tour for Gracie Abrams and, more recently, celebrated two sold-out shows in Los Angeles; at one of those shows, he welcomed Reneé Rapp on stage as a surprise guest during “Sally.” Attendees at the L.A. concerts included Laufey, The Kid Laroi, Shaboozey, Shaboozey and Jason Sudeikis.

In May, it was announced that Role Model will make his acting debut in the upcoming Lena Dunham-directed Netflix film, Good Sex, starring Mark Ruffalo and Natalie Portman. He will be credited under his born name of Tucker Pillsbury.

Trending on Billboard

Creed founded Good World in August 2023. At the top of 2025, he was named Billboard‘s Manager of the Year along with his tight-knit team. In the interview, he said of signing new talent: “We are extremely discerning,” before adding, “We have room, don’t get me wrong, for the right thing.”

A federal judge has rejected R. Kelly’s emergency request to be let out of prison due to an alleged jailhouse murder plot against the disgraced R&B star, who’s serving more than 30 years for multiple sex crime convictions.

Kelly’s attorney, Beau Brindley, has been petitioning a Chicago court for Kelly’s release since last week, saying prison guards are trying to have the singer (Robert Sylvester Kelly) killed to stop him from uncovering prosecutorial misconduct in his case. Brindley claims jail officials attempted to solicit a fellow inmate to carry out the hit, and that when that didn’t work, they fed Kelly an overdose quantity of sleeping pills and denied him medically-necessary surgery for blood clots.

Prosecutors have dismissed the allegations as a “fanciful conspiracy” and “deeply unserious.” Judge Martha M. Pacold denied the bid for release on Thursday (June 19) without addressing its merits, saying such a request must be brought as a civil rights lawsuit or habeas corpus petition in North Carolina, where Kelly is imprisoned.

“Jurisdictional limitations must be respected even where, as here, a litigant claims that the circumstances are extraordinary,” wrote the judge.

Judge Pacold issued her decision ahead of a hearing that had been set for Friday (June 20), canceling the court date after seemingly learning all she needed to know from voluminous court papers that have been filed on the issue.

In a statement shared with Billboard on Thursday, Brindley said his team is “not surprised by this ruling as we knew that technical jurisdiction would be a challenge under these circumstances.”

“However, we had no choice but to act immediately given explicit evidence of a threat to Robert Kelly’s life,” Brindley added.

On Friday (June 20), Brindley tried another avenue to convince the Chicago judge to release Kelly: filing a motion for a new trial and asking for emergency bail in the meantime.

The Friday motion reiterates Brindley’s previous allegations that prosecutors unlawfully pressured a witness to testify against Kelly and intercepted Kelly’s communications with his lawyers ahead of his federal trial in Chicago.

“If someone dies in prison, it seems commonplace,” writes Brindley. “With that in mind, it becomes easy to understand how the people who committed this corruption and those that helped cover it up would rather kill a disgraced inmate convicted of sex crimes than face consequences that could ruin their lives and careers.”

The motion repeatedly notes that President Donald Trump is prioritizing rooting out corruption in the justice system. Brindley has publicly asked Trump to pardon Kelly in conjunction with the jailhouse murder plot claims.

A spokesperson for prosecutors did not immediately return a request for comment on Friday.

Kelly was convicted in Chicago of child pornography and enticing minors for sex in 2022, one year after a separate federal jury in New York also found the singer guilty of racketeering and sex trafficking

The former R&B star was sentenced to 30 years in prison for the New York conviction and 20 years in the Chicago case, though all but one year of the second sentence will overlap with the first. Both convictions have been upheld on appeal.

State Champ Radio

State Champ Radio