Business

Page: 22

Trending on Billboard Spotify said on Tuesday its third quarter revenue and profit margin improved thanks to double-digit growth in subscribers and monthly active users. The leading music and podcast streaming platform said its pool of paying subscribers rose by 12% to 218 million, and its monthly average users rose 11% to 713 million from […]

Trending on Billboard

Agents Jenna Adler of CAA, Marsha Vlasic of Independent Artist Group, Sara Williams of WME and Elisa Vazzana of UTA took part in a conversation about the current challenges and trends in touring — and what it’s like being a female agent in 2025 — at the Billboard Live Music Summit on Monday (Nov. 3) in West Hollywood, California.

In a panel moderated by Billboard editor-in-chief Hannah Karp, the four agents — who collectively represent artists including Green Day, Neil Young, Luke Combs and Megan Maroney — discussed the expansion of the micro-residency model as one of the ways the live business is likely to change over the next few years.

Adler remarked that “micro-residencies are only going to get more and more expansive; micro-residencies meaning it’s no longer a 45-date tour across the country, it’s more like four or six markets and we’re going to do multiple days. I think it not only saves on costs, because it’s so expensive to tour these days, especially as a mid-level and young artist, that these micro-residencies actually really help curtail that.”

Adler also noted that global touring is now a major priority for artists, “so as we’re planning 24-month calendars. I think that we’re looking at all of it and making sure there’s breaks in between and just really being mindful for the artist, because it’s grueling out there.”

Vazzana noted that with this emphasis on global touring, it’s important for artists to grow their international fanbases earlier in their careers, as “it hurts a lot more when you have a much bigger team to go and try to do it then, than if you had just done it from day one and taken those incremental steps. I also think that international audiences really appreciate the early investment.”

The agents also discussed the state of the glass ceiling for women agents. Vlasic, who began her career 40 years ago, when she was often the only woman in meetings, reflected that “there are more women in our business than ever. When I started out there were three. It has tremendously [improved].”

“Learning form the past, being in rooms with women who have taught us to come into the room and bring another woman into the room and have those conversations,” is important, Williams continues, “because it’s not over. It’s much better, but it’s not over. The number of times we might be one of the only women on a screen or in the room is significant in this business, still.”

“I feel like we’ve come such a long way, but there’s so much more to do,” added Adler. “We do belong in the room, and we have to advocate for ourselves, and we have to continue to advocate and fight.”

“But you must do it,” said Vlasic. “You cannot expect to have the path laid for you; you have to create it yourself.”

“Sometimes I just feel like we just have to continue to fight for each other and to be there and show up for each other,” Adler continues, “because as much as people try to pit us against each other, I just feel like we just need to be screaming and amplifying from the rooftops that we do belong in the room, because it’s systemic at times.”

“I’ve always said that it’s not a disadvantage to be a woman, and I firmly believe that,” continued Vazzana. “I was raised by a dad who was like, ‘Get in there, do the job, be smarter than everyone else,’ and by the way, sometimes I maybe have to yell a little louder, but I don’t see that as a negative. I see it as a necessity, and if it helps move women forward, so be it.”

Trending on Billboard

A new entrant to Australia’s live music market has officially landed, with the inaugural edition of Strummingbird, a touring country music festival presented by Live Nation and Kicks Entertainment, drawing tens of thousands across three cities over two weekends.

Held in the Sunshine Coast (Oct. 25), Newcastle (Nov. 1), and Perth (Nov. 2), the multi-date, all-ages event marked one of the most ambitious country-focused touring formats launched in Australia in recent years.

Related

The 2025 lineup combined U.S. charting acts like Jelly Roll, Shaboozey, and Treaty Oak Revival with a strong mix of emerging and established domestic talent, including James Johnston, Kaylee Bell, Wade Forster, The Dreggs, and Rachael Fahim.

Beyond traditional main stage performances, organizers leaned into fan engagement and social content opportunities, from line-dancing workshops and crowd-wide Nutbush dance breakouts to surprise collaborations — including Jelly Roll bringing out both Shaboozey and Bell during his Newcastle and Perth sets, and Johnston filming a live music video during his Sunshine Coast appearance.

The debut comes amid rising interest in country-adjacent genres across the Australian market. Jelly Roll has achieved notable chart success in Australia, with his 2024 album “Beautifully Broken” peaking at No. 19 on the ARIA Top 50 Albums chart. On the ARIA Top 40 Country Albums Chart, “Beautifully Broken” peaked at No. 3 and has maintained a strong presence. Meanwhile, local breakout James Johnston recently scored a top-five ARIA album debut — a rare feat for an independent country act.

Programming across cities was localized, with unique artist configurations in each market and strong integration of Māori and First Nations acknowledgments. The event’s Sunshine Coast leg sold out in advance, and Newcastle received strategic backing from Destination NSW as part of its tourism and major events initiative.

Festival co-presenter Live Nation, which has been expanding its genre footprint across ANZ through a mix of pop, country, hip-hop and Latin offerings, is already planning a return in 2026.

In addition to the core music offering, activations included the “Strummo Bowlo”, a communal dancefloor space where attendees engaged with both country and crossover pop tracks, including viral moments set to Charli XCX’s “Brat” anthems — a programming nod to Gen Z festivalgoers.

Trending on Billboard

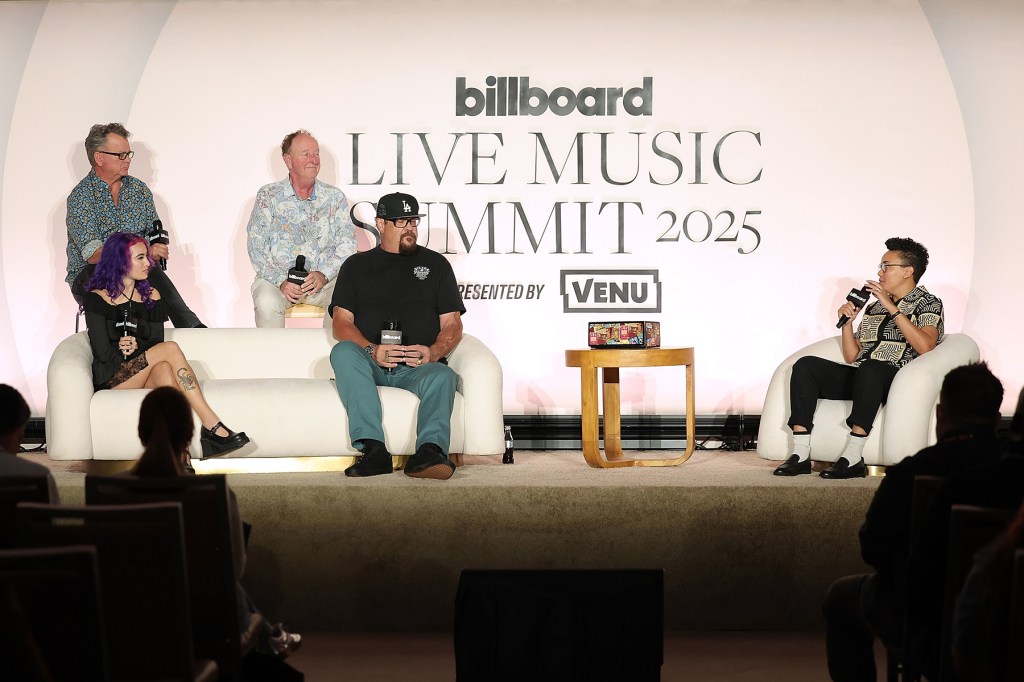

When Warped Tour kicked off in 1995, we’re guessing founder Kevin Lyman didn’t have any idea he’d be mounting a 30th-anniversary edition of his traveling rock fest in 2025 — or that he’d be named Billboard‘s 2025 Visionary at Monday’s (Nov. 3) Billboard Live Music Summit for all the ways he’s helped revolutionize the industry. In fact, he joked onstage that he thought he’d be receiving a different honor: “When you called, I thought it was maybe the ’64 Under 65′ now, and I finally made the list.”

During a panel titled “How Warped Tour Built A Lasting Legacy – And Returned In 2025” at West Hollywood, California’s, 1 Hotel, Lyman was joined by Steve Van Doren, an executive from the tour’s presenting sponsor Vans, as well as Warped vet Fletcher Dragge from the SoCal punk band Pennywise and first-time performer-but-longtime attendee Devin Papdol from L.A. pop-rock band Honey Revenge for a conversation moderated by Billboard editor Taylor Mims.

Below, find the best quotes from each panelist about what makes Warped Tour so special and how it’s evolved across three decades.

Warped Tour founder Kevin Lyman

It was always about trying to get people out to their first festival. You know, having the show end by sunset was a big part of it too. Because to me, 90% of the problems were caused by 10% of the people under cover of darkness at shows. So if we could bring it into the sunshine, we eliminated some of the problems we had, maybe of certain things in punk rock, but it gave people a chance to listen to the music and really observe. … Everything we did from the reverse daycare center [letting parents attend for free in a “Parents’ tent” so teens could attend], all these things I developed were how to get these young people turned on to this music at a younger age, so they can stay with us. I always said they stayed with us until they were 19, and then they wanted to go to a festival and burn up their student loans and do modeling in the desert.

Vans’ Steve Van Doren

I wanted to get skateboarding from Florida, Texas and California to the rest of the country. He [Lyman] wanted to get music in the rest of the country, 35 to 45 stops each year. I thought it’d be perfect. And no room for rock stars — learned that one early. Everybody’s treated the same. Being able to meet [Pennywise’s] Fletcher in the early days, where he invited me over to the barbecue area, and that’s where you get to meet everybody. Everybody’s done at 8:30, 9 o’clock at night. The buses aren’t leaving until 11 o’clock or 11:30, so everybody’s hungry, come back there. And every day is a little bit different.

Pennywise’s Fletcher Dragge

I never went to summer camp, but it was the best summer camp on the planet. So why wouldn’t you go do what you love to do: play music and hang out with the coolest people and do the coolest sh–? Kevin and these guys would always arrange off days, like river trips or wherever you were, and everyone would come, like, all crew, all bands. It was just completely, undeniably some of the best times of my life. So it was like a no-brainer. “You want to come?” Yes. Ten years later: “Now you want to come?” Yes.

Honey Revenge’s Devin Papadol

I went to my first Warped Tour in 2013 and it was kind of the first opportunity for me to be around so many people that liked the same music as me. … Going to Warped opened up this incredible community that I didn’t know was real locally to me; it kind of felt far away until I went. And I went every year until it stopped. … It was how I found all of the music I ended up listening to, and all the music that ended up influencing Honey Revenge.

Trending on Billboard

Rauw Alejandro took a day off between stops on his Cosa Nuestra tour to attend the 2025 Billboard Live Music Summit in Los Angeles to explain how a new partnership with Live Nation helped him create a theatrical spectacle that could “travel through the whole world.”

Alejandro — who came straight from a Sunday (Nov. 2) show in Monterrey, Mexico and has to fly right back for a Tuesday (Nov. 4) performance in Mexico City — took the stage for a spotlight conversation with Billboard’s Leila Cobo and Live Nation senior vp of global touring Hans Schafer at the 1 Hotel West Hollywood on Monday (Nov. 3).

Related

The Cosa Nuestra tour is a high-concept, 1970s New York-inspired spectacle supporting Alejandro’s 2024 album of the same name, which hit No. 6 on the Billboard 200. The tour grossed $91.7 million across spring and summer legs in North America and Europe before heading to South America and Mexico. Alejandro will conclude at the end of this month with a five-date residency at San Juan’s Coliseo de Puerto Rico José Miguel Agrelot.

During the discussion, the cover star of Billboard’s touring issue explained that after attending live theater in New York, he was inspired to create what he called “the biggest Broadway show on earth” — though it’s not so easy to bring Broadway to an arena. Enter Live Nation.

“I consider myself the best, so I want to work with the best team,” said Alejandro of joining up with the concert giant for the tour.

As Alejandro explained, Live Nation helped him bring his vision to life using maximum precision. “We could sell stadiums,” said Alejandro, but ultimately, he and his team decided to schedule his tour in arenas to “focus on the art.” The tour also eschewed outdoor venues, preferring the dark environment of an indoor arena to better evoke the feel of a Broadway theater.

Related

A huge priority, said Alejandro, was to create consistency across markets. As he put it, he didn’t want South American fans to watch one version of Cosa Nuestra on TikTok during the U.S. leg and then be disappointed when a different show came to their cities.

“I had to find a show that I can take everywhere, because I think my fans deserve the best of me,” said Alejandro. “For me, it was really important to put our minds together and find this perfect show that I can travel through the whole world, and I think we did it.”

Schafer, who runs Latin touring for Live Nation, said he was galvanized by Alejandro’s desire to prioritize performance quality over all else.

“The greatest is when you partner with an artist team and they are not looking to make it the biggest, they are looking to make it matter,” said Schafer.

Monday’s panel also covered the way Alejandro was inspired by salsa music for Cosa Nuestra and how he stays in shape for the demanding, dance-heavy show. He said he eats clean — “salmon, white rice, vegetables” — works out and doesn’t drink or smoke on show days.

Alejandro also hinted at what’s next for his touring career. The reggaeton star said he does intend to play stadiums — and that in the future, he aims to take his shows to even more markets than he did this time around. “We want to conquer Asia,” he said.

Trending on Billboard

When it comes to convincing major artists to use sustainable merch on tour, it doesn’t take much work, says Bravado president Matt Young. As he puts it, a little competitive spirit goes a long way.

“For us, it’s just about using the platform to tell the story,” Young said at the Billboard Live Music Summit on Monday (Nov. 3) in West Hollywood, California, noting that stars including Billie Eilish, Paul McCartney, Shawn Mendes and Lorde used sustainable merch options on their most recent tours. “And it gets our competition to follow suit. The artists are saying, ‘Hey, how come we can’t do that?’”

Related

Young was speaking during the panel “Building Touring’s Sustainable Future With Maggie Baird.” Moderated by Billboard senior music correspondent Katie Bain, the panel also featured Adam Gardner, frontman of the band Guster and co-founder of the environmental music nonprofit REVERB; and Maggie Baird, founder of nonprofit Support+Feed and mother of Eilish — arguably the most outspoken major artist on the subject of sustainability.

Below are four major highlights from the panel.

The price point for sustainable merch is trending down as more artists adopt it.

While noting that sustainable merch tends to be “a few dollars more” than non-sustainable, Young said that once artists and their teams realize it’s an option, they tend to be open to it.

“The ultimate sell is, ‘This is the right thing to do,’” said Young. “A few months ago, we did a summit in Nashville, where we were sitting down with partners in town and just talking about the options. And half the time, they go, ‘I didn’t realize that.’ And the other part about this is, because we’ve done so much over the last three or four years, we’re starting to see the price gap close a bit.”

Related

Added Gardner, “Once enough artists are asking for the same things, they make permanent change.”

Offering plant-based meals at concerts is actually cheaper.

You know which sustainable option is actually less expensive than the status quo, according to Baird? Plant-based food. That’s helpful when it comes to her organization, Support + Feed, selling organizations on offering more non-meat options.

“One of the whys [to offer plant-based options] is you can save money,” said Baird. “That’s really an important part of the storytelling, is getting arenas to understand it’s actually cheaper to serve whole, plant-based foods. And then we offer tools — tools about menu guidance, creating dishes, how to sell more of them. You don’t just put the vegan option at the bottom [of the menu]…you want it to be No. 2.”

Some sustainable options take a little more convincing than others.

In attempting to sell artists and their teams on battery-powered vs. traditional diesel-powered generators, Gardner says it took proof of concept to get more artists on board. That proof of concept came courtesy of Eilsh, who partially powered her headlining seat at Lollapalooza 2023 using zero-emissions battery systems, charged using solar power, without a hiccup.

Related

“The first step was just convincing folks that it was feasible and that it was okay,” said Gardner. “Because obviously, when you’re talking about powering the stage, nobody wants the power to go out during a concert. So it is scary, and yet it’s also necessary.”

Once Eilish’s 2023 Lollapalooza set proved it could work, the festival “has continued to use battery[-powered generators] since that year.” In 2025, Lollapalooza announced its main stage would be entirely powered by a hybrid battery system — a joint effort by REVERB, C3 Presents and Live Nation’s Green Nation sustainability initiative.

This is just the beginning.

While some strides have been made on the sustainability front in the touring business, there’s still a lot more work to be done. As Young optimistically put it, “The beauty of this is, every day, there’s a new, innovative, entrepreneurial company trying something new in this space.”

He added, “We’re just getting started.”

Trending on Billboard

Offset has been hit with new lawsuit claiming he attacked a security guard at a cannabis dispensary in Los Angeles after being asked to show his I.D.

The rapper (Kiari Cephus) faces civil assault and battery claims in a complaint filed last Wednesday (Oct. 29) by Jim Leobardo Sanchez, a security guard at the MedMen licensed recreational dispensary near Los Angeles International Airport.

Related

Offset and a group of associates visited the dispensary on March 14 of this year, according to the lawsuit. Sanchez alleges that the rapper grew violent when he was asked to provide I.D. before entering the store.

“Without legal justification or provocation, defendant Cephus became hostile, verbally confrontational and physically attacked plaintiff by striking him in the face,” writes Sanchez’s attorney Michael Karikomi. “Several unidentified individuals who were accompanying defendant Cephus then proceeded to grab, push and further assault and batter plaintiff.”

Sanchez says he was in “immediate and severe pain” after the alleged attack, and was treated by paramedics at the scene before being transported by ambulance to the emergency room.

According to the lawsuit, Sanchez has continued to suffer due to Offset’s behavior — and he now wants financial compensation from the rapper.

“Plaintiff suffered physical injuries, emotional distress, incurred medical expenses, suffered lost income and continues to experience pain and discomfort,” reads the lawsuit, which asks for unspecified monetary damages.

Offset’s reps did not immediately return a request for comment on Monday (Nov. 3).

This isn’t the first time Offset has been accused of attacking a security guard. In 2023, he was sued for allegedly assaulting a guard at a convention put on by Complex Networks two years earlier. That lawsuit claimed Offset and fellow rapper YRN Murk got physical after being told the event was restricted.

The security guard in that case, Daveon Clark, has not yet managed to serve Offset with legal papers. The claim remains pending.

Trending on Billboard

When scrolling through TikTok following the onsale of Chappell Roan’s Visions of Damsels & Other Dangers Things tour dates, Foundations Artists Management’s Lauren McKinney noticed something interesting: In a stark contrast to most fans of major artists in 2025, the reviews were overwhelmingly positive.

McKinney and Roan’s team at Foundations scrolled the social media site to find “fans being excited they got tickets, and saying how calm the process was and how nice it was that they weren’t having to battle other fans,” McKinney told the audience at Billboard’s 2025 Live Music Summit in Los Angeles on Monday (Nov. 3) during a panel titled “No Bots Allowed: Inside Chappell Roan’s Fan-First Ticketing Strategy.” She added, “Our team was just so happy with that.”

Related

Wasserman Music Nashville’s Kristen Mitchell echoed McKinney’s excitement about the results of the ticketing strategy that they, along with AXS ticketing, implemented to ensure tickets for Roan’s nine-show summer run made it into the hands of fans instead of resellers. “I was obsessively reloading the AXS mobile reporting app, and I saw that at the Kansas City show, it was a 97% check-in. So, there was very little attrition. That’s incredible,” said Mitchell.

In 2025, concerts across the country are seeing higher-than-normal attrition rates (where far fewer fans show up to shows than the number of tickets sold) because many tickets are purchased during onsale and immediately placed on the secondary market for double or triple the face value. When fans are unable or unwilling to pay those exorbitant prices, those seats are left empty at the venues.

When tickets went on sale for Roan’s stadium dates, she and her team knew the demand for tickets would far outweigh the demand, so they turned to Fair AXS for a slower approach to selling tickets.

As Billboard reported in the 2025 touring issue, Roan’s fans signed up over a three-day period, after which AXS used a proprietary system to verify that each registrant was a real person, including those who had purchased Roan tickets in the past. AXS then delivered a list of registrants who met the criteria to her agents at Wasserman. The AXS team subsequently released a batch of ticket-purchasing invitations to fans across 24 hours. Based on the ratio of those fans who actually purchased the tickets, they subsequently released a second batch the following day, and a third the day after that.

“It requires a lot of trust in the fan to be patient in that process and know that they will have to sign up, wait a week, maybe receive an email,” McKinney said during the panel. “Overall, we learned that people are willing to be patient and willing to jump through some additional steps, if they can feel like the end result is equitable and that it’s a fair process all.”

AXS head of North American venues Dean Dewulf added that with Fair AXS, “we’re essentially deconstructing [the onsale] process.”

“We essentially are having a unlimited registration window where everybody can register. And what’s really important about that is that fans have two to four days, depending on the configuration of the program, to register when it’s convenient for them,” Dewulf explained on the panel, moderated by Billboard’s touring director Dave Brooks. “Once the registration ends, then we run it through our process to essentially hand pick and invite specific fans to buy the tickets.”

The process is a lot more intensive than a typical onsale and requires a lot more human power. As Mitchell joked, “AXS was not sleeping.”

“This was such a great passion project for a lot of the folks that worked on this,” said Dewulf on the panel. “We loved every minute. Honestly, this is why I got into the business. I don’t know about any of you, but getting tickets in the hands of real fans is really cool.”

When asked about how they deal with tickets that do end up on the secondary market, Mitchell said Wasserman has worked with AXS to combat the high prices by fighting fire with fire.

“AXS has something called AXS Distro, which actually allows you to — it sounds counterintuitive — but you’re feeding tickets to the secondary market. But you’re undercutting the pricing,” Mitchell said. “So, what happens when you undercut the pricing is people aren’t purchasing those higher price tickets.”

“I don’t know that that exists across other platforms, but I personally think that might be the future of what we’re looking at in ticketing,” Mitchelle continued. “I’m not saying that we want scalping, but it’s going to be there no matter what. So, it’s really on us as an industry to figure out how we’re dealing with that, and, in some cases, competing with it.”

Trending on Billboard

Mention Jeff Price‘s name in a room full of music executives and some will almost certainly wince and say that he is a troublemaker — an entrepreneur who enjoys noisily lashing out at those in the business he perceives are not doing right by music artists, songwriters, comedians and other creators.

Most conspicuously, that sense of righteousness has manifested in a two-year on-and-off email battle — often with journalists, including this reporter cc’d — with the Mechanical Licensing Collective (MLC), the nonprofit organization established by the Music Modernization Act (MMA) to administer blanket licenses for digital streams and downloads in the United States.

Related

Price claims that deficiencies in the MLC’s operations have deprived clients of his current startup, Word Collections, royalty payments, and, in other cases, have delayed payments.

What Price’s critics rarely acknowledge is that Word Collections is the third successful business that he has built as a result of his indignation. “It’s usually a combination of something that I’m frustrated with, combined with having an opportunity in my professional career to correct it,” he says of his entrepreneurial ventures.

For example: Price founded TuneCore in 2006 to help DIY artists and indie labels get their music onto digital platforms for a fraction of what it previously cost. Then, in 2013, he started Audiam, which claims YouTube publishing royalties for DIY songwriters who, in many cases, are uninformed about music publishing and how to get paid for their work. And he established his latest venture, Word Collections, in 2020 to fight for and collect mechanical royalties for comedians’ recordings, which many digital services were not paying at the time.

Although Price admits he departed the first two companies under unpleasant circumstances — possibly due to his combative nature — TuneCore and Audiam were successfully sold. Word Collections is still in a growth phase, but many of Audiam’s investors are helping to fund it — proof that he remains a bankable entrepreneur.

Related

And these investors are not small players. Key among them is Black Squirrel Partners, the investment division of Metallica’s business operations. The band and Black Squirrel were a client and investor, respectively, in Audiam and followed Price to Word Collections, which now also represents music artists. (Pop artist Jason Mraz is among other investors who did the same.)

The reason: Black Squirrel principal and partner Eric Wasserman says that while at Audiam, Metallica’s income “went from a small amount to a significant portion of the revenue from their [intellectual property].”

The band apparently is happy at Word Collections as well. In July 2023, Price and Word Collections closed on a $5 million investment round led by Black Squirrel, which became its lead investor. “We are very enthusiastic about this company and Jeff’s leadership,” Wasserman says. “Word Collections is doing a great job representing the Metallica catalog.”

Other Word Collections clients include Greta Van Fleet, The Offspring, Grace Potter, Thomas Dolby, Galactic, John Oates, Switchfoot, Richard Marx and the estate of Johnny Marks, among other songwriters. Word Collections, which employs a staff of 10, also represents the comedy catalogs of Robin Williams, George Carlin, Margaret Cho, Jerry Seinfeld and Billy Crystal, among others.

Related

Because of his history of saber-rattling, Price acknowledges that industry executives have accused him of being an opportunist looking for industry problems so that he could profit from those issues.

“Yes, it [can be] a business opportunity, but that’s usually not the driving force,” he says. “It isn’t like, ‘Ha ha, here’s this thing, let me go make money off it.’ It’s more of, ‘This thing is not right, let’s fix it,’ which also happens to be a business opportunity.”

Metallica

Ross Halfin

‘That’s stealing in my mind’

Slim with gray hair parted in the middle, Price does not resemble a street fighter. He even sports a broad smile in his LinkedIn photo. Of all the stands he has taken against the industry, he is best known for publicly opposing — and loudly criticizing — the MMA, which passed in 2018 and dramatically changed digital music licensing and how payments are made for compositions. He was even part of a group, which dubbed itself the American Music Licensing Collective (AMLC), that vied against the National Music Publishers’ Association’s (NMPA) preferred assemblage of major music publishers to be designated the MMA’s administrator of digital licenses.

The U.S. Copyright Office went with the NMPA-backed team — now known as the MLC — but not before Price had alienated several of the industry’s legacy players.

While the passage of the MMA was largely hailed as a beneficial game-changer for songwriters, Price alleges that the law created a form of legal theft that benefits large publishers. That’s because songs for which the publisher or payout instructions cannot be determined are designated as black-box monies — they are also called unmatched or unclaimed royalties — and if the rightful recipient cannot be determined within three years, the MLC has the authority to distribute these monies to publishers based on their market share.

Related

Unmatched royalties total hundreds of millions of dollars annually, and Price contends that the bulk of them are generated by DIY creators who don’t know how to properly register their songs with the MLC. Worse, he says, if those creators learn belatedly that their royalties were distributed elsewhere, they cannot retroactively claim them, because according to the text of the MMA, distributions of unclaimed and/or unmatched royalties “shall supersede and preempt any state law (including common law) concerning escheatment or abandoned property, or any analogous provision, that might otherwise apply.”

“I believe [digital services] should get a license and pay a commensurate royalty, and the entity that earns the royalty should get the money,” Price says. “The other side is like, ‘We don’t want to do that. Why don’t we just take all this money that’s not getting paid and hand it to ourselves based on a black-box [market-share] allocation?’ And that’s stealing, in my mind.”

However, the MLC has yet to use this market-share mechanism to disburse any black-box monies, which have been accumulating for the last eight years and predate the passage of the MMA.

Price has other issues with the MLC, and in addition to the blizzard of emails he has sent its CEO, Kris Ahrend, and other executives there, his complaints are collected in a 53-page memo submitted by Word Collections that opposes redesignating the organization as the administrator of blanket compulsory mechanical licenses “without significant policy and governance changes to achieve the [MMA’s] intended goals and objectives.”

Related

Word Collections’ memo is one of 63 posted on the U.S. Copyright Office website as it conducts a mandated periodic review on whether the MLC should be redesignated. While other submissions suggest improvements, the overwhelming majority support the MLC’s reappointment, if the more than 500 publishing companies and industry trade organizations cited in the MLC’s own filing are counted. Among those in favor are Warner Chappell Music, peermusic, the RIAA, the Recording Academy, the Academy of Country Music, the Association of Independent Music Publishers and the NMPA.

The MLC declined to comment, but industry executives say in its defense that the organization is dealing with a vast amount of data and, as a result, its execution “will never be flawless or perfect,” as one music publishing source puts it.

In the early days of streaming, Price’s squeaky-wheel approach earned him grudging respect as a renegade. But over the years, his detractors have grown in number, and some say they are weary of his unyielding combativeness, even if he is right.

‘The messenger being the problem’

One executive says Price “is a classic example of the messenger being the problem, not the message,” explaining, “While he is really trying to get the most money for songwriters, the way he has gone about highlighting these issues pisses off everybody.”

An executive in the digital music realm calls Price “litigious.” In reality, Price has not directly sued any digital services, but through data supplied by his company, he was involved in songwriter lawsuits filed against Spotify, including a 2017 legal action led by Camper Van Beethoven founder and musicians’ rights activist David Lowery that resulted in a $45 million settlement, and others by Four Seasons member and songwriter Bob Gaudio, Bluewater Music, and Dolby.

Word Collections’ data was also used in lawsuits filed by a number of comics against Pandora, including Andrew Dice Clay, Bill Engvall, Ron White and the estates of Carlin and Williams. Price says his clients usually don’t resort to litigation until a digital service has spent about a year ignoring requests for payment.

Others in the industry offer a more charitable assessment of Price. One executive who has crossed swords with him says he’s “difficult to work with” but concedes that “98% of what he says is correct.” The executive adds, “[Price] is not a lawyer, so sometimes he gets a nuance wrong, but in terms of the important stuff — like how digital services didn’t pay publishing properly and what’s wrong with the system in publishing — he was the only one making noise.”

Related

“I think Jeff is a catalyst and is brilliant,” says Jordan Bromley, entertainment group leader for law firm Manatt Phelps & Phillips. “Guys like him don’t follow rules or lines of politics. They say the quiet things out loud.”

Though Price concedes that he “once” apologized to the MLC for mistakenly claiming it hadn’t paid out Pandora royalties due to Word Collections, he expresses no regret for his unflagging approach to perceived transgressors. “Water on stone eventually makes the Grand Canyon,” he says. “I am working from outside the system to change the system.”

Before entering the music industry, Price lived an itinerant life. His mother founded an advertising agency in the 1970s when it was still a male-dominated business, and they moved frequently for her career. Growing up, he says he attended eight schools in a 12-year period. He also spent time in Japan and Israel, where he served in the latter’s military reserve. He worked as a bartender, sold books out of mall kiosks and was a production assistant for film/TV producer Rachael Horovitz, the older sister of the Beastie Boys’ Adam “Ad-Rock” Horovitz.

Price, who attributes his rectitude to once witnessing his father stop an attack against another person, entered the music industry in 1991 as a co-founder of the SpinART indie label, which released the music of such indie acts as Frank Black, The Church, Apples in Stereo, The Boo Radleys and Vic Chesnutt before succumbing to bankruptcy in 2007. “SpinART taught me everything I know about the industry,” Price says. “I wouldn’t be able to make informed decisions without the knowledge that experience gave me.”

Related

As iTunes, Rhapsody and other online music stores started up, Price began looking for a digital distributor for SpinART, but says he was angered by the terms he was offered, especially what he considered unwarranted high distribution fees. “Distributors were demanding 15% to 30% of revenue to basically send a digital file to places like Apple and Amazon,” he says. “Overlaying the analog business funnel on top of the digital channel just didn’t make sense.”

Price voiced his grievances in a 2006 issue of Billboard. “I despise the economic model of aggregators. They are morally repugnant,” he said. “On the physical side, distributors work their asses off. They provide co-op opportunities; they’ll have regional sales reps. In the digital world, they don’t provide that service. They’re an aggregator.”

Through his dissatisfaction, Price saw an opportunity to fill a void in the market, and with partners Gary Burke and Peter Wells launched TuneCore in 2006. To date, it’s his most successful venture and remains a major indie player 13 years after he and his partners left the company.

TuneCore’s model was simple and elegant. It initially charged a flat rate of $7.98 an album per year and a delivery charge of 99 cents per song to put titles up on all the digital stores, with all sales revenue going to the artist. By 2010, prices had increased to $49.99 an album per year and $9.99 per song.

Related

Price’s refusal to play by established rules earned him scorn when he created his own International Standard Recording Code (ISRC) — essentially digital fingerprints for tracking royalties — for works released by TuneCore artists instead of paying the RIAA, which, at the time, assigned the codes.

‘Took off like a rocket‘

TuneCore “took off like a rocket and it was a heck of a learning curve,” Price recalls. “All of a sudden, we were doing over a million dollars a month. We were like, ‘Holy crap!’ And then that number became $8 million to $10 million a month. It got crazy how quickly it grew.”

The company eventually needed funding to accommodate that growth and brought in Guitar Center and Opus Capital as investors. But the introduction of private equity blew up management in 2012. Price and some of his staff were ousted, and in 2015, the company was acquired by Believe Music, where it is now one of the largest independent distributors in the world.

While at TuneCore, Price realized that indie artists were not collecting their fair share of music publishing royalties and started a publishing administration division. After his departure, he founded Audiam in June 2013 as, he says, a corrective.

Related

His team built a system that tracked down cover versions of songs and user-generated videos on YouTube and other streaming platforms that included unlicensed recordings of songs. On behalf of its clients, Audiam claimed the songs to collect both publishing and recorded master royalties that were due.

A publisher administrator client of Audiam says, “We may have found 30 cover versions of a song, but when Jeff entered the picture, he said, ‘Here are 225 ISRC cover versions of that song.’ ”

Like TuneCore, anyone could sign up for Audiam, but this time Price’s economic model took an undisclosed percentage of the revenue.

Official videos of a song were easy to find and claim, but songs included in user-generated videos and cover versions performed by DIY artists were not, and Audiam’s success enabled the company to expand into licensing and collecting publishing royalties from other digital platforms such as Spotify and Amazon. But that meant Price was soon butting heads with those platforms’ service agents, like the Harry Fox Agency and Music Reports Inc.

Audiam eventually attracted major artists such as Metallica, Mraz and Jimmy Buffett. Industry heavyweights also invested, including Q Prime co-founder Cliff Burnstein, then-WME head of music Mark Geiger, Victory Records founder Tony Brummel, Distrokid founder Philip Kaplan, Silva Entertainment namesake Bill Silva and Provident Financial Management.

Related

When Audiam’s growth required new sources of funding, Price and his investors agreed to sell the company to the Canadian performing rights organization SOCAN in 2016. But his relationship with the PRO soured, in part because of his vociferous opposition to the MMA and the NMPA’s backing of the legislation that calls for market-share distribution of black-box monies.

When Price and the AMLC team he helped assemble began jockeying with the NMPA’s choice to administer blanket mechanical licenses for the MMA, informed sources say his efforts — which included posting videos to YouTube that questioned the fairness and transparency of music publishing — resulted in SOCAN management taking fire from the mainstream music industry.

SOCAN pressured Price to abandon his protest, sources say, and his relationship with the PRO became further complicated when Audiam’s investors began agitating for an additional equity payout because, they claimed, the company had hit previously agreed-upon profit performance targets.

Price says he resigned due to the equity payout issue, which created a conflict because he was serving as his initial investors’ security representative while also still leading the company. He says he agreed to stay on long enough to help prepare Audiam for a sale, but was terminated before that happened.

Related

Price declines to elaborate but says his parting with Audiam, like his departure from TuneCore, was “unpleasant,” and in 2021, SOCAN sold the company — ironically, to the MLC’s data management agent, the Harry Fox Agency, which is now owned by the Blackstone-owned SESAC Music Group. As for Audiam’s investors, sources say that a lawsuit filed on their behalf resulted in an undisclosed settlement in addition to the initial payout from the sale. (SOCAN declined to comment, as did Eric Baptiste, who led the PRO when it purchased Audiam.)

By then, Price had started Word Collections, which originally focused on comedy streams. He likened comedians’ jokes to song compositions that were deserving of publishing royalties. Up to then, most digital services had been paying record labels for comedic master recordings but not the underlying literary compositions. “That’s what Jeff does,” says ClearBox Rights founder and principal John Barker. “He recognizes when people aren’t getting paid, and he finds a solution.”

After the expiration of Price’s noncompete clause with Audiam, Word Collections expanded into music publishing administration, putting him in competition with his former company. And though TuneCore remains Price’s most successful startup, he claims Word Collections’ revenue now matches the publishing royalty volume collected by Audiam.

Price retains strong opinions on the MMA and gives no indication that he’s ready to ease up on the MLC, certainly as long as publisher market share could be used to disburse black-box monies. But he claims he has dialed back his combativeness on a number of industry issues because much of what he complained about has been corrected.

And in a number of ways, Price is no longer the outsider he claims to be. “It’s an interesting paradox for me,” he says. “We are directly licensed outside North America with the largest digital services in the world, which enables Word Collections to collect mechanical and performance royalties from streams. Wherever we can, we disintermediate the CMOs, the subpublishers and the black boxes in between songwriters and their money. For nondigital, we collect from 104 countries and are direct members in 40 of the music rights organizations in their countries through a joint venture with Nashville publishing administrator Bluewater Music,” he adds. “We work for some of the most important artists in the world and some of the biggest artist management companies and music companies in the world. I like being on the same side of the fence as them.”

Trending on Billboard

The annual Music Tectonics conference kicks off Tuesday (Nov. 4), bringing together music industry professionals, entrepreneurs, and investors alongside the Pacific Ocean in Santa Monica, Calif.

Music Tectonics was founded in 2019 by Dmitri Vietze and his team at public relations firm Rock Paper Scissors. The three-day gathering not only has a great location — the first two days are beachside — but a valuable position on the calendar: After Music Tectonics, music industry events wind down to accommodate the holidays and won’t pick up until Grammy week in Los Angeles in late January.

Related

The first day of Music Tectonics’ three-day event takes place at the Santa Monica Pier Carousel. On Wednesday, the conference moves to the Annenberg Community Beach House about a mile up the coast. Thursday’s events — which are focused on entrepreneurism and startups — take place at Expert Dojo, a startup accelerator located near the Santa Monica Pier. A closing party will take place at Universal Music Group’s nearby headquarters.

To help attendees know what to expect from the event, Billboard is highlighting some of the most promising programming.

Optimization is Not Enough: Are You Ready for Streaming’s Reckoning?

MIDiA Research’s Tatiana Cirisano talks about the future of music streaming. In a fireside chat moderated by Music Tectonics founder Dmitri Vietze, Cirisano will argue that focusing on optimization — getting the most out of existing subscribers with higher prices and value-added perks — won’t attract the next generation of customers.

The Investor Panel

AI startups have commandeered an astounding 51% of venture capital funding in 2025, according to CB Insights. To find out if music is less one-sided, a panel of seasoned investors will discuss what business ideas excite them and where music and technology are headed. They are also expected to give attendees tips on how to pitch them.

Featured speakers: Aadit Parikh from Sony Ventures, Conor Healy from Yamaha Music Innovations Fund, and Lucas Cantor Santiago from Mindset Ventures. Entrepreneur and advisor Angel Gambino will moderate.

What Everyone Should Know about the New Frontiers: Music, Gaming, AI, and Beyond!

If you want to know where the music business is headed, it’s best to hear from the people who help build the products, create the partnerships and advise the companies that are pushing music into the future. The panelists’ many decades of expertise covers streaming platforms, gaming, social media and musical instruments.

Featured speakers: Elizabeth Moody from Granderson Des Rochers, Paul McCabe from Roland, and Kirsten Bender from Universal Music Group. Music Tectonics’ Dmitri Vietze will moderate.

Related

Tools of the Trade: Platforms That Launch You Out of DIY

The best conference panels are often those that offer practical tips that are worth the price of admission. At the “Tools of the Trade” panel, music professionals will give their thoughts on the services that help independent musicians operate in the marketplace.

Featured speakers: Kevin Lazaroff from Amuse, Charles Alexander from ViNiL, and Crystal Desai from HiFi Labs. Tetris Kelly from Billboard will moderate.

The New Direct-to-Fan E-Commerce

“The future of fandom is direct,” says the page for the panel on direct-to-consumer e-commerce. In fact, the future is already here. Direct-to-consumer sales accounted for “two-thirds to 75%” of sales of Universal Music Group’s new releases, COO Boyd Muir said during the company’s Oct. 30 earnings call.

Featured speakers: Joshua Stone from Stuff.io, Shannon Herber from Wise River Consulting, and Fabrice Sargent from Bandsintown. Billboard’s Taylor Mims will moderate.

State Champ Radio

State Champ Radio