Business News

Page: 22

For Leslie Fram, the highly respected former senior vp of music and talent for CMT, launching her own company that continues her work advocating and amplifying artists’ voices is a natural move.

Fram, Billboard’s 2021 Country Power Players executive of the year, has founded FEMco (Fram Entertainment & Music), a consulting company with divisions focused on artist development, talent booking and production, as well as a B2B arm that will connect outside businesses to Nashville companies.

“I’ve always wanted to start my own company, leveraging my three decades of accumulated experience and opportunities to intentionally design a purpose-driven business that aligns with my personal and professional aspirations,” Fram tells Billboard. “Through my time in radio and television, I’ve gained a wealth of knowledge, skills and insights from various roles, industries and projects that are not just a collection of past events but a foundation for future endeavors with FEMco. Starting my own company, doing what I enjoy most, was the best choice for me.”

Trending on Billboard

The new company will allow Fram to use her estimable mentoring, community-building and networking skills that she put into practice during her 13-year tenure at CMT, which she left in September. While there, Fram launched a number of programs, including CMT’s Next Women of Country, which gave a platform to nascent female country artists. She also created the Next Women of Country Tour, which paired Next Women of Country participants with established headlining acts. She was also a fierce advocate for equity, pushing CMT to institute its Equal Play initiative, with a commitment to 50/50 video airplay for female artists on the TV network and CMT Music channels.

FEMco

Courtesy Photo

While at CMT, Fram executive-produced the annual CMT Music Awards, CMT Crossroads and Storytellers. In January, she served as talent producer on CBS Presents Ringo & Friends at the Ryman. Prior to CMT, she had an illustrious background in rock and alternative radio, serving as program director and on-air talent at influential Atlanta alternative rock station 99X before becoming program director and morning show co-host with Matt Pinfield at New York rock station WRXP. She moved to Nashville in 2011.

While FEMco’s other divisions focus on all genders, keeping with her groundbreaking work with female country artists at CMT, Fram has already launched FEMco Presents, “the company’s music-focused production arm that will create multiple opportunities for female artists to increase their visibility and reach via events, sponsorships and more,” Fram says. The first franchise under FEMco Presents is FEMcountry, which will work with women country artists as “a continuation of my work in creating programs like ‘Next Women of Country’ and my passion for elevating female voices in country,” she adds.

FEMcountry soft-launched in March with a singer-songwriter event at Reynolds Lake Oconee in Georgia. “Moving forward, FEMcountry will include writer’s rounds, showcases, listening events both in Nashville and nationwide, along with curating festivals,” Fram says. “The goal is to support female artists in all aspects of their career, finding a stage to play on and to get paid.”

Fram sees her new venture as a through-line in her decades-long work supporting artists. “FEMco will absolutely represent the work I did at CMT in elevating women in country music via FEMcountry,” she says. “A program like ‘Next Women of Country’ is still as relevant today as it was when I launched it over 10 years ago — women are still criminally underrepresented in the country music format.”

Fram also plans to launch FEMpop and FEMrock.

The B2B element will connect companies and brands looking to establish a presence in Nashville with the local music and entertainment market. “Through our extensive industry relationships, we are able to help navigate the city’s unique blend of creativity and commerce with relationships to build authenticity and visibility,” Fram says.

Through FEMco, Fram will also continue working with mtheory CEO Cameo Carlson on another former CMT program, Equal Access, which helps artists and management professionals break into the country music industry.

FEMco will work with artists and companies on an a la carte basis depending upon their individual needs, Fram says.

Mike Van has been elevated to the role of CEO of Billboard — the first time anyone has held the role.

In this position, Van will oversee Billboard’s global brand footprint in 15 countries, along with all aspects of strategy, revenue, business operations, live experiences, international licensing and brand partnerships. Van will oversee both the business and editorial teams, with Billboard editor-in-chief Hannah Karp now reporting to him directly.

Van has served as the president of Billboard since 2022, driving double-digit revenue growth and expanding the brand’s global presence. Van has also driven Billboard‘s digital transformation and continued to develop cutting-edge live experiences, including Latin Music Week, the Billboard Latin Music Awards, THE STAGE at SXSW, the Billboard Music Awards and Billboard Women in Music.

Van will report to Jay Penske, chairman and CEO, Penske Media Corporation.

Trending on Billboard

“Mike is a one-of-a-kind leader, visionary and partner,” Penske said. “His passion for the Billboard brand and clear vision for its future has always set him apart. Mike has fostered a collaborative environment with a team committed to building a formidable global business – innovating and trailblazing at every level. It has been inspiring to watch Billboard’s seismic growth over the last several years and I look forward to seeing the brand continue to thrive under Mike’s leadership.”

“It is the honor of a lifetime to lead Billboard and the team,” Van said. “Together, we have cultivated a culture of excellence. What we’ve built over the last several years has been nothing short of extraordinary, particularly in a media landscape marked by contraction and consolidation. I am deeply proud to carry this legacy forward as we shape the next 125 years by continuing to celebrate artist and executive achievements through our charts, content, global IP expansion and evolving our signature live experiences, cementing our position as the definitive voice of music business and culture.”

Van’s career has spanned media, entertainment and business transformation. He has held leadership positions at Billboard for the last seven years before serving as president. In addition to his time with Billboard, Van brings more than 25 years of marketing and monetization experience, including leadership roles at Pandora, Electronic Arts and Complex.

Proving that the best way to get stock prices to rally is to first bury them deep underground, markets surged this week as President Trump eased his tone on U.S. Federal Reserve chair Jerome Powell and said tariff negotiations with China are ongoing (although China denied the claim).

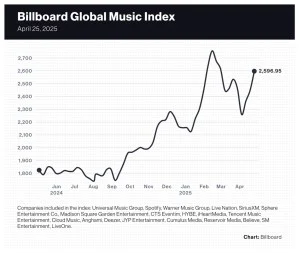

The 20-company Billboard Global Music Index surged 6.1% to 2,595.95, marking its third consecutive weekly gain after falling 10.9% in the two-week period ended April 4. The spoils of a less chaotic global market were felt by nearly all music stocks. Of the 20 stocks in the index, 16 finished the week in positive territory, and two — Anghami and Sphere Entertainment Co. — had gains exceeding 10%.

Major indexes improved this week as investor sentiment regarding U.S. tariff policy improved and President Trumpsaid he would not fire Powell. The Nasdaq composite rose 6.7% to 17,382.94 and the S&P 500 gained 4.6% to 5,525.21. The U.K.’s FTSE 100 improved 1.7% to 8,415.25. South Korea’s KOSPI composite index rose 2.5% to 2,546.30. China’s SSE Composite Index rose 0.6% to 3,295.06.

Trending on Billboard

After investors’ confusion about the U.S. tariff policy put a damper on stocks in recent weeks, markets seemed to find comfort in reports that said the U.S. Trade Representative was quickly working with some trading partners under a streamlined process. Jay Hatfield, founder/chief investment officer of InfraCap, told CNBC, “We’ve reached peak tariff tantrum” and believes the worst of the uncertainty has passed. In fact, the market could have been due for a rebound. Thomas Martin, senior portfolio manager at GLOBALT in Atlanta, told Reuters the stock market “was oversold by virtually all measures.”

Sphere Entertainment Co. was one of the week’s winners, rising 13.8% to $28.88. On Friday, Sphere Entertainment subsidiary MSG Networks announced it had negotiated a $514 million reduction in its debt and lower fees to broadcast New York Knicks and New York Rangers games. The news sent Sphere’s share price up 9.1%.

Spotify, which reports first quarter earnings on Tuesday (April 29), rose 8.1% to $620.72, giving the streaming giant a 23.3% gain over the past three weeks. This week, UBS lowered its price target to $680 from $690 and Wolfe Research raised its outlook on SPOT to “outperform” from “peer perform.”

Live Nation gained 4.4% to $132.76. Wolfe Research lowered its price target to $158 from $165 and maintained its “outperform” rating.

Warner Music Group (WMG) improved 2.4% to $29.83. Morgan Stanley lowered WMG shares to $32 from $37 and dropped the rating to “equalweight” from “overweight.” Universal Music Group (UMG), which also reports earnings on Tuesday, rose 3.5% to 24.79 euros ($28.28), bringing its year-to-date gain to 3.7%.

K-pop stocks had an unremarkable week after performing well during the tariff-driven chaos. HYBE, which, like Spotify and UMG, reports first-quarter earnings on Tuesday, rose 0.9%. SM Entertainment and JYP Entertainment improved 0.6% and 0.2%, respectively. YG Entertainment dropped 4.9%. Still, K-pop stocks are outperforming most music stocks this year. Collectively, the four South Korean music companies have posted an average year-to-date gain of 27.1%.

Cumulus Media shares dropped 16.0% to $0.21 after the company announced on Wednesday (April 23) it will de-list from the Nasdaq exchange on May 2 and immediately begin trading over the counter. The radio broadcaster’s shares are down 72.7% in 2025 and have fallen 92.2% over the last 52 weeks.

Billboard

Billboard

Billboard

Music Canada has applied to intervene in a key Canadian music policy battle.

The organization, which advocates for the major labels in Canada, is seeking leave to intervene in the legal challenge over the Canadian Radio-television and Telecommunications Commission’s (CRTC’s) 2024 decision that major streaming services must pay into Canadian content funds as part of the implementation of the Online Streaming Act.

The mandate specifies that foreign-owned services with more than $25 million in annual revenue contribute 5% of that revenue to funding bodies like FACTOR and Musicaction and an in-development Indigenous Music Fund.

That decision has become a major battle in the Canadian music industry. Organizations like the Canadian Independent Music Association (CIMA) and the Indigenous Music Office have welcomed it. Others, like the Digital Media Association (DIMA), which represents the major streamers, have been fiercely critical of what they call the “streaming tax.”

Trending on Billboard

In December, the Federal Court of Appeal paused the mandated payments until an appeal of the decision is heard this year.

Now, Music Canada is wading into the legal challenge, aiming to speak to what it calls the potential harms the regulation may cause to existing investments made by streaming companies in the country.

“Specifically, we are asking the court to consider music streaming services’ direct investments in Canada among qualifying contributions,” reads a statement from Music Canada. “We are concerned that the CRTC’s base contributions decision risks harming ongoing and direct investments in the Canadian music streaming market and Canadian and Indigenous artists.”

Music Canada points out that streaming services have dedicated teams in Canada, investing in programs and initiatives that support Canadian and Indigenous musicians.

“In setting the 5% levy, the CRTC did not take into account or recognize any of the investments made by music streaming services in Canada,” they write.

However, in a previous interview with Billboard Canada, CIMA president Andrew Cash argued that the investments streamers currently make aren’t comparable to the career development enabled by Canadian organizations like FACTOR and Musicaction.

“Over the last five years, FACTOR has supported over 6,500 artists across the country,” he said, pointing to artists like Charlotte Cardin and The Weeknd as just two musicians who received key early investment from FACTOR.

Music Canada also takes issue with the fact that a portion of the base contributions will be used for a news fund that isn’t specifically related to music. (Specifically, 1.5% of the 5% contributions are mandated for “a new temporary fund supporting local news production by commercial radio stations outside of the designated markets.”)

“While support for news is a laudable goal, it should not come at the expense of artists who are already trying to compete in a highly competitive, global music marketplace,” Music Canada’s statement reads.

Read more here. – Rosie Long Decter

More Than 150 Canadian Musicians Sign Open Letter Against Conservative Leader Pierre Poilievre Ahead of Canadian Election

Canadian musicians are making their election choices known.

More than 150 musicians have signed a new letter from Music Votes Canada that aims to stop conservative leader Pierre Poilievre from winning the federal election on Monday (April 28).

“An Open Letter to Canadians: Why We Must Stop Pierre Poilievre from Becoming Prime Minister” features major signatories like Allison Russell, Dan Mangan, Raffi, Torquil Campbell (Stars), Haley Blais, Charlotte Cornfield and Damian Abraham (F—ed Up).

Also signing on was The Weather Station, who last week, upon returning home from a tour through the U.S., published an impassioned plea for Canadians to stay engaged in the election.

“Music comes from a place of deep love, and as musicians, we want to use the power of music to help bring our country together in this time of poly crises,” the letter reads.

Canadians are at a crossroads, the letter continued, stating that the “federal election on April 28th is possibly the most important in our country’s history.” It goes on to argue that Poilievre’s platform runs counter to “Canada’s core values” such as public services, climate action and inclusive democracy.

“His agenda echoes Donald Trump’s playbook: sowing division, empowering the wealthy, and weakening institutions that unite us,” it reads.

The letter highlights several parts of the Conservative campaign that are particularly concerning for musicians: Poilievre’s threats to public broadcaster CBC; his commitments to expanding fossil fuel production amidst the climate crisis; and rhetoric that is “fostering division instead of unity” when it comes to marginalized communities.

The letter calls for leaders to ensure that every Canadian has a safe, affordable home; to tackle the climate crisis; to tax corporate profits; and to support arts and culture in Canada through a 1% commitment of the federal budget to the arts.

Outside of its anti-Poilievre position, Music Votes Canada doesn’t explicitly endorse any particular party or candidate in the letter. Instead, it concludes by calling on voters to support candidates who are best positioned to defeat the Conservative Party, endorsing resources such as Cooperate for Canada and Lead Now, which provide candidate and riding guides.

One major Canadian star has come out with a strong endorsement of a specific candidate: Neil Young, who is putting his support behind Prime Minister Mark Carney’s Liberals in a letter titled “I’m With You, Mr. Carney.”

Though Young now has dual citizenship with the U.S >, as he writes on his website, “I am a Canadian and always will be.” He goes on to reminisce about his childhood in Ontario and Manitoba and express gratitude for the platform he has built to speak truth to power.

“Canada is facing threats to its very existence, incredibly from people we thought were our friends,” Young writes. “They want our resources, they want our land, they want our fisheries, they want our water, they want our Arctic, maybe they want our souls. I know the U.S. president could use a soul.”

Addressing Carney directly, he writes, “I believe you are the person our country needs to lead us through this crazy situation and bring us out the other side as a stronger, smarter, more resilient Canada, our core values of caring and fairness and generosity intact, along with our souls.”

Read more here. – RLD

Nigerian Music Executives Ikenna Nwagboso and Camillo Doregos Launch Hi-Way 89 Entertainment in Canada

There’s a new music company bridging Canada and Africa.

Hi-Way 89 Entertainment is a new Canadian music company headquartered between Toronto and Calgary, founded by two Nigerian-Canadian music executives — Ikenna Nwagboso and Camillo Doregos — who both have deep experience in breaking African artists on the international stage.

The new company will focus on providing artist development and label services, concentrating on artists from both Canada and Africa. Its first signing is Canadian pop/R&B singer Chrissy Spratt, who on Friday (April 25) released a new single on the label, “In Too Deep,” with distribution through Vydia/gamma.

“We are a Canadian company and, with the tremendous success we’ve had exporting African music globally, we want to do the same thing in Canada, working with Canadian artists and showing the world the gem that is Canada, and the amount of talent here,” Nwagboso said in a statement. “We understand what it takes to develop global superstars and we have the knowledge, access, resources, contacts, and partnerships to make that happen.”

Nwagboso and Doregos are now based in Toronto and Calgary, respectively. Nwagboso previously co-founded African music company emPawa Africa in 2018, serving as global head of label services and partnerships before stepping down in January. In that role, he oversaw the signing and development of artists including GuiltyBeatz, Joeboy, Fave, King Promise, Minz, Xenia Manasseh, Nandy, Tekno and Nezsa.

Nwagboso also led emPawa Africa’s flagship initiatives: the emPawa 100 and emPawa 30 campaigns, which developed 130 emerging artists from across the continent. Nwagboso is also a co-founder of Exodus Music Group, home to artists Geo Baddoo (U.K.), Nezsa (Canada/Nigeria) and Zubi (Nigeria).

Doregos, previously a manager for Mr Eazi, is the founder of DC Talent Agency, the management company behind Nigerian music stars Pheelz and Kah-Lo and South African amapiano duo TxC. He also operates a booking agency, DC Talent Agency, that has secured festival appearances, live shows and brand deals for artists including Rema, Wizkid, Davido and Moliy.

Hi-Way 89 aims to “cast a wide net with our signings,” the company said, but the initial focus will be on acts from Canada and Africa. In addition to Spratt, the first round of signings includes Nigerian artist Siraheem and South African DJ Chelsea Sloan.

The new label has high hopes for Spratt. The Ottawa artist has made a major splash on Instagram and TikTok, with an audience now numbering more than 5.5 million followers between the two platforms. There, she has grabbed attention with covers of songs ranging from R&B to Latin, with her versions of Afrobeats hits like Kizz Daniel’s “Cough (Odo)” and Ckay’s “Love Nwantiti” especially connecting with listeners in Nigeria and earning endorsements from top Nigerian artists.

Spratt is now concentrating on original music, and Hi-Way 89 plans to release her debut EP this summer. “In Too Deep” was produced by Grammy Award winner Daramola (Danny Ocean, Kapo), while the EP will feature such collaborators as Nonso Amadi, Tems’ “Higher” producer Tejiri, and Canadian songwriting team Coleman Hell & La+ch. – Kerry Doole

SGAE, the collective management organization in Spain, took in the most money in its history in 2024, 390 million euros, or $422 million based on the average 2024 Euro-dollar conversion rate, it announced. That’s up 41 million euros ($44.4 million), or 11.7%, from 2023. The organization distributed more than 349 million euros ($377.6 million) to rightsholders, up 6%, its second-highest distribution ever. It also lowered its administration fees, resulting in an increase in distributions of 6.7 million euros ($7.3 million).

Unsurprisingly, the fastest-growing category of revenue was digital, which came in at 60 million euros ($64.9 million), up 25% over 2023. Of that revenue, more than 55% came from streaming, while 43% came from audiovisual content.

Trending on Billboard

The biggest source of revenue was TV and radio, which reached 110 million euros ($119 million) in 2024, up 18.9% over the previous year. Some of that bump comes from private TV companies paying for previous uses of music.

Concert collections also grew, increasing 16.2% to 64.1 million euros ($69.4 million). Much of that money came from live pop music, which brought in 48.7 million euros ($52.7 million), up 7.4%. The biggest shows were performances by Karol G, Bruce Springsteen & the E Street Band, and Metallica.

Foreign revenue reached 35.2 million euros ($38.1 million), up 15.4%. The biggest source of that revenue was Europe, especially France and Italy, followed by Latin America, various Caribbean countries, the U.S., and Canada.

Revenue from private copying, the levies charged by collecting societies on blank memory and associated products, reached 16.2 million euros ($17.5 million). That represents a gain of 57.2% over regular collections in 2023, but a decrease of 38.1% once a special payment from 2023 is included. Mechanical rights revenue also climbed, by 11.8%, thanks to the vinyl boom, to 3.8 million euros ($4.1 million).

MSG Networks, a subsidiary of Sphere Entertainment Co., was able to negotiate a reduction in debt and the fees it pays to MSG Sports to broadcast professional basketball and hockey games, the company announced Friday (April 25).

The regional sports network’s borrowers forgave $514 million of debt. Along with cash contributions by Sphere Entertainment and MSG Networks, the old debt of $804 million was reduced to $210 million. Sphere Entertainment will pay $15 million to the borrowers while MSG Networks will contribute $65 million.

Sphere Entertainment Co. and MSG Sports are part of the entertainment empire owned by the Dolan family. James Dolan is CEO of both companies as well as live events company MSG Entertainment.

Trending on Billboard

All parties have agreed to the term sheet. Per the SEC filing, the consenting stakeholders “have agreed to implement the Transactions by June 27, 2025, which date may be extended or waived in writing by each of the Consenting Stakeholders and MSG Networks.”

The news provided a bounce to Sphere Entertainment’s share price, which has fallen sharply since President Trump announced his global tariff policy on April 2. Shares of Sphere Entertainment jumped 13.2% in early morning trading and had settled to $28.70, up 8.4%, by late morning. Even after the bounce on good news, the share price is down 32.4% year to date.

The fees paid to MSG Sports to broadcast games by the New York Knicks and the New York Rangers dropped by 28% and 18%, respectively. Neither team will receive annual rights fee increases. In return, MSG Networks will issue to MSG Sports penny warrants exercisable for 19.9% of equity interest in MSG Networks.

Sphere Entertainment Group and its subsidiaries will not be obligated to fund the borrowings of MSG Networks’ new term loan or pledge its assets as security.

The company and its borrowers had agreed to numerous forbearance agreements leading up to the agreement announced Friday. MSG Networks first announced in October it was attempting to refinance its term loan and had entered into a forbearance with its lenders. The latest forbearance period ended Thursday (April 24).

According to a report at the New York Post, the renegotiated debt paves the way for a merger of MSG Sports and the YES Network, the regional sports network that airs the games of the New York Yankees and Brooklyn Nets.

It’s time to tighten our belts for another Executive Turntable, Billboard’s weekly compendium of promotions, hirings, exits and firings — and all things in between — across the music business. There’s been a gob of staffing news this week, so let’s hop to it.

Dawn Gates, senior vp of digital business and creative development at Universal Music Group Nashville (UMGN), announced her departure after nearly 20 years to launch Seven Note Enterprises, a consulting and management firm. Her exit coincides with UMGN’s rebranding as MCA under new leadership by CEO Mike Harris and chief creative officer Dave Cobb, who came aboard in early February following the departure of Cindy Mabe. During her tenure with UMG Nashville, Gates most recently served as the core liaison for global digital businesses, integration strategies and marketing initiatives. Gates initiated the launch of and oversaw Sing Me Back Home Productions, a production arm of UMG Nashville, established in 2024. Gates, who recently welcomed twins with her wife, Harper Grae, expressed gratitude for her time at UMGN and excitement for her new venture.

“After 19 transformative years with Universal Music Group, I’m stepping away to write the next chapters of my career,” said Gates, who can be reached at dawn@seven-note.com. “I’m deeply grateful to UMG – especially Mike Dungan and Cindy Mabe – for the belief in my vision and the support in taking bold, often unconventional, risks. I’ve had the privilege of working alongside some of the most innovative and driven minds in music. However, the industry continues to shift and the way we develop artists, build stories, and connect with audiences is changing – and so am I.”

Trending on Billboard

Meanwhile…

Universal Music UK appointed Rachel Tregenza and Charlotte Allan to lead its communications and policy team, reporting to svp of communications and policy Tom Williams. Tregenza, a Universal Music Group veteran of over a decade, steps into the role of senior director of communications and global artist strategy. She will focus on international storytelling for UMUK artists and collaborate with the audience and media division. Allan joins as vp of global communications and public policy from Milltown Partners, where she advised clients across creative and tech sectors. Her responsibilities will include corporate communications and UK policy initiatives. Williams, who has led global communications campaigns for UMG, will now oversee all communications and public policy efforts for Universal Music UK. Jonathan Badyal, who has spent eight years at UMUK, most recently as director of communications, will depart this summer for a new opportunity. UMUK president Dickon Stainer praised Tregenza and Allan for bringing a dynamic perspective and thanked Badyal for his contributions. “With Tom’s guidance, they have a fresh and ambitious perspective both for our communications and storytelling in the UK, as well as the international storylines of our UK artists overseas,” said Stainer.

iHeartMedia appointed David Hillman as executive vice president, chief legal officer and secretary. Hillman, who is based in Los Angeles, will oversee all legal matters, including compliance, regulatory, corporate governance, government and business affairs, and privacy teams. He brings extensive media experience, having recently served as chief legal officer at Venu Sports, a joint venture between ESPN, FOX, and Warner Bros. Discovery. Hillman also held roles at Paramount Global, Simon & Schuster and Westwood One. Bob Pittman, iHeartMedia’s chairman and CEO, praised Hillman’s relevant experience and “familiarity with the audio industry.” Hillman added: “I look forward to working with iHeart’s leadership, partners, and the talented Legal team to help advance the company across every corner of the audio landscape.”

Virgin Music Group promoted Hannah Thompson-Waitt to senior vice president of commercial strategy. In her new role, she’ll lead the U.S. commercial team from the company’s Los Angeles headquarters, focusing on streaming strategy, analysis and fan acquisition across a wide swath of artists. Thompson-Waitt, who reports to Zack Gershen, evp of global commercial and digital strategy, previously served as vp of commercial strategy and held senior roles at mtheory, with a career that began in 2014 when she launched her own K-pop media company. Her experience includes work with Clairo, St. Vincent and others. She also sits on the advisory board of Queer Capita and holds degrees from the University of Texas and NYU.

Michael Beckerman has been named the next dean of The UCLA Herb Alpert School of Music, beginning no later than Oct. 1 of this year. A leading musicologist known for his work in Czech and Eastern European music, Beckerman has held academic positions at NYU, UC Santa Barbara and Washington University in St. Louis, and has authored seven books and received prestigious honors such as the Dvořák and Janáček Medals. Beckerman holds degrees from Hofstra and Columbia, and serves on various academic boards. UCLA executive vice chancellor and provost Darnell Hunt lauded Beckerman’s credentials, saying his “academic, professional and administrative experience and achievements, coupled with his UC roots, position him well to lead The UCLA Herb Alpert School of Music at this pivotal moment.” Beckerman, in turn, emphasized his passion for music and dedication to supporting students and expanding the school’s reach locally and internationally. The UCLA Herb Alpert School of Music combines performance, scholarship and music industry training in its program.

Messina Touring Group made a round of promotions. The company has elevated Nick Ayoub to head of digital strategy and operations, to lead MTG’s overall digital operations. Ayoub also leads digital strategy for record-breaking stadium tours, including those by Taylor Swift, Ed Sheeran and more. Kara Smoak rises to director of digital marketing and continuing to lead digital marketing and creative strategy for all MTG country artists, including George Strait, Kenny Chesney, Eric Church, Blake Shelton and more. Meesha Kosciolek has been promoted to director of production, MTG Nashville, while Alvin Abshire has risen to digital operations manager. Lucy Freeman has been promoted to digital marketing manager, and Madison Machen has been elevated to manager, partnerships and branding. –Jessica Nicholson

Black River Entertainment named LeAnn Bennett as vice president of label services. In her new role, Bennett will oversee business affairs, A&R administration and sync licensing, reporting to EVP Rick Froio. A longtime consultant for Black River, she officially joins the team with over 30 years of industry experience, including past roles at Capitol Records Nashville, Compass Records and the Country Music Hall of Fame. Since 2010, she has also led Bennett Entertainment Group. Froio praised the move, calling it “a natural fit,” while Bennett called the BRE “the best in the business.”

NASHVILLE NOTES: Curb Records elevated Allyson Gelnett (Massey) to national director of promotion & strategic initiatives, up from her previous role as director of promotion. Since joining the label in 2018, Gelnett has played a key role in developing artist campaigns and driving success across country radio. In her expanded role, she’ll work alongside svp of promotion RJ Meacham to craft and implement strategies aimed at growing fanbases and boosting airplay in top markets … Warner Music Nashville promoted two members of its commercial partnerships team: Katherine Firsching shifted to partnerships director from manager of video strategy, and Blair Poirier stepped up to division manager from coordinator.

Darkroom Records named Nina Lee as head of communications and publicity. Based in New York, Lee will lead the label’s communication strategies and publicity campaigns, collaborating closely with CEO Justin Lubliner and the Darkroom team. With over ten years of experience in music, tech and entertainment PR, Lee will manage publicity for artists including d4vd, John Summit, and Wisp. Meanwhile, Alexandra Baker of High Rise PR continues to oversee campaigns for Billie Eilish and FINNEAS. Previously, Lee held senior roles at Shore Fire Media and The Oriel Company. A first-gen Korean American and NYU alum, she is a strong advocate for equity in entertainment and mentors through the Next Gem Femme program. Lubliner praised Lee’s creative approach and deep understanding of artist development, noting “she understands the importance of narrative and works closely with artists to help them best tell their stories.”

Ikenna Nwagboso and Camillo Doregos launched Hi-Way 89 Entertainment, a new music company based between Toronto and Calgary, with distribution through Vydia/gamma. The company focuses on artist development and label services, highlighting talent from Canada and Africa. Their first major signing is Canadian pop/R&B singer Chrissy Spratt, whose debut single “In Too Deep” releases on April 25. Nwagboso, co-founder of emPawa Africa, has launched careers for artists like Joeboy and Fave. Doregos, founder of DC Talent Agency, has worked with artists like Pheelz and booked talent for major festivals. Both hail from Nigeria, and Hi-Way 89 has also signed Nigerian artist Siraheem and South African DJ Chelsea Sloan, aiming to bridge African and Canadian music markets.

BOARD SHORTS: The MLC put out an APB seeking candidates for its board of directors and several key committees. Several terms for publisher reps are expiring this year, with elections for open seats taking place soon. Selected members will serve three-year terms, with the possibility of renewal. Current openings include one publisher seat on the Dispute Resolution Committee, two on the Operations Advisory Committee, and two on the Unclaimed Royalties Oversight Committee. These groups provide policy and procedural recommendations to the board. Suggestions are due by May 22 and can be submitted via this form … AEG Presents executive Brent Fedrizzi was elected to his second non-consecutive term as board president of the North American Concert Promoters Association, following the trade group’s annual meeting April 15 at the Beverly Wilshire in Los Angeles. (His initial term ended in 2022, with Jodi Goodman succeeding him.) NACPA also elected 2025 board members, including Anthony Nicolaidis (Live Nation), Chuck Steedman (The Live Co.), Jodi Goodman (Live Nation) and John Valentino (AEG).

Shelby Paul launched boutique public relations firm Evolvance PR, specializing in strategic communications, media relations, story development and more. Paul previously worked as director of communications at Big Machine Label Group, leading media strategy for the label and its publishing arm Big Machine Music. At BMLG, she worked with artists including Carly Pearce, Conner Smith, Thomas Rhett, Lady A, Rascal Flatts, songwriters Jessie Jo Dillon and Laura Veltz, and more. Paul’s prior stops include the Academy of Country Music, Detroit Pistons and Allied Global Marketing. –J.N.

Trent Allison has been promoted to senior director of sales and special events for AEG Presents‘ venues in Georgia and Tennessee. Based in Nashville, he will oversee certain events at The Pinnacle, AEG’s new flagship venue, while continuing his leadership at The Eastern, Terminal West, Variety Playhouse and Georgia Theater. Reporting to regional vp Mike DuCharme, Allison brings over 25 years of sales experience and a strong track record in revenue growth. Margarita Rios will become director of sales in Georgia, and Dell Ressl will be promoted to sales and operations manager, both reporting to Allison. Allison has been key to AEG’s venue expansion in Georgia since 2013.

Discord appointed Humam Sakhnini as chief executive officer, effective April 28. He will also join the board of directors. Co-founder Jason Citron will transition to an advisor role while remaining on the board, and Stanislav Vishnevskiy continues as chief technology officer. Sakhnini, with over 15 years of gaming industry experience, previously held leadership roles at Activision Blizzard and King Digital Entertainment. His appointment aligns with Discord’s renewed focus on gaming, including expansions into advertising, micro-transactions, and developer tools. Discord serves over 200 million monthly active users, who spend 2 billion hours gaming each month, and has seen strong revenue growth.

ALL IN THE FAMILY: Tim Chan is promoted to vp of e-commerce at PMC. In his new role, he will lead editorial strategy and performance across PMC’s e-commerce initiatives, collaborating with editorial, sales, and revenue teams to meet commerce goals. Chan will oversee shopping, hospitality and consumer tech content for PMC’s fashion and entertainment brands, including Billboard, and spearhead projects to grow revenue and audience reach. Chan joined PMC in 2016 as the founding editor of Spy.com and later became lifestyle editor at Rolling Stone. He has also worked at Snapchat, founded the independent fashion magazine Corduroy, and began his career in Canada as a producer for E! Network and MuchMusic. Craig Perreault, PMC’s chief strategy officer, praised Chan’s talent and creativity since joining the company nearly a decade ago: “He brings his deep talent, creativity and natural business instincts to everything he does and is responsible for significantly growing our e-commerce programs across the portfolio.”

ICYMI:

Nicole George-Middleton

Universal Music Group Nashville is rebranding as MCA under CEO Mike Harris and chief creative officer Dave Cobb. Staffing changes include Katie McCartney as executive vp and general manager and Tom LaScola as head of artist and audience strategy, reflecting the new direction … Atlantic veteran Gina Tucci launched a new independent dance label, 146 Records … Nicole George-Middleton was elevated to evp and head of creative membership at ASCAP. [Keep Reading]

Last Week’s Turntable: Island Elevates Its Head of Analytics

Northern Irish hip-hop trio Kneecap have split with their booking agent IAG (Independent Artist Group) following the controversy caused by their recent Coachella performances.

The news was confirmed by an IAG representative to The Hollywood Reporter. The report states that the Belfast group and IAG, which includes Metallica, Billy Joel and 50 Cent on its roster, split between Coachella’s first and second weekends. A spokesperson for Kneecap told Billboard U.K. that they would not be commenting on the split.

During the first weekend, the group claimed that the YouTube stream of their live performance had been cut following anti-Margaret Thatcher and pro-Palestine chants by the group and crowd. Thatcher was the U.K. prime minister between 1979 and 1990, and played a pivotal role during the violent Troubles in Northern Ireland during that span; she died in 2013, aged 87. The group have long expressed support for a united Ireland, and frequently spoken out on the war on Gaza at their shows and in interviews.

Trending on Billboard

During the band’s second set at Coachella, a projected message stated: “Israel is committing genocide against the Palestinian people. It is being enabled by the U.S. government who arm and fund Israel despite their war crimes. F–k Israel; free Palestine.” The set was not livestreamed on YouTube, but images from the onstage projections were widely shared on social media.

Since the band’s set, they have faced a wave of criticism from industry figures. Sharon Osbourne, wife and manager of husband Ozzy, called for their U.S. work visas to be revoked, saying that “At a time when the world is experiencing significant unrest, music should serve as an escape, not a stage for political discourse.” She also criticised Goldenvoice, Coachella’s organiser alongside AEG, for allowing the band to be booked. A previous report in The Hollywood Reporter said that Goldenvoice was “blindsided” by the messaging.

On Wednesday, London’s Metropolitan Police confirmed they were assessing a video taken of a band member appearing to say “up Hamas, up Hezbollah” at a headline performance in the capital in November. The two militant groups have been ascribed “terrorist group” status by the U.K. Government and expressing support for either is forbidden under the Terrorism Act 2000.

Following the fallout, the group have shared a number of messages on social media from Palestinians thanking them for speaking out. Kneecap member Mo Chara responded to the criticism on Wednesday, telling Rolling Stone that their message is “about [the Israeli government’s] government’s sickening actions, not ordinary people.”

Kneecap released their second studio album Fine Art in June 2024 on Heavenly Recordings. Their 2024 music biopic Kneecap, starring Michael Fassbender, was nominated for two Academy Awards, and in February director Rich Peppiat won a prize for his work on the film at the BAFTAs (British Academy Film Awards). The group will play a number of shows in Europe this summer including at Primavera Sound in Barcelona, Spain and Glastonbury Festival in England. They will return to North American for a headline tour in October.

The European Commission said on Friday it will investigate Universal Music Group’s planned acquisition of Downtown Music Holdings, according to a statement.

The investigation will determine whether “the transaction threatens to significantly affect competition in certain markets of the music value chain, where both companies are active, in Austria and in the Netherlands,” which requested the probe, according to an announcement by the EC. UMG is legally registered in the Netherlands and its stock trades on the Euronext Amsterdam.

A UMG spokesperson said a statement that the company looks “forward to continuing to co-operate with the European Commission in the weeks ahead. We are confident that we will close this acquisition in the second half of the year, on its original timeline.”

Trending on Billboard

UMG, the world’s largest music company, announced plans late last year to acquire Downtown for $775 million. The deal would significantly expand UMG’s presence in the market catering to do-it-yourself artists, songwriters and indie labels.

New York-based Downtown is the owner of the direct-to-creator distributor CD Baby, and the direct-to-business technology and distribution platform FUGA, the administration business SongTrust, and royalty and financial services companies, including Curve.

The fast-growing sector of the music business serving artists and companies that want to maintain greater control of their works has seen a flurry of investment and acquisitions in recent years.

In addition to its bid for Downtown, UMG acquired a controlling stake in the indie label group [PIAS], an expansion of its 2022 investment in the London-based business.

IMPALA, the European association of independent music companies, which has been critical of UMG’s prior acquisitions, said it welcomed the EC’s investigation and hopes regulators will stop “UMG’s juggernaut strategy.”

“The acquisition would further entrench UMG’s position across European music markets, squeezing out competition, narrowing opportunities for independents and the artists they work with and allowing UMG to exercise more control over streaming services,” IMPALA said in a statement.

In a research note published this week, analysts at J.P. Morgan agreed the deal would increase UMG and Virgin Music’s reach, and said it would enhance UMG’s “support of independent music entrepreneurs … [and] double Downtown’s [earnings before interest, taxes, depreciation, and amortization] over 2-3 years.”

UMG’s deal must receive regulatory approval to proceed, and the European Commission said it has asked UMG to officially report the deal.

Jeremy Tucker of Raven Music Partners is content to operate in areas of the music business that attract relatively little attention. “I am certainly not going to pretend that I’m the coolest person at cocktail parties,” Tucker says, “and I’ve never signed any famous bands as a former A&R rep.”

As co-founder and managing member of the Nashville-based investment firm, Tucker isn’t focused on acquiring what he calls “trophy” catalogs — the Taylor Swifts, Bruce Springsteen and Queens of the world. Nor is he creating biopic films made for the artists in his catalog. Instead, he’s wringing out value from acquired music catalogs and trying to provide his investors a good, risk-adjusted return.

While interest in music rights from financial buyers has exploded in the last five years, Raven Music Partners launched in 2015 and has built a 15,000-song portfolio of assets including recorded music, music publishing and derivative rights such as producers’ royalties. Tucker and his team focus on the small- to medium-sized part of the market with deal sizes typically ranging from $5 million to $35 million but going up to $100 million.

Trending on Billboard

The world of music catalog investors can be broken into two camps: strategic buyers and financial buyers. Large music companies like Universal Music Group are called strategic buyers because they have a large infrastructure and creative talent to generate additional value from catalogs. These multi-faceted companies will pursue everything from movies to box sets to artist-branded jukeboxes in order to generate licensing income from their catalogs.

Raven Music Partners is a financial buyer, the kind of investor that treats music royalties as financial instruments similar to stocks, exchange-traded funds, mutual funds and debt. Financial buyers seek out catalogs with predictable cash flows and opportunities to generate a better return. Strategic buyers often pay a premium to control 100% of the rights; financial buyers are more willing to have fractional ownership of a recording or composition.

“What we’re focused on is the boring part of the business,” says Tucker, a former managing partner at Merrill Lynch who specialized in alternative asset classes.

Administration fees lack pizazz but are a good example of how a financial buyer can improve the returns on its investments. After an acquisition, Raven Music Partners will consolidate the rights under its rights management partner, Endurance Music Group, to cut out as many of the middleman fees as possible. Tucker says it’s not uncommon to see administration or distribution fees on acquired catalogs around 15% to 25%, and he’s seen catalogs with fees as high as 40%. Reducing fees isn’t the sexiest of accomplishments, but it increases the catalog’s net cash flows. “Saving 10% in collection fees can be pretty meaningful in terms of value-add,” he says.

There are also creative options for finding return on its catalog investments: re-releasing the masters in high-fidelity audio and Dolby Atmos, anniversary editions of albums or songs, and YouTube lyric videos, for example. Sometimes, says Tucker, there’s value in something as simple as a YouTube fan page or making sure all an artist’s tracks are available on the platform. “There are plenty of bands out there that might have several million repeat followers on Spotify or one of these other DSPs, but maybe they’re not that focused on all of the different media.”

Tucker says the Raven catalog has “a good amount” of rock, country, pop and Christian music, with some hip-hop and Latin. “From a genre standpoint, we are agnostic, and we think that all of these genres have value,” he says. “What’s important is that they have a fan base that cares.” The catalog includes well- known tracks by major artists, such as “Whiskey Glasses” by Morgan Wallen, “All About That Bass” by Meghan Trainor, and “Say You Won’t Let Go” by James Arthur.

There’s a lot more music for financial buyers like Raven Music Partners to acquire. Tucker puts a rough estimate of $500 billion on the total addressable market for recorded music and publishing assets. The majors probably own close to half of that number, he says, while financial buyers like Raven Music Partners probably own “less than $20 billion.” That leaves much of the market potentially for sale. And with more artists retaining ownership of their rights, Tucker believes there will continue to be investment opportunities.

“We don’t think that it’s gotten to the point where people can’t compete in this market. Some of the more iconic catalogs are, of course, going to have everyone in the space interested in owning them. But for us, because we focus on a small- to medium-sized part of the market where things are a little more fragmented, we just don’t see that much repeat competition from the same people.”

In March, Raven Music Partners formed a joint venture with Aquarian Holdings, an asset manager with nearly $22 billion of assets under management, to invest in music rights. Raven’s ability to unlock value from catalogs through “active management and creative monetization strategies” aligns with Aquarian’s belief that music can be “both culturally significant and financially compelling,” says Rudy Sahay, founder and managing partner of Aquarian Holdings.

“At Aquarian, we’re focused on backing high-quality, enduring assets — and few assets are as enduring as great music,” says Sahay. “We see real value in partnering with Raven Music Partners, whose investment strategy is rooted in both discipline and deep industry connectivity.”

State Champ Radio

State Champ Radio