Business News

Page: 12

Tencent Music Entertainment, China’s fast-growing streaming platform, announced on Tuesday (June 10) it plans to acquire Ximalaya, a Shanghai-based service for streaming podcasts and audiobooks. Under a merger agreement signed today, Ximalaya will become a wholly owned subsidiary of TME, subject to regulatory approvals and closing conditions. According to filings with the SEC and the […]

Billy Jones, a longtime figure in New York’s live music scene, has died at age 45. A statement provided to multiple outlets by a spokesman for the club says Jones died on Saturday morning (June 7) due to “a highly aggressive case of glioblastoma,” a form of brain cancer. Jones was the co-founder/owner of Brooklyn’s […]

Music rights and media investment company HarbourView Equity Partners raised $500 million through the sale of a private asset-backed securitization (ABS), backed by royalties generated from its music catalog, to insurance vehicles managed by global investment firm KKR, HarbourView announced on Monday (June 9). The news comes a little more than a year after HarbourView […]

Exceleration Music has announced an agreement to acquire Cooking Vinyl, a key independent music company in the U.K. market (Jun. 9).

The move is the latest by Exceleration, lead by former Concorde CEO Glen Barros alongside influential executives John Burk, Amy Dietz, Charles Caldas and Dave Hansen, to consolidate its standing in the independent music space, offering distribution, investment and label support services.

In 2023, Exceleration also acquired distribution company Redeye Worldwide, joining existing labels such as +1 Records, Alligator, Azadi, Bloodshot, Candid, Kill Rock Stars, Mom+Pop, Redeye Worldwide, SideOneDummy, The Ray Charles Foundation/Tangerine Records and Yep Roc Records in Exceleration’s portfolio.

Cooking Vinyl originated in 1993 with its signing of folk troubadour and activist Billy Bragg, and over its 32-year history, has worked with acts such as Shed Seven, Suzanne Vega, Passenger, The Prodigy, The Cranberries, The Darkness, Deacon Blue, 47 Soul, Roger Waters and The Jesus and Mary Chain.

Trending on Billboard

In 2024, Cooking Vinyl enjoyed a pair of No. 1 albums with two separate LPs by Shed Seven hitting the top spot on the U.K.’s Official Albums Chart: January’s A Matter of Time and September’s Liquid Gold. In February 2025, The Darkness hit No. 2 with Dreams on Toast.

A press release adds that Cooking Vinyl will operate independently and continue to be led by managing director Rob Collins, with founder Martin Goldschmidt remaining in his position as chairman. Cooking Vinyl Publishing UK, Cooking Vinyl Publishing Australia and Motus Music, the statement continues, are not included within the acquisition.

“At Cooking Vinyl, we’ve worked tirelessly to help our artists achieve both artistic and commercial success — without ever compromising their uniqueness or creative control. This deal enhances that mission,” says Collins in a statement.

“Our artists will still benefit from our close-knit, highly personalised team that combines deep industry expertise with old-fashioned hard graft. But now, with the expanded U.S. capabilities, enhanced resources, and the broader global reach of the Exceleration structure, we’re able to offer even stronger support to our current and future roster. I look forward to working with their team to spearhead this next phase for Cooking Vinyl!”

As the SXSW festival made its London debut this week, a group of top music industry leaders convened for an intimate dinner hosted by Luminate — the data and insights company that powers the Billboard charts — and Music Business Worldwide. The mix of music company CEOs and entrepreneurs — many of whom had just […]

Spotify’s share price surpassed $700 for the first time this week and reached a new all-time high of $717.87 on Thursday (June 5). The Swedish-based, New York-listed company ended the week up 6.9% to $712.26.

Through Friday (June 6), Spotify’s share price has increased 52.6% year to date, and its market capitalization has gained $54 billion to $145.8 billion. In an up-and-down year for most stocks, Spotify has rewarded investors with consistent subscriber growth and improved margins resulting from layoffs in 2023. The company finished the first quarter with 268 million subscribers, up 12% year over year, and total revenue of $4.54 billion was up 15%.

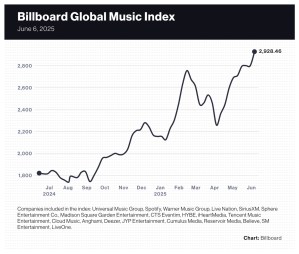

Spotify wasn’t the biggest gainer of the week, but its immense size was a major factor behind the 4.6% gain by the 20-company Billboard Global Music Index (BGMI) for the week ended June 6. The BGMI has gone nine consecutive weeks without a decline after a two-week decline in late March and early April. Behind 14 gainers and only six losers, the index reached a new high of 2,928.46 and brought its year-to-date gain to 37.8%.

Trending on Billboard

Markets finished the week strong after a U.S. jobs report on Friday showed that unemployment remained steady amidst the uncertainty caused by U.S. trade policy. The Nasdaq composite was up 2.2% while the S&P 500 rose 1.5%. South Korea’s KOSPI composite index gained 4.2%. China’s SSE Composite Index improved 1.1% and the U.K.’s FTSE 100 gained 0.7%.

Music streaming stocks performed especially well this week. LiveOne was the biggest gainer after rising 16.2% to $0.86. Tencent Music Entertainment jumped 6.8% to $17.96 and is trading at its highest mark since 2021. Netease Cloud Music rose 3.6% to 218.80 HKD ($27.88). Deezer and Anghami were exceptions, falling 1.5% and 5.3%, respectively.

Live Nation was the best-performing live music stock after gaining 5.0% to $144.15. Bernstein initiated coverage of Live Nation this week with an “outperform” rating and a $185 price target. MSG Entertainment rose 1.8% to $37.77, and CTS Eventim was up 0.5% to 107.20 euros ($122.26). Sphere Entertainment Co. fell 0.3% to $37.67, bringing its year-to-date loss to 11.3%.

iHeartMedia gained 14.5% to $1.50. The stock rose 10% on Thursday as the company announced the appointment of deputy CFO Michael McGuinness as iHeartMedia’s principal accounting officer. Previous principal accounting officer Scott Hamilton transitioned to a consultant role for the company.

Believe rose 11.6% to 17.08 euros ($19.48) after the company increased its bid to buy out remaining shareholders to 17.20 euros ($19.62), a 12.4% increase from the original bid of 15.30 euros ($17.45). The consortium that took the Paris-based company private in 2024 currently owns 96.7% of share capital.

The two standalone major music companies had mixed results. Warner Music Group rose 0.2% to $26.37, bringing its year-to-date decline to 15.0%. Universal Music Group fell 2.8% to 27.36 euros ($31.20), lowering its year-to-date gain to 14.4%.

K-pop stocks posted gains across the board. HYBE rose 7.0%, erasing the previous week’s 6.8% decline. YG Entertainment was up 7.9%. SM Entertainment rose 4.8% and JYP Entertainment improved 4.0%.

Reservoir Media fell 6.4% to $7.30, increasing its year-to-date loss to 13.7%. On Friday (June 6), B Riley lowered its price target for Reservoir Media to $11.50 from $12.50 and maintained its “buy” rating.

Billboard

Billboard

Billboard

The Billboard Canada Screen Composers of the Year Award has its inaugural shortlist.

The award, presented by SOCAN, is shining a light on five talented composers who have made a global impact, scoring some of the most powerful moments in film and television.

Together, these musicians are responsible for the sounds behind some of the most talked about television and cinema of the past year, from The White Lotus to Palm Royale, massive IMAX documentaries to video games to major broadcasts of one of Canada’s national pastimes: hockey.

The winner will be announced at Billboard Canada Power Players on June 11, giving these pivotal artists – often positioned behind the scenes – a position onstage alongside the most powerful executives in Canadian music.

The shortlisters include:

Trending on Billboard

Cristobal Tapia de Veer – A three-time Emmy and BAFTA-winning composer who’s known for work on critically acclaimed series like HBO’s The White Lotus, C4’s Utopia, Black Mirror, and No. 1 box office surprise hit Smile.

Andrew Lockington – Hybrid composer for sci-fi film Atlas, Mayor Of Kingstown, Lioness and Landman. An avid Maple Leafs fan, he also composed the theme for Amazon Prime Monday Night Hockey NHL broadcast series.

Michelle Osis – Four-time Canadian Screen Award nominee Michelle Osis is best known for her score to the gigantic screen documentary TRex in IMAX, as well as for her collaborations with composer Mark Korven on Netflix’s Don’t Move and the MGM+ series Billy the Kid. With partner Terry Benn, she’s composed for Carved for Disney+ and the festival favourites film Dark Match and Sway.

Mark Korven – Award-winning composer Mark Korven is best known for his scores to the A24 features The Witch and The Lighthouse, and for the over 10 million YouTube views of him performing on his invention, the Apprehension Engine. The last two years have seen him working The Black Phone, The First Omen and Until Dawn for Sony Playstation.

Jeff Toyne – Toyne’s score to Apple TV+’s Palm Royale (Kristen Wiig, Laura Dern, Carol Burnett) combines jazz, Latin and orchestral elements to evoke the 1960s and has won multiple Emmys and Canadian Screen Music Awards, among others.

Read more about all the nominees here.

deadmau5 & REZZ, Khalid Star on the Cover of Billboard Canada

Billboard is bringing the Billboard Summit to Canada next Wednesday (June 11) at Toronto’s NXNE, and one of the standout panels is a conversation between deadmau5 and REZZ. This week, the pair appeared on the cover of Billboard Canada to unpack their creative process in a rare joint interview.

“We produce in two totally different ways,” says Joel Zimmerman, the man behind deadmau5. “I am so old school and she is so new school.”

Both artists hail from Niagara Falls, Ontario, and both are known for their innovative production, DIY ethos and big-stage spectacle. They’re both big thinkers and big presences, instantly recognizable for their larger-than-life visual trademarks – deadmau5 with his signature LED mau5head helmet and REZZ with her hypnotic spinning light glasses – and they both have dedicated cult fanbases.

REZZ – born Isabelle Rezazadeh – cites deadmau5 as an immeasurable influence.

“He essentially birthed me as a producer,” she says. “He birthed my entire interest in making music.”

In 2021, deadmau5 and REZZ officially joined forces with their first on-record collaboration, “Hypnocurrency.” It’s dark, spellbinding and meticulously layered – a slow-burning cinematic journey that lands squarely between their two sonic worlds. To create it, they both had to step outside their comfort zones.

When asked what he learned from working with REZZ, deadmau5 doesn’t miss a beat.

“I learned that there are BPMs that actually do exist below 128,” he deadpans. “I didn’t know that all you had to do was click on the number and drag it down.”

The two give unprecedented access into how they create, including a tease of another upcoming track as REZZMAU5.

Read the full story here and get your tickets to Billboard Summit here.

Khalid will headline Billboard Canada The Stage at NXNE the following day, on June 12. He also joined Billboard for a cover story for Billboard Canada and Billboard that dropped today.

The R&B and pop artist talks about his ‘flirty side,’ gay identity and the myth that he’s an introvert. “My new era of music feels like I’m finally ready to be the artist I’ve always dreamt of being,” he says. “It goes back to the regressions of when I was a child — imagining myself and thinking, ‘I want to be this artist one day.’ Now I feel like I have the confidence to finally be that artist.”

Read the full story here.

The Academy of Country Music held a round of layoffs on Thursday (June 5), with approximately one-quarter of the staff impacted, Billboard has learned.

“Coming off a successful 60th ACM Awards week and renewal with Prime Video through 2028, the Academy implemented a strategic staff realignment in an effort to support its future business and growth initiatives, resulting in the elimination of five staff positions across various departments including communications, marketing, events and community relations,” the ACM told Billboard in a statement. “We thank these individuals for their dedication and contributions to the work of the Academy.”

ACM staffers who were laid off include Alexis Bingham (coordinator, events), Lexi Cothran (senior manager, communications and strategic initiatives), Jesse Knutson (director, publicity and media relations), and Brittany Uhniat (manager, creative and content production).

Trending on Billboard

Prior to joining the ACM, Knutson joined the ACM in 2022 and previously worked in television news, including time at Nashville’s NewsChannel 5 (WTVF). Bingham served as an intern at the ACM before joining the staff full-time in 2021. Cothran joined the ACM in 2024, and previously worked for PR companies including Shore Fire Media and Sweet Talk PR. Prior to joining the ACM, Uhniat served as creative coordinator at Resin8 Music.

Nearly a month ago, on May 8, the Academy of Country Music celebrated the milestone 60th annual ACM Awards, which aired on Prime Video from the Ford Center at the Star in Frisco, Texas. Ella Langley, Lainey Wilson and Alan Jackson were among the night’s biggest winners, with Wilson taking home her second ACM entertainer of the year trophy. Meanwhile, Langley won five trophies and Jackson was feted with the inaugural ACM lifetime achievement award. The 60th anniversary ACM Awards was hosted by Reba McEntire.

Meanwhile, the ACM also recently announced that the organization and ACM Awards producer Dick Clark Productions (DCP) had cemented a deal with Prime Video for the ACM Awards to continue on Prime Video for the next three years, running through the 63rd annual ACM Awards ceremony in 2028.

No billionaires bickering here — just your regularly scheduled edition of Executive Turntable, Billboard‘s weekly roundup of promotions, hires, exits and everything in between across the music industry. Let’s get to it…

Veteran touring executive Leslie Cohea will join WME’s Nashville office in mid-July as a partner and music touring executive. She comes to the agency after 10 years at Sandbox Entertainment, where she served as global head of touring and played a key role in guiding the careers of artists including Kacey Musgraves, Dan + Shay, Kelsea Ballerini, Midland and Little Big Town. Before playing in the Sandbox, Cohea spent nearly a decade at AEG Live/The Messina Group, focusing on touring and concert promo and producing national tours for biggies like Ed Sheeran, Dave Matthews and Eagles. Named a Billboard executive of the week in 2023, Cohea will report to WME co-heads Becky Gardenhire, Joey Lee and Jay Williams.

Trending on Billboard

iHeartMedia announced that Scott Hamilton shifted from his role as principal accounting officer to a consulting position, effective June 2. Subsequently, Michael McGuinness, the deputy CFO since 2019, was appointed as the new accounting chief. Hamilton has served in senior accounting roles at iHeartMedia since 2010 and previously held leadership positions at Avaya and PwC. McGuinness joined iHeartMedia in 2019 and brings prior experience from The Hain Celestial Group and Monster Worldwide. In its SEC filing regarding the change, iHeart emphasized that Hamilton’s transition is not due to any dispute with the company, including issues related to accounting practices or financial reporting.

Big Loud Records appointed Lauren “LT” Thomas as senior vp of radio promotion. Thomas joins Big Loud’s fellow svp of radio promo Tyler Waugh, with both execs reporting to evp of radio promotion Stacy Blythe. Thomas previously served as svp of promotion at Sony Music Nashville, where she led promotion efforts for RCA Nashville and Columbia. Prior to her role at Sony, Thomas worked for five years at Phoenix country music station KMLE-FM. –Jessica Nicholson

Melanie Johnson is PPL’s first-ever director of transformation, a role created to lead a company-wide innovation initiative aimed at expanding PPL into the global leader in neighbouring rights royalty collections. Reporting to CEO Peter Leathem, Johnson will leverage her extensive experience across publishing, labels, DSPs and tech — including roles at Audoo, Utopia Music, Facebook and Sony/EMI — to enhance royalty distribution through amped-up technology and data systems. Her appointment comes as PPL reports over $375 million in collections for 2024. Johnson also serves as vice chair of Music Minds Matter and has been a trustee for the Ivors Academy Trust. Leathem said Johnson’s “commercial thinking, paired with deep industry knowledge” will be a great asset to the UK collective management organization.

Oak View Group welcomed Donna Freislinger Huffman as svp of global procurement. Reporting to CFO Ade Patton and president of premium experiences Josh Pell, Huffman will lead initiatives to streamline procurement, boost cost efficiency across OVG’s global footprint. Her responsibilities also include advancing supplier diversity and sustainability. Huffman brings over 20 years of experience from roles at United Airlines, Vanderbilt University and Hillrom, with a “track record for transforming sourcing organizations and driving enterprise-wide value,” said Patton.

Riser House Entertainment expanded its team with three key hires at the Nashville-based label and publisher. Alex Heimerman joins as vp of streaming and strategic partnerships, bringing experience from UMG Nashville, Red Light Management and The Trenches. Hayley Irvine becomes product manager, overseeing project execution after roles at BMG/Broken Bow Records. Eliza Charette steps in as project and label relations coordinator, supporting artist campaigns and operations, with priors at Madison Square Garden and Big Loud. All three report to Riser House president Jennifer Johnson and label manager Megan Schultz. “At Riser House, we don’t just chase trends — we build legacies,” said Johnson. “As our roster grows with some of the most authentic artists in music, it’s only fitting that our team grows too.”

NASHVILLE NOTES: Marketing agency Results Global launched a new four-person digital and social media division, led by Katrina Maddox, formerly head of digital at The HQ. Joining her are Lindsey Parrish, previously a marketing manager at MV2, and Tess Schoonhoven, who served as social media manager at Venture Music. Rounding out the team is Conner McEuen, appointed as paid media manager after his role as a paid social strategist at Zero Gravity Marketing … Bobbii Jacobs launched Wildflower Entertainment Group, a multifaceted company specializing in artist management, development, brand partnerships and talent booking. Alongside it, she introduced a sister venture, Backstage Access Presents, which focuses on curating VIP fan experiences. Jacobs brings extensive experience to the new ventures, having most recently served as partner and president at Forefront Networks.

IMAGINE, a Berlin-based creative studio specializing in music-driven storytelling, opened a new office in Paris as part of its European expansion. Marie Gleiss has been appointed head of expansion, and Maxence Janvrin joins as business development manager, both bringing deep ties to the City of Lights’s cultural scene. The duo will help advance IMAGINE’s mission of building brand connections through music-first strategies. Co-founder Shai Caleb Hirschson emphasized that music has the ability to foster brand recall and drive more than just clicks. “We’re not here to slap a jingle on a logo,” he said. “We create sound-first strategies that move people, inspire loyalty, and generate long-term brand value.”

Betsie Becker is officially the executive director of Berklee NYC, following her interim leadership since September 2023. Over the past two years, she has been instrumental in growing the campus’s leadership team, enhancing academic programs, and deepening community partnerships. Her achievements include appointing Merrily James and Daniel Pembroke to key roles and strengthening collaborations with NYC Public Schools, Carnegie Hall’s B-Side program and the Fashion Institute of Technology. Becker joined Berklee in 2019 as assistant vp for global program development and co-led the institution’s COVID-19 response. Her previous leadership experience includes roles at Juilliard, Decoda and Ensemble Connect.

Top Drawer Merch, a Los Angeles-based full-service merchandise company, appointed Claudia Peña as director of live events. In this role, she will lead the creation of immersive, attendee-focused brand activations at festivals, tours, and pop-ups, merging storytelling with commerce. Peña, founder of festival beauty brand Lunautics, brings experience in luxury retail and experiential marketing. Her hire follows Top Drawer’s success with events like SLANDER and Insomniac’s Starbase Festival.

Round Hill Music acquired the publishing catalogs of songwriters Terry Shaddick (Olivia Newton-John’s “Physical”), Linus Eklöw (Icona Pop’s “I Love It”) and Carmine Appice (Rod Stewart’s “Do Ya Think I’m Sexy”) along with publishing assets of the band Dirty Heads (“Vacation”) and a portion of the master rights for Al Stewart (“Year of the Cat”). According to a press release, the acquisitions bring Round Hill’s catalog value under management back to more than $1 billion following the sales of its London Stock Exchange-listed fund to Concord in 2023. The company continues managing five private funds.

Rezonate Music Rights, a new investment platform that’s looking to acquire the royalty rights of music producers backed by a $150 million partnership with Bridgepoint Credit, announced its launch. According to a press release, the investment will allow Rezonate to make “high-profile” producer catalog acquisitions; Bridgepoint is also acquiring a minority stake in Rezonate’s management company. Co-founded by music producer Cam Blackwood, Rezonate has already acquired rights from producers including Loma Blackwood, Mark Crew, James Earp and Jussi Karvinen.

Trending on Billboard

Live Nation acquired Dominican Republic-based live entertainment company SD Concerts, which promotes Latin and international talent in the Dominican Republic, along with Aruba, Chile, Colombia, Costa Rica, Guatemala, Panama and Puerto Rico. The company also operates a ticketing platform that services all SD events; it will become part of the Ticketmaster ecosystem under the deal. According to Live Nation, fan attendance in the Latin American region was up more than 25% in the first quarter of this year.

Global streaming service Audiomack signed a deal with music fraud detection company Beatdapp to help eliminate streaming fraud on its platform. Through the deal, Beatdapp will remove fraudulent streams from sales reports, detect bots and more by analyzing streaming activity on Audiomack. “By partnering with Beatdapp, we have adopted the best-in-class technology from an impartial third party to demonstrate our commitment to both our creator and rights holder partners, and to uphold the integrity of our editorial recommendations and chart activity,” said Audiomack CEO Dave Macli in a statement.

Spotify struck a deal with United Airlines to bring more than 450 hours of free Spotify-curated playlists, podcasts and audiobooks to more than 130,000 United seatback screens. In a blog post, the streaming giant said it’s the first time it has offered audiobooks and video podcasts on an airline. Next year, United passengers will be able to use their personal devices to log in to the Spotify app on the airline’s in-flight screens, allowing them to pick up where they left off on their personal Spotify accounts.

Music synch platform SourceAudio launched the first comprehensive AI dataset licensing marketplace through which it will offer 14 million fully cleared tracks to AI companies via an opt-in model. The tracks come from major publishers, indie artists and production music libraries, providing AI companies with training datasets while offering compensation to writers and publishers. So far, the company has partnered with several AI companies, including Wondera.ai, generating more than $1.35 million in new annual recurring revenue for artists and publishers who opted in, according to a press release. Revenue from dataset licensing is paid out to rights holders up front or throughout the term of each license agreement. Rightsholders already on SourceAudio can contact their rep at the company to explore dataset licensing for themselves. Those not on SourceAudio can opt in by contacting the company here.

Karaoke technology company Singa signed a deal with Warner Music Group to bring original master recordings from the label’s artists to the Singa platform (the agreement includes both Warner Chappell Music and Warner Recorded Music). “This game-changing deal allows karaoke singers at home and Singa-powered venues worldwide to perform songs by iconic Warner Music Group artists, all using the original backing tracks,” said Singa co-founder/CEO Atte Hujanen in a statement. This is Singa’s first deal with a major label, though it has previously secured deals with publishers and indie labels.

Sony Music India signed a joint venture with The Hello Group (THG) to form THG India. Through the deal, Sony Music India’s local reach will be paired with THG’s international touring and artist development network to help Indian artists thrive in the country’s growing live music ecosystem and beyond. THG India will offer comprehensive support for talent, including management, global concert booking and publishing, while Sony Music India will provide strategic investment and access to its creative and commercial platforms.

AEG Presents acquired Nashville-based special events production company Gary Musick Productions and the affiliated entity Destination Musick City. Gary Musick Productions will keep its name and continue providing corporate and social event services, including audio-visual production, scenic fabrication, custom set design, live streaming and branding integration. Destination Musick City will remain a destination management company offering immersive experiences and full meeting execution services for groups visiting Nashville. With the deal, Gary Musick Productions will expand its design and fabrication services to music festivals and concerts while giving its clients access to AEG’s network of venues.

Symphonic Distribution partnered with Hitmakers Entertainment, which boasts Australian pop and R&B artist Tash on its roster. Going forward, the two companies will support emerging and established artists from Australia and Southeast Asia. “This collaboration allows us to further expand Tash’s career as well as our continually growing roster with the help of Symphonic’s creative and strategic vision,” said Hitmakers boss Mark Feist in a statement.

New Sweden-based generative AI startup Songfox struck a deal with Musical AI, through which it will use Musical AI’s platform, containing fully cleared music catalogs, to train its models. Musical AI will provide full reports of what data contributed to each generated song, allowing Songfox to pay rightsholders. According to a press release, Songfox allows users to generate and “tweak” full songs, including AI-assisted lyrics and a library of licensed voices.

State Champ Radio

State Champ Radio