universal music group

Page: 4

On Valentine’s Day, Drake teamed up with OVO signee and frequent collaborator PARTYNEXTDOOR to release the collaborative album Some Sexy Songs 4 U, a 21-track project that marks his first release since the three-track project 100 Gigs last August.

More significantly, it’s his first release since he filed a lawsuit against his record label, Universal Music Group (UMG), on Jan. 15 for defamation over the release of Kendrick Lamar’s “Not Like Us,” the searing, chart-topping diss track aimed at the Canadian rapper that was released by UMG’s Interscope Records. In the lawsuit, lawyers for Drake alleged that “UMG intentionally sought to turn Drake into a pariah, a target for harassment, or worse,” by pushing a “false and malicious narrative” that the star rapper was a “certified pedophile,” as Lamar rapped on the track. (UMG, in response, said in part, “Not only are these claims untrue, but the notion that we would seek to harm the reputation of any artist—let alone Drake—is illogical.”)

That raises the question: How is Drake able to release an album while he’s actively suing the record label to which he’s signed?

Trending on Billboard

First, the logistics: The new album was released jointly through OVO Sound, to which PARTYNEXTDOOR is signed, which is distributed by Santa Anna, a company under Sony Music Group’s Alamo Records umbrella; and OVO, which is Drake’s vehicle through UMG’s Republic Records. They are co-billed that way and in that order on digital service providers like Spotify and Apple Music. These types of joint releases are relatively common; think Future and Metro Boomin’s back-to-back We Don’t Trust You albums last year, released jointly via Future’s label Epic Records (also a Sony label) and Metro’s label Republic Records. (Coincidentally, We Don’t Trust You contained the song “Like That” featuring Lamar, the track that kicked off the Drake-Kendrick beef in earnest.) Another, more current, example is the Lady Gaga–Bruno Mars collaboration “Die With A Smile,” currently sitting at No. 1 on the Hot 100 for its fifth week, which is co-billed to Gaga’s Interscope and Mars’ Atlantic Records.

That means UMG would have had to legally clear Drake’s appearance on the album, an outcome that a handful of lawyers consulted by Billboard say would not necessarily be affected by any ongoing litigation. “Suing UMG shouldn’t preclude him from working with them legally,” one lawyer says. “As for their desire to be in a contractual relationship with him while he is litigating against them, that’s a different story.” Adds another, who agreed that it would not affect his ability to release an album: “Whether or not UMG decides to properly fund and support a release that Drake wants to do while Drake is suing UMG is another question.”

A UMG spokesperson did not immediately respond to a request for comment. In its response to the initial lawsuit last month, the company wrote, “We have invested massively in [Drake’s] music and our employees around the world have worked tirelessly for many years to help him achieve historic commercial and personal financial success. … Throughout his career, Drake has intentionally and successfully used UMG to distribute his music and poetry to engage in conventionally outrageous back-and-forth ‘rap battles’ to express his feelings about other artists. He now seeks to weaponize the legal process to silence an artist’s creative expression and to seek damages from UMG for distributing that artist’s music.”

An artist suing their record label is not an unheard-of occurrence; it has happened several times through the years, often over royalty payments or other contractual disputes. Suing their own record label for defamation over a diss track, however, is unprecedented; given the mutually beneficial financials involved in an artist and an album’s commercial success, it would stand to reason that UMG would not aim to materially harm one of their superstar artists. But that’s a determination for the courts to make.

Additional reporting by Elias Leight.

Universal Music Group (UMG) and Nashville-based non-profit Music Health Alliance (MHA) are expanding their relationship to launch the Music Industry Mental Health Fund, which will provide comprehensive, high-quality outpatient mental health resources for music industry professionals across the United States, it was announced Thursday (Feb. 13).

The new partnership, which builds upon the healthcare access program launched by UMG and MHA in April 2021, will provide a range of mental health services, including individualized recommendations for mental health professionals; grants to help offset costs; and funding resource recommendations to ensure continuity of care through additional financial and mental health support. Clients from UMG and beyond will have access to MHA’s team of advocates, with initial inquiries receiving a response within 24 hours.

“Music Health Alliance possesses the comprehensive resources necessary to address the full spectrum of mental health needs for music industry professionals,” said MHA founder/CEO Tatum Hauck Allsep in a statement. “This includes financial assistance, a continuum of care for both mental and physical health, and wraparound services such as psychiatric support, facilitation of intensive outpatient and inpatient programs, and data collection. MHA’s holistic approach ensures a long-term commitment to the health, well-being, and sustainability of the music industry workforce.”

Trending on Billboard

Services will be open to current and former music professionals, including those outside of UMG.

“We have been working on ways to establish a streamlined pathway for mental health access, funding and care planning,” said UMG chief impact officer Susan Mazo. “Growing and continuing our partnership with Tatum and the Music Health Alliance was the most natural way to ensure continuous and effective mental health support for anyone working in our industry.”

In addition to the expanded services, MHA offers a full spectrum of mental health and healthcare advocacy services, including dental care resources via the Richard M. Bates SMILE Fund, group health services, healthcare advocacy and confidential guidance. MHA, which boasts more than 32,000 members from across the music community, also offers individual/family healthcare insurance, senior care support via Price Legacy Fund and vision care resources.

According to UMG and MHA, the entities’ earlier healthcare access program, which provides a healthcare concierge to clients, has served nearly 1,000 clients to date and saved them more than $12.5 million in healthcare costs.

Universal Music Group announced on Friday (Feb. 7) that Julie Adam has been promoted to president and CEO of Universal Music Canada. She succeeds longtime chief Jeffrey Remedios, who has been named president of strategic development for REPUBLIC Collective, which includes Island, Def Jam, Mercury, and Republic Records. Both appointments are effective immediately.

Adam has served as executive vp and general manager of UMC since March 2023. In that role, she drove record-breaking success for UMG’s global and domestic artists in Canada, expanded e-commerce and direct-to-consumer initiatives, and strengthened brand partnerships. As CEO, she’ll lead the company’s overall strategy and operations. Before joining Universal, Adam spent nearly 24 years at Rogers Media. As president of news and entertainment, she led the strategy and oversaw the management and development of a portfolio of brands that spanned dozens of radio stations, podcast networks and TV channels.

“Julie is a generous, intuitive, and astute leader. Her impact since joining Universal has been transformative and can be felt industry wide: with artists, our team, and partners,” said Remedios. “Her passion and drive, coupled with her ability to laser-focus on results, all while ensuring the artist comes first, has propelled our roster to new heights. With Julie’s continued leadership, UMC is poised for the next phase of growth and evolution.”

Trending on Billboard

After a decade as chairman and CEO of UMC, Remedios will now lead high-priority growth initiatives for Republic’s labels, focusing on international A&R, Republic recording studios, brand expansion and more. He will work from both New York and Toronto, reporting to REPUBLIC Collective CEO Monte Lipman and COO Avery Lipman.

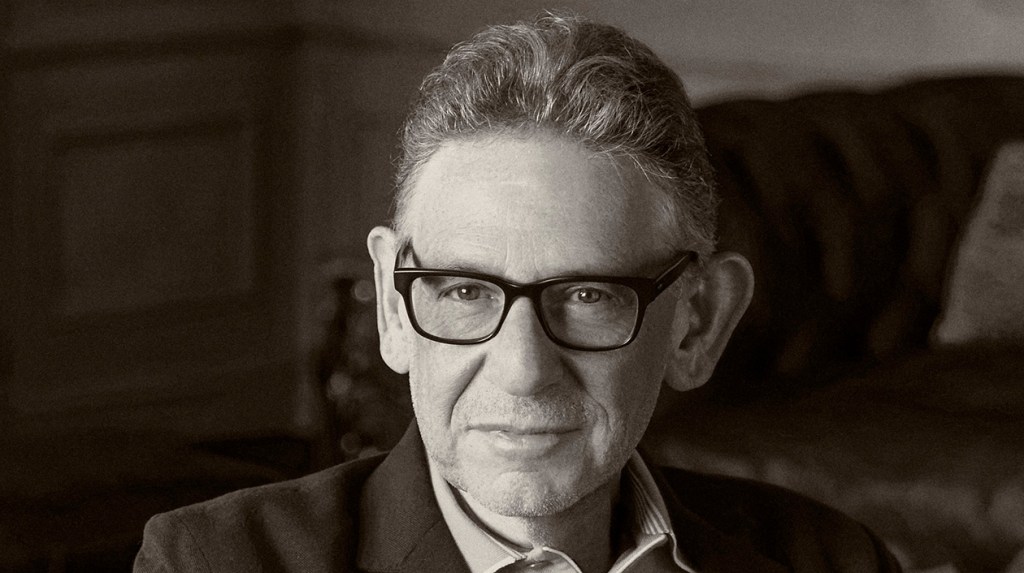

Jeffrey Remedios

Katherine Holland

During his time at UMC, Remedios redefined the company’s A&R strategy, dramatically boosting revenue for Canadian-signed artists. He also spearheaded the creation of UMC’s creative campus in downtown Toronto, establishing it as a hub for the broader music industry.

Reflecting on his tenure, Remedios stated deep pride in UMC’s evolution and appreciation for UMG leadership’s support. “I’ve dedicated my career to serving artists, and I’m incredibly proud of what we’ve built at Universal Music Canada,” he said, while also thanking Universal CEO Lucian Grainge and executive vp Michele Anthony for their mentorship. “The company I joined in 2015 and the one I leave in 2025 are vastly different—proof of our growth through creative innovation.”

“Jeffrey brings a wealth of experience as a leader and entrepreneur to the collective, said Monte Lipman. “In his new role, focused on exploring and capitalizing on opportunities in emerging areas of the industry, Jeffrey will play a critical role in scaling our business and proving new creative and commercial outlets for our artists.”

The leadership change in Toronto reflects similar actions taken by UMG approximately 700 miles south a day earlier. Following Cindy Mabe’s departure as CEO and chairman of Universal Music Group Nashville on Thursday, UMG announced the appointment of Mike Harris as CEO and producer and nine-time Grammy winner Dave Cobb as chief creative officer.

Will Drake’s pending defamation lawsuit stop Kendrick Lamar from performing “Not Like Us” during his Super Bowl halftime performance? Legal experts say it might — but that it really shouldn’t.

Under normal circumstances, it’s silly to even ask the question. Obviously a Super Bowl halftime performer will play their chart-topping banger — a track that just swept record and song of the year at the Grammys and was arguably music’s most significant song of the past year.

But these are very much not normal circumstances. Last month, Drake filed a lawsuit over “Not Like Us,” accusing Universal Music Group of defaming him by boosting the scathing diss track. The case, which doesn’t name Lamar as a defendant, claims UMG spread the song’s “malicious narrative” — namely, that Drake is a pedophile — despite knowing it was false.

Trending on Billboard

That pending legal action makes it fair to wonder: When Lamar steps onto the world’s biggest stage on Sunday night (Feb. 9), will he face pressure to avoid the whole mess by just skipping “Not Like Us” entirely?

He shouldn’t, legal experts say, and for a pretty simple reason: Drake’s lawsuit against UMG is a legal loser. “I don’t think the case is strong at all,” says Samantha Barbas, a legal historian and an expert in defamation law at the University of Iowa’s College of Law.

For Drake to eventually win the case over “Not Like Us,” he’ll need to show that Lamar’s claims about him are provably false assertions — meaning the average person would hear them and assume Kendrick was stating actual facts. Barbas says that’ll be tough for Drake to do about a diss track, where fans expect bombast and “rhetorical hyperbole” more so than objective reality.

“In the context of a rap battle, the average listener is going to know that the allegations aren’t to be taken seriously,” she says. “Taunts and wild exaggerations are par for the course.”

Another challenge for Drake is that he’s a public figure. Under key First Amendment rulings by the U.S. Supreme Court, a public figure like Drake must show that UMG either knew the lyrics were false or that the company acted with reckless disregard for the truth — a legal standard that’s intentionally difficult to meet so that rich and famous people don’t abuse libel lawsuits to squelch free speech.

“A high-profile public figure like Drake immediately enters the case with a high burden of proof,” says Roy Gutterman, the director of the Newhouse School’s Tully Center for Free Speech at Syracuse University.

UMG’s attorneys will also likely point to the fact that Drake himself made harmful allegations against Kendrick earlier in the same exchange of diss tracks, including that Lamar had abused his fiancée and that one of his children was fathered by another man. Were those defamatory statements of fact, or merely the exercise of artistic license within the conventions of a specific genre of music?

“Factoring in the context here — music and art within an ongoing dispute between rival musicians — he has an even tougher case,” Gutterman says.

So if Drake’s case is likely to eventually be dismissed, then there’s no reason for Kendrick to hold back on Sunday, right?

Not exactly.

For starters, Federal Communications Commission rules prohibit the airing of “obscene, indecent, or profane content” on broadcast television during primetime hours. To avoid those rules, Super Bowl halftime performers typically avoid curse words or overtly sexual material — something that would probably already preclude the “pedophile” line and other lyrics in “Not Like Us.”

Corporate legal departments are also famously risk averse, and often prefer to play it safe rather than potentially face expensive litigation, even if they’d ultimately win. That could lead any of the big companies involved here to put pressure on Kendrick to skip “Not Like Us.” His label, UMG, has vowed to fight back against Drake’s “frivolous” lawsuit, but might not want to add complications mid-litigation; the game’s broadcaster, Fox, or the NFL itself might worry about getting added to the suit as defendants.

Gutterman said it would be “a significant stretch of liability law” for Drake to successfully sue Fox or the NFL simply because Kendrick played “Not Like Us” at the halftime show. But in practice, that might not be how their in-house attorneys are thinking about it.

“The threat of litigation can have a chilling effect on speech,” Barbas says. “The safe thing to do is not to publish or broadcast.”

Reps for Lamar did not return a request for comment on whether he’ll perform the song. The British tabloid newspaper The Sun, citing anonymous sources, reported last week that Kendrick has faced pressure to skip the track but plans to perform it anyway and “won’t be silenced.” But that report could not be confirmed by Billboard and was not widely re-reported by other outlets.

Asked whether they have a position on whether Lamar plays the song, reps for UMG, Fox, the NFL and Roc Nation (Jay-Z’s company that produces the halftime show) all either declined to comment or did not return requests for comment.

When the show kicks off on Sunday night, the most likely outcome is probably somewhere down the middle: That Kendrick plays the song’s already-iconic instrumental hook and perhaps some of the lyrics, but skips any of the portions that are directly at play in Drake’s lawsuit.

“It wouldn’t be surprising,” Barbas says, “if the challenged lyrics are changed.”

Universal Music Group (UMG) chairman/CEO Lucian Grainge released his annual New Year’s memo to staff on Monday (Feb. 3), about a month later than usual owing to the wildfires that broke out in Los Angeles in early January.

In the 3,113-word letter, Grainge retreaded much of the same ground covered in his 2023 and 2024 New Year’s addresses and his presentation at the company’s Capital Markets Day in September, including mentions of “Streaming 2.0,” “responsible AI,” “artist-centric” approaches, “super fans” and more.

Grainge began the letter by noting UMG’s accomplishments over the last year, including breaking new artists like Sabrina Carpenter and Chappell Roan, working with Taylor Swift — the most streamed artist globally on Spotify, Amazon and Deezer — and Apple Music’s Artist of the Year Billie Eilish, adding that “achievements like these don’t just happen.”

Trending on Billboard

“Those achievements were greatly assisted by our continuing self-reinvention, reshaping our organizational structure,” wrote Grainge, referring to the widespread restructuring of UMG’s recorded music division in 2024 that led to layoffs. “Within months we were operating with greater agility and efficiency. We then saw something exceptional take place.”

As the largest music company in the world enters 2025, Grainge reminded his staff that UMG is still a “relative minnow” compared to the trillion-dollar tech companies it calls its partners. Still, he noted that UMG was successful in ushering in its “artist-centric strategy,” a term he introduced two years ago to describe UMG’s efforts to better monetize music and to limit gaming of the systems.

“Not only do we want to ensure that artists are protected and rewarded, but we’re also going after bad actors who are actively engaged in nefarious behavior such as large-scale copyright infringement,” he wrote. In the last year, UMG forged new deals with TikTok, Spotify and Amazon to aid in those efforts. Also in 2024, UMG sued AI companies Suno and Udio and music distributor Believe to prevent what Grainge called “large-scale copyright infringement.”

Grainge then detailed his plans to influence and set the ground rules for “Streaming 2.0” — or “the next era of streaming” — with UMG’s partners. He pointed back to new agreements with Amazon and Spotify as major wins, adding, “We expect that similar agreements with other major platforms will be coming in the months ahead.”

He also discussed the company’s goal of finding ways to “accelerat[e] our direct to consumer and superfan strategy,” building on past moves like its strategic partnership and investment in NTWRK and Complex. “This year will see us expanding our product offerings to fans, as we continue to redefine the ‘merch’ category and create superfan collectibles and experiences,” Grainge wrote.

He also noted the company’s focus to “aggressively grow our presence in high potential markets,” whether that’s through A&R, artist and label service agreements or mergers and acquisitions. In the last year, UMG has managed to work towards this goal by announcing that Virgin had entered an agreement to acquire Downtown Music Holdings, purchasing the remaining share of [PIAS] and partnering with Mavin Global in Nigeria.

“The reason so many independent music entrepreneurs actively seek to partner with UMG when they have more alternatives than ever before is that we provide what they’re seeking… After all, we’re not a financial institution that views music as an ‘asset,’” he wrote. “And we’re not an aggregator that views music as ‘content.’ We are a music company built by visionary music entrepreneurs. For us, music is a vital — perhaps the vital — art form.”

Grainge ended on a high note, writing, “Let me leave you with this: Some will try to disrupt our business or criticize us. That we know. It comes with being in the most competitive market that music and music-based entertainment has ever seen, and it comes with being the industry’s leader and primary driving force. But our vision and our ability to consistently execute gives us the momentum to continue to succeed and grow.”

Read Grainge’s full New Year’s note to staff below.

Dear Colleagues:

When I wrote my first letter about the L.A. fires, I said that my annual New Year’s note would have to come later than usual. And so here it is…

Last night’s Grammy awards served as a perfect metaphor for our company’s performance in 2024—breaking new artists and taking our superstars to new heights. In fact, last night, UMG artists and songwriters brought home more Grammys than ever before in our history. You can read more about that here.

Thanks to your day-in, day-out dedication and hard work, we accomplished so much together in 2024 and are positioning ourselves for another great year of success. I’ll sum up some of UMG’s stunning achievements last year and give you a glimpse of what we plan for this year. Our company’s fundamental building block is artist developmentand in 2024, investment in new talent continued to produce spectacular results around the world. Consider the following facts: that UMG broke the two biggest artists in the world last year in Sabrina Carpenter and Chappell Roan; Taylor Swift was the most streamed globally on Spotify, Amazon and Deezer; and Apple Music named Billie Eilish its Artist of the Year. And that a UMG recording artist who is also signed to UMPG as a songwriter had the No. 1 song globally on the year-end lists for both Apple Music (Kendrick Lamar) and Spotify (Sabrina Carpenter). Or that UMG had four of the Top 5 artists globally on Spotify with Taylor Swift (No. 1), The Weeknd, Drake and Billie Eilish; eight of the Top 10 albums (Taylor Swift’s The Tortured Poets Department at No. 1); five of the Top 10 songs (Sabrina Carpenter’s “Espresso” at No. 1), and six of the 10 Most Viral songs (Lady Gaga and Bruno Mars’ “Die With A Smile” at No. 1). Or consider that in the U.S., UMG had all Top 3 label groups according to Billboard (Republic, Interscope and Universal Music Enterprises) not to mention four of the Top 5 artists and eight of the Top 10 albums, including all of the Top 5 – Taylor Swift (No. 1 and No. 2), Morgan Wallen, Noah Kahan and Drake. And on YouTube, six of the Top 10 songs (Kendrick Lamar at No. 1) and two spots on the Trending Topics Top 10 across all content categories in 2024 (Kendrick Lamar and Sabrina Carpenter). You can read more of our remarkable achievements around the world at the end of this note, but as you can already see, in 2024, our momentum only grew. Also, these were achievements not only by a few superstars, but also by dozens of artists from around the world—both developing and established—performing in multiple genres, styles and languages. Achievements like these don’t just happen. They are the culmination of maintaining a clear vision of who we are, what we do and where we’re going, then executing on that vision, maintaining momentum and, of course, at the heart of it all, having some absolutely incredible music to work with. And last year those achievements were greatly assisted by our continuing self-reinvention, reshaping our organizational structure, re-building our teams and refining our strategy. A vision which boldly and, when necessary, quickly adapts to an ever-changing world. For example, in early 2024 we executed on our vision to realign our U.S. label structure, and within months we were operating with greater agility and efficiency. We then saw something exceptional take place: UMG had its best U.S. performance in six years, according to Luminate. I’m confident that our realignment will yield still further momentum around the world and that the achievements of our artists and songwriters—as well as UMG’s success—will reach new heights.In 2024, we continued to lead the media industry in our embrace and advancement of “Responsible AI.” Three recent examples of that initiative include our agreements with SoundLabs, ProRata and KLAY—companies that are taking unique approaches to the rapidly evolving AI space through new technologies that provide accurate attribution and tools to empower and compensate artists.Our leadership also includes our commitment to the enactment of Responsible AI public policies, fighting back against so-called text and data mining copyright exceptions and other misguided and ill-intentioned proposals that would enable what I will euphemistically call the unauthorized exploitation of creators’ work. Instead, we will work towards legislative “guardrails” to ensure the healthy evolution and growth of AI that mutually serves creators, consumers and responsibly innovative technology players.In my note last year, I said that 2024 would see us once again attracting the brightest entrepreneurs, expanding our existing relationships with other such talents and investing more resources into providing a full suite of artist services businesses to independent labels around the world. And we did exactly that. We acquired the remaining share of [PIAS] two years after taking an initial stake in the company and brought its highly respected co-founder Kenny Gates into our family. And we grew our geographic footprint. One example: our partnering with and investing in Mavin Global, whose founders Don Jazzy and Tega Oghenejobo continue to lead that company as well as, going forward, all of UMG’s business in Nigeria.Just last month, Virgin announced it entered into an agreement to acquire Downtown Music Holdings, which includes FUGA, Downtown Artist & Label Services, Curve Royalties, CD Baby, Downtown Music Publishing and Songtrust.The reason so many independent music entrepreneurs actively seek to partner with UMG when they have more alternatives than ever before is that we provide what they’re seeking: the most innovate creatives and finest resources that will advance the careers of their artists and achieve their financial goals within a culture that respects artists and their music. After all, we’re not a financial institution that views music as an “asset.” And we’re not an aggregator that views music as “content.” We are a music company built by visionary music entrepreneurs. For us, music is a vital—perhaps the vital—art form. Artists and the music they create are our lifeblood. We’re proud both to invest in businesses that can and do support today’s leading music entrepreneurs and to advocate for the policies and practices that are designed to protect and grow the entire music ecosystem.And finally, one of 2024’s announcements of which I am proudest is the formation of our Global Impact Team, whose mission is to enact positive change in our industry and in the communities in which we serve. This cross-functional group of executives brings a deep understanding of our global organization and will develop and execute strategies to tackle a variety of critical issues, including: equality; mental health and wellness; food insecurity and the unhoused; the environment; and education. By dovetailing seamlessly with our goals and those of our artists, we can promote and even catalyze beneficial and authentic changes where they are needed. Recently, in the wake of the terrible Los Angeles wildfires, the Impact Team mobilized, offering support to those affected, activating a multi-pronged relief effort to help both our own employees and the broader L.A. communities.Before I get to what lies ahead for 2025, let me first provide you with some context as to the enviable position UMG holds.UMG is a global creative enterprise at the center of an ecosystem of hundreds of digital partners. And while we’ve consistently been the music industry’s leader since the advent of the streaming era—an era whose dawn we were instrumental in ushering in—the leadership posture among our DSP partners has undergone some significant changes. For example, one of our fastest-growing subscription partners, YouTube, is also one of the most recently launched. We expect more inevitable jockeying for the leadership position among standalone platforms as well as among the music services that are divisions of trillion-dollar valuation tech companies.But, even though we are a relative minnow in comparison to a trillion-dollar tech company, the music of our incredible artists and songwriters enables us to exercise outsized influence on the global stage and serve as a critical catalyst in fostering a truly competitive commercial marketplace for music. We will keep using our position to promote a healthy and sustainable music ecosystem that benefits all artists at all stages of their careers.Now to 2025 … starting with our artist-centric strategy:When we introduced that strategy two years ago, we immediately went to work with our partners to make it a reality. In a matter of months, we reached agreements in principle on a number of issues: increasing the monetization of artists’ music; limiting the gaming of the system by protecting against fraud and content saturation; and focusing on the value of authentic artist-fan relationships, inspiring the development of more engaging consumer experiences, including specially designed new products and premium tiers for superfans. Platforms as diverse as Deezer, Spotify, TikTok, Meta and most recently Amazon, have adopted artist-centric principles in a wide variety of ways—principles that benefit the entire music industry from DIY to independent to major label artists and songwriters.Our work in driving these artist-centric principles will continue in 2025. Not only do we want to ensure that artists are protected and rewarded, but we’re also going after bad actors who are actively engaged in nefarious behavior such as large-scale copyright infringement. To that end, we’re setting forth the best practices that every responsible platform, distributor and aggregator should adopt: content filtering; checks for infringement across streaming and social platforms; penalty systems for repeat infringers; chain-of-custody certification and name-and-likeness verification. If every platform, distributor and aggregator were to adopt these measures and commit to continue to employ the latest technology to thwart bad actors, we would create an environment in which artists will reach more fans, have more economic and creative opportunities, and dramatically diminish the sea of noise and irrelevant content that threatens to drown out artists’ voices.In September, during our Capital Markets Day presentation, I described what would constitute the next era of streaming—Streaming 2.0. Built on a foundation of artist-centric principles, Streaming 2.0 will represent a new age of innovation, consumer segmentation, geographic expansion, greater consumer value and ARPU growth.I’m pleased to report that the Streaming 2.0 era has arrived. We recently announced a new agreement with Amazon that includes many of these elements, and just last week, we announced a multi-year agreement with Spotify. We expect that similar agreements with other major platforms will be coming in the months ahead. In 2025, we’ll also be reaching out in new ways to engage fans. In addition to listening to their favorite artists’ music, fans want to build deeperconnectionsto artists they love. Last year, in accelerating our direct-to-consumer and superfan strategy, we formed a strategic partnership and became an investor in NTWRK and Complex to build a premium live-video shopping platform for superfan culture. This year will see us expanding our product offerings to fans, as we continue to redefine the “merch” category and create superfan collectibles and experiences. Some of this will be done through our current partners and some through our own D2C channels, which we will continue scaling to meet the massive appetite of fans. After years of working to aggressively build a healthy commercial environment for artists and music—one in which we have reached approximately 670 million subscribers—we will be laser-focused in 2025 on continuing to expand the ecosystem and improve its monetization. As we did in 2024, this year we will continue to aggressively grow our presence in high potential markets through organic A&R, artist and label services agreements, and M&A.The work that lies ahead of us will bring challenges, no doubt about that. But we will meet those challenges with pride and a sense of privilege, because no other form of creative expression is more fundamental to human existence than music. By that, of course, I mean real music created by human artists. So let me leave you with this:Some will try to disrupt our business or criticize us. That we know. It comes with being in the most competitive market that music and music-based entertainment has ever seen, and it comes with being the industry’s leader and primary driving force. But our vision and our ability to consistently execute gives us the momentum to continue to succeed and grow. Our global worldview and the internal competition fueled by our entrepreneurial spirit breeds innovation. Our passion for finding new and better ways to bring music to the world will keep us ahead of competitors and new entrants alike. We’ll continue to do what we do because what we do and how we do it is impossible to replicate. Our culture and our people—you—are our superpower.I can’t wait to see and hear what this year brings, and I am thrilled to be on this journey with you.Let’s go!Lucian

In a banner week for music stocks, record labels and music publishers posted gains after Universal Music Group (UMG) signed a new licensing deal with Spotify and Amazon announced further price increases for its music streaming service.

UMG gained 11.2% to 26.94 euros ($27.91) after the company announced it renewed its licensing deal with Spotify for its record labels and music publishing. According to the company, the agreement will allow for “new paid subscription tiers,” such as Spotify’s anticipated high-priced superfan offering, and bundling of music and non-music content. UMG also got a boost from news that Amazon is raising prices on its Amazon Music Unlimited on-demand service in the U.S., U.K. and Canada. After the week’s gain, UMG had recovered nearly all of the 24% decline it suffered after its second-quarter earnings results showed lower-than-expected streaming growth.

Morgan Stanley analysts called it “an important and positive week” for investors in companies that operate in the music streaming space. Warner Music Group (WMG) rose 6.7% to $31.80 as investors likely assumed the company will follow UMG and negotiate a mutually beneficial licensing deal with Spotify later this year. Both Believe and Reservoir Media rose 2%.

Trending on Billboard

Spotify rose another 7.5% to a new record closing price of $548.55 after multiple analysts raised their price targets and the streaming giant emerged victorious in a U.S. court case over a tactic employed to lower its royalty obligations. The streaming company’s stock reached as high as $560.36 on Friday (Jan. 31), valuing the company’s market capitalization at approximately $111 billion. More analysts hiked their price targets ahead of Spotify’s earnings call on Tuesday (Feb. 4). Deutsche Bank increased its Spotify price target on Monday to $550 from $535, while Citi raised it to $540 from $500.

Music stocks have produced strong gains just one month into the new year. This week, the 20-company Billboard Global Music Index (BGMI) rose 6.4% to a record 2,447.97. Just two of the index’s 20 stocks lost ground while one was unchanged and 17 posted gains. The index’s third-straight weekly gain was the best of the year and the best single-week performance since the BGMI gained 6.8% in the week ended July 21, 2023. Just 31 days into 2025, the index is up 15.2% and is outpacing major indexes such as the Nasdaq composite (up 1.6%), S&P 500 (up 2.7%) and FTSE 100 (up 6.1%).

Aside from Spotify, other streaming companies posted large gains. LiveOne, the week’s greatest gainer, jumped 20.8% to $1.45 after CEO Robert Ellin announced — from President Trump’s The Mar-a-Lago Club — that LiveOne had surpassed 700,000 Tesla users, half of which are free, ad-supported users. Chinese music streaming company Cloud Music also improved, with its stock up 8.4% to 112.20 HKD ($14.40), after the company announced it had reached a “preliminary” agreement with K-pop company SM Entertainment to keep the K-pop company’s catalog at the platform. Paris-based Deezer rose 9.6% to 1.26 euros ($1.31). Abu Dhabi-based Anghami improved 4.2% to $0.75.

SiriusXM rose 9.3% to $24.01 after the company’s fourth-quarter earnings on Thursday (Jan. 30) showed a drop in revenue and subscribers but gross margins and earnings before interest, taxes, depreciation and amortization (EDITDA) that were in line with guidance. For full-year 2025, SiriusXM expects slight declines in both revenue and adjusted EBITDA but an increase in free cash flow to $1.15 billion from $1.02 billion in 2024. Ahead of the company’s earnings, Deutsche Bank lowered its price target to $25 from $28.

Sphere Entertainment Co. shares rose 8.5% to $46.60, with Guggenheim raising the company’s price target to $69 from $64 and maintaining its “buy” rating. Sister company MSG Entertainment, which will announce earnings on Thursday (Feb. 6), rose just 0.1% to $36.34.

iHeartMedia had the week’s largest decline, dropping 8.3% to $2.22, after posting gains in previous weeks. iHeartMedia shares are up 12.1% year to date.

Universal Music Group chairman and CEO Lucian Grainge delivered an update on the company’s response to the Los Angeles wildfires on Tuesday, writing in a staff memo obtained by Billboard that while many evacuated employees have returned home, others remain displaced, while some have “lost their homes completely.”

Grainge said the Santa Monica-based company is actively supporting affected employees by providing resources to meet both immediate and long-term needs. Over 100 employees have volunteered to help colleagues through various means, such as offering shelter, babysitting and donating clothes, he said.

Beyond internal support, UMG has been involved in community relief efforts, including volunteering, providing meals and donating clothing and hotel rooms for displaced families. Additionally, Grainge said UMG has made financial contributions to several organizations supporting relief efforts, including the American Red Cross, California Community Foundation, The California Fire Foundation, Direct Relief, Entertainment Industry Foundation, L.A. Regional Food Bank, MusiCares, Music Health Alliance, Mutual AID Network L.A., Pasadena Humane Society and World Central Kitchen, among others.

Trending on Billboard

“What has impressed me the most throughout this tragic event is the fact that collectively we haven’t just made financial contributions, but so many of our colleagues have rolled up their sleeves and gone to work,” he said. “We know that even after every fire is extinguished the road to recovery will be very long. We will be there every step of the way.”

UMG announced earlier this month that it is canceling all of the company’s Grammy-related events, including its artist showcase and after-Grammy party, and will instead “redirect the resources that would have been used for those events to assist those affected by the wildfires.”

Read Grainge’s full memo below:

Dear Colleagues,

I’m writing to update you on our efforts related to the Los Angeles fires. In short, while many of our evacuated employees have fortunately been able to return to their homes, others who are in the most seriously affected areas remain displaced and will be so for some time to come. Some have lost their homes entirely.

We are working closely with those affected employees, providing them a range of resources and support to meet their immediate individual or family needs. Following meetings with the team of UMG leaders that I mentioned in my prior note, we are also determining the best ways to help these employees going forward. And in addition to the company’s support, more than 100 employees have volunteered to help their colleagues—from opening their homes to babysitting, dog walking, donating clothes, and more.

In terms of recovery of the broader community, from Day One we’ve been on the ground helping wherever we can. Whether it’s volunteering at relief organizations, providing meals to first responders and affected community members, donating clothing or providing hotel rooms to displaced families.

And in addition to all this, we’ve made financial contributions to a range of organizations, including the American Red Cross, California Community Foundation, The California Fire Foundation, Direct Relief, Entertainment Industry Foundation, L.A. Regional Food Bank, MusiCares, Music Health Alliance, Mutual AID Network L.A., Pasadena Humane Society, World Central Kitchen, and more.

What has impressed me the most throughout this tragic event is the fact that collectively we haven’t just made financial contributions, but so many of our colleagues have rolled up their sleeves and gone to work.

We know that even after every fire is extinguished the road to recovery will be very long. We will be there every step of the way.

You can read more about these efforts in our latest edition of our All Together Now bi-weekly newsletter.

I’m so enormously proud of the fact that so many of you have shown up to help our community and your colleagues. I’m grateful but not surprised. As a company, this is who we are.

Lucian

Universal Music Group and Spotify have struck a new direct deal, impacting both the company’s recorded music and publishing royalty rates, the companies announced today (Jan. 26). In a statement, UMG chairman/CEO Lucian Grainge said that the deal is “precisely the kind of partnership development [UMG] envisioned” as part of its idea for “Streaming 2.0,” the company’s proposed changes to revamp streaming royalty rates and improve remuneration for its artists on streaming platforms.

Under the new agreement, UMG and Spotify “will collaborate closely to advance the next era of streaming innovation,” according to a press release. “Artists, songwriters and consumers will benefit from new and evolving offers, new paid subscription tiers, bundling of music and non-music content, and a richer audio and visual content catalog,” the press release continues. The deal also includes continued protection for UMG through Spotify’s fraud detection and enforcement systems.

Importantly, the agreement includes a direct deal between Spotify and Universal Music Publishing Group, the first direct deal between Spotify and a publisher since the passage of the Music Modernization Act in 2018. One top publishing executive tells Billboard that this change “sounds like Spotify is raising the white flag” about the so-called “bundling” dispute which has soured relations between many publishers, writers and Spotify since it launched last year. In March, Billboard reported that Spotify’s payments to music publishers and songwriters would be cut significantly to account for Spotify bundling in audiobooks as part of its premium tiers. Instead of paying out royalties for these tiers purely to music publishers and writers, Spotify began splitting the payments between music and books publishers.

Trending on Billboard

Billboard estimated the losses to be about $150 million in the first year the bundled audiobooks took effect. Now, nearly a year later, Universal Music Publishing Group appears to be back in a better position with Spotify. One source familiar with the deal said it has improved royalty payments for UMPG songwriters, although the two companies declined to state the specifics of how the new publishing royalty model (or the one for recorded music) works.

“Spotify maintains its bundle, but with this direct deal, it has evolved to account for broader rights, including a different economic treatment for music and non-music content,” a Spotify spokesperson clarified in a statement to Billboard.

“[This deal] makes sense,” the publishing executive tells Billboard. “[Spotify is] despised in the songwriting industry. Their main competitor, Amazon, has already left them isolated and alone. And they claim to want to expand into more videos but can’t get deals done. It was monumentally stupid for them to put themselves in this position but perhaps they are finally trying to get out of the bind they put themselves in.”

Grainge said, in his complete statement about the deal, “When we first presented our vision for the next stage in the evolution of music subscription several months ago — Streaming 2.0 — this is precisely the kind of partnership development we envisioned. This agreement furthers and broadens the collaboration with Spotify for both our labels and music publisher, advancing artist-centric principles to drive greater monetization for artists and songwriters, as well as enhancing product offerings for consumers.”

“For nearly two decades, Spotify has made good on its commitment to return the music industry to growth, ensuring that we deliver record payouts to the benefit of artists and songwriters each new year,” Spotify founder/CEO Daniel Ek said in a statement. “This partnership ensures we can continue to deliver on this promise by embracing the certainty that constant innovation is key to making paid music subscriptions even more attractive to a broader audience of fans around the world.”

HipHopWired Featured Video

Source: Bernard Beanz Smalls / Bernard Beanz Smalls,

We are not even a month into 2025 and Jim Jones keeps going viral. Capo says he sees nothing wrong with Drake suing Universal Music Group.

As spotted on HipHopDX Jim Jones recently paid a visit to the Broke N’ Frontin podcast. While he discussed a variety of topics regarding his career, the music industry and more it was his very hot take about Champagne Papi that took many people by surprise. “He’s not snitching on nobody. He’s not in a court of law, he’s not personally suing Kendrick Lamar, which everybody seems to think that this lawsuit is about,” he explained. “He’s suing UMG, which is the biggest company that has the biggest bag, n***a.”

Jomo went on to remind everyone that the lines behind this lawsuit have been blurred in the media and made sure to clarify that Drake is not suing Kendrick Lamar. “Y’all associating motherf***ing brussel sprouts with apples. It’s two totally different things. If it was any other thing, I would call a red flag. But this has got no reflection of the street or rap culture.” To hear Jim Jones tell it the Hip-Hop community should be happy for Drake if he is successful in this legal battle. “When Tracy Morgan caught that bag, we were happy for him. So how the f*** we not going be happy about somebody getting a bag from one of the biggest companies that’s been raping everybody anyway?”

You can see Jim Jones discuss Drake, Harlem, Cam’ron and more below.

Pershing Square Holdings chief Bill Ackman won’t get his wish of a Universal Music Group (UMG) de-listing from the Euronext Amsterdam exchange, but the hedge fund king’s push for a UMG listing on a U.S. exchange will nevertheless come to fruition in 2025. UMG announced Wednesday (Jan. 15) that Pershing Square and some of its […]

State Champ Radio

State Champ Radio