Tencent Music Entertainment

Luminate has announced a new global data partnership with Tencent Music Entertainment (TME), marking the company’s first data collaboration with a chart that measures music engagement in China, the companies announced Wednesday (Nov. 5).

Under the agreement, Luminate, Billboard‘s longtime data partner, will integrate streaming and sales metrics from TME’s platforms — including QQ Music, Kugou Music, Kuwo Music and JOOX — into its music data platform CONNECT. The data will be reflected on CONNECT in the coming weeks and integrated into Billboard‘s global charts on a date yet to be announced. This marks the first time Chinese music market activity will be measured and reflected on the Billboard global charts.

Related

Wednesday’s news represents the latest international expansion for Luminate, which now tracks data for more than 60 countries, with other recent additions in the Middle East and North and Sub-Saharan Africa. With the addition of TME to its data set, the company will be able to identify the appeal of genres and artists originating in China across markets.

Notably, in 2023, the TME UNI Chart became the first music chart from the Chinese Mainland to be featured on Billboard‘s U.S. website.

“This partnership marks a pivotal moment for the global music industry, underscoring Luminate’s unwavering commitment to providing the most accurate and comprehensive measurement of music activity worldwide,” said Luminate CEO Rob Jonas in a statement. “As the industry’s most trusted source of streaming and sales data, our customers and partners expect as much information as possible to make the best business decisions, and we know how valuable it is for a market as large and influential as China to be represented in those insights.”

Added TC Pan, group vp of TME and president of the Content Cooperation Department, “This collaboration with Luminate represents a data-driven effort to establish a unified global content ecosystem. China is one of the most dynamic music markets in the world, and through this partnership, all content on TME’s platforms — whether domestic or international — will participate in, and even help shape, global music trends. Moving forward, TME will continue to strengthen its content ecosystem, enabling more quality content to be discovered worldwide, realizing long-term value through a journey from ‘data connectivity’ to ‘ecosystem synergy.’”

Also weighing in was Ryan Liang, vp of corporate development and content system at TME, who said, “Our partnership with Luminate marks TME Chart as Billboard’s first in-depth data partner in China,which demonstrates that its objectivity and professionalism have gained recognition from international authorities. We see this partnership as an opportunity to further strengthen the TME Chart’s role as a bridge connecting Chinese music with the global market. By integrating China’s music data into the global chart ecosystem, we are dedicated to delivering Chinese music to a broader audience and enhancing its international recognition.”

Tencent Music Entertainment, China’s fast-growing streaming platform, announced on Tuesday (June 10) it plans to acquire Ximalaya, a Shanghai-based service for streaming podcasts and audiobooks. Under a merger agreement signed today, Ximalaya will become a wholly owned subsidiary of TME, subject to regulatory approvals and closing conditions. According to filings with the SEC and the […]

Now that all the major music companies have reported earnings for the quarter ended March 31, it’s a good time to reflect on the notable performances in the bunch. Most companies posted good results and showed that music is a reliable business during times of uncertainty, with nearly all trending in the right direction (though companies not mentioned here didn’t necessarily have something to crow about). But because companies naturally experience ebbs and flows — a slow new release schedule or heavy sales of low-margin vinyl records can wreak havoc on market perceptions — the results for any one quarter won’t tell the entire story.

Below, I run down a few notable and/or interesting highlights from the latest earnings releases. For a full recap of earnings reports, refer to Billboard’s 2025 Q1 earnings roundup, which provides quick summaries of music companies’ earnings reports issued from April 29 to May 28. Best top-line revenue growth: 22% by CTS Eventim

Trending on Billboard

German concert promoter and ticketing company CTS Eventim’s top-line revenue got a boost from its 2024 acquisitions of See Tickets and France Billet, as consolidated revenue jumped 22.0% to 499 million euros ($525 million). Growth of the existing business was “slightly higher” than a strong prior-year period, CFO Holger Hohrein said on the May 22 earnings call. Ticketing revenue improved 16.9% to 214 million euros, a record for the first quarter. Retail tickets sold improved 42.1% to 40.5 million. Live entertainment revenue increased 24% to 292 million euros ($316 million), also a first-quarter record. Best streaming growth, record label: 9.5% by Universal Music Group (UMG)

Subscriptions helped offset a lackluster 2.9% increase in other streaming revenue, including ad-supported streaming, resulting in overall streaming growth of 9.5%. UMG executives have told investors they can achieve long-term recorded music subscription growth of 8% to 10% through 2028. While the figure bounces from quarter to quarter — and has fallen well below the target range — UMG landed above the high end of the target by achieving recorded music subscription revenue growth of 11.5% in the first quarter. The subscription growth was “driven primarily by growth in the number of subscribers, and to a much lesser extent, helped by certain price increases,” COO Boyd Muir said during the April 29 earnings call. Best subscription growth, streaming platform: 16.6% by Tencent Music Entertainment (TME)

TME’s subscription growth dominated the quarter for two reasons. First, average revenue per user improved 7.5% to $1.57, in part from the popularity of the Super VIP tier that costs five times as much as a normal subscription. Second, the number of subscribers grew 8.3% to 122.9 million. With more people paying a higher monthly fee, subscription growth rose to 17%. The ripple effects could be seen elsewhere: gross profit margin rose to 44.1% from 40.9% in the year-ago period, and the percentage of paying subscribers versus all music users improved to 22.1% from 19.6% a year earlier. Most surprising new business segment: Tencent Music Entertainment’s physical music sales.

In the first quarter, TME had a 10-day “head-start presale” of the Teens in Times album Beyond Utopia. TME also sold physical albums for One Hundred Thousand Volts by Silence Wang. For the K-pop artist G-Dragon, TME conducted a presale of light sticks and other products and offered limited-edition merchandise to buyers of his digital albums. Most impactful executive quotes: Sphere Entertainment Co. Executive chairman/CEO James Dolan and Vivid Seats CEO Stan Chia

Two vastly different companies provided contrasting takes on the state of live music demand. Amidst reports of falling international tourism to the U.S., Sphere Entertainment Co. CEO James Dolan downplayed concerns about visits to Las Vegas and attendance at the Sphere venue. Even if tourism took a hit, Dolan explained that “demand exceeds capacity, so we have room to absorb any issues from that.”

On the other hand, Stan Chia, CEO of secondary tickets marketplace Vivid Seats, described a more challenging landscape. The quarter “fell short of our expectations,” he said during the May 6 earnings call. Chia blamed the shortfall on “robust competitive intensity” and “softening industry trends amidst consumer uncertainty.” What’s more, he added, “economic and political volatility has impacted consumer sentiment, and this uncertainty can also impact how and when artists and rights holders go to market.” A 14% decline in revenue, combined with Chia’s comments and the company’s suspension of full-year guidance, caused a 38% one-day decline in Vivid Seats’ share price.

HYBE has disclosed the sale of its remaining 9.38% stake in rival SM Entertainment to Tencent Music Entertainment (TME), a subsidiary of Chinese tech giant Tencent. The deal, valued at approximately 243.35 billion South Korean won (approximately $177 million), involves the transfer of 2.21 million shares at 110,000 won per share and is set to close on May 30, according to a new regulatory filing.

This transaction marks HYBE’s complete exit from SM Entertainment, a powerhouse K-pop agency behind acts like EXO, aespa and NCT 127.

Trending on Billboard

HYBE initially entered SME in 2023, acquiring a 14.8% stake from founder Lee Soo Man and later raising its holding to 15.78% through a failed takeover bid, ultimately losing out to Kakao, which now holds a 40.28% stake. After reducing its stake to 9.38% in May 2024, HYBE has now sold its remaining shares.

Why get out of the SME business? HYBE said on Tuesday that it has “divested noncore assets as part of a choice and concentration strategy” and that “secured funds will be used to secure future growth engines.”

TME’s acquisition makes it the second-largest shareholder in SME, behind Kakao. It operates leading Chinese music platforms such as QQ Music and Kugou Music and has existing ties to K-pop through partnerships with HYBE and others. TME also holds minority stakes in YG Entertainment and Kakao Entertainment, signaling its broader strategy to expand influence in the global K-pop landscape.

For SME, the deal could strengthen its reach in the Chinese market and enhance its digital distribution, artist promotion and content collaborations through Tencent’s various platforms. SME is coming off a strong Q1, with revenue up 5.2% year-over-year, driven by strong growth in concerts and recorded music. Concert revenue surged 58% thanks to tours by NCT 127, aespa and others, and recorded music rose 23.1%, led by Hearts2Hearts’ debut.

The acquisition reflects TME’s ongoing investment in Korean assets and sets the stage for deeper cross-border collaboration in music and media. It also marks the latest shift in the balance of power within the K-pop industry, highlighting the growing influence of Chinese tech giants in South Korea’s entertainment sector.

Meanwhile, HYBE is repositioning itself for future expansion, using the proceeds from this sale to invest in new ventures. The company continues to grow globally with its roster of artists including BTS, NewJeans and SEVENTEEN, and remains focused on developing next-gen platforms and talent. In the first quarter, HYBE reported strong financial performance despite a 5.9% drop in recorded music revenue. Total revenue rose 38.7% year-over-year, driven by a 252% surge in concert revenue and a 75.2% increase in merch and licensing. HYBE also expanded into Latin America with festivals and a music competition show.

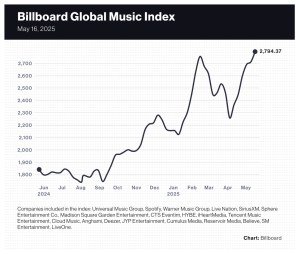

Music stocks — and stocks in general — had a terrific week as Sphere Entertainment Co., Tencent Music Entertainment and Cloud Music posted double-digit gains and the 20-company Billboard Global Music Index (BGMI) set a new high mark.

The BGMI rose 3.1% to an all-time high of 2,794.37, bringing its year-to-date gain to 31.5%. The index has overcome two downturns — one caused by an escalation of trade tensions, the other prompted by President Trump’s announcement of his tariff policy — to surpass the previous record of 2,755.53 set on Feb. 14.

Sphere Entertainment Co. gained 19.3% to $38.78. The company’s quarterly earnings, released on Monday (May 12), showed the Sphere venue was able to cut costs to offset a decline in event-related revenue. Investors cheered the result: flat operating income rather than a loss. As for tourism to Las Vegas, CEO James Dolan brushed aside concerns and said demand for Sphere concerts is strong enough to withstand a downturn should one arise.

Trending on Billboard

China’s Tencent Music Entertainment (TME) jumped 18.0% to $18.62 after the company reported on Tuesday (May 13) a 17% increase in music subscription revenue in the first quarter. Following earnings, CFRA upped its price target to $18 from $17 but downgraded its rating to “hold” from “buy.” TME, which operates Kugou Music, QQ Music and Kuwo Music, finished the quarter with 122.9 million subscribers, up 8.3% from the prior-year period.

Another Chinese music streamer, Netease Cloud Music, rose 12.6% to 203.40 HKD ($26.03) after the company’s financial results, released on Thursday (May 15), showed an 8.4% drop in revenue that the company attributed to a decline in its social entertainment business. The scant Q1 numbers didn’t provide details on the online music side of the business, but the two sides of the business are going in opposite directions. In 2024, social entertainment revenue fell 26% while online music revenue grew 23%.

Not only were TME and Cloud Music among the top performers of the week, they are among the biggest gainers in 2025. Year to date, TME shares are up 49.1% while Cloud Music has gained 81.3%. SM Entertainment’s 64.9% gain is the second-best amongst music stocks.

Live Nation improved 8.2% to $147.68 this week despite news that the company and AEG Presents are facing a criminal antitrust probe by the U.S. Department of Justice over pandemic-era refund policies. Live Nation shares are still well below the all-time high of $157.75 reached on Feb. 21, but they’ve gained 14.0% year to date and are up 52.9% over the last 52 weeks.

Spotify, the index’s most valuable component, rose 1.2% to $656.30. Guggenheim raised its price target to $725 from $675 on the heels of a judge’s favorable ruling in Epic Games v. Apple. Guggenheim sees the ruling, which allows Spotify to display pricing options within the iOS app, as helpful to audiobook monetization.

German concert promoter CTS Eventim gained 3.2% to 111.90 euros ($124.90). Barclays started covering the company with a 130 euro ($145.12) price target and an “overweight” rating.

Elsewhere in the index, Universal Music Group and Warner Music Group gained 0.9% and 1.2%, respectively, and HYBE improved 1.9%. SiriusXM jumped 5.4%.

Only four of the BGMI’s 20 stocks lost value this week. SM Entertainment was the week’s biggest loser with a 5.2% drop. Believe fell 1.3%, Deezer dipped 1.5% and iHeartMedia dropped 1.6.%.

Stocks were up globally but performed especially well in the U.S. The Nasdaq composite rose 7.2% and the S&P 500 improved 5.3%. In the U.K., the FTSE 100 was up 1.5%. South Korea’s KOSPI composite index gained 1.9%. China’s SSE Composite Index rose 0.8%.

Investors were encouraged by a reduction of U.S. tariffs on Chinese goods while the two countries continue to negotiate a trade deal. Goldman Sachs lifted its estimate for the S&P 500 on Tuesday as tensions over tariffs eased between the U.S. and China.

There is still uncertainty about the U.S. economy, however. Since last week, numerous reports have warned of a sharp slowdown at the Port of Los Angeles, the nation’s busiest port. This week, Walmart CFO John David Rainey said high tariffs could cause the company to raise prices by the end of the month. And on Friday (May 16), the University of Michigan’s closely watched index of consumer sentiment fell to its second-lowest level on record.

Billboard

Billboard

Billboard

Chinese streaming platform Tencent Music Entertainment grew its stake in the world’s largest music company, Universal Music Group (UMG), by picking up a direct 2% equity holding worth $327 million in March, the company said on Tuesday (May 13).

While it did not identify the seller — described in Tuesday’s filings only as “one of our associates” — Pershing Square sold 50 million shares of UMG on March 13, raising about $1.3 billion, according to filings and research reports. Tencent Music and Pershing Square did not immediately respond to requests for comment.

The news means that Tencent Music and UMG each own notable stakes in each other’s companies, as UMG owns a 0.79% stake in TME as of Dec. 31 that’s currently worth $181.2 million.

Trending on Billboard

Tencent Music has been an investor in UMG since March 2020, when it joined a consortium of investors led by its parent company, Tencent Holdings. That consortium accumulated a 20% stake in UMG from UMG’s parent company, Vivendi S.A., between 2020 and 2021, of which Tencent Music owned a 10% share, according to filings.

This March, that consortium “completed a transfer of the UMG shares held by the consortium to its members,” which resulted in Tencent Music acquiring a direct 2% equity interest in UMG, according to its annual report.

Tencent Music, which reported first-quarter revenue of 7.36 billion Chinese yuan ($1.01 billion) on Tuesday, recognized “other gains” worth 2.44 billion Chinese yuan (US$336 million), of which the UMG stock comprised 2.37 billion Chinese yuan (US$327 million), according to filings.

Pershing Square has been an investor in UMG since 2021, and though the mid-March stock sale reduced its stake in UMG to 4.9% from 7.6%, the music company remains the hedge fund’s largest single holding, comprising 17% of its capital.

The sale came ahead of Pershing Square’s plan to register its UMG shares in the United States in September. Pershing Square head and UMG board member Bill Ackman has advocated for the company to move its primary listing from the Euronext Amsterdam stock exchange to a U.S.-based exchange, saying it would add value for the company.

Tencent Music Entertainment (TME) said on Tuesday a 17%-surge in music subscription revenue drove higher first quarter revenue for China’s fast-growing streaming platform.

Total revenues rose 8.7% to RMB7.36 billion (US$1.01 billion), with music subscription revenue up 16.6% to RMB4.22 billion (US$581 million) for the quarter ending March 31, 2025, compared to the same time period a year ago. TME’s total subscriber base now stands at 122.9 million, up 8.3% from a year ago. While that is still less than half of Spotify’s total number of paying subscribers — Spotify reported 268 million subscribers in the first quarter — it drove monthly average revenue per paying user (ARPPU) up to RMB11.4 ($1.57) from RMB10.6 ($1.47) a year ago.

“With the sound foundations we have built, a thriving music ecosystem, and healthy financial position, we are well equipped to navigate global uncertainties,” TME’s executive chairman Cussion Pang said in a statement. “We remain on track … to achieve sustainable growth in 2025.”

Trending on Billboard

The Chinese music streaming company operates three music streaming services — Kugou Music, QQ Music and Kuwo Music — as well as WeSing, a karaoke app. In recent years, Tencent Music’s business has become dominated by music services, while its social entertainment business has declined.

Online music revenue increased by nearly 16% to RMB5.80 billion (US$800 million) from a year ago, driven by the rise in music subscription revenues and an increase in advertising revenue. The business also benefitted from higher merchendise revenue from physical album sales for artists like Teens in Times and Silence Wang, and offline performance revenue.

Chinese genres are still the most popular music streamed on its platform, TME executives said, but the growing popularity of Korean, English and Japanese tracks on Tencent Music drove the company to expand existing partnerships with South Korea’s Starship Entertainment and YG Entertainment and Japan’s ACG entertainment company during the quarter.

The company also disclosed it signed a new multi-year licensing agreement with Sony Music Entertainment and extended agreements with Emperor Entertainment Group and Rock Records during the quarter.

TME’s social entertainment business, which has been in decline in part due to government crackdowns on social platforms, fell by nearly 12% to RMB1.55 billion (US$214 million). TME said the decline was “mainly the result of adjustments to certain live-streaming interactive functions and more stringent compliance procedures implemented.”

The strength in subscription revenues drove TME’s gross margin to 44.1% from 40.9%, with a total operating profit of RMB4.84 billion (US$666 million) in the first quarter of 2025, a whopping 146.9% increase from a year ago. Net profit attributable to equity holders was RMB4.29 billion (US$591 million), representing 201.8% year-over-year growth.

The company also said it received 2% equity stake in Universal Music Group in March as a result of a “distribution-in-kind from one of our associates” worth RMB2.37 billion (US$327 million).

Pershing Square Holdings, the hedge fund run by UMG board member Bill Ackman, sold 50 million shares of its UMG holdings — approximately 2.7% of UMG’s outstanding stock — in mid-March as part of a campaign to get UMG to list in the United States.

After a four-week span that negated some positive earnings results and strong global trends, music stocks received a reprieve from the gloom that has spread over the economy since the Trump administration imposed tariffs on Canada, Mexico and European countries.

Tencent Music Entertainment shares rose 11.6% to $14.00 after the company’s fourth-quarter earnings release on Tuesday (March 18) showed a big increase in both subscribers and subscription revenue. The Chinese streaming company’s revenue surpassed $1 billion in the fourth quarter, an 8.2% increase, and net profit climbed 47.3% to $284 million. Additionally, Tencent Music made two announcements that tend to get a warm reaction from investors: a dividend and a $1 billion share repurchase program.

The Billboard Global Music Index gained 3.0% to 2,533.53 as 12 of its 20 stocks posted gains, seven lost value and one was unchanged. After suffering through a tariff-induced, four-week losing streak, the S&P 500 improved 0.5% and the Nasdaq composite gained 0.2%. In the U.K., the FTSE 100 broke a two-week losing streak by gaining 0.2%. South Korea’s KOSPI composite index gained 3.0%. China’s SSE Composite Index dropped 1.6%.

Trending on Billboard

Music streaming company LiveOne gained 13.3% after the company announced it surpassed 1.3 million subscribers and ad-supported users. The index’s third-best performer, K-pop company SM Entertainment, rose 10.0% to 100,300 KRW ($68.46).

A handful of companies that had taken a hit since mid-February fared better this week. iHeartMedia gained 9.3% to $1.76, improving its year-to-date loss to 17.4%. Madison Square Garden Entertainment rose 7.6% to $33.85, its first weekly gain in four weeks. Live Nation also broke a four-week losing streak, improving 3.2% to $123.06.

Satellite radio broadcaster SiriusXM shares gained 3.5% to $23.47. The company announced on Thursday at named Anjali Sud, CEO of on-demand video streaming platform Tubi, as an independent director to its board. SiriusXM shares are down 39.5% over the last 52 weeks but have rebounded recently and are up 5.0% year to date.

French streaming company Deezer shares fell 6.0% to 1.41 euros ($1.53) following the company’s fourth-quarter earnings release on Tuesday (March 18). Deezer’s revenue grew 12% to $591 million but its subscribers fell 3.1% to 9.7 million (the decline was actually more significant Deezer because removed 500,000 inactive family accounts from its 2023 subscriber count). Despite the week’s decline, Deezer shares are up 7.6% year to date.

The biggest loser of the week, JYP Entertainment, fell 12.2% this week following the K-pop company’s fourth-quarter and full-year earnings release on Tuesday (March 18). Revenue grew 26.8% in the fourth quarter and 6.2% in the full year, but operating profit dropped 2.6% in the quarter and 24.3% in the full year due to a decline in album sales, a higher proportion of management revenue and an introduction of new artist lineups.

Tencent Music Entertainment surpassed revenue of $1 billion in the fourth quarter, representing an 8.2% increase from the prior-year period, while net profit climbed 47.3% to $284 million.

The Chinese music streaming company operates three music streaming services — Kugou Music, QQ Music and Kuwo Music — as well as WeSing, a karaoke app. In recent years, Tencent Music’s business has become increasingly dominated by its music services as its social entertainment business continues to lose business.

Online music revenue grew 16.1% to $799 million due to music subscription gains and growth in advertising revenue, while music subscription revenue jumped 18% to $552 million in the quarter as the number of subscribers increased 13.4% to 121 million. Additionally, gross margin jumped to 43.6% in the fourth quarter from 38.3% in the prior-year period. The company attributed the improvement to strong growth in music subscriptions and advertising revenue and increased usage of owned content, as well as its adoption of the Super VIP program, a subscription tier that costs five times the normal rate. Monthly average revenue per user (ARPU) grew to 11.1 RMB ($1.52) from 10.7 RMB ($1.47) due in part to the expansion of the Super VIP membership program.

Trending on Billboard

The social entertainment business has suffered a sharp decline since the Chinese government began cracking down on the use of live-streaming apps to enable gambling in 2021. In the fourth quarter, social entertainment revenue fell 13% to $223 million and mobile monthly active users declined 21.2% to 82 million (the number stood at 223 million at the end of 2020). Monthly ARPU fell 9.7% to 70.4 RMB ($9.64), down from 172.1 RMB ($26.38) at the end of 2020, and paying users slipped 3.8% to 7.7 million.

For the full year, revenue increased 2.3% to $3.89 billion while net profit climbed 36.2% to $974 million, and gross margin improved to 42.3% from 35.3%. Online music revenue grew 25.5% to $2.98 billion while social entertainment revenue fell 36.1% to $912 million. Full-year gross margin improved to 42.3% from 35.3% in 2023.

Tencent Music Entertainment’s music platforms have evolved into one-stop shops that also include audiobooks, merchandise, downloads and live-streaming. In 2024, the company produced physical albums for Xiao Zhan and Lay Zhang and boosted album sales for Esther Yu by providing options to purchase merchandise along with her digital albums. It also partnered with the band Mayday for an online New Year’s Eve concert.

The company also announced a $273 million dividend and a share repurchase program of up to $1 billion over a two-year period that will commence this month. A $500 million share repurchase program announced in March 2023 will conclude this month.

Tencent Music Entertainment’s shares, which trade on both the New York Stock Exchange (NYSE) and the Stock Exchange of Hong Kong, had risen 15.8% to $15.12 on the NYSE at the close of trading on Tuesday.

Tencent Music Entertainment reported a 35% uptick in profit on Tuesday after the Chinese music streamer added 2 million subscribers over the third quarter.

TME reported net profit for the third quarter of RMB1.71 billion ($244 million), and total revenues of RMB7.02 billion ($1 billion)–increases of 35.3% and 6.8% respectively from the third quarter last year. Music subscription revenue grew by more than 20%, which offset the continued decline in social entertainment services revenue TME has seen for more than a year.

“This quarter’s robust music subscription performance, with better-than-expected net subscriber additions and an expanding ARPPU, highlights the effectiveness of our balanced approach to achieve growth, which is important to drive paying user base expansion in the coming years,” TME’s chief executive officer Ross Liang said in a statement.

Trending on Billboard

TME added 2 million new paying users during the third quarter to bring its total number of subscribers to 119 million, which drove a 4.9% expansion of the company’s monthly average revenue per paying user (ARPPU). That metric now stands at RMB 10.8 ($1.50). Music subscriptions revenue grew to RMB3.84 billion ($547 million) representing 20.3% year-over-year growth.

The company’s gross margin — the percentage of company revenue that remains after expenses are taken out — rose to 42.6% from 35.7% in the year-ago quarter, thanks to increased revenues from subscriptions and advertising.

Notably, TME said its number of SVIP subscribers — a premium tier that costs five times more than the regular version — topped 10 million in the quarter ending Sept. 30.

Tencent Music executives said partnering with Galaxy Corporation this quarter for K-pop icon G-Dragon upcoming tour boosted its content offerings with audiences.

G-Dragon released his first single in seven years, “POWER,” in October ahead of his tour of Southeast Asia, the Middle East, Hong Kong, Macao, Taiwan, Australia and New Zealand.

TME’s stock was trading at $10.46, down 9.48% at 10:25 a.m. in New York. TME’s stock has declined by nearly 18% in the past month, but is still up 19.7% year to date.

State Champ Radio

State Champ Radio