tariffs

As with just about every other industry in the world, some of music’s biggest issues in 2025 have revolved around the Trump administration. Artificial intelligence? Upon taking office, Trump revoked an order by President Biden that ensured “safe, secure and trustworthy development” of the technology. Share prices for public companies like Warner Music and Live […]

For years, to make the Canvas Power 15, Walrus Audio has spent $95.32 per unit on parts. So the rainbow-stamped power supply device for multiple guitar pedals has rarely cost customers more than $270, a price consistency that has helped the 14-year-old Oklahoma City company earn $10 million in annual sales and employ 31 guitar players. “We were cruising, and stuff was selling, and we’re like, ‘Man, we’re having a fun year,’” owner Colt Westbrook says.

But a surge protector that resembles a small, black brick is a key part of every Canvas Power 15 package and can be made in only one country: China. Last month, when the Trump Administration raised tariffs for Chinese imports from 84 percent to 145 percent, the cost to make the Power 15 soared to $139.54. That gave Westbrook a choice: Raise Walrus’ prices, potentially alienating customers, or slash expenses. “We’d have to lose some people,” says Westbrook, whose customers include Maroon 5, the Roots, Haim and Bon Jovi. “We’d have to cut some products, because they wouldn’t be financially viable anymore. Which would be sad.”

Given the unpredictable nature of recent U.S. tariffs on China, and, to a lesser extent, other countries, Walrus is one of many music-gear manufacturers freaking out about the sudden instability of its long-steady industry. Although Trump announced a trade deal with China last week, lowering the U.S. tariffs on Chinese imports to 30 percent, Westbrook was not reassured. “Everybody’s just, ‘We’re holding onto our cash because we don’t know what’s going to happen,’” he says.

Trending on Billboard

Small music-gear companies fear the worst. In testimony Wednesday (May 14) before the U.S. Senate Committee on Small Business and Entrepreneurship, Julie Robbins, owner/CEO of EarthQuaker Devices, a 35-employee Akron, Ohio, guitar-effect pedal manufacturer, declared the tariffs are “putting us at risk of bankruptcy,” demanded they be “reversed immediately” and dismissed “offensive” suggestions that she borrow money to cover fees “abruptly imposed on me by the government with no notice and no consideration.”

Although many music instruments are manufactured in the U.S., as well as relatively low-tariffed countries like Canada, Mexico and Indonesia, John Mlynczak, CEO/president of the National Association of Music Merchandisers (NAMM), recently told Billboard: “China is the largest manufacturing hub for products worldwide.” Gear-makers big and small say circuit boards, capacitors, resistors, transistors, fret wire, tubes and, as Walrus discovered, surge protectors, are made outside the U.S. — and many come from China alone.

“Nearly all musical products imported into the world’s largest market for [these] products are affected,” Mlynczak says by email. “This could have a devastating effect not only for the companies in our industry, but also for music-makers who buy these products.”

Trump recently declared U.S small businesses would not require government relief: “They’re going to make so much money — if you build your product here,” he said. But Josh Scott, owner, creator and president of Kansas City-based JHS Pedals, which employs 40 people and releases 100,000 products annually, argues Trump’s prediction can’t come true in his industry, which relies on parts that haven’t been made in the U.S. for years, if ever. “It’s like telling someone in Detroit to make diamonds out of the ground,” he says. “It’s physically not a thing.”

“It’s not just going to affect gear prices. It’s going to put a lot of these people out of business,” adds Rhett Shull, whose YouTube guitar-tips channel has 728,000 followers. “We’re heading for a massive nationwide shortage of goods in about a month. Even if Trump said, ‘Oh, nevermind, tariffs off, we’re all good,’ the damage is already going to be done.”

Due to the tariffs — and the uncertainty surrounding the tariffs — music-business products from T-shirts and other merch to vinyl records are bracing for higher manufacturing prices. U.S. companies that specialize in music gear are already seeing the impact: Philippe Herndon, founder/chief product designer for Caroline Guitar Co., recently posted on Threads that his company was “startled” to receive a March tariff bill that was “twice as much as we were expecting”; John Snyder, owner of Electronic Audio Experiments, adds in an interview that the cost of metal enclosures used for a new pedal “basically tripled overnight,” forcing his $1 million-in-annual-sales company to discontinue the product. “You don’t want to pass that cost onto the customers,” he says. “At some point, you have to take the ‘L’ and move on, and focus on stuff where the margins are better.”

The tariffs haven’t fully kicked in for the music-gear business, in part because of Trump administration uncertainty: In addition to the fluctuating tariff rates, particularly on China, Trump has granted, without much explanation, exemptions for certain industries, like smartphones, laptops and other electronics. NAMM has lobbied U.S. senators and the Commerce Department for an exemption on the types of lumber, known as tonewoods, that are used in guitars.

Another reason consumers may not have noticed a widespread increase in guitar-gear costs: Like many aggressive U.S. businesses, some music-equipment companies began preparing when Trump won the 2024 election. Electronic Audio Experiments, according to Snyder, spent last December and January working with a longtime supplier to buy as much inventory as possible so the company could maintain prices through the end of 2025. “Our circuit-board assembly house is located in North Carolina. We loaded them up with as much raw material as we could stand and just tried to coast from there,” Snyder says. “It was a very anxious time. Nobody knew exactly what was happening. We just knew it was going to be bad.”

For now, some music-gear manufacturers detect a shift among consumers to the used market. On Reverb, which sells new and used gear, April prices dropped by about 1 percent compared to the same time in 2024. “There have been a few manufacturers who have raised prices in the last few weeks on synthesizers and pedals,” says Cyril Nigg, Reverb’s senior analytics director. “A lot of the other manufacturers are trying to hold prices where they are for now. The retailers who are selling those products on Reverb are trying to keep the prices stable.”

Used gear prices are typically about 50 percent to 80 percent of the new price, according to Herndon, whose company earns less than $500,000 in annual sales. “The used market is indexed to the price of new goods,” he says. “Somebody goes, ‘I want to buy a Stratocaster, and everything has gotten more expensive — screw this, I’m going to buy it used.’ Well, the tariffs have raised the price of the new goods, and now the used goods are going to come up.”

Elizabeth Dilts Marshall contributed to this report.

Investors seeking shelter from the chaos unleashed by President Trump’s often incoherent tariff policy can find safety in companies without direct exposure to tariffs or the teetering advertising market. And music, especially digital music, will be able to weather the storm, say many analysts — with one major exception.

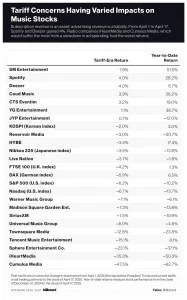

To understand what people are thinking about tariffs’ impact on the business world, look no further than stock prices. The performance of various music-related stocks reveals how investors are betting that economic uncertainty will affect various companies.

Many stocks — especially those of companies traded on U.S. exchanges — have taken a hit as investors fled for safer alternatives. The Nasdaq and S&P 500, U.S. indexes, are down 6.2% and 6.7%, respectively, since April 1, the day before President Trump announced his tariff plans. Elsewhere in the world, indexes have generally performed better. South Korea’s KOSPI is down just 2.0%. Japan’s Nikkei 225 is off 3.5%. The U.K.’s FTSE 100 is down 4.2%. Germany’s DAX has lost 5.9%.

Trending on Billboard

Within music, companies that get most of their revenue from streaming are faring relatively well. Since April 1, Spotify and Deezer have each gained 4.0%, two of the better showings for music stocks. Cloud Music improved 3.9%. Tencent Music Entertainment, on the other hand, has fallen 15.1%, although its share price remains up 8.1% year to date.

Record labels and publishers have also been holding up well, in relative terms, particularly outside the U.S. Since April 1, shares of Universal Music Group (UMG) — which is headquartered in the U.S. but trades in Amsterdam — and Warner Music Group (WMG) are down 8.0% and 7.1%, respectively. Reservoir Media lost 3.0%. K-pop companies — much like South Korean companies in general — have fared well. Since April 1, SM Entertainment has gained 7.9%, YG Entertainment is up 1.1% and JYP Entertainment has gained 0.7%. HYBE fell 3.4%.

UMG and WMG’s post-tariff declines are slightly greater than the drops in the Nasdaq and S&P 500 of 6.7% and 6.2%, respectively. But both UMG and WMG had strong starts to 2025, and their year-to-date losses of 4.5% and 6.1% are far better than the S&P 500’s 10.2% drop and the Nasdaq’s 15.7% year-to-date decline.

Some live music companies’ stocks have been resilient, too. Live Nation shares are down 3.7% since April 1, while German concert promoter CTS Eventim is up 3.2%. Sphere Entertainment Co., owner of the Sphere venue in Las Vegas, is an exception. Sphere Entertainment shares have plummeted 23.1% since President Trump’s tariff announcement, a far more significant drop than the stocks of other companies — Caesars Entertainment, Wynn Resorts, MGM Resorts — that rely on consumers’ willingness to part with their money in Las Vegas.

For many U.S. media stocks, the direct impact of tariffs is “relatively muted,” wrote Citi analysts in an April 7 report, as many of the companies rely on discretionary spending, not ad revenue. Apple and other tech companies, for example, got an exemption from the 145% tariffs on Chinese imports but must still pay the blanket 20% tariff. Companies that get much of their revenues from subscriptions — Netflix, Spotify, UMG and WMG — will be less impacted.

Music streaming, most notably subscription services, is considered by equity analysts to be safe from whatever tariff-induced economic chaos awaits the global market. “Digital goods are unaffected by tariffs,” wrote TD Cowen analysts in an April 14 investor report. Subscription services, they argued, provide enough bang for the buck, and customers have such an emotional attachment to music that subscribers are unlikely to leave in “meaningful” numbers if the economy goes south.

Streaming and subscription growth slowed in 2024, but many analysts expect improvements to come from a regular drumbeat of price increases, renewed licensing deals and super-premium tiers. That said, analysts believe that Spotify’s latest licensing deals with UMG and WMG, and upcoming deals with other rights holders, better reward labels and publishers for price increases. As a result, TD Cowen slightly lowered its estimates for Spotify’s revenue, gross profit margin and operating income in 2025. Likewise, in an April 4 note to investors, Guggenheim analysts lowered their estimate for Spotify’s gross margin in the second half of 2025.

Companies reliant on advertising revenue will also take an indirect hit. Citi estimates that $4 trillion of imports could generate $700 billion in tariffs and reduce personal consumer and ad spending by 1.9%. Tariffs have ripple effects, too. Because household net worth and personal spending are highly correlated, says Citi, the recent declines in stock prices could reduce personal and advertising spending by 3.0%.

Consumer spending is at the heart of the concert business, but analysts agree that fans’ affection for their favorite artists protects live music from economic downturns. As a result, Live Nation has “less risk than the average business that depends on discretionary spending,” according to TD Cowen analysts.

Advertising-related businesses aren’t so lucky, though. As tariffs raise prices and household wealth declines, personal spending also declines, and, in turn, brands pull back on their advertising spending. Investors’ expectations for advertising-dependent businesses were apparent before April but have become clearer since President Trump’s April 2 tariff announcement. iHeartMedia, which closed on Thursday (April 17) below $1.00 per share for the first time since June 4, 2024, has dropped 35.3% since April 1 and fallen 50.3% year to date. Cumulus Media has fared even worse, dropping 47.5% since April 1 and 62.7% year to date. Townsquare Media has fallen 12.8% in the tariff era and 23.8% year to date.

J.P. Morgan analysts believe iHeartMedia’s full-year guidance of $770 million is “somewhat optimistic” given economic uncertainties and ongoing pressures in the radio business. It forecasts full-year EBITDA of $725 million — nearly 6% lower than iHeartMedia’s guidance. If things wind up going more the way J.P. Morgan predicts than iHeart, it would be a big blow to the company and an unfortunate bellwether for the already struggling radio business. While other music industry sectors look to ride out the tariffs at least in the shorter term, the economic uncertainty introduced by the Trump administration may only hasten radio’s ongoing decline.

As Billboard has noted numerous times in recent weeks, investors are attracted to music assets because they are counter-cyclical, meaning they don’t follow the typical ups and downs of the economy. Consumers will, by and large, stick with their music subscription services and continue going to concerts. But by introducing the tariffs, the Trump regime exposed one of radio’s greatest weaknesses as a business: a greater exposure, due to its reliance on advertising, to the state of the wider economy.

Billboard

Six months ago, a stadium-concert headliner decided to create tens of thousands of high-end T-shirts and hoodies to “rival any streetwear brand and be able to sell it for less than Sabrina Carpenter or Billie Eilish,” says Billy Candler, CEO/co-founder of Absolute Merch, a 13-year-old company that works with 30 artists. Candler arranged to purchase the shirts from China, then ship them on April 9, two weeks before a new U.S. tour.

But on April 2, President Trump imposed an 84% tariff on Chinese imports. Then, in the next few days, he boosted them to 104%, then 125%, then 145%. With each increase, Candler says, “I almost had a heart attack. It’s just exploded our plan.” As of Saturday (April 12), the company’s freight order has been “literally sitting in Customs waiting to be cleared,” with new tariffs imposed.

Trending on Billboard

As with industries that manufacture and ship smartphones, aluminum foil, car parts and toasters, artist-merch companies like Absolute are scrambling to predict the Trump administration’s final number on Chinese tariffs and figure out how to transfer production to alternative countries. Ideally, Absolute Merch would simply cancel its China order and restart in the U.S., but the deadline is too tight for the stadium-level act’s upcoming tour and, as Candler says, “You can’t do it in America. We really don’t make fabric here.” It may eventually be possible to shift to Vietnam or elsewhere, but Chinese prices for blank shirts tend to be cheapest, music-merch sources say, and nobody knows whether Trump will reimpose tariffs on other countries in July, after his 90-day respite period.

Even if every company in the $13.4 billion global music-merch business, as MIDiA Research estimated, pulls out of China, demand will spike in other countries, and merch manufacturers will likely raise their prices. “Costs will go up because of capacity shortages once China is not an option,” says Barry Drinkwater, executive chairman of Global Merchandising Services, which works with Iron Maiden, Guns N’ Roses and others.

Will artists and their merch companies pass the additional costs stemming from tariffs to their customers? They may have no choice but to raise prices, Candler says, speculating that hoodies could rise to $150 and T-shirts to $65 if the trade war continues. “I have a client manufacturing a cut-and-sew bomber jacket,” adds Pat Dagle, owner of Terminal Merchandise, which works with 20 artists. “That jacket jumped from a price point of $35 to $80, on our side, because of the tariffs. The cost falls onto us, so it’s negating a lot of our profit.”

“It’s going to affect everybody,” says Kevin Meehan, a 30-year artist-merch manufacturer in Costa Mesa, Calif. “Because 90% of the trims in the world are made in China — your zippers, your buttons, your snaps, your drawcords, your eyelets, all that stuff for apparel.”

Andy Stensrud, a veteran Nashville music merchandiser who works with Bad Bunny, IU and other Latin and K-pop stars, adds of China: “When it comes to the custom apparel, they are so far ahead of everybody else with turnaround times and pricing. We just made some custom hockey jerseys for a band, and they cranked them out in 10 days. No one can touch that.”

For now, many in music merch are remaining calm as the U.S.-Chinese tariff situation fluctuates. Dov Charney, the American Apparel founder who created Los Angeles Apparel in 2016, stands to benefit from artists and others seeking merch items not made in China. He says most touring artists source T-shirts and other clothing products from Honduras, El Salvador and Central America, which haven’t had to contend with high tariffs. Even China-made products are unlikely to increase by more than $5 or $10 for a T-shirt, he adds, because wholesale shirt costs are low and the high expenses come from things like transportation and design, which are unlikely to change due to tariffs. “OK, boo-hoo,” Charney tells Billboard. “It’s not going to have a profound effect as much as people are saying.”

Brent Rambler, guitarist for hard-rock band August Burns Red, which runs its own merch operation, is avoiding the tariff uncertainty, refusing to “proactively raise our prices” and risk turning off fans in the long term. The band’s T-shirts come from Bangladesh, and while its coffee mugs are made in China, a manufacturing increase of $1.50 to $2 per unit is unlikely to lead to a consumer price bump: “You don’t want to turn people away,” Rambler says.

Steve Culver, president of Nashville-based merch company Dreamer Media, adds that the tariffs are a political issue likely to be resolved before consumer costs rise too dramatically. “It’s too early to understand how it’s going to play out,” he says. “I’m not panicking.”

For now, tariff stress has spread to all levels of the touring business, which relies on merch, especially artists who can’t make a living on streaming revenues. Reached by phone while driving from St. Louis to Kansas City in a van stuffed with cardboard merch boxes, Evan Thomas Weiss, frontman of Pet Symmetry, says the emo band pays $13 to $15 to print a T-shirt, plus more on transportation and other expenses, then sells it for $30 at a show in order to make a small profit. If tariffs cause production prices to rise by even 20%, a fan could pay as much as $40.

“I don’t know how anybody’s going to be able to afford that,” he says.

Pet Symmetry was lucky — its latest order of 300 to 400 shirts and other merch items arrived two weeks ago, in time for its current club tour.

“But if something happens over the summer, and tariffs go into effect, we have to do some real reflection, and decide whether to order more now or wait,” Weiss says. “Which is such a difficult position for a small band to be in.” From the van, guitarist Erik Czaja adds: “If it came to it, one of us would learn how to screen-print.”

Chris Eggertsen contributed to this report.

President Trump’s global tariffs, which were paused for 90 days shortly after going into effect on Wednesday (April 9), have set global markets on a rollercoaster downhill and put on hold many of the year’s most-anticipated IPOs. Although markets rebounded strongly after the U.S. Treasury Department lowered most tariffs to a flat 10% — China is a notable exception — some anticipate the market volatility could present an opportunity for music catalogs and debt in the coming months, as investors look for more stable ground.

Both sectors — investing in music intellectual property and buying asset backed securities (ABS) collateralized by music rights — could see more demand from institutional investors looking to stockpile cash and safeguard against equities, several royalty investors, music valuation experts and entertainment bankers tell Billboard. For over a decade, music catalog returns have held relatively steady even during economic downturns, which may appeal to investors looking for assets they can easily cash out of in a pinch, those sources said.

Trending on Billboard

“The royalties space has been relatively calm over the last week given the volatility seen elsewhere, with many investors expecting their portfolios to remain resilient as they have been through other macroeconomic and geopolitical events, although it’s still early days,” says Stephen Otter, managing director at the Swiss-based private equity firm Partners Group. An investor in Harbourview Equity Partners, Round Hill Music and Lyric Capital Group, Partners launched its own royalty investment strategy in February to acquire music, healthcare, renewable energy and other royalties, with the aim of accumulating $30 billion in assets under management by 2033.

“As investors reassess their portfolio allocations in today’s environment, we expect many may consider casting their net wider to incorporate other asset classes, such as royalties,” Otter adds.

The rise of paid music streaming, which accounted for 51% of global recorded music revenues in 2024, according to the IFPI, has helped stabilize music royalties and make their returns more predictable into the future. While rights holders have some exposure to recessionary changes such as advertising spending and consumer discretionary spending, “Music streaming tends to perform well and has historically offset other declines,” says Brad Sharp, senior managing partner at Virtu Global Advisors.

Shot Tower Group, a Baltimore-based boutique investment bank, said that investor interest in music assets remains high despite industry reports of slowing streaming growth, although that outlook could change if macro-economic uncertainty persists, or a trade war were to take hold.

Brian Richards, managing partner at the music-focused investment bank Artisan, tells Billboard, “We haven’t seen any evidence of pullback in the music market during this past week of turbulence.”

Two sources said they expect more activity in the near-term in the credit markets for music. In the past 18 months, a growing number of music companies, like Concord, HarbourView and Recognition, formerly Hipgnosis, have raised money in the debt markets by selling asset backed securities backed by the songs they own in their portfolios.

These sources anticipate more esoteric debt like this to become available to investors because corporate bonds have been rallying since the beginning of the year, driving a narrowing in the difference between the yields of Treasury bonds and corporate bonds. A narrow, or tight, spread between those bonds typically signals optimism.

Shot Tower says it expects at least one music company to issue an asset-backed security in April, which could provide a gauge of investor sentiment. If the chaotic market mood and global uncertainty stick around, however, it could mean fewer music catalogs come up for sale and financing becomes more selective, Shot Tower says.

At least one industry group expressed fears over the possibility of retaliatory tariffs on digital services companies, such as Apple Music, Amazon, Meta and YouTube, and maybe even issues collecting royalties.

“Since creative industries are among the few American industries that have a positive balance of trade with other nations, we will be watching closely to see if other countries target American music in any retaliation, which could include tariffs or other actions like withholding royalty payments,” A2IM president/CEO Richard Burgess wrote in an email to members this week.

The withholding of royalties is unlikely, says Sharp, or may be limited to countries such as China that have higher tensions with the U.S.; on Wednesday, the Treasury raised the tariff on goods from China to 125% following the country’s imposition of retaliatory tariffs on U.S.-made goods.

“A rise in global economic tensions may result in an increase in consumption of more localized content on a by-country or by-region basis,” says Sharp. Economic policy could also result in higher inflation, he adds, “which will potentially impact interest rates and have a knock-on effect on valuations.”

Additional reporting by Ed Christman.

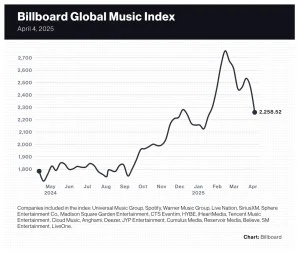

Music stocks were battered this week after President Donald Trump unveiled the tariffs that will be applied to imported goods from around the world.

The 20-company Billboard Global Music Index (BGMI) fell 8.2% for the week ended Friday (April 4), marking the largest single-week decline in the index’s two-and-a-half-year history. Among the 17 stocks that posted losses, eight declined by 10% or more, and one — iHeartMedia — far surpassed a 20% decline. Of the 20 stocks on the index, only three South Korean K-pop companies posted gains for the week.

Markets around the world experienced large declines in the wake of the tariffs. In the U.S., the tech-heavy Nasdaq fell 10.0% and the S&P 500 dipped 9.1%. The U.K.’s FTSE 100 slipped 7.0%. South Korea’s KOSPI composite index fell 3.6%. China’s SSE Composite Index declined just 0.3%.

Trending on Billboard

SM Entertainment was the top performer of the week with an 8.3% gain, besting JYP Entertainment’s 3.3% increase and HYBE’s 2.3% improvement. No other music stock finished the week in positive territory, although French company Believe came close with a 0.1% decline.

Spotify fell 10.3% to $503.30, erasing approximately $12 billion of market value. While most stocks cratered on Thursday (April 3), Spotify had fared relatively well by losing just 1.2%. But Spotify shares fell 9.9% on Friday (April 4), paring down the once high-flying stock’s year-to-date gain to 7.9%.

Like Spotify, Tencent Music Entertainment bucked the downward trend on Thursday by suffering only a minor loss, but declined 9.5% on Friday, dropping 9.9% to $12.95.

Radio companies, which are heavily dependent on advertising revenue, were among the most affected stocks. iHeartMedia shares fell 26.8% to $1.20, bringing its year-to-date decline to 43.7%. Cumulus Media dropped 14.9% to $0.40. SiriusXM declined 14.2% to $19.51.

Live entertainment stocks were also hit hard. Sphere Entertainment Co., owner of the Sphere venue in Las Vegas, fell 19.5% to $26.74, mirroring sharp declines in gaming companies reliant on travel to Las Vegas such as Wynn Resorts (down 14.9% this week) and Caesars Entertainment (down 9.7%). Sphere announced on Friday that it has two new experiences in production: The Wizard of Oz at Sphere and From The Edge, a film about extreme sports.

Madison Square Garden Entertainment dropped 11.9% to $29.71, widening its year-to-date loss to 17.2%. Live Nation had been up 7.7% through Wednesday (April 2) but finished the week down 3.4% after losing a combined 10.3% over Thursday and Friday. German concert promoter CTS Eventim fell just 6.2%.

Music stocks started 2025 well, but concerns about tariffs have wiped out the index’s early gains. The BGMI has lost 18.0% of its value since Feb. 14 and has declined in five of the previous seven weeks. Halfway through February, the index had gained nearly 30% in the first six weeks of the young year. By Friday, that year-to-date gain was down to 6.3%.

Billboard

Billboard

Billboard

The Trump administration’s tariff policy aims to return manufacturing to the United States is already having ripple effects throughout for the U.S. music industry and could have further consequences in the future.

Trump announced on Wednesday (April 2) a minimum 10% tariff on all trade partners, a 25% tariff on all foreign-made automobiles and additional tariffs on countries with which the U.S. has a trade deficit. No country is safe — not even Australia’s uninhabited territories near Antarctica, which got slapped with a 10% tariff despite having more penguins than people.

The tariffs are meant to protect America’s manufacturing industry and encourage businesses and consumers to purchase U.S.-made goods. But because many goods produced in the U.S. consist of raw goods and finished components imported from elsewhere, even products made at home are subject to higher costs that may be passed on to consumers. Musical instruments are likely to suffer from the tariffs, and they’re not alone.

Trending on Billboard

“Domestic vinyl pressing costs are likely to rise,” says an executive in the vinyl manufacturing business. Much of the PVC used to manufacture records comes from overseas and will be subject to tariffs, this person says. Canada supplies much of the board stock and paper for record packaging. Lacquers used to create temporary masters for vinyl pressing come from Japan.

The cost of physical music product from Europe will also become more expensive, says David Macias, co-founder of Thirty Tigers. Macias is trying to help Thirty Tigers’ labels source manufacturing in the U.S. to avoid the additional costs, but he notes that because domestic manufacturing costs will likely increase, independent record stores may still face “a chilling effect” from higher wholesale prices and financially stressed consumers. “We’re heading straight into $35 single vinyl albums,” says Macias. “In an economy where everything else costs more, vinyl will become a luxury item.”

The music business could be spared some of the pain. As the American Association of Independent Music (A2IM) noted in a message emailed to its members, the Berman Amendment to the International Emergency Economic Powers Act — which President Trump invoked to launch the tariffs — prevents the president from regulating or banning the import of “informational materials” such as phonographs and CDs. And the Free Trade in Ideas Act of 1994 expanded the Berman Amendment to include newer forms of communication. The vinyl manufacturing executive expressed uncertainty about the exemptions, however, and expects vinyl imports will be subject to tariffs “at least in the short run.”

Responses from foreign countries could heighten tensions and ensnare music companies in unexpected ways. China responded by slapping a 34% tariff on U.S. imports, and the U.K. is reportedly compiling a list of U.S. products it could hit with tariffs. A2IM told its members that countries could also respond by withholding royalty payments.

Some U.S. contingents have praised the tariffs: steel manufacturers, electrical contractors and the cattle industry, among others. “This is exactly the type of bold action America needs to restore its industrial leadership,” Zach Motti, chairman of the Coalition for Prosperous America (CPA), said in a statement. The CPA represents U.S. farmers, labor unions, manufacturers and ranchers, and it advocates for trade protections, according to non-partisan watchdog InfluenceWatch.

But the tariffs, and the Trump administration’s bellicose and often threatening statements, aren’t being well received by other countries. Not only are U.S. trading partners responding with tariffs of their own, but some foreigners are also avoiding the U.S. altogether. That presents a huge potential loss of visits to experience everything from music festivals in Southern California to the rich musical history of the Mississippi Delta.

Nashville, a city heavily dependent on tourism, is already seeing fewer visitors from the north. “Canada is our top international market, and unfortunately, we are already seeing a decrease in Canadian visitors,” Deana Ivey, president/CEO, of the Nashville Convention & Visitors Corp, said in a statement to Billboard. “We know how much they enjoy coming here for the music, and we’re hopeful they will still make the trip to CMA Fest” in June. International visitors accounted for approximately 3% of the 17 million visitors to Nashville in 2024, with about half coming from Canada, according to the Nashville Convention & Visitors Corp.

A decline in Canadian tourism would hurt more than Nashville. The U.S. Travel Association estimated the tariffs could result in a 10% decline in U.S. tourism from Canada, the No. 1 source of tourism to the U.S. with 20.4 million visitors and $20.5 billion in spending in 2024. Las Vegas would be hard-hit: Canada was the top source of foreign visitors to the city in 2024, bringing in more than 1.4 million people, according to the Las Vegas Convention and Visitors Authority.

There are already signs that Canadians are avoiding their neighbor to the south. In March, Canadian airline Flair Airlines announced it canceled flights from Canada to Nashville — a loss of 18,000 seats, according to the commissioner of Tennessee’s Department of Tourist Development. Also last month, the president/CEO of Visit Buffalo Niagara told CP24.com that cross-border visits were down 14% in February from the prior-year period. “This is a big concern for us,” he said.

The testy relationship between the governments of the U.S. and Canada prompted the Canadian Independent Music Association (CIMA) to pull out of SXSW. Back in February, CIMA president/CEO Andrew Cash became concerned that spending Canadian tax dollars on a trade mission to the U.S. might not be a good choice given the tone of political discourse. CIMA’s presence at SXSW, Canada House, is a public-facing, Canadian-branded event that hosts “vulnerable artists” and their teams, he explains. “It was hard to know what effect that was having on the attitude towards Canada,” he explains. “That was part of it. CIMA also is the custodian of a certain amount of taxpayer dollars. And I also thought about the optics of that.”

Cash isn’t alone in his unwillingness to spend money in the U.S. Rob Oakie, executive director of Music PEI, a non-profit that aids music development for Prince Edward Island, says the recent political rhetoric, combined with the increased cost of time required for Canadians to obtain a visa to tour the U.S., will result in fewer trips to a market that has always been a focus for Canadian artists.

Oakie says his music development colleagues at the other three Atlantic providences — Nova Scotia, New Brunswick and Newfoundland — have collectively decided “not to invest any money in the U.S. in the immediate future.” That affects upcoming travel to the Folk Alliance International Conference to be held in January in New Orleans and the IBMA Bluegrass Music Awards to be held in September in Chattanooga, Tenn.

“On the artist side,” Oakie adds, “I have heard quite a number of artists saying they have no intention of touring the U.S.” He points to an incident in March with Canadian folk duo Cassie and Maggie that received national attention after the musicians were pulled over by sheriff deputies in Ohio. According to reports, each sister was asked if they preferred Canada or the U.S. while the officers echoed a Trump talking point about the amount of fentanyl that comes into the U.S. from Canada.

While President Trump’s tariffs are meant to fix a deficit in the goods trade, they could end up affecting the country’s services trade surplus. The European Union’s anti-coercion instrument (ACI), introduced in 2023, allows the EU to impose penalties on countries that use trade policy to attempt to get a country to change policy. Created mainly as a deterrent, the ACI provides tools for the EU to deal with coercion, including tariffs on goods but, importantly, also trade restrictions on services, intellectual property and foreign direct investment.

That could leave American tech companies, many of which provide music services globally, vulnerable. A French government spokesperson told Reuters that digital services are likely to be a focus, and a senior European Union official told Politico a response could target intellectual property rights. In other words, Trump’s tariffs could affect not just physical goods but the digital engine that drives the modern music business.

President Donald Trump’s so-called “Liberation Day,” which marked the imposition of tariffs on all U.S. trading partners on Wednesday (April 2), was followed by a bloodbath on Wall Street on Thursday (April 3).

The tech-heavy Nasdaq fell 6.0% while the S&P 500 dropped 4.8% — the largest single-day decline since 2020 for both. The Russell 2000, an index of small-cap companies, dropped 6.6% and entered bear market territory, having lost more than 20% of its value since reaching its all-time high in November.

All music stocks except three K-pop companies suffered losses Thursday, with a handful losing 13% or more of their value and most dropping by mid-single digits. Music is largely a service that operates seamlessly across borders and is mostly immune from the tariffs applied to manufactured goods. But investors clearly expect U.S. consumers to face higher prices and an uncertain labor market, which in turn causes people to reduce their spending on everything from everyday household items to more expensive items such as concert tickets and travel.

Trending on Billboard

The severity of stock declines varied by industry segment. Companies with high exposure to the U.S. advertising market were hit particularly hard, a reflection of brands’ tendency to reduce their ad spending in times of economic uncertainty. In the radio segment, iHeartMedia shares fell 13.1%, Cumulus Media dropped 10.1% and Townsquare Media sank 6.3%. Satellite radio company SiriusXM lost 5.4%. Music streamer LiveOne, which has both subscription and ad-supported offerings, fell 12.9%. PodcastOne, a podcast company majority owned by LiveOne, dipped 10.3%.

Companies involved in live music also fared poorly. Sphere Entertainment Co. fell 13.9% while sister company MSG Entertainment fell 6.8%. Live Nation dropped 6.4%. Secondary ticket marketplace Vivid Seats fell 9.6% and ticketing company Eventbrite sank 4.7%. Sphere Entertainment’s decline was mirrored in other companies that also rely on travel to Las Vegas: Las Vegas Sands Corp. lost 6.7%, MGM Grand International dipped 9.3%, Caesars Entertainment fell 9.5% and Wynn Resorts dropped 10.6%.

Multi-sector music companies — a combination of mainly recorded music and music publishing — fared relatively well. Universal Music Group lost 1.5%. Warner Music Group dropped just 0.7%. Reservoir Media was down 3.5%.

There was also a clear divide between companies that derive the majority of their income within the U.S. and companies that do not. Live music and ticketing companies based in the U.S. fell an average of 8.3% while German concert promoter CTS Eventim fell just 2.4%. Radio companies and LiveOne, which are more subject to the health of the U.S. advertising market, fared worse than Spotify, which fell just 1.2% despite offering an ad-supported tier in the U.S.

The most valuable American companies suffered huge losses as investors gauged the tariffs’ impact on foreign-manufactured goods. Apple shares dropped 9.3%, wiping out more than $300 billion of market value. Amazon, which does brisk business on items manufactured in Asian countries facing large tariffs, fell 9.0%. Meta, which relies on advertising for nearly all of its revenue, also dropped 9.0%.

In a first, the Polaris Music Prize is rescinding Buffy Sainte-Marie‘s wins. The Juno Awards have also revoked the singer-songwriter’s awards and her induction into the Canadian Music Hall of Fame.

The Canadian Academy of Recording Arts and Sciences (CARAS), the organization that administers the Junos, released a statement, writing that the singer-songwriter does not meet eligibility requirements following her confirmation that she is not Canadian — similar criteria that the Polaris Prize cited. It was a “not a reflection of Ms. Sainte-Marie’s artistic contributions,” CARAS writes.

CARAS says it made the decision following a thorough review and consultations with the CARAS Indigenous Music Advisory Committee.

Trending on Billboard

Sainte-Marie has faced criticism and scrutiny following a 2023 CBC investigation that cast serious doubt on her claims of Indigenous identity.

In January of this year, Sainte-Marie’s Order of Canada was terminated. On March 4, The Canadian Press reported Sainte-Marie issued a statement about the termination, saying that she returned the Order “with a good heart” and affirming that she is a U.S. citizen. “My Cree family adopted me forever and this will never change,” she added.

Sainte-Marie won the Polaris Prize — which is awarded annually by a jury of music critics to one Canadian album based on merit — in 2015 for Power In The Blood. She was also awarded a Polaris Heritage Prize, which honours albums released before the Prize’s founding in 2006, in 2020 for her debut solo album It’s My Way!

Now, those two awards will no longer be hers.

“Based on Sainte-Marie’s statement, Buffy does not meet Polaris Music Prize’s rules and regulations,” wrote the Polaris Prize. “Given Buffy’s statement regarding her citizenship, Polaris Music Prize will be rescinding all awards including her 2015 Polaris Music Prize and 2020 Heritage Prize,” the Prize states.

The PMP statement also acknowledges that not all Indigenous artists have access to government-issued paperwork, with the Prize asserting that this should not impact eligibility for the award.

The Prize’s eligibility criteria requires that nominees “be Canadian citizens or permanent residents, with proof of status provided through government-issued documentation, including passports, birth certificates, permanent resident cards, and/or Secure Certificates of Indian Status.”

Read the Polaris Prize and Juno Awards’ full statements on Billboard Canada .

≈

Canadian Vinyl Pressing Plant Promises to Absorb Tariff Costs for American Customers

An Ontario-based vinyl company has announced it will absorb tariff costs for American customers, receiving a mixed response.

As America imposes 25% tariffs on some Canadian imports (with others delayed until April 2), Precision Record Precision is committing to keeping prices stable for U.S. clients.

“We understand that recent tariff announcements may raise concerns, and we want to assure our US-based customers that any tariffs imposed by the US government on Canadian exports will be paid by and fully absorbed by PRP,” says a statement from CEO Shawn Johnson.

With manufacturing based in Burlington, Ontario, the company bills itself as one of the largest pressing plants in North America. The company was established in 2016 as a partnership between the massive Czech-owned vinyl manufacturer GZ Media and Canadian music distributor Isotope Music.

Some customers welcomed the decision, but the top comment on Instagram disagrees with the company.

“But the American clients SHOULD be paying the tariffs. Not the Canadian company. I understand the desire to not lose business but this is disappointing from a Canadian company and makes me question if I want to use Precision Pressing again thin [sic] the future,” the comment reads.

The trade battle between the U.S. and Canada, as well as persistent threats by the American President to annex Canada, have prompted uncertainty in the Canadian cultural industries as well as a wave of nationalism.

≈

Canadian Artists Hold the Top Two Spots on Billboard Albums Charts

Tate McRae is so close to superstardom.

The Calgary pop singer has notched her first No. 1 album with So Close To What, topping the Billboard Canadian Albums chart on the chart dated March 8. She bumps Drake and PartyNextDoor’s $ome $exy $ongs 4 U to no. 2, on that Canadian chart and on the Billboard 200 — a rare occasion where Canadians have the top 2 albums in both Canada and the U.S.

It marks a major ascension for the Canadian star, who has been building her profile since her breakthrough with 2020’s “You Broke Me First.” In the five years since, McRae has evolved into one of Gen Z’s biggest singers and performers.

McRae expressed her excitement at the No. 1 debut on Instagram. “????????? Are you kidding meeeeeeee Thank you Thank you Thank you 😭’” she wrote.

McRae also has 15 songs in total on the Canadian Hot 100 this week. Her highest placement is the sultry “Sports Car,” which she performed on Saturday Night Live this past weekend. That track sits at No. 11 on the Canadian Hot 100 and No. 16 in the U.S.

Drake and PartyNextDoor, meanwhile, have 16 tracks on the Canadian Hot 100 this week, though they are not as high as in the first week. The top placed song, “Nokia” drops 5-10, and “Gimme a Hug” moves down 10-39.

Overall, it’s a big week for Canadian artists on the charts.

Last Week In Canada: Billboard Live Stage Coming to NXNE

Growing up in Virginia, John Mlynczak, now president/CEO of the National Association of Music Merchants (NAMM), didn’t have much money to spare, but he always dreamed about the day he could take home a Martin guitar. In college, he says his now-wife and mom “plotted and saved up to both go in together” to buy him one as a gift. “I still have it,” he recalls with pride. “It was made in Mexico. I didn’t care. I would not have been able to hold that brand and that signature square headstock in my hand if it wasn’t for the affordability and quality” of what Martin was making in its Mexican factories.

Mlynczak’s story is a common one. Many musicians, whether they know it or not, are playing instruments that were made entirely (or in part) in Mexico, Canada or China. For example, 989,621 acoustic guitars were imported from China and 187,722 acoustic guitars were imported from Mexico in 2024, according to data from the U.S. International Trade Commission. Top guitar brands like Fender, Martin, Taylor and more create many of their moderately priced products in Mexico; popular drum kit manufacturers like PDP, Yamaha and Pearl all list instruments made in China on their sites. While Mlynczak says instrument brands “have so much strong manufacturing in the U.S.” already — more than most other industries — those American-made products are cost-prohibitive for a lot of musicians.

Trending on Billboard

So when the Trump administration enacted a new 25% tariff on imports from Mexico and Canada and added an additional 10% tariff for Chinese goods on Tuesday (March 4), Mlynczak and NAMM sprung into action to help members weather the storm — though really, the trade organization has been helping members with storm after storm over the last decade, which has been especially turbulent for the instrument market. Whether it was the tariffs during Trump’s first term in 2018, the stress on the supply chain during COVID-19, or this week’s latest action, NAMM has engaged in a never-ending effort to make the voice of music manufacturers heard.

Though there’s not much anyone can do to stop the tariffs, NAMM is creating working groups for its members to come together and share tips, including providing essential information straight from Washington, D.C.; encouraging members to submit comments to Congress about how tariffs affect business; and building alliances with other impacted industries.

“The global supply chain has allowed us to make high-quality, affordable products, and it’s taken decades to do that,” says Mlynczak. “When you start raising the price everywhere of what it costs to import goods, it’s challenging, and it really threatens everything we’ve learned to do as an industry.”

Now that these tariffs have taken effect, what is NAMM’s role in helping its members?

NAMM’s first job as a trade association is to represent our industry on anything that affects them, and research and get the facts and help our industry navigate any policy. NAMM has been involved in tariffs, especially since the 2018 tariffs were imposed. We did a lot of work on that, and we were monitoring all the pre-election coverage on tariffs last year. We were fully ready for this and have been heavily involved, not only with our NAMM members but also building alliances with other associations and industries that were also impacted.

What are the key differences about the tariffs in 2025 versus those during Trump’s first term in 2018?

There was a different mechanism used by President Trump at the time, and there was an exception process. So after the tariffs were imposed, we led efforts to try to get exceptions from tariffs for music product categories. It was a long process that we worked through with many associations. This round, however, the tariffs so far have been implemented with no exceptions and no process for exceptions.

Were you able to get any exceptions last time? If so, for what product categories?

In 2018, very few exceptions were granted for musical instruments — those typically were granted to larger industries. We are actually a very small industry overall. While we work really hard for exceptions for music-making equipment, concerns about the furniture industry or the lumber industry, for example, can dominate the conversation… Unfortunately, we fought the good fight, but few exceptions were granted – but really that’s true for most industries.

What country or region is most popular for the manufacturing of musical instruments?

China is the largest manufacturing hub for products worldwide. Secondarily, there is a lot of instrument manufacturing in Mexico, U.S., Canada, Indonesia. We have lots of manufacturing in Europe too. But I think the thing to keep in mind is that this is important for the affordability of products and the level of musicians that can afford them. As an industry, you have people who are starting out playing music for the first time. They don’t know how much to invest, but they want a quality product and a price that is reasonable. They’re not ready to get a customized mahogany-backed instrument right away, right? As you progress as a musician, then you start spending more.

We have lots of companies that make musical products in the U.S. We are proud to have a substantial amount of high quality music products made in the U.S. — it’s an impressive number compared to other industries — but the way it works is you have your highest level custom products made in the U.S., then your mid level and entry level products are made by partners in Mexico, China and other countries.

One thing we’d like people to understand is the reason why we have companies that can afford to build their highest-end products in the U.S. is because they have the revenue from the mid-to-entry level products from overseas. Our supply chain is deeply interconnected. It’s not like an instrument is solely made in China or Mexico. What happens is you have certain components that are made really well in China that are then imported for final assembly. Or you have a factory in Mexico that has a specialty in making certain components that are imported. Then they are assembled in the U.S. This happens because this work is highly specialized.

What’s really devastating about this idea of “Oh, we’ll just move manufacturing elsewhere” is that it’s actually not that easy. What we’re building are not generic widgets that come off a line. These workers around the world are trained to understand how to test musical products, to buff the bell of a brass instrument perfectly, to tune the strings on a violin. There are handmade components to these instruments that take — in some cases — decades to do right. These factories often have multi-generational workers. This isn’t a skill set you pick up overnight.

Now that you know Trump’s tariffs are being enacted — and that there are no exceptions — what course of action do you take from here as a trade organization?

Our members are looking for the most factual information, so we have a lobbying firm and law firm in D.C. that allows us to get vetted, factual information. With all the news coming out, it’s difficult to get down to the actual nitty-gritty information that a brand needs. So we are a source for our members to come to. What we try to do is save them time — there’s thousands of companies impacted right now. We’re also creating a working group of members specifically who are impacted by tariffs and bringing them together every two weeks so we can feed them what we’re hearing, anything like “We think this might happen” or “There’s talks of this…”’ and they can share advice with each other.

I know this is not a support group, this is business, but in a tough time that impacts the whole industry, it almost feels like that.

Yeah, these are groups of competitors coming together, but they all are actually concerned for each other and their product categories. They’re concerned for music-making in general. It’s really sweet to see that, as an industry, people are literally sitting across from their number one competitor and saying, “What are you hearing? How can we work together?”

I know, as a trade organization, you can’t speak to individual companies and how they are reacting, but have you heard of any solutions that companies are turning to that seem helpful?

The challenge is that these tariffs are intentionally punitive, intentionally non-exemptible. The retaliatory tariffs actually make the impact harsher because we have so much strong manufacturing in the U.S., so not only do import tariffs cause problems, but export tariffs do too. American-made instruments are really coveted by musicians around the world. It’s a double whammy. The squeeze is really real.

Given tariffs often lead to an increase in the price of products, do you think this will lead to a surge in the used instrument market?

It could… we’re actually in a surge of used products right now because of COVID. In the pandemic lockdown, we saw a really big boom of musical product sales, and our industry is at the tail end of that now. Lots of instruments are being re-sold on the used market. So I don’t know how much more surging it can do, but that’s a perfectly good idea.

The instrument market has been hit with so many challenges over the last decade. From the 2018 tariffs, the supply chain disruption and surge in sales during COVID-19, and now this. Has this been a uniquely challenging decade for this market or has this market experienced this level of ups and downs before?

You’re right. It’s been a wild seven years. From NAMM’s perspective, there’s never been a more important time for us to be there as a trade association, to double down on policy work, and double down on working groups. I feel like now we are probably more united as an industry than ever.

We’re a 124-year-old organization. Historically, musical products are seen as a luxury good. Of course, I would argue music is essential to life, but we are a luxury, unlike bread or gas or housing. Luxury industries historically struggle with high inflation and rising costs… When that happens, traditionally, it becomes harder for us because people don’t buy a seventh guitar — they are trying to figure out how to feed their family. In these times, we as an industry have to come together because the last thing we want to see is companies going out of business.

NAMM members are resilient — we are very used to contracting businesses or experiencing booms, like during COVID. We have a lot of multi-generational companies and incredibly resilient people. This is probably a weather-the-storm situation, and our job is to help companies do that.

If there are less affordable, high-quality options for American families to help their children get interested in playing an instrument, what ripple effect could that have on the market long-term?

Every company recognizes that a user’s first touch point, when they buy an instrument at an affordable price, that if it’s not a quality instrument or the user has a bad experience, then we’ve lost a customer for life.

It’s important to remember that these truly are quality instruments coming from these overseas suppliers. In the instrument market, you need options at every level. Our customers’ buying habits are like a pyramid. There is a very, very small market for the highest tier, custom instrument models, but it is very wide at the bottom. You can’t have that custom shop model at the top without the support of a very wide entry-level bottom.

I understand the reasoning given for being “America First,” but we’re not an industry that builds only in America and only for Americans, and every musical brand wants to sell in the United States. We are global and interconnected. It’s very hard to disrupt that. Our companies say that any change will take about three to five years to implement. We’re talking years of planning. The biggest issue right now is that this administration has been predictably unpredictable.

We need to remember that there’s an executive order that was signed that required departments to research tariffs on every other country by April, so we could see more and more and more of these. So even though the guidance is to stop making in China, Mexico and Canada, our companies don’t know where to move to because we don’t know where the tariffs could be imposed next.

-

Pages

State Champ Radio

State Champ Radio