Streaming

Page: 16

Spotify added 35 million monthly active users in the fourth quarter last year — the most ever in a single quarter — bringing the total number of people streaming on the Swedish music and audiobook platform to 675 million, the company reported on Tuesday. Premium or paying subscribers totaled 263 million as of the end […]

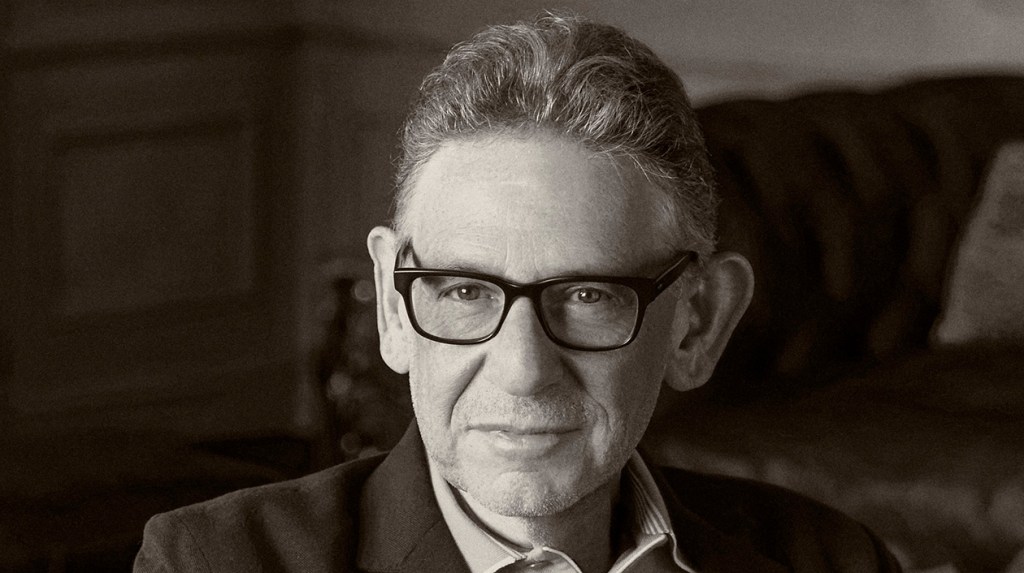

Universal Music Group (UMG) chairman/CEO Lucian Grainge released his annual New Year’s memo to staff on Monday (Feb. 3), about a month later than usual owing to the wildfires that broke out in Los Angeles in early January.

In the 3,113-word letter, Grainge retreaded much of the same ground covered in his 2023 and 2024 New Year’s addresses and his presentation at the company’s Capital Markets Day in September, including mentions of “Streaming 2.0,” “responsible AI,” “artist-centric” approaches, “super fans” and more.

Grainge began the letter by noting UMG’s accomplishments over the last year, including breaking new artists like Sabrina Carpenter and Chappell Roan, working with Taylor Swift — the most streamed artist globally on Spotify, Amazon and Deezer — and Apple Music’s Artist of the Year Billie Eilish, adding that “achievements like these don’t just happen.”

Trending on Billboard

“Those achievements were greatly assisted by our continuing self-reinvention, reshaping our organizational structure,” wrote Grainge, referring to the widespread restructuring of UMG’s recorded music division in 2024 that led to layoffs. “Within months we were operating with greater agility and efficiency. We then saw something exceptional take place.”

As the largest music company in the world enters 2025, Grainge reminded his staff that UMG is still a “relative minnow” compared to the trillion-dollar tech companies it calls its partners. Still, he noted that UMG was successful in ushering in its “artist-centric strategy,” a term he introduced two years ago to describe UMG’s efforts to better monetize music and to limit gaming of the systems.

“Not only do we want to ensure that artists are protected and rewarded, but we’re also going after bad actors who are actively engaged in nefarious behavior such as large-scale copyright infringement,” he wrote. In the last year, UMG forged new deals with TikTok, Spotify and Amazon to aid in those efforts. Also in 2024, UMG sued AI companies Suno and Udio and music distributor Believe to prevent what Grainge called “large-scale copyright infringement.”

Grainge then detailed his plans to influence and set the ground rules for “Streaming 2.0” — or “the next era of streaming” — with UMG’s partners. He pointed back to new agreements with Amazon and Spotify as major wins, adding, “We expect that similar agreements with other major platforms will be coming in the months ahead.”

He also discussed the company’s goal of finding ways to “accelerat[e] our direct to consumer and superfan strategy,” building on past moves like its strategic partnership and investment in NTWRK and Complex. “This year will see us expanding our product offerings to fans, as we continue to redefine the ‘merch’ category and create superfan collectibles and experiences,” Grainge wrote.

He also noted the company’s focus to “aggressively grow our presence in high potential markets,” whether that’s through A&R, artist and label service agreements or mergers and acquisitions. In the last year, UMG has managed to work towards this goal by announcing that Virgin had entered an agreement to acquire Downtown Music Holdings, purchasing the remaining share of [PIAS] and partnering with Mavin Global in Nigeria.

“The reason so many independent music entrepreneurs actively seek to partner with UMG when they have more alternatives than ever before is that we provide what they’re seeking… After all, we’re not a financial institution that views music as an ‘asset,’” he wrote. “And we’re not an aggregator that views music as ‘content.’ We are a music company built by visionary music entrepreneurs. For us, music is a vital — perhaps the vital — art form.”

Grainge ended on a high note, writing, “Let me leave you with this: Some will try to disrupt our business or criticize us. That we know. It comes with being in the most competitive market that music and music-based entertainment has ever seen, and it comes with being the industry’s leader and primary driving force. But our vision and our ability to consistently execute gives us the momentum to continue to succeed and grow.”

Read Grainge’s full New Year’s note to staff below.

Dear Colleagues:

When I wrote my first letter about the L.A. fires, I said that my annual New Year’s note would have to come later than usual. And so here it is…

Last night’s Grammy awards served as a perfect metaphor for our company’s performance in 2024—breaking new artists and taking our superstars to new heights. In fact, last night, UMG artists and songwriters brought home more Grammys than ever before in our history. You can read more about that here.

Thanks to your day-in, day-out dedication and hard work, we accomplished so much together in 2024 and are positioning ourselves for another great year of success. I’ll sum up some of UMG’s stunning achievements last year and give you a glimpse of what we plan for this year. Our company’s fundamental building block is artist developmentand in 2024, investment in new talent continued to produce spectacular results around the world. Consider the following facts: that UMG broke the two biggest artists in the world last year in Sabrina Carpenter and Chappell Roan; Taylor Swift was the most streamed globally on Spotify, Amazon and Deezer; and Apple Music named Billie Eilish its Artist of the Year. And that a UMG recording artist who is also signed to UMPG as a songwriter had the No. 1 song globally on the year-end lists for both Apple Music (Kendrick Lamar) and Spotify (Sabrina Carpenter). Or that UMG had four of the Top 5 artists globally on Spotify with Taylor Swift (No. 1), The Weeknd, Drake and Billie Eilish; eight of the Top 10 albums (Taylor Swift’s The Tortured Poets Department at No. 1); five of the Top 10 songs (Sabrina Carpenter’s “Espresso” at No. 1), and six of the 10 Most Viral songs (Lady Gaga and Bruno Mars’ “Die With A Smile” at No. 1). Or consider that in the U.S., UMG had all Top 3 label groups according to Billboard (Republic, Interscope and Universal Music Enterprises) not to mention four of the Top 5 artists and eight of the Top 10 albums, including all of the Top 5 – Taylor Swift (No. 1 and No. 2), Morgan Wallen, Noah Kahan and Drake. And on YouTube, six of the Top 10 songs (Kendrick Lamar at No. 1) and two spots on the Trending Topics Top 10 across all content categories in 2024 (Kendrick Lamar and Sabrina Carpenter). You can read more of our remarkable achievements around the world at the end of this note, but as you can already see, in 2024, our momentum only grew. Also, these were achievements not only by a few superstars, but also by dozens of artists from around the world—both developing and established—performing in multiple genres, styles and languages. Achievements like these don’t just happen. They are the culmination of maintaining a clear vision of who we are, what we do and where we’re going, then executing on that vision, maintaining momentum and, of course, at the heart of it all, having some absolutely incredible music to work with. And last year those achievements were greatly assisted by our continuing self-reinvention, reshaping our organizational structure, re-building our teams and refining our strategy. A vision which boldly and, when necessary, quickly adapts to an ever-changing world. For example, in early 2024 we executed on our vision to realign our U.S. label structure, and within months we were operating with greater agility and efficiency. We then saw something exceptional take place: UMG had its best U.S. performance in six years, according to Luminate. I’m confident that our realignment will yield still further momentum around the world and that the achievements of our artists and songwriters—as well as UMG’s success—will reach new heights.In 2024, we continued to lead the media industry in our embrace and advancement of “Responsible AI.” Three recent examples of that initiative include our agreements with SoundLabs, ProRata and KLAY—companies that are taking unique approaches to the rapidly evolving AI space through new technologies that provide accurate attribution and tools to empower and compensate artists.Our leadership also includes our commitment to the enactment of Responsible AI public policies, fighting back against so-called text and data mining copyright exceptions and other misguided and ill-intentioned proposals that would enable what I will euphemistically call the unauthorized exploitation of creators’ work. Instead, we will work towards legislative “guardrails” to ensure the healthy evolution and growth of AI that mutually serves creators, consumers and responsibly innovative technology players.In my note last year, I said that 2024 would see us once again attracting the brightest entrepreneurs, expanding our existing relationships with other such talents and investing more resources into providing a full suite of artist services businesses to independent labels around the world. And we did exactly that. We acquired the remaining share of [PIAS] two years after taking an initial stake in the company and brought its highly respected co-founder Kenny Gates into our family. And we grew our geographic footprint. One example: our partnering with and investing in Mavin Global, whose founders Don Jazzy and Tega Oghenejobo continue to lead that company as well as, going forward, all of UMG’s business in Nigeria.Just last month, Virgin announced it entered into an agreement to acquire Downtown Music Holdings, which includes FUGA, Downtown Artist & Label Services, Curve Royalties, CD Baby, Downtown Music Publishing and Songtrust.The reason so many independent music entrepreneurs actively seek to partner with UMG when they have more alternatives than ever before is that we provide what they’re seeking: the most innovate creatives and finest resources that will advance the careers of their artists and achieve their financial goals within a culture that respects artists and their music. After all, we’re not a financial institution that views music as an “asset.” And we’re not an aggregator that views music as “content.” We are a music company built by visionary music entrepreneurs. For us, music is a vital—perhaps the vital—art form. Artists and the music they create are our lifeblood. We’re proud both to invest in businesses that can and do support today’s leading music entrepreneurs and to advocate for the policies and practices that are designed to protect and grow the entire music ecosystem.And finally, one of 2024’s announcements of which I am proudest is the formation of our Global Impact Team, whose mission is to enact positive change in our industry and in the communities in which we serve. This cross-functional group of executives brings a deep understanding of our global organization and will develop and execute strategies to tackle a variety of critical issues, including: equality; mental health and wellness; food insecurity and the unhoused; the environment; and education. By dovetailing seamlessly with our goals and those of our artists, we can promote and even catalyze beneficial and authentic changes where they are needed. Recently, in the wake of the terrible Los Angeles wildfires, the Impact Team mobilized, offering support to those affected, activating a multi-pronged relief effort to help both our own employees and the broader L.A. communities.Before I get to what lies ahead for 2025, let me first provide you with some context as to the enviable position UMG holds.UMG is a global creative enterprise at the center of an ecosystem of hundreds of digital partners. And while we’ve consistently been the music industry’s leader since the advent of the streaming era—an era whose dawn we were instrumental in ushering in—the leadership posture among our DSP partners has undergone some significant changes. For example, one of our fastest-growing subscription partners, YouTube, is also one of the most recently launched. We expect more inevitable jockeying for the leadership position among standalone platforms as well as among the music services that are divisions of trillion-dollar valuation tech companies.But, even though we are a relative minnow in comparison to a trillion-dollar tech company, the music of our incredible artists and songwriters enables us to exercise outsized influence on the global stage and serve as a critical catalyst in fostering a truly competitive commercial marketplace for music. We will keep using our position to promote a healthy and sustainable music ecosystem that benefits all artists at all stages of their careers.Now to 2025 … starting with our artist-centric strategy:When we introduced that strategy two years ago, we immediately went to work with our partners to make it a reality. In a matter of months, we reached agreements in principle on a number of issues: increasing the monetization of artists’ music; limiting the gaming of the system by protecting against fraud and content saturation; and focusing on the value of authentic artist-fan relationships, inspiring the development of more engaging consumer experiences, including specially designed new products and premium tiers for superfans. Platforms as diverse as Deezer, Spotify, TikTok, Meta and most recently Amazon, have adopted artist-centric principles in a wide variety of ways—principles that benefit the entire music industry from DIY to independent to major label artists and songwriters.Our work in driving these artist-centric principles will continue in 2025. Not only do we want to ensure that artists are protected and rewarded, but we’re also going after bad actors who are actively engaged in nefarious behavior such as large-scale copyright infringement. To that end, we’re setting forth the best practices that every responsible platform, distributor and aggregator should adopt: content filtering; checks for infringement across streaming and social platforms; penalty systems for repeat infringers; chain-of-custody certification and name-and-likeness verification. If every platform, distributor and aggregator were to adopt these measures and commit to continue to employ the latest technology to thwart bad actors, we would create an environment in which artists will reach more fans, have more economic and creative opportunities, and dramatically diminish the sea of noise and irrelevant content that threatens to drown out artists’ voices.In September, during our Capital Markets Day presentation, I described what would constitute the next era of streaming—Streaming 2.0. Built on a foundation of artist-centric principles, Streaming 2.0 will represent a new age of innovation, consumer segmentation, geographic expansion, greater consumer value and ARPU growth.I’m pleased to report that the Streaming 2.0 era has arrived. We recently announced a new agreement with Amazon that includes many of these elements, and just last week, we announced a multi-year agreement with Spotify. We expect that similar agreements with other major platforms will be coming in the months ahead. In 2025, we’ll also be reaching out in new ways to engage fans. In addition to listening to their favorite artists’ music, fans want to build deeperconnectionsto artists they love. Last year, in accelerating our direct-to-consumer and superfan strategy, we formed a strategic partnership and became an investor in NTWRK and Complex to build a premium live-video shopping platform for superfan culture. This year will see us expanding our product offerings to fans, as we continue to redefine the “merch” category and create superfan collectibles and experiences. Some of this will be done through our current partners and some through our own D2C channels, which we will continue scaling to meet the massive appetite of fans. After years of working to aggressively build a healthy commercial environment for artists and music—one in which we have reached approximately 670 million subscribers—we will be laser-focused in 2025 on continuing to expand the ecosystem and improve its monetization. As we did in 2024, this year we will continue to aggressively grow our presence in high potential markets through organic A&R, artist and label services agreements, and M&A.The work that lies ahead of us will bring challenges, no doubt about that. But we will meet those challenges with pride and a sense of privilege, because no other form of creative expression is more fundamental to human existence than music. By that, of course, I mean real music created by human artists. So let me leave you with this:Some will try to disrupt our business or criticize us. That we know. It comes with being in the most competitive market that music and music-based entertainment has ever seen, and it comes with being the industry’s leader and primary driving force. But our vision and our ability to consistently execute gives us the momentum to continue to succeed and grow. Our global worldview and the internal competition fueled by our entrepreneurial spirit breeds innovation. Our passion for finding new and better ways to bring music to the world will keep us ahead of competitors and new entrants alike. We’ll continue to do what we do because what we do and how we do it is impossible to replicate. Our culture and our people—you—are our superpower.I can’t wait to see and hear what this year brings, and I am thrilled to be on this journey with you.Let’s go!Lucian

January is not even over and 2025 already feels like a peak year for animosity toward Spotify — and that’s saying something given the criticism the company has attracted since emerging in 2008 as a potential savior for a piracy-riddled music industry. Even though music and commerce have always been uncomfortable partners in a marriage of necessity, the relationship has never been sourer.

Call it “the Spotify paradox.” Streaming — led by Spotify — has made the music business the biggest it’s been in 25 years, allowed unsigned artists to reach fans around the world, revived the popularity of local language music and enabled artists to sell their catalogs at valuations unthinkable a decade earlier — and yet discontent has never been greater. Industry revenues are soaring, but many artists and songwriters are struggling and angry.

Part of the disgruntlement can be explained by simple math. There are more songs by more artists chasing a finite amount of listeners’ attention. Spotify had a catalog of 35 million songs at the end of 2017, according to its F-1 filing. At the end of 2023 — the latest count available — Spotify had over 100 million tracks and 5 million podcasts. That’s nearly a threefold increase in catalog in just six years. And although its subscribers grew more than threefold to 236 million from 71 million over that time span, Spotify’s success at keeping its listeners engaged is such that the per-stream royalty — the metric people associate with economic health and fairness — is lower than that of its peers. (See Liz Dilts Marshall’s recent article that ranks streaming services by per-stream royalties, according to a report from catalog investor Duetti.) Global recorded music revenues have improved greatly over that time span, rising 81% to $28.6 billion in 2023 from $15.8 billion in 2017, according to the IFPI.

Trending on Billboard

But as industry revenues have consistently grown, individual artists — whose numbers are growing fast because barriers to entry no longer exist — don’t feel like they’re receiving a fair share of the bounty. Discontent is so noticeable because, in part, there are more artists to complain. Three decades ago, it required a record contract to enter the commercial music world. Today, anybody can do it. Luminate tracked an average of 99,000 new tracks uploaded to DSPs per day in 2024. That’s about 36 million new tracks competing for listeners’ attention each year. On Spotify alone, 5 million artists had a catalog of at least 100 tracks, according to the company’s latest Loud & Clear report.

Of course, per-stream payouts could be improved if Spotify encouraged people to listen less, thereby reducing the number of songs paid out from a fixed pool of money and raising the average per-stream royalty. With less music streamed, the average payout would shoot well beyond its current 0.3 cents per stream. But that would be counterproductive. In the streaming world, growth comes from keeping people engaged and, ultimately, turning them into paying subscribers. Turn away listeners and they could end up at social media platforms, where payouts are even skimpier, or broadcast radio, which pays artists and record labels nothing.

Many people see that royalties from purchases are fairer than streaming royalties, but listening and buying habits have changed how the money flows. As more people streamed more often, artists and songwriters received less money from old formats. In the fourth quarter of 2017, AM/FM radio accounted for 48% of Americans’ time spent listening to audio while streaming (including YouTube and podcasts) took a 26.5% share, according to Edison Research. By the fourth quarter of 2023, AM/FM commanded just a 36% share, while streaming (including podcasts) accounted for 45%. (Including audiobooks, which are both streamed and downloaded, that number rises to 48%.) Owned music’s share of listening — a.k.a. sales of CDs, vinyl and downloads, which fell sharply over that time span — dropped from 13% in 2017 to 4% in 2023. Also, in the streaming economy, new artists are competing for royalties with older songs. In the U.S. in 2024, catalog music (defined as more than 18 months old) accounted for 73.3% of total album equivalent consumption, according to Luminate.

Much of the discontent over Spotify, however, is less wonky and more human. The company’s actions have become widely seen as antithetical to the artists it claims to support. A turning point came in December when Harper’s ran an excerpt from Liz Pelly’s Mood Machine, a book that reveals, among other things, how Spotify bought music from nameless musicians to infuse some playlists — namely background music such as “chill” where brand names aren’t necessary — with cost-saving alternatives to professional musicians who would receive royalties for each stream. This alleged use of “fake” musicians has been reported in music circles for years, but Pelly’s book, in part because of its deep reporting and previously unknown details, captured mainstream attention rarely attained by a music industry topic that doesn’t involve Taylor Swift.

The Harper’s article, and Pelly’s ensuing book tour, spawned a flood of reviews and reaction articles about how Spotify devalues music, hurts artists, gives users a poor listening experience and is an algorithm-driven song-picker that provides its users only an illusion of choice. But the onslaught of Spotify coverage at old-school media is nothing compared to the countless videos uploaded to YouTube over the years. Enter a search phrase such as “Spotify hurts artists” or “Spotify royalties” and you can wade for hours through such topics as Spotify’s change in royalty payouts (“Spotify no longer paying artists for streams in 2024?”) and explainers on royalty accounting (“Spotify doesn’t pay artists….this is why”).

Contributing to the storm clouds was Spotify’s scheme to lower its royalties to songwriters and publishers. Last March, Spotify incensed the songwriting community when it adopted a lower mechanical royalty rate by contending its premium subscription tier’s music-and-audiobook offering qualified for a reduced royalty rate granted to bundles of digital services. Unsurprisingly, the publishing community, including numerous Grammy songwriter of the year nominees, said they wouldn’t attend Spotify’s Songwriter of the Year Grammy party, which ended up being canceled in the wake of the fires in Los Angeles. Earlier this week, a U.S. court agreed with Spotify, saying the federal royalty rules are “unambiguous” and rejecting the Mechanical Licensing Collective’s lawsuit arguing that Spotify was not actually offering a bundle of services.

Writing the biggest checks of any streaming service doesn’t get Spotify out of this paradox. This week, Spotify announced it paid $10 billion to the music industry in 2024, a tenfold increase from a decade earlier. That figure implies Spotify generated nearly 20% of the global music copyright, assuming 2024 saw an 8% increase from Will Page’s latest estimate of $45.5 billion in 2023. As Spotify’s payments to the music industry increased tenfold over the last decade, streaming’s growth helped compensate for declines in CD and download sales, and global recorded music revenues more than doubled from 2014 to 2024. But, again, aggregate industry gains don’t capture the experiences of individual artists who feel cheated by streaming economics.

Help could be on the way — someday. If it’s higher per-stream royalties artists want, then changing how royalties are calculated could make a difference. Currently, a streaming service pays royalties by divvying up all users’ subscription and advertising revenue amongst all the tracks streamed during a given month. Whether or not you listened to Taylor Swift, your subscription fees go into the same pile of money funded by Swift’s fans. An alternative method that has gained some traction is a user-centric approach that pays artists from each individual listener. Under this scheme, a listener’s subscription fees, or advertising revenue, goes only to the artists that person streamed. That’s a more favorable approach for album-oriented and niche artists and less appealing for popular songs that get repeat listens. So far, only SoundCloud has adopted the user-centric model.

Artists’ royalties also stand to benefit from efforts to clean up streaming services’ catalogs. Spotify and Deezer have signed on to Universal Music Group’s plan to reward professional musicians by demoting “functional” music and incentivizing distributors to crack down on fraud. Deezer has removed tens of millions of low-quality tracks, and anti-fraud measures may explain why the number of daily new tracks uploaded to streaming services fell about 4% in 2024, according to Luminate. But not all artists feel like they are benefiting from these changes. Spotify’s move to limit royalty payments to tracks with at least 1,000 streams was widely seen as harmful to developing artists (as seen in this column on the streaming threshold from Ari Herstand).

The Spotify paradox may never end, but artists can adjust to their new environment. In 2014, Swift’s catalog was removed from Spotify by her record label, Big Machine Label Group. Earlier that year, Swift had penned an op-ed for The Wall Street Journal that argued “music should not be free” and urged artists to “realize their worth and ask for it.” Her entire catalog returned to Spotify and other streaming platforms in 2017. Did the economics of streaming change during Swift’s three-year hiatus? No, not really. Licensing deals may have extracted marginally better terms for artists and record labels, but streaming royalties are still a fraction of a cent per stream. One thing that changed was that more of Swift’s fans became subscribers to Spotify, Apple Music (which launched in 2015) and other streaming platforms. Today, free streaming still exists, and a stream is still worth a fraction of a cent, but Swift is a case study in how to cultivate a vibrant streaming business while reviving the lost art of album sales.

Heidi Montag’s 15-year-old dance-pop album Superficial has generated nearly $150,000 from streaming and digital sales since the MTV reality show star lost her home to the Pacific Palisades wildfire in Los Angeles in early January.

In the days following the destruction of the couple’s home on Jan. 7, Montag’s husband Spencer Pratt took to TikTok, sharing videos of the ashes and their children’s burned toys and asking viewers to stream wife Heidi’s music. Pratt later told Variety in a Jan. 17 article that he made a combined $24,000 from donations on TikTok, but he had no idea if they were making any money from her music.

His plea appears to be paying off. From Jan. 3 to Jan. 23, Montag’s 2010 album Superficial and its individual songs have generated $147,011.61 from streaming, digital album and song sales and publishing revenue, according to Billboard estimates based on data from Luminate.H

Trending on Billboard

This month, Montag made her first appearance on the Billboard Artist 100 chart, which ranks the most popular artists of the week, and Superficial and its songs landed on the Billboard 200, Top Album Sales, Top Dance Albums and Hot Dance/Pop Songs charts for the week of Jan. 25. Her appearance on those charts may translate into additional revenue for her new album Superficial 2, which the artist released last Friday (Jan. 24).

Montag has also benefitted from widespread support. TikTok launched a Heidi hub with a link to create content using a sped-up version of her song “I’ll Do It.” (TikTok says that, as of Jan. 28, there are more than 2.8 million creations using the track — both the original and sped-up remix.) The online marketing hub LinkTree paid for a billboard in Times Square with the message “Stream Superficial by Heidi Montag” and Montag appeared on Good Morning America, according to her TikTok posts.

The ramp-up in revenue has been swift. In the first week of January, Billboard estimates that the album produced $1,762.97. Following Montag and Pratt’s request, the album and songs produced $98,002.57 in the second week of January and $48,009.04 in the third week of January.

Digital album sales have contributed the greatest amount of revenue so far, generating revenues of $82,497.22, based on Billboard estimates.

In the first week 2025, nine digital copies of the album were sold, worth about $50. In the second week of 2025, 11,258 digital copies of the album were sold, worth about $62,930; and in the third week of 2025, 3,484 digital copies of the album were sold, worth about $19,475.

Montag and Pratt did not respond to requests for comment made to their publicists.

Additional reporting by Ed Christman.

Amazon informed customers on Wednesday (Jan. 29) that the prices for Amazon Music Unlimited, the company’s on-demand music streaming service, are increasing in the U.S., U.K. and Canada. In the U.S., the individual plan will rise to $11.99 per month from $10.99 per month, according to a company spokesperson. For Prime members, the monthly cost […]

How much are 1,000 streams worth? A new report from catalog investor and lending platform Duetti attempts to answer this question.

According to the report, released Thursday (Jan. 23), independent artists and others who own master recordings received about $3.41 per 1,000 streams globally in 2024.

That global payout rate is down from $4.04 per 1,000 streams in 2021, according to the study, which included data related to Spotify, Apple Music, YouTube, Amazon Music, TIDAL, Qobuz, Deezer, SoundCloud and Pandora.

Of those companies, Amazon Music paid the most at $8.80 per 1,000 streams in 2024.

While the rate paid per 1,000 streams has declined each year since 2021, Duetti CEO Lior Tibon says rates appear to be plateauing because the higher price of streaming subscriptions at some companies is raising royalty payouts. Tibon says they also found that the portion of overall payouts coming from YouTube, which Duetti found pays more than Spotify, increased for the artists in its study — while the portion coming from Spotify for those artists decreased 2%.

Trending on Billboard

Duetti, which provides financing for independent artists in exchange for a stake in their master recordings, says that Spotify’s Discovery Mode and its greater adoption outside the U.S. are the main drivers driving down payout rates, even though Spotify raised subscription prices in most major markets. Artists who sign up their tracks for Spotify’s Discovery Mode program gain more algorithmic exposure on the platform through Spotify Radio and autoplay in exchange for a lower royalty rate. The program, which was expanded in 2023 to be open to anyone with access to Spotify For Artists, has been criticized by music trade organizations and some in Congress who are concerned it puts artists in a position where they feel the need to pay to play.

Spotify did not immediately respond to a request for comment.

The growth of Discovery Mode’s contribution to overall streams for independent artists in this study is slowing, which means its impact on payout rates is starting to stabilize, Tibon says.

“We are at the point where it is not going to continue to increase as much as it did over prior years, and the growth of YouTube is counteracting the impact of its growth outside the U.S. and [the growth of] discount plans,” Tibon says.

Certain subgenres, such as hyperpop, saw slightly higher royalty payouts — as much as 30 cents more per 1,000 streams — than mainstream genres, in part because artists who produce this music less often enroll in Discovery Mode, according to the report.

WHO PAYS WHAT

According to the study, Amazon Music pays the highest royalty rate of any streaming service at $8.80 per 1,000 streams. (Amazon Music services are bundled with a Prime membership, which costs $139 per year.)

TIDAL pays the second most at $6.80 per 1,000 streams, while Apple Music pays $6.20 per 1,000 streams “due to their foothold in higher price markets, and the lack of ad-supported tiers,” the report found.

Though YouTube’s payout rates vary significantly among artists, Duetti found that on average across the independent artists in its study, the video streaming platform paid out $4.80 per 1,000 streams in 2024.

Meanwhile, Spotify paid out around $3 per 1,000 streams due to “high usage, geographical mix, reliance on discounted [and] free plans, and their Discovery Mode program,” according to the report.

Counter to conventional wisdom, going viral on TikTok only resulted in higher royalty payouts 15% of the time, the report found.

Amazon, TIDAL and YouTube did not immediately respond to requests for comment.

TikTok has said in the past that it plays a major role in artists getting their songs discovered, claiming that 84% of all songs on the Billboard Global 200 in 2024 started as viral hits on its platform.

DATA FROM CATALOG VALUATIONS

Founded in 2022, Duetti is a catalog investment company that provides independent artists with capital — amounts range from $10,000 to $3 million — in exchange for a stake in the master recordings of certain songs. The data Duetti uses to value artists’ catalogs before buying them — including royalty statements, streaming performance and other analytics — underpin the findings in the report.

Duetti works with more than 500 artists, including Shayne Orok, known for his Japanese versions of pop songs, and Adán Cruz, a Mexican rapper and songwriter, to promote their works digitally, including across Duetti’s network of YouTube channels.

“YouTube has always been the foundation of my career, allowing me to connect directly with fans and build a sustainable livelihood doing what I love,” Orok said in a statement from Duetti. “Partnering with Duetti has taken that connection to the next level by helping my music reach new audiences in ways I couldn’t achieve on my own.”

Alex Cooper is expanding her broadcasting duties even further in 2025, with SiriusXM announcing new exclusive programming as part of a multi-year agreement with the world’s most-listened-to female podcaster.

Beginning on Feb. 11, Cooper – the host and executive producer of the Call Her Daddy podcast – will give SiriusXM subscribers the chance to get closer to her and the Unwell Network with two new channels and live shows.

The first of these, Unwell Music, is curated by Cooper and is presented as a mixtape featuring the songs that have scored her life. Broadcasting contemporary hits alongside nostalgic pop anthems, Unwell Music will feature names such as Miley Cyrus, Tate McRae, Sabrina Carpenter, Beyoncé, Gracie Abrams and more. Alongside its eclectic playlist, the music will also be complemented by personal commentary from Cooper and behind-the-scenes stories.

The second of these channels, Unwell On Air, is designed to deliver a “live and curated pulse on what’s trending now”. In addition to highlights from the Unwell Network’s podcasts, it will also feature live daily programming that puts their Daddy Gang fanbase as the center of the conversation.

Trending on Billboard

This live programming includes Dialled In, which sees hosts Rachel Friedman and Montaine taking calls from listeners about relationship problems, friendship drama, and more. Dialled In airs from Monday to Friday at 7pm ET (4pm PT).

The programming also features The Daily Dirty, which sees hosts Sequoia Holmes, Fiona Shea and Hannah Kosh providing an hour-long catch-up focusing on pop culture-focused sharp takes, candid conversations, and playful segments. The Daily Dirty airs from Monday to Friday at 6pm ET (3pm PT).

“I’m constantly trying to find new ways to interact with my audience and with Unwell Music and Unwell On Air I’m able to deliver brand new daily live shows and playlists curated specifically by me,” said Cooper in a statement. “I can’t wait for everyone to experience a whole new world of Unwell.”

“Alex Cooper and her Unwell brand continue to be at the vanguard of pop culture with their authentic and unfiltered approach,” said Scott Greenstein, President, and Chief Content Officer at SiriusXM. “With the launch of Unwell Music and Unwell On Air, Alex is creating something that is only possible through the power of SiriusXM: a live 24/7 audio destination for her fans to immerse themselves further into her world. We can’t wait for you to hear what she has in store.”

Cooper first rose to fame with the Call Her Daddy in 2018, which was swiftly acquired by Barstool Sports shortly after its launch. In 2021, Spotify took ownership thanks to a $60M deal before it found a new home with SiriusXM in August 2024. The multi-year agreement provides SiriusXM with exclusive advertising and distribution rights, content, events, and more for both the Call Her Daddy podcast and the other titles on the Unwell Network – the production house Cooper founded in 2023.

Spotify paid $10 billion to music rights holders in 2024, according to a blog post published Tuesday (Jan. 29) from David Kaefer, the streamer’s vp/head of music business.

Last year, Spotify reported that it finished the third quarter of 2024 with 252 million subscribers. “Today, there are more than 500 million paying listeners across all music streaming services,” Kaefer writes. “A world with 1 billion paying listeners is a realistic goal.”

Spotify’s $10 billion payout, a new record for the company, is roughly 10 times as much as it shelled out to the music industry a decade ago. Kaefer says the streaming service has now contributed roughly $60 billion to the music industry since its founding.

Trending on Billboard

Also notable for Spotify in 2024 was CEO Daniel Ek‘s announcement to financial analysts in November that the company was “on track for our first full year of profitability.”

“We’re not here to merely optimize for today,” he added. “As you think about Spotify in 2025 and beyond, picture a company that operates with the same disciplined management you’ve seen this year, but one that also has the ambition to seize the opportunities presented by what’s happening in technology. In the near term, I see potential for transformative shifts in music discovery and new ways to connect artists and fans like never before.”

On Sunday (Jan. 26), Spotify announced that it had reached a new direct deal with Universal Music Group that will impact the company’s recorded and publishing royalty rates. “Constant innovation is key to making paid music subscriptions even more attractive to a broader audience of fans around the world,” Ek said in a statement regarding the news.

This sentiment was echoed in Kaefer’s blog post on Tuesday. “We offer an ad-supported free tier, while some services don’t,” he writes. “Beyond the ad dollars this generates, more than 60% of Premium subscribers were once free tier users. Bringing in users who don’t expect to pay for music, and deepening their engagement, means they’re more inclined to become subscribers in the future.”

“Onboarding people to paid streaming,” he continues, “is precisely what has increased our payouts — tenfold — over the past decade.”

Spotify will report its fourth-quarter earnings on Feb. 4.

Spotify general counsel Eve Konstan is exiting her role at the streaming giant “to step away from full-time corporate life,” she announced via LinkedIn on Monday (Jan. 27). “This marks the end of a chapter that’s been filled with unforgettable experiences and immense personal growth,” Konstan wrote, “and while it’s bittersweet to step away from […]

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Another Sean “Diddy” Combs documentary has arrived. Following Peacock’s Making of a Bad Boy earlier this month, Investigation Discovery released its own four-part docuseries, The Fall of Diddy, starting Monday (Jan. 27).

Airing on Max, the series follows the rise and fall of the hip-hop mogul, offering personal insights into harrowing abuse allegations, violent behavior and illegal activity throughout his career. You can stream the series Monday night at 9 p.m. ET.

Trending on Billboard

With Diddy still behind bars at the Metropolitan Detention Center in Brooklyn awaiting his day in court, many alleged victims are coming forward to share their stories. The docuseries features testimonies from an array of members in Diddy’s inner circle and industry piers including VIBE editor-in-chief Danyel Smith, Danity Kane’s D. Woods, and Rodney “Lil Rod” Jones, who has accused Diddy of sexual harassment. The doc also features interviews with childhood friends, security guards, personal chefs, and several alleged rape and assault victims.

The debut episode of the Fall of Diddy airs on Jan 27. Check out how you can watch the series below.

Here’s How to Watch ‘The Fall of Diddy’ Series

ID’s Fall of Diddy will premiere tonight, Jan. 27 on Max and Discovery+ at 9 p.m ET. The second and third episode will release the following day, Jan. 28, alongside the finale premiering the following Friday. You can tune in to watch the docuseries with a Max bundle deal with Hulu and Disney+. The streaming bundle allows subscribers to stream from all three platforms for one base price. On their own, each streamer costs $10/month, but the Max bundle gets you all three for just $16.99. That’s a 43% savings and one of the best Max deals online.

Another great bundle deal to stream the Fall of Diddy is with Amazon Prime Video with Max. The house of Bezos is filled with incredible original programming, exclusive movies, and a great 30-day free trial.

Watch the trailer for the Fall of Diddy below.

State Champ Radio

State Champ Radio