stocks

Trending on Billboard

Spotify’s stock price has fallen more than $200 below its all-time high of $785.00 set on June 27 after falling 8.2% to $583.62 in the week ended Friday (Nov. 21). The Swedish streaming giant’s share price dropped more than 7% in the two days after it announced the purchase of WhoSampled, an online song samples database, to power a new song credits feature, SongDNA.

Investors’ reaction to a relatively small acquisition appears to be part of a larger theme in recent weeks. While Spotify is one of the better-performing music stocks of 2025, it has struggled since the company announced on Sept. 30 that CEO Daniel Ek will step down and assume the role of executive chairman. Ek attempted to assuage investors who might be wary of his departure, saying in an open letter that “very little will change” when Spotify is led by co-CEOs Alex Norström and Gustav Söderström, two longtime Spotify executives. Ek added that he will operate with a European-style approach to the executive chairman position that is “more hands-on than the traditional U.S. model.”

Related

But investors aren’t showing much faith in the post-Ek era. Since the announcement, Spotify shares have fallen 19.9%, erasing $29.7 billion of market value.

Driven by Spotify’s 8.2% decline — the worst for all music companies this week — the Billboard Global Music Index (BGMI) fell 4.8% to 2,571.67. Eight of the index’s companies had gains while 11 finished the week with losses. The BGMI has not posted a gain in 10 weeks and now stands 17.5% below the all-time high of 3,117.20 set during the week of June 30.

Markets were down around the world this week. In the U.S., the Nasdaq fell 2.7% to 22,273.08 and the S&P 500 dropped 1.9% to 6,602.99. The U.K.’s FTSE 100 sank 1.6% to 9,539.71. South Korea’s KOSPI composite index and China’s Shanghai Composite Index each dropped 3.9%.

Warner Music Group (WMG) finished the week up 1.1% to $30.69. After releasing earnings on Thursday morning (Nov. 20), WMG shares dropped 2.7% on Thursday but gained 3.4% gain on Friday. Investors may not have received their desired message from WMG management, but analysts were upbeat about the numbers and management’s outlook. CFRA bumped WMG shares up to a “hold” rating from the “sell” rating it issued in July. Guggenheim kept its “buy” rating and $37 price target while noting that WMG’s “capital efficient” joint venture with Bain is likely to provide growth to both revenue and earnings. J.P. Morgan, which maintained its “overweight” rating and $40 price target, was “encouraged” by WMG management’s comments on margin expansion and market share gain.

Related

CTS Eventim shares rose 7.2% to 84.65 euros ($97.52). The German concert promoter and ticketing company released third-quarter earnings on Thursday that showed revenue rose 4%. The week’s gain brought CTS Eventim’s year-to-date gain to 0.8%.

Netease Cloud Music fell 7.1% to 189.40 HKD ($24.33) after its third-quarter earnings, released on Thursday, revealed a 2% decline in revenue. Cloud Music remains one of the year’s best-performing music stocks, however, with a 2025 gain of 68.8%.

Live Nation shares fell 3.9% to $130.55. Deutsche Bank lowered its price target to $160 from $173, which suggests 22.6% of upside based on Friday’s closing price, and maintained its “buy” rating.

The week’s greatest gainer was Cumulus Media, which rose 29% to $0.11. Such large swings are common for Cumulus, which has lost 85.7% of its value in 2025 and experiences sizable moves when it rises or falls a mere penny. With a market capitalization of just $2 million, the radio broadcaster has little effect on the BGMI.

Billboard.com

Billboard.com

Billboard.com

Trending on Billboard

As some once high-flying streaming stocks limp toward the end of the year, music stocks have fallen far below their all-time high.

Tencent Music Entertainment (TME) dropped 11.0% to $18.93 after the company reported its third-quarter earnings on Tuesday (Nov. 11). TME reported strong growth in online music of 27.2% and music subscriptions of 17.2%. It’s not clear why investors reacted negatively, but it’s possible they have concerns that TME’s margins will suffer as offline (merchandise sales and performances) revenues grow faster than online revenues; as CFO Shirley Hu said during Tuesday’s earnings call, “offline performances and artist-related merchandise sales delivered triple-digit year-on-year revenue growth” in the quarter, adding that those offline revenues have a “lower gross margin.” Another factor was Nomura’s decision on Friday (Nov. 14) to lower its TME price target to $26 from $30 while maintaining its “buy” rating.

Related

Spotify was one of the week’s few winners, rising 3.1% to $635.81 and recapturing some of the previous week’s 5.9% decline. The stock reached as high as $668.49 on Thursday (Nov. 14) after news reports revealed the company unveiled a new Premium Platinum plan that will take the place of Premium Family in five markets, including India and South Africa.

Among streaming stocks, TME is up 66.2% year to date but has fallen 25.9% over the last 13 weeks. Spotify has gained 58.8% in 2025 but is $150 below its all-time high of $785 set in June. Similarly, Netease Cloud Music is up 64.8% year to date but has lost 30.8% in the last 9 weeks.

The 19-company Billboard Global Music Index (BGMI) fell 0.1% to 2,700.25, marking the eighth consecutive week the index has failed to post a gain; over those eight weeks, the index has dropped 12.9%. Only three of the index’s 19 stocks finished the week in positive territory, while two stocks were unchanged and 14 were in the red.

Related

StubHub, which is not included in the BGMI, dropped 23.5% to $14.87 after the company’s first quarterly earnings release as a public company on Thursday (Nov. 13). StubHub reported an 8% increase in revenue but declined to provide guidance for the fourth quarter, causing the stock price to fall 21.0% on Friday alone. After the precipitous decline, StubHub is now 36.7% below its $23.50 IPO price.

Warner Music Group (WMG) finished the week in positive territory, rising 0.4% to $30.36. WMG will report results for its fourth quarter and fiscal year on Thursday (Nov. 20).

HYBE dropped 2.6% to 297,500 KRW ($205.24). On Tuesday (Nov. 11), Nomura dropped its price target on HYBE to 354,000 KRW ($TK) from 370,000 KRW ($244.22) and kept its “buy” rating. The week could have been worse: HYBE shares rose 4.5% on Thursday (Nov. 13) on news that the members of girl group NewJeans will return to HYBE imprint ADOR after losing their legal battle to break away from the company. The stock jumped 18% in the week ended Oct. 31 after the court’s ruling.

Related

Universal Music Group fell 0.8% to 22.30 euros ($25.92). On Thursday, Sadif Investment Analytics trimmed its price target to 28.56 euros ($33.20) from 28.82 euros ($33.50) and lowered its rating to “hold” from “strong buy.”

On the radio front, Cumulus Media fell 28.8% to $0.0085, bringing its year-to-date decline to 88.9%. Cumulus reported earnings on Oct. 31 but could have been dragged down by iHeartMedia, which reported earnings on Monday (Nov. 10) and finished the week down 12.1% to $4.07.

Markets were mixed as investors contemplated an AI bubble and the likelihood of another rate cut by the U.S. Federal Reserve. In the U.S., the Nasdaq composite index fell 0.5% to 22,900.59 and the S&P 500 rose 0.1% to 6,743.11. In the U.K., the FTSE 100 gained 0.2% to 9,698.37. South Korea’s KOSPI composite index improved 1.5% to 4,011.57, bringing its year-to-date gain to 64.3%. China’s Shanghai Composite Index fell 0.2% to 3,990.49.

Trending on Billboard

Music stocks had their worst week in three months, as most companies that reported earnings this week were penalized for not offering more to investors. Spotify, Live Nation, SM Entertainment and Reservoir Media all finished the week ended Nov. 7 in the red — though live entertainment companies Sphere Entertainment and MSG Entertainment bucked the trend by posting sizable gains after putting out their quarterly earnings reports.

The 19-company Billboard Global Music Index (BGMI) fell 5.0% to 2,703.11 as losers outnumbered winners 15 to 4. After soaring earlier in the year, the BGMI is now 13.3% below its all-time high of 3,117.20 (in the week ended June 30) and is now equal to its value in early May.

Related

iHeartMedia was a notable exception to the carnage. The radio company’s shares jumped 55.9% to $4.63 after a report at Bloomberg said the company is in talks to license its podcasts to Netflix. Netflix is known to be seeking video podcast content and has also reportedly approached SiriusXM about distributing its podcasts. The week’s high mark of $4.77, reached on Thursday (Nov. 6), was iHeartMedia’s highest mark since March 17, 2023.

Sphere Entertainment Co. rose 12.6% to $77.08 after the company’s earnings report on Tuesday (Nov. 4) showed an improvement in the Sphere segment’s operating loss. Led by the popularity of The Wizard of Oz, the number of film viewings, called The Sphere Experience, rose to 220 from 207 in the prior-year period. Sphere’s shares are now up 81.5% year to date.

MSG Entertainment (MSGE) shares gained 5.3% to $46.51 following the company’s earnings report on Thursday. MSGE’s revenue jumped 14% to $158.3 million while its operating loss deepened to $29.7 million from $18.5 million a year earlier. J.P. Morgan raised its price target to $47 from $41, citing management’s comments on pricing and higher expectations for the Christmas Spectacular at Radio City Music Hall.

Related

Companies such as Live Nation and Spotify reported solid results but suffered a large share price decline — part of a trend that extends well beyond music companies, Bernstein analysts wrote in an investor note on Thursday: “We’ve seen a brutal theme emerge across the consumer [technology, media and telecommunications] sector: stocks that deliver perfectly in-line or modestly better than expected results are still getting sold.” Growth is not good enough, they explained, and investors are “shooting first and asking questions later” when a company doesn’t have a “bulletproof guide” for the next year or two.

Live Nation shares ended the week down 6.0% to $140.51 after the company reported third-quarter earnings on Tuesday (Nov. 4). Despite showing continued revenue and adjusted operating income growth, Live Nation’s share price fell 10% the following day, though the price recovered some losses in each of the next two trading days. Bernstein maintained its $185 price target and called the sell-off a buying opportunity, but numerous other analysts lowered their Live Nation price targets, including Oppenheimer (from $180 to $175), Evercore (from $180 to $168), Morgan Stanley (from $180 to $170), J.P. Morgan (from $180 to $172) and Roth Capital (from $180 to $176).

Also releasing third-quarter earnings on Tuesday was Spotify, whose stock fell 5.9% to $616.91 in the aftermath. The company reported 12% revenue growth, but the title of Bernstein’s investor note on Tuesday perfectly captured Spotify’s need to constantly impress investors: “When you trade at 50x EPS, you’d better make sure everybody’s happy.” Meanwhile, J.P. Morgan called the company’s fourth-quarter outlook “slightly mixed”: The company’s guidance on monthly average users and gross margin were “above expectations,” it said, but guidance on subscribers, revenue and operating income were lighter than expected. Guggenheim lowered its price target to $800 from $850, noting that results met expectations but that “questions remain” on Spotify’s ability to improve margins through price increases.

Related

Elsewhere, Reservoir Media fell 3.0% to $7.37 following the release of its quarterly earnings on Tuesday, while Warner Music Group, which reports earnings on Nov. 20, fell 5.4% to $30.23. Universal Music Group, which reported earnings on Oct. 30, dropped 3.4% to 22.48 euros ($26.01).

K-pop company SM Entertainment fell 14.1% to 102,600 KRW ($70.47), having dropped 9.6% in the two days following the release of third-quarter results on Thursday. Other K-pop companies also experienced large declines as HYBE dropped 10.4%, JYP Entertainment dipped 11.0% and YG Entertainment sank 21.3%, likely because of a report that BLACKPINK’s next album has been delayed until January 2026.

Most indexes had an off week. In the U.S., the Nasdaq composite fell 3.0% to 23,004.54, marking its worst week since April. The S&P 500 dropped 1.6% to 6,728.80. The U.K.’s FTSE 100 sank 0.4% to 9,682.57. South Korea’s KOSPI composite index plummeted 3.7% to 3,953.76. China’s Shanghai Composite Index rose 1.1% to 3,997.56.

Created with Datawrapper

Created with Datawrapper

Trending on Billboard

HYBE shares soared 18.4% in the week ended Oct. 31 after a South Korean court ruled that K-pop group NewJeans may not leave HYBE imprint ADOR and make music under a different name. The five members of the girl group had attempted to break away from HYBE after the K-pop giant dismissed NewJeans’ mentor, ADOR CEO Min Hee-jin, in April 2024.

Rather than lose NewJeans — which would have created additional headaches for HYBE and other K-pop companies — ADOR will retain the group through the end of its exclusive contract in 2029. The fact that Min is no longer at ADOR didn’t sway the court. “Merely the fact that NewJeans personally places high trust in Min Hee-jin does not make guaranteeing her the position of ADOR’s CEO a significant obligation under the exclusive contract,” according to a report. The ruling added approximately $1.5 billion to HYBE’s market value, suggesting that investors were fearful a court loss would spill over to other acts currently under contract with HYBE.

Related

Despite HYBE’s considerable gain, the 19-company Billboard Global Music Index was unchanged at 2,845.53. Music stocks were almost evenly mixed between winners and losers, and only two companies had either a gain or a loss in excess of 10%.

Music stocks lagged behind major indexes’ gains. In the U.S., the Nasdaq composite index rose 2.2% to 23,724.96 and the S&P 500 improved 0.7% to 6,840.20. The U.K.’s FTSE 100 rose 0.7% to 9,717.25. South Korea’s KOSPI composite index jumped 4.2% to 4,107.50 on AI optimism after Samsung announced it would build a semiconductor factory in partnership with American company Nvidia. China’s Shanghai Composite Index ticked upward 0.1% to 3,954.79.

SiriusXM shares finished the week up 1.4% to $21.69 after a see-saw end to the week. The stock gained 10.1% on Thursday (Oct. 30) after the company’s third-quarter results, but fell 6.5% on Friday (Oct. 31). The bump in share price came after SiriusXM increased its full-year forecasts for revenue, EBITDA and free cash flow. The Q3 results also showed that the satellite radio company, which also owns streaming platform Pandora, turned a net loss into a net profit.

Related

Universal Music Group shares fell 2.3% to 23.27 euros ($26.99) despite gaining 1% on Friday after the company reported solid Q3 earnings following the close of trading on Thursday. Following the results, J.P. Morgan reiterated its “overweight” rating and 39.00 euros ($45.23) price target while Guggenheim maintained its “neutral” rating and eliminated its price target, which was previously 27.00 euros ($31.32).

Spotify’s stock benefited from news that the company is raising prices in the U.K., finishing the week up 1.5% to $655.32. That modest gain helped Spotify reclaim some of the loss it suffered after the share price dropped 4.1% on Oct. 24. The Stockholm-based company will report Q3 earnings on Tuesday (Nov. 4).

Radio giant iHeartMedia was the week’s biggest loser after dropping 12.4% to $2.97. The company’s share price has been on a roll lately, though, gaining 39.4% in 2025. iHeartMedia will release Q3 earnings on Nov. 10.

Most live music stocks lost ground. Live Nation fell 2.2% to $149.53 ahead of its earnings results on Tuesday. German promoter CTS Eventim dropped 2.9% to 77.60 euros ($90.00). MSG Entertainment dipped 3.5% to $44.16. Sphere Entertainment Co. was an exception, rising 1.7% to $68.48.

Billboard

Billboard

Billboard

Trending on Billboard

Buoyed by news that The Wizard of Oz surpassed 1 million tickets sold and $130 million in sales since its Aug. 28 debut, Sphere Entertainment Co. shares rose 14.5% to a new all-time high closing price of $67.24. The film has helped send Sphere Entertainment’s stock price into a new stratosphere. Shares of the Las Vegas venue’s parent company are up 58.4% year to date and have gained 56.4% since Sphere debuted its revamped version of the classic film.

While some music stocks had big gains this week, the 19-company Billboard Global Music Index (BGMI) fell 1.4% to 2,845.60, marking its fifth consecutive losing week. Three music companies had stock gains over 10%, but they are relatively small compared to the index’s largest companies, Spotify and Live Nation, both of which lost ground this week. Foreign exchange rates also played a role in the BGMI’s poor performance despite numerous music stocks posting gains. In the last week, the euro fell about 0.3% against the U.S. dollar while the Korean won lost approximately 1.2%.

Related

Spotify had the week’s biggest loss after falling 3.8% to $645.78, bringing its five-week decline to 12.1%. Numerous analysts expect the company to raise U.S. subscription prices by early 2026, which would provide further margin improvement and help deliver streaming royalty growth to rights holders. Investors appear not to be taking a possible price increase into account yet, though. The Stockholm-based streaming company will announce third-quarter earnings on Nov. 4.

Live Nation shares slipped 1.5% to $152.86. Although the stock is up 18.0% in 2025, it has fallen 12.0% over the last six weeks. On Wednesday (Oct. 22), Deutsche Bank lowered its price target to $173 from $175. Then on Thursday (Oct. 23), Citi lowered its price target to $181 from $195.

LiveOne rose 23.3% to $5.55. The music streaming company announced on Monday (Oct. 20) that it plans to launch a subsidiary in Africa, LiveOneAfrica, in partnership with Virtuosity Music Group. “Through this partnership, we’ll connect LiveOne’s technology and artist ecosystem with one of the most vibrant creative markets in the world,” CEO Robert Ellin said in a statement.

Related

Anghami rose 0.4% to $2.85. On Wednesday (Oct. 22), the company announced it will issue 2.38 million shares of common stock to satisfy the convertible debt held by OSN Streaming Limited. Anghami’s share price fell 5% following the news but recovered on Thursday and Friday.

K-pop stocks were in the black this week. HYBE jumped 6.9%, JYP Entertainment rose 6.1% and SM Entertainment increased 1.5%. YG Entertainment rose just 0.6%.

Inflation data announced Friday showed a modest increase to 3%, leading to a jump in stock prices as investors anticipated a pending interest rate cut by the U.S. Federal Reserve. The economy hasn’t fallen apart despite reports of growing auto reposessions and a never-fail sign of tightening budgets: a surge in sales of Hamburger Helper.

In the U.S., the Nasdaq composite index rose 2.3% to 23,204.87 and the S&P 500 improved 1.9% to 6,791.69 — both record highs. The U.K.’s FTSE 100 gained 3.1% to 9,645.62. South Korea’s KOSPI composite index soared 5.1% to 3,941.59 and hit an all-time high on Friday. China’s Shanghai Composite Index rose 2.9% to 3,950.31.

As demand for concerts appears strong heading into the busy summer months, Live Nation led nearly all music stocks this week by jumping 7.7% to $148.87. On Friday (June 20), the concert gian surpassed $150 per share for the first time since Feb. 25, and its intraday high of $150.81 was roughly $7 below its all-time high of $157.49 set on Feb. 24. Earlier in the week, Goldman Sachs increased its price target on the stock to $162 from $157, implying Live Nation shares have an 8.8% upside from Friday’s closing price.

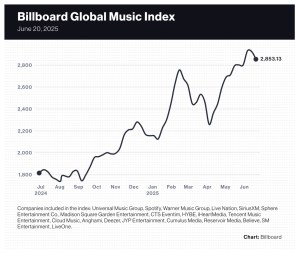

The 20-company Billboard Global Music Index (BGMI), which tracks the value of public music companies, finished the week ended June 20 down 2.4% to 2,853.13, its second consecutive weekly decline after nine straight gains. Despite large single-digit gains by Live Nation, MSG Entertainment and SM Entertainment, the index was pulled down due to losses by its two largest components: Spotify and Universal Music Group (UMG). The week’s decline lowered the BGMI’s year-to-date gain to 34.3%, though it’s still well ahead of the Nasdaq (down 0.9%) and the S&P 500 (up 0.4%) on that metric.

Markets sagged in the latter half of the week as investors expressed concerns about tensions in the Middle East and thepotential impacts on global oil supplies and gas prices. The tech-heavy Nasdaq finished the week up 0.2% to 19,447.41 while the S&P 500 fell 0.2% to 5,976.97. In the U.K., the FTSE 100 dropped 0.9% to 8,774.65. South Korea’s KOSPI composite index jumped 4.4% and China’s SSE Composite Index dipped 0.5%.

Trending on Billboard

New York-based live entertainment company MSG Entertainment rose 5.6% to $38.44, bringing its year-to-date gain to 7.1%. Elsewhere, SM Entertainment stock saw a 4.5% improvement, taking its 2025 gain to 90.4% — the best amongst music stocks save for Netease Cloud Music, which has seen a 111.2% year-to-date gain.

With streaming stocks posting the biggest gains of the year, Spotify shares reached a record high of $728.80 on Wednesday (June 18) but stumbled over the next two days and finished the week down 0.5% to $707.42. That decline took Spotify’s year-to-date gain down to 51.6%.

UMG shares fell 4.2% to 26.73 euros, marking its largest one-week decline since falling 9.2% in the week ended April 4. At the same time, Bernstein restarted coverage of UMG shares this week. Analysts believe it’s a “best in class” music company, which “implies predictability, a capital allocation framework consistent with industry trends, and steady operating leverage,” analysts wrote. Bernstein set a 33 euro ($38.03) price target, implying 23% upside over Friday’s closing price.

Shares of music streaming company LiveOne fell 6.5% on Friday and finished the week down 10.0% after the company released earnings results for its fiscal fourth quarter and year ended March 31. Fiscal fourth-quarter revenue fell 37.6% to $19.3 million due primarily to a decrease in Slacker revenue. For the full year, revenue slipped 3.4% to $114.4 million and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) fell 18.7% to $8.9 million.

Billboard

Billboard

Billboard

Spotify’s share price surpassed $700 for the first time this week and reached a new all-time high of $717.87 on Thursday (June 5). The Swedish-based, New York-listed company ended the week up 6.9% to $712.26.

Through Friday (June 6), Spotify’s share price has increased 52.6% year to date, and its market capitalization has gained $54 billion to $145.8 billion. In an up-and-down year for most stocks, Spotify has rewarded investors with consistent subscriber growth and improved margins resulting from layoffs in 2023. The company finished the first quarter with 268 million subscribers, up 12% year over year, and total revenue of $4.54 billion was up 15%.

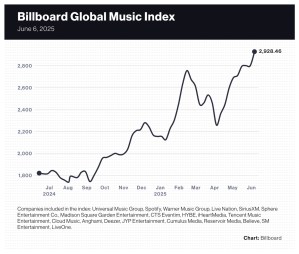

Spotify wasn’t the biggest gainer of the week, but its immense size was a major factor behind the 4.6% gain by the 20-company Billboard Global Music Index (BGMI) for the week ended June 6. The BGMI has gone nine consecutive weeks without a decline after a two-week decline in late March and early April. Behind 14 gainers and only six losers, the index reached a new high of 2,928.46 and brought its year-to-date gain to 37.8%.

Trending on Billboard

Markets finished the week strong after a U.S. jobs report on Friday showed that unemployment remained steady amidst the uncertainty caused by U.S. trade policy. The Nasdaq composite was up 2.2% while the S&P 500 rose 1.5%. South Korea’s KOSPI composite index gained 4.2%. China’s SSE Composite Index improved 1.1% and the U.K.’s FTSE 100 gained 0.7%.

Music streaming stocks performed especially well this week. LiveOne was the biggest gainer after rising 16.2% to $0.86. Tencent Music Entertainment jumped 6.8% to $17.96 and is trading at its highest mark since 2021. Netease Cloud Music rose 3.6% to 218.80 HKD ($27.88). Deezer and Anghami were exceptions, falling 1.5% and 5.3%, respectively.

Live Nation was the best-performing live music stock after gaining 5.0% to $144.15. Bernstein initiated coverage of Live Nation this week with an “outperform” rating and a $185 price target. MSG Entertainment rose 1.8% to $37.77, and CTS Eventim was up 0.5% to 107.20 euros ($122.26). Sphere Entertainment Co. fell 0.3% to $37.67, bringing its year-to-date loss to 11.3%.

iHeartMedia gained 14.5% to $1.50. The stock rose 10% on Thursday as the company announced the appointment of deputy CFO Michael McGuinness as iHeartMedia’s principal accounting officer. Previous principal accounting officer Scott Hamilton transitioned to a consultant role for the company.

Believe rose 11.6% to 17.08 euros ($19.48) after the company increased its bid to buy out remaining shareholders to 17.20 euros ($19.62), a 12.4% increase from the original bid of 15.30 euros ($17.45). The consortium that took the Paris-based company private in 2024 currently owns 96.7% of share capital.

The two standalone major music companies had mixed results. Warner Music Group rose 0.2% to $26.37, bringing its year-to-date decline to 15.0%. Universal Music Group fell 2.8% to 27.36 euros ($31.20), lowering its year-to-date gain to 14.4%.

K-pop stocks posted gains across the board. HYBE rose 7.0%, erasing the previous week’s 6.8% decline. YG Entertainment was up 7.9%. SM Entertainment rose 4.8% and JYP Entertainment improved 4.0%.

Reservoir Media fell 6.4% to $7.30, increasing its year-to-date loss to 13.7%. On Friday (June 6), B Riley lowered its price target for Reservoir Media to $11.50 from $12.50 and maintained its “buy” rating.

Billboard

Billboard

Billboard

Amidst new reports about a South Korean investigation into its chairman, HYBE shares fell 6.8% to 266,000 KRW ($192.69) during the week ended May 30. That was the biggest decline for a music stock in a week marked by modest gains and losses.

Reports out of South Korea this week said police in Seoul have resubmitted a search and seizure warrant for HYBE chairman Bang Si-hyuk in an investigation into allegations of fraudulent stock transactions by the music mogul. Bang allegedly misled previous shareholders about HYBE’s intention to go public, which caused them to sell HYBE shares ahead of the company’s initial public offering in 2020. Sources told Yonhap News Agency that Bang netted $291 million in 2020 from deals with private equity firms to share a portion of the gains from HYBE’s IPO.

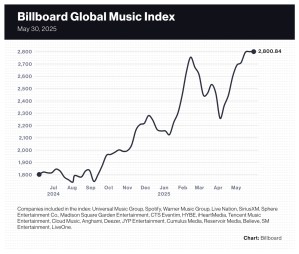

The 20-company Billboard Global Music Index (BGMI) was unchanged at 2,800.84 as the index had an even number of winners and losers. In a week with a remarkable amount of unremarkable movement, the majority of companies fell within a narrow band between a 2% gain and a 1% loss.

Trending on Billboard

Music stocks underperformed numerous market indexes. In the U.S., the Nasdaq gained 2.0% to 19,113.77 and the S&P 500 rose 1.9% to 5,911.69. The U.K.’s FTSE 100 climbed 0.6% to 8,772.38. South Korea’s KOSPI composite index jumped 4.1% to 2,697.67. China’s SSE composite was flat at 3,347.49.

But music stocks have posted big gains in 2025. The BGMI is up 31.8%, far surpassing the gains of the Nasdaq (14.2%) and the S&P 500 (up 12.0%). Spotify, the index’s most valuable component, has risen 42.8%. Universal Music Group (UMG), the BGMI’s second-largest company, has gained 17.8%.

The lone music company to report earnings this week, Reservoir Media, rose 7.9% to $7.80. The quarterly earnings released on Wednesday (May 28) showed a 10% revenue gain and a 14% improvement in adjusted EBITDA. Meanwhile, the only company to post a double-digit gain was Cumulus Media, which rose 15.4% to $0.15. Cumulus tends to have wild swings, however, since it was delisted from the Nasdaq on May 2 and began trading over the counter.

iHeartMedia jumped 6.5% to $1.31. Spotify, the BGMI’s fourth-best performer, rose 1.9% to $666.25. Madison Square Garden Entertainment improved 1.5% to $37.11, and UMG gained 1.4% to 28.16 euros ($31.95).

Live Nation fell 5.4% to $137.24, lowering its year-to-date gain to 6.0%. On Thursday, the company fell 2.9% on heavier-than-average trading volume following reports that it canceled concerts at Boston’s Fenway Park by Shakira and Jason Aldean due to safety concerns about the venue’s stage.

Both Chinese music streamers had off weeks that reduced their stellar year-to-date performances. Tencent Music Entertainment (TME) fell 4.0% to $16.82, lowering its year-to-date gain to 50.9%. Netease Cloud Music, the BGMI’s biggest gainer of 2025 at 88.2%, fell 2.9% to 211.20 HKD ($26.94).

Billboard

Billboard

Billboard

Music stocks — and stocks in general — had a terrific week as Sphere Entertainment Co., Tencent Music Entertainment and Cloud Music posted double-digit gains and the 20-company Billboard Global Music Index (BGMI) set a new high mark.

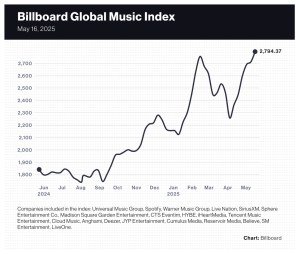

The BGMI rose 3.1% to an all-time high of 2,794.37, bringing its year-to-date gain to 31.5%. The index has overcome two downturns — one caused by an escalation of trade tensions, the other prompted by President Trump’s announcement of his tariff policy — to surpass the previous record of 2,755.53 set on Feb. 14.

Sphere Entertainment Co. gained 19.3% to $38.78. The company’s quarterly earnings, released on Monday (May 12), showed the Sphere venue was able to cut costs to offset a decline in event-related revenue. Investors cheered the result: flat operating income rather than a loss. As for tourism to Las Vegas, CEO James Dolan brushed aside concerns and said demand for Sphere concerts is strong enough to withstand a downturn should one arise.

Trending on Billboard

China’s Tencent Music Entertainment (TME) jumped 18.0% to $18.62 after the company reported on Tuesday (May 13) a 17% increase in music subscription revenue in the first quarter. Following earnings, CFRA upped its price target to $18 from $17 but downgraded its rating to “hold” from “buy.” TME, which operates Kugou Music, QQ Music and Kuwo Music, finished the quarter with 122.9 million subscribers, up 8.3% from the prior-year period.

Another Chinese music streamer, Netease Cloud Music, rose 12.6% to 203.40 HKD ($26.03) after the company’s financial results, released on Thursday (May 15), showed an 8.4% drop in revenue that the company attributed to a decline in its social entertainment business. The scant Q1 numbers didn’t provide details on the online music side of the business, but the two sides of the business are going in opposite directions. In 2024, social entertainment revenue fell 26% while online music revenue grew 23%.

Not only were TME and Cloud Music among the top performers of the week, they are among the biggest gainers in 2025. Year to date, TME shares are up 49.1% while Cloud Music has gained 81.3%. SM Entertainment’s 64.9% gain is the second-best amongst music stocks.

Live Nation improved 8.2% to $147.68 this week despite news that the company and AEG Presents are facing a criminal antitrust probe by the U.S. Department of Justice over pandemic-era refund policies. Live Nation shares are still well below the all-time high of $157.75 reached on Feb. 21, but they’ve gained 14.0% year to date and are up 52.9% over the last 52 weeks.

Spotify, the index’s most valuable component, rose 1.2% to $656.30. Guggenheim raised its price target to $725 from $675 on the heels of a judge’s favorable ruling in Epic Games v. Apple. Guggenheim sees the ruling, which allows Spotify to display pricing options within the iOS app, as helpful to audiobook monetization.

German concert promoter CTS Eventim gained 3.2% to 111.90 euros ($124.90). Barclays started covering the company with a 130 euro ($145.12) price target and an “overweight” rating.

Elsewhere in the index, Universal Music Group and Warner Music Group gained 0.9% and 1.2%, respectively, and HYBE improved 1.9%. SiriusXM jumped 5.4%.

Only four of the BGMI’s 20 stocks lost value this week. SM Entertainment was the week’s biggest loser with a 5.2% drop. Believe fell 1.3%, Deezer dipped 1.5% and iHeartMedia dropped 1.6.%.

Stocks were up globally but performed especially well in the U.S. The Nasdaq composite rose 7.2% and the S&P 500 improved 5.3%. In the U.K., the FTSE 100 was up 1.5%. South Korea’s KOSPI composite index gained 1.9%. China’s SSE Composite Index rose 0.8%.

Investors were encouraged by a reduction of U.S. tariffs on Chinese goods while the two countries continue to negotiate a trade deal. Goldman Sachs lifted its estimate for the S&P 500 on Tuesday as tensions over tariffs eased between the U.S. and China.

There is still uncertainty about the U.S. economy, however. Since last week, numerous reports have warned of a sharp slowdown at the Port of Los Angeles, the nation’s busiest port. This week, Walmart CFO John David Rainey said high tariffs could cause the company to raise prices by the end of the month. And on Friday (May 16), the University of Michigan’s closely watched index of consumer sentiment fell to its second-lowest level on record.

Billboard

Billboard

Billboard

Chinese streaming platform Tencent Music Entertainment grew its stake in the world’s largest music company, Universal Music Group (UMG), by picking up a direct 2% equity holding worth $327 million in March, the company said on Tuesday (May 13).

While it did not identify the seller — described in Tuesday’s filings only as “one of our associates” — Pershing Square sold 50 million shares of UMG on March 13, raising about $1.3 billion, according to filings and research reports. Tencent Music and Pershing Square did not immediately respond to requests for comment.

The news means that Tencent Music and UMG each own notable stakes in each other’s companies, as UMG owns a 0.79% stake in TME as of Dec. 31 that’s currently worth $181.2 million.

Trending on Billboard

Tencent Music has been an investor in UMG since March 2020, when it joined a consortium of investors led by its parent company, Tencent Holdings. That consortium accumulated a 20% stake in UMG from UMG’s parent company, Vivendi S.A., between 2020 and 2021, of which Tencent Music owned a 10% share, according to filings.

This March, that consortium “completed a transfer of the UMG shares held by the consortium to its members,” which resulted in Tencent Music acquiring a direct 2% equity interest in UMG, according to its annual report.

Tencent Music, which reported first-quarter revenue of 7.36 billion Chinese yuan ($1.01 billion) on Tuesday, recognized “other gains” worth 2.44 billion Chinese yuan (US$336 million), of which the UMG stock comprised 2.37 billion Chinese yuan (US$327 million), according to filings.

Pershing Square has been an investor in UMG since 2021, and though the mid-March stock sale reduced its stake in UMG to 4.9% from 7.6%, the music company remains the hedge fund’s largest single holding, comprising 17% of its capital.

The sale came ahead of Pershing Square’s plan to register its UMG shares in the United States in September. Pershing Square head and UMG board member Bill Ackman has advocated for the company to move its primary listing from the Euronext Amsterdam stock exchange to a U.S.-based exchange, saying it would add value for the company.

State Champ Radio

State Champ Radio