spotify

Page: 6

Led by Spotify and Live Nation, music stocks surged on Wednesday (April 9) after the U.S. Treasury placed a 90-day pause on most tariffs and recaptured some of the losses from the chaotic previous week.

A week after losing $12 billion in market value, Spotify was one of the top-performing music stocks of the week, gaining 8.0% and offsetting most of the previous week’s 10.3% decline. A 9.8% gain on Wednesday helped improve the streaming company’s two-week loss to 3.1%.

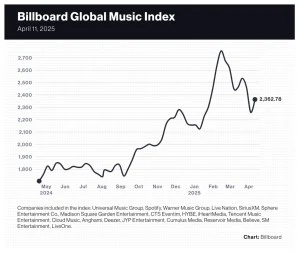

The 20-company Billboard Global Music Index (BGMI) gained 4.6% to 2,362.78 on Wednesday’s 90-day tariff pause. That welcome news recaptured only a fraction of the previous week’s losses, however, and music stocks were hurt by a weakened U.S. dollar and growing fears the U.S. could slip into a recession. After losing 8.2% in the previous week, the index’s two-week loss stands at 4.0%.

Trending on Billboard

U.S. markets rebounded after a miserable week. The Nasdaq rose 7.3% to 16,724.46, bringing its two-week loss to 3.5%. The S&P 500 rose 5.7% to 5,363.36, giving it a two-week decline of 3.9%.

Many markets outside of the U.S. were down, however. In the U.K., the FTSE 100 dropped 1.1%, giving it a two-week loss of 8.0%. South Korea’s KOSPI composite index was down 1.3%, adding to the previous week’s 3.6% decline. China’s SSE Composite Index dipped 3.1% a week after falling 0.3%.

Music streamer LiveOne was the week’s biggest gainer after jumping 18.0% to $0.72. The company’s preliminary results for fiscal 2025 released on Monday (April 7) showed the music streaming company had revenue of more than $112 million, while subscribers and ad-supported listeners surpassed 1.45 million. Even after the large increase, LiveOne shares have fallen 47.4% year to date.

Live Nation, which jumped 7.2% to $129.52 this week, is the only music company to post a gain over the past two weeks. The concert promoter’s share price dropped 3.4% the previous week but, with the help of a 10.9% jump on Wednesday, recovered well enough for a two-week gain of 3.6%.

Record labels and publishers finished the week in the middle of the pack. Warner Music Group fell 1.5% to $29.03, bringing its two-week decline to 8.0%. Universal Music Group was down 1.6%, giving it a two-week decline of 10.7%. Reservoir Media rose 0.7% to $7.10, giving it a two-week deficit of just 2.1%.

Sphere Entertainment Co. is one of the worst-performing music stocks over the past two weeks with an 18.5% decline. The company’s shares finished the week up 1.3%, barely offsetting the previous week’s 19.5% decline. A spike on Wednesday was partially offset by declines of 4.3% and 7.7% on Tuesday (April 8) and Thursday (April 10), respectively.

Most radio companies, which are heavily exposed to slowed advertising spending during recessions, had another down week. Cumulus Media dropped 22.5% to $0.31, bringing its two-week loss to 34.0%. iHeartMedia fell 4.2%, which took its two-week decline to 29.9%. Townsquare Media was down 4.9% this week and 13.6% over the past two weeks. Satellite broadcaster SiriusXM, which was upgraded by Seaport to buy from neutral, gained 2.6% this week, narrowing its two-week loss to 12.0%.

The two Chinese music streaming companies on the BGMI fared poorly despite the recoveries by Spotify, LiveOne and Deezer, which gained 2.3%. Tencent Music Entertainment fell 5.5% to $12.24 but was likely helped by Nomura initiating coverage this week with a buy rating and a $17.20 price target. Cloud Music shares dropped 5.7% to 141.50 HKD ($18.24).

K-pop companies, which bucked the downward trend the previous week, posted declines as well. SM Entertainment fell 8.2%, HYBE dropped 8.1%, JYP Entertainment sank 5.8% and YG Entertainment dipped 4.1%.

Billboard

Billboard

Billboard

Interest in superfans and their revenue potential has become so strong that market research firms and equity analysts are digging into the topic. This week, Bernstein released a report on music streaming services’ potential moves and MIDiA Research released a new report about music streaming pricing strategy.

For the uninitiated, a music superfan has been defined by Luminate as those fans who interact with artists and their content in multiple ways, including streaming, social media, physical music purchases and buying merchandise. These superfans make up 19% of U.S. music listeners, according to Luminate, and are more likely than the average fan to buy physical music, spend more on music, discover new music, connect with artists on a personal level and participate in fan communities.

Efforts are well underway to tap into superfans. Labels and artists employ e-commerce to sell merchandise, LPs and CDs directly to consumers, circumventing traditional retail channels and building a direct billing relationship with the most valuable fans. Startups such as EVEN and Fave — Sony Music and Warner Music Group are investors in the latter — are focused on connecting artists with their most fervent supporters. Given the multi-billion-dollar size of the music streaming market, though, Spotify’s plan to launch a superfan tier could be the most impactful play.

Trending on Billboard

Bernstein’s “Superfan Economics 101” report argues that a super-premium tier will help music streaming platforms achieve “sustained success in an increasingly competitive environment.” Analyst Annick Maas sees superfan-focused products as a function of the shift from mass consumption to direct-to-consumer tactics. Reaching out to smaller subsets of a larger audience, he writes, allows a streaming platform to “create a sense of belonging for its subscribers” and increase loyalty and engagement. That an equity analyst would highlight superfans in a report to investors speaks to the revenue potential in targeting subsets of consumers and the likelihood that publicly traded companies will make superfans a larger priority.

MIDiA Research also added to the superfan knowledge base this week by releasing a report based on a survey of 2,000 U.S. consumers. The main takeaway is that MIDiA found widespread interest in paying a higher price for a streaming service with additional features: Just under three-quarters of people surveyed have “some level of interest” in paying for a super-premium tier as an add-on to the basic subscription plan.

Exactly what people are willing to pay varies greatly, though: 22% of respondents are willing to pay an additional $1.99 per month fee while 10% are willing to pay an additional $13.99, more than double the current $11.99 price for an individual subscription.

To give an idea of the amount of revenue at stake, consider that there was an average of 100 million subscribers of subscription music services in the U.S. in 2024 who paid an average of $8.91 per month, according to the RIAA. (That figure does not include limited-tier subscriptions such as ad-free internet radio.) Those 100 million subscribers generated $10.69 billion over the year, which works out to $106.87 per subscriber per year.

If 10% of those 100 million subscribers — which include student and family plans in addition to standard individual plans — paid more than double the current price, total revenue would increase 10.8% to $11.76 billion, equal to $117.56 per subscriber annually or $9.80 per month. The 10.8% revenue growth is equal to $1.15 billion of incremental royalties.

The RIAA’s average revenue per user (ARPU) of $8.91 for 2024 is lower than the $11.99/$12.99 price being charged for the most popular individual plans, suggesting the 100 million subscribers figure includes many student and family plans. So, to measure the effect of the price increase on the RIAA’s ARPU, I multiplied ARPU by the ratio of the super-premium individual plan ($12.99 + $13.99) to a standard individual plan ($12.99).

So, without an increase in the number of subscribers or a price hike, doubling the fee for a tenth of subscribers would deliver a 10.8% revenue boost. Not all of those consumers would jump to the super-premium tier at once, however, meaning a double-digit increase in subscription revenue would accrue gradually over multiple years.

Charging an additional $1.99 super-premium fee on top of a standard subscription price would result in an incremental $334 million. Total revenue would increase 3.1% to $11.02 billion and ARPU would rise from $8.91 to $9.18.

Another option to expand the subscription base is a low-priced, “subscription-light” tier that incorporates advertising into paid subscriptions. Music streaming subscriptions have kept advertising out of their paid products, but there have been suggestions — namely from Goldman Sachs analysts who prepare the influential Music in the Air report — that a subscription-light tier that includes ads could help expand the subscription market.

Paid video subscriptions used to be a respite from the advertising world, but advertising has become well established on video platforms like Netflix, Amazon Prime and Hulu. Amazon Prime now inserts ads in movies, and Netflix and Hulu offer a low-cost, ad-supported option to make their products palatable for more price-conscious consumers.

But MIDiA’s survey suggests a subscription-light option is unpopular. About three-quarters of respondents who aren’t currently subscribed to a music streaming service aren’t interested in starting. This sizeable group of consumers doesn’t listen to music often enough to pay, or they find the current prices too high. Excluding the 100 million U.S. subscribers, there are approximately 188 million Americans aged 13 or older who do not subscribe to a streaming service (there are 51.9 million people under 13). Based on MIDiA’s findings, roughly 141 million of them aren’t interested in paying for a subscription. For them, there’s also YouTube and ad-supported radio.

What’s more, a subscription-light offering could be problematic. MIDiA found that ad-supported paid streaming attracted interest only “at very low price points” and warned it could harm overall subscription revenues by cannibalizing normal subscription tiers. With paid subscriptions currently creating the majority of U.S. recorded music revenue, and with subscription growth playing a prime role in Wall Street’s expectations for music companies, both platforms and labels may be unwilling to put that revenue at risk by offering a less expensive choice to millions of consumers who may soon be looking for ways to tighten their belts.

Spotify customers in the Benelux countries will be paying more for their subscriptions after the streaming company raised prices in Belgium, the Netherlands and Luxembourg. In both the Netherlands and Luxembourg, an individual subscription plan increased to 12.99 euros ($14.73) from 10.99 euros ($12.46). A family plan jumped to 21.99 euros ($24.94) from 17.99 euros […]

Music stocks were battered this week after President Donald Trump unveiled the tariffs that will be applied to imported goods from around the world.

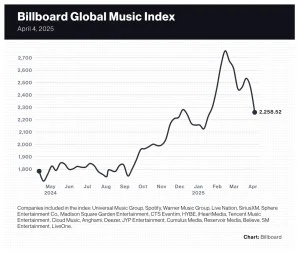

The 20-company Billboard Global Music Index (BGMI) fell 8.2% for the week ended Friday (April 4), marking the largest single-week decline in the index’s two-and-a-half-year history. Among the 17 stocks that posted losses, eight declined by 10% or more, and one — iHeartMedia — far surpassed a 20% decline. Of the 20 stocks on the index, only three South Korean K-pop companies posted gains for the week.

Markets around the world experienced large declines in the wake of the tariffs. In the U.S., the tech-heavy Nasdaq fell 10.0% and the S&P 500 dipped 9.1%. The U.K.’s FTSE 100 slipped 7.0%. South Korea’s KOSPI composite index fell 3.6%. China’s SSE Composite Index declined just 0.3%.

Trending on Billboard

SM Entertainment was the top performer of the week with an 8.3% gain, besting JYP Entertainment’s 3.3% increase and HYBE’s 2.3% improvement. No other music stock finished the week in positive territory, although French company Believe came close with a 0.1% decline.

Spotify fell 10.3% to $503.30, erasing approximately $12 billion of market value. While most stocks cratered on Thursday (April 3), Spotify had fared relatively well by losing just 1.2%. But Spotify shares fell 9.9% on Friday (April 4), paring down the once high-flying stock’s year-to-date gain to 7.9%.

Like Spotify, Tencent Music Entertainment bucked the downward trend on Thursday by suffering only a minor loss, but declined 9.5% on Friday, dropping 9.9% to $12.95.

Radio companies, which are heavily dependent on advertising revenue, were among the most affected stocks. iHeartMedia shares fell 26.8% to $1.20, bringing its year-to-date decline to 43.7%. Cumulus Media dropped 14.9% to $0.40. SiriusXM declined 14.2% to $19.51.

Live entertainment stocks were also hit hard. Sphere Entertainment Co., owner of the Sphere venue in Las Vegas, fell 19.5% to $26.74, mirroring sharp declines in gaming companies reliant on travel to Las Vegas such as Wynn Resorts (down 14.9% this week) and Caesars Entertainment (down 9.7%). Sphere announced on Friday that it has two new experiences in production: The Wizard of Oz at Sphere and From The Edge, a film about extreme sports.

Madison Square Garden Entertainment dropped 11.9% to $29.71, widening its year-to-date loss to 17.2%. Live Nation had been up 7.7% through Wednesday (April 2) but finished the week down 3.4% after losing a combined 10.3% over Thursday and Friday. German concert promoter CTS Eventim fell just 6.2%.

Music stocks started 2025 well, but concerns about tariffs have wiped out the index’s early gains. The BGMI has lost 18.0% of its value since Feb. 14 and has declined in five of the previous seven weeks. Halfway through February, the index had gained nearly 30% in the first six weeks of the young year. By Friday, that year-to-date gain was down to 6.3%.

Billboard

Billboard

Billboard

For years, Spotify’s founder and CEO, Daniel Ek, has aimed to make the streaming service “the world’s number one audio platform.” Between its music, podcast and audiobook offerings, and its formidable market share, it arguably has become just that.

But there’s one form of audio that the service is less excited about: noise. Also referred to as “non-artist noise content,” “non-music,” “functional music” (a commonly used term that some disagree with), and more by Spotify and music industry skeptics, these tracks capture sounds like wind, bird calls and white noise, and have become popular for listeners to stream, often for hours on end, while they sleep, focus, relax or meditate.

As streaming services become increasingly interested in changing their royalty models, these noise tracks have provoked debate between those who believe the content has value and those who feel it takes away from traditional musicians. And as Spotify and Deezer lead the charge, creating new policies that lower the money-making potential of noise, could penalizing this form of audio free up new money for musicians and help curb artificial streaming?

Trending on Billboard

In early 2023, Lucian Grainge, chairman/CEO of Universal Music Group, drew attention to the topic when he began to speak out against noise tracks regularly. “Our industry is entering a new chapter where we’re going to have to pick sides, all of us are going to have to pick sides,” he said at Billboard’s Power 100 event that February. “Are we on the side of…functional music, functional content? Or are we on the side of artistry and artists?”

Those who work in the noise space, however, don’t see the debate as that black and white. “I hate that stance,” says Jordan Smith, co-founder of Arden Records, a label which puts out lo-fi, ambient and field recordings. “We’ve done a lot of nature stuff, including a project with the National Parks, where we’ve released nature sounds. Our artists will go on a hike and field record it. They’ve spent time, effort and energy into that. They shouldn’t be penalized because it’s a different way of listening.”

Some have even dedicated their life to this work. Birmingham, England-born Martyn Smith, for example, has recorded and released 30,000 hours of nature sounds, dating back to the mid 1960s, to streaming services. Smith and his team see it as a method of environmental conservation, given that so many of these habitats were destroyed or permanently altered after Smith recorded them. “When you get to dip your toe into a different world and see people who are committing so much time and energy to [these field recordings], it’s genuinely awe-inspiring,” Smith’s collaborator, Robert Shields, told Billboard previously.

Others don’t have such lofty, artistic goals with noise tracks. One music industry professional, who spoke to Billboard under the condition of anonymity, puts out white noise to make money on the side while working a traditional music job. While they admit they’ve been exploiting the streaming model, ultimately, they say, “Who am I to say what audio is valuable to a Spotify user and what isn’t? Maybe white noise is the only way that person can fall asleep.”

Grainge and others, like Warner Music Group CEO Robert Kyncl, see this form of content not as a value add or an artistic endeavor but as a way of siphoning money away from their businesses. “It can’t be that an Ed Sheeran stream is worth exactly the same as a stream of rain falling on the roof,” Kyncl told investors in 2023. The noise issue has become one of the points of attack in Grainge’s “Streaming 2.0” plan, which aims to revise streaming royalty models to unlock more money for “professional artists” — like the ones signed to major label groups. Along with downgrading the value of noise, it also includes other suggestions, like implementing a threshold of minimum streams to qualify for monetization and penalizing fraudulent activity.

As the CEO of the largest music company in the business, Grainge has gotten his plan implemented at multiple services already, including Spotify and Deezer. While streamers are largely neutral about where they send appropriate royalty payments, as long as it abides by their guidelines, it matters much more to label bosses, who depend on the growing size and proper allocation of the royalty pool.

It’s hard to gauge exactly how much money has been paid out to noise content creators over the years, but its popularity is undeniable. On Apple Music, the playlist “Rain Sounds” is its third most popular offering. In a quick glance on Spotify, one of many tracks featured on its “White Noise 10 Hour” playlist has 226 million Spotify streams and counting.

To combat the amount of money flowing toward this content, Deezer has elected to remove user-uploaded noise content altogether from its service, instead offering company-owned, company-made noise offerings that do not generate royalties. Spotify took a different approach. While it has allowed outside noise tracks to stay on the service, it downgraded royalty-earning potential by 80% in late 2023.

According to a Spotify blog post about these rules, “functional genres…[are] sometimes exploited by bad actors who cut their tracks artificially short — with no artistic merit — in order to maximize royalty-bearing streams… The massive growth of the royalty pool has created a revenue opportunity for noise uploaders well beyond their contribution to listeners.”

While many publicly celebrated these changes, others quietly worried about it. For David Green, founder/CEO of Ameritz, an instrumental record label that has also released field recordings, “When [Spotify’s new rules around noise] were announced last year, there was a bit of fear across all providers. I think it was across the board. You’d be surprised how many providers do this type of [noise content].” Like the anonymous industry professional, many who dabble in noise recordings do it to earn additional income on the side of more traditional music industry work. “Then there was the fear of, ‘Maybe this detection won’t be as accurate as it should be,’” says Green, and it could accidentally pick up music too, especially more experimental ambient works.

For decades, musicians on the cutting edge have experimented with the sometimes-blurry line between music and noise. Musique Concrète, for example, is an experimental form of music that dates back to the 1940s and uses a compilation of raw, found audio to create a sound collage. Ambient musician TJ Dumser, who releases under the moniker Six Missing, says he doesn’t like the idea of people playing the system with white noise, but adds, “I think the only concern for me is, ‘Where is the line? How do we draw the line from noise, ambient and even noise rock? Who is to say what’s not music to somebody else?’”

But one year in, Green says Spotify’s tool seems to be accurate at drawing that line between noise and music. Spotify confirmed to Billboard that to monitor and filter noise tracks effectively it uses Sonalytic, an audio detection technology it acquired in 2022 that can identify songs, mixed content and audio clips, as well as track copyright-protected material. A Deezer spokesperson confirmed that it has an “algorithm that has been specifically trained to detect non-music noise tracks,” but that the company also can manually whitelist tracks that could be detected as noise but actually are experimental music.

While this battle over noise content hit a fever pitch in 2023, determining the value of alternative forms of audio has been a much longer-running challenge for streaming services. In 2014, independent funk band Vulfpeck released Sleepify, a silent album, to Spotify. The band’s frontman, Jack Stratton, then asked fans to stream the 10-track album on repeat overnight while sleeping to fund the band’s upcoming tour. After the project earned an estimated $20,000, Spotify removed the project, saying it violated its terms of content.

The hope is that, over time, these increasingly stringent policies against silent and noise tracks will put more money into musicians’ pockets. Spotify estimates that its new streaming policies, including but not limited to royalty reductions for noise, will lead to an increase of $1 billion available to artists in its royalty pool over the next five years.

When asked for comment about whether or not these policies had their desired effects yet, just over one year in, both Spotify and Deezer have positive, but mixed, results. A Spotify spokesperson said these rules have decreased Spotify’s issues with spam and artificial streaming from noise and decreased the number of short noise tracks. A representative for Deezer says, “The level of fraud, at least in terms of number of attempts, is not directly connected to our catalog cleaning efforts. However, we have seen that fraud has decreased on Deezer between 2023 and 2024.”

National Music Publishers’ Association (NMPA) president/CEO David Israelite joined the Association of Independent Music Publishers (AIMP) to give his annual State of Music Publishing address on Wednesday (April 2) at Lawry’s in Beverly Hills. In his speech, Israelite discussed hot button issues for publishers, including Spotify bundling (“we are still at war”), AI concerns, PRO reform and more.

Israelite started by sharing the NMPA’s data on the revenue sources for songwriters and publishers. It found that songwriters and publishers earn 45% of revenue from streaming services, 11% from general licensing and live, 9% from traditional synchronization licensing, 8% from mass synch (licenses for UGC video platforms like YouTube), 8% from radio, 7% from TV, 4% from labels, 2% from social media, 1% from sheet music, and 1% from lyrics. The NMPA says that 75% of its income is regulated by either a compulsory license or a consent decree, while the remaining 25% is handled via free-market negotiation.

On the AI front, Israelite explained that the NMPA is actively watching and supporting pending legal action.

Trending on Billboard

“We have not filed our own lawsuit yet, but I can promise you that if there is a path forward with a productive lawsuit, we will be filing it,” he said. As far as trying to regulate AI through policy, Israelite added, “We’re doing everything that can be done.” The NMPA is participating in both a White House initiative and a Copyright Office initiative, but he added, “If you are waiting for the government to protect your rights and AI models, I think that is a very bad strategy.”

Instead, Israelite said that the “most emphasis” should be placed on forming business relationships with AI companies. “When that date comes [that AI companies are willing to come to the table to license music], I believe the most important principle is that the song is just as valuable, if not more, than the sound recording in the AI model,” he continued.

During the speech, Israelite said he had a recent conversation with “the CEO of one of the major AI companies” who told him that “by far, the song [as opposed to the sound recording] is the most important input into these models. I tell you this because I am fearful that as these models develop, if we do not protect our rights, we will find ourselves in a situation where we are not getting as much or more than the sound recording when it comes to revenue…that is a responsibility of this entire community to fight for that.”

Israelite added that his “number one problem when it comes to revenue is how we are treated with these bundled plans,” pointing to publishers’ ongoing issues with Spotify. Last year, Spotify added audiobooks into its premium tier offerings and began claiming those tiers as “bundles,” a term referring to a type of subscription that qualifies for a discounted rate for music. Spotify claimed that it now had to pay to license both books and music from the same subscription price and subsequently started paying songwriters and publishers about 40% less for music, according to the NMPA. At the time, Billboard estimated that this would lead to a $150 million reduction in payments to publishers in the next year, compared to what publishers would have been paid if the tiers had never been reclassified.

In January, news broke that Universal Music Group (UMG) and Spotify had forged a direct deal that gave UMG’s publishing arm improved terms, effectively minimizing the harm caused by the previous year’s bundling change. Shortly after, Warner Music Group (WMG) followed suit with its own direct deal with Spotify for improved publishing remuneration. “I know in this room in particular, there is a great concern about what those market deals mean for the whole industry,” Israelite says. “I want to be very clear about this. I believe those market deals are a good thing, but until everybody benefits from the same protections about how bundles are treated, we are still at war. Nothing has changed.”

Israelite added later that UMG and WMG’s direct deals could be cited as “evidence” to support the publishers’ position during the next Copyright Royalty Board (CRB) fight, which will determine the U.S. mechanical royalty rates for publishers in the future. The CRB proceedings begin again in 10 months, and Israelite estimates his organization will spend $36 million in the next trial to fight for the publishers’ position. While he often noted that “we shouldn’t be in this system in the first place” during his address, Israelite conceded that despite his calls for a legislative proposal that would give publishers and writers the right to pull out of the 100-year-old system of government-regulated price setting for royalties, the “brilliant idea” is “next to impossible to accomplish.”

Israelite went on to detail all the ways the NMPA and others are still fighting back against Spotify over the bundling debacle. He noted that the Mechanical Licensing Collective (MLC) “is doing a fantastic job of continuing the fight” against Spotify, adding that its lawsuit, which was dismissed earlier this year by a judge who called the federal royalty rules “unambiguous,” has “been revived.” He added, “[It’s] our best chance of getting back what we lost.”

Elsewhere in his speech, Israelite told the crowd of independent publishers that the NMPA has now sent three rounds of takedown notices to Spotify for various podcast episodes, citing copyright infringement of its members’ songs, and that “over 11,000 podcasts have been removed from Spotify” as a consequence.

The recent calls for performing rights organization (PRO) reform are also top of mind for publishers in 2025. Last year, the House Judiciary Committee sent a letter to the Register of Copyrights, Shira Perlmutter, requesting an examination of PROs, citing two areas of concern: the “proliferation” of new PROs and the lack of transparency about the distribution of general licensing revenue. This spurred the Copyright Office to take action, opening a notice of inquiry that allows industry stakeholders to submit comments, sharing their point of view about what, if anything, should be reformed at American PROs. However, some fear that the notice of inquiry could lead to increased regulation at the PROs, further constraining publishing income.

Israelite addressed this by giving publishers a preview of the NMPA’s forthcoming comments. “I will tell you today exactly what our comments are going to say,” he said. “It is very simple. Music publishers and songwriters are already over-regulated by the federal government. Congress should be focused on decreasing regulation of our industry, not increasing regulation of our industry, and to the extent that any of these issues are substantive issues. This should be dealt with between the PROs and their members. It has nothing to do with the Copyright Office. It has nothing to do with Congress. It has nothing to do with the federal government.”

With Spotify leading the way in subscriber counts, the number of global music subscribers grew 11.6% to 818.3 million in 2024, according to MIDiA Research’s music subscribers market shares Q4 2024 report. That was about the same number of subscribers added in 2023, but where those new subscribers originated continues to change.

“The continued fast rise of the Global South is the market-defining dynamic, pointing to a rebalancing of the global music industry,” Mark Mulligan, managing director/senior music industry analyst, said in a statement. MIDiA Research defines the Global South as regions other than Europe and North America, where subscription penetration rates and prices are the highest in the world. “Revenues still skew heavily to the West but user growth is now consistently coming from elsewhere.”

Trending on Billboard

Nearly four out of every five new subscribers added in 2024 came from the mid-tier and emerging markets in the Global South, accounting for 78.4% of the 84.8 million new subscriptions last year and nearly three of five global subscribers overall. In turn, the mature streaming markets in Europe and North America represented 41.0% of global subscribers, down from 52.3% in 2020 and 62.0% in 2015.

The Global South has relatively small but fast-growing regions, often places where streaming has enabled a legal music ecosystem to thrive where little to none existed a decade or two ago. As Billboard reported last week, Mexico replaced Australia as the No. 10 market in 2024, according to the IFPI. The Middle East-North Africa region grew 22.8% while Sub-Sahara Africa improved 22.6%. China, the No. 5 market, grew revenues by 9.6%.

Spotify had a 32.2% share of global subscribers and finished 2024 with 236 million global subscribers, according to its latest earnings release. Spotify had more than double the No. 2 company, China’s Tencent Music Entertainment, which had a 14.7% share based on 121 million subscribers. Tencent Music Entertainment operates Kugou Music, Kuwo Music and QQ Music.

Apple Music was No. 3 at 11.6%, which works out to 95 million subscribers. YouTube Music and Amazon Music were tied for fourth at 10.1%,, or 83 million subscribers, each. Neither Apple Music, YouTube Music nor Amazon Music publicly releases their subscriber counts. YouTube’s latest number of 125 million subscribers announced on March 5 includes both YouTube Music and YouTube Premium, the ad-free tier of the video streaming service.

Apple Music and Amazon Music each lost nearly a percentage point of market share and added fewer subscribers than in the previous year. Of all globally available platforms, YouTube Music was the only major streaming service to post accelerated subscriber growth compared to 2023. That tracks to comments made last year by Universal Music Group CFO Boyd Muir. While Spotify, YouTube [Music] and some regional and local platforms showed “healthy growth,” Muir said during the company’s July 24 earnings call, some other, unnamed platforms “have seen a slowdown in new subscriber additions.”

China’s NetEase Cloud Music was No. 6 at 6.7%, which works out to approximately 55 million subscribers. Russia’s Yandex was No. 7 with a 5.0% share equal to 41 million subscribers. All others—including TIDAL, Qobuz, SoundCloud, Deezer, Napster and South Korea’s Melon—had a combined 9.5% share, which equals roughly 78 million subscribers.

Spotify continued its push into the live music business this week with the launch of Concerts Near You, a personalized playlist designed to help artists market and build awareness for their upcoming shows. Company officials say the playlist will update every Wednesday with 30 new tracks from artists performing near Spotify users based on the […]

In a first for a music streaming company, Paris-based Qobuz has publicly released the per-stream royalty rate it pays to rights holders. Qobuz tells Billboard it paid out an average per-stream royalty rate of $0.018732, or 1.8782 cents, in the 12 months ended March 31, 2024. That all-in rate, which covers both recorded music and publishing, works out to $18.73 for every 1,000 streams.

“Today, we are taking this step for greater transparency,” Qobuz deputy CEO Georges Fornay said in a statement. “Our payout rates are now public. This unprecedented move in our industry is a necessary first step toward promoting a fairer and more sustainable streaming model. Choosing Qobuz means taking concrete action for fairer compensation for all artists and supporting musical diversity, values that our customers cherish.”

One reason streaming companies haven’t released their per-stream royalty rates is because royalties aren’t paid on a simple, per-stream basis. Rather, royalties are the result of complex calculations based on such factors as market share and guaranteed minimums. Qobuz admits as much in the press release announcing its first-of-its-kind calculation, which was conducted by a major accounting firm. “It should be noted that the methods of payment to labels and publishers are not systematically based on remuneration per stream,” it reads. “Calculation methods may vary from one contract to another.”

Trending on Billboard

Nevertheless, the per-stream royalty rate has persisted as a popular metric for gauging streaming services’ value to artists and rights holders. And although Qobuz is often mentioned as the platform with the highest per-stream rate, there are no official numbers to show its place in the royalty hierarchy. Companies have disclosed the amounts of royalties paid annually and cumulatively, but never, until now, on a per-stream basis.

At approximately $0.0187 cents per stream, Qobuz ranks well ahead of its peers, based on the limited, imperfect information available. The best comparisons come from music catalog investor Duetti, which released its own calculations in January for per-stream rates paid to independent artists. That report said the average royalty for master recordings—excluding the publishing component that Qobuz included—was $0.00341 per stream in 2024, though Qobuz wasn’t included in those rankings. Publishing typically accounts for approximately 20% of music streaming content costs, which would put Qobuz’s recorded music per-stream royalty at approximately $0.015—4.4 times the average on Duetti’s list.

Amazon ranked first on Duetti’s list at $0.0088 per stream and was followed by TIDAL at $0.0068, Apple Music at $0.0062 and YouTube at $0.0048. Spotify’s $0.003 per-stream payout was lower than its peers because of high usage, geographical mix, reliance on free and discounted plans and Discovery Mode, through which artists accept a lower royalty in exchange for in-app promotion.

One reason Qobuz pays relatively well is because it charges a relatively high price. Average revenue per user (ARPU) at Qobuz is $121.13 annually or $22.38 per month, while Spotify’s latest ARPU (for the quarter ended December 31, 2024) was 4.85 euros ($5.29). In the U.S., Qobuz charges $12.99 per month—$1 more than Spotify’s music-and-audiobook tier—or $129.99 per month when purchased annually. In its home country of France, Qobuz charges 14.99 euros ($16.35) per month or 149.99 euros ($163.55) annually. That’s 34% higher than the 11.12 euros ($12.13) per month Spotify charges.

The company cited other aspects of its business that result in the relatively high royalty rate. Qobuz does not have an ad-supported tier that would pay less than subscriptions. Additionally, the platform provides greater valued through uncompressed files and high-resolution audio, which, along with “exclusive editorial content,” merit a higher price, the company says. And Qobuz highlights artists and genres—jazz and classical, for example—that are underrepresented at other streaming platforms. As a result, the company argues, more revenue is generated for a wider range of artists.

Geography also plays an important role in the size of Qobuz’s royalties. In the 26 markets where where Qobuz is available—including the U.S., Japan, U.K., Germany, France, Sweden and Canada—consumers tend to spend money on music subscriptions. The service is not available in many emerging countries such as India where subscription prices are low and listeners overwhelmingly opt for free, ad-supported options. And while Qobuz available in places like Mexico and Brazil where subscription costs are lower, it costs more than its competitors in those markets. In Mexico, for example, Qobuz’s monthly price is 150 pesos ($7.49) to Spotify’s 129 pesos ($6.44). In Brazil, Qobuz costs R$25.90 ($4.59) to Spotify’s R$21.90 ($3.88).

The difference between Qobuz and its peers may narrow over time as royalty rates improve—slightly—in the coming years. Spotify, according to reports, plans to launch a higher-priced plan that includes high-quality audio. Various companies are taking measures to marginally improve payouts. Deezer, for example, has changed its royalty scheme by demoting AI-created tracks, removing “non-artist noise content” and provide better payouts to what it terms “professional artists.” Spotify changed its royalty payout scheme in 2023. As more platforms follow suit, average royalty rates should inch upward.

Playboi Carti‘s new album is off to a strong start on streaming platforms.

Following its release on Friday (March 14), the Atlanta rapper’s long-awaited third studio album, MUSIC, became Spotify‘s most-streamed album in a single day in 2025 so far.

“Carti’s MUSIC is already making history,” the streaming giant captioned its announcement on X on Saturday.

In the lead-up to the album’s release, Spotify supported the rollout by putting up billboards in major cities such as Los Angeles, New York City, and Miami, displaying messages like “STREETS READY,” “SORRY4 DA WAIT” and “I AM MUSIC MF.”

MUSIC was preceded by the official single “All Red,” which reached No. 15 on the Billboard Hot 100 chart and No. 3 on Billboard‘s Hot R&B/Hip-Hop Songs chart. Carti also released several tracks on his YouTube and Instagram, including “2024,” “BACKR00MS” featuring Travis Scott, and “H00DBYAIR.”

Trending on Billboard

Additionally, Carti performed unreleased songs during his headlining set at Rolling Loud Miami in December 2024, including “Lose You” featuring The Weeknd. Carti and The Weeknd’s collaboration “Timeless,” from The Weeknd’s Hurry Up Tomorrow album, reached No. 3 on the Hot 100 last year, following the success of their platinum-certified hit “Popular” with Madonna.

MUSIC features star-studded collaborations from Young Thug, Travis Scott, Future, Kendrick Lamar, The Weeknd, Lil Uzi Vert, Skepta and Ty Dolla $ign. It also boasts an impressive list of producers, including Cardo, Metro Boomin, Southside, F1lthy, Ye, Cash Cobain and the production duo Ojivolta, among others.

The 30-track project arrives five years after Carti’s last album, Whole Lotta Red, which topped the Billboard 200 and the Top R&B/Hip-Hop Albums chart. The 2020 set featured collaborations with Ye (formerly known as Kanye West) on “Go2DaMoon,” Kid Cudi on “M3tamorphosis,” and Future on “Teen X.”

Carti is set to headline Rolling Loud California on Sunday (March 16). The festival posted on X earlier this week, noting that his 2018 debut album, Die Lit, dropped the day before Rolling Loud Miami, and he’s continuing that tradition by releasing MUSIC the day before Rolling Loud California opens.

State Champ Radio

State Champ Radio