spotify

Page: 5

Apple approved Spotify’s app update in the U.S. on Friday (May 2), marking “a significant milestone for developers and entrepreneurs everywhere who want to build and compete on a more level playing field,” according to the streamer.

The announcement followed the news that a judge told Apple to stop collecting a commission on some app sales. “After nearly a decade, this will finally allow us to freely show clear pricing information and links to purchase, fostering transparency and choice for U.S. consumers,” Spotify wrote in a blog post. “We can now give consumers lower prices, more control, and easier access to the Spotify experience.”

Epic Games, the company behind the wildly popular game Fortnite, sued Apple over its App Store policies — which ensured that Apple took a 30% cut of any payments — in 2020.

Trending on Billboard

Epic Games was not the only company that disliked this arrangement: Horacio Gutierrez, Spotify’s chief legal officer, said in 2020 that Apple “acts as the stadium owner, referee and player, and tilts the playing field in favor of its own services.”

The following year, Yvonne Gonzalez Rogers, a judge in the U.S. District Court for the Northern District of California, ruled that Apple had violated the state’s laws prohibiting unfair competition.

Despite that ruling, the same judge said this week that Apple put a new system in place that required apps with external sales to pay a 27% commission. The company “sought to maintain a revenue stream worth billions in direct defiance of this court’s injunction,” the judge wrote.

The judge demanded that Apple stop collecting that commission. “We strongly disagree with the decision,” an Apple spokeswoman told The New York Times. “We will comply with the court’s order, and we will appeal.”

Spotify hailed the development as “a great day” for its U.S. users. “The ruling made it clear that Apple deliberately abused its market power to intentionally harm others and benefit only itself,” the company wrote.

Moving forward, Spotify said U.S. users will now have visibility into “pricing details on subscriptions and information about promotions that will save money,” have the option to pay for subscriptions outside of Apple’s system, and have the ability to easily upgrade from their account or change their subscription plan.

“The fact that we haven’t been able to deliver these basic services, which were permitted by the judge’s order four years ago, is absurd,” Spotify added.

While many public companies are struggling amid the backdrop of macroeconomic uncertainty and the looming threat of global tariffs, music company executives are beating the drum for music as a stable place to invest. Despite a plateauing of the growth curve, revenue from streaming subscriptions continues to drive relative stability at Spotify, Unversal Music Group […]

Spotify’s first quarter revenue rose 15% as its subscriber base increased 12%, the company’s highest first quarter subscriber gains since early in the COVID-19 pandemic, the company reported on Tuesday. The music and podcast streaming giant reported total revenue of 4.2 billion euros ($4.54 billion) in the quarter ending March 31, and total paying subscribers […]

Proving that the best way to get stock prices to rally is to first bury them deep underground, markets surged this week as President Trump eased his tone on U.S. Federal Reserve chair Jerome Powell and said tariff negotiations with China are ongoing (although China denied the claim).

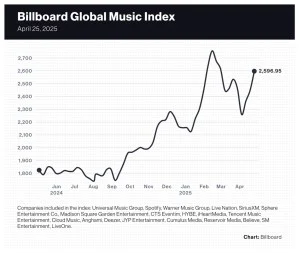

The 20-company Billboard Global Music Index surged 6.1% to 2,595.95, marking its third consecutive weekly gain after falling 10.9% in the two-week period ended April 4. The spoils of a less chaotic global market were felt by nearly all music stocks. Of the 20 stocks in the index, 16 finished the week in positive territory, and two — Anghami and Sphere Entertainment Co. — had gains exceeding 10%.

Major indexes improved this week as investor sentiment regarding U.S. tariff policy improved and President Trumpsaid he would not fire Powell. The Nasdaq composite rose 6.7% to 17,382.94 and the S&P 500 gained 4.6% to 5,525.21. The U.K.’s FTSE 100 improved 1.7% to 8,415.25. South Korea’s KOSPI composite index rose 2.5% to 2,546.30. China’s SSE Composite Index rose 0.6% to 3,295.06.

Trending on Billboard

After investors’ confusion about the U.S. tariff policy put a damper on stocks in recent weeks, markets seemed to find comfort in reports that said the U.S. Trade Representative was quickly working with some trading partners under a streamlined process. Jay Hatfield, founder/chief investment officer of InfraCap, told CNBC, “We’ve reached peak tariff tantrum” and believes the worst of the uncertainty has passed. In fact, the market could have been due for a rebound. Thomas Martin, senior portfolio manager at GLOBALT in Atlanta, told Reuters the stock market “was oversold by virtually all measures.”

Sphere Entertainment Co. was one of the week’s winners, rising 13.8% to $28.88. On Friday, Sphere Entertainment subsidiary MSG Networks announced it had negotiated a $514 million reduction in its debt and lower fees to broadcast New York Knicks and New York Rangers games. The news sent Sphere’s share price up 9.1%.

Spotify, which reports first quarter earnings on Tuesday (April 29), rose 8.1% to $620.72, giving the streaming giant a 23.3% gain over the past three weeks. This week, UBS lowered its price target to $680 from $690 and Wolfe Research raised its outlook on SPOT to “outperform” from “peer perform.”

Live Nation gained 4.4% to $132.76. Wolfe Research lowered its price target to $158 from $165 and maintained its “outperform” rating.

Warner Music Group (WMG) improved 2.4% to $29.83. Morgan Stanley lowered WMG shares to $32 from $37 and dropped the rating to “equalweight” from “overweight.” Universal Music Group (UMG), which also reports earnings on Tuesday, rose 3.5% to 24.79 euros ($28.28), bringing its year-to-date gain to 3.7%.

K-pop stocks had an unremarkable week after performing well during the tariff-driven chaos. HYBE, which, like Spotify and UMG, reports first-quarter earnings on Tuesday, rose 0.9%. SM Entertainment and JYP Entertainment improved 0.6% and 0.2%, respectively. YG Entertainment dropped 4.9%. Still, K-pop stocks are outperforming most music stocks this year. Collectively, the four South Korean music companies have posted an average year-to-date gain of 27.1%.

Cumulus Media shares dropped 16.0% to $0.21 after the company announced on Wednesday (April 23) it will de-list from the Nasdaq exchange on May 2 and immediately begin trading over the counter. The radio broadcaster’s shares are down 72.7% in 2025 and have fallen 92.2% over the last 52 weeks.

Billboard

Billboard

Billboard

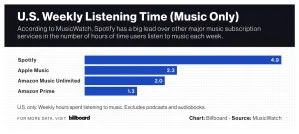

Spotify gets more engagement — much more — than its competitors in the music subscription space.

In the second quarter of 2024, the average Spotify Premium listener spent 4.9 hours per week listening to music, according to a MusicWatch survey of U.S. consumers that excluded time spent listening to podcasts and audiobooks. That easily bested Apple Music (2.3 hours), Amazon Music Unlimited (2.0 hours) and Amazon Prime (1.3 hours). These ratios have been fairly consistent over the past five years, with Spotify having an approximately 2.0 to 2.5-times advantage over its nearest competitor.

Billboard

Last year, Spotify executives described “the Spotify machine” as multiple verticals working together to give consumers more content choices and increase engagement. Podcasts, which are a natural fit for a music service built on audio advertising, offered the promise of keeping people listening longer. The same goes for audiobooks, which Spotify began streaming in the U.S. in 2023. Product features such as Spotify Wrapped and Discover Weekly are also intended to keep people listening.

Judging from statements made by Spotify’s executives, the Spotify machine is working as intended. In November, CEO Daniel Ek said that “overall, Spotify keeps bringing up engagement and bringing down churn,” the term for a subscription service’s subscriber losses. In July, Ek said the company was seeing “healthy MAU [monthly active user] engagement trends year-over-year.”

Trending on Billboard

But Spotify’s own numbers show its average global user’s listening time has remained steady over the past six years. According to data available in Spotify’s annual reports, the service had an average of 24.8 hours per monthly average user (MAU) per month in 2024, down slightly from 25.2 hours per month in 2023 and on par with the preceding four years (24.6 in 2022, 24.4 in 2021, 24.9 in 2020 and 25.5 in 2019). These listening averages cover music, podcasts and audiobooks.

Billboard

So, based on Spotify’s publicly available figures for global listening hours and MAUs, the average user’s listening time has not increased as hundreds of millions of new users have flocked to the platform.

Why the disconnect? How can Spotify executives say that engagement is growing while its own numbers show flat engagement? Perhaps engagement has increased within pockets of Spotify users. MusicWatch’s Russ Crupnick believes that in the U.S., Spotify’s late adopters are relatively light users who balance out the higher streaming activity of earlier adopters. In that scenario, if Spotify is adding listeners, it will always have new listeners to drag down other listeners’ increasing listening time.

Geographical differences could be at play, too, based on the length of time Spotify has been in each market. In July, Ek described engagement in mature markets as “high” but chose the word “different” for engagement in emerging markets. Based on his choice of words, engagement differs depending on the length of time Spotify has been in a market.

But in the U.S., at least, the time spent listening to music on Spotify has remained “reasonably” steady over the years, says Crupnick. In fact, Spotify’s weekly listening time was “actually a bit higher a few years ago,” he says. Again, the listening habits of late adopters are a reasonable explanation.

It’s worth noting that MusicWatch’s figures exclude podcast and audiobook listening. If Spotify has been able to maintain weekly music listening over the years, it stands to reason that podcasts and audiobooks have provided incremental engagement. Spotify’s lucrative, exclusive deal with The Joe Rogan Experience worked so well that Spotify became the top network for podcast listening in the U.S. in the second quarter of 2023. Last year, Spotify ranked No. 2 behind YouTube for podcast listening (26% to YouTube’s 33% and Apple Podcast’s 14%), according to Edison Research’s The Infinite Dial 2025 report.

In the subscription business, engagement is king. It leads to more subscriptions, lower subscriber churn and a better “lifetime value,” or LTV, a metric that quantifies the present value of future revenue from a subscriber. Stronger engagement gives companies the confidence to raise prices, as Spotify has recently done, and launch superfan tiers, as Spotify has teased, that offer additional bells and whistles for a higher price.

The ability to keep people listening — and be better at it than your peers — can also be a competitive advantage. One reason Spotify has a market capitalization of more than $110 billion is because investors believe Spotify is a “best in class” service that merits such a high share price.

There’s an incredible amount of product innovation going on at music subscription services. Apple Music recently launched three more live, global radio stations. Amazon Music Unlimited offers hands-free listening with Alexa. Both services provide high-quality audio at no extra cost. But Spotify has succeeded in keeping people listening longer.

Investors seeking shelter from the chaos unleashed by President Trump’s often incoherent tariff policy can find safety in companies without direct exposure to tariffs or the teetering advertising market. And music, especially digital music, will be able to weather the storm, say many analysts — with one major exception.

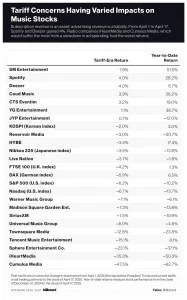

To understand what people are thinking about tariffs’ impact on the business world, look no further than stock prices. The performance of various music-related stocks reveals how investors are betting that economic uncertainty will affect various companies.

Many stocks — especially those of companies traded on U.S. exchanges — have taken a hit as investors fled for safer alternatives. The Nasdaq and S&P 500, U.S. indexes, are down 6.2% and 6.7%, respectively, since April 1, the day before President Trump announced his tariff plans. Elsewhere in the world, indexes have generally performed better. South Korea’s KOSPI is down just 2.0%. Japan’s Nikkei 225 is off 3.5%. The U.K.’s FTSE 100 is down 4.2%. Germany’s DAX has lost 5.9%.

Trending on Billboard

Within music, companies that get most of their revenue from streaming are faring relatively well. Since April 1, Spotify and Deezer have each gained 4.0%, two of the better showings for music stocks. Cloud Music improved 3.9%. Tencent Music Entertainment, on the other hand, has fallen 15.1%, although its share price remains up 8.1% year to date.

Record labels and publishers have also been holding up well, in relative terms, particularly outside the U.S. Since April 1, shares of Universal Music Group (UMG) — which is headquartered in the U.S. but trades in Amsterdam — and Warner Music Group (WMG) are down 8.0% and 7.1%, respectively. Reservoir Media lost 3.0%. K-pop companies — much like South Korean companies in general — have fared well. Since April 1, SM Entertainment has gained 7.9%, YG Entertainment is up 1.1% and JYP Entertainment has gained 0.7%. HYBE fell 3.4%.

UMG and WMG’s post-tariff declines are slightly greater than the drops in the Nasdaq and S&P 500 of 6.7% and 6.2%, respectively. But both UMG and WMG had strong starts to 2025, and their year-to-date losses of 4.5% and 6.1% are far better than the S&P 500’s 10.2% drop and the Nasdaq’s 15.7% year-to-date decline.

Some live music companies’ stocks have been resilient, too. Live Nation shares are down 3.7% since April 1, while German concert promoter CTS Eventim is up 3.2%. Sphere Entertainment Co., owner of the Sphere venue in Las Vegas, is an exception. Sphere Entertainment shares have plummeted 23.1% since President Trump’s tariff announcement, a far more significant drop than the stocks of other companies — Caesars Entertainment, Wynn Resorts, MGM Resorts — that rely on consumers’ willingness to part with their money in Las Vegas.

For many U.S. media stocks, the direct impact of tariffs is “relatively muted,” wrote Citi analysts in an April 7 report, as many of the companies rely on discretionary spending, not ad revenue. Apple and other tech companies, for example, got an exemption from the 145% tariffs on Chinese imports but must still pay the blanket 20% tariff. Companies that get much of their revenues from subscriptions — Netflix, Spotify, UMG and WMG — will be less impacted.

Music streaming, most notably subscription services, is considered by equity analysts to be safe from whatever tariff-induced economic chaos awaits the global market. “Digital goods are unaffected by tariffs,” wrote TD Cowen analysts in an April 14 investor report. Subscription services, they argued, provide enough bang for the buck, and customers have such an emotional attachment to music that subscribers are unlikely to leave in “meaningful” numbers if the economy goes south.

Streaming and subscription growth slowed in 2024, but many analysts expect improvements to come from a regular drumbeat of price increases, renewed licensing deals and super-premium tiers. That said, analysts believe that Spotify’s latest licensing deals with UMG and WMG, and upcoming deals with other rights holders, better reward labels and publishers for price increases. As a result, TD Cowen slightly lowered its estimates for Spotify’s revenue, gross profit margin and operating income in 2025. Likewise, in an April 4 note to investors, Guggenheim analysts lowered their estimate for Spotify’s gross margin in the second half of 2025.

Companies reliant on advertising revenue will also take an indirect hit. Citi estimates that $4 trillion of imports could generate $700 billion in tariffs and reduce personal consumer and ad spending by 1.9%. Tariffs have ripple effects, too. Because household net worth and personal spending are highly correlated, says Citi, the recent declines in stock prices could reduce personal and advertising spending by 3.0%.

Consumer spending is at the heart of the concert business, but analysts agree that fans’ affection for their favorite artists protects live music from economic downturns. As a result, Live Nation has “less risk than the average business that depends on discretionary spending,” according to TD Cowen analysts.

Advertising-related businesses aren’t so lucky, though. As tariffs raise prices and household wealth declines, personal spending also declines, and, in turn, brands pull back on their advertising spending. Investors’ expectations for advertising-dependent businesses were apparent before April but have become clearer since President Trump’s April 2 tariff announcement. iHeartMedia, which closed on Thursday (April 17) below $1.00 per share for the first time since June 4, 2024, has dropped 35.3% since April 1 and fallen 50.3% year to date. Cumulus Media has fared even worse, dropping 47.5% since April 1 and 62.7% year to date. Townsquare Media has fallen 12.8% in the tariff era and 23.8% year to date.

J.P. Morgan analysts believe iHeartMedia’s full-year guidance of $770 million is “somewhat optimistic” given economic uncertainties and ongoing pressures in the radio business. It forecasts full-year EBITDA of $725 million — nearly 6% lower than iHeartMedia’s guidance. If things wind up going more the way J.P. Morgan predicts than iHeart, it would be a big blow to the company and an unfortunate bellwether for the already struggling radio business. While other music industry sectors look to ride out the tariffs at least in the shorter term, the economic uncertainty introduced by the Trump administration may only hasten radio’s ongoing decline.

As Billboard has noted numerous times in recent weeks, investors are attracted to music assets because they are counter-cyclical, meaning they don’t follow the typical ups and downs of the economy. Consumers will, by and large, stick with their music subscription services and continue going to concerts. But by introducing the tariffs, the Trump regime exposed one of radio’s greatest weaknesses as a business: a greater exposure, due to its reliance on advertising, to the state of the wider economy.

Billboard

Last month, Billboard was invited to the Spotify offices in Downtown Los Angeles to meet its top editors and curators and get an inside look at how Spotify’s playlists come together, genre-by-genre. And leading that team is Sulinna Ong, global head of editorial at Spotify. Over time, Ong has held a variety of roles at companies like Live Nation, Sony BMG Music and French streaming service Deezer, before joining Spotify in 2019. After coming aboard, she served as its Head of Music (UK) and Head of Artist and Label Services (UK) before taking the helm of editorial.

In her role, Ong has worked to evolve what playlists can be — from launching the ephemeral and personalized options like Daylist and AI DJ, to further building out the worlds of longstanding flagship playlists RapCaviar and Today’s Top Hits. These days, most of all, Ong is interested in adding more context to the playlists, as she senses Spotify users becoming increasingly interested in having more of a human touch to those listening experiences.

Trending on Billboard

To explain her strategy with Spotify’s editorial in 2025, Ong sat down with Billboard for an extended interview to explain her stance on AI music in playlists, changing user behavior, future growth markets and why she wants to bring her team of editors into the spotlight more than ever.

What are some of your goals for Spotify’s editorial team in 2025?

We’re thinking about how to make the playlists more engaging, and we think it’s a combination of short-form video and editorial. We refer to our roles as editorial, but they also involve curation. Editorial is the storytelling, the context: “Why is this important? Why is it culturally relevant?” The curation is, “What song? What artist?” There’s an art to combining both. As we look to the future, the editorial side is becoming even more critical. We are doubling down as human music editors in music discovery and trend forecasting in 2025.

What will this editorial short-form look like? And is it something that’s interactive, allowing for comments, likes, etc.?

We format this in what we call editorial Watchfeeds. That will include written track commentary, editor videos and more. We’ve been thinking about how do we incorporate social and community elements? Whether that’s commenting, liking — it’s a combination of all those things.

Spotify used to have more social-like features, like the direct message feature, which has since been removed. Do you see this move towards more social elements as a way to retain users in-app?

We want to broaden the ecosystem. We want to have our users spend as much [time] as possible and interact with one another as well. One of the editorial Watchfeeds that we did, as an early example to test the hypothesis, was Carl Chery [head of urban editorial] during the Drake–Kendrick battle. We kept getting asked, especially Carl, about what was happening. It was all coming so fast. So we did an editorial Watchfeed where we explained it in sequence. That did really well. Some of the feedback from users was, “I didn’t have to go elsewhere to find this information.” That was really interesting for me.

Why did you decide that short-form video was the right way to editorialize these playlists?

In a world where people’s attention spans are short, it made sense. Are users really going to sit and watch a 30 minute diatribe monologue before getting into the playlist? That’s not realistic.

TikTok, Reels and Shorts have been in the short-form video space for years now. Is Spotify getting on this trend too late?

We’re not a social media platform. This is a tool to expand the storytelling experience of the music and the recommendations, which is why it’s not all short-form video. It’s just one part of our toolkit. Text and track commentary is also something we want to do, so it’s not all short-form video content.

For a long time, it was Daniel Ek’s goal to make Spotify the destination for audio. More recently, that goal has expanded to video. The Watchfeed is not the first time Spotify has experimented with video. What have you learned from previous successes and failures with video on Spotify?

We experimented with longer-form video a few years ago, and it didn’t really connect. I think actually podcasts were something that were really interesting for us to watch. It was interesting to see how core video actually ended up being to the podcast experience and the podcast audience. Yes, podcasts are longer-form, but might that be interesting for a playlist experience to try some kind of video for editorializing? I come back to editorializing because that’s what podcasts do — they provide context on a topic. We thought the next step is to do that for music. It’s not exactly the same experience, it’s not like for like, but there are components of that technology that became Watchfeed.

Until now, Spotify’s curators have largely worked anonymously. Why change that?

A lot of thought went into it. When you think about the era that we’re in in terms of AI and machine learning, people want to know — is this AI or human? What’s your point of view? AI doesn’t have a point of view. We found that people actually are interested about the people behind the playlist.

Over the couple of years, Spotify has leaned into cutting edge tech-driven features like Daylist or AI DJ. In 2025, though you’re leaning into editorializing playlists. How do you see the balance between human and algorithmic aspects of playlisting today?

They live together. I’ve never seen it as an either/or situation. I think you need both and both have unique strengths. Over time the editorial role has grown. But we are still focused on the strengths of each and combining the two.

AI has played a key role in some of your newer features, like AI DJ, but how does the editorial team treat generative AI music that ends up on Spotify? Do you have any rules against playlisting it?

We are focused on human artists and the music they create. That is what we feel is really important. We did curate, though, Kito’s track [“Cold Touch”] that used Grimes’ AI voice on it. But Kito is a bonafide artist that had the blessing of another artist to use her AI likeness and voice. That is different to us. But we think very thoughtfully about our focus on supporting real, human artists. To this point so far, I have not seen a generative AI artist or track take off. That’s not to say that it won’t happen in the future, but right now, that’s not what we’re seeing.

What markets do you think will grow significantly in the next few years?

India will only be a more important player. Same with Southeast Asia. It’s interesting to look at Southeast Asia because we see Western artists actually getting their foothold in countries like the Philippines. In general, local-language content continues to grow.

I’ve been asking all of your editors the same question: What is the most common misconception about the role of a Spotify curator?

There are two. There’s that we are in service to labels and we curate what we’re told; that can’t be further from the truth. There’s an editorial independence that the editorial team has. The second misconception is that you can pay to get on an editorial playlist. I still see people claiming that they can get you on one for a price. It’s a scam. We have a code of ethics for our editors.

What are some things that are part of your code of ethics, and has your code of ethics evolved over time?

We have strict rules to protect our editorial independence, like if we get invited to a gig or a festival, and there’s an offer to cover our flights or travel, we’re not allowed to accept. If there is a reason, a business reason, for us to be there, Spotify will cover our travel. We don’t want to be beholden to anyone. And we are constantly reviewing [our code of ethics]. It’s a yearly process of, like, “Do we have the right guidelines and guardrails in place?”

There are reports that there is a super-premium tier on the way for Spotify users willing to pay an extra subscription cost. In return, they will receive new features. Are there any extra editorial offerings in the upcoming new tier?

I don’t have any info to share with you other than what you already know. We are obviously always thinking about what superfans want and what would entice them to go onto that super premium tier, but I’ve got no details to share.

Dating back to a Music Business Worldwide story in 2016, there have been reports that Spotify has used company-owned music or so-called “fake artists” or “ghost artists” in its playlists, like Peaceful Piano or Ambient Chill. Those allegations resurfaced this year in the book Mood Machine. Can you provide any comment or clarification on those allegations?

My team curates purely editorial lists. We curate playlist music from artists. Our team doesn’t touch that.

How much creative freedom do editors actually have? How often do they get the ability to go with their gut?

They’ve got a lot of freedom to do that, but you do need to critically explain why you believe in something. There’s a balance between our personal tastes and what we think will resonate with a listener. You need to understand the shift between the two. As an editor, it’s important to understand what your biases are and make sure you are not curating with bias. What I mean by that is overdoing it because I really love this artist, or [underdoing it] because I don’t. That’s why we also curate in groups, so we challenge each other. “Why is that there? Why is that not there?” It’s actually part of our training.

It sounds like the playlists operate in a tier structure. Like, an artist can get on Fresh Finds, and if it does well, then maybe the artists get onto All New Indie next. Is that right?

Yes, we have a playlist pyramid. It’s like working an artist up through the ecosystem. You can’t slam an artist into a big flagship. There needs to be a strategic approach as to how you introduce someone to a new audience.

When Spotify’s social media accounts started posting about the editorial team’s song of the summer predictions in 2024, global head of editorial Sulinna Ong noticed a lot of commenters asking the same question: Is this artificial intelligence? “I actually went in and said, ‘I can assure you we’re not AI,’ ” she says, adding that she then found herself wondering, “Do people care whether it is [AI]?” The answer was a resounding yes. Ong recalls commenters were overjoyed to be able to identify her as a warm-blooded source of the faceless predictions. The reaction amounted to a collective “This is great. You’re human!”

Having focused on high-tech improvements to playlisting over the last few years, such as the AI DJ that subscribers can utilize and improved personalized Daily Mixes, Daylist and other features, Ong says she realized listeners value human input and connection more than ever and decided to recalibrate the “equilibrium” between AI and Spotify’s flesh-and-blood tastemakers.

Trending on Billboard

“A big tenet of editorial is this idea of reflecting culture and also being able to propel culture forward,” says J.J. Italiano, head of global music curation and discovery.

As a result, Spotify’s editorial team is leaning further into its top playlists with new “Watchfeeds” — written and video content that contextualizes its choices. There’s also more freestyling involved, such as the throwback songs that Spotify head of urban music, editorial Carl Chery slips into RapCaviar on Thursdays, or the newsletter that head of indie/alternative Lizzy Szabo writes for Lorem. Ong says interactive elements such as likes and comments may be added in the future.

To further individualize their work, Spotify’s editorial team came together for a photo and spoke to Billboard about their backgrounds, their work and their favorite music. “We know that cultural knowledge is really important. AI and machine learning excel in passing large data sets and scaling, but when it comes to cultural understanding, that’s where human editors really excel,” Ong says. “But we are still focused on the strengths of both [tech and human features] and combining the two.”

Sulinna OngGlobal head of editorial

Sulinna Ong

Yuri Hasegawa

Raised in the United Kingdom, Iran and Australia, Ong caught the music bug when she heard Kim Gordon singing Sonic Youth’s “Kool Thing” as a 13-year-old. She worked in a wide array of roles for Live Nation, Sony BMG Music and French streaming service Deezer before joining Spotify in 2019. Prior to assuming her current position in 2021, Ong served as the streaming platform’s U.K. head of music and U.K. head of artist and label services.

Favorite Spotify playlists?

Misfits 2.0, Liminal.

What are your 2025 goals for the editorial team?

We’re thinking about how to make the playlists more engaging, and we think it’s a combination of short-form video and editorial. We refer to our roles as editorial, but they also involve curation. Editorial is the storytelling, the context: “Why is this important? Why is it culturally relevant?” The curation is, “What song? What artist?” There’s an art to combining both. As we look to the future, the editorial side is becoming even more critical. We are doubling down as human music editors in music discovery and trend forecasting in 2025.

Until now, Spotify’s curators have largely worked anonymously. Why change that?

AI doesn’t have a point of view. We found that people actually are interested about the people behind the playlists.

Read Ong’s full interview here.

Carl CheryHead of urban music, editorial

Carl Chery

Rebecca Sapp

After working at hip-hop magazine XXL, Chery joined Beats Music in 2012, which was folded into Apple Music in 2014. He oversaw hip-hop and R&B at both streaming services before moving to Spotify in 2018, where he leads curation for its urban music playlists, including RapCaviar.

Favorite Spotify playlists?

Locked In, Gold School.

What trends are you spotting?

I’m interested in seeing what happens with sexy drill. Drill’s been around for a long time, and it keeps morphing. If you go back five years, that’s when it really broke through with Pop Smoke and Fivio [Foreign] and the Brooklyn drill scene. Part of the conversation around drill is that its subject matter is so hardcore it’s potentially [limiting the style]. But sexy drill has a lot of appeal. I’m keeping an eye on whether this is going to finally break through as the sound du jour in hip-hop.

What are some common misconceptions about Spotify editors?

Some people think playlisting is based on favors. They don’t pitch songs based on their merits or performance. They think building a relationship with editors enhances their chance of getting playlisted. That’s never been the case. [Others] think that playlisting is based on personal taste. Technically, it doesn’t matter if we like it. One of the most important qualities for editors is to be objective, [though] this doesn’t mean that personal taste doesn’t come into play. The sweet spot is when you get to support something that is at the intersection of your taste and what the audience likes.

Ronny HoHead of dance & electronic, editorial

Ronny Ho

Yuri Hasegawa

Though Ho booked concerts and hosted radio shows in college, she first worked in investment banking, and her initial job at Spotify was in business development. During her first years at the company, she got to know the members of the editorial team because she sat next to them. After moving to Spotify’s music team as a business manager, a role opened up in editorial, and she was given a tryout despite her unorthodox résumé.

Favorite Spotify playlists?

Tech House Operator, Marrow.

Given the global popularity of dance, how do you coordinate with curators around the world to make the best playlists?

We have global curation groups. Dance was one of the first ones that started. It happened naturally with us just reaching out to curators in other markets to see what they’re seeing. We talk now on a weekly basis about new music coming out, trends that are popping off, local subgenres or communities we find interesting.

How are you discovering music for your playlists?

It’s a mix. We get inbound pitches from the Spotify for Artists pitch tool, but I am also going to shows all the time. A lot of DJs are rinsing tracks that aren’t released yet live. I’ll watch and see what the reaction is. If there’s something that really hits with a fan base, I’ll make note of it. Also, I look on the internet.

J.J. ItalianoHead of global music curation and discovery

JJ Italiano

Yuri Hasegawa

Italiano entered the music industry as an artist manager, then shifted his focus when he took a job as head of streaming at talent agency YMU in 2016. He joined Spotify’s editorial team the following year.

Favorite Spotify playlist?

Lorem.

How do you curate New Music Friday?

New Music Friday is a bit like the newspaper. We’re trying to create opportunities for people to discover new stuff that we think they will like so, yes, there’s going to be a handful of high-profile releases that you would expect. Then everyone from their respective genres comes together and brings the tracks they think are most relevant, as well as their favorite songs. Through a process of democracy and a little bit of chaos, we get it out the door.

How do you compile Spotify’s biggest playlist, Today’s Top Hits?

One of the core tenets is that it is not a chart. Yes, we want them to be 50 of the biggest songs that week, but we’re also looking at user behavior. We look at all other playlists — how songs perform with different audiences. It’s more of a science than an art, but it is still both.

Does anyone listen to songs submitted through the pitch tool?

We get pretty decent coverage by humans. There’s over 100 people at Spotify whose job it is to listen to music. We use a combination of the tools we’ve built to sort through it and hiring the right people. Also, we pay attention to songs over time and can identify things that are trending upward or being saved a lot post-release.

Alaysia SierraHead of R&B, editorial

Alaysia Sierra

Yuri Hasegawa

After cutting their teeth as a playlist curator for Apple Music, Sierra was recruited by former Apple Music colleague Carl Chery to spearhead R&B curation.

Favorite Spotify playlist?

Riffs and Runs.

What’s the process of making a playlist?

A few years ago, I noticed there was a sound that emerged out of trap-soul, like Bryson Tiller, PartyNextDoor, Brent Faiyaz. Mostly, when people think of R&B they think of women, but this subgenre of R&B caters to men. I thought, “How do I create a space for them to lean into their R&B-loving?” So we created DND, or Do Not Disturb, to feature that laid-back, masculine feel. I wrote up my ideas, what artists would make sense in the space, what it would look like and presented it.

What changes have you brought to R&B playlists?

When I came in here, I felt like there could be a fresher perspective to R&B that can cater to the TikTok era. There’s a romanticization of ’90s and pre-’90s R&B, but there are all these kids coming up who love and are inspired by the genre. I wanted to evolve R&B at Spotify to showcase that the genre can be so many things today.

Any emerging trends you are particularly excited about?

I’m really excited about U.K. R&B right now. Streaming has globalized music, and I think it’s given a lot of opportunity to that scene. We show that scene on Riffs and Runs.

John SteinHead of North America, editorial

John Stein

Yuri Hasegawa

With almost 12 years at Spotify under his belt, Stein has been involved with playlisting from the beginning. He joined Spotify when the streaming platform acquired his previous employer, the now-defunct curation app Tunigo. Stein and his team became the curators of Spotify’s Browse page, and he worked his way up to his current position.

Favorite Spotify playlist?

Fresh Finds.

How has Spotify’s editorial playlisting evolved?

Back in those early days, we were very broad — much more moods- and moments-focused. There was a real emphasis on being an alternative to terrestrial radio. We wanted to introduce some new options: “Let’s think about activities and curate for those in addition to genres.” Over time, we created strong flagship genre playlists to be anchors, but we’ve also wanted to build out spaces that hit other moments in people’s lives — hopefully pushing forward the idea of blending genres.

What’s the balance of data and human curation in playlists today?

We’re coming to a point where the algorithmic side and the human side are coming together in a really balanced, beautiful way. As a company, we’re trying to embrace the fact that AI is really good at scale and serving you what we know you already like. But [identifying] moments of surprise and serendipity and cultural awareness is really difficult for it. You need a human editor to contextualize it in a way that brings emotion to it.

Lizzy SzaboEditorial lead, indie/alternative

Lizzy Szabo

Yuri Hasegawa

Szabo got her start in music as an agent’s assistant before becoming the executive assistant for former Spotify global head of creator services Troy Carter. She wrote an essay asking to move to the editorial team and detailing what she could do to expand the company’s playlists. It worked: Szabo became an editorial coordinator and worked her way up to helm the service’s indie and alternative coverage.

Favorite Spotify playlists?

All New Indie, Wine Bar.

How do you define the term “indie”?

More and more the question is, “What even is genre?” So we try to think in terms of audiences. With All New Indie, Lorem and those playlists, we are really fluid. Some weeks we question, “Is Caroline Polachek pop or indie?” You can make the case for either, but [we conclude] she would likely work best in indie.

With smaller artists, how do you balance human curation and metrics?

It is a challenge because it feels like there’s a new breakthrough every week in indie. It’s hard to predict. When we’re looking at priority releases for the year, the truth is you might not know. Someone could come along in two months that’s going to change the game. What’s incredible about something like the Fresh Finds program is that it encourages us to go with our guts on the really tiny stuff and have somewhere to put it [for] an audience craving music discovery.

Antonio VasquezHead of U.S. Latin, editorial

Antonio Vazquez

Courtesy of Spotify

A 15-year music business vet, Vasquez began his career doing digital marketing for legacy musicians in Mexico City as social media and Facebook advertisements began to take off. Spotify then hired him as its first editor on the Mexico team. After a year, he moved to New York to start a U.S. Latin team. He’s now based in Miami.

Favorite Spotify playlists?

Fuego, Hanging Out and Relaxing.

How does the Latin editorial team work?

On the U.S. Latin team, we have a small but mighty team of three people. We have balanced our skill sets and music expertise to make sure we are covering the most Latin genres as possible. Antonella [Bocaranda] handles pop and tropical music. DC [Daniel Calderon] has his ear to the ground in Los Angeles with all things música mexicana. We always make sure that everyone has a bit of say in editorial decisions so we don’t fall [victim to] bias. Almost all priority markets in [Latin America] have their own editors locally. We work closely with them almost every day to exchange music and create a strategy.

What’s a Latin trend you’re tracking?

We’re starting to see stronger local scenes. So we need to be communicating even more across countries to make sure we are aware of what’s happening.

What’s a common misconception about Spotify editors?

That everything is data-driven. That really takes away from the heart and soul we put into our playlists every day.

Cecelia WinterEditorial lead, pop

Cecelia Winter

Yuri Hasegawa

Winter got her start in the music curation business with Spring, an app founded by elite runners that gave music fans song recommendations based on how fast they wanted to work out. After working as YouTube’s pop editor, she joined Spotify’s editorial team in 2023.

Favorite Spotify playlist?

Pop Sauce.

How do you define “pop” music?

Pop, by its traditional definition, wouldn’t allow space for smaller artists, so we are really working to create spaces where artists who are making music that sounds pop — hook-driven and following a certain structure — can grow and find their audience. It’s hard to define, but you know it when you hear it. Pop music is not as tied to commercial success as it once was either. There’s top 40, which skews pop, but those metrics of success are not accessible to the vast majority of pop musicians. [With playlists] there is now an emerging mid-tier.

What is a market that tends to lead to pop trends that later emerge in the United States?

There’s a lot of interesting music coming out of the Nordics, and there are a lot of interesting stories where American or British artists who have trouble [breaking through] in their home market really explode in the Nordics first. We saw that with Benson Boone. Our editor in the Nordics flagged him really early on.

This story appears in the April 19, 2025, issue of Billboard.

Something went wrong with Spotify this morning, leading to a widespread outage of the streaming service that impacted its desktop and mobile apps, as well as its web player, on a global scale for several hours. According to the company, the issues were not due to a security breach. The platform appears to be returning […]

HipHopWired Featured Video

CLOSE

Spotify is a dominant force in the music and audio streaming space and owns a large market share of users who enjoy the service. On Wednesday (April 16), however, Spotify found itself trending on X after users complained of the service going dark on them and sparking complaints.

As of this writing, Spotify still appears to be down, and neither the Web nor mobile versions are working. We even tried the desktop app, and that too was not responsive. Taking a look at Downdetector, it appears the service went out around 8 AM ET this morning with nearly 50,000 users reporting an outage.

Via the Spotify Status account on X, the service’s teams are aware of the issues and have posted a message.

“We’re aware of some issues right now and are checking them out!” read their reply on X.

In the comment section of Downdetector, some are reporting limited functionality, but overall, most are saying that all forms of the service are inaccessible at the moment.

While the company addresses the issue and gets the fix going, we’ve scoured X for some replies regarding the outage of the audio streaming service. According to some of the replies we’ve seen, some people felt inconvenienced by the service interruption.

Check out those replies below.

—

Photo: SOPA Images / Getty

State Champ Radio

State Champ Radio