spotify

Page: 3

Trending on Billboard

A lot is changing at Spotify. In recent weeks, the company announced its founder and CEO, Daniel Ek, is stepping down from the CEO post (he will stay on Spotify’s chairman); it announced plans to develop generative AI music models with the support of the music industry; it updated its AI policies; it finally launched lossless audio; it updated its free tier; it forged new deals with a number of top music companies; and the company rolled out a number of new features, like direct messaging and “Mix With Spotify.”

The changes are a lot to keep track of, so on this week’s episode of Billboard’s new music business podcast, On the Record w/ Kristin Robinson, Spotify’s global head of marketing and policy, music business, Sam Duboff, joins to explain how the company is evolving, from a static destination for music consumption to what he calls “a place where fans can experience the whole world of an artist.”

Related

Duboff is one of the executives who determines how Spotify will handle the growing presence of AI music on its platform. He also is key in the development of Spotify for Artists, the company’s hub for musicians that enables them to manage their artist profiles and connect with fans.

Below is an excerpt of Billboard’s wide-ranging conversation with Duboff on this week’s episode of On the Record, focusing on its treatment of AI music on the platform.

Watch or listen to the full episode of On the Record on YouTube, Spotify or Apple Podcasts here, or watch it below.

I wanted to hear a little bit more about the fact that y’all are developing generative AI with the consent of many players in the music industry. There isn’t much information out there, so what is going on?

Duboff: We have been hearing from artists and their teams for a few years now that merging music AI tech products don’t feel like they’re built for them, not built for the power of their businesses, their careers, their existing fan bases. So we recently announced we’re collaborating with some of our top industry partners, across major labels and indies, to collaboratively develop artist-first, responsible AI music products.

So what would that look like?

We want to do this in consultation with the industry. People talk to artists about it, songwriters about it, and it feels like a lot of principles about AI and music and what these should look like. It’s happening in real time. So we didn’t want to wait until we have a product ready for a big launch to start talking about how we’re going to build AI products. We want to talk now, while we see lots of other folks in the industry are investing in the space, to be clear about our principles and how we’re gonna work with the industry for any product we build. So we’re looking at four key principles we outlined.

Related

First, [we have forged] upfront agreements with the music industry. [We are] not using tons of music [without permission] and asking for forgiveness later. Second, we wanna make sure artists, songwriters, rights holders have agency and choice about how their music does or doesn’t participate in these tools. They should have control and choice around how fans can or can’t interact with the music using AI. Third, we will always have proper monetization and compensation built in. So artists, songwriters, right holders [are] always compensated for all uses of their work [and] properly credited transparently. We’ll have an eye towards building new revenue streams for the music industry, so not just splitting up the existing royalty pool. We think that could be really important for powering what the next stage of the music industry looks like. Fourth, and really important to us, when we think about our role right now in music, is we want to build AI music products that deepen existing artist-fan connections. With 700 million monthly listeners coming to Spotify already, to listen to their favorite artists, we can play this really unique role where we build tools and help fans go deeper with their favorite artists and connect with their favorite artists in new ways, and make sure AI tools aren’t there to kind of compete with artists or to try to replace human artistry.

I know it is still very preliminary, but you talked about how this will increase the connection between fans and artists. Tell me if I’m off base, but it kind of sounds more like Spotify is leaning towards AI-powered remixing of current songs, rather than a model that generates a new song from scratch, like Suno or Udio, right?

Yeah. I think we see our role as the biggest streaming home for professional artists today. We facilitate those connections between artists and fans through their music already. So we think we’re best positioned to help have AI power this next stage of the industry. In some ways, it’s just in that space of existing artists and connections and building on artists’ catalogs with their consent. Yeah, not tools that are built to compete or kind of siphon off [royalties] from parts of the industry.

Related

To me, this signals a shift for Spotify. Spotify has always been the final destination for listening. This now feels like it’s a more playful, interactive music creation tool. Do you see Spotify continuing to expand from being the place for static streaming?

Over the past few years, we’ve been evolving Spotify from a place that’s just about the music to giving artists all these tools to share the world around their music. So three, four or five years ago, on Spotify, you get an artist profile with some pictures and canvases [looping visuals paired to songs]. It was mostly just about the music, and then you’d have to go to social media or elsewhere to experience the artist’s broader world. Where we’ve been focusing is bringing in artist clips so that artists can share 30-second videos, sharing the meaning of their songs, music videos, live performance videos, which we’ve launched in 100 countries outside the U.S. We’re working to bring that to the U.S. [There are] countdown pages that build up your album release. You can sell your merch in advance. We’re seeing artists use that in really creative ways. So we’ve already been on this journey of making Spotify a place where fans can experience the whole world of an artist. These AI music principles are an extension of that philosophy.

Spotify has also recently updated its policies on AI music. This included a note that the service has removed “75 million spammy tracks.” I’ve seen some outlets post stories about this figure incorrectly, calling it 75 million AI tracks, but it feels like the word “spammy” is intentional, referring to both AI spam and human-made spam. Can you explain what Spotify meant by this?

We’ve definitely seen modern Gen AI tools increase the scale of spam, and so certainly AI played a role in this scale. Not so long ago, there weren’t even 75 million tracks on streaming services, and now, we’re removing that many, but yeah, we’re working to identify spam, regardless of whether AI’s part of the creative process or not.

Related

Spotify is also working with DDEX to create a standardized way to disclose exactly how AI is used in the music creation process. It feels like a step in the right direction to create a standard, but if I’m a bad actor, why would I self-disclose? I probably wouldn’t.

We see this as the first step. No matter what the long-term solution is going to be, of the system of incentives and deterrence that will get people to disclose, the starting point has to be shared language through the existing supply chain of music about what the formatting of that will be.

But I think you do see already a lot of artists, songwriters, producers, starting to talk about how they’re using AI more often. So you see the K-Pop Demon Hunters songwriter who talked about brainstorming with Chat-GPT when he wrote “Soda Pop” through to Brenda Lee using AI to translate “Rockin’ Around the Christmas Tree” into Spanish, but still her voice. It was so cool, but it may have been confusing for Spanish listeners, if they thought Brenda Lee or any artist spoke a language they don’t speak. Now, [with the DDEX partnership] it will be really cool for them to know transparently [exactly how AI was used.]

When Spotify came out with these policies, it did feel like a start, but I heard from some people that they felt it didn’t go far enough. So, what do you say to those who feel like it’s not going far enough?

It’s early days for AI tech. I know it feels like it’s moving fast, but consumption of AI-generated music’s insanely low. We have some time for artists, songwriters, producers to take the lead in figuring out how they want to use these tools. We don’t want to act like we know where AI music’s headed and exactly every policy and role we need to future-proof for the next two or three years. But also, we didn’t just want to wait and do nothing. Some areas we all can agree now that we need to act now, no matter where AI tech heads. We think it’s going to be necessary to have great systems in place to stamp out spam, deception, impersonation. So that’s our starting point. We try to be upfront. We see these as first, critical early steps. There’s more to come.

Related

French streaming service Deezer reported recently that 28% of daily uploaded songs are fully AI-generated. That’s a shockingly high number. At Spotify, have you seen the same figures?

AI detection tech isn’t really foolproof yet. You know, every streaming service has pretty much an integral catalog. We have no reason to disbelieve it’s a similar amount on any streaming service. That said, I think they shared the point that .5% of streams is all those songs were getting. We’ve tried a few different tactics to test that — different detection tech, testing out different proxies — to understand how much prompt-generated music may be listened to on Spotify, and we find it is way lower than .5% in the share of streams, in total consumption. So I know sometimes it feels scary when you see those upload percentages…but yeah, there’s a lot of uploads [of AI music.] We’re doing a lot of work to release that kind of spam, where there are mass uploads that can add up to those kinds of percentages, but keeping a close eye on the part that actually matters, which is, are listeners listening to it? Is it generating royalties?

Consumption being really low makes me think that it must be a burden on streaming services to hold all of this music, especially when no one’s listening to it. Would Spotify ever remove tracks that are just getting absolutely no traction?

I don’t think so. Whether they’re AI or otherwise, people upload their music to streaming services for all different reasons. I have family members that upload music to send to family and friends. That’s a great thing at Spotify, [where] we are focused on emerging and professional artists. Our policies are in service of professional artists and emerging artists on their way to that. So we take on the burden of how many songs are uploaded, and certainly the overwhelming majority of songs aren’t getting streamed much. I still think it’s really important for there to be this open outlet.

Related

Is this a cloud storage issue? I have no idea how big these songs are to hold onto.

Maybe someday, with AI scale, it will be.

Earlier this year, I spoke to Spotify’s global head of editorial, Sulinna Ong, and I asked her about whether or not she would ever forbid AI tracks from living on Spotify editorial playlists. She didn’t have a clear answer at that moment — it wasn’t a yes or a no, so I wanted to ask again. Could you ever imagine fully AI-generated tracks living on a Spotify playlist?

It’s a hard question, because I think we recognize AI music as a spectrum… I think what you’re getting at is completely prompt-generated music without any human input. Is there some world where listener behavior really changes, and there’s huge musical, cultural relevance from music that doesn’t spam, deceive or impersonate, but somehow finds an audience, [that] could make it on to a viral hits sort of playlist? I can’t speak for their team, but fundamentally, 100% of the focus of our editorial efforts is helping to identify, uplift [and] develop the careers of professional artists who are making amazing music. So it’s always hard to answer that question in absolutes, but certainly that’s not the focus of anyone at Spotify, or, I think, any streaming service.

Trending on Billboard

Brace yourself for another jump in your monthly bills: Spotify is expected to raise its subscription prices in the U.S. early next year. According to multiple equity analysts, the streaming company is likely to implement a price hike by the first quarter of 2026, continuing a trend that’s changed what consumers pay to stream music and vastly improved the company’s bottom line.

Related

In a Tuesday (Oct. 21) investor note, Morgan Stanley analysts pointed to Spotify’s price increases in Australia in September as “the beginning of a pricing cycle in ’26” and a move that “creates a template” for pricing in other markets in which Spotify bundles music and audiobooks. The price increase in Australia amounted to 14% for individual plans and 17% for multi-person family plans.

Likewise, analysts at J.P. Morgan expect a U.S. price increase will come “by year end or early 2026,” they wrote in an Oct. 14 note. The analysts estimated that recent price increases — which included Germany, Austria and Lichtenstein — represent just 25% to 30% of subscription revenue and could account for incremental annual revenue of 380 million euros ($441 million). A U.S. price increase would be even more impactful, they added, driving 425 million ($493 million) of annual incremental revenue.

Guggenheim expects a U.S. price increase to be announced by the end of the year, with the financial impact hitting Spotify’s income statement in early 2026, analysts wrote in an Aug. 18 note to investors. The analysts believe that the latest round of licensing agreements with record labels “included pending increases in per-subscriber minimum fees,” which would lead to higher prices paid by subscribers.

Related

In the U.S., a Spotify individual plan was raised to $11.99 per month in July 2024. The price had gone unchanged since launching in the U.S. in 2011 until Spotify bumped the price to $10.99 in July 2023. The family plan increased from $15.99 to $16.99 in 2023 and further rose to $19.99 in 2024.

Spotify executives have not explicitly said they intend to further raise prices in the coming months. Instead, management frequently talks about the company’s efforts to make Spotify a more valuable experience, which gives it the ability to raise prices without losing subscriptions. This “value-to-price” ratio has become a key metric that helps guide Spotify. As co-president Alex Norström explained during a May 1 earnings call, the company “takes steps to balance the value-to-price ratio,” adding value and then adjusting the price “when it makes sense for the market.”

Raising prices has been instrumental in helping Spotify become a more profitable company. Looking ahead, Morgan Stanley analysts believe Spotify is likely to achieve 14% to 15% compound annual revenue growth through 2028. Analysts Benjamin Swinburne and Cameron Mansson-Perrone “see significant margin potential still ahead as the company follows product enhancements with price increases and diversifies into higher margin products” in its subscription segment. Put another way, the analysts see room for Spotify’s financials to improve as it raises prices and adds additional products such as a “superfan” tier on top of the standard subscription price.

Guggenheim has a $850 price target, suggesting 19% upside from Tuesday’s $689.21 closing price. Morgan Stanley has an $800 price target while J.P. Morgan is slightly more bullish, forecasting a price target of $805.

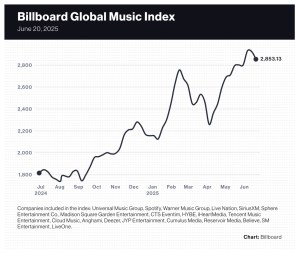

As demand for concerts appears strong heading into the busy summer months, Live Nation led nearly all music stocks this week by jumping 7.7% to $148.87. On Friday (June 20), the concert gian surpassed $150 per share for the first time since Feb. 25, and its intraday high of $150.81 was roughly $7 below its all-time high of $157.49 set on Feb. 24. Earlier in the week, Goldman Sachs increased its price target on the stock to $162 from $157, implying Live Nation shares have an 8.8% upside from Friday’s closing price.

The 20-company Billboard Global Music Index (BGMI), which tracks the value of public music companies, finished the week ended June 20 down 2.4% to 2,853.13, its second consecutive weekly decline after nine straight gains. Despite large single-digit gains by Live Nation, MSG Entertainment and SM Entertainment, the index was pulled down due to losses by its two largest components: Spotify and Universal Music Group (UMG). The week’s decline lowered the BGMI’s year-to-date gain to 34.3%, though it’s still well ahead of the Nasdaq (down 0.9%) and the S&P 500 (up 0.4%) on that metric.

Markets sagged in the latter half of the week as investors expressed concerns about tensions in the Middle East and thepotential impacts on global oil supplies and gas prices. The tech-heavy Nasdaq finished the week up 0.2% to 19,447.41 while the S&P 500 fell 0.2% to 5,976.97. In the U.K., the FTSE 100 dropped 0.9% to 8,774.65. South Korea’s KOSPI composite index jumped 4.4% and China’s SSE Composite Index dipped 0.5%.

Trending on Billboard

New York-based live entertainment company MSG Entertainment rose 5.6% to $38.44, bringing its year-to-date gain to 7.1%. Elsewhere, SM Entertainment stock saw a 4.5% improvement, taking its 2025 gain to 90.4% — the best amongst music stocks save for Netease Cloud Music, which has seen a 111.2% year-to-date gain.

With streaming stocks posting the biggest gains of the year, Spotify shares reached a record high of $728.80 on Wednesday (June 18) but stumbled over the next two days and finished the week down 0.5% to $707.42. That decline took Spotify’s year-to-date gain down to 51.6%.

UMG shares fell 4.2% to 26.73 euros, marking its largest one-week decline since falling 9.2% in the week ended April 4. At the same time, Bernstein restarted coverage of UMG shares this week. Analysts believe it’s a “best in class” music company, which “implies predictability, a capital allocation framework consistent with industry trends, and steady operating leverage,” analysts wrote. Bernstein set a 33 euro ($38.03) price target, implying 23% upside over Friday’s closing price.

Shares of music streaming company LiveOne fell 6.5% on Friday and finished the week down 10.0% after the company released earnings results for its fiscal fourth quarter and year ended March 31. Fiscal fourth-quarter revenue fell 37.6% to $19.3 million due primarily to a decrease in Slacker revenue. For the full year, revenue slipped 3.4% to $114.4 million and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) fell 18.7% to $8.9 million.

Billboard

Billboard

Billboard

Given the enormous stakes at play, when business leaders talk about AI, people listen.

In May, Dario Amodei, CEO of AI firm Anthropic — who stands to personally benefit from companies’ widespread adoption of his technology — gained widespread attention after he predicted that AI will wipe out half of all entry-level jobs within five years. And in music, Sony Music CEO Rob Stringer, in an annual presentation to investors, said the company is “going to do deals for new music AI products this year” and that it has “actively engaged with more than 800 companies” on various AI-related initiatives.

Perhaps most notable, at least on the music front, are the comments made about AI in various interviews given by Spotify CEO Daniel Ek in recent years. In them, he’s provided insights into how Spotify, the most valuable and important music platform in the world, approaches the technology. Ek’s comments carry weight: While generative AI platforms such as Suno and Udio have stirred the greatest amount of fear over AI’s ability to undermine human creativity, the largest music platforms will play a huge role in how both creators and listeners engage with it.

Understanding Spotify’s approach to AI doesn’t always require reading tea leaves. Some of its products that use AI are out in the open. For example, in 2023, the company launched two major products that utilize the technology: a personalized AI-powered DJ and a voice translation tool for podcasters that can translate recordings into other languages. Still, given that the company’s attitudes and approaches to AI will affect Spotify’s 678 million monthly users and millions of creators, it’s worth examining Ek’s statements to see how Spotify intends to incorporate AI, embrace opportunities and address concerns. To that end, this author examined 10 podcast interviews, numerous online articles and a 2024 open letter Ek penned with Meta CEO Mark Zuckerberg to get a better sense of how he views the technology. The one aspect about AI that Ek has talked about most often is its ability to help Spotify deliver to listeners the right audio — whether it’s music, a podcast or an audiobook — at a particular moment. He has described a mismatch between supply and demand, and how using new innovations can help better connect listeners and creators. Right now, Spotify users can search and find what they want 30% to 40% of the time, Ek told the New York Post in May, adding that he believes AI can improve that number. “So, we still have some ways to go before we’re at that point where we can just serve you that magical thing that you didn’t even know that you liked better than you can do yourself,” he explained. Most germane to people reading this article, the interviews show that Ek has consistently voiced a respect for creators and a belief that AI should enhance creativity, not replace it. That may not reassure songwriters who are receiving fewer royalties after Spotify adopted a lower royalty rate afforded to bundles in the U.S. Ek’s stated respect for artists also contrasts with the criticism Spotify has attracted — as detailed in the book Mood Machine and news reports — for paying flat fees for music tagged with fake artist names and inserted into playlists in order to reduce its royalty obligations. (Spotify denied claims that it’s created fake artists.) But in his public comments, Ek’s support for creators doesn’t waver, and there’s no indication that Spotify will follow in the footsteps of Tencent Music Entertainment, which offers music-making generative AI tools — it incorporates Chinese AI company DeepSeek’s large language model — and allows users to upload the resulting songs to its QQ Music platform. But AI can aid the creative process without stepping on creators’ rights, and Ek has talked with excitement about how AI tools can help lower barriers to entry and help musicians bring their visions to life. Although making music no longer requires learning and mastering an instrument, there’s still some technical know-how involved in producing music on digital audio workstations (DAWs). AI tools can reduce the complexity of DAWs and increase creators’ productivity. “We’re most likely going to have another order of magnitude of simplicity,” Ek said on the Acquired podcast in 2023. At the same time, Ek admits there are some frightening potential applications for AI. In 2023, he told CBS Morning that AI can make experiences in every field “better and easier,” while admitting that the notion that AI will be smarter than any human is “daunting to think about what the consequences might be for humanity.” And despite the potential for AI to unleash untold amounts of creativity, Ek admits that the ultimate outcome for creators is difficult to ascertain. “We want real humans to make it as artists and creators, but what is creativity in the future with AI? I don’t know,” he said in May at an open house at Spotify’s Stockholm headquarters, according to AFP. Just as lawmakers and music industry groups are pushing for legislation to protect artists’ names and likenesses, Ek has revealed concern about AI’s ability to replicate a musician’s voice. “Imagine if someone walked around claiming to be you, saying things that you’ve never said,” he told Jules Terpak in 2024. Spotify wouldn’t allow it on the platform without the artist’s permission, Ek said, citing Grimes — who launched a project in 2023 allowing fans to replicate her voice to use in their songs and evenly split the royalties — as an example of permissible use of an AI-generated name and likeness. “Of course, we will let her experiment, because she’s fine with it,” Ek said. Now that Spotify is in the audiobook business, the company’s use of AI will impact a wider swath of creators than just musicians. As Ek told The New York Post, Spotify “can play a role” in getting more books converted into audiobooks using AI — specifically smaller authors who can’t afford the expense of hiring someone to read them. Such affordable text-to-voice tools already exist and are offered to authors who would otherwise be locked out of the audiobook market. It makes sense: Just as Spotify was built on providing listeners the long tail of music, it doesn’t want its audiobook selection to be limited to major titles. If Spotify builds or buys such a tool, it could vastly increase the number of audiobooks available to its listeners. In the interview with CBS Morning, Ek quoted Microsoft co-founder Bill Gates to explain how he finds inspiration in innovation. “He says that the future is already here,” Ek said during the 40-minute talk. “It’s just not evenly distributed.” What Ek means is that he looks around the world, sees what others are doing with technology and then considers how he can bring those innovations to a wider audience. And as the CEO of the world’s largest and most influential audio streaming service, how he chooses to approach AI will go a long way in determining — for better or worse — how millions of people create, consume and profit from music, podcasts and audiobooks in the future.

Trending on Billboard

Senators Marsha Blackburn (R-Tenn.) and Ben Ray Luján (D-N.M.) asked the Federal Trade Commission to investigate Spotify on Friday (June 20). In a letter to FTC Chairman Andrew Ferguson obtained by Billboard, the senators accused the streamer of converting “all of its premium music subscribers into different — and ultimately higher-priced — bundled subscriptions without […]

As fortunate fans spilled into the intimate and sweaty Maxim’s de Paris on Wednesday night (June 18), no one knew exactly what to expect. Vocals? For sure. Fashion? Absolutely. This is Miley Cyrus, after all.

But when the superstar combined two of her biggest hits – none other than “The Climb” and “We Can’t Stop” – into a special one-off medley, fans were floored. “We put this together just for all of you tonight,” shared Cyrus, in her first of two Mugler looks.

The special and career-spanning fusion – reminiscent of two distinct times in the pop star’s life – was fitting for an equally special evening. Cyrus hadn’t performed in Paris for over 10 years, and she made sure her grand return was well worth the wait. The evening’s set was for Spotify’s Billions Club Live, making Cyrus only the second artist, after The Weeknd, to ever earn a Billions Club concert. (As Spotify previously confirmed to Billboard, Cyrus’ Billions Club Live show was filmed to be released later this summer.)

Trending on Billboard

Despite such a massive milestone, Cyrus stayed true to form and kept the setting and guest list rather intimate, with only a few hundred fans packed into Maxim’s downstairs venue. But unlike her famed Chateau Marmont sets in Los Angeles or her recent performance at an equally intimate New York space — all in support of her latest album, Something Beautiful — Wednesday night was perhaps the most wide-ranging setlist fans have enjoyed for some time.

Thanks to the nature of Spotify’s Billions Club Live, Cyrus’ set was a tight hour (including an outfit change) of her biggest hits on the platform — all of which, yes, have reached more than 1 billion streams. (On the pre-show playlist, deep cuts including “Cattitude” off her She Is Coming EP satiated superfans.)

“Being a part of the Billions Club is only a part of me – it’s an honor, but in no means is it holistic,” Cyrus said. “Each of you are a piece of a billion, and without each of you, the billion doesn’t even exist. That’s how important and crucial you are to the success in my life. The confidence and goals that I have achieved [is] because of you and your support. And I’ve never really been too interested in numbers because math is done from the mind, but true authentic beauty is from the heart.”

During her set, Cyrus demonstrated just how much of her heart has always been in her hits – and is likely what has pushed these in particular to become some of her biggest. During opener “Flowers,” she emphasized and riffed on the line “no regrets, baby” while holding up a bouquet of flowers gifted by a fan. And while introducing “The Climb,” she shared that the song is “inspired by the effort and the struggles that it takes to become the person you want to be. … I truly believe the most authentic version of yourself is deep within the struggle. … Everything in my life that I can stand here and be proud of at one point was towering over me like a mountain.” (The mere mention of a mountain elicited emphatic cheering.)

And before performing her Plastic Hearts hit “Angels Like You” accompanied by nothing more than a piano, Cyrus told her fans: “You are the earth angels that make my life heaven.” And in another unexpected twist, she performed the impassioned “Wrecking Ball” next while still backed by only keys.

After an outfit and hairdo change – from teased waves and a Mugler dress dripping with crystals to an updo with a Mugler crystal corset and suit jacket – Cyrus returned to the stage alongside her full backing band, which included a four-person string section and guitarist Maxx Morando. A front-row fan declared that Cyrus looked “super French,” to which Cyrus replied that they’ve actually been discussing what to name her current backing band, before concluding that “Super French” was the best idea they’ve heard yet.

Cyrus then closed the show with a one-two punch of Something Beautiful standouts: “End of the World” and “More to Lose.” Before performing the latter, she said, “A lot of my songs are about resilience, and I’m very proud of that,” noting that the theme of resilience is one not only personal to her and her music, but that is universally felt – and desperately needed right now.

Halfway through “More to Lose,” she turned to Morando and said she’s tired of crying and wanted to do something a bit more fun. The solution? “Easy Lover.” Cyrus performed the song with an extended outro, during which she strutted from one side of the small stage to the other, blowing kisses to fans who were within arm’s length before returning to its center to take a bow.

And after showing off her outfit one last time, Cyrus seamlessly disappeared behind thick red velvet curtains, as if bringing her “End of the World” lyric to life: “Let’s go to Paris, I don’t care if we get lost in the scene.”

As the wide-eyed expressions across the room proved, there’s hardly a better scene to get lost in.

It has been over one year since Spotify brought limited audiobook functionality to its Spotify premium products in November 2023. In March 2024, in a major shift for songwriters and music publishers, Spotify began reporting its three principal premium subscription tiers to the Mechanical Licensing Collective (MLC) as “bundled subscription services” rather than as “standalone portable subscriptions,” as they had previously done. In response, the MLC sued Spotify in May 2024 for allegedly underpaying music publishers, but a judge dismissed the case in January 2025. A motion for reconsideration filed by the MLC in February 2025 remains pending in the Southern District of New York.

Earlier this month, the National Music Publishers’ Association (NMPA) stated at its annual meeting that this change has resulted in a first-year loss of $230 million in mechanical royalties to songwriters and music publishers. Spotify’s own recent SEC filing states a loss of 205 million euros in mechanical royalties for the 13-month period between March 1, 2024, and March 31, 2025. This is actual money that should have, but did not, make it into the pockets of songwriters and music publishers. It has instead remained with Spotify.

Trending on Billboard

Spotify’s actions have already been publicly lambasted by this author, the NMPA and the songwriter and music publisher communities as perhaps the worst affront in a long line of offenses committed by Spotify against songwriters. So why am I writing about this issue again, a year after first doing so in Billboard? Because with a year’s worth of additional facts and data at hand, it is my opinion that this is one of the greatest injustices visited upon songwriters in the era of music streaming, sadly perpetuated by the company that has perhaps benefited more than any other from the creativity and labor of songwriters. All songwriters and music publishers should be aware of this critical issue and deserve to know all of the supporting facts.

When I wrote on this issue back in May 2024, I opined that Spotify’s actions would likely reduce the effective share of its U.S. subscription revenue paid to songwriters and music publishers from the agreed-upon 15.1% to 15.35% in the Phonorecords IV settlement to less than 12%. I wrote that Spotify’s timing felt engineered to partially sideline songwriters and music publishers from benefiting from price increases that were reportedly soon to take effect (and did). I wrote that the Spotify Audiobooks Access tier was seemingly not commercially viable as a standalone product and was launched in the U.S. (and nowhere else) with the primary and perhaps sole purpose of supporting Spotify’s attempt to report most of its subscription tiers to the MLC as bundles and reduce mechanical royalty payments to songwriters. And finally, I wrote that Spotify was motivated to take publishing royalties out of the pockets of songwriters in order to improve its gross margin and offset the costs of running its new audiobook initiative.

One year later, I believe that all of this has proved to be true. Let’s look at the facts.

What is a bundle?

In this context, a bundle occurs when Spotify — or another music service — is sold to consumers for a single price as part of a package which includes other goods and services. Some bundles package music with digital services such as subscription video on demand and/or physical goods such as phones, tablets and delivery services. The components of the bundle typically can be purchased on an individual basis if a consumer is not interested in purchasing the entire package, and those components typically have a clear independent commercial value to some segment of consumers.

For rightsholders, the potential value exchange is that a tech platform may package a bundle of goods and services (including music) together in a manner that could potentially bring additive revenue, users and engagement to music creators that, absent the bundle, might be less obtainable. Basically, the platform is offering a package deal to reach customers who may be less likely to pay for a music service sold on its own.

Rightsholders operating in a free market may be asked by the licensee to help offset their other costs of operating such a bundle (e.g., non-music licensing costs, other operating expenses) by agreeing to reduced royalty terms than what would typically apply to a standalone music service, which a licensee may also offer. Rightsholders are able to consider such requests, sometimes referred to as “bundle discounts,” by engaging in discussions with the licensee and utilizing pertinent data and information such as market research, reporting and revenue forecasts to inform their viewpoints and make decisions that are in the best interests of music creators.

A range of outcomes is possible in the free market. A rightsholder may refuse to license the bundled service at all, or they may license the bundled service for the same price and terms they’d grant to a standalone music service, or they may agree to some means of discounting. The Phonorecords IV settlement includes examples of such terms, including a specific definition of revenue for bundled services and other terms that are reduced relative to those that apply to standalone music services.

When this works as intended, music rightsholders may choose to effectively co-invest with a streaming service in creating a discounted bundle that they feel has the potential to earn additional revenue, even if there may be less revenue earned on a per-user basis from the bundle relative to a standalone music service. The potential benefit to music creators is that they may capture additional royalty amounts from users who might not have signed up for a music service absent the additional non-music components of the bundled offerings. The licensee is rewarded for bringing some level of added value to music creators by building, offering and marketing the bundled package to consumers.

Why Spotify’s bundle is different

But this is not what Spotify has done. Spotify has built a music subscription empire based upon the creativity and labor of songwriters and now reduced their U.S. mechanical royalties in a manner that implies that songwriters now contribute less to the success of Spotify. That could not be further from the truth. Regardless of the legal issues surrounding this matter, Spotify’s reduction of songwriters’ mechanical royalties, in my opinion, has no commercial merit.

In June 2024, a few months after Spotify began including the limited audiobook functionality (15 hours of listening time per month) in Spotify’s premium tier, it launched a tier called Spotify Basic. Spotify Basic, which is $1 to $3 less expensive than Spotify’s premium tier, depending on the number of users, is what Spotify’s premium tier was prior to November 2023 — a music subscription service without the audiobook functionality. It is the service that tens of millions of users signed up for prior to November 2023 because they acknowledged the value of unfettered access to music and are willing to pay for it. But all of those premium users, regardless of whether or not they want audiobooks, are now considered by Spotify to be bundled subscribers as of March 2024. That is, unless they manually selected to switch to Spotify Basic.

Most Spotify users probably don’t know that all of this happened, or that Spotify Basic exists. Spotify Basic is not available to new subscribers; it is only available in the U.S. to existing premium users who were subscribed as of June 20, 2024. Promotion and marketing of Spotify Basic to qualifying users has been limited. If a Spotify user cancels their Spotify Basic plan later on, it is not possible to resubscribe to it. Basic is also not available via upgrade paths. For example, a subscriber cannot upgrade from Basic Individual to Basic Duo. Instead, they are forced to pay $2 more for Premium Duo even if they have no interest in audiobooks.

Since Spotify’s November 2023 launch of the limited audiobook functionality, it has not been possible for new Spotify users to obtain a Spotify subscription that does not include audiobooks (save for qualifying student plans, which are bundled with Hulu). This is important because, absent a clearly presented and available option for a new (or existing) customer to choose between one offering that is music-only and another offering that includes audiobooks but is more expensive, the very clear conclusion is that music alone continues to drive consumer decision making around Spotify, including users’ decisions to pay for Spotify, what price they are willing to pay and what levels of price increases they are willing to endure without canceling their subscriptions.

Most Spotify users also don’t know that there’s a Spotify Audiobook Access tier. Last year, many — including this author — opined that the Audiobook Access tier was launched solely in the U.S. for the primary or sole purpose of lending legal support and a pricing benchmark to Spotify’s reduction of mechanical royalties. One year later, this appears on its face to have been true. Spotify Audiobook Access only remains available in the U.S., and there appears to be little, if any, earnest effort on Spotify’s part to promote and market it to consumers. They do not publicly report subscriber numbers for Spotify Audiobook Access, nor do they seem to talk about it much. In my opinion, it appears to be an offering that Spotify is not serious about and that was launched to prop up the reduction of songwriter’s mechanical royalty payments.

I’ve also been asked why Spotify did not declare its premium tier to be a bundled product when it began offering podcasts to subscribers many years before its introduction of audiobooks. The answer may lie in the fact that podcasts are monetized by selling advertising to businesses and brands, and there has been clear demand for Spotify to provide that service. Audiobooks, by contrast, have historically been monetized mostly via subscriptions sold to consumers by digital retailers. In Spotify’s case, it is possible that while some segment of premium subscribers might utilize limited audiobook access if they are already paying to access unlimited music, those same subscribers might not be motivated enough to pay Spotify specifically for access to audiobooks. In other words, engagement alone might not be an indicator of willingness to pay. It costs Spotify money to offer audiobooks to its subscribers, and if those subscribers aren’t willing to pay for them specifically, it’s possible that Spotify needs to offset those costs in some other manner. As I’ve opined before, I believe this has been a material driver behind Spotify’s bundling initiative that has cost songwriters and music publishers hundreds of millions of dollars in U.S. mechanical royalties to date.

Spotify’s financials post-bundling

Finally, let’s talk about how this issue has impacted Spotify’s financial performance. Spotify’s premium gross margin increased from 29.1% to 33.5% between Q4 2023 (the last full quarter unimpacted by Spotify’s reduction of mechanical royalties via bundling) and Q1 2025. The $230 million first-year loss of U.S. mechanical royalties reported by the NMPA equates to about 1.4% of Spotify’s global premium revenue of 13.82 billion euros (approximately $15.89 million) for 2024. There are a number of factors that have allowed Spotify to improve its gross margin performance, but its reduction of U.S. mechanical royalties has contributed to that improvement on a very real and material basis, as Spotify has noted on quarterly earnings calls.

Spotify’s gross margin improvement has undoubtedly been a big factor in the performance of its stock, which is up about 130% year-over-year as of this writing. It is perverse that songwriters and music publishers have contributed so meaningfully towards these recent improvements in Spotify’s financial performance and the market’s reaction, yet find themselves not only unrewarded for their contributions but on the wrong end of Spotify’s efforts to reduce its U.S. music publishing costs.

So, where do songwriters and music publishers go from here? While it has been reported that Universal Music Publishing Group and Warner Chappell have entered into direct agreements with Spotify for the U.S. as part of broader deals that include their associated record labels, the upcoming Phonorecords V process before the Copyright Royalty Board — which starts early next year — presents the entire songwriter and music publishing community with the opportunity to right Spotify’s wrong. I encourage all who depend on songwriting and publishing royalties for their livelihood to educate themselves on the facts and stay aware of new developments.

Adam Parness was the global head of music publishing at Spotify from 2017 to 2019. He currently operates Adam Parness Music Consulting and serves as a highly trusted and sought after strategic advisor to numerous music rightsholders, notably in the music publishing space, as well as popular global brands, technology-based creative services companies and firms investing in music and technology.

Source: picture alliance / Getty / Alphabet / Google

You were not bugging if your Spotify, Gmail, or Discord was acting funky today. Google confirmed there was a massive Google Cloud outage affecting those other services and more.

The Times of India reports that Alphabet’s Google Cloud experienced a widespread outage, affecting tens of thousands of users across various platforms.

According to reports, platforms such as Spotify, YouTube, Google Meet, Snapchat, Shopify, Discord, and Switch all suffered some form of service disruptions.

Google confirmed the outage, noting that numerous products were experiencing service disruptions. The company wrote on its status page, “Our engineers are continuing to mitigate the issue, and we have confirmation that the issue has recovered in some locations.” Google did not provide a time for a resolution at the time.

Per Times of India:

Downdetector, which tracks outages based on user reports, recorded over 10,000 incidents related to Google Cloud and more than 44,000 reports for Spotify around 2:46 p.m. ET in the U.S. Additionally, users reported over 4,000 incidents each for Google Meet and Google Search, and more than 8,000 for Discord.

Cloudflare, which also reported an outage on Thursday, clarified through spokesperson Alexander Modiano that its core services were unaffected, attributing the issue to Google Cloud’s disruption.

Spotify users took to X, formerly Twitter, to voice their displeasure. You can see those reactions in the gallery below.

HipHopWired Featured Video

CLOSE

2025 has marked a pivotal year for Japan‘s music culture, with signs of transformation echoing both at home and abroad. But what does the future look like from a global vantage point? To find out, Billboard JAPAN sat down with Joe Hadley – Spotify‘s Global Head of Music Partnerships & Audience – during his visit to Japan in May for the inaugural MUSIC AWARDS JAPAN 2025, the country’s first-ever global music awards.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

In recent years, a growing number of Japanese artists, like Kenshi Yonezu, Fujii Kaze, YOASOBI, and Ado, have gone on successful world tours. People are saying that J-pop is starting to make sweeping advances overseas. How do you see the current situation?

It’s amazing to see these artists touring globally and resonating with fans around the world. And it’s not just about live shows – the streaming numbers tell a compelling story of growing global interest as well. In 2024, about 50% of the royalties paid out to Japanese artists were from outside of Japan, and nearly three-quarters of that was for tracks in Japanese. In other words, the music doesn’t have to be in English to travel. It does really well in Japanese, which is a very telling sign about the world’s reception and readiness for Japanese music.

Trending on Billboard

Here’s another really fun stat: in 2024 alone, Japanese artists saw about 2.6 billion first-time streams from listeners outside of Japan. This is a pretty incredible number. Japanese music is really expanding its global reach.

So does this mean that Japanese music is drawing a lot of attention, or that the widespread use of music streaming services like Spotify is transforming the structure of the global music business, or both?

It’s a bit of both. We have a really strong product and we also have an incredible editorial team. When you talk about the globalization of music, you also have to talk about global curation groups within Spotify. These are teams of editors specializing in each genre and region who come together from around the world to share music and support one another in getting music playlisted in the right places. Creating playlists like Gacha Pop, which is popular outside of Japan, is really important, and our role is to use curated playlists like this to stream music to global audiences. Personalization features like AI DJ also help share the world discover this music on Spotify.

Could you talk to us a bit about the current state of music culture? What trends and movements are you keeping an eye on?

Music is really travelling around the world. All kinds of artists are being listened to in countries and regions outside the ones they’re from. This is tremendously exciting. Spotify has almost 700 million monthly listeners, and its ability to export music globally just keeps growing and growing.

One recent trend I’m keeping my eye on is the global growth of country music. We’re starting to see it spreading outside of the U.S. to places like the U.K. and Europe, but really in Australia and New Zealand. You’d also be hard-pressed to miss the growth of African music outside Africa.

Of course, Japanese music is important, too. For example, I saw in the news the other day that ONE OR EIGHT’s “DSTM” had become the first song by a Japanese boy band in America’s Media Base Top 40 radio chart. That’s a great starting point. Even beyond the collaboration between Megan Thee Stallion and Yuki Chiba, we’re seeing the potential for a lot of growth around the world. This ties back to what we were talking about earlier, regarding global artists that are touring.

Until now, some have been saying that Japan’s music industry is lagging behind the rest of the world. What do you see as Japan’s current position within the global music scene?

Japan is in the middle of that same movement. That’s why we’re all here in Japan, and I’m really looking forward to going to the MUSIC AWARDS JAPAN (MAJ) award ceremony in Kyoto.

What do you think about the launch of the MUSIC AWARDS JAPAN?

I think it’s an incredible opportunity and a super exciting one. Spotify is really proud to partner with CEIPA (the Japan Culture and Entertainment Industry Promotion Society, which is made up of five major music industry groups) on MAJ. It’s CEIPA’s role to empower artists and creators, and we want to be side-by-side with them on their journey of developing Japan’s music industry both at home and abroad. That’s why we’re here taking part in this inaugural event.

The five nominees for Top Global Hit From Japan were selected using Spotify’s voting feature, and they were voted on by general overseas Spotify listeners. How do you see this award?

There are a lot of award shows out there, but I think having one that involves ordinary music fans is very meaningful. I can’t divulge any specific voting numbers, but the number of voters was far more than I’d expected, which really impressed on me how interested people are in the award.

I was a part of the voting process, and that was very much a learning experience for me. It made me feel even more involved with Japan and created a stronger sense of responsibility. The selection of nominees was quite diverse, which I think is representative of Japanese music as a whole. I think it’s easy if you’re not familiar with Japanese music to pigeonhole or stereotype it, but there are many different genres. That definitely came across in the nomination process.

What kind of future do you think the MUSIC AWARDS JAPAN will help create for Japan’s music culture?

In my opinion, the biggest contribution right away is the very fact that the event is happening. It’s like a wedding, where you gather together people who’ve probably never all been in the same room – in this case, artists, executives, writers, and the like. So this will be the first time, but it’s going to continue and grow to have a massive impact. It won’t just be Japanese artists, but it will get artists from other countries to come to Japan, which is going to have ripple effects. But for me, the most exciting part and the biggest impact will be having those people in the room, feeling the energy and the connections that come from it.

What do you see for the future of Japan’s music scene?

It’s already been going in a pretty incredible direction these last five or ten years. I think if Spotify continues to grow, we continue to work with more local partners like CEIPA, and we continue to think globally, Japanese music will keep growing at the same rate. I do think it’s on the artists, the labels, and their teams to make sure that they’re hitting the markets, going out and continuing to tour, and being intentional about collaborations, but the sky’s the limit. I’m very, very optimistic and excited about the future of Japanese music and music as a whole.

—This interview by Tomonori Shiba first appeared on Billboard Japan

Spotify has partnered with industry mental health nonprofit Backline to launch a global hub of mental health resources as part of their nascent Heart & Soul initiative.

Officially dubbed ‘Heart & Soul, Mental Health for Creators,’ the new partnership sees Backline and Spotify joining forces to launch their Global Mental Health Resource Hub, which aims to serve as a comprehensive support platform for industry professionals around the world.

While Spotify first launched its Heart & Soul initiative in 2018 as a way of providing support and deepening understanding of emotional well-being amongst its employees, Backline first emerged in 2019 to connect industry professionals and their family with mental health and wellness resources.

Trending on Billboard

The new partnership sees Backline now expanding their services beyond U.S. borders for the first time, serving as a response to the growing mental health crisis that affects industry workers – be it artists, touring crew and industry professionals – of all levels and locations.

“Backline is honored to serve as a steward of Spotify’s investment into the creative community,” Hilary Gleason, Backline’s Executive Director & Co-Founder, said in a statement. “Bringing our work to scale is a meaningful way to uplift the well-being of artists all around the world.

“This collaboration is taking these invaluable mental health and wellness resources beyond borders. Music knows no bounds, and now people who make music happen have access to care and a compassionate community. Our work together will help ensure that artists have the resources, support, and stability they need to thrive both personally and professionally.”

The new initiative will see Backline’s expanding their resources worldwide, including an international, multilingual database of trusted music industry and mental health support resources and crisis lines from around the world; an email concierge service that provides one-on-one support to aid individuals in navigating care options and mental health systems in their countries; and access to their free digital guide Mind the Music: A Mental Health Guide for the Music Industry.

Additionally, support for songwriters, and access to wellness events are included, as is free therapy access for ambassadors of Spotify’s EQUAL, GLOW, and RADAR programs.

“It’s clear that the mental health challenges artists face are real, and that the current support systems often fall short. It’s on all of us in the industry to respond with action,” noted Monica Herrera Damashek, Spotify’s Head of Artist & Label Partnerships.

“We know this is only one step but we look forward to building on this for a more supported, sustainable environment for the artists who shape culture every day.”

Additionally, Spotify is also providing financial support to expand organizations such as MusiCares, Music Health Alliance, Music Minds Matter, and Noah Kahan’s The Busyhead Project; spotlighting mental health stories from the creative community across Spotify for Artists and Spotify Songwriting; and offering curated playlists, podcasts, and audiobooks to support creators’ wellbeing via the Heart & Soul, Mental Health for Creators hub.

“Heart & Soul is our commitment to the creators behind the music. Artists and songwriters face immense pressure, and their mental health can’t be an afterthought,” added Spotify’s Head of Social Impact Lauren Siegal Wurgaft.

“Supporting creators’ well-being is essential to sustaining a vibrant music ecosystem. By working closely with trusted partners like Backline, we’re not just offering resources, we’re helping drive lasting change in how the industry approaches mental health.”

State Champ Radio

State Champ Radio