Record Labels

Page: 16

After Chappell Roan‘s best new artist acceptance speech Sunday (Feb. 2) at the Grammy Awards, in which she demanded working musicians receive healthcare from their labels and the rest of the record industry “profiting millions of dollars off of artists,” Duncan Crabtree-Ireland approached the singer at the Crypto.com Arena in Los Angeles.

“I said, ‘Hi. You could help us get the word out, because we do provide health benefits — but not everybody knows that,’” says SAG-AFTRA’s national executive director and chief negotiator, who wore a navy-blue tuxedo, blue suede shoes, a black shirt and a pink bowtie to the event. “I gave her my contact information.”

Crabtree-Ireland, who attends the Grammys yearly as a leader of the union representing CBS broadcast employees, adds that all three major labels, plus Disney-owned music companies, pay into the SAG-AFTRA fund, making all signed artists eligible for its health insurance. Roan, reading from a notebook onstage, had said in her speech that after her previous label, Atlantic Records, dropped her during the pandemic, she struggled to find a job and affordable healthcare: “If my label would have prioritized artists’ health, I could have been provided care by a company I was giving everything to,” she said. “Labels, we got you, but do you got us?”

Trending on Billboard

After being dropped, Roan would have qualified for COBRA coverage, which is much more expensive, but might have helped during the leaner years before she rose to superstardom. (The SAG-AFTRA plan’s monthly premiums are $125; COBRA rates are $1,201.) Also, because Roan was younger than 26, she could have qualified to be part of her parents’ health insurance, or signed up for a plan under the Affordable Care Act (ACA).

But music-business healthcare advocates, including Crabtree-Ireland, are not dismayed that Roan neglected to mention these details. “I was jumping on my couch when Chappell was giving her acceptance speech. I was like, ‘Gosh, thank you for bringing this up.’ The conversation was started,” says Tatum Allsep, founder/CEO of the Music Health Alliance, a 12-year-old Nashville group that provides healthcare information for artists. “What’s really important to know for all the young artists who are listening is you don’t have to go without if you are making a living within our industry.”

Still, the music business is not set up to cater to artists as employees, and Allsep is skeptical of the idea that major labels must provide healthcare directly to every signed artist — beyond the SAG-AFTRA eligibility. Almost all signed musicians are “gig economy” workers without full-time employment and receive income through touring, sponsorship, streaming and other revenue sources. They tend to be disinclined to do what a typical employer would ask of an employee: report to a cubicle to work for a corporate supervisor or give up the rights to their songs and other work to an employer. “It would not be in an artist’s best interests to be an employee at a label,” Allsep says. “They would get a monthly check vs. the opportunity to earn infinitely more.”

Artists could remain independent and negotiate more healthcare as part of their contract, but, according to Allsep, these expenses are “typically recoupable” — which means artists pay these costs from recording advances and must reimburse them out of future profits.

Label contracts, adds Howard King, an attorney who has represented Metallica, Dr. Dre, Eminem and others, “could include provisions for payment of health-insurance premiums or anything else, including payments for car payments or singing lessons.” All contracts are negotiable, so artists who have leverage (like a veteran touring star or someone with multiple viral videos) can request more benefits out of labels than other artists — perhaps like Roan used to be at Atlantic — who are less established as money-making stars.

“Is that fair?” King asks. “I don’t think so, but that’s the practice.”

Healthcare resources for artists are available from several sources, in addition to the ACA, from the Recording Academy-run MusiCares to the Music Health Alliance to the American Federation of Musicians union representing orchestra musicians, studio workers and others, and the American Association of Independent Musicians, which has its own healthcare plan.

Major labels could do more in terms of boosting healthcare resources for artists, according to Kevin Erickson, director of the Washington, D.C., music-industry lobbyist group Future of Music Coalition, but not in the way Roan demanded. He argues labels must aggressively support the ACA, also known as Obamacare, against long-running defunding threats from the Trump Administration and Republicans, as well as advocating over the long term for a single-payer healthcare system, like those in Canada and parts of Europe. “[Labels] already have resources and the ability to fight for additional relief and support [for] the artist community,” he says, referring to the Recording Industry Association of America’s lobbying efforts on other issues. “We need more of that energy.”

Renata Marinaro, managing director of health services for the Entertainment Community Fund, suggests Roan, who is signed to Island Records, owned by major label Universal Music Group, was likely upset not with record-industry inaction but inadequate U.S. healthcare funding in general. “The frustration stems from the fact that there’s no universal coverage,” she says. “I don’t think you can lay that at the feet of any particular employer.”

Cindy Mabe, Universal Music Group Nashville’s chair/CEO, has left the company, Billboard has confirmed.

Mabe, whose reign lasted almost two years, was the successor to Mike Dungan, who retired in March 2023. Mabe became the first woman to lead a Nashville major label group. Country Aircheck first broke the news.

Mabe, who was 2019 Billboard’s Country Power Player executive of the year, had come out of the gate with ambitious plans that greatly broadened the scope of UMG Nashville’s remit, including an alliance with Cirque du Soleil, signing a number of acts that she introduced during a “Revival” that were left-of-center of mainstream country, launching a TV/film production company and, last month, reviving Lost Highway Records with T Bone Burnett.

The label is home to such acts as Chris Stapleton, Eric Church, Luke Bryan, George Strait, Carrie Underwood, Mickey Guyton, Little Big Town and The War and Treaty. Among its more recent successes were upstart Tucker Wetmore, who reached No. 2 on Billboard’s Country Airplay chart last year with “Wind Up Missin’ You,” and Ringo Starr, whose country album is the first release from Lost Highway/UMGN and debuted at No. 27 on Top Country Albums.

Trending on Billboard

In a January interview with Billboard about restarting Lost Highway, Mabe stressed focusing on artistry and lamented the loss of art in music as analytics have played a bigger role. “T Bone and I keep talking about the reason that we’re going to win is we’re going to put quality art back into the marketplace,” Mabe said. “It’s just missing. I’m not saying that there’s not some quality art out there, but it’s not always the goal. You don’t get artist development just by spinning the wheel and seeing how many ‘likes’ are out there. You actually have to make people feel something.”

Upon Mabe’s ascension from UMG Nashville president, she quickly made staffing changes, including the departures of the head of promotion, Royce Risser, and two heads of A&R, Brian Wright and Stephanie Wright, while bringing in Chelsea Blythe as executive vp of A&R. Blythe had been best known for her work with hip-hop artists at Def Jam, Columbia and Interscope. More recently, executive vp/COO Mike Harris left UMG Nashville in September.

UMG Nashville and UMG representatives did not immediately respond to requests for comment.

What a difference a year can make.

Warner Music Group said on Thursday that revenue from its first fiscal quarter fell 5% to $1.67 billion from a year ago, as the company suffered tough comparisons to a period last year when it still had BMG as a physical and digital distribution client and enjoyed a $30-million boon from a digital licensing renewal deal.

But the third-biggest major music company also showed that the deep staffing cuts and wind-down of certain businesses over 2024 freed up money for investment — such as the $450-million acquisition of Tempo Music‘s catalog — and growth, like Atlantic’s half-a-percentage point market share expansion.

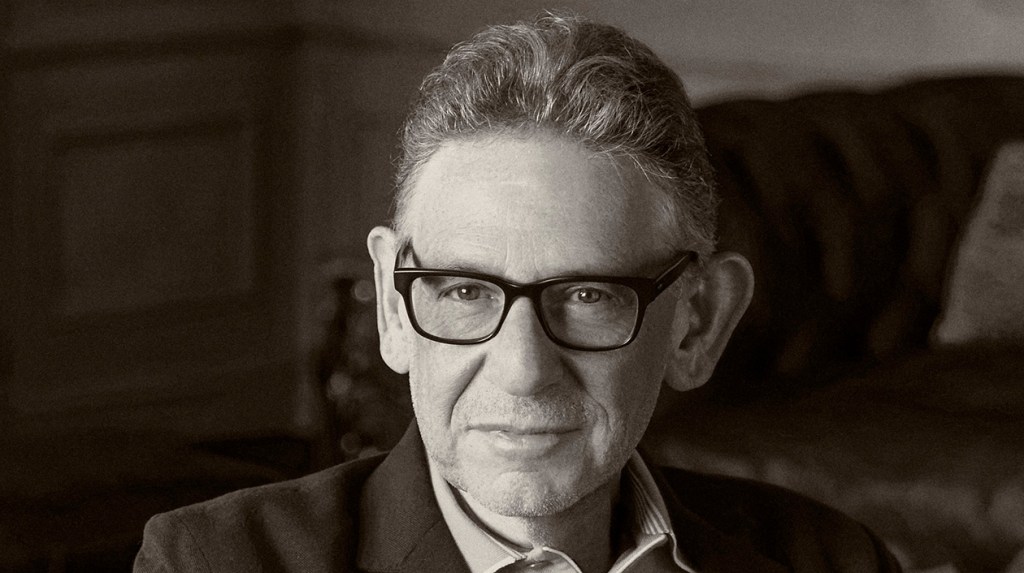

WMG’s quarterly results — which included a nearly 40% decrease in operating income and $27 million in restructuring costs and impairment charges — depict a company deep in transformation. Chief executive Robert Kyncl is trying to increase efficiency in legacy businesses and technology, while standardizing its sprawling global network, and striking more lucrative deals with streaming platforms.

Recorded music revenue in the first fiscal quarter, which ended Dec. 31, 2024, fell 7% to $1.35 billion from last year’s quarter, as BMG’s termination of its distribution deal created a $32 million drag (evenly split between streaming and physical revenue). Last year’s quarter also included the extension of one artist’s licensing agreement worth $75 million, and the $30-million renewal of a digital partner’s license.

Trending on Billboard

WMG says if you strip those three things out, total revenue rose 3.4%.

Overall, digital revenue and streaming revenue each fell by around 2%.

Adjusted operating income before depreciation and amortization (adjusted OIBDA)–which measures the profitability of a company’s core businesses–fell 19.5% to $363 million, and adjusted OIBDA margin fell to 21.8% from 25.8% in the prior-year quarter. If you take out the negative impacts of the licensing agreement and digital partner renewal, the company said its adjusted OIBDA fell by just 0.3% and adjusted OIBDA margin decreased 0.8 percentage point.

The company said adjusted OIBDA margin was also dragged down by the 8% rise in the value of the U.S. dollar since last year’s presidential election. (Almost 60% of Warner’s income is earned in euros and other currencies that trade against the dollar, according to the company.)

“All of these impacts will stabilize over time,” Kyncl said on a call with analysts discussing the earnings. “We’re confident about the future. Our goals are clear: increase our share of the pie, meaning market share; grow the pie itself by increasing the value of music; and become more efficient, providing greater cash flow, both for re-investment and for shareholder return.”

The company’s net income was up nearly 25% to $241 million, boosted by foreign exchange hedging activity and the sale of a $29-million of an investment. Free cash flow was up 12% to $296 million.

Other highlights from the company’s earnings and conference call:

» Within Recorded Music, digital and streaming revenue both fell by 3.9% and 3.7%, which reflects a 2% decline in subscription revenue and an 8.2%-decline in ad-supported revenue. If you strip out BMG’s termination and the digital partner’s license renewal, the company says recorded music streaming revenue was up 1.5% and subscription revenue increased 5.3%, while ad-supported revenue still fell by 7.9%. Nonetheless, physical revenue rose 7.8% thanks to the strength of releases by Linkin Park, Charli XCX, Teddy Swims, Mariya Takeuchi and Benson Boone.

» Music publishing revenue rose 6.3% to $323 million from growth in digital, performance and other revenue, partially offset by lower mechanical revenue.

» Warner completed multi-year publishing and recorded music licensing deals with Amazon and Spotify over the past year, Kyncl said, though he declined to provide much detail. The deal with Spotify notably includes a new publishing agreement with a direct licensing model with Warner Chappell Music for the United States and several other countries. “There’s more work to do with others and for all of this to cycle through, but this is a really great step in the right direction.”

» Atlantic’s market share ticked half a percentage point up, a small win Kyncl attributed to the growing investments made in A&R last year. He said the investments came as a result of money left over after it made” organizational changes and investments into technology … [and] exited some non-core businesses.” Kyncl later said, “Our goal was to reinvest the majority of those savings into strategically important initiatives that will propel our business forward. This enabled us to increase our A&R investment by double-digits last year and this year.”

» Kyncl said buying Tempo is “a great example” of the company’s acquisition strategy. “As we become more efficient, we are creating a virtuous cycle that will enable greater reinvestment that delivers accelerated growth.”

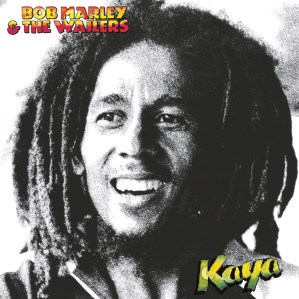

Among the gold gramophones handed out at the recent 67th Grammy Awards was one for best reggae album: Bob Marley: One Love — Music Inspired by the Film (Deluxe). Now in addition to the soundtrack and the global box office success of its accompanying 2024 biopic, the celebration of the reggae pioneer’s generational legacy continues in 2025 in honor of what would have been his 80th birthday (Feb. 6).

In partnership with the Marley family, Acoustic Sounds’ Analogue Productions label is announcing its reissue of seven of the late artist’s most iconic albums. With specific release dates to be announced, the album series will launch this spring and is centered around the theme of uprising — also the title of Marley’s last studio project released during his lifetime. Reflective of his spiritual and prophetic vision, the 1980 set includes memorable tracks such as “Redemption Song,” “Could You Be Loved” and “Pimper’s Paradise.”

The other six albums comprising the series are: 1973’s Catch a Fire (“Stir It Up,” “Concrete Jungle,” “Kinky Reggae”), 1973’s Burnin (“Get Up Stand Up,” “I Shot the Sheriff,” “Burnin’ & Lootin’”), 1974’s Natty Dread (“No Woman No Cry,” “Them Belly Full [But We Hungry],” “Lively Up Yourself”), 1976’s Rastaman Vibration (“Roots Rock Reggae,” “War,” “Rat Race”), 1977’s Exodus (“Three Little Birds,” “Jamming,” “One Love”) and 1978’s Kaya (“Is This Love,” “Satisfy My Soul,” “Easy Skanking”).

Trending on Billboard

Bob Marley, ‘Kaya’

Acoustic Sounds is reissuing the albums in a number of deluxe configurations, varying by title: 33rpm UHQR (ultra high quality record), 45rpm UHQR, 2LP 45rpm, SACD (super audio CD) and reel-to-reel tape (15 IPS on 1/4-inch tape). The UHQR and 2LP 45rpm releases will be sourced from the original master tapes and mastered by Ryan Smith at Sterling Sound. Pressing will be handled by Acoustic Sounds’ Quality Record Pressing plant in Salina, Kansas.

“We’re honored to be working with the Marley Family to give these records the treatment they deserve,” said Acoustic Sounds founder Chad Kassem in a statement. “The experience of going to Jamaica, visiting Tuff Gong and meeting the people carrying Bob Marley’s legacy forward was incredible, and we believe this series is a beautiful tribute to one of music’s greatest innovators.”

More about Kassem’s time in Jamaica and the making of Uprising can be found HERE. Acoustic Sounds’ recent vinyl releases include Steely Dan’s 1970s recordings, Buena Vista Social Club’s self-titled album and Miles Davis’ Birth of the Blue.

Warner Music Group is buying a controlling stake in Tempo Music Investment, a catalog company that owns rights to songs by Wiz Khalifa, Florida Georgia Line and Brett James, in a deal sources say is worth around $450 million. WMG said it will acquire the stake from Tempo’s founder, Providence Equity Partners. Providence will remain a […]

Reggaetón star Nicky Jam has signed a new global agreement with Virgin Music Group after spending more than a decade with Sony Music Latin.

Under the new agreement, Nicky Jam’s new music will be distributed by Virgin Music Group, which will also administer and supervise Nicky Jam’s catalog for YouTube and will work some material in digital platforms in different territories.

Nicky Jam (born Nick Rivera Camerino) disclosed the terms and impetus behind the deal during an exclusive interview with Billboard in Miami.

“I went with my gut,” he tells Billboard, noting that his contract with Sony had been up and he had met with several labels. “I thought it was the best thing to do. I have too much respect for Afo [Verde, chairman of Sony Music Latin Iberia] and my Sony family. I owe a lot to them and I love them very much. It’s just that sometimes you feel you have to move. I’m very spontaneous and that’s just the way I am. I could say I’m a bohemian. I take my luggage and I go wherever I have to go.”

In this case, Nicky Jam decided to go with a company that is giving him broad latitude. He’ll get to retain ownership of his masters, and will also have wide latitude in determining when he releases his music.

“It’s a distribution contract, but under that contract I can come out with music whenever I want. They are not going to mess with my creative part and that’s beautiful,” says Jam.

Nicky Jam’s new label deal coincides with a series of major changes in both his personal and professional life. Last year, he got married (to 22-yer-old model Juana Valentina Varón], split with his longtime manager Juan Diego Medina and spoke openly about his problems with alcohol and quitting drinking.

From left: Larry Gonzalez, David Daza, Michael Cantor (VMG SVP, Business Affairs and Development), Chi Orjiakor (VMG VP, Strategy), Victor Gonzalez (VMG, President of Latin America and Iberia), Nicky Jam (Artist), and Armando Rodriguez (VMG SVP/General Manager of Latin U.S.).

Courtesy of Nicky Jam

Now, a fit and trim Nicky Jam is readying to release new music that he says reflects his current, positive state of mind. “If you listen to my last album, it was called Insomnio. It was mostly what I was going through: Drinking, partying, it was all dark,” says the singer. “This is the new Nicky Jam,” he adds.

“Nicky has been a true pioneer in Latin music,” says Victor González, president of Virgin Music Group for Latin America and the Iberian Peninsula. “Having him choose Virgin Music Group for this new chapter of his career is incredibly rewarding for me and our entire team.”

Armando Rodríguez, general manager of Virgin Music Group for the U.S. Latin market adds: “Nicky is creating incredible music, and we are excited to work alongside him—not only on his upcoming releases but also in developing a strategic approach for his entire catalog.”

In the past couple of years, Virgin has notably expanded its Latin footprint, signing major names in Mexican music like Carín León, Pepe Aguilar, Angela Aguilar and Espinoza Paz. In the urban realm, Nicky Jam is their biggest get. The Puerto Rican star brings a legacy of hits, including the “El Perdón,” the 2015 smash alongside Enrique Iglesias that spent 30 weeks at No. 1 on Billboard’s Hot Latin Songs chart. All told, Nicky has charted nine songs on the Billboard Hot 100 and 58 on Billboard’s Hot Latin Songs chart, including five Number 1s. This week, he ranked at Nol 162 in streams globally on Spotify, a testament to his lasting appeal.

“This agreement with Virgin Music Group marks a new chapter in my artistic journey. I have always believed in the importance of evolution and adaptation, and I am confident that, together with Virgin Music Group, we will achieve incredible things,” says Nicky Jam.

Universal Music Group (UMG) chairman/CEO Lucian Grainge released his annual New Year’s memo to staff on Monday (Feb. 3), about a month later than usual owing to the wildfires that broke out in Los Angeles in early January.

In the 3,113-word letter, Grainge retreaded much of the same ground covered in his 2023 and 2024 New Year’s addresses and his presentation at the company’s Capital Markets Day in September, including mentions of “Streaming 2.0,” “responsible AI,” “artist-centric” approaches, “super fans” and more.

Grainge began the letter by noting UMG’s accomplishments over the last year, including breaking new artists like Sabrina Carpenter and Chappell Roan, working with Taylor Swift — the most streamed artist globally on Spotify, Amazon and Deezer — and Apple Music’s Artist of the Year Billie Eilish, adding that “achievements like these don’t just happen.”

Trending on Billboard

“Those achievements were greatly assisted by our continuing self-reinvention, reshaping our organizational structure,” wrote Grainge, referring to the widespread restructuring of UMG’s recorded music division in 2024 that led to layoffs. “Within months we were operating with greater agility and efficiency. We then saw something exceptional take place.”

As the largest music company in the world enters 2025, Grainge reminded his staff that UMG is still a “relative minnow” compared to the trillion-dollar tech companies it calls its partners. Still, he noted that UMG was successful in ushering in its “artist-centric strategy,” a term he introduced two years ago to describe UMG’s efforts to better monetize music and to limit gaming of the systems.

“Not only do we want to ensure that artists are protected and rewarded, but we’re also going after bad actors who are actively engaged in nefarious behavior such as large-scale copyright infringement,” he wrote. In the last year, UMG forged new deals with TikTok, Spotify and Amazon to aid in those efforts. Also in 2024, UMG sued AI companies Suno and Udio and music distributor Believe to prevent what Grainge called “large-scale copyright infringement.”

Grainge then detailed his plans to influence and set the ground rules for “Streaming 2.0” — or “the next era of streaming” — with UMG’s partners. He pointed back to new agreements with Amazon and Spotify as major wins, adding, “We expect that similar agreements with other major platforms will be coming in the months ahead.”

He also discussed the company’s goal of finding ways to “accelerat[e] our direct to consumer and superfan strategy,” building on past moves like its strategic partnership and investment in NTWRK and Complex. “This year will see us expanding our product offerings to fans, as we continue to redefine the ‘merch’ category and create superfan collectibles and experiences,” Grainge wrote.

He also noted the company’s focus to “aggressively grow our presence in high potential markets,” whether that’s through A&R, artist and label service agreements or mergers and acquisitions. In the last year, UMG has managed to work towards this goal by announcing that Virgin had entered an agreement to acquire Downtown Music Holdings, purchasing the remaining share of [PIAS] and partnering with Mavin Global in Nigeria.

“The reason so many independent music entrepreneurs actively seek to partner with UMG when they have more alternatives than ever before is that we provide what they’re seeking… After all, we’re not a financial institution that views music as an ‘asset,’” he wrote. “And we’re not an aggregator that views music as ‘content.’ We are a music company built by visionary music entrepreneurs. For us, music is a vital — perhaps the vital — art form.”

Grainge ended on a high note, writing, “Let me leave you with this: Some will try to disrupt our business or criticize us. That we know. It comes with being in the most competitive market that music and music-based entertainment has ever seen, and it comes with being the industry’s leader and primary driving force. But our vision and our ability to consistently execute gives us the momentum to continue to succeed and grow.”

Read Grainge’s full New Year’s note to staff below.

Dear Colleagues:

When I wrote my first letter about the L.A. fires, I said that my annual New Year’s note would have to come later than usual. And so here it is…

Last night’s Grammy awards served as a perfect metaphor for our company’s performance in 2024—breaking new artists and taking our superstars to new heights. In fact, last night, UMG artists and songwriters brought home more Grammys than ever before in our history. You can read more about that here.

Thanks to your day-in, day-out dedication and hard work, we accomplished so much together in 2024 and are positioning ourselves for another great year of success. I’ll sum up some of UMG’s stunning achievements last year and give you a glimpse of what we plan for this year. Our company’s fundamental building block is artist developmentand in 2024, investment in new talent continued to produce spectacular results around the world. Consider the following facts: that UMG broke the two biggest artists in the world last year in Sabrina Carpenter and Chappell Roan; Taylor Swift was the most streamed globally on Spotify, Amazon and Deezer; and Apple Music named Billie Eilish its Artist of the Year. And that a UMG recording artist who is also signed to UMPG as a songwriter had the No. 1 song globally on the year-end lists for both Apple Music (Kendrick Lamar) and Spotify (Sabrina Carpenter). Or that UMG had four of the Top 5 artists globally on Spotify with Taylor Swift (No. 1), The Weeknd, Drake and Billie Eilish; eight of the Top 10 albums (Taylor Swift’s The Tortured Poets Department at No. 1); five of the Top 10 songs (Sabrina Carpenter’s “Espresso” at No. 1), and six of the 10 Most Viral songs (Lady Gaga and Bruno Mars’ “Die With A Smile” at No. 1). Or consider that in the U.S., UMG had all Top 3 label groups according to Billboard (Republic, Interscope and Universal Music Enterprises) not to mention four of the Top 5 artists and eight of the Top 10 albums, including all of the Top 5 – Taylor Swift (No. 1 and No. 2), Morgan Wallen, Noah Kahan and Drake. And on YouTube, six of the Top 10 songs (Kendrick Lamar at No. 1) and two spots on the Trending Topics Top 10 across all content categories in 2024 (Kendrick Lamar and Sabrina Carpenter). You can read more of our remarkable achievements around the world at the end of this note, but as you can already see, in 2024, our momentum only grew. Also, these were achievements not only by a few superstars, but also by dozens of artists from around the world—both developing and established—performing in multiple genres, styles and languages. Achievements like these don’t just happen. They are the culmination of maintaining a clear vision of who we are, what we do and where we’re going, then executing on that vision, maintaining momentum and, of course, at the heart of it all, having some absolutely incredible music to work with. And last year those achievements were greatly assisted by our continuing self-reinvention, reshaping our organizational structure, re-building our teams and refining our strategy. A vision which boldly and, when necessary, quickly adapts to an ever-changing world. For example, in early 2024 we executed on our vision to realign our U.S. label structure, and within months we were operating with greater agility and efficiency. We then saw something exceptional take place: UMG had its best U.S. performance in six years, according to Luminate. I’m confident that our realignment will yield still further momentum around the world and that the achievements of our artists and songwriters—as well as UMG’s success—will reach new heights.In 2024, we continued to lead the media industry in our embrace and advancement of “Responsible AI.” Three recent examples of that initiative include our agreements with SoundLabs, ProRata and KLAY—companies that are taking unique approaches to the rapidly evolving AI space through new technologies that provide accurate attribution and tools to empower and compensate artists.Our leadership also includes our commitment to the enactment of Responsible AI public policies, fighting back against so-called text and data mining copyright exceptions and other misguided and ill-intentioned proposals that would enable what I will euphemistically call the unauthorized exploitation of creators’ work. Instead, we will work towards legislative “guardrails” to ensure the healthy evolution and growth of AI that mutually serves creators, consumers and responsibly innovative technology players.In my note last year, I said that 2024 would see us once again attracting the brightest entrepreneurs, expanding our existing relationships with other such talents and investing more resources into providing a full suite of artist services businesses to independent labels around the world. And we did exactly that. We acquired the remaining share of [PIAS] two years after taking an initial stake in the company and brought its highly respected co-founder Kenny Gates into our family. And we grew our geographic footprint. One example: our partnering with and investing in Mavin Global, whose founders Don Jazzy and Tega Oghenejobo continue to lead that company as well as, going forward, all of UMG’s business in Nigeria.Just last month, Virgin announced it entered into an agreement to acquire Downtown Music Holdings, which includes FUGA, Downtown Artist & Label Services, Curve Royalties, CD Baby, Downtown Music Publishing and Songtrust.The reason so many independent music entrepreneurs actively seek to partner with UMG when they have more alternatives than ever before is that we provide what they’re seeking: the most innovate creatives and finest resources that will advance the careers of their artists and achieve their financial goals within a culture that respects artists and their music. After all, we’re not a financial institution that views music as an “asset.” And we’re not an aggregator that views music as “content.” We are a music company built by visionary music entrepreneurs. For us, music is a vital—perhaps the vital—art form. Artists and the music they create are our lifeblood. We’re proud both to invest in businesses that can and do support today’s leading music entrepreneurs and to advocate for the policies and practices that are designed to protect and grow the entire music ecosystem.And finally, one of 2024’s announcements of which I am proudest is the formation of our Global Impact Team, whose mission is to enact positive change in our industry and in the communities in which we serve. This cross-functional group of executives brings a deep understanding of our global organization and will develop and execute strategies to tackle a variety of critical issues, including: equality; mental health and wellness; food insecurity and the unhoused; the environment; and education. By dovetailing seamlessly with our goals and those of our artists, we can promote and even catalyze beneficial and authentic changes where they are needed. Recently, in the wake of the terrible Los Angeles wildfires, the Impact Team mobilized, offering support to those affected, activating a multi-pronged relief effort to help both our own employees and the broader L.A. communities.Before I get to what lies ahead for 2025, let me first provide you with some context as to the enviable position UMG holds.UMG is a global creative enterprise at the center of an ecosystem of hundreds of digital partners. And while we’ve consistently been the music industry’s leader since the advent of the streaming era—an era whose dawn we were instrumental in ushering in—the leadership posture among our DSP partners has undergone some significant changes. For example, one of our fastest-growing subscription partners, YouTube, is also one of the most recently launched. We expect more inevitable jockeying for the leadership position among standalone platforms as well as among the music services that are divisions of trillion-dollar valuation tech companies.But, even though we are a relative minnow in comparison to a trillion-dollar tech company, the music of our incredible artists and songwriters enables us to exercise outsized influence on the global stage and serve as a critical catalyst in fostering a truly competitive commercial marketplace for music. We will keep using our position to promote a healthy and sustainable music ecosystem that benefits all artists at all stages of their careers.Now to 2025 … starting with our artist-centric strategy:When we introduced that strategy two years ago, we immediately went to work with our partners to make it a reality. In a matter of months, we reached agreements in principle on a number of issues: increasing the monetization of artists’ music; limiting the gaming of the system by protecting against fraud and content saturation; and focusing on the value of authentic artist-fan relationships, inspiring the development of more engaging consumer experiences, including specially designed new products and premium tiers for superfans. Platforms as diverse as Deezer, Spotify, TikTok, Meta and most recently Amazon, have adopted artist-centric principles in a wide variety of ways—principles that benefit the entire music industry from DIY to independent to major label artists and songwriters.Our work in driving these artist-centric principles will continue in 2025. Not only do we want to ensure that artists are protected and rewarded, but we’re also going after bad actors who are actively engaged in nefarious behavior such as large-scale copyright infringement. To that end, we’re setting forth the best practices that every responsible platform, distributor and aggregator should adopt: content filtering; checks for infringement across streaming and social platforms; penalty systems for repeat infringers; chain-of-custody certification and name-and-likeness verification. If every platform, distributor and aggregator were to adopt these measures and commit to continue to employ the latest technology to thwart bad actors, we would create an environment in which artists will reach more fans, have more economic and creative opportunities, and dramatically diminish the sea of noise and irrelevant content that threatens to drown out artists’ voices.In September, during our Capital Markets Day presentation, I described what would constitute the next era of streaming—Streaming 2.0. Built on a foundation of artist-centric principles, Streaming 2.0 will represent a new age of innovation, consumer segmentation, geographic expansion, greater consumer value and ARPU growth.I’m pleased to report that the Streaming 2.0 era has arrived. We recently announced a new agreement with Amazon that includes many of these elements, and just last week, we announced a multi-year agreement with Spotify. We expect that similar agreements with other major platforms will be coming in the months ahead. In 2025, we’ll also be reaching out in new ways to engage fans. In addition to listening to their favorite artists’ music, fans want to build deeperconnectionsto artists they love. Last year, in accelerating our direct-to-consumer and superfan strategy, we formed a strategic partnership and became an investor in NTWRK and Complex to build a premium live-video shopping platform for superfan culture. This year will see us expanding our product offerings to fans, as we continue to redefine the “merch” category and create superfan collectibles and experiences. Some of this will be done through our current partners and some through our own D2C channels, which we will continue scaling to meet the massive appetite of fans. After years of working to aggressively build a healthy commercial environment for artists and music—one in which we have reached approximately 670 million subscribers—we will be laser-focused in 2025 on continuing to expand the ecosystem and improve its monetization. As we did in 2024, this year we will continue to aggressively grow our presence in high potential markets through organic A&R, artist and label services agreements, and M&A.The work that lies ahead of us will bring challenges, no doubt about that. But we will meet those challenges with pride and a sense of privilege, because no other form of creative expression is more fundamental to human existence than music. By that, of course, I mean real music created by human artists. So let me leave you with this:Some will try to disrupt our business or criticize us. That we know. It comes with being in the most competitive market that music and music-based entertainment has ever seen, and it comes with being the industry’s leader and primary driving force. But our vision and our ability to consistently execute gives us the momentum to continue to succeed and grow. Our global worldview and the internal competition fueled by our entrepreneurial spirit breeds innovation. Our passion for finding new and better ways to bring music to the world will keep us ahead of competitors and new entrants alike. We’ll continue to do what we do because what we do and how we do it is impossible to replicate. Our culture and our people—you—are our superpower.I can’t wait to see and hear what this year brings, and I am thrilled to be on this journey with you.Let’s go!Lucian

At this point in his career, Bad Bunny is way beyond breaking records. In 2020, he became the first artist to notch a No. 1 on the Billboard 200 with an all-Spanish album, and he’s the only one to repeat the feat — not one, not two, but four times.

Now, Bad Bunny’s latest album, Debí Tirar Más Fotos, has spent two weeks at No. 1 on the Billboard 200 — and it currently seems poised to notch a third consecutive week atop the tally. Of his four No. 1 albums on the all-genre chart, it’s now the second longest running at the top spot; his 2022 set, Un Verano Sin Ti, collected the most weeks there with 13 non-consecutive weeks.

This week, Debí Tirar Más Fotos is also No. 1 on Billboard’s Top Latin Albums chart, and the song “DtMF” is No. 1 on the Billboard Global 200 chart for the second consecutive week. Bunny, in fact, occupies more than half the top 10 on the Global 200. On Billboard’s Hot Latin Songs chart, nine of the top 10 songs are Bunny’s, including “DtMF” at No. 1.

Trending on Billboard

It’s an astounding showing, even for an artist as big as Bad Bunny. It’s also worth considering that Debí Tirar Más Fotos debuted at No. 2 on the Billboard 200 following an incomplete debut tracking week due to his decision to release the album on a Sunday — Jan. 5 — in anticipation of the Jan. 6 celebration of Three Kings Day, which is a big deal in Puerto Rico and ties with the album’s love of Puerto Rico theme.

But Bunny quickly made up for lost time with a blitz of finely-tuned and very creative publicity efforts that ping-ponged from the U.S. to Puerto Rico, including his stint co-hosting The Tonight Show alongside Jimmy Fallon, playing a surprise concert at a New York subway station, co-hosting a morning news show in Puerto Rico and surprising local podcaster Chente Ydrach with Puerto Rican parranda.

The final flourish was announcing a 21-date residency at Puerto Rico’s Coliseo de Puerto Rico, with the first several dates available exclusively to Puerto Rican residents.

A major architect in Bunny’s marketing and promotional strategy is Monica Jiménez, director of marketing and brand partnerships at Rimas’ Bad Bunny Division.

Jiménez, who worked with brands like Coty and Procter & Gamble before joining Bunny’s label and management company, works together with Rimas CEO Noah Assad on everything Bad Bunny and was pivotal in executing the artist’s complex vision. The success of Debí Tirar Más Fotos earns her the title of Billboard‘s Executive of the Week.

What exactly was your role in this album’s roll-out?

One of my duties is understand and bring to life the vision of the artist for the album. Benito is an artist who fully immerses himself in the many facets of a release process, including marketing, and it’s crucial to achieve what he visualizes for the project. I usually bring together the amazing ideas of the entire team and also look for new ideas to ensure a robust and strategic plan. I also focus on implementing the plan so it meets expectations, but above all, so it truly represents Benito’s essence as an artist and conveys the message of the project.

So, what was this message? And what was the overlying strategy for the album?

The strategy was telling a story through nostalgia and taking a message of love and appreciation for our upbringing, regardless of where or what that upbringing was. With this album, we underscored our pride for Puerto Rico, and we wanted the whole world to feel this same pride. That’s what we’ve presented in all our storyline and in everything we’ve done inside and outside the island. I think that’s what’s pushed such a special connection between the album and its listeners.

We’re closing in on a third consecutive week at No. 1 on the Billboard 200, more than any other of Benito’s albums except for Un Verano Sin Ti. What do you attribute that success to?

DEBí TiRAR MáS FOToS has been a very special project. I think the entire world has seen and understood the essence of what the album wanted to communicate: Benito’s love for his culture and for his Latin people. I believe this has made the reception to the album different [from other albums].

This feels like more of a passion project than any of Benito’s previous albums. Do you think that has had an impact on people’s obsession with it?

Definitely. Benito has always been very vocal about his commitment and love for Puerto Rico. But here, he’s devoted an entire project to his island — not only conceptually but also musically, betting on root genres and on young, local talent like Los Sobrinos [the band on the album, made up of students from Puerto Rico’s Escuela Libre de Música] and Los Pleneros de La Cresta. It’s made people look at the project from another point of view and value it even more.

Benito did more promo for this album than any other. Why? And how did you convince him to do it?

I truly think his connection with the project made everything flow easier. He wanted to do it that way, to support the release in the way he did. The key is ensuring that what we do resonates with him, with his personality as an artist and with his vision. Once we have that, everything is easier.

Can you give me examples of marketing strategies that you thought were particularly effective?

Our strategy to reveal the song names generated a lot of buzz. We collaborated with Google Maps and Spotify, and as part of the collaboration, coordinates for each song on the album’s tracklist were revealed on Spotify, encouraging fans to dive into Google Maps for hidden clues. We not only looked for a different, interactive way to do this, but it led to many people discovering different places on our island.

Another major effort was the short film released prior to the album. The story it told [of an older man, played by filmmaker and actor Jacobo Morales, who reminisces of his life and love for Puerto Rico] was a great preamble to the album. It was an emotional, well-done piece [directed by Bad Bunny himself] that connected with many people in and out of Puerto Rico. Plus, those short previews of different tracks that were included in the video opened up an enormous conversation on social media on what people could expect from the album.

Does it surprise you that such a Latin album is the most consumed in the U.S.?

More than a “Latin” album, it’s about the [Puerto Rican] rhythms that make up the album. I’m definitely positively surprised, and as a Puerto Rican, it fills my heart. It’s a huge step for music as a whole.

What’s next with this album?

We never stop. There are many things coming up around the album. Plus the residency in Puerto Rico, which is something historic and will definitely be special for everyone who comes to visit and enjoy.

Mike Chester has been promoted to general manager of Warner Records, expanding his responsibilities to include digital and viral marketing, as well as artist development, while continuing to oversee promotion and commerce.

Based in Los Angeles, Chester reports to co-chairman & COO Tom Corson and works closely with label CEO & co-chairman Aaron Bay-Schuck on company goals and artist release strategies.

Chester joined Warner in 2018 as executive vp of promotion, later adding commerce to his title in 2021. His leadership has been instrumental in Warner Records’ revitalization, earning him recognition as Billboard‘s Executive of the Week following a barrage of midyear wins in 2024.

Trending on Billboard

Before Warner, he served as senior vp at Scooter Braun’s SB Projects, working with Justin Bieber and Ariana Grande, and spent over a decade at Def Jam Recordings. He began his career at Arista Records before moving to Atlantic and then Def Jam in 2004.

Corson and Bay-Schuck praised Chester’s leadership, artist relations expertise, and strategic vision, crediting him with playing a key role in Warner’s resurgence.

“He possesses extraordinary leadership qualities, has excellent artist relations skills, and knows how to balance all with confidence, compassion, and integrity,” they said. “He is an invaluable member of our senior management team and we know he will continue to thrive and innovate in his new role.”

Chester also shared his excitement about the new role, emphasizing Warner’s dedication to artist development and innovation.

“The team here at Warner is phenomenal, and our artist roster – from emerging talent to superstars – is second to none,” he said. “We pride ourselves on being the premiere artist development label, and we constantly discover new avenues in which to bring even more music to fans. I’m excited to continue promoting, innovating, and building careers in this dynamic and rapidly expanding musical environment.”

Esha Tewari is taking the next big step in her career. The rising singer-songwriter has officially signed with Warner Music in collaboration with Atlantic Records, setting the stage for a massive year ahead.

The deal, announced today (Jan. 30), marks a pivotal moment for Tewari, who built an impressive following through TikTok and streaming platforms.

Trending on Billboard

“I am super excited to welcome Esha Tewari to the Warner Music family and to be working with Atlantic Records to take her music to a global audience,” Rosen said. “Esha is an incredible talent with a unique ability to connect with her fans through her songs, and I can’t wait to work with her to amplify her music and her authentic storytelling to every corner of the world.”

For Tewari, the decision to sign with Warner wasn’t just about major-label backing—it was about finding a team that aligned with her fiercely independent vision.

“I’m so excited to be a part of the Warner Music family,” Tewari comments in a statement. “From LA to New York, we met with executives who spoke about an evolving label system that now gives artists more ownership and control. Warner stood out as their actions matched their words.”

She continues, “Especially this early in my career, the deal I have done with Warner Music gives me the ability to remain hands-on with the whole creative vision, and allows me to remain the leader of my now expanded team.”

Tewari first started making waves in February 2024 by posting covers and original songs on TikTok, quickly amassing a loyal fanbase she calls “Tewarians.”

Her independently released single “Beautiful Boy” went viral, catapulting her to over 601,000 monthly Spotify listeners, 217,000 Instagram followers, and 172,000 TikTok followers.

Her success continued with the release of two EPs—i can and Better Off—which helped establish her indie-folk sound. Now, she’s gearing up for her third EP, led by the heartfelt new single “You Were Mine,” which has already racked up 17,000 TikTok creations using the original sound.

With her career gaining momentum, Tewari is preparing for a North American tour in mid-2025, but first, she’s returning to Australian stages this April and May for her second national headline tour.

If the demand is anything to go by, she’s becoming a serious live force—Sydney, Brisbane, Melbourne, and Perth have already sold out, prompting a second show in Perth, while Adelaide is nearing capacity. It follows her completely sold-out Australian tour in November 2024.

State Champ Radio

State Champ Radio