Music Stocks

Page: 2

Led by two entertainment companies in the Dolan family portfolio, music stocks collectively eked out a small gain this week, marking their fifth consecutive weekly gain after a Trump tariff-induced two-week slide in early April.

Sphere Entertainment Co. shares jumped 18.9% to $28.05 after the company’s quarterly earnings on Thursday (May 8) showed that the Sphere venue’s cost management helped offset a 12.8% decline in revenue. CEO James Dolan told analysts he isn’t concerned about a possible downturn in tourism from a sluggish U.S. economy or a drop in international visitors. “When it comes to concerts,” he said, “demand exceeds capacity, so we have room to absorb any issues.”

MSG Entertainment, another Dolan family-controlled company, rose 7.7% to $33.59 after the company’s quarterly earnings report on Tuesday (May 6) showed a 6% revenue increase and steady consumer spending despite a decrease in event-related revenue due to fewer events. JP Morgan maintained both its “neutral” rating and $41 price target.

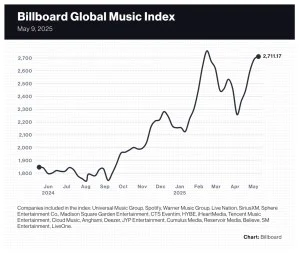

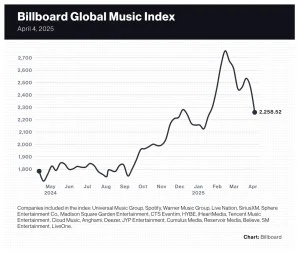

The 20-company Billboard Global Music Index (BGMI) rose 0.8% to 2,717.17, its second-highest mark and its first time above 2,700 since it closed at a record 2,755.53 the week ended Feb. 14. With five consecutive weeks in the black, the BGMI is up 10.2% since President Trump announced his tariff policy and set off a stock sell-off.

Music stocks outperformed the Nasdaq composite (down 0.3%), the S&P 500 (down 0.6%), the U.K.’s FTSE 100 (down 0.5%) and South Korea’s KOSPI composite index (up 0.7%). China’s SSE composite index gained 1.9%.

Universal Music Group, which reported earnings on April 29, received a healthy bounce this week, gaining 4.5% to 25.86 euros ($29.10). That brought its year-to-date gain to 13.0%.

Warner Music Group (WMG) shares fell 8% on Thursday after its quarterly earnings release and finished the week down 9.6% to $30.26. WMG stock was likely impacted by a 0.3% decline in streaming revenue, a metric closely watched by investors. The decline took WMG’s year-to-date loss to 11.8%. Numerous analysts reacted by decreasing their WMG price targets: Morgan Stanley (to $31 from $32), Barclays (to $28 from $31), UBS (to $38 from $41) and TD Cowen (to $36 from $41).

Radio companies enjoyed a positive week amidst uncertainty about the U.S. advertising market. The greatest gainer of the week was iHeartMedia, which jumped 18.9% to $1.06 ahead of the company’s first quarter earnings release on Monday (May 12). Year-to-date, the radio giant’s shares have fallen 40.8%. SiriusXM rose 5.4% to $20.47.

K-pop companies had a mixed week. YG Entertainment spiked 9.9% after the company reported large increases in both operating income and net profit in the first quarter. Elsewhere, HYBE rose 2.1% while SM Entertainment, which announced earnings on Wednesday (May 7), fell 0.9% and JYP Entertainment dropped 1.8%.

Secondary ticketing marketplace Vivid Seats (which is not listed on the BGMI) fell 33.9% to $1.79 after the company’s first quarter revenue plummeted 14% due to what CEO Stan Chia called “softening industry trends amidst economic uncertainty.” While Live Nation previously told investors it’s seeing strong demand for events later in 2025, Vivid Seats painted a different picture. The company suspended guidance for the full year and said it expects industry volumes to be flat or decrease in 2025. Previous guidance called for mid-to-high single-digit growth.

Billboard

Billboard

Billboard

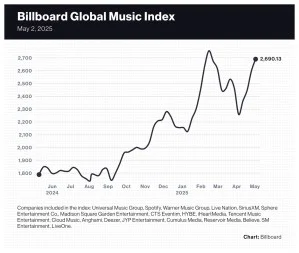

Though economic uncertainty lingers, some music companies’ stocks got boosts following their first quarter earnings releases this week, while a better-than-expected jobs report on Friday (May 2) lifted stocks across the board.

K-pop companies were among the top performers of the week. Led by HYBE’s 13.8% gain following its first quarter earnings report on Tuesday (April 29), the four South Korean companies had an average share price gain of 10.3%. JYP Entertainment rose 11.7% and SM Entertainment, which announces earnings on Wednesday (May 7), improved 9.0%. YG Entertainment gained 6.6%.

The 20-company Billboard Global Music Index (BGMI) rose 3.6% to 2,690.13, its fourth consecutive weekly improvement. At 2,690.13, the BGMI has improved 19.1% since a two-week slide and stands just 2.4% below its all-time high of 2,755.53 set during the week ended Feb. 14.

Trending on Billboard

Music stocks slightly outperformed the Nasdaq and S&P 500, which rose 3.4% and 3.1%, respectively. Foreign markets were mostly positive but more subdued. The U.K.’s FTSE 100 rose 2.2%. South Korea’s KOSPI composite index gained 0.5%. China’s SSE Composite Index lost 0.5%.

Universal Music Group (UMG) gained 4.3% to 25.86 euros ($29.23) following a quarterly earnings report showing that recorded music subscription revenue grew 11.5% and overall revenue improved 11.8%. JP Morgan analysts’ conviction on UMG “remains very high,” and the strong quarter “should help rebuild confidence and share price momentum” dented by Pershing Square’s sale of $1.5 billion in UMG shares, analysts wrote in an investor note on Tuesday.

Spotify finished the week up 3.7% to $643.73 despite its shares dropping 3.4% on Tuesday after the company’s first-quarter earnings report included guidance on second-quarter subscription additions that seemed to underwhelm investors. Gross margin of 31.6% beat Spotify’s 31.5% guidance. Loop Capital raised Spotify to $550 from $435, while Barclays lowered it to $650 from $710. UBS maintained its $680 price target and “buy” rating. Guggenheim maintained its “buy” rating and $675 price target.

Live Nation, which reported first quarter earnings on Thursday (May 1) and predicted a “historic” 2025, gained 2.3% on Friday and finished the week up 0.7%. A slew of analysts updated their price targets on Friday. Two were upward revisions: Jefferies (from $150 to $160) and Wolfe Research (from $158 to $160). Two were downward revisions: Rosenblatt (from $174 to $170) and JP Morgan (from $165 to $170).

Nearly all streaming stocks posted gains. LiveOne was the week’s top performer, jumping 18.0% to $0.72. Chinese music streaming companies Cloud Music and Tencent Music Entertainment gained 11.6% and 7.1%, respectively. French music streamer Deezer gained 1.4% to 1.44 euros ($1.63) after the company’s first-quarter earnings on Tuesday. Abu Dhabi-based Anghami fell 3.1% to $0.62.

Cumulus Media fell 33.% to $0.14. Most of the decline came on Friday as the stock ceased trading on the Nasdaq and began trading over the counter.

Created with Datawrapper

Created with Datawrapper

Created with Datawrapper

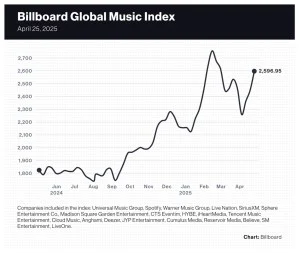

Proving that the best way to get stock prices to rally is to first bury them deep underground, markets surged this week as President Trump eased his tone on U.S. Federal Reserve chair Jerome Powell and said tariff negotiations with China are ongoing (although China denied the claim).

The 20-company Billboard Global Music Index surged 6.1% to 2,595.95, marking its third consecutive weekly gain after falling 10.9% in the two-week period ended April 4. The spoils of a less chaotic global market were felt by nearly all music stocks. Of the 20 stocks in the index, 16 finished the week in positive territory, and two — Anghami and Sphere Entertainment Co. — had gains exceeding 10%.

Major indexes improved this week as investor sentiment regarding U.S. tariff policy improved and President Trumpsaid he would not fire Powell. The Nasdaq composite rose 6.7% to 17,382.94 and the S&P 500 gained 4.6% to 5,525.21. The U.K.’s FTSE 100 improved 1.7% to 8,415.25. South Korea’s KOSPI composite index rose 2.5% to 2,546.30. China’s SSE Composite Index rose 0.6% to 3,295.06.

Trending on Billboard

After investors’ confusion about the U.S. tariff policy put a damper on stocks in recent weeks, markets seemed to find comfort in reports that said the U.S. Trade Representative was quickly working with some trading partners under a streamlined process. Jay Hatfield, founder/chief investment officer of InfraCap, told CNBC, “We’ve reached peak tariff tantrum” and believes the worst of the uncertainty has passed. In fact, the market could have been due for a rebound. Thomas Martin, senior portfolio manager at GLOBALT in Atlanta, told Reuters the stock market “was oversold by virtually all measures.”

Sphere Entertainment Co. was one of the week’s winners, rising 13.8% to $28.88. On Friday, Sphere Entertainment subsidiary MSG Networks announced it had negotiated a $514 million reduction in its debt and lower fees to broadcast New York Knicks and New York Rangers games. The news sent Sphere’s share price up 9.1%.

Spotify, which reports first quarter earnings on Tuesday (April 29), rose 8.1% to $620.72, giving the streaming giant a 23.3% gain over the past three weeks. This week, UBS lowered its price target to $680 from $690 and Wolfe Research raised its outlook on SPOT to “outperform” from “peer perform.”

Live Nation gained 4.4% to $132.76. Wolfe Research lowered its price target to $158 from $165 and maintained its “outperform” rating.

Warner Music Group (WMG) improved 2.4% to $29.83. Morgan Stanley lowered WMG shares to $32 from $37 and dropped the rating to “equalweight” from “overweight.” Universal Music Group (UMG), which also reports earnings on Tuesday, rose 3.5% to 24.79 euros ($28.28), bringing its year-to-date gain to 3.7%.

K-pop stocks had an unremarkable week after performing well during the tariff-driven chaos. HYBE, which, like Spotify and UMG, reports first-quarter earnings on Tuesday, rose 0.9%. SM Entertainment and JYP Entertainment improved 0.6% and 0.2%, respectively. YG Entertainment dropped 4.9%. Still, K-pop stocks are outperforming most music stocks this year. Collectively, the four South Korean music companies have posted an average year-to-date gain of 27.1%.

Cumulus Media shares dropped 16.0% to $0.21 after the company announced on Wednesday (April 23) it will de-list from the Nasdaq exchange on May 2 and immediately begin trading over the counter. The radio broadcaster’s shares are down 72.7% in 2025 and have fallen 92.2% over the last 52 weeks.

Billboard

Billboard

Billboard

Radio broadcaster Cumulus Media was notified by the Nasdaq Composite on Wednesday (April 23) that its shares will be de-listed from the exchange on May 2, according to a Cumulus regulatory filing. The stock will transition the same day to trading on the over-the-counter (OTC) market and will retain the CMLS ticker. Shares of Cumulus […]

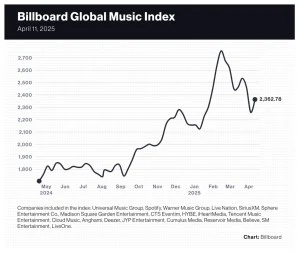

Music stocks bounced back — and performed better than major U.S. indexes— for a second week after President Trump’s tariff policy sent markets into a tailspin.

The 20-company Billboard Global Music Index (BGMI) rose 3.6% to 2,446.90, its second consecutive gain after falling 8.2% the week ended April 4. Fourteen of the 20 stocks were winners and five had gains exceeding 5%. The largest companies were among the week’s winners, which had an outsized impact on the index’s value, while the four worst performers are the index’s least valuable companies.

The BGMI outperformed the Nasdaq and S&P 500, which lost 2.6% and 1.5%, respectively, but fell short of the FTSE 100’s 3.9% improvement. South Korea’s KOSPI composite index gained 2.1% and China’s SSE Composite Index rose 1.2%.

Trending on Billboard

Streaming companies, which analysts believe are well-suited to survive the impacts of the U.S. tariff policy, were among the week’s best performers. Cloud Music was the week’s biggest gainer, rising 10.5% to 156.40 HKD ($20.15). Deezer was the third-best performer with a 6.7% gain.

Spotify, the most valuable music company, rose 5.6% to $574.25. UBS lowered its Spotify price target on Tuesday to $680 from $690 but maintained its buy rating. Tencent Music Entertainment improved just 0.4%, giving it a 10.2% gain in 2025.

Multi-sector companies, particularly those from South Korea, also performed well. YG Entertainment rose 10.0% to 66,800 KRW ($47.10). SM Entertainment rose 9.3% to 116,300 KRW ($81.99) and JYP Entertainment improved 6.2% to 63,300 KRW ($44.63). HYBE rose 2.0% to 230,500 KRW ($162.51).

Universal Music Group rose 3.2% to 23.96 euros ($27.25), turning a deficit into a year-to-date gain of 0.2%. Warner Music Group rose 0.3%, bringing its loss in 2025 to 6.1%.

Live entertainment companies had mixed results. German promoter CTS Eventim gained 4.2% to 97.20 euros ($110.54) and MSG Entertainment rose 1.2% to $30.69. Live Nation fell 1.8% to $127.22. Sphere Entertainment Co. dropped 6.3% to $25.38. The company, which owns the Sphere venue in Las Vegas, has fallen 40.2% year to date.

Radio companies continued their decline. iHeartMedia dropped 14.8%, bringing its year-to-date loss to 54%. Cumulus Media’s 19.4% fall took its year-to-date deficit to 67.5%.

Tariffs continued to be a dominant theme in the financial world this week. Apple and other tech companies that import phones, computers and chips from China and other Asian countries gained a reprieve from the most burdensome tariffs. The announcement, which came on April 11, sent Apple’s stock up 2% on Monday (April 14) and pushed its market capitalization back past $3 trillion. On Thursday, the Trump administration announced new fees on Chinese-made ships entering U.S. ports. Some of those fees were quickly walked back, however, by exempting ships that travel between U.S. ports of call, and from domestic ports to Caribbean islands or U.S. territories.

Billboard

Billboard

Billboard

Believe intends to acquire the few remaining shares it does not own through a public buyout offer or “assimilation,” the company announced Wednesday (April 16). The offer will be launched by an entity named Upbeat BidCo that’s controlled by CEO Denis Ladegaillerie and private equity funds EQT and TCV.

Upbeat BidCo, which owns 96.7% of Believe’s outstanding shares, will offer 15.30 euros ($17.40) per share for the remaining 3.3% of share capital. The bid represents a 1.2% premium over the previous day’s closing price of 15.12 euros ($17.20).

The offer will be filed on Wednesday. Subject to clearance by the Autorité des Marchés Financiers (AMF), France’s securities commission, it’s expected to begin in the second quarter of 2025. After the closing of the bid, Upbeat BidCo will implement a “squeeze-out,” in which an acquiring company uses various tactics to pressure non-tendering shareholders to accept the buyout offer.

Trending on Billboard

Believe’s board of directors has established an ad hoc committee consisting of three independent directors: Orla Noonan, Anne-France Laclide-Drouin and Cécile Frot-Coutaz. According to the press release, the committee will “monitor and facilitate the work of the independent expert, and to prepare a draft reasoned opinion on the merits of the offer and its consequences for Believe, its shareholders and its employees.”

On Tuesday (April 15), Believe’s board of directors unanimously welcomed Upbeat BidCo’s intent to file the public buyout offer based on a preliminary recommendation of the ad hoc committee.

The Paris-based company was publicly traded for three years before a consortium led by Ladegaillerie, EQT and TCV took the company private in 2024 with a buyout offer of 15.00 euros ($17.06). The consortium did not squeeze out the remaining shareholders, however, and the small float remains trading on the Euronext Paris stock exchange.

Buying the remaining shares won’t come with much of a premium. Since the tender offer closed in June 2024, Believe’s shares have traded in a narrow band, reaching a high of 16.00 euros ($18.20) and a low of 13.70 euros ($15.58). Earlier this year, Believe shares had gained 5.0% before the announcement. On Wednesday, Believe rose 0.9% to 15.26 euros ($17.36), just below the 15.30 euros offer price.

Led by Spotify and Live Nation, music stocks surged on Wednesday (April 9) after the U.S. Treasury placed a 90-day pause on most tariffs and recaptured some of the losses from the chaotic previous week.

A week after losing $12 billion in market value, Spotify was one of the top-performing music stocks of the week, gaining 8.0% and offsetting most of the previous week’s 10.3% decline. A 9.8% gain on Wednesday helped improve the streaming company’s two-week loss to 3.1%.

The 20-company Billboard Global Music Index (BGMI) gained 4.6% to 2,362.78 on Wednesday’s 90-day tariff pause. That welcome news recaptured only a fraction of the previous week’s losses, however, and music stocks were hurt by a weakened U.S. dollar and growing fears the U.S. could slip into a recession. After losing 8.2% in the previous week, the index’s two-week loss stands at 4.0%.

Trending on Billboard

U.S. markets rebounded after a miserable week. The Nasdaq rose 7.3% to 16,724.46, bringing its two-week loss to 3.5%. The S&P 500 rose 5.7% to 5,363.36, giving it a two-week decline of 3.9%.

Many markets outside of the U.S. were down, however. In the U.K., the FTSE 100 dropped 1.1%, giving it a two-week loss of 8.0%. South Korea’s KOSPI composite index was down 1.3%, adding to the previous week’s 3.6% decline. China’s SSE Composite Index dipped 3.1% a week after falling 0.3%.

Music streamer LiveOne was the week’s biggest gainer after jumping 18.0% to $0.72. The company’s preliminary results for fiscal 2025 released on Monday (April 7) showed the music streaming company had revenue of more than $112 million, while subscribers and ad-supported listeners surpassed 1.45 million. Even after the large increase, LiveOne shares have fallen 47.4% year to date.

Live Nation, which jumped 7.2% to $129.52 this week, is the only music company to post a gain over the past two weeks. The concert promoter’s share price dropped 3.4% the previous week but, with the help of a 10.9% jump on Wednesday, recovered well enough for a two-week gain of 3.6%.

Record labels and publishers finished the week in the middle of the pack. Warner Music Group fell 1.5% to $29.03, bringing its two-week decline to 8.0%. Universal Music Group was down 1.6%, giving it a two-week decline of 10.7%. Reservoir Media rose 0.7% to $7.10, giving it a two-week deficit of just 2.1%.

Sphere Entertainment Co. is one of the worst-performing music stocks over the past two weeks with an 18.5% decline. The company’s shares finished the week up 1.3%, barely offsetting the previous week’s 19.5% decline. A spike on Wednesday was partially offset by declines of 4.3% and 7.7% on Tuesday (April 8) and Thursday (April 10), respectively.

Most radio companies, which are heavily exposed to slowed advertising spending during recessions, had another down week. Cumulus Media dropped 22.5% to $0.31, bringing its two-week loss to 34.0%. iHeartMedia fell 4.2%, which took its two-week decline to 29.9%. Townsquare Media was down 4.9% this week and 13.6% over the past two weeks. Satellite broadcaster SiriusXM, which was upgraded by Seaport to buy from neutral, gained 2.6% this week, narrowing its two-week loss to 12.0%.

The two Chinese music streaming companies on the BGMI fared poorly despite the recoveries by Spotify, LiveOne and Deezer, which gained 2.3%. Tencent Music Entertainment fell 5.5% to $12.24 but was likely helped by Nomura initiating coverage this week with a buy rating and a $17.20 price target. Cloud Music shares dropped 5.7% to 141.50 HKD ($18.24).

K-pop companies, which bucked the downward trend the previous week, posted declines as well. SM Entertainment fell 8.2%, HYBE dropped 8.1%, JYP Entertainment sank 5.8% and YG Entertainment dipped 4.1%.

Billboard

Billboard

Billboard

Music stocks were battered this week after President Donald Trump unveiled the tariffs that will be applied to imported goods from around the world.

The 20-company Billboard Global Music Index (BGMI) fell 8.2% for the week ended Friday (April 4), marking the largest single-week decline in the index’s two-and-a-half-year history. Among the 17 stocks that posted losses, eight declined by 10% or more, and one — iHeartMedia — far surpassed a 20% decline. Of the 20 stocks on the index, only three South Korean K-pop companies posted gains for the week.

Markets around the world experienced large declines in the wake of the tariffs. In the U.S., the tech-heavy Nasdaq fell 10.0% and the S&P 500 dipped 9.1%. The U.K.’s FTSE 100 slipped 7.0%. South Korea’s KOSPI composite index fell 3.6%. China’s SSE Composite Index declined just 0.3%.

Trending on Billboard

SM Entertainment was the top performer of the week with an 8.3% gain, besting JYP Entertainment’s 3.3% increase and HYBE’s 2.3% improvement. No other music stock finished the week in positive territory, although French company Believe came close with a 0.1% decline.

Spotify fell 10.3% to $503.30, erasing approximately $12 billion of market value. While most stocks cratered on Thursday (April 3), Spotify had fared relatively well by losing just 1.2%. But Spotify shares fell 9.9% on Friday (April 4), paring down the once high-flying stock’s year-to-date gain to 7.9%.

Like Spotify, Tencent Music Entertainment bucked the downward trend on Thursday by suffering only a minor loss, but declined 9.5% on Friday, dropping 9.9% to $12.95.

Radio companies, which are heavily dependent on advertising revenue, were among the most affected stocks. iHeartMedia shares fell 26.8% to $1.20, bringing its year-to-date decline to 43.7%. Cumulus Media dropped 14.9% to $0.40. SiriusXM declined 14.2% to $19.51.

Live entertainment stocks were also hit hard. Sphere Entertainment Co., owner of the Sphere venue in Las Vegas, fell 19.5% to $26.74, mirroring sharp declines in gaming companies reliant on travel to Las Vegas such as Wynn Resorts (down 14.9% this week) and Caesars Entertainment (down 9.7%). Sphere announced on Friday that it has two new experiences in production: The Wizard of Oz at Sphere and From The Edge, a film about extreme sports.

Madison Square Garden Entertainment dropped 11.9% to $29.71, widening its year-to-date loss to 17.2%. Live Nation had been up 7.7% through Wednesday (April 2) but finished the week down 3.4% after losing a combined 10.3% over Thursday and Friday. German concert promoter CTS Eventim fell just 6.2%.

Music stocks started 2025 well, but concerns about tariffs have wiped out the index’s early gains. The BGMI has lost 18.0% of its value since Feb. 14 and has declined in five of the previous seven weeks. Halfway through February, the index had gained nearly 30% in the first six weeks of the young year. By Friday, that year-to-date gain was down to 6.3%.

Billboard

Billboard

Billboard

President Donald Trump’s so-called “Liberation Day,” which marked the imposition of tariffs on all U.S. trading partners on Wednesday (April 2), was followed by a bloodbath on Wall Street on Thursday (April 3).

The tech-heavy Nasdaq fell 6.0% while the S&P 500 dropped 4.8% — the largest single-day decline since 2020 for both. The Russell 2000, an index of small-cap companies, dropped 6.6% and entered bear market territory, having lost more than 20% of its value since reaching its all-time high in November.

All music stocks except three K-pop companies suffered losses Thursday, with a handful losing 13% or more of their value and most dropping by mid-single digits. Music is largely a service that operates seamlessly across borders and is mostly immune from the tariffs applied to manufactured goods. But investors clearly expect U.S. consumers to face higher prices and an uncertain labor market, which in turn causes people to reduce their spending on everything from everyday household items to more expensive items such as concert tickets and travel.

Trending on Billboard

The severity of stock declines varied by industry segment. Companies with high exposure to the U.S. advertising market were hit particularly hard, a reflection of brands’ tendency to reduce their ad spending in times of economic uncertainty. In the radio segment, iHeartMedia shares fell 13.1%, Cumulus Media dropped 10.1% and Townsquare Media sank 6.3%. Satellite radio company SiriusXM lost 5.4%. Music streamer LiveOne, which has both subscription and ad-supported offerings, fell 12.9%. PodcastOne, a podcast company majority owned by LiveOne, dipped 10.3%.

Companies involved in live music also fared poorly. Sphere Entertainment Co. fell 13.9% while sister company MSG Entertainment fell 6.8%. Live Nation dropped 6.4%. Secondary ticket marketplace Vivid Seats fell 9.6% and ticketing company Eventbrite sank 4.7%. Sphere Entertainment’s decline was mirrored in other companies that also rely on travel to Las Vegas: Las Vegas Sands Corp. lost 6.7%, MGM Grand International dipped 9.3%, Caesars Entertainment fell 9.5% and Wynn Resorts dropped 10.6%.

Multi-sector music companies — a combination of mainly recorded music and music publishing — fared relatively well. Universal Music Group lost 1.5%. Warner Music Group dropped just 0.7%. Reservoir Media was down 3.5%.

There was also a clear divide between companies that derive the majority of their income within the U.S. and companies that do not. Live music and ticketing companies based in the U.S. fell an average of 8.3% while German concert promoter CTS Eventim fell just 2.4%. Radio companies and LiveOne, which are more subject to the health of the U.S. advertising market, fared worse than Spotify, which fell just 1.2% despite offering an ad-supported tier in the U.S.

The most valuable American companies suffered huge losses as investors gauged the tariffs’ impact on foreign-manufactured goods. Apple shares dropped 9.3%, wiping out more than $300 billion of market value. Amazon, which does brisk business on items manufactured in Asian countries facing large tariffs, fell 9.0%. Meta, which relies on advertising for nearly all of its revenue, also dropped 9.0%.

K-pop companies SM Entertainment and HYBE were among the best-performing music stocks of the week as most stocks were dragged down by continued uncertainty about U.S. tariff policy and new data on higher-than-expected inflation.

SM Entertainment, home to NCT Dream and RIIZE, was the week’s best performer after gaining 6.7% to 107,000 KRW ($72.91). That brought the company’s year-to-date gain to 47.4% — the best of any music stock.

HYBE, which counts BTS and its solo members’ projects among its vast roster, improved 3.7% to 240,500 KRW ($163.87). On Thursday (March 27), HYBE announced that BTS songs such as “Dynamite” and “Butter” will be featured on Lullaby Renditions of BTS, out April 4 on Rockabye Baby! Music. HYBE shares are up 19.7% year to date, the fifth-best among music stocks.

Trending on Billboard

K-pop fared well during a down week for most stocks and markets in general. YG Entertainment, home of BLACKPINK and BABYMONSTER, rose 3.3% to 63,500 KRW ($43.27) while JYP Entertainment was unchanged at 61,300 KRW ($41.77).

Outside of South Korea, music stocks reflected the challenging economic conditions and uncertainties that have hurt stocks in recent weeks. The 20-company Billboard Global Music Index (BGMI) declined 2.9% to 2,459.98, marking its fourth decline in the last six weeks. With just eight of its 20 stocks finishing the week in the black, the BGMI fell into correction territory as its value has declined 10.7% since the week ended Feb. 14. The first six weeks of 2025 were good enough to overcome the recent slump, however, and the BGMI is up 15.8% year to date and has gained 40.4% over the last 52 weeks.

Stocks took another hit on Friday (March 28) after the core personal consumption expenditures price index, a measure closely watched by the U.S. Federal Reserve, increased 0.4% in February. That put the 12-month inflation rate at 2.8%. Both figures were above experts’ expectations. The tech-heavy Nasdaq composite finished the week down 2.6%, increasing its year-to-date decline to 11.7%, while the S&P 500 fell 1.5%. In the U.K., the FTSE 100 increased 0.1%. South Korea’s KOSPI composite index fell 3.2%. China’s SSE Composite Index dropped 0.4%.

The BGMI was pulled down by Spotify’s 6.5% decline and a 4.2% drop by German concert promoter CTS Eventim. Warner Music Group, one of the index’s largest companies, dropped 2.7% to $31.56.

Tencent Music Entertainment (TME) gained 2.7% to $14.38 after Deutsche Bank upgraded its rating on TME shares to buy from hold. Universal Music Group rose 2.0% to 25.99 euros ($28.12) after Wells Fargo upped the rating on the company’s shares to overweight from equal weight and increased the price target to 33 euros ($35.70) from 28 euros ($30.29).

Music streaming company LiveOne had the week’s biggest decline at 14.1%. The company announced on Wednesday (March 26) that subscribers and ad-supported users surpassed 1.4 million.

Radio company iHeartMedia fell 6.8%, putting its year-to-date loss at 23.0%. Satellite broadcaster SiriusXM dropped 3.1% to $22.75, though it’s still up 1.7% in 2025.

State Champ Radio

State Champ Radio