Korea

Page: 2

HYBE is continuing to work to protect its artists. Korea’s Northern Gyeonggi Provincial Police Agency (NGPPA) worked with the global entertainment company to arrest eight individuals who are suspected of creating and distributing deepfake videos of HYBE Music Group artists, Billboard can confirm. Deepfakes are false images, videos or audio that have been edited or generated using […]

On March 12, a video surfaced online that caused quite a stir. It was a new Coca-Cola ad featuring K-pop group NewJeans, also known as NJZ, which is currently at the center of much controversy. The ad quickly garnered reactions from around the world.One comment on the ad effectively captures the essence of the project: “Is this from the ’80s or 2025? Is it real or is it a dream? Is it nostalgia or a memory of something I never experienced? It’s a work that confuses all of this. It feels like it’s depicting the past, but actually, it seems like an idealized version of the present moment. Ordinary yet beautiful people, scenes that feel both real and dreamlike, all captured with ethereal music and visuals. I can’t stop replaying it, as I don’t want to let go of the dreamlike feeling it gives me.”

The campaign, with creative direction by Billboard Korea, presented a unique blend of subtle retro vibes and fresh, modern sensibility that immediately caught fans’ attention. More than just a brand advertisement, it has been recognized as a work that conveys cultural and emotional interpretation. In the conversation below, Billboard Korea explains how they created a unique sensibility connecting the 1980s with Seoul in 2025.

[embedded content]

How was the theme “I Feel Coke” conceptualized for the ad?

“I Feel Coke” was both the theme of a Coca-Cola Japan ad series that aired between 1987 and 1990 and the title of a song by Daisuke Inoue, which was featured in those commercials. The original ad was widely praised for capturing the spirit of Japan’s economic boom in the 1980s. In the 2025 Seoul version, we reinterpreted it as a tribute, blending nostalgia with a contemporary twist.

The new ad was inspired by the concept of Anemoia, a term that describes a sense of longing for a time or culture one has never actually experienced. We wanted to evoke the emotions tied to Coca-Cola from past eras while reimagining them in a fresh, modern way. Every detail was carefully crafted to preserve that feeling of nostalgia while making it relevant to today’s audience.

Can you explain “Anemoia” in more detail?

The term Anemoia was first introduced in 2012 by American writer John Koenig in “The Dictionary of Obscure Sorrows.” It describes the feeling of nostalgia for a time or culture one has never personally experienced. This emotion resonates strongly with Generation Z, who, amid uncertainty and anxiety, find themselves longing for the perceived prosperity and joy of past eras.

This growing fascination with revisiting and reinterpreting the past played a key role in shaping our creative direction. Our goal was to modernize nostalgia—capturing the essence of past memories while making them feel fresh and relevant today.

It’s clear that NewJeans being the models fits well. They both represent Gen Z and evoke nostalgia.

Exactly. NewJeans effortlessly blend a “longing for the past” with the “sophistication of the present.” As highlighted in Billboard Artist last October, they are not only icons of Gen Z but also a reflection of the nostalgia this generation experiences. Their unique ability to reimagine past eras with a fresh, modern twist made them the perfect match for this project and that synergy shines through in the ad.

What elements from the past were specifically referenced and which parts were reinterpreted in a new way?

One element that deeply moved us in the original ad was the happiness depicted — especially the brief moments of happiness that can be found in everyday life. We also paid close attention to authentic 1980s Japanese elements, such as the yuppie lifestyle, baseball, pay phones, leisure and health aesthetics, and more. In the 2025 Seoul version, we sought to reframe these experiences through the lens of Gen Z, while still capturing the sense of longing that was present in the original ad, reimagined with modern sensibilities.

What aspects of 2025 Seoul did you incorporate into the ad?

We aimed to capture different aspects of everyday life in 2025 Seoul, from the city’s efficient transportation system and vintage markets to social media content creation, instant photography and young adults moving into their first apartments. We also highlighted outdoor delivery meals and romantic moments on college campuses, small yet authentic elements that will resonate with people for years to come. These moments represent the happiness of today’s youth, which was at the heart of our vision for this project.

NewJeans’ rendition of “I Feel Coke” has garnered attention for its refreshing and dreamy vibe. How does it differ from the original song from the past?

ADOR and its A&R team aimed to preserve the essence of both the original song and the era it came from while capturing the signature feeling of the Coca-Cola brand. At the same time, they wanted to reinterpret it through the emotions NewJeans embodies today. The goal was to craft a track that complements NewJeans’ warm, understated, yet sophisticated vocal style.

The intro’s synthesizer melody follows the same pattern as the original, but with a fresh sound design. As the song progresses, the synthesizer and electric guitar in the second verse echo the original’s nostalgic vibe, while the outro introduces a saxophone, bridging the dreamy atmosphere of the past with a modern, refreshing touch.

How was the vocal distribution among the members decided?

ADOR carefully arranged the vocal distribution to highlight each member’s individual strengths. For the final choir section, they focused on enhancing the harmonies, ensuring that each member’s unique tone blended seamlessly while preserving the choral beauty of the original song.

Were there any special episodes during the arrangement and recording process?

During the arrangement process, the members of NewJeans gave input on the intro sound, helping refine it to perfectly complement the visuals of the ad. During recording, they focused on making the song their own while also capturing Coca-Cola’s signature sense of energy and refreshment, making the entire experience truly special.

In addition to the main ad video, there were also sub-content pieces. What were they?

Yes, we created several additional content pieces to enhance the campaign. For example, we designed illustrated posters featuring the 1980s Coca-Cola logo and imagined what Billboard Korea magazine covers might have looked like if it had existed back then.

NewJeans also shared behind-the-scenes collage videos filmed with disposable cameras and camcorders, capturing candid and intimate moments. These extra elements added emotional depth to the ad and gave fans a rare, personal glimpse into the members’ real personalities.

After the online release, there was an overwhelming public response. Can you share some memorable comments?

We got a lot of reactions, like: “It’s strange that I cried even though it’s just a commercial.” “It feels like watching an uplifting youth movie.” “The legendary collaboration between Billboard and Coca-Cola.” “I can’t stop replaying it.” “I’m only drinking Coca-Cola now.” (Fun fact: Coca-Cola sales went up on the release day and the day after.) The project manager at Coca-Cola Korea also shared that the comment “It delivers happiness in chunks” really stood out to them.

The collaboration between Billboard and Coca-Cola was also unique.

Exactly. We often take “happiness” for granted because it’s always around, and we think we understand it. But one of the simplest yet most essential ways to capture that feeling is through music. That’s why we believe music is the perfect medium to express the “feeling of happiness” that Coca-Cola stands for. The partnership between Coca-Cola and Billboard, with their rich histories, created a unique connection between music and advertising.

Do you have any behind-the-scenes stories you can share?

The sunny, warm summer vibe in the ad was actually filmed on a snowy day. [Laughs]

For over a year, the K-pop industry has been embroiled in a heated debate over the girl group NewJeans. In fact, even the name “NewJeans” has become a point of contention following the group’s announcement in February that they would be rebranded as NJZ. However, their management company, ADOR, has disputed the legitimacy of this name change. While the group has requested to be referred to as NJZ, no legal ruling has been made on the matter, leaving the existing contract intact. As a result, from a legal standpoint, NewJeans remains the more accurate designation for the time being.

Amid ongoing legal uncertainties, NewJeans is moving ahead independently. This March, the group is scheduled to perform at ComplexCon Hong Kong, where they are reportedly debuting a new song. This move appears to be an attempt to further establish their rebranded identity as NJZ. After all, performing NewJeans’ hit songs while adopting a new name could be seen as contradictory.

Trending on Billboard

Music organizations and associations in Korea are closely monitoring the NewJeans situation. In February, five major organizations — the Korea Management Federation, Korea Entertainment Producers’ Association, Record Label Industry of Korea, Recording Industry Association of Korea and the Korea Music Content Association — issued a statement expressing concerns over NewJeans and former ADOR CEO Min Hee-jin’s independent activities. Their primary issue is “tampering,” with suspicions that Min has been attempting to remove NewJeans from ADOR.

The statement from the five organizations reads, “For the past 10 months, we have observed a growing trend, in which certain parties attempt to resolve private disputes through media campaigns and unilateral public statements instead of proper negotiations or legal procedures, including former ADOR CEO Min Hee-jin’s press conferences, NewJeans member Hanni’s appearance at a National Assembly audit, and the group’s independent activities.”

NewJeans fans argue that these five organizations are merely echoing ADOR/HYBE’s stance. However, the key issue at hand is their emphasis on the importance of “adhering to legal processes.”

At a press conference on Nov. 28, 2024, NewJeans members announced that “their contract with ADOR would officially end at midnight on November 29th.” They stated, “We have had enough conversations and sent certification of content, but there were no responses during that time. As ADOR and HYBE have breached the contract, we are terminating it.”

Since then, NewJeans has continued its individual actions and reiterated its stance in interviews with foreign media. In a CNN interview last month, the group emphasized, “We have completely lost trust in ADOR. We believe we will win this battle against HYBE and ADOR.” Through Japan’s TV Asahi, a subsidiary of Asahi Shimbun, they stated, “Right now, there are very few media outlets in Korea that carry our voices. Instead of letting that discourage us, we will enjoy our activities.”

International fans who have closely followed NewJeans’ statements may be more inclined to side with the group. However, with both the lawsuit verifying the validity of their claims and the injunction application still ongoing, their assertions remain one-sided. In this context, foreign media that present NewJeans’ perspective without providing balanced coverage of the ongoing legal dispute risk spreading misinformation.

NewJeans and ADOR remain deeply divided, locked in a tense standoff. On March 7, the Seoul Central District Court held the first hearing on ADOR’s provisional injunction request to “maintain the status of agency and prohibit the signing of advertising contracts.” Both parties presented conflicting arguments and failed to reach a resolution.

As a result, it is challenging to take a definitive stance between ADOR or NewJeans. The most prudent thing to do right now is to wait and see how the court reaches its decision, based on the various claims and substantial evidence presented by both parties.

This is precisely the position shared by the five music industry organizations in Korea. On Feb. 27, they held a press conference titled, “Let’s Keep a Promise: Without Record Producers, There is No K-pop!,” where they declared:

“No one can confirm the cancellation of a contract before the court’s judgment, and we must all accept the legal outcome, whatever it may be. This is the only way to protect our industry amid conflict and dispute.”

For now, the K-pop community watches and waits for the court’s decision — a ruling that could have lasting implications for NewJeans, ADOR and the entire industry.

This article was written by Austin Jin and originally appeared on Billboard Korea.

With their first anniversary just a month away, UNIS looks back on a year of unforgettable moments and exciting changes. In an exclusive interview, the members share what they have learned, how they’ve evolved, and the new challenges they’re ready to embrace.In about a month, you’ll celebrate your one-year anniversary since debut. What has been the most memorable moment of the past year and why?

HYEONJU: My debut is the moment I remember most. It was UNIS’s very first step, and it remains vividly imprinted in my memory.

NANA: I feel the same way.

GEHLEE: I loved the experience of our very first fan signing at a shopping mall in the Philippines. It was my first time witnessing firsthand how deeply my hometown fans adore UNIS. It was truly an honor.

KOTOKO: For me, the day I first met our fans is unforgettable. Meeting those I had longed to see filled me with immense joy.

YUNHA: I believe our debut moment is the most memorable. Revealing UNIS to our eagerly waiting fans was incredibly nerve-racking!

ELISIA: It was during the KBS Music Festival, sharing the stage with our seniors in our first collaborative performance on such a grand scale. UNIS’s “Curious” featured a fresh, fun intro and an energetic dance break that made it especially enjoyable.

YOONA: I clearly remember when we received our first rookie award. It was a prize we had dreamed of, and it felt like a true recognition of all our hard work.

SEOWON: my birthday in 2025 stands out. It was the day I truly realized how much EverAfter supports me and why I started this journey.

Comparing your early days to now, what has been the biggest change?

HYEONJU: It’s the sense of responsibility. Initially, I felt an overwhelming pressure to “do well,” but now I trust my members and simply think, “We’ll be great.”

NANA: I’d say the biggest change is that I’ve grown 1cm taller since debuting!

GEHLEE: I feel much more relaxed and confident. The training after the debut has helped tremendously, and improving my Korean has made adaptation so much easier. I really feel like I’m on the right track now.

KOTOKO: It seems that everything has changed, especially my ability to express myself through a variety of facial expressions.

Over the past year, is there a particular skill or quality you’d like to pass on to your fellow members?

NANA: I want to learn English from ELISIA and GEHLEE!

KOTOKO: HYEONJU’s charisma is incredibly captivating.

ELISIA: I used to move gently and fluidly, but since coming to Korea, I’ve learned to execute sharper, move quickly.

YOONA: I admire ELISIA’s wide range of expressions on music shows and stage performances. I’d love to learn that from her.

SEOWON: I’d love to learn knitting from the talented YUNHA!

As a multinational group representing Korea, Japan, and the Philippines, how do you integrate this strength into your stage, performances, and music?

HYEONJU: Our multinational makeup naturally enhances our expressiveness.

NANA: Knowing the tastes of each country gives us a unique advantage to incorporate diverse elements into our performances.

KOTOKO: Our ability to cover Japanese, Filipino, and various other songs is a major strength.

YUNHA: Being multinational means we can cover songs from our respective countries and showcase new facets of ourselves in different languages.

YOONA: At fan signings, for instance, many international fans attend. We communicate in three languages and even perform cover dances to foreign songs.

With the fandom name “EverAfter” in mind, what special memories do you hope to create with your fans in the future?

GEHLEE: I dream of holding a concert just for EverAfter. Seeing fans holding light sticks and sparkling like stars on stage would be an unforgettable moment, Everafter our fandom name.

KOTOKO: I want to embark on a world tour and meet EverAfter fans around the globe.

SEOWON: I envision opening a café exclusively for EverAfter fans, staffed entirely by UNIS!

Which cities would you like to visit on a world tour?

HYEONJU: I want to visit countries on the other side of the globe. I’ve been to nearby countries, but I’ve yet to meet EverAfter fans from the farthest corners of the world.

NANA: Japan, since it’s my hometown. It would be a dream to visit on tour someday.

KOTOKO: Me too!

GEHLEE: Personally, I’d love to visit New York or Paris. Their fashion scenes fascinate me and meeting fans there would be incredibly exciting.

YUNHA: I’d go anywhere EverAfter is present. I visited Taiwan briefly for a performance and, although it was short, I loved the city’s vibe and would love to return.

ELISIA: I aim to perform at Japan’s Kyocera Dome. I want to become a world-star artist and take the stage there!

YOONA: I’d like to visit Singapore. It’s a country I’ve always wanted to see, with beautiful scenery and a wonderful atmosphere.

SEOWON: For me, it’s Paris and New York. I’ve always wanted to visit these cities at least once.

What is UNIS’s goal for this year?

HYEONJU, KOTOKO, YUNHA, ELISIA, YOONA, SEOWON: Our goal is to top all the music shows!

NANA: For me, it’s all about meeting as many EverAfter fans as possible!

GEHLEE: It would be amazing to hold a UNIS-only concert this year. Even though each of us brings a unique charm, we’re working together to deliver a spectacular performance.

What new aspects or endeavors can fans expect from UNIS in 2025?

HYEONJU: We plan to showcase many sides of UNIS that we haven’t had the chance to reveal before.

NANA: While we’ve always shown a cool image, we’d also love to show a cuter side of ourselves.

GEHLEE: I believe UNIS won’t be confined to a single concept. We’re ready to display everything from cute and lovable to chic and cool. Fans can look forward to a variety of styles next year.

YUNHA: Now that we’re nearing our first anniversary, we hope fans will see a more refined and dynamic performance that reflects our growth from countless stage experiences.

What must UNIS overcome to be recognized as the representative 5th generation girl group?

HYEONJU: I think it comes down to growth. We must continue to develop and show progress.

GEHLEE: To be acknowledged as the leading 5th generation girl group, we need to better showcase our unique identity. With so many amazing groups out there, it’s vital that we continually cultivate and enhance UNIS’s distinctive charm through our performances, music, and teamwork.

YUNHA: For me, it’s about mastering our mindset and always challenging ourselves with confidence is the key.

ELISIA: We must connect people of all generations through our music.

SEOWON: We need to carve out our own unique identity rather than being just another ordinary girl group. That’s how we can present ourselves as a fresh, innovative act to the public.

Are there any hidden talents or personal skills among the members that fans might not know about?

NANA: My fingers are very flexible!

GEHLEE: I’m not sure if it’s a talent, but I frequently notice “angel numbers” like 111, 2222, and 3737, whether on clocks, license plates, or suddenly appearing in my surroundings.

KOTOKO: I’d say it’s HYEONJU. She’s our very own “food expert” who knows all the best eats!

ELISIA: SEOWON can make the most amazing sauces. They’re so delicious, they completely blew me away!

YOONA

Image Credit: FandF Entertainment

I love it when fans call me: Yoondol-e or Yoondang-e (puppy)

My favorite song at the moment?: “To My X” by KYUNGSEO – The lyrics are so warm, and I’ve always admired this Sunbae!

But my favorite song of all time is?: “Good Parts” by LE SSERAFIM – It’s soft, warm, and uplifting—my perfect combo!

How to “heal” yourself when you’re feeling overwhelmed?: Journaling about my day. If that doesn’t work, I read or listen to music!

My favorite quote or best advice someone gave me: Practice as seriously as you perform—that’s how you master the stage.

SEOWON

Image Credit: FandF Entertainment

I love it when fans call me: SEOWON: Lim-hamkki! (Lim-Hamster)

My favorite song at the moment?: “Just For Today I LOVE YOU” by BOYNEXTDOOR – I’m a fan of this style of music!

But my favorite song of all time is?: “Play Pretend” by Alex Sampson – It comforts me. I still listen to it all the time!

How to “heal” yourself when you’re feeling overwhelmed?: I haven’t found my healing method yet. Maybe someday I will!

My favorite quote or best advice someone gave me: You don’t have to try so hard. If you’re struggling, that’s not happiness. Remember why you started. It’s a journey—perfection isn’t required.

KOTOKO

Image Credit: FandF Entertainment

I love it when fans call me: Ko-chan!

My favorite song at the moment?: “Classified” by OH MY GIRL – It magically melts my stress away!

But my favorite song of all time is?: “Candy Pop” by TWICE – I sang this during my audition. Full of memories!

How to “heal” yourself when you’re feeling overwhelmed?: Putting stickers or playing games!

My favorite quote or best advice someone gave me: Try anything at least once.

GEHLEE

Image Credit: FandF Entertainment

I love it when fans call me: Princess!

My favorite song at the moment?: “Strategy” by TWICE – It’s my confidence anthem! I can’t stop humming it!

But my favorite song of all time is?: “Lovefool” by The Cardigans – My mom and I sing this out daily. Our ultimate bonding song!

How to “heal” yourself when you’re feeling overwhelmed?: I write down my feelings, dance to my favorite song, or vent to someone close. Letting it all out helps me reset!

My favorite quote or best advice someone gave me: When hard times come, remember it’s just a step toward everything you’ve prayed for.

ELISIA

Image Credit: FandF Entertainment

I love it when fans call me: Baby/Ellie!

My favorite song at the moment?: “First Love” by Hikaru Utada – A Japanese song my family and I always sing together. It feels nostalgic!

But my favorite song of all time is?: “Times Are Hard for Dreamers” from Amelie, the Musical – It’s my anthem for chasing my K-pop dreams!

How to “heal” yourself when you’re feeling overwhelmed?: Listening to music or curating new playlists!

My favorite quote or best advice someone gave me: Love yourself first before loving others.

NANA

Image Credit: FandF Entertainment

I love it when fans call me: Nana-chan!

My favorite song at the moment?: “Heroine” by Back Number – It’s a winter song, perfect for this chilly season!

But my favorite song of all time is?: “Last Dance” by BIGBANG – I danced to this as a kid, and it’s been my anthem ever since!

How to “heal” yourself when you’re feeling overwhelmed?: Going outside!

My favorite quote or best advice someone gave me: Nana, there’s something only you can do.

HYEONJU

Image Credit: FandF Entertainment

I love it when fans call me: Jyu!

My favorite song at the moment?: “Toxic Till The End” by ROSE – I’ve always loved this ‘Sunbae(Senior in Korean)’, and now it’s stuck in my head!

But my favorite song of all time is?: “I Hate You, I Love You” by Gnash – My go-to song during my training days. Still holds a special place!

How to “heal” yourself when you’re feeling overwhelmed?: Going outside for a walk!

My favorite quote or best advice someone gave me: You can do anything.

YUNHA

Image Credit: FandF Entertainment

I love it when fans call me: Bbang-ahji! (Puppy)

My favorite song at the moment?: “Gondry” by HYUKOH – I’m obsessed with calm, moody tracks lately.

But my favorite song of all time is?: “New Rules” by Dua Lipa – This song inspired me to become a singer. Life-changing!

How to “heal” yourself when you’re feeling overwhelmed?: Drawing, reading, or crafting—hobbies keep negative thoughts away!

My favorite quote or best advice someone gave me: If you don’t speak up about your hunger, no one will know.

ATEEZ has emerged as one of the most popular K-pop groups in the U.S., achieving milestones that defy industry norms. They became the first group unaffiliated with the “Big Four” entertainment companies, such as SM, JYP, YG, and HYBE, to top the Billboard 200 chart. In 2024, they became the first K-pop boy group to perform at Coachella and claimed their second Billboard 200 No. 1 with their 11th mini album, Golden Hour: Part 2. Yet, their name remains curiously absent from Korea’s domestic music scene.

Album sales paint a striking picture. Their 11th mini album sold over one million copies in its first week. However, their Korea streaming performance tells a different story. ATEEZ is nowhere to be found on Korea’s YouTube Music Hot 100 chart or the charts of local platforms like Melon, Genie, Bugs, and FLO. Spotify data reveals their most streamed cities are Jakarta, Bangkok, Tokyo, Kuala Lumpur, and Singapore, notably excluding Seoul.

Stray Kids, under JYP Entertainment, face a similar paradox. Their album HOP made history in 2024 as the first to achieve six consecutive Billboard 200 No. 1 albums by a group. This record-breaking achievement prompted the announcement of a 20-stop global stadium tour in 2025, solidifying their global appeal. Yet in Korea, their title track “Chk Chk Boom” failed to claim the top spot on major streaming charts. Like ATEEZ, their strongest Spotify numbers come from Indonesia, Japan, Chile, Brazil, and Malaysia.

Trending on Billboard

K-pop thrives globally, driven by its fiercely loyal fanbase. According to IFPI’s Global Music Report, SEVENTEEN’s FML and Stray Kids’ 5-STAR ranked first and second, respectively, in global album sales for 2023. In IFPI’s Global Artist Chart, SEVENTEEN, Stray Kids, Tomorrow X Together, and NewJeans all placed in the Top 10. However, this global success highlights a surprising shift: K-pop’s domestic market no longer mirrors its international dominance.

Data from the Korea Culture and Tourism Institute (KCTI) illustrates this disparity. In 2023, K-pop’s overseas revenue reached 1.2377 trillion KRW (approximately $950 million USD), while HYBE reported 63.3% of its earnings from international markets in the first half of 2023. JYP followed with 52.2% and YG at 48.6%. Luminate’s Mapping Out K-pop’s Global Dominance report placed Korea as the fourth largest consumer of K-pop, trailing Japan, the U.S., and Indonesia.

Then why is K-pop less visible in its home country?

To better understand this, one must revisit the mid-2010’s, a period when K-pop began its meteoric rise in the U.S., spearheaded by BTS’s success at the Billboard Music Awards and their domination of Western charts. Back home, K-pop reigned supreme in Korea’s music scene, led by heavyweights like BLACKPINK, TWICE, EXO and SEVENTEEN, while audition programs such as Produce 101 captivated audiences and amplified K-pop’s domestic appeal.

Ironically, as K-pop’s global footprint grew, its local presence waned. The absence of a trusted official chart to represent Korea’s music industry dealt a major blow. Once reliable indicators of popularity, real-time charts on platforms like Melon and Genie fell into disrepute after controversies surrounding chart manipulation and ballot rigging in audition programs. These incidents eroded public trust in K-pop as a genre.

By 2018, the industry shifted its focus from broad audience appeal to catering to core fandoms. Fanbases, in turn drove album sales to record-breaking heights, pushing physical sales to over 116 million units in 2023, a tenfold increase over the past decade. Billboard 200 chart topping acts, which were once a rarity, have now expanded to include a slew of K-pop groups like SuperM, Tomorrow x Together, and NewJeans.

Billboard Korea: Predicting K-pop Companies’ Strategies for 2025

Meanwhile, K-pop’s evolution into a fandom centric business model has redefined its strategy. Entertainment companies prioritize retaining and strengthening existing fanbases over attracting casual listeners and songs are designed to reinforce a group’s identity rather than to appeal to the masses. Global promotions, such as BTS’s and BLACKPINK’s massive stadium tours in the U.S. and Japan, underscore this trend, with groups like Stray Kids and ATEEZ leading the charge in self-produced artistry.

In Korea, K-pop activities increasingly resemble fan service. Despite low domestic ratings, programs like Music Bank, M Countdown, and Inkigayo remain important platforms for launching new songs and generating live performance clips for social media platforms such as YouTube. This demonstrates that while K-pop may no longer be music for everyone, its transformation into a niche-driven, global phenomenon is undeniable.

However, not all groups face this disconnect. Acts like aspea, IVE, SEVENTEEN and NewJeans continue to dominate Korean media and achieve commercial success domestically. Across the board, K-pop’s overall revenues keep climbing, driven largely by its international market.

As K-pop popularity continues to grow around the global, its strategy continues to evolve. English lyrics, international artist collaborations, and streamlined promotional cycles reflect its shift toward the global stage. Circle Chart data shows that the percentage of English lyrics in girl group releases reached 41.3% in 2023, up nearly 19% from 2018. For boy groups, the figure stood at 24.3%. Major comebacks are now followed by world tours, with U.S. talk shows often serving as debut platforms for new releases.

As K-pop increasingly focuses on global markets, can it find a balance between domestic recognition and international acclaim? Will it achieve a universal appeal similar to Latin music, fostering sustainable support both at home and abroad? The dual identity of K-pop, its paradoxical success offers both challenges and opportunities for the industry’s future.

This article is courtesy of Billboard Korea.

When BLACKPINK was gearing up for its highly anticipated debut in 2016, rising creative director SINXITY was adamant the group needed an unexpected sound to distinguish itself. Alongside the group’s explosive EDM-trap banger “BOOMBAYAH,” the young exec at YG Entertainment pushed for a secondary, simultaneous single in the minimalist-yet-emotionally tinged “Whistle” to show their wider, “magical” range to distinguish them from YG’s other female outfit, 2NE1. Nearly a decade later, BLACKPINK remains one of the most successful acts from South Korea, and SINXITY is overseeing a new female quartet made for the global stage while emphasizing that “identity and diversity are important.”

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

Seven years after exiting YG Entertainment and launching AXIS as a multi-operational label, production house and creative incubator for internationally minded projects, SINXITY (neé SJ Shin) is the executive producer for the freshly debuted cosmosy. The act consists of four Japanese singers who trained in Korea under the K-pop system and sing in a mix of English, Japanese and Korean to appeal to the global pop market. Two members, De_Hana and Kamión, rose to recognition after competing on Produce 101 Japan The Girls (a local spin-off of the Korean singing competition series that created Billboard Japan Hot 100 chart-toppers JO1, INI and ME:I), are joined by relative newcomers Himesha and A’mei, respectively the eldest and youngest member, who trained in dance since childhood (while idolizing the likes of British superstar Dua Lipa and BLACKPINK’s Thai icon Lisa).

Trending on Billboard

Executing the internationally minded group brings NTT Docomo Studio & Live (the entertainment wing of Japan’s major mobile carrier) together with Sony Music Korea (the Seoul-based label that recently signed multilingual Monsta X member I.M in 2022 for his solo work). The move isn’t entirely without precedence with XG (the Japanese girl group based in South Korea that sings in English with a mix of U.S., Japanese and Korean management), or the likes of HYBE’s KATSEYE and JYP Entertainment’s VCHA girl groups (both Los Angeles-based acts sing in English but have performed across Asia and the Americas). Leading all of cosmosy’s creative and professional decisions, SINXITY proudly says this is a group where the members’ “natural talent should be what’s emphasized.”

“I really want to open up a new path for the girls for them to be able to do a lot of different genres and try different concepts,” he shares during an afternoon video call when he’s taking a break from putting the final touches on cosmosy’s first music video before it goes live at midnight. “Inevitably, people are gonna compare the girls to groups like XG, NiziU, and the other Japanese girl groups, but I want to do something for them that is new and different. Whether it’s K-pop, J-pop, pop, hip-hop, R&B, I want to incorporate various music genres and create a new path for them.”

SINXITY and cosmosy both describe the group as having a “girlish crush” concept, inspired by the girl crush image that K-pop acts like BLACKPINK, ITZY, and (G)I-DLE embody with cosmosy peppering in additional sprinkles of mystique, innocence and even a little devilishness blended into “a group that has never existed before,” according to De_Hana.

“Unlike the typical girl crush everyone knows, our concept includes both cool and cute elements,” explains Kamión, an Osaka native who spent time studying abroad. “There is also a touch of mystery, which evokes the atmosphere of Japanese horror or anime.” Meanwhile, Himesha and A’mei use “mysterious” to describe the group.

After unveiling cosmosy’s debut single “zigy=zigy” alongside its music video on New Year’s Eve, the track was released globally on Feb. 7 to kick off the first of multiple digital singles the act will drop throughout the year with an EP potentially eyed for spring. With Korean television appearances and fashion-magazine features on the horizon, SINXITY emphasizes that as important as new cosmosy content is, the next, urgent priority is to meet fans in person.

“They’re super talented, really pretty, such nice and charming girls; I really want people and fans to meet them directly,” the producer adds. “The key factor is how to meet core fans.”

Showing up to work as one’s true self and connecting to others authentically is personally important for SINXITY, who says he’s finally at ease in a professional environment where he’s comfortable to fully focus his energy on the work at hand.

“The Korean entertainment industry has become safer than in the past,” he shares. “Because I am gay, identity and diversity are very important to me and something I’m trying to build on…it’s still not widely accepted to be in the LGBT community since there are restrictions and laws for gay people, but it’s more accepted and it’s a safer, better space compared to others. But it’s still not a thing to come out and be openly gay.”

Noting the three women assisting him during this video call in Seoul, SINXITY estimates that 90 percent of the crew that works with cosmosy are women. That’s a rarity in Korean entertainment, and an even bigger percentage than AXIS’ division focused on producing Boy Love (also known as BL) television, the popular genre of same-sex drama series that boasts majority female audiences. With works including the 2022 breakout hit Semantic Error and FC Soldout currently airing, SINXITY and AXIS are inevitably shifting the norms of what and how Korean-pop entertainment operates simply in the name of creativity — and openly support other industry shakers.

“I’ve worked overseas, I’ve done a lot of projects with YG in Japan and Korea,” says SINXITY, who also worked with YG Entertainment’s actors roster during his time. “I have a unique identity, so I can’t help but talk about it and share myself here anyway. I just want to be free to create, reach more people and show them even more in these creative areas.”

SINXITY smiles before asking to include an additional note before the call wraps and he goes back to color-correcting the “zigy=zigy” video.

“One more thing: wait for NewJeans and stand up for Min Hee-jin,” SINXITY says, with a visibly surprised translator noting that he may be the first Korean executive to support the embattled former CEO of ADOR publicly. “I really admire Min Hee-jin and respect her. She’s the one and only best producer in this K-pop industry, so I really [want to] stand with her and really pray for NewJeans to have more free activities. We’re in some of the same networks, but I’m really just a fan. She’s really the one-and-only qualified producer.”

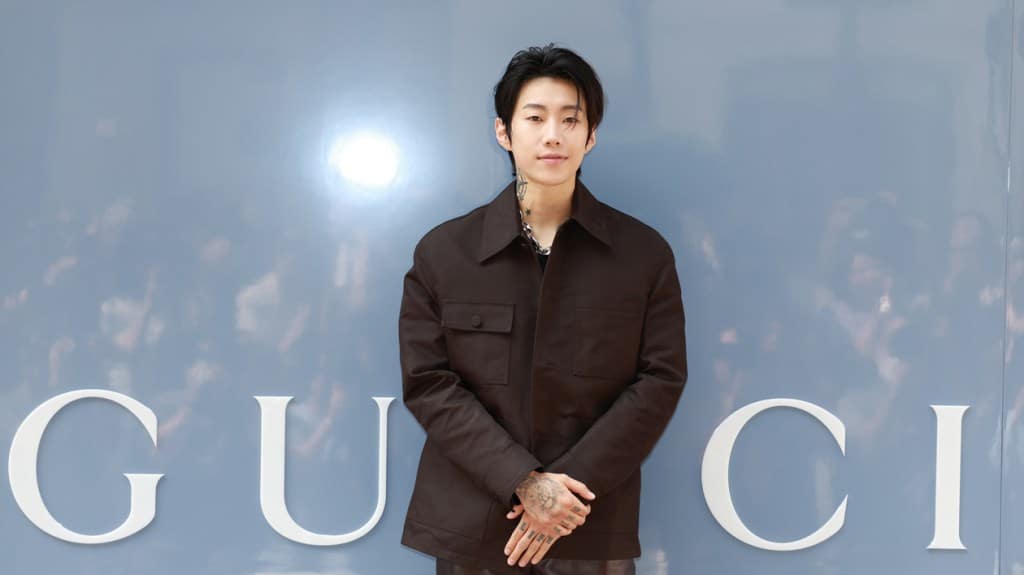

K-hip-hop star Jay Park is asking a U.S. court to force Google to unmask an anonymous YouTube user so he can sue in Korean court, citing allegedly defamatory internet videos linking him to drug traffickers and disparaging Korean-Americans.

Attorneys for the American-born Park say a YouTube account transliterated as Bburingsamuso has subjected the artist to a “malicious” campaign of videos, including one claiming he works with Chinese mobsters to import drugs and another suggesting Korean-Americans like Park “exploit” the country with illegal activities.

Park’s lawyers have already filed a defamation lawsuit in Korea, but in a petition filed Thursday (Jan. 9) in California federal court, they say that the foreign lawsuit “cannot proceed” without a U.S. subpoena forcing Google to hand over the user’s identity.

Trending on Billboard

“The defamatory statements falsely accuse Jay Park of being involved with organized crime, drug trafficking, and unethical conduct, all of which have caused significant harm to his reputation and professional endeavors,” the singer’s attorneys write. “Despite extensive efforts to identify the anonymous YouTuber through publicly available information, Jay Park has been unsuccessful to date. Consequently, Jay Park now seeks the assistance of this court.”

Google could legally object to such a request, including by potentially arguing that the subpoena would violate the First Amendment and its protections for anonymous speech. But Park’s attorneys say the U.S. Constitution simply doesn’t apply since they “strongly” believe the poster lives in Korea.

“Jay Park is not attempting to infringe on the anonymous YouTuber’s First Amendment rights because the anonymous YouTuber appears to be a citizen of Southern Korea,” the filing says. Park’s lawyers cite an earlier precedent that says U.S. legal protection for free speech “doesn’t reflect a U.S. policy of protecting free speech around the world.”

As K-pop and other Korean music have exploded in global popularity over the past decade — and with it an intensely enthusiastic online fan culture — numerous stars have turned to Korea’s strict defamation laws to fight back against what they say are false statements about them on the internet.

In 2019, HYBE (then Big Hit Entertainment) filed criminal cases alleging “personal attacks” on the superstar band BTS. In 2022, Big Hit did so again over “malicious postings” about BTS, even asking the group’s famous fan “army” to help gather evidence. YG Entertainment, the label behind BLACKPINK, has also filed its own complaint against “internet trolls,” accusing them of “spreading groundless rumours about our singers.”

It’s also not the first time such litigants have turned to the U.S. courts to help. In March, the K-pop group NewJeans filed a similar petition in California federal court, seeking to unmask a YouTube user so that the band could press for criminal charges in Korea over “derogatory” videos.

In that case — filed by the same lawyer who represents Park in his case filed this week — a judge eventually granted the subpoena. But it’s unclear from court records the extent to which Google has complied with it.

A Google spokesman did not respond to a request for comment on Park’s petition. But in a policy statement regarding government requests for personal information, the company says: “Google carefully reviews each request to make sure it satisfies applicable laws. If a request asks for too much information, we try to narrow it, and in some cases we object to producing any information at all.”

ROSÉ has signed a global publishing administration deal with Warner Chappell Music. News of the deal arrives as her single “APT.” (featuring Bruno Mars, who is also signed to Warner Chappell and Atlantic Records) continues to dominate on the Billboard Global 200 and Global Excl. U.S. charts.

About a month ago, the song debuted at No. 1 on both charts and continues to rank at the top through the week of Nov. 23. It also debuted in the top 10 of the Billboard Hot 100 chart, which tracks popular singles in the U.S.

Though ROSÉ has been a global icon since she joined BLACKPINK as its lead singer in 2016, “APT.” further solidified the singer as a star in her own right and acts as an introduction for her solo debut album rosie, which is set to drop on Dec. 6.

Trending on Billboard

“I am beyond excited to join the team at Warner Chappell,” ROSÉ said of her new deal in a statement. “There is so much more to come that I can’t wait to share — it’s going to be an amazing journey.”

“ROSÉ has earned this moment, and it’s a huge honor to officially welcome her to our Warner Chappell family,” added Ryan Press, president of North America at Warner Chappell, in a statement. “As she breaks record after record, she’s singlehandedly redefining the K-pop genre while also paving the way for a new era of cross-cultural expression. We’ve already hit the ground running with our partners at Atlantic to support ROSÉ’s bold vision and explore new creative opportunities for her songs. Above all, we can’t wait to see where her music takes us next.”

Born in Auckland and raised in Melbourne, ROSÉ has had her mind set on a career in music since she was 15. To help her achieve her dreams, the young singer moved to South Korea and soon after was selected as a member of BLACKPINK, the first K-Pop girl group to grace the cover of Billboard, win a VMA and headline Coachella.

Though BLACKPINK had a number of top global hits, including “Pink Venom,” “How You Like That,” “Ice Cream (with Selena Gomez),” “Shut Down” and more, the members of BLACKPINK, like many other performers in the K-pop genre, did not take part in the songwriting process of those songs, meaning ROSÉ and her bandmates did not receiving publishing royalties. Now, the singer, whose real name is Park Chaeyoung (or Roseanne Park in English), is in the writing room, lending her pen to her new solo works “APT.” and “Number One Girl,” the second single to be released ahead of rosie. She also received writing credit for the two songs on her debut EP R, released in 2021.

Billboard and Billboard Korea have joined forces with CJ ENM to expand the global influence of the K-pop industry. The entertainment company behind KCON and MAMA AWARDS has inked a memorandum of understanding (MOU) with Billboard and Billboard Korea, ahead of the first Billboard Korea print issue mid-year. Harry H.K. Shin, Head of Music Entertainment […]

Kakao Entertainment is aiming to accelerate the global expansion of K-pop thanks to a new partnership with Billboard and Billboard Korea. The company announced that it has signed a partnership agreement with the American music and entertainment magazine to enhance the influence of K-pop worldwide. Joseph Chang, co-CEO of Kakao Entertainment, met with Billboard President […]

State Champ Radio

State Champ Radio