iHeartMedia

Trending on Billboard

Radio companies had mixed results in the third quarter in their efforts to build digital businesses, cut costs and manage a decline in broadcast advertising dollars as consumers shift to newer entertainment platforms.

iHeartMedia’s consolidated revenue of $997 million was down just 1.1%, well within the company’s guidance of a low single-digit decline. Excluding the impact of political advertising in the prior-year period, revenue was up 2.8%. CEO Bob Pittman said during the company’s earnings call on Monday (Nov. 10) that the advertising environment is “pretty good” and iHeartMedia is “not feeling anything” related to the U.S. government shutdown.

Related

An operating loss of $116 million stemmed from a $209 million impairment charge related to the value of iHeartMedia’s FCC licenses. Excluding the impact of the write-down and other extraordinary items, adjusted earnings before interest, taxes, depreciation and amortization (EBITDA), a common measure of profitability from ongoing operations, was flat at $205 million.

The multi-platform division, which includes iHeartMedia’s broadcast and network businesses, had revenue of $591 million, down 4.6% due to lower political advertising and what the company called “uncertain market conditions.” Adjusted EBITDA of $119.2 million marked an 8.3% decrease from the prior-year period, despite lower employee compensation costs.

The digital audio group, which includes podcasts, had revenue of $342 million, up 14%, and adjusted EBITDA of $130.3 million, up 30.3%. Podcast revenue increased by 22% to $140 million.

Based on trends for the top advertisers and advertising agencies, Pittman said he has “confidence” that the multi-platform division will return to revenue growth. “We’re feeling similar momentum to what other ad-supported companies have discussed right now: Spending is holding up, and discussions with advertisers are positive,” he noted on the company’s earnings call. Although iHeartMedia has not felt any impact from the government shutdown, Pittman conceded it “does add a level of uncertainty.”

Related

iHeartMedia said it remains on track to create $150 million in annual cost savings in 2025. In addition, the company took steps in the third quarter to save an additional $50 million in 2026, which COO/CFO Rich Bressler said will come mainly from the multi-platform division.

Looking ahead, iHeartMedia expects fourth quarter revenue to be down in the low single digits. Adjusted EBITDA is expected to be $200 million to $240 million, down from $246 million in the prior-year quarter because of political advertising in the 2024 election year. The multi-platform division is expected to be down in the low single digits. Digital revenue is expected to grow in the high single digits, and podcast revenue specifically is expected to grow in the mid-teens.

Cumulus Media, the country’s third-largest radio broadcaster by revenue, reported that third-quarter revenue fell 11.5% to $180.3 million. CEO Mary Berner cited a “challenging” advertising environment and touted Cumulus’s efforts to cut costs and employ AI to improve efficiency. Broadcast revenue plummeted 17.2% to $115.0 million. Digital revenue fell 2.6% to $39.0 million but would have grown 8.4% without the losses of The Daily Wire and conservative commentator Dan Bongino, who left podcasting to become the deputy director of the FBI. Consolidated adjusted EBITDA fell to $16.7 million from $24.1 million a year earlier.

Related

Townsquare Media faced “numerous headwinds,” CEO Bill Wilson said in a statement, but the company met its previous guidance on revenue and adjusted EBITDA. Revenue dropped 7.4% to $106.8 million and would have dropped 4.5% if political advertising were excluded. Adjusted EBITDA fell 13.5% to $3.4 million.

iHeartMedia shares fell 6.0% to $4.29 on Tuesday (Nov. 11) following the earnings announcement on Monday afternoon. The stock had jumped 55.9% in the week ended Nov. 7 following a report that the company was in talks with Netflix to distribute its podcast content.

Cumulus Media shares soared 31% to $0.135 the day after the company released earnings on Oct. 30. The stock has since lost all of those gains and more, however, and closed at $0.10 on Tuesday (Nov. 11).

Townsquare Media shares fell 11.3% to $5.42 on Monday following the quarterly earnings report. The stock rose 0.6% to $5.45 on Tuesday.

Trending on Billboard

iHeartMedia struck a new partnership with TikTok that will see TikTok creators featured in long-form audio and video content across iHeart platforms, it was announced on Monday (Nov. 10).

The deal includes the launch of the TikTok Podcast Network, a slate of up to 25 podcasts from TikTok creators. Under the agreement, iHeartMedia will open co-branded podcast studios in Los Angeles, New York and Atlanta that will be set up for both audio and video content. The podcasts will be distributed by iHeartPodcasts and made available on the iHeartRadio app and other podcast platforms. Listeners will also be able to watch highlights and clips from the podcasts on TikTok.

Related

Another component of the deal is TikTok Radio, which will pair TikTok creators and established iHeartRadio personalities on iHeart broadcast radio stations across the U.S. and digitally on iHeartRadio. According to a press release, “TikTok Radio will feature not only TikTok’s hottest new songs, but also trend-driven storytelling and emotional context behind the music,” with segments including Behind-the-Charts, New Music Fridays and On the Verge.

iHeart and TikTok will additionally team up on iHeart events like the iHeartRadio Music Festival and iHeartRadio Jingle Ball, “empowering brands to activate with a dynamic network of content creators,” according to the release.

More details on the partnership will be announced in the coming months.

“This partnership connects TikTok’s cultural energy and creator community with the unmatched scale and reach of iHeartMedia,” said Rich Bressler, president, COO and CFO of iHeartMedia, in a statement. “We’re giving creators access to the biggest audio platforms in America — creating new ways to tell stories, entertain, and build deeper connections with fans. Together, we’re combining our vast networks to deliver relevant content on a massive scale. It’s a win for creators, fans, and brands alike.”

Related

“At TikTok, empowering creativity and connecting communities are at the heart of everything we do,” added Dan Page, global head of media and licensing partnerships at TikTok. “This partnership with iHeartMedia opens up exciting new opportunities for creators and brands to reach wider audiences, collaborate across platforms and extend their creativity beyond the TikTok platform. Together, we’re amplifying the connection between artists, creators and our community through the shared power of cross platform storytelling.”

TikTok and iHeart kicked off their partnership earlier this year with the singing competition Next up: Live Music, which was hosted exclusively on TikTok LIVE.

No billionaires bickering here — just your regularly scheduled edition of Executive Turntable, Billboard‘s weekly roundup of promotions, hires, exits and everything in between across the music industry. Let’s get to it…

Veteran touring executive Leslie Cohea will join WME’s Nashville office in mid-July as a partner and music touring executive. She comes to the agency after 10 years at Sandbox Entertainment, where she served as global head of touring and played a key role in guiding the careers of artists including Kacey Musgraves, Dan + Shay, Kelsea Ballerini, Midland and Little Big Town. Before playing in the Sandbox, Cohea spent nearly a decade at AEG Live/The Messina Group, focusing on touring and concert promo and producing national tours for biggies like Ed Sheeran, Dave Matthews and Eagles. Named a Billboard executive of the week in 2023, Cohea will report to WME co-heads Becky Gardenhire, Joey Lee and Jay Williams.

Trending on Billboard

iHeartMedia announced that Scott Hamilton shifted from his role as principal accounting officer to a consulting position, effective June 2. Subsequently, Michael McGuinness, the deputy CFO since 2019, was appointed as the new accounting chief. Hamilton has served in senior accounting roles at iHeartMedia since 2010 and previously held leadership positions at Avaya and PwC. McGuinness joined iHeartMedia in 2019 and brings prior experience from The Hain Celestial Group and Monster Worldwide. In its SEC filing regarding the change, iHeart emphasized that Hamilton’s transition is not due to any dispute with the company, including issues related to accounting practices or financial reporting.

Big Loud Records appointed Lauren “LT” Thomas as senior vp of radio promotion. Thomas joins Big Loud’s fellow svp of radio promo Tyler Waugh, with both execs reporting to evp of radio promotion Stacy Blythe. Thomas previously served as svp of promotion at Sony Music Nashville, where she led promotion efforts for RCA Nashville and Columbia. Prior to her role at Sony, Thomas worked for five years at Phoenix country music station KMLE-FM. –Jessica Nicholson

Melanie Johnson is PPL’s first-ever director of transformation, a role created to lead a company-wide innovation initiative aimed at expanding PPL into the global leader in neighbouring rights royalty collections. Reporting to CEO Peter Leathem, Johnson will leverage her extensive experience across publishing, labels, DSPs and tech — including roles at Audoo, Utopia Music, Facebook and Sony/EMI — to enhance royalty distribution through amped-up technology and data systems. Her appointment comes as PPL reports over $375 million in collections for 2024. Johnson also serves as vice chair of Music Minds Matter and has been a trustee for the Ivors Academy Trust. Leathem said Johnson’s “commercial thinking, paired with deep industry knowledge” will be a great asset to the UK collective management organization.

Oak View Group welcomed Donna Freislinger Huffman as svp of global procurement. Reporting to CFO Ade Patton and president of premium experiences Josh Pell, Huffman will lead initiatives to streamline procurement, boost cost efficiency across OVG’s global footprint. Her responsibilities also include advancing supplier diversity and sustainability. Huffman brings over 20 years of experience from roles at United Airlines, Vanderbilt University and Hillrom, with a “track record for transforming sourcing organizations and driving enterprise-wide value,” said Patton.

Riser House Entertainment expanded its team with three key hires at the Nashville-based label and publisher. Alex Heimerman joins as vp of streaming and strategic partnerships, bringing experience from UMG Nashville, Red Light Management and The Trenches. Hayley Irvine becomes product manager, overseeing project execution after roles at BMG/Broken Bow Records. Eliza Charette steps in as project and label relations coordinator, supporting artist campaigns and operations, with priors at Madison Square Garden and Big Loud. All three report to Riser House president Jennifer Johnson and label manager Megan Schultz. “At Riser House, we don’t just chase trends — we build legacies,” said Johnson. “As our roster grows with some of the most authentic artists in music, it’s only fitting that our team grows too.”

NASHVILLE NOTES: Marketing agency Results Global launched a new four-person digital and social media division, led by Katrina Maddox, formerly head of digital at The HQ. Joining her are Lindsey Parrish, previously a marketing manager at MV2, and Tess Schoonhoven, who served as social media manager at Venture Music. Rounding out the team is Conner McEuen, appointed as paid media manager after his role as a paid social strategist at Zero Gravity Marketing … Bobbii Jacobs launched Wildflower Entertainment Group, a multifaceted company specializing in artist management, development, brand partnerships and talent booking. Alongside it, she introduced a sister venture, Backstage Access Presents, which focuses on curating VIP fan experiences. Jacobs brings extensive experience to the new ventures, having most recently served as partner and president at Forefront Networks.

IMAGINE, a Berlin-based creative studio specializing in music-driven storytelling, opened a new office in Paris as part of its European expansion. Marie Gleiss has been appointed head of expansion, and Maxence Janvrin joins as business development manager, both bringing deep ties to the City of Lights’s cultural scene. The duo will help advance IMAGINE’s mission of building brand connections through music-first strategies. Co-founder Shai Caleb Hirschson emphasized that music has the ability to foster brand recall and drive more than just clicks. “We’re not here to slap a jingle on a logo,” he said. “We create sound-first strategies that move people, inspire loyalty, and generate long-term brand value.”

Betsie Becker is officially the executive director of Berklee NYC, following her interim leadership since September 2023. Over the past two years, she has been instrumental in growing the campus’s leadership team, enhancing academic programs, and deepening community partnerships. Her achievements include appointing Merrily James and Daniel Pembroke to key roles and strengthening collaborations with NYC Public Schools, Carnegie Hall’s B-Side program and the Fashion Institute of Technology. Becker joined Berklee in 2019 as assistant vp for global program development and co-led the institution’s COVID-19 response. Her previous leadership experience includes roles at Juilliard, Decoda and Ensemble Connect.

Top Drawer Merch, a Los Angeles-based full-service merchandise company, appointed Claudia Peña as director of live events. In this role, she will lead the creation of immersive, attendee-focused brand activations at festivals, tours, and pop-ups, merging storytelling with commerce. Peña, founder of festival beauty brand Lunautics, brings experience in luxury retail and experiential marketing. Her hire follows Top Drawer’s success with events like SLANDER and Insomniac’s Starbase Festival.

In a year filled with economic uncertainty and instability, iHeartMedia is seeing “generally stable ad spend,” CEO Bob Pittman said during the company’s first quarter earnings call on Monday (May 12).

The radio and podcasting giant had first-quarter revenue of $807 million, up 1.0% from the prior-year period. Excluding political advertising, which was boosted by the 2024 elections, revenue increased 1.8%.

The multi-platform segment, which includes broadcast stations, had revenue of $473 million, down 4%. But Pittman expressed cautious optimism that radio advertisers are remaining with the format. Premiere Radio Networks, which represents national advertising, was up 2% in the quarter. “I think that’s sort of an indication that the bigger advertisers are hanging in there,” he said.

The 1% revenue uptick was a positive for a company that stood to bear the brunt of an advertising slowdown due to U.S. tariff policy. Analysts had expected revenue to decline 1.6% to $786 million.

Trending on Billboard

iHeartMedia is increasingly a podcast company, and the digital audio group continued to be a growth source. In digital, revenue rose 16% to $277 million and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) improved 28% to $87 million. The company had a unique podcast audience of 32.7 million and 177 million streams and downloads in March — both No. 1 in the U.S., according to Podtrack.

“We’re beginning to feel the flywheel effect of being the strong number one in podcast publishing. Our podcasting financial discipline and our focus on the high-margin podcast publishing sector continue to fuel what we believe is the most profitable podcasting business in the United States and to accelerate our growth,” said Pittman.

The audio and media division’s revenue fell 14% to $59.3 million due primarily to non-recurring contract termination fees earned by Katz Media last year. The segment’s adjusted EBITDA dropped 33% to $15.8 million.

The company expects its second quarter consolidated revenue to be down in the low single digits compared to the same period last year. April “pacing” was down 2% year over year, according to CFO Rich Bressler. For iHeartMedia to hit its full-year guidance and avoid a possible down advertising market, Bressler added, the company will need “some positive movement in the macro [environment] and improvement to the uncertainty in the back half of the year.”

Shares of iHeartMedia jumped 19.3% to $1.54 in early trading Tuesday (May 13) but had fallen to $1.22, down 5.4%, by midday.

iHeartRadio is facing a class-action lawsuit from subscribers after disclosing that several of its radio stations were hacked months ago, exposing Social Security numbers, financial information and other personal details.

The lawsuit came a week after the radio giant warned customers in regulatory filings last week that “an unauthorized actor viewed and obtained files” at a “small number of our local stations” in December, potentially stealing SSNs, dates of birth, and credit card info.

iHeart said it “immediately implemented our response protocols” to contain the hack, and is offering free credit monitoring to those affected. The company also said it had “strengthened its existing security measures” to “help prevent something like this from happening again.”

Trending on Billboard

Those assurances were not enough for Cheryl Shields, a subscriber who filed a proposed class action against iHeart on Wednesday in New York federal court, seeking to represent customers nationwide whose data was compromised. In doing so, her attorneys blasted iHeart for waiting four months to warn subscribers that their data was at risk.

“As a result of this delayed response, plaintiff and class members had no idea for four months that their private information had been compromised, and that they were, and continue to be, at significant risk of identity theft and various other forms of personal, social, and financial harm,” Shield’s lawyers write. “The risk will remain for their respective lifetimes.”

The data exposed in the iHeart breach “represents a gold mine for data thieves,” the lawyers write, and there has been “no assurance offered by iHeart that all personal data or copies of data have been recovered or destroyed.”

A spokesperson for iHeart did not immediately return a request for comment on Thursday.

Such lawsuits are common following data breaches. After the credit-reporting company Equifax suffered a 2017 data breach that exposed the personal data of nearly 150 million Americans, the company agreed to pay $425 million to resolve nationwide class-action litigation filed by consumers.

The scale of the iHeart data breach is undoubtedly far smaller. The company did not disclose in regulatory filings how many total victims were involved nationwide, though a notification filed in Maine said only three subscribers in that state had been impacted. Disclosure forms were also filed in California and Massachusetts, as first reported The Record.

In technical legal terms, Wednesday’s lawsuit accused iHeart of negligence, arguing that the company had a legal duty to safeguard consumer’s data.

“As a national media and audio provider in possession of millions of customers’ private information, iHeart knew, or should have known, the importance of safeguarding the

Private Information entrusted to it by Plaintiff and Class Members and of the foreseeable consequences they would suffer if iHeart’s data security systems were breached,” Shields’ lawyers write. “Nevertheless, iHeart failed to take adequate cybersecurity measures to prevent the data breach.”

It’s time to tighten our belts for another Executive Turntable, Billboard’s weekly compendium of promotions, hirings, exits and firings — and all things in between — across the music business. There’s been a gob of staffing news this week, so let’s hop to it.

Dawn Gates, senior vp of digital business and creative development at Universal Music Group Nashville (UMGN), announced her departure after nearly 20 years to launch Seven Note Enterprises, a consulting and management firm. Her exit coincides with UMGN’s rebranding as MCA under new leadership by CEO Mike Harris and chief creative officer Dave Cobb, who came aboard in early February following the departure of Cindy Mabe. During her tenure with UMG Nashville, Gates most recently served as the core liaison for global digital businesses, integration strategies and marketing initiatives. Gates initiated the launch of and oversaw Sing Me Back Home Productions, a production arm of UMG Nashville, established in 2024. Gates, who recently welcomed twins with her wife, Harper Grae, expressed gratitude for her time at UMGN and excitement for her new venture.

“After 19 transformative years with Universal Music Group, I’m stepping away to write the next chapters of my career,” said Gates, who can be reached at dawn@seven-note.com. “I’m deeply grateful to UMG – especially Mike Dungan and Cindy Mabe – for the belief in my vision and the support in taking bold, often unconventional, risks. I’ve had the privilege of working alongside some of the most innovative and driven minds in music. However, the industry continues to shift and the way we develop artists, build stories, and connect with audiences is changing – and so am I.”

Trending on Billboard

Meanwhile…

Universal Music UK appointed Rachel Tregenza and Charlotte Allan to lead its communications and policy team, reporting to svp of communications and policy Tom Williams. Tregenza, a Universal Music Group veteran of over a decade, steps into the role of senior director of communications and global artist strategy. She will focus on international storytelling for UMUK artists and collaborate with the audience and media division. Allan joins as vp of global communications and public policy from Milltown Partners, where she advised clients across creative and tech sectors. Her responsibilities will include corporate communications and UK policy initiatives. Williams, who has led global communications campaigns for UMG, will now oversee all communications and public policy efforts for Universal Music UK. Jonathan Badyal, who has spent eight years at UMUK, most recently as director of communications, will depart this summer for a new opportunity. UMUK president Dickon Stainer praised Tregenza and Allan for bringing a dynamic perspective and thanked Badyal for his contributions. “With Tom’s guidance, they have a fresh and ambitious perspective both for our communications and storytelling in the UK, as well as the international storylines of our UK artists overseas,” said Stainer.

iHeartMedia appointed David Hillman as executive vice president, chief legal officer and secretary. Hillman, who is based in Los Angeles, will oversee all legal matters, including compliance, regulatory, corporate governance, government and business affairs, and privacy teams. He brings extensive media experience, having recently served as chief legal officer at Venu Sports, a joint venture between ESPN, FOX, and Warner Bros. Discovery. Hillman also held roles at Paramount Global, Simon & Schuster and Westwood One. Bob Pittman, iHeartMedia’s chairman and CEO, praised Hillman’s relevant experience and “familiarity with the audio industry.” Hillman added: “I look forward to working with iHeart’s leadership, partners, and the talented Legal team to help advance the company across every corner of the audio landscape.”

Virgin Music Group promoted Hannah Thompson-Waitt to senior vice president of commercial strategy. In her new role, she’ll lead the U.S. commercial team from the company’s Los Angeles headquarters, focusing on streaming strategy, analysis and fan acquisition across a wide swath of artists. Thompson-Waitt, who reports to Zack Gershen, evp of global commercial and digital strategy, previously served as vp of commercial strategy and held senior roles at mtheory, with a career that began in 2014 when she launched her own K-pop media company. Her experience includes work with Clairo, St. Vincent and others. She also sits on the advisory board of Queer Capita and holds degrees from the University of Texas and NYU.

Michael Beckerman has been named the next dean of The UCLA Herb Alpert School of Music, beginning no later than Oct. 1 of this year. A leading musicologist known for his work in Czech and Eastern European music, Beckerman has held academic positions at NYU, UC Santa Barbara and Washington University in St. Louis, and has authored seven books and received prestigious honors such as the Dvořák and Janáček Medals. Beckerman holds degrees from Hofstra and Columbia, and serves on various academic boards. UCLA executive vice chancellor and provost Darnell Hunt lauded Beckerman’s credentials, saying his “academic, professional and administrative experience and achievements, coupled with his UC roots, position him well to lead The UCLA Herb Alpert School of Music at this pivotal moment.” Beckerman, in turn, emphasized his passion for music and dedication to supporting students and expanding the school’s reach locally and internationally. The UCLA Herb Alpert School of Music combines performance, scholarship and music industry training in its program.

Messina Touring Group made a round of promotions. The company has elevated Nick Ayoub to head of digital strategy and operations, to lead MTG’s overall digital operations. Ayoub also leads digital strategy for record-breaking stadium tours, including those by Taylor Swift, Ed Sheeran and more. Kara Smoak rises to director of digital marketing and continuing to lead digital marketing and creative strategy for all MTG country artists, including George Strait, Kenny Chesney, Eric Church, Blake Shelton and more. Meesha Kosciolek has been promoted to director of production, MTG Nashville, while Alvin Abshire has risen to digital operations manager. Lucy Freeman has been promoted to digital marketing manager, and Madison Machen has been elevated to manager, partnerships and branding. –Jessica Nicholson

Black River Entertainment named LeAnn Bennett as vice president of label services. In her new role, Bennett will oversee business affairs, A&R administration and sync licensing, reporting to EVP Rick Froio. A longtime consultant for Black River, she officially joins the team with over 30 years of industry experience, including past roles at Capitol Records Nashville, Compass Records and the Country Music Hall of Fame. Since 2010, she has also led Bennett Entertainment Group. Froio praised the move, calling it “a natural fit,” while Bennett called the BRE “the best in the business.”

NASHVILLE NOTES: Curb Records elevated Allyson Gelnett (Massey) to national director of promotion & strategic initiatives, up from her previous role as director of promotion. Since joining the label in 2018, Gelnett has played a key role in developing artist campaigns and driving success across country radio. In her expanded role, she’ll work alongside svp of promotion RJ Meacham to craft and implement strategies aimed at growing fanbases and boosting airplay in top markets … Warner Music Nashville promoted two members of its commercial partnerships team: Katherine Firsching shifted to partnerships director from manager of video strategy, and Blair Poirier stepped up to division manager from coordinator.

Darkroom Records named Nina Lee as head of communications and publicity. Based in New York, Lee will lead the label’s communication strategies and publicity campaigns, collaborating closely with CEO Justin Lubliner and the Darkroom team. With over ten years of experience in music, tech and entertainment PR, Lee will manage publicity for artists including d4vd, John Summit, and Wisp. Meanwhile, Alexandra Baker of High Rise PR continues to oversee campaigns for Billie Eilish and FINNEAS. Previously, Lee held senior roles at Shore Fire Media and The Oriel Company. A first-gen Korean American and NYU alum, she is a strong advocate for equity in entertainment and mentors through the Next Gem Femme program. Lubliner praised Lee’s creative approach and deep understanding of artist development, noting “she understands the importance of narrative and works closely with artists to help them best tell their stories.”

Ikenna Nwagboso and Camillo Doregos launched Hi-Way 89 Entertainment, a new music company based between Toronto and Calgary, with distribution through Vydia/gamma. The company focuses on artist development and label services, highlighting talent from Canada and Africa. Their first major signing is Canadian pop/R&B singer Chrissy Spratt, whose debut single “In Too Deep” releases on April 25. Nwagboso, co-founder of emPawa Africa, has launched careers for artists like Joeboy and Fave. Doregos, founder of DC Talent Agency, has worked with artists like Pheelz and booked talent for major festivals. Both hail from Nigeria, and Hi-Way 89 has also signed Nigerian artist Siraheem and South African DJ Chelsea Sloan, aiming to bridge African and Canadian music markets.

BOARD SHORTS: The MLC put out an APB seeking candidates for its board of directors and several key committees. Several terms for publisher reps are expiring this year, with elections for open seats taking place soon. Selected members will serve three-year terms, with the possibility of renewal. Current openings include one publisher seat on the Dispute Resolution Committee, two on the Operations Advisory Committee, and two on the Unclaimed Royalties Oversight Committee. These groups provide policy and procedural recommendations to the board. Suggestions are due by May 22 and can be submitted via this form … AEG Presents executive Brent Fedrizzi was elected to his second non-consecutive term as board president of the North American Concert Promoters Association, following the trade group’s annual meeting April 15 at the Beverly Wilshire in Los Angeles. (His initial term ended in 2022, with Jodi Goodman succeeding him.) NACPA also elected 2025 board members, including Anthony Nicolaidis (Live Nation), Chuck Steedman (The Live Co.), Jodi Goodman (Live Nation) and John Valentino (AEG).

Shelby Paul launched boutique public relations firm Evolvance PR, specializing in strategic communications, media relations, story development and more. Paul previously worked as director of communications at Big Machine Label Group, leading media strategy for the label and its publishing arm Big Machine Music. At BMLG, she worked with artists including Carly Pearce, Conner Smith, Thomas Rhett, Lady A, Rascal Flatts, songwriters Jessie Jo Dillon and Laura Veltz, and more. Paul’s prior stops include the Academy of Country Music, Detroit Pistons and Allied Global Marketing. –J.N.

Trent Allison has been promoted to senior director of sales and special events for AEG Presents‘ venues in Georgia and Tennessee. Based in Nashville, he will oversee certain events at The Pinnacle, AEG’s new flagship venue, while continuing his leadership at The Eastern, Terminal West, Variety Playhouse and Georgia Theater. Reporting to regional vp Mike DuCharme, Allison brings over 25 years of sales experience and a strong track record in revenue growth. Margarita Rios will become director of sales in Georgia, and Dell Ressl will be promoted to sales and operations manager, both reporting to Allison. Allison has been key to AEG’s venue expansion in Georgia since 2013.

Discord appointed Humam Sakhnini as chief executive officer, effective April 28. He will also join the board of directors. Co-founder Jason Citron will transition to an advisor role while remaining on the board, and Stanislav Vishnevskiy continues as chief technology officer. Sakhnini, with over 15 years of gaming industry experience, previously held leadership roles at Activision Blizzard and King Digital Entertainment. His appointment aligns with Discord’s renewed focus on gaming, including expansions into advertising, micro-transactions, and developer tools. Discord serves over 200 million monthly active users, who spend 2 billion hours gaming each month, and has seen strong revenue growth.

ALL IN THE FAMILY: Tim Chan is promoted to vp of e-commerce at PMC. In his new role, he will lead editorial strategy and performance across PMC’s e-commerce initiatives, collaborating with editorial, sales, and revenue teams to meet commerce goals. Chan will oversee shopping, hospitality and consumer tech content for PMC’s fashion and entertainment brands, including Billboard, and spearhead projects to grow revenue and audience reach. Chan joined PMC in 2016 as the founding editor of Spy.com and later became lifestyle editor at Rolling Stone. He has also worked at Snapchat, founded the independent fashion magazine Corduroy, and began his career in Canada as a producer for E! Network and MuchMusic. Craig Perreault, PMC’s chief strategy officer, praised Chan’s talent and creativity since joining the company nearly a decade ago: “He brings his deep talent, creativity and natural business instincts to everything he does and is responsible for significantly growing our e-commerce programs across the portfolio.”

ICYMI:

Nicole George-Middleton

Universal Music Group Nashville is rebranding as MCA under CEO Mike Harris and chief creative officer Dave Cobb. Staffing changes include Katie McCartney as executive vp and general manager and Tom LaScola as head of artist and audience strategy, reflecting the new direction … Atlantic veteran Gina Tucci launched a new independent dance label, 146 Records … Nicole George-Middleton was elevated to evp and head of creative membership at ASCAP. [Keep Reading]

Last Week’s Turntable: Island Elevates Its Head of Analytics

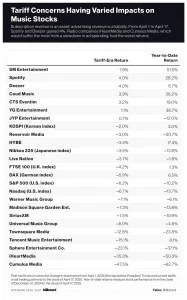

Investors seeking shelter from the chaos unleashed by President Trump’s often incoherent tariff policy can find safety in companies without direct exposure to tariffs or the teetering advertising market. And music, especially digital music, will be able to weather the storm, say many analysts — with one major exception.

To understand what people are thinking about tariffs’ impact on the business world, look no further than stock prices. The performance of various music-related stocks reveals how investors are betting that economic uncertainty will affect various companies.

Many stocks — especially those of companies traded on U.S. exchanges — have taken a hit as investors fled for safer alternatives. The Nasdaq and S&P 500, U.S. indexes, are down 6.2% and 6.7%, respectively, since April 1, the day before President Trump announced his tariff plans. Elsewhere in the world, indexes have generally performed better. South Korea’s KOSPI is down just 2.0%. Japan’s Nikkei 225 is off 3.5%. The U.K.’s FTSE 100 is down 4.2%. Germany’s DAX has lost 5.9%.

Trending on Billboard

Within music, companies that get most of their revenue from streaming are faring relatively well. Since April 1, Spotify and Deezer have each gained 4.0%, two of the better showings for music stocks. Cloud Music improved 3.9%. Tencent Music Entertainment, on the other hand, has fallen 15.1%, although its share price remains up 8.1% year to date.

Record labels and publishers have also been holding up well, in relative terms, particularly outside the U.S. Since April 1, shares of Universal Music Group (UMG) — which is headquartered in the U.S. but trades in Amsterdam — and Warner Music Group (WMG) are down 8.0% and 7.1%, respectively. Reservoir Media lost 3.0%. K-pop companies — much like South Korean companies in general — have fared well. Since April 1, SM Entertainment has gained 7.9%, YG Entertainment is up 1.1% and JYP Entertainment has gained 0.7%. HYBE fell 3.4%.

UMG and WMG’s post-tariff declines are slightly greater than the drops in the Nasdaq and S&P 500 of 6.7% and 6.2%, respectively. But both UMG and WMG had strong starts to 2025, and their year-to-date losses of 4.5% and 6.1% are far better than the S&P 500’s 10.2% drop and the Nasdaq’s 15.7% year-to-date decline.

Some live music companies’ stocks have been resilient, too. Live Nation shares are down 3.7% since April 1, while German concert promoter CTS Eventim is up 3.2%. Sphere Entertainment Co., owner of the Sphere venue in Las Vegas, is an exception. Sphere Entertainment shares have plummeted 23.1% since President Trump’s tariff announcement, a far more significant drop than the stocks of other companies — Caesars Entertainment, Wynn Resorts, MGM Resorts — that rely on consumers’ willingness to part with their money in Las Vegas.

For many U.S. media stocks, the direct impact of tariffs is “relatively muted,” wrote Citi analysts in an April 7 report, as many of the companies rely on discretionary spending, not ad revenue. Apple and other tech companies, for example, got an exemption from the 145% tariffs on Chinese imports but must still pay the blanket 20% tariff. Companies that get much of their revenues from subscriptions — Netflix, Spotify, UMG and WMG — will be less impacted.

Music streaming, most notably subscription services, is considered by equity analysts to be safe from whatever tariff-induced economic chaos awaits the global market. “Digital goods are unaffected by tariffs,” wrote TD Cowen analysts in an April 14 investor report. Subscription services, they argued, provide enough bang for the buck, and customers have such an emotional attachment to music that subscribers are unlikely to leave in “meaningful” numbers if the economy goes south.

Streaming and subscription growth slowed in 2024, but many analysts expect improvements to come from a regular drumbeat of price increases, renewed licensing deals and super-premium tiers. That said, analysts believe that Spotify’s latest licensing deals with UMG and WMG, and upcoming deals with other rights holders, better reward labels and publishers for price increases. As a result, TD Cowen slightly lowered its estimates for Spotify’s revenue, gross profit margin and operating income in 2025. Likewise, in an April 4 note to investors, Guggenheim analysts lowered their estimate for Spotify’s gross margin in the second half of 2025.

Companies reliant on advertising revenue will also take an indirect hit. Citi estimates that $4 trillion of imports could generate $700 billion in tariffs and reduce personal consumer and ad spending by 1.9%. Tariffs have ripple effects, too. Because household net worth and personal spending are highly correlated, says Citi, the recent declines in stock prices could reduce personal and advertising spending by 3.0%.

Consumer spending is at the heart of the concert business, but analysts agree that fans’ affection for their favorite artists protects live music from economic downturns. As a result, Live Nation has “less risk than the average business that depends on discretionary spending,” according to TD Cowen analysts.

Advertising-related businesses aren’t so lucky, though. As tariffs raise prices and household wealth declines, personal spending also declines, and, in turn, brands pull back on their advertising spending. Investors’ expectations for advertising-dependent businesses were apparent before April but have become clearer since President Trump’s April 2 tariff announcement. iHeartMedia, which closed on Thursday (April 17) below $1.00 per share for the first time since June 4, 2024, has dropped 35.3% since April 1 and fallen 50.3% year to date. Cumulus Media has fared even worse, dropping 47.5% since April 1 and 62.7% year to date. Townsquare Media has fallen 12.8% in the tariff era and 23.8% year to date.

J.P. Morgan analysts believe iHeartMedia’s full-year guidance of $770 million is “somewhat optimistic” given economic uncertainties and ongoing pressures in the radio business. It forecasts full-year EBITDA of $725 million — nearly 6% lower than iHeartMedia’s guidance. If things wind up going more the way J.P. Morgan predicts than iHeart, it would be a big blow to the company and an unfortunate bellwether for the already struggling radio business. While other music industry sectors look to ride out the tariffs at least in the shorter term, the economic uncertainty introduced by the Trump administration may only hasten radio’s ongoing decline.

As Billboard has noted numerous times in recent weeks, investors are attracted to music assets because they are counter-cyclical, meaning they don’t follow the typical ups and downs of the economy. Consumers will, by and large, stick with their music subscription services and continue going to concerts. But by introducing the tariffs, the Trump regime exposed one of radio’s greatest weaknesses as a business: a greater exposure, due to its reliance on advertising, to the state of the wider economy.

Billboard

Welcome to the latest Executive Turntable, Billboard’s weekly compendium of promotions, hirings, exits and firings — and all things in between — across the music business. There’s a full slate of personnel news this week, so let’s get started.

John Trimble, the longtime chief advertising revenue officer of SiriusXM — and Pandora before that — announced his departure after 16 years at the satellite/digital radio giant. Reflecting on his journey, he highlighted the twists and turns of his tenure, from Pandora’s start-up phase in the late aughts to its public offering and integration into SiriusXM in 2019. “Each step was defined by the risk-takers, colleagues who were truly teammates, and teammates who became friends,” he said on LinkedIn. “We built a high quality and sustainable revenue organization that can withstand the ups, downs and twists of crazy ad markets while being an integral part of the digital audio market.” Trimble, who lasted through seven CEOs and Pandora’s acquisition by SiriusXM, said he felt the company is in good hands and that it’s “time to go chase my growing bucket list.” Trimble joined Pandora in 2009 following stints at Glam Media and Fox Interactive. His successor as CARO is Scott Walker, previously the senior vp of the SiriusXM-owned ad platform AdsWizz. In a chat with Adweek this week, Walker said he aims to expand the company’s reach and improve its measurement and attribution capabilities.

Adrian Pope is the new executive vice president of digital business and global partner relations at Virgin Music Group. Based in London, he will connect VMG with its independent clients and digital partners globally. Pope previously served as chief digital officer at [PIAS] and managing director of its distribution and services business [Integral], collaborating with top indie labels and artists. He was instrumental in integrating [Integral] into Virgin following Universal Music Group’s acquisition of [PIAS] in 2024. With over 20 years in the digital music industry, Pope’s experience includes roles at Music Week and consultancy Understanding & Solutions. JT Myers, co-CEO of Virgin Music Group, praised Pope’s contributions to both [PIAS] and [Integral]. “We know his relationships and expertise will be important in our continued growth and success around the world and are grateful to have him play a key role on Virgin’s global leadership team,” said Myers.

Trending on Billboard

Jordan Fasbender, executive vp, chief legal officer and secretary of iHeartMedia, announced this week that she’ll resign by the end of the month to take a position outside the company. According to a new SEC filing, her resignation is not due to any disagreement with the company. The NYC-based legal executive joined iHeartMedia in mid-2019 as deputy general counsel and rose to her current role in November 2024 after signing new agreement extending her role through at least 2026. She previously served as senior vp and associate general counsel at 21st Century Fox and began her career as an associate at Weil, Gotshal & Manges LLP. Fabender’s replacement has not been announced, nor has she said where she’s headed next.

BMG is merging its Sync and Production Music teams into a unified global Sync Services structure to streamline operations and enhance services for clients in TV, film, advertising, gaming and tech. As part of this restructuring, Amberly Crouse-Knox and Scott Doran have been appointed senior vice presidents of Sync Services & Partnerships. Crouse-Knox will oversee North America and Latin America from Los Angeles, while Doran will lead UK and Asia-Pacific from London. Both will report to Johannes von Schwarzkopf, BMG’s chief strategy officer, and join Allegra Willis Knerr and Caspar Kedros in the global sync leadership team. Crouse-Knox has been with BMG since 2014, playing a key role in integrating X-Ray Dog Music. Doran, who joined in 2016, previously co-owned Altitude Music. This restructuring aims to strengthen the bridge between creators and clients, matching catalog cuts with impactful opportunities.

SharpTone Records appointed Jackie Andersen as its new head of label, succeeding Shawn Keith. With over 20 years in the industry and five years at SharpTone, Andersen has played a key role in the label’s growth. Her background in artist management has helped create supportive environments for musicians. She says “our commitment to empowering artists and connecting fans with cutting-edge music remains stronger than ever.” As part of the transition, Sal Torres has been promoted to head of A&R, bringing experience from Hopeless and Fearless Records. Founded in 2016, SharpTone, under the Nuclear Blast and Believe umbrella, continues to evolve. Nuclear Blast CEO Marcus Hammer and Believe Germany’s Managing Director Thorsten Freese praised Andersen’s vision, with Freese highlighting her “vision and expertise will foster even greater synergies across our network, allowing SharpTone to capitalize on Believe’s unique distribution, and audience development capabilities and global presence.”

Jody Williams Songs (JWS) promoted Nina Jenkins Fisher to vp/general manager and Tenasie Courtright to creative director. Fisher, with JWS since its inception in 2020, has signed and managed a diverse group of writers, including developing and major label artists, writer-producers and songwriters. She also oversees the company’s partnership with Warner Chappell Music. Courtright joined JWS in 2022 as creative coordinator and was later elevated to creative manager. Under Fisher’s supervision, Courtright now plays a key role within the company. JWS represents songwriters such as Andy Austin, Ashley McBryde and Vince Gill, and is a joint venture with Warner Chappell Music. Founder Jody Williams praised Fisher’s leadership in helping her launch the company from scratch and called Courtright an “innate communicator” who “offers creative ideas and solutions like a seasoned pro.”

Lauren Kilgore joined Sony Music Nashville and Provident Entertainment as senior vp of legal and business affairs. In this role, effective immediately, she oversees legal activities for both labels and collabs with business leaders to develop and implement legal, business and operational strategies. Kilgore reports to Taylor Lindsey, chair & CEO of Sony Music Nashville, and Ken Robold, president and COO. Recognized as one of Billboard‘s top music lawyers, Kilgore has spent her entire legal career in Nashville. She most recently served as a shareholder at Buchalter, where she handled various transactional entertainment matters.

Shore Fire Media promoted Chris Brudzinski to senior vp of business affairs and Dan Mansen to business operations specialist, reflecting the company’s growth since joining the Dolphin collective of marketing companies. Brudzinski, with 26 years at Shore Fire, will continue reporting to founder/CEO Marilyn Laverty. His role has expanded since joining as office manager in 1998 to include business development, accounting and human resources. He played a key role in adapting accounting practices after Shore Fire became a Dolphin subsidiary, collaborating with Dolphin CFO Mirta Negrini and overseeing a 50% increase in staff. Mansen, who started as mailroom coordinator in 2016, advanced to assist Brudzinski and became office manager in 2022. He led return-to-office procedures post-pandemic and managed Brooklyn HQ operations. In his new role, he’ll oversee accounts payable, sales order entry, and monthly accounting closings.

Global concert promoter Peachtree Entertainment added Marty Elliott as vp of university relations, and Andrew Goldberg as vp of strategic partnerships. Elliott has over 27 years of experience in venue management, business development and booking. Goldberg has previously held roles at Danny Wimmer Presents, Live Nation and Vinik Sports Group. –Jessica Nicholson

Musicians On Call, which brings music to the bedsides of patients in health care facilities, announced 11 internal promotions. Katy Epley is now chief operating officer, Elizabeth Black is senior vp of operations, and Nicole Rivera is vp of innovation. Other promotions include PJ Cowan (director of programs), Tarah Duarte (director of corporate partnerships), Melinda LaFollette (director of PR and events), Alli Prestby (creative director), Torianne Valdez (director of artist relations), Audrey Jadwisiak (senior program manager), Lia Okenkova (senior development manager) and Sasha Arnkoff (program manager).

NASHVILLE NOTES: Rachel Whitney is taking a sabbatical from her role as Spotify‘s head of editorial in Nashville, the company confirmed … Capitol Christian Music Group senior vp of A&R Josh Bailey left the company with plans to create his own firm involving both Christian and country music … Hsquared Management expanded its team with Kimberly Hopkins, who will serve as the day-to-day manager for Provident Label Group artist Lizzie Morgan and other clients.

New music streaming platform HIO is launching with an artist-first model designed to ensure a transparent path to compensation. Unlike traditional platforms, HIO’s per-user engagement model pays artists directly based on individual listener activity. HIO is led by CEO and founder Ryder Havdale, an indie label executive and musician, who envisioned the platform as an alternative to legacy streaming services. Arthur Falls, chief marketing officer, brings expertise from DFINITY Foundation and ConsenSys, while Galen Hogg, product lead, is a music industry veteran and NFT entrepreneur. The artist outreach team includes musician Eamon McGrath and Sheila Roberts, former director of marketing for PUMA Canada. “This isn’t about unpacking what traditional streaming services do or don’t do—it’s about proving there’s a better way,” said Havdale. “We built HIO because we believe artists deserve transparency, real engagement with their fans, and a revenue model that actually works for them.”

Chrysalis Records, part of the Reservoir group, appointed Colin Rice as director of catalogue marketing. Based in London, the former Sony executive will report to James Meadows, senior vp of marketing. He’ll focus on developing marketing strategies for the label’s catalog artists in the UK and internationally, collaborating with the US marketing team. Rice previously worked at Sony Music’s commercial music group division, overseeing international marketing for artists like Jimi Hendrix, Pink, Celine Dion. His achievements include international No. 1s for Mariah Carey’s “All I Want For Christmas” and campaigns for iconic albums by Pearl Jam, the Clash and others. Rice’s career began at Sanctuary Records, followed by roles at we7/Blinkbox music and Union Square Music. Meadows and Alison Wenham of Chrysalis Records praised Rice’s extensive experience and reputation.

Sound Talent Group promoted Sarah Pederson to director of finance, overseeing all accounting and finance operations for the agency. She began her entertainment career as founder and president of Family Tree Presents in Anchorage, promoting shows for bands like 36 Crazyfists. Through this work, she connected with STG co-founder Dave Shapiro, who invited her to join STG in San Diego as controller in 2020. Pederson, a metal fan, is excited about shaping STG’s future. Shapiro added: “She has been an integral part of our growth over the last 5 years and we look forward to many more years to come.”

Key Production Group, Europe’s leading bespoke physical music and packaging manufacturing broke, launched Key Intel, a new product development division led by strategy director John Service. This expansion includes entering the Irish market with newly hired consultant Ann Marie Shields. Key Intel will manage the ideation, creation and release of new products across the company’s subsidiaries. Upcoming innovations with sustainability in mind include a multi-disc boxset series, 3D packaging and a “100 % recycled alternative to shrink wrap.”

Iron Mountain Media and Archival Services appointed Andrea Kalas as vp to lead its expanded division. With over 20 years of experience, Kalas previously worked at Paramount, where she built a valuable film archive and preserved over 2,000 films, including The Godfather. She has also held roles at DreamWorks, Discovery and the British Film Institute. A former president of the Association of Moving Image Archivists, she is a member of the Academy of Motion Picture Arts and Sciences and founded the Academy Digital Preservation Forum Initiative.

ICYMI:

Julie Greenwald

Mercury Records promoted Tyler Arnold to chairman/CEO and Ben Adelson to president/COO of the label, home to Post Malone and Noah Kahn … Street Mob Records hired veteran music executive Gustavo López as its new president … Richard Vega and Stephen Schulcz were promoted to partners in WME’s music division … and former Atlantic Music Group boss Julie Greenwald is now an executive-in-residence at the Clive Davis Institute of Recorded Music at NYU’s Tisch School. [Keep Reading]

Last Week’s Turntable: EMPIRE Hires MD of Europe

Doja Cat, KATSEYE, Gwen Stefani, David Guetta, Meghan Trainor and more are set to perform at iHeartRadio’s 102.7 KIIS FM Wango Tango in May.

And for the first time ever, the summer-kickoff concert will be held in Huntington Beach, California. Hosted by Ryan Seacrest, Wango Tango will take place Sunday, May 10, and feature more performances by NMIXX, xikers, Hearts2Hearts and A2O MAY.

“We’re thrilled to bring Wango Tango back, knowing fans have been eagerly awaiting its return,” said Beata Murphy, program director of iHeartMedia Los Angeles’ 102.7 KIIS FM. “This year, we’re elevating the experience with an unforgettable day of music, energy, and beachside vibes — everything that defines SoCal. We’re also shaking things up by featuring some of the biggest artists with extended set times, unlike ever before.”

This will be the first Wango Tango event in three years, since it hit Dignity Health Center in Carson, California, in June 2022.

Trending on Billboard

iHeartMedia Los Angeles partnered with powerhouse global experience agency Code Four to execute this year’s outdoor, beachside concert experience.

“We are privileged to work with the world-class team at iHeartMedia on such an iconic brand, Wango Tango,” said Kevin Elliott, CEO of Code Four. “I grew up attending this festival as a KIIS FM listener, and it’s surreal for our team to now be working on delivering the next iteration of the Wango Tango experience – here in my hometown of Huntington Beach – one of the most incredible venues in the world!”

Added Paul Corvino, regional president of iHeartMedia: “Wango Tango has become a legendary event for Southern California music fans, something they’ve looked forward to year after year. Our partnership with Code Four is taking it to the next level, bringing it back bigger and better than ever for an unforgettable fan experience at the beach.”

Tickets go on sale first to KIIS CLUB VIP members (fans can sign up to be one for free here) on Thursday, March 13 at 10 a.m. PT. General on-sale begins Friday, March 14 at 10 a.m. PST.

iHeartMedia CEO Bob Pittman apparently believes his company’s stock is undervalued.

The executive sent a message to Wall Street on Tuesday (March 4) when he spent $320,000 to purchase 200,000 iHeartMedia shares, according to an SEC filing released Thursday (March 6). Investors took note, sending the company’s stock price up 23.2% to $1.86.

iHeartMedia shares had plummeted 27.7% in the four trading days following the company’s fourth quarter earnings release on Feb. 27. The stock fell 15.3% to $1.77 following the announcement and slipped an additional 14.8%, to $1.51, by Wednesday (March 5). But Thursday’s SEC filing reduced iHeartMedia’s year-to-date decline to 6.1% from 23.7%.

CEOs will occasionally buy shares of their companies when they believe the market is undervaluing the company. In March 2020, Live Nation CEO Michael Rapino bought approximately $1 million worth of shares as the price faltered at the pandemic’s onset; Live Nation’s share price has since risen 262% to $131.11. In May 2022, Spotify CEO Daniel Ek bought $50 million of Spotify shares a week after the stock hit an all-time low of $95.74. “I believe our best days are ahead,” Ek wrote on Twitter at the time. Spotify’s share price has since risen nearly six-fold to $543.51.

iHeartMedia, the country’s largest radio broadcaster, is trying to navigate the decline in broadcast radio while building a digital business. Although it ranks No. 1 in podcast market share, the company’s legacy business is still twice the size of its digital business. To shore up its financials, the company has laid off employees, sold tower sites and restructured its debt.

Trending on Billboard

Last week, iHeartMedia executives told investors that first-quarter revenue would decline in the low single-digits and full-year revenue would be flat. CFO Rich Bressler said that January revenue was up 5.5% but February revenue was on track for a 7% decline as consumer sentiment suffered its biggest one-month decline since August 2021.

“Although the year began with optimism, many companies are now focusing on how potential tariffs, inflation and higher interest rates may impact their businesses, introducing an element of uncertainty,” said Bressler.

Pittman remained optimistic and believed those uncertainties will “steady up a lot” as the year progresses. “If there’s a change, people take a beat and adjust to the change,” he said. “There’s a big change between this [presidential] administration and the last one, and I think people are digesting. I don’t think the uncertainty is totally unexpected, and it’s certainly understandable.”

State Champ Radio

State Champ Radio