HYBE

Trending on Billboard K-pop music giant HYBE said on Monday that concerts by BTS member Jin, SEVENTEEN and TOMORROW X TOGETHER helped drive its third quarter revenues up 38%, but lagging album sales contributed to an overall unprofitable quarter. Operating profit, which measures a company’s total core business earnings after interest and tax are taken out, […]

Trending on Billboard

The 2026 Grammy nominations were announced Friday (Nov. 7), with Bad Bunny, Sabrina Carpenter, Kendrick Lamar and Lady Gaga highlighting some of the biggest categories. Within the traditional Big Four categories — record of the year, song of the year, album of the year and best new artist — Interscope led all record labels with eight nominees among the 32 slots, giving parent company Universal Music Group (UMG) a commanding 21 of those 32 nods. What’s more, Interscope’s leadership structure means its total is even higher: Interscope Capitol includes Capitol (two nominations), Motown (two nominations) and the joint HYBE/Geffen partnership that signed KATSEYE (one nomination), meaning that Interscope Capitol led the way with 13 total nominations in those four categories.

Related

That marks the fifth time in the past eight years Interscope has led among labels. Interscope artists that received those nominations were Billie Eilish (record, song), Kendrick Lamar (record, song, album) and Lady Gaga (record, song, album). Capitol’s nominations were for Doechii (record, song), Motown’s came for Leon Thomas (album, best new artist) and KATSEYE’s nomination was for best new artist.

In second among labels with six nominations is Island Records, which achieved a few feats of its own. For the second year in a row, the label had two nominees for best new artist. This year, those two honorees are Olivia Dean and Lola Young, while last year, Carpenter and Chappell Roan were both nominated (Roan ultimately took home the award). Island — which led all labels last year, when Carpenter and Roan were both nominated in all of the Big Four categories — also saw additional nominations for Carpenter (record, song and album) and Roan (record), each of whom has received nominations in those categories for the second year in a row. Carpenter now joins Taylor Swift (who has done it twice) as the only artists to receive album of the year nominations in back-to-back years since the categories were expanded from five to eight nominees for the 2019 ceremony.

Related

Island is also part of a larger structure in REPUBLIC Collective, which encompasses Republic Records, Def Jam and more. REPUBLIC Collective, overall, received eight nominations, as “Golden” from the Kpop Demon Hunters soundtrack was nominated for song of the year for Republic Records and Justin Bieber’s SWAG album, released by Def Jam, was recognized for album of the year.

In third among labels is Atlantic, which got song and record nominations for ROSÉ and Bruno Mars’ “APT.,” as well as best new artist nominations for Alex Warren and The Marías. In fourth is Rimas, home to Bad Bunny, who saw his DeBÍ TiRAR MáS FOToS album nominated for album of the year, while its title track “DtMF” got song and record nominations. Columbia also grabbed two nominations — album of the year for Tyler, The Creator’s CHROMAKOPIA and best new artist for Addison Rae — while Roc Nation Distribution got a nod for releasing Clipse’s album of the year-nominated Let God Sort Em Out and Warner Records kept its best new artist success alive with a nod for Sombr, marking the seventh best new artist nod the label has racked up in the past six years.

Among label groups, the aforementioned UMG dominated with 21 nominations, while Warner Music Group accounted for five, the indies collectively garnered four and Sony Music had two.

Trending on Billboard

HYBE shares soared 18.4% in the week ended Oct. 31 after a South Korean court ruled that K-pop group NewJeans may not leave HYBE imprint ADOR and make music under a different name. The five members of the girl group had attempted to break away from HYBE after the K-pop giant dismissed NewJeans’ mentor, ADOR CEO Min Hee-jin, in April 2024.

Rather than lose NewJeans — which would have created additional headaches for HYBE and other K-pop companies — ADOR will retain the group through the end of its exclusive contract in 2029. The fact that Min is no longer at ADOR didn’t sway the court. “Merely the fact that NewJeans personally places high trust in Min Hee-jin does not make guaranteeing her the position of ADOR’s CEO a significant obligation under the exclusive contract,” according to a report. The ruling added approximately $1.5 billion to HYBE’s market value, suggesting that investors were fearful a court loss would spill over to other acts currently under contract with HYBE.

Related

Despite HYBE’s considerable gain, the 19-company Billboard Global Music Index was unchanged at 2,845.53. Music stocks were almost evenly mixed between winners and losers, and only two companies had either a gain or a loss in excess of 10%.

Music stocks lagged behind major indexes’ gains. In the U.S., the Nasdaq composite index rose 2.2% to 23,724.96 and the S&P 500 improved 0.7% to 6,840.20. The U.K.’s FTSE 100 rose 0.7% to 9,717.25. South Korea’s KOSPI composite index jumped 4.2% to 4,107.50 on AI optimism after Samsung announced it would build a semiconductor factory in partnership with American company Nvidia. China’s Shanghai Composite Index ticked upward 0.1% to 3,954.79.

SiriusXM shares finished the week up 1.4% to $21.69 after a see-saw end to the week. The stock gained 10.1% on Thursday (Oct. 30) after the company’s third-quarter results, but fell 6.5% on Friday (Oct. 31). The bump in share price came after SiriusXM increased its full-year forecasts for revenue, EBITDA and free cash flow. The Q3 results also showed that the satellite radio company, which also owns streaming platform Pandora, turned a net loss into a net profit.

Related

Universal Music Group shares fell 2.3% to 23.27 euros ($26.99) despite gaining 1% on Friday after the company reported solid Q3 earnings following the close of trading on Thursday. Following the results, J.P. Morgan reiterated its “overweight” rating and 39.00 euros ($45.23) price target while Guggenheim maintained its “neutral” rating and eliminated its price target, which was previously 27.00 euros ($31.32).

Spotify’s stock benefited from news that the company is raising prices in the U.K., finishing the week up 1.5% to $655.32. That modest gain helped Spotify reclaim some of the loss it suffered after the share price dropped 4.1% on Oct. 24. The Stockholm-based company will report Q3 earnings on Tuesday (Nov. 4).

Radio giant iHeartMedia was the week’s biggest loser after dropping 12.4% to $2.97. The company’s share price has been on a roll lately, though, gaining 39.4% in 2025. iHeartMedia will release Q3 earnings on Nov. 10.

Most live music stocks lost ground. Live Nation fell 2.2% to $149.53 ahead of its earnings results on Tuesday. German promoter CTS Eventim dropped 2.9% to 77.60 euros ($90.00). MSG Entertainment dipped 3.5% to $44.16. Sphere Entertainment Co. was an exception, rising 1.7% to $68.48.

Billboard

Billboard

Billboard

The ongoing dispute between K-pop breakout group NewJeans and its agency ADOR, a HYBE subsidiary, escalated this week as the Seoul Central District Court approved a stricter legal measure restricting the group’s independent activities. In a ruling issued Friday (May 31), the court granted ADOR’s request for indirect compulsory enforcement, ordering each member of the group — Minji, Hanni, Danielle, Haerin and Hyein — to pay 1 […]

Amidst new reports about a South Korean investigation into its chairman, HYBE shares fell 6.8% to 266,000 KRW ($192.69) during the week ended May 30. That was the biggest decline for a music stock in a week marked by modest gains and losses.

Reports out of South Korea this week said police in Seoul have resubmitted a search and seizure warrant for HYBE chairman Bang Si-hyuk in an investigation into allegations of fraudulent stock transactions by the music mogul. Bang allegedly misled previous shareholders about HYBE’s intention to go public, which caused them to sell HYBE shares ahead of the company’s initial public offering in 2020. Sources told Yonhap News Agency that Bang netted $291 million in 2020 from deals with private equity firms to share a portion of the gains from HYBE’s IPO.

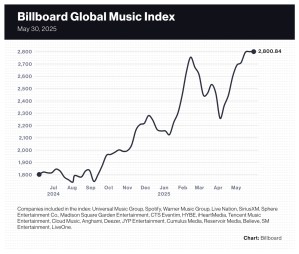

The 20-company Billboard Global Music Index (BGMI) was unchanged at 2,800.84 as the index had an even number of winners and losers. In a week with a remarkable amount of unremarkable movement, the majority of companies fell within a narrow band between a 2% gain and a 1% loss.

Trending on Billboard

Music stocks underperformed numerous market indexes. In the U.S., the Nasdaq gained 2.0% to 19,113.77 and the S&P 500 rose 1.9% to 5,911.69. The U.K.’s FTSE 100 climbed 0.6% to 8,772.38. South Korea’s KOSPI composite index jumped 4.1% to 2,697.67. China’s SSE composite was flat at 3,347.49.

But music stocks have posted big gains in 2025. The BGMI is up 31.8%, far surpassing the gains of the Nasdaq (14.2%) and the S&P 500 (up 12.0%). Spotify, the index’s most valuable component, has risen 42.8%. Universal Music Group (UMG), the BGMI’s second-largest company, has gained 17.8%.

The lone music company to report earnings this week, Reservoir Media, rose 7.9% to $7.80. The quarterly earnings released on Wednesday (May 28) showed a 10% revenue gain and a 14% improvement in adjusted EBITDA. Meanwhile, the only company to post a double-digit gain was Cumulus Media, which rose 15.4% to $0.15. Cumulus tends to have wild swings, however, since it was delisted from the Nasdaq on May 2 and began trading over the counter.

iHeartMedia jumped 6.5% to $1.31. Spotify, the BGMI’s fourth-best performer, rose 1.9% to $666.25. Madison Square Garden Entertainment improved 1.5% to $37.11, and UMG gained 1.4% to 28.16 euros ($31.95).

Live Nation fell 5.4% to $137.24, lowering its year-to-date gain to 6.0%. On Thursday, the company fell 2.9% on heavier-than-average trading volume following reports that it canceled concerts at Boston’s Fenway Park by Shakira and Jason Aldean due to safety concerns about the venue’s stage.

Both Chinese music streamers had off weeks that reduced their stellar year-to-date performances. Tencent Music Entertainment (TME) fell 4.0% to $16.82, lowering its year-to-date gain to 50.9%. Netease Cloud Music, the BGMI’s biggest gainer of 2025 at 88.2%, fell 2.9% to 211.20 HKD ($26.94).

Billboard

Billboard

Billboard

HYBE has disclosed the sale of its remaining 9.38% stake in rival SM Entertainment to Tencent Music Entertainment (TME), a subsidiary of Chinese tech giant Tencent. The deal, valued at approximately 243.35 billion South Korean won (approximately $177 million), involves the transfer of 2.21 million shares at 110,000 won per share and is set to close on May 30, according to a new regulatory filing.

This transaction marks HYBE’s complete exit from SM Entertainment, a powerhouse K-pop agency behind acts like EXO, aespa and NCT 127.

Trending on Billboard

HYBE initially entered SME in 2023, acquiring a 14.8% stake from founder Lee Soo Man and later raising its holding to 15.78% through a failed takeover bid, ultimately losing out to Kakao, which now holds a 40.28% stake. After reducing its stake to 9.38% in May 2024, HYBE has now sold its remaining shares.

Why get out of the SME business? HYBE said on Tuesday that it has “divested noncore assets as part of a choice and concentration strategy” and that “secured funds will be used to secure future growth engines.”

TME’s acquisition makes it the second-largest shareholder in SME, behind Kakao. It operates leading Chinese music platforms such as QQ Music and Kugou Music and has existing ties to K-pop through partnerships with HYBE and others. TME also holds minority stakes in YG Entertainment and Kakao Entertainment, signaling its broader strategy to expand influence in the global K-pop landscape.

For SME, the deal could strengthen its reach in the Chinese market and enhance its digital distribution, artist promotion and content collaborations through Tencent’s various platforms. SME is coming off a strong Q1, with revenue up 5.2% year-over-year, driven by strong growth in concerts and recorded music. Concert revenue surged 58% thanks to tours by NCT 127, aespa and others, and recorded music rose 23.1%, led by Hearts2Hearts’ debut.

The acquisition reflects TME’s ongoing investment in Korean assets and sets the stage for deeper cross-border collaboration in music and media. It also marks the latest shift in the balance of power within the K-pop industry, highlighting the growing influence of Chinese tech giants in South Korea’s entertainment sector.

Meanwhile, HYBE is repositioning itself for future expansion, using the proceeds from this sale to invest in new ventures. The company continues to grow globally with its roster of artists including BTS, NewJeans and SEVENTEEN, and remains focused on developing next-gen platforms and talent. In the first quarter, HYBE reported strong financial performance despite a 5.9% drop in recorded music revenue. Total revenue rose 38.7% year-over-year, driven by a 252% surge in concert revenue and a 75.2% increase in merch and licensing. HYBE also expanded into Latin America with festivals and a music competition show.

After shaping some of the biggest acts in global pop, HYBE is setting its sights on Latin music with an ambitious new reality series from its subsidiary, HYBE Latin America. Billboard has exclusively learned that production kicks off this week in Mexico City on the yet-to-be-titled project, which aims to form a new all-male pop group.

The series will train and develop 16 contestants from countries including Mexico, Brazil, the U.S., Peru and Spain, narrowing the field to a final five by the end of the season this fall.

The series’ format and execution differs from other reality talent competition in multiple key ways. First and foremost, it’s HYBE’s first artist development venture of this scale focused entirely on Latin talent, combining the development discipline the company has applied in K-pop with Latin American cultural and artistic sensibility.

Trending on Billboard

Further, instead of airing as a carefully formatted weekly television show, the reality show is a multi-platform production that integrates long-form storytelling, performance content and behind-the-scenes narratives distributed across streaming, social and music platforms.

The project also features a roster of mentors that may be unprecedented in a Latin reality show. It includes director and choreographer Kenny Ortega (High School Musical, The Descendants) as executive producer; Charm La’Donna (Kendrick Lamar’s 2024 Super Bowl, Bruno Mars) as head choreographer; and Robert J “RAab” Stevenson (SZQ, Rihanna) as head vocal coach.

“This project is about much more than music. It’s about reimagining how Latin talent can be discovered, developed and presented to the world. We are building the foundation for the next generation of global Latin artists with the highest creative and production standards,” said J.H. Kah, CEO of HYBE Latin America, who is leading efforts on the venture, in a statement.

The new project joins a roster of properties that includes newly-announced talent competition Pase a la Fama, which HYBE Latin America developed with Telemundo. The competition show seeks to find the next regional Mexican band and premieres on Telemundo June 8 with Ana Bárbara, Horacio Palencia and Adriel Favela as judges.

This show, however, doesn’t have a partner network.

While contestants officially arrive in Mexico this week (beginning May 12), preproduction for the show has been underway for months. Hundreds of applications poured in from across Latin America and the U.S., leading to an initial shortlist of 300 candidates. From there, 16 finalists were selected to begin intensive training at a custom-built “bootcamp” located in Mexico City’s Parque Bicentenario.

The bootcamp will include some 30 instructors, including vocal coaches, producers, fitness trainers and choreographers and is supported by Weverse, HYBE’s extremely successful social media/fandom platform.

HYBE Latin America

courtesy of HYBE Latin America. ©️ 2025 HYBE Corporation.

Make no mistake — this is a distinctly Latin production. The show is being helmed by two seasoned Colombian producers: showrunner Jaime Escallón (X Factor, Survivor) and production designer Lucas Jaramillo. Both serve as executive producers and co-creators of the format, with a clear mission to build a production environment that authentically reflects Latin culture.

“This is different from other talent reality shows in that it takes place in a space designed for the city to participate in,” says Jaramillo, noting that production is working closely with Mexico City government and fans will be allowed to actually visit the space and be part of performances and media experiences. “That’s why we’ve developed a cultural program that’s both artistic and media driven, and includes things like podcasts. This is a show that’s alive.”

The project is HYBE Latin America’s latest venture after launching in 2023 with the acquisition of Exile Music, the music division of Spanish-language studio Exile Content, led by Isaac Lee, who is now chairman of HYBE Latin America. The company has moved quickly since then. With offices in Mexico City, Miami, and Los Angeles, the division houses labels such as DOCEMIL Music and Zarpazo Entertainment.

Though economic uncertainty lingers, some music companies’ stocks got boosts following their first quarter earnings releases this week, while a better-than-expected jobs report on Friday (May 2) lifted stocks across the board.

K-pop companies were among the top performers of the week. Led by HYBE’s 13.8% gain following its first quarter earnings report on Tuesday (April 29), the four South Korean companies had an average share price gain of 10.3%. JYP Entertainment rose 11.7% and SM Entertainment, which announces earnings on Wednesday (May 7), improved 9.0%. YG Entertainment gained 6.6%.

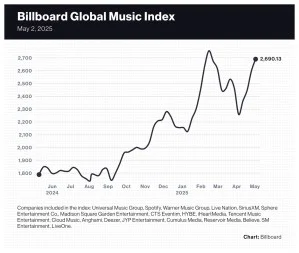

The 20-company Billboard Global Music Index (BGMI) rose 3.6% to 2,690.13, its fourth consecutive weekly improvement. At 2,690.13, the BGMI has improved 19.1% since a two-week slide and stands just 2.4% below its all-time high of 2,755.53 set during the week ended Feb. 14.

Trending on Billboard

Music stocks slightly outperformed the Nasdaq and S&P 500, which rose 3.4% and 3.1%, respectively. Foreign markets were mostly positive but more subdued. The U.K.’s FTSE 100 rose 2.2%. South Korea’s KOSPI composite index gained 0.5%. China’s SSE Composite Index lost 0.5%.

Universal Music Group (UMG) gained 4.3% to 25.86 euros ($29.23) following a quarterly earnings report showing that recorded music subscription revenue grew 11.5% and overall revenue improved 11.8%. JP Morgan analysts’ conviction on UMG “remains very high,” and the strong quarter “should help rebuild confidence and share price momentum” dented by Pershing Square’s sale of $1.5 billion in UMG shares, analysts wrote in an investor note on Tuesday.

Spotify finished the week up 3.7% to $643.73 despite its shares dropping 3.4% on Tuesday after the company’s first-quarter earnings report included guidance on second-quarter subscription additions that seemed to underwhelm investors. Gross margin of 31.6% beat Spotify’s 31.5% guidance. Loop Capital raised Spotify to $550 from $435, while Barclays lowered it to $650 from $710. UBS maintained its $680 price target and “buy” rating. Guggenheim maintained its “buy” rating and $675 price target.

Live Nation, which reported first quarter earnings on Thursday (May 1) and predicted a “historic” 2025, gained 2.3% on Friday and finished the week up 0.7%. A slew of analysts updated their price targets on Friday. Two were upward revisions: Jefferies (from $150 to $160) and Wolfe Research (from $158 to $160). Two were downward revisions: Rosenblatt (from $174 to $170) and JP Morgan (from $165 to $170).

Nearly all streaming stocks posted gains. LiveOne was the week’s top performer, jumping 18.0% to $0.72. Chinese music streaming companies Cloud Music and Tencent Music Entertainment gained 11.6% and 7.1%, respectively. French music streamer Deezer gained 1.4% to 1.44 euros ($1.63) after the company’s first-quarter earnings on Tuesday. Abu Dhabi-based Anghami fell 3.1% to $0.62.

Cumulus Media fell 33.% to $0.14. Most of the decline came on Friday as the stock ceased trading on the Nasdaq and began trading over the counter.

Created with Datawrapper

Created with Datawrapper

Created with Datawrapper

While many public companies are struggling amid the backdrop of macroeconomic uncertainty and the looming threat of global tariffs, music company executives are beating the drum for music as a stable place to invest. Despite a plateauing of the growth curve, revenue from streaming subscriptions continues to drive relative stability at Spotify, Unversal Music Group […]

South Korea’s HYBE used its artists’ heavy touring schedule and strong merchandise and licensing revenues to overcome a slight drop in recorded music sales in the first quarter of 2025.

In the historically slow first quarter, total revenue rose 38.7% to 500.6 billion KRW ($350 million), the second-lowest quarterly revenue since the first quarter of 2023. Earnings before interest, taxes, depreciation and amortization (EBITDA) of 47.3 billion KRW ($33 million) was up 19% from the prior-year period.

“Typically, the first quarter is a period when artists take a break after busy year-end activities and prepare for new albums and projects,” CFO Kyungjun Lee said during the earnings call Tuesday (April 29). “Therefore, in Q1, we had relatively fewer album releases and content offerings, thus posting a slightly lower profitability compared to the prior quarter.”

Trending on Billboard

Recorded music revenue fell 5.9% to 136.5 billion KRW ($95 million), with streaming accounting for almost half of recorded music sales, said CEO Jaesang Lee. “While album sales fluctuate quarter over quarter depending on release schedules, steady streaming revenue serves as a stable source of profit. Streaming helps mitigate recorded music sales volatility in quarters like this quarter, when the number of new albums is relatively smaller.”

Concerts revenue jumped 252% to 155.2 billion KRW ($108 million). CEO Lee cited the “huge success” of tours in South Korea, the U.S., Japan and elsewhere in Asia by J-Hope, TOMORROW X TOGETHER, ENHYPEN and BOYNEXTDOOR. Additionally, J-Hope’s solo shows in Mexico “marked the beginning of active expansion to the Latin market,” he added.

Merchandise and licensing improved 75.2% to 106.4 billion KRW ($74 million). Whereas concert-related merchandise was most popular in the past, HYBE has found success with artists’ character-driven merchandise, such as for Seventeen’s MINITEEN, a group of animal representatives for the band. “All the character products have been selling really quickly, and many items are in high demand, resulting in additional rounds of pre-order sales,” said CFO Lee.

Content revenue fell 32.7% to 41.2 billion KRW ($29 million). It included sales of the Seventeen in Carat Land Memory Book and BTS 7 Moments, an archive of group members throughout 2022 and 2023 that includes a 66-minute video and 180-page photo book.

CEO Lee also teased details of Big Hit Music’s upcoming boy band that will debut in the third quarter of 2025. He described the five-member group as “a next generation creator crew that pursues self-expression in completely new styles and senses” and will perform “very original music that has not existed in the past.”

Separately, a seven-member, all-Japanese boy band called aeon will debut in June. Created by YX Labels, HYBE’s Japanese operation, the group formed from a TV show that aired in Japan on Nippon TV from February to April.

State Champ Radio

State Champ Radio