Cloud Music

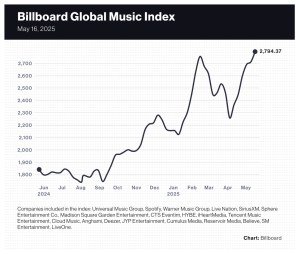

Music stocks — and stocks in general — had a terrific week as Sphere Entertainment Co., Tencent Music Entertainment and Cloud Music posted double-digit gains and the 20-company Billboard Global Music Index (BGMI) set a new high mark.

The BGMI rose 3.1% to an all-time high of 2,794.37, bringing its year-to-date gain to 31.5%. The index has overcome two downturns — one caused by an escalation of trade tensions, the other prompted by President Trump’s announcement of his tariff policy — to surpass the previous record of 2,755.53 set on Feb. 14.

Sphere Entertainment Co. gained 19.3% to $38.78. The company’s quarterly earnings, released on Monday (May 12), showed the Sphere venue was able to cut costs to offset a decline in event-related revenue. Investors cheered the result: flat operating income rather than a loss. As for tourism to Las Vegas, CEO James Dolan brushed aside concerns and said demand for Sphere concerts is strong enough to withstand a downturn should one arise.

Trending on Billboard

China’s Tencent Music Entertainment (TME) jumped 18.0% to $18.62 after the company reported on Tuesday (May 13) a 17% increase in music subscription revenue in the first quarter. Following earnings, CFRA upped its price target to $18 from $17 but downgraded its rating to “hold” from “buy.” TME, which operates Kugou Music, QQ Music and Kuwo Music, finished the quarter with 122.9 million subscribers, up 8.3% from the prior-year period.

Another Chinese music streamer, Netease Cloud Music, rose 12.6% to 203.40 HKD ($26.03) after the company’s financial results, released on Thursday (May 15), showed an 8.4% drop in revenue that the company attributed to a decline in its social entertainment business. The scant Q1 numbers didn’t provide details on the online music side of the business, but the two sides of the business are going in opposite directions. In 2024, social entertainment revenue fell 26% while online music revenue grew 23%.

Not only were TME and Cloud Music among the top performers of the week, they are among the biggest gainers in 2025. Year to date, TME shares are up 49.1% while Cloud Music has gained 81.3%. SM Entertainment’s 64.9% gain is the second-best amongst music stocks.

Live Nation improved 8.2% to $147.68 this week despite news that the company and AEG Presents are facing a criminal antitrust probe by the U.S. Department of Justice over pandemic-era refund policies. Live Nation shares are still well below the all-time high of $157.75 reached on Feb. 21, but they’ve gained 14.0% year to date and are up 52.9% over the last 52 weeks.

Spotify, the index’s most valuable component, rose 1.2% to $656.30. Guggenheim raised its price target to $725 from $675 on the heels of a judge’s favorable ruling in Epic Games v. Apple. Guggenheim sees the ruling, which allows Spotify to display pricing options within the iOS app, as helpful to audiobook monetization.

German concert promoter CTS Eventim gained 3.2% to 111.90 euros ($124.90). Barclays started covering the company with a 130 euro ($145.12) price target and an “overweight” rating.

Elsewhere in the index, Universal Music Group and Warner Music Group gained 0.9% and 1.2%, respectively, and HYBE improved 1.9%. SiriusXM jumped 5.4%.

Only four of the BGMI’s 20 stocks lost value this week. SM Entertainment was the week’s biggest loser with a 5.2% drop. Believe fell 1.3%, Deezer dipped 1.5% and iHeartMedia dropped 1.6.%.

Stocks were up globally but performed especially well in the U.S. The Nasdaq composite rose 7.2% and the S&P 500 improved 5.3%. In the U.K., the FTSE 100 was up 1.5%. South Korea’s KOSPI composite index gained 1.9%. China’s SSE Composite Index rose 0.8%.

Investors were encouraged by a reduction of U.S. tariffs on Chinese goods while the two countries continue to negotiate a trade deal. Goldman Sachs lifted its estimate for the S&P 500 on Tuesday as tensions over tariffs eased between the U.S. and China.

There is still uncertainty about the U.S. economy, however. Since last week, numerous reports have warned of a sharp slowdown at the Port of Los Angeles, the nation’s busiest port. This week, Walmart CFO John David Rainey said high tariffs could cause the company to raise prices by the end of the month. And on Friday (May 16), the University of Michigan’s closely watched index of consumer sentiment fell to its second-lowest level on record.

Billboard

Billboard

Billboard

Cloud Music’s revenue from subscriptions grew 22.2% year over year, helping the Chinese music streaming company post a 113% increase in profit, to 1.7 billion RMB ($233.4 million), as revenue increased by only 1%, to 7.95 billion RMB ($1.09 billion), the company announced Thursday (Feb. 20). Revenue from online music services increased 23.1% to 5.35 […]

The Billboard Global Music Index — a diverse collection of 20 publicly traded music companies — finished 2023 up 31.3% as Spotify’s share price alone climbed 138% thanks to cost-cutting and focus on margins. Spotify is the single-largest component of the float-adjusted index and has one of the largest market capitalizations of any music company.

The music index was outperformed by the tech-heavy Nasdaq composite, which gained 43.4% with the help of triple-digit gains from chipmaker Nvidia Corp (+239%) and Meta Platforms (+194%). But the Billboard Global Music Index exceeded some other major indexes: the S&P 500 gained 24.2%, South Korea’s KOSPI composite index grew 18.7% and the FTSE 100 improved 3.8%.

Other than Spotify, a handful of major companies had double-digit gains in 2023 that drove the index’s improvement. Universal Music Group finished the year up 14.7%. Concert promoter Live Nation rode a string of record-setting quarters to a 34.2% gain. HYBE, the increasingly diversified K-pop company, rose 34.6%. SM Entertainment, in which HYBE acquired a minority stake in March, gained 20.1%.

A handful of smaller companies also finished the year with big gains. LiveOne gained 117.4%. Reservoir Media improved 19.4%. Chinese music streamer Cloud Music improved 15.8%.

The biggest loser on the Billboard Global Music Index in 2023 was radio broadcaster iHeartMedia, which fell 56.4%. Abu Dhabi-based music streamer Anghami finished 2023 down 34.8%. After a series of large fluctuations in recent months, Anghami ended the year 69% below its high mark for 2023. Hipgnosis Songs Fund, currently undergoing a strategic review after shareholders voted against continuation in October, finished the year down 16.6%.

Sphere Entertainment Co., which split from MSG Entertainment’s live entertainment business back in April, ended 2023 down 24.4%. Most of that decline came before the company opened its flagship venue, Sphere, in Las Vegas on September 29, however. Since U2 opened the venue to widespread acclaim and earned Sphere global media coverage, the stock dropped only 8.5%.

For the week, the index rose 1.1% to 1,534.07. Fourteen of the index’s 20 stocks posted gains this week, four dropped in price and one was unchanged.

LiveOne shares rose 15.7% to $1.40 after the company announced on Friday (Dec. 29) it added 63,000 new paid memberships in December and surpassed 3.5 million total memberships, an increase of 29% year over year. iHeartMedia shares climbed 14.6% to $2.67. Anghami continued its ping-pong trajectory by finishing the week up 16.9%.

Chinese music streaming company Cloud Music’s revenue fell 16.3% to 1.95 billion RMB ($270.4 million) in the third quarter, the company’s controlling shareholder, tech giant NetEase, announced on Thursday (Nov. 16).

Gross profit margin of 27.2% was almost double the 14.2% seen in the prior-year quarter and about even with the 27% gross margin in the second quarter. Cloud Music attributed the higher gross margin to the gain in subscriptions and cost control measures.

Through the nine-month period ended Sept. 30, Cloud Music had revenue of 6.6 billion RMB ($806.1 million), down 11.1% year over year. Gross profit almost doubled, to 1.5 billion RMB ($205.8 million), while gross profit margin (as a percent of revenue) also nearly doubled from 13.2% to 25.5%.

Cloud Music, which spun off from NetEase in 2021 and trades on the Hong Kong Stock Exchange, said it “considerably strengthened its music-centric membership monetization and further improved profitability.” The company also pointed to its premium offerings that include “expansive content and innovative features.”

Investors appeared to focus on the drop in revenue rather than the other metrics and developments. The news sent Cloud Music’s share price down 12.6% to 82.25 HKD ($10.55) on Monday (Nov. 20).

Because Cloud Music’s unaudited results were released as part of NetEase’s third-quarter earnings report, the company released few metrics and did not say exactly how many subscribers it acquired in the quarter. Three months ago, Cloud Music announced it had 41.8 million subscribers on June 30, up 11% from 37.6 million a year earlier.

While music subscriptions have been on the rise, the social entertainment side of the business is faltering. In the first half of 2023, Cloud Music’s social entertainment business declined 23.8% year over year due to a crackdown by Chinese authorities over livestreaming features that can be used for illegal gambling. Social entertainment accounted for about half of Cloud Music’s total revenue in the first half of 2023.

Tencent Music Entertainment has also suffered a sharp drop in social entertainment revenue while growing its music subscription business. While its music subscribers grew 20.8% to 103 million and subscription revenue jumped 42% in the third quarter, its social entertainment revenue fell 49%, causing total revenue to fall 10.8% to 6.57 billion RMB ($900 million).

Cloud Music third-quarter financial metrics:

Revenue of 1.95 billion RMB ($270.4 million), down 16.3% year over year.

Cost of revenue of 1.42 billion RMB ($196.9 million), down 29% year over year.

Gross profit of 525.7 million RMB ($73.5 million), up 61% year over year.

iHeartMedia shares dropped 19.6% to $2.01 this week as the company warned investors of continued softness in radio advertising dollars. Fourth quarter results “will be weaker than we originally anticipated,” said CEO Bob Pittman during Thursday’s earnings call. In October, consolidated revenue was down 8% from the prior-year period. For the fourth quarter, iHeartMedia expects consolidated revenue excluding political ad revenue to decline in the low single digits.

Still, iHeartMedia’s third-quarter results were in line with previous guidance. Revenue of $953 million was down 3.6% from the prior-year period, a bit better than the guidance of a low single-digit decrease. Adjusted earnings before interest, taxes, depreciation and amortization of $204 million was within the guidance of $195 million to $205 million.

The week’s sharp decline brought iHeartMedia’s year-to-date loss to 67.2%, far deeper than the declines of broadcast radio company Cumulus Media (-21.9%) and satellite radio company SiriusXM (-20.7%). Not only has broadcast radio suffered from weak national advertising, it lacks the high growth rates of music streaming and podcasting. PwC’s latest forecasts call for U.S. radio advertising revenues to rise just 4% from 2023 to 2027 while U.S. podcast advertising — where iHeartMedia has a large footprint — will grow 41% to $2 billion.

Next year’s elections should provide a shot in the arm, though. “As we look forward to 2024, we expect to generate significantly better free cash flow driven in part by an improving macro environment, as well as the impact of political dollars,” said CFO Rich Bressler. In 2020, the company generated $167 million in political revenues, he noted.

The Billboard Global Music Index mostly held steady this week, dropping just 0.3% to 1,390.68. Of the index’s 20 stocks, seven gained this while while 13 finished in negative territory. Most stocks had low-single-digit gains or losses and iHeartMedia was the only stock with a double-digit move in either direction.

French company Believe was the index’s greatest gainer of the week after improving 7.4% to 9.93 euros ($10.64). German concert promoter CTS Eventim, which will release third-quarter earnings on Nov. 21, gained 5.5% to 62.75 euros ($67.24). Music streaming company LiveOne gained 4.7% to $1.12. Chinese music streamer Cloud Music, which has not yet announced the date of its third-quarter earnings release, gained 3.3% to 99.50 HKD ($12.74).

Shares of Sphere Entertainment Co. dropped 1.5% to $35.95 after a roller-coaster week. Following the company’s Nov. 3 announcement that CFO Gautum Ranji had left the company, Sphere Entertainment shares dropped 9.6% to $32.97 on Monday. The share price fell an additional 4.5% to $31.87 on Wednesday following the quarterly earnings release. But Sphere Entertainment picked up momentum in the latter half of the week, gaining 12.8% over Thursday and Friday to close at $35.95.

U.S. stocks were broadly up this week despite news that consumer sentiment declined in November and expectations for future inflation reached their highest level since 2011. The Nasdaq composite rose 2.4% while the S&P 500 improved 1.3%. Many major U.S. tech stocks posted big gains. Microsoft hit an all-time high of $370.09 on Friday and finished the week at $369.67, up 4.8%. Apple rose 5.5% to $186.40. Amazon improved 3.6% to $143.56. Meta jumped 4.5% to $32.8.77. In the United Kingdom, the FTSE 100 fell 0.8%. South Korea’s KOSPI composite index gained 1.7%.

Spotify led a group of high-flying streaming stocks this week by gaining 14.8% to $157.54 per share, increasing its market capitalization by nearly $4 billion to $30.7 billion. The world’s largest streaming company, which boasted 220 million subscribers as of June 30, has clawed back nearly all its losses since its share price dropped 14% […]

-

Pages

State Champ Radio

State Champ Radio