catalog acquisitions

Trending on Billboard

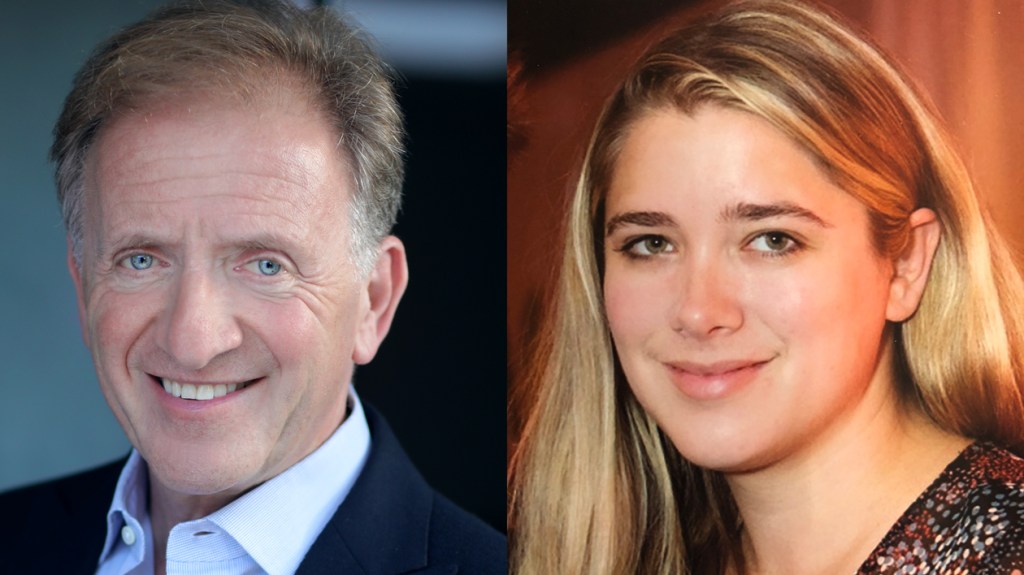

Bella Figura Music, a London-based catalog firm with rights to classic hits like Joan Jett’s “I Love Rock ‘n’ Roll,” The Human League’s “Don’t You Want Me” and Hot Chocolate’s “You Sexy Thing,” is making a push into the U.S. market, hiring former Capitol Records exec Gary Gersh and opening an L.A. office.

Founded in 2022 by former BMG U.K. President Alexi Cory-Smith and Neelesh Prabhu, Bella Figura has accumulated a catalog worth more than $160 million — a nearly 50% increase in its portfolio value this year, the firm says. With backing from Freshstream Investment Partners and the Canadian pension fund OPTrust, Cory-Smith says the firm’s expansion plans include deploying another roughly $100 million in the coming year.

Related

To help guide those investments, establish the firm’s reputation in the U.S. and grow the value of its portfolio—which Cory-Smith likens to a Ferrari garage—Bella Figura hired Gersh as chairman and inked a global administration deal with Sony Music Publishing.

“I’ve always used the Ferrari analogy,” Cory-Smith tells Billboard. “They get their hands dirty … constantly going back to fix it and get it better. It’s got to be a champion. Our thing is, is it good? It’s got to be great. The high value, slightly low margin game—that’s not us at all.”

Among the company’s largest acquisitions were the 2024 acquisition of iconic British publisher RAK, which brought in roughly 1,500 copyrights, and the British independent label Jeepster Records, which has the rights to several Belle and Sebastian and Snow Patrol albums. Bella Figura also owns the publishing catalog of songwriter and Robbie Williams collaborator Guy Chambers’, including rights to “Angels,” Feel” and “Let Me Entertain You,” and the master recordings to David Gray’s “Babylon,” because of its acquisition of his IHT record label.

Known for signing Nirvana and Sonic Youth and later running the global live entertainment company of AEG’s touring division, Gersh will be a key adviser in Bella Figura’s U.S. expansion, which he described as careful and precise.

“We’re offering attention to detail, focus, real partnership and opportunity,” Gersh says. “We are picking partners that understand that by doing less better we stay essential. We stay focused.”

Gary Gersh

Bella Figura

Cory-Smith says roughly three-quarters of the firm’s portfolio are publishing copyrights, a “scalable” asset they can maximize returns from by cleaning up metadata and ensuring more efficient registration of songs, using third party tools from Curve and Orpheum. Successful new creative projects have included landing “You Sexy Thing” in a Verizon commercial for the iPhone 17 pro that featured Kevin Hart and plans for special 30th anniversary records for Belle and Sebastian’s If You’re Feeling Sinister.

Cory-Smith and Gersh say their worldwide administration deal with Sony Music Publishing (SMP) opens the door to SMP’s global network, including its industry-leading film, TV and video game sync and licensing resources.

SMP President and Co-managing Director Tim Major said by email that Sony’s global reach makes it a “worthy guardian” for Bella Figura’s works.

“Bella Figura represents iconic and evergreen songs from some of the greatest songwriters we have known–songs that people love and will continue to love for generations to come,” Major said. “[We] are excited to work together … to create new and exciting opportunities and strategies for these songs around the world.”

Former Mojo Music executive Alan Wallis has launched Dynamite Songs, a new publishing venture that boasts rights to songs performed by Ed Sheeran, Kendrick Lamar and Papa Roach, it was announced on Wednesday (May 28).

Described as a “specialist music publisher,” Dynamite Songs has acquired around 50 catalogs to date, including those of Ed Sheeran and Paolo Nutini songwriter Chris Leonard; Sly Jordan, whose songs have been performed by Lamar and Sean Kingston; Jim Sullivan of the English electronic music duo The Wideboys; Dan + Shay songwriter Danny Orton; and Papa Roach’s Anthony Esperance and Bruce Elliott-Smith.

With backing from Crestline Investors Inc., a Fort Worth, Texas-based investment manager with $16 billion in alternative credit assets under management that previously invested in Mojo, Wallis says Dynamite will focus on rights to enduring catalogs that are considered “smaller sized deals.”

Trending on Billboard

“The smaller end of the music rights market has been under-appreciated for too long,” said Wallis, who previously led the music transactions practice valuing catalogs at Ernst & Young LLP and will serve as Dynamic Songs’ CEO.

“Our experience with Mojo Music has shown that there are brilliant songwriters and catalogues to be found — you just need to know where to look. With one of the best teams and networks in the business behind us, we’re strongly placed to navigate this market segment, allowing us to support songwriters and honour their works and legacies,” Wallis said in a statement.

Started in 2018 by Wallis and two former Spirit Music Group principals, Mark Fried and Peter Shane, Mojo Music & Media grew to include some 40 catalogs and 30,000 songs before it was acquired by Concord in 2023 for an undisclosed amount. Mojo’s portfolio included portions of songs recorded by REO Speedwagon, KISS, Cheap Trick, Duran Duran and Earth Wind & Fire.

Wallis’s team includes former Mojo Music & Media executives Sophie Brown, who will serve as CFO/COO; Lisa Macy, who will serve as head of sync; and Tom Donovan, Dynamite’s head of business development. Dynamite’s investment manager is Naomi Riley, whil Peter Thomas, previously MD of Carlin Music, serves as chief catalogue officer.

Warner Music Group (WMG) and Boston-based private equity firm Bain Capital are in advanced talks to form a joint venture worth around $1 billion to acquire music catalogs, according to three sources with knowledge of the talks.

Led by an equity investment from Bain, the joint venture will enable WMG to write bigger checks while spending less of its own money to acquire the catalogs it wants most.

A representative for WMG declined to comment, and a representative for Bain did not respond to a request for comment.

High interest rates and intense competition to own the rights to music from bands like the Red Hot Chili Peppers is leading major music companies to partner with outside investors to bolster their bids and assuage shareholders who may be put off by the price of a prized catalog.

Trending on Billboard

Some of the biggest catalog sales of all time occurred last year, with Sony Music acquiring Queen’s catalog and other rights for $1.27 billion. Earlier in 2024, Sony also acquired a stake in Michael Jackson‘s catalog for $600 million.

In many cases, music companies are looking to buy out an artist with whom they’ve worked for years and whose catalog they already partially own — like Sony Music did in 2022 when it bought Bob Dylan‘s master recordings. Owning more of the music’s intellectual property not only allows for more control over how the songs are used and licensed in the future, it prevents potentially embarrassing break-ups between record labels and their superstars.

The bidding wars have grown particularly pitched for master recording rights, which are more valuable today because streaming has extended the period that a song remains popular by several years, according to entertainment banking sources. Before streaming provided listeners with easy access to the entire universe of popular music and kept songs in regular rotation through playlisting, the revenue generated by a hit song’s master recording would fall off precipitously after its hype period waned.

A growing number of successful artists are also leaving major music companies to release music independently, have grown entire careers independently or have negotiated more favorable contracts with their major label partners, giving them more ownership of their master royalties. It all has some investors worried that the total addressable market of master royalties will grow more slowly in the future than in prior decades.

In early 2024, Universal Music Group (UMG) invested roughly $240 million to partner with Chord Music, a catalog investment company majority-owned by Dundee Partners, to give it similar flexibility to acquire catalogs off of its balance sheet and with financial help. The agreement gave UMG the administration and distribution business for the 60,000 music copyrights owned in Chord, and, in exchange for throwing its power as the world’s largest music company behind those assets to make them make more money, Dundee Partners became UMG’s long-term co-investment partner.

Sony Music has also partnered with institutional investors to help finance acquisitions, including Apollo, and WMG has explored investing in catalogs through outside vehicles as an early investor in both Tempo Music Group and Influence Media.

One of the financial engineers involved in structuring UMG’s deal with Chord was Michael Ryan-Southern. At the time, Ryan-Southern led Goldman Sachs’ investment banking team focused on the music industry. WMG hired Ryan-Southern last summer to serve as its head of corporate and business development, overseeing mergers and acquisitions.

Ryan-Southern’s team was key toWMG’s acquisition of Tempo Music, a $450 million deal announced on Feb. 6 that gives Warner the rights to songs by Wiz Khalifa, Florida Georgia Line and Brett James.

WMG’s ties to Bain Capital date back to 2004 when Bain was part of the investor group — also including Thomas H. Lee Partners, Edgar Bronfman, Jr. and Providence Equity Partners — to buy WMG for what was then $2.6 billion cash.

Duetti, a growing catalog acquisition company that works with independent artists, said on Tuesday it has secured $200 million from Viola Credit and another bank. Duetti says it will use the new lines of credit to finance the acquisitions of royalty and publishing catalogs, masters rights, and an expansion into “catalog management and marketing opportunities […]

Jukebox, a music platform where retail investors can buy royalty shares linked to songs like Adele’s “Rumour Has It” or Taylor Swift’s “Welcome to New York”, has appointed Mike Coppola to be its new CEO and board member, the company announced Wednesday (Feb. 26).

Coppola, previously a senior adviser at the fintech growth fund WestCap who was an executive at TouchTunes when it was acquired by Searchlight Capital, assumed the CEO role in January. He succeeds Scott Cohen, former chief innovation officer at Warner Music Group and co-founder of The Orchard, who has led Jukebox since its launch in 2022.

Trending on Billboard

Previously referred to as JKBX, Jukebox says it’s entering a pivotal new phase aimed at growing its investor base through partnerships with popular retail brokerages, and Coppola’s background and network is key to developing the company’s market presence and recruiting talent.

“Mike’s proven track record as an operator, driving growth, fostering innovation, and scaling companies across finance and technology makes him the ideal leader for Jukebox’s next chapter,” Sam Hendel, Jukebox’s co-founder/chairman, said in a statement. “Together, we are pioneering an SEC-qualified offering to take music public, unlocking investment opportunities for both institutional and retail investors. Mike is a crucial component in bringing this vision to life, and I couldn’t ask for a better partner leading this charge.”

Founded on the idea that investing in iconic music catalogs should not be exclusively available to record labels, private equity funds and institutional investors, Jukebox launched its first investment offering last year — a Tier 2 Regulation A offering approved by the U.S. Securities and Exchange Commission.

Visitors to Jukebox’s website can buy royalty shares in songs like Beyoncé’s “Halo,” Ellie Goulding’s “Burn” and “Lean On,” performed by Major Lazer, MØ and DJ Snake — and, as of this year, they can earn dividends when those songs are played. Through founders Hendel and John Chapman, whose Dundee Partners owns a controlling stake in the catalog investment company Chord, Jukebox has exclusive access to Chord’s 60,000 music copyrights that could be packaged into future offerings.

For now, Coppola tells Billboard they’re focused on growing Jukebox’s market presence and that it’s currently in a pilot phase with one major investment platform. Notably, retail brokerages such as Robinhood, Charles Schwab and Fidelity are expanding their list of alternative investment offerings beyond cryptocurrency to reach eager young investors.

In addition to reaching more investors through inclusion on those investment platforms, Coppola says the company is working through several regulatory steps to develop a secondary marketplace for Jukebox royalty shares.

“It took Jukebox a year and a half to get SEC approval, and the founders here spared no expense … to make sure they could get that done and they did,” says Coppola. “The next thing we have to build is the ability for these securities to be tradable anywhere, and not just on our website.”

Earlier this month, Warner Bros. Discovery and Cutting Edge Group announced they were teaming up to launch a joint venture to generate more money from one of the original Hollywood studios’ catalog of 400,000 movie and television songs.

The blockbuster deal — reportedly worth $1 billion — includes the Harry Potter and Lord of the Rings franchises, Friends, Game of Thrones, and Succession, to name a few.

This novel arrangment was inspired by WBD’s need to get more out of its most valuable assets as the rise of streaming shakes the fundamental economics underlying modern media businesses. Cutting Edge Group is a nearly 15-year-old company founded by Philip Moross, a former real estate developer who saw an opportunity to acquire, manage and develop music rights from films and TV shows.

Trending on Billboard

Now a three-prong company that also includes studios where partnering artists like Timbaland produce music specifically for Cutting Edge projects in the film, TV or wellness space, Cutting Edge is embarking on its biggest project yet.

Billboard spoke with CEG’s Moross about how the joint venture with Warner Bros. Discovery will work, including what Cutting Edge brings to the table and if they other joint ventures between music companies and studios to follow.

What are you aiming to accomplish with this joint venture, and what role will Cutting Edge play do day-to-day?

I put the idea [to WBD] that as we are solely focused on music, we could help make it a larger profit center for them. We are working closely with Warners’s music department … and hope to build a music business within the framework of Warner Bros. Discovery the way that Warner Chappel was in the past. We are a music business. They are a film and television business that incorporates music into their creative process. Our job is to effectively maximize the monetary end of it. But how it’s going to work on a day-to-day basis we are still working out. I will say We have no interest in changing the relationships [Warner Bros. Discovery] has with UMPG and Sony. We’re an independent and we don’t compete with any of them.

This is a massive catalog. How will you manage maximizing its value?

You compartmentalize—pure instrumentals, songs, etc.—and then see what the market wants from each category … and take into account the composers. We understand the composers are the lifeblood of the business. Warner wants to take care of them from a creative point of view.You must balance the economic value of that with the creative process. A composer may not want the main theme to Harry Potter used anywhere else, but the body of the music may be available. On the other hand, the song “Shallow” is a huge song, which is relevant now, that you may be able to get some very big synchs on. We are going to have to work to make sure all parties are involved–because it is not 100% owned by one party and the master is owned by Gaga’s record label. We have the time and inclination to do that whereas Warner is on to the next movie already.

You’ve got 400,000 titles so it’s not going to be quick and easy. If I am advising I’d be saying go for the top 20% that generate 80% of the revenue, but don’t lose sight of the gems in there.

Will Cutting Edge be providing its two cents on films?

We hope to provide input on songs for films in the works. In the core business of Cutting Edge, we’ve done that. We’ve bought catalogs of film rights and suggested to composers … to use the same themes again because creatively it works.

What is so important to Warner Bros. Discovery is maintaining creative integrity. They are never going to tell a director what music to use and what music not to use. … [and] it is not our role to impose any creative ideas. What we hope to do is to suggest [through the Warner Bros. Discovery music department] to the creatives, “If you’re doing Aquaman 3, why don’t you use the same themes from Aquaman 1 and 2 for certain characters?”

Cutting Edge’s Myndstream business does a lot linking music with the wellness industry. Are there opportunities in the wellness space in this catalog?

Absolutely it’s an area of focus for us. We work on [opportunities like these] all the time. There is a Nicholas Britell track called Agape [from the score of If Beale Street Could Talk]. It’s one of the most used tracks on Peloton for their meditation programs. Everything is about the emotional connection and identifying opportunities.

Everyone knows the soundtracks of “Harry Potter” and Friends. But there are music cues in the catalog as well. Can you describe what those are and their potential?

When you are watching a film or television show and you hear the background music, every item of music that sits in that film or television show is a cue. It is the background music that you’ve got right up to the songs. For example, The Rembrandts in Friends — the opening titles can be a cue. It could be the 3 ½ minute version of the Rembrandt song — a full song — or the 1-minute portion of that. That is the cue. The cue that is registered with BMI is earning its revenue from broadcast performance. So when the TV show plays, the network that is paying the royalty will pay the PRO which then pays the publisher, which in this case is our joint venture. We track to make sure nothing is missed.

How much of your day will be devoted to this?

[Cutting Edge’s] operating team will spend the majority of its time on this. It’s certainly the biggest deal that I’ve ever done. It deserves the attention because it is such a big scale.

What kind of return is this JV expected to produce on Warner Bros. catalog?

I can’t give you a number as to how much we will increase revenue.

Tell us about your team.

This is a family affair. My background was in real estate historically; I gave it up in 2010. All three of my kids are in the business; 12 on 12 is run by my daughter Claudia, Freddie runs the MyndStream business, and Tara [Finnegan] runs the bigger picture. Tara has done an exceptional job in this whole process, but we have really navigated together from the beginning. Tim Hegarty and the Cutting Edge M&A team, as well. The deal could not have been done without them.

Do you think more studios will do deals like the one Cutting Edge has done with Warner Bros. Discovery?

I hope so. We are having discussions with various rights owners who are interested in maximizing the value of their music rights either through a sale or a partnership with Cutting Edge. They are driven by different motivations, which include the ability to release equity from ancillary rights that are fully amortized on their balance sheets; or the opportunity to work with Cutting Edge’s team of professionals to help with supervision, exploitation, soundtrack release and marketing.

There should be no major obstacles since we have completed the deal with WBD and proved the value we can add to these types of copyrights. We operate in a very specialist area of the music business and each rights owner has their own specific needs. It takes time to create a bespoke offer to meet these needs, which Cutting Edge is uniquely placed to do.”

Charles Goldstuck‘s GoldState Music is quietly bulking up thanks to two back-to-back catalog acquisitions in the last six months.

According to sources, GoldState has laid out some $200 million to acquire portfolios of music publishing and recorded music royalty income streams from two boutique music asset investment firms: CatchPoint Rights Partners in a deal that sources say closed in the last month; and AMR Songs, whose catalog GoldState acquired earlier this year.

The CatchPoint portfolio includes stakes in songs like Kanye West‘s “Flashing Lights,” Sheryl Crow‘s “If It Makes You Happy” and Panic! At The Disco‘s “I Write Sins Not Tragedies,” along with slices of songs and/or recordings by the likes of Brantley Gilbert, Smash Mouth, Avril Lavigne and others.

Meanwhile, the AMR catalog includes John Sebastian’s writer’s share of all of his The Lovin’ Spoonful songs, including “Summer In the City,” “Daydream” and “Do You Believe In Magic,” as well as all rights from Sebastian’s solo catalog, which includes “Welcome Back.” AMR has also made investments in SOJA’s catalog, from the band’s inception through 2020 — covering music publishing and artist royalties and various master recordings — as well as stakes in songs by the likes of Macy Gray and Ivan Neville.

While the above list includes artist names, the two firms have also invested in co-writer shares of songs or producer points on artist royalties — and their websites don’t always specify, when citing song and recording investments, which assets have been acquired.

Trending on Billboard

All told, the two firm’s catalogs each had about $7 million in annual income, or a combined $14 million, in a combination of music assets that split about 50/50 active and passive income, sources say. (Passive income would be the writer’s share of a song owned and controlled by a publisher or an artist’s royalty income stream from a master recording owned by a label. Active income would be ownership of the song publishing and/or the master recordings.)

Goldstuck has a long history in the music industry, having held senior executive positions at such labels as Arista Records, Capitol Records, J Records and RCA before becoming president/COO of the Bertelsmann Music Group. More recently, he was co-chairman of Hitco Entertainment, which was sold to Concord. Moreover, Goldstuck is the founder of The Sanctuary At Albany, which is described as a state-of-the-art recording studio in the Bahamas, and is also currently the executive chairman of TouchTunes Interactive Networks, the digital jukebox company with over 80,000 locations, according to his LinkedIn profile.

The GoldState Music website says Goldstuck founded the GoldState investment firm in 2022 and lists Flexpoint Ford, Pinnacle Financial Partners and Regions as its financial backers. The website also lists TouchTunes, The Sanctuary at Albany and Create Music as part of the GoldState Music growth portfolio. In June, GoldState Music participated in Flexpoint Ford’s $165 million funding round to Create Music Group, although the amount it invested was undisclosed.

Prior to making its latest catalog acquisitions, Goldstuck began by acquiring music intellectual property rights on its own, including by buying — based on the GoldState website — the rights of music by recording artists such as EDM DJ/artist Alan Walker, Christian group Anberlin, pop singer Daya, punk band Dead Kennedys and legendary soul singer Sam Moore, among others. The company’s website doesn’t specify which rights of those artists it has acquired.

In moving on to bigger acquisitions like its recent CatchPoint portfolio and AMR Songs deals, Goldstate so far appears to be eschewing iconic songs and catalogs that trade for frothy prices and multiples and instead has chosen to buy the catalogs of two firms, which separately on their own pursued niche genres and name artists — but not superstars — whose music rights assets produce steady income streams that trade at more reasonable price points.

CatchPoint was founded in 2020 by former BMI executive Rich Conlon, Wall Street executive Patrick Riordon and PJ Miklus, a business executive with a background in finance and the music industry. Sources suggest that CatchPoint sold its portfolio of songs to GoldState as a proof-of-concept to potential investors. Sources add that the firm didn’t sell all of the music assets in its catalog and has funding for further music asset acquisitions.

Meanwhile, AMR was founded by Tamara Conniff, a former music publishing executive at such firms as Roc Nation and Artist Publishing Group, and Wall Street private equity executive Steve Reinstadtler. According to the GoldState website, Conniff and some of her team have joined the GoldState staff.

Executives at GoldState, Catchpoint and AMR either didn’t return phone calls seeking comment or declined to comment on the transactions.

HarbourView Equity Partners has acquired the master royalty income of renowned jazz guitarist, singer-songwriter and 10-time Grammy Award winner George Benson. Terms of the transaction were not disclosed. In the press release announcing the transaction, HarbourView Equity Partners founder and CEO Sherrese Clarke Soares said, “We maintain a commitment to be a canon for legendary culture […]

Anthem Entertainment has acquired a “wide” selection of songs from Darell‘s catalog, the company tells Billboard. Included in the deal is the urbano superstar’s star-studded “Te Boté (Remix)” with Casper Mágico, Nio García, Nicky Jam, Ozuna & Bad Bunny, which peaked at No. 36 on the Billboard Hot 100 in 2018 and ruled the Hot Latin Songs chart for 14 weeks.

Additional Darell songs that are part of the acquisition include “Otro Trago” with Sech and “Asesina” with Brytiago, along with tracks featuring Jennifer Lopez, Rauw Alejandro, J Balvin and more.

The Darell catalog acquisition further boosts Anthem’s presence in the Latin music space. The indie music company’s publishing catalog also includes an array of hits by Latin acts such as Pitbull, Karol G, Farruko, Camilo and Ricky Martin.

Trending on Billboard

Also on Wednesday (Nov. 13), Anthem also announced that industry veteran Victor Mijares has been appointed as the company’s first vp of Latin music and will “work closely” with Anthem’s acquisitions team to “source and evaluate investment opportunities in the Latin market,” according to a press release.

“We are excited to welcome Victor as Anthem’s first-ever Vice President of Latin Music,” Anthem CEO Jason Klein said in a statement. “With his deep expertise in Latin music and culture, alongside his extensive industry experience, Victor will play a crucial role as we expand our presence in this vibrant and rapidly growing market. Under Victor’s leadership, Anthem’s acquisition of this extraordinary catalog of songs from Darell is a significant step in our strategy to invest in exceptional Latin music, further diversifying and enriching our already impressive catalog of songs.”

“I am honored and thrilled to have joined Jason Klein’s outstanding team and to contribute to Anthem’s Entertainment’s continuing success,” Mijares added. “I believe that the potential to grow our business in the Latin sector is open-ended. We have the passion, commitment, and resources to shape exciting opportunities for our partners. The acquisition of a large portion of Darell’s catalog is a very important step for us as a company as well as for the Canadian music industry. We are delighted to add Darell’s masterful works to our growing repertoire.”

Darell was represented in the deal by Angie Martinez, Esq., Denny Marte at MPA Advisors, LLC and Eddy Perdomo at EPM Entertainment.

Duetti, a fintech platform that lends money to independent artists in exchange for stakes in their back catalogs, said Tuesday it secured $114 million from investors led by Create Music Group-backer Flexpoint Ford.

Co-founded by former Tidal COO Lior Tibon and former Apple Music business development executive Christopher Nolte in 2023, Duetti is the latest company in the indie music sector to capitalize on the flood of financing and interest coming from institutional investors and private equity firms.

Duetti said it raised $34 million in an equity financing from Flexpoint Ford, Nyca Partners and Viola Ventures. Chicago-based Flexpoint Ford invested $165 million in Create Music Group earlier this year. Duetti also secured $80 million through a privately rated asset-backed security, structured and placed by Barclays.

Trending on Billboard

This is Duetti’s second publicly-disclosed fundraise — last year it raised $32 million from investors including Roc Nation, Viola Ventures and Presight Capital — and its first ABS. Duetti chief executive Tibon described the combination of equity investments and ABS financing as more efficient, and said in a statement that it will help them to “accelerate [the company’s] acquisition of music catalogs and expand its proprietary forecasting, pricing, sourcing, and marketing technology.”

“We believe we are leading the way in educating the capital markets on the significant long-term value of the independent music sector,” said Tibon. “The number of independent artists is growing at an unprecedented rate, and Duetti is here to ensure they have access to differentiated financing solutions.”

Duetti says it works with 500-plus artists, including MC Delux, SadBoyProlific and Savannah Dexter, purchasing their tracks or entire master catalogs, in exchange for funds that typically range from $10,000 to $3 million. Through digital marketing campaigns like playlists and channels on Spotify and YouTube, along with traditional sync placements and better distribution, Duetti says it helps artists grow their audience, thereby generating more streaming revenue and a profit for their investors.

Flexpoint Ford managing director Mike Morris called Duetti one of the fastest growing rights music rights companies in recent years.

“We see tremendous potential in their ability to provide scalable, data-backed solutions that address the evolving needs of musicians today,” Morris said in a statement.

State Champ Radio

State Champ Radio