Business

Page: 84

Nelly’s former St. Lunatics bandmate Ali wants to drop a lawsuit that had accused the rapper of failing to pay him for his alleged work on Nelly’s 2000 debut album Country Grammar. But Nelly’s lawyers say Ali and his lawyers must pay for bringing a “ridiculous” case.

The action, filed last year, alleged that Nelly (Cornell Haynes) had cut four of his former St. Lunatics crew out of the credits and royalty payments for the hit album. It claimed the star had repeatedly “manipulated” them into falsely thinking they’d be paid for their work.

But three of the St. Lunatics quickly dropped out, saying they had never actually wanted to sue Nelly and had never given legal authorization to the lawyers who filed the case. And in recent months, Nelly’s lawyers had sought punishing sanctions against those attorneys.

Trending on Billboard

In a motion filed Thursday (April 10), Ali and his lawyers moved to voluntarily dismiss the case. They offered no rationale for why they were doing so, and there was no indication that a settlement of any kind had been reached. They did not immediately return a request for comment.

Nelly’s attorneys aren’t going to let him off the hook that easily. In a quick response, they urged the judge to refuse to dismiss the case until he decides whether Ali and his attorneys should face punishment for filing a “vexatious” lawsuit that “should never have been brought.”

“Plaintiff’s counsel succeeded in its frivolous campaign aimed at forcing Haynes to spend money defending Plaintiff’s ridiculous time-barred claims,” the star’s lawyers write. “The Court is respectfully requested to retain jurisdiction and set a briefing and hearing schedule for [potential sanctions].”

Nelly rose to fame in the 1990s as a member of St. Lunatics, a hip-hop group also composed of St. Louis high school friends Ali (Ali Jones), Murphy Lee (Tohri Harper), Kyjuan (Robert Kyjuan) and City Spud (Lavell Webb). With the June 2000 release of Country Grammar — which spent five weeks atop the Billboard 200 — Nelly broke away from the group and started a solo career that later reached superstar heights with his 2002 chart-topping singles “Hot in Herre” and “Dilemma.”

In September, all four St. Lunatics accused Nelly of cheating them out of compensation for contributions they’d made to Country Grammar. They claimed they had waited so long to sue because they believed their “friend and former band member would never steal credit” from them.

But a month later, the lawsuit took a strange turn: Nelly’s lawyers filed a letter warning that Lee, Kyjuan and Spud had never actually wanted to sue Nelly and that they had not given legal authorization to the lawyers who filed the lawsuit to include them as plaintiffs.

“They are hereby demanding you remove their names forthwith,” Nelly’s lawyers wrote in a letter to Walton. “Failure to do so will cause them to explore any and all legal remedies available to them.”

In November, Ali’s attorneys filed an updated version of the lawsuit listing only Ali as a client and vowed to fight on. But Nelly’s attorneys have since argued that the case is “frivolous,” claiming it was clearly filed years after the statute of limitations had expired. In January, they said it was so obviously flawed that the lawyers who filed it should be punished for going to court.

“Plaintiff and his counsel should be sanctioned in the full amount … that Haynes has been forced to incur in defending this action,” the rapper’s lawyers wrote at the time. “That is because plaintiff’s claims should never have been brought in the first place.”

Last month, the judge overseeing the case said he would not rule on that motion until he decided whether to dismiss the case. Such a motion to dismiss from Nelly’s attorneys was pending when the case was voluntarily dropped.

Longtime dance/electronic world agent Maria May of CAA will be honored with the Legends Award at IMS Ibiza 2025 for her notable contributions to electronic music culture.

With her career extending back more than three decades, May helped develop and legitimize the electronic music scene, bringing it out of warehouses to large-scale venues and events worldwide.

May currently represents a flurry of dance world stars, including David Guetta, Sara Landry, Marlon Hoffstadt, Róisín Murphy, Paul Kalkbrenner, Robin Schulz, Icona Pop, The Chainsmokers, Jonas Blue and Black Eyed Peas, among others. She’s also worked with artists including Frankie Knuckles, David Morales, Layo and Bushwacka, Hercules and Love Affair, Azari and III, Moloko, Soulwax, 2manydjs, Lee Burridge, and X-press 2.

“To receive this recognition is both humbling and very exciting,” May said in a statement. “Not merely because of what it represents for my career, but because of what it stands for in the wider culture of electronic music. The first woman to be publicly recognized for her efforts with an award of this gravitas has been a long time coming. Watching electronic music evolve from underground rebellion to a global movement and being one of the many architects of the global business phenomenon that we have created and now being recognized for these efforts is something I never imagined when I went to my first rave.”

Trending on Billboard

Beyond her work as an agent, May is being honored for advocacy work that includes her role as a board member of Lady of the House, a collective that works to amplify women in the dance music industry. She has a position on the board of Beatport, a position on the advisory board of the Frankie Knuckles Foundation, was a founding advisory board member of the Association For Electronic Music (AFEM) and has been a longtime board member of the Night Time Industries Association.

May has also been included multiple times on Billboard‘s International Power Players and Women In Music power lists.

The award will be presented during The Beatport Awards, happening at Atzaró Agroturismo on the evening of April 24. It’s one of the many gatherings happening on the island in conjunction with IMS Ibiza. There will also be an industry lunch in May’s honor during the three-day dance industry gathering.

“I have enjoyed watching Maria’s career grow from my first meeting with her in the offices of ITB in 1994, seeing her develop with her acts into a global force of nature when it comes to agenting talent,” says IMS and AFEM co-founder Ben Turner. “Her role behind the scenes in affecting how the industry operates may not be seen by so many, but is felt by everybody. She challenges the industry to think and be better. She cares as much today as she did as a passionate agent in her early 20s on the dancefloor at Liquid in Miami listening to Frankie Knuckles and David Morales — which is how I will always visualize her! Both IMS and the clubbing industry of Ibiza are truly proud of her achievements. Electronic music is in a better place because of the person that is Maria May.”

“Maria May has been a transformative force in electronic music for over three decades,” adds Robb McDaniels of The Beatport Group, which acquired a majority stake in IMS in 2023. “Her work behind the scenes has helped shape the careers of some of the most iconic artists in our culture. At Beatport, we’re proud to recognize her contributions and leadership, especially her tireless advocacy for women in our industry. Maria has not only opened doors, she’s helped rebuild the very rooms where decisions are made. She embodies the spirit of this award.”

IMS Ibiza happens at the Mondrian Ibiza and Hyde Ibiza hotels this April 23-25. The event will feature three days’ worth of panel discussions from experts across many sectors of the industry, along with mixers, networking opportunities, performances, a robust wellness program and much more. See the complete IMS Ibiza 2025 schedule here.

Delhi, a city of 34 million people, was the obvious setting for Indian pop star Diljit Dosanjh to open his home-country tour last October — and he quickly sold out Jawaharlal Nehru Stadium and added a second date. But after that, Dosanjh wanted to plunge deeper into India, performing in Lucknow, Indore, Guwahati and other areas with a mere 1 million to 4 million residents. “We actually got to cities where there wasn’t any big concert, ever,” says Sonali Singh, Dosanjh’s business manager and tour producer. “When we started off, it was kind of an experiment.”

Dasanjh’s tour, which sold 200,000 tickets across its initial 10 venues in less than 10 minutes when it went on sale last September, showed not only the Punjab native’s star power but the massive potential of India as a concert market. In January, Coldplay broke a global attendance record with 223,000 fans at two shows in Narendra Modi Stadium in Ahmedabad, Gujarat, India; in February, Ed Sheeran closed a six-city tour of the country with 120,000 ticket sales. (By contrast, Zach Bryan sold out the biggest stadium in the U.S., Michigan Stadium in Ann Arbor, Mich., with 112,000 tickets for a show this coming September.)

Trending on Billboard

“We are at the cusp of hockey-stick growth, as far as this market is concerned,” says Naman Pugalia, chief business officer of live events for BookMyShow, the Indian entertainment platform that promoted the Sheeran dates with AEG.

For decades, India’s demand for large music concerts has outstripped its capacity: Led Zeppelin’s Jimmy Page and Robert Plant, and The Police, played what Rolling Stone India called “niche, often low-key shows” in Mumbai in the ‘70s and ‘80s, in part because local officials considered Western music “anti-Indian.” Although local bands played hotel clubs and pubs and developed rock scenes in Mumbai and elsewhere over the years, it wasn’t until the early 2010s that promoters put on larger electronic dance music, blues and rock festivals, such as the Bacardi NH7 Weekender (at a Pune wedding venue) and the VH1 Supersonic (on a beach in Goa). By 2017, Justin Bieber was playing to 56,000 fans at a Mumbai stadium.

Coldplay perform at Narendra Modi Stadium on Jan. 25, 2025 in Ahmedabad, India.

Anna Lee

A 2024 BookMyShow report suggests India’s international concert market of 1.4 billion people is no longer untapped — live entertainment grew 18% compared to the previous year, live events in “Tier 2” cities such as Kanpur and Shillong grew 682%, and more than 477,000 fans traveled to shows outside their hometowns. In March 2024, after Sheeran sold out Mumbai’s Mahalaxmi Racecourse (which BookMyShow had helped revitalize into a large-scale concert venue), the British singer-songwriter asked his team to return this year and “go deep into India and cover as much ground as possible,” according to Simon Jones, senior vp of international touring for AEG.

That was a challenge. “Landing a spaceship in the middle of nowhere in India is tough, and it’s not the same as doing it in America, Europe or even South America,” Jones says. “But the infrastructure in India is certainly getting a lot better, and the country, in terms of its touring future, will be very, very different in five years’ time, and especially 10 years’ time.”

In recent years, stars such as Post Malone, Imagine Dragons and Dua Lipa have sold out shows in the country; Lollapalooza India reportedly drew 60,000 fans in 2023, and a rep for promoter Live Nation said the 2025 festival last month, starring Green Day and Shawn Mendes, scored its highest attendance ever. Cigarettes After Sex sold out two large India shows in January; Guns N’ Roses will perform at Mahalaxmi Racecourse next month; and Travis Scott plays Delhi in October.

The recent concert boom is due, in part, to the boom in India’s middle-class population over the last two decades. “India’s disposable income is growing day by day, and the audience is seeking more experiences to spend their money on,” says Bhavya Anand, manager of rapper King and co-founder of talent agency Bluprint. “We see that there will eventually be a lot of clout in ticket buyers — but it’s also scary, because it’s not possible for everyone to attend everything.”

Since the pandemic, social media platforms such as Snapchat and Instagram have taken off in India, and residents have been “going out with a vengeance,” according to Jay Mehta, managing director of Warner Music India and SAARC. As recently as 2018, he adds, international touring artists were largely limited as far as how many fans they could draw — Bryan Adams, a huge regional star who has played India since the ’90s, sold out a Mumbai concert with just 10,000 people that year.

But promoters have been methodically building production systems and ticket-selling technology to prepare for an expected entertainment boom. Since then, governments have become more sophisticated in adapting cricket stadiums and other large venues to concerts and providing public transportation. “There were a lot of struggles, from bureaucracy to permissions,” Mehta says. “In the past, the production costs were so high, you’d have only 10,000 people coming, you’d have a massive loss.” More recently, he adds, promoters who’ve “gone through this pain for the last 10 years finally enjoy the fruits of the concert ecosystem.”

One of those early companies was Only Much Louder, a 22-year-old promoter that initially focused on concerts and managed Indian music stars but has shifted into comedy and other non-music entertainment. Until recently, says Tusharr Kumar, the company’s CEO, it was impossible to fund large concerts without significant corporate sponsorship, but given newly built stadiums and arenas, as well as prominent financial successes such as Coldplay’s shows and the Dosanjh and Sheeran tours, that is starting to change. “We’ve been having so many conversations: ‘Did we exist at the wrong time? Because it’s suddenly getting interesting in India.’ It feels good to know all the hard work we did back then is paying off in a big way.”

From a concert-business point of view, India still has work to do, regional sources say. The country’s club circuit remains modest, with electronic-music stars such as Kasablanca and MissMonique as top headliners, due to low production costs, compared to full bands. And while Dosanjh’s 2024 success speaks to the potential for country-wide touring, and India is producing global stars such as King and singer-rapper Karan Aujla, the biggest artists still tend to do just a date or two in big cities like Mumbai and Delhi. “We’ve just had the initial spark,” Warner’s Mehta says. “Imagine once we see the complete picture.”

A Los Angeles jury held Soulja Boy liable Thursday (April 10) in a civil lawsuit filed by a former personal assistant who says he raped her, awarding the unnamed woman $4 million in damages.

As first reported by Courthouse News, jurors held the “Crank That” rapper (DeAndre Cortez Way) liable for assault, sexual battery and intentional infliction of emotional distress. The jury cleared him of claims of false imprisonment or hostile work environment.

Following the month-long trial, the jury awarded the Jane Doe accuser $4 million in so-called compensatory damages. And they could award more in so-called punitive damages in future proceedings.

Trending on Billboard

The accuser, who says she was hired as Soulja Boy’s assistant in 2018, sued the star in 2021, claiming he had repeatedly beaten and raped her over a two-year, sometimes consensual relationship. In one alleged assault, her lawyers claimed that “Way attacked plaintiff so hard that she thought she was going to die.” The rapper has “vehemently and unequivocally” denied the woman’s allegations.

During closing arguments Monday (April 7), as reported by Rolling Stone, attorneys for the Jane Doe portrayed Soulja Boy as a vicious boss and told jurors that “he raped her, he punched her, he kicked her, he cut her.” The rapper’s lawyers, meanwhile, painted the accuser as a bitter former love “motivated by jealousy, revenge and financial gain”: “She wanted to be paid. That’s what this case is all about. It’s not about the truth, it’s just not,” they said.

“We’re happy our client was vindicated and the jury believed her claims,” said Ron Zambrano, the accuser’s lead attorney. “We’re looking forward to moving on to the punitive damages phase of the case.”

An attorney for Soulja Boy did not immediately return a request for comment.

This isn’t the first time Soulja Boy has faced such accusations. Back in 2023, he was ordered to pay ex-girlfriend Kayla Myers $471,900 stemming from an assault and kidnapping lawsuit she filed against the rapper in 2020.

President Trump’s global tariffs, which were paused for 90 days shortly after going into effect on Wednesday (April 9), have set global markets on a rollercoaster downhill and put on hold many of the year’s most-anticipated IPOs. Although markets rebounded strongly after the U.S. Treasury Department lowered most tariffs to a flat 10% — China is a notable exception — some anticipate the market volatility could present an opportunity for music catalogs and debt in the coming months, as investors look for more stable ground.

Both sectors — investing in music intellectual property and buying asset backed securities (ABS) collateralized by music rights — could see more demand from institutional investors looking to stockpile cash and safeguard against equities, several royalty investors, music valuation experts and entertainment bankers tell Billboard. For over a decade, music catalog returns have held relatively steady even during economic downturns, which may appeal to investors looking for assets they can easily cash out of in a pinch, those sources said.

Trending on Billboard

“The royalties space has been relatively calm over the last week given the volatility seen elsewhere, with many investors expecting their portfolios to remain resilient as they have been through other macroeconomic and geopolitical events, although it’s still early days,” says Stephen Otter, managing director at the Swiss-based private equity firm Partners Group. An investor in Harbourview Equity Partners, Round Hill Music and Lyric Capital Group, Partners launched its own royalty investment strategy in February to acquire music, healthcare, renewable energy and other royalties, with the aim of accumulating $30 billion in assets under management by 2033.

“As investors reassess their portfolio allocations in today’s environment, we expect many may consider casting their net wider to incorporate other asset classes, such as royalties,” Otter adds.

The rise of paid music streaming, which accounted for 51% of global recorded music revenues in 2024, according to the IFPI, has helped stabilize music royalties and make their returns more predictable into the future. While rights holders have some exposure to recessionary changes such as advertising spending and consumer discretionary spending, “Music streaming tends to perform well and has historically offset other declines,” says Brad Sharp, senior managing partner at Virtu Global Advisors.

Shot Tower Group, a Baltimore-based boutique investment bank, said that investor interest in music assets remains high despite industry reports of slowing streaming growth, although that outlook could change if macro-economic uncertainty persists, or a trade war were to take hold.

Brian Richards, managing partner at the music-focused investment bank Artisan, tells Billboard, “We haven’t seen any evidence of pullback in the music market during this past week of turbulence.”

Two sources said they expect more activity in the near-term in the credit markets for music. In the past 18 months, a growing number of music companies, like Concord, HarbourView and Recognition, formerly Hipgnosis, have raised money in the debt markets by selling asset backed securities backed by the songs they own in their portfolios.

These sources anticipate more esoteric debt like this to become available to investors because corporate bonds have been rallying since the beginning of the year, driving a narrowing in the difference between the yields of Treasury bonds and corporate bonds. A narrow, or tight, spread between those bonds typically signals optimism.

Shot Tower says it expects at least one music company to issue an asset-backed security in April, which could provide a gauge of investor sentiment. If the chaotic market mood and global uncertainty stick around, however, it could mean fewer music catalogs come up for sale and financing becomes more selective, Shot Tower says.

At least one industry group expressed fears over the possibility of retaliatory tariffs on digital services companies, such as Apple Music, Amazon, Meta and YouTube, and maybe even issues collecting royalties.

“Since creative industries are among the few American industries that have a positive balance of trade with other nations, we will be watching closely to see if other countries target American music in any retaliation, which could include tariffs or other actions like withholding royalty payments,” A2IM president/CEO Richard Burgess wrote in an email to members this week.

The withholding of royalties is unlikely, says Sharp, or may be limited to countries such as China that have higher tensions with the U.S.; on Wednesday, the Treasury raised the tariff on goods from China to 125% following the country’s imposition of retaliatory tariffs on U.S.-made goods.

“A rise in global economic tensions may result in an increase in consumption of more localized content on a by-country or by-region basis,” says Sharp. Economic policy could also result in higher inflation, he adds, “which will potentially impact interest rates and have a knock-on effect on valuations.”

Additional reporting by Ed Christman.

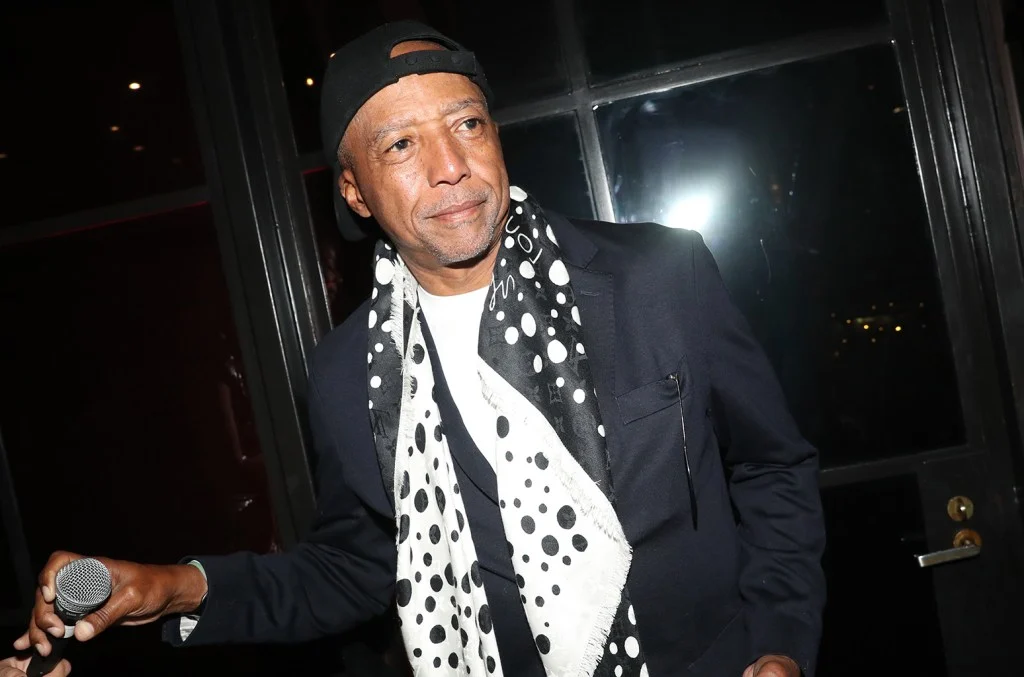

Record executive Kevin Liles is asking a federal judge to throw out a lawsuit accusing him of sexual assault in the early 2000s, arguing there’s zero evidence for the “salacious” allegations because they are “entirely false.”

In a letter to the judge filed Tuesday, attorneys for the 300 Entertainment founder say they’re planning to file a motion to dismiss the case, which alleges that Liles harassed and sexually assaulted an unnamed female employee while serving as the president of Def Jam Records in 2002.

“During his storied career, Mr. Liles has never faced a single accusation of sexual impropriety,” his attorneys write. “That is, until plaintiff filed this patently false and untimely lawsuit some twenty-three years after the alleged conduct purportedly occurred.”

Trending on Billboard

Liles’ lawyers say the Jane Doe’s lawsuit contains only generic accusations and almost no specific details to support her allegations – an omission that they say is “not surprising as the claims are entirely false.”

“Beyond these threadbare assertions, spanning only three paragraphs, plaintiff offers zero factual bases for her salacious allegations,” his attorneys say “This court need not credit Plaintiff’s threadbare recitals and ‘defendant-unlawfully-harmed-me’ accusations.”

Liles served as president of Universal Music Group’s Def Jam Recordings and executive vice president of the Island Def Jam Music Group from 1999 to 2004. After a stint at Warner Music Group, he co-founded 300 Entertainment in 2012 with Lyor Cohen, Roger Gold and Todd Moscowitz. The label, which quickly gained recognition for developing hip-hop superstars like Megan Thee Stallion, Migos and Young Thug, was acquired by Warner in 2021 for $400 million. In September, Liles announced he would step down from his role as chairman and CEO.

The case against Liles was filed in February by a woman who says she was hired as an executive assistant at UMG in 1999. She claims that Liles began sexually harassing her shortly after she was hired, which then “escalated” into groping. In an alleged 2002 incident, Doe says he assaulted her after she rebuffed his advances.

“Kevin Liles proceeded to physically force himself on top of [Jane Doe] where he began to sexually assault and ultimately rape her despite her continued protests,” her attorneys wrote in their complaint.

But in Tuesday’s response, Lile’s attorneys say those allegations are woefully insufficient, arguing they lack the kind of basic facts required to bring legal allegations in court. They say Doe “does little more than simply assert in conclusory form that Mr. Liles assaulted her.”

“Plaintiff offers no detail whatsoever regarding the nature of the purported assault she suffered,” they write. “She fails … to explain when these purported acts occurred, where in UMG’s offices they occurred, identify a single person she reported this information to, or who was present.”

As for the rape allegation, Liles’ attorneys say the case is similarly lacking: “Like the other specific details she fails to provide, plaintiff does not offer a specific time, how she came to be in contact with Mr. Liles who she neither reported to nor worked for, or anything other than the conclusory assertion that she suffered an assault.”

Beyond the alleged deficiencies in the case, attorneys for Liles say the case should also be dismissed for a simpler reason: That it was filed well beyond the statute of limitations. Doe’s attorneys sued under a New York state law that created a one-year window to file such cases, but did so after the deadline to bring them: “Plaintiff failed to assert any claim against Mr. Liles whatsoever during that one-year window, and it has now closed.”

UMG, which was named as a co-defendant in the case, also filed a letter Tuesday saying it would seek to dismiss the case. The music giant’s attorneys have similar protests about time limits, but also argue more broadly that they cannot be sued over alleged actions by one of its executives.

“UMGR cannot be held liable for the alleged actions of Mr. Liles,” the company’s attorneys write, referring to UMG Recordings. “Assuming he had engaged in the conduct alleged, UMGR is a music company and the alleged conduct was indisputably not in furtherance of any business of UMGR.”

Seeker Music has partnered with Blackheart, the independent company founded by Joan Jett and longtime collaborator Kenny Laguna, to acquire what is described as a “substantial share” of Jett’s publishing and recorded music rights, it was announced on Thursday. This collaboration aims to enhance the Joan Jett and the Blackhearts catalog, with plans for releasing unreleased music, reimagining classic albums and launching new campaigns tied to her global tours.

The Rock and Roll Hall of Fame inductee (class of 2015) has left quite a mark on rock music with hits like “Bad Reputation,” “Crimson and Clover,” “Do You Wanna Touch Me (Oh Yeah)” and “I Hate Myself for Loving You.” Formed in 1979 following the breakup of The Runaways, Joan Jett and the Blackhearts have achieved eight platinum and gold albums and nine Top 40 singles, including her sneering hit “I Love Rock ‘N Roll,” which topped the Hot 100 for several leather-clad weeks in early 1982.

Trending on Billboard

Seeker Music, founded in 2020 by M&G Investments and led by Evan Bogart, manages a diverse catalog of over 15,000 copyrights, including works by artists like Run The Jewels, Jon Bellion, Christopher Cross and others.

The partnership between Blackheart and Seeker Music represents a full-circle moment of sorts, connecting two storied rock and roll family legacies. Carianne Brinkman, Laguna’s daughter and the president of Blackheart, and Evan Bogart, son of legendary record executive Neil Bogart, who signed Jett to his Boardwalk Records, are key figures in this collaboration.

“Seeker joining forces with Joan, Kenny, Carianne and Blackheart isn’t just a partnership, it’s a personal, powerful reunion… reigniting a legacy and carrying the torch forward with the same rebellious spirit that ignited it,” said Evan Bogart.

Kenny Laguna, Steven Melrose, Joan Jett, Evan Bogart and Carianne Brinkman.

Brandon Young

Brinkman and Laguna echoed Bogart’s sentiment on the serendipity of the collaboration.

“I can’t imagine a better partnership that is at once completely new but a return to a shared legacy that began with the belief in Joan Jett and the Blackhearts,” said Brinkman.

Laguna added: “It’s too coincidental to be a coincidence, so I am so overwhelmed to see how fate brought Carianne and Evan Bogart at Seeker together 58 years after I had my first hit with Neil Bogart.”

The partnership was negotiated by LaPolt Law, P.C., and Reed Smith, LLP, with support from Seeker’s chief creative officer Steven Melrose and Blackheart’s head of distribution and operations Hubert Górka.

“At Seeker, our celebrated creative and innovative approach to catalog means that our focus is on super-serving Joan’s current fans, whilst growing her fandom year on year – essentially taking Joan’s music into millions of new homes globally,” said Melrose. “For a catalog as expansive and legendary as Joan Jett and the Blackhearts’, we’re working on plans to release incredible archival moments, activations around her best-selling global tours, reaching new fans through global and cross-genre campaigns, and creative re-releases of beloved albums utilizing new platforms around the world.”

The companies did not disclose financial aspects of the deal, nor the specifics of the “substantial share” of the acquired catalog.

HYBE Interactive Media (HYBE IM) secured an additional KRW 30 billion ($21 million) investment, with existing investor IMM Investment contributing another KRW 15 billion ($10 million) in follow-on funding. Shinhan Venture Investment and Daesung Private Equity joined as new investors in the company, which plans to expand its game business using HYBE’s K-pop artist IPs. To date, HYBE IM has raised a total of KRW 137.5 billion ($100 million). With the new money, the company plans to enhance its publishing capabilities and execute its long-term growth strategy by allocating it to marketing, operations and localization strategies to support the launch of its gaming titles.

Live Nation acquired a stake in 356 Entertainment Group, a leading promoter in Malta’s festival and outdoor concert scene that operates the country’s largest club, Uno, which hosts more than 100 events a year. The two companies have a longstanding partnership that has resulted in events including Take That’s The Greatest Weekend Malta and Liam Gallagher and Friends Malta Weekender being held in the island country. According to a press release, 356’s festival season brought 56,000 visitors to the island, generating an economic impact of 51.8 million euros ($56.1 million). Live Nation is looking to build on that success by bringing more diverse international acts to the market.

Trending on Billboard

ATC Group acquired a majority stake in indie management company, record label and PR firm Easy Life Entertainment. The company’s management roster includes Bury Tomorrow, SOTA, Bears in Trees, Lexie Carroll, Mouth Culture and Anaïs; while its label roster boasts Lower Than Atlantis, Tonight Alive, Softcult, Normandie, Amber Run, Bryde and Lonely The Brave. Its PR arm has worked on campaigns for All Time Low, 41, Deaf Havana, Neck Deep, Simple Plan, Travie McCoy and Tool.

Triple 8 Management partnered with Sureel, which provides AI attribution, detection, protection and monetization for artists. Through the deal, Triple 8 artists including Drew Holcomb & the Neighbors, Local Natives, JOHNNYSWIM, Mat Kearney and Charlotte Sands will have access to tools that allow them to opt-in or opt-out of AI training with custom thresholds; protect their artist styles from being used in AI training without consent by setting time-and-date stamp behind ownership; monetize themselves in the AI ecosystem through ethical licensing that can generate revenue for them; and access real-time reporting through Sureel’s AI dashboard. Sureel makes this possible by providing AI companies “with easy-to-integrate tools to ensure responsible AI that fully respects artist preferences,” according to a press release.

Merlin signed a licensing deal with Coda Music, a new social/streaming platform that “is reimagining streaming as an interactive, artist-led experience, where fans discover music through community-driven recommendations, discussions, and exclusive content” while allowing artists “to cultivate more meaningful relationships with their audiences,” according to a press release. Through the deal, Merlin’s global membership will have access to Coda Music’s suite of social and discovery-driven features, allowing artists to engage with fan communities by sharing exclusive content and more. Users can also follow artists and fellow fans on the platform and exchange music recommendations with them.

AEG Presents struck a partnership with The Boston Beer Company that will bring the beverage maker’s portfolio of brands — including Sun Cruiser Iced Tea & Vodka, Truly Hard Seltzer, Twisted Tea Hard Iced Tea and Angry Orchard Hard Cider — to nearly 30 AEG Presents venues nationwide including Brooklyn Steel in New York, Resorts World Theatre in Las Vegas and Roadrunner in Boston, as well as festivals including Electric Forest in Rothbury, Mich., and the New Orleans Jazz & Heritage Festival.

Armada Music struck a deal with Peloton to bring an exclusive lineup of six live DJ-led classes featuring Armada artists to Peloton studios in both New York and London this year. Artists taking part include ARTY and Armin van Buuren.

Venu Holding Corporation acquired the Celebrity Lanes bowling alley in the Denver suburb of Centennial, Colo., for an undisclosed amount. It will transform the business into an indoor music hall, private rental space and restaurant.

Secretly Distribution renewed its partnership with Sufjan Stevens‘ Asthmatic Kitty Records, which has released works by Angelo De Augustine, My Brightest Diamond, Helado Negro, Linda Perhacs, Lily & Madeleine, Denison Witmer and others. Secretly will continue handling physical and digital music distribution, digital and retail marketing, and technological support for all Asthmatic Kitty releases.

Symphonic Distribution partnered with digital marketing platform SymphonyOS in a deal that will give Symphonic users discounted access to SymphonyOS via Symphonic’s client offerings page. Through SymphonyOS, artists can launch and manage targeted ad campaigns on Meta, TikTok and Google; access personalized analytics for a full view of fan interactions across platforms; build tailored pre-save links, link-in-bio pages and tour info pages; and get AI-powered real time recommendations to improve marketing campaigns.

Bootleg.live, a platform that turns high-quality concert audio into merch, partnered with Evan Honer and Judah & the Lion to offer fans unique audio collectibles on tour. Both acts are on tour this fall. The collectibles, called “bootlegs,” are concert recordings taken directly from the board, enhanced using Bootleg’s proprietary process, and combined with photos and short videos.

Tens of thousands of music fans will descend on the California desert this weekend for the first of two iterations of the Coachella Music and Arts festival outside of Palm Springs, Calif.

Approximately 80,000 to 100,000 fans each weekend will have coughed up the $599 ticket price to see headliners Lady Gaga, Travis Scott, Green Day and Post Malone. But ticket price is often just the cost of entry — many of those fans will spend more than a $1,000 per weekend on lodging and cough up hundreds of dollars more for food, drinks and merchandise. It’s a substantial spend for any of the 20-somethings in Coachella’s target demographic. But festival organizers have increasingly helped finance their purchase through payment plan programs.

Approximately 60 percent of general admission ticket buyers at this year’s festival opted to use Coachella’s payment plan system, which requires as little as $49.99 up front for tickets to the annual concert. The desert festival isn’t alone — Lollapalooza, Electric Daisy Carnival and Rolling Loud all sell the majority of their tickets using some kind of payment plan system.

Trending on Billboard

Representatives at Goldenvoice, which puts on Coachella, declined to comment for this story. One source, who asked to remain anonymous because they weren’t authorized to speak to the media, told Billboard that payment plans have fundamentally changed how festivals are marketed to the public.

“Festivals are now marketing a cheap down payment as their main call to action,” the source says. “The messaging is $20 down gets you in the door, or $50 down gets you started. It’s no longer about the artists, or the festival lifestyle — the message is, ‘You can afford this if you act today.’”

The same source told Billboard it’s not uncommon for some fans to have four or five different festival payment plans hitting their accounts at one time. Typically, fans pay as little as $19.99 to get started on a payment plan that’s extended over a period of several months — three months generally for Coachella, since most buying happens after the lineup is announced, which until 2025 took place in early January. This year, fans who signed up before Jan. 25 had their payments split into three payments, with the last payment hitting a user’s account in March.

The system is different than those of popular fintech payment-plan firms like Klarna, Affirm and Sezzle, which pay out the vendor in full and reimburse themselves by collecting the remaining payments from buyers. These firms make money from merchant and processing fees they collect from vendors and, in some cases, interest payments charged to customers that go beyond the terms of their original payment plan. Because firms like Klarna and Affirm essentially grant buyers credit, and often run credit histories on their users, they are heavily regulated under a number of state and federal financial frameworks.

The payment systems used by festival promoters are administered by ticketing companies like AXS, Ticketmaster and Frontgate, and are offered as a service in exchange for the festival promoter’s business. These systems are not considered credit providers since there’s no third party fronting the vendor the full price of the transaction. Instead, the vendor is paid out over time, as each payment goes through.

Ticket buyers are charged a $41 fee for using Coachella’s payment plan, similar to what other festivals charge fans for the use of payment plans. The fee is equivalent to approximately eight percent of the ticket price, which is still far cheaper than what a fan might pay for financing a ticket on their credit card. The revenue generated from this fee is split between the ticketing company and the promoter.

While some have criticized festivals for using fees as a revenue generator, fest organizer Bob Sheehan with the California Roots Festival in Monterey, Calif. tells Billboard that payment plans “are a critical link between fan affordability and generating the revenue needed to finance a modern multiday festival.”

Sheehan estimates that 65 percent to 70 percent of his festival attendees use payment plans to pay for their tickets and adds “the entire system is built upon trust — trust that we will deliver the experience we promised and trust that our fans will make their payments on time.”

If Coachella attendees miss their scheduled payments — typically, the attempt to debit their account is declined for insufficient funds or having an expired credit card — they are given 10 days to bring their account current. If the 10th day passes and the payment is not received, then the order is cancelled and the fan is issued a credit that can be used towards next year’s festival.

“Credit expires 12 months from issuance,” Coachella officials explain on their website. “No exceptions.”

Expired monies and credits — often referred to as “breakage” in business — are governed by state law, though one source says the revenue generated from breakage is miniscule.

“Most defaults happen after the initial deposit is made on the first payment — it’s very rare that a fan will default on tickets after two payments have been made, so the revenue from breakage is very low,” explains one source familiar with how festivals operate their payment plans. “All of the incentives for the promoter are that the fan pay off their ticket in full and attend the event so they can spend money on beer and parking and merchandise.”

Create Music Group has acquired longstanding indie electronic label !K7. The acquisition comes two months after the death of !K7 founder Horst Weidenmueller at age 60.

The acquisition was in motion before Weidenmueller’s death, with a representative for the deal sharing a statement made by the founder before he died: “This transition is a deeply personal one for me, but I know that with Create Music Group, !K7 is in the right hands. Create Music Group shares our commitment to artists, labels, and creativity, and I am confident that this partnership will strengthen !K7’s legacy while opening new doors for the future. I want to thank our incredible team, partners, and artists for being part of this journey — what we have built together will continue to thrive and evolve for years to come.”

Founded in 1985, !K7 began releasing artist albums in 1996, putting forth music from across the wide electronic spectrum and beyond. The company now has offices in Berlin, London and New York, with its label group including the in-house labels !K7, AUS, 7K!, Soul Bank and Strut Records. Its longstanding influential DJ Kicks mix series is an influential and globally known platform for a wide range of DJs and producers.

Trending on Billboard

!K7 CEO Tom Nieuweboer says the partnership will allow the label “to scale our vision while staying true to our core values of independent artistry, innovation, and quality.”

This is the second high-profile acquisition Create has made in the electronic space this year, with the company announcing in March that it acquired the deadmau5 catalog, along with the catalog of the producer’s mau5trap records, for $55 million.

!K7 will be an asset to Create with its global brand recognition, ubiquity in and knowledge of the European music industry ecosystem, and its physical distribution network. Meanwhile, !K7’s artists and label partners will leverage Create’s in-house services spanning distribution, marketing and more.

“Horst was a special music entrepreneur who built !K7 over 40 years into a globally renowned brand,” said Create CFO William Smith in a statement. “Long before he passed, we spent many hours discussing ways that we could invest more into !K7 to help the business reach new heights, while also preserving the culture and principles that make the business so unique. We’re proud that Horst has trusted us with his legacy and the next chapter of !K7’s growth, and are excited to partner with Tom and the rest of the team in achieving this shared vision.”

“We are thrilled to welcome !K7 and its iconic DJ-Kicks series to the Create Music Group family,” added Create’s senior vp of global corporate development and M&A Eric Nguyen. “This acquisition not only deepens our footprint in electronic music but also reinforces our commitment to forward-thinking music across a wide spectrum of specialist genres represented by its globally respected imprint Strut Records. We’re proud to support the innovative spirit that defines the !K7 catalogue. We look forward to powering the next chapter for !K7, its exceptional roster of artists, and its visionary label partners around the world.”

State Champ Radio

State Champ Radio