Business

Page: 82

This is The Legal Beat, a weekly newsletter about music law from Billboard Pro, offering you a one-stop cheat sheet of big new cases, important rulings and all the fun stuff in between.

This week: DMX’s estate wins a legal battle with his ex-wife over his music catalog; Nelly’s former St. Lunatics bandmate drops a lawsuit over his debut solo album; Soulja Boy is hit with a $4 million civil verdict for assault and sexual battery; and much more.

THE BIG STORY: DMX Estate Battle

Back in 2016, the late great DMX (Earl Simmons) signed a divorce settlement with his then-wife Tashera Simmons, ending a long marriage that had extended through his turn-of-the-century heyday, as he released Billboard Hot 100 hits like “Party Up (Up In Here).”

Trending on Billboard

Among other provisions, the deal mentioned “intellectual property,” a key marital asset for a chart-topping musician. Tashera says that clause gave her co-ownership of his copyrights and trademarks, but DMX insisted that it only granted her the right to receive royalty payments — an argument his estate has maintained in the years since his 2021 death.

That’s a crucial distinction. Royalties are all well and good, but ownership would give Tashera approval power over the use of DMX’s catalog and name. That would mean an effective veto over potentially lucrative projects, like a biopic about the legendary rapper.

In a ruling last week, a New York judge ruled against Tashera on that question, declaring that DMX’s estate (run by an ex-fiancée and a daughter by another woman) was the “sole owner of all intellectual property rights.” Why that ruling? To find out, go read our full story here, with access to the full decision issued by the judge.

Other top stories this week…

NELLY CASE CLOSED – OR IS IT? – Nelly’s former St. Lunatics bandmate Ali moved to voluntarily dismiss a lawsuit that had accused the rapper of failing to pay him for his alleged work on Nelly’s 2000 debut album Country Grammar. But Nelly’s lawyers quickly opposed the move, arguing that Ali and his lawyers must face sanctions for filing a “ridiculous” case that “should never have been brought.”

SOULJA BOY VERDICT – Following a month-long trial, a Los Angeles jury held Soulja Boy liable for assault, sexual battery and intentional infliction of emotional distress in a civil lawsuit filed by a former personal assistant who claimed that he raped her. Jurors awarded the Jane Doe accuser more than $4 million in damages, and she could win even more in so-called punitive damages in future proceedings.

“PATENTLY FALSE” – Record executive Kevin Liles asked a federal judge to throw out a lawsuit accusing the 300 Entertainment founder of sexual assault in the early 2000s, arguing there’s zero evidence for the “salacious” allegations because they are “entirely false.” His lawyers argued the allegations — that Liles harassed and sexually assaulted an unnamed female employee while serving as the president of Def Jam Records in 2002 — are both “patently false” and were filed far past the statute of limitations.

LIMITATIONS OF STATUE – Former Migos rapper Quavo (Quavious Marshall) was hit with a copyright lawsuit centered on a recent music video he released on TikTok — not over an uncleared sample or a stolen melody, mind you, but a quartz sculpture of a 1961 Ferrari that he used as a prop. The case, filed by sculptor Daniel Arsham, claimed that Quavo “unlawfully exploited” the piece by rapping in front of it during the December social media video: “Mr. Arsham never consented to the artwork being used in the infringing content.”

KAROL G RULING – A court in Colombia ruled that Karol G’s “+57” violated that country’s laws because its lyrics “sexualized” minors, capping off months of controversy over the track. “Sexualizing minors reduces them to becoming objects of desire, and exposes them to risks that can affect their development,” the court wrote in the ruling. The song, also featuring J Balvin, Maluma, Feid, Blessd, Ryan Castro and DFZM, has faced a barrage of criticism after it originally included a line about a woman being a “mamacita” since she was 14 years old.

AI LEGISLATION – A federal law that would ban unauthorized AI deepfake impersonations, known as the NO FAKES Act, was reintroduced in Congress — only this time with public support from AI powerhouses including OpenAI and YouTube. First introduced last year, the bill would create a federal right of publicity for the first time, allowing individuals to police how their name, image and likeness are used by others, an issue that has become far more pressing as AI video generators make it far easier to create uncanny deepfakes.

Brooklyn Bowl is known for emo nights, jam bands, fried chicken fare and 16 lanes for spares, strikes and gutter balls. What patrons might not know is that it is also one of the few music venues run by women.

Less than half of the 72,000 managers employed in the entertainment and recreation industries in the United States last year were women, according to the U.S. Bureau of Labor Statistics. However, at Brooklyn Bowl — launched in 2009 by live music impresario Peter Shapiro — women make up 75% of the full-time salaried staff running the show.

General manager Anna Ayers leads the original Brooklyn-based Bowl, and her majority female staff have plenty of company across Shapiro’s venues. Sara Barnett serves as the general manager of the Brooklyn Bowl Nashville; Alyssa Kitchen is the general manager of The Capitol Theatre, where 60% of managers are women; and the head of venue operations for the chain of Brooklyn Bowls and The Capitol Theatre is Rachel Baron.

Trending on Billboard

Anna Ayers, General Manager, Brooklyn Bowl.

Diane Bondareff

“I don’t think this happens at a lot of venues,” says Ayers, general manager of the Bowl in Williamsburg, which celebrated its 15th anniversary last July. “Operationally, being a woman on the floor is not the norm. And it’s challenging running it because it’s not what people typically see.”

The majority of the jobs in the music industry in production, distribution, retail, management or promotion are held by men, particularly upper management roles, according to data from U.S. Bureau of Labor Statistics (BLS). For example, the number of women among the top ranks of major music companies took a hit last year after a wave of retirements and company restructuring.

The percentage of women employed by establishments that organize, promote or manage concerts has been increasing in the past 15 years, from 36% in 2008 to 43% in 2013 to 46% in 2018, according to data from the BLS. The percentage has held steady at between 44% and 46% since 2018. (The BLS also includes sports management, promotion and agent jobs in this category.)

Sarah Barnett

Mitzi Rose

Prior to the COVID-19 pandemic, Ayers says the Bowl’s operations managers — who are often the last people to leave at night — were mostly men. Today, all four of the Bowl’s operations managers are women who have risen through the ranks, such as Beatriz Gonzalez, a 15-year Bowl veteran who started as a busser.

Shapiro created the Brooklyn Bowl venue chain — which also operates venues in Philadelphia, Las Vegas and Nashville — and owns The Capitol Theatre, the Bearsville Theater and Garcia’s clubs, a restaurant and venue chain that pays tribute to the Grateful Dead frontman. Managed under the umbrella of Dayglo Presents, Shapiro says the leadership across Dayglo took shape without planning or hiring initiatives.

“It just happened organically because these are the best people for the roles,” says Shapiro, who also owns Relix Magazine. “Women are often really well suited to run music venues.”

Rachel Baron

dayglo Presents

Shapiro says the Brooklyn Bowls’ concert hall-bowling alley-restaurant concept with their brick and wood aesthetic aim to create a warm environment and high-touch experience.

“We are just looking for the right people, and it just so happens that they ended up being women in a lot of key roles,” Shapiro says, pointing to other women leaders at his companies, including Brooklyn Bowl Nashville’s general manager Barnett and Baron, the head of venue operations for the four Brooklyn Bowls and The Capitol Theatre.

Kitchen, general manager at The Capitol Theatre, says she thinks women holding top roles at her company is reflective of a shift she has seen in other industries.

Alyssa Kitchen

Amanda Brandl

“Specifically, in the Dayglo companies I think that’s happened very fast,” says Kitchen, a former accountant whose staff includes women managers who handle oversight of cash operations, accounting, artist contracts, the box office and more. “We are a collaborative group.”

Amid the backdrop of economic uncertainty and diversity, equity and inclusion initiatives falling out of favor at many institutions since the Trump administration took power, Shapiro says his venues have seen measurable success as women have made up a greater percentage of their workforce.

“There’s something about the touch that women leaders have that is unmatched,” Shapiro says. “I think it’s an important to running a music venue in 2025.”

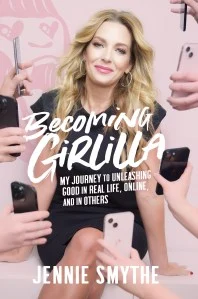

By the time Nashville-based digital marketer Jennie Smythe launched her company Girlilla Marketing in 2008, she had already gained significant experience working in marketing and promotion for companies including Hollywood Records, Yahoo Music, and Elektra. She also forged her path in digital marketing as the music industry was undergoing the profound transition to a primarily digital medium.

“A portion of it was just being in the right place at the right time,” she recalls to Billboard. “I found myself in a unique position to be able to be the bridge between the two. And it just so happened that nobody was speaking the digital language. I became the person—this was [when] Napster [was happening], when the industry was suing kids in college and doing everything in their power to squash the new business. I was one of the people who was like, ‘Wait a second, if we’re hearing that this is what they want and they’re seeking it out…’ It was very ‘flip the script,’ because up until then, it was the industry telling the people what they were going to get, the industry making those decisions. That’s completely changed.”

Today, the all-woman team at Girlilla Marketing leads social media initiatives and content creation for its clients, helping to develop online audiences, virtual events, digital monetization, analytics tracking and more. During her career, Smythe has worked with artists including Willie Nelson, Darius Rucker, Vince Gill, Blondie, and Dead & Company. She chairs the CMA board and serves on the boards of the CMA Foundation and Music Health Alliance.

Trending on Billboard

Now, Smythe is sharing the lessons she’s learned along the way in her memoir, Becoming Girlilla: My Journey to Unleashing Good — In Real Life, Online, and in Others, which releases via Resolve Editions/Simon & Shuster today (April 15). Her book also delves into Smythe’s personal journey including her 2018 breast cancer diagnosis and treatment. Smythe was named a 2025 Advocacy Ambassador with the Susan G. Komen Center for Public Policy.

Jennie Smythe

Courtesy Photo

“[The book] really was a way for me to express my gratitude to the music business and the digital marketing community. It was a way to share my survivorship so that I could help other people. And my intention was to be able to be a support document for entrepreneurs and especially young women,” she says.

Billboard spoke with Smythe about writing her book, launching Girlilla Marketing, the importance of mental health advocacy and leading the next generation of women music industry execs.

Why was it important to you to share your life and career experiences in this book?

I thought I was going to write a business book about business lessons, anecdotal humor in the workplace, generational bridges, that kind of thing. But I got sick and our music community also lost several people to cancer, like [music industry executives] Jay [Frank], Lisa Lee, and Phran Galante. I had 12 rounds of chemo, six surgeries. [Part of me] was like, ‘Can I just go back to work?’ But I realized, ‘No, you can’t. This is part of your story now.’ Every single one of those three people–Jay, Phran and Lisa–called me every day when I shared my story [about her battle with breast cancer]. They all were in harder circumstances than I was. So I was like, ‘I want to do this for them.’ And the Nashville community, it is like a family. That’s one of the most special things, and no matter how big Nashville gets, we don’t lose that.

A conversation with your father led you to launch Girlilla Marketing. What do you recall about that?

I was 30, I had had a pretty successful career, and then my dad was diagnosed with pancreatic cancer. I was in the hospital room with him and he said, ‘What would you do if your life was half over?’ When he asked me that question, in that moment, it drilled down to two different things: I want to start a digital agency and I want to travel more. I realized, “There’s never going to be a perfect time, a perfect amount of money—if I don’t do it now, I will not do it.”

Girlilla Marketing is an all-woman company. What inspired you to launch a female-first company?

I feel like through my whole career of working for other people, I only had the opportunity to work for one woman, and she was amazing. But I wished I would’ve had more opportunity to do that. So, I created what I wanted, the place I wanted to work, because it didn’t exist.

One of the key early moments in the book was when, during your career at Yahoo Music, you received a performance review from your former boss, Jay Frank. You received some feedback you didn’t expect.

That’s what made him my trusted mentor because he was like, “You’re so smart and you’re doing all the right things, but you’ve got to be human, or people won’t want to work for you.” I thought if you are the champion and you are the best, then you will be rewarded for that behavior. Not at all. Everything that has come to me in a good way has come because of a team mentality. It was a lesson in leadership.

What are some things were you able to implement because of that conversation?

How do you come into the office in the morning, no matter how stressed you are—do you say good morning to everyone, or do you just ignore everyone? When you are in a meeting and somebody is not prepared, instead of drilling somebody down to where they feel like they can’t get out of that hole, what do you do? Isn’t the job of a manager to lift them up?

What are some of the biggest myths that persist around digital marketing in music?

One of the myths is that [artists] have to create all the time. That’s not true. You do have to figure out what your cadence is, but if you are creative and you’re constant, you’ll be okay. Some people are too precious with it, they feel like they can’t, and we have to get them out of that.

With things like TikTok and A.I., so many things are swiftly changing in the industry. What do you think are some of the biggest issues?

Mental health. Giving people the space to create without the pressure of the analytics, which are glaringly upfront in every conversation that we have. Once a week, somebody comes in here ready to quit because they’ve been told that if they don’t hit a certain threshold, that they don’t have a career. I’ve been around artists my whole life and that’s not conducive to a creative career. My thing is telling artists constantly that they are the CEOs of their lives, and their digital ecosystem is part of it, but it’s a wide net.

Also, the mental health thing starts from the top. I am so lucky to be in this community with people like Tatum [Allsep] from Music Health Alliance, and grateful for people like at the CMA who put together the mental health fund. People talk about artists, but it’s also the people in the business that need support, like our touring families.

For those who are just starting out in digital marketing, what essential tools do they need to know?

I think just being an avid user, and you need to know how to shoot and edit content. It’s all video. This is the biggest merge of the decade. We used to have the creative people and the analytical people. To inform the creative, sometimes you need to understand what the market is requesting—very much the same conversation we had with Napster, when it was like, “So this is the most illegally downloaded file in Green Bay, Wisconsin—maybe we should go play there.” It’s also having somebody that can purposely come up with a creative strategy that also speaks to the analytical success to something, that’s the job for the next 10 years. That’s exciting because I think when I was in college, my [current] job didn’t exist. But along the way, everything I picked up mattered.

EMPIRE Publishing has hired !llmind as a senior vp of A&R. As part of his duties, the tech entrepreneur and Grammy-winning producer, who has worked with Drake, The Carters, Eminem, Ye, Nicki Minaj, Nathy Peluso, Romeo Santo and more, will screen songs and provide feedback, based on his production expertise. !llmind will also act as a bridge between EMPIRE’s publishing and label arms.

Along with !llmind’s appointment, the independent music giant is also promoting Al “Butter” McLean to executive vp of global creative, where he will keep co-leading EMPIRE Publishing with senior vp of global head of business Vinny Kumar. Over McLean’s 30-year career as an artist, producer, street promoter, manager and A&R, he’s inked deals for names like Yung Bleu, Childish Gambino, Alicia Keys, Daddy Yankee, Lecrae, Mint Condition, KEM and Kirk Franklin. As part of his elevation, McLean will now be responsible for overseeing all global deals and signings. He will also provide internal leadership to ensure EMPIRE Publishing continues to grow.

“I’ve worked with !llmind for years and have seen firsthand how his passion, taste, and commitment to excellence inspire everyone around him,” says Kumar. “He’s a true visionary—constantly evolving, embracing new technology, and defining the future of music and culture. We’re beyond excited to officially welcome him to the EMPIRE Publishing family.”

Trending on Billboard

“I was fortunate to have signed the amazing !llMind to a publishing venture years ago – so now this is full circle not only re-signing him as a writer, producer, and publisher, but to work alongside him as a colleague,” says McLean. “He is a legend and what he brings to our entire EMPIRE Publishing and Creative team is immeasurable”.

Adds !llmind: “My entire career I’ve always felt like an outsider because I like to dive head first into innovation, solving things in unique ways and pushing the sound of music forward. I can’t wait to contribute to this movement and learn more in the years ahead!”

Los Angeles-based Interscope Geffen A&M (IGA) Records has set down roots in Nashville with the relaunch of the iconic Lost Highway imprint.

Former Thirty Tigers executive Robert Knotts and Universal Music Group Nashville (UMGN) executive Jake Gear will serve as co-heads and executive vps of the resurrected label.

“Lost Highway carved out a special place in the remarkable musical legacy of Nashville. It was a left-of-center label with one-of-a-kind artists who, at their core, were great songwriters and moved culture,” John Janick, chairman/CEO of Interscope Capitol and IGA, said in a statement. “Similarly, Interscope has always been a beacon to artists who don’t fit into a box yet are destined to inspire what comes next. With this new chapter in Lost Highway’s history, we are devoted to empowering the next generation of trailblazers, both artists and executives.”

The revered label, which takes its name from the song made famous in 1949 by Hank Williams, had been dormant for 13 years after being launched by then-UMGN head Luke Lewis in 2000, who retired in 2012.

From the start, Lewis and his team curated a tasty roster focused on roots-leaning music from artists including Willie Nelson, Lucinda Williams, Ryan Bingham, Hayes Carll, Mary Gauthier, Lyle Lovett and Kacey Musgraves, who signed with the label in 2011, shortly before it was folded into Mercury Nashville.

Trending on Billboard

Lost Highway was also home to soundtracks, including the T Bone Burnett-produced, Grammy-winning O Brother, Where Art Thou.

Lost Highway

Courtesy Photo

Janick says he picked Knotts and Gear because their musical aesthetic matches the imprint’s storied history. While at Thirty Tigers, where he rose to senior vp of artist and label services, Knotts worked with such artists as Jason Isbell and the 400 Unit, Sturgill Simpson, Turnpike Troubadours, Muscadine Bloodline and more.

“Over the course of my career, my goal has always been to operate in service to the artist’s vision while understanding the emotional connection to their art. It is with this same spirit that Lost Highway left a lasting impact on the Nashville community — providing a home for artists who aren’t defined by genre and recognizing that the artist’s vision ultimately shapes culture itself,” Knotts said. “I am honored to carry that approach forward alongside one of my closest friends, Jake Gear. With John Janick’s guidance, and support from the entire Interscope team, we have an incredible opportunity to combine an artist-first mentality with Interscope’s remarkable ability to help build worlds around an artist’s vision.”

Gear was most recently vp of A&R at UMG Nashville, where he signed and/or developed upstarts Tucker Wetmore and Vincent Mason and A&R’d projects by Parker McCollum, Dierks Bentley, Jordan Davis, Sam Hunt and Brothers Osborne, among others.

“Lost Highway has a rich history. Many of these releases and artists were formative in developing my own appreciation of the craft of songwriting,” Gear said. “The label was a pioneer in taste, representing an ethos of artistry first, an openness to taking creative risks and shining a light on artists who drifted on the fringes of the major label defined ‘mainstream.’ Together with my friend, Robert, and with the backing of John Janick and Interscope, I look forward to curating the roster.”

Lost Highway was briefly resurrected earlier this year by UMG Nashville’s chair/CEO Cindy Mabe, who exited the label in February, in partnership with iconic producer Burnett. Their first release under the revamped Lost Highway was Ringo Starr’s country album, Look Up, which came out Jan. 10. Burnett will now work with the IGA iteration, including on a 25th anniversary edition of the O Brother, Where Art Thou soundtrack. A release date on the reissue, artists on the roster and staffing are expected to be announced shortly.

Rapper Tay-K has been found guilty of murdering a photographer in 2017, but was acquitted of capital murder. On Monday (April 14), a jury found the rapper, real name Taymor Mclntyre, guilty of robbing and killing photographer Mark Anthony Saldivar, according to News 4 San Antonio. Prosecutors had argued Mclntyre fatally shot Saldivar after stealing […]

Opry Entertainment Group (OEG) has named Tim Jorgensen as vp of operations on its Austin team. In the new role, Jorgensen will lead OEG’s Block 21 businesses in the city, including ACL Live, 3TEN and W Austin. In addition to leading strategic direction for the Block 21 complex, he will oversee day-to-day operations at ACL […]

Warner Music Group announced on Monday (April 14) that Armin Zerza will join the company as executive vice president and chief financial officer, effective May 5, reporting to CEO Robert Kyncl. Zerza, who previously served as CFO of Activision Blizzard, brings extensive global financial, commercial and operational leadership experience.

Bryan Castellani, the current executive vp and CFO, will serve until May 5 and then act as an advisor to ensure a smooth transition.

Armin Zerza

Zerza has three decades of experience across the entertainment, technology and consumer goods sectors. At Activision Blizzard, the game publisher behind Call of Duty and Tony Hawk’s Pro Skater, he held roles as CFO and chief commercial officer, playing a pivotal role in the company’s acquisition by Microsoft. Before joining Activision Blizzard in August 2015, Zerza spent over 20 years at Procter & Gamble, serving in various senior leadership roles across North America, Europe and Latin America. He managed multibillion-dollar businesses such as P&G’s European Baby Care and Latin America divisions and was part of the global M&A team.

Trending on Billboard

CEO Robert Kyncl praised Zerza’s 30 years of global experience and his track record of delivering results through innovation and financial discipline, adding, “He’ll help us evolve our long-term strategy and build WMG for the lasting benefit of our artists, songwriters, investors, employees, and partners.”

“I am thrilled to join WMG, a dynamic and innovative leader in the music industry,” said Zerza. “I believe the business has tremendous potential and look forward to working closely with Robert and the talented team at WMG to help deliver its ambitious vision for innovation, growth, and long-term value creation.”

Castellani joined WMG in August 2023 after nearly 30 years at The Walt Disney Company, rising to CFO for Disney Entertainment & ESPN. Prior to that, he held such roles as evp of finance for Disney Media, where he oversaw its distribution, ad sales and networks businesses, and previously he was evp and CFO of ESPN proper. Castellani succeeded longtime CFO Eric Levin.

“It’s been a rewarding experience to contribute to the ongoing evolution of this great company,” he said. “There’s so much we achieved at a pivotal time for the industry. I thank Robert, the Board of Directors, and everyone at WMG, especially the global finance team.”

Earlier this year, the Copyright Office opened a notice of inquiry (NOI) into U.S. performing rights organizations (PROs) – asking the music industry, venues and broadcasters that hold performance licenses to weigh in on whether or not they should face any new reform. Triggered by a so-called “proliferation” of new PROs in the market, and PROs alleged “lack of transparency,” it’s shaping up to be one of the most important issues facing the music publishing business this year. On Friday (April 11), the industry’s chance to submit comments came to a close. Ahead of all comments being made public, Billboard explains the origins of this inquiry and its possible implications.

How the NOI Started

On Sept. 12, 2024, Billboard broke the news that the House Judiciary Committee sent a letter to the Register of Copyrights, Shira Perlmutter, requesting the examination of “concerns” and “emerging issues” with U.S. PROs.

Trending on Billboard

The House Judiciary’s note cites two key issues: the “lack of transparency” surrounding PRO distributions and how they “currently gather information from…general licensees about public performance;” and the “proliferation” of PROs in the United States. This references the fact that, with newer entrants like Global Music Rights (GMR), PRO Music Rights (PMR) and AllTrack emerging over the last decade or so, the U.S. PRO total is up to six different options — making the licensing system more complicated and expensive for licensees. In contrast, most countries only have one PRO – while a small number have two – for writers to choose from.

Perlmutter and the Copyright Office replied to the letter by opening this inquiry in early 2025.

PRO History

The U.S. PRO system dates back to 1914 with the founding of the American Society of Composers, Authors and Publishers (ASCAP), which was created to help songwriters and publishers collect their earnings from public performances. This included collecting royalties from venues, restaurants, bars, college campuses and anywhere else music is played or performed in front of other people. It also included radio broadcasters. (In later years, as technology developed, performance monies also started to be collected from TV broadcasters and music streaming services.)

In 1931, the Society of European Stage Authors and Composers (SESAC) opened as a more boutique option, largely representing works published by European firms. In 1939, broadcasters in the radio business banded together in protest of some of ASCAP’s licensing practices, which they felt were unfair, to eventually form their own competing PRO, Broadcast Music Inc. (BMI).

For many years, ASCAP and BMI acted on a not-for-profit basis (BMI changed to for-profit status in 2022) and allowed any writer to join. Their open door policies meant that the two came to represent the vast majority of songwriters in the U.S., while SESAC continued as a smaller, for-profit player that allowed sign-ups by invitation only.

Alleging ASCAP and BMI were partaking in “anticompetitive business practices,” the Department of Justice (DOJ) sued ASCAP and BMI beginning in the 1930s. By 1941, the two PROs had settled their cases and entered consent decrees with the DOJ. One of the stipulations of these consent decrees said that ASCAP and BMI were subject to oversight by a “rate court” if a licensee couldn’t reach an agreement with them on an appropriate royalty. In short, ASCAP and BMI could no longer negotiate any rate they wanted to for their songwriters, which became increasingly challenging to navigate as performance licensees expanded over the years to include major tech platforms.

Royalty rates in the music publishing sector, unlike those in the recorded music business, are often overseen by government bodies in the U.S. That includes the rate court, which steps in to set performance license rates for ASCAP and BMI when they can’t agree with licensees; and the Copyright Royalty Board, which regulates the rates for all U.S. mechanical royalties. For that reason, the publishing business is particularly sensitive to talk of any additional criticism, restriction or regulation, which is a possible result of the U.S. Copyright Office’s inquiry should Congress find it appropriate to take further action afterwards.

Why the NOI Started

From the perspective of small venues around the country that have already been squeezed by the COVID-19 pandemic, the U.S. PRO system today — including having to pay up to six different PROs for music — is seen as complicated and increasingly expensive. Sources in the live industry say one of the newcomers, GMR, also charges higher prices than its competitors for its performance license. Because it was founded in 2013, long after ASCAP and BMI’s DOJ woes, and because it positioned itself as an invite-only, for-profit PRO for elite musicians like Drake, Bruce Springsteen and Billie Eilish, GMR charges a premium.

The other two newcomers, AllTrack and PMR, are less understood by some licensees. AllTrack was founded in 2017 by former SESAC board member Hayden Bower and focuses on mid-sized and/or independent talent, hoping to provide a modernized, streamlined approach to the over 100 year old PRO system of royalty collection; while PMR was founded in 2018 by serial entrepreneur Jake Noch. PMR is perhaps best known for suing “the entire music industry,” as the PRO put it, for allegedly “running an illegal cartel for the performance rights of musical works… [and entering] into an illegal agreement, combination and/or conspiracy to shut PMR out of the market and fix prices.”

The House Judiciary Committee also expressed concern that the increasing number of PROs in the U.S. “represents an ever-present danger of infringement allegations and potential litigation risk from new and unknown sources,” as it stated in its letter to Perlmutter.

Besides frustration about how many PROs there are in today’s market, the House Judiciary flags a number of areas where transparency might require improvement. “It is difficult to assess how efficiently PROs are distributing general licensing revenue based on publicly available data,” the letter reads. “[We] request that the Office examine how the various PROs currently gather information from live music venues, music services, and other general licensees about public performance; the level of information currently provided by PROs to the public; whether any gaps or discrepancies occur in royalty distribution; what technological and business practices exist or could be developed to improve the current system; the extent to which the current distribution practices are the result of existing legal and regulatory constraints; and potential recommendations for policymakers.”

Transparency issues have been flagged a number of times over the years by stakeholders who feel PROs – in the U.S. and abroad – can be unclear about how they calculate royalties, bonuses and advances distributed to talent. Some PROs, however, would likely disagree with that characterization. ASCAP, for example, is proud of its songwriter-led board of directors, which determines how it handles distributions.

What Happens Next

The comment period ended on Friday, and soon, the responses from publishers, PROs, venues, broadcasters and more will be made public. From there, the Copyright Office will review the comments, and it will eventually write up a report with its findings. There is no timeline for this report, and it should be noted that the Copyright Office does not have the remit to make any specific changes to PROs but its findings could be influential to Congress.

Marc Nathan, the promotion and A&R executive who in his 55-year career helped Barenaked Ladies, 3 Doors Down and more get record deals, has died. He was 70.

He passed away earlier this week at Vanderbilt Medical Center in Nashville, a representative says. A statement said Nathan had “been ill for some time and he finally succumbed to a variety of afflictions.”

Nathan got his foot in the door in the music industry at just 15 years old, when the then-Queens, New York, kid wrote a letter to Todd Rundgren and received a reply from Ampex Records’ Paul Fishkin, in regards to a track listing anomaly he found on Rundgren’s Runt album.

“He just so happened to open a stack of Todd’s fan mail that day. If he hadn’t opened that stack of mail that day, you know … My life would have been altered forever,” Nathan said in an interview in 2019.

Nathan soon landed his first industry job in radio promotion at Ampex, which led to him building a career with roles in promotion at labels including Bearsville, Casablanca, Playboy, Sire and Atlantic.

“I lost my best friend of 55 years,” Fishkin noted following his death. “Marc Nathan walked like he talked as well as anyone I’ve ever known. His irascible, acquired taste persona was what I enjoyed the most, even though maddening at times. We had much in common chiding and deriding phonies and pretentious fools in sports, politics, but most importantly, the music business. We occasionally enjoyed busting each other as well. We delighted in having our own sometimes hilarious shorthand putting us on the floor at times with uncontrollable laughter. He was a great record man, and a baseball and hockey chronicler supreme, among his many talents and passions. And yes, I have stories! But most important was his loyalty and support for all the right people and issues. And he never let me down in all those 55 years.”

Over the years — with stints in New York, Los Angeles and, most recently, Nashville — Nathan also worked in A&R, having a hand in Universal’s acquisition of Cash Money Records, and in talent development for Universal, Capitol, Atlantic/ATCO and imprints.

Among the artists he got signed were the bands 3 Doors Down (at Universal) and Barenaked Ladies (at Sire). He later established a label, Flagship Records, to release solo work from Barenaked Ladies co-founder Steven Page.

“Marc was a record person of the highest order,” Page wrote following his death. “He was absolutely and passionately obsessed with music and amassed an encyclopedic memory for songs, charts and artists. He played a huge role in my career and in my life — a role that arced across our entire shared timeline. Marc was a guy who loved big, emotional music and also too-smart-for-its-own-good pop and had a huge soft spot for silly novelty songs too. We kind of fit the bill perfectly for him and he got us. Marc took our demo tape to Seymour Stein at Sire records, and, thankfully, Seymour got it. While everyone else was calling us a throwaway, Seymour looked at Marc and said, ‘They’re a Simon and Garfunkel for the ‘90s.’ Marc was always especially proud of his involvement, and I’m eternally grateful to him for it.”

Page added, “He was among the first and most persistent of my friends to lend me support, advice and solidarity. He could be a nudge, but that’s only because he had a huge heart and he really, really cared. There were many, many people in his life that he would counsel and coach and cajole and mentor through their darkest hours — he’d been there and back several times himself — and I’m proud and grateful to be one of those friends. I’m lucky to have known him.”

State Champ Radio

State Champ Radio