Business

Page: 54

Private equity firm Providence Equity Partners has made a majority investment in logistics company GCL, the companies announced Wednesday (May 21). Previous majority owner ATL Partners will retain a minority stake in GCL. Terms of the deal were not announced, but The Wall Street Journal reported the investment values GCL at more than $1 billion. […]

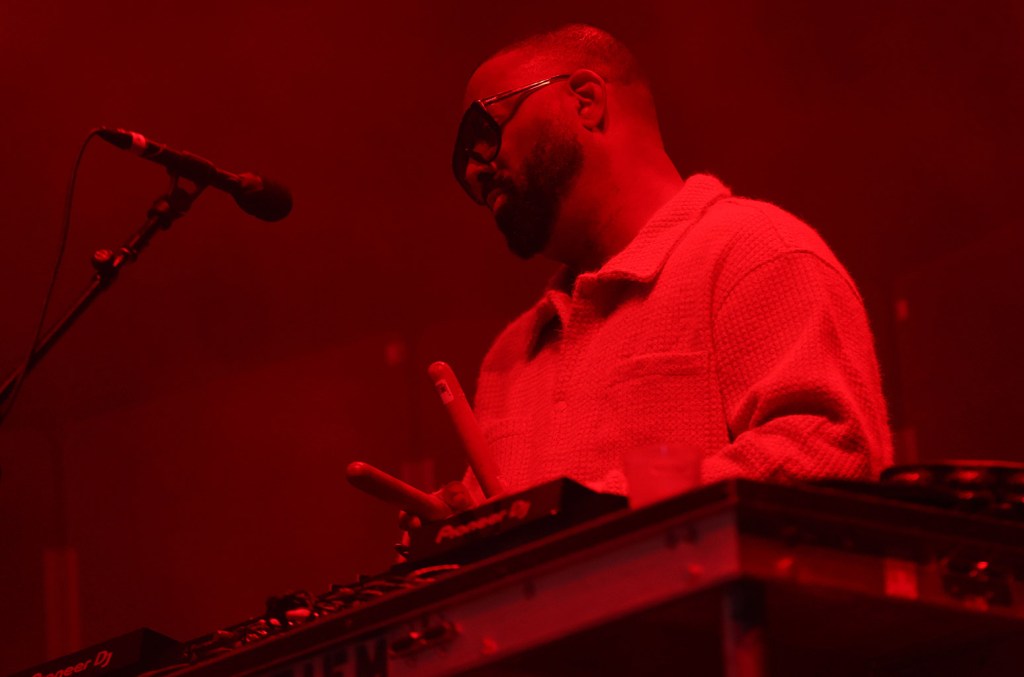

Billboard Canada is getting a major headliner for the inaugural Billboard Canada Live Stage.

Khalid will perform at the heart of downtown Toronto at Sankofa Square as part of NXNE’s 30th anniversary. That’s been the site of many of the beloved festival’s most memorable shows, including performances by Wu-Tang Clan, The Flaming Lips, The National, Iggy Pop & The Stooges and many more.

Billboard’s The Stage is known for bringing major chart-topping artists to festivals like SXSW, and Khalid is a perfect choice to expand it to Canada. He’s a major star of the streaming era, and he’ll return to the city for the first time since playing with Ed Sheeran at Rogers Centre in 2023.

Since debuting nearly a decade ago, Khalid has 40 charting hits on the Billboard Canadian Hot 100 and 5 charting albums on the Canadian Albums chart, including Free Spirit, which went to No. 1 in 2019. He returned after a brief hiatus in 2024 with Sincere, his most mature and personal album yet, which has started a new phase of the R&B and pop artist’s illustrious career.

Trending on Billboard

Khalid has an undeniable connection to Canada, and has collaborated over the years with Canadian artists like Shawn Mendes, Tate McRae, Justin Bieber, Alessia Cara, Majid Jordan and more.

He’s played some huge shows in Toronto, including the city’s biggest arenas and stadiums. This show will bring him to the city’s most bustling intersection for a special moment celebrating his whole career.

Limited VIP tickets are available now, here. –Richard Trapunski

–

Steven Guilbeault Becomes Canada’s New Minister of Culture. What Does That Mean For the Music Industry?

Prime Minister Mark Carney has unveiled his new Liberal Cabinet, which will have ramifications for some key ongoing issues in the music industry.

Steven Guilbeault was appointed as Minister of Canadian Identity and Culture, a post with particular interest to the sector. He was also appointed Minister responsible for Official Languages.

The Canadian Independent Music Association (CIMA) wasted no time in outlining its industry concerns and requests to the new Minister. In a statement, the trade org welcomed Guilbeault to the position while issuing an urgent call to prioritize Canadian-owned culture, IP and sovereignty.

“Minister Guilbeault takes on this portfolio at a critical moment for Canada’s cultural sector,” CIMA writes after congratulating the new Minister. “As venture capital, global tech platforms, and multinational entertainment corporations expand their dominance and market share, the future of Canadian-owned culture — and the intellectual property that drives it — is at risk without renewed, dynamic and stable investment in the sector.”

The organization points to three recent events that they suggest threaten independent music in Canada, and says they “all underscore the growing concentration of global corporate power.” They are: TikTok’s withdrawal from global licensing negotiations with Merlin, Universal Music Group’s acquisition of Downtown Music’s assets and legal challenges launched by streaming services against paying into Canadian Content funds.

Andrew Cash, President and CEO of CIMA, stressed that “Canadian-owned music companies are not just players in our cultural economy — they are part of its foundation. They create intellectual property, generate jobs, tell Canadian stories, and fuel long-term economic growth. Without Canadian-owned companies, our culture risks being outsourced, diluted, and devalued.”

CIMA issued a very similar statement two weeks earlier, when the results of the federal election became known. It also urged Prime Minister Mark Carney to “make the investment in and promotion of Canadian-owned cultural businesses a top priority…to secure a strong future for Canadian culture.”

CIMA’s statement comes at a pivotal time, as hearings begin on drafting a new definition for CanCon in the implementation of the Online Streaming Act. A court challenge by major foreign-owned streaming companies like Spotify and Apple will also begin in June, with tech companies (joined by Music Canada) challenging the CRTC’s mandated fee payments for Canadian Content. –Kerry Doole

–

Toronto’s Bowl at Sobeys Stadium Concert Venue Goes Quiet in 2025

Last year, a new concert venue was unveiled. In summer 2024, The Feldman Agency opened The Bowl at Sobeys Stadium, located at the site of Canada’s biggest tennis tournament, the National Bank Open. It was a partnership between Tennis Canada and the Toronto-based talent and booking company.

Now, after one summer of shows, the venue has gone quiet.

“We can confirm that we are hitting pause for summer 2025,” says Jeff Craib, president of The Feldman Agency, in a statement to Billboard Canada. “We will make further comment when there is any news to share.”

In a report by theToronto Star, Tennis Canada also confirmed the news, while saying they will “continue to work with the Feldman Agency with the hope the concert series will return in 2026 and beyond.”

The 9,000 capacity venue hosted a limited series of 2024 shows at The Bowl at Sobeys Stadium, including performances by the Barenaked Ladies, Shaggy, Bachman-Turner Overdrive, The Tea Party and comedian Kevin Hart.

Billboard Canada reported on the launch of the Bowl at Sobeys Stadium in December 2023, and Craib expressed optimism about its potential then. “We will be working closely together with Tennis Canada to provide the best of tennis and live entertainment to Toronto and its surrounding areas,” Craib said, noting that “Sobeys Stadium’s location in North America’s third-largest concert market (after New York and Los Angeles) and surrounding population of more than 6.8 million makes it a well-positioned live entertainment venue for both performers and fans.”

At the time, Craib shared that he expected around 15 shows per year at the open air venue.

Toronto is not starved for major concerts in summer 2025. The demand is high for arena and stadium shows, as stakeholders at the biggest companies have recently reported. This summer will see the opening of another temporary open-air venue, the 50,000 capacity Rogers Stadium, where Live Nation will present a full slate of concerts this summer. –KD

With the Diddy trial now in recess for the long holiday weekend, Billboard is recapping the biggest moments over the first two weeks — from Cassie Ventura’s bombshell testimony about “freak offs” to a hunt for Suge Knight to Kid Cudi’s torched Porsche.

The trial, which is expected to last six more weeks, will decide the fate of Sean “Diddy” Combs, who federal prosecutors say coerced Ventura and other women to partake in the freak offs — drug-fueled sex with male escorts for his entertainment. His attorneys say the events were entirely consensual.

After just two weeks of testimony, there’s no shortage of big moments. Here are the six you — and the jurors — are going to remember.

The Video

On the very first day of the trial, prosecutors wasted no time getting to their most explosive piece of evidence: a headline-grabbing surveillance video of Combs beating Ventura in the hallway at Los Angeles’ Intercontinental Hotel in March 2016.

Ahead of the trial, the two sides spent months arguing over whether the clip could be played for the jury. Combs’ team argued first that it had been unfairly leaked to the press to taint the jury pool, and later said it had been deceptively edited and would confuse jurors. But prosecutors said he was merely “desperate” to hide “some of the most damning evidence of his sex trafficking,” and a judge eventually ruled that it could be played.

Prosecutors did so immediately, calling as their very first witness a former security guard at the hotel who responded to the incident. Playing with no audio in a silent courtroom, jurors looked on impassively as the ugly footage played twice, once with the security guard describing each moment in detail from the witness stand.

Graphic Details About Freak-Offs

Freak offs — elaborate events in which Combs allegedly forced Ventura and others to have sex with escorts while he masturbated — have been at the center of the case since it was filed. But on the first day of the trial, jurors got far more vivid details.

Daniel Philips, a male exotic dancer who said he’d taken part in numerous freak offs, described arriving to dark Manhattan hotel rooms, where he would have sex with Ventura at Diddy’s direction. When a prosecutor asked what Combs had been doing during the events, Philips didn’t mince words: “He was sitting in the corner masturbating.”

Philips’ testimony got darker and more graphic from there, describing ejaculation, urination, drug use and finally an outburst of physical violence against Cassie: “I was shocked. It came out of nowhere. I was terrified,” Philips said.

Later, Cassie told jurors her own side of the story, saying the parties left her feeling “humiliated” and eventually “became a job,” but that she felt she had no choice but to participate — first out of wanting to please a man she loved, and later out of fear of blackmail videos and physical violence.

When asked about whether she had wanted to be urinated on, Cassie was unequivocal: “No, I did not want it,” she said. “It was disgusting, it was too much. I choked. No one could think I wanted it.”

Celebrity Name Drops

The first two weeks of the Diddy trial have seen a number of major celebrity name-drops — none accused of any wrongdoing, but likely still to the chagrin of their publicists.

Under cross-examination, Ventura told the jury about a 21st birthday party that Combs threw for her at a Las Vegas club in 2007 — a key early moment in their romantic relationship. When asked about other celebrities in attendance, she said that Diddy had “brought Britney Spears” to the event. Later, defense attorneys mentioned Michael B. Jordan, suggesting Combs was jealous because he was suspicious Ventura was having an affair with the actor in 2015.

Then at the start of the second week, Danity Kane singer Dawn Richard told jurors that Combs once punched Ventura in the stomach at a Los Angeles restaurant where Usher and other celebrities were present. Richard’s testimony left it unclear whether the A-listers had actually seen the incident or merely been at the event.

The Hunt For Suge Knight

But no celebrity name drop was more dramatic than that of Suge Knight — the former CEO of Death Row Records and a major Diddy rival in the East Coast–West Coast hip-hop rivalry of the 1990s.

During her testimony last week, Cassie told jurors of a 2008 incident in which Combs abruptly left a freak-off after learning that Knight was at a diner nearby. “I was crying,” she said. “I was screaming, ‘Please don’t do anything stupid’.”

Then on Tuesday, Diddy’s former personal assistant David James offered another, more detailed perspective on the incident — saying he driven a black SUV carrying Combs, a security guard and multiple handguns to the restaurant, but that Knight had already left when they arrived. “It was the first time I realized my life was in danger,” James said.

Cassie’s Settlements

During cross-examination, Diddy’s lawyers got Cassie to reveal the size of two major civil settlements stemming from the abuse she allegedly suffered — a tactic likely aimed at making jurors question her motives for speaking out against Combs.

It was Ventura’s civil lawsuit, filed in November 2023, that first raised allegations against Combs. Though it sparked a flood of additional cases and set into motion the criminal probe that led to his indictment, the case itself was almost immediately dismissed after Cassie reached a private settlement.

At trial this week, Cassie confirmed that she had she had received $20 million in that deal. Diddy’s defense attorney quickly noted that Ventura had canceled an upcoming concert tour soon after inking that settlement. “As soon as you saw that you were going to get the $20 million, you canceled the tour because you didn’t need it anymore, right?” Estevao asked Ventura. “That wasn’t the reason why,” she replied.

Later that same day, Ventura said she would give the money back if she could reverse Combs’ abuse. “If I never had to have freak-offs I would have agency and autonomy,” Ventura said.

Near the very end of her testimony, Ventura also revealed another settlement for the first time, disclosing that she was expecting to receive roughly $10 million from InterContinental Hotels over the 2016 incident captured in the surveillance tape.

Kid Cudi Takes The Stand

Beyond Cassie herself, the highest-profile witness to testify so far has been Kid Cudi — a critically acclaimed rapper who briefly dated Ventura in 2011.

Cudi has long been linked to the case. Back when Ventura first sued, she suggested that Combs had blown up Cudi’s car as an act of jealous revenge. A spokesperson for the rapper later confirmed her account to the New York Times: “This is all true.”

Sitting on the witness stand, Cudi said it himself — telling jurors that he believes Combs broke into his Los Angeles house and later torched his Porsche with a Molotov cocktail. Shown a photo of his burnt-up luxury car, Cudi said, “It looks like the top of my Porsche was cut open, and that’s where the Molotov cocktail was put in.”

Cudi later told jurors that Combs had promised him he wasn’t responsible for the car explosion, but he said he believed Combs was lying.

Two weeks ago, on May 8, the Trump Administration dismissed Librarian of Congress Carla Hayden; then, two days later, Register of Copyrights Shira Perlmutter, alarming rightsholders that the White House would try to make it easier for AI companies to train their software on unlicensed copyrighted material.

The Trump Administration hasn’t said much about this, and the situation has only become weirder. The following week (May 12), Wired reported that two Trump appointees were blocked from entering the Copyright Office, and left voluntarily after Library of Congress staffers contacted the Capitol Police. As recently as January 2024, remember, the New York Times referred to the agency — erroneously and rather obnoxiously — as “the sleepy Copyright Office.”

Now, amid disagreements about the process to replace Hayden and Perlmutter, the latter, who is on administrative leave, just filed a lawsuit (on May 22) claiming that the Trump Administration has no right to replace Hayden or dismiss her, and asking for an injunction to restore her role as Register. At the same time, the Trump Administration’s “Big, Beautiful Bill,” which passed the House of Representatives on May 22, contains language that would drastically limit enforcement of state-level AI regulations, including those that would protect artists’ name, image and likeness rights. If the bill passes the Senate intact, assuming the federal government has the power to limit state laws without making its own, this would represent a serious giveaway to the technology sector. Considered together with Perlmutter’s dismissal, it suggests that the Trump Administration may try to give AI companies a pass to ignore creators rights — along with those of other people.

Trending on Billboard

It’s tough to know this is true, of course, because the Administration still hasn’t said much about dismissing Hayden and Perlmutter — a White House explanation about Hayden “putting inappropriate books in the library for children” is absurd, since the Library of Congress is a research institution. Troublingly, the move to dismiss both officials seems to have been sparked by an April 17 American Accountability Foundation report on “Liberals of the Library of Congress.” (The organization is a political nonprofit run by Tom Jones, a former Capitol Hill staffer with a background in opposition research who did not respond to a request for comment.) The report makes for a thin meal. Both Hayden and Perlmutter are registered Democrats who each donated less than $15,000 to national candidates over the last two decades. Hayden, who is Black, “participated in a roundtable on DEI” and moderated a conference of the American Library Association, which is portrayed, with considerable exaggeration, as a group of far-left radicals. Perlmutter, who served in the US Patent and Trademark Office under the first Trump administration and is widely respected for her expertise, “is part of a left-wing family,” according to the report. If this makes her unfit for public office, so is Stephen Miller.

It is possible that the Trump Administration simply could not bring itself to tolerate a Register of Copyrights with siblings who criticized the president online. But it’s also possible that some of the technology companies that have influence in the White House want a Copyright Office that will be more compliant. In March, the venture capital firm Andreessen Horowitz responded to a request for public comments on the White House AI Action Plan by saying that “neither the Copyright Office nor any other government agency should release guidance related to this issue — or other issues critical to American competitiveness in AI — until the conclusion of the National AI Action Plan process.” In other words, we would prefer new rules to those that exist now.

Or perhaps no rules at all? Technology companies often push for legislation that allows them to avoid other laws or liability: The “safe harbor” from liability in the Digital Millennium Copyright Act; Section 230 of the Communications Act, which gives them immunity from liability for user content; and the Internet Tax Freedom Act. The current version of the “Big, Beautiful Bill” — which I can’t even type without laughing and crying at the same time — could be even worse. It would block enforcement of all current and future local and state laws on AI, including the Tennessee ELVIS ACT (Ensuring Likeness Voice and Image Security Act), which protects artists from AI imitations; and the California AI Transparency Act, which requires big AI companies to identify what has been created by AI tools. Music would only be the beginning, of course. Would this act also forbid the enforcement of laws preventing AI systems from engaging in illegal discrimination? (It’s not clear.) What about deepfake porn?

Although the moratorium on state AI law enforcement would only last for 10 years, laws to protect technology companies can stick around, as what was intended to be an initial boost for an important sector of the economy slowly becomes the status quo. Look at the Internet Tax Freedom Act, passed in 1998 to last a decade, then extended several times and made permanent in 2016. The issues involved in AI will be far more profound, of course, not least because some of those systems might be able to outthink their creators within a decade or two. Imagine creating systems that will soon become smarter than humans, then purposefully making them harder to regulate. This sounds less like legislation than the first act of a Syfy disaster movie. The third won’t be pretty.

Copyright has always been one of the few remaining bipartisan issues in Washington, and Democrats who champion the arts — and, often, the media business — join forces with Republicans who see copyright as a property right worth protecting. Opposing copyright, and online regulation in general, has become a bipartisan issue as well, though. Before Elon Musk had way too much power in the Trump Administration, former Google CEO Eric Schmidt had too much power in the Obama Administration. Now, with Republicans controlling all three branches of government, the political fight over the future of the Copyright Office will take place mostly within the GOP, with MAGA-friendly “tech bros” on one side and more traditional business-focused Republicans on the other.

That is, if Perlmutter doesn’t get the injunction she’s asking for in her lawsuit. Essentially, the President has the power to appoint the Librarian of Congress, who is then confirmed by the Senate. The Librarian then has the power to appoint, or dismiss, the Register. Without a replacement Librarian, Perlmutter argues, “the President’s attempt to remove Ms. Perlmutter was unlawful and ineffective.” This makes sense, but the Trump Administration has taken an expansive view of presidential power, to say the least, and we are now in uncharted territory. And not in a good way.

Even if Perlmutter wins, the Trump Administration will eventually appoint a new Librarian, who will in turn hire a new Register. The question is, who and when? And, more urgently, what happens until then — different people show up and say they have jobs, only to be turned away? That sounds pretty chaotic. Perhaps the chaos is the point, though. The more the Trump Administration interferes with the basic machinery of government — the endless list of federal agencies known by initials, rather than names — the easier it is to argue that all of this is part of a problem, not a solution. And that could be the biggest problem of all.

Looks like another Executive Turntable, Billboard’s weekly compendium of promotions, hirings, exits and firings — and all things in between — across the music business. First and foremost, our thoughts are with the family of Sound Talent Group (STG) owner Dave Shapiro, who was among those killed in a plane crash in San Diego early on Thursday (May 22). Two other STG employees were also killed, Billboard has learned, though they were not named in order to notify their families. More on this tragedy here.

Earlier this week, we revealed our annual list of executives driving success for artists outside the United States. With that…

Trending on Billboard

Big Loud Records elevated Tyler Waugh to senior vice president of radio promotion, effective immediately. A key player at the label for nearly a decade, Waugh has contributed to 30 No. 1 singles and helped deliver a historic add day with Post Malone and Morgan Wallen’s “I Had Some Help,” which earned support from all reporting country radio stations. Based in Nashville, Waugh was honored with the CRS Award for Director of National Promotion in 2023, and his team secured Country Aircheck’s Label of the Year for 2023 and 2024, as well as Billboard’s top Country Airplay Label. Before joining Big Loud in 2016, he held radio promotion roles at Blaster, Streamsound and Arista Nashville. EVP Stacy Blythe praised Waugh’s leadership and strategic vision in announcing the promotion. “The deep respect that he earns from the team speaks volumes,” said Blythe.

Warner Music Nashville made two moves within its radio promo teams. Paige Elliott has been hired as national director for the WEA Radio Promotion Team, bringing nearly two decades of experience, including her most recent role as Columbia director of promotion at Sony Music Nashville. She also held regional promotion roles at Capitol Records Nashville and Capitol Music Group. Elliott steps into the position previously held by Stephanie Hagerty. Additionally, Kayla Burnett has been promoted to manager of radio for the WMN Team. Since joining WMN as a coordinator in 2020, Burnett has played a vital role in crafting radio strategies at the label. The announcement was made by Kristen Williams, svp of radio and commercial partnerships. They can be reached at Paige.Elliott@wmg.com and Kayla.Burnett@wmg.com.

Audio Chateau Records, a division of Audio Up Media, appointed Grammy-nominated producer Poo Bear to its advisory board. Reuniting with Audio Up CEO Jared Gutstadt, Poo Bear will co-write and produce the debut album for Randy Savvy, frontman of the Compton Cowboys. Known for his work with Justin Bieber, DJ Khaled and Nicky Jam, Poo Bear has a longstanding creative partnership with Gutstadt, including projects like Bear and a Banjo, featuring Bob Dylan. Also joining the board is Nathan Miller, CEO of Miller Ink, to enhance brand and media strategy. Randy Savvy and the Compton Cowboys will debut their album — which they’re dubbing as “street country” — on June 6 at CMA Fest’s “Been Country: Black Roots in Rhythm,” celebrating Black country music and cowboy heritage. “Poo Bear is a generational talent, and his involvement will add fuel to Audio Chateau’s creative engine, elevating our label and roster of artists to a new level,” said Gutstadt. “We’re ready to debut a bold new sound with Randy and the Compton Cowboys’ album—one that will redefine the crossroads of country and hip-hop.”

Molly DeMellier is ready to shine as chief operating officer Sundaze PR, teaming up with founder and CEO Sarah Jackson to scale the agency’s operations across the US and UK. With a background at Acast, where she was marketing and PR director in the US, the NYC-based exec brings deep experience in audio and creator tech to support Sundaze’s mission of providing strategic communications for B2B companies in the creator economy. Sundaze, known for its story-driven PR approach, already serves clients like Adelicious, Slipstream and Wondercraft. DeMellier will focus on helping creator-tech brands craft purposeful communications strategies that elevate their impact in content and community. “This next chapter is about doubling down on what we do best,” says Jackson, who founded Sundaze after leaving her role as global head of PR at Acast. “There’s a huge gap in quality PR for this space, and we’re building an agency designed to fill it.”

NASHVILLE NOTES: BBR Music Group/BMG Nashville promoted Allan Geiger to senior director and Haley Wirthele to manager within the company’s content and creative department, both reporting to vp of global content creative Jen Morgan … Prescriptions Songs promoted Kelly White to A&R coordinator from assistant … Business management firm Harris, Huelsman, Barnes & Company made three staff moves, including the promotion of Amanda Goff to client manager from assistant. It also hired client manager Amanda Remo, who previously held the same role at Farris, Self & Moore, and junior business manager Ryan Spradlin, formerly of the Mechanical Licensing Collective … Nashville Public Radio named longtime public media executive Holly Kernan — ex-chief content officer at KQED/San Francisco — as its new president and CEO, succeeding Steve Swenson, and she will now oversee 90.3 WPLN News, WNXP 91.1 and Nashville Classical Radio.

Recognition Music Group, the Blackstone-owned catalog company formerly called Hipgnosis, launched a senior advisory group chaired by Matt Spetzler, former co-head of Europe for boutique investment bank Francisco Partners and now head of his own investment firm Jamen Capital. Top copyright and music assets lawyer Lisa Alter of Alter, Kendrick & Baron, and David Johnson, former Warner Chappell and EMI executive and Sony Music and Warner Music’s former general counsel, will also sit on the advisory committee. “We very much look forward to working with Matt, Lisa and David,” Recognition CEO Ben Katovsky said in a statement. “Their combined expertise and insight will be a powerful support as we continue to enhance and protect the legacy and value of the incredible songs in our portfolio.”

Berklee appointed Jonathan Mahoney as the new dean of its Pre-College, Online and Professional Programs (POPP) division, effective May 28. He brings nearly two decades of experience in EdTech, most recently serving as vp of online learning at the Recording Academy, where he launched GRAMMY GO — the organization’s first creator-to-creator learning platform. Before that, he spent over a decade at 2U, the technology and services provider behind edX. “Jonathan’s learner-first mindset and track record of scaling innovative programs align seamlessly with our mission,” said Debbie Cavalier, Berklee Online cofounder and CEO.

ICYMI:

Richard Grenell

Due to a prolonged delay in the reopening of Brooklyn Mirage, Josh Wyatt is stepping down as CEO of its parent company, Avant Gardner. In the interim, day-to-day operations will be overseen by Gary Richards, Avant Gardner’s non-executive chairman of the board … Live Nation elected Trump devotee Richard Grenell to its board of directors. Grenell was recently appointed to run the Kennedy Center following a shakeup. Live Nation, currently navigating an antitrust lawsuit brought by the DOJ, donated $500k towards Trump’s inauguration. [Keep Reading]

Last Week’s Turntable: Former BMG Exec Joins Armin van Buuren’s Armada

On the last night of the Music Biz conference in Atlanta on Thursday (May 15), the Music Business Association held its annual Bizzy Awards dinner honoring industry executives, including the late Cindy Charles, who was posthumously bestowed with the organization’s Presidential Award. Charles tragically died in a traffic accident in the Netherlands in October.

In announcing the award — presented to individuals or organizations that have contributed greatly to the overall success of the music industry — Music Biz president Portia Sabin called Charles, who headed the Twitch music team, “a no-nonsense, get-it-done person who loved the music industry…She inspired people to tackle important issues head-on and solve problems the right way. We wanted to give her the Presidential Award posthumously to celebrate all she did for our industry, for women in music, and to create a space for the many people she touched to remember her life and be a part of her legacy.” Charles’ husband and family accepted the award in her honor.

The event was hosted by Lecrae, an artist with nearly 4 million album consumption units accumulated in the U.S., as well as a business executive who founded and runs Reach Records, an Atlanta-based label with a roster that includes himself, Andy Mineo, Trip Lee, Tedashii and Hulvey. In serving as the moderator, Lecrae kept things moving along. Early in the evening, he joked about his dual role as an artist and executive, saying he had to negotiate with himself in signing with his label: “I asked myself for an advance I couldn’t afford,” he quipped.

Trending on Billboard

At the end of the dinner, Lecrae reminded music executives of their responsibilities to the music fans. “I want to share something with you,” he said. “Before I was an artist and an executive, I was a kid on the block hanging with my teenage uncle, who was senselessly gunned down. But music back then spoke to me, and music became my lifeline. As an artist, I get first-hand feedback, so I know every song you fight for in marketing is building a bridge to a kid like I was. So, whatever you do in the music business, whether it is working in metadata, being a lawyer, or at a label, it matters. Remember, you are not just in the music business, you are in the people business.”

Moving back to the awards, most of the categories are contests — each with 3 nominees, with the awards handed out to the winners on Wednesday night (May 14). First up, Colleen Theis won the Leading Light Award, which is presented to a company or executive that has supported their staff via internal initiatives aimed at improving mental health, wellbeing and work/life balance. Meanwhile, the Frontline Innovator award went to Grimey’s Music, an independent record store in Nashville that was cited for showing exceptional inventiveness and ingenuity in store practices during the past year in its interactions with consumers. Meanwhile, the Marketing Superstar Award went to Rhymesayers Entertainment for its campaign around the late MF Doom‘s Mm..Food album.

Prior to the convention, the organization announced that it would present DDEX (Digital Data Exchange) with its Impact Award, with Sabin noting that the organization “has been at the forefront of tackling issues around education, effectiveness & use of music metadata since the early days of music downloads & streaming.” Also at the conference, Elysha Miracle, Concord’s senior vp of rights data management, scooped up the Maestro of MetaData Award.

In other awards, Downtown Music Publishing president Emily Stephenson received the #Next Gen — NOW One To Watch Award, an honor that goes to an executive under 40 whose work has been exceptional, innovative and stands out in its contribution to the industry. Elsewhere, Jerry Brindisi of Columbia College Chicago picked up the award for Music Business Educator of the Year, which celebrates an educator who inspires students to enter the music business.

Finally, Equal Access was presented with the Agent of Change Award for the organization’s efforts “to empower artists and managers from underrepresented demographics in country music by providing financial resources, training and networking opportunities,” according to its website.

Conference capsules:

Record Store Day Town Hall: During this event, indie store owners and label executives wrestled with the right amount of releases for Record Store Day (RSD), with Carrie Colliton of the Dept. of Record Stores, who co-manages the event for the U.S. music industry, noting, “We get a lot more than 500 submissions” for the RSD list. But after surveying U.S. stores participating in the event, “We think 350 titles is the sweet spot,” she added. That amount can provide a good representation, covering different genres and generations. On the latter topic, Colliton noted that “This year, there were a lot of younger customers, but that is the result of a five year campaign” to get labels to release RSD titles that appeal to the younger generation — because the older male music fans who used to dominate the RSD customer base might not want to leave the house for the event as they get older.

This year, a lot of young females came out for RSD, thanks to releases from the likes of Gracie Abrams, Taylor Swift and Charlie xcx. In fact, Doyle Davis from Grimey’s New and Pre-Loved Music in Nashville noted that one of his older customers, who was always first in line every year, was about 20th in line this year even though he showed up at least a day early — supplanted at the front of the line by the younger consumers who are now embracing RSD. Davis reported that the older customer, upon seeing those who had beaten him in line, said, “I am going to have to up my game next year.”

Beyond the younger generation, labels have also been cooperative in releasing titles in genres beyond rock. Even with that, said Tobago Benito of DBS Sounds in Riverdale, Ga., “We need more R&B for RSD.” When pushed to be specific, he asked for the re-release of more 1990s R&B titles, especially given, as someone else pointed out, that those titles likely never had a vinyl release in the first place.

Looking ahead, Colliton noted that the keynote for the RSD coalitions’ annual “Summer Camp” will be given by legendary artist/producer Todd Rundgren, so “expect to see badges that say, ‘Hello It’s Me,’” the title of one of Rundgren’s famous tunes. Further ahead, 2027 marks the 20th anniversary of RSD, and Colliton invited all in attendance to start brainstorming for that event to make it even more special.

Getting Played, Need To Get Paid: During a panel on streamlining song registrations, Dae Bogan, head of third-party partnerships at the Mechanical Licensing Collective (MLC) — who was the founder of the company TuneRegistry earlier in his career — noted that at one point, besides the Harry Fox Agency and whatever performance rights organization a music creator was affiliated with, a simple 14-track album would have to make about 140 registrations when you considered such services as Gracenote, Luminate, and international collection management organizations. “That means that if you had 10 albums, it would require 1,400 registrations,” Bogan said. It was noted during the panel and other seminars that nowadays, there are a lot of companies and services that help make song registration easier, though it still takes a lot of work.

What’s The Payoff? A panel for music industry startups pointed out that unless your company is going to provide at least a 10-times return on investment, venture capitalists are not interested, and you might be better off having a corporate partner or “an angel investor who are into what you are doing,” said Sound Media Ventures founder/CEO Shachar Oren. But, added Influence Partners’ Sun Jen Yung, angel partners and family offices also want big returns. On the other hand, she continued, private equity will take a chance and make an investment in a startup with a payoff that is less than a 10-times return on investment, if the startup is producing cash flow already.

Here’s What Investors Look For in Music Startups: For one, investors like startups that are less risky, so “if you have validated your model and have started generating revenue, that is more attractive to us,” said Oren. That was echoed by Yung, who said, “It is really hard to have a company without a revenue model.” Artes Management principal Tracy Maddox backed up those observations by adding, “Pre-revenue, there are only two names that will invest in your start-up — and their names are Mom and Dad.” Moreover, Yung added, investors also find that startups that offer a renewable payout, not just a one-time payment, as an attractive investment. Secondly, investors look for technology that will not only solve an industry problem but have scalability, meaning it can solve problems for multiple industries, according to Maddox. During another seminar, Bogan reminded technology companies that “interoperability” is a desirable feature.

Here’s What Investors Avoid: “We are staying away from investing in something that [merely] enhances what has been done before,” said Oren, while Rock Paper Scissors CEO Dmitri Vietze joked that investors stay away from any companies spelled with the letters “N,” “F” or “T.”

Other Ways to Corral Piracy: During a panel on what adult entertainment’s dealings with piracy can teach the music industry, Digital Rebelle’s Magali Rheault noted that the adult film genre was “the most pirated…at the beginning” of the digital revolution. While some in the industry tried to fight piracy through lawsuits, it soon became clear that it had to work its way around it, and so most companies hit upon the strategy of using piracy “as a funnel” to ad-supported monetization, she said.

What’s Happening In Catalog Acquisition? In a panel titled “Major Money Moves,” City National Bank’s Denise Colletta noted that the trend of asset-backed securitizations (ABS) is picking up steam. “We are finding a lot of our clients are looking at [ABS deals] for a number of reasons, including the higher advance rate” they provide, she said. (Financial executives have noted to Billboard that when traditional loans are provided to close a deal, the maximum amount of leverage involved is about 45%, while a deal financed with an ABS component may allow for up to 65% leverage. “We have led 3 asset-backed securitizations in the past 12 months,” Colletta said, adding, “We may see seven to ten [ABS deals] this year.”

A producer on Lil Wayne’s hit 2008 album Tha Carter III has sued Universal Music Group (UMG) over claims that he’s owed more than 10 years’ worth of royalties totaling more than $3 million. UMG was hit with the federal lawsuit on Thursday (May 22) over Darius “Deezle” Harrison’s production work on Tha Carter III, […]

Following an extended delay in the reopening of New York club Brooklyn Mirage, Josh Wyatt will no longer serve as CEO of the club’s parent company, Avant Gardner, sources close to the situation confirm to Billboard.

Gary Richards, Avant Gardner’s non-executive chairman of the board, will manage day-to-day operations for Avant Gardner in the interim, effective immediately.

The leadership swap follows a turbulent few weeks for Avant Gardner, the company and events complex, and its flagship venue, Brooklyn Mirage. After an extensive remodel and much fanfare, the club was set to open on May 1 with a two-night run from hard techno producer Sara Landry. Those shows were both canceled by the club hours before they were set to begin, after building inspectors declined to grant the recently renovated facility a permit to open.

All subsequent shows at the venue have been canceled or postponed, with the club making a statement on social media earlier this week that read, “We’re sad to announce that our Brooklyn Mirage shows through Memorial Day weekend have been moved to dates in July and August.”

Trending on Billboard

As reported by Billboard earlier this month, sources monitoring the situation said Mirage officials were given a list of fixes that needed to be completed for the club to open following an extensive renovation at the venue complex Avant Garner, which includes the 80,000-square-foot, 6,000-capacity Williamsburg nightclub. Widely recognized as one of the top stops in New York for electronic and dance acts, the Mirage had operated for years with the support of New York Mayor Eric Adams, whose office has intervened on Avant Gardner’s behalf as part of an ongoing legal fight with New York’s State Liquor Authority.

The former CEO of NeueHouse, Wyatt was hired as Avant Gardner CEO last October. Richards, meanwhile, is a longtime dance industry figure who founded HARD Events in Los Angeles in 2007 (the company was acquired by Live Nation in 2012). He is also the former North American president of Live Style, the founder of the All My Friends and Friendship festivals, and has been a board member at Avant Gardner since 2024.

A representative for Avant Gardner did not immediately respond to Billboard’s request for comment.

Kid Cudi took the witness stand Thursday (May 22) in the sex-trafficking trial of Sean “Diddy” Combs, telling jurors that he believes Combs broke into his Los Angeles house and later torched his Porsche with a Molotov cocktail out of anger over his relationship with Cassie Ventura.

The “Day ‘n’ Nite” rapper (Scott Mescudi) was a much-anticipated witness in the criminal trial of Combs, who’s accused of coercing Ventura and other women into participating in drug-fueled sex shows known as “freak-offs.” The trial closed out its second week on Thursday (May 22) and is expected to continue for at least another month.

Mescudi was photographed arriving at the Manhattan federal courthouse in a leather jacket and smoking a cigarette. According to reporting from CNN and the Associated Press, he began testifying in the morning and told jurors he briefly dated Ventura in 2011.

From the stand, Mescudi said Ventura, an R&B singer who dated Combs for 11 years, became very scared when the music mogul learned about her new relationship in December 2011. He then claimed Combs broke into his L.A. house while he was at a hotel with Ventura, and that items were moved and his dog was locked in a bathroom when he returned.

Combs allegedly tried to talk to Mescudi after this incident, but the rapper said he ignored the mogul’s texts: “You broke into my house, you messed with my dog, I don’t want to talk to you,” Mescudi testified.

Ventura claimed during her marathon testimony last week that Combs had threatened to blow up Mescudi’s car out of anger about their relationship, and, in her 2023 civil lawsuit against Combs, said that shortly after Combs issued these threats, Mescudi’s car was blown up. Mescudi seemed to confirm this, saying his Porsche 911 was torched in his driveway in early 2012.

At one point, the jury was shown a photo of Mescudi’s burnt-up luxury car. “It looks like the top of my Porsche was cut open, and that’s where the Molotov cocktail was put in,” Mescudi testified of the photo.

Mescudi later said he met up with Combs to discuss their differences after the incident, and that Combs acted “like a Marvel supervillain” during their meeting. He added that Combs promised he wasn’t responsible for the car explosion, but Mescudi said he believed Combs was lying.

Combs has not been officially linked to the car explosion — a point that Combs’ attorneys emphasized when cross-examining Mescudi. Defense attorney Brian Steel suggested that DNA collected from the car was identified as belonging to a woman, though Mescudi responded that he never heard from authorities about this.

Steel did get Mescudi to confirm on cross-examination that Ventura confided in him about physical abuse from Combs, but never mentioned sexual abuse. This supports the defense’s argument that while Combs committed domestic violence, he never engaged in trafficking and that all of his sexual encounters were consensual.

Mescudi posted a video on X thanking fans for support after departing the courthouse.

Also on Thursday, the jury heard additional testimony from Combs’ former assistant George Kaplan, who said he quit in 2015 after witnessing the rapper’s violent treatment of Ventura and other girlfriends.

“The central reason that I left my job as Mr. Combs’ assistant was that I was not comfortable or aligned with the physical behavior that had been going on,” said Kaplan, who began his testimony on Wednesday (May 21). Notably, Kaplan was granted immunity after initially being reluctant to testify.

A parade of other witnesses also briefly took the stand on Thursday. This included Ventura’s former makeup artist, Mylah Morales, who said she saw Ventura with extensive injuries after an argument with Combs in 2010, plus a hotel employee and a computer forensics agent.

The trial is off for the next few days and slated to resume on Tuesday (May 27).

Combs was indicted in September, charged with running a sprawling criminal operation aimed at facilitating the freak-offs and using violence, money and blackmail to keep victims silent and under his control. (Read Billboard‘s full explainer of the case against Diddy here.)

Once one of the music industry’s most powerful men, Combs is accused of racketeering conspiracy (a so-called RICO charge), sex trafficking and violating a federal prostitution statute. If convicted on all of the charges, he faces a potential life prison sentence.

Months after hip-hop producer Madlib filed a lawsuit against his former manager and business partner Eothen “Egon” Alapatt, the exec is now suing him right back — blasting him for “having the audacity to bring this mean-spirited personal action” and citing a potential release of music by the late Mac Miller.

In a countersuit filed last week in Los Angeles court, Egon accused Madlib of a wide range of “misconduct” following the sudden end of their long partnership — a split that Egon said came after he had spent more than a decade building Madlib’s career and catering to his “whims and eccentricities.”

“Madlib had the audacity to bring this mean-spirited personal action against Egon, accusing him with no basis or any proof,” Kenneth Freundlich, the manager’s lawyer, writes in the May 14 cross-complaint. “Instead, under the apparent spell of his transactional lawyer/manager, it is Madlib who has unlawfully absconded with [shared] property.”

Trending on Billboard

The lawsuit did not disclose the identity of the “lawyer/manager” in question. Madlib’s attorney did not immediately return a request for comment on the allegations in the countersuit.

Madlib, a critically acclaimed producer known for his work with Kanye West (now Ye) and the late MF Doom, filed his lawsuit against Egon in October, accusing him of “rank self-dealing” and “pervasive mismanagement.” The case accused Egon of abusing his power over their companies (record label Madicine Show and merch firm Rapp Cats) to profit at Madlib’s expense.

But in last week’s countersuit, it was Egon’s turn to level accusations. After more than a decade together, he says Madlib “cut off all ties” in 2022 and launched his own label called Madlib Invazion — a name he says belongs to their old company. In one of his many claims, he says Madlib is infringing Madicine Show’s trademarks by using that name.

“It could not be clearer that Madlib did this to usurp and disrupt Madicine Show’s business and to blatantly trade on the goodwill created by Madicine Show in the name ‘Madlib Invazion,’” Egon’s lawyers wrote. “Because of Madlib’s nefarious formation of a record label with the identical name … the public is confused and misled.”

Egon says Madlib’s new label is interfering with music projects that legally belong to the old company, including the release of a years-old recording of the late Miller that has long been rumored to be in the works. (Miller’s estate is not involved in the dispute nor accused of any wrongdoing.) He also says Madlib is refusing to complete an album for Freddie Gibbs that they are contractually obligated to deliver to Sony Music.

The lawsuit from Madlib is the second legal battle Egon has faced in recent years. Back in 2023, MF Doom’s widow (Jasmine Dumile Thompson) filed a case against him, claiming he stole dozens of private notebooks belonging to the late hip-hop legend and was refusing to return them in the years since Doom’s 2020 death.

In a response filing, Egon’s lawyers blasted that case as “baseless and libelous” and part of a “year-long smear campaign.” The lawsuit ended last year with a settlement, which reportedly saw the notes returned to Thompson.

State Champ Radio

State Champ Radio