Business

Page: 53

Gebbia Media has acquired Big Machine Rock from HYBE America for an undisclosed price in an effort to move into the rock space.

Big Machine Rock has been part of Big Machine Label Group (BMLG), which was founded by CEO Scott Borchetta in 2005. SB Projects bought BMLG in 2019 and, in 2021, HYBE bought Ithaca Holdings, which included SB Projects and BMLG for $1.05 billion.

Big Machine Rock’s current roster includes Daughtry, Badflower, Sammy Hagar and Ryan Perdz. Since its move into rock in 2017, BMLG has placed hits across Billboard’s rock charts, including Mainstream Rock Airplay and Alternative Airplay, with past and present acts like Badflower, Cheap Trick, Daughtry, Friday Pilots Club, Ayron Jones, L.A. Rats, Motley Crue, Pretty Vicious, Starcrawler and The Struts.

“Growing up with incredible music by iconic artists like Sammy Hagar, Van Halen and The Doors, I recognize the importance of bringing rock to a new generation of listeners and fans who are ready to embrace it,” said David Gebbia, CEO of Gebbia Media, in a statement. “Big Machine Rock embodies the Gebbia Media approach: bold, cross-generational, and deeply in touch with the culture. This acquisition allows us to further our mission of empowering artists through investment in robust catalogs and cross-platform expansion.”

The move is also expected to expand Big Machine Rock’s global reach.

Trending on Billboard

Heather Luke-Husong will continue to serve as GM of the Nashville-based imprint.

“Gebbia Media’s investment will allow Big Machine Rock to grow into a full-fledged label completely focused on rock,” says Borchetta, who is also chairman of labels for HYBE America. “They will continue to be distributed through our family of labels and will stay connected to the Big Machine mothership.”

Gebbia Media is a subsidiary of Siebert Financial Corp.

“By bringing Big Machine Rock into the Gebbia Media portfolio, we’re aligning visionary talent with the resources and stability of a diversified financial platform, ensuring long-term growth and cultural impact,” said John J Gebbia, CEO of Siebert Financial.

In the music space, Siebert has also formed partnerships with Larry Jackson’s GAMMA and L.A. Reid LLC for the female trio SIMIEN, building on Gebbia Media’s alliance with artist and entrepreneur Akon.

As part of the agreement, Borchetta will join the advisory board of Siebert Financial.

Assistance in preparing this story provided by Keith Caulfield.

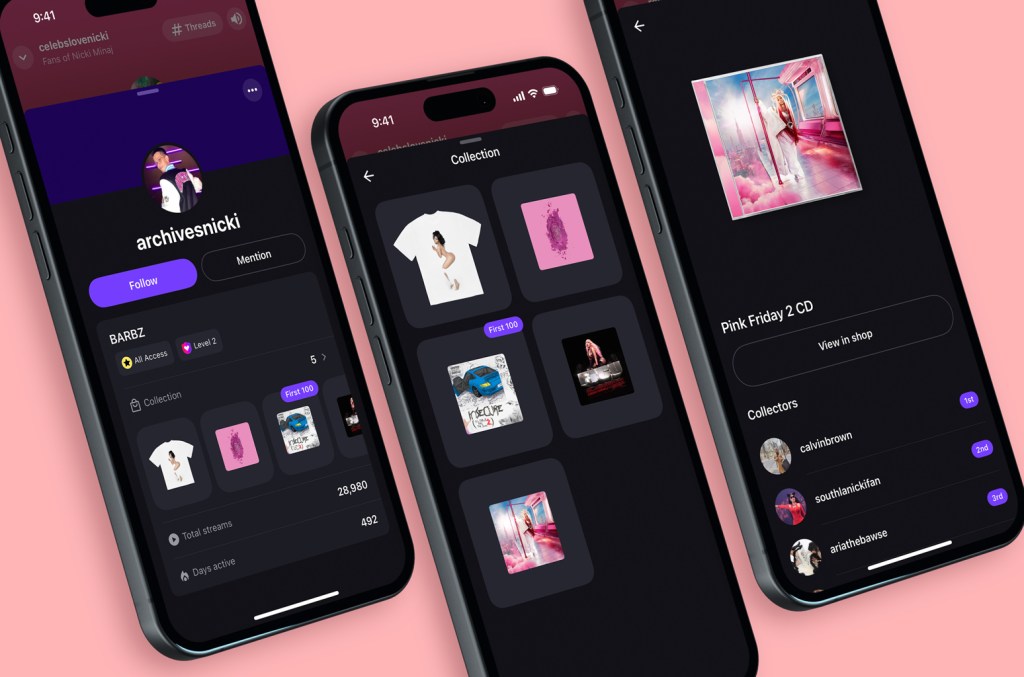

Stationhead announced the launch of a new feature on Wednesday (May 28): Collections, which allows users to show off the physical and digital merchandise that they have bought through the fandom platform.

“We were inspired by what fans were already doing,” Ryan Star, founder and CEO of Stationhead, said in a statement. “They would post receipts to prove they were there first — that they didn’t just show up late to the party. We wanted to honor that devotion and make it more fun, meaningful, and permanent.”

Stationhead debuted in 2017 as an app that allowed Spotify subscribers to transform their playlists into personalized radio stations. “It turns everybody into a DJ, basically,” Troy Carter said at the time. “You can play music, you can go live, there’s a great flow and people are commenting — it’s almost as if you took Facebook Live and layered it onto the platform.” When the civilian-turned-DJ played music, every listener also streamed it on their Spotify account, so the streams counted towards the charts.

Trending on Billboard

In January 2023, the platform added “channels,” rooms dedicated to the fanbases of specific artists. A year later, when “superfan” became the buzzword of choice for the major labels, Stationhead was well positioned to take advantage of additional interest.

The company says it now has 20 million users, and half of them are between 18 and 25. It makes money primarily from taking a portion of downloads that are sold through the platform.

The rollout of Collections follows close on the heels of another new initiative, Stationhead Shop, which launched in March, allowing artists to sell their merch on the platform through an integration with Shopify.

The goal of Stationhead Shop, Star explained, was twofold: To “combine the excitement of the merch booth with the scale and social currency of a gaming platform,” while also providing artists with another way “to monetize and build direct relationships with their most passionate and loyal fans.”

After fans buy something, they now have the ability to flaunt their purchase. “In a world where your online identity matters, this is how fandom shows up,” Star added. “If Roblox and Fortnite taught a generation to express themselves through virtual skins and items, we see Stationhead Collections becoming that for music.”

Stockholm-born music library giant Epidemic Sound is launching a new remix series, called Extra Version, on Wednesday (May 28) with help from DJ/producer Honey Dijon. As part of Extra Version, Epidemic pays participating DJs and producers “five to six figure sums” to pick from the songs, stems, samples and loops in its catalog of over 250,000 pieces of IP — and remix them into something new.”

Epidemic then adds the results to its ever-growing catalog available for use by clients — like content creators, advertisers and brands looking for easy-to-clear songs to soundtrack videos — and distributes them to streaming services.

To kick it off, Honey Dijon flipped the Epidemic-owned song “Umbélé” by electronic artist Ooyy and Swedish Grammy-award winning performer Ebo Krdum. “Teaming up with Epidemic Sound was a vibe,” she said in a press release. “They’re shaking things up in the best way… It’s all about freedom, fun and keeping the groove 100%.” The company plans to also collaborate with Major Lazer co-founder Switch and rising Korean talent Jeonghyeon on future Extra Version editions.

Trending on Billboard

With this series, Epidemic Sound CEO/co-founder Oscar Höglund tells Billboard he wants to show off the “high quality” of Epidemic’s catalog, which he believes rivals the quality of traditional major label releases. “The art of consuming music is changing,” he says. “It’s going from being a spectator sport to being a participative one. People want to remix their favorite music, they want to collaborate, and they want to create.” Epidemic, he continues “is creating the opportunity for incredibly talented producers and remixers and DJs to collaborate [and remix] our catalog. And then, we will help them distribute their remixes around the globe [both to streaming services and to their platform which provides pre-cleared music to content creators] – and they’ll get paid well while doing it.”

In this interview, Höglund talks the ins and outs of Extra Version, the ways he is integrating AI remix features to “create more use cases for the same songs,” and why he feels the allegations that Epidemic Sound has filled Spotify mood playlists with “ghost artists” is “deeply offensive to the artist in question.”

Why are you launching Extra Version?

We’ve seen that even though culture is moving towards [more participation and remixing], creatives have held back from doing it because from a legal perspective, it’s very hard to get rights to music because of fractional ownership. Our catalog has been built up, for almost a decade and a half, around the premise of having all the rights in one place. There’s nothing fractional about it. We own all of our music, and we are more than happy to offer the catalog up to producers. We just want to do it in a way that works for the artists who originally made the music [that Epidemic now owns], the remixers, the creators and the platforms where this music will go live and proliferate.

What is the payment model for Extra Version participants, and how does that differ from how producers are typically paid for remixes?

What often ends up happening is that producers are asked to create a remix for an artist, and they don’t get paid much to do it. Rather, the logic has been, the more culturally relevant the artist in question is, the lower your compensation, because your payment is in the cultural value you receive as a remixer from being associated with the artist.

We took a contrarian view here. We’ve always prided ourselves on putting our money where our mouth is, so instead we’re paying much more handsomely up front [to Extra Version participants]. We can’t disclose exactly how much, but I would say between five and six figures [for each remix]. We’re paying a lot up front, and this is not recoupable. It’s not a loan. It’s something the producer gets to keep.

Next step is that we allow the remixer to choose whatever track they feel creatively inclined to use from our catalog. Allowing for choice is a huge part of this. Remixers don’t have to license anything or worry about different samples being unlicensed. We own everything in perpetuity, and it’s all made available to you to pick and choose from. Then we will distribute the song. Most remixers don’t get a commission, just a flat fee. With Extra Version, we want to cut the remixers and producers in.

With Extra Version, Epidemic is opening up its catalog for remixes, and also making stems available so producers can mix and match the building blocks of your catalog. Does Epidemic have the goal of taking on sample or beat marketplaces like Splice or is this just for Extra Version?

When we started commissioning songs, we always got stems for everything. It is important from a soundtracking perspective. To the second part, the way we think about Extra Version is that this is not the end. We’re definitely not stopping here — rather, we’re saying this is the first step in our endeavor to help more music creators sustain themselves and democratize access to music. The bigger picture here is we want to help soundtrack the entire creator economy, and as such, we need to unlock our music.

So it sounds like the future of Epidemic Sound is offering samples, beats, and individual elements of the songs in the catalog to everyone, not just fully formed songs?

Correct.

Do you see Extra Version as an ongoing series, or is it a limited run?

This is not a limited run series. It’s the starting point of ushering in a completely new paradigm, one which is much more centered around the remixing and collaborative nature of culture. This is something that we’re deeply committed to and we’re going to spend a lot of time experimenting and seeing how this space is going to evolve.

It feels like you’re moving in the opposite direction of major labels. Nowadays, competitive deals at majors regularly involve the artist getting their masters back eventually, but the advance the artist gets up front is recoupable. Meanwhile, Epidemic is asking for full ownership of an artist’s tracks, but you provide non-recoupable money up front for the song. What is your goal with this approach?

At our core, we’ve taken one fundamentally contrarian belief: if you’re an artist, common wisdom says you should hold on to all of your [intellectual property]. That’s the traditional music industry right now. We think, in order to provide wide distribution and to provide superior monetization, we need to own 100% of the copyright. If we can build a platform, like we have, where there’s one point of contact when you want to license the song, then we can indemnify our customers and allow them to use the songs across all platforms, in all jurisdictions, and in all different scenarios. This allows for us to create predictability with Epidemic, so we can also pay our artists more predictable fees, too.

How is Epidemic thinking about AI?

We think that AI is an incredible tool to help augment human creativity, but never replace it. We’ve so far found that there’s tremendous amounts of value in using AI to help both music creators and video creators. We can use AI during the recommendation phase. If you’re a video creator we can use advanced AI search tools to help recommend tracks.

The old paradigm was, if you found a track that you like, suddenly you had to spend hours trying to re-edit that track such that it perfectly fit the video story you’re trying to tell, often with huge challenges from a legal perspective. “Am I even allowed to change the composition of this track?” The answer is often no. We’ve now been able to use AI [so] that, if you are a content creator, and you find this one track that you want to use to soundtrack your video, you can now speed it up, slow it down, change it. You can cut it. You can edit it — not replace it. This helps create more use cases for the same songs. Where there might have previously been 10 content creators who can use your track, now with adaptation maybe 20 or 30 or 100 creators will use it. That means the track is going to get played more and it’s going to earn more royalties [on streaming services]. And so ultimately, the human who made that track is going to make much more money, because AI has augmented the use cases.

Point three is purely generative — we’ve launched a product called AI Voice. We’ve gone to human voice actors, and we’ve struck agreements with them such that we pay them up front, we train and we use their voice, and then we allow our customers to use their voices. Every time they do, there’s an additional royalty so that the voice artists make additional money. We also put their personal emails out there in case content creators want to work directly with them. So suddenly, even when we go into the generative world of voice, we’re seeing that voice actors get used more, get more work, and get paid.

There have been allegations dating back to 2016 that Epidemic Sound has a deal of some kind with Spotify to fill some Spotify playlists with royalty-free music. It has been highly criticized. Can you explain what that arrangement is, if there is one?

I’d be happy to. Epidemic parallel publishes all of its music to all of the major DSPs around the entire world. We do that for a couple of different reasons, but the primary reason is it’s in our artists’ best interest, because we realized early on there was a Stranger Things, Kate Bush effect, meaning when Kate Bush’s track was used in Stranger Things, there was a massive surge in that song on streaming platforms around the world. We realized early on that that happens [when content creators use our songs].

There was also an adjacent trend, which we also tapped into very early, on streaming platforms in general — Spotify being one of them — that there was much more lean-back listening going on. The role of the record [or album] as the [driver] for music consumption started to diminish. More and more, [people were listening to] standalone tracks, but then ultimately playlists started to proliferate and come into their own.

Many of [the playlists] are hits-oriented, but there’s a huge proportion of playlists which are more functionally oriented. We do incredibly well across all the different playlists where people are looking to get to a specific theme or in a specific emotion. There’s music for sleeping, for concentrating, for studying, for getting ready, for meditating or for walking your dogs. Because what we do at our core is soundtracking, it turns out we were really, really good at [those playlists]. And while other people were trying to get into the bigger playlists to create the hits of tomorrow, we just kept doing the thing that we do really well. There was huge demand across all different DSPs, so we started to grow. And we became very, very significant and very, very successful.

Do you feel that it harms non-Epidemic artists in these genres to be competing for spots on mood-based playlists with your music?

No. If anything, the contrary: I think the old articles about Epidemic artists are deeply unfair. There was speculation: “Who are these artists? Do they even exist?” They are super talented artists in their own right. I took issue very much with that.

Various writers have referred to your music that is on Spotify playlists as “ghost artists” or fake artists.” How do you feel about those titles?

I think it’s deeply offensive for the artist in question. If you are an actor, you can play multiple different roles because you portray many different characters. That’s second nature. Artists, like actors, have the right to express their creativity in a multitude of different ways. It’s always them who determines if they want to publish their music under one name or not. Odds are that their fans might think they are all over the place, so quite often what we see happen is that artists have one brand for a certain genre of music, and different brand for another kind. If you look at Elton John, Madonna they [use] aliases. I seriously doubt that Madonna and Elton John would like to be called fake artists or ghost artists. That’s them creatively expressing through a different persona.

THE BIG STORY: The Beastie Boys and Universal Music Group both reached settlements to end copyright lawsuits in which they accused Chili’s of using their songs in videos posted to TikTok, Instagram and other platforms – part of a flood of recent litigation over music on social media.

The cases, filed last year, claimed the restaurant chain featured copyrighted music in what amounted to advertisements on social media. The UMG case involved songs by Ariana Grande, Justin Bieber, Mariah Carey, Lady Gaga, Snoop Dogg and dozens of other artists, but the problem was particularly galling for the Beastie Boys, a group that’s long been famously opposed to their music appearing in ads.

When it comes to music, social media has increasingly become a legal minefield for brands. TikTok, Instagram and other services provide their users with huge libraries of fully licensed songs to play over their videos, but those tracks are strictly for personal use and cannot be used for commercial videos. That kind of content requires a separate “synch” license, just like any conventional advertisement on TV.

Trending on Billboard

That distinction appears to have been lost on many brands. Sony filed a lawsuit against Marriott last year for allegedly using nearly 1,000 of its songs in social media posts, and Kobalt and other publishers sued more than a dozen NBA teams over the same thing a few months later. In March, Sony sued the University of Southern California for allegedly using Michael Jackson and AC/DC songs on in videos hyping its college sports teams. Then last month, Warner Music filed a case against cookie chain Crumbl, claiming it used songs by Lizzo, Mariah Carey, Ariana Grande and Beyoncé without clearing them.

What comes next? For music owners, you should take a swing through TikTok and see if any big companies are profiting off your songs. For brand owners, experts tell Billboard they need to be taking “proactive steps” to fix the problem before it turns into a costly lawsuit.

You’re reading The Legal Beat, a weekly newsletter about music law from Billboard Pro, offering you a one-stop cheat sheet of big new cases, important rulings and all the fun stuff in between. To get the newsletter in your inbox every Tuesday, go subscribe here.

Other top stories this week…

DIDDY TRIAL GOES ON – The Diddy trial continued in its second week, with blockbuster testimony from Kid Cudi about how he believes that the indicted mogul once broke into his house and ordered someone to torch his Porsche with a Molotov cocktail. To get up to speed on the trial, go read our full recap of the first two weeks.

LIL WAYNE LAWSUIT – Darius “Deezle” Harrison, a producer on Lil Wayne’s hit album 2008’s Tha Carter III, sued Universal Music Group over allegations that he’s owed more than 10 years’ worth of royalties from the chart-topping record – a figure he says totals more than $3 million. His lawyers say he has not been paid royalties from the album in over a decade.

HITTING BACK – Months after hip-hop producer Madlib filed a lawsuit against his former manager and business partner Eothen “Egon” Alapatt, the exec sued him right back — blasting him for “having the audacity to bring this mean-spirited personal action.” The countersuit accused Madlib of a wide range of “misconduct” following the sudden end of their long partnership, including promising to release music by the late Mac Miller that he doesn’t own.

IS IT OVER NOW? – Justin Baldoni dropped his subpoena of Taylor Swift in his messy legal battle against her friend Blake Lively – that Swift’s reps had fiercely criticized as “tabloid clickbait.” Baldoni’s lawyers had sought communications between the Swift and Lively teams, citing anonymous accusations that Lively asked Swift to delete text messages and demanded a statement of support. But a judge quickly struck those claims from the case docket as improper, irrelevant and “potentially libelous.”

LILES CLAIMS EXTORTION – Record exec Kevin Liles claimed that a rapper named Lady Luck was trying to extort him by falsely accusing him of sexual assault in the 2000s. He said her lawyers threatened to publicize the “utterly false and horrendous allegations” if he didn’t pay them $30 million: “I intend to vigorously fight any complaint she may file and will take whatever legal action is necessary against her and the attorneys who have participated in this attempted shakedown.” The new dispute is unrelated to another sexual assault lawsuit against Liles filed by an unnamed woman earlier this year, which he is seeking to have dismissed.

MEGAN BLASTS TORY – Megan Thee Stallion’s legal team fired back at recent claims of new evidence that would exonerate Tory Lanez, who was convicted in 2022 of shooting the rapper. Lanez’s supporters say there’s new surveillance footage and a new witness who can ID a different shooter, but Megan’s lawyers issued a detailed report rejecting those claims: “One by one, their misleading statements unravel and all that is left is the simple truth: he was convicted by overwhelming evidence.”

BOWLING ALLEY BRAWL – DaBaby won a court order tossing out assault and battery claims over a 2022 bowling-alley brawl with Brandon Curiel, the brother of his ex-girlfriend DaniLeigh, after a judge ruled that the rapper had not been properly served for years. Though the case against DaBaby was dismissed, the rapper could still be on the hook financially as the case continues against the bowling alley where the attack allegedly occurred.

FORTNITE PATENT VERDICT – Epic Games, the company behind the video game Fortnite, defeated a $32.5 million patent lawsuit over animated in-game concerts put on by Travis Scott and Ariana Grande. A company called Utherverse Digital claimed Epic infringed its virtual reality patents when it staged the virtual concerts for tens of millions of Fortnite gamers during the COVID-19 pandemic, but a jury in Seattle said neither the Scott nor the Grande concert used Utherverse’s technology.

300 Entertainment co-founder Kevin Liles has denied sexual assault allegations made by rapper Lady Luck (born Shanell Jones). Liles released a statement on Tuesday (May 27) claiming the former Def Jam artist engaged in a $30 million extortion plot against him earlier this month. According to Liles, Jones and her legal team threatened to release […]

Citrin Cooperman estimates a record-setting number of music catalogs with a combined value of around $20 billion were floated to investors last year. While economic and political uncertainty so far in 2025 has sent stocks and global trade on a roller coaster, the head of Citrin Cooperman’s music and entertainment valuation practice Barry Massarsky says his team has never been busier.

Massarsky and partner Jake DeVries reviewed over 550 music catalogs with a combined asset value of $10.7 billion last year, a figure that Massarsky says “demonstrates very loudly how much volume is in the marketplace.”

“Yesterday, I was dealing with a seminal holiday music catalog, a well-known classical music artist, this group from Nigeria, and film and television,” Massarsky told Billboard during a conversation in mid-April at Citrin Cooperman’s offices in Rockefeller Center.

Trending on Billboard

Over his two-plus decades in practice, Massarsky’s best known clients have been Primary Wave, Round Hill Music, Hipgnosis, Reservoir and nearly every major music company. Since joining Citrin in 2021, their business expanded to offer entertainment tax advice, audit inspection, transaction strategy, and recently, to include a valuation team focused Hollywood actors’ and directors’ participation rights.

Massarsky and DeVries shared their observations about the current market value being placed on pop and hip-hop music, the average size of a catalog they valued in 2024—it’s smaller than you might think—and the ongoing popularity of music from the 1980s.

Here are some highlights from our conversation:

Hip-hop and pop music catalogs 10 years old and older fetch the highest valuation multiples, a trend that’s held steady since 2022.

Pop music and hip-hop catalogs of songs released more than a decade ago received valuation multiples—a measure of future growth—of 17.6 and 17.4 respectively on average from 2022-2024. Latin catalogs had an average multiple of 17.1, country catalogs had 16.8 average multiple and rock music averaged a 16.7 multiple.

Some of the biggest hip-hop catalog deals of recent years include Primary Wave’s $200 million acquisition of Notorious B.I.G.’s works, Shamrock Holdings’ purchase of Dr. Dre’s catalog along with other rights for around $200 million and Opus Music Group’s acquisition of Juice WRLD’s catalog for $115 million, according to Billboard estimates.

Those deals aside, the priciest catalogs have been mostly older vintage pop and rock music from artists like Queen, Michael Jackson, Bruce Springsteen, Pink Floyd and Bob Dylan.

Massarsky says hip-hop catalogs are now in-demand because “it is one of the most favored formats for continued streaming activity” and the revenue it generates from publishing royalties has risen significantly due to higher payout rates coming from streaming platforms in recent years.

DeVries says hip-hop music is also over-indexed, or consumed at a proportionately higher rate, on Apple Music, which adds to its value because Apple Music’s payout rates are high among streaming platforms since it does not offer any free plans.

“If there previously was a concern about whether Hip-hop had legs to grow and whether the music would have certain constancy of staying power,” Massarsky says, “the data suggests the answer is yes.”

While deals like Sony Music’s $1.27 billion acquisition of Queen’s catalog and naming rights get the most attention, Massarsky and DeVries say the average valuation for a catalog they worked on in 2024 was $19 million.

“[That] illustrates how much volume there is outside of what garners the most attention,” DeVries says.

Catalogs that included master recording and publishing rights received the highest multiples because often those catalogs are also near the end of certain contracts, and a new buyer could have the opportunity to assume administration or ownership of certain other rights.

Music from the 1980s performs better on streaming platforms than music from the 1970s, 1990s or 2000s.

Music released in the 1980s saw a nearly 20% compound annual growth rate (CAGR) in cash flows from U.S. streams for the years 2022 to 2024, compared to a 17.9% rate for the 1970s, 14.9% for the 1990s and 14% for music of the 2000s.

Massarsky thinks the strength of older music comes, in part, from adult listeners who started Spotify subscriptions during the pandemic.

“An older generation turned to streaming services during that period, and I think they stayed,” Massarsky says, adding the popularity of 1980s music has not resulted in lower streaming revenue for music from other decades.

“It has not crowded out newer music. It’s just added more value to the supply of music on streaming.”

Although Citrin’s team is not involved in catalog sales directly, the value they give a catalogs is usually close to the price an asset sells for. In other words, despite occasionally eye-popping sums, buyers rarely overpay.

Citrin’s valuations are often commissioned by rights holders for use by commercial banks to secure financing or other bank services. The banks test Citrin’s valuations to determine the difference between the revenue an asset actually generated and how much Citrin estimated it might generate. Massarsky says Citrin’s estimates always fall within the bank’s acceptable range of plus or minus 5%.

“For me, that implies that our forecasts are fairly accurate, and also implies, I think, that what these funds are transacting at is credible,” he says.

DeVries says that they might not know if there is a gulf between Citrin’s valuation and ultimately where the catalog transacts. But if a buyer overpays, it is likely because of “some qualitative, intangible” benefit, like making a splash for a newcomer to the market.

Buyers and sellers of catalogs are not showing signs of holding their breath.

If there hadn’t been catalogs that were re-sold in 2024—such as Blackstone buying out shareholders of Hipngosis Songs Fund Limited or Opus Group selling their catalog to Litmus—”it might be a different story this year,” DeVries says. But investor demand is robust, Citrin says.

“The resiliency of music as an asset class is why there haven’t been any significant disruptions,” DeVries says. “We had the experience of the COVID-19 pandemic, and oddly enough music thrived. Now with questions around tariffs, music is a protected vehicle from tariffs. When these large hurdles are thrown at music, it has continued to prove itself as essentially unperturbed.”

HYBE has disclosed the sale of its remaining 9.38% stake in rival SM Entertainment to Tencent Music Entertainment (TME), a subsidiary of Chinese tech giant Tencent. The deal, valued at approximately 243.35 billion South Korean won (approximately $177 million), involves the transfer of 2.21 million shares at 110,000 won per share and is set to close on May 30, according to a new regulatory filing.

This transaction marks HYBE’s complete exit from SM Entertainment, a powerhouse K-pop agency behind acts like EXO, aespa and NCT 127.

Trending on Billboard

HYBE initially entered SME in 2023, acquiring a 14.8% stake from founder Lee Soo Man and later raising its holding to 15.78% through a failed takeover bid, ultimately losing out to Kakao, which now holds a 40.28% stake. After reducing its stake to 9.38% in May 2024, HYBE has now sold its remaining shares.

Why get out of the SME business? HYBE said on Tuesday that it has “divested noncore assets as part of a choice and concentration strategy” and that “secured funds will be used to secure future growth engines.”

TME’s acquisition makes it the second-largest shareholder in SME, behind Kakao. It operates leading Chinese music platforms such as QQ Music and Kugou Music and has existing ties to K-pop through partnerships with HYBE and others. TME also holds minority stakes in YG Entertainment and Kakao Entertainment, signaling its broader strategy to expand influence in the global K-pop landscape.

For SME, the deal could strengthen its reach in the Chinese market and enhance its digital distribution, artist promotion and content collaborations through Tencent’s various platforms. SME is coming off a strong Q1, with revenue up 5.2% year-over-year, driven by strong growth in concerts and recorded music. Concert revenue surged 58% thanks to tours by NCT 127, aespa and others, and recorded music rose 23.1%, led by Hearts2Hearts’ debut.

The acquisition reflects TME’s ongoing investment in Korean assets and sets the stage for deeper cross-border collaboration in music and media. It also marks the latest shift in the balance of power within the K-pop industry, highlighting the growing influence of Chinese tech giants in South Korea’s entertainment sector.

Meanwhile, HYBE is repositioning itself for future expansion, using the proceeds from this sale to invest in new ventures. The company continues to grow globally with its roster of artists including BTS, NewJeans and SEVENTEEN, and remains focused on developing next-gen platforms and talent. In the first quarter, HYBE reported strong financial performance despite a 5.9% drop in recorded music revenue. Total revenue rose 38.7% year-over-year, driven by a 252% surge in concert revenue and a 75.2% increase in merch and licensing. HYBE also expanded into Latin America with festivals and a music competition show.

Laura Segura, executive director of MusiCares, has departed the organization after five years as executive director, according to an email sent to staff by Harvey Mason Jr., CEO of the Recording Academy and MusiCares.

The memo announced a “key leadership transition” heading into Memorial Day weekend, revealing that Segura is “no longer with MusiCares” — and that Theresa Wolters, who’s been serving as MusiCares’ head of health and human services, “is stepping into the role of interim executive director.”

No reason or details regarding Segura’s departure were given. Billboard reached out to the Recording Academy and MusiCares on Saturday (May 24) for comment.

Trending on Billboard

The leadership and staff directory on MusiCares’ website no longer includes Segura’s name and lists Wolters as interim executive director.

Segura was named executive director at MusiCares in 2020, after serving as vp of membership and industry relations at the Recording Academy.

She was honored at Billboard‘s Women in Music, which recognizes top executives in the industry, in both 2022 and 2023.

Segura and Wolters, who is now MusiCares’ interim executive director, co-penned a guest column for Billboard, “Health Insurance Isn’t Enough — Music Also Needs a Financial Safety Net,” published in March.

MusiCares, founded by the Recording Academy in 1989, provides a safety net of critical health and welfare services to the music community. The U.S. based, independent 501(c)(3) charity offers financial grant programs, support resources and crisis relief.

Earlier this month, MusiCares reported that nearly $10 million raised for Los Angeles wildfire relief efforts during the 2025 Grammy Awards was distributed to recipients across the region. As of May 2, $6,125,000 was disbursed to more than 3,100 music professionals across L.A, and $3,969,005 had been directed to the community-based organizations California Community Foundation, Direct Relief and Pasadena Community Foundation.

An additional $16 million was raised by MusiCares and the Recording Academy during Grammy weekend with the MusiCares Fire Relief campaign and its annual Persons of the Year gala. $6 million of that amount was allocated to longterm fire relief efforts, and $10 million will go toward the organization’s year-round mission delivery.

“What moved us most in the days following the Grammy telecast wasn’t just the scale of support, it was the spirit behind it, Segura said in a statement on May 2. “Thousands of people gave what they could, and together, their generosity became a lifeline for those in crisis, which reached far beyond our industry. That’s why we partnered with trusted community organizations who are helping Angelenos across the region access the care, resources and support they need to rebuild.”

Billboard has learned the identities of all six individuals killed in a fiery jet crash early Thursday morning (May 22) in San Diego, California.

The victims of the crash include Kendall Fortner, Emma Lynn Huke, Dominic Damian and Celina Kenyon. Billboard previously reported that talent agent and the flight’s pilot, Dave Shapiro, and Daniel Williams, former drummer with metal band The Devil Wears Prada, were among those who perished in the crash early Saturday morning just two miles south of an executive airport in San Diego. The crash caused a massive fire as it tore through the residential enclave, damaging homes, melting vehicles and causing panic in the coastal suburb where residents were shocked but, thankfully, uninjured from the violent crash that killed all six passengers.

Fortner, 24, had interned at Sound Talent Group while a student at San Diego State University, joining the company after graduating in 2021 with a degree in business. Fortner was born in Glendale, California, and raised in Santa Clarita, attending West Ranch High School.

Kendall Fortner

The Fortner Family

“Ever since Kendall’s father took her to concerts at a young age, she was hooked on music,” a letter from Sound Talent Group reads. “From 1950s doo-wop to classic rock, Green Day to Ed Sheeran, Kendall loved it all. She taught herself to play a variety of instruments, including piano and guitar.”

Fortner had expressed interest in working in the music business as a teenager, “and the job at STG was a perfect fit that showcased her work ethic and ability to plan tours and festivals nationwide,” the letter continued. “Fiercely independent and strong-willed, Kendall was the life of the party and lit up any room she entered.”

Fortner is survived by her parents Gary and Kristin, her brother Justin and his wife Hannah and their son, Theo, and her brother Jordan and his wife Kailey.

Huke, 25, was born and raised in Orange County, California, and attended Santa Margarita Catholic High School, where she was part of a national championship-winning dance team.

Emma Huke

The Huke Family

“After graduating from the University of Oregon in 2022 with a degree in journalism, Emma completed several internships in the music industry before joining Sound Talent Group in 2024 as a booking associate,” according to STG.

“There was nothing Emma loved more than live music. She worked hard to save up money so she could travel to concerts and festivals. And while she loved all genres of music, her favorite artists to see live were Taylor Swift and The 1975,” the letter read. “Emma also brought that passion for live music to her work. She was smart and organized, helping STG plan and promote their biggest tours. Clients and friends called Emma a force of nature, and she was a beautiful soul who brought joy and a light to everyone in her presence.”

Huke is survived by her parents, Tim and Allison, and her younger sibling, Ellis.

Damian was a personal friend of Shapiro and worked as a senior software engineer, according to his LinkedIn page.

Damian held a black belt in Brazilian Jui-Jitsu who trained at Baret Yoshida’s gym in San Diego, where Damian lived. The gym is honoring Damian on Monday (Mat 26) in a special event.

“Dom was intelligent, thoughtful and had amazing jiu jitsu. A really kind guy who will be missed,” one online poster wrote.

Kenyon, 36, was a professional photographer who had joined the group to take photographs at a concert. Kenyon “decided to fly home to San Diego with other crew and friends on a late night private flight rather than a commercial flight so she could get home early to take her daughter to school,” a letter from Kenyon’s family reads, describing the San Diego resident as “an amazing mother, daughter, sister, grand-daughter, partner and friend.”

“Celina’s legacy is her daughter and partner, her parents, as well as countless family members,” they continue. “Our family is devastated beyond these words. The world has lost a beautiful bright light.”

The letter from STG also included additional information about Shapiro, who had moved to Alaska in 2020.

“Dave’s superpower was his ability to recognize new talent, work with their unique skills and sound, and give them the counsel and resources to make a living in the music industry. Some of your favorite bands wouldn’t be on your playlists right now without Dave,” the letter read.

“Dave impacted the lives of countless people in the music industry, but on a personal level, he was the best friend you could ever want – funny, full of life, always passionate about music, and never jaded. He was the guy that would give you the shirt off his back if you needed it,” according to the letter.

Shapiro is survived by his wife, Julia; his sister, Jennifer, and her children, Isabella and Jonathan Lee, and Dave’s beloved dogs, Amigo, Juneau and Monster.

Williams, 39, is a former drummer and founding member of the band The Devil Wears Prada. He was a native of Dayton, Ohio, who began playing drums in the sixth grade.

Williams left the band in 2016 to pursue a career in the tech industry, serving as a senior software architect at GoPro and Apple Inc.

With stock markets slipping and tariff concerns rising, music stocks from South Korea and China were the best performers for the week ended May 23.

K-pop company SM Entertainment, home to aespa and RIIZE, led music stocks with a 10.6% gain. Two Chinese music streamers, Netease Cloud Music and Tencent Music Entertainment (TME), followed with gains of 7.0% and 5.4%, respectively. HYBE, home to BTS and its members’ solo projects, was close behind with a 4.0% gain.

Driven by the gains in Asian stocks, the 20-company Billboard Global Music (BGMI) rose 0.2% to a record 2,800.92. The small gain marked the seventh consecutive weekly gain after a two-week loss centered around President Trump’s April 1 tariffs announcement. Proving that music performs well in times of economic uncertainty, the BGMI has gained 31.8% year to date, far exceeding both the Nasdaq (down 4.5%) and S&P 500 (down 2.4%).

Trending on Billboard

U.S.-listed stocks performed especially poorly this week. Only one music stock traded on a U.S. exchange, TME, posted a gain this week. (TME is dual listed and also trades on the Hong Kong Stock Exchange. Its American Depository Receipts trade on the New York Stock Exchange.) Of the 12 stocks on the BGMI that lost value this week, only German concert promoter CTS Eventim trades outside of the U.S.

U.S. stocks finished the week on a sour note after President Trump recommended a 50% tariff on the European Union after trade negotiations stalled. The S&P 500 dropped 2.6% and the Nasdaq fell 2.5% amidst a battery of warning signs for the U.S. economy: Moody’s downgrade of the U.S. debt rating, the resulting concerns about the U.S. debt and a drop in the Leading Economic Index, among other factors. The U.S. is experiencing “death by a thousand cuts” and suffering from “the drip, drip, drip of poor fiscal news,” Deutsche Bank’s Jim Reid wrote this week.

CTS Eventim, which fell 4.7% to 106.60 euros ($121.21), was the only music company to announce quarterly results this week. While the 2024 acquisition of See Tickets helped revenue jump 22%, adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) improved just 8.9% and the company missed some analysts’ expectations. After Thursday’s announcement, the company’s share price fell as much as 14.7% before ending the day down 6.2% to 105.60 euros ($111.09).

Among multi-sector companies in the label and publishing business, Universal Music Group fared well, gaining 1.8% to 27.77 euros ($31.57). Warner Music Group fell 5.3% to $26.22 despite a lack of market-moving news or analyst comments. Reservoir Media, which reports earnings on May 28, dipped 1.2% to $7.23.

Streaming services were a mixed bag. Spotify fell 0.4% to $653.82. Deezer rose 0.8% to 1.31 euros ($1.49). Anghami sank 5.1% to $0.56. LiveOne was one of the week’s biggest losers after dropping 20.8% to $0.76. On Thursday (May 22), LiveOne announced it secured $27.8 million of convertible notes financing and drew down $16.8 million on May 19. The notes convert into shares of LiveOne common stock at $2.10 per share.

Live Nation fell 1.8% to $145.01. Macquarie increased its price target to $175 from $165 and maintained its “outperform” rating. On Tuesday, Live Nation named Richard Grenell, an appointee during President Trump’s first term, to its board of directors.

Created with Datawrapper

Created with Datawrapper

Created with Datawrapper

State Champ Radio

State Champ Radio