Business News

Page: 48

The majority ownership stake in Global Music Rights (GMR) is now in new hands after a deal that valued the boutique performance rights organization at $3.3 billion closed just before Christmas, sources tell Billboard. According to those sources, Hellman & Friedman, a San Francisco-based private equity firm, bought out Texas Pacific Group’s stake in GMR, as well as a slice of the minority equity stake held by the Azoff Company.

In the wake of the deal, sources say that Hellman & Friedman now owns nearly 90% of GMR, which was founded by Irving Azoff and Randy Grimmett in 2013. Moving forward, the Azoff Company and Grimmett — who also serves as CEO — will retain control of GMR’s operations, which is considered an essential ingredient to GMR’s continued success, given the affiliation with Azoff and his portfolio of companies that employ powerful industry executives.

Hellman & Friedman has not previously invested in music assets, but it was drawn to the stability and reliability inherent to the business of collecting music royalties. Those traits have made performance rights organizations ripe targets for private equity funds interested in investing in music. BMI was acquired by New Mountain Capital in early 2024, and SESAC is said to be fielding acquisition offers from interested parties.

Trending on Billboard

When Billboard first reported on the GMR deal in September, a source familiar with the matter said that the switch in majority ownership would not change anything “for the writers or the GMR management team. GMR’s goal will remain the same: to transform the industry and bring more value to songwriters and their publishers.”

GMR is one of four U.S. performance rights organizations, with the others being ASCAP, BMI and SESAC. While ASCAP and BMI operate under U.S. Department of Justice consent decrees and must accept any songwriter who applies as a member, SESAC and GMR are invitation-only societies. SESAC pioneered that strategy, although in the last five years, it has been quietly pruning its membership from 35,000 members in 2019 to 15,000 currently.

GMR is even more exclusive, with a membership roster that numbers between 150 and 200 songwriters or songwriter estates, all of whom are considered to have star status as a writer or artist. That roster includes the likes of Bad Bunny, Billie Eilish, Billy Idol, Bob Seger, Bob Scaggs, Bruce Springsteen, Bruno Mars, Bryan Adams, Drake, Eddie Vedder, George Harrison, George Michael, Glenn Frey, Gwen Stefani, Harry Styles, Ira Gershwin, James Hetfield, John Lennon, Jon Bon Jovi, Lizzo, Nicki Minaj, Pete Townshend, Philip Lawrence, Post Malone, Prince, Ryan Tedder, Shane McAnally, Shawn Mendes, Slash, Smokey Robinson, Stephen Stills, Steve Miller, The Weeknd, Travis Scott and YoungBoy Never Broke Again, among others.

Even with a limited roster, GMR has grown into a powerhouse in the U.S., with estimated revenue of about $400 million to $450 million, sources say, with some suggesting that its net publisher share (NPS) — what the company retains after royalties are paid out — approaching 50% of the revenue estimate. Given that, if GMR had $200 million in NPS, that $3.3 billion valuation translates into a 16.5 times multiple.

Building a company from scratch into one that can command a $3.3 billion valuation in 10 years is a big accomplishment, several people say. Moreover, that valuation appears to have ignited a process that could see SESAC come up for sale, which Billboard reported last week (Dec. 24). As one music asset investor told Billboard, many private equity firms looked at GMR and were “all shocked by the final valuation … Those firms have a real appetite for music because music assets are doing well.”

Hellman & Friedman specializes in traditional buyouts in the technology and financial services sectors. Among media and entertainment companies, it previously invested in the German media company Axel Springer and Getty Images, although it has since sold its stakes in both companies.

Representatives for GMR, the Azoff Company and Hellman & Friedman did not respond immediately to requests for comment.

Dr. Sasha J. Carr, a clinical psychologist who focused on family care for all ages, died in Norwalk, Conn., on Saturday (Dec. 28). She was 55. A cause of death has not been reported.

Dr. Carr was the daughter of Barbara Carr, longtime co-manager of Bruce Springsteen, and the stepdaughter of music critic and author Dave Marsh.

She was predeceased by her sister Kristen Ann Carr, who died in 1993 at age 21 of sarcoma, a rare form of cancer. The Kristen Ann Carr Fund, supported by major artists and executives, was established in her sister’s memory to advance sarcoma research and support families affected by cancer.

Dr. Carr was born in London, lived in New York City through her high school years and had been a longtime resident of Norwalk. In 2022, she relocated to Burlington, Vt. She attended The Chapin School in New York, received her undergraduate degree in 1992 from Brown University and was awarded a Ph.D. in clinical psychology in 2006 from Rutgers University.

Trending on Billboard

While her parents have been prominent in the music industry, Dr. Carr’s career followed a different path.

In Norwalk, she built a consulting practice, Off to Dreamland, and was a sought-after family sleep expert, dedicated to helping babies, children and families get the rest they need.

She was also a faculty member of the Family Sleep Institute. She published an illustrated children’s book, Putting Bungee to Bed, which empowered children to develop good sleep habits. Her passion for travel and adventure inspired her to help families in yet another way, by acting as a travel agent for kids-oriented vacations.

Dr. Carr’s career was focused on family care for all ages, and she was one of the first to address the unique and challenging role of caregivers with her book The Caregiver’s Essential Handbook: More than 1,200 Tips to Help You Care for and Comfort the Seniors in Your Life (McGraw-Hill, 2003).

Dr. Carr was a devoted mother to her beloved son Weston Kristoff Carr, 13. She is survived by Weston; her mother Barbara Carr and stepfather Dave Marsh of Norwalk; her father Patrick Carr of Florida ; and many loving aunts, uncles and cousins. Sasha was predeceased by her sister, Kristen Ann.

For those who wish to make a contribution in Dr. Carr’s memory, her family has requested donations be made to the Kristen Ann Carr Fund, for which Dr. Carr was a founding Board of Trustees member, or a charity of their choice.

Classic rock is still big — it’s the pictures that are getting smaller.

The definitive modern pop music documentary was Beatles Anthology, the 1995 multi-night television project released with three CD sets of band outtakes and a coffee table book. More recent years brought Ron Howard’s 2016 documentary about the band’s touring years, Peter Jackson’s 2021 series about the making of Let It Be, and the self-explanatory Beatles ’64. In 2027, the Beatles’ Apple Corps will release four more films, one about each individual member of the band.

Bob Dylan, like the Beatles, has always loomed too large for one movie. Don’t Look Back, arguably the most powerful rock documentary ever made, followed Dylan’s 1965 tour of the U.K. Martin Scorsese’s 2005 No Direction Home chronicled the first five years of his career. Then the director made another documentary, this one full of fictional elements and in-jokes, just about Dylan’s 1975-’76 Rolling Thunder Revue tour.

Now James Mangold’s A Complete Unknown, which opened Christmas Day in the U.S., offers a fictionalized take on the first chapter of Dylan’s career, from 1961 through the 1965 concert at which he “went electric.” Timothée Chalamet stars as Dylan, with Edward Norton as Pete Seeger, Monica Barbaro as Joan Baez and Elle Fanning as a character based on Suze Rotolo (the woman pictured on the cover of The Freewheelin’ Bob Dylan). It’s a fantastic film, and the performances are incredible — Chalamet captures Dylan’s lost-boy charisma, and Norton channels Seeger’s inflexible idealism perfectly. The movie, based on author Elijah Wald’s Dylan Goes Electric!, took in more than $23 million during its first week in theaters, and reviews have been almost universally favorable.

Trending on Billboard

The story of the movie is anything but unknown, and there’s not much suspense in it — Dylan grows up fast in the Greenwich Village folk scene, then plays an electric rock set at the Newport Folk Festival, upsetting much of the audience. Dylan’s early career now has the quality of myth, so even the most casual rock fan knows where the story is going — the joy is in seeing it get there in the hands of such talented storytellers. How surprising was Dylan’s decision to play with a rock band, given that the half-electric album Bringing It All Back Home had been out for three months and the single “Like A Rolling Stone” came out five days before the show? Were people booing because Dylan went electric, because the volume obscured his voice, or because his new songs weren’t political? Wald’s excellent book gets at the truth behind the myth — the movie just retells it.

And why not? Stories become myths partly because they’re compelling, and A Complete Unknown evokes nothing so much as a superhero origin story — except that in Dylan’s case, so much of his origin involves making up his actual origin as he went along. In the movie, by the time people realize that this brash young Jewish kid from Minnesota didn’t really work in a traveling circus, he had managed to acquire his own mystique. (In real life, it was a bit more complicated.) As with comic book movies, this leaves plenty of room for sequels, and jokes about this have already been made.

Now’s the time: Chalamet captures Dylan so well that I hope someone signs him up for a sequel based on Dylan’s 1965 tour with the Band, ending with his 1966 motorcycle crash. After that, there’s a domestic drama to be made about Dylan’s retreat into family life in Woodstock, ending with his divorce and Blood on the Tracks. That’s only the first decade and a half of Dylan’s career — there’s another movie to be made about Dylan’s born-again period, when he again offered new music to fans who didn’t receive it well. And what about a comeback story on the making of Oh Mercy or Time Out of Mind?

Dylan’s career lends itself to a certain kind of expansive storytelling, partly because he’s changed so much. (Todd Haynes’ I’m Not There had six different actors essentially playing six different Dylans.) But it’s also worth asking if Dylan is pointing the way forward for music films, as he did with Don’t Look Back. Think about it. Walk the Line told the Johnny Cash story in a way that ends in the late ‘60s, but Cash went on to decline in the ‘80s and came back in the ‘90s, with some of his best work, on the “American Recordings” albums. Isn’t that story worth its own movie? Straight Outta Compton tells the N.W.A. story, but the group’s members went on to have compelling careers that are worth their own stories.

Film executives might suggest that the big stories have already been done, but these days aren’t big stories just foundations for a franchise? Seeing a hero become himself is just the beginning — the best stories are often about what happens next. That’s certainly true in Dylan’s case, and I think it’s true of other artists, to one extent or another. That’s the idea behind the forthcoming Paul McCartney documentary Man on the Run, which tells his story after the Beatles broke up. I hope a Dylan movie sequel follows.

Billionaire hedge fund investor and Universal Music Group director Bill Ackman is a step closer to de-listing his Pershing Square Holdings from the Euronext Amsterdam exchange, a move that Ackman — whose Pershing Square company has owned around 10% of stock in the Universal Music Group since 2021 — has advocated for UMG to do, too.

The Euronext Amsterdam approved a plan for Pershing Square Holdings to de-list, with the closed-end fund’s last day of trading to be Jan. 30. The investment vehicle will consolidate trading of its shares on the London Stock Exchange, where it was co-listed in 2017 and where the majority of its trading happens.

Ackman and his family own more than 20% of the fund, and in November he advocated for moving the fund and UMG’s listing from the main Netherlands’ stock exchange after fans of an Israeli soccer team were attacked in early November in Amsterdam.

Trending on Billboard

UMG said at the time that it will review and decide what is in the best interests of all shareholders.

In a separate announcement on Thursday, Pershing Square said it distributed around 47 million shares of Universal Music Group stock, or roughly 2.6% of its overall stake, to investors as part of a planned wind-down of one of the funds Pershing Square initially used to purchase UMG shares from Vivendi in September 2021.

Pershing Square, which managed the closed-end fund called PSVII, said it decided to distribute, rather than cash out, the UMG stock “because we believe that UMG stock is substantially undervalued at its current share price, and the tax-free stock distribution enables our limited partners to continue to own UMG shares.”

Pershing Square continues to own around 140 million shares, equal to a 7.6% stake in UMG, through its core funds — Pershing Square Holdings, Ltd., Pershing Square, L.P. and Pershing Square International, Ltd. — Bill Ackman, Pershing Square employees and other affiliates, according to a company statement. UMG is still Pershing Square’s largest single holding.

As of Dec. 31, Pershing Square said UMG has had a total return of “46% including dividends over the approximately three-and-one-quarter-year life of the investment.” The company said that is better than “the S&P 500’s 37% return and the Amsterdam Exchange Index’s return of 21% over the same period.”

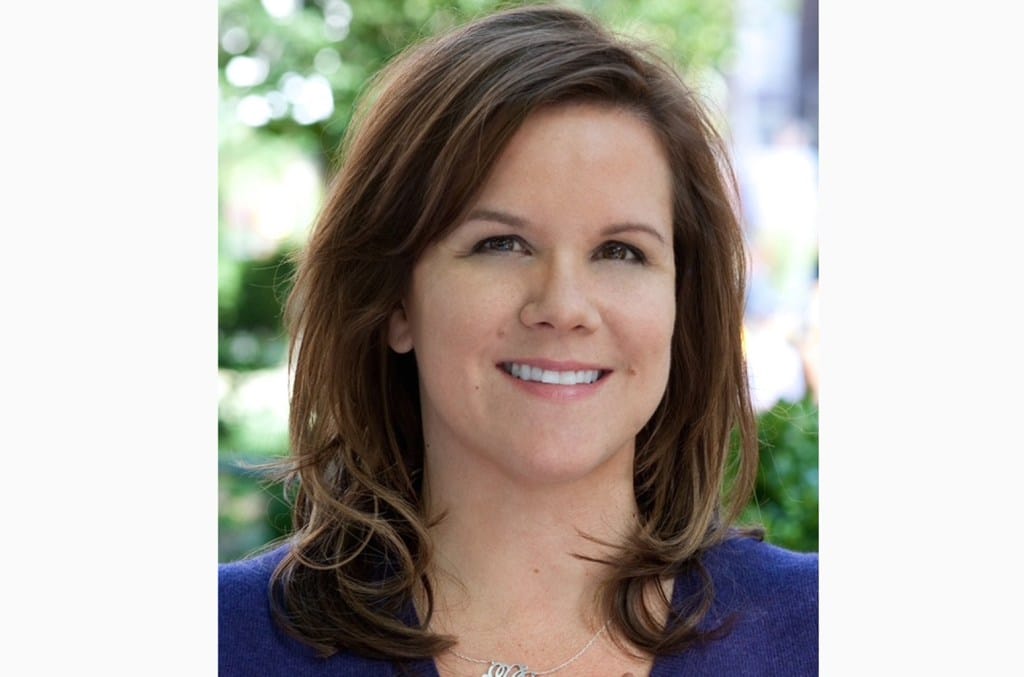

Lauren Davis, a veteran music business attorney, has been promoted to associate chair of New York University’s Clive Davis Institute of Recorded Music.

Davis joined the institute’s full-time faculty in 2006, teaching courses on the legal and business aspects of the music industry, including intellectual property law. She has also lectured on social entrepreneurship and advancing equity and inclusion in music. As the director of professional development at CDI, she oversees the professional planning and Senior Year Professional Development courses for graduating students.

With 33 years of experience as a music and entertainment attorney, Davis has represented high-profile recording artists, songwriters, producers, publishers, and music companies. She has also served as the faculty senator on NYU’s Faculty Council for six years, advocating for faculty interests.

Trending on Billboard

Nick Sansano, chair of the Clive Davis Institute, praised Davis for her unwavering support and inspiration to students since the institute’s inception.

“Her music business and legal expertise, and her academic focus on policy, rights advocacy, and gender equity in the music industry has influenced and directed the professional lives of so many of our students and alumni,” he said. “Her willingness to take on the role of Associate Chair, deepening her contribution to the development of our curriculum and mission, is a huge win for our program.”

Davis expressed her excitement about her new role, stating it has been a privilege to teach and prepare future industry leaders over the past 18 years, adding that she’s “excited to roll up my sleeves, work with Nick Sansano as chair, and help steer the Clive Davis Institute’s growth and expansion in the years ahead.”

Named after the iconic music executive, the program offers a distinctive BFA that blends business, creative and intellectual exploration as part of NYU’s Tisch School of the Arts. The CDI marked its 20th anniversary earlier this year and is a fixture in Billboard‘s annual list of top music business schools.

In the end, 2024 was the year that the U.S. performance rights societies found out what type of valuations they can command when they are put up on the block. As the year comes to a close, a select group of private equity suitors is kicking the tires on yet another performance rights organization, SESAC, according to sources.

Those sources say that deals like New Mountain Capital’s acquisition of BMI in February and Hellman & Friedman signing a letter of intent in September to replace Taxes Pacific Group as the majority owner of Global Music Rights that gave GMR a $3.3 billion valuation served as a catalyst for some private equity firms to reach out to SESAC’s corporate owner Blackstone to see if it was interested in selling.

Consequently, Blackstone is fielding inbound interest from a group of private equity firms that unsuccessfully bid on GMR, according to a source familiar with the matter.

Trending on Billboard

Many private equity firms look at GMR and are “all shocked by the final valuation,” says a music asset investor. “Those firms have a real appetite for music because music assets are doing well.” In fact, some sources suggest that SESAC has been a fantastic performer for Blackstone. Nevertheless, as an investment firm representing institutional clients, Blackstone has a fiduciary obligation to maximize returns on their investments. So with the aid of the Moelis & Co. and Morgan Stanley investment banks, Blackstone is selectively and informally shopping the PRO and its subsidiaries to a targeted group of private equity firms, while so far eschewing to reach out to potential strategic buyers, sources say. “You can’t blame Blackstone for testing to see what the market will pay for SESAC,” says one music asset buyer.

SESAC, Blackstone, Moelis and Morgan Stanley executives either declined to comment or didn’t respond to a request for comment.

Blackstone, which bought SESAC in 2017 for $1.125 billion, has since invested in the company as the PRO, led by chairman John Josephson, has been making subsequent add-on acquisitions to complement its core business. During Josephson’s tenure, SESAC has acquired the Harry Fox Agency and Audiam to go along with earlier acquisitions like RumbleFish and Christian Copyright Licensing International. What’s more, in 2021, when Blackstone bought Hasbro’s music assets, including the MNRK record label and the Audio Network production music house, the latter company was added to SESAC’s portfolio. (Sources say Audio Network is included in the SESAC assets being looked at, but Billboard could not determine if MNRK is also included in any potential deal.)

Along the way, Blackstone loaded up SESAC with about $1 billion in debt through a series of asset-backed bond offerings, with the latest securitization for $180 million happening earlier this year. On Feb. 8, Kroll Bond Rating Agency (KBRA) noted that the proceeds from that bond sale would be used for “distribution to equity investors” as well as to pay certain transaction expenses and make deposits into certain transaction accounts.

According to that credit rating report, SESAC had revenue of $388.6 million in 2024, presumably the fiscal year ended Jan. 31, 2024. It also said that the company is expected to hit over $400 million in its current fiscal year, likely the one that will end Jan. 31, 2025. What’s more, that $388.6 million revenue total tracks only the SESAC businesses that are part of the collateral for the February 2024 securitization offering, which included SESAC, Christian Copyrights and Audio Network. Revenue from the Harry Fox Agency (HFA), the Stephen Arnold Group (SAG) and a few other smaller entities are not included as collateral. With HFA and SGA consistently reaching a combined total of $20 million to $25 million, according to revenue numbers given in earlier SESAC bond rating documents — published by the likes of Morningstar and the Kroll Bond Rating Agency — for 2022 and 2019 SESAC bond offerings, it’s conceivable that SESAC’s revenue was already above $400 million by the end of its most recent fiscal year. Those assets are included in what’s being shopped, sources say.

A 2019 Morningstar analysis found that SESAC has had a 12.9% annual growth rate since 1994. While that report didn’t cite revenue from those earlier years, other SESAC-related documents obtained by Billboard through the years show that SESAC had grown from $9 million in revenue in 1994 to about $57 million by 2004, then to about $206 million by 2014 and about $275 million by 2018.

While it’s unclear what price will tempt Blackstone to sell, sources say that as recently as last year, Blackstone and SESAC executives were saying that the PRO and its subsidiary companies were carrying about a $2 billion to $2.5 billion valuation. However, that’s when its securitized net cash flow was $118 million on collections (revenue) of about $318 million, versus the latest financials, which put securitized net cash flow at $147 million on $388.6 million in revenue, according to the Kroll report. That represents increases of 24.6% in securitized net cash flow and nearly 22.2% in collections/revenue over the prior year. Besides that growth, the implied valuation of SESAC is further enhanced by the BMI and GMR deals, which shows that PROs are attractive to private equity, sources say.

Unlike BMI and ASCAP, SESAC and GMR are not stymied by consent decrees, which is also a positive as far as private equity is concerned. A further deal point is that SESAC has a diversified revenue base. According to the Kroll report, at the end of fiscal year 2024, SESAC derived 37.2% of its annual revenue from general licensing, 21.7% from digital, 18.9% from TV, 9.7% from Audio Network, 6.4% from radio, 0.7% from foreign affiliates and 5.5% from other efforts.

On the other hand, that percentage breakout shows that even with the company’s diversification efforts into related music industry functions, its core business remains SESAC’s performance rights licensing, which it does through a boutique strategy of inviting songwriters to join as members. Through this strategy, it has landed such clients as Bob Dylan, Adele and Neil Diamond.

Still yet another plus that suitors will find attractive, says a music industry source, is the savvy stewardship of SESAC under Josephson. “He is been very effective there,” that source adds.

Moreover, in order to improve profitability, SESAC has been quietly pruning songwriters who are not generating enough royalties from their catalog. According to Kroll, the number of songwriter and publisher affiliates (with the former presumably the preponderance of the total), has shrunk from 35,000 in 2019 to 15,000 last year.

Pricing is paramount in whether Blackstone will do a deal. But it will be weighted against the possible return on investment if it chooses to retain ownership of SESAC. As it is, Blackstone and its equity investors likely have already clawed back a good portion of their initial investment in SESAC. In addition to the aforementioned possible equity distribution from the February bond offering, during the eight years it has owned SESAC, it’s likely that Blackstone made earlier dividend payouts to investors from the PRO’s profits down through the years; and possibly from earlier bond offerings, too. Besides that, Blackstone has provided itself with an annual $30 million management fee as measured against 16% of SESAC’s core retained collections, whichever is greater. (While the rating agencies do not define core retained collections, that could be the equivalent of net publisher share — what’s left after making royalty payments to songwriters and publishers.)

As for possible suitors, so far the only private equity firm that has come up in more than one conversation with music industry sources is TA Associates, a Boston-based private equity firm that says it has raised $65 billion in capital. A perusal of the investment firm’s website reveals that it has invested in another music company: In 2022, it acquired TouchTunes, the digital jukebox network that supplies music to bars, clubs, restaurants and other social spaces in North America and Europe. Moreover, a source says that TA may have even looked at SESAC in the past; SESAC has come up for sale a few times over the years and consequently had a few other institutional investor owners in the past, including Rizvi Traverse; before that, Oct-Ziff Capital Management Group was a minority shareholder in the company.

TA Associates representatives couldn’t be reached for comment over the year-end holidays.

Moelis, which is one of the banks said to be shopping SESAC, has made its mark elsewhere in the music business in 2024. Earlier this year, it was the buy-side advisor to New Mountain Capital in its BMI acquisition and the sell-side advisor for GMR in its search for an investor to replace the Texas Pacific Group. Morgan Stanley has music industry experience, including investing with Kobalt in making music acquisitions, among other deals.

Additional reporting by Elizabeth Dilts Marshall.

LONDON — Proposed changes to U.K. copyright law that would allow tech companies to freely use songs for AI training without permission threaten to place the country’s status as a “world music power” at risk, record labels trade body BPI has warned.

In 2024, hit records by Charli XCX, Sabrina Carpenter, Coldplay and Taylor Swift helped lift the United Kingdom’s streaming market to a record high with just under 200 billion music tracks streamed across the 12 months, up 11% year-on-year, according to year-end figures released Tuesday (Dec. 31) by BPI.

Overall recorded music consumption across streaming and physical album sales rose by a tenth (9.7%) on 2023’s total to 201 million equivalent albums, marking a decade of uninterrupted growth, reports the organization, which represents over 500 independent record labels, as well as the U.K. arms of the three majors: Universal Music Group, Sony Music Entertainment and Warner Music Group.

Trending on Billboard

However, the success of the U.K. music business is being challenged on multiple fronts, including intensifying competition from other global markets and proposed regulations around the use of artificial intelligence (AI), says BPI.

The proposed AI guidelines were announced by the British government two weeks ago (Dec. 17) as part of a 10-week consultation on how copyright-protected content, such as music, can lawfully be used by tech companies to train generative AI models. Among them is a controversial new data mining exception that would allow developers to use copyrighted songs for AI training, including commercial purposes, but only in instances where rights holders have not reserved their rights.

BPI chief executive Jo Twist said the proposed opt out mechanism was the “wrong way to realise the exciting potential of AI” and places the U.K.’s music and creative industries at risk by allowing “international tech giants to train AI models on artists’ work without payment or permission.”

“The U.K. remains a world music power, but this status cannot be taken for granted,” said Twist in a statement accompanying Tuesday’s year-end figures. She said that in order to continue to thrive, the U.K. music business needs “a supportive policy environment that puts the focus on human artistry and enables continued investment in the next generation of British talent.”

Of the current generation, more than 20 British groups and solo acts topped the U.K. albums chart in 2024, although Charli XCX and Coldplay were the only homegrown artists in the year’s top 10 best-selling artist albums list, occupying the eighth and ninth positions with Brat and Moon Music, respectively. Veteran British American rock band Fleetwood Mac had the year’s seventh most popular album with their compilation 50 Years – Don’t Stop.

Topping the year-end albums list was Taylor Swift’s The Tortured Poets Department, which has sold over 783,000 equivalent units since its release in April – the most for any artist release in a calendar year since 2017, reports BPI. The Tortured Poets Department was one of four albums by Swift to feature among the year’s 20 biggest titles alongside 1989 (Taylor’s Version), Lover and Folklore.

In total, female artists accounted for six of the top 10 and half of the 20 biggest selling artist albums in the U.K. last year with hit releases by Sabrina Carpenter, Billie Eilish, Chappell Roan and Olivia Rodrigo helping make it a landmark year for women.

Female artists also spent an unprecedented 34 weeks at No. 1 on the United Kingdom’s official singles chart, largely driven by Carpenter, who spent 21 weeks at the top with her three hit singles: “Espresso, “Please Please Please” and “Taste.” The best-selling single in the U.K. last year was Noah Kahan‘s “Stick Season,” which topped the U.K. charts for seven weeks, followed by Benson Boone‘s “Beautiful Things.”

Vinyl helps physical album sales return to growth

In terms of formats, streaming now makes up 88.8% of music sales in the United Kingdom, a marginal 1.1% rise on 2023’s figure and more than double streaming’s share of the U.K. market six years ago, reports BPI.

Meanwhile, physical sales experienced year-on-year growth for the first time since 1994 with vinyl and CD album purchases up 1.4% to 17.4 million units. Driving the resurgence in physical formats was a 17th consecutive annual rise in vinyl album sales which grew by just over 9% to 6.7 million units, marking a three-decade high.

The year’s most popular vinyl album was Swift’s The Tortured Poets Department, which sold more than 111,000 vinyl copies, followed by a 30th anniversary reissue of Oasis‘ debut Definitely Maybe. Other top-selling vinyl titles included Eilish’s Hit Me Hard And Soft, Fontaines D.C.‘ Romance, The Cure‘s Songs Of A Lost World and Charli XCX’s Brat.

CD sales fell 2.9% year-on-year to 10.5 million units, representing a significant slowdown on the 19% drop recorded in 2022 and the almost 7% slide in sales experienced in 2023. Digital album sales dropped almost 6% to 3.3 million units.

BPI’s preliminary year-end report doesn’t include financial sales data. Instead, it uses Official Charts Company data to measure U.K. music consumption in terms of volume. The London-based organization will publish its full year-end report, including recorded music revenues, later this year.

The U.K. is the world’s third-biggest recorded music market behind the U.S. and Japan with sales of $1.9 billion in 2023, according to IFPI. It is also the second-largest exporter of recorded music worldwide behind the U.S.

Tougher competition from other international markets, including Latin America and fast-growing countries like South Korea, has seen the U.K.’s share of the global recorded music market shrink over the past decade, however.

In 2015, artists from the United Kingdom cumulatively accounted for 17% of global music streams, according to BPI export figures. That figure now stands at 10% with U.K. artists accounting for just nine of the top 40 tracks streamed in the country last year – the highest being “Stargazing” by Myles Smith at number 12.

“From Coldplay, and Charli XCX, to The Last Dinner Party, and Myles Smith, there were plenty of examples of U.K. music success stories in 2024. But there are also rising challenges for domestic talent in a rapidly changing and hyper-competitive global music economy,” said BPI’s Jo Twist.

“By meeting the growing global challenge head-on, tackling challenges around AI, copyright and streaming fraud, and encouraging consumers towards viable models, like paid streaming subscriptions, we can help to ensure that the value of British music is protected and that our industry can continue to grow and flourish at home and around the world,” she said.

≈

Music Business Year In Review

Charles F. Dolan, who founded some of the most prominent U.S. media companies including Home Box Office Inc. and Cablevision Systems Corp., has died at age 98. A statement issued Saturday by his family said Dolan died of natural causes, Newsday reported late Saturday.

“It is with deep sorrow that we announce the passing of our beloved father and patriarch, Charles Dolan, the visionary founder of HBO and Cablevision,” the statement said.

Dolan’s legacy in cable broadcasting includes the 1972 launch of Home Box Office, later known as HBO, and founding Cablevision in 1973 and the American Movie Classics television station in 1984. He also launched News 12 in New York City, the first 24-hour cable channel for local news in the U.S., Newsday reported.

Trending on Billboard

The Cleveland native, who dropped out of John Carroll University in suburban Cleveland, completed the sale of Cablevision to Altice, a European telecommunications and cable company, for $17.7 billion in June 2016.

Dolan, whose primary home was in Cove Neck Village on Long Island in New York, also held controlling stakes in companies that owned Madison Square Garden, Radio City Music Hall and the New York Knicks and New York Rangers sports franchises, Newsday reported.

James L. Dolan, one of his sons, was the Cablevision CEO from 1995 until the 2016 sale to Altice. He now is the executive chairman and CEO of Madison Square Garden Sports Corp. The company owns the Knicks and Rangers, among other properties, according to the MSG Sports website.

A statement from MSG Entertainment, MSG Sports and Sphere Entertainment recalled Dolan’s “vision.”

“Mr. Dolan’s vision built the foundation for the companies we are today, and as a member of our Boards he continued to help shape our future. The impact he made on the media, sports, and entertainment industries, including as the founder of Cablevision and HBO, is immeasurable,” the statement said. “We do not expect this to directly or indirectly change ownership by the Dolan family.”

Newsday, which Cablevision purchased in 2008, also came under the control of Altice with the sale. Patrick Dolan, another son of Charles Dolan, led a group that repurchased 75% of Newsday Media Group in July 2016. Patrick Dolan then purchased the remaining 25% stake in 2018.

At the time of his death, Charles Dolan and his family had a net worth of $5.4 billion, Forbes reported.

Dolan was a founder and chairman emeritus of The Lustgarten Foundation in Uniondale, New York, which conducts pancreatic cancer research.

He is survived by six children, 19 grandchildren and five great-grandchildren. His wife, Helen Ann Dolan, died in 2023, Newsday reported.

In a week with little news and few regulatory filings, music stocks finished the last full week of 2024 by dropping for the third consecutive week. The 20-company Billboard Global Music Index (BGMI) fell 0.6% to 2,155.51, lowering its year-to-date gain to 40.5%. The index has fallen 5.5% over three weeks after rising 14.6% over […]

Richard Parsons, one of corporate America’s most prominent Black executives who held top posts at Time Warner and Citigroup, died Thursday. He was 76.

Parsons, who died at his Manhattan home, was diagnosed with multiple myeloma in 2015 and cited “unanticipated complications” from the disease for cutting back on work a few years later.

The financial services company Lazard, where Parsons was a longtime board member, confirmed his death. Parsons’ friend Ronald Lauder told The New York Times that the cause of death was cancer.

Parsons stepped down Dec. 3 from the boards of Lazard and Lauder’s company, Estée Lauder, citing health reasons. He had been on Estée Lauder’s board for 25 years.

Trending on Billboard

“Dick was an American original, a colossus bestriding the worlds of business, media, culture, philanthropy, and beyond,” Ronald Lauder said in a statement on behalf of the Lauder family.

David Zaslav, the CEO of Time Warner successor Warner Bros. Discovery, hailed Parsons as a “great mentor and friend” and a “tough and brilliant negotiator, always looking to create something where both sides win.”

“All who got a chance to work with him and know him saw that unusual combination of great leadership with integrity and kindness,” Zaslav said, calling him “one of the great problem solvers this industry has ever seen.”

Parsons, a Brooklyn native who started college at 16, built a track record of steering big companies through tough times.

He returned Citigroup to profitability after turmoil from the global financial crisis and helped restore Time Warner after its much-maligned acquisition by internet provider America Online.

Parsons was named to the board of CBS in September 2018 but resigned a month later because of illness.

Parsons said in a statement at the time that he was already dealing with multiple myeloma when he joined the board, but “unanticipated complications have created additional new challenges.” He said his doctors advised him to cut back on his commitments to ensure recovery.

“Dick’s storied career embodied the finest traditions of American business leadership,” Lazard said in a statement. The company, where Parsons was a board member from 2012 until this month, praised his “unmistakable intelligence and his irresistible warmth.”

“Dick was more than an iconic leader in Lazard’s history — he was a testament to how wisdom, warmth, and unwavering judgment could shape not just companies, but people’s lives,” the company said. “His legacy lives on in the countless leaders he counseled, the institutions he renewed, and the doors he opened for others.”

Parsons was known as a skilled negotiator, a diplomat and a crisis manager.

Although he was with Time Warner through its difficulties with AOL, he earned respect for the company and rebuilt its relations with Wall Street. He streamlined Time Warner’s structure, pared debt and in early 2004 sold Warner Music Group to an investor group led by the Seagram heir Edgar Bronfman Jr. for about $2.6 billion. For Parsons, the sale represented the fulfillment of a key promise to Wall Street — he had pledged to reduce Time Warner’s debt by $8 billion by the end of 2004. Before selling the music division, Parsons had already offloaded a half-stake in Comedy Central, a share in the satellite TV company operating DirecTV, and the Atlanta Hawks and Thrashers sports teams. He also secured a $750 million settlement from Microsoft to resolve an antitrust lawsuit.

He later fended off a challenge from activist investor Carl Icahn in 2006 to break up the company and helped Time Warner reach settlements with investors and regulators over questionable accounting practices at AOL.

Parsons joined Time Warner as president in 1995 after serving as chairman and chief executive of Dime Bancorp Inc., one of the largest U.S. thrift institutions.

In 2001, after AOL used its fortunes as the leading provider of Internet access in the U.S. to buy Time Warner for $106 billion in stock, Parsons became co-chief operating officer with AOL executive Robert Pittman. In that role, he was in charge of the company’s content businesses, including movie studios and recorded music.

He became CEO in 2002 with the retirement of Gerald Levin, one of the key architects of that merger. Parsons was named Time Warner chairman the following year, replacing AOL founder Steve Case, who had also championed the combination.

The newly formed company’s Internet division quickly became a drag on Time Warner. The promised synergies between traditional and new media never materialized. AOL began seeing a reduction in subscribers in 2002 as Americans replaced dial-up connections with broadband from cable TV and phone companies.

Parsons stepped down as CEO in 2007 and as chairman in 2008. A year later AOL split from Time Warner and began trading as a separate company, following years of struggles to reinvent itself as a business focused on advertising and content. Time Warner is now owned by AT&T Inc.

A board member of Citigroup and its predecessor, Citibank, since 1996, Parsons was named chairman in 2009 at a time of turmoil for the financial institution. Citigroup had suffered five straight quarters of losses and received $45 billion in government aid. Its board had been criticized for allowing the bank to invest so heavily in the risky housing market.

Citigroup returned to profit under Parsons, starting in 2010, and would not have a quarterly loss again until the fourth quarter of 2017. Parsons retired from that job in 2012.

In 2014 he stepped in as interim CEO of the NBA’s Los Angeles Clippers until Microsoft CEO Steve Ballmer took over later that year.

“Dick Parsons was a brilliant and transformational leader and a giant of the media industry who led with integrity and never shied away from a challenge,” NBA Commissioner Adam Silver said.

Parsons, a Republican, previously worked as a lawyer for Nelson Rockefeller, a former Republican governor of New York, and in Gerald Ford’s White House. Those early stints gave him grounding in politics and negotiations. He also was an economic adviser on President Barack Obama’s transition team.

Parsons, whose love of jazz led to co-owning a Harlem jazz club, also served as Chairman of the Apollo Theater and the Jazz Foundation of America. And he held positions on the boards of the Smithsonian National Museum of African American History and Culture, the American Museum of Natural History and the Museum of Modern Art in New York City.

Parsons played basketball at the University of Hawaii at Manoa and received his law degree from Albany Law School in 1971. He is survived by his wife, Laura, and their family.

State Champ Radio

State Champ Radio