Business News

Page: 24

Investors seeking shelter from the chaos unleashed by President Trump’s often incoherent tariff policy can find safety in companies without direct exposure to tariffs or the teetering advertising market. And music, especially digital music, will be able to weather the storm, say many analysts — with one major exception.

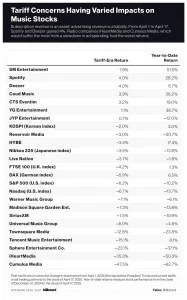

To understand what people are thinking about tariffs’ impact on the business world, look no further than stock prices. The performance of various music-related stocks reveals how investors are betting that economic uncertainty will affect various companies.

Many stocks — especially those of companies traded on U.S. exchanges — have taken a hit as investors fled for safer alternatives. The Nasdaq and S&P 500, U.S. indexes, are down 6.2% and 6.7%, respectively, since April 1, the day before President Trump announced his tariff plans. Elsewhere in the world, indexes have generally performed better. South Korea’s KOSPI is down just 2.0%. Japan’s Nikkei 225 is off 3.5%. The U.K.’s FTSE 100 is down 4.2%. Germany’s DAX has lost 5.9%.

Trending on Billboard

Within music, companies that get most of their revenue from streaming are faring relatively well. Since April 1, Spotify and Deezer have each gained 4.0%, two of the better showings for music stocks. Cloud Music improved 3.9%. Tencent Music Entertainment, on the other hand, has fallen 15.1%, although its share price remains up 8.1% year to date.

Record labels and publishers have also been holding up well, in relative terms, particularly outside the U.S. Since April 1, shares of Universal Music Group (UMG) — which is headquartered in the U.S. but trades in Amsterdam — and Warner Music Group (WMG) are down 8.0% and 7.1%, respectively. Reservoir Media lost 3.0%. K-pop companies — much like South Korean companies in general — have fared well. Since April 1, SM Entertainment has gained 7.9%, YG Entertainment is up 1.1% and JYP Entertainment has gained 0.7%. HYBE fell 3.4%.

UMG and WMG’s post-tariff declines are slightly greater than the drops in the Nasdaq and S&P 500 of 6.7% and 6.2%, respectively. But both UMG and WMG had strong starts to 2025, and their year-to-date losses of 4.5% and 6.1% are far better than the S&P 500’s 10.2% drop and the Nasdaq’s 15.7% year-to-date decline.

Some live music companies’ stocks have been resilient, too. Live Nation shares are down 3.7% since April 1, while German concert promoter CTS Eventim is up 3.2%. Sphere Entertainment Co., owner of the Sphere venue in Las Vegas, is an exception. Sphere Entertainment shares have plummeted 23.1% since President Trump’s tariff announcement, a far more significant drop than the stocks of other companies — Caesars Entertainment, Wynn Resorts, MGM Resorts — that rely on consumers’ willingness to part with their money in Las Vegas.

For many U.S. media stocks, the direct impact of tariffs is “relatively muted,” wrote Citi analysts in an April 7 report, as many of the companies rely on discretionary spending, not ad revenue. Apple and other tech companies, for example, got an exemption from the 145% tariffs on Chinese imports but must still pay the blanket 20% tariff. Companies that get much of their revenues from subscriptions — Netflix, Spotify, UMG and WMG — will be less impacted.

Music streaming, most notably subscription services, is considered by equity analysts to be safe from whatever tariff-induced economic chaos awaits the global market. “Digital goods are unaffected by tariffs,” wrote TD Cowen analysts in an April 14 investor report. Subscription services, they argued, provide enough bang for the buck, and customers have such an emotional attachment to music that subscribers are unlikely to leave in “meaningful” numbers if the economy goes south.

Streaming and subscription growth slowed in 2024, but many analysts expect improvements to come from a regular drumbeat of price increases, renewed licensing deals and super-premium tiers. That said, analysts believe that Spotify’s latest licensing deals with UMG and WMG, and upcoming deals with other rights holders, better reward labels and publishers for price increases. As a result, TD Cowen slightly lowered its estimates for Spotify’s revenue, gross profit margin and operating income in 2025. Likewise, in an April 4 note to investors, Guggenheim analysts lowered their estimate for Spotify’s gross margin in the second half of 2025.

Companies reliant on advertising revenue will also take an indirect hit. Citi estimates that $4 trillion of imports could generate $700 billion in tariffs and reduce personal consumer and ad spending by 1.9%. Tariffs have ripple effects, too. Because household net worth and personal spending are highly correlated, says Citi, the recent declines in stock prices could reduce personal and advertising spending by 3.0%.

Consumer spending is at the heart of the concert business, but analysts agree that fans’ affection for their favorite artists protects live music from economic downturns. As a result, Live Nation has “less risk than the average business that depends on discretionary spending,” according to TD Cowen analysts.

Advertising-related businesses aren’t so lucky, though. As tariffs raise prices and household wealth declines, personal spending also declines, and, in turn, brands pull back on their advertising spending. Investors’ expectations for advertising-dependent businesses were apparent before April but have become clearer since President Trump’s April 2 tariff announcement. iHeartMedia, which closed on Thursday (April 17) below $1.00 per share for the first time since June 4, 2024, has dropped 35.3% since April 1 and fallen 50.3% year to date. Cumulus Media has fared even worse, dropping 47.5% since April 1 and 62.7% year to date. Townsquare Media has fallen 12.8% in the tariff era and 23.8% year to date.

J.P. Morgan analysts believe iHeartMedia’s full-year guidance of $770 million is “somewhat optimistic” given economic uncertainties and ongoing pressures in the radio business. It forecasts full-year EBITDA of $725 million — nearly 6% lower than iHeartMedia’s guidance. If things wind up going more the way J.P. Morgan predicts than iHeart, it would be a big blow to the company and an unfortunate bellwether for the already struggling radio business. While other music industry sectors look to ride out the tariffs at least in the shorter term, the economic uncertainty introduced by the Trump administration may only hasten radio’s ongoing decline.

As Billboard has noted numerous times in recent weeks, investors are attracted to music assets because they are counter-cyclical, meaning they don’t follow the typical ups and downs of the economy. Consumers will, by and large, stick with their music subscription services and continue going to concerts. But by introducing the tariffs, the Trump regime exposed one of radio’s greatest weaknesses as a business: a greater exposure, due to its reliance on advertising, to the state of the wider economy.

Billboard

Canadian musicians and music organizations are speaking out ahead of the federal election on April 28.

Indie folk artist The Weather Station took to Instagram on April 15 to make an impassioned plea to Canadians not to check out of this election. She had just returned from a tour in the U.S., supporting her new album Humanhood, and told followers that now is the time to prevent Canada from following in America’s footsteps.

“I cannot articulate the level of relief I felt this time crossing the border back into Canada,” she says. “I think we have no lived understanding of how bad things could get.”

The Weather Station, whose name is Tamara Lindeman, has previously spoken out about the U.S. administration, citing authoritarianism, threats to free speech and the right to protest, and dismantling of public services serving climate, education, health care and social security.

Trending on Billboard

In her new video, she highlights the people fighting for those issues and to build community amidst the crisis south of the border.

“Loved the shows, loved all the people we met, but it’s so incredibly painful to see what people are going through,” she says. “People feel exhausted, they feel afraid and at risk, they feel powerless…a lot of people increasingly feel kind of silenced, which is really scary.”

Speaking to Billboard Canada about why she felt compelled to share the video, Lindeman adds that when it comes to this election, the stakes couldn’t be higher. “For an avalanche of reasons — from Trump’s threats of annexation, to how misinformation and MAGA-style politics are moving across the border, to the immensity of the climate crisis, to the affordability crisis across this country,” she elaborates.

She also points out Conservative leader Pierre Poilievre‘s desire to defund the CBC as particularly concerning for musicians, given how the public broadcaster supports Canadian music through radio airplay and events.

Her post received positive comments from fellow Canadian musicians like Jill Barber and Bells Larsen. Larsen, a folk singer-songwriter, last week shared that he cannot tour in the U.S. due to changes in Visa application policy that target trans musicians, requiring legal ID to match sex assigned at birth.

Canadian music organizations have also been emphasizing the importance of this election across party affiliations, against the backdrop of American politics.

Allistair Elliott, AFM vice president from Canada, sent out a message today to American Federation of Musicians members in Canada titled “Make Your Vote Count.”

“The upcoming election is critical for Canadians — no matter your political leanings, your vote matters,” Elliott writes. “Look south of the border to understand what can happen. In the last U.S. election, 32% of votes went to Republicans and 31% to Democrats. That means 68% of U.S. voters did not vote for the current president. True democracy is achieved when everyone votes. Plan, do your research, and most importantly, vote. It really matters, can, and will make a difference.”

The message stops short of endorsing particular parties or candidates, but highlights policy areas that affect musicians and arts workers, such as generative artificial intelligence, diversity equity and inclusion, trade tariffs, and strengthening public health care.

The Canadian Live Music Association published a note last week from President Erin Benjamin, emphasizing the importance of the live music industry in Canada to both the country’s economy and its cultural identity.

Benjamin called on supporters to send a letter to federal election candidates of all parties, calling on them to leverage Canadian music for the future.

The Canadian federal election is Monday, April 28. –Rosie Long Decter

Hamilton Indie Label Sonic Unyon Launches SUM Artist Management, Headed By Wayne Pett

Hamilton-based independent label and music company Sonic Unyon Records has unveiled its latest initiative, SUM Artist Management. It’s a new arm of the company dedicated to representing and developing artists, identifying and opening opportunities to them.

Taking the helm as both director of artist management at SUM Artist Management and label operations for Sonic Unyon Records is Wayne Petti, a well-known figure on the Canadian music scene as frontman for highly-regarded roots-rockers Cuff the Duke. At SUM, Petti will work in league with Sonic Unyon owner/CEO Tim Potocic, representing a musically diverse and notable roster of clients.

That includes roots-rock singer-songwriter Terra Lightfoot, Polaris Prize-winning auteur Owen Pallett, Hamilton shoegaze combo Basement Revolver, American feminist performance artist and electro-rocker JD Samson (Le Tigre), retro cover band Born in the Eighties, multi-instrumentalist and composer Michael Peter Olsen, and three bands at the forefront of an Indigenous wave in Canadian rock, Zoon, OMBIIGIZI and Status/Non-Status.

“We’re about constant evolution,” says Potocic. “As a label, we’ve signed newcomers and longtime favourites as well as bigger bands like Danko Jones and Big Wreck. All of that is super exciting and some of the best music we’ve ever released. At the same time, this is not an industry that rewards sitting still. It’s a challenging time and a tough landscape, but opportunities still abound. We’ve always believed in the value of our artists, and artists more generally, so artist management is the natural outgrowth of that.”

In an interview with Billboard Canada, Petti notes that, “I’ve been involved in artist management for close to 10 years now. I have a unique perspective on the music business having both experienced what it’s like to be a recording artist and everything that goes along with that, plus experiencing working with artists and helping to guide them through their own careers. I’m very much an ‘artist first’ type of manager. I don’t chase things just for the money. I want the artists I work for to feel supported. I want them to focus on being creative and unique artists and I’m just there to help facilitate their vision and goals artistically.”

“Our main goal at SUM is to work with unique artists regardless of whether they are Canadian, American or from somewhere else around the world,” he continues. “I think we’re off to a great start.”

Petti previously made a major mark in artist management during eight years with Hamilton-based Straight & Narrow Management, which handles major international stars The National, as well as Broken Social Scene, Hannah Georgas, Kevin Drew and Georgia Harmer.

The creation of SUM Artist Management aligns with Sonic Unyon’s expansion into industry sectors beyond the traditional duties of a record label. Sonic Unyon Distribution was founded in 1998 to distribute Sonic Unyon and other labels in Canada, going on to build a roster that included dozens of domestic imprints and the exclusive representation of over 200 international independent labels in Canada. –Kerry Doole

It’s time to drop the needle on another Executive Turntable, Billboard’s weekly compendium of promotions, hirings, exits and firings — and all things in between — across the music business. There’s been a fair share of news this week, so let’s get cracking.

Sony Music Entertainment named Kevin Foo as managing director for Southeast Asia, overseeing operations in the Philippines, Indonesia and Thailand, effective immediately. Based in Singapore, Foo will lead efforts to expand SME’s presence in these rapidly growing music markets, focusing on artist development and audience engagement. He will report to Shridhar Subramaniam, president of Asia and Middle East, and manage a squad including general managers and a vp of international marketing for Southeast Asia. Foo brings a strong track record, having previously served as MD of RCA Records Greater China and GM of SME Taiwan. During the Covid-19 pandemic, he led a cross-border collaboration supporting Taiwanese artist Eric Chou’s charity initiative. Prior to joining the Sony family in 2022, Foo co-founded Umami Records, ran Beep Studios, managed artists through Foundation Music, and did some consulting for UMG. His appointment signals SME’s commitment to growth of local genres like P-pop and T-pop. “Kevin has a unique ability to connect artists, markets, and audiences in ways that drive both commercial and cultural impact,” said Subramaniam. “His deep understanding of the region, coupled with his passion for artist development, makes him an ideal leader to shape the next phase of our Southeast Asia strategy.”

Island Records elevated Matt Palazzolo from vp to senior vp and head of analytics at the UMG imprint. Based in New York, he’ll report directly to co-chairmen and CEOs Imran Majid and Justin Eshak. In his new role, Palazzolo will continue to enhance the label’s data capabilities and provide action-oriented insights to the organization, management partners and artists. Since joining Island in 2022 after a lengthy stint at Sony Music Publishing, Palazzolo and his team have excelled in using insights to support artist development. Eshak praised Palazzolo as “key to our culture of learning” at the label, adding, “he also has a real understanding of music and culture that’s indispensable to the delicate process of combining art and analytics.” Majid emphasized Palazzolo’s skill in integrating analytics into the label’s “DNA… He has an incredible ability to attune to what each department is doing and add value by way of his intensive and comprehensive research.”

Trending on Billboard

Big Machine Label Group hired Chris Koon as executive vice president of finance. Koon will report directly to BMLG president Andrew Kautz and HYBE America CFO Eric Holden. Koon has over three decades of financial experience across recorded music, distribution and publishing operations, holding financial leadership positions at Universal Music Group/Capitol CMG, managing business acquisitions and integrations. –Jessica Nicholson

Marc Eckō

Complex founder Marc Eckō is returning as chief creative and innovation officer, overseeing creative strategy and integrating technologies like artificial intelligence to boost audience engagement. Eckō founded Complex magazine in 2002, transforming how youth culture and streetwear are covered in media. Before Complex, he pioneered Eckō UNLTD., blending music and design. Complex, acquired by NTWRK in 2024 with strategic investment from UMG, Jimmy Iovine, Goldman Sachs and Main Street advisors, has expanded into e-commerce, revived its print magazine, and globally expanded ComplexCon. Additionally, Ray Elias joined as chief marketing officer, leading brand, growth and communications. Elias, with over 25 years of experience, has held pivotal roles at high-growth startups and market-leading brands, including CMO at HotelTonight and StubHub, driving significant business growth and industry disruption.

Smith Entertainment Law Group (SELG), known for its expertise in production counsel for awards shows, series, films, documentaries, and live events, named Lynn Elliot, Esq. as senior counsel. Based in NYC, Elliot brings extensive experience in film, television, music, live events, and new media, having worked on projects like Precious, Alive Inside, and The Rachel Zoe Project. Her clients include producers, writers, directors, musicians, and event promoters. Previously, she served as Associate General Counsel at Dayglo Presents, handling legal matters for ventures like Brooklyn Bowl and Relix Magazine. At SELG, Elliot will lead deal structuring, risk assessment, employment transactions, and business operations support. With a background in film, TV writing, and clinical psychology, she offers a unique blend of creative and legal insight. Kerry Smith, founder and managing partner of SELG, praised Elliot’s breadth of experience and noted “her passion for supporting creative visionaries will further elevate the comprehensive services we offer to our clients.”

Warner Music Nashville promoted Katherine Firsching to director of commercial partnerships and Blair Poirier to manager of commercial partnerships. Both will report to Kristen Williams, svp of radio and commercial partnerships. Firsching, who joined WMG in 2020 as an interactive marketing coordinator, later became manager of video strategy. Poirier joined WMG in 2022 as commercial partnerships coordinator after working at Pierce Public Relations. Williams praised Firsching’s ability to build relationships with partners and artists, highlighting her “driving spirit to learn and win,” while commending Poirier’s skills in DSP account management and her ability to manage workloads “while also building fantastic relationships with our premiere DSP accounts.” They can be reached at katherine.firsching@wmg.com and/or blair.poirier@wmg.com.

Berklee appointed Edward J. Lewis III as senior vp of institutional advancement, effective May 15, a role in which he’ll work with Berklee’s top leadership to drive global fundraising and engagement initiatives. Lewis brings over 20 years of experience in higher education and the performing arts, with expertise in fundraising and strategic planning. Previously, Lewis was president and CEO of the Caramoor Center for music and the arts, where he launched its first major gifts program and advanced diversity and inclusion efforts. As vice chancellor for advancement at the University of North Carolina School of the Arts, he led a $75 million fundraising campaign and doubled the school’s endowment. A professional violist, Lewis also held development roles at the University of Maryland. “[Lewis’] extensive leadership and fundraising expertise, coupled with his community-focused approach, will help us realize our ambitious institutional advancement priorities across our campuses,” said president Jim Lucchese.

5B Artist Management announced internal promotions and the launch of its new creative and marketing agency, Pink Motel. Brad Fuhrman has been promoted to senior vp, managing artists like Lamb of God, BABYMETAL and Stone Sour. Lindsey Medina joins as senior manager of business development, bringing experience from Danny Wimmer Presents and Live Nation. In the UK, Adam Foster has been promoted to general manager, working with acts such as Behemoth and Slaughter to Prevail. Pink Motel, led by Stephen Reeder and Audrey Flynn, will focus on music marketing, brand campaigns and digital strategy. The agency already partners with top clients including Sony, BMG and Live Nation, while Reeder and Flynn continue their roles at 5B.

Jay Ahmed has been promoted to head of promotions at London-based promo agency Your Army, where he’ll lead the DJ, UK Radio, international radio and third party playlist departments. Having joined the company seven years ago as a national radio plugger, Ahmed has played a key role in successful campaigns for artists like BICEP, Barry Can’t Swim, Sub Focus, A Little Sound, salute, LF SYSTEM and KILIMANJARO. In his new position, he will oversee all promotional operations, develop global strategies and strengthen ties with media, artist management and label partners. Ahmed expressed gratitude for the opportunity and praised the Your Army team and artist roster, stating his excitement for what lies ahead in his expanded role.

ICYMI:

Armin Zerza

EMPIRE Publishing appointed producer !llmind as senior vp of A&R. Additionally, Al “Butter” McLean was elevated to executive vp of global creative, continuing to co-lead EP with Vinny Kumar … Opry Entertainment Group named Tim Jorgensen as vp of operations for its Austin team, overseeing ACL Live, 3TEN and W Austin … Warner Music Group hired Armin Zerza as evp and chief financial officer, effective May 5, bringing extensive leadership experience from his previous role as CFO of Activision Blizzard. [Keep Reading]

Last Week’s Turntable: Orchard Veteran Breaks Out on His Own

GoldState Music has raised $500 million in financing, the private investment firm announced on Thursday. Although specific details of the funding breakdown were not disclosed, the capital infusion consists of both equity and debt, and is described in a press release as a “structured capital facility… as well as separately raised leverage,” with Northleaf Capital Partners and Ares Management leading the deal.

“Our new relationship with Northleaf and Ares marks the next step in the evolution of our music investing strategy,” GoldState founder and managing partner Charles Goldstuck, said in a statement. “This additional capital will enable us to further accelerate our ability to capitalize on increasing demand for music and build a diversified portfolio of music assets across artists and genres. As leading institutional investors, Northleaf and Ares bring critical experience that will support GoldState’s continued growth and differentiation to the benefit of our artists, investors and other stakeholders.”

Northleaf is a well-known investor in the music industry, having previously financed $500 million through Lyric Capital Group for Spirit Music Group in 2021 and $75 million for Duetti last year.

Trending on Billboard

“Led by Charles, GoldState is well-positioned to execute on a disciplined music acquisition strategy, and Northleaf is pleased to support the Company and its exceptional team,” said CJ Wei, managing director, Private Credit at Northleaf. “Northleaf’s investment in GoldState directly aligns with our asset-based specialty finance strategy, which is designed to provide our investors with diversified and low correlation exposure while delivering strong cash yield.”

On the other hand, this appears to be the first music asset investment for Ares, or at least the first one they’ve publicly disclosed.

“Charles and GoldState Music bring a bold, visionary approach to music rights investment that seeks to empower artists,” Ares Management managing director Jeevan Sagoo said in a statement. “We are excited to collaborate with them and provide Ares’ deep sector and investment experience as they advance their long-term growth and value creation strategy.”

GoldState Music has acquired catalogs from two boutique music asset investors, Catchpoint Partners and AMR Songs. These catalogs feature notable tracks such as Kanye West’s “Flashing Lights,” Sheryl Crow’s “If It Makes You Happy” and Panic! At The Disco’s “I Write Sins Not Tragedies.” Additionally, they include portions of songs and recordings by artists like Brantley Gilbert, Smash Mouth, and Avril Lavigne. The acquisition also encompasses John Sebastian’s writer share of all his compositions with the Lovin’ Spoonful, including “Summer In The City,” “Daydream” and “Do You Believe In Magic,” as well as rights from his solo career, including “Welcome Back.”

The GoldState website also lists other financial backers, including Flexpoint Ford, Pinnacle Financial Partners and Regions. Prior to founding GoldState, Goldstuck has had a long career in the music industry, having held senior executive positions at various major labels before becoming president and COO of the Bertelsmann Music Group.

On April 25, MusiCares will host The Day That Music Cares, an annual worldwide day of service. Now in its third year, the initiative invites everyone in the music community — both people who work in music and music fans — to give back in ways that feel meaningful to them. Last year, more than […]

Record Store Day delivered another triumphant sales day to brick and mortar indie retailers with the hot sellers being Taylor Swift, Gracie Abrams and Charli XCX titles, while the Oasis and Wicked releases were among the most in demand — if only more copies had been manufactured for the event.

While this year’s Record Store Day (RSD) represented the usual sales bonanzas for retailers, merchants in some of the stores visited by Billboard reporters said that even with one of the stronger release day schedules in recent years, it was difficult for them to top last year’s RSD, which at the time many retailers proclaimed as their best day ever.

Trending on Billboard

However, there were other mitigating factors beyond the strength of last year’s performance that were felt by stores. For instance, in the Northeast, RSD was a miserable, rain-drenched day, which put a damper on sales. But that’s not all. As Ilana Costa, who co-owns the 12-year old Vinyl Fantasy Records and Comic Books in Brooklyn with her husband Joe, puts it, “A mixture of the weather, the economy and the news about tariffs” impacted the sales at their store, which were down about one-third from the prior year. Moreover, she said the recent economic turmoil — a chaotic tariff strategy by the Trump administration and the stock and bond market meltdowns and upward swings — had been impacting the store’s performance in the weeks prior to RSD.

Vinyl Fantasy

Ed Christman

Likewise at Pancake Records in Astoria, Queens, co-owner AJ Pacheco said sales at the two-year-old store were down about eight percent from the prior RSD due to the economy, tariffs and the weather, though he thinks the early date for RSD was also a factor in the sales decline. RSD is typically held on the third Saturday of April, but this year it was on the second Saturday.

The weather in New York didn’t stop customers from standing in line at Rough Trade at Rockefeller Center in Manhattan or at Pancake Records. At the latter, about 100 customers were waiting in line when the store opened at 8 am on Saturday morning. In fact, the “line started forming last night, right about when I was closing [at about 9:30],” Pacheco reported on RSD to Retail Track. “I was worried about the customer [who lined up at 9:30] because he was young, it was pouring rain and our store is not in the center of the town,” he said. “But things worked out.”

In Manhattan, Rough Trade Records had a huge line of customers waiting to get into the store all day, which lasted until about 3 pm, after which the store let customers come in and browse as usual.

Amoeba Music in Los Angeles also had a long line waiting to get in the store when Retail Track visited at about 11:15, shortly after the store’s 11 am opening. In fact, customers began lining up two days before RSD, floor manager Rik Sanchez told Retail Track.

With that kind of anticipation, the store “did a little better than last year,” Sanchez reported, though he added that last year was also very strong. While sales were up, “it wasn’t substantially more than last year,” he elaborated.

Sanchez dismissed another factor — Coachella — that one might think would have a sales impact, at least at California stores. “No, it happens around this time every year,” Sanchez said. “[RSD] always lands on one of the Coachella or Stagecoach weekends. I remember thinking, many years ago when we first started this, ‘Oh man, Coachella is going to really have an impact on us,’ but it didn’t.”

Besides, he added, “we also get business from the people who are leaving Coachella, passing through here on Monday.”

Back in New York, Rough Trade reported that sales were up 30%, and that within that, RSD titles were up 20 percent over last year. But Rough Trade had the bonus of a newly-opened second store in the Rockefeller Center complex, this one in the below-ground retail center. That store, referred to as Rough Trade Below and measuring 8,000 square feet, tripled the company’s retail space in the complex as the Sixth Avenue store, now referred to as Rough Trade Above, has 4,000 square feet of space.

Rough Trade

Brenda Manzanedo

Rough Trade co-owner Stephen Godfroy reports that the company used the RSD titles to introduce customers to the new location, which only opened on April 8, four days before the event. Consequently, the line that stretched down the block was funneled to the downstairs store where all the RSD titles were stored.

A few years back, Swift helped change the dynamic of Record Store Day, which used to be dominated by releases of legacy titles in colored vinyl that appealed to older, mainly male, customers. When Swift was named Record Store Day Ambassador back in 2022 and released a 7-inch single of a Folklore bonus track, “The Lakes,” young fans flocked to stores. Once record labels saw that young fans would go, it led to a steady stream of RSD releases in subsequent years with titles from younger stars like Olivia Rodrigo, Chappell Roan, Sabrina Carpenter, Noah Kahan, and this year, Abrams, among others.

Nowadays, Record Store Day’s main traffic driver is young female music fans, RSD co-founder Michael Kurtz says. In fact, store merchants report that the long lines waiting for record stores to open on RSD are largely made up of younger consumers, with the older customers showing up around midday. Along that line, Rough Trade’s Godfroy says two young ladies displaced longtime Rough Trade customer George West, who is usually at the front of the queue, as first in line for RSD this year, getting there the day before.

Retail Track’s View From Eight Indie Record Stores

Shoppers line up outside Rough Trade Below in Rockefeller Center.

Brenda Manzanedo

Rough Trade: Ponchos, Pastries and The Hives in RegaliaMidtown Manhattan

People who lined up early waiting for the Rough Trade store to open received free food and drinks from the different vendors who operate in the Rockefeller Center complex, Godfroy reported. “We look after people as much as we can,” he added. Along those lines, “We gave out 2,000 ponchos to those waiting in line in the rain.”

Like other merchants, Godfroy told Retail Track that the demand for the Oasis boxset and the double LP Wicked: The Soundtrack on green/pink glitter vinyl “was ridiculous.” But like most stores, Rough Trade only got one copy of each, and he wishes more were produced. “While I realize scarcity is what drives people to the stores on RSD,” it’s not fair to the customers waiting in long lines for those titles produced in meager numbers, he added.

Similar to bestseller reports from other retailers, Godfroy said that the store’s bestselling titles were Taylor Swift’s “Fortnight,” followed by Charlie XCX’s two RSD titles — “Number 1 Angel” and “Guess” — and Gracie Abrams’ Live From Radio City Music Hall.

In addition to RSD titles and the new store, Rough Trade had another big traffic driver — iNDIEPLAZA — which each year sees the store host seven live bands playing throughout the day from noon until 9:30 p.m., headlined this year by the Hives. While he was waiting on final figures, Godfroy noted that he didn’t expect attendance to equal last year’s, when 89,000 people walked through the indie festival area, due to the rain. But he said each band drew healthy crowds during their performances, topped by The Hives, which he said drew a crowd of several thousand people.

As an added bonus for store customers, at one point earlier in the day, The Hives’ lead singer dressed up as a king in full regalia and walked around the new store signing things and in general “lording it up,” Godfroy said.

Amoeba Music: Smooth Sailing Amid ScarcityLos Angeles

Even Amoeba Music, one of the largest independent stores in the U.S., had to deal with the difficulty of obtaining the desired number of copies for the big in-demand RSD titles. Two of the titles everyone was asking for were the Wicked release and the Oasis box set, “but we only got one of those,” reported Amoeba Music’s Sanchez, regarding the British band. Another thing that doesn’t make for smooth sailing: “During the course of the week people called us all the time asking, ‘Are you going to have this [title]?’ Or ‘Are you going to have that [title]?’ It’s always the case, but we can never because we’re literally getting stuff right up until the night before.”

But other than that, Amoeba can handle whatever RSD throws its way because by now, the store staff isn’t surprised by what happens. “We’ve been doing this for so long, we have it literally dialed in; it’s like a science for us,” Sanchez told Retail Track, noting it’s generally the store’s biggest sales day of the year.

Of course, it wasn’t a science in the early days of RSD, Sanchez recalled. “When we first started this, we actually experienced … 300 people running in here, climbing all over each other, trying to get at the stuff,” he said. The staff realized they needed to handle the RSD rush a different way because that way was “freaking dangerous,” he said. “The way we do it now is smooth and it’s fair.”

So how does the store handle crowd control on RSD? “All the people that are lined up out there before we open get a menu,” Sanchez explained. “They check off what it is that they’d like to get; and then we literally, as they come in, fill their order right up in front of the floor. We just burn right through it.”

What’s more, a lot of preparation goes into prepare for RSD. “We start prepping in January for this,” Sanchez said. “We build up an inventory just for this day because, again, experience has shown us over the years that come Monday, after the weekend [RSD] binge we [would have nothing left]” to restock shelves with, because even the non-RSD titles fly off the shelves over the RSD weekend. Come Monday, if there are any RSD titles left, Amoeba Music will put them up for sale at its online store. “We wait for the weekend to be over,” Sanchez said. “The people who make the trip out get the first pick.”

For The Record: Pre-Noon Sellouts But Plenty of CoffeeGreenpoint, Brooklyn

The Brooklyn contingent of the Retail Track force first stopped by For The Record in North Greenpoint, which has been open for just shy of three and a half years. Owner Lucas Deysine said customers started lining up around 4:30 a.m. — the first person in line brought a beach chair, which he then left on the street outside the store — and the shop, which doubles as a coffee shop and cafe, first pre-opened at 8 am to allow customers to come in from the cold and rain and have some coffee and pastries while receiving a number corresponding with their spot in line.

For The Record then officially opened for RSD at 9 am, with an in-store DJ spinning while customers browsed the RSD stock in the order that they had lined up earlier — a process, Deysine said, which ran much smoother than last year. And it seems to have paid off for the shop. Deysine — who has a background in the hospitality industry but had never really set foot in a record store before opening For The Record — said the store outsold what it did last year before noon, with the hottest titles being Swift’s “Fortnight” and records from Charli XCX and Abrams. (While Retail Track was speaking to Deysine, he took a call from a customer looking for the double-LP Abrams live album, which the store had sold out of already.)

In addition to its coffee, records and used books and tapes, For The Record also holds events and early listening sessions at the store, as well as live vinyl auctions on the site Whatnot, which got its start in the trading cards business but has gotten more into vinyl record auctions of late. While there, Retail Track bought an RSD title, Sly & the Family Stone’s The First Family: Live at Winchester Cathedral 1967, as well as a used copy of UTFO’s “Roxanne, Roxanne,” single.

Retail Track also walked past the not-yet-open Record Grouch — which, even though it was cited on the Record Store Day website as having signed the RSD Pledge, sported a sign in the window informing customers, “No Record Store Day, Just Music, 2pm.”

Captured Record Shop: No Oasis, No ProblemGreenpoint, Brooklyn

After that, Retail Track moved on to Captured Record Shop — the Greenpoint store that was called Captured Tracks until recently, changing its name after the owner got tired of being confused for the independent record label of the same name — and it was still buzzing at 1:30 p.m. The store opened at noon and had a big line well before 11:30 a.m., which remained out the door until around 1 p.m. as collectors came looking for Charli XCX, Taylor Swift and Oasis (though Captured, despite ordering five copies, didn’t stock the latter).

Store buyer Nyerah Thornton told Retail Track that last year’s line was longer, but that the store was selling more this year, with Wicked, Swift and Charli XCX having the hottest records and headlining a collection that was awash in great inventory. (Retail Track bought a live recording of The Meters from 1975). The first customer of the day zeroed in on the Grateful Dead box set, undeterred by its $120 sticker price.

Earwax: Jazz Gems and Hardcore CollectorsWilliamsburg, Brooklyn

By 2 p.m., Earwax in Williamsburg only had a small crate of RSD exclusives left given the rush that had occurred before Retail Track’s arrival. The store only got one copy of the Wicked soundtrack, but it was the first record to go, snapped up alongside the Oasis record by the first person in line outside the store, who had been there for a couple of hours before opening. Sales were slower and there were fewer customers this year than last, with store owner Fabio Roberti attributing much of that to the miserable weather — though the hardcore collectors, he noted, were largely undeterred.

Those RSD exclusives can be as expensive for stores as they are for fans, which is why the shop only had one or two copies of the most high-profile titles; though the shop’s staff was more excited about records by Pharaoh Sanders, Sun Ra and Charles Mingus anyway, wryly hoping that no one would buy those during the day so that they could buy them themselves later. Retail Track bought the RSD title from Orchestral Manoeuvres in the Dark, Peel Sessions 1979-1983, at Earwax.

Pancake Records: Sweet Sales, No TearsAstoria, Queens

Pancake Records

Ed Christman

Pancake Records co-owner Tanya Gorbunoca said she was “surprised” that the Wicked album was such a hot title this year because multiple versions of that album from the musical film have been released in the last year. Meanwhile, Pacheco, Gorbunoca’s partner in the store, said that besides Abrams and Swift, the store also received plenty of requests for Rage Against The Machine‘s Live On Tour 1993 and Post Malone‘s Tribute To Nirvana cover album, most of which couldn’t be fulfilled. “We never get enough” of the sought-after titles, Pacheco said. That particularly is hurtful when dealing with the younger customers, especially the ones who “come up with their list and we have to say, ‘Sorry, we are all sold out,’ on those titles; and then they get sad.” On the other hand, he added that this year, at least “there were no tears.”

More importantly, there were enough RSD titles this year so that everyone could get something. In looking at inventory after the weekend, Pacheco reported, “We didn’t have a lot of RSD records left over, which is different than last year. That tells me we did a good job of owning the right thing, and that we got the right amount.”

Before moving on to the next store, Retail Track bought two vinyl albums: a used copy of the Vibrations‘ Shout! album and Betty Davis’ Crashin’ From Passion.

Black Star Vinyl: Coffee and CurtisBed-Stuy, Brooklyn

At Black Star Vinyl, Retail Track found a small store that served coffee, had novelty knickknacks, what appeared to be self-printed books of various titles and a decent selection of used records, but no RSD titles. Nevertheless, Retail Track scored two Curtis Mayfield vinyl albums there: Honestly and Back To The World.

Vinyl Fantasy Record and Comic Books: No Line, No ProblemBushwick, Brooklyn

Vinyl Fantasy

Ed Christman

At Vinyl Fantasy, which caters to customers who are fans of punk, metal, experimental drone, industrial and electronica, the best sellers were Kelela‘s In The Blue Light and Earth’s Hex. Costa said that due to how the store’s inventory is slanted to the above genres, it got practically all the copies of the RSD titles it requested. When Retail Track stopped by at the store at 11:15 am, there was only one other customer, and, when asked if there was a line when she opened, Costa said no. The only other customer besides Retail Track piped in that according to Google, the store wasn’t scheduled to open for almost another hour; while Costa said she opened early just to throw a curve ball at customers.

The next day, Costa later reported, “We had a ton of new people coming into the store, and there were a surprising amount of people asking for Taylor Swift and Charli XCX, but we usually don’t do a lot of pop [sales].” The customers were disappointed that the store didn’t have music from either artist, leading Retail Track to suggest that maybe Vinyl Fantasy could explore getting more pop titles for next year’s RSD. But Costa was unconvinced. “I don’t think so,” she responded. “That’s not our jam.”

This story was prepared by Retail Track, otherwise known as Ed Christman, who deputized other Billboard staffers to take on the mantle of Retail Track for Record Store Day: Joe Lynch, Kristin Robinson and Dan Rys.

Believe intends to acquire the few remaining shares it does not own through a public buyout offer or “assimilation,” the company announced Wednesday (April 16). The offer will be launched by an entity named Upbeat BidCo that’s controlled by CEO Denis Ladegaillerie and private equity funds EQT and TCV.

Upbeat BidCo, which owns 96.7% of Believe’s outstanding shares, will offer 15.30 euros ($17.40) per share for the remaining 3.3% of share capital. The bid represents a 1.2% premium over the previous day’s closing price of 15.12 euros ($17.20).

The offer will be filed on Wednesday. Subject to clearance by the Autorité des Marchés Financiers (AMF), France’s securities commission, it’s expected to begin in the second quarter of 2025. After the closing of the bid, Upbeat BidCo will implement a “squeeze-out,” in which an acquiring company uses various tactics to pressure non-tendering shareholders to accept the buyout offer.

Trending on Billboard

Believe’s board of directors has established an ad hoc committee consisting of three independent directors: Orla Noonan, Anne-France Laclide-Drouin and Cécile Frot-Coutaz. According to the press release, the committee will “monitor and facilitate the work of the independent expert, and to prepare a draft reasoned opinion on the merits of the offer and its consequences for Believe, its shareholders and its employees.”

On Tuesday (April 15), Believe’s board of directors unanimously welcomed Upbeat BidCo’s intent to file the public buyout offer based on a preliminary recommendation of the ad hoc committee.

The Paris-based company was publicly traded for three years before a consortium led by Ladegaillerie, EQT and TCV took the company private in 2024 with a buyout offer of 15.00 euros ($17.06). The consortium did not squeeze out the remaining shareholders, however, and the small float remains trading on the Euronext Paris stock exchange.

Buying the remaining shares won’t come with much of a premium. Since the tender offer closed in June 2024, Believe’s shares have traded in a narrow band, reaching a high of 16.00 euros ($18.20) and a low of 13.70 euros ($15.58). Earlier this year, Believe shares had gained 5.0% before the announcement. On Wednesday, Believe rose 0.9% to 15.26 euros ($17.36), just below the 15.30 euros offer price.

Billboard’s data partner Luminate has signed a new partnership with South Korean firm KreatorsNetwork, granting the company exclusive rights to distribute Luminate’s global music streaming data, consumer insights, and metadata products via its CONNECT platform in South Korea.

The agreement, announced on Tuesday (April 16), positions KreatorsNetwork as Luminate’s sole authorized reseller in the Korean market, providing localized access to global streaming analytics and music intelligence tools for labels, distributors, and music marketers.

“At Luminate, we are dedicated to working with partners across the entertainment industry at a global level, helping them to make data-informed decisions in an ever-evolving media landscape,” said Luminate CEO Rob Jonas in a statement. “We’re glad to enter this new partnership with KreatorsNetwork, which allows us to amplify our service within such an influential and forward-thinking international market.”

Trending on Billboard

Steve Shin, CEO of KreatorsNetwork, added: “After serving K-pop labels for the past five years via data-driven promotional strategies, we are confident that Luminate’s expertise will help us pave the way for the Korean music industry’s move to the next phase of global expansion.”

The deal comes at a moment of continued global growth in music streaming, particularly across Asia. According to Luminate’s 2024 Year-End Music Report, global on-demand audio streams reached 4.8 trillion last year — up 14% from 2023. While the U.S. saw a 6.4% increase, ex-U.S. markets grew by 17.3%, with Asia leading the way in premium (paid) streaming growth. South Korea, in particular, was among the top ten countries globally for premium streaming expansion, up 14.7% year-over-year.

For Luminate, the partnership strengthens its presence in one of the world’s most influential music markets, while offering Korean music companies more robust access to tools for analyzing streaming performance, audience behavior, and cross-border trends.

Luminate’s CONNECT platform — launched in 2024 — provides a centralized dashboard for global music data, consumer insights, and metadata delivery, and is designed to support music clients with real-time intelligence for campaign planning and market expansion.

By the time Nashville-based digital marketer Jennie Smythe launched her company Girlilla Marketing in 2008, she had already gained significant experience working in marketing and promotion for companies including Hollywood Records, Yahoo Music, and Elektra. She also forged her path in digital marketing as the music industry was undergoing the profound transition to a primarily digital medium.

“A portion of it was just being in the right place at the right time,” she recalls to Billboard. “I found myself in a unique position to be able to be the bridge between the two. And it just so happened that nobody was speaking the digital language. I became the person—this was [when] Napster [was happening], when the industry was suing kids in college and doing everything in their power to squash the new business. I was one of the people who was like, ‘Wait a second, if we’re hearing that this is what they want and they’re seeking it out…’ It was very ‘flip the script,’ because up until then, it was the industry telling the people what they were going to get, the industry making those decisions. That’s completely changed.”

Today, the all-woman team at Girlilla Marketing leads social media initiatives and content creation for its clients, helping to develop online audiences, virtual events, digital monetization, analytics tracking and more. During her career, Smythe has worked with artists including Willie Nelson, Darius Rucker, Vince Gill, Blondie, and Dead & Company. She chairs the CMA board and serves on the boards of the CMA Foundation and Music Health Alliance.

Trending on Billboard

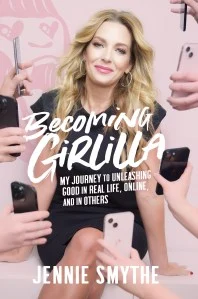

Now, Smythe is sharing the lessons she’s learned along the way in her memoir, Becoming Girlilla: My Journey to Unleashing Good — In Real Life, Online, and in Others, which releases via Resolve Editions/Simon & Shuster today (April 15). Her book also delves into Smythe’s personal journey including her 2018 breast cancer diagnosis and treatment. Smythe was named a 2025 Advocacy Ambassador with the Susan G. Komen Center for Public Policy.

Jennie Smythe

Courtesy Photo

“[The book] really was a way for me to express my gratitude to the music business and the digital marketing community. It was a way to share my survivorship so that I could help other people. And my intention was to be able to be a support document for entrepreneurs and especially young women,” she says.

Billboard spoke with Smythe about writing her book, launching Girlilla Marketing, the importance of mental health advocacy and leading the next generation of women music industry execs.

Why was it important to you to share your life and career experiences in this book?

I thought I was going to write a business book about business lessons, anecdotal humor in the workplace, generational bridges, that kind of thing. But I got sick and our music community also lost several people to cancer, like [music industry executives] Jay [Frank], Lisa Lee, and Phran Galante. I had 12 rounds of chemo, six surgeries. [Part of me] was like, ‘Can I just go back to work?’ But I realized, ‘No, you can’t. This is part of your story now.’ Every single one of those three people–Jay, Phran and Lisa–called me every day when I shared my story [about her battle with breast cancer]. They all were in harder circumstances than I was. So I was like, ‘I want to do this for them.’ And the Nashville community, it is like a family. That’s one of the most special things, and no matter how big Nashville gets, we don’t lose that.

A conversation with your father led you to launch Girlilla Marketing. What do you recall about that?

I was 30, I had had a pretty successful career, and then my dad was diagnosed with pancreatic cancer. I was in the hospital room with him and he said, ‘What would you do if your life was half over?’ When he asked me that question, in that moment, it drilled down to two different things: I want to start a digital agency and I want to travel more. I realized, “There’s never going to be a perfect time, a perfect amount of money—if I don’t do it now, I will not do it.”

Girlilla Marketing is an all-woman company. What inspired you to launch a female-first company?

I feel like through my whole career of working for other people, I only had the opportunity to work for one woman, and she was amazing. But I wished I would’ve had more opportunity to do that. So, I created what I wanted, the place I wanted to work, because it didn’t exist.

One of the key early moments in the book was when, during your career at Yahoo Music, you received a performance review from your former boss, Jay Frank. You received some feedback you didn’t expect.

That’s what made him my trusted mentor because he was like, “You’re so smart and you’re doing all the right things, but you’ve got to be human, or people won’t want to work for you.” I thought if you are the champion and you are the best, then you will be rewarded for that behavior. Not at all. Everything that has come to me in a good way has come because of a team mentality. It was a lesson in leadership.

What are some things were you able to implement because of that conversation?

How do you come into the office in the morning, no matter how stressed you are—do you say good morning to everyone, or do you just ignore everyone? When you are in a meeting and somebody is not prepared, instead of drilling somebody down to where they feel like they can’t get out of that hole, what do you do? Isn’t the job of a manager to lift them up?

What are some of the biggest myths that persist around digital marketing in music?

One of the myths is that [artists] have to create all the time. That’s not true. You do have to figure out what your cadence is, but if you are creative and you’re constant, you’ll be okay. Some people are too precious with it, they feel like they can’t, and we have to get them out of that.

With things like TikTok and A.I., so many things are swiftly changing in the industry. What do you think are some of the biggest issues?

Mental health. Giving people the space to create without the pressure of the analytics, which are glaringly upfront in every conversation that we have. Once a week, somebody comes in here ready to quit because they’ve been told that if they don’t hit a certain threshold, that they don’t have a career. I’ve been around artists my whole life and that’s not conducive to a creative career. My thing is telling artists constantly that they are the CEOs of their lives, and their digital ecosystem is part of it, but it’s a wide net.

Also, the mental health thing starts from the top. I am so lucky to be in this community with people like Tatum [Allsep] from Music Health Alliance, and grateful for people like at the CMA who put together the mental health fund. People talk about artists, but it’s also the people in the business that need support, like our touring families.

For those who are just starting out in digital marketing, what essential tools do they need to know?

I think just being an avid user, and you need to know how to shoot and edit content. It’s all video. This is the biggest merge of the decade. We used to have the creative people and the analytical people. To inform the creative, sometimes you need to understand what the market is requesting—very much the same conversation we had with Napster, when it was like, “So this is the most illegally downloaded file in Green Bay, Wisconsin—maybe we should go play there.” It’s also having somebody that can purposely come up with a creative strategy that also speaks to the analytical success to something, that’s the job for the next 10 years. That’s exciting because I think when I was in college, my [current] job didn’t exist. But along the way, everything I picked up mattered.

Opry Entertainment Group (OEG) has named Tim Jorgensen as vp of operations on its Austin team. In the new role, Jorgensen will lead OEG’s Block 21 businesses in the city, including ACL Live, 3TEN and W Austin. In addition to leading strategic direction for the Block 21 complex, he will oversee day-to-day operations at ACL […]

State Champ Radio

State Champ Radio