Business News

Page: 20

Warner Music Group reported quarterly revenue edged nearly 1% lower and net income was down almost 63% for the start of the year, as the label home of stars like Bruno Mars and Lady Gaga struggled with tough comparisons to last year’s quarter.

WMG reported overall revenue of $1.48 billion and recorded music revenue of $1.175 billion, a 1% decline, for the fiscal second quarter, which ended March 31, compared to a year ago. Publishing revenue rose 1% to $310 million. Net income was $36 million compared to $96 million a year ago, due to lower recorded music revenue, a $34-million loss due to exchange rates costing the company more on its euro-denominated loans and an $11 million increase in a certain kind of taxes.

Total digital revenue slipped 1% with streaming revenue roughly flat, which reflects the comparison to last year’s boon quarter, a lighter release slate and market share loss in China.

Trending on Billboard

WMG CEO Robert Kyncl says these results belie the green shoots showing from company’s cost-cutting and new releases strategy, which he says results in their growing market share of new releases. Songs performed by WMG artists like Mars, Billie Eilish, Benson Boone and Teddy Swims currently claim half of the spots atop Billboard’s Global 200 chart.

“Our strategy is starting to bear fruit, with our strongest chart presence in two years … As a result, our true strength this quarter was partially obscured by challenging comparisons with last year’s outperformance,” Kyncl said in a statement, referring in part to last year’s 13.5% subscription streaming growth. “As we replicate our strategy across other labels and geographies, and drive a virtuous cycle of greater reinvestment, we expect to deliver lasting value for artists and songwriters, and sustained growth and profitability for shareholders.”

Adjusted operating income before depreciation and amortization (OIBDA) declined 3% to $303 million, and adjusted OIBDA margin decreased half a percentage point to 20.4%.

Because it earns more than half of its income from outside of the United States, WMG releases earnings on constant currency basis — a method that updates last year’s revenue and other line items using this year’s foreign exchange rates.

On a constant currency basis, overall quarterly revenue rose 1% — though recorded music and publishing both still declined by 2% and 5% respectively — and adjusted OIBDA declined by 1%.

Growth in music and concert revenue pushed K-pop company SM Entertainment’s consolidated revenue to 231.4 billion KRW ($159 million), up 5.2% from the prior-year period. Operating profit of 32.6 billion KRW ($22 million) was up 109.6% while operating margin improved to 32.6% from 15.5%. SM’s concert revenue grew 58.0% to 39 billion KRW ($27 million) […]

Five years ago, fitness companies looked like the next big thing for music rights owners as the onset of the COVID-19 lockdown turned Peloton, the maker of high-tech stationary bicycles and treadmills, into a household name and the leader in a suddenly hot connected fitness market.

Peloton’s founder, John Foley, had created an online version of music-driven, brick-and-mortar studios such as SoulCycle. Unlike the staid strength and cardio products of earlier years, the new breed of bikes and treadmills manufactured by the company were internet-ready and could stream live or pre-recorded workouts. Other startups took notice, with competitors like Tonal and Hydrow vying for market share.

“There were fitness companies who saw what Peloton was doing, which was really putting music at the center of their workouts,” says Vickie Nauman, a licensing expert and founder/CEO of CrossBorderWorks. Instructors, some of whom would become small-time celebrities, used music to create identities and build communities. “This was the original founder’s vision,” she says.

Trending on Billboard

Flush with investment capital, fitness companies followed Peloton into expensive licensing agreements with rights holders to infuse music into their at-home products. Royalties from connected fitness companies, as well as social media and other new revenue streams, went from about 3% of the average catalog’s revenue in 2021 to “something like 7%” in 2023, according to Jake Devries, a director in Citrin Cooperman’s music and entertainment valuation services practice.

As it turned out, 2020 and 2021 were peak at-home fitness. The financial impact of the post-pandemic fitness bubble was seen in Universal Music Group’s results for the fourth quarter of 2024: A decline in its fitness business accounted for a nearly one percentage-point decline in its subscription growth rate, equal to approximately $12.5 million. And during its most recent earnings call on April 29, the company noted that fitness revenue was flat in the first quarter.

After pandemic restrictions ended, the stay-at-home fitness business ran into competition from gyms and fitness studios as people returned to public life. As a result, according to numerous people who spoke with Billboard, connected fitness companies had less cash to put into music licensing and, realizing they didn’t need massive catalogs and didn’t have the expertise to properly manage the rights and issue royalty payments, looked for more affordable, less arduous options.

Peloton, founded in 2012, was a trailblazer in at-home fitness. Its studio-quality bikes, which currently cost between $1,445 and $2,495, are outfitted with touchscreens that stream live and on-demand content for an additional $44 per month. Music is a focal point for the online classes, just as brick-and-mortar studios like SoulCycle incorporate popular songs into their workouts. Despite the high prices of Peloton’s bikes, online content has a greater financial impact: In its latest fiscal year, subscriptions accounted for 63% of the company’s $2.7 billion of revenue and 96% of its $1.2 billion of gross profit.

Music enhances online workouts in the same way it makes going to a fitness studio or a gym more enjoyable. But building cycle workouts around setlists of specific songs isn’t straightforward. Unlike brick-and-mortar locations that require only blanket licenses from performance rights organizations such as ASCAP and BMI, Peloton required more expensive direct licenses to incorporate music into its streaming content. After being sued by music publishers for copyright infringement in 2019, Peloton settled the following year and began negotiating the proper licenses.

Such a license had never been done for a fitness company, so major labels and publishers modeled custom licenses for Peloton based on their deals with Spotify and other on-demand music platforms, according to a licensing executive familiar with the negotiations. The agreements called for Peloton to pay rights holders based on a monthly per-subscriber fee, and the pool of royalties would then be proportionally divided based on usage, according to this person.

Peloton had built a name for itself in the fitness community by 2019, but it was supercharged the following year by the COVID-19 pandemic. As people stayed away from public places such as gyms and fitness studios, Peloton’s revenue jumped from $384 million in fiscal 2019 to $1.45 billion two years later, and its share price climbed from $27 following its September 2019 initial public offering to $171 in January 2021.

The enthusiasm for at-home fitness also benefited Peloton’s competitors. Hydrow, which offers rowing machines with Peloton-like streaming content, raised $25 million in June 2020 and another $55 million in March 2022. Tonal, a connected strength training platform, had raised a total of $90 million by 2019, before the pandemic piqued interest, then raised $110 million in September 2020 and $380 million in two funding rounds in 2021 and 2023 — the latter at a lower valuation.

As other connected fitness companies quickly sought music licenses to replicate Peloton’s success, rights holders offered them a version of the Peloton license, which provided them rights to large catalogs. (Peloton, the lone publicly traded company of the bunch, revealed in its 2021 annual report that it had a catalog of 2.6 million tracks.) “Once there was a model, it was always going to be easier to replicate a model you think is working than create a new licensing deal,” says the licensing executive.

But these fitness startups, desperate to corner share in a fast-growing market, initially made some missteps. “Because it was such a race, I think that many online fitness companies saw this as an existential opportunity, and they did not take the time to investigate what they were getting into,” says Nauman. “And so, they licensed all of this music, and that sent a signal to rights holders all over the world that fitness was going to be an enormous new line of business.”

The Peloton-style licenses weren’t cheap. Record labels and publishers were “aggressive with the rates they were asking for a lot of the services,” says an attorney familiar with the terms of the licensing contracts. An app-based product would likely pay 30% of revenue to music rights holders, according to this person, while hardware-based products with higher overhead and costs would pay approximately 16% of revenue. “That’s a pretty big share of revenue for a company that is not a music company,” the attorney adds.

The Peloton-style sync licenses also came with more complexity than fitness companies could handle. Managing a music catalog requires technology and know-how that fitness companies don’t have. They needed help matching compositions to sound recordings to ensure licenses were acquired from all rights holders, and the reporting required for PROs and making direct payments to record labels and publishers were outside of the fitness companies’ expertise.

As fitness companies dealt with stagnant growth, they laid off staff and tightened their budgets. From February 2022 to May 2024, founder/CEOs at Peloton, Tonal and Hydrow were forced out. When Peloton replaced Foley with former Spotify CFO Barry McCarthy in February 2022 and announced plans to lay off 20% of its corporate staff, its share price was trading under $30, down more than 82% from its high mark just 13 months earlier. Tonal and Hydrow each laid off about 35% of their workforces in 2022, and Hydrow further thinned its staff in 2023.

Sync licenses are crucial to Peloton because classes are often built around playlists, and music is crucial to the indoor cycling experience. But not every connected fitness product needs to integrate music in a way that requires a more expensive, Peloton-style license. For many other companies, a non-interactive, DMCA-compliant radio service with pre-cleared music is more than adequate.

Constrained by tighter budgets, some connected fitness companies started looking for alternatives to their original licenses. Today’s connected fitness CEOs tend to be most concerned about the cost and complexity of music licensing and the likelihood of being sued, says Jeff Yasuda, founder/CEO of Feed.fm, a provider of licensed music to connected fitness companies such as Hydrow, Tonal, Future and Ergatta. Being able to use popular music in their apps isn’t a priority.

“For a fitness company, your job is to make the best jumping jack app on the planet,” says Yasuda. Making a mistake handling music rights would put a company in jeopardy of facing lawsuits brought by music rights holders. “It’s just not worth the risk,” he says.

Feed.fm assures clients that the rights are compatible with various laws in different countries. It provides pre-cleared catalogs from Sony Music, Warner Music Group, Merlin, Insomniac Music Group and A Train Entertainment, and it works with record labels to create thematic stations, including one curated by CYRIL, a recording artist for Warner-owned Spinnin’ Records, and a Brat-inspired station featuring Charlie xcx, Dua Lipa, Chappell Roan and other artists that represent the brat summer of 2024. A rights holder itself, Feed.fm has signed 40 to 50 artists, which its vp of music affairs, Bryn Boughton, says gives it greater flexibility in licensing.

Outsourcing the licensing ultimately saves fitness companies money, says Con Raso, co-founder/managing director of Australia-based Tuned Global. Raso’s pitch to fitness companies is to invest money in marketing and let companies like Tuned Global handle the technology. “We don’t think, unless you’re doing it on a massive scale, you’re going to save money,” he says. Raso estimates that Tuned Global can remove 70% of clients’ costs versus licensing music and managing rights themselves.

Beyond traditional fitness apps, there’s big potential for licensing ambient or mood music for a new wave of mental health-focused apps. In the last six months, Raso has seen an uptick in demand for licensed music from companies more broadly associated with health and medical care. Consumers have a wide choice of apps for yoga, meditation, mindfulness and sleeping that incorporate music. Led by companies such as Calm, the market for spiritual wellness apps hit $2.16 billion in 2024, according to Researchandmarkets.com, and will grow nearly 15% annually to $4.84 billion by 2030. Record labels have already made forays into this space. Universal Music Group, for example, formed a partnership in 2021 with MedRhythms, which uses software and music to restore functions lost to neurological disease or injury.

The COVID-era boom of connected fitness products, though, seems all but over, having failed to live up to lofty expectations. Chalk it up to the chaotic nature of the pandemic and fast-moving startups battling for market share, says Nauman. “I don’t think it’s anybody’s fault,” she says. “I think it was such a lightning-in-a-bottle time that they were in a race to get to market as fast as they possibly could.”

Additional reporting by Liz Dilts Marshall.

With the Music Business Association getting ready to hold its annual conference for the first time in Atlanta after nearly 10 years in Nashville, some longtime attendees thought the move might diminish turnout. But the organization’s president, Portia Sabin, says the event (May 12-15) is on track to match last year’s total attendance of 2,200 industry executives. More importantly, she adds that sponsorships for the convention are outpacing last year’s numbers.

That’s a crucial factor, because this conference — and others the organization hosts throughout the year — provides about 60% of Music Biz’s revenue, according to its most recently available 990 form, which nonprofit organizations are required to file annually with the IRS. For the year ended Sept. 30, 2023, $1.85 million of Music Biz’s $3.07 million in revenue came from its programs, while another $1.214 million came from membership fees, contributions, and grants. That revenue supports the organization’s staff, which consists of 10 employees, as well as covers the expenses of its operations, including its Nashville office and events.

Since taking the helm in 2019, Sabin has led the organization’s evolution from a trade group focused on music merchandisers into one that serves the broader music business. As part of that mission, she has helped the organization grow into an international force, with executives from 168 overseas music companies coming to Atlanta for this year’s conference. She has also worked to diversify the organization, increasing the presence of women and minorities on its board of directors, which has been expanded to 25 members to ensure Music Biz represents all sectors of the industry. “We’re always trying to be inclusive here,” she says.

Trending on Billboard

In preparation for this year’s event, Billboard caught up with Sabin to discuss what attendees can expect.

So are you and the Music Biz Assn. staff ready to rock and roll?

We are so ready to rock and roll!

How is the conference shaping up so far?

It’s shaping up amazingly. Our sponsorships are off the charts—way over what we budgeted for. Our hotel has been sold out for months, and all the overflow hotels are sold out too. So it’s shaping up great.

Where does attendance stand compared to last year?

We’re on track — about the same as last year [when 2,200 attended]. Attendance at this conference is always a little unpredictable because people book their hotels really early, but many wait until after South by Southwest to register. It’s just how it is.

Why did you decide to move the conference to Atlanta after nearly a decade in Nashville?

Multiple reasons. One was that I wanted to return to the older model where we moved around to great music cities, like Atlanta. The music industry is in many great cities in America, it’s not all just Los Angeles, New York and Nashville. Another reason was financial. Nashville has become increasingly expensive, and we didn’t want to raise conference fees or see hotel room prices skyrocket. So, we really wanted to keep costs down for our members and for our attendees and keep make sure the conference is reasonably priced.

What’s the makeup of this year’s attendees?

When I was hired in 2019, the board expressed that they wanted Music Biz to become a global organization that reflects the fact that the music industry is global. I think we’re really achieving that. A lot of people from overseas have gotten excited about the conference—they’ve seen it as a value add to their business. This year we’ve got 256 attendees from 168 companies coming from overseas.

Is the Trump-era tariff chaos affecting attendance?

There may be a person here or there who feels like they are not willing to travel at this time. But, we saw a similar thing the first year back after the pandemic, right? Then some people said, ‘Listen, I just can’t travel, and just I don’t feel safe.’ I feel like there’s always something going on where some people won’t attend for one reason or another.

Beyond the international presence, how else has the conference evolved over the last five years?

Our fastest-growing membership sector is tech, which I think reflects what’s going on in the industry as a whole. And it’s different now. Ten or 15 years ago, tech companies entered music with no real understanding — they were like, ‘I’ve got a cool idea for an app.’ And it was just dumb stuff that was not needed. Now, they’re more informed, trying to solve real problems. We’re seeing real solutions with real benefits. But now [the tech] people got more with the program, and they are like ‘let’s learn about the music industry and then figure out what problems need to be solved.’ So we’re seeing people coming into the industry with real solutions that give benefits to various players in the industry. Our tech sector has grown a lot.

What other changes have you seen?

Since I’ve been here, we have really worked hard to be more inclusive. So we have more publishing members now. We have people from the live sector—ticketing and touring. It’s become abundantly clear that the music industry has to work together here. We can’t just silo ourselves like maybe once we thought we could, 25 or 30 years ago.

From a publishing perspective, the CMOs (collective management organizations) seem to be getting a lot of attention this year.

Our programming is totally crowd-sourced, so we open the call for proposals, and then we just work through the proposals. The interest in publishing at the conference is huge, and we got a lot of proposals for CMOs programming this year, and a lot of it was coming from European members. So we have some really great, high level attendance from those folks. People were very excited about publishing and we even have a dedicated publishing track this year that’s sponsored by EMPIRE.

You mentioned a growing tech presence. Does that have its own track too?

One of the new themes is “new tech trends” and its programming that focuses on the new stuff that is happening in tech that people can learn from. For instance, one panel I’m really excited about is “From Piracy to Profit: What Adult Entertainment’s Digital Revolution Can Teach Us About the Future of Music.” This panel sounds really futuristic but it’s also about learning from other sectors in digital entertainment.

Will there be programming for DIY artists?

Yes, absolutely. We offer a special ticket price of $49 for artist and we give them a full day of programming on Monday (May 12) where they can get information on making and running a business and it’s topped off with the Spotify party at night.We also do the Roadshow were we visit 3-7 cities a year. We just did one last month in Toronto, as our first international show.

What other programming highlights can you share?

We have a new track called Human of Music, focused on workforce well-being. Another favorite is Workflow Workshop, which focuses on what we do and how we can do it better. And we are still doing the “Let’s Talk Physical” track, which we also do quarterly through online webinars. At the conference it will be on Monday. And there is always the Record Store Day Town Hall [on Wednesday, May 14]. We love the retail sector; it is very near and dear to my heart. We try to support that sector as much as possible.

Is there an AI track this year? What about metadata?

Last year we did a track on AI because it is just so ubiquitous. This year we said, let’s just intersperse it through the programming. So in every track there is at least one panel that’s got something to do with AI, because that was just what was submitted when we made the call out for programming. As for the Metadata summit, because there are so many other pieces, it’s become like the Metadata Technology and Rights Summit; and that’s on Wednesday morning.

You crowd-source your panel programming, but how do you evaluate the success of sessions afterward?

One thing I want to say about the surveys is people would sometimes say the panelists were great but the moderator was boring. So over the last two years, we have been offering moderator training pre-conference, just to improve their skills. We did it in April with a professional moderator trainer, and it’s free for a moderator on the program.

Having attended for years, I know the hotel layout really matters. How does this year’s venue stack up?

This year’s hotel, in my opinion, is more conducive for the conference than the JW Marriott in Nashville — because it’s just really straightforward. You walk in and there’s a big lobby, then you go up the escalator, and there’s a big atrium, and that’s the central hub of where everything will be, with the programming panel rooms branching off from there. That central hub, sponsored by Downtown, will have seating and tables; it’s the sort of place where everyone can hang out. Downtown will have a DJ there at different times of the day, which is awesome.

Will there be live music?

Yes! Every evening event features music. The Spotify-sponsored welcome bash on Monday night will have live performances. The Wednesday night Bizzy Awards, sponsored by Warner Music Group, will also feature live artists. Performing artists include Kayla Park and Yami Sadie.

Will there be a trade show floor?

No, but there will be companies displaying what they do in spaces around the central hub. We call that “activations” and they are all filled.

How are you handling the private meetings that are a big part of the conference?

The private meetings will be happening. All the meeting rooms sell out quickly. We know that is a big thing for people so we structure our programming and try to build it so there is a block open for lunch and other meetings. And while we love the panels, there are other ways for people to interact. So this year, we have a bunch of round tables. We have sync round tables. We have women’s leadership round tables. We’ve got the Startup Lab, where startups can meet with [potential] investors and with people who have been in the industry for a while who can act as advisors for startups.

Now the big question: where’s the bar?

There are two bars in the lobby—one is a standard hotel bar, and the other is a sunken bar sponsored by TuneCore.

Last question. Last year, you said the Atlanta conference would feel like summer camp. Is that happening?

Well, I bought some footie pajamas so I can walk around the hotel in them. And yes, it will feel really summer campy because every floor is going to be filled with just our people so it will be a lot of fun.

Blue Note Jazz Club has confirmed that plans to open a new venue in London, England will proceed following the granting of a late license by the local council. The 350-capacity venue will be the first Blue Note Jazz Club to be established in the U.K. and is slated for an early 2026 opening.

The news follows reports of opposition by the Metropolitan Police Service and local residents. In February a Licensing Sub-Committee Report from the City of Westminster outlined a number of objections from the local police enforcement, who objected to the venue’s opening on the grounds it would undermine the licensing objective of “prevention of crime and disorder”.

The move was criticised by a number of local musicians and industry figures, with claims that the council was stifling the capital’s nightlife scene. The venue was initially granted a license that would see the club close at 11:30 p.m., but Steven Bensusan – president of Blue Note Entertainment Group and son of the original Blue Note Cafe founder Danny Bensusan – told Sky News that the opening of its planned European flagship venue may not be viable without a late license. “If they’re not giving us a late license, I can’t imagine how they would be supportive of other smaller venues, which are important for the ecosystem in general.”

Trending on Billboard

However the Westminster City Council has since reversed its opposition and said that the “venue management have engaged extensively with local people to improve their application and address the concerns that were raised by the police.”

The venue will be based in the basement of the St Martins Lane hotel in Covent Garden in central London. The license will allow the club to open until 1 a.m. on Monday to Saturday, to midnight on Sundays.

The Blue Note Jazz Club will host two performance spaces: a main room with 250 person capacity, alongside a secondary 100 person capacity space. The venue will host a full-service kitchen and beverage menu and will be open for dinner throughout the week.

The new venue will continue the expansion of Blue Note Jazz Clubs internationally. The original club in New York City was opened in 1981, and new venues have since opened in Milan, Beijing, Shanghai, Tokyo, Rio de Janeiro and São Paulo. Stevie Wonder, Tony Bennett, Ezra Collective and more have all performed at the club and its sister institutions.

Steven Bensusan, president of Blue Note Entertainment Group said in a statement, “We’re excited to be coming to London and grateful to Westminster Council for recognising what Blue Note can bring to the city’s nightlife. As we prepare to open in early 2026, we’re looking forward to bringing world-class jazz and a deep cultural legacy to one of the greatest music cities in the world.”

Andrea Bocelli signed an exclusive, five-year worldwide agreement with AEG Presents for the creation and management of his live performances, in collaboration with his management team (Veronica Berti and Francesco Pasquero), agency WME and record label Universal Music Group. The deal, which begins on Jan. 1, 2026, covers all of Bocelli’s ticketed live events globally.

Mark Ambor, who scored his first Billboard Hot 100 entry with the smash 2024 track “Belong Together,” signed to Capitol Records. The singer-songwriter is currently touring in Europe and set to play festivals including Governors Ball, Lollapalooza (in both Chicago and Berlin) and Outside Lands. He concluded his North American tour last year.

Don McLean (“American Pie”) signed with Day After Day Productions for exclusive global touring representation. The singer-songwriter currently has more than a dozen tour dates lined up in the U.S.

Trending on Billboard

Country singer-songwriter Ink signed with Big Loud Records and Electric Feel Records. She is managed by SALXCO. Ink co-wrote three tracks for Beyoncé’s Cowboy Carter, including “16 Carriages,” “Texas Hold ‘Em” and “American Requiem,” as well as Kendrick Lamar and SZA’s smash single “Luther,” among many other credits.

Management firm Shelter Music Group announced the signings of five artists: Cheap Trick, Boys Like Girls, Chiodos, American Hi-Fi and Dead Poet Society. Cheap Trick is gearing up for its 2025 tour and a new album; Boys Like Girls will support the Jonas Brothers on its 20th anniversary stadium and arena tour; Chiodos is currently touring to promote the 20th anniversary of All’s Well That Ends Well and will embark on another tour in the fall, with a new studio album and more touring to come next year; American Hi-Fi are gearing up to celebrate the 25th anniversary of the band’s self-titled debut album; and Dead Poet Society are set to tour across Europe and the U.K. this summer, and later across the U.S. in support of Chevelle.

New Found Glory signed to Pure Noise Records, which released the band’s latest single, “100%.” The band is set to perform at Slam Dunk Music Festival before touring with The Offspring and Jimmy Eat World on the SUPERCHARGED: Worldwide in ’25 Tour in North America, followed by several U.K. headline dates.

Country singer-songwriter Mark Chesnutt signed with Conway Entertainment Group/Ontourage Management for management and Absolutely Publicity for PR. Chesnutt is represented by Risha Rodgers at WME’s Nashville division for live bookings.

RaeLynn signed with The Valory Music Co., which will release her latest track, “Heaven Is a Honky Tonk,” on Friday (May 9) in partnership with Red Van Records/Jonas Group Entertainment. The country singer-songwriter is touring with Jason Aldean on his Full Throttle Tour this summer.

British Columbia-based singer-songwriter Luca Fogale signed to Nettwerk, which released “Begin,” his first single of 2025, with more music set for release in the coming months. Fogale just wrapped a headline tour of North America and is currently touring in Europe. He’s managed by Colin McTaggart and Piers Henwood at Amelia Artists and booked by Grant Paley at Midnight Agency for Canada.

R&B artist RAAHiiM (“Peak (Fed Up)”) signed with MNRK Music Group, which released his single “Just Like Me” on Friday (May 2). He’s set to support Jessie Reyez on her North American tour beginning on June 10. RAAHiiM is managed by Joven Haye and booked by Olivia Mirabella, Yves Pierre and Jacqueline Reynolds-Drumm at CAA.

Capitol Christian Music Group signed singer-songwriter Eli Gable, whose debut single, “Holy Ghost Town,” releases May 16. The Ohio native moved to Nashville in 2020 and creates music that blends worship, folk and rock styles. Gable will join Rend Collective on the Folk! 2025 Fall Tour starting Oct. 17 in Portland, Maine. The CCMG roster also includes Chris Tomlin, Blessing Offor, Crowder and Franni Cash. – Jessica Nicholson

Universal Music Korea signed hip-hop artists Okasian and Bryan Chase. Both rose to prominence in Korea as part of The Cohort’s hip-hop crew. Both recently featured on “LOV3,” a track off Sik-k and Lil Moshpit’s [K-FLIP+] EP released in March.

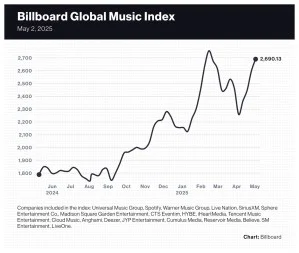

Though economic uncertainty lingers, some music companies’ stocks got boosts following their first quarter earnings releases this week, while a better-than-expected jobs report on Friday (May 2) lifted stocks across the board.

K-pop companies were among the top performers of the week. Led by HYBE’s 13.8% gain following its first quarter earnings report on Tuesday (April 29), the four South Korean companies had an average share price gain of 10.3%. JYP Entertainment rose 11.7% and SM Entertainment, which announces earnings on Wednesday (May 7), improved 9.0%. YG Entertainment gained 6.6%.

The 20-company Billboard Global Music Index (BGMI) rose 3.6% to 2,690.13, its fourth consecutive weekly improvement. At 2,690.13, the BGMI has improved 19.1% since a two-week slide and stands just 2.4% below its all-time high of 2,755.53 set during the week ended Feb. 14.

Trending on Billboard

Music stocks slightly outperformed the Nasdaq and S&P 500, which rose 3.4% and 3.1%, respectively. Foreign markets were mostly positive but more subdued. The U.K.’s FTSE 100 rose 2.2%. South Korea’s KOSPI composite index gained 0.5%. China’s SSE Composite Index lost 0.5%.

Universal Music Group (UMG) gained 4.3% to 25.86 euros ($29.23) following a quarterly earnings report showing that recorded music subscription revenue grew 11.5% and overall revenue improved 11.8%. JP Morgan analysts’ conviction on UMG “remains very high,” and the strong quarter “should help rebuild confidence and share price momentum” dented by Pershing Square’s sale of $1.5 billion in UMG shares, analysts wrote in an investor note on Tuesday.

Spotify finished the week up 3.7% to $643.73 despite its shares dropping 3.4% on Tuesday after the company’s first-quarter earnings report included guidance on second-quarter subscription additions that seemed to underwhelm investors. Gross margin of 31.6% beat Spotify’s 31.5% guidance. Loop Capital raised Spotify to $550 from $435, while Barclays lowered it to $650 from $710. UBS maintained its $680 price target and “buy” rating. Guggenheim maintained its “buy” rating and $675 price target.

Live Nation, which reported first quarter earnings on Thursday (May 1) and predicted a “historic” 2025, gained 2.3% on Friday and finished the week up 0.7%. A slew of analysts updated their price targets on Friday. Two were upward revisions: Jefferies (from $150 to $160) and Wolfe Research (from $158 to $160). Two were downward revisions: Rosenblatt (from $174 to $170) and JP Morgan (from $165 to $170).

Nearly all streaming stocks posted gains. LiveOne was the week’s top performer, jumping 18.0% to $0.72. Chinese music streaming companies Cloud Music and Tencent Music Entertainment gained 11.6% and 7.1%, respectively. French music streamer Deezer gained 1.4% to 1.44 euros ($1.63) after the company’s first-quarter earnings on Tuesday. Abu Dhabi-based Anghami fell 3.1% to $0.62.

Cumulus Media fell 33.% to $0.14. Most of the decline came on Friday as the stock ceased trading on the Nasdaq and began trading over the counter.

Created with Datawrapper

Created with Datawrapper

Created with Datawrapper

Billboard Canada is getting ready to spotlight some of the most vital players in the music industry: music managers.

Managers to Watch — Billboard’s spotlight on the teams behind music’s biggest breakout artists — will expand to Canada for the first time at this year’s NXNE festival.

A special invite-only Managers to Watch reception will take place on June 11, directly before Billboard Canada Power Players. The event will build on Billboard Canada’s new partnership with Music Managers Forum, which is moving its Honour Roll celebration of the most legendary managers in the business to NXNE this year.

Both recognitions will be given out at the Managers to Watch reception, after which all invited managers will be invited to stay and mingle with the most influential members of the industry at Billboard Canada Power Players.

The event will foster community and opportunity for self-managed artists and managers, who play a critical role in the success of Canadian artists on the international stage.

Trending on Billboard

“We’re proud to partner with MMF Canada to spotlight the managers powering the next wave of talent,” says Mo Ghoneim, president of Billboard UK and Billboard Canada. “They’re key players behind many of the industry’s biggest breakthroughs, and we’re excited to recognize their contributions on a global stage through Billboard.”

The Music Managers to Watch list will feature a hand-selected list of artists and self-managed artists making waves in the industry. It will be chosen by the editorial team at Billboard Canada. Managers can submit for consideration using this form.

Find more info here. – Richard Trapunski

CIMA Makes an Appeal to Prime Minister Mark Carney

The votes were still being tallied in the Canadian federal election on Monday morning (April 29) when the Canadian Independent Music Association (CIMA) sprang into action. The trade org issued a press release congratulating Mark Carney and the Liberal Party of Canada on their electoral victory while urging Carney to, in its words, “make the investment in and promotion of Canadian-owned cultural businesses a top priority.”

The statement stressed that “the global cultural economy is changing rapidly, and with it come significant risks to Canada’s cultural and economic sovereignty. Recent developments — including TikTok’s decision to walk away from licensing negotiations with Merlin, a key representative of independent music worldwide; Universal Music Group’s acquisition of Downtown Music’s assets; and the legal challenge by global tech platforms, in partnership with foreign-owned multinational record companies, to avoid regulation under Bill C-11 — starkly illustrate the growing concentration of global corporate power in Canada’s cultural sector. If left unchecked, these trends threaten to erode Canadian ownership of intellectual property, diminish our global competitiveness, and compromise the future of Canadian cultural exports.”CIMA emphasizes four priorities for the most industry and suggests the government act quickly:

Prioritize Canadian ownership in cultural policy and investment frameworks;

Strengthen competition, trade, and copyright policies to protect Canadian IP holders;

Champion independent Canadian businesses in international markets;

Defend Canada’s right to regulate its cultural industries against multinational corporate resistance.

CIMA concluded by noting, “We are eager to work with your government to secure a strong future for Canadian culture — Canadian culture remains Canadian-owned, Canadian-created, and world-renowned.”

Read more here. – Kerry Doole

Black Eyed Peas’ Apl.de.Ap and Other Lapu Lapu Day Festival Performers Speak After Van Attack in Vancouver

Artists are sharing their heartbreak after a deadly attack at Vancouver’s Lapu Lapu Day festival.

The attack killed 11 people, leaving dozens more injured, when an SUV drove through the block party on Saturday (April 26.) A 30-year-old man has been charged with eight counts of second-degree murder.

Organized by Filipino BC, the festival is a celebration of Filipino hero Datu Lapu-Lapu and an annual occasion for the Filipino-Canadian community to celebrate resilience and cultural heritage.

The attack took place in the evening, following a day of performances from artists like The Black Eyed Peas‘ apl.de.ap (the Filipino-American artist also known as Allan Pineda Lindo), multi-disciplinary artist Kaya Ko and R&B singer Sade Awele. Festival performers are sharing messages and calling for support for the B.C. Filipino community following the attack.

Apl.de.ap and Filipino singer J. Rey Soul had recently left the stage after finishing their headlining set when the attack took place.

“It’s hard to describe the shock and heaviness we feel,” they shared in a joint statement on social media. “Please keep the victims, their families, and the organizers in your prayers.”

“The one thing I have noticed, from the audience to the messages sent around, is the sense of community that wraps its loving arms around us.”

Festival chair RJ Aquino spoke about the support that’s been pouring in from around the world.

“It’s not lost on us … that the spirit of the festival was about that resistance, resilience, that courage, that strength,” he told reporters, per CBC.

“And you know, we’re going to have to call that up in ourselves.”

Awele shared her prayers for the B.C. Filipino community on Instagram. “I was barely able to sleep thinking about the tragic incident that occurred after the festival,” she said. “We can’t keep living like this — treating each other with hate and violence. We have to do better.”

Read more here. – Rosie Long Decter

According to Live Nation CEO Michael Rapino during the company’s earnings call on Thursday (May 1), every chief executive is being asked the same question this earnings season: Are you feeling a consumer pullback?

It’s a reasonable query given the worsening state of the economy. U.S. gross domestic product decreased at an annual rate of 0.3%, the U.S. Bureau of Economic Analysis announced on Tuesday (April 30). And on Thursday, news broke that U.S. joblessness claims for the week ended April 26 surged beyond expectations. Earlier in April, the University of Michigan reported that its consumer sentiment score fell to 57.0 in March, down from 71.8 in November. That puts the closely watched measure on par with scores during the 2009 fallout of the U.S. housing crisis and in August 2011, as consumers feared a stalled recovery.

But on Friday (May 2), a reprieve from the bad news arrived in the form of a better-than-expected jobs report. And judging from comments during this week’s earnings calls, many music companies remain confident that their businesses will weather whatever storms develop in 2025.

Trending on Billboard

“We haven’t felt [a pullback] at all yet,” Rapino said. Whether it’s a festival on-sale, a new tour or a standalone concert, Live Nation has seen “complete sell-through” and “strong demand” that surpasses 2024’s record numbers, he added: “So, we haven’t seen a consumer pullback in any genre, club, theater, stadium [or] amphitheater.”

To see how Live Nation fared during the last recession, you’d have to go back to 2009. The U.S. housing crisis had shaken the economy and GDP shrank 2.0% that year, but Live Nation’s revenue increased 2.3%. Then, as the economy rebounded in 2010, the company’s revenue jumped 21.1% in 2011.

Of course, live music took a nosedive during the pandemic, but the drop-off in 2020 and 2021 was caused by a decrease in the supply of concerts, not a dip in demand for live music. When artists returned to touring, fans showed up in record numbers.

Some parts of the economy can be trusted to stumble during a downturn. Case in point: U.S. advertising revenue fell 14.6% in 2009 and dipped 5.4% in 2020. Brands are quick to cut their ad spending when they anticipate a pending sales decline. For example, car dealerships frequently advertise on TV and radio, but cut back as auto sales fell 17.6% in 2009 and 20.3% in 2020.

A decline in advertising is harmful to some parts of the music business. Radio companies have struggled with weak ad revenues in recent years, and their stock prices have taken a beating. Through Friday, iHeartMedia’s stock price is down 50% year to date, and Cumulus Media, which de-listed from the Nasdaq today, has lost 82%.

But music is a “counter-cyclical” business, meaning it doesn’t follow larger economic trends, and the popularity of subscriptions has helped insulate the music industry from economic woes. It’s widely believed that consumers simply won’t part with their favorite music service. In fact, $11.99 for a month from Spotify or Apple Music, although a few dollars higher than two years ago, is considered by top music executives to be underpriced.

During Spotify’s earnings call on Tuesday, CEO Daniel Ek said “engagement remains high, retention is strong” and the ad-supported free tier gives users a way to remain at Spotify “even when things feel more uncertain” — not that Ek is uncertain about the company’s future. “I don’t see anything in our business right now that gives me any pause for concern,” he said flatly.

Universal Music Group (UMG) is on the same page as Ek. CEO Lucian Grainge attempted to ease investors’ concerns by explaining that he has witnessed music weather numerous recessions. “Music has always proven to be incredibly resilient,” he said during an earnings call on Tuesday. “It’s low cost, high engagement and obviously a unique form of entertainment.” In addition, added chief digital officer Michael Nash, UMG’s licensing agreements include minimum guarantees that provide “very significant protection against digital revenue downside risk this year.”

There’s always a chance that unforeseen events or a particular confluence of factors will ruin music’s winning streak. With subscription prices rising, a possible “superfan” subscription tier on the horizon, ticketing prices not getting any cheaper and tariffs increasing the costs of music merchandise, consumers may reach a breaking point. MIDiA Research’s Mark Mulligan argued this week that superfans are being “pushed to the limit” and concertgoers don’t have an unlimited ability to absorb higher ticket prices.

So far, however, the evidence suggests music fans’ spending is continuing unabated. Live Nation says its various metrics — ticket sales, deferred revenue for future concerts — point to another “historic” year in 2025. Rapino added that the company’s clubs and theaters haven’t reported a decrease in on-site spending. Part of that could be that Live Nation carefully curates an array of food and beverage options that maximize per-head revenue. But a more likely explanation is that people need entertainment now more than ever.

As part of the ongoing Jazz & Heritage Festival in New Orleans, a jubilant event took place at music venue Tipitina’s on Monday (April 28): the annual Shorty Fest, which took over the block outside the legendary club to showcase the talented teens and young adults involved with the Trombone Shorty Foundation.

This marked the 13th year the Foundation hosted Shorty Fest, which gives kids a chance to show off their skills outside Tipitina’s before heading inside for a student-assisted performance by “Trombone Shorty” (born Troy Andrews). The annual event serves as a fundraiser for the foundation, started by New Orleans native Shorty, that provides a free after-school program for kids aged 12-18 (Trombone Shorty Academy); a music industry apprenticeship program; a free program on the music business (Fredman Music Business Institute); and masterclasses and cultural experiences including trips to Cuba.

The young students not only perform at Shorty Fest, but use the skills learned through the foundation’s business-oriented programs to help produce the event, which features marching bands, alumni bands and a battle of the bands contest.

Trending on Billboard

“People can see on display the full beauty of New Orleans music culture, but through the eyes of the younger generation,” says Trombone Shorty Foundation co-founder/executive director Bill Taylor. “Then throughout the evening, our young people sit in with the various bands that are performing, and then they all come out with [Trombone Shorty] during his set, and it creates this magical moment that it’s hard not to be emotionally moved seeing that on stage playing out in front of your eyes. It’s like watching the passing on of culture in real time.”

The Trombone Shorty Foundation launched in 2012 as a way to pass on and preserve the various musical cultures that have made New Orleans such a vibrant city. Taylor tells Billboard that the foundation was created in the aftermath of Hurricane Katrina in 2006. With so many families displaced by the tragedy, historically Black neighborhoods became gentrified, especially the Treme neighborhood where Shorty grew up.

Trombone Shorty Foundation at Shorty Fest in New Orleans.

Jafar M. Pierre

“One of the things that New Orleans has always been known for is its ability to regenerate that culture and pass it down to the next generation. And the way Troy was able to absorb a lot of it early on was through his neighborhood,” says Taylor. “We recognized the need to protect the culture and to give young people the same opportunities that a young musician like Troy had when he was their age.”

The foundation’s flagship program, the Trombone Shorty Academy, provides students a chance to learn how to play instruments, perform on stage and be immersed in the musical traditions of New Orleans. While the city is best known for brass bands and jazz, students are also taught about soul music, funk and other less well-known influences on the Louisiana sound.

Shortly after the foundation launched in 2012, the leadership decided they needed to also educate students on the business side of the music industry and launched the Fredman Music Business Institute. The free program gives students insight into how to financially support themselves as musicians, but also how to get involved in event production, touring, licensing, management, finance and marketing. The foundation takes the students — roughly 200 per year — to other U.S. music hubs to see how the business of music is run outside New Orleans, giving them the chance to visit studios, agencies, management companies and more in Nashville, New York, San Francisco and other locations.

“That infrastructure that exists in Nashville, and obviously New York and L.A., is pretty lacking in New Orleans,” says Taylor. “It is going to be the young people who are going to change that.”

The foundation’s apprenticeship program allows kids ages 12-24 to learn from industry experts and then apply those skills to paid positions with hands-on work throughout the city, with apprentices selecting the industry partners that best align with their interests.

Taylor offers an example of a talented young trumpet player who performed and traveled with the Academy but whose real passion was graphic design. “He is out of college now and opened up his own graphic design company,” Taylor says. “He now designs some of the artwork for our events. He connected with his real passion and it’s connected to music, but he’s not trying to be a professional musician, necessarily.”

Trombone Shorty

Jafar M. Pierre

Along with a trip to Nashville, the foundation also recently took a group of 250 students, staff and musicians to Havana, Cuba — where Shorty found a lot of inspiration while visiting a relative — for an annual trip that started in 2020. The most recent visit to the country included appearances by George Clinton, Valerie June, Yola, Robert Randolph and more.

“New Orleans is your superpower, because if you’re from New Orleans and you’re in music, you naturally get respect,” says Taylor. “Then the question is, what can we do to connect some of these young people to a bigger world, so that the possibilities of what they can do with their career, with their life, with their music, starts to expand?”

State Champ Radio

State Champ Radio