Billboard Global Music Index

Page: 2

Proving that the best way to get stock prices to rally is to first bury them deep underground, markets surged this week as President Trump eased his tone on U.S. Federal Reserve chair Jerome Powell and said tariff negotiations with China are ongoing (although China denied the claim).

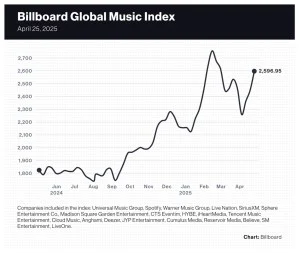

The 20-company Billboard Global Music Index surged 6.1% to 2,595.95, marking its third consecutive weekly gain after falling 10.9% in the two-week period ended April 4. The spoils of a less chaotic global market were felt by nearly all music stocks. Of the 20 stocks in the index, 16 finished the week in positive territory, and two — Anghami and Sphere Entertainment Co. — had gains exceeding 10%.

Major indexes improved this week as investor sentiment regarding U.S. tariff policy improved and President Trumpsaid he would not fire Powell. The Nasdaq composite rose 6.7% to 17,382.94 and the S&P 500 gained 4.6% to 5,525.21. The U.K.’s FTSE 100 improved 1.7% to 8,415.25. South Korea’s KOSPI composite index rose 2.5% to 2,546.30. China’s SSE Composite Index rose 0.6% to 3,295.06.

Trending on Billboard

After investors’ confusion about the U.S. tariff policy put a damper on stocks in recent weeks, markets seemed to find comfort in reports that said the U.S. Trade Representative was quickly working with some trading partners under a streamlined process. Jay Hatfield, founder/chief investment officer of InfraCap, told CNBC, “We’ve reached peak tariff tantrum” and believes the worst of the uncertainty has passed. In fact, the market could have been due for a rebound. Thomas Martin, senior portfolio manager at GLOBALT in Atlanta, told Reuters the stock market “was oversold by virtually all measures.”

Sphere Entertainment Co. was one of the week’s winners, rising 13.8% to $28.88. On Friday, Sphere Entertainment subsidiary MSG Networks announced it had negotiated a $514 million reduction in its debt and lower fees to broadcast New York Knicks and New York Rangers games. The news sent Sphere’s share price up 9.1%.

Spotify, which reports first quarter earnings on Tuesday (April 29), rose 8.1% to $620.72, giving the streaming giant a 23.3% gain over the past three weeks. This week, UBS lowered its price target to $680 from $690 and Wolfe Research raised its outlook on SPOT to “outperform” from “peer perform.”

Live Nation gained 4.4% to $132.76. Wolfe Research lowered its price target to $158 from $165 and maintained its “outperform” rating.

Warner Music Group (WMG) improved 2.4% to $29.83. Morgan Stanley lowered WMG shares to $32 from $37 and dropped the rating to “equalweight” from “overweight.” Universal Music Group (UMG), which also reports earnings on Tuesday, rose 3.5% to 24.79 euros ($28.28), bringing its year-to-date gain to 3.7%.

K-pop stocks had an unremarkable week after performing well during the tariff-driven chaos. HYBE, which, like Spotify and UMG, reports first-quarter earnings on Tuesday, rose 0.9%. SM Entertainment and JYP Entertainment improved 0.6% and 0.2%, respectively. YG Entertainment dropped 4.9%. Still, K-pop stocks are outperforming most music stocks this year. Collectively, the four South Korean music companies have posted an average year-to-date gain of 27.1%.

Cumulus Media shares dropped 16.0% to $0.21 after the company announced on Wednesday (April 23) it will de-list from the Nasdaq exchange on May 2 and immediately begin trading over the counter. The radio broadcaster’s shares are down 72.7% in 2025 and have fallen 92.2% over the last 52 weeks.

Billboard

Billboard

Billboard

Led by Spotify and Live Nation, music stocks surged on Wednesday (April 9) after the U.S. Treasury placed a 90-day pause on most tariffs and recaptured some of the losses from the chaotic previous week.

A week after losing $12 billion in market value, Spotify was one of the top-performing music stocks of the week, gaining 8.0% and offsetting most of the previous week’s 10.3% decline. A 9.8% gain on Wednesday helped improve the streaming company’s two-week loss to 3.1%.

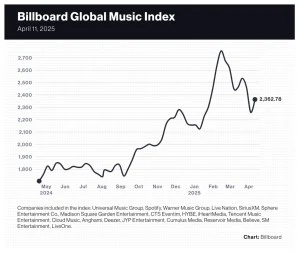

The 20-company Billboard Global Music Index (BGMI) gained 4.6% to 2,362.78 on Wednesday’s 90-day tariff pause. That welcome news recaptured only a fraction of the previous week’s losses, however, and music stocks were hurt by a weakened U.S. dollar and growing fears the U.S. could slip into a recession. After losing 8.2% in the previous week, the index’s two-week loss stands at 4.0%.

Trending on Billboard

U.S. markets rebounded after a miserable week. The Nasdaq rose 7.3% to 16,724.46, bringing its two-week loss to 3.5%. The S&P 500 rose 5.7% to 5,363.36, giving it a two-week decline of 3.9%.

Many markets outside of the U.S. were down, however. In the U.K., the FTSE 100 dropped 1.1%, giving it a two-week loss of 8.0%. South Korea’s KOSPI composite index was down 1.3%, adding to the previous week’s 3.6% decline. China’s SSE Composite Index dipped 3.1% a week after falling 0.3%.

Music streamer LiveOne was the week’s biggest gainer after jumping 18.0% to $0.72. The company’s preliminary results for fiscal 2025 released on Monday (April 7) showed the music streaming company had revenue of more than $112 million, while subscribers and ad-supported listeners surpassed 1.45 million. Even after the large increase, LiveOne shares have fallen 47.4% year to date.

Live Nation, which jumped 7.2% to $129.52 this week, is the only music company to post a gain over the past two weeks. The concert promoter’s share price dropped 3.4% the previous week but, with the help of a 10.9% jump on Wednesday, recovered well enough for a two-week gain of 3.6%.

Record labels and publishers finished the week in the middle of the pack. Warner Music Group fell 1.5% to $29.03, bringing its two-week decline to 8.0%. Universal Music Group was down 1.6%, giving it a two-week decline of 10.7%. Reservoir Media rose 0.7% to $7.10, giving it a two-week deficit of just 2.1%.

Sphere Entertainment Co. is one of the worst-performing music stocks over the past two weeks with an 18.5% decline. The company’s shares finished the week up 1.3%, barely offsetting the previous week’s 19.5% decline. A spike on Wednesday was partially offset by declines of 4.3% and 7.7% on Tuesday (April 8) and Thursday (April 10), respectively.

Most radio companies, which are heavily exposed to slowed advertising spending during recessions, had another down week. Cumulus Media dropped 22.5% to $0.31, bringing its two-week loss to 34.0%. iHeartMedia fell 4.2%, which took its two-week decline to 29.9%. Townsquare Media was down 4.9% this week and 13.6% over the past two weeks. Satellite broadcaster SiriusXM, which was upgraded by Seaport to buy from neutral, gained 2.6% this week, narrowing its two-week loss to 12.0%.

The two Chinese music streaming companies on the BGMI fared poorly despite the recoveries by Spotify, LiveOne and Deezer, which gained 2.3%. Tencent Music Entertainment fell 5.5% to $12.24 but was likely helped by Nomura initiating coverage this week with a buy rating and a $17.20 price target. Cloud Music shares dropped 5.7% to 141.50 HKD ($18.24).

K-pop companies, which bucked the downward trend the previous week, posted declines as well. SM Entertainment fell 8.2%, HYBE dropped 8.1%, JYP Entertainment sank 5.8% and YG Entertainment dipped 4.1%.

Billboard

Billboard

Billboard

Music stocks were battered this week after President Donald Trump unveiled the tariffs that will be applied to imported goods from around the world.

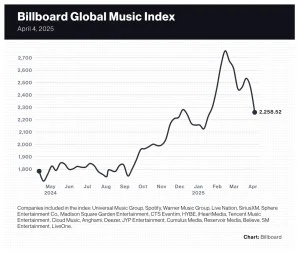

The 20-company Billboard Global Music Index (BGMI) fell 8.2% for the week ended Friday (April 4), marking the largest single-week decline in the index’s two-and-a-half-year history. Among the 17 stocks that posted losses, eight declined by 10% or more, and one — iHeartMedia — far surpassed a 20% decline. Of the 20 stocks on the index, only three South Korean K-pop companies posted gains for the week.

Markets around the world experienced large declines in the wake of the tariffs. In the U.S., the tech-heavy Nasdaq fell 10.0% and the S&P 500 dipped 9.1%. The U.K.’s FTSE 100 slipped 7.0%. South Korea’s KOSPI composite index fell 3.6%. China’s SSE Composite Index declined just 0.3%.

Trending on Billboard

SM Entertainment was the top performer of the week with an 8.3% gain, besting JYP Entertainment’s 3.3% increase and HYBE’s 2.3% improvement. No other music stock finished the week in positive territory, although French company Believe came close with a 0.1% decline.

Spotify fell 10.3% to $503.30, erasing approximately $12 billion of market value. While most stocks cratered on Thursday (April 3), Spotify had fared relatively well by losing just 1.2%. But Spotify shares fell 9.9% on Friday (April 4), paring down the once high-flying stock’s year-to-date gain to 7.9%.

Like Spotify, Tencent Music Entertainment bucked the downward trend on Thursday by suffering only a minor loss, but declined 9.5% on Friday, dropping 9.9% to $12.95.

Radio companies, which are heavily dependent on advertising revenue, were among the most affected stocks. iHeartMedia shares fell 26.8% to $1.20, bringing its year-to-date decline to 43.7%. Cumulus Media dropped 14.9% to $0.40. SiriusXM declined 14.2% to $19.51.

Live entertainment stocks were also hit hard. Sphere Entertainment Co., owner of the Sphere venue in Las Vegas, fell 19.5% to $26.74, mirroring sharp declines in gaming companies reliant on travel to Las Vegas such as Wynn Resorts (down 14.9% this week) and Caesars Entertainment (down 9.7%). Sphere announced on Friday that it has two new experiences in production: The Wizard of Oz at Sphere and From The Edge, a film about extreme sports.

Madison Square Garden Entertainment dropped 11.9% to $29.71, widening its year-to-date loss to 17.2%. Live Nation had been up 7.7% through Wednesday (April 2) but finished the week down 3.4% after losing a combined 10.3% over Thursday and Friday. German concert promoter CTS Eventim fell just 6.2%.

Music stocks started 2025 well, but concerns about tariffs have wiped out the index’s early gains. The BGMI has lost 18.0% of its value since Feb. 14 and has declined in five of the previous seven weeks. Halfway through February, the index had gained nearly 30% in the first six weeks of the young year. By Friday, that year-to-date gain was down to 6.3%.

Billboard

Billboard

Billboard

K-pop companies SM Entertainment and HYBE were among the best-performing music stocks of the week as most stocks were dragged down by continued uncertainty about U.S. tariff policy and new data on higher-than-expected inflation.

SM Entertainment, home to NCT Dream and RIIZE, was the week’s best performer after gaining 6.7% to 107,000 KRW ($72.91). That brought the company’s year-to-date gain to 47.4% — the best of any music stock.

HYBE, which counts BTS and its solo members’ projects among its vast roster, improved 3.7% to 240,500 KRW ($163.87). On Thursday (March 27), HYBE announced that BTS songs such as “Dynamite” and “Butter” will be featured on Lullaby Renditions of BTS, out April 4 on Rockabye Baby! Music. HYBE shares are up 19.7% year to date, the fifth-best among music stocks.

Trending on Billboard

K-pop fared well during a down week for most stocks and markets in general. YG Entertainment, home of BLACKPINK and BABYMONSTER, rose 3.3% to 63,500 KRW ($43.27) while JYP Entertainment was unchanged at 61,300 KRW ($41.77).

Outside of South Korea, music stocks reflected the challenging economic conditions and uncertainties that have hurt stocks in recent weeks. The 20-company Billboard Global Music Index (BGMI) declined 2.9% to 2,459.98, marking its fourth decline in the last six weeks. With just eight of its 20 stocks finishing the week in the black, the BGMI fell into correction territory as its value has declined 10.7% since the week ended Feb. 14. The first six weeks of 2025 were good enough to overcome the recent slump, however, and the BGMI is up 15.8% year to date and has gained 40.4% over the last 52 weeks.

Stocks took another hit on Friday (March 28) after the core personal consumption expenditures price index, a measure closely watched by the U.S. Federal Reserve, increased 0.4% in February. That put the 12-month inflation rate at 2.8%. Both figures were above experts’ expectations. The tech-heavy Nasdaq composite finished the week down 2.6%, increasing its year-to-date decline to 11.7%, while the S&P 500 fell 1.5%. In the U.K., the FTSE 100 increased 0.1%. South Korea’s KOSPI composite index fell 3.2%. China’s SSE Composite Index dropped 0.4%.

The BGMI was pulled down by Spotify’s 6.5% decline and a 4.2% drop by German concert promoter CTS Eventim. Warner Music Group, one of the index’s largest companies, dropped 2.7% to $31.56.

Tencent Music Entertainment (TME) gained 2.7% to $14.38 after Deutsche Bank upgraded its rating on TME shares to buy from hold. Universal Music Group rose 2.0% to 25.99 euros ($28.12) after Wells Fargo upped the rating on the company’s shares to overweight from equal weight and increased the price target to 33 euros ($35.70) from 28 euros ($30.29).

Music streaming company LiveOne had the week’s biggest decline at 14.1%. The company announced on Wednesday (March 26) that subscribers and ad-supported users surpassed 1.4 million.

Radio company iHeartMedia fell 6.8%, putting its year-to-date loss at 23.0%. Satellite broadcaster SiriusXM dropped 3.1% to $22.75, though it’s still up 1.7% in 2025.

The music business has earned a reputation for being recession-proof. In bad economic times, people still pay for their music subscription services and want to go to concerts. Some synch opportunities may dry up as advertisers make cutbacks, but overall, the music is a hearty business that doesn’t follow typical economic cycles.

Music business stocks, however, aren’t immune to fluctuations in the market and investors’ worries about the increasingly fragile state of the economy. This week, just three of the 20 companies on the Billboard Global Music Index (BGMI) finished with gains, and five stocks had losses in excess of 10%. Despite a host of strong quarterly earnings results in recent weeks, President Donald Trump’s tariffs on goods from Canada, Mexico, China and Europe have caused markets to panic, taking down music stocks along with the industrial and agricultural companies most likely to be affected.

The S&P 500 entered correction territory on Thursday (March 13) when it closed down 10% from the all-time high. The Russell 2000, an index of small companies, was down 18.4% from its peak. Most stocks improved on Friday (March 14) as markets rallied — despite a decline in the University of Michigan’s consumer confidence index — but the first four days of the week were too much to overcome. The S&P 500 finished the week down 2.3% and the Nasdaq composite closed down 2.4%.

Trending on Billboard

Markets outside of the U.S. fared better than U.S. markets. The U.K.’s FTSE 100 dropped just 0.5%. South Korea’s KOSPI composite index rose 0.1% and China’s SSE Composite Index improved 1.4%.

Even though 17 of the 20 companies on the BGMI posted losses this week, the index rose 0.5% to 2,460.71 because of Spotify’s 8.1% gain, and the dollar’s nearly 1% increase against the euro offset the weekly declines of 17 other stocks. Spotify is the BGMI’s largest component with a market capitalization of approximately $117 billion — more than twice that of Universal Music Group’s (UMG’s) $50.2 billion. The stock also received rare good news this week as Redburn Atlantic initiated coverage of Spotify with a $545 price target (which implies 5.5% upside from Friday’s closing price) and a neutral rating.

UMG shares fell 8.8% on Friday, a reaction to Pershing Square’s announcement on Thursday that it will sell 50 million shares worth approximately $1.5 billion. Pershing Square CEO Bill Ackman called UMG “one of the best businesses we have ever owned.” JP Morgan analyst Daniel Kerven admitted the news was “a near-term negative for confidence” in UMG but saw Pershing Square’s decision to sell shares as a move to take profits and re-weigh its portfolio (UMG was 27% of Pershing Square’s holdings) rather than a commentary about UMG’s long-term potential or recent operating performance. UMG shares ended the week down 8.2% to 25.46 euros ($27.78) but remained up 6.5% year to date.

Live Nation shares dropped 6.5% to $119.22, marking the stock’s fourth consecutive weekly decline. During the week, Deutsche Bank increased its Live Nation price target to $170 from $150 and maintained its “buy” rating. On Friday, a judge denied Live Nation’s request to dismiss an accusation that the promoter illegally forced artists to use its promotion business if they wanted to perform in its amphitheaters.

Other U.S.-based live entertainment companies also fell sharply. Sphere Entertainment Co. fell 10.1% to $31.55. MSG Entertainment dropped 1.3% to $31.46 despite Wolfe Research upgrading the stock to “outperform” from “peer perform” with a $46 price target. Vivid Seats, a secondary ticketing platform, fell 28.1% to $2.86 after the company announced fourth-quarter earnings.

Radio companies, which tend to suffer when economic uncertainty causes advertisers to pull back spending, had yet another down week. iHeartMedia fell 12.0% to $1.61. Cumulus Media dropped 11.5% to $0.46. And SiriusXM, which announced layoffs this week, fell 10.1% to $22.67. Year to date, iHeartMedia is down 24.4% and Cumulus Media is down 40.3%. SiriusXM, on the other hand, has gained 1.4% in 2025.

K-pop stocks also fell sharply despite South Korea’s market finishing the week with a small gain. HYBE, SM Entertainment, JYP Entertainment and YG Entertainment had an average decline of 7.4% for the week. Collectively, however, the four South Korean companies have had a strong start to 2025 and, after this week, had an average year-to-date gain of 19.3%.

Live Nation, Sphere Entertainment Co. and MSG Entertainment stocks fell this week as markets were hurt by fears about the impacts of U.S. tariffs, ongoing inflation and government layoffs.

Live Nation, which reported record full-year results on Feb. 20, dropped 11.0% to $127.51, erasing the stock’s entire year-to-date gain. Sphere Entertainment Co. dropped 18.8% to $35.45 following the company’s quarterly earnings on Monday (March 3). MSG Entertainment slipped 7.7% to $31.86.

U.S. stocks had their worst week in months. The Dow slipped 2.1%, the S&P 500 dropped 3.1% and the Nasdaq Composite fell 3.5%. In the U.K., the FTSE 100 dipped 1.5%.

Trending on Billboard

On Friday, Treasury Secretary Scott Bessent told CNBC that the U.S. economy would go through an adjustment period with less government spending. “The market and the economy have just become hooked,” he said. “We’ve become addicted to this government spending, and there’s going to be a detox period.”

Doubts about live music’s ability to sustain growth in the current economic climate were captured in a CFRA analyst’s note. “Live entertainment and exorbitant ticket prices have raised investor concerns whether record demand will recede with a rising household cost of living and lower consumer confidence,” analyst Kenneth Leon wrote in a March 5 note to investors.

Nevertheless, Leon maintained its $135 price target and upgraded Live Nation shares to “hold” from “sell.” The company, he added, “is a market leader in tickets and continues to fund large capital expenditures to expand its own venues.”

Sphere Entertainment Co. shares fell 13.6% on Monday (March 3), the day the company released quarterly earnings, and slipped another 6% through Friday (March 7). Revenue fell 2% to $308.3 million from the prior-year period, although revenue for the Sphere venue was up 1%. At the company’s MSG Networks division, revenue dropped 5% and its $34.2 million operating profit turned into a $35 million operating loss.

Numerous analysts made downward revisions to their Sphere models after the earnings release. Benchmark dropped its price target to $35 from $36. JP Morgan cut its price target to $54 from $57. And Seaport cut its earnings-per-share estimate for the current quarter to -$2.03 from -$1.66.

Other companies in the live entertainment space also declined. MSG Entertainment fell 7.7%, Vivid Seats dropped 3.9%, Eventbrite dipped 2.1% and German concert promoter CTS Eventim lost 0.6%. Many other companies that depend on consumer discretionary spending also fell this week, including Expedia Group (down 6.9%), Hyatt Hotels (down 3.7%) and cruise operator Carnival Corporation (down 13.7%).

The 20-company Billboard Global Music Index (BGMI) dropped for the third consecutive week, falling 6.3% to 2,449.61. Although the index is up 15.3% year to date, it has fallen 11.1% in the last three weeks. Most of the index’s most valuable companies were among the week’s winners. Other than Live Nation, none of the 13 stocks that lost ground are among the index’s most valuable companies — with one major exception.

Spotify, the BGMI’s largest single component, dropped 12.6% to $531.71, putting the stock 18.5% below its all-time high set on Feb. 13. With a market capitalization of roughly $105 billion, Spotify is large enough to influence the fortunes of an index that contains 19 other stocks. Despite having a few off weeks, however, Spotify is the best-performing music stock of the last year and has gained 14.0% year to date.

Universal Music Group (UMG) shares rose 6.8% on Friday following the company’s fourth-quarter earnings release on Thursday (March 6), though itended the week up just 3.3%. Warner Music Group appeared to benefit from investors’ enthusiasm about UMG’s earnings as its shares rose 2.0% to $34.39.

iHeartMedia CEO Bob Pittman caused his company’s stock to spike 23% on Thursday after an SEC filing revealed the executive purchased 200,000 shares. Investors noted the CEO’s optimism in his company’s future, and the stock ended a downward slide to finish the week up 3.4% to $1.83.

The week’s biggest gainer, Chinese music streaming company Tencent Music Entertainment (TME), rose 9.2% to $13.31. TME benefitted from a surge in Chinese stocks as comments made during the country’s parliamentary meetings this week fueled optimism that the government will provide stimulus for Chinese technology companies. The company will release fourth-quarter earnings on March 18.

Cumulus Media was the week’s biggest loser after dropping 27.8% to $0.52. The company revealed on Friday that it received a warning from the Nasdaq stock exchange that it faces a de-listing for failing to meet the minimum shareholders’ equity threshold of $10 million.

HYBE shares closed the week up 4.9% to 245,500 won ($167.94) after the company teased the return of BTS in 2025 during its fourth-quarter earnings release on Tuesday (Feb. 25), effectively leading a strong week for K-pop stocks amid an overall down period for both music stocks and markets in general. Among other K-pop companies, YG Entertainment gained 8.8%, JYP Entertainment improved 2.4% and SM Entertainment rose 0.9%.

HYBE partially attributed its 38% decline in 2024 operating income to the BTS hiatus that began in 2023 when several of the group’s members were forced to step away to complete South Korea’s required military service. But the company said it believes operating profit will improve in 2025 “through the comeback of 21st-century icons BTS” and payoffs from investments in the company’s social media-superfan platform, Weverse.

The K-pop giant’s revenue increased 4% to $1.58 billion last year, with recorded music revenue, the company’s largest source of income, dipping 11.3% but concerts revenue jumping 25.6% as the number of performances rose from 125 in 2023 to 172 in 2024. HYBE’s South Korean labels generated 15% more streaming revenue internationally even as streaming fell 17% at home. Revenue from U.S. labels (Big Machine and Quality Control) fell 16%.

The 20-company Billboard Global Music Index (BGMI) had more losers than winners this week as it fell 2.3% to 2,613.79. Just seven of the index’s stocks finished in positive territory, and outside of K-pop stocks, none gained more than 2%.

Markets had a rough week owing to inflation and recession fears. Amidst talks of U.S. tariffs on foreign imports, the Federal Reserve Bank of Atlanta is now predicting U.S. gross domestic product, a measure of the country’s economic activity, will decline 1.5% in the first quarter. The S&P 500 finished the week down 1.0% to 5,954.44 while the tech-heavy Nasdaq composite, weighed down by Nvidia’s weaker-than-expected first-quarter guidance, fell 3.5% to 18,847.28. The U.K.’s FTSE 100 was an outlier, gaining 1.7% to 8,809.74. South Korea’s KOSPI composite index sank 4.6% to 2,532.78. China’s SSE composite index dropped 1.7% to 3,320.90.

Live Nation shares fell 4.1% to $149.48 — the concert promoter’s second consecutive weekly decline. Wolfe Research lowered its Live Nation price target to $165 from $175 and Citigroup raised Live Nation to $175 from $163. Despite those declines, the company’s shares are up 10.6% year-to-date and 47.5% over the last 52 weeks.

Universal Music Group (UMG) and Warner Music Group (WMG) fell 4.2% and 4.2%, respectively, with UMG slated to report fourth-quarter earnings on Thursday (March 6). Sphere Entertainment Co., which reports quarterly earnings on Monday (March 3), dropped 7.0% to $46.90, lowering its year-to-date gain to 2.8%.

Chinese music streamer Tencent Music Entertainment (TME) fell 15.3% to $14.40. On Friday (Feb. 28), the company announced a change on its board of directors, as Matthew Yun Ming Cheng retired from the board and was replaced by Wai Yip Tsang, the current financial controller of Tencent Holdings. In announcing Tsang’s appointment, Cussion Pang, executive chairman of Tencent Music Entertainment, said Tsang’s “deep financial background, extensive experience and business insights will be a tremendous asset to TME.”

iHeartMedia shares fell 15.3% on Friday and ended the week down 16.1% following the company’s fourth-quarter earnings release on Thursday (Feb. 27). The radio company said it expects first-quarter revenue to fall in the low single digits and forecasts full-year revenue will be flat compared to 2024.

The largest decline of the week came from Cumulus Media, which fell 20.0% on Friday and finished the week down 19.1% after the radio company released fourth-quarter earnings on Thursday. Cumulus’ revenue fell 1.2% in the fourth quarter and was down 2.1% for the full year.

Strong earnings releases from Live Nation, CTS Eventim and Cloud Music clashed with a downturn in the market this week. The most notable release of the week came from Live Nation, which reported record revenue of $23.1 billion in 2024 and forecast a healthy stadium business in 2025.

Still, Live Nation shares fell 1.9% on Friday (Feb. 21) after Thursday’s earnings release and finished the week down 2.8% to $148.48. The stock had gained 19.7% in the first seven weeks of the year, however, and expectations for a strong quarterly report and 2025 outlook were likely priced into the shares. More telling is Live Nation’s 56.8% increase over the previous 52 weeks, suggesting that investors are convinced the company has a winning combination of concerts, ticketing, and sponsorships and advertisements.

A bevy of analysts upped their Live Nation price targets following the company’s earnings release on Thursday (Feb. 20), including Evercore ISI (to $180 from $160), JP Morgan (to $170 from $150), Jefferies (to $180 from $150) and Rosenblatt (to $174 from $146). Ahead of the company’s earnings report, Morgan Stanley raised its price target to $170 from $150 and Seaport Global Securities raised Live Nation shares to $170 from $157. A dissenting voice came from CFRA, which has a “sell” rating on Live Nation shares and this week increased its price target to $135 from $115.

Trending on Billboard

The 20-company Billboard Global Music Index (BGMI) fell 2.9% to 2,674.34, marking its first decline in seven weeks and only its second weekly loss of 2025. Only six of the 20 stocks gained ground while 14 finished the week in negative territory. Even so, music stocks are performing well this year. Only four of the 20 stocks have lost value in 2025 and the BGMI has gained 25.9% year to date.

U.S. stocks cratered on Friday amidst a drop in consumer sentiment, an uptick in inflation expectations and worries the economy may be slowing. The Dow dropped 1.7%, the S&P 500 also fell 1.7% and the Nasdaq composite sank 2.2%. Summing up the market’s tenuous mood, Steve Cohen, CEO of hedge fund Point72, told the FII Priority Summit on Friday that tariffs, sharp cuts in government spending and slowing immigration will have negative consequences. “It may only last a year or so, but it’s definitely a period where I think the best gains have been had and wouldn’t surprise me to see a significant correction,” he said.

The best-performing music stock of the week was Chinese music streaming company Cloud Music, which jumped 18.1% on Friday and ended the week up 20% after the company’s 2024 earnings release on Thursday showed a 22% jump in music subscription revenue. At 170.70 HKD ($21.97), Cloud Music is up 52.1% year to date. Another Chinese music streamer, Tencent Music Entertainment, rose 5.6% to $14.40.

CTS Eventim shares rose 4.7% to 104.00 euros ($108.83) after the company announced record results for 2024 on Tuesday (Feb. 18). Consolidated revenue increased 19.1% to 2.81 billion euros ($2.94 billion) and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA), a common measure of profitability, jumped 21.9% to 444.8 million euros ($465 million). Live entertainment revenue rose 17.6% to 1.97 billion euros ($2.06 billion) while ticketing revenue climbed 22.7% to 879.9 million euros ($921 million).

Spotify fell 4.8% to $607.36 while Warner Music Group dropped 2.9% to $35.26 and Universal Music Group was down 3.0% to 28.02 euros ($29.32). Sphere Entertainment Co., which will announce quarterly earnings on Feb. 28, lost 2.8% and sister company MSG Entertainment fell 5.0%.

Most K-pop stocks rose this week as South Korea’s KOSPI composite index gained 2.5%. YG Entertainment rose 12.0% to 57,900 ($40.30) following the announcement on Wednesday (Feb. 19) of BLACKPINK’s 10-city 2025 world tour that commences in July and stops in Seoul, Los Angeles, Chicago, New York, Toronto, Paris, London, Milan, Barcelona and Tokyo. SM Entertainment shares rose 7.8% to 99,500 KRW ($69.25), bringing its year-to-date gain to 37.1%. JYP Entertainment rose 1.6% and HYBE fell 1.0%.

For more than a year, record labels and publishers have seen investors pour into streaming stocks — namely Spotify — while downplaying the potential benefits rights owners will accrue from rising subscription prices. Now, Universal Music Group (UMG) and Warner Music Group (WMG) are getting some attention as analysts are optimistic about the terms of new licensing agreements Spotify reached with the companies.

WMG shares rose 10.9% to $36.20 a week after the company released fiscal first-quarter results. This week, the stock got a boost when Citi raised its WMG price target to $42 from $34 and upgraded the stock to a “buy” rating from “neutral.” As Morningstar explained last week, WMG is a “primary beneficiary of the ongoing growth” in the music industry. At $36.20, WMG shares have gained 17.0% in 2025 and are only slightly below their 52-week high of $36.64 set in February 2024. WMG shares fell 13.4% in 2024.

Trending on Billboard

At UMG, shares rose 7.1% to 28.89 euros ($30.32), the stock’s highest closing price since May 27, 2024. Morgan Stanley analysts have been making the case that UMG is undervalued given Spotify’s soaring share price and this week raised its UMG price target to 42 euros ($44.07) from 36 euros ($37.78). Recent licensing deals with Spotify and Amazon “increases our confidence that its subscription growth will accelerate” from approximately 5% at the start of 2025 to “closer to 15%” at the beginning of 2026, they wrote in a Monday (Feb. 10) investor note. After falling 4.2% in 2024, UMG shares are up 20.8% in 2025.

WMG and UMG were among the best performers on the 20-company Billboard Global Music Index (BGMI) this week. The BGMI rose 4.6% to a record 2,755.53, bringing its year-to-date gain to 29.7%. Only two stocks lost ground while one was unchanged and 17 posted gains for the week. The index outperformed the Nasdaq composite (up 2.6%), the S&P 500 (up 1.5%), the FTSE 100 (up 0.4%), China’s SSE Composite Index (up 1.3%) and South Korea’s KOSPI composite index (flat versus the previous week).

Live Nation reached an all-time high of $152.94 on Friday (Feb. 14) before closing at $153.76, up 3.7% for the week. Ahead of the concert promoter’s earnings results on Thursday (Feb. 20,) Wolfe Research increased its price target to $175 from $160 and Goldman Sachs raised it to $166 from $148.

Streaming services fared well, too. Spotify rose another 2.4% to $637.73 and reached a new all-time high of $652.63 on Thursday (Feb. 13). Fewer than seven weeks into 2025, Spotify shares have gained 36.7%. Elsewhere on the streaming front, Cloud Music rose 9.1% to 142.20 HKD ($18.01) and Tencent Music Entertainment gained 8.7% to $13.63.

Music streamer LiveOne had the week’s biggest loss after falling 20.5% to $0.93. On Thursday, the company announced that its revenue fell 6% in the fiscal third quarter. LiveOne also lowered revenue and earnings guidance for its full year, causing shares to end the day down 18.6%. The other streaming loser was Abu Dhabi-based Anghami, which fell 2.7% to $0.71.

Satellite radio broadcaster SiriusXM shares rose 6.6% to $27.11, bringing its year-to-date gain to 21.2%. This week, Deutsche Bank raised its price target to $27 from $25.

Most K-pop companies finished the week in positive territory. HYBE shares rose 5.8% and reached their highest mark since July 2023. SM Entertainment, which reported a 9% increase in revenue this week, increased 5.4%. JYP Entertainment improved 4.2% and YG Entertainment fell 1.3%.

Spotify led all music stocks this week with a 13.6% gain after its fourth-quarter earnings results on Tuesday (Feb. 4) showed that the company posted its first-ever net profit. The streamer’s share price reached an all-time high of $632.41 on Friday (Feb. 7) before closing at $622.99, slightly lower than its closing prices on Wednesday ($626.00) and Thursday ($625.87). Fewer than six weeks into 2025, the Swedish streaming company’s stock has risen 39.3%.

With 203.8 million shares outstanding, according to its 2024 annual report released this week, Spotify’s market capitalization briefly reached $128.9 billion. A week ago, Spotify was worth nearly as much as the three major music groups. As of Friday, after gaining another 13.6%, Spotify is worth more than Universal Music Group (UMG), Sony Music and Warner Music Group (WMG) combined.

Trending on Billboard

Guggenheim was among a host of analysts to increase its Spotify price target, raising the streaming company’s shares to $675 from $520 and increasing its forecast for 2025 operating income to 2.61 billion euros ($2.7 billion) from 2.46 billion euros ($2.54 billion). Others that raised their price targets for Spotify were Evercore ISI (to $700 from $500), Morgan Stanley (to $670 from $550), DA Davidson (to $680 from $350) and Deutsche Bank (to $700 from $550).

Led by Spotify, the 20-company Billboard Global Music Index (BGMI) rose 7.7% to a record 2,635.41, bringing its year-to-date gain to 24.0%. The index’s most valuable companies were among the 13 gainers while the seven companies that lost ground have relatively small market capitalizations. In contrast to music stocks’ gains, major indexes were muted this week. In the U.S., the Nasdaq composite index and S&P 500 fell 0.5% and 0.2%, respectively. In the U.K., the FTSE 100 rose 0.3%. South Korea’s KOSPI composite index gained 3.0%. China’s SSE Composite Index was up 1.6%.

Chinese music streamer Cloud Music had the week’s second-best performance, rising 6.6% to 130.30 HKD ($16.73). SiriusXM was third-best after rising 6.0% to $25.44. Another Chinese music streaming company, Tencent Music Entertainment, improved 4.7% to $12.54. And K-pop companies all fared well: SM Entertainment was up 4.9%, HYBE improved 4.2% and JYP Entertainment rose 3.6%.

While record labels and publishers have benefitted from Spotify’s price increases, their stock prices haven’t followed the same trajectory. WMG gained 2.9% to $32.72 following its quarterly earnings report on Thursday (Feb. 6) and is up 5.5% year to date. Reservoir Media, which released earnings on Wednesday (Feb. 5) and raised its full-year guidance, closed the week down 4.2% to $7.96 and has lost 12.0% in 2025. UMG, which will announce its fourth-quarter earnings on March 6, rose 0.1% to $26.98 and is up 9.1% year-to-date.

MSG Entertainment gained 1.1% to $36.73. On Thursday (Feb. 6), the concert promoter reported that revenue increased 1% to $407.4 million and adjusted operating income improved 2% to $164 million in the fiscal second quarter ended December 31, 2024. Event-related revenue fell $22.5 million due to lower revenue from concerts and a drop in other live entertainment at the company’s venues.

LiveOne had the largest decline of the week, falling 19.3% to $1.17. The music streaming company will announce earnings on Feb. 14.

State Champ Radio

State Champ Radio