Billboard Global Music Index

Trending on Billboard

Spotify’s stock price has fallen more than $200 below its all-time high of $785.00 set on June 27 after falling 8.2% to $583.62 in the week ended Friday (Nov. 21). The Swedish streaming giant’s share price dropped more than 7% in the two days after it announced the purchase of WhoSampled, an online song samples database, to power a new song credits feature, SongDNA.

Investors’ reaction to a relatively small acquisition appears to be part of a larger theme in recent weeks. While Spotify is one of the better-performing music stocks of 2025, it has struggled since the company announced on Sept. 30 that CEO Daniel Ek will step down and assume the role of executive chairman. Ek attempted to assuage investors who might be wary of his departure, saying in an open letter that “very little will change” when Spotify is led by co-CEOs Alex Norström and Gustav Söderström, two longtime Spotify executives. Ek added that he will operate with a European-style approach to the executive chairman position that is “more hands-on than the traditional U.S. model.”

Related

But investors aren’t showing much faith in the post-Ek era. Since the announcement, Spotify shares have fallen 19.9%, erasing $29.7 billion of market value.

Driven by Spotify’s 8.2% decline — the worst for all music companies this week — the Billboard Global Music Index (BGMI) fell 4.8% to 2,571.67. Eight of the index’s companies had gains while 11 finished the week with losses. The BGMI has not posted a gain in 10 weeks and now stands 17.5% below the all-time high of 3,117.20 set during the week of June 30.

Markets were down around the world this week. In the U.S., the Nasdaq fell 2.7% to 22,273.08 and the S&P 500 dropped 1.9% to 6,602.99. The U.K.’s FTSE 100 sank 1.6% to 9,539.71. South Korea’s KOSPI composite index and China’s Shanghai Composite Index each dropped 3.9%.

Warner Music Group (WMG) finished the week up 1.1% to $30.69. After releasing earnings on Thursday morning (Nov. 20), WMG shares dropped 2.7% on Thursday but gained 3.4% gain on Friday. Investors may not have received their desired message from WMG management, but analysts were upbeat about the numbers and management’s outlook. CFRA bumped WMG shares up to a “hold” rating from the “sell” rating it issued in July. Guggenheim kept its “buy” rating and $37 price target while noting that WMG’s “capital efficient” joint venture with Bain is likely to provide growth to both revenue and earnings. J.P. Morgan, which maintained its “overweight” rating and $40 price target, was “encouraged” by WMG management’s comments on margin expansion and market share gain.

Related

CTS Eventim shares rose 7.2% to 84.65 euros ($97.52). The German concert promoter and ticketing company released third-quarter earnings on Thursday that showed revenue rose 4%. The week’s gain brought CTS Eventim’s year-to-date gain to 0.8%.

Netease Cloud Music fell 7.1% to 189.40 HKD ($24.33) after its third-quarter earnings, released on Thursday, revealed a 2% decline in revenue. Cloud Music remains one of the year’s best-performing music stocks, however, with a 2025 gain of 68.8%.

Live Nation shares fell 3.9% to $130.55. Deutsche Bank lowered its price target to $160 from $173, which suggests 22.6% of upside based on Friday’s closing price, and maintained its “buy” rating.

The week’s greatest gainer was Cumulus Media, which rose 29% to $0.11. Such large swings are common for Cumulus, which has lost 85.7% of its value in 2025 and experiences sizable moves when it rises or falls a mere penny. With a market capitalization of just $2 million, the radio broadcaster has little effect on the BGMI.

Billboard.com

Billboard.com

Billboard.com

Trending on Billboard

As some once high-flying streaming stocks limp toward the end of the year, music stocks have fallen far below their all-time high.

Tencent Music Entertainment (TME) dropped 11.0% to $18.93 after the company reported its third-quarter earnings on Tuesday (Nov. 11). TME reported strong growth in online music of 27.2% and music subscriptions of 17.2%. It’s not clear why investors reacted negatively, but it’s possible they have concerns that TME’s margins will suffer as offline (merchandise sales and performances) revenues grow faster than online revenues; as CFO Shirley Hu said during Tuesday’s earnings call, “offline performances and artist-related merchandise sales delivered triple-digit year-on-year revenue growth” in the quarter, adding that those offline revenues have a “lower gross margin.” Another factor was Nomura’s decision on Friday (Nov. 14) to lower its TME price target to $26 from $30 while maintaining its “buy” rating.

Related

Spotify was one of the week’s few winners, rising 3.1% to $635.81 and recapturing some of the previous week’s 5.9% decline. The stock reached as high as $668.49 on Thursday (Nov. 14) after news reports revealed the company unveiled a new Premium Platinum plan that will take the place of Premium Family in five markets, including India and South Africa.

Among streaming stocks, TME is up 66.2% year to date but has fallen 25.9% over the last 13 weeks. Spotify has gained 58.8% in 2025 but is $150 below its all-time high of $785 set in June. Similarly, Netease Cloud Music is up 64.8% year to date but has lost 30.8% in the last 9 weeks.

The 19-company Billboard Global Music Index (BGMI) fell 0.1% to 2,700.25, marking the eighth consecutive week the index has failed to post a gain; over those eight weeks, the index has dropped 12.9%. Only three of the index’s 19 stocks finished the week in positive territory, while two stocks were unchanged and 14 were in the red.

Related

StubHub, which is not included in the BGMI, dropped 23.5% to $14.87 after the company’s first quarterly earnings release as a public company on Thursday (Nov. 13). StubHub reported an 8% increase in revenue but declined to provide guidance for the fourth quarter, causing the stock price to fall 21.0% on Friday alone. After the precipitous decline, StubHub is now 36.7% below its $23.50 IPO price.

Warner Music Group (WMG) finished the week in positive territory, rising 0.4% to $30.36. WMG will report results for its fourth quarter and fiscal year on Thursday (Nov. 20).

HYBE dropped 2.6% to 297,500 KRW ($205.24). On Tuesday (Nov. 11), Nomura dropped its price target on HYBE to 354,000 KRW ($TK) from 370,000 KRW ($244.22) and kept its “buy” rating. The week could have been worse: HYBE shares rose 4.5% on Thursday (Nov. 13) on news that the members of girl group NewJeans will return to HYBE imprint ADOR after losing their legal battle to break away from the company. The stock jumped 18% in the week ended Oct. 31 after the court’s ruling.

Related

Universal Music Group fell 0.8% to 22.30 euros ($25.92). On Thursday, Sadif Investment Analytics trimmed its price target to 28.56 euros ($33.20) from 28.82 euros ($33.50) and lowered its rating to “hold” from “strong buy.”

On the radio front, Cumulus Media fell 28.8% to $0.0085, bringing its year-to-date decline to 88.9%. Cumulus reported earnings on Oct. 31 but could have been dragged down by iHeartMedia, which reported earnings on Monday (Nov. 10) and finished the week down 12.1% to $4.07.

Markets were mixed as investors contemplated an AI bubble and the likelihood of another rate cut by the U.S. Federal Reserve. In the U.S., the Nasdaq composite index fell 0.5% to 22,900.59 and the S&P 500 rose 0.1% to 6,743.11. In the U.K., the FTSE 100 gained 0.2% to 9,698.37. South Korea’s KOSPI composite index improved 1.5% to 4,011.57, bringing its year-to-date gain to 64.3%. China’s Shanghai Composite Index fell 0.2% to 3,990.49.

Trending on Billboard

Music stocks had their worst week in three months, as most companies that reported earnings this week were penalized for not offering more to investors. Spotify, Live Nation, SM Entertainment and Reservoir Media all finished the week ended Nov. 7 in the red — though live entertainment companies Sphere Entertainment and MSG Entertainment bucked the trend by posting sizable gains after putting out their quarterly earnings reports.

The 19-company Billboard Global Music Index (BGMI) fell 5.0% to 2,703.11 as losers outnumbered winners 15 to 4. After soaring earlier in the year, the BGMI is now 13.3% below its all-time high of 3,117.20 (in the week ended June 30) and is now equal to its value in early May.

Related

iHeartMedia was a notable exception to the carnage. The radio company’s shares jumped 55.9% to $4.63 after a report at Bloomberg said the company is in talks to license its podcasts to Netflix. Netflix is known to be seeking video podcast content and has also reportedly approached SiriusXM about distributing its podcasts. The week’s high mark of $4.77, reached on Thursday (Nov. 6), was iHeartMedia’s highest mark since March 17, 2023.

Sphere Entertainment Co. rose 12.6% to $77.08 after the company’s earnings report on Tuesday (Nov. 4) showed an improvement in the Sphere segment’s operating loss. Led by the popularity of The Wizard of Oz, the number of film viewings, called The Sphere Experience, rose to 220 from 207 in the prior-year period. Sphere’s shares are now up 81.5% year to date.

MSG Entertainment (MSGE) shares gained 5.3% to $46.51 following the company’s earnings report on Thursday. MSGE’s revenue jumped 14% to $158.3 million while its operating loss deepened to $29.7 million from $18.5 million a year earlier. J.P. Morgan raised its price target to $47 from $41, citing management’s comments on pricing and higher expectations for the Christmas Spectacular at Radio City Music Hall.

Related

Companies such as Live Nation and Spotify reported solid results but suffered a large share price decline — part of a trend that extends well beyond music companies, Bernstein analysts wrote in an investor note on Thursday: “We’ve seen a brutal theme emerge across the consumer [technology, media and telecommunications] sector: stocks that deliver perfectly in-line or modestly better than expected results are still getting sold.” Growth is not good enough, they explained, and investors are “shooting first and asking questions later” when a company doesn’t have a “bulletproof guide” for the next year or two.

Live Nation shares ended the week down 6.0% to $140.51 after the company reported third-quarter earnings on Tuesday (Nov. 4). Despite showing continued revenue and adjusted operating income growth, Live Nation’s share price fell 10% the following day, though the price recovered some losses in each of the next two trading days. Bernstein maintained its $185 price target and called the sell-off a buying opportunity, but numerous other analysts lowered their Live Nation price targets, including Oppenheimer (from $180 to $175), Evercore (from $180 to $168), Morgan Stanley (from $180 to $170), J.P. Morgan (from $180 to $172) and Roth Capital (from $180 to $176).

Also releasing third-quarter earnings on Tuesday was Spotify, whose stock fell 5.9% to $616.91 in the aftermath. The company reported 12% revenue growth, but the title of Bernstein’s investor note on Tuesday perfectly captured Spotify’s need to constantly impress investors: “When you trade at 50x EPS, you’d better make sure everybody’s happy.” Meanwhile, J.P. Morgan called the company’s fourth-quarter outlook “slightly mixed”: The company’s guidance on monthly average users and gross margin were “above expectations,” it said, but guidance on subscribers, revenue and operating income were lighter than expected. Guggenheim lowered its price target to $800 from $850, noting that results met expectations but that “questions remain” on Spotify’s ability to improve margins through price increases.

Related

Elsewhere, Reservoir Media fell 3.0% to $7.37 following the release of its quarterly earnings on Tuesday, while Warner Music Group, which reports earnings on Nov. 20, fell 5.4% to $30.23. Universal Music Group, which reported earnings on Oct. 30, dropped 3.4% to 22.48 euros ($26.01).

K-pop company SM Entertainment fell 14.1% to 102,600 KRW ($70.47), having dropped 9.6% in the two days following the release of third-quarter results on Thursday. Other K-pop companies also experienced large declines as HYBE dropped 10.4%, JYP Entertainment dipped 11.0% and YG Entertainment sank 21.3%, likely because of a report that BLACKPINK’s next album has been delayed until January 2026.

Most indexes had an off week. In the U.S., the Nasdaq composite fell 3.0% to 23,004.54, marking its worst week since April. The S&P 500 dropped 1.6% to 6,728.80. The U.K.’s FTSE 100 sank 0.4% to 9,682.57. South Korea’s KOSPI composite index plummeted 3.7% to 3,953.76. China’s Shanghai Composite Index rose 1.1% to 3,997.56.

Created with Datawrapper

Created with Datawrapper

Trending on Billboard

HYBE shares soared 18.4% in the week ended Oct. 31 after a South Korean court ruled that K-pop group NewJeans may not leave HYBE imprint ADOR and make music under a different name. The five members of the girl group had attempted to break away from HYBE after the K-pop giant dismissed NewJeans’ mentor, ADOR CEO Min Hee-jin, in April 2024.

Rather than lose NewJeans — which would have created additional headaches for HYBE and other K-pop companies — ADOR will retain the group through the end of its exclusive contract in 2029. The fact that Min is no longer at ADOR didn’t sway the court. “Merely the fact that NewJeans personally places high trust in Min Hee-jin does not make guaranteeing her the position of ADOR’s CEO a significant obligation under the exclusive contract,” according to a report. The ruling added approximately $1.5 billion to HYBE’s market value, suggesting that investors were fearful a court loss would spill over to other acts currently under contract with HYBE.

Related

Despite HYBE’s considerable gain, the 19-company Billboard Global Music Index was unchanged at 2,845.53. Music stocks were almost evenly mixed between winners and losers, and only two companies had either a gain or a loss in excess of 10%.

Music stocks lagged behind major indexes’ gains. In the U.S., the Nasdaq composite index rose 2.2% to 23,724.96 and the S&P 500 improved 0.7% to 6,840.20. The U.K.’s FTSE 100 rose 0.7% to 9,717.25. South Korea’s KOSPI composite index jumped 4.2% to 4,107.50 on AI optimism after Samsung announced it would build a semiconductor factory in partnership with American company Nvidia. China’s Shanghai Composite Index ticked upward 0.1% to 3,954.79.

SiriusXM shares finished the week up 1.4% to $21.69 after a see-saw end to the week. The stock gained 10.1% on Thursday (Oct. 30) after the company’s third-quarter results, but fell 6.5% on Friday (Oct. 31). The bump in share price came after SiriusXM increased its full-year forecasts for revenue, EBITDA and free cash flow. The Q3 results also showed that the satellite radio company, which also owns streaming platform Pandora, turned a net loss into a net profit.

Related

Universal Music Group shares fell 2.3% to 23.27 euros ($26.99) despite gaining 1% on Friday after the company reported solid Q3 earnings following the close of trading on Thursday. Following the results, J.P. Morgan reiterated its “overweight” rating and 39.00 euros ($45.23) price target while Guggenheim maintained its “neutral” rating and eliminated its price target, which was previously 27.00 euros ($31.32).

Spotify’s stock benefited from news that the company is raising prices in the U.K., finishing the week up 1.5% to $655.32. That modest gain helped Spotify reclaim some of the loss it suffered after the share price dropped 4.1% on Oct. 24. The Stockholm-based company will report Q3 earnings on Tuesday (Nov. 4).

Radio giant iHeartMedia was the week’s biggest loser after dropping 12.4% to $2.97. The company’s share price has been on a roll lately, though, gaining 39.4% in 2025. iHeartMedia will release Q3 earnings on Nov. 10.

Most live music stocks lost ground. Live Nation fell 2.2% to $149.53 ahead of its earnings results on Tuesday. German promoter CTS Eventim dropped 2.9% to 77.60 euros ($90.00). MSG Entertainment dipped 3.5% to $44.16. Sphere Entertainment Co. was an exception, rising 1.7% to $68.48.

Billboard

Billboard

Billboard

Trending on Billboard

Buoyed by news that The Wizard of Oz surpassed 1 million tickets sold and $130 million in sales since its Aug. 28 debut, Sphere Entertainment Co. shares rose 14.5% to a new all-time high closing price of $67.24. The film has helped send Sphere Entertainment’s stock price into a new stratosphere. Shares of the Las Vegas venue’s parent company are up 58.4% year to date and have gained 56.4% since Sphere debuted its revamped version of the classic film.

While some music stocks had big gains this week, the 19-company Billboard Global Music Index (BGMI) fell 1.4% to 2,845.60, marking its fifth consecutive losing week. Three music companies had stock gains over 10%, but they are relatively small compared to the index’s largest companies, Spotify and Live Nation, both of which lost ground this week. Foreign exchange rates also played a role in the BGMI’s poor performance despite numerous music stocks posting gains. In the last week, the euro fell about 0.3% against the U.S. dollar while the Korean won lost approximately 1.2%.

Related

Spotify had the week’s biggest loss after falling 3.8% to $645.78, bringing its five-week decline to 12.1%. Numerous analysts expect the company to raise U.S. subscription prices by early 2026, which would provide further margin improvement and help deliver streaming royalty growth to rights holders. Investors appear not to be taking a possible price increase into account yet, though. The Stockholm-based streaming company will announce third-quarter earnings on Nov. 4.

Live Nation shares slipped 1.5% to $152.86. Although the stock is up 18.0% in 2025, it has fallen 12.0% over the last six weeks. On Wednesday (Oct. 22), Deutsche Bank lowered its price target to $173 from $175. Then on Thursday (Oct. 23), Citi lowered its price target to $181 from $195.

LiveOne rose 23.3% to $5.55. The music streaming company announced on Monday (Oct. 20) that it plans to launch a subsidiary in Africa, LiveOneAfrica, in partnership with Virtuosity Music Group. “Through this partnership, we’ll connect LiveOne’s technology and artist ecosystem with one of the most vibrant creative markets in the world,” CEO Robert Ellin said in a statement.

Related

Anghami rose 0.4% to $2.85. On Wednesday (Oct. 22), the company announced it will issue 2.38 million shares of common stock to satisfy the convertible debt held by OSN Streaming Limited. Anghami’s share price fell 5% following the news but recovered on Thursday and Friday.

K-pop stocks were in the black this week. HYBE jumped 6.9%, JYP Entertainment rose 6.1% and SM Entertainment increased 1.5%. YG Entertainment rose just 0.6%.

Inflation data announced Friday showed a modest increase to 3%, leading to a jump in stock prices as investors anticipated a pending interest rate cut by the U.S. Federal Reserve. The economy hasn’t fallen apart despite reports of growing auto reposessions and a never-fail sign of tightening budgets: a surge in sales of Hamburger Helper.

In the U.S., the Nasdaq composite index rose 2.3% to 23,204.87 and the S&P 500 improved 1.9% to 6,791.69 — both record highs. The U.K.’s FTSE 100 gained 3.1% to 9,645.62. South Korea’s KOSPI composite index soared 5.1% to 3,941.59 and hit an all-time high on Friday. China’s Shanghai Composite Index rose 2.9% to 3,950.31.

Amidst new reports about a South Korean investigation into its chairman, HYBE shares fell 6.8% to 266,000 KRW ($192.69) during the week ended May 30. That was the biggest decline for a music stock in a week marked by modest gains and losses.

Reports out of South Korea this week said police in Seoul have resubmitted a search and seizure warrant for HYBE chairman Bang Si-hyuk in an investigation into allegations of fraudulent stock transactions by the music mogul. Bang allegedly misled previous shareholders about HYBE’s intention to go public, which caused them to sell HYBE shares ahead of the company’s initial public offering in 2020. Sources told Yonhap News Agency that Bang netted $291 million in 2020 from deals with private equity firms to share a portion of the gains from HYBE’s IPO.

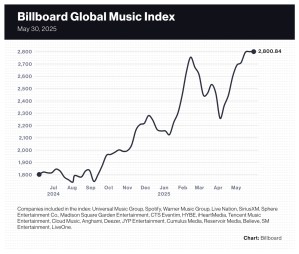

The 20-company Billboard Global Music Index (BGMI) was unchanged at 2,800.84 as the index had an even number of winners and losers. In a week with a remarkable amount of unremarkable movement, the majority of companies fell within a narrow band between a 2% gain and a 1% loss.

Trending on Billboard

Music stocks underperformed numerous market indexes. In the U.S., the Nasdaq gained 2.0% to 19,113.77 and the S&P 500 rose 1.9% to 5,911.69. The U.K.’s FTSE 100 climbed 0.6% to 8,772.38. South Korea’s KOSPI composite index jumped 4.1% to 2,697.67. China’s SSE composite was flat at 3,347.49.

But music stocks have posted big gains in 2025. The BGMI is up 31.8%, far surpassing the gains of the Nasdaq (14.2%) and the S&P 500 (up 12.0%). Spotify, the index’s most valuable component, has risen 42.8%. Universal Music Group (UMG), the BGMI’s second-largest company, has gained 17.8%.

The lone music company to report earnings this week, Reservoir Media, rose 7.9% to $7.80. The quarterly earnings released on Wednesday (May 28) showed a 10% revenue gain and a 14% improvement in adjusted EBITDA. Meanwhile, the only company to post a double-digit gain was Cumulus Media, which rose 15.4% to $0.15. Cumulus tends to have wild swings, however, since it was delisted from the Nasdaq on May 2 and began trading over the counter.

iHeartMedia jumped 6.5% to $1.31. Spotify, the BGMI’s fourth-best performer, rose 1.9% to $666.25. Madison Square Garden Entertainment improved 1.5% to $37.11, and UMG gained 1.4% to 28.16 euros ($31.95).

Live Nation fell 5.4% to $137.24, lowering its year-to-date gain to 6.0%. On Thursday, the company fell 2.9% on heavier-than-average trading volume following reports that it canceled concerts at Boston’s Fenway Park by Shakira and Jason Aldean due to safety concerns about the venue’s stage.

Both Chinese music streamers had off weeks that reduced their stellar year-to-date performances. Tencent Music Entertainment (TME) fell 4.0% to $16.82, lowering its year-to-date gain to 50.9%. Netease Cloud Music, the BGMI’s biggest gainer of 2025 at 88.2%, fell 2.9% to 211.20 HKD ($26.94).

Billboard

Billboard

Billboard

With stock markets slipping and tariff concerns rising, music stocks from South Korea and China were the best performers for the week ended May 23.

K-pop company SM Entertainment, home to aespa and RIIZE, led music stocks with a 10.6% gain. Two Chinese music streamers, Netease Cloud Music and Tencent Music Entertainment (TME), followed with gains of 7.0% and 5.4%, respectively. HYBE, home to BTS and its members’ solo projects, was close behind with a 4.0% gain.

Driven by the gains in Asian stocks, the 20-company Billboard Global Music (BGMI) rose 0.2% to a record 2,800.92. The small gain marked the seventh consecutive weekly gain after a two-week loss centered around President Trump’s April 1 tariffs announcement. Proving that music performs well in times of economic uncertainty, the BGMI has gained 31.8% year to date, far exceeding both the Nasdaq (down 4.5%) and S&P 500 (down 2.4%).

Trending on Billboard

U.S.-listed stocks performed especially poorly this week. Only one music stock traded on a U.S. exchange, TME, posted a gain this week. (TME is dual listed and also trades on the Hong Kong Stock Exchange. Its American Depository Receipts trade on the New York Stock Exchange.) Of the 12 stocks on the BGMI that lost value this week, only German concert promoter CTS Eventim trades outside of the U.S.

U.S. stocks finished the week on a sour note after President Trump recommended a 50% tariff on the European Union after trade negotiations stalled. The S&P 500 dropped 2.6% and the Nasdaq fell 2.5% amidst a battery of warning signs for the U.S. economy: Moody’s downgrade of the U.S. debt rating, the resulting concerns about the U.S. debt and a drop in the Leading Economic Index, among other factors. The U.S. is experiencing “death by a thousand cuts” and suffering from “the drip, drip, drip of poor fiscal news,” Deutsche Bank’s Jim Reid wrote this week.

CTS Eventim, which fell 4.7% to 106.60 euros ($121.21), was the only music company to announce quarterly results this week. While the 2024 acquisition of See Tickets helped revenue jump 22%, adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) improved just 8.9% and the company missed some analysts’ expectations. After Thursday’s announcement, the company’s share price fell as much as 14.7% before ending the day down 6.2% to 105.60 euros ($111.09).

Among multi-sector companies in the label and publishing business, Universal Music Group fared well, gaining 1.8% to 27.77 euros ($31.57). Warner Music Group fell 5.3% to $26.22 despite a lack of market-moving news or analyst comments. Reservoir Media, which reports earnings on May 28, dipped 1.2% to $7.23.

Streaming services were a mixed bag. Spotify fell 0.4% to $653.82. Deezer rose 0.8% to 1.31 euros ($1.49). Anghami sank 5.1% to $0.56. LiveOne was one of the week’s biggest losers after dropping 20.8% to $0.76. On Thursday (May 22), LiveOne announced it secured $27.8 million of convertible notes financing and drew down $16.8 million on May 19. The notes convert into shares of LiveOne common stock at $2.10 per share.

Live Nation fell 1.8% to $145.01. Macquarie increased its price target to $175 from $165 and maintained its “outperform” rating. On Tuesday, Live Nation named Richard Grenell, an appointee during President Trump’s first term, to its board of directors.

Created with Datawrapper

Created with Datawrapper

Created with Datawrapper

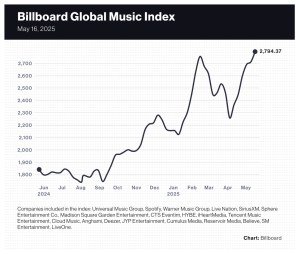

Music stocks — and stocks in general — had a terrific week as Sphere Entertainment Co., Tencent Music Entertainment and Cloud Music posted double-digit gains and the 20-company Billboard Global Music Index (BGMI) set a new high mark.

The BGMI rose 3.1% to an all-time high of 2,794.37, bringing its year-to-date gain to 31.5%. The index has overcome two downturns — one caused by an escalation of trade tensions, the other prompted by President Trump’s announcement of his tariff policy — to surpass the previous record of 2,755.53 set on Feb. 14.

Sphere Entertainment Co. gained 19.3% to $38.78. The company’s quarterly earnings, released on Monday (May 12), showed the Sphere venue was able to cut costs to offset a decline in event-related revenue. Investors cheered the result: flat operating income rather than a loss. As for tourism to Las Vegas, CEO James Dolan brushed aside concerns and said demand for Sphere concerts is strong enough to withstand a downturn should one arise.

Trending on Billboard

China’s Tencent Music Entertainment (TME) jumped 18.0% to $18.62 after the company reported on Tuesday (May 13) a 17% increase in music subscription revenue in the first quarter. Following earnings, CFRA upped its price target to $18 from $17 but downgraded its rating to “hold” from “buy.” TME, which operates Kugou Music, QQ Music and Kuwo Music, finished the quarter with 122.9 million subscribers, up 8.3% from the prior-year period.

Another Chinese music streamer, Netease Cloud Music, rose 12.6% to 203.40 HKD ($26.03) after the company’s financial results, released on Thursday (May 15), showed an 8.4% drop in revenue that the company attributed to a decline in its social entertainment business. The scant Q1 numbers didn’t provide details on the online music side of the business, but the two sides of the business are going in opposite directions. In 2024, social entertainment revenue fell 26% while online music revenue grew 23%.

Not only were TME and Cloud Music among the top performers of the week, they are among the biggest gainers in 2025. Year to date, TME shares are up 49.1% while Cloud Music has gained 81.3%. SM Entertainment’s 64.9% gain is the second-best amongst music stocks.

Live Nation improved 8.2% to $147.68 this week despite news that the company and AEG Presents are facing a criminal antitrust probe by the U.S. Department of Justice over pandemic-era refund policies. Live Nation shares are still well below the all-time high of $157.75 reached on Feb. 21, but they’ve gained 14.0% year to date and are up 52.9% over the last 52 weeks.

Spotify, the index’s most valuable component, rose 1.2% to $656.30. Guggenheim raised its price target to $725 from $675 on the heels of a judge’s favorable ruling in Epic Games v. Apple. Guggenheim sees the ruling, which allows Spotify to display pricing options within the iOS app, as helpful to audiobook monetization.

German concert promoter CTS Eventim gained 3.2% to 111.90 euros ($124.90). Barclays started covering the company with a 130 euro ($145.12) price target and an “overweight” rating.

Elsewhere in the index, Universal Music Group and Warner Music Group gained 0.9% and 1.2%, respectively, and HYBE improved 1.9%. SiriusXM jumped 5.4%.

Only four of the BGMI’s 20 stocks lost value this week. SM Entertainment was the week’s biggest loser with a 5.2% drop. Believe fell 1.3%, Deezer dipped 1.5% and iHeartMedia dropped 1.6.%.

Stocks were up globally but performed especially well in the U.S. The Nasdaq composite rose 7.2% and the S&P 500 improved 5.3%. In the U.K., the FTSE 100 was up 1.5%. South Korea’s KOSPI composite index gained 1.9%. China’s SSE Composite Index rose 0.8%.

Investors were encouraged by a reduction of U.S. tariffs on Chinese goods while the two countries continue to negotiate a trade deal. Goldman Sachs lifted its estimate for the S&P 500 on Tuesday as tensions over tariffs eased between the U.S. and China.

There is still uncertainty about the U.S. economy, however. Since last week, numerous reports have warned of a sharp slowdown at the Port of Los Angeles, the nation’s busiest port. This week, Walmart CFO John David Rainey said high tariffs could cause the company to raise prices by the end of the month. And on Friday (May 16), the University of Michigan’s closely watched index of consumer sentiment fell to its second-lowest level on record.

Billboard

Billboard

Billboard

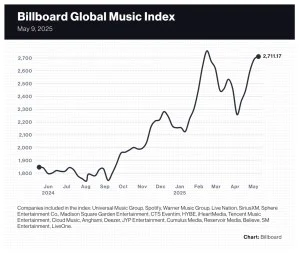

Led by two entertainment companies in the Dolan family portfolio, music stocks collectively eked out a small gain this week, marking their fifth consecutive weekly gain after a Trump tariff-induced two-week slide in early April.

Sphere Entertainment Co. shares jumped 18.9% to $28.05 after the company’s quarterly earnings on Thursday (May 8) showed that the Sphere venue’s cost management helped offset a 12.8% decline in revenue. CEO James Dolan told analysts he isn’t concerned about a possible downturn in tourism from a sluggish U.S. economy or a drop in international visitors. “When it comes to concerts,” he said, “demand exceeds capacity, so we have room to absorb any issues.”

MSG Entertainment, another Dolan family-controlled company, rose 7.7% to $33.59 after the company’s quarterly earnings report on Tuesday (May 6) showed a 6% revenue increase and steady consumer spending despite a decrease in event-related revenue due to fewer events. JP Morgan maintained both its “neutral” rating and $41 price target.

The 20-company Billboard Global Music Index (BGMI) rose 0.8% to 2,717.17, its second-highest mark and its first time above 2,700 since it closed at a record 2,755.53 the week ended Feb. 14. With five consecutive weeks in the black, the BGMI is up 10.2% since President Trump announced his tariff policy and set off a stock sell-off.

Music stocks outperformed the Nasdaq composite (down 0.3%), the S&P 500 (down 0.6%), the U.K.’s FTSE 100 (down 0.5%) and South Korea’s KOSPI composite index (up 0.7%). China’s SSE composite index gained 1.9%.

Universal Music Group, which reported earnings on April 29, received a healthy bounce this week, gaining 4.5% to 25.86 euros ($29.10). That brought its year-to-date gain to 13.0%.

Warner Music Group (WMG) shares fell 8% on Thursday after its quarterly earnings release and finished the week down 9.6% to $30.26. WMG stock was likely impacted by a 0.3% decline in streaming revenue, a metric closely watched by investors. The decline took WMG’s year-to-date loss to 11.8%. Numerous analysts reacted by decreasing their WMG price targets: Morgan Stanley (to $31 from $32), Barclays (to $28 from $31), UBS (to $38 from $41) and TD Cowen (to $36 from $41).

Radio companies enjoyed a positive week amidst uncertainty about the U.S. advertising market. The greatest gainer of the week was iHeartMedia, which jumped 18.9% to $1.06 ahead of the company’s first quarter earnings release on Monday (May 12). Year-to-date, the radio giant’s shares have fallen 40.8%. SiriusXM rose 5.4% to $20.47.

K-pop companies had a mixed week. YG Entertainment spiked 9.9% after the company reported large increases in both operating income and net profit in the first quarter. Elsewhere, HYBE rose 2.1% while SM Entertainment, which announced earnings on Wednesday (May 7), fell 0.9% and JYP Entertainment dropped 1.8%.

Secondary ticketing marketplace Vivid Seats (which is not listed on the BGMI) fell 33.9% to $1.79 after the company’s first quarter revenue plummeted 14% due to what CEO Stan Chia called “softening industry trends amidst economic uncertainty.” While Live Nation previously told investors it’s seeing strong demand for events later in 2025, Vivid Seats painted a different picture. The company suspended guidance for the full year and said it expects industry volumes to be flat or decrease in 2025. Previous guidance called for mid-to-high single-digit growth.

Billboard

Billboard

Billboard

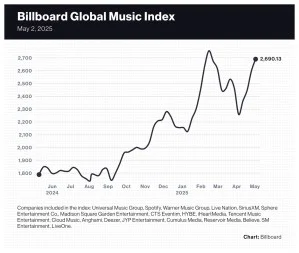

Though economic uncertainty lingers, some music companies’ stocks got boosts following their first quarter earnings releases this week, while a better-than-expected jobs report on Friday (May 2) lifted stocks across the board.

K-pop companies were among the top performers of the week. Led by HYBE’s 13.8% gain following its first quarter earnings report on Tuesday (April 29), the four South Korean companies had an average share price gain of 10.3%. JYP Entertainment rose 11.7% and SM Entertainment, which announces earnings on Wednesday (May 7), improved 9.0%. YG Entertainment gained 6.6%.

The 20-company Billboard Global Music Index (BGMI) rose 3.6% to 2,690.13, its fourth consecutive weekly improvement. At 2,690.13, the BGMI has improved 19.1% since a two-week slide and stands just 2.4% below its all-time high of 2,755.53 set during the week ended Feb. 14.

Trending on Billboard

Music stocks slightly outperformed the Nasdaq and S&P 500, which rose 3.4% and 3.1%, respectively. Foreign markets were mostly positive but more subdued. The U.K.’s FTSE 100 rose 2.2%. South Korea’s KOSPI composite index gained 0.5%. China’s SSE Composite Index lost 0.5%.

Universal Music Group (UMG) gained 4.3% to 25.86 euros ($29.23) following a quarterly earnings report showing that recorded music subscription revenue grew 11.5% and overall revenue improved 11.8%. JP Morgan analysts’ conviction on UMG “remains very high,” and the strong quarter “should help rebuild confidence and share price momentum” dented by Pershing Square’s sale of $1.5 billion in UMG shares, analysts wrote in an investor note on Tuesday.

Spotify finished the week up 3.7% to $643.73 despite its shares dropping 3.4% on Tuesday after the company’s first-quarter earnings report included guidance on second-quarter subscription additions that seemed to underwhelm investors. Gross margin of 31.6% beat Spotify’s 31.5% guidance. Loop Capital raised Spotify to $550 from $435, while Barclays lowered it to $650 from $710. UBS maintained its $680 price target and “buy” rating. Guggenheim maintained its “buy” rating and $675 price target.

Live Nation, which reported first quarter earnings on Thursday (May 1) and predicted a “historic” 2025, gained 2.3% on Friday and finished the week up 0.7%. A slew of analysts updated their price targets on Friday. Two were upward revisions: Jefferies (from $150 to $160) and Wolfe Research (from $158 to $160). Two were downward revisions: Rosenblatt (from $174 to $170) and JP Morgan (from $165 to $170).

Nearly all streaming stocks posted gains. LiveOne was the week’s top performer, jumping 18.0% to $0.72. Chinese music streaming companies Cloud Music and Tencent Music Entertainment gained 11.6% and 7.1%, respectively. French music streamer Deezer gained 1.4% to 1.44 euros ($1.63) after the company’s first-quarter earnings on Tuesday. Abu Dhabi-based Anghami fell 3.1% to $0.62.

Cumulus Media fell 33.% to $0.14. Most of the decline came on Friday as the stock ceased trading on the Nasdaq and began trading over the counter.

Created with Datawrapper

Created with Datawrapper

Created with Datawrapper

State Champ Radio

State Champ Radio