Billboard Boxscore

Chris Brown’s Breezy Bowl XX wrapped over a month ago, but is still generating new chart highlights. According to figures reported to Billboard Boxscore, its seven shows in October grossed $46.8 million and sold 286,000 tickets, scoring yet another month at No. 1 on Billboard’s Top Tours chart.

When Brown was No. 1 last month, he matched a Boxscore feat only previously achieved by Bad Bunny and Beyonce by linking two consecutive months with a reported gross of $90 million or more. Now, he joins them in another elite club, as the only acts to ever string together three consecutive months at No. 1 on Top Tours.

Related

In fact, Brown immediately follows Beyonce’s three-peat from May-July, capping a six-month stretch of only those two superstars atop the list. The streak ends here, as he had no concerts on the books for November.

Brown’s October routing mostly stuck to the American Southeast, selling out stadiums in Atlanta; Birmingham, Ala.; New Orleans; and Raleigh, N.C.. But his stop in Washington, D.C. was the biggest, playing to 121,000 fans over three nights (Oct. 5, 8-9), combining for $20.7 million.

Those shows at Nationals Park give Brown his first month at No. 1 on Top Boxscores. He’s the first artist in venue history to report an engagement with a gross of more than $10 million (let alone $20 million), attendance of more than 100,000, or a string of three shows.

Since launching in June, Breezy Bowl XX grossed $295.5 million and sold just under two million tickets (1.983 million) over its 49 shows in Europe and North America. It’s the highest-grossing and best-selling tour of Brown’s career, more than three times over.

Guns N’ Roses follows at No. 2 on Top Tours, with $35.2 million and 346,000 tickets from 11 shows in October. It’s the second highest gross of the month, but the hard rock legends sold more tickets than anyone else.

GNR stakes their claim with the Latin American leg of the Because What You Want & What You Get Are Two Completely Different Things Tour. The biggest one-night stop was the Oct. 25 performance at Sao Paulo’s Allianz Parque ($5.2 million; 47,600 tickets), but Buenos Aires in Argentina was the band’s ultimate winner, with $7.8 million and 73,300 tickets over two nights (Oct. 17-18) at Estadio Tomas Adolfo Duco.

The tour began on May 1 in South Korea, playing throughout Asia and Europe over the summer. Those 27 shows grossed $95.6 million and sold 823,000 tickets. The October and November shows push the tour’s total revenue well over the $100 million mark, with one show in Mexico City left to be reported.

Yesterday (Nov. 24), Guns N’ Roses announced its 2026 world tour with headline dates in Brazil, Europe, and North America. It will continue a consistent pattern of touring for the band since reuniting in 2016. Since then, it has grossed more than $980 million, surely surging beyond $1 billion with next year’s tour.

Brown and GNR’s totals are significantly down from top honors in September, marking the end of stadium season in North America and Europe. Still, the top 30 is strong, with a total gross of $568.7 million and attendance of 4.5 million. Those figures are up 7% and 6%, respectively, from October of last year.

Two rap acts follow in the top five, with Travis Scott and YoungBoy Never Broke Again at Nos. 3-4, respectively. It’s relatively rare for a rapper to be in the top five, but the one-two punch of Scott and YoungBoy lengthens a strong 2025 for the genre, marking the third month where two such artists (with significant history on the Top Rap Albums and Hot Rap Songs charts) have paired up simultaneously. Tyler, The Creator did it in February with Drake, and again in March with j-hope.

They took wildly different paths to the top five this month. YoungBoy played 18 arena shows in the U.S., stacking up to $32.8 million in the second month of his first headline tour. Scott played five stadiums in Asia and South Africa, pushing his sprawling Circus Maximus Tour to $265 million since launching in 2023.

Lady Gaga rounds out the top five with $31.9 million and 185,000 tickets sold while in Europe on The Mayhem Ball. It’s her fourth month in the top 10 this year, stretching back to May when she hit Singapore’s Indoor Stadium for four nights. Through her Paris shows (Nov. 17-18, 20, 22), Gaga has grossed more than $225 million and sold 1.1 million tickets in 2025.

Last month, Tate McRae and Benson Boone made their top 10 debuts on the monthly Top Tours listing. This month, McRae ranks even higher (at No. 6) as her $111 million Miss Possessive Tour came to a close. She passes the proverbial baton, as another young woman in pop hits the top 10 for the first time: Laufey is No. 10 with $19.2 million and 180,000 tickets sold.

Tate McRae wrapped the Miss Possessive Tour in Los Angeles on Nov. 8. Since kicking off in March, the tour grossed $110.8 million and sold 1 million tickets over 77 shows, according to figures reported to Billboard Boxscore. It’s easily the biggest of McRae’s fast-growing career, quintupling the earnings of her previous tour, just one year ago.

Related

It’s another year in a successive growth pattern for McRae. She’s toured for the last four years, building upon each in every metric. She averaged 1,084 tickets per show in clubs on her reported dates from 2022, before scaling to 2,607 in 2023. Last year, she stretched to 5,999, before elevating to sold-out arenas, with an average of 13,480 tickets in 2025. This is the third consecutive year that she doubled her nightly ticket sales.

Compounded by surging demand and an ever-increasing ticketing market, McRae’s earnings grew even bigger. She’s up from a per-show average of $26,600 in 2022, to $96,800 in 2023, to $349,000 in 2024, and now to $1.4 million in 2025. She grew by 265%, then 261% and then again by 312%.

McRae’s busy touring schedule has complemented a nearly constant output of new music. I Used to Think I Could Fly was released in May 2022, followed by Think Later in December 2023 and So Close to What in February 2025.

McRae’s numbers have soared on a per-show basis, but she’s also added more dates to her schedule each year, creating exponential growth to her total figures. The Miss Possessive Tour is her first to sell more than a million tickets and gross more than $100 million, and she hadn’t come close before: The tour’s total attendance triples last year’s count of 336,000, and the total gross laps last year’s $19.6 million five times over.

The Miss Possessive Tour started on March 18 with one show in Mexico City before a string of Latin American festival slots. McRae played 26 shows in Europe ($27.9M; 359K tickets) and then 50 in the United States and Canada ($82.7M; 673K). Both regions were up, to say the least, from last year, with North America earning more than seven times its 2024 gross.

That global growth can be distilled to the local level. In New York, McRae has evolved from one show at Irving Plaza (1,200 capacity) in 2022, to two at The Rooftop at Pier 17 (7,494 tickets in 2023). She played her first solo headline show at Madison Square Garden in 2024 (12,458) and then played three in 2025 (41,503). She also had three arena shows in the Los Angeles area, selling 42,224 tickets at Kia Forum in Inglewood, Calif., up 612% from last year’s lone show at the Greek Theatre (5,930).

Over the course of three years, McRae has expanded her nightly reach by more than 5,300%. Fellow emerging pop stars have experienced similar growth in the last decade, but it hasn’t been quite as speedy. Both Billie Eilish and Dua Lipa kicked off their latest arena spectacles last fall, two years removed from the end of their previous tours. McRae, on the other hand, has fired off three tours in three years, with no more than six months in between any of them.

In the eight months since her latest album became her first No. 1 on the Billboard 200, she topped the Billboard Hot 100 alongside Morgan Wallen on “What I Want” and scored her first Grammy nomination with F1’s “Just Keep Watching.”

Now, McRae is preparing the deluxe release of So Close to What, set to drop on Friday (Nov. 21). It’s led by “Tit for Tat,” which debuted on the Hot 100 at No. 3 in October. In the year since the Miss Possessive Tour dates went on sale, she’s created enough new momentum to continue this growth into the latter part of the 2020s.

Trending on Billboard Earlier today (Oct. 29), Billboard published the September Boxscore report, with Chris Brown repeating as the biggest touring act of the month. But while the biggest stars of rock, hip-hop and more packed stadiums, comedians were road warrior-ing their way to sold-out theaters and arenas. Here, we’re looking at the five biggest […]

On August’s Boxscore recap, Chris Brown became the fourth artist to lead the monthly Top Tours chart in 2025, coming close to the nine-figure mark with $96.8 million. According to figures reported to Billboard Boxscore, he comes even closer on September’s report, logging a second consecutive month at No. 1 with $98.1 million and 580,000 tickets sold.

When Brown topped the charts last month, he became the 10th artist to report monthly earnings of more than $90 million since the lists launched in 2019. By immediately hitting that mark again, he becomes just the third act to do so twice. Beyoncé grossed more than $90 million in six different months, split evenly between 2023’s Renaissance World Tour and this year’s Cowboy Carter Tour. Bad Bunny did it twice, both during 2022’s World’s Hottest Tour.

Related

Brown’s 13 shows during September were spread across 10 U.S. cities, three of which boasted double-headers. Those – Arlington, Texas (Globe Life Park on Sept. 2-3), Inglewood, Calif. (SoFi Stadium on Sept. 13-14), and Las Vegas (Allegiant Stadium on Sept. 19-20) – broke $10 million each, grossing $14 million, $16.3 million, and $15.8 million, respectively. They all appear in the top 10 of Top Boxscores.

Brown launched Breezy Bowl XX in June and wrapped two weeks ago (Oct. 16). The entire trek earned $295.5 million and sold just under two million tickets (1.983 million) over 49 shows. Of those totals, $47.8 million and 490,000 tickets are from the tour’s European leg, and the remaining $247.8 million and 1.5 million tickets are from North American shows.

On Brown’s first stadium tour, he’s up by 39% from his previous European trek (Under the Influence Tour 2023). In the U.S. and Canada, the leap is more pronounced, up 201% from last year’s The 11:11 Tour.

Brown’s final Breezy Bowl shows push his career earnings over the half-billion mark. Across 322 reported shows, the R&B phenom has grossed $511.4 million and sold 4.9 million tickets. That includes all of his solo headline revenue, plus 50% of co-headline tours like a pair of 2007 tours with Ne-Yo and Bow Wow, 2015’s Between The Sheets Tour (with Trey Songz) and 2022’s One of Them Ones Tour (Lil Baby).

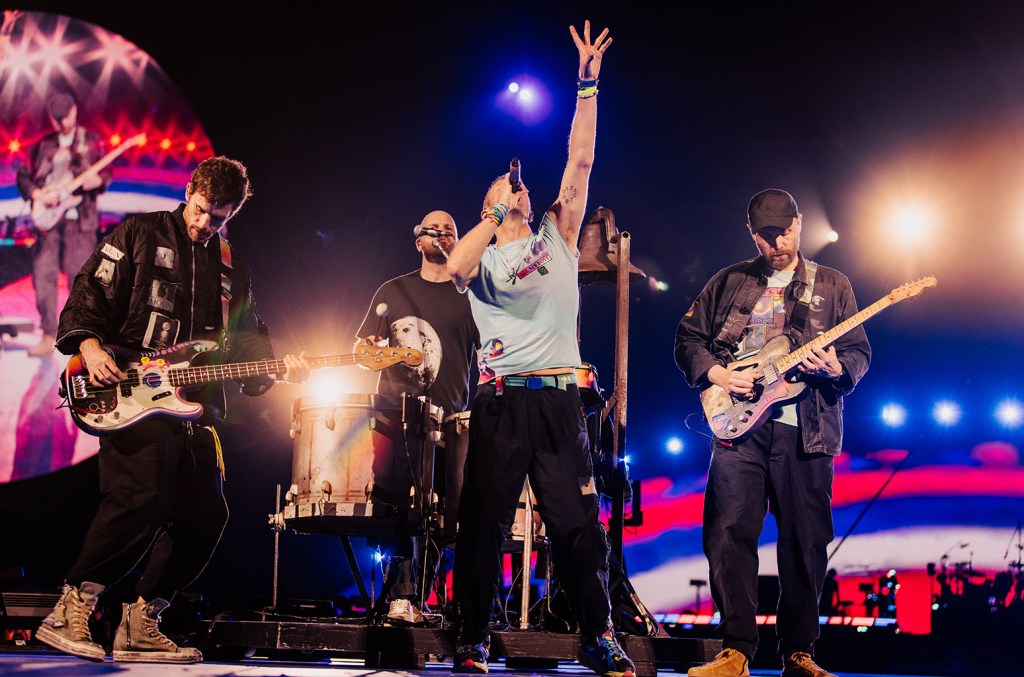

It’s not just Brown who repeats atop the monthly charts: Coldplay is No. 1 for a second straight month on Top Boxscores, with the final four of its 10 shows at London’s Wembley Stadium. The first six topped the August ranking with $78.9 million, and this month’s shows add $52.5 million. Altogether, the three-week run brought in $131.4 million and sold 791,000 tickets.

Both in terms of earnings and attendance, Coldplay’s Wembley Stadium run is the biggest single-venue engagement by a headline artist ever. That record applies to artists on tour, and does not include extended residencies, like Celine Dion at The Colosseum at Caesars Palace or Billy Joel at Madison Square Garden.

The Wembley shows were the only dates on Coldplay’s calendar in September, but they are enough to earn the band the runner-up spot on Top Tours. In addition to a record-tying seven months at No. 1, this is its sixth appearance at No. 2. Brown and Coldplay are the third duo to go back-to-back at Nos. 1-2 this year, following Shakira and Tyler, The Creator in February and March, and Beyoncé and The Weeknd in May and June.

As previously reported, Coldplay is planning more shows on the record-breaking Music of the Spheres World Tour for 2027. It’s already sold more tickets than any tour ever, and by the end of its teased 360-show run, it will likely be the biggest grosser as well.

September marks the first top 10 appearance on Top Tours for three artists. Benson Boone is No. 6 with $29 million and 238,000 tickets. He previously topped out at No. 19 in January with shows in Asia and Australia. Tate McRae is No. 9 with $21.9 million and 175,000 tickets, up from No. 14 last month.

In between, YoungBoy Never Broke Again makes his Top Tours debut, hitting No. 8 on his first chart appearance. The first 17 shows of the Make America Slime Again Tour pulled in $28.3 million from 231,000 tickets sold. He had a packed schedule, stretching from the 1st to the 29th, peaking with two shows each in Dallas ($3.9 million at American Airlines Center on Sept. 1-2) and Los Angeles ($3.8 million at Crypto.com Arena on Sept. 9-10).

Lady Gaga is no stranger to the Top Tours chart but hits a new career high on the September ranking. After bouncing in and out of the top 10 over the last five months, she is No. 3 on the current edition. Eleven shows from The MAYHEM Ball grossed $39.7 million and sold 159,000 tickets, including major-market, multi-national dates in Chicago, London, Miami, New York, and Toronto.

Just beneath her, former chart-topper Shakira is No. 4 with $33.9 million from eight shows in Mexico. Las Mujeres Ya No Lloran World Tour is already the highest-grossing Latin tour by a woman, and 17 yet-to-be-reported shows in South America could push its all-time status even further before its Dec. 11 Buenos Aires.

Rounding out the top five, Zach Bryan earned $29.4 million and sold 192,000 tickets from just two shows in September. First, he performed at Notre Dame Stadium, welcoming 79,300 fans to the South Bend, Ind. stadium. But his second date, a Sept. 27 show at Michigan Stadium in Ann Arbor, upped the ante with 112,000 tickets sold. It is reported to be the largest ticketed concert in U.S. history.

Billboard‘s Live Music Summit will be held in Los Angeles on Nov. 3. For tickets and more information, click here.

Earlier this month, Chappell Roan wrapped a brief run of concerts in the United States, paired with a few European dates in August. The Visions of Damsels & Dangerous Other Things Tour complemented Roan’s ongoing sweep of dominant festival performances over the last year and a half, cementing her as one of her generation’s fastest-growing live acts. She finished her recent tour, her only headline shows for 2025, playing to crowds of 30,000 and more, marking an eye-openingly fast rise to the biggest venues in the world.

Related

According to figures reported to Billboard Boxscore, Roan’s 11 headline shows in 2025 grossed $28.3 million and sold 276,000 tickets. They split between three overseas and eight in the United States. Some of the shows were in arenas and amphitheaters: Zurich’s Hallenstadion (12,539 tickets) and New York’s Forest Hills Stadium, which despite its name, is significantly smaller than a typical football or baseball stadium (53,458 tickets, spread across four shows). The others escalated her reach in Edinburgh, Kansas City, and Los Angeles.

Two nights at Royal Highland Centre in Edinburgh, Scotland drew 60,000 fans, averaging 30,000 per show. Two dates at Kansas City’s Liberty Memorial Park sold 69,600 tickets, averaging 34,800. The final two concerts, at Brookside Park at The Rose Bowl in Pasadena, Calif., moved 80,000 tickets, eclipsing 40,000 each night.

These venues are flat parks that recreate the sprawling crowd shots of Roan’s famed festival performances, more so than a typical football stadium with its enclosed stadium-style seating. But the number of tickets sold is comparable to any baseball stadium in the United States and far exceeds – roughly doubles – the capacity of an arena show.

These stadium-sized Boxscore figures elevate Roan even beyond the startling heights of her 2024. Her North American headline shows from last year broke into three legs. She averaged 2,083 tickets per show while performing one-offs during her opening stint on Olivia Rodrigo’s GUTS World Tour (Feb. – April). In May and June, following the release of breakout hit “Good Luck, Babe!,” she paced 3,581 tickets. By October, she was up to 10,179. One year later, Roan sold 25,389 tickets per show, ranging from 13,365 in New York to 40,010 in Los Angeles.

All of that growth, and all of these fans, with just one album under her belt. Selling out stadiums is a career-capping accomplishment for any artist, but almost an unfathomable one just two years removed from the release of one’s debut LP. The umbrella of stadium acts has grown wider in the years since returning from the COVID-19 blackout, but Roan’s supercharged ascent is still quite notable.

Zach Bryan first elevated to stadiums in 2024, almost exactly two years after he cracked the Billboard 200 with American Heartbreak. But his discography expanded by the time he played Oakland’s RingCentral Coliseum, with two more top 10 albums and four other charting titles. Fellow country chart-topper Morgan Wallen played one such show in 2021, three years and two albums deep.

Global stadium schedules have also welcomed younger artists who don’t primarily perform in English, specifically Latin and Korean acts. Still, all of them had meatier discographies than Roan’s to fill out their stadium setlists: Bad Bunny released three albums in three years before his stadium debut. Karol G and SEVENTEEN each had four albums in seven years. TWICE had six entries on the Billboard 200, all between 2020-23, before reporting a stadium show. By the time Fred again.. announced similarly eye-popping stadium shows, he had a few albums to his name.

Closer to Roan stylistically, Lady Gaga hit Mexico City’s Foro Sol (now called Estadio GNP Seguros) in May 2011, ending The Monster Ball in stadiums a year and a half after beginning it in theaters. Still, she had two top 10 albums and was weeks away from releasing her third. The year before, Taylor Swift also capped her debut headline tour at a stadium, but she was supporting her sophomore set Fearless, which won the Grammy for album of the year months prior.

Perhaps Peso Pluma comes closest to mirroring Roan’s timeline to stadiums. He played Monterrey, Mexico’s Estadio Mobil Super in November 2023, about 15 months after his first Billboard chart appearance. Even so, Genesis, his breakthrough album from 2023, was his third. J-Hope, JIN, and SUGA each hit at least one stadium on their first tours, but their history as part of BTS surely added depth to their respective ticket-buying bases.

Clearly, Roan has built a large, dedicated fan base from just one album. After first debuting on the Billboard 200 and Billboard Hot 100 in April 2024, she jumped from clubs to theaters to festivals, and then to solo headline stadium-sized engagements, all in the span of less than 18 months. Her recent tour was brief but mighty, leaving little to the imagination as to her potential box office success whenever her next shows are announced, whichever venues she decides to play.

Billboard‘s Live Music Summit will be held in Los Angeles on Nov. 3. For tickets and more information, click here.

Last month, Billboard Boxscore revealed its midyear touring recap, dominated by Coldplay, K-pop and Las Vegas’ Sphere. With the launch of Billboard’s comedy hub, we’re taking a closer look at the top-grossing comedy acts at the midyear mark. The 2025 midyear recap provides a switch-up at the top of the list. Kevin Hart led the […]

Shakira is the top Latin touring artist on the Billboard Boxscore midyear chart, grossing $130 million on her Las Mujeres Ya No Lloran World Tour so far. Shakira reported 21 concerts for the midyear touring period, which runs from Oct. 31, 2024, to March 31, 2025, landing her the number two slot overall on the […]

Coldplay was back on the road in April, extending the group’s reach to Hong Kong and Goyang, South Korea (14 miles from Seoul). According to figures reported to Billboard Boxscore, the British band is No. 1 on the monthly Top Tours chart, with $67.4 million in the bank and 502,000 tickets sold.

Coldplay has been one of the most dominant acts on the Boxscore charts since the 2022 kickoff of the Music of the Spheres World Tour, reigning over seven Top Tours charts. The band’s touring calendar has become an accurate predictor of chart results: Its last batch of shows was in January, which matches its sixth monthly victory. Before that, Coldplay had dates in November, aligning with its fifth monthly win. Coldplay has only one show scheduled in May, but a busier calendar throughout the summer immediately makes the band prohibitive competition for the top spot over the next several months.

With its April triumph, Chris Martin & Co. tie Bad Bunny and Elton John for the most months at No. 1 (seven). Trans-Siberian Orchestra follows with five (December of every year since the chart premiered).

Beyoncé and P!nk have each led four times. The latter did it twice on the Beautiful Trauma World Tour in 2019 and twice more with dates from Summer Carnival and Trustfall Tour in 2023-24. Beyoncé dominated the summer of 2023 with the Renaissance World Tour and played the first show on Cowboy Carter Tour on April 28, squeaking onto the month’s list with one date.

Coldplay’s April boils down to four shows at Hong Kong’s Kai Tak Stadium and six at Goyang Stadium in South Korea. The first set of dates grossed $32.9 million and sold 184,000 tickets. The second set moved $34.4 million from 318,000 tickets. That’s enough to secure the top two positions on the Top Boxscores chart.

The grosses of Coldplay’s two stops are close, separated by just 4%. But the longer stay in Goyang sold 73% more tickets, which means that the ticket price in Hong Kong had to be much higher. At Kai Tak Stadium, Coldplay averaged $179 per seat, while the Korean shows paced $108.22.

Added to Coldplay’s January run in the United Arab Emirates and India, the 2025 Asian leg wrapped with $124 million and 1.1 million tickets. Combined with the 2023-24 leg in Japan, Taiwan, Indonesia and more, Asia accounts for $253.4 million on the Music of the Spheres World Tour. Worldwide, the trek has brought in $1.3 billion and sold 11.4 million tickets, extending its lead as the bestselling tour in history.

Coldplay picks back up on May 31 in Stanford, Calif., kicking off a 17-show run in the U.S. and Canada. Finally, there are 12 dates scheduled in the U.K., closing out the three-and-a-half-year tour with 10 shows at London’s Wembley Stadium. By closing night, the trek will be approaching $1.5 billion and 13 million tickets sold.

From one of the biggest tours of all time nearing its close to the opening shows of one of 2025’s hottest tickets, Kendrick Lamar and SZA are No. 2 on April’s tally. The first four shows of the Grand National Tour brought in $43.2 million and sold 180,000 tickets.

Lamar and SZA premiered their co-headline trek on April 19 at Minneapolis’ U.S. Bank Stadium, before hitting Houston, Dallas and Atlanta. These are the first stadium shows for each artist, having previously conquered arenas in 2022 (Lamar’s The Steppers Tour) and 2023 (SZA’s SOS Tour).

Already, the Grand National Tour is the biggest tour of either artist’s career, and they are only 10 shows deep. Including six reported shows in May, which will count toward next month’s charts, the trek has earned $115.7 million and sold 508,000 tickets through the May 17 show at Seattle’s Lumen Field.

Thirteen shows remain on the pair’s schedule in North America, before traveling to Europe for 16 dates. Before its close on Aug. 9 in Stockholm, the Grand National Tour will be one of the biggest co-headline treks in history.

April was not just the stadium launchpad for Lamar and SZA. In the closing days of the month, Lady Gaga played her first two ticketed shows of the year at Mexico City’s Estadio GNP Seguros (April 26-27), hitting No. 6 on Top Boxscores and No. 10 on Top Tours. Beyoncé opened Cowboy Carter Tour in Los Angeles (April 28), reaching Nos. 14 and 15, respectively. And Post Malone unleashed the Big Ass Stadium Tour with assistance from Jelly Roll in Salt Lake City (April 29).

Beyoncé, Gaga and SZA help to make April a banner month for women on tour. They are three of 10 women on the Top Tours chart, up from seven in March, six in February, and just one in January. Still less than half, the 33% representation in April represents the most women on a Top Tours chart in its 58 editions, surpassing nine, or 30%, in December 2019 and January 2022.

In between SZA and Gaga, Shakira is No. 7 after leading the list in February and March. The first Latin American leg of her 2025 tour ended mid-month, handicapping her potential rank. Elsewhere, Charli xcx and Olivia Rodrigo carry over tours that began in 2024. Kelsea Ballerini, Mary J. Blige and Kylie Minogue wrapped up spring runs, while Katy Perry began The Lifetimes Tour with five shows in Mexico.

On Wednesday (May 28), Billboard revealed its midyear Boxscore charts, celebrating the top-grossing and best-selling artists, venues, and concert promoters around the world between Oct. 1, 2024, and March 31, 2025. Amid the pop, rock, R&B and Latin acts that blanket the Top Tours ranking, an unprecedented string of K-pop artists are in the mix, with five such acts among the all-genre top 50.

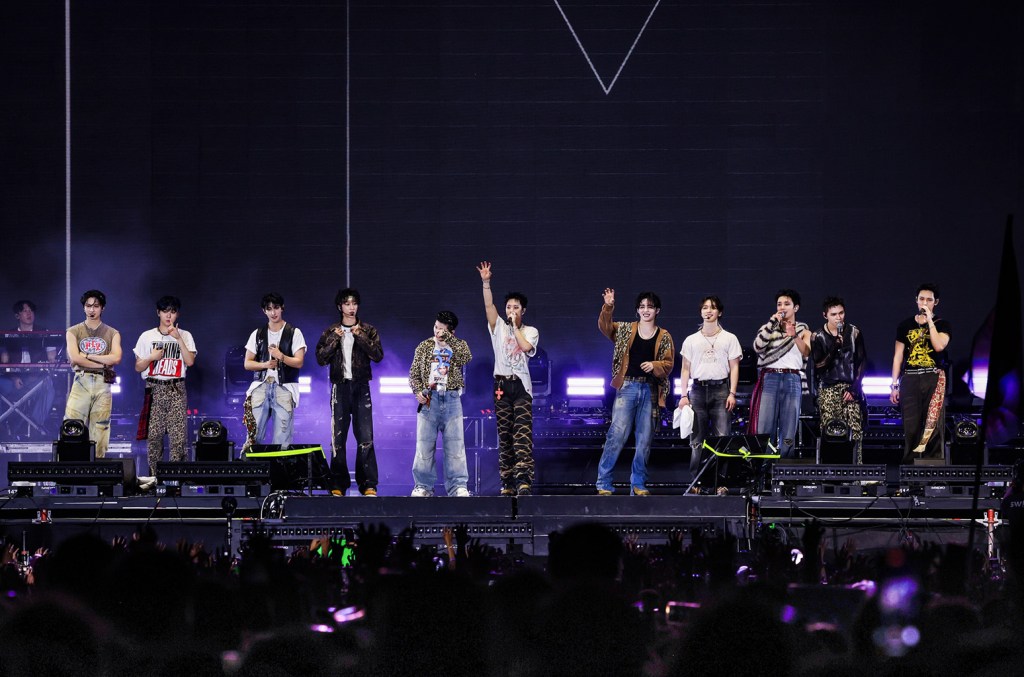

SEVENTEEN leads the pack, as it did for K-pop on midyear recaps for 2024 and 2023. But after grossing $30 million on the 2023 list, and $67.5 million for 2024, the group is No. 3 on the overall tally with $120.9 million and 842,000 tickets sold, according to figures reported to Billboard Boxscore. The group is sandwiched between Shakira at No. 2 ($130 million) and Eagles at No. 4 ($112.2 million).

SEVENTEEN is the highest-ranking Korean act ever on the all-genre midyear list, surpassing BTS’ No. 4 rank in 2022. BTS did manage a matching No. 3 rank on 2019’s year-end tally, but hadn’t played enough shows in the first half of that chart year to appear on the midyear chart.

Not only has K-pop’s top artist essentially doubled its midyear gross for the second consecutive year, but the bench is deepening. This year’s all-genre top 50 includes five K-pop acts, up from three in 2023 and 2024, and two in 2022. The threshold for K-pop’s top five is $25.1 million at the midyear point – this time last year, it was $3.1 million.

After SEVENTEEN, ATEEZ and J-Hope are next at Nos. 2-3 on Top Tours by Genre (K-pop), each with earnings of more than $28 million. The latter is the first K-pop soloist to make the midyear overall Top Tours chart, though he previously was included with his fellow BTS bandmates. ENHYPEN and TOMORROW X TOGETHER round out the list, also within a couple percentage points of one another above the $25 million mark.

These four groups and one soloist made their millions while proving the international strength of Korean artists. During the six-month tracking period, they toured arenas and stadiums throughout Asia (SEVENTEEN, J-Hope, ENHYPEN and TOMORROW X TOGETHER), Europe (ATEEZ and TOMORROW X TOGETHER), Mexico (J-Hope) and the U.S. (SEVENTEEN and J-Hope).

Altogether, K-pop acts on the midyear Top Tours chart brought in a collective $228 million and sold 1.6 million tickets from 78 shows. That marks a 79% increase over the genre’s 2024 showing, which itself was a 93% jump from 2023. In just two years, K-pop has more than tripled its presence on the midyear chart.

Scroll down for details on the top five K-pop acts on Billboard’s midyear Boxscore report. The midyear tracking period covers all reported shows, worldwide, between Oct. 1, 2024, and March 31, 2025.

On Wednesday (May 28), Billboard revealed its midyear Boxscore report, tracking the top touring artists, concert venues and promoters around the world. From October 1, 2024, to March 31, 2025, the midyear recap focuses on the biggest tours from the end of 2024 and beginning of 2025, before global stadium tours and music festivals take over the summer.

The animated graphic below shows how the top 10 tours have shaped and shifted over this six-month period.

The immediate leader was Paul McCartney. The legendary Beatle played a sold-out stadium show in Montevideo, Uruguay on the first day of the tracking period, bringing in $4.5 million from 37,573 tickets sold. Later that week, he had two dates at Estadio River Plate in Buenos Aires, adding $20.6 million and 128,000 tickets to his totals.

But by October 9, Bruno Mars stole McCartney’s thunder. Four shows deep into a six-night run at Sao Paulo’s Estadio do Morumbi, Mars’ $28.2 million surpassed McCartney’s $25.1 million. These early shows, plus Luis Miguel’s seven nights in Mexico City and Aventura’s stadium shows in Argentina and Peru, helped establish Latin America as live music’s center of gravity for the early days of the 2025 Boxscore tracking period.

Before the end of October, estimates for Taylor Swift’s The Eras Tour overtook Mars, McCartney and everyone else, as she began the final leg of her record-breaking two-year trek. While overall tour gross and attendance was reported by The New York Times, show-by-show data has still not been reported to Billboard Boxscore. Therefore, Swift remains absent from official midyear charts and her specific grosses in this time period have not been officially submitted.

Swift stays on top throughout the rest of the video, ultimately grossing an estimated $250 million in the tour’s final months in the U.S. and Canada. But the top 10 continued to fluctuate with November and December shows from Aventura, P!nk and Usher.

After bouncing around the top five in the late months of 2024, Coldplay asserted itself under Swift in January. The band played shows in the United Arab Emirates and India, breaking stadium attendance records for the 21st century with its two nights in Ahmedabad, India (more than 111,000 tickets each show).

Late-in-the-game moves come from K-pop boy band SEVENTEEN and Latin pop icon Shakira. Both artists grossed more than $100 million by the end of March, with Shakira banking her entire $130 million in just the last two months of the tracking period.

Coldplay, Shakira, Eagles, and Usher have all had reported shows in April and May that set them up for bigger totals by year-end. And the last few weeks have seen the kick-off for major tours by Beyoncé, Lady Gaga, Kendrick Lamar & SZA and Post Malone. By the end of 2025, this top 10 will likely get shaken up several times over.

State Champ Radio

State Champ Radio