bang si-hyuk

Amidst new reports about a South Korean investigation into its chairman, HYBE shares fell 6.8% to 266,000 KRW ($192.69) during the week ended May 30. That was the biggest decline for a music stock in a week marked by modest gains and losses.

Reports out of South Korea this week said police in Seoul have resubmitted a search and seizure warrant for HYBE chairman Bang Si-hyuk in an investigation into allegations of fraudulent stock transactions by the music mogul. Bang allegedly misled previous shareholders about HYBE’s intention to go public, which caused them to sell HYBE shares ahead of the company’s initial public offering in 2020. Sources told Yonhap News Agency that Bang netted $291 million in 2020 from deals with private equity firms to share a portion of the gains from HYBE’s IPO.

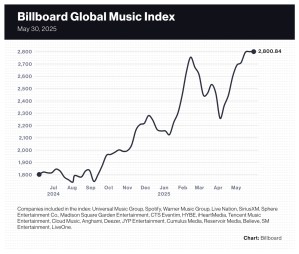

The 20-company Billboard Global Music Index (BGMI) was unchanged at 2,800.84 as the index had an even number of winners and losers. In a week with a remarkable amount of unremarkable movement, the majority of companies fell within a narrow band between a 2% gain and a 1% loss.

Trending on Billboard

Music stocks underperformed numerous market indexes. In the U.S., the Nasdaq gained 2.0% to 19,113.77 and the S&P 500 rose 1.9% to 5,911.69. The U.K.’s FTSE 100 climbed 0.6% to 8,772.38. South Korea’s KOSPI composite index jumped 4.1% to 2,697.67. China’s SSE composite was flat at 3,347.49.

But music stocks have posted big gains in 2025. The BGMI is up 31.8%, far surpassing the gains of the Nasdaq (14.2%) and the S&P 500 (up 12.0%). Spotify, the index’s most valuable component, has risen 42.8%. Universal Music Group (UMG), the BGMI’s second-largest company, has gained 17.8%.

The lone music company to report earnings this week, Reservoir Media, rose 7.9% to $7.80. The quarterly earnings released on Wednesday (May 28) showed a 10% revenue gain and a 14% improvement in adjusted EBITDA. Meanwhile, the only company to post a double-digit gain was Cumulus Media, which rose 15.4% to $0.15. Cumulus tends to have wild swings, however, since it was delisted from the Nasdaq on May 2 and began trading over the counter.

iHeartMedia jumped 6.5% to $1.31. Spotify, the BGMI’s fourth-best performer, rose 1.9% to $666.25. Madison Square Garden Entertainment improved 1.5% to $37.11, and UMG gained 1.4% to 28.16 euros ($31.95).

Live Nation fell 5.4% to $137.24, lowering its year-to-date gain to 6.0%. On Thursday, the company fell 2.9% on heavier-than-average trading volume following reports that it canceled concerts at Boston’s Fenway Park by Shakira and Jason Aldean due to safety concerns about the venue’s stage.

Both Chinese music streamers had off weeks that reduced their stellar year-to-date performances. Tencent Music Entertainment (TME) fell 4.0% to $16.82, lowering its year-to-date gain to 50.9%. Netease Cloud Music, the BGMI’s biggest gainer of 2025 at 88.2%, fell 2.9% to 211.20 HKD ($26.94).

Billboard

Billboard

Billboard

For some music companies, 2022 was the payoff for weathering the darkest days of the COVID-19 pandemic. When business returned that year — sometimes in record-setting fashion — these companies rewarded their executives handsomely, according to Billboard’s 2022 Executive Money Makers breakdown of stock ownership and compensation. But shareholders, as well as two investment advisory groups, contend the compensation for top executives at Live Nation and Universal Music Group (UMG) is excessive.

Live Nation, the world’s largest concert promotion and ticketing company, rebounded from revenue of $1.9 billion and $6.3 billion in 2020 and 2021, respectively, to a record $16.7 billion in 2022. That performance helped make its top two executives, president/CEO Michael Rapino and president/CFO Joe Berchtold, the best paid music executives of 2022. In total, Rapino received a pay package worth $139 million, while Berchtold earned $52.4 million. Rapino’s new employment contract includes an award of performance shares targeted at 1.1 million shares and roughly 334,000 shares of restricted stock that will fully pay off if the company hits aggressive growth targets and the stock price doubles in five years.

Live Nation explained in its 2023 proxy statement that its compensation program took into account management’s “strong leadership decisions” in 2020 and 2021 that put the company on a path to record revenue in 2022. Compared with 2019 — the last full year unaffected by the COVID-19 pandemic — concert attendance was up 24%, ticketing revenue grew 45%, sponsorships and advertising revenue improved 64%, and ancillary per-fan spending was up at least 20% across all major venue types. Importantly, Live Nation reached 127% of its target adjusted operating income, to which executives’ cash bonuses were tied.

The bulk of Rapino’s and Berchtold’s compensation came from stock awards — $116.7 million for Rapino and $37.1 million for Berchtold — on top of relatively modest base salaries. Both received a $6 million signing bonus for reupping their employment contracts in 2022. (Story continues after charts.)

Lucian Grainge, the top-paid music executive in 2021, came in third in 2022 with total compensation of 47.3 million euros ($49.7 million). Unlike the other executives on this year’s list, he wasn’t given large stock awards or stock options. Instead, Grainge, who has been CEO of UMG since 2010, was given a performance bonus of 28.8 million euros ($30.3 million) in addition to a salary of 15.4 million euros ($16.2 million) — by far the largest of any music executive.

This year, shareholders have shown little appetite for some entertainment executives’ pay packages — most notably Netflix — and Live Nation’s compensation raised flags at two influential shareholder advisory groups, Institutional Shareholder Services and Glass Lewis, which both recommended that Live Nation shareholders vote “no” in an advisory “say on pay” vote during the company’s annual meeting on June 9. Shareholders did just that, voting against executives’ pay packages by a 53-to-47 margin.

Failed “say on pay” votes are rare amongst United States corporations. Through Aug. 17, just 2.1% of Russell 3000 companies and 2.3% of S&P 500 companies have received less than 50% votes on executive compensation, according to executive compensation consultancy Semler Brossy. (Live Nation is in both indexes.) About 93% of companies received at least 70% shareholder approval.

ISS was concerned that the stock grants given to Rapino and Berchtold were “multiple times larger” than total CEO pay in peer group companies and were not adequately linked to achieving sustained higher stock prices. Additionally, ISS thought Live Nation did not adequately explain the rationale behind the grants.

To determine what Rapino, Berchtold and other executives should earn, Live Nation’s compensation committee referenced high-earning executives from Netflix, Universal Music Group, SiriusXM, Spotify, Endeavor Group Holdings, Fox Corporation, Warner Bros. Discovery, Inc. and Paramount Global. Netflix co-CEOs Reed Hastings and Ted Sarandos were paid $51.1 million and $50.3 million, respectively, in 2022. Warner Bros. Discovery CEO David Zaslov made $39.3 million in 2022 — including a $21.8 million cash bonus — a year after his pay totaled $246.6 million, including $202.9 million in stock option awards that will vest over his six-year employment contract. Endeavor CEO Ari Emanuel and executive chairman Patrick Whitesell received pay packages worth $308.2 million and $123.1 million, respectively, in 2021 thanks to equity awards tied to the company’s IPO that year (the received more modest pay of $19 million and $12.2 million in 2022).

Some companies in the peer group didn’t fare well in “say on pay” votes in 2023, though. Netflix, got only 29% shareholder approval in this year’s say-on-pay advisory vote after Hastings’ and Sarandos’ compensations both increased from higher stock option awards while the company’s stock price, riding high as COVID-19 lockdowns drove investors to streaming stocks, fell 51% in 2022. Warner Bros. Discovery’s 2022 compensation squeaked by with 51% shareholder approval.

Minutes from UMG’s 2023 annual general meeting in May suggest many of its shareholders also didn’t approve of Grainge’s compensation. UMG’s 2022 compensation was approved by just 59% of shareholders, and the company’s four largest shareholders own 58.1% of outstanding shares, meaning virtually no minority shareholders voted in favor.

UMG shareholders’ votes could be meaningfully different next year. Anna Jones, chairman of the music company’s remuneration committee, said during the annual meeting that in 2024, shareholders will vote on a pay package related to Grainge’s new employment agreement that takes minority shareholders’ concerns from the 2022 annual meeting into consideration. Grainge’s contract lowers his cash compensation, and more than half of his total compensation will come from stock and performance-based stock options.

Other companies in Live Nation’s peer group received near unanimous shareholder approval. SiriusXM’s 2022 executive compensation received 98.5% approval at the company’s annual meeting. Paramount Global’s executive compensation was approved by 96.4% of its shareholders. Endeavor didn’t have a “say on pay” vote in 2023, but a year ago, it’s sizable 2021 compensation packages were approved by 99% of voting shareholders.

As the radio industry came back from pandemic-era doldrums, two iHeartMedia executives — Bob Pittman, CEO, and Richard Bressler, president, CFO and COO — were among the top 10 best-paid executives in the music industry. It was new employment contracts, not iHeartMedia’s financial performance, that put them into the top 10, however. Both executives received performance stock awards — $6.5 million for Pittman and $6 million for Bressler — for signing new four-year employment contracts in 2022. Those shares will be earned over a five-year period based on the performance of the stock’s shareholder return. Neither Pittman nor Bressler received a payout from the annual incentive plan, however: iHeartMedia missed the financial targets that would have paid them millions of dollars apiece. Still, with salaries and other stock awards, Pittman and Bressler received pay packages valued at $16.3 million and $15.5 million, respectively.

Spotify co-founders Daniel Ek and Martin Lorentzon once again topped the list of largest stockholdings in public music companies. Ek’s 15.9% stake is worth nearly $4.8 billion while Lorentzon’s 11.2% stake has a market value of nearly $3.4 billion. Both Ek and Lorentzon have benefitted from Spotify’s share price more than doubling so far in 2023. In September 2022, the inaugural Money Makers list had Ek’s stake at $3.6 billion and Lorentzon’s shares at $2.3 billion.

The billionaire club also includes No. 3 HYBE chairman Bang Si-hyuk, whose 31.8% of outstanding shares are worth $2.54 billion, and No. 4 CTS Eventim CEO Klaus-Peter Schulenberg, whose 38.8% stake — held indirectly through his KPS Foundation non-profit — is worth $2.25 billion. They, too, have benefitted from higher share prices in 2023. Last year, Bang’s stake was worth $1.7 billion and Schulenberg’s shares were valued at $2.1 billion.

These top four shareholders and three others in the top 10 have one important thing in common — they are company founders. At No. 5, Park Jin-young, founder of K-pop company JYP Entertainment, owns a $559 million stake in the label and agency he launched in 1997. Another K-pop mogul, No. 8 Hyunsuk Yang, chairman of YG Entertainment, owns shares worth $199 million in the company he founded in 1996. And No. 9 Denis Ladegaillerie, CEO of 18-year-old French music company Believe, has a 12.5% stake worth $112.7 million.

Live Nation’s Rapino again landed in the top 10 for amassing a stockholding over a lengthy career, during which he has helped significantly increase his company’s value. Rapino, the only CEO Live Nation has ever known, took the helm in 2005 just months before the company was spun off from Clear Channel Entertainment with a market capitalization of $692 million. Since then, Live Nation’s market capitalization has grown at over 20% compound annual growth rate to $19.1 billion. Rapino’s 3.46 million shares represent a 1.5% stake worth $291 million.

Selling a company that one founded is another way onto the list. Scooter Braun, CEO of HYBE America, has a 0.9% stake in HYBE worth $69.8 million. That’s good for No. 10 on the list of executive stock ownership. Braun, HYBE’s second-largest individual shareholder behind chairman Bang, sold his company, Ithaca Holdings — including SB Projects and Big Machine Label Group — to HYBE in 2021 for $1.1 billion.

These rankings are based on publicly available financial statements and filings — such as proxy statements, annual reports and Form 4 filings that reveal employees’ recent stock transactions — that publicly traded companies are required by law to file for transparency to investors. So, the list includes executives from Live Nation but not its largest competitor, the privately held AEG Live.

Some major music companies are excluded because they are not standalone entities. Conglomerates that break out the financial performance of their music companies — e.g., Sony Corp. (owner of Sony Music Entertainment) and Bertelsmann (owner of BMG) — don’t disclose compensation details for heads of record labels and music publishers. Important digital platforms such as Apple Music and Amazon Music are relatively small parts of much larger corporations.

The Money Makers executive compensation table includes only the named executive officers: the CEO, the CFO and the next most highly paid executives. While securities laws vary by country, they generally require public companies to named executive officers’ salary, bonuses, stock awards and stock option grants and the value of benefits such as private airplane access and security.

And while Billboard tracked the compensation of every named executive for publicly traded music companies, the top 10 reflects two facts: The largest companies tend to have the largest pay packages and companies within the United States tend to pay better than companies in other countries.

The list of stock ownership is also taken from public disclosures. The amounts include common stock owned directly or indirectly by the executive. The list does not include former executives — such as former Warner Music Group CEO Stephen Cooper — who are no longer employed at the company and no longer required to disclose stock transactions.

HYBE founder and chairman Bang Si-hyuk said his company is only getting started in its bid to grow into a global music powerhouse that can rival the three major labels.

The South Korean company’s two U.S. acquisitions — Scooter Braun’s Ithaca Holdings and QC Media Holdings, parent company of hip-hop label Quality Control Music — are “just the beginning,” Bang said Wednesday at Gwanhun Forum in Seoul. The executive behind supergroup BTS insisted HYBE must have a “sense of urgency” and look outside of Korea to continue to grow.

“We are living in an era where everything we do in the content industry resonates beyond geographical boundaries,” Bang said. “At the same time, K-pop has become a global industry that can only continue to grow by targeting both domestic and international markets.”

At home, Bang said HYBE and its Korean rivals can’t do it alone. In his speech, he called on the South Korean government to support the K-pop companies in their bid to take on the global majors – Universal Music Group, Sony Music Entertainment and Warner Music Group — by helping them become national champions in the way that electronics companies Samsung and LG have become global powerhouses with government support.

While K-pop built HYBE into a powerhouse, the company might have only a brief window to capitalize on its global success. “K-pop is in crisis,” the HYBE chief said, asserting that by most measures the genre is in decline in Southeast Asia, other than growth in China and spending per consumer. In the United States, 53% fewer K-pop tracks charted on the Billboard Hot 100 in 2022 than the previous year, according to Bang. He attributed the K-pop slowdown to BTS’ hiatus as a group in 2022 and said he doesn’t believe the group’s eventual comeback will bring back the lost revenue.

When Bang talks about exporting K-pop around the world, he isn’t referring to just a genre of music. To him, K-pop is “a culture that encompasses music-oriented systems such as music and content production, distribution, marketing, communication with fans, and other systems of music.” In HYBE’s “multi-label” structure, he added, the Korean headquarters provides guidance to its labels and disperses the risk so its subsidiaries can operate “in a healthy competition that drives each other to improve.”

For HYBE to make inroads in the United States, the world’s largest music market, it needs “a strong network and infrastructure … to minimize the cost of trial and error” involved in exploring an unfamiliar landscape, Bang added. In the U.S., Braun leads HYBE America, the umbrella organization for SB Projects’ management clients, Big Machine Music Group and Quality Control. HYBE also has a joint venture in the U.S. with Universal’s Geffen Records to develop a girl pop group for the domestic market.

While Bang didn’t say which companies HYBE is targeting for further acquisitions, in a press conference after his speech he noted HYBE’s interest in Latin labels. The company certainly has the resources to buy additional record labels, artist management firms or tech platforms to further fuel its expansion: HYBE had cash and cash equivalents of 903 billion won ($689 million) as of Sept. 30, 2022, the latest date for which data is available. The goal, said Bang, is to achieve scale “that can’t be ignored.”

Even though HYBE dominates K-pop and generated revenue of $1.4 billion in 2022, Bang described his company in biblical terms: He is David, the three major labels are Goliath. Major K-pop companies account for less than 2% of the global music market, he said, while the majors own 67.4%.

Looking around the world, Bang sees “alarming trends,” including K-pop commanding fewer chart positions in 2022 than in the previous year. “In this context, the existence of global K-pop artists without a dominant global entertainment company inevitably leads to concerns about the industry’s ability to be on the lookout for future uncertainties,” he said.

What will it take for HYBE to turn from David into a sustainable Goliath? Bang wants more scale and stronger distribution partners to give K-pop additional bargaining power to negotiate more favorable distribution rates. In that way, he said, HYBE can improve its financial performance “and enable the company and our artists to grow.”

Further entering the U.S. market will require building “a strong network and infrastructure,” Bang said. “Through this, we need to minimize the cost of trial and error caused by situations that are difficult for us to change, or due to our unfamiliarity with the local conditions, and secure an equal level of presence and influence in the mainstream market equivalent to local companies.”

Breaking artists isn’t a matter of “luck or sheer intuition,” the HYBE founder added. Rather, success is the result of a management process that can be systemized and replicated in other markets. HYBE’s multi-label structure demonstrates this approach, Bang said: “It is a system that has been meticulously established based on experience, trial and error, and contemplation to enable the company’s success.”

Additional reporting by Jeyup S. Kwaak

-

Pages

State Champ Radio

State Champ Radio