Warner Bros. Discovery

Earlier this month, Warner Bros. Discovery and Cutting Edge Group announced they were teaming up to launch a joint venture to generate more money from one of the original Hollywood studios’ catalog of 400,000 movie and television songs.

The blockbuster deal — reportedly worth $1 billion — includes the Harry Potter and Lord of the Rings franchises, Friends, Game of Thrones, and Succession, to name a few.

This novel arrangment was inspired by WBD’s need to get more out of its most valuable assets as the rise of streaming shakes the fundamental economics underlying modern media businesses. Cutting Edge Group is a nearly 15-year-old company founded by Philip Moross, a former real estate developer who saw an opportunity to acquire, manage and develop music rights from films and TV shows.

Trending on Billboard

Now a three-prong company that also includes studios where partnering artists like Timbaland produce music specifically for Cutting Edge projects in the film, TV or wellness space, Cutting Edge is embarking on its biggest project yet.

Billboard spoke with CEG’s Moross about how the joint venture with Warner Bros. Discovery will work, including what Cutting Edge brings to the table and if they other joint ventures between music companies and studios to follow.

What are you aiming to accomplish with this joint venture, and what role will Cutting Edge play do day-to-day?

I put the idea [to WBD] that as we are solely focused on music, we could help make it a larger profit center for them. We are working closely with Warners’s music department … and hope to build a music business within the framework of Warner Bros. Discovery the way that Warner Chappel was in the past. We are a music business. They are a film and television business that incorporates music into their creative process. Our job is to effectively maximize the monetary end of it. But how it’s going to work on a day-to-day basis we are still working out. I will say We have no interest in changing the relationships [Warner Bros. Discovery] has with UMPG and Sony. We’re an independent and we don’t compete with any of them.

This is a massive catalog. How will you manage maximizing its value?

You compartmentalize—pure instrumentals, songs, etc.—and then see what the market wants from each category … and take into account the composers. We understand the composers are the lifeblood of the business. Warner wants to take care of them from a creative point of view.You must balance the economic value of that with the creative process. A composer may not want the main theme to Harry Potter used anywhere else, but the body of the music may be available. On the other hand, the song “Shallow” is a huge song, which is relevant now, that you may be able to get some very big synchs on. We are going to have to work to make sure all parties are involved–because it is not 100% owned by one party and the master is owned by Gaga’s record label. We have the time and inclination to do that whereas Warner is on to the next movie already.

You’ve got 400,000 titles so it’s not going to be quick and easy. If I am advising I’d be saying go for the top 20% that generate 80% of the revenue, but don’t lose sight of the gems in there.

Will Cutting Edge be providing its two cents on films?

We hope to provide input on songs for films in the works. In the core business of Cutting Edge, we’ve done that. We’ve bought catalogs of film rights and suggested to composers … to use the same themes again because creatively it works.

What is so important to Warner Bros. Discovery is maintaining creative integrity. They are never going to tell a director what music to use and what music not to use. … [and] it is not our role to impose any creative ideas. What we hope to do is to suggest [through the Warner Bros. Discovery music department] to the creatives, “If you’re doing Aquaman 3, why don’t you use the same themes from Aquaman 1 and 2 for certain characters?”

Cutting Edge’s Myndstream business does a lot linking music with the wellness industry. Are there opportunities in the wellness space in this catalog?

Absolutely it’s an area of focus for us. We work on [opportunities like these] all the time. There is a Nicholas Britell track called Agape [from the score of If Beale Street Could Talk]. It’s one of the most used tracks on Peloton for their meditation programs. Everything is about the emotional connection and identifying opportunities.

Everyone knows the soundtracks of “Harry Potter” and Friends. But there are music cues in the catalog as well. Can you describe what those are and their potential?

When you are watching a film or television show and you hear the background music, every item of music that sits in that film or television show is a cue. It is the background music that you’ve got right up to the songs. For example, The Rembrandts in Friends — the opening titles can be a cue. It could be the 3 ½ minute version of the Rembrandt song — a full song — or the 1-minute portion of that. That is the cue. The cue that is registered with BMI is earning its revenue from broadcast performance. So when the TV show plays, the network that is paying the royalty will pay the PRO which then pays the publisher, which in this case is our joint venture. We track to make sure nothing is missed.

How much of your day will be devoted to this?

[Cutting Edge’s] operating team will spend the majority of its time on this. It’s certainly the biggest deal that I’ve ever done. It deserves the attention because it is such a big scale.

What kind of return is this JV expected to produce on Warner Bros. catalog?

I can’t give you a number as to how much we will increase revenue.

Tell us about your team.

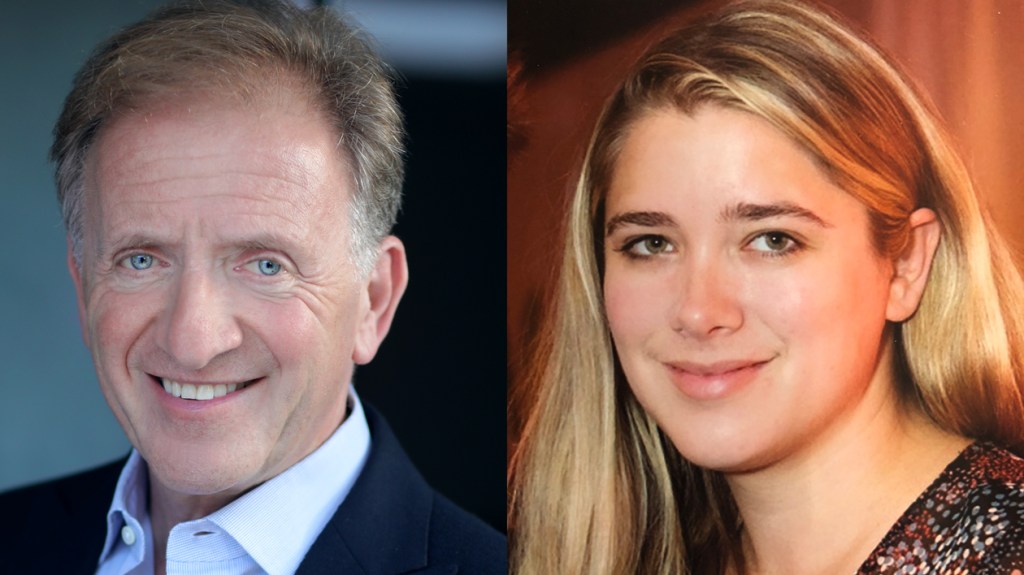

This is a family affair. My background was in real estate historically; I gave it up in 2010. All three of my kids are in the business; 12 on 12 is run by my daughter Claudia, Freddie runs the MyndStream business, and Tara [Finnegan] runs the bigger picture. Tara has done an exceptional job in this whole process, but we have really navigated together from the beginning. Tim Hegarty and the Cutting Edge M&A team, as well. The deal could not have been done without them.

Do you think more studios will do deals like the one Cutting Edge has done with Warner Bros. Discovery?

I hope so. We are having discussions with various rights owners who are interested in maximizing the value of their music rights either through a sale or a partnership with Cutting Edge. They are driven by different motivations, which include the ability to release equity from ancillary rights that are fully amortized on their balance sheets; or the opportunity to work with Cutting Edge’s team of professionals to help with supervision, exploitation, soundtrack release and marketing.

There should be no major obstacles since we have completed the deal with WBD and proved the value we can add to these types of copyrights. We operate in a very specialist area of the music business and each rights owner has their own specific needs. It takes time to create a bespoke offer to meet these needs, which Cutting Edge is uniquely placed to do.”

Warner Bros. Discovery on Friday (Jan. 31) entered into a joint venture with Cutting Edge Group, an investor and manager of niche media music rights, aimed at generating more revenue from its massive catalog of iconic film and TV songs, including the Harry Potter and Lord of the Rings franchises.

Cutting Edge, which works with wellness music for hotel spas and orchestral renditions of pop songs for shows like Bridgerton, will jointly manage the new business, while Warner Bros. Discovery will keep creative and operational control of the catalog. Global asset manager DWS Group co-invested and sponsored the transaction with Cutting Edge.

Warner Bros. Discovery previously explored selling part of its catalog and hired famed entertainment attorney Allen Grubman to shop it for as much as $1 billion. The launch of a company dedicated to exploiting the catalog of more than 400,000 compositions and song cues signals its potential value is even higher.

Trending on Billboard

The catalog spans almost 100 years of copyrights, including music from the DC Comics movies, Rebel Without a Cause, The Exorcist, A Star is Born, Blade Runner and Shawshank Redemption; and hit TV shows like Friends, Game of Thrones, The Big Bang Theory, Two and Half Men, Succession, The White Lotus, The West Wing, ER, Full House, Sex & The City and Gossip Girl.

Warner Bros. Discovery was formed in 2022 through the merger of AT&T’s WarnerMedia Unit and Discovery Inc. Universal Music Publishing Group will continue to administer the works from Warner Brothers, HBO and Turner Networks, while the works from Discovery and Scripps will continue to be administered by Sony Music Publishing.

“This partnership … is the perfect way to expand access to our unparalleled music library while honoring our long history of strong creative oversight and protecting the integrity of the works and artists,” Paul Broucek, Warner Bros. Discovery’s president of music, said in a statement.

Cutting Edge head Philip Moross said the joint venture was the result of years of work.

“This truly is an iconic assembly of catalogs created over almost a century by one of Hollywood’s original studios and to have the opportunity to invest in and manage this JV alongside WBD is an incredibly exciting prospect for us,” Moross said.

Cutting Edge said last year it secured a $500 million credit facility from Fifth Third Bank, Northleaf Capital Partners and other banks.

Warner Bros. Discovery is exploring a sale of its music assets that could be worth upwards of $1 billion, according to a source familiar with the matter. The catalog is being shopped by famed entertainment attorney Allen Grubman.

While the potential sale — which was first reported by The Financial Times — is still in the very early stages, some of Warner Bros. Discovery’s current music partners could be potential buyers.

Universal Music Group (UMG) already administers the publishing assets, which are likely the largest part of the deal, and Warner Music Group (WMG) distributes WaterTower Music, Warner Bros. Discovery’s in-house record label.

The assets being shopped, including music and production music from the company’s television and film projects, are not the kinds of music rights that have made headlines over the past couple of years as investors have flocked to the music business. Unlike most publishing rights or royalty streams, the Warner Bros. Discovery assets are not tied to the steady growth trend affecting traditional streaming. That’s because relatively few people head to Spotify to stream the soundtracks for Game of Thrones, The White Lotus or Batman, for example, even if the television and film projects are smash successes. As such, these type of assets have historically trade lower than popular music rights — typically in the single-digit multiples.

The asset valuations will likely be tied to broadcast trends, which are growing slower for film and television than for music. But due to the depth of the catalog, which dates back decades, the package will likely be seen as an attractive and stable investment for any major music company or private equity fund.

Warner Bros. Discovery formed last year through the merger of AT&T’s WarnerMedia unit and Discovery Inc.

Warner Bros. Discovery, UMG and Grubman did not respond to requests for comment at the time of publishing. WMG declined to comment for this story.

-

Pages

State Champ Radio

State Champ Radio