Touring

Page: 34

For anyone looking to escape the onslaught of terrible news in 2025, drag superstar Trixie Mattel has an offer: Why not come dance with a drag queen for a while?

On Tuesday (Feb. 4), Mattel announced her upcoming North American tour for her live DJ show Solid Pink Disco: Blonde Edition. Set to start on April 5 in Toronto, the 16-date trek will take the Drag Race All Stars winner through Atlanta, Denver, Pittsburgh, Los Angeles, Chicago and more cities, before closing out on June 3 in Washington, D.C.

Mattel’s new rendition of her live DJ sets will feature an array of other artists across different dates, including DJ Mateo Segade, Daya, Rebecca Black, Shea Couleé, Snow Wife, Vincint, Zolita and more special guests.

Trending on Billboard

“We need something to feel good about right now, and what better way than to put on your brightest pink and your blondest wig and dance surrounded by homosexuals?” Mattel tells Billboard in an exclusive statement shared with the news. “This Solid Pink Disco is going to be better and gayer than ever before.”

Mattel began performing DJ sets live after she discovered her passion for the artform during the pandemic. She revealed in a 2024 episode of her podcast The Bald and the Beautiful that she had decided to take a break from her career as a recording artist because she felt the “glass ceiling” of the music industry weighing on her.

“I recently have been taking a break from music because I feel the glass ceiling so fiercely,” she told Monét X Change in the episode. “We’re only ever taken seriously about one month a year. And it kind of takes the wind out of your sails. I want to make music, but if I don’t have this wig on, no one will pay attention. But because I have this wig on, no one will take it seriously.”

Tickets for Mattel’s Solid Pink Disco: Blonde Edition tour go on-sale starting Friday, Feb. 7 at 10 a.m. local time on the star’s touring website. Check out the full list of dates below:

Solid Pink Disco: Blonde Edition tour dates:

Saturday, April 5 – Toronto – History

Sunday, April 6 – Austin, Texas. – ACL Live at The Moody Theater

Thursday, April 17 – San Antonio – Boeing Center at Tech Port

Friday, April 18 – Brooklyn, N.Y. – Brooklyn Paramount

Saturday, April 19 – Atlanta – The Eastern

Thursday, May 1 – Denver – The Ogden Theatre

Friday, May 2 – Montreal – MTELUS

Saturday, May 3 – Pittsburgh – Stage AE

Thursday, May 8 – Los Angeles – Hollywood Palladium

Friday, May 9 – Oakland, Calif. – Fox Theater

Saturday, May 10 – Salt Lake City – Rockwell at The Complex

Thursday, May 15 – San Diego – Observatory North Park

Thursday, May 29 – Chicago – The Salt Shed

Friday, May 30 – Minneapolis – First Avenue

Saturday, May 31 – Nashville, Tenn. – The Pinnacle

Tuesday, June 3 – Washington, D.C. – Echostage

On Monday morning (Feb. 3), Beyoncé announced details for her Cowboy Carter Tour. Following shortly after 2023’s record-breaking Renaissance World Tour, she could add another $300 million to her career Boxscore total.

Like most weeks, it’s a good week to be Beyoncé. Last night, she won her record-extending 33rd, 34th and 35th Grammys, including album of the year for Cowboy Carter. But one night earlier, she teased a 2025 tour for her genre-busting album, and the morning after, she confirmed it with dates and venues.

Cowboy Carter Tour will take Beyoncé across the U.S. and over to Europe, just like the routing for the Renaissance World Tour. But while her 2023 trek took a relatively traditional route through 14 European cities and then another 25 in North America, her upcoming schedule is consolidated into a series of multi-night stops in major markets.

First, the tour will begin with four shows at SoFi Stadium in Inglewood, Calif., less than a half-hour drive from downtown Los Angeles. Then, two nights in Chicago and four in New Jersey (New York market). Next, Beyoncé will fly to London for four shows and to Paris for two. Finally, she’ll return Stateside for double-headers in Houston, Washington, D.C., and Atlanta.

With an initial routing of 22 shows, the Cowboy Carter Tour will be Beyoncé’s briefest solo headline tour yet, but that doesn’t mean it won’t register mammoth grosses. Using the same average ticket prices and per-show attendance from each city’s stop on the Renaissance World Tour, the 2025 trek would sprint to a finish of $294.3 million and almost 1.2 million tickets. Just two years removed from her last tour, a 4% inflation bump would bring her upcoming stint to $306 million.

But just as the initial announcement for the Renaissance World Tour grew from 41 shows to a final count of 56, additional dates for Cowboy Carter Tour could push its final gross further beyond the $300 million mark. And like its predecessor, its actual impact will go far beyond standard ticket sales.

By playing 22 shows in just eight markets over two and a half months, Cowboy Carter Tour reframes Beyoncé’s touring schedule and capitalizes on some of the frenzied energy that followed the Renaissance World Tour. During that trek, it was well–documented that fans were traversing across city, state and country lines, turning Renaissance shows into festival-style destinations. From travel and lodging to wardrobe and entertainment, the tour boosted local economies beyond the purchase of a concert ticket.

Channeling the scale of a world tour to eight major cities on either side of the pond, Cowboy Carter Tour teases each stop as a destination event. It makes sense, then, that Live Nation partner Vibee is providing curated experience packages that pair concert tickets with hotel stays and other VIP add-ons. While the company’s homepage shows similar packages for artist residencies like Bad Bunny’s upcoming 21 shows in Puerto Rico and various artists at Sphere in Las Vegas, Cowboy Carter Tour is the only proper tour featured. Further signaling a new era of concerts that double as immersive experiences, it’s another way to efficiently meet growing demand in the post-pandemic touring landscape.

Beyoncé’s Boxscore history has continued to bloom into the new decade. The Renaissance World Tour finished with $579.8 million and 2.8 million tickets in 56 shows. That’s more than double the take of 2016’s The Formation World Tour and 2018’s On the Run II Tour with Jay-Z ($256.1 million and $253.5 million, respectively), both of which had improved upon The Mrs. Carter Show World Tour ($211.9 million in 2013-14) and the original On the Run Tour ($109.6 million in 2014).

By design, simply due to the limited number of scheduled tour dates, it’s unlikely that Beyoncé will continue to one-up herself with Cowboy Carter Tour, but it will push her career totals to new heights. Dating back to the 2004 Verizon Ladies First Tour with Alicia Keys and Missy Elliott, and her first solo outing with 2007’s The Beyoncé Experience, the pop-dance-R&B-country superstar has grossed $1.3 billion and sold 11.6 million tickets over 431 reported concerts. By year’s end, those totals should climb past $1.6 billion and 12.8 million tickets.

Cowboy Carter Tour follows Beyoncé’s album of the same name. In addition to its Grammy win for album of the year, it made her the first Black artist to win best country album. Upon its release last Spring, the set debuted atop the Billboard 200 with 407,000 equivalent album units earned, according to Luminate, marking Queen Bey’s biggest week, by units, since Lemonade eight years prior. Cowboy Carter includes “Texas Hold ‘Em,” which topped the Billboard Hot 100 for two weeks and Hot Country Songs for 10 frames.

A ticketing reform law meant to clean up the concert industry has been revived in the U.S. Senate after nearly becoming law at the end of last year.

Originally introduced by representative Gus M. Bilirakis (R-Florida), the Transparency in Charges for Key Events Ticketing Act (TICKET Act) would introduce a number of reforms to the ticket-buying process. That includes rules to increase pricing transparency, which would require sports teams and concert promoters to clearly and prominently display the full price of a concert ticket, with fees and taxes added, so that the price they first see is the price they pay at checkout.

The TICKET Act died with the end of the 2023-2024 congressional term but has been reintroduced in the U.S. Senate by senators Eric Schmitt (R-Missouri) and Ed Markey (D- Massachusetts). It heads to the Senate Commerce Committee on Wednesday (Feb. 5) for a hearing.

Trending on Billboard

The TICKET Act would also mandate refunds for canceled events, ban speculative ticket sales and crack down on the unauthorized use of venues, teams and artists on resell sites designed to confuse fans. Born out of the bungled Taylor Swift ticket sale for her record-breaking Eras Tour — which was crashed by scalpers and billions of bots trying to buy up tickets to flip for profit — the TICKET Act passed the House Energy and Commerce Committee in December 2023 and passed the House in June of last year in a 344 to 24 vote. The bill was even included in the first iteration of the end-of-year Continuing Resolution spending bill signed by former president Joe Biden at the end of last year before eventually being pulled from it.

Whether or not the TICKET Act ends up on President Donald Trump’s desk, one of its key tenets — all-in pricing — was solidified in December by the Federal Trade Commission (FTC) when it announced a rule change tackling “junk fees.” The so-called Junk Fees Rule — which also applies to hotel rooms and airline fees — requires total price disclosure including fees for any event tickets listed for sale on the internet.

“People deserve to know up-front what they’re being asked to pay — without worrying that they’ll later be saddled with mysterious fees that they haven’t budgeted for and can’t avoid,” former FTC Chair Lina M. Khan said on Dec. 17, hours after FTC commissioners announced the rule change.

The TICKET Act isn’t the only bill designed to create a more hospitable ticketing marketplace for consumers — though some have claimed that violators of existing laws aren’t being held to account. In September, the National Independent Talent Organization (NITO) sent Khan a letter urging her to begin enforcing the 2016 BOTS Act, which prohibits scalpers from using technology that circumvents “a security measure, access control system, or other technological measure used to enforce ticket purchasing limits for events with over 200 attendees.” The Sept. 9 letter claimed NITO members had attended a ticket resale conference and “observed a sold-out exhibition hall filled with vendors selling and marketing products designed to bypass security measures for ticket purchases, in direct violation of the BOTS Act.”

In July, songwriter and music industry analyst Chris Castle wrote that the BOTS Act has only been enforced one time since its 2017 passage. He went on to argue that the government needs to focus on enforcing its existing laws before moving on to a new regime of legislation that will ultimately go “under-enforced.”

The directory business hasn’t changed much in the last 50 years, but a group of young entrepreneurs are looking to shake things up with the help of artificial intelligence.

Promoters and booking agents have long relied on printed and bound phone and email directories for connecting with the tens of thousands of venues that make up the global touring network. Booking a 25-date tour might require contacting more than 100 venues and clubs for calendar availability, creating reliable demand for companies like Pollstar, VenuesNow and groups like the International Association of Venue Managers to print and publish an updated version of their database each year.

Updating these directories can be a huge undertaking, requiring hundreds of phone calls, emails and queries by the publisher’s staff. Entrepreneur Benji Stein, founder of Booking-Agent.IO, believes there is a better way and his new plan could revolutionize the way valuable information, such as professional contact details, is compiled and monetized by publishers.

Trending on Billboard

Booking-Agent.IO’s data comes from regularly scraping the websites of major venues, and then analyzing and rating that data using AI tools. Contacts for each venue are cross-checked in real time against a number of databases including LinkedIn, Hunter.IO and Apollo, he said, and “searches specifically for the talent buyer of that venue, providing users with an email score” to rate the likely accuracy of the lead.

“We started building this tool a number of years ago, before the prevalence of ChatGPT,” Stein said, noting “it’s basically a search engine for talent buyers and for venues,” adding that “it allows you to see venues on a regional basis with information like capacity, upcoming events and social media links.”

Stein said he expects most current Booking-Agent.IO users to fit into the DIY category and are either self-represented or working with artists without a full-time agent. When available, BookingAgent.io also includes contact information for other positions like production manager and marketing director.

Pricing is $49.99 per month for the basic membership, which comes with unlimited searches and 100 contacts per month. Booking-Agent.IO also offers enterprise subscription plans and only charges users for contacts that are accurate.

“If you book a show with the tool, it essentially pays for itself,” he said.

Challenging Pollstar’s dominance and market share seems unlikely in the long-term, but Stein says when it comes to data accuracy, he believes Booking-Agent.IO has a long-term advantage, noting that print directories eventually become outdated and need to be replaced. As users look to purchase a more recent edition of their booking directory, Stein hopes buyers will increasingly seek out an alternative and find Booking-Agent.io.

“We’re very fresh. It’s a new tool,” Stein says. “Up until now, there’s been nothing like it and we’ve gotten really positive feedback from the kind of music industry people that we’ve onboarded.

SYDNEY, Australia — As Groovin the Moo disappears from the events calendar for the second successive year, a call for urgent assistance from the federal government.

Last Friday, Jan. 31, news broke of GTM’s decision to sit out its second successive year, joining Splendour In The Grass from the sidelines.

“It’s disappointing to see that Groovin the Moo, one of Australia’s longest-running touring festivals, will not be going ahead in 2025,” reads a statement from Olly Arkins, managing director of the Australian Festival Association, which counts GTM among its members.

Trending on Billboard

Regional festivals like GTM “play a vital role in connecting audiences with live music outside of major cities, providing opportunities for artists, local businesses, and festival workers,” the statement continues.

“But like many events across the country, the rising costs of production and ongoing challenges in the industry have made it increasingly difficult to operate.”

AFA’s Arkins says now is the moment for government to pump much-needed funds into “Revive Live,” part of the government’s National Cultural Policy, Revive, which launched in 2023.

The cancelation “highlights the urgent need for the Federal Government to extend Revive Live funding to ensure festivals of all sizes can continue to thrive. Festivals are essential to Australia’s cultural and economic landscape, and we look forward to seeing Groovin the Moo return in the future.”

Last Friday, festival producers Fuzzy shared the news no one wanted to hear. “Groovin The Moo won’t be happening in 2025,” reads a statement posted on social media, “while we work on finding the most sustainable model for Australia’s most loved regional touring festival.”

The message continues, “We will really miss seeing the smiling faces of all our beloved Moo Crew – and that means YOU! In the meantime, which artist would you most like to see on a GTM lineup?”

It was a similar story a year earlier, when organizers canceled the 2023 show due to poor ticket sales. That fest had been announced with a bill featuring Alison Wonderland, DMA’S, Jet, Armani White, GZA & the Phunky Nomads, the Jungle Giants and more.

GTM’s point of difference is in its route around the country, visiting primarily regional centers and bypassing Australia’s big three east coast cities (Sydney, Melbourne, Brisbane). The 2023 run was scheduled to start April 25 at Adelaide Showground, then visit sites in Canberra, Bendigo, Newcastle, Sunshine Coast and wrap up May 11 in Bunbury, Western Australia.

Established by Cattleyard Promotions, GTM’s first festival was held on April 2005 in Gloucester, New South Wales.

Through the years, a who’s who of edgy rock, pop, hip-hop and electronic music have graced its stages, from Vampire Weekend and Silverchair to Disclosure, The Darkness and many more.

GTM made international headlines in 2018 when its Canberra leg trialed pill testing, a first in Australia. A second trial was conducted in 2019, with more than 230 festival-goers reported to have used the pill-testing service, and seven substances were found to contain the potentially lethal n-ethylpentylone.

Researchers said the trial worked, and similar models are being rolled out at festivals in other states.

When the pandemic shut borders, grounded travel and social distancing became the norm, the festival brand halted its 2020 and 2021 events.

Australia’s colorful festivals marketplace is struggling under the weight of pressures coming at every angle, from the cost-of-living crisis, to the soaring price of securing talent and crew, changing ticket-buying behavior and more. Bluesfest director Peter Noble has described the troubles punishing the festivals industry as an “extinction event” – not everyone will survive, but life will go on and evolve.

Beyoncé is taking her Cowboy Carter album on the road.

On Sunday (Feb. 2), the 43-year-old superstar officially teased her 2025 Cowboy Carter Tour. Bey posted a short video on Instagram showcasing a large hanging neon sign that read “Cowboy Carter Tour,” accompanied by the sound of wind in the background.

In a follow-up post, she shared a promotional image of herself sporting blonde braids with the caption “Cowboy Carter Tour 2025.” Details about the upcoming trek remain under wraps, but the announcement came just hours before Sunday’s 67th Annual Grammy Awards, where she is expected to attend.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

After her headline-grabbing halftime show performance at the Baltimore Ravens vs. Houston Texans game on Christmas Day, the 32-time Grammy winner posted a cinematic teaser on social media hinting at a mystery project set for announcement on Jan. 14. Many fans speculated the reveal would be related to a tour in support of her country album Cowboy Carter, which topped the Billboard 200. These theories gained traction when Live Nation, which also backed her Renaissance World Tour, reposted her teaser content.

When Jan. 14 arrived, however, Beyoncé postponed the announcement, citing the devastating Los Angeles wildfires.

Trending on Billboard

“The January 14th announcement will be postponed to a later date due to the devastation caused by the ongoing wildfires around areas of Los Angeles,” she wrote on social media. “I continue to pray for healing and rebuilding for the families suffering from trauma and loss. We are so blessed to have brave first responders who continue to work tirelessly to protect the Los Angeles community.”

Beyoncé’s Renaissance World Tour was named Billboard‘s top-grossing tour of 2023, earning nearly $580 million and attracting 2.8 million concertgoers across 56 shows, according to Billboard Boxscore.

In addition to her tour news, Beyoncé — who was named Billboard’s Greatest Pop Star of the 21st Century in 2024 — is dominating the 2025 Grammy nominations with 11 nods. Cowboy Carter is nominated for album of the year and best country album. The set’s lead single “Texas Hold ‘Em” is up for song of the year, record of the year and best country song.

The 2025 Grammy Awards will be broadcast live from Los Angeles’ Crypto.com Arena on Sunday (Feb. 2) at 8 p.m. ET on CBS.

Approximately 900 people joined a town hall meeting hosted by Burning Man Project on Saturday (Feb. 1) with the organization’s CEO Marian Goodell, along with other staffers, making myriad announcements regarding the 2025 event, including information regarding a tiered ticketing system with new prices.

The town hall happened after months of fundraising efforts by Burning Man Project — the nonprofit behind the annual gathering in Nevada’s Black Rock Desert and other Burning Man-related initiatives –after it reported a $10 million deficit due, as Goodell explained to Billboard in November, 2024 tickets not selling as forecasted.

The financial issue was compounded when Burning Man 2024 failed to sell out for the first time in many years. In November, Goodell said all ticket tiers saw decreased sales in 2024 and estimated that attendance was down by roughly 4,000. As such, in the latter part of 2024, Burning Man spent months trying to raise $20 million (with 2024’s $10 million deficit added to $10 million the organization typically raises every year) through a subscription program that encouraged Burners from around the world to make monthly donations to Burning Man Project.

Trending on Billboard

In the Saturday meeting, Goodell noted that the organization did not meet this fundraising goal, although she did not announce how much money was raised. (Goodell did note that a December campaign to raise $3 million was a success, and elaborated on the organization’s financial picture in a recent blog post.) She added that Burning Man Project “did manage to reduce our internal spending and budget by 9%… and will continue to tightly manage operating expenses and capital expenses across the organization.”

Goodell and the team then unveiled a revamped ticketing program, with new and updated price tiers. Tickets for Burning Man 2025 will start at $550, with prices scaling up from there — $650, $750 and $950m and more.

Tickets will be sold in three separate public sales, with the first happening on Feb. 12. Tickets in this sale (dubbed the “Today Sale”) will be $550, $650, $750, $950, $1,500, and $3,000, plus applicable taxes and fees. Registration for this sale opens on Monday (Feb. 3), with the sale offering a limited number of tickets available at each price. The Burning Man site notes that “$550 and $650 tickets are expected to sell quickly.” The meeting did not address how many tickets will be available at each price point.

Since 2022, Burning Man’s main sale tickets cost $575, an increase from $475 in 2019. (Burning Man didn’t officially happen in 2020 or 2021 due to the pandemic.) Therefore, many 2025 main sale tickets will be sold at a higher price than in previous years. In the meeting, Goodell emphasized that making new tiers (with ticket tiers previously offering no tickets between $550 and $1,500) provides more pricing options than ever before and “helps keep ticket prices affordable”

Beyond this first sale, the annual Steward’s Sale will happen on March 5, with these tickets going to camps, art installations, art cars, and groups supporting organizational initiatives having access to attending the event. The Stewards Sale has its own ticket price allotments reserved unrelated to other ticket sales.

Another ticket sale (dubbed the “Tomorrow Sale”) will happen at to be determined date and include ticket tiers based on ticketing availability following the “Today Sale.” A final sale (the annual “OMG sale”) will happen in July and offer any remaining tickets across all the price points.

Meanwhile, two new programs — the “Renaissance Program” and “Resilience Program” — will debut with the goal of bringing networks and groups to Black Rock City and brings people affected by natural disasters and geographical conflict, respectively. More information regarding these programs will be announced in the coming weeks and months.

Goodell alluded to backlash over the recent fundraising campaign among factions of the global Burning Man community, saying that “with the event selling out every year, we [previously] didn’t need to explain that tickets do not cover the event cost and that philanthropy is needed, but the game has changed, and we should have brought you along better on this journey and we appreciate you sticking with us… We are learning and improving, reducing bureaucracy and red tape, and we hope that you see and feel this in how you engage with us and one another.”

The meeting featured presentations from several members from Burning Man Project, with operations director Charlie Dolman explaining several new processes, including an expedited process to acquire the vehicle passes that allow Burners to drive through the event. Burning Man will also issue new “decommodification guidelines” meant to, as Dolman said, address “cultural issues,” along with a more organized ingress and egress system. (In previous years it’s taken some attendees roughly 12 hours to leave the event.)

“Over the last last few months we’ve gotten a lot of feedback from a lot of people, and I just want to say that we’ve heard you, and honestly even when it’s been uncomfortable we’ve kept our eyes and ears open. We want that feedback,” Dolman said, continuing that “in places we’ve overcomplicated things and we’ve made things too bureaucratic maybe, and that’s no fun. That has all been done with good intention… but also it became not fun, so we needed to course correct.”

Later in the presentation, Goodell also noted a new attempt to push back on costs related to the Bureau of Land Management, with fees from the organization typically coming in at $8 million. “I think we’re going to see some improvements in costs with the BLM,” she disclosed.

Lainey Wilson‘s career whirlwind will continue surging this year, when the 2023 CMA entertainer of the year winner launches her Whirlwind World Tour in March.

The nearly 50-date trek will feature openers Maddox Batson, Kaitlin Butts, Ernest, Zach Meadows, Drake Milligan, Muscadine Bloodline and Lauren Watkins at various shows. The Whirlwind Tour, which takes its name from Wilson’s 2024 album, will play across Europe, Canada and the United States, hitting London’s O2 Arena, Los Angeles’ Kia Forum, Nashville’s Bridgestone Arena and New York’s Madison Square Garden along the way.

Explore

See latest videos, charts and news

See latest videos, charts and news

Wilson revealed the tour in a comedic skit with openers Ernest and Muscadine Bloodline’s Charlie Muncaster and Gary Stanton that plays with the tour’s title. Wilson portrays a meteorologist, who is telling viewers about a powerful whirlwind that is ripping through (tour stop) cities across the U.S., while Ernest and Muscadine Bloodline portray fellow newscasters/weathermen impacted by the whirlwind.

Trending on Billboard

Wilson’s album Whirlwind is currently nominated for best country album at the upcoming 67th annual Grammy Awards, which are this Sunday (Feb. 2).

See the full list of tour dates below.

March 4: Zurich, CH (X-TRA)~

March 6: Antwerp, BE (De Roma)~

March 8: Rotterdam, NL (Rotterdam Ahoy)

March 9: Berlin, DE (Uber Eats Music Hall)

March 12: Copenhagen, DK (Vega Main)~

March 14: London, UK (O2 Arena)

March 15: Belfast, N. Ireland (SSE Arena)

March 16: Glasgow, Scotland (The SSE Hydro)

March 18: Kingston upon Thames, UK (Banquet Records)

March 19: Paris, FR (Elysée Montmartre)~

May 30: Panama City Beach, Fla. (Pepsi Gulf Coast Jam)

May 31: Lexington, Ky. (Railbird Festival)

June 6: Myrtle Beach, S.C. (Carolina Country Music Fest)

June 20: Wildwood, N.J. (Barefoot Country Music Fest)

June 26: Milwaukee (Summerfest)

June 27: Cadott, Wis. (Country Fest)

July 12: Cavendish, PEI (Cavendish Beach Music Festival)

Aug. 14: Phoenix (Footprint Center) *

Aug. 15: Albuquerque, N.M. (Isleta Amphitheater)*

Aug. 16: Denver (Ball Arena) *

Aug. 21: Bend, Ore. (Hayden Homes Amphitheater)*

Aug. 22: Sacramento, Ca. (Golden 1 Center)*

Aug. 23: Los Angeles (Kia Forum)*

Aug. 28: Calgary, AB (Scotiabank Saddledome)*

Aug. 29: Edmonton, AB (Rogers Place)*

Aug. 30: Saskatoon, SK (SaskTel Centre) *

Sept. 11: Baton Rouge, La. (Raising Cane’s River Center) †

Sept. 13: Bossier City, La. (Brookshire Grocery Arena)†

Sept. 18: Austin, Texas (Moody Center) ‡

Sept. 19: Fort Worth, Texas (Dickies Arena)‡

Sept. 20: Houston (The Cynthia Woods Mitchell Pavilion presented by Huntsman) ‡

Sept. 25: Toronto, Ontario (Budweiser Stage) §

Sept. 26: Clarkston, Mich. (Pine Knob Music Theatre) §

Sept. 27: Grand Rapids, Mich. (Van Andel Arena) §

Oct. 2: Nashville, Tenn. (Bridgestone Arena) ||

Oct. 3: Noblesville, Ind. (Ruoff Music Center) §

Oct. 4: Cleveland, Ohio (Blossom Music Center) §

Oct. 9: Columbia, Md. (Merriweather Post Pavilion) §

Oct. 10: New York (Madison Square Garden) §

Oct. 11: Mansfield, Ma. (Xfinity Center) §

Oct. 16: St. Louis, Mo. (Hollywood Casio Amphitheatre) ||

Oct. 17: Rosemont, Ill. (Allstate Arena) ||

Oct. 18: Saint Paul, M.N. (Xcel Energy Center) ||

Oct. 24: Knoxville, Tenn. (Thompson-Boling Arena at Food City Center) #

Oct. 25: Charlotte, N.C. (Spectrum Center)#

Nov. 7: Tampa, Fla. (Amalie Arena) #

Nov. 8: Orlando, Fla. (Kia Center) #

~with special guest Zach Meadows

*with special guests ERNEST and Kaitlin Butts

†with special guests ERNEST and Maddox Batson

‡with special guests Muscadine Bloodline and Drake Milligan

§with special guests Muscadine Bloodline and Lauren Watkins

||with special guests Muscadine Bloodline and Maddox Batson

#with special guests ERNEST and Drake Milligan

Hitsujibungaku announced its first first U.S. tour, the Hitsujibungaku US West Coast Tour 2025, set to kick off April 10 in San Diego, California. The three-piece alternative J-pop band’s trek is scheduled to make stops in San Diego, Los Angeles, San Francisco and Portland, Oregon. Canadian pop singer Jonathan Roy will accompany the group to […]

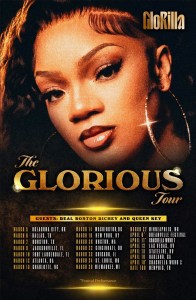

GloRilla is hitting the road. Coming off a banner 2024 campaign full of wins, Big Glo announced plans for The Glorious Tour on Wednesday night (Jan. 29). The North American trek will see support from Real Boston Richey and Queen Key as opening acts. The tour will kick off in Oklahoma City on March 5 […]

State Champ Radio

State Champ Radio