Streaming

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Trending on Billboard

Tonight, the world of country music is celebrating the holidays. ABC’s CMA Country Christmas musical special is back and bringing with it a jam-packed lineup of performances to a live audience in Nashville. Hosted by by Jordan Davis and Lauren Dangle, fans can expect a very merry, festive lineup of country stars including Riley Green, Lady A, Little Big Town, Parker McCollum, Megan Moroney, Preservation Hall Jazz Band, Susan Tedeschi, Derek Trucks, and BeBe Winans.

Explore

See latest videos, charts and news

Watch CMA Country Christmas, at a Glance:

Don’t have cable? There’s plenty of ways to stream tonight’s Christmas special online and even for free. Keep scrolling to check out our guide to watching the CMA Country Christmas Special.

How to Watch CMA Country Christmas Without Cable for Free

With the CMA Country Christmas special streaming on ABC, there are a few great streaming options that will let you watch ABC online for free or for a discounted price. All the below streamers let you watch ABC online without cable and stream content from your phone, tablet, computer or smart TV. Check below to find the right option for your viewing needs.

DirecTV

You can watch ABC online for free on DirecTV, which is offering a 5-day free trial for new users who sign up for one of the four packages. DirecTV lets you watch live television online and its channel packages include a live feed of ABC.

Besides access to hundreds of live TV channels, you’ll also receive unlimited DVR storage, local channels and the ability to stream on as many devices as you want. After your free trial, DirecTV plans start at $49.99/month.

Fubo TV

FuboTV is another affordable live TV streamer as it comes with a five-day free trial for new users who sign up. The streaming service has three different plans, including a new skinny bundle called “Sports + News” that starts at only $45.99 for the first month ($55.99 per month afterwards). In addition, Fubo has $30 off their Pro and Elite plans for the first month right now, which includes more than 300 channels, as well as 1,000 hours of free DVR and the option to stream on 10 devices at once.

Sling TV

Sling TV is offering new half off off their first month with any of its three packages. You can choose from: the Orange, Blue or Orange + Blue. However, ABC is only offered on the Blue package, but you can watch simulcasted games on ESPN3 (which is only offered on Sling’s Orange package). Rather than choose between the two, you can combine the two with the Orange + Blue package, which will give you access to more than 50 channels, DVR storage and the ability to stream on up to three devices.

Hulu + Live TV

A subscription to Hulu + Live TV gets you more than 95 live TV channels, such as ABC, to watch live sports, TV series and specials whenever you want. You also get access to the entire Hulu on-demand library (including select ABC content available to watch the day after it airs).

Right now, the streamer is offering three-day free trial. Once the trial is over, a regular subscription starts for $89.99 per month.

For even more content options, Hulu + Live TV includes a subscription both Disney+ and ESPN Unlimited, which will give you access to more sports coverage and ESPN exclusive content.

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Trending on Billboard

Apple TV raised its monthly subscription price back in August of this year to $12.99 a month; however, you can sign up for the service for just $5.99 a month right now.

Explore

See latest videos, charts and news

That’s over 50% off on the first six months. This will give subscribers access to a slew of Apple TV classics like The Morning Show, Ted Lasso and Severance, in addition to live sports like Major League Baseball and Major League Soccer. Today, Dec. 1, is the last day you can take advantage of this deal before it’s gone for good. After the six-month promotional period has passed, your subscription price will go back up to $12.99 a month. We’ve never seen a deal like this before on Apple TV, especially one as affordable as this.

Some of our favorite music-related content that you can stream via Apple TV includes the drama-filled Love & Hip-Hop Miami, FX’s documentary on the Sex Pistols titled Pistol, films like School of Rock, Wu-Tang Clan: Of Mics and Men, George & Tammy, the musical hit Smash and the ever-popular K-pop-centric competition show where musicians reimagine their hits with K-pop idols and go head-to-head in song battles KPopped. With so much music content to stream, we think the service is a must-have for our readers, especially if you want to keep up on the “what’s what” of all things music.

Get Apple TV for $5.99

$5.99

$12.99

54% off

A streaming deal for Apple TV.

You can also take advantage of this $5.99 a month streaming deal via Amazon’s Prime. To tap in, you’ll want to subscribe to the Apple TV channel add-on within the Prime Video app to get started. That way, you’ll have access to a ton of Apple TV and Prime Video titles, all in one place at no extra cost to you. It’s a win-win situation. Other channels that you’ll find in the Black Friday Amazon streaming deal include Hallmark+, Acorn TV, Britbox, Vix, PBS Masterpiece and PBS Kids. You can also get streaming bundle subscription deals like BET+ and Starz together for just $3.99/month here (regularly $15.99).

Keep in mind, you’ll need to be an Amazon Prime member to take advantage of this Prime Video channels streaming deal. If you’re not a Prime member, you can use this link to get a 30-day free trial here. This will give you access to shop this Prime Channels deal, along with a plethora of the last of the retailer’s Black Friday deals.

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Trending on Billboard

Ready to get into the holiday spirit? Disney is here to help.

On Monday, Dec. 1, 2025, Disney will be hosting The Wonderful World of Disney: Holiday Spectacular at 8:00 p.m. EST/PST on ABC. This marks the show’s 10th anniversary. The seasonal celebration will feature new musical performances from Walt Disney World Resort in Florida, Disneyland Resort in California and Aulani and a Disney Resort & Spa in Ko Olina, Hawaii. Notable performers that you’ll want to catch live will include Bebe Rexha, Derek Hough, Gwen Stefani, Trisha Yearwood and Nicole Scherzinger, among others.

The event first began back in 2016 and has featured some major musical guests in the past, including Kelly Clarkson, Garth Brooks, Trisha Yearwood, OneRepublic, Alessia Cara, Ciara, Darius Rucker, Fifth Harmony, Jason Derulo and Lea Michele.

Explore

See latest videos, charts and news

Where to Watch The Wonderful World of Disney: Holiday Spectacular 2025

The Wonderful World of Disney: Holiday Spectacular 2025 will go premiere Monday (Dec. 1) on ABC. You can tune in to the special via your local affiliate channel, which can be found using the on-screen guide for DirecTV.

Right now, the service’s Entertainment package is available for $49.99 a month, a package which includes access to ABC. Along with you your subscription to this package, you’ll have access to 90+ local channels ESPEN Unlimited and Disney+ and Hulu bundle with ads and 130+ MyFree DIRECTV channels.

If you don’t have time to tune in live, you can stream the show the next day with a Hulu with Disney+ bundle for just $12.99/month. These Disney+ bundles save users on average 44% per month. Think of it this way. A standalone subscription to Hulu and or Disney+ with ads is 11.99/month, which is basically the cost of the aforementioned bundle. You’re getting more bang for your buck by bundling because it gives you access to a wider variety of streaming services all in one place. Stick with us. Your wallet will thank you.

Bundle subscribers will have access to a vast range of Disney+ and Hulu titles, including movies and series from Disney, Pixar, Marvel, Star Wars and National Geographic along with Hulu Originals. Some of our favorites currently, perfect for getting you into the Christmas mood, include A Very Jonas Christmas Movie, Elf, Die Hard and The Polar Express. If you’re not ready to jingle your bells, you can always tap into other cheerful content including The Fantastic Four: First Steps, The Roses, Elio, Dancing with the Stars and the Glen Powell football comedy Chad Powers.

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Trending on Billboard

BTS‘ Jung Kook and Jimin are back for a second season of adventure for their hit show Are You Sure?!

The eight-episode season will premiere on Dec. 3 and sees the duo break new ground by traveling to Switzerland and Vietnam. Two episodes will be released each week up until Dec. 24. The season was filmed after both members completed their mandatory military service.

According to a press release, this season sees Jungkook and Jimin “embarking on an unforgettable 12-day journey that spans from the majestic mountains of Switzerland to the vibrant shores of Vietnam. Traveling light with only their luggage, a modest budget, and a trusty guidebook, the pair dive into a mix of thrilling adventures, serene getaways, and spontaneous, fun-filled moments.” Sounds like good TV to us.

Explore

See latest videos, charts and news

The show’s first season became the most-watched non-drama series globally for 42 days according to Disney+ and saw the boy band members explore New York, South Korea’s Jeju Island and Sapporo, Japan.

The show’s second season will be the metaphoric table-setter for the main course, which will find the pair reuniting with Jin, Suga, RM, J-Hope and V next year now that all the group’s members have completed their military training. The group released their last studio album, Be, a whopping five years ago. The full-length offering debuted at No. 1 on the Billboard 200 in Nov. 2020.

In the meantime, if you want to tune into the latest season of Are You Sure!?, we’re showing you how below.

How To Watch “Are You Sure?!”

The second season of Are You Sure!? will be available to stream on Disney+ starting Dec. 3.

While you could get a solo subscription to Disney+ for $11.99 a month, you could also get two streaming services for the price of one by bundling Hulu with Disney+ for $12.99/month. These Disney+ bundles save users on average 44% per month. Think of it this way. A standalone subscription to Hulu and or Disney+ with ads is 11.99/month, which is basically the cost of the aforementioned bundle. You’re getting more bang for your buck by bundling because it gives you access to a wider variety of streaming services all in one place. Stick with us. Your wallet will thank you.

Bundle subscribers will have access to a vast range of Disney+ and Hulu titles, including movies and series from Disney, Pixar, Marvel, Star Wars and National Geographic along with Hulu Originals. Some of our favorites currently, perfect for getting you into the Christmas mood, include A Very Jonas Christmas Movie, Elf, Die Hard and The Polar Express. If you’re not ready to jingle your bells, you can always tap into other cheerful content including The Fantastic Four: First Steps, The Roses, Elio, Dancing with the Stars and the Glen Powell football comedy Chad Powers.

Watch the Trailer for Season 2 of “Are You Sure?!” Below

Trending on Billboard

The hard hats came off for the first official concert at TD Coliseum in Hamilton, Ontario last Friday night (Nov. 21) — and it started with a bang.

The first show at the former Copps Coliseum and FirstOntario Centre arena since its nearly $300-million transformation by American sports and live entertainment company Oak View Group was one of the most prominent music legends still playing today: Sir Paul McCartney. That’s a big flex for a venue aiming to prove itself as both a relief valve for the red-hot Toronto live music touring market and a destination in its own right, as well as Oak View Group’s new flagship venue in Canada.

Related

McCartney has a discography packed full of some of the most immortal songs of all time from the Beatles to Wings to his solo career, and the multigenerational crowd that packed the sold-out 18,000-capacity venue showed their appreciation by shouting and singing along with every song.

Partway through the set, the 83-year-old artist took an informal poll: “How many of you here are actually from Hamilton?” he asked, before repeating the question asking how many are not. Judging by the cheers, it sounded like 60-40 out-of-towners to Hamiltonians. It’s been nearly 10 years since McCartney last played the city, and he made it count with a marathon 36-song setlist that lasted close to three hours.

The arrival of TD Coliseum may be described as an upgrade of an existing arena, but that tag seriously underplays the significance of what is a genuinely dramatic $300 million transformation of the 18,000-capacity venue.

The ribbon cutting on Nov. 20 was attended by Ontario Premier Doug Ford (taking time out on his birthday), several of his provincial cabinet members, the mayor of Hamilton, Andrea Horwath, and high-level representatives from Oak View Group, the Denver-based international venues giant in charge of the project, and its partners, including TD Bank and Live Nation Canada.

Nick DeLuco, senior vice president and general manager of TD Coliseum, launched the event by recalling that “749 days ago, we were here, talking about a vision, a dream of what this venue was going to become, and now it’s real.”

Read more on the opening McCartney concert here and the opening of TD Coliseum here. — Richard Trapunski and Kerry Doole

—

Macklam Feldman Management Celebrates 30th Anniversary

Macklam Feldman Management (MFM) is celebrating 30 years.

As the Canadian-born international talent agency embarks on its third decade, the company is welcoming new team members and a bevy of emerging talent.

Founded in Vancouver in 1995 by industry titans Stephen Macklam and Sam Feldman, the partnership initially emerged to manage Irish folk band The Chieftains. The success of the group proved their joint prowess — and Macklam Feldman Management was born.

Related

Since then, the management company — a subsidiary of Feldman’s A&F Music Ltd. — has overseen and guided the careers of some of the biggest artists in the world including Joni Mitchell, Norah Jones, Leonard Cohen, Bette Midler, Tracy Chapman and James Taylor alongside a roster that today includes legends Sarah McLachlan, Diana Krall, Elvis Costello, Colin James and more.

“We’ve been fortunate to work with some of the most iconic artists in the world, and this recent momentum marks the most concentrated period of investment in artist development since the company was founded,” Feldman tells Billboard Canada.

While working with icons like McLachlan and Costello, Macklam and Feldman are music industry legends in their own right. (The latter also founded The Feldman Agency, one of Canada’s biggest booking agencies, before selling the namesake company to his executive team in 2019.) Recently, however, MFM has increasingly invested in artist development.

Over the last two years, MFM has expanded its team with four new staff members — Samuel Chadwick, Sam Hughes, Connor Macklam and Wesley Attew — who are dedicated to artist development and digital marketing. They will work with artist managers Scott Oerlemans and Kyle Kubicek to strengthen MFM’s artist development and digital marketing operations for their growing roster.

Over the past year, they have welcomed a new wave of artists, including American singer-songwriter aron!, rock band Tommy Lefroy, U.K. post-punk band YAANG and country singer Dawson Gray. They join 2022 signees, emerging folk-pop trio Tiny Habits, who recently opened for McLachlan on her 30th anniversary Fumbling Towards Ecstasy tour. Each brings a fresh musical perspective and global prospects to the agency.

Read more here. — Heather Taylor-Singh

—

New National Report Calls for Boost to Indigenous Music ‘Discoverability’ in Canada’s Streaming Era

As Canada updates its rules for how streaming platforms support local culture, a key opportunity is emerging to strengthen the visibility of Indigenous music at home and abroad.

The Indigenous Music Office (IMO) has released a new study that sheds light on the challenges affecting Indigenous artists and music companies accessing international markets.

Related

Pathways to International Markets: A Strategy to Increase Export Capacity for Indigenous Music is the music organization’s first major research project. The study establishes four key strategic directions that identify the roles that funders, music industry organizations and partners play in increasing financing, professional development and discoverability for Indigenous artists and industry professionals.

In the study, the IMO highlights that export activities generate significant career development opportunities for Indigenous music artists. However, most funds available to the Canadian music industry lack a strategic focus on assisting the development and export of Indigenous music.

“A strategy to increase the export capacity of the Indigenous music sector is timely as demand for Indigenous music is growing in Canada and around the world,” the report reads.

This includes financing the growth of a domestic Indigenous-owned and led music ecosystem, strengthening export readiness of Indigenous artists, prioritizing international showcasing, touring and networking and promoting discoverability of Indigenous music on streaming and broadcasting platforms.

The study calls for promoting “discoverability of Indigenous music on streaming and broadcasting platforms” as the most specific pathway for Indigenous artists and organizations to reach larger audiences.

In addition to working closely with the CRTC on the implementation of Online Streaming Act, the IMO has assisted in the development of the commission’s new Indigenous Broadcasting Policy, in partnership with First Nations, Métis and Inuit broadcasters, along with Indigenous content creators and audiences.

The study was developed amidst the implementation of the Online Streaming Act, a once-in-a-generation update to CanCon regulations, and ongoing Canadian Radio-television and Telecommunications Commission (CRTC) hearings. In September, various Canadian music orgs voiced their opinions on the changes, one of which highlights the importance of artist discoverability for Indigenous musicians.

An important part of the hearings was last year’s CRTC decision to enforce major foreign-owned streaming services with Canadian revenues over $25 million to pay a now-paused 5% of revenues into Canadian content funds, like the Indigenous Music Office and FACTOR.

Read more here. — HTS

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Brandy has been winning over sold out crowds on her “The Boy Is Mine Tour” with Monica, but the multitalented star is hoping to win over television viewers tonight with the premiere of her brand new holiday film, Christmas Everyday.

Explore

See latest videos, charts and news

The new film stars Brandy alongside her daughter Sy’rai, who makes her acting debut playing Brandy’s younger sister in the movie. Airing tonight, Saturday, Nov. 29 at 8 p.m. ET/PT, Christmas Everyday is Lifetime’s first original holiday movie of 2025 and sure to be a fan favorite.

Want to watch Christmas Everyday on TV? You can tune in to Brandy’s new Christmas movie by using any cable package that includes the Lifetime network. Don’t have cable? There are also a few ways to watch Christmas Everyday online.

How to Watch Christmas Everyday Online Free

If you want to livestream Christmas Everyday as it airs on Lifetime tonight, sign-up for a free trial to DirecTV, which lets you watch 90+ live TV channels over the internet with no commitment. DirecTV’s current channel lineup includes Lifetime, so you can use it to watch Christmas Everyday online without cable.

Test out DirecTV with a five-day free trial here and continue with one of their streaming packages from just $49.99/month. Or you can cancel at any time.

You can also watch Lifetime channel online free through Frndly TV, which offers a seven-day free trial here. Frndly TV is one of the most affordable streaming services online, with more than 50 live TV channels that you can watch from just $6.99/month. A bonus: this Black Friday offer gets you a monthly subscription for just $0.99 for a limited time.

Sign up for the Frndly TV deal here or use their free trial to watch Christmas Everyday on Lifetime online for free. Or you can try Philo, which offers a live Lifetime channel feed in addition to 70 other channels, plus HBO Max included for just $38/month.

All of the above services let you livestream Christmas Everyday live online as it airs on Lifetime. If you want to watch it on demand, Brandy’s new holiday film is expected to be available on Lifetime Movie Club, the network’s exclusive streaming home. You can get a free trial to Lifetime Movie Club here and use it to watch Christmas Everyday on-demand from home.

What Is Christmas Everyday About?

Christmas Everyday follows Fancy (Brandy) who is left to organize Christmas after her father’s untimely death and her mother’s health begins to deteriorate. As if that wasn’t enough, Fancy has to deal with her bridezilla sister (Sy’rai), whose wedding is coming up at the same time. Of course as with every Lifetime romance movie, there’s some fairy tale magic involved as well. As a movie description teases, “Fancy finds herself unexpectedly drawn to the rugged, yet charming, contractor Jaylen (Robert C Riley) who is tasked with the repairs and renovation of the family home,” after a water pipe bursts and threatens to derail everyone’s holiday plans. “Through all the chaos, Fancy learns valuable lessons about faith, family, and the true meaning of Christmas,” a press release says.

Christmas Everyday is executive produced by Brandy and marks the first time she appears on screen with real-life daughter Sy’rai. In a statement, Brandy says, “The holidays are always about family as part of the festivities,” adding that she’s “thrilled” to have “my own daughter star with me – even though we are playing sisters! Lifetime movies have become such a beloved tradition, and I’m honored to star and executive produce.”

Christmas Everyday airs tonight, Nov. 29 at 8 p.m. on Lifetime. The two-hour film will be followed by the premiere of The Christmas Campaign, starring Vivica A. Fox and Jackée Harry. Watch everything live online with a free trial to DirecTV here.

Trending on Billboard Kelly Clarkson has officially joined Spotify’s Billions Club. The 43-year-old pop superstar and talk show host earned her place in the streaming service’s elite circle as her hit “Since U Been Gone” became her first song to surpass 1 billion streams on Spotify. The pop-rock anthem was released as the second single […]

Trending on Billboard

SYDNEY — Australia’s federal parliament has passed legislation that will enforce content quotas for popular streaming video on-demand platforms.

Earlier this month, the national government announced it would push ahead with quotas, that would require those services with over 1 million domestic subscribers to invest 10% of total program expenditure for Australia, or 7.5% of their total Australian revenue, to support local storytelling.

Now those points become law.

Explore

See latest videos, charts and news

There’s a strong incentive to play by the rules. The Bill provides the Australian Communications and Media Authority (ACMA) with “substantial powers” to determine compliance. Failure to do so would see the streaming businesses face large civil penalties, with fines of up to ten times their annual Australian revenues.

“We have Australian content requirements on free-to-air television and pay television, but until now, there has been no guarantee that we could see our own stories on streaming services,” comments Australia’s arts minister Tony Burke. “Streaming services create extraordinary shows, and this legislation ensures Australian voices are now front and centre. Now, no matter which remote control you’re holding, Australian stories will be at your fingertips.”

With that investment, the likes of Netflix, Disney, Amazon and other SVOD services operating in these parts will be compelled to create more local content, from drama, children’s programming, documentaries, arts programs and educational shows.

“Today marks a watershed moment for Australian storytelling and the music that brings screen stories to life,” reads a statement from Dean Ormston, CEO of APRA AMCOS. “This legislation means local composers will have unprecedented opportunities to contribute to the next era of local screen creation.”

Passing in parliament on Thursday night, Nov. 27, the Communications Legislation Amendment (Australian Content Requirement for Subscription Video On Demand (Streaming) Services) Bill 2025 should create “substantial new opportunities” for Australian screen composers and music creators, according to APRA AMCOS.

Eligible programs must pass the scrutiny of the Australian Content Test Standards (ACTTS), which sets the bar applied to commercial and subscription television services, including post-production in Australia.

Additionally, the legislation has been supported by the Greens and includes an extra A$50 million ($32 million) in funding for the Australian Broadcasting Corporation (ABC) to invest in homemade children’s and drama content.

“Screen music is fundamental to storytelling – it drives emotional connection and defines the cultural fingerprint of Australian productions,” adds Ormston. “The IP developed by our screen composers represents valuable cultural and economic assets that resonate with audiences both here and around the world.”

Screen Producers Australia welcomed the development. “Today is a landmark day for Australian screen storytelling,” remarks SPA CEO Matthew Deaner, nothing the organization’s members had worked “patiently and tirelessly” on the issue for more than 10 years, roughly the time when Netflix switched on. “It finally puts in place a strong starting point for a regulatory framework that responds to the enormous changes that digital streaming platforms have made to our industry dynamics and viewing habits.

Adds Australian Writers’ Guild CEO Claire Pullen: “This is a watershed moment for Australia’s screen industry. This will give our members and the entire creative community more certainty around their careers, and the industry here at home.”

The new rules should’ve been implemented in 2024 but were delayed over concerns on how they might create a stumbling block for Australia’s trade agreement with the United States.

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Trending on Billboard

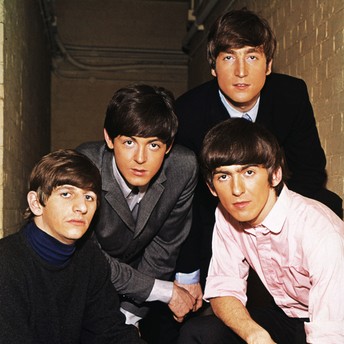

You know them, you love them, and now, The Beatles’ legacy is being immortalized in a re-released anthology series.

The iconic British band has amassed a whopping 20 number one hits on Billboard’s Hot 100, with famed tracks like “Hey Jude,” “Get Back,” and “I Want To Hold Your Hand,” holding the record for the most No. 1’s since 1965. The band’s musical reach is unmistakable, which is why Peter Jackson’s Park Road Post digital team and Apple Corps’ multimedia production team have restored and remastered the 1995 anthology series about the band, set to stream on Disney+.

The Beatles Anthology will feature previously unseen footage restored in vivid fashion. We’ll see The Beatles journey from Liverpool to becoming a global phenomenon as told through the perspective of all four members. The original eight episode documentary featured long-form interviews with the band along with archival concert footage and studio sessions.

Explore

See latest videos, charts and news

The production team behind the remastering has worked on several Beatles projects in the past, including the 2021 documentary The Beatles: Get Back and the original Let It Be film, which they restored. Keep reading for more details on how to watch The Beatles Anthology.

How to Watch The Beatles Anthology

You can find The Beatles Anthology streaming only on Disney+, with the first three episodes becoming available on Wednesday (Nov. 26.). The series will then continue to release three more episodes on Thursday (Nov. 27), before unveiling the final three episodes on Friday (Nov. 28).

Hulu & Disney+ Bundle

Instead of getting one of two streaming services to watch the anthology, you can bundle Hulu with Disney+ for $12.99/month. These Disney+ bundles save users 44% per month on average. A standalone subscription to Hulu or Disney+ with ads is $11.99/month, which is just one dollar less than the cost of the bundle. You’re getting more bang for your buck by bundling because it gives you access to a wider variety of streaming services all in one place.

Beyond the obvious saving perks, subscribers will have access to a wide range of Disney+ and Hulu titles, including movies and series from Disney, Pixar, Marvel, Star Wars and National Geographic along with Hulu Originals. Some of our favorites on the service currently are perfect for getting you into the Christmas mood, including Elf, Die Hard and The Polar Express. If you’re already bored of jingle bells, you can always stream blockbuster flicks like A Real Pain or Insidious: The Red Door along with classic family-friendly shows like Hannah Montana, Dancing with the Stars and more.

Hulu + Live TV

For the most content options, Hulu + Live TV gives you access to the entire Hulu library in addition to more than 95 live TV channels, Disney+ and ESPN for just $89.99 per month with ADs or $99.99 per month to go ad-free. The ad-free option does exclude ESPN Unlimited given the streaming service features live sports and other programming.

Watch the Trailer for The Beatles Anthology Below

All products and services featured are independently chosen by editors. However, Billboard may receive a commission on orders placed through its retail links, and the retailer may receive certain auditable data for accounting purposes.

Trending on Billboard

Thanksgiving is almost here, which means watching football all-day long. While you’re chowing down on turkey and shopping the best early Black Friday deals, there will be three hard-hitting NFL games to watch live, but wait, there’s more. If you’re a fan of the Super Bowl halftime performances, music lovers will be getting three mini-sized versions on Thanksgiving. Post Malone, Jack White and Lil Jon are set to perform during each game on Nov. 27.

Explore

See latest videos, charts and news

At a Glance: How to Watch NFL Thanksgiving Games Online

Game 1: Detroit Lions vs Green Bay Packers

The NFL Thanksgiving games will kick off with the Green Bay Packers heading to Detroit to face the Lions for their 86th annual Thanksgiving Day Classic. If this tough NFC matchup wasn’t electrifying enough, Detroit native and legendary rocker, Jack White will be shredding the stage during the halftime show. The Lions vs Packers game will kick off on Fox at 1 p.m. ET.

Game 2: Kansas City Chiefs vs. Dallas Cowboys

The battle for the “America’s Team” title is next. The Kansas City Chiefs and the Dallas Cowboys are facing off at AT&T Stadium in Arlington, Texas with kickoff at 4:30 p.m. ET. Post Malone will be bringing the hits for the halftime show, which fans can stream live on Paramount+.

Game 3: Cincinnati Bengals vs. Baltimore Ravens

To conclude the holiday football lineup, we have an AFC North rivalry game between the Cincinnati Bengals vs. Baltimore Ravens. Taking place at M&T Bank Stadium in Baltimore, Maryland, the final Thanksgiving game will kickoff at 8:20 p.m. ET on Peacock with a hyped halftime performance from Lil Jon.

How to Watch Every Thanksgiving Halftime Show Online

For cord-cutters, there are a few ways to watch the NFL Thanksgiving games and halftime performances, if you don’t have cable, especially if you want to watch for free. DirecTV has a five-day free trial, while other streaming services, such as Fubo, offer free trials, so you can watch games for free. In addition, streaming services, like Peacock and Paramount+ include free trials.

Keep reading for more details on how to watch holiday games as well as Post Malone, White and Lil Jon’s performances online.

DirecTV

A subscription to DirecTV — which comes with CBS, ESPN, Fox, NBC, ABC and NFL Network — gets you access to live TV, local and cable channels, starting at $49.99 for the first month $84.99 per month afterwards. The service even offers a five-day free trial to watch for free, if you sign up now.

You can watch local networks such as PBS, while you can watch many cable networks, including Lifetime, FX, AMC, A&E, Bravo, BET, MTV, Paramount Network, Cartoon Network, VH1, Fuse, CNN, Food Network, CNBC and many others.

Fubo

To watch NFL games, Fubo starts at $54.99 for the first month of service $84.99 per month afterwards with nearly 235 channels — including local and cable networks — that are streamable on smart TVs, smartphones, tablets and on web browsers. And with a seven-day free trial, you can watch for free, if you act fast and sign up now.

The service even gets you live access to local broadcast networks including ABC, CBS, Fox and NBC, while it has dozens of cable networks, such as ESPN and NFL Network and much more.

Sling TV

Although Sling TV doesn’t offer a free trial, new subscribers can join for as low as $! for a Sling Day Pass (during Black Friday)to access Sling Orange. However, to watch most of NFL season online, Sling Orange + Blue lets you access more than 50 channels including ESPN, Fox, NBC, ABC and NFL Network and others (DVR storage included). Please note: Sling TV’s pricing and channel availability varies from location to location.

Hulu + Live TV

NFL games on CBS, ESPN, Fox, NBC, ABC and NFL Network are available to watch with Hulu + Live TV too. Prices for the cable alternative start at $82.99 per month, while each plan comes with Hulu, Disney+ and ESPN Unlimited for free.

Hulu + Live TV might be best for those who want all of these streaming services together in one plan. It features many other networks, including Hallmark Channel, BET, CMT, Disney Channel and much more. The services comes with a three-day free trial.

Paramount+

NFL games that air live on CBS, livestream on Paramount+ too. If you don’t already have a Paramount+ subscription, join today and enjoy a seven-day free trial. The streaming service starts at $7.99 per month (or $79.99 per year), while it grants you access NFL on CBS. With Paramount+, you’ll get access to a vast selection of TV shows and movies, live sports, 24-hour news with CBS News and more.

Peacock

The NFL on NBC livestreams Peacock. If you’re already a subscriber to Peacock, you can watch games for free. Cable subscribers can watch with their cable login. Not a Peacock subscriber? Monthly plans start at just $10.99 per month for Peacock Premium and $16.99 per month for the commercial-free, Premium Plus.

NFL+

For die-hard football fans, NFL+ has every game during the regular season, post-season, and even the Super Bowl. NFL+ starts at $6.99 per month month for the standard subscription, or $14.99 per month for NLF+ Premium. Additionally, with NFL+, fans can watch or listen to games live and on-demand, plus enjoy recaps and more.

State Champ Radio

State Champ Radio