Sphere Entertainment

Proving that the best way to get stock prices to rally is to first bury them deep underground, markets surged this week as President Trump eased his tone on U.S. Federal Reserve chair Jerome Powell and said tariff negotiations with China are ongoing (although China denied the claim).

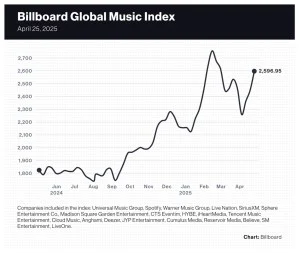

The 20-company Billboard Global Music Index surged 6.1% to 2,595.95, marking its third consecutive weekly gain after falling 10.9% in the two-week period ended April 4. The spoils of a less chaotic global market were felt by nearly all music stocks. Of the 20 stocks in the index, 16 finished the week in positive territory, and two — Anghami and Sphere Entertainment Co. — had gains exceeding 10%.

Major indexes improved this week as investor sentiment regarding U.S. tariff policy improved and President Trumpsaid he would not fire Powell. The Nasdaq composite rose 6.7% to 17,382.94 and the S&P 500 gained 4.6% to 5,525.21. The U.K.’s FTSE 100 improved 1.7% to 8,415.25. South Korea’s KOSPI composite index rose 2.5% to 2,546.30. China’s SSE Composite Index rose 0.6% to 3,295.06.

Trending on Billboard

After investors’ confusion about the U.S. tariff policy put a damper on stocks in recent weeks, markets seemed to find comfort in reports that said the U.S. Trade Representative was quickly working with some trading partners under a streamlined process. Jay Hatfield, founder/chief investment officer of InfraCap, told CNBC, “We’ve reached peak tariff tantrum” and believes the worst of the uncertainty has passed. In fact, the market could have been due for a rebound. Thomas Martin, senior portfolio manager at GLOBALT in Atlanta, told Reuters the stock market “was oversold by virtually all measures.”

Sphere Entertainment Co. was one of the week’s winners, rising 13.8% to $28.88. On Friday, Sphere Entertainment subsidiary MSG Networks announced it had negotiated a $514 million reduction in its debt and lower fees to broadcast New York Knicks and New York Rangers games. The news sent Sphere’s share price up 9.1%.

Spotify, which reports first quarter earnings on Tuesday (April 29), rose 8.1% to $620.72, giving the streaming giant a 23.3% gain over the past three weeks. This week, UBS lowered its price target to $680 from $690 and Wolfe Research raised its outlook on SPOT to “outperform” from “peer perform.”

Live Nation gained 4.4% to $132.76. Wolfe Research lowered its price target to $158 from $165 and maintained its “outperform” rating.

Warner Music Group (WMG) improved 2.4% to $29.83. Morgan Stanley lowered WMG shares to $32 from $37 and dropped the rating to “equalweight” from “overweight.” Universal Music Group (UMG), which also reports earnings on Tuesday, rose 3.5% to 24.79 euros ($28.28), bringing its year-to-date gain to 3.7%.

K-pop stocks had an unremarkable week after performing well during the tariff-driven chaos. HYBE, which, like Spotify and UMG, reports first-quarter earnings on Tuesday, rose 0.9%. SM Entertainment and JYP Entertainment improved 0.6% and 0.2%, respectively. YG Entertainment dropped 4.9%. Still, K-pop stocks are outperforming most music stocks this year. Collectively, the four South Korean music companies have posted an average year-to-date gain of 27.1%.

Cumulus Media shares dropped 16.0% to $0.21 after the company announced on Wednesday (April 23) it will de-list from the Nasdaq exchange on May 2 and immediately begin trading over the counter. The radio broadcaster’s shares are down 72.7% in 2025 and have fallen 92.2% over the last 52 weeks.

Billboard

Billboard

Billboard

Time for a pre-holiday madness edition of Executive Turntable, Billboard’s compendium of promotions, hirings, exits and firings — and all things in between — across music.

Read on for better-late-than-never personnel news and don’t forget to check out WMG chief Robert Kyncl’s year-end note to staff and dig into all of our year-end business content, plus peruse our weekly interview series spotlighting a single c-suiter and our daily calendar of notable goings-on.

Luke Armitage was appointed senior vp of global marketing at Warner Records, where he’ll oversee international marketing for the label’s U.S. roster. Based in Los Angeles, he reports to Warner Music’s chief marketing officer, Jessica Keeley-Carter, and collaborates with Warner Records’ co-chairmen Tom Corson and Aaron Bay-Schuck. Armitage joins Warner after six years at Capitol Music Group’s Astralwerks Records, where he led global marketing for artists like Marshmello and Katy Perry. He also contributed to projects by The Chemical Brothers, FISHER and Meduza, among others. Prior to Astralwerks, Armitage held court at Universal Music’s international division in London, Metropolis Studios, and Universal Music Publishing.

Trending on Billboard

Avex USA promoted Ryusuke (Ryan) Kamada to CFO, recognizing his pivotal role in the company’s growth since its 2020 launch. Ryan joined Avex in 2018 and transitioned from Avex’s Japanese headquarters to Avex USA, where he leveraged his expertise in global finance and law to expand operations in North America. He developed Avex USA’s corporate strategy, co-manages the Future of Music Fund and spearheaded partnerships with S10 and Roc Nation, among others. In Japan, Kamada was chief producer of Avex’s investment group, leading M&A and corporate venture capital investments. Prior to Avex, he worked in JP Morgan’s Tokyo office. The University of Pennsylvania grad began his career in Toyota’s legal division, handling major U.S. litigation and congressional hearings. Avex USA CEO Naoki Osada commended Ryan’s strategic vision, financial acumen, and “sincere respect and passion for songwriters are integral to the company culture.” Since its launch in Los Angeles in 2020, the U.S. branch of the Tokyo-based music and entertainment company has established a publishing division, a music start-up investment program and a record label.

Sphere Entertainment appointed Marcus Ellington as executive vp of ad sales and sponsorships, effective immediately. Ellington will develop and lead an ad sales and sponsorships unit to maximize revenue for Sphere’s assets, including the Vegas venue’s unmistakable exterior, known as the Exosphere. He’ll also drive brand-centric opportunities and broader marketing partnerships. Ellington is based in New York and reports to Jennifer Koester, Sphere’s president and COO. Ellington joins Sphere from Google, where he held various sales and partnership roles, most recently as director of Americas partnerships solutions. His experience includes overseeing relationships and ad revenue for Google’s largest media and entertainment partners. Prior to Google, he worked at Interactive One and CBS, and over the years has received industry awards and served on several boards. Koester praised Ellington’s innovative leadership and track record with premier brands “across a range of industries, which will be an asset as we continue evolving how brands can partner with Sphere to create impactful experiences unlike anywhere else.”

Melanie Santa Rosa

Third Side Music named Melanie Santa Rosa as its new head of copyright, based in New York. Reporting to co-founder/CEO Patrick Curley, Santa Rosa will lead the copyright department, focusing on transparency, efficiency and maximizing value for the independent publisher’s extensive roster, which includes Kurt Vile, SOFI TUKKER, Future Islands, Sky Ferreira and more. Santa Rosa brings a wealth of experience to the role, having previously served as executive vp of global digital copyright administration at Word Collections, managing worldwide copyright and royalty administration. She also spent 12 years at Spirit Music Group, rising to senior vp of global administration, and worked at BMI for a decade, collaborating with songwriters, publishers, and performing rights organizations. An advocate for creators, Santa Rosa serves on the AIMP New York Chapter board and is active in several industry organizations. Patrick Curley praised Santa Rosa’s expertise and reputation: “She is precisely the person we needed to lead the operation and development of Third Side Music’s worldwide collections platform in the years to come,” he said.

Infinite Reality, a leader in digital media and e-commerce leveraging spatial computing and AI, appointed Drew Wilson as chief operating officer. Wilson, who most recently served as both COO and chief financial officer at SoundCloud, will manage business operations, drive revenue, and advance iR’s strategic vision. Under his watch at SoundCloud, the audio platform achieved profitability for the first time in the company’s history, driving significant revenue growth, margin improvements and product innovation. He has also held key roles at First Look Media, AwesomenessTV, RLJ Entertainment and Warner Bros. Discovery, contributing to revenue growth and digital transformation. John Acunto, iR’s co-founder and CEO, praised Wilson’s proven ability to scale digital media businesses and his expertise in technology and fan engagement.

AEG Presents promoted Evan Marks to talent buyer for the Rocky Mountains region. Previously an assistant in the role, Marks will now oversee bookings at prominent venues like Mission Ballroom, Ogden Theatre, Gothic Theatre, Bluebird Theatre and some outdoor spot called Red Rocks. Based in Denver, he’ll report to Don Strasburg, president of Rocky Mountains and Pacific Northwest. A Houston native, Marks has been active in the Colorado music scene for nearly 15 years. After graduating from CU Boulder, he began his career as a talent buyer at Cervantes’ Masterpiece Ballroom in 2017 before joining AEG Presents Rocky Mountains in 2022. Strasburg commended Marks for his passion and dedication to live music, highlighting his deep musical knowledge and strong execution skills. “Evan’s wide berth of musical knowledge and ability to execute will meet and exceed the lofty expectations of our music community.”

Eddie Kloesel has been named partner at WHY&HOW, the management company founded by Bruce Kalmick. Joining at its inception in 2020 as vp of touring and sponsorships, Kloesel was later promoted to executive vp, playing a pivotal role in shaping the company’s strategic goals. He has spearheaded brand partnerships, touring strategies and album releases, contributing to the success of clients like Whiskey Myers and Chase Rice. With a music industry career spanning nearly two decades, Kloesel began in 2005 as a day-to-day tour manager for Brandon Rhyder and joined Triple 8 Management in 2011 before becoming a member of WHY&HOW’s founding team. Kalmick calls Kloesel a a “trusted strategic thinker who approaches our clients’ business like an entrepreneur,” adding, “He’s always thinking outside the box and has brought forward opportunities that are not only lucrative for our clients but are also unique within the industry.”

Supreme Music secured the exclusive services of renowned sound designer Markus Stemler, celebrated for his Academy Award-nominated and BAFTA-winning work on All Quiet on the Western Front. This collaboration strengthens Supreme Music’s sound design and audio post-production for advertising and branded content. Stemler, known for projects like The Matrix Resurrections and Cloud Atlas, brings expertise in dialogue editing, ADR, Foley and re-recording mixing. His recent credits include Tides (2021) and Perfect Days (2023). For Supreme Music, he has contributed to standout campaigns such as Penny’s Wonderful World and the American Red Cross’ Mom, showcasing his exceptional artistry and versatility.

HarbourView Equity Partners partnered with The CultureShaker to lead its brand, marketing and PR efforts. The CultureShaker’s founder, Lucinda Martinez, will now serve as chief marketing officer of the investment firm, joined by Deborah Renteria as vice president of brand and content strategy. Martinez, known for award-winning campaigns like Game of Thrones and Insecure, brings a quarter-century of experience from Netflix, HBO and Comedy Central. Renteria brings complimenting expertise in content development and audience engagement from roles at Lionsgate, Facebook, and HBO. HarbourView CEO Sherrese Clarke Soares praised the team’s cultural and strategic insights, essential for the firm’s rapid growth, adding: “The CultureShaker is our first operating partner under our Create Platform, further cementing our position as a valued partner to artists, content creators, investors as we broaden our footprint and deepen our focus across the entertainment and creative ecosystem to continue to drive ROI.”

Curbside Concerts, a Canadian company that produces curbside concerts, welcomed Tracy Posadowski and Tom Yeates as managing directors of sales and marketing. Posadowski, co-founder of ATTCo Global Services, and Yeates, with extensive revenue management experience, aim to expand the company in Canada, enter the U.S. market, and explore new business avenues. Founded by Matt and Amanda Burgener during the COVID-19 pandemic to support struggling musicians, Curbside Concerts has grown significantly in its first four years, bringing music to people’s yards and curbs.

Isekai Records, a joint venture with Broke Records, launched in August 2024 by Ewan Jenkins, Jack Mangan and RJ Pasin, aims to be artist-friendly. Jenkins and Mangan, co-founders of E2J Artist Management, gained recognition in 2023 by managing Pasin, whose TikTok followers grew from 10,000 to 2.8 million and Spotify listeners to 7.5 million monthly. Isekai Records leverages their expertise to support emerging talent. Their debut release, “Embrace It” by Ndotz, marked their global entry and commitment to artist-centric music production.

ICYMI:

Hugh Forrest

The board of directors of Farm Aid appointed Shorlette Ammons and Jennifer Fahy to lead the non-profit effective Jan. 1 … Hugh Forrest was promoted to president of South by Southwest, where he’ll continue to oversee programming and assume full leadership of an organization. Jann Baskett, the current co-president and chief brand officer, prepares to step down on New Year’s Eve.

Last Week’s Turntable: Red Light Green Lights Former Warner Nashville Prez

Drop that stylus on this week’s stacked Executive Turntable, Billboard’s compendium of promotions, hirings, exits and firings — and all things in between — across music.

Read on for some very personnel news and don’t forget to cast your vote for the Power 100 Players’ Choice Award, plus peruse our annual list of the industry’s savviest financial advisers, our weekly interview series spotlighting a single c-suiter and our calendar of notable industry events.

SoCal concert promoter Goldenvoice, a subsidiary of AEG Presents, announced the retirement of its senior vice president, Susan Rosenbluth. With a career spanning six decades, Rosenbluth has worked with artists like Elton John, Talking Heads, BTS and Van Morrison, among others. She began her career at the Greek Theatre in 1978 and became its general manager by 1982. She later managed concert presentations at various venues for Nederlander, including the Pantages Theatre, the Pacific Amphitheatre and the Honda Center, and became a talent buyer in 1995. In 2003, Rosenbluth joined Goldenvoice, overseeing talent buying for concerts across California, Alaska, Hawaii and Arizona. She also spearheaded the Latin concert promotion division and became a key figure in promoting K-pop acts in North America, including BTS and BLACKPINK. She also co-chairs AEG’s Women’s Leadership Council and has received numerous awards, including from Billboard and Pollstar. “My work life has been filled with so many meaningful experiences, due to the Goldenvoice concert promotion team, artists and their crews who come together to present these events,” said Rosenbluth, “I am grateful to the people of the concert community.” Goldenvoice president Paul Tollett added: “Susan is a legend… that goes without saying. But she also charted a new course for Goldenvoice musically and made us better for it.”

Trending on Billboard

Goldenvoice has promoted Lea Swanson to vp of talent, where she’ll oversee booking for the Mountain Winery, contribute to talent buying at key Los Angeles venues like the Peacock Theater and Shrine Auditorium, and book shows in across multiple markets in California and Hawaii. Based in San Diego, Swanson will report to COO Melissa Ormond. Swanson brings over 25 years of experience in talent buying, including 17 years with Goldenvoice parent AEG Presents. Her career began in 1999 at Viejas Casino, where she helped develop a 1,500-capacity concert venue. She has since booked a wide range of events, from small clubs to full-size arenas, and worked with venues like the Rady Shell, Humphreys Concerts by the Bay and Pechanga Resort Casino. Stoked for her new role, Swanson emphasized the can’t-pass-up opportunity to grow within the mega-market just north of her. “After over 17 years with AEG Presents in my home market of San Diego and supporting numerous casino clients, I feel fortunate to be in the right place at the right time to step into this elevated role,” she said. “A year after accepting the lead booking role at the Mountain Winery in Saratoga, having the chance to grow and promote shows in one of the primary music markets in North America was an opportunity I had to take.”

Bill Walshe is Sphere Entertainment‘s new executive vp and global head of venue operations and development. The hospitality industry veteran will lead operations at the mothership in Las Vegas, while also running point on developing a global network of other orbs the world over. Reporting to Jennifer Koester, president and COO, Walshe will lean on his skillset to enhance the guest experience at Sphere. Walshe’s career includes leadership positions at Viceroy Hotel Group, The Doyle Collection and Jumeirah Group, where he oversaw sales, marketing, and innovation initiatives. Koester praised Walshe’s expertise in international markets, citing his ability to align with Sphere’s ambitious vision. “Sphere is a global destination for immersive experiences unlike anywhere else,” said Koester. “Bill’s expertise across premier brands in international markets will be an asset as we continue to deliver an unparalleled experience for guests, artists, and partners at our Las Vegas venue, while pursuing our long-term growth goals for this next-generation entertainment medium.”

The New York Philharmonic appointed Matías Tarnopolsky to president and CEO of the storied symphony, effective New Year’s Day. Currently leading The Philadelphia Orchestra and Ensemble Arts, Tarnopolsky has held prominent roles at Cal Performances, the Chicago Symphony Orchestra and the BBC Symphony Orchestra. He previously served as vice president of artistic planning at the New York Phil from 2005 to 2009. Board co-chairmen Peter W. May and Oscar L. Tang praised Tarnopolsky’s innovative leadership and strong relationships within the artistic community. Gustavo Dudamel, the Philharmonic’s incoming music and artistic director, expressed confidence in their shared vision for the orchestra. “I vividly remember when Matías came to Caracas in 2006 and, from that moment, I knew that I had met someone who would become one of the most important leaders in our industry,” recalled Dudamel. Tarnopolsky said he looks forward to returning to the Phil, inspired by its newly renovated David Geffen Hall, Dudamel’s leadership and plans to elevate the Philharmonic’s cultural impact and foster inclusivity. “We will rededicate ourselves to the New York Philharmonic’s contemporary place in the cultural and civic life of New York, for all New Yorkers, to create an inclusive, expansive, and joyful musical future,“ he said.

Rachael Stoeltje will become chief of the Library of Congress‘s National Audio-Visual Conservation Center, beginning in January. She’ll oversee the Packard Campus in Virginia, managing the world’s largest collection of films, TV programs, radio broadcasts and sound recordings, focusing on acquisition, preservation and accessibility. Previously, Stoeltje directed Indiana University Libraries Moving Image Archive, leading its expansion and film digitization and preservation efforts. As president of the Association of Moving Image Archivists, she championed diversity and global cooperation in media preservation. Library of Congress associate librarian for researcher and collections services Hannah Sommers praised Stoeltje’s career as “visionary” and “laser-focused on the future and leading by example.” Stoeltje emphasized tackling challenges like AI’s impact on archival authenticity and global archival risks. “The big issues on the horizon are an important part of our future work, along with preserving and making accessible our nation’s moving image and sound recording cultural heritage,” she said.

Capitol Records tapped Sam Breslin as vice president of marketing, a bump-up from his previous role of senior director. In his elevated position, Breslin will continue crafting and implementing strategies for a wide array of newer and legacy artists at the legendary label. Having joined Capitol over a decade ago as a coordinator, he has since contributed to significant successes for Lewis Capaldi, The Beatles, Paul McCartney, Niall Horan, Norah Jones, Good Neighbours, Beck and more.

Venu Holding Corporation (VENU) named Terri Liebler as its chief marketing officer. With 30 years of experience in sports and entertainment, Liebler previously served as senior vp in Live Nation Entertainment’s media and sponsorship division, where she led strategic planning and innovative growth initiatives. During her 22-year tenure at Live Nation, she played a key role in expanding U.S. and international venue and festival platforms and cultivating partnerships. Liebler’s career also includes roles with the NBA’s Seattle SuperSonics and San Antonio Spurs, as well as work on the Premium Seat operations team for the 1996 Atlanta Olympics. VENU’s founder and CEO, J.W. Roth, praised Liebler’s passion and leadership, anticipating she’ll bring with her “an unrelenting enthusiasm and dedication for our brands that will undoubtedly drive our unparalleled venues to new heights.”

VENU also announced that Live Nation Entertainment veteran Will Hodgson has been its president since October. He spent 13 years at LNE, where he led House of Blues Entertainment, overseeing 20 venues, 17 restaurants, and seven cocktail lounges. His background also includes investment banking and developing ticketing solutions for major festivals. “Will is a rockstar, he will do an incredible job quarterbacking our strategic growth and operations,” said J.W. Roth. “His unique expertise across live music, finance, ticketing, food and beverage, and real estate development is a powerful fit for our vision.”

Nashville-based music publishing company Little Extra Music hired Victoria Goodvin to represent the company’s catalog. Goodvin’s career includes time at Song Factory Music, Wide Open Music, Liv Write Play and Row Entertainment. Also joining the team is Tristan Scaife (son of Little Extra Music co-founder Joe Scaife), who will work alongside Goodvin. LEM was founded in 2013 by Scaife and Lisa Ramsey-Perkins. The company’s catalog features more than 100 cuts, including the four-week Billboard Country Airplay chart-topper “She Got the Best of Me,” and the Walker Hayes-recorded “You Broke Up With Me. Writers Rob Snyder, Tia Sillers, Kylie Sackley, Will Bowen and Kelsey Waters are represented in the catalog. –Jessica Nicholson

NASHVILLE NOTES: PLA Media appointed Krista Dykes as senior media relations manager. Dykes began her career in 2007, contributing to communications projects in online insurance and inside the country music industry. She most recently served as media relations manager for the Country Music Association from 2015 to 2023, fostering relationships with national media and TV affiliates, and she’s the founder of the Secret Mom Hacks podcast and Mom Boss Mastermind, a virtual networking group for entrepreneurial mothers … O’Neil Hagaman, LLC promoted Tiffany Wiggers to principal, where she will influence the Nashville firm’s productivity and growth while continuing to serve her diverse client base. Wiggers, who began as an intern in 2004, is a current member of the Tennessee and Nashville Bar Association’s Entertainment Divisions, as well as the Gospel Music Association and the Country Music Association.

Big Loud Rock appointed Jenn Essiembre as senior vp of A&R. Reporting to Big Loud partner Joey Moi and GM Lloyd Norman, Essiembre will lead the label’s A&R strategy, focusing on talent identification and development. Essiembre previously served as vp at 300 Publishing, a division of 300 Entertainment, where she signed and developed artists and songwriters like Sean Momberger, Hunxho and Spencer Jordan. Her career began at ole Music Publishing, where she facilitated placements for stars like Sam Smith, Justin Timberlake, and Maluma. Essiembre expressed enthusiasm for her new role, aligning with Big Loud Rock’s artist development values, while Moi praised her energy, expertise and vision. “From our first conversation, I knew she’d be the right fit for this role,” he said.

Independent publisher OTM Music has appointed Emmy Feldman as U.S. head of A&R. Feldman brings extensive music experience, having helped open the Brooklyn outpost of Rough Trade before spending seven years in A&R at Atlantic Records and Canvasback Music. She then moved to Heavy Duty, where she managed a roster of songwriters, producers, and artists, including Buddy Ross and BJ Burton. In July of this year, she joined OTM, managing a roster that includes Dot Da Genius, Metronomy, Sub Focus, Still Woozy and Hemlocke Springs. OTM Music, launched by CEO Alex Sheridan in 2017, supports a roster of songwriters who have collaborated with SZA, Travis Scott, and A$AP Rocky. Recent high-profile deals include Kid Cudi producer Dot Da Genius, Sub Focus, and partnerships with artists like Sudan Archives and HONNE. Operating in London, New York, and Los Angeles, OTM also named Kristin Genovese as U.S. Head of Sync and added Kate Sweetsur and Ethan Mizen to its UK A&R team.

Hook, a new AI-powered social music app centered on remixes and mashups, expanded its leadership team with four key appointments. Katerina Kosta, formerly of TikTok/ByteDance and Jukedeck, joined as head of AI to develop ethically-trained AI tools that enhance music creativity while ensuring fair artist treatment. Grammy-nominated engineer Prash Mistry is now head of audio development and UK general manager. Karan Bhatnagar, previously head of digital at Three Six Zero management, stepped in as head of artist and creator strategy to support artist campaigns. Ed Pak, with a decade of industry experience and involvement in Saavn’s acquisition by Reliance Jio, is taking on the role of head of business development and Partnerships. The app, launched on Apple’s App Store this fall, also announced new offices in Los Angeles and London.

SILO Music appointed Marcy Bulkeley as head of sync A&R and music supervision of the publishing, management and sync house. Bulkeley will manage sync licensing and music supervision for film, TV, motion picture advertising and emerging media through her venture, Subtle Mother Music Supervision Services. With over 25 years of industry experience, she is known for her expertise in music curation and creative collaboration. Previously, as vp of sync A&R at Universal Music Group, she led custom music and remix projects, earning Clio awards and Guild of Music Supervisors nominations. SILO Music’s CEO, Jack Ormandy, praised Bulkeley’s innovative approach as aligning with the company’s mission to create elevated experiences through music. Under her leadership, SILO aims to expand its reach, delivering bar-none music curation and sync services to clients across multiple industries.

Bootleg, a company specializing in high-end concert recordings, appointed Rohan Adarkar as an equity advisor. The longtime entrepreneur is tasked with helping the company by leveraging his expertise in scaling entertainment tech products and building partnerships with global music stakeholders. In 2003, Adarkar co-founded txttunes, an early text-to-pay service for DRM-free MP3 downloads, which partnered with the American Association for Independent Musicians during the 50th Grammy Awards before its acquisition in 2007. Adarkar also founded totally different, a B2B consultancy, and advises the New Zealand government and its Ministry of Arts and Culture. He is a trustee of the Click Foundation, supporting education initiatives.

Splice appointed Jeff Roberto as senior vp of marketing, tasking him with leading global marketing initiatives and expanding the platform’s presence for musicians. Roberto brings extensive experience, including leadership roles at Nodle, DistroKid, and Picsart, where he helped drive a $130 million funding round and a $1 billion valuation. His career also spans Shazam, Napster, MAGNIFI and Astralwerks Records. Roberto aims to enhance Splice’s impact through innovative AI tools and brand growth. CEO Kakul Srivastava commended Roberto’s industry expertise and commitment to creative communities, emphasizing Splice’s AI roadmap as transformational.

Various Artists Management elevated Rebecca Dixon to global head of marketing & general manager UK. Dixon, previously head of marketing and promotions, will now split her time between VAM’s London and LA offices, reporting to CEOs David Bianchi and Matt Luxon. In her expanded role, Dixon will oversee UK marketing and audience development, deepen her involvement in LA, and strengthen partnerships across Europe. Over her decade-long tenure with VAM, she has led innovative campaigns for artists like Ashnikko, Tom Grennan, and The Libertines. Her promotion follows her recognition as the Trailblazer: The Richard Antwi Award winner at the Music Business UK Awards.

Fixated, a digital entertainment company launched in early 2024 by former BMG North America president Zach Katz and creator economy exec Jason Wilhelm, has added key hires to its executive and talent management teams. Jeff Shaivitz (svp of business and sales), Kou Chaichian (vp of brand partnerships) and Daniel Coughlan (head of content development) bring extensive expertise to support the company’s growth. Additionally, new talent managers Anooj Desai, Kasia Turek and Kyle Rooney have joined to oversee Fixated’s growing roster of top digital creators.

ICYMI:

Cara Donatto

Cara Donatto is appointed evp of media strategy for Atlantic Music Group, overseeing publicity and communications strategy and execution … BMG promoted Katie Kerkhover to the role of svp of A&R, Frontline Recordings in North America … Troy “Tracker” Johnson is launching TRACK mgmt following nearly 10 years with Big Loud … Sony Music UK hired former UMG exec Azi Eftekhari as its COO, in charge of key areas, including the label’s Commercial Group. [KEEP READING]

Last Week’s Turntable: UMG Touts Liszt of Promotions in Classics Group

Sphere didn’t announce any new acts during its earnings call on Tuesday (Nov. 12), but the Las Vegas venue has enough interest from artists that the venue is “struggling with how to squeeze everybody in through the fall,” said CEO James Dolan.

Having a long line of artists waiting to perform is a good problem to have. Residencies by U2, Phish, Dead & Co. and The Eagles have changed how artists perform live and turned the state-of-the-art Sphere into a must-see for music fans. But running a one-of-a-kind venue presents unique challenges and requires on-the-fly learning.

To keep the venue busy and generate more revenue, last quarter Sphere increased the number of “side by sides,” the company’s term for running multiple events in a single day—a showing of “Postcards from Earth” before a music concert, for example. “A lot of this has to do with logistics, about about setting up the arena for one and taking it down and then setting it up for the other,” said Dolan.

Trending on Billboard

Still, a full year of operational experience didn’t lead to more business last quarter. Total Sphere revenue was $127.1 million in the quarter ended Sept. 30, down from $151.2 million and $170.4 million in the prior two quarters, respectively. Revenue from events such as concerts was $40.9 million, down from $58.4 million in the previous quarter. The Eagles began a residency in September, and the same month Sphere hosted its first live sports event, UFC 306, which become Sphere’s highest grossing single event to date.

The Sphere Experience, which covers showings of Postcard from Earth and V-U2: An Immersive Concert Film, generated $71.5 million, down from $74.5 million and $100.5 million in the previous two quarters.

Exosphere advertising and suite license fees totaled $8.5 million, down from $15.9 million in the previous quarter. Dolan said Sphere was experiencing “structural” issues in securing advertising on the venue’s 580,000 square-foot exterior. “I wish the day we lit it up that we knew exactly how to run it, and exactly how to sell it, and exactly how to program it, etc.,” he admitted. “But that’s just not the case.”

The company is also learning how to program its original content such as “V-U2,” which captures U2’s residency at the venue. “How we market it, how we just, you know, how we we schedule it, etc, that I’m not sure of,” said Dolan. “But I do think that the product is valuable. And I also think that it’s going to be evergreen. You’re not going to be able to see Bono 20 years from now.”

Sphere’s operating loss of $125.1 million improved to $16.1 million after adjustments to remove nearly $80 million of depreciation, $13.2 million of share-based compensation and other non-operational items such as amortization, restructuring charges and merger-related costs. The venue’s selling, general and administrative expenses totaled $105 million while direct operating expenses were $62.5 million.

Sphere shares were down 8.7% to $40.22 in morning trading.

MSG Networks, Sphere Entertainment Co.’s other division, had revenue of $100.8 million, down 9% from the prior-year quarter. MSG Networks owns regional sports networks and the streaming platform MSG+. The impact of a 13% drop in subscribers was partially offset by an increase in affiliation rates.

In October, Sphere Entertainment announced plans to build the next Sphere venue in Abu Dhabi, the capitol city of the United Arab Emirates. Unlike the $2.3-billion Las Vegas venue, which was entirely funded by Sphere Entertainment Co., the Abu Dhabi venue will be entirely funded by the government’s Department of Culture and Tourism and operate under a franchise model. Dolan said Sphere Entertainment will receive a franchise initiation fee that grants Abu Dhabi the right to use the company’s intellectual property.

James Dolan will continue his run as Sphere Entertainment Co.’s executive chairman/CEO for another three years. Sphere Entertainment gave Dolan a three-year contract extension that runs from July 1 to June 30, 2027, according to a July 3 regulatory filing. Sphere Entertainment consists of Sphere, the groundbreaking, $2.3-billion venue in Las Vegas; MSG Networks, which […]

Billionaire hedge fund titan Steve Cohen‘s Point72 Asset Management has acquired a 5.5% stake in Sphere Entertainment Co, the MSG Entertainment spin-off company that owns the state-of-the-art Las Vegas Sphere venue. Point72 disclosed in a regulatory filing on Monday (June 24) that it acquired 1.56 million shares of Sphere Entertainment Co in the second quarter, […]

Jennifer Koester is expanding her role at Sphere Entertainment. The live entertainment executive has been named president/COO of Sphere, effective immediately.

Prior to her promotion, Koester served as the company’s president of Sphere Business Operations, which saw her lead the strategy and execution of all business aspects of Sphere, the next-generation entertainment venue in Las Vegas.

In her new role, Koester will continue to work with executive leadership and provide strategic oversight for Sphere Studios, the immersive content studio in Burbank dedicated to developing multi-sensory experiences exclusively for Sphere, including further developing Sphere Studios’ capabilities as a full-service production studio. Koester will also continue to focus on maximizing venue utilization across a range of categories such as original programming, attractions, concerts, residencies, and corporate and marquee events, as well as driving strategic partnerships, delivering the best customer experience and growing Sphere as a premium global brand.

“Since joining our team earlier this year, Jennifer’s contributions have had a significant impact,” said Sphere Entertainment executive chairman/CEO James Dolan in a statement. “We believe we are just scratching the surface of what is possible with Sphere, and her expertise will be essential as we continue to advance on our long-term vision for this next-generation entertainment medium.”

Trending on Billboard

“I welcome the opportunity to take on this expanded role,” added Koester. “Across the Sphere organization we are focused on both bringing unique experiences to life in Las Vegas, and developing new experiences that will keep Sphere at the forefront of immersive entertainment. I look forward to continuing to work with our world-class team to grow our business and deliver on Sphere’s vision for the future of entertainment.”

Koester has 30 years of experience in technology, media and entertainment. She joined Sphere Entertainment in February from Google, where she served as MD, Americas strategic alliances, global partnerships at Google Commercial Operations. Her experience prior to Google includes serving as senior vp of advanced advertising product development, data analytics and ad operations at Cablevision, along with various legal roles.

Koester received a J.D. from St. John’s University School of Law and a B.S. in management information systems from Binghamton University.

Sphere Entertainment announced on Monday that it has acquired all of the remaining shares it did not previously own of Holoplot GmbH, a global leader in 3D audio technology based in Berlin. Explore Explore See latest videos, charts and news See latest videos, charts and news Sphere first invested in Holoplot in 2018 when the […]

In its first full quarter of operation, Sphere, the next-generation music venue in Las Vegas, lost $193.9 million on revenue of $167.8 million, its owner, Sphere Entertainment Co., announced Monday (Feb. 5). The company posted an adjusted operating gain of $14.1 million if “certain corporate overhead expenses” were excluded.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

In the quarter ended Dec. 31, nearly half of Sphere’s revenue — $92.9 million — came from The Sphere Experience’s 191 performances. (The Sphere Experience includes a tour of the venue and a viewing of the film Postcard From Earth.) Concerts accounted for nearly all of the $55.2 million of event-related revenues. Advertising on the outside of the venue and suite license fees totaled $17.5 million.

After U2’s residency ends on Mar. 2, the venue will host runs by Phish and Dead & Company. Executive chairman/CEO Jim Dolan didn’t announce any new residencies but said during Monday’s earnings call that “pretty much our calendar is full for this calendar year.” Demand from artists continues to grow, Dolan added, and the company expects 2025 to be “another full year.”

Including MSG Networks, Sphere Entertainment had $314.2 million of revenue and an operating loss of $159.7 million. MSG Networks had revenue of $146.4 million, a 12.5% decline from the prior-year period.

Sphere opened on Sept. 29 and posted $4.1 million from two U2 concerts, and $7.8 million in total revenue, in the previous quarter. The venue has received rave reviews and worldwide attention for its captivating audio-visual experience and presence on the Las Vegas skyline. It featured prominently in Las Vegas’s Formula 1 race in November and will grab more attention this weekend as Las Vegas hosts Super Bowl LVIII on Sunday (Feb 11).

Although Sphere ended its bid to expand into London, the company is having “substantive discussions about expanding to international markets,” said Dolan. The plan is to have a franchise model for additional venues that will generate revenues immediately through construction and development, Dolan added.

Shares of Sphere Entertainment rose as much as 10.4% to $39.11 on Monday and closed at $38.97, up 10.1%.

The Billboard Global Music Index — a diverse collection of 20 publicly traded music companies — finished 2023 up 31.3% as Spotify’s share price alone climbed 138% thanks to cost-cutting and focus on margins. Spotify is the single-largest component of the float-adjusted index and has one of the largest market capitalizations of any music company.

The music index was outperformed by the tech-heavy Nasdaq composite, which gained 43.4% with the help of triple-digit gains from chipmaker Nvidia Corp (+239%) and Meta Platforms (+194%). But the Billboard Global Music Index exceeded some other major indexes: the S&P 500 gained 24.2%, South Korea’s KOSPI composite index grew 18.7% and the FTSE 100 improved 3.8%.

Other than Spotify, a handful of major companies had double-digit gains in 2023 that drove the index’s improvement. Universal Music Group finished the year up 14.7%. Concert promoter Live Nation rode a string of record-setting quarters to a 34.2% gain. HYBE, the increasingly diversified K-pop company, rose 34.6%. SM Entertainment, in which HYBE acquired a minority stake in March, gained 20.1%.

A handful of smaller companies also finished the year with big gains. LiveOne gained 117.4%. Reservoir Media improved 19.4%. Chinese music streamer Cloud Music improved 15.8%.

The biggest loser on the Billboard Global Music Index in 2023 was radio broadcaster iHeartMedia, which fell 56.4%. Abu Dhabi-based music streamer Anghami finished 2023 down 34.8%. After a series of large fluctuations in recent months, Anghami ended the year 69% below its high mark for 2023. Hipgnosis Songs Fund, currently undergoing a strategic review after shareholders voted against continuation in October, finished the year down 16.6%.

Sphere Entertainment Co., which split from MSG Entertainment’s live entertainment business back in April, ended 2023 down 24.4%. Most of that decline came before the company opened its flagship venue, Sphere, in Las Vegas on September 29, however. Since U2 opened the venue to widespread acclaim and earned Sphere global media coverage, the stock dropped only 8.5%.

For the week, the index rose 1.1% to 1,534.07. Fourteen of the index’s 20 stocks posted gains this week, four dropped in price and one was unchanged.

LiveOne shares rose 15.7% to $1.40 after the company announced on Friday (Dec. 29) it added 63,000 new paid memberships in December and surpassed 3.5 million total memberships, an increase of 29% year over year. iHeartMedia shares climbed 14.6% to $2.67. Anghami continued its ping-pong trajectory by finishing the week up 16.9%.

State Champ Radio

State Champ Radio