Live nation

Page: 2

Billboard Canada Power Players is back for a second year, and it comes at a pivotal time for Canadian music. Canadian Content regulations — a principle that built the domestic industry — are up for review for the first time in a generation, with ongoing hearings taking place with the CRTC. The Online Streaming Act, meanwhile, is attempting to regulate major foreign streaming services to contribute to CanCon as the CRTC once did for radio — but companies like Spotify, Amazon and Apple Music aren’t taking it without a fight.

Those issues shadow the industry, which has recently seen both struggles and successes. The country was recently named the 8th largest music market in the world by the IFPI, and Toronto has emerged as a marquee live music market. That’s been reflected in the successes of and investments in new venues by companies like Live Nation Canada, MLSE and Oak View Group, who all appear on the list.

Trending on Billboard

As top execs at Live Nation Canada, Erik Hoffman, Riley O’Connor and Melissa Bubb-Clarke are orchestrating one of the most ambitious stretches in the company’s history. Together, the trio claims the No. 1 spot on Billboard Canada Power Players 2025. Already the biggest players in the Canadian music business, Live Nation is just getting bigger — and it’s on track for a record-breaking summer.

In the new Billboard Canada cover story, the three talk about their ambitious plans — including the about-to-open Rogers Stadium in Toronto, which will bring Oasis, Coldplay and BLACKPINK to the city this summer and triple the number of stadium shows.

Derek “Drex” Jancar of OVO Wins the Impact Award

As part of Billboard Canada Power Players, Derek “Drex” Jancar took the No. 1 spot in the Foundations category and accepted the Impact Award at the celebration in Toronto on Wednesday (June 11).

In the mid-2000s, Drex, Gavin Sheppard and Kehinde Bah co-founded The Remix Project, a community initiative that continues to influence global culture. Now, he’s doing it again as CEO of October’s Very Own (OVO).

On Wednesday night (June 11), Derrick Ross of Slaight Music presented Drex with the Impact Award as part of Billboard Canada Power Players 2025, with a donation to the Remix Project — a testament to the immense influence Drex has had within Canadian music and culture.

In an interview, Drex tells Billboard Canada about the impact of the Toronto community on all the work he does.

“It’s the nucleus of everything. It’s the thing you constantly come back to and think about: ‘Does this represent us, honestly and authentically?’” he says. “It’s where everyone worked on their skills and put blood, sweat and tears into their career paths. We obviously are global thinkers, but we’re always coming from that place. That’s our identity. It’s shaped us and it’s what makes us unique.”

Drex recalls meeting the key figures at OVO at Remix, including Oliver El-Khatib, Future The Prince, Niko Carino and Drake. The dedication that they poured into Drake’s burgeoning career in the late 2000s created a special energy in Toronto. He was already the hottest artist in the city, Drex recalls, but you could feel he was on the verge of becoming a global phenom — all while wearing his local connections on his sleeve.

“You could see what was happening behind the scenes, and it was really special to see everyone rally around and build such an amazing brand around him,” Drex says. “It was a time where you really started to believe in the city and the talent and the potential in the city and you were like, ‘Anyone can do anything from here. This is possible, it’s happening right in front of us.’”

The First Canadian Edition of Managers to Watch

Also this week, Billboard Canada unveiled its first Music Managers to Watch list.

Managers are the unsung heroes of the music industry. They are the hard-working decision makers behind some of the country’s most beloved artists. They make deals, orchestrate partnerships and make key strategic decisions. And though fans rarely know their names, they are key to the success of Canadian musicians. They don’t do it for personal glory, but to fulfill artistic visions that can break barriers and move millions.

These talented managers on the rise have helped some of the biggest artists tour stadiums, stun at the Met Gala or go gold without any label support. That’s an extra feat in Canada, where managers often have to navigate a tight-knit industry and geographic barriers to breakout success. In the feature, they share their tips for people new to the business and those who want to help introduce their artists to a global audience.

The list includes managers for Kaytranada, Jessie Reyez, Charlotte Cardin, Connor Price and more.

The Beaches’ manager, Laurie Lee Boutet, was named Manager of the Year. In an interview, she talks about how she helped navigate the Toronto band’s 2023 viral moment into sustained momentum on its way to its first hometown arena tour this fall.

In honor of the FIFA World Cup coming to North America next year, Liberty State Park in New Jersey — located across the Hudson River from Manhattan — has been selected as the official site of the FIFA Fan Festival, produced by Live Nation and DPS.

Met Life Stadium will host eight FIFA World Cup 26 games, including the Final Match. As a result, the NYNJ Host Committee chose Liberty State Park due to its stunning views of the Manhattan skyline and proximity to Ellis Island and the iconic Statue of Liberty. The FIFA Fan Festival NYNJ is expected to attract tens of thousands of fans during the 39-day tournament, which is set to take place from June 11 to July 19, 2026. Besides concerts and chances to participate in soccer challenges, fans can watch real-time match broadcasts and interactive fan activations, as well as activations for FIFA’s various corporate sponsors.

“The FIFA Fan Festival NYNJ will be the largest and most visible fan experience of the entire tournament,” said Alex Lasry, CEO of the NYNJ Host Committee, in a statement. “This isn’t just about watching matches, it’s about celebrating the game” and “creating lasting impact for our communities, partners, and millions of fans.”

Trending on Billboard

As part of its role programming FIFA Fan Festival NYNJ, Live Nation will present a number of premier concerts on non-match days, “creating marquee moments that celebrate the intersection of soccer, music, and culture,” according to a press release.

“The FIFA World Cup 2026 is one of the world’s most prestigious events and an unparalleled opportunity to highlight the region’s diversity and deliver unforgettable fan experiences,” added Geoff Gordon, Chairman of Live Nation Northeast Region. “We’re honored to support the NYNJ Host Committee on this historic moment.”

Production company Diversified Production Services will handle most of the logistics of the FIFA Fan Festival, said Darren Pfeffer, president of DPS, who said in a statement, “The FIFA World Cup draws billions of viewers from all over the planet, and the FIFA Fan Festival NYNJ will enable hundreds of thousands of fans to experience it in an immersive way.”

Christie Huus, chief events officer of the FIFA World Cup 2026 NYNJ Host Committee, added, “There’s nothing more powerful than bringing people together, and the FIFA World Cup will ignite our region with energy and excitement. The depth of experience Live Nation and DPS bring will ensure success in transforming NYNJ into one big block party.”

Tickets for the FIFA Fan Festival go on sale soon at FIFA.com/tickets.

Live Nation announced a deal to operate Arena Cañaveralejo in Cali, Colombia, in partnership with Mexican promoter OCESA and Colombian promoter Grupo Páramo. The 15,000-capacity arena is the concert giant’s first venue in the country. Notably, Live Nation acquired a 51 percent interest in OCESA in 2021 for $416 million and a majority stake in Páramo in 2023. Upcoming concerts to be hosted at the venue, which was built in 1957 and underwent a major renovation in 2021, include a show by Fonseca and Andrés Calamaro. “This venue will allow us to bring more world-class artists to Cali while also supporting local talent and growing the live music ecosystem in Colombia,” said Live Nation president/CEO Michael Rapino in a statement. “Live Nation is committed to investing in Latin America’s thriving music scene, and this partnership with Grupo Páramo will help us create unforgettable experiences for fans in the region.”

Management at music video streaming service ROXi completed a buyout of the ROXi business in partnership with investors that include U.S. TV broadcasters Sinclair and Gray Media. The new company created under the deal, FastStream Interactive Limited, has struck distribution deals with U.S. broadcasters that will bring FastStream’s new interactive TV channels to their customers. The first FastStream-powered TV channel will be ROXi, which is touted in a press release as “America’s first Interactive TV Music Channel.” The channel will be available for free on NEXTGEN TV, a “new digital TV standard” in the U.S. “By 2028, over 75% of all US TVs sold will be NEXTGEN TV sets,” the release states. Shareholders in the new venture include Sinclair and Gray Media; U2 bassist Adam Clayton; Terra Firma founder Guy Hands; British billionaire businessman Jim Mellon; and Warner Mandel, a global co-head of telecom, media and technology at Rothschilds Warner Mandel.

Trending on Billboard

British indie label Cherry Red Records acquired U.K.-based Dome Records from directors Peter and Santosh Robinson. Dome’s catalog primarily consists of soul and R&B from artists including Lulu, Beverley Knight, Incognito, Hil St Soul, the James Taylor Quartet, Shaun Escoffery, Brenda Russell, George Duke, Anthony David, Jarrod Lawson and Andrew Gold. Peter Robinson will continue working with Dome as a consultant.

Independent New York-based rock label Equal Vision Records announced a partnership with kill iconic records, the label that sprang from the quarterly heavy and progressive music magazine kill iconic. Through the deal, kill iconic brings current artists Moondough, Lobby Boxer, ahh-ceh and Gold Necklace along with new signings Dwellings, Mella and Resilia. The first release under the agreement is the single “IDGAF2” by Dwellings, a Sacramento, Calif.-based post-hardcore band. Equal Vision also announced it has partnered with Burlington Record Pressing to open a boutique solar-powered manufacturing plant located in Albany, N.Y., that uses recycled and lead-free materials to create custom vinyl records.

SongTools, a marketing and ad tech solutions platform for music creators, teamed up with Latin American radio monitoring company monitorLATINO to launch digitalLATINO, a new platform that offers digital charts, playlist promotion, automated advertising campaigns and more for musicians. In other SongTools news, the platform has also been integrated into the marketing dashboard for Symphonic via a new partnership with the distributor.

ALTER Music, a new indie record label founded by former 300 Entertainment executives Rob Stevenson and Matt Signore, signed a joint venture partnership with Firebird, a multi-sector music company that invests in and services labels and publishers, with an emphasis on management and label services. Through the deal, Firebird will provide ALTER with financial, analytical and strategic support.

Web3-based distribution and label services company Unchained Music struck a manufacturing and distribution partnership with vinyl pressing plant Sonic Wax. Under the deal, select artists on the Unchained Web3 services platform will enjoy physical releases of their music. Sonic Wax is a global vinyl distributor that has served artists including Raye, Swedish House Mafia, Boy George, Masters At Work and Chase & Status.

Loaded Dice Entertainment, the newly launched full-scale label services and distribution company, signed a deal with e-commerce storefront and supplier Amaze Holdings. Through the agreement, Amaze — which utilizes a print-on-demand model to reduce merch overproduction — will host Loaded Dice-branded merchandise and artist-specific items. The first Loaded Dice artist to be hosted on Amaze is Hudson Thames.

Live Nation has elected acting Kennedy Center president and Donald Trump ally Richard Grenell to its board of directors, according to a recent disclosure from the Securities and Exchange Commission. Grenell was appointed to run the federally owned performing arts center in February following a Trump-led shakeup that saw the President appoint himself chairman of […]

The U.S. Department of Justice is conducting a criminal investigation into whether Live Nation and AEG illegally colluded in their concert refund policies at the beginning of the COVID-19 pandemic, Live Nation confirmed, though the concert giant is denying any wrongdoing.

Bloomberg first reported Thursday (May 15) that the Department of Justice (DOJ) is investigating whether Live Nation and AEG violated federal antitrust laws by coordinating their responses to mass concert cancellations via a task force when the pandemic first hit in 2020.

Prosecutors have weighed bringing charges against Live Nation and its CEO, Michael Rapino, according to Bloomberg. No such charges have yet been filed; the statute of limitations for federal antitrust prosecutions is five years, meaning that if a case is going to be brought, it will have to be soon.

Trending on Billboard

Live Nation’s regulatory chief, Dan Wall, confirmed the criminal probe in a statement to Billboard but says the company did nothing wrong.

“It is not illegal for artist agents, promoters and ticketing companies to work together to solve the unprecedented challenges of a global pandemic,” Wall says. “While Live Nation contributed to this industry effort in good faith, we set our own unique policies and refund terms to support fans and artists. We did not collude with AEG or anyone else. We are proud of our leadership during those trying times, and if any charges result from this investigation, we will defend them vigorously.”

A DOJ spokesperson declined to comment on the matter Friday (May 16). Reps for AEG did not immediately return a request for comment.

The criminal investigation comes on top of the DOJ’s civil antitrust action accusing Live Nation and its subsidiary Ticketmaster of illegally monopolizing the live music industry. The lawsuit, filed last May, seeks to break up the two live entertainment behemoths that merged in 2010.

Live Nation and Ticketmaster insist that they are in compliance with antitrust regulations and have said they plan to “vigorously defend” against the lawsuit at trial, currently scheduled for March 2026.

The Live Nation-Ticketmaster suit was brought by then-President Joe Biden’s DOJ, and Bloomberg reports that the criminal investigation into Live Nation and AEG also began when Biden was president. But both enforcement actions have continued under President Donald Trump, who has made a priority of cracking down on issues within the live entertainment business

Trump signed an executive order in March — with musician and political supporter Kid Rock in attendance — calling for greater transparency around ticket sales and directing regulators to look into possible instances of deceptive and anticompetitive conduct in the industry.

The DOJ and Federal Trade Commission (FTC) responded by launching an official inquiry into the event ticketing business on May 7. The agencies said the probe is aimed at increasing competition in order to lower ticket prices, as well as rooting out exploitative scalpers and bots.

Live Nation has announced the launch of a $30 concert ticket initiative for summer 2025, through which fans will be able to access more than 1,000 shows at select amphitheaters across the U.S. and Canada throughout the season.

Live music fans can catch concerts from The Offspring, Halsey, Nelly, Pierce the Veil, Avril Lavigne, Kesha, HARDY, Dierks Bentley, Cyndi Lauper, Kidz Bop Kids, Rod Stewart and many more for just $30 — an all-inclusive price with no additional fees outside of local taxes.

Additional artists under the $30 ticket options include Willie Nelson, Simple Plan, The Black Keys, Weird Al Yankovic, Little Big Town, James Taylor, Leon Bridges, Goo Goo Dolls, Luke Bryan, Barenaked Ladies, Billy Idol, Cody Jinks, Keith Urban, Big Time Rush, Volbeat, Slightly Stoopid and more.

Trending on Billboard

More shows will be added throughout the summer, giving fans multiple chances to score $30 tickets all season long.

Starting May 21 in the U.S. and Canada, fans can go to Live Nation’s Ticket to Summer site to see the full list of participating events and add the ticket type “$30 Ticket to Summer” to their cart for the deal. T-Mobile and Rakuten members will get early access on May 20. All ticket sales will begin at 10 a.m. ET on the given day.

The $30 Tickets to Summer initiative follows Live Nation’s similar summer offering, Live Nation Concert Week. Live Nation Concert Week, which hit its 10-year anniversary last year, only lasted seven days. Notably, the promoter recently discontinued its popular Lawn Pass program, through which music fans paid a flat fee for a lawn ticket to every summer concert at participating amphitheaters. At the time of that announcement, the company said it would replace the six-year-old program with something different. The $30 Ticket to Summer will be the promotion giant’s only summer offering for the 2025 season.

Tickets for this year’s $30 Tickets to Summer are available for select Live Nation shows while inventory lasts.

Live Nation has agreed to a long-term lease for a 5,000-seat venue in downtown Atlanta that will be part of a development around the Mercedes-Benz Stadium and State Farm Arena.

Centennial Yards is described by CIM, the developer that has partnered with the City of Atlanta, as a “mixed-used community featuring residential units, retail and entertainment establishments, community gathering spaces and more.” The 50-acre site is expected to have a $5 billion price tag. In addition to the music venue, it will include a 14-story hotel, a two-story food and beverage hall and a Cosm entertainment venue. The development already includes a brewery, loft residences and a 500-foot pedestrian bridge.

Live Nation’s involvement with the development was first reported by The Wall Street Journal.

Trending on Billboard

Concert venues are increasingly popular properties in urban developments centered around the venues of professional sports teams. Mercedes-Benz Stadium has been the home of the Atlanta Falcons since 2017. The Atlanta Hawks basketball team plays at State Farm Arena.

“Every owner of a major sports team that wants to have their new building is not just building a building anymore,” Live Nation president/CFO Joe Berchtold said at the J.P. Morgan Global Technology, Media and Communications Conference on Tuesday (May 13). “They’re building an entertainment district around it.”

Centennial Yards is the latest example of concert promoters taking part in developments that aim to revitalize urban areas. Downtown Nashville’s The Pinnacle, a 4,500-capacity music venue operated by AEG Presents, is part of Nashville Yards, owned by real estate developer Southwest Value Partners. Nashville Yards also houses AEG Presents’ regional offices, CAA and, starting in July, Messina Touring Group.

Another massive multi-purpose project getting underway is RFK Stadium in Washington, D.C. The development currently includes a food hall, a skate park and festival grounds that hosts music festivals and other large gatherings. Berchtold said at the conference that he was in D.C. last week but didn’t mention the RFK project.

Leasing a mid-sized venue in Atlanta will add to Live Nation’s portfolio of venues under its Venue Nation business segment. Venue Nation plans to open 20 additional venues globally in 2025, which it believes will add 7 million incremental fans annually. As of the end of 2024, Live Nation leased 222 venues, owned 32 and operated 67. It has the exclusive booking rights to another 69 venues and owns an equity stake in 4.

Though economic uncertainty lingers, some music companies’ stocks got boosts following their first quarter earnings releases this week, while a better-than-expected jobs report on Friday (May 2) lifted stocks across the board.

K-pop companies were among the top performers of the week. Led by HYBE’s 13.8% gain following its first quarter earnings report on Tuesday (April 29), the four South Korean companies had an average share price gain of 10.3%. JYP Entertainment rose 11.7% and SM Entertainment, which announces earnings on Wednesday (May 7), improved 9.0%. YG Entertainment gained 6.6%.

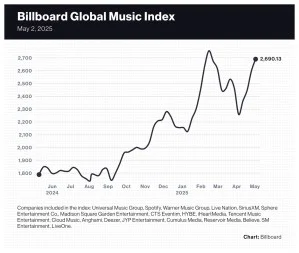

The 20-company Billboard Global Music Index (BGMI) rose 3.6% to 2,690.13, its fourth consecutive weekly improvement. At 2,690.13, the BGMI has improved 19.1% since a two-week slide and stands just 2.4% below its all-time high of 2,755.53 set during the week ended Feb. 14.

Trending on Billboard

Music stocks slightly outperformed the Nasdaq and S&P 500, which rose 3.4% and 3.1%, respectively. Foreign markets were mostly positive but more subdued. The U.K.’s FTSE 100 rose 2.2%. South Korea’s KOSPI composite index gained 0.5%. China’s SSE Composite Index lost 0.5%.

Universal Music Group (UMG) gained 4.3% to 25.86 euros ($29.23) following a quarterly earnings report showing that recorded music subscription revenue grew 11.5% and overall revenue improved 11.8%. JP Morgan analysts’ conviction on UMG “remains very high,” and the strong quarter “should help rebuild confidence and share price momentum” dented by Pershing Square’s sale of $1.5 billion in UMG shares, analysts wrote in an investor note on Tuesday.

Spotify finished the week up 3.7% to $643.73 despite its shares dropping 3.4% on Tuesday after the company’s first-quarter earnings report included guidance on second-quarter subscription additions that seemed to underwhelm investors. Gross margin of 31.6% beat Spotify’s 31.5% guidance. Loop Capital raised Spotify to $550 from $435, while Barclays lowered it to $650 from $710. UBS maintained its $680 price target and “buy” rating. Guggenheim maintained its “buy” rating and $675 price target.

Live Nation, which reported first quarter earnings on Thursday (May 1) and predicted a “historic” 2025, gained 2.3% on Friday and finished the week up 0.7%. A slew of analysts updated their price targets on Friday. Two were upward revisions: Jefferies (from $150 to $160) and Wolfe Research (from $158 to $160). Two were downward revisions: Rosenblatt (from $174 to $170) and JP Morgan (from $165 to $170).

Nearly all streaming stocks posted gains. LiveOne was the week’s top performer, jumping 18.0% to $0.72. Chinese music streaming companies Cloud Music and Tencent Music Entertainment gained 11.6% and 7.1%, respectively. French music streamer Deezer gained 1.4% to 1.44 euros ($1.63) after the company’s first-quarter earnings on Tuesday. Abu Dhabi-based Anghami fell 3.1% to $0.62.

Cumulus Media fell 33.% to $0.14. Most of the decline came on Friday as the stock ceased trading on the Nasdaq and began trading over the counter.

Created with Datawrapper

Created with Datawrapper

Created with Datawrapper

According to Live Nation CEO Michael Rapino during the company’s earnings call on Thursday (May 1), every chief executive is being asked the same question this earnings season: Are you feeling a consumer pullback?

It’s a reasonable query given the worsening state of the economy. U.S. gross domestic product decreased at an annual rate of 0.3%, the U.S. Bureau of Economic Analysis announced on Tuesday (April 30). And on Thursday, news broke that U.S. joblessness claims for the week ended April 26 surged beyond expectations. Earlier in April, the University of Michigan reported that its consumer sentiment score fell to 57.0 in March, down from 71.8 in November. That puts the closely watched measure on par with scores during the 2009 fallout of the U.S. housing crisis and in August 2011, as consumers feared a stalled recovery.

But on Friday (May 2), a reprieve from the bad news arrived in the form of a better-than-expected jobs report. And judging from comments during this week’s earnings calls, many music companies remain confident that their businesses will weather whatever storms develop in 2025.

Trending on Billboard

“We haven’t felt [a pullback] at all yet,” Rapino said. Whether it’s a festival on-sale, a new tour or a standalone concert, Live Nation has seen “complete sell-through” and “strong demand” that surpasses 2024’s record numbers, he added: “So, we haven’t seen a consumer pullback in any genre, club, theater, stadium [or] amphitheater.”

To see how Live Nation fared during the last recession, you’d have to go back to 2009. The U.S. housing crisis had shaken the economy and GDP shrank 2.0% that year, but Live Nation’s revenue increased 2.3%. Then, as the economy rebounded in 2010, the company’s revenue jumped 21.1% in 2011.

Of course, live music took a nosedive during the pandemic, but the drop-off in 2020 and 2021 was caused by a decrease in the supply of concerts, not a dip in demand for live music. When artists returned to touring, fans showed up in record numbers.

Some parts of the economy can be trusted to stumble during a downturn. Case in point: U.S. advertising revenue fell 14.6% in 2009 and dipped 5.4% in 2020. Brands are quick to cut their ad spending when they anticipate a pending sales decline. For example, car dealerships frequently advertise on TV and radio, but cut back as auto sales fell 17.6% in 2009 and 20.3% in 2020.

A decline in advertising is harmful to some parts of the music business. Radio companies have struggled with weak ad revenues in recent years, and their stock prices have taken a beating. Through Friday, iHeartMedia’s stock price is down 50% year to date, and Cumulus Media, which de-listed from the Nasdaq today, has lost 82%.

But music is a “counter-cyclical” business, meaning it doesn’t follow larger economic trends, and the popularity of subscriptions has helped insulate the music industry from economic woes. It’s widely believed that consumers simply won’t part with their favorite music service. In fact, $11.99 for a month from Spotify or Apple Music, although a few dollars higher than two years ago, is considered by top music executives to be underpriced.

During Spotify’s earnings call on Tuesday, CEO Daniel Ek said “engagement remains high, retention is strong” and the ad-supported free tier gives users a way to remain at Spotify “even when things feel more uncertain” — not that Ek is uncertain about the company’s future. “I don’t see anything in our business right now that gives me any pause for concern,” he said flatly.

Universal Music Group (UMG) is on the same page as Ek. CEO Lucian Grainge attempted to ease investors’ concerns by explaining that he has witnessed music weather numerous recessions. “Music has always proven to be incredibly resilient,” he said during an earnings call on Tuesday. “It’s low cost, high engagement and obviously a unique form of entertainment.” In addition, added chief digital officer Michael Nash, UMG’s licensing agreements include minimum guarantees that provide “very significant protection against digital revenue downside risk this year.”

There’s always a chance that unforeseen events or a particular confluence of factors will ruin music’s winning streak. With subscription prices rising, a possible “superfan” subscription tier on the horizon, ticketing prices not getting any cheaper and tariffs increasing the costs of music merchandise, consumers may reach a breaking point. MIDiA Research’s Mark Mulligan argued this week that superfans are being “pushed to the limit” and concertgoers don’t have an unlimited ability to absorb higher ticket prices.

So far, however, the evidence suggests music fans’ spending is continuing unabated. Live Nation says its various metrics — ticket sales, deferred revenue for future concerts — point to another “historic” year in 2025. Rapino added that the company’s clubs and theaters haven’t reported a decrease in on-site spending. Part of that could be that Live Nation carefully curates an array of food and beverage options that maximize per-head revenue. But a more likely explanation is that people need entertainment now more than ever.

In the historically slow first quarter, Live Nation’s revenue dropped 11% to $3.38 billion (an 8% decline in constant currency), but adjusted operating income (AOI) fared better, declining 6% (or 0.5% in constant currency) to $341.1 million.

As the U.S. economy teeters and businesses brace for a protracted and uncertain trade war, Live Nation, the world’s largest concert promoter and ticketing company, believes the business will recover from the slow start to the year. CEO Michael Rapino expects 2025 to be “a historic year for live music, with a strong start having us on track to deliver double-digit growth in operating income and AOI this year,” he said in a statement.

The first quarter is relatively slow as concerts are concentrated in clubs and theaters before festivals, stadium and amphitheater shows appear later in the year. In 2024, the first quarter accounted for just 16% of Live Nation’s full-year revenue, and the concerts division received just 15% of its 2024 revenue in the first quarter. The second and third quarters, in contrast, accounted for 59% of 2024 revenue.

Trending on Billboard

Various financial metrics portend well for a stronger finish to 2025. Through mid-April, event-related deferred revenue — money collected for future concerts — of $5.4 billion was up 24% year-over-year. The 95 million concert tickets sold for Live Nation concerts represented a double-digit increase. On-sale sell-through rates were at or better than the same period last year. Ticketmaster’s primary ticketing volume was up 5% and gross transaction value (GTV) was up 10%.

The various divisions expect to have similar margins to previous years. Concerts’ AOI margin should be consistent with the 3% achieved in 2024. Ticketmaster’s AOI margin should be in the high 30s and sponsorships in the low 60s.

Absent stadium and amphitheater shows that occur later in the year, Live Nation’s concerts business had $2.48 billion in revenue, down 14% (11% in constant currency) from the prior-year quarter, from 22.3 million fans who attended 11,300 events. Concerts’ adjusted AOI improved to $6.6 million from a $1.8 million loss a year earlier.

In the ticketing segment, revenue fell 4% (1% at constant currency) to $695 million, and adjusted AOI of $253.1 million was down 11% (7% in constant currency). Concerts’ primary GTV was up 9%. Of the 78 million fee-bearing tickets, a number that was consistent with the first quarter of 2024, concert tickets were up 4% and accounted for 60% of volume. Non-concert tickets were down 9%.

Sponsorship revenue of $216.1 million was up 2% (9% at constant currency) while the division’s adjusted AOI of $136.0 million was up 5% (11% in constant currency). In the quarter, Live Nation secured new name-in-title sponsorships, including Citizens Live at The Wylie and Synovus Bank Amphitheater at Chastain Park.

Foreign exchange affected AOI by 5% due to Live Nation’s exposure to the Mexican peso and other Latin American currencies. The company expects foreign exchange headwinds to result in low, single-digit impacts to revenue and AOI in the second quarter.

State Champ Radio

State Champ Radio