Korea

Trending on Billboard

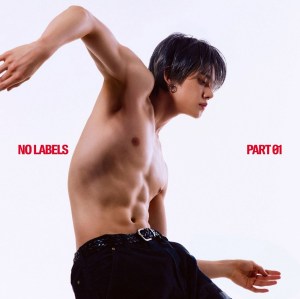

Released Nov. 7, YEONJUN’s debut solo album NO LABELS: PART 01 is one of the most compelling K-pop releases of 2025.

When his first mixtape GGUM dropped in fall 2024, it initially felt like a slightly puzzling choice. Its electronic-tinged hip-hop sound — filled with mechanical textures, indistinct vocals, and a repetitive hook — seemed to lean more toward concept than toward showcasing YEONJUN’s strengths: vocal ability, dynamic tonal shifts, and live power that had long been overshadowed by his reputation as a dancer. Yet as reactions remained divided, the view began to shift as I watched YEONJUN continue stepping onto stages alone — including year-end award music shows — driven purely by love for performance. I began to understand why he had chosen the song and, eventually, to cheer for that choice. During the group’s subsequent tour, TOMORROW X TOGETHER members appeared in various ways during YEONJUN’s “GGUM” stage, making it clear that they were proud of the performance as well. And when YEONJUN chose the reggae rock genre track “Ghost Girl” for TXT’s fourth studio album The Name Chapter: TOGETHER released in July this year, the question naturally arose: Where would he go next? The answer arrived in the form of NO LABELS: PART 01.

The album cover — an instantly viral image capturing YEONJUN dancing shirtless in his most unfiltered form — was shot by photographer Hye.W.Kang (@hyeawonkang). Although she had previously worked with him for magazine covers and TXT group shoots, this was the first time they spent three full days together on a project. To her, YEONJUN was unmistakably an artist with strong self-assurance.

YEONJUN, “NO LABELS: PART 01”

Courtesy of BIGHIT MUSIC

“YEONJUN knows exactly what he wants to express; he moves with a clear artistic direction in both performance and music,” Kang told Billboard Korea. “The album title NO LABELS had already been finalized, and because I naturally gravitate toward work that focuses on the person rather than any devices or concepts, I was grateful to be offered this project.” Understanding the music was also essential. “From the morning of the first day, I kept listening to his tracks so I could fully absorb the mood he wanted to convey. I listened to them over and over — quite a lot.” In both the early-released images and the album cover, YEONJUN exists not as a static figure but as a presence defined through movement. The slight distortions, shadows, and irregular poses are not “safe A-cuts,” but closer to the aesthetic of a deliberately chosen B-cut — images that capture an artist’s energy most vividly. “The shirtless shoot took place on the second day. YEONJUN felt a bit unfamiliar at first, but quickly found his rhythm. We did very minimal retouching. We all agreed that rather than crafting a smooth, refined image, we wanted to preserve his natural expressions and movements.” While design considerations likely influenced the final cover choice, YEONJUN’s own presence — and the strength of his decisions — undoubtedly played the biggest role.

The first day’s shots, using props like a bed and chairs, were featured prominently in the album’s ‘SET-UP B’ version. Kang felt that if the focus remained solely on movement, YEONJUN’s iconic face and energy might not fully come through. The result: images that balanced his power as a performer with his presence as an individual.

YEONJUN

Hye.W. Kang / Courtesy of BigHit Music

The third day of shooting took place alongside the music video schedule in Thailand. “The movement-based scenes and video shots wrapped surprisingly quickly,” Hyewon Kang recalls. “YEONJUN was already fully prepared for his performance. He wasn’t someone who ‘showed’ something in front of the camera — he was an artist who stepped in with conviction and completion already within him.”

“NO LABELS, JUST ME” — a phrase anyone could throw around rhetorically — is something YEONJUN proves thoroughly through both the music and visuals of his first solo album. Aside from the final track “Coma,” all six songs were produced entirely by producer-songwriter MISHA (@thatboymishaa), giving the album remarkable cohesion. MISHA, who previously worked with TXT’s “Upside Down Kiss,” shared via social media, “This project is a lot of firsts for me and means the world. Thank you for believing in these songs and allowing me to be completely myself as a writer and producer throughout this project.”

YEONJUN

Courtesy of BigHitMusic

The opening track “Talk to You” begins with crisp drum beats and YEONJUN’s confident attitude, pairing his rap with rhythmically controlled vocals that cut through the intense electric guitar in the chorus. Its rock energy flows naturally into the relaxed electronic sound, synth textures, and minimal rhythm of “Forever.” The third track, “Let Me Tell You (feat. Daniela of KATSEYE),” featuring KATSEYE’s Daniela, continues the synth-driven warmth and sensual tone, deepening the album’s cohesive mood. “Do It,” an old-school hip-hop number built on drums, bass, and a standout keyboard in the latter half, lets YEONJUN’s laid-back voice take the lead — before shifting into the hard-hitting hip-hop sound of the fifth track, “Nothin’ Bout Me.” With lines like ‘Define me if you can,’ ‘Say what you want, no cares,’ and the explosive ‘All that talkin’ Shut up,’ punctuated by scratching and shouting, the track delivers the album’s message most directly. The heightened energy flows seamlessly into “Coma,” whose tape-stop effects allow the intensity to slowly ease as the album nears its end — leaving behind the line, “You’re in my zone, come and follow.”

Given its cohesive sound and concept, the music video for this project was created as a six-minute omnibus combining three tracks — “Coma,” “Let Me Tell You (feat. Daniela of KATSEYE),” and “Talk to You” — under the banner of NO LABELS: PART 01. Director Song Taejong(@songtaejong) recalls, “The idea of making a 6-minute omnibus video came from the label(BigHit Music). Honestly, I was worried at first. Since videos are getting shorter these days, we added fun moments and unexpected elements throughout the 6-minute video to keep viewers attention. I always try to capture the full charm of my subjects, but during the wire scenes, I looked at the monitor and thought, ‘This might be the coolest shot I’ve ever filmed,’” he said with a laugh.

Conversations around K-pop are endless. Whether it’s “music to watch or music to listen to,” what elements it borrows from past legacies, or whether its intricate vocabulary and overbuilt imagery allow the core — the music — to truly shine. Amid constant doubt, criticism, pressure, and anxiety — YEONJUN has openly shared that he cried from fear and burden before his “GGUM” promotions, and his behind-the-scenes videos show the emotional strain of songwriting, choreography, performance, and tight deadlines — he still brought forward something entirely his own. And for that reason, YEONJUN’s latest album carries no labels and no references. Perhaps it’s because he doesn’t need them. He already knows — with his whole body, through every lesson learned — exactly how he is meant to move.

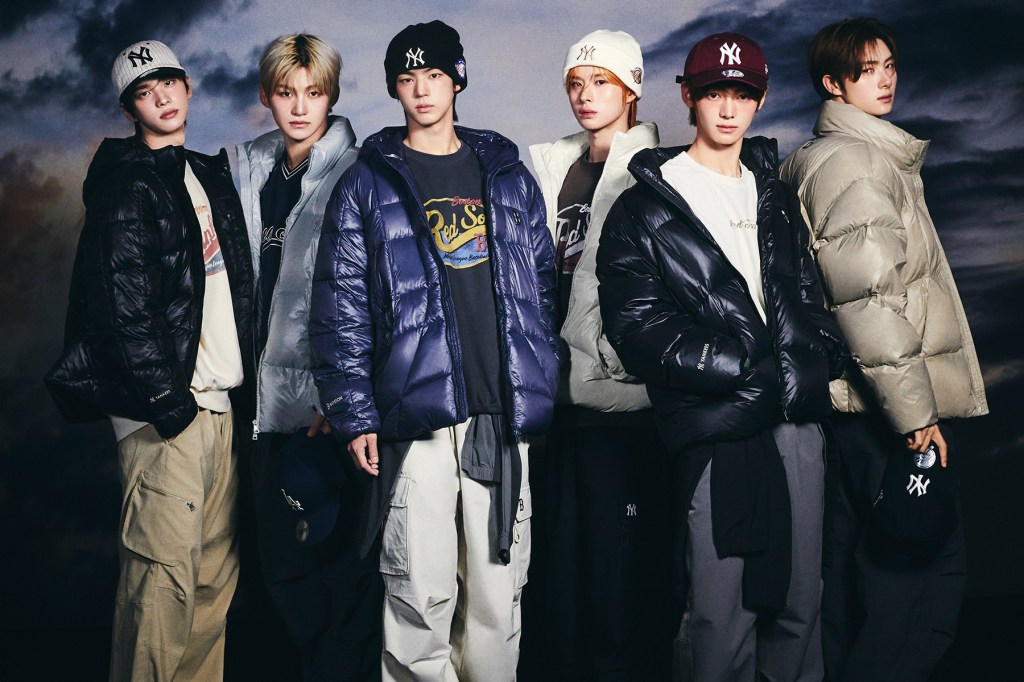

Hyeonbin, Yeonwoo, Yoon, Siyun, and Jinhyuk

Image Credit: Kim MinSeok

YEONWOO

You trained for seven years at CUBE entertainment. Known as the team’s “all-rounder” for your performance and vocal skills, your hard work really shows. What did you learn from the experience as a trainee?

I think I naturally picked up not just dance and singing, but also other skills like speaking and languages. All of that has helped me, especially on stage, where every detail matters.

A debut showcase must have been an emotional moment for you.

It was the moment of reaping seven years of effort and taking a new leap forward, so the excitement was unforgettable. I’ve faced many nerve-wracking stages since, but that one felt like my heart was literally going to jump out of my chest (laughs).

The title track of NOWZs EP IGNITION, released this July, “EVERGLOW,” is about running toward the light even in darkness. How did your pre-debut experiences shape you?

As a trainee, you’re always in a position where growth is necessary. There were times of improvement, but also moments that I’d call failures. Looking back, I think I learned the most from those failures. That goes for skills, but also for relationships. You really can’t know anything without experiencing it, and every experience ends up being important.

As a member of NOWZ, what do you feel you do best?

I’d say keeping the group’s performance in sync. I tend to dive deeply into things, so I notice a lot of details. I also watch the stage as a whole and often suggest ways to make it look even better.

How would you define NOWZ’s current identity?

With “EVERGLOW,” we tried to convey the message that even painful moments eventually shine. We’ve all felt the struggles of growing up and the uncertainties about the future, so we could put genuine emotion into that. On stage, it feels like we’re showing our true selves. We often talk about NOWZ’s ‘color’ as a group, but it’s still something we’re discovering. What’s certain is that we want to share stories that resonate with people our age, offering empathy and comfort to those watching. Hearing that someone felt comforted through our performances is incredibly motivating.

You mentioned energy, but that you were also comforted by BTS’s music during your trainee years. Is there anything that’s inspired you recently?

I recently saw a video from Travis Scott’s concert where the fans jumped so energetically that it created vibrations like an earthquake. I started thinking about what it must feel like to be on a stage like that, and what it is that makes people go so wild with excitement.

Having spent years at CUBE’s office building, you must know it better than most. Can you share a little?

There’s nothing really secret, but the building has about 15 vocal rooms and 5 dance studios. Recently, NOWZ even got our own floor! Before debut, I used to be a little intimidated by the fourth floor — that’s where we were evaluated by the performance director every Friday. Now, I feel completely comfortable going there (laughs).

At this point, what do you enjoy the most?

Nothing compares to being on stage. I’ve been chasing the dream of standing on stage for so long, and it’s where I feel most alive. Moving and singing on stage brings me the greatest joy and makes me feel truly fulfilled.

NOWZ have performed covers of Stray Kids’ “Back Door” and “MANIAC”, as well as NCT U’s “Seventh Sense”. What do you focus on when doing cover stages?

For “MANIAC” at KCON LA, we wanted a song that could match the energy of the local audience, and that’s what we chose. Stray Kids are incredibly energetic, and performing on stage while feeling that energy made it one of the most memorable stages for me. Watching other artists’ performances always inspires me — seeing different music and styles makes me realize just how wide the world is.

Do you have something you do just for yourself?

I recently started enjoying biking. From our company in Seongsu-dong to the Jamsu Bridge, it’s a decent distance, but biking makes it quick. I love riding while listening to music. I also enjoy gaming, of course. And, honestly, the little happiness of lying in bed after everything and feeling the coolness of the blanket — that’s pure bliss.

What comes to mind first when you think of ‘Billboard’?

BTS! I’ve always admired them, and seeing their Billboard records made me imagine a bigger world. It also reminds me of my trainee days when the company told us to check the Billboard charts to understand global music trends.

As K-pop reaches audiences all over the world, what’s a dream you hope to achieve?

It’s always amazing to see people doing ‘dance challenges’ with our songs. One day, I’d love to hear someone singing our music casually while walking down the street. I’ve seen moments like that in BTS’s overseas vlogs, and while it may be routine for them, I can’t help but imagine how incredible it would feel for us to experience that too.

What does music mean to you right now?

Music feels like the ocean. I’ve explored some parts of it, but there’s still so much to discover. I’m curious about the things I haven’t experienced yet. I want to dive into broader genres and keep exploring the depths of music.

SIYUN

Your first EP IGNITION has been described as showcasing NOWZ’s new identity. Aside from the title track “EVERGLOW”, is there another track you’re particularly proud of?

Definitely “Problem Child”. The concept itself felt fresh and fun to me. I remember writing the lyrics excitedly while waiting in the car on set during the music video shoot.

You’ve been working closely with member JINHYUK, who’s also born in 2004. How do your studio sessions usually go?

Usually, late at night, I listen to the beat and think, “This could work — let’s try this together,” and I’ll take JINHYUK to the studio(laughs). Sometimes we try writing in our dorm first, then go back to the studio to record. Other times, we just head straight to the studio and start working. Since we’re both rappers, a lot of our work is collaborative.

And he follows along willingly?

Honestly, I need JINHYUK! I’ve learned so much from JINHYUK. I used to work really slowly — sometimes it took me a week just to write four bars. Thanks to him, I can put something together relatively quickly now.

What joy do you get from participating in the songwriting process yourself?

I know my pronunciation, tone, and flow better than anyone. So if I want to show my style at 100%, it’s better for me to be directly involved. Of course, there’s also the pride I feel when people like the songs I’ve worked on. That’s really rewarding.

Once you described yourself as “someone who can do anything.” Do you feel the same way now?

Absolutely. I feel like I’m constantly proving myself. When I first started as a trainee at 17, my dancing and singing were really clumsy. Looking back now, I can see how much I’ve grown — my speed in songwriting has improved, and my vocal parts have gotten stronger too. There have been many moments where I’ve realized, “OK, I can do this.”

What has motivated you to keep pushing yourself?

These days, so many people start training or debut at a very young age. Since I felt like I started a bit later, I think it pushed me to work even harder.

You’ve been active for a year and a half since debut. Do you see areas where you can have more fun or improve?

I’ve never once regretted choosing this path. Even the tough parts feel worthwhile because it’s a career that truly fits me. The best part, of course, is having our fans.

Are there performances by other artists that inspire or motivate you?

Watching NCT DREAM’s “We Go Up” performance is what made me dream of becoming a K-pop idol. After our debut, I saw their “Smoothie” stage on a music show, and it was truly overwhelming. That was the day I really thought, “Wow, this is the epitome of K-pop idol.”

Your cover of MARK’s “Fraktsiya (Feat. Lee Youngji)” with Jinhyuk hit 1 million views on YouTube. What do you focus on when performing a cover?

Rather than just copying the original, I focus on emphasizing the parts where we can showcase our own charm. For example, when preparing Stray Kids’ “MANIAC” for KCON LA, I tried adding elements that suited me better and worked with the members to refine the key choreography points. It’s all about making the performance feel like us.

If you return to LA, what would you like to enjoy more?

The U.S. is really the center of the music industry. While performing and doing interviews there were invaluable experiences, I’d love to go deeper into the culture — participating in a songwriting camp, taking dance classes at local studios, that kind of thing. I’m also studying English diligently.

As a Billboard K-pop rookie of the month, do you remember the first moment that you were aware of ‘Billboard’?

During my trainee years, I was told that checking the Billboard charts would help me study rap, so I started exploring them. Artists like Drake were often at the top back then, and I think that really helped me. Now, being on the Billboard chart as a K-pop artist has become one of my personal goals as well.

After a year and a half as a five-member team, is there a particular member whose charm you hope more people recognize?

A lot of my and JINHYUK’s work has been released, but HYEONBIN has also created some amazing tracks. And Yoon is probably the most variety-show-savvy member in our team — I hope people get to see that side of him too.

What does music mean to you right now?

Music is like food to me. Just as I can’t live without eating, music is something I absolutely need. And depending on which ingredients I use and how I technically cook them, the taste can vary greatly — that’s how I see creating music.

Trending on Billboard

if ( !window.pmc.harmony?.isEventAdScheduledTime() ) {

pmcCnx.cmd.push(function() {

pmcCnx({

settings: {

plugins: {

pmcAtlasMG: {

iabPlcmt: 2,

}

}

},

playerId: ‘4057afa6-846b-4276-bc63-a9cf3a8aa1ed’,

playlistId: ‘b7dab6e5-7a62-4df1-b1f4-3cfa99eea709’,

}).render(“connatix_contextual_player_div”);

});

} else {

// This should only be get called when page cache is not cleared and it’s event time.

window.pmc.harmony?.switchToHarmonyPlayer();

}

“Someday, through a world tour, I want TWS to reach another major level of growth. To do that, I want to become a more self-directed person.”

You were selected as Billboard‘s K-Pop Rookie of the Month in January by Billboard Korea and Billboard U.S. What has changed over these nine months?

We successfully wrapped our first tour in Japan and tried a hip-hop concept with the pre-release “Head Shoulders Knees Toes.” It was a meaningful stretch of time in many ways. Through those changes, we became closer not only among ourselves but also with 42 [our fandom]. Personally, I also spent time thinking about how to make myself a more valuable person.

How do you define “a valuable person”?

Simply put, someone who’s self-directed. To be that, I first had to know who I am and what I truly want to do. As TWS’s Youngjae, I’d like to be someone who broadly makes a positive impact on society and the public through music.

“Head Shoulders Knees Toes” is a strong hip-hop track that differs from TWS’s previous image. What was your first reaction on hearing it?

Because the song itself is so high-energy and different from our earlier image, we needed time to adjust — myself included. If we were going to make a change, I didn’t want that first attempt to fall flat. So we spoke more candidly than ever about our concerns — right down to the tricky parts — to make sure both fans and the general public would receive it well.

Did anything change in your vocal approach?

Up to now, I focused on a clean, pristine feel — a tone people might describe as “pretty.” For “Head Shoulders Knees Toes,” I tried to sing rougher. Since it was unfamiliar, I took breaks when it didn’t work, then tried again — with the mindset of “break the limit.” During recording I kept asking, “Can I try it this way?” and looked for places to add a bit of my own color.

What about the title track “OVERDRIVE”?

The moment I heard it, I thought, “That’s our song.” [Laughs] The melody felt like home, so recording was enjoyable and relaxed. I could already imagine how we’d look performing it as TWS.

TWS’s music evokes a bright blue for many listeners. What color was added this time?

Through B-sides, we’ve been trying things beyond bright tracks — like “Comma,” “Double Take,” and “Oh Mymy : 7s.” Those attempts piled up and paved the way for a song like “Head Shoulders Knees Toes.” With this album, I think we added a slightly darker tone to the color people associate with TWS.

You talk about teamwork a lot. Anything you want to say to the members?

We’re all still young — our maknae Kyungmin is 19, and I’m 21 — so we’ve all worked really hard since early on. Even if we sometimes miss out on things kids our age get to enjoy, I think it’s amazing how passionately everyone commits to what they love. I’m grateful that we’re building good memories together in the midst of those limited days.

What reaction would make you happiest from listeners of this album?

“If it’s TWS, I’ll listen — no questions.” That one line would make me truly happy.

A vocalist you’d like to collaborate with someday?

Dean. He’s an artist in every sense — fashion, music, vocal. He communicates his own color across different fields in a way that connects with the public. In so many ways, I want to learn from him.

You mentioned a songwriter’s ambition, too. What are you doing for that despite your busy schedule?

I’ve been taking piano lessons — paused for now — because I think you should be able to handle at least one instrument to compose. Learning an instrument helps in many ways, so I’m trying to keep at it intentionally.

You’re studying Japanese consistently. Your recent Japan tour must’ve given you chances to use it.

The more chances I get to use it, the less satisfied I am — I just want to get better. [Laughs] Whenever we go abroad, I want to keep learning and become more fluent.

What’s your current goal for TWS in the global music market?

A world tour. As we toured Japan, I realized how much you can learn from encountering new cultures in different countries. You grow through that process. Through a world tour, I want us to take another big leap.

You’re not afraid of being thrown into new environments, huh?

Nope. I’m not afraid! [Laughs]

The Seoul High Court has sided with ADOR, the label behind K-pop powerhouse NewJeans, in an ongoing legal dispute that’s captivated fans and industry insiders alike.

On Tuesday (June 17), a panel of judges — Hwang Byung-ha, Jeong Jong-gwan, and Lee Kyun-yong — upheld a prior injunction barring the five-member group, currently promoting as NJZ, from pursuing independent activities outside of their exclusive contract with ADOR.

The court rejected the group’s appeal, stating there were no sufficient legal grounds to overturn the original decision, which was put in place to maintain the status quo of the contract.

Trending on Billboard

In their filing, the members of NewJeans argued that HYBE, the parent company of ADOR, had broken the trust central to their contract — pointing to HYBE’s internal audit and the controversial dismissal of former ADOR CEO Min Hee-Jin. They also cited a lack of support and neglect from the label as further grounds for appeal.

However, the court disagreed, finding no contractual clause that guaranteed Min’s position as CEO or producer. Judges emphasized that while the leadership dispute may have created tension, it did not invalidate the binding nature of the agreement.

The court further noted that HYBE had acted in good faith by establishing ADOR specifically for NewJeans and providing major support for the group’s debut and rise to stardom. Even after Min’s dismissal, HYBE reportedly offered to keep her involved in the group’s creative direction and later reinstated her as an internal director of ADOR.

In response to concerns about inactivity and career disruption, the judges concluded that any resulting harm stemmed from the members’ refusal to fulfill contractual obligations — not from actions by the company. They also emphasized that the contract had been individually negotiated and could not be considered an unfair, one-size-fits-all agreement under Korean law.

The ruling highlighted the potential financial damage to ADOR if the group were allowed to unilaterally terminate the agreement, a risk the artists had acknowledged at the outset. The seven-year term, the court noted, was clearly agreed upon by all parties.

With the decision, the court reaffirmed ADOR’s legal authority over NewJeans’ management and effectively shut down the group’s attempt to gain independent control of their activities marking a significant chapter in a legal battle that could reshape how artist-label contracts are viewed in the K-pop industry.

BTS officially kicked off its offline event 2025 BTS FESTA on Friday (June 13) at Halls 9 and 10 of KINTEX Exhibition Center 2 in Goyang, Gyeonggi Province, in celebration of the group’s 12th debut anniversary. Running for two days from June 13 to 14, this year’s FESTA features a variety of hands-on experiences designed especially for their fandom, ARMY.The theme for this year’s FESTA is Twelve O’Clock, symbolizing the beginning of a new chapter and hinting at the group’s imminent full-group return. BTS members Jin and j-hope introduced the concept in the YouTube segment BTS News released in early June, marking their first official appearance in a while.

The event is open from 10 a.m. to 7 p.m KST, with last entry allowed until 6 p.m. Admission is available for fans age 9 and above; children under 9 are not permitted to enter, regardless of parental accompaniment.

From early in the morning, countless fans holding ARMY Bomb light sticks gathered at the venue, filling the KINTEX exhibition halls. Long lines quickly formed in front of the most popular interactive zones.

The venue includes more than 20 interactive zones. Below, we have a closer look at a few of the zones.

1. ARMY BOMB PHOTO SPOT & WHALE PHOTO SPOT

Two large-scale installations greet fans as they enter: the ARMY BOMB PHOTO SPOT and the WHALE PHOTO SPOT, both inspired by BTS’ signature motifs.

2. LIGHT SHOW

Beginning at noon, a five-minute light show takes place every hour on the hour, utilizing the synchronized ARMY Bomb light sticks to create a breathtaking visual spectacle. Widely praised by fans and media alike, the light show transformed the venue into an emotionally charged atmosphere and was hailed as one of the major highlights of the event.

3. VOICE ZONE

The Voice Zone offers an emotional connection as fans listen to voice messages recorded by BTS members specifically for the 2025 FESTA. These messages carry deeper meaning as the members participated directly in scripting them.

4. BTS LOCKER

BTS Locker presents personalized displays curated by each member, offering a look into their tastes, personalities, and memories.

5. TROPHY ZONE

The Trophy Zone commemorates BTS’s historic milestones. The display includes 50 trophies, from their first rookie award at the 5th Melon Music Awards in 2013 to their first music show win on KBS2’s Music Bank in 2015, and their first international honor at the Billboard Music Awards in 2017. Awards received by ARMY, such as the iHeartRadio Music Awards’ “Best Fan Army,” are also on display, reflecting the shared journey of the group and its fans.

6. COLORING WALL

The Coloring Wall, where fans filled in a large white artwork outline, was a participatory art zone at the 2025 BTS FESTA. Fans added their own colors and personal touches to the mural, contributing to its creation while covering the wall with heartfelt messages of support for BTS.

With an array of immersive experiences and engaging attractions tailored for fans, the 2025 BTS FESTA proved to be more than just a celebration — it was a heartfelt tribute to BTS’s legacy and their long-awaited return as a full group.

BIGHIT MUSIC stated, “We are sincerely grateful to ARMY for the unwavering love and support for BTS,” adding, “To better accommodate visitors, we have significantly expanded the event in terms of venue, content, and operations compared to previous years. We are doing our utmost to ensure that all attendees can enjoy a safe and meaningful experience.”

See photos of all the interactive zones below:

All seven members of BTS reunited in person at j-hope’s solo concert, marking the group’s long-awaited return as a complete unit.The emotional highlight of the evening came when Jin and Jung Kook surprised fans by joining j-hope onstage, creating unforgettable moments for those in attendance.

Held Friday (June 13) at the Goyang Sports Complex Main Stadium in Gyeonggi Province, South Korea, the final show of j-hope’s “HOPE ON THE STAGE” world tour encore coincided with the 12th anniversary of BTS’ debut — making the night even more meaningful for both the group and its global fandom, ARMY.

Jung Kook made a surprise appearance during j-hope’s solo track “i wonder…,” instantly sending the crowd into a frenzy. His unexpected entrance electrified the atmosphere, and fans responded with roaring cheers. “I really missed you,” he told the audience with a bright smile, before launching into a powerful performance of his solo hit “Seven,” drawing an explosive response.

Later in the show, Jin took the stage during the encore segment. After performing BTS’ beloved hit “Spring Day” alongside j-hope, Jin continued with a moving performance of his second solo EP’s title track, “Don’t Say You Love Me.” The emotional momentum continued as Jung Kook returned to the stage, joining Jin and j-hope for a special unit performance of “Jamais Vu,” closing the evening on a high note.

While Jin and Jung Kook took the stage, RM, Jimin, V and SUGA were spotted in the audience, watching the show and cheering their bandmate on. “I was singing while looking at my members,” j-hope told the crowd, expressing his deep affection for the group.

Jung Kook later added, “I was so nervous backstage. I’m here today because of my members. It felt overwhelming to stand in front of our fans again.”

This show also marked the first live performance of j-hope’s new post-military track “Killin’ It Girl” featuring GloRilla, signaling the start of a new chapter in his solo journey.

The stadium was filled with fans from both Korea and around the world, who came together to witness the long-awaited full group reunion. As all seven members reunited at j-hope’s concert, the moment served as a powerful reminder of BTS’ enduring unity and connection with their fans.

See photos of the night below:

The ongoing dispute between K-pop breakout group NewJeans and its agency ADOR, a HYBE subsidiary, escalated this week as the Seoul Central District Court approved a stricter legal measure restricting the group’s independent activities. In a ruling issued Friday (May 31), the court granted ADOR’s request for indirect compulsory enforcement, ordering each member of the group — Minji, Hanni, Danielle, Haerin and Hyein — to pay 1 […]

Dragon Pony is a four-member Korean rock band bringing fresh energy and musical depth to the scene. Signed under Antenna, they debuted on September 26, 2024, with the EP POP UP, delivering raw emotion and a genre-blending sound. Their name comes from the members’ zodiac signs — leader An Tae-gyu is a Dragon, while the others were born in the Year of the Horse — symbolizing strength, balance and unity. Each member actively contributes to songwriting and production, creating music rooted in honest storytelling and rock’s dynamic edge.With their debut EP’s title track, they announced themselves with an anthem of self-expression and bold ambition. Since then, they’ve played major stages like the Busan International Rock Festival, launched a nationwide club tour, and even sold out a show in Taipei. Their latest EP, Not Out (March 2025), signals further growth and ambition, as the band sets its sights on global stages and future collaborations.

Dragon Pony is not just a band to watch; they’re a force redefining what modern Korean rock can be.

Please introduce Dragon Pony. What kind of team are you, and what kind of music do you pursue?

An Tae Gyu: Hello, we are Dragon Pony. The music we make is all about sharing candid stories and emotions, built on band sounds and loaded with raw, passionate energy. We’re not stuck to any one single format or genre — we just want to make good music that feels right to us.

What’s the meaning behind the name “Dragon Pony”?

Pyun Sung Hyun: In Korea, your zodiac sign is determined by the year you were born. An Tae Gyu was born in 2000, so he’s a Dragon. The rest of us — Kwon Se Hyuk, Ko Gang Hun and I — were born in 2002, the year of the Horse. That’s how we came up with the name “Dragon Pony.” Dragons and horses are both strong, powerful creatures, and we thought that the energy fit perfectly with the rock sound we’re going for.

How did the members meet and form the team?

Kwon Se Hyuk: Pyun Sung Hyun, Ko Gang Hun and I went to the same high school. Ko Gang Hun and I passed Antenna’s audition together, but I had no idea that Pyun Sung Hyun had auditioned too. A few months later, when I heard a new trainee was joining us, I was shocked to find out it was him. Eventually, An Tae Gyu came onboard. As our leader, he’s done an amazing job bringing us together, and that’s how the four of us formed Dragon Pony.

What message did you want to convey through your debut album or title track?

Ko Gang Hun: The title of our debut album and lead single POP UP reflects our sudden entrance into the music scene as well as our drive to make ourselves known. Since it’s our first release, it sends a clear message: “Let’s show the world the kind of music we do best.” If you listen to the entire album, you’ll get a good sense of the sound Dragon Pony is bringing to the table.

How did it feel to be onstage for the first time?

An Tae Gyu: We played our first show at Club FF in Hongdae, Seoul. I was super nervous since the crowd was way bigger than we expected. There was this mix of anxiety and excitement as we waited to see how the audience would react to our music

What do you think is Dragon Pony’s unique musical color?

Pyun Sung Hyun: Dragon Pony is a band where all four of us take part in writing, composing, arranging and producing, which lets us explore a wide range of musical styles — and that’s definitely one of our biggest strengths. We’re all huge fans of ’70s and ’80s hard rock, and that influence runs deep in the sound we create. If you listen to “To. Nosy Boy” and “Waste” from our latest EP Not Out, you’ll quickly understand what makes our music unique.

What is the most important element for you when working on music?

An Tae Gyu: For me, the melody and lyrics are the most important. As a vocalist, I’m the one delivering the song directly to the audience, so I naturally focus on those two elements.

Pyun Sung Hyun: I think music should leave a lasting impression — and for me, it’s usually the melody that stays with me. That’s why I try to write melodies that really linger in your ears.

Kwon Se Hyuk: The melody and lyrics are the backbone of any song. You can change the chords and shift the vibe, but changing the melody or lyrics transforms the whole song. So when I start working on a track, I always begin with those two elements before building everything else around them.

Ko Gang Hun: I prioritize sound above everything. When I listen to music, the first thing that hits me is the texture of the sound. So when I’m writing, I focus on crafting fresh, distinctive sounds that grab your attention right away.

What aspects of stage performance do you pay special attention to?

Ko Gang Hun: Since performances happen live, right in front of the audience, I think their reactions and energy matter the most. That’s why we put a lot of thought into the overall flow, the performance itself, and how we deliver the message — so the audience can really enjoy the show and connect with us.

Are there any genres or concepts you’d like to try in the future?

An Tae Gyu: As a newly debuted band, each of us has different genres and concepts we’d love to explore. But for now, we’re focused on sharing music that really shows our unique color to the public. We’re also interested in incorporating classical instruments into our band sound and creating something fresh, fun, and different to listen to.

Do you have an official fandom name? If so, what does it mean?

Pyun Sung Hyun: We recently decided on the name of Dragon Pony’s fan club — it’s called Poyong. The name combines the “Po” from Pony and “Yong,” which is the Korean word for Dragon, symbolizing the bond between us and our fans, where we support and embrace each other. In English, it’s written as “For Young,” which also reflects the idea of sharing the passionate moments of youth that the four of us in Dragon Pony hope to bring to our fans.

How did you feel when you met your fans for the first time?

Kwon Se Hyuk: When I first met our fans, it just felt surreal. We had a club show before our debut, and the fact that people came to enjoy our music even though we hadn’t yet officially debuted was so surprising and we were all really grateful. It’s a moment I’ll never forget.

Is there a comment from a fan that stuck with you?

Ko Gang Hun: Before our debut, a fan said, “See you next time,” and I thought it was just a polite goodbye. I didn’t expect them to actually see us again. But when they did, it was incredibly touching and unforgettable. More recently, someone said, “Seeing Dragon Pony gave me a dream,” and that really stuck with me. It reminded me of why we need to keep pushing forward.

Any memorable episodes from social media or fan sign events?

An Tae Gyu: We’ve only just started doing a few fan signing events, so everything still feels new and a little awkward. At a recent one, we did a live acoustic performance with our songs and some covers — something we don’t usually get to do. The fans really enjoyed it, and since it was our first time performing live at a fan signing, it was a fun and memorable experience for all of us.

What are some goals Dragon Pony hopes to achieve in the future?

Pyun Sung Hyun: The bigger the goal, the better—and we’ve got a few big ones. First, we want to make it onto the Billboard Hot 100 Chart. We also hope to perform for fans in more countries, so going on a world tour is definitely on our list. One day, we’d love to headline major festivals like Glastonbury and Coachella. Now that I say it all out loud, we’ve got a lot of dreams — which just means we’ll have to work much harder to make them happen.

Is there a dream stage you’d like to perform on?

Kwon Se Hyuk: Like Pyun Sung Hyun said, we’d love to perform at Glastonbury, Coachella and even the Super Bowl halftime show one day. In the end, our dream is to headline every festival that invites us!

If you could collaborate with any artist, who would it be?

Ko Gang Hun: Recently, Coldplay came to Korea for some concerts, and watching them perform was just incredible. I really admire how they’ve stayed together and kept making music for so long. If we ever had the chance to collaborate with Coldplay, it would be a dream come true.

Where do you see Dragon Pony in five years?

An Tae Gyu: Since we’ve only just debuted, we feel still young and inexperienced, and we have a lot to learn. But five years from now, I think we’ll be more mature and confident in ourselves. If we keep working hard, we’ll be performing at bigger venues and maybe even going on a world tour. We’re curious and excited to see how far Dragon Pony will have come by then. Please keep supporting our music until then!

If you had to describe Dragon Pony in three words, what would they be?

Pyun Sung Hyun: I’d like to express Dragon Pony through the three elements of music — rhythm, melody, and harmony. They’re the most basic yet essential components, and just as these three come together to create music, the four of us come together as one to make the kind of music we love and do best. That’s why I think these elements best represent Dragon Pony.

Are there any inside jokes or phrases trending among the members these days?

Kwon Se Hyuk: Among the members, we often say, “That’s kinda true.” It’s a meme that’s been trending among Korea’s MZ generation.

An Tae Gyu

Image Credit: Yujin Kim

What role or position do you each play in the group? I’m An Tae Gyu, the vocalist and leader.

What do you consider your personal strengths? I think my strength is the bright, positive energy I bring. Whenever we perform, I genuinely enjoy being on stage and I think that energy naturally gets passed on to the audience. That’s something I’m proud of.

What was the most difficult moment before debut, and how did you overcome it? I developed vocal cord nodules during my trainee days. Back then, I hadn’t debuted yet, and I didn’t really know how to use my voice properly or take care of it—I just pushed myself too hard during practice. I struggled with it for a long time, so I kept going to the hospital and worked on useful techniques to sing without straining my voice. That experience taught me how crucial it is for vocalists to manage their condition, especially vocal health. Even now, I make it a top priority.

If you were to give each other nicknames, what would they be? How about we give each other a “boy” nickname? I’ll go with Shy Boy for Pyun Sung Hyun. The way he talks and his expressions totally fit the name.

Do you have any personal stage routines or superstitions? I always do some stretching before performances. It helps loosen up my body and relax my throat, which makes singing on stage feel a lot more comfortable.

Kwon Se Hyuk

Image Credit: Yujin Kim

What role or position do you each play in the group? I’m Kwon Se Hyuk, the guitarist.

What do you consider your personal strengths? Perseverance and tenacity are my strengths. I think having that kind of character really helps in making good music.

What was the most difficult moment before debut, and how did you overcome it? I actually failed the Antenna audition the first time. It was a company I really wanted to join, and I’d put in a lot of practice, so the rejection hit me pretty hard. But like I said earlier, I’m persistent. I sent them another email to reintroduce myself, and thankfully, they appreciated that and gave me another shot—and that’s how I was able to become a trainee.

If you were to give each other nicknames, what would they be? Ko Gang Hun looks really tough when he’s playing the drums, so I’d call him Tough Boy.

Do you have any personal stage routines or superstitions? I like playing games in my free time, and squeezing in a quick game before going on stage helps me relax. It’s a fun way to ease the tension.

Ko Gang Hun

Image Credit: Yujin Kim

What role or position do you each play in the group? I’m Ko Gang Hun, the drummer.

What do you consider your personal strengths? I have a steady personality. I don’t really have big emotional swings, and I’m not easily influenced by external circumstances. That helps me stay focused and keeps me working toward my goals without easily getting shaken.

What was the most difficult moment before debut, and how did you overcome it? During my trainee period, we had monthly evaluations, and the pressure to perform well was one of the hardest parts for me. There was a time when I kept receiving only negative feedback, and it was really tough. But I didn’t give up—I pushed myself to practice even harder and also kept writing songs. Eventually, I started getting positive feedback, and once that happened, it felt like I was naturally able to pull myself out of the slump.

If you were to give each other nicknames, what would they be? An Tae Gyu’s always uplifting and positive, so Joyful Boy feels just right for him.

Do you have any personal stage routines or superstitions? I have this habit of checking out the audience before we go on stage. Since their energy plays such a big role in a performance, I naturally find myself scanning the crowd to feel the vibe before we start.

Pyun Sung Hyun

Image Credit: Yujin Kim

What role or position do you each play in the group? I’m Pyun Sung Hyun, the bassist.

What do you consider your personal strengths? Honesty is my strength. I’d rather be genuine than put on a facade, and that mindset naturally carries over into our music. I try to keep our lyrics as candid and unfiltered as possible.

What was the most difficult moment before debut, and how did you overcome it? Joining the company and living with others as a trainee was a completely new experience for me. It was tough to adjust at first. But I was able to get through it by being honest about my struggles and working together with the company to find ways to improve.

If you were to give each other nicknames, what would they be? I think Kwon Se Hyuk’s pretty cute, so I’d call him Cute Boy.

Do you have any personal stage routines or superstitions? Before going on stage, I make sure to check how everyone’s doing. Since we’re a band, staying in sync is really important, so I try to keep an eye on the team and help us all stay focused.

Dragon Pony

Image Credit: Yujin Kim

Lastly, please share a message for Billboard readers and your global fans!

Dragon Pony: Being selected as Billboard’s Rookie of the Month is truly an honor and an incredible experience. We’re deeply grateful and will continue to work hard to live up to the support we’ve received. We’ll keep growing and aim to reach the Billboard charts in the near future. Please continue to show your love and support for Dragon Pony. Thank you, Billboard!

Billboard’s data partner Luminate has signed a new partnership with South Korean firm KreatorsNetwork, granting the company exclusive rights to distribute Luminate’s global music streaming data, consumer insights, and metadata products via its CONNECT platform in South Korea.

The agreement, announced on Tuesday (April 16), positions KreatorsNetwork as Luminate’s sole authorized reseller in the Korean market, providing localized access to global streaming analytics and music intelligence tools for labels, distributors, and music marketers.

“At Luminate, we are dedicated to working with partners across the entertainment industry at a global level, helping them to make data-informed decisions in an ever-evolving media landscape,” said Luminate CEO Rob Jonas in a statement. “We’re glad to enter this new partnership with KreatorsNetwork, which allows us to amplify our service within such an influential and forward-thinking international market.”

Trending on Billboard

Steve Shin, CEO of KreatorsNetwork, added: “After serving K-pop labels for the past five years via data-driven promotional strategies, we are confident that Luminate’s expertise will help us pave the way for the Korean music industry’s move to the next phase of global expansion.”

The deal comes at a moment of continued global growth in music streaming, particularly across Asia. According to Luminate’s 2024 Year-End Music Report, global on-demand audio streams reached 4.8 trillion last year — up 14% from 2023. While the U.S. saw a 6.4% increase, ex-U.S. markets grew by 17.3%, with Asia leading the way in premium (paid) streaming growth. South Korea, in particular, was among the top ten countries globally for premium streaming expansion, up 14.7% year-over-year.

For Luminate, the partnership strengthens its presence in one of the world’s most influential music markets, while offering Korean music companies more robust access to tools for analyzing streaming performance, audience behavior, and cross-border trends.

Luminate’s CONNECT platform — launched in 2024 — provides a centralized dashboard for global music data, consumer insights, and metadata delivery, and is designed to support music clients with real-time intelligence for campaign planning and market expansion.

As artificial intelligence continues to blur the lines of creativity in music, South Korea’s largest music copyright organization, KOMCA (Korea Music Copyright Association), is drawing a hard line: No AI-created compositions will be accepted for registration. The controversial decision took effect on March 24, sending ripples through Korea’s music scene and sparking broader conversations about AI’s role in global songwriting.

In an official statement on its website, KOMCA explained that due to the lack of legal frameworks and clear management guidelines for AI-generated content, it will suspend the registration of any works involving AI in the creative process. This includes any track where AI was used — even in part — to compose, write lyrics or contribute melodically.

Now, every new registration must be accompanied by an explicit self-declaration confirming that no AI was involved at any stage of the song’s creation. This declaration is made by checking a box on the required registration form — a step that carries significant legal and financial consequences if false information is declared. False declarations could lead to delayed royalty payments, complete removal of songs from the registry, and even civil or criminal liability.

Trending on Billboard

“KOMCA only recognizes songs that are wholly the result of human creativity,” the association said, noting that even a 1% contribution from AI makes a song ineligible for registration. “Until there is clear legislation or regulatory guidance, this is a precautionary administrative policy.”

The non-profit organization represents over 30,000 members, including songwriters, lyricists, and publishers, and oversees copyright for more than 3.7 million works from artists like PSY, BTS, EXO and Super Junior.

Importantly, the policy applies to the composition and lyric-writing stages of song creation, not necessarily the production or recording phase. That means high-profile K-pop companies like HYBE, which have used AI to generate multilingual vocal lines for existing songs, are not directly affected — at least not yet.

While South Korea’s government policy allows for partial copyright protection when human creativity is involved, KOMCA’s stance is notably stricter, requiring a total absence of AI involvement for a song to be protected.

This move comes amid growing international debate over the copyrightability of AI-generated art. In the U.S., a federal appeals court recently upheld a lower court’s decision to reject copyright registration for a work created entirely by an AI system called Creativity Machine. The U.S. Copyright Office maintains that only works with “human authorship” are eligible for protection, though it allows for copyright in cases where AI is used as a tool under human direction.

“Allowing copyright for machine-determined creative elements could undermine the constitutional purpose of copyright law,” U.S. Register of Copyrights Shira Perlmutter said.

With AI tools becoming increasingly sophisticated — and accessible — KOMCA’s policy underscores a growing tension within the global music industry: Where do we draw the line between assistance and authorship?

This article originally appeared on Billboard Korea.

State Champ Radio

State Champ Radio