iHeartMedia

Page: 2

In 2000, after Larry Magid sold his Philadelphia promotion company Electric Factory Concerts for an undisclosed sum, the buyer, Robert Sillerman, called at 12:30 a.m. to congratulate him. Then Sillerman said, “Now you congratulate me.”

“OK, congratulations on what?” Magid asked Sillerman, his new boss.

“Well, we merged,” Sillerman said.

Sillerman, then executive chairman of SFX Entertainment, was referring to his company’s $4.4 billion dollar sale to San Antonio, Texas-based broadcast behemoth Clear Channel Communications, which he’d finished at almost exactly the same time he bought Magid’s company. Thus, Magid would become an employee not of SFX, but Clear Channel, for the next five years — a period that was not easy for Magid, who had been Philly’s top independent promoter since roughly 1968, when he opened the Electric Factory club with a Chambers Brothers show. “It just seemed to be a struggle,” he recalls. “There were a lot of meetings, none of which we were used to.”

All this took place 25 years ago this week — Clear Channel’s purchase of SFX was announced Feb. 29, 2000 — and it would change the concert business forever. For decades, the live industry was ruled by unaffiliated local promoters like Magid, who ran their cities like local cartels as rock’n’roll evolved from tiny events to stadium concerts. Sillerman had spent the past three years buying out those local promoters — an acquisition spree that included big names like the late Bill Graham’s company in the Bay Area (for a reported $65 million), Don Law‘s company in Boston ($80 million) and lesser-known indies such as Avalon Attractions in Southern California ($27 million). The result was a consolidated behemoth that guaranteed advance payments of up to millions of dollars for top artists to do national tours, prompting promoters to raise prices for tickets, parking, food and alcohol to pay for their costs — all of which has become standard industry practice for concerts over the ensuing 25 years.

Trending on Billboard

Then Sillerman turned around and sold everything to Clear Channel.

By that point, the concert business no longer operated as a collection of regional fiefdoms — in which Bill Graham Presents and its Bay Area competitors competed for, say, a U2 date — but as a central entity in which SFX booked U2’s entire U.S. tour. In 2000, SFX was to promote 30 tours, from Tina Turner to Britney Spears to Ozzfest, “light years beyond what any other company has ever attempted,” Billboard reported at the time. “It has become nearly impossible for a major act to tour without SFX being involved in some way.”

“What [Sillerman] accomplished revolutionized the business. It was probably the biggest impact in the industry since the Beatles,” recalls Dennis Arfa, longtime agent for Billy Joel and others, who sold his talent agency to SFX and worked there for several years. “Bob took the business from a millionaire’s game to a billionaire’s game. From the street to Wall Street.” (Sillerman died in 2019.)

Sillerman’s sale to Clear Channel offered an even more tantalizing promise for the concert business: linking hundreds of top radio stations with top promoters and venues — “taking advantage of the natural relationship between radio and live music events,” Lowry Mays, Clear Channel’s chairman and CEO, said at the time of the sale.

But the venture ultimately failed. Many of the SFX promoters never felt they fit in at San Antonio-based Clear Channel. “We knew we were dealing with a very conservative family out of Texas — that was people’s main concern,” recalls Pamela Fallon, who’d worked with Boston promoter Don Law when SFX bought his company, then became a Clear Channel senior vp of communications. “We were pretty footloose and fancy-free in the concert business.”

Clear Channel’s meetings-heavy corporate culture reflected Mays, a former Texas petroleum engineer who, by 2000, had expanded the company from a single station in the early 1970s to a media giant with 867 radio stations and 19 TV stations, a robust billboard business and a weekly consumer base of 120 million. Along the way, Mays helped build conservative talk radio, using Clear Channel-owned syndicate Premiere Radio Networks to expand the reach of Rush Limbaugh, Laura Schlessinger and other right-wing hosts.

In 2001, writing in Salon, former Billboard reporter Eric Boehlert, later a progressive media critic, called Clear Channel “radio’s big bully.” In 2003, U.S. Senators questioned Mays about Clear Channel’s business practices during a committee hearing on media consolidation; the Eagles’ Don Henley showed up to accuse Clear Channel of strong-arming artists to work with the company, as opposed to its competitors. John Scher, a New York promoter who did not sell to SFX, Clear Channel or Live Nation, adds today: “The merger with Clear Channel, in some markets, was the death knell to local promoters: Sell to Clear Channel, or not be able to do any significant marketing with their radio stations.”

But the Clear Channel vision of combining radio with concerts had a fundamental flaw: It may have violated antitrust laws, as a rival Denver promoter claimed in a 2001 lawsuit, alleging the company blacked out radio airplay for artists who booked tours with Clear Channel rivals. (The parties settled in 2004.)

Other flaws in the “mega-merger,” as Billboard referred to it in a March 2000 front-page headline, were less public. In every market, according to Angie Diehl, a longtime marketing exec for promoters, who worked for both SFX and Clear Channel at the time, there were multiple competing radio stations that could present a concert. There were also multiple competing rival concert promoters. Clear Channel aimed to lock down all of these entities in one city so the company could control all the marketing, advertising and promotion of, say, U2.

“But there’s only one U2,” Diehl says. “The artist still dictates what they want. If you want U2 to play for you, and U2 says, ‘Well, we want KROQ to present the show,’ that’s who’s going to present the show.” Arfa adds that the combined company “never quite lived up to its synergistic ambitions.”

Perhaps recognizing this reality, Clear Channel spun off its concert division in 2005 — which would come to be known as Live Nation, led by Michael Rapino, a Canadian promoter who’d also sold his company to SFX. At first, despite emerging as the world’s biggest promoter, Live Nation struggled with hundreds of millions of dollars in debt — $367 million from the initial Clear Channel spin-off, growing to $800 million due to venue-maintenance fees over the next few years. But Rapino steered the promoter into a merger with ticket-selling giant Ticketmaster in 2008, providing crucial cashflow for years to come. “Until the Ticketmaster merger, I don’t think it made any money,” Scher says, adding that he used to book 30 to 40 New York arena shows per year, but industry dominance among Live Nation and top rival AEG has forced him to downsize to three or four. “They are formidable adversaries.”

In the long run, Live Nation solved a problem that the short-lived, SFX-infused Clear Channel Communications never quite figured out. (Clear Channel Communications renamed its radio operation iHeartMedia in 2014; Mays died in 2022.) So despite the promise — and the fears — that Clear Channel would take over the concert business and shut out competition, it was actually what came before and after the $4.4 billion acquisition that proved far more significant. Before the acquisition, SFX was the entity that expanded concert promotion from regional to national; after the acquisition, Live Nation made the concert industry more profitable than ever.

The promise of Clear Channel “synergy,” during its concert-industry excursion from 2000 to 2005, never fully paid off. “The idea was they were going to be able to promote all our concerts over their radio stations,” recalls Danny Zelisko, a Phoenix promoter who sold his company, Evening Star Productions, to SFX. “But at Clear Channel, [promoters] were the stepchild in the backseat. We were almost a dirty word. There was never anything about bringing the radio and the concerts together. It just wasn’t meant to be.”

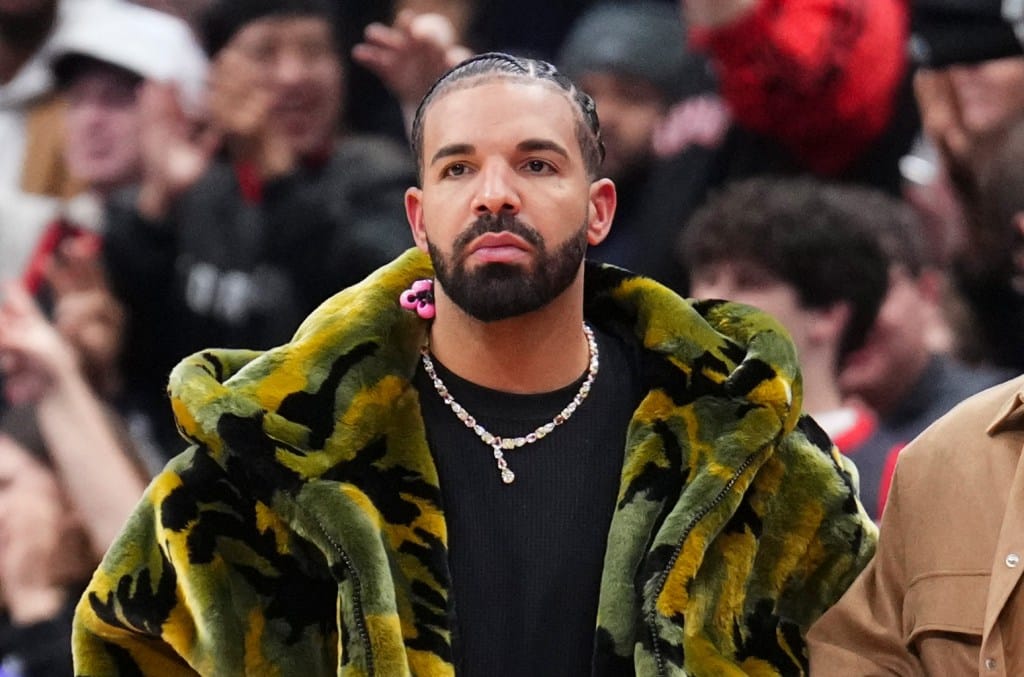

Drake has reached a settlement with Texas-based iHeartMedia in his ongoing legal dispute over Kendrick Lamar’s diss track “Not Like Us,” according to court records.

In November, Drake filed a legal petition in Bexar County, Texas, where San Antonio is located, alleging that iHeartMedia had received illegal payments from Universal Music Group to boost radio airplay for “Not Like Us.” UMG is the parent record label for both Drake and Lamar.

The petition, a precursor to a potential lawsuit, had sought depositions from corporate representatives of both companies.

Trending on Billboard

In a court document filed Thursday, attorneys for Drake said the rapper and iHeartMedia had “reached an amicable resolution of the dispute” but did not offer any other information.

“We are pleased that the parties were able to reach a settlement satisfactory to both sides, and have no further comment on this matter,” Drake’s legal team said in a statement.

In an email Friday, iHeartMedia declined to comment on the settlement.

The claims against UMG remain active, and a hearing on a motion by UMG’s lawyers to dismiss the petition was scheduled to be held Wednesday in a San Antonio courtroom.

Drake has alleged UMG engaged in “irregular and inappropriate business practices” to get radio airplay for “Not Like Us.” The petition also alleges that UMG knew “the song itself, as well as its accompanying album art and music video, attacked the character of another one of UMG’s most prominent artists, Drake, by falsely accusing him of being a sex offender, engaging in pedophilic acts, harboring sex offenders, and committing other criminal sexual acts.”

An email to a UMG representative seeking comment was not immediately answered.

In January, Drake filed a defamation lawsuit in federal court in New York City against UMG over what he alleges are false allegations of pedophilia made in “Not Like Us.” Lamar is not named in the lawsuit.

The feud between Drake, a 38-year-old Canadian rapper and singer and five-time Grammy winner, and Lamar, a 37-year-old Pulitzer Prize winner who headlined the Super Bowl halftime show on Feb. 9, is among the biggest in hip-hop in recent years.

The Federal Communications Commission sent a letter Monday to iHeartMedia’s CEO and chairman, Robert Pittman, saying the commission is looking into whether the audio company is forcing musicians to perform at its May country music festival in Austin for reduced pay in exchange for favorable airplay of their songs on iHeart radio stations.

“We look forward to demonstrating to the Commission how performing at the iHeartCountry Festival – or declining to do so – has no bearing on our stations’ airplay,” iHeart Media said in a statement. “We do not make any overt or covert agreements about airplay with artists performing at our events.”

This article was originally published by The Associated Press.

iHeartMedia expects first-quarter revenue to decline in the low single digits and full-year revenue to be flat, suggesting the radio giant hasn’t yet turned the proverbial corner financially, according to the company’s latest earnings release. After revenue was up 5.5% in January, February is on track for a 7% decline as consumer sentiment dropped to a level not seen since 2021, CFO Rich Bressler said during Thursday’s earnings call.

The company ended 2024 with fourth-quarter revenue up 4.8% to $1.11 billion, while adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) spiked 18.2% to $246.2 million. Revenue growth was below the company’s previous guidance due to lower-than-expected political advertising and a slowdown in non-political advertising before the election, said Bressler.

The fires in Los Angeles created a disruption to iHeartMedia’s business in the first quarter, although CEO Bob Pittman called it “a little bit of a blip” and said a larger impact comes from people returning to work. “Traffic is getting long again, and I hate to sound cynical here, but traffic jams are our friend,” he said. “We’re a company that benefits from people with longer commutes and more time in the car.”

Mired in a weak advertising market for broadcast radio, iHeartMedia is busy finding ways to create value from its broadcast assets. To that end, in March the company will make its broadcast advertising inventory available to programmatic buyers through Yahoo DSP and Google’s DV360 ad-buying platforms. “This is a critical early step in aligning our broadcast assets with digital buying behavior,” said Pittman, “which will allow iHeart’s broadcast radio assets to participate in the growing digital and programmatic [total addressable markets].”

Last year, iHeartMedia took steps to cut costs and improve its balance sheet. The company expects to have net savings of $150 million in 2025 and beyond — $200 million from cost reductions undertaken in 2024 and an additional $50 million of expenses. In December, iHeart reduced its debt load and extended maturity dates through a debt exchange that attracted a 92.2% participation rate.

For the full year, iHeartMedia’s revenue totaled $3.86 billion, up 3% year-over-year (and flat if political advertising is excluded). Adjusted EBITDA increased 1% to $705.6 million while EBITDA margin improved to 22.0% in 2024 from 19.5% in 2023. The multiplatform group, which includes the company’s core broadcast stations, saw its revenue decline 2.6% to $2.37 billion, while the digital audio group’s revenue increased 8.9% to $1.16 billion due to increased advertising demand for podcasting. The audio and media services group had revenue of $327 million, up 27.4%.

Cumulus Media, the country’s third-largest radio company by revenue, fared a bit worse in 2024. For the full year, Cumulus’ revenue fell 2.1% to $827.1 million and adjusted EBITDA dropped 8.8% to $82.7 million. While digital revenue grew 5.3% to $154.2 million, broadcast revenue slipped 5.1% to $564.1 million. In the fourth quarter, revenue dipped 1.2% to $218.6 million and adjusted EBITDA grew 9.8% to $25 million.

Cutting costs and restructuring debt are common tactics in the radio business. Just as iHeartMedia shaved its expenses, Cumulus will realize $43 million in annualized cost savings, with $15 million of savings coming in 2024. In addition, in May, Cumulus completed a debt exchange, which lowered its outstanding debt by $33 million and extended maturity dates while securing “attractive” interest rates.

iHeartMedia shares fell 7.9% to $2.09 before earnings were released, and dropped another 9.9%, to $1.90, in after-hours trading. Through Thursday, iHeartMedia shares are down 1.9% year-to-date but have more than doubled since May 2024.

Cumulus, which reported earnings earlier in the day, saw its share price decline only 0.3% to $0.90. Year-to-date, Cumulus shares have gained 16.9%.

The Federal Communications Commission (FCC) is scrutinizing iHeartMedia’s upcoming iHeartCountry Festival in Austin as part of an investigation into whether radio stations have been offering airplay to artists in exchange for free shows.

In a lengthy letter sent Monday (Feb. 24) to iHeartMedia chairman/CEO Robert Pittman, FCC chairman Brendan Carr — who was appointed to the FCC board in 2023 by former President Joe Biden and promoted to chairman via an executive order from President Donald Trump on Jan. 21 — said he “want[s] to know whether iHeart is effectively and secretly forcing musicians to choose between, one, receiving their usual, ordinary, and full scale compensation for performing or, two, receiving less favorable airplay on iHeart radio stations.”

Carr went on to note that “certain owners of federally licensed radio stations are effectively compelling musicians to perform at radio station events or festivals for free (or for reduced compensation) in exchange for more favorable airplay,” a practice he warned violated federal bans on practices like payola.

Trending on Billboard

The letter follows a previous letter sent by U.S. Senator Marsha Blackburn (R-Tenn.) to the FCC earlier this month in which she asked the agency to take action to prevent the alleged practice, claiming it was “critically impacting Tennessee’s content creators.” The FCC subsequently issued an enforcement advisory in which it warned that promising radio play in exchange for free concerts would break federal law. The agency further said it would “consider investigating substantive allegations of payola that come to its attention.”

Traditionally, payola investigations have dealt with music labels and publishing groups paying radio stations to illegally promote commercial music and boost album sales. In 1959, popular radio personalities like Alan Freed were investigated by both the U.S. House and Senate for accepting cash “consulting fees” to play songs on the radio as requested by the shadowy radio promotion industry. In the 1970s, the investigation expanded to include the Italian mafia, whom the FCC accused of using drugs like cocaine for payola. In the 1990s, former NY District Attorney Elliot Spitzer won payola settlements against Sony, BMG and Warner Music, and won a civil lawsuit against Entercom.

Carr’s letter to iHeartMedia hints that the federal government may adopt a novel legal theory that radio promotion concerts, held by large FM radio stations in markets across the U.S., could be a form of payola. Specifically, Carr singles out the May 3 iHeartCountry Festival in Austin, Texas.

Carr’s three-page letter to iHeart included eight lengthy questions he asked Pittman to answer within 10 days. Among other things, Pittman is requesting a list of all artists playing iHeartCountry Festival at Austin’s Moody Center, how much they would normally be paid for a concert appearance and whether any of the artists “will receive better or worse airplay on iHeart radio stations based on their participation in the Festival or the compensation they receive for performing at the Festival.”

In the music business, artists’ appearances are typically delineated into two categories: promotional, or media, appearances, when an artist is promoting a new venture like an album or a film and appears on a talk show to promote that project; and paid appearances, when an artist performs or showcases their talents to audience members who have typically paid some type of admission fee. Artists aren’t usually paid for promotional appearances, and radio concerts have long been categorized by radio stations as promotional in nature and typically do not include payments.

Carr continued that he wants to learn more about the upcoming iHeart concert so that he can get “a real-world example of how such events are put together—including artist solicitation and compensation—and the procedures that are in place to ensure compliance with the relevant statutes and regulations.”

Officials with iHeartMedia responded to the letter in a statement, noting that the company looks forward to “demonstrating to the Commission how performing at the iHeartCountry Festival — or declining to do so — has no bearing on our stations’ airplay, and we do not make any overt or covert agreements about airplay with artists performing at our events.”

The iHeart statement goes on to say, “The iHeartCountry Festival provides the same kind of promotion that that we see with artists on talk shows, late night television, the Super Bowl and in digital music performances and events: the promotional value to the artists is the event itself, and, in our case, is unrelated to our radio airplay.”

This lineup at this year’s iHeartCountry Festival lineup, which is slated for May 3, includes Brooks & Dunn, Thomas Rhett, Rascal Flatts, Cole Swindell, Sam Hunt, Megan Moroney, Bailey Zimmerman and Nate Smith.

Song Exploder, Questlove Supreme, Popcast, The Wonder of Stevie and The Joe Budden Podcast are vying for best music at the 2025 iHeartPodcast Awards, in partnership with South by Southwest (SXSW). The annual event will take place live on March 10 at 7 p.m. CT at ACL Live at The Moody Theater in Austin, Texas. In addition to the in-person show, the ceremony will also be live-broadcasted on select iHeartMedia Radio Stations, on the iHeartRadio app and on iHeartRadio’s YouTube Channel.

New Heights With Jason & Travis Kelce is among the nominees for best sports. Travis Kelce has become a household name since he began dating pop superstar Taylor Swift. The other nominees in that category are The Herd with Colin Cowherd, The Dan Le Batard Show With Stugotz, The Bill Simmons Podcast and All the Smoke

Winners in each category will be determined by a panel of podcast industry leaders and creatives. Each year, podcast fans help decide the winner of the podcast of the year award by voting online at the awards’ website. Fan voting will begin Tuesday, Jan. 7, and runs through Feb. 16.

Trending on Billboard

The 2025 iHeartPodcast Awards will also present three icon awards. Sarah Spain, host of Good Game, will be honored with the 2025 social impact award for her role in championing equity in sports coverage, equal pay for female athletes and better investment in women’s sports infrastructure. Dan Taberski will be honored with the 2025 audible audio pioneer award for his influence in the podcasting landscape, including his latest podcast Hysterical (nominated for podcast of the year and more). The 2025 innovator award will honor Daniel Alarcón, a Peruvian-American journalist and novelist, for his work on The Good Whale (nominated for podcast of the year), which revisits the life of Keiko, the orca who gained fame as the star of the 1993 film Free Willy.

“Following our in-person return to SXSW last year, we’re thrilled to be bringing the iHeartPodcast Awards to an even bigger stage in 2025,” Conal Byrne, CEO of iHeartMedia’s Digital Audio Group, said in a statement. “Podcasting is growing in both scale and influence every year, and SXSW brings a level of innovative spirit and excitement that makes it the perfect setting to celebrate the very best of our industry.”

“We’re thrilled to once again partner with iHeartMedia for the return of the Podcast Awards, amplifying its impact within an even larger footprint at SXSW,” said Peter Lewis, SXSW chief partnerships officer. The iHeartPodcast Awards will be open to select SXSW badge holders for the first time.

Executive producers for the 2025 iHeartPodcast Awards are John Sykes, Tom Poleman, Conal Byrne and Bart Peters for iHeartMedia. Audible is a sponsor of the 2025 iHeartPodcast Awards.

Here’s a full list of 2025 iHeartPodcast Award nominees across 29 categories.

Podcast of the Year

Normal Gossip

Three

Giggly Squad

Call Her Daddy

Las Culturistas With Matt Rogers and Bowen Yang

Hysterical

The Telepathy Tapes

Who Killed JFK?

Empire City: The Untold Origin Story of the NYPD

The Good Whale

Best Overall Host

Alex Cooper (Call Her Daddy)

Jamie Loftus (Sixteenth Minute (of Fame))

Sabrina Tavernise (The Daily)

Mel Robbins (The Mel Robbins Podcast)

Dan Taberski (Hysterical)

Best Overall Ensemble

We Can Do Hard Things

My Favorite Murder With Karen Kilgariff and Georgia Hardstark

Handsome

Armchair Expert With Dax Shepard

The Breakfast Club

Best Music

Song Exploder

Questlove Supreme

Popcast

The Wonder of Stevie

The Joe Budden Podcast

Best TV & Film

Films to Be Buried With With Brett Goldstein

Two Ts in a Pod with Teddi Mellencamp and Tamra Judge

How Did This Get Made?

The Rewatchables

Blank Check with Griffin & David

Best Pop Culture

Las Culturistas With Matt Rogers and Bowen Yang

The World’s First Podcast With Erin & Sara Foster

Still Processing

Keep It!

Pop Culture Happy Hour

Best Sports

New Heights With Jason & Travis Kelce

The Herd With Colin Cowherd

The Dan Le Batard Show With Stugotz

The Bill Simmons Podcast

All the Smoke

Best Kids & Family

Good Inside With Dr. Becky

Koala Moon – Kids Bedtime Stories & Meditations

Smash Boom Best: A Funny, Smart Debate Show for Kids and Family

Story Pirates

Wow in the World

Best Comedy

The Nikki Glaser Podcast

Fly on the Wall With Dana Carvey and David Spade

Normal Gossip

The Joe Rogan Experience

Call Her Daddy

Best Spanish Language

Radio Ambulante

Duolingo Spanish Podcast

Leyenda Legendarias

Mija Podcast

Escuela Secreta

Best Business & Finance

Planet Money

How to Money

Networth and Chill With Your Rich BFF

Money Rehab With Nicole Lapin

The Ramsey Show

Best Crime

Three

Betrayal

Up and Vanished

CounterClock

Something Was Wrong

Best Food

Gastropod

Christopher Kimball’s Milk Street Radio

Be My Guest With Ina Garten

The Recipe With Kenji and Deb

The Sporkful

Best Wellness & Fitness

Huberman Lab

The Mel Robbins Podcast

10% Happier With Dan Harris

A Slight Change of Plans

We Can Do Hard Things

Best History

The Rest Is History

Empire City: The Untold Origin Story of the NYPD

Throughline

American History Tellers

You’re Wrong About

Best News

The Journal.

The Daily

Up First from NPR

Pivot

Today, Explained

Best Fiction

Hello From the Magic Tavern

Welcome to Night Vale

Impact Winter

The Magnus Archives

Midnight Burger

Best Science

Hidden Brain

StarTalk Radio

Stuff To Blow Your Mind

Ologies With Alie Ward

Science Vs

Best Technology

All-In with Chamath, Jason, Sacks & Friedberg

Hard Fork

Better Offline

Darknet Diaries

Ted Radio Hour

Best Ad Read

Conan O’Brien Needs a Friend

Where Everybody Knows Your Name with Ted Danson and Woody Harrelson (Sometimes)

My Brother, My Brother and Me

SmartLess

Office Ladies

Best Political

Native Land Pod

The NPR Politics Podcast

Pod Save America

The Megyn Kelly Show

Breaking Points With Krystal and Saagar

Best Advice/Inspirational

Wiser Than Me With Julia Louis-Dreyfus

On Purpose With Jay Shetty

The Mel Robbins Podcast

Life Kit

Savage Lovecast

Best Beauty & Fashion

Naked Beauty

The goop Podcast

Glowing Up

Breaking Beauty Podcast

Lipstick on the Rim

Best Travel

Travel With Rick Steves

The Atlas Obscura Podcast

Zero to Travel Podcast

Women Who Travel

JUMP With Traveling Jackie

Best Green

Unf–king the Future

Environmental Insights: Conversations on Policy and Practice From the Harvard Environmental Economics Program

Green Dreamer: Seeding Change Towards Collective Healing, Sustainability, Regeneration

Threshold

TED Climate

Best Spirituality & Religion

Elevation With Steven Furtick

Oprah’s Super Soul

WHOA That’s Good Podcast

Bible in a Year With Jack Graham

Transformation Church

Best Branded Podcast

Nerdwallet’s Smart Money Podcast

Into the Mix (Ben and Jerry’s)

Symptomatic: A Medical Mystery Podcast (Nova Nordisk)

You Can’t Make This Up (Netflix)

Mind the Business: Small Business Success Stories (Intuit Quickbooks)

Best Emerging

Not Gonna Lie With Kylie Kelce

So True With Caleb Hearon

Hysterical

Wild Card With Rachel Martin

Shell Game

Best International

The Business of Doing Business With Dwayne Kerrigan – Canada

Mamamia Out Loud – Australia

Between Two Beers Podcast – New Zealand

The Diary of a CEO with Steven Bartlett – United Kingdom

Las Alucines – Mexico

iHeartMedia subsidiary iHeartCommunications pushed back the maturity date of much of its debt by three years and reduced its amount of long-term debt by $440 million. In November, the company’s debt holders were given the opportunity to exchange existing debt for new debt with higher interest — and approximately $4.8 billion, or 92.2%, of them […]

Drake has launched a second bombshell legal action against Universal Music Group over Kendrick Lamar’s “Not Like Us,” accusing the music giant of defamation and claiming it could have halted the release of a song “falsely accusing him of being a sex offender.”

A day after filing an action in New York accusing UMG of illegally boosting Lamar’s track with payments to Spotify, Drake’s company leveled similar claims in Texas court regarding radio giant iHeartRadio. The new filing, filed late Monday and made public on Tuesday, claims UMG “funneled payments” to iHeart as part of a “pay-to-play scheme” to promote the song on radio.

But the filing also offers key new details about Drake’s grievances toward UMG, the label where he has spent his entire career. In it, he says UMG knew that Kendrick’s song “falsely” accused him of being a “certified pedophile” and “predator” but chose to release it anyway.

Trending on Billboard

“UMG … could have refused to release or distribute the song or required the offending material to be edited and/or removed,” Drake’s lawyers write. “But UMG chose to do the opposite. UMG designed, financed and then executed a plan to turn ‘Not Like Us’ into a viral mega-hit with the intent of using the spectacle of harm to Drake and his businesses to drive consumer hysteria and, of course, massive revenues. That plan succeeded, likely beyond UMG’s wildest expectations.”

Like the New York filing on Monday, the new petition isn’t quite a lawsuit. Instead, it’s so-called pre-action filing aimed taking depositions from key figures at UMG and iHeart in order to obtain more information that might support Drake’s accusations in a future lawsuit.

In seeking that information, Drake’s lawyers say they already have enough evidence to pursue a “claim for defamation” against UMG, but that they might also tack on claims of civil fraud and racketeering based on what they discover from the depositions.

UMG and iHeartRadio did not immediately return requests for comment on the new filing. Lamar is not named as a respondent in the filing and is not legally accused of any wrongdoing.

Universal Music Group responded to yesterday’s filing with a statement provided to Billboard. “The suggestion that UMG would do anything to undermine any of its artists is offensive and untrue,” the company said. “We employ the highest ethical practices in our marketing and promotional campaigns. No amount of contrived and absurd legal arguments in this pre-action submission can mask the fact that fans choose the music they want to hear.”

Like Monday’s bombshell petition, the new filing in Texas is another remarkable escalation in the high-profile beef between the two stars, which saw Drake and Lamar exchange stinging diss tracks over a period of months earlier this year. Such beefs happen frequently in the world of hip-hop, but few thought either side would file legal actions over the insults.

It also represents a deepening of the rift between Drake and UMG, where the star has spent his entire career — first through signing a deal with Lil Wayne’s Young Money imprint, which was distributed by Republic Records, then by signing directly to Republic. Lamar, too, has spent his entire career associated with UMG and is currently signed to a licensing deal with Interscope.

In Tuesday’s new petition, Drake essentially accused the music giant of using illegal means to unfairly prioritize one of its artists over the other.

“Before it approved the release of the song, UMG knew that the song itself, as well as its accompanying album art and music video, attacked the character of another one of UMG’s most prominent artists, Drake, by falsely accusing him of being a sex offender, engaging in pedophilic acts, harboring sex offenders and committing other criminal sexual acts,” his lawyers write.

Congrats! You have elected to check out the latest edition of Executive Turntable, Billboard’s comprehensive(ish) compendium of promotions, hirings, exits and firings — and all things in between — across music.

Read on for mostly good news and don’t forget to nominate an impactful executive for our Power 100 Players’ Choice Award, plus peep our weekly interview series spotlighting a single c-suiter and our helpful calendar of notable industry events and confabs.

Lekeisha Irion is the new head of A&R at Warner Chappell Music Benelux — a nifty portmanteau for Belgium, the Netherlands and Luxembourg. Based in Amsterdam, Irion will report to Niels Walboomers, president of records and publishing in the three-nation region. Since joining as A&R Manager last year following a stint as an office manager for Sony Music Publishing, Irion has influenced Dutch pop and hip-hop, working with artists like Roxy Dekker, who has slapped four No. 1s in the Netherlands this year, Dutch singer-rapper Antoon. Known for her collaborative work with Warner Music Benelux’s recorded music team, Irion has helped secure both publishing and recording deals for several artists. Walboomers and Shani Gonzales, WCM’s Head of International A&R, praised Irion’s early success and strong instincts for new talent. “She understands how genres and scenes are evolving in different markets and spots the opportunities for her writers to jump into collabs,” Gonzales said.

Trending on Billboard

Sony Music Publishing elevated Racheal Conte to vice president of sample clearance, legal and business affairs. In her new role, Conte will lead the U.S. sample clearance team, modernize operations and develop strategies to expand sampling opportunities for SMP’s songwriters and catalog. She’ll also collaborate with global offices to streamline sample clearances for U.S.-based works, reporting directly to Peter Brodsky, evp of business and legal affairs and general counsel, from New York. Conte joined SMP in 2006 and has held various roles, most recently assistant director of sample clearance. “Racheal’s contributions have been key to the success of SMP’s songwriters and catalogs, and it has been rewarding to see her growth as a leader throughout her time at the company,” said Brodsky.

RADIO, RADIO: iHeartMedia laid off dozens — hundreds, according to reports — of staffers from radio stations around the country. Among the impacted in the sweeping cuts are regional presidents Matt Scarano (Chicago), Clyde Bass (Texas/Arkansas), Alan Chartrand (Boston) and Michael Burger (Raleigh), among others … Back at the home office, iHeart elevated Jordan Fasbender from general counsel to chief legal officer, with the former 21st Century Fox exec retaining her other titles of evp and corporate secretary … Audacy hired senior vp of research and insights Ray Borelli, who arrives after working as Warner Bros. Discovery vp of ad sales research.

Emily Crews, former vp of brands and synchronisation at Warner Music Australia, joined Level Two Music as head of partnerships. She brings extensive experience in synch licensing and artist-brand collaborations from her time at Warner and, prior to that, Universal Music. The Sydneysider said she’s excited about Level Two’s dynamic and thoughtful approach to music supervision, while managing director Jen Taunton praised Crews’ ability to “navigate through often complex and layered deals, always managing to find the ‘sweet spot.’”

Nashville-based Reliant Talent Agency has announced a round of promotions and hires, with former Paradigm music executive Keith Richards joining RTA’s festival department. Reliant has also promoted Ron Kaplan and Garry Buck to executive vp roles, while Kailey Edgerton, Cole Speed and Robert Baugh have been promoted from coordinators to agents. Additionally, the agency has relocated its headquarters to a new office space at 1610 West End Ave. in Nashville. –Jessica Nicholson

NASHVILLE NOTES: Kelli Wasilauski resigned as The Oriel Co. director of Nashville operations, ending her year-long tenure on Oct. 28 … Keller Turner Andrews & Ghanem expanded with three new attorneys. J. Rush Hicks joins as Of Counsel, adding decades of experience and previous leadership at Belmont’s Mike Curb College of Entertainment & Music Business. New associates Cheshire Rigler and Alyssa Johnson also bring experience from other Nashville entertainment law firms.

Los Angeles marketing agency Game Over Media named Gavrielle Chavez as chief operating officer. Chavez will oversee operations across Game Over Studios, Game Over Agency, Game Over Records, and the new GameTune platform. Her role emphasizes expanding reach within next-gen communities and enhancing fan engagement at the company, where recent projects include campaigns for Big Sean, Childish Gambino, Imagine Dragons and Tyla. Chavez previously worked at Scopely, where she led product marketing for the popular game Monopoly Go!, and before that was a creator strategic at TikTok, where she launched TikTok Shop and fostered partnerships between gaming brands and creators. Founder Anthony Pisano said Chavez’s experience at Scopely and TikTok align with Game Over Media’s vision, adding “Gavi’s expertise will also be invaluable as we scale GameTune, our new cutting-edge AI platform that empowers record labels, brands, and gaming publishers to reach their audiences through strategic, data-driven marketing.”

Kuke Music Holding Limited, a NYSE-listed classical music service based in China, announced that its president, Li Sun, resigned in July. The company, which provides classical content to educational resources and boasts a library of about 3 million audio and video tracks, clarified that Sun’s departure was amicable, with no disputes over operational or policy issues. Following her resignation, CEO and chairman He Yu has overseen the company.

ICYMI:

Azu Olvera

Deezer appointed Pedro Kurtz as director of operations for the Americas … Former SiriusXM exec Azucena “Azu” Olvera is now general manager of WK Records … Alana Dolgin joined Atlantic Music Group as the label’s first president of digital marketing … Spinnin’ Records president Roger de Graaf is retiring from the Dutch label he co-founded … and Cara Hutchison was named head of The Lede Company‘s new music division, while Jess Anderson also joins her team. [KEEP READING]

Last Week’s Turntable: UMG’s Nigerian Label Picks a President

As iHeartMedia deals with weak advertising trends and another round of layoffs, the country’s largest broadcast radio company will save $200 million in 2025 compared with 2024 and has renegotiated 80% of its long-term debt, the company revealed on Thursday (Nov. 7) in its third-quarter earnings release.

The debt “exchange offers,” which are expected to close by the end of the year, will extend the majority of iHeartMedia’s debt maturities by three years, allow cash interest expense to “remain essentially flat,” and provide for “some overall debt reduction,” CEO Bob Pittman said during an earnings call. “The transaction support agreement marks an important step in our effort to optimize our balance sheet, and it provides the company with the flexibility to remain focused on iHeart’s transformation.”

The disclosure about cost savings and revamped debt comes days after news broke that iHeartMedia had laid off dozens — hundreds, according to one report — of staffers from radio stations around the country. Pittman called the layoffs part of iHeartMedia’s “modernization journey” that will create a flatter organization, eliminate redundancies and make it easier to do business with the company. Those cuts add to three rounds of layoffs in 2020 as the radio business struggled with an advertising slump during the first year of the pandemic.

Trending on Billboard

Throughout the earnings call, Pittman and CFO/COO Rich Bressler underscored the company’s embrace of technology to make improvements and cut costs. “Technology is the key to increasing our operating leverage and is a constant focus for us,” said Pittman. “It allows us to speed up processes, streamline legacy systems and it enables our folks to create more, better and faster.” Technology alone will reduce annual expenses by $150 million in 2025, he said, while measures taken earlier this year will bring the total annual savings to $200 million.

In explaining how iHeartMedia uses technology to save such a large sum of money, Pittman gave the example of expanding the reach of on-air talent. “What we’re able to do now, because we’ve got technology, is we can take talent we have in any location and put them on the air in another location,” he explained. “So it allows us to substantially upgrade the quality of our talent in every single market we’re in and allows us to project talent into the situations in which you’re going to have the best impact.”

As for the financial performance, iHeartMedia’s third-quarter revenue increased 5.8% to $1.01 billion, meeting the company’s prior guidance of mid-single-digit growth. Excluding political revenue, revenue was up 2.0%. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA), a common measure of operating profitability, was flat at $204 million and fell on the low end of the guidance range of $200 million to $220 million.

At iHeartMedia’s multi-platform group, which includes broadcast stations and radio networks, revenue fell 1.1% to $619.5 million and adjusted EBITDA dipped 20.1% to $129.9 million. Broadcast revenue dropped 1.4% due to lower spot revenue but was helped by an increase in political advertising.

The digital audio group, which includes podcasts and iHeartMedia’s digital service, saw its revenue jump 12.7% to $301 million and its adjusted EBITDA improve 6.8% to $100 million. Podcast revenue grew 11.1% to $114 million. Audio and media services revenue rose 45.3% to $90 million due to the political advertising spending for the recent national and local elections.

iHeartMedia’s Q3 2024 financial metrics:

Revenue: up 5.8% to $1.01 billion

Adjusted EBITDA: flat at $204 million

Net loss: up 360% to $41.3 million

Free cash flow: up 8.4% to $73.3 million

Live Nation, which is facing a lawsuit brought by the Department of Justice (DOJ) under President Joe Biden, saw its share price jump on Wednesday (Nov. 6) following Donald Trump’s victory in the U.S. presidential election a day earlier.

Live Nation shares gained 7.1% to $125.99 and rose as high as $127.64, just shy of its all-time high of $127.75 set on Nov. 5, 2021. Investors could see Trump’s re-entrance into the White House as a good sign for Live Nation’s efforts to thwart efforts by the DOJ to break up the company.

In a lawsuit filed in May, the DOJ alleged Live Nation abused its market power to hurt competition through exclusive ticketing contracts and threats and retaliations against venues that choose competing ticketing companies, among other actions the DOJ claims are illegal and violate the consent decree that placed competition-enhancing restrictions on the 2010 merger of Live Nation and Ticketmaster.

Trending on Billboard

“The change in administration typically brings a change in the climate around anti-trust efforts and could impact a case such as Live Nation,” says Bill Morrison, a partner at Haynes and Boone. “It depends on the who are in those key spots, and then what the priorities are of those offices. We’ve seen big pivots in the past.”

Faced with the prospect of fewer regulations and an administration perceived to be pro-market, U.S. indexes posted big gains on Wednesday. The Dow Jones Industrial Average gained 3.6% to a record high. Similarly, the Nasdaq composite rose 3.0% and the S&P 500 improved 2.5% as both reached all-time highs. The NYSE composite gained 1.9% but fell short of its all-time high.

Stocks associated with Trump also fared well, including Tesla, whose CEO, Elon Musk, campaigned heavily for Trump. The company’s shares rose 14.8% while its competitors Rivian and Lucid Group fell 8.3% and 5.3%, respectively. Trump Media & Technology Group Corp., owner of the Truth Social app used by Trump, rose 5.9%.

Bitcoin rose 9.4% to an all-time high of $76,012 on Wednesday. Trump has signaled a laissez-faire approach to cryptocurrency and said he would quickly fire Securities and Exchange Commission chair Gary Gensler, a critic who has punished numerous crypto companies and favors tighter regulations. Trump himself is involved with a new cryptocurrency through World Liberty Financial, a decentralized finance startup that sells a token called WLFI.

In other music stocks news, music streamer LiveOne jumped 28.5% a day ahead of the company’s earnings release for the quarter ended Sept. 30 while iHeartMedia shares fell 12.6% following news that the radio broadcaster cut dozens of jobs at stations across the country this week.

State Champ Radio

State Champ Radio