Department of Justice

Source: Samuel Corum / Getty

A federal judge overseeing the Justice Department’s case against former FBI Director James Comey called out the largest DOJ for a “disturbing pattern of profound investigative missteps” in the process of securing an indictment.

According to the Associated Press, Magistrate Judge William Fitzpatrick noted that the DOJ didn’t even provide defense lawyers with all the grand jury materials from the case.

“Those problems, wrote Judge Fitzpatrick, include ‘fundamental misstatements of the law’ by a prosecutor to the grand jury that indicted Comey in September, the use of potentially privileged communications during the investigation and unexplained irregularities in the transcript of the grand jury proceedings,” AP reports.

Love Hip-Hop Wired? Get more! Join the Hip-Hop Wired Newsletter

We care about your data. See our privacy policy.

“The Court recognizes that the relief sought by the defense is rarely granted,” Fitzpatrick wrote. “However, the record points to a disturbing pattern of profound investigative missteps, missteps that led an FBI agent and a prosecutor to potentially undermine the integrity of the grand jury proceeding.”

Judge Fitzpatrick’s 24-page opinion is a literal smackdown to the Justice Department’s actions leading up to the Comey indictment. The opinion points to how the DOJ’s rush to indict lead to procedural missteps, which gives the appearance that the independent arm of the law is working lockstep with President Donald Trump for “reasons separate and apart from the substance of the disputed allegations against Comey,” AP notes.

The Comey case and a separate prosecution of New York Attorney General Letitia James shows that the Justice Department is being weaponized to attack Trump’s political opponents. Both Comey and James filed several motions to dismiss these cases before the trials even began, claiming that the vindictive nature of the cases and the prosecutor who filed them, Lindsey Halligan, wasn’t even appointed properly.

Halligan apparently had no prior prosecutorial experience before being appointed as the interim U.S. attorney. Critics argue that making her the sole prosecutor for such high-stakes cases raises serious questions about competence and legitimacy and who may be pulling the strings behind the scene.

A different judge is expected to decide whether Halligan’s appointment can be challenged.

The U.S. Department of Justice is conducting a criminal investigation into whether Live Nation and AEG illegally colluded in their concert refund policies at the beginning of the COVID-19 pandemic, Live Nation confirmed, though the concert giant is denying any wrongdoing.

Bloomberg first reported Thursday (May 15) that the Department of Justice (DOJ) is investigating whether Live Nation and AEG violated federal antitrust laws by coordinating their responses to mass concert cancellations via a task force when the pandemic first hit in 2020.

Prosecutors have weighed bringing charges against Live Nation and its CEO, Michael Rapino, according to Bloomberg. No such charges have yet been filed; the statute of limitations for federal antitrust prosecutions is five years, meaning that if a case is going to be brought, it will have to be soon.

Trending on Billboard

Live Nation’s regulatory chief, Dan Wall, confirmed the criminal probe in a statement to Billboard but says the company did nothing wrong.

“It is not illegal for artist agents, promoters and ticketing companies to work together to solve the unprecedented challenges of a global pandemic,” Wall says. “While Live Nation contributed to this industry effort in good faith, we set our own unique policies and refund terms to support fans and artists. We did not collude with AEG or anyone else. We are proud of our leadership during those trying times, and if any charges result from this investigation, we will defend them vigorously.”

A DOJ spokesperson declined to comment on the matter Friday (May 16). Reps for AEG did not immediately return a request for comment.

The criminal investigation comes on top of the DOJ’s civil antitrust action accusing Live Nation and its subsidiary Ticketmaster of illegally monopolizing the live music industry. The lawsuit, filed last May, seeks to break up the two live entertainment behemoths that merged in 2010.

Live Nation and Ticketmaster insist that they are in compliance with antitrust regulations and have said they plan to “vigorously defend” against the lawsuit at trial, currently scheduled for March 2026.

The Live Nation-Ticketmaster suit was brought by then-President Joe Biden’s DOJ, and Bloomberg reports that the criminal investigation into Live Nation and AEG also began when Biden was president. But both enforcement actions have continued under President Donald Trump, who has made a priority of cracking down on issues within the live entertainment business

Trump signed an executive order in March — with musician and political supporter Kid Rock in attendance — calling for greater transparency around ticket sales and directing regulators to look into possible instances of deceptive and anticompetitive conduct in the industry.

The DOJ and Federal Trade Commission (FTC) responded by launching an official inquiry into the event ticketing business on May 7. The agencies said the probe is aimed at increasing competition in order to lower ticket prices, as well as rooting out exploitative scalpers and bots.

The Department of Justice (DOJ) and the Federal Trade Commission (FTC) have launched an official inquiry into the event ticketing business at the urging of President Donald Trump, the agencies announced Wednesday (May 7).

As part of the inquiry, “the agencies invite members of the public to submit comments and information on harmful practices and on potential regulation or legislation to protect consumers in the industry,” according to a press release. Anyone “impacted by anticompetitive practices in the live concert and entertainment industry” will have 60 days to submit comments to Regulations.gov, with the comment period concluding on July 7.

After the comment period closes, the agencies state they will “use the information in their preparation of the report and recommendations directed by President Trump” in his Executive Order 14254, also known as Combating Unfair Practices in the Live Entertainment Market. Signed by the president during a March 31 meeting in the Oval Office with musician Kid Rock in attendance, the order directed the Attorney General, along with the Secretary of the Treasury and the chairman of the FTC, to submit a report identifying “recommendations for regulations or legislation necessary to protect consumers” in the industry, including by enforcing the Better Online Tickets Sales (BOTS) Act.

Trending on Billboard

Passed in 2016, the BOTS Act gives both the DOJ and the FTC broad power to crack down on scalpers who illegally use automated technology to skirt the restrictions placed on high-demand ticket sales and prevents scalpers from buying up the best seats to flip for profit. Yet since its passage in 2016, the BOTS Act has only been used once to prosecute scalpers who knowingly break the rules put in place to make ticket buying fairer and more equitable.

“Competitive live entertainment markets should deliver value to artists and fans alike,” said Assistant Attorney General Abigail Slater of the DOJ’s Antitrust Division in a statement. “We will continue to closely examine this market and look for opportunities where vigorous enforcement of the antitrust laws can lead to increased competition that makes tickets more affordable for fans while offering fairer compensation for artists.”

Added FTC Chairman Andrew N. Ferguson, “Many Americans feel like they are being priced out of live entertainment by scalpers, bots, and other unfair and deceptive practices. Now their voices are being heard. President Trump has sent a clear message that bad actors who exploit fans and distort the marketplace will not be tolerated. The FTC is proud to help deliver on that promise and restore fair and competitive markets that benefit ordinary Americans.”

The inquiry comes as several ticketing bills work their way through Congress, most notably the TICKET ACT, which passed the House of Representatives on April 29 and also includes language calling for the enforcement of BOTS Act.

“Illegal bot use runs rampant in the ticketing industry because the FTC has only brought one enforcement action since the use of bots was banned in 2016,” read a statement from Stephen Parker, executive director of National Independent Venue Association (NIVA), shortly after the April 29 passage of the TICKET ACT in the House. He added, “We hope Congress does not miss the opportunity to ensure these laws are actually enforced in the future.”

HipHopWired Featured Video

Source: OLIVER CONTRERAS / Getty

More than 100 attorneys with the Department of Justice‘s Civil Rights Division have resigned en masse, essentially, because they’d rather get new jobs than continue to serve a White House administration that is dedicated to perverting what civil rights protections are all about.

From Newsweek:

“No one has been fired by me … but what we have made very clear last week in memos to each of the 11 sections in the Civil Rights Division is that our priorities under President Trump are going to be somewhat different than they were under President Biden,” Harmeet Dhillon, the assistant attorney general for the DOJ’s Civil Rights Division, told conservative commentator Glenn Beck during an appearance on his show at the weekend.

“And then we tell them, these are the President’s priorities, this is what we will be focusing on—you know, govern yourself accordingly. And en masse, dozens and now over 100 attorneys decided that they’d rather not do what their job requires them to do.”

Dhillon just basically towed Trump’s narrative around “woke ideology,” which, essentially, is anything related to racial justice, social justice, non-whitewashed American history, anti-racism, or anything else that gets white conservatives all in their eternally fragile feelings.

More from Newsweek:

The DOJ’s civil rights division, founded after the passage of the Civil Rights Act, initially focused on protecting the voting rights of Black Americans. But Congress later expanded its responsibilities to include protecting Americans from discrimination on the basis of race, national origin, sex, disability, religion, sexual orientation, gender identity and military status.

But Dhillion reportedly issued a series of memos earlier in April detailing the division would be focusing on priorities laid out in Trump’s executive orders, such as the participation of transgender athletes in women’s sports, combating antisemitism and ending diversity, equity and inclusion (DEI) initiatives.

What neither Dhillion, President Donald Trump, nor anyone else in Trump’s abysmally incompetent Cabinet will admit is that the White House’s so-called civil rights agenda is all about returning America to a nation that protects practically no one except heterosexual, cisgendered, Christian identifying white people.

It’s why white American history and studies that cover and celebrate Western civilization are virtually the only teachings that have gone unaffected by Trump’s takeover of federally funded museums and arts institutions being purged of so-called “improper ideology.”

It’s why Trump, who, during his last campaign, pledged to fight fictitious anti-white oppression in America, is reportedly taking his cues from white lawyers who are unilaterally deciding how much Black history is too much history.

It’s why Trump’s factless anti-DEI propaganda has gotten so out of control that the Department of Justice recently ended a settlement agreement regarding wastewater issues in a mostly Black rural Alabama county, citing the White House’s anti-DEI directive, which, of course, has absolutely nothing to do with a court settlement.

It’s why the Trump administration is working so hard to fight against the rare occurrence of transwomen participating in women’s sports — which isn’t any of the federal governments’s business in the first place — while it also reportedly toys around with the idea of defunding specialized services for LGBTQ+ youth on the 988 Suicide and Crisis Lifeline.

More than 100 attorneys left the DOJ’s Civil Rights Division because, under Trump, the DOJ no longer fights for civil rights — it fights to make white nationalism and the right-wing agenda great again. That’s it, and that’s all.

HipHopWired Featured Video

Source: Noam Galai / Getty

A federal judge held off ruling on the Justice Department’s motion to dismiss corruption charges against New York City Mayor Eric Adams after a hearing.

On Wednesday (Feb. 19), U.S. District Court Judge Dale E. Ho held off on issuing a ruling on whether the Department of Justice’s motion to dismiss federal corruption charges against New York City Mayor Eric Adams. Adams and his legal team along with acting Deputy Attorney General Emil Bove were present for the hearing, which lasted a shade under 90 minutes. Attorneys who had prosecuted Adams in the past were not present.

“I’m going to take everything you said under careful consideration,” Judge Ho told Bove after hearing arguments from him and Adams’ lawyers. “It’s not in anyone’s interest here for this to drag on. I understand that.” Judge Ho would add, “To exercise my discretion properly, I’m not going to shoot from the hip here on the bench.” He promised to provide a ruling in writing, but asked for “patience as I consider these issues carefully.” The prior arguments from Bove denied that there was a “quid pro quo,” calling it a fabrication. “We offered nothing and the department asked nothing of us,” Bove claimed. When asked if the dismissal meant there would be no further investigations against Adams, Bove replied, “No.”

Mayor Adams has been under intense scrutiny since the Justice Department’s recommendations to drop the case against him, allegedly so that Adams can aid President Donald Trump further in his immigration agenda of deportations. The directive led to the resignation of a half-dozen attorneys from the DOJ, including Danielle C. Sassoon, the acting U.S. Attorney of the Southern District of New York who penned a stern letter to U.S. Attorney General Pam Bondi, saying she was “baffled” by Bove’s decision.

While Adams seemed unfazed by the proceedings, even smiling and cracking a joke at one point, the situation has added more trouble to his future. New York Governor Kathy Hochul is weighing whether to remove Adams from his position. “In the 235 years of New York State history, these powers have never been utilized to remove a duly-elected mayor; overturning the will of the voters is a serious step that should not be taken lightly,” she said in a statement, adding: “That said, the alleged conduct at City Hall that has been reported over the past two weeks is troubling and cannot be ignored.”

HipHopWired Featured Video

Source: YUKI IWAMURA / Getty

The Department of Justice has reportedly discussed dropping the federal charges against New York City Mayor Eric Adams with Manhattan prosecutors.

According to reports, senior officials with the Department of Justice have discussed the future of the federal corruption case against New York City Mayor Eric Adams and the possibility that the charges would be dropped outright. DOJ officials are slated to meet with prosecutors in Manhattan from the office of the Southern District of New York this week and with the legal defense team for Adams. The embattled mayor is slated to go on trial April 21 and has been in constant communication with President Donald Trump in recent weeks, including attending his inauguration and visiting him at his Mar-a-Lago estate in Florida. Trump has publicly supported Adams, stating that he would “take a look” at a pardon for him in a press briefing last month.

Sources close to the discussions have framed them as preliminary. The Southern District of New York declined to comment – since Damian Williams stepped down last month, the office has been run by Danielle R. Sassoon, a veteran prosecutor appointed by Trump on an interim basis. Speculation has risen that the Justice Department is seeking a fast resolution to the matter before Trump’s picks for the SDNY and the U.S. Attorney General (Jay Clayton and Pamela Bondi, respectively) are confirmed. According to the New York Times, Sassoon is in a precarious position – if she were to drop the charges, it would allow Adams to say that the charges shouldn’t have been brought in the first place. If she refused, she could be forced to resign or be fired.

The news comes amid rumors that Adams, who until early Thursday (Jan. 30) was out of the public eye dealing with illness, would potentially accept a pardon and then resign. Adams’ lawyer, Alex Spiro (who also represents Trump crony and tech billionaire Elon Musk) dismissed that theory to reporters. “No, he’s innocent,” he said. The same sources claim that Shapiro intimated to the DOJ officials that Adams would hinder further immigration crackdowns in New York City if he were still under indictment. “That is a complete lie.” Shapiro said when asked about that conversation.

HipHopWired Featured Video

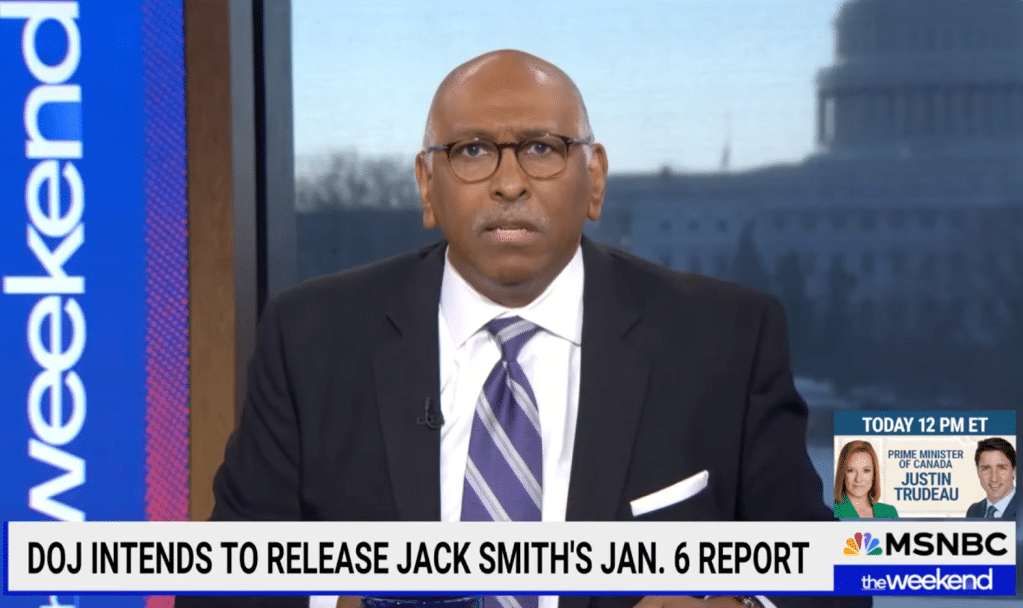

Source: MSNBC / Youtube

MSNBC host Michael Steele called out Attorney General Merrick Garland for his lack of holding Donald Trump accountable.

Outgoing Attorney General Merrick Garland has been attacked for his reluctance to fully hold Donald Trump accountable, and an MSNBC host raked him over the coals for it. Former Republican National Committee chairman and co-host of The Weekend Michael Steele began a segment blasting U.S. District Court Judge Aileen Cannon on Sunday (Jan. 12), for her attempts to help the president-elect ward off investigations by former Special Counsel Jack Smith as he sat with former lawyer Kathy Greenberg. He would veer off to address Garland’s apparent delay in releasing the final report of Special Counsel Jack Smith after Greenberg characterized Cannon’s previous rulings as “lawless.”

“I’m of the view I don’t care how you release it, just get the damn thing released because we have nickel and dimed around this. Merrick Garland has been wholly useless in this process, completely useless,” Steele thundered. “The most timid person at justice, period, in the history of the organization. Even in this hour, in the face of everything else, knowing what happens on January 20th: ‘Well, I don’t know if we should put this out because something may come,’” he continued, referring to the date that Trump is set to be sworn in for his second presidential term.

“Nothing’s coming of this because it’s all gone at 12:01 next Tuesday, next Monday!” he exclaimed. “So what’s the point, Kristy? I mean, citizens look at this and they go, this has been a complete cluster for the American people relative to our judicial process. How do you restore that faith? Where do we begin to get back this idea that our judiciary, particularly since Donald Trump is going to stack it with more Judge Cannons, is impartial and a place where you can go and have those scales balanced in a way in which you can receive some justice, or that we can at least see it working.”

Steele’s comments echoed those of many observers and experts who agreed about Garland’s lack of urgency. In a surprise move, however, Judge Cannon denied a motion from Trump’s co-defendants Walt Nauta and Carlos De Oliveira to block the release of Smith’s report on the classified documents case on Monday (Jan. 13). Barring an appeal, the decision means that after the temporary injunction expires on Tuesday, the report will be released to the public.

HipHopWired Featured Video

Source: Scott Olson / Getty

The Department of Justice issued a report detailing the numerous abuses by the Memphis Police Department based on their investigation after the death of Tyre Nichols.

On Wednesday (Dec. 4), the Department of Justice released a scathing report containing the findings of an investigation into the Memphis Police Department, revealing that the department “engages in a pattern or practice of using excessive force, conducting unlawful stops, searches and arrests and discriminatory policing of Black people and residents with behavioral health disabilities,” according to DOJ’s Civil Rights Division Assistant Attorney General Kristen Clarke. The department began its investigation 17 months after the beating death of Tyre Nichols by Memphis Police officers in 2023 after a traffic stop.

The report went into detail on how officers would employ excessive force “almost immediately in response to low-level, nonviolent offenses, even when people are not aggressive.” One example detailed how nine police cruisers and 12 officers responded to a call of a mentally ill person who stole a $2 soft drink from a gas station, using a Taser and pepper spray in the process. Another data point by Clarke highlighted the disparity of police interactions between Black and white residents, where she noted: “MPD cites or arrests Black adults for marijuana possession at 5.2 times the rate of White adults.” Another instance detailed how a Memphis Police officer picked up an 8-year-old with behavioral issues and tossed him onto a couch. These were in addition to “inconsistencies” between written reports and body camera footage.

The city of Memphis held a press conference to respond to the findings of the report. “In the last three years we have changed over 700 policies… that help to direct process, help to improve officer response. Community engagement has been a significant part of the work we have been doing,” said Memphis Police Department Chief Cerelyn “C.J” Davis. Davis is Black, as is 50% of the police department, including the five officers involved in beating Nichols. Memphis City Attorney Tannera George Gibson stated that the city had been presented with a consent decree granting further federal oversight over the department, but it declined in a letter, writing: “Until the City has had the opportunity to review, analyze, and challenge the specific allegations that support your forthcoming findings report, the City cannot — and will not — agree to work toward or enter into a consent decree that will likely be in place for years to come and will cost the residents of Memphis hundreds of millions of dollars.”

The federal judge presiding over the Department of Justice’s sweeping antitrust case against Live Nation thinks the trial can begin as early as March 2026, according to recent federal court filings.

Judge Arun Subramanian explained Thursday (June 27) in the case’s first pre-trial hearing that he hoped jury selection could begin that month, although he stopped short of setting a firm date.

One of the first items of business for Subramanian, who was appointed to the federal bench by President Joe Biden in 2023, is to rule on a planned motion by Live Nation to move the case from the Southern District of New York to the federal circuit court in Washington, D.C., where Live Nation’s 2010 merger with Ticketmaster was first approved. Subramanian said he believed his court could properly preside over the case but that he would fully consider the advisement.

Prior to being appointed to the federal bench, Subramanian was a partner at litigation firm Susman Godfrey LLP, which currently represents Live Nation in the 2021 Astroworld festival class action lawsuit. Subramanian did not work on that case.

Trending on Billboard

Government attorneys said in a Tuesday (July 25) filing that they plan to bring additional claims against Live Nation, noting the new claims could include information that attorneys from Live Nation have designated as highly confidential and might ask the courts to seal.

Attorneys for the government “do not believe any of the information at issue merits sealing or overcomes the presumption of public access to judicial documents,” the filings explain, noting that if Live Nation doesn’t budge, the government will ask the judge to rule on the matter.

Department of Justice (DOJ) lawyers also complained that Live Nation attorneys have delayed discovery requests and failed to “fully comply with any of the United States’s three pre-complaint civil investigative demands” dating back to October 2022.

“It took Defendants nearly a year to start producing custodial documents,” the filing reads, noting that “their responses to many specifications remain incomplete today.”

Lawyers for Live Nation called the government’s discovery allegation false, noting that “since October 2022, Defendants have spent over 200,000 attorney hours reviewing documents, produced over 600,000 documents from nearly 70 custodians, produced over 33 million observations of data, submitted dozens of written responses, and provided investigative deposition testimony from three high-level executives in response to Plaintiffs’ investigations. In addition, DOJ has access to nearly two million documents that Defendants produced during prior investigations.”

Attorneys for Live Nation added that they want “any documents, data or testimony Plaintiffs received from third parties during their investigation” no later than July 22, 2024.

Live Nation is also challenging the government’s unusual request for a jury trial instead of having the verdict determined by a judge. “If it occurred, it would be the first jury trial ever in a government-brought monopolization case,” the company’s attorneys wrote.

Outside of Live Nation, the government also says it plans to issue more than 100 third-party subpoenas to “ticketers, promoters, ticket brokers, venues, venue management companies, artists, and artists’ agents and managers.”

Live Nation declined to comment for this story.

Live Nation is being represented by longtime attorney and litigator Timothy L. O’Mara and Alfred C. Pfeiffer, both partners at Latham and Watkins. Pfeiffer is the former co-chair of the firm’s Antitrust & Competition Practice. Ticketmaster is represented by David R. Marriott with Cravath, who successfully represented Illumina against the Federal Trade Commission and secured a 2022 victory for the Louis Dreyfus Company against DOJ efforts to block the sale of Imperial Sugar to U.S. Sugar.

The government is represented by Bonny Sweeney, who joined the DOJ in 2022. Sweeney formerly served as a partner at San Francisco firm Hausfeld where she was co-chair of its U.S. antitrust practice group. In 2023, she was named antitrust lawyer of the year by the California Lawyers Association.

Given the glacial pace at which federal antitrust litigation moves, the U.S. Department of Justice’s historic lawsuit against Live Nation and its wholly owned subsidiary Ticketmaster is expected to take years to wind its way through the legal system whether it’s fully adjudicated or the live-event Goliath agrees to make changes to its business, which the government often terms “behavioral remedies.”

And though it’s clearly too early to predict how the case will play out, legal expert and antitrust attorney Lawrence J. White from New York University’s Stern School of Business says the potential winners and losers have already been largely pre-determined based on hints found in the 128-page complaint that the DOJ filed May 23 in U.S. District Court in the Southern District of New York.

“The companies mentioned in the complaint as being the most harmed by anti-competitive behavior are typically the same companies that stand the most to gain in the solution,” White says.

Trending on Billboard

In the case of Live Nation, the winners will very likely be the company’s main concert promotion rival, AEG Presents; secondary-market ticketing competitor SeatGeek; and a handful of major independent promoters like Chicago’s Jam Productions. The losers would likely be Live Nation; Irving Azoff and Tim Leiweke’s venue owner, management and hospitality company, Oak View Group — which the DOJ alleges “has described itself as a ‘hammer’ and ‘protect[or]’ for Live Nation” — as well as, potentially, major artist management companies and talent agencies, depending on the government’s solution for more competitive ticket pricing.

“The government tends to rely on private companies to carry out its policy goals during the remedy phase of an antitrust case,” explains White, pointing toward the original consent decree drafted around the 2010 merger of Live Nation and Ticketmaster. That agreement unsuccessfully propped up two private companies — AEG and Comcast Spectacor — to serve as competitors to Ticketmaster.

Whether the DOJ wins in court or ends up settling with Live Nation, White says it will lean on large corporations to assist with enforcement of the ruling. As Live Nation’s only major competitor for ticketing and concert promotion, AEG, which owns AXS Ticketing, is an obvious choice as a DOJ partner because of the company’s large scale, which will be critical for the DOJ’s long-shot goal to lower ticket prices. (The DOJ is believed to have interviewed more than 100 individuals from the live-music industry as part of its recent antitrust investigation into Live Nation.)

In a May 23 press release that announced the lawsuit filing, Attorney General Merrick Garland said, “We allege that Live Nation relies on unlawful, anti-competitive conduct to exercise its monopolistic control over the live-events industry in the United States at the cost of fans, artists, smaller promoters and venue operators.” He contends that increasing competition among Live Nation’s ticketing rivals and in the artist promotion space will lower the face value prices of tickets.

Prior to the 2010 merger of Live Nation and Ticketmaster, four or five ticketing companies were capable of competing with the latter at the arena level. In 2024, only two remain: AXS and SeatGeek, the secondary site that also happens to own one of the only primary ticketing products capable of servicing major arenas and stadiums.

In a statement released to Billboard, SeatGeek said, “We are hopeful that the Department of Justice’s antitrust lawsuit to break up the Live Nation-Ticketmaster monopoly will restore fair market competition to live entertainment.” On the concert promotion front, there are far fewer major independent promoters now than there were prior to 2010 and only a handful capable of touring major arena acts across the country. In addition to Jam Productions, they include Nashville’s Outback Concerts and Another Planet Entertainment in the San Francisco Bay Area. All three promoters declined to comment for this story.

In a May 31 letter to his staff, AEG chairman/CEO Jay Marciano outlined how the DOJ could make concert promotion fairer and drive down the cost of ticketing by dismantling Live Nation’s “flywheel” business model, which is cited in the DOJ’s complaint and described in its May 23 press release as “a self-reinforcing business model that captures fees and revenue from concert fans and sponsorship, uses that revenue to lock up artists to exclusive promotion deals and then uses its powerful cache of live content to sign venues into long-term exclusive ticketing deals, thereby starting the cycle all over again.”

Marciano’s letter said Live Nation’s flywheel model “deploys the excessive profits of its ticketing monopoly to outspend what the concert market can profitably sustain.”

Under this theory, ticket prices would drop if Live Nation was prevented from using its other revenue sources to overpay artists and compete with other promoters offering artists an 85/15 or a 90/10 split on ticket sales.

Although the theory is not widely accepted by most major talent agents or managers — IAG executive vp/head of global music Jarred Arfa calls it “unrealistic” and “illogical” — it is gaining popularity among large indie promoters and DOJ lawyers, sources tell Billboard. White notes that whether the government settles or takes Ticketmaster to trial will depend on “the time and resources the DOJ wants to expend on the case and the evidence against Live Nation it has collected.”

State Champ Radio

State Champ Radio