Charts

Page: 3

Tate McRae scores her first No. 1 album on the Billboard 200 chart as her third full-length studio set, So Close to What, debuts atop the list dated March 8. It arrives with 177,000 equivalent album units earned in the U.S. in the week ending Feb. 27, according to Luminate — marking the biggest debut week, by units, for a studio album by a woman in five months.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

It’s the second top 10-charting effort for the singer-songwriter, who previously visited the region with the No. 4-peaking Think Later in December 2023. The album generated a trio of charted songs on the Billboard Hot 100, including the No. 3-peaking “Greedy.”

So Close to What was announced in November 2024 and its release was preceded by three charted titles on the Hot 100, including a pair of top 40 hits: “It’s OK I’m OK” (No. 20, September 2024) and “Sports Car” (No. 21 in February).

Trending on Billboard

The Billboard 200 chart ranks the most popular albums of the week in the U.S. based on multi-metric consumption as measured in equivalent album units, compiled by Luminate. Units comprise album sales, track equivalent albums (TEA) and streaming equivalent albums (SEA). Each unit equals one album sale, or 10 individual tracks sold from an album, or 3,750 ad-supported or 1,250 paid/subscription on-demand official audio and video streams generated by songs from an album. The new March 8, 2025-dated chart will be posted in full on Billboard‘s website on March 4. For all chart news, follow @billboard and @billboardcharts on both X, formerly known as Twitter, and Instagram.

Of So Close to What’s 177,000 first-week equivalent album units, SEA units comprise 105,000 (equaling 137.30 million on-demand official streams of the set’s songs; McRae’s biggest streaming week ever, and it debuts at No. 2 on Top Streaming Albums), album sales comprise 71,000 (her best sales week ever, it debuts at No. 1 on Top Album Sales) and TEA units comprise 1,000.

With So Close to What’s launch of 177,000 equivalent album units, the set tallies the biggest debut week for a studio album by a woman since Sabrina Carpenter’s Short n’ Sweet bowed at No. 1 with 362,000 units on the Sept. 7, 2024-dated chart.

So Close to What’s streaming activity was led by the tracks “Sports Car,” “Revolving Door,” “It’s OK I’m OK” and “Dear God,” which collectively comprise a little more than a third of the album’s total streams for the week.

So Close to What was released across an array of permutations and variants. It was issued as a standard 11-song digital download album, a 13-song physical set (on CD, cassette and vinyl), a 15-song digital download and streaming edition, a 16-song digital download and streaming set, and an 18-song digital download sold exclusively in McRae’s webstore. Each variation of the album beyond the 11-song set contained the core 11 songs found on the standard edition, as well as additional tracks (which varied depending on the version).

The album’s first-week sales were bolstered by its availability across four download variants (three widely available, and one exclusive to the artist’s webstore), three CD variants (including one signed), seven vinyl variants (including two signed editions) and a cassette.

McRae ushered in the release of the new album with an appearance on NBC’s The Tonight Show Starring Jimmy Fallon, along with interviews with Apple Music’s Zane Lowe, iHeartRadio and Allure, among other outlets. The performer’s Miss Possessive Tour kicks off on March 18 in Mexico City and has dates scheduled through Nov. 8 in Inglewood, Calif. McRae will play more than 80 dates in over 20 countries on three continents.

As for the rest of the top 10 on the latest Billboard 200 chart, it’s a quiet week, as McRae’s set is the lone new arrival in the region. PARTYNEXTDOOR and Drake’s $ome $exy $ongs 4 U falls to No. 2 in its second week, earning 119,000 equivalent album units (down 52%). The next five titles on the Billboard 200 are all former No. 1s: Kendrick Lamar’s GNX holds at No. 3 (106,000 units; down 22%); SZA’s SOS is a non-mover at No. 4 (82,000; down 13%); Sabrina Carpenter’s Short n’ Sweet slips 2-5 (76,000; down 51%); Bad Bunny’s Debí Tirar Más Fotos falls 5-6 (63,000; down 6%); and The Weeknd’s Hurry Up Tomorrow drops 6-7 (50,000; down 14%).

Chappell Roan’s The Rise and Fall of a Midwest Princess dips 7-8 (46,000 equivalent album units; down 5%), Morgan Wallen’s chart-topping One Thing at a Time is stationary at No. 9 (41,000; up 4%), and Billie Eilish’s Hit Me Hard and Soft falls 8-10 (nearly 41,000; down 11%).

Luminate, the independent data provider to the Billboard charts, completes a thorough review of all data submissions used in compiling the weekly chart rankings. Luminate reviews and authenticates data. In partnership with Billboard, data deemed suspicious or unverifiable is removed, using established criteria, before final chart calculations are made and published.

PARTYNEXTDOOR and Drake’s first collaborative album, $ome $exy $ongs 4 U, debuts atop the Billboard 200 chart (dated March 1), earning 246,000 equivalent album units in the U.S. in the week ending Feb. 20, according to Luminate. It’s the first leader for PARTYNEXTDOOR and fourth top 10 charting set. It’s 14th No. 1 for Drake among 17 top 10s. Drake now ties JAY-Z and Taylor Swift for the most No. 1s among soloists in the nearly-69-year history of the chart. Overall, only The Beatles, with 19 No. 1s, have more.

Explore

See latest videos, charts and news

See latest videos, charts and news

A collaborative project from PARTYNEXTDOOR and Drake had been teased for months, but was only officially announced on Feb. 3, in advance of its release on Feb. 14.

Trending on Billboard

The Billboard 200 chart ranks the most popular albums of the week in the U.S. based on multi-metric consumption as measured in equivalent album units, compiled by Luminate. Units comprise album sales, track equivalent albums (TEA) and streaming equivalent albums (SEA). Each unit equals one album sale, or 10 individual tracks sold from an album, or 3,750 ad-supported or 1,250 paid/subscription on-demand official audio and video streams generated by songs from an album. The new March 1, 2025-dated chart will be posted in full on Billboard‘s website on Feb. 25. For all chart news, follow @billboard and @billboardcharts on both X, formerly known as Twitter, and Instagram.

Of $ome $exy $ongs 4 U’s 246,000 first-week equivalent album units, SEA units comprise 219,000 (equaling 287.04 million on-demand official streams of the set’s songs; it debuts at No. 1 on Top Streaming Albums), album sales comprise 25,000 (it debuts at No. 3 on Top Album Sales) and TEA units comprise 2,000.

With 287.04 million on-demand official streams generated of its songs, $ome $exy $ongs 4 U nets the largest streaming week for an album in 2025. It’s the largest streaming week for any album since Kendrick Lamar’s GNX debuted at No. 1 on the Dec. 7, 2024, chart with 379.72 million.

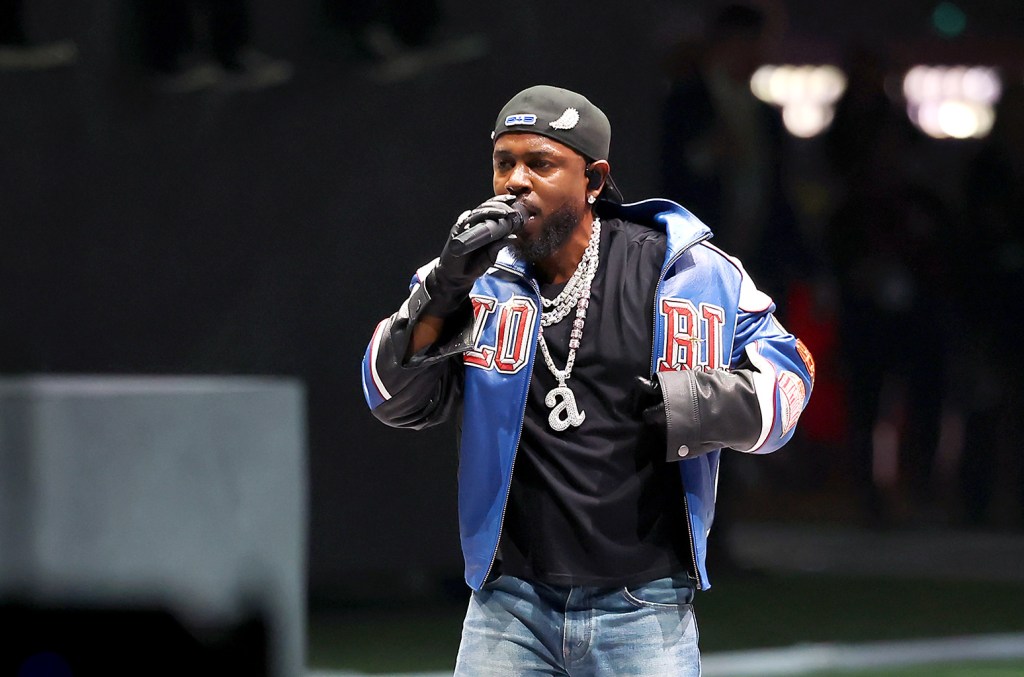

Speaking of Lamar, $ome $exy $ongs 4 U is Drake’s first album since the feud between him and Lamar escalated in March 2024 with the release of “Like That” by Future, Metro Boomin and Lamar. A flurry of diss tracks followed from each artist, with Lamar’s “Not Like Us” finding the most commercial success, spending three nonconsecutive weeks at No. 1 on the Billboard Hot 100 (including a return to the top a week ago after he performed the track during his Super Bowl LIX halftime show on Feb. 9).

$ome $exy $ongs 4 U replaces Lamar’s GNX atop the Billboard 200, as the latter falls to No. 3 after returning to No. 1 a week ago in the wake of the halftime show. It’s the first time Lamar and Drake have swapped the No. 1 slot on the Billboard 200. This is also only the third time Lamar and Drake have been in the top three at the same time on the Billboard 200. They previously shared space in the top three on the May 13, 2017, chart, when Lamar’s DAMN. was in its second week at No. 1 and Drake’s former leader More Life was No. 2, and on the May 6, 2017, chart, when DAMN. debuted at No. 1 and More Life was No. 3. (DAMN. spent four nonconsecutive weeks at No. 1 in May-August 2017 and More Life had three weeks at No. 1, consecutively, in April 2017.)

$ome $exy $ongs 4 U is the first collaborative No. 1 on the Billboard 200 in 2025. There were three collab No. 1s in 2024, none in 2023, one in 2022, one in 2021 and one in 2020. Of Drake’s 14 leaders, three are collaborative sets. He previously led with the collab projects Her Loss (with 21 Savage in 2022) and What a Time to Be Alive (with Future in 2015).

On the new Billboard 200 chart, Sabrina Carpenter’s former leader Short n’ Sweet surges 7-2 with 156,000 equivalent album units earned (up 208%) following its reissue with five additional tracks on Feb. 14. The set was reissued on streamers, as well as at retail as a digital download, CD, cassette and two vinyl variants. One of the additional cuts on the reissue is a reworked version of Carpenter’s solo No. 1 Hot 100 hit “Please Please Please,” now rerecorded as a collaboration featuring Dolly Parton.

With 156,000 equivalent album units earned in the latest tracking week, Short n’ Sweet snags its biggest week since it debuted at No. 1 on the chart dated Sept. 7, 2024, with 362,000. Of the album’s 156,000 units earned, SEA units comprise 83,000 (up 108%, equaling 111.95 million on-demand official streams of the set’s songs; it climbs 7-4 on Top Streaming Albums), album sales comprise 71,000 (up 616%; it rises 6-1 on Top Album Sales) and TEA units comprise 2,000 (up 198%).

SZA’s chart-topping SOS falls 2-4 on the Billboard 200 with 93,000 equivalent album units earned (down 14%); Bad Bunny’s former No. 1 Debí Tirar Más Fotos dips 4-5 with 67,000 units (down 14%); and The Weeknd’s chart-topping Hurry Up Tomorrow descends 3-6 with 58,000 units (down 42%).

Chappell Roan’s The Rise and Fall of a Midwest Princess slips 5-7 on the Billboard 200 (49,000 equivalent album units earned; down 17%); Billie Eilish’s Hit Me Hard and Soft drops 6-8 (46,000; down 18%); Morgan Wallen’s chart-topping One Thing at a Time dips 8-9 (39,000; down 5%); and Lamar’s DAMN. falls 9-10 (33,000; down 14%).

Luminate, the independent data provider to the Billboard charts, completes a thorough review of all data submissions used in compiling the weekly chart rankings. Luminate reviews and authenticates data. In partnership with Billboard, data deemed suspicious or unverifiable is removed, using established criteria, before final chart calculations are made and published.

Following the 2025 Super Bowl halftime show (Feb. 9), headliner Kendrick Lamar sees his GNX album return to No. 1 on the Billboard 200 for a second nonconsecutive week (rising 4-1 on the Feb. 22-dated chart), while his special guest SZA climbs 3-2 with her former leader SOS. With Lamar and SZA at Nos. 1 […]

Kendrick Lamar’s Super Bowl halftime show (Feb. 9) sparked big gains for the rapper’s catalog of albums, as three of his releases dot the top 10 of the Billboard 200 chart dated Feb. 22. GNX returns to No. 1 (rising 4-1) for a second nonconsecutive week (it debuted atop the list in December), 2017’s chart-topping DAMN. jumps 29-9 and 2012’s good kid, m.A.A.d city vaults 27-10.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

It’s the first time in the nearly 69-year history of the chart that a rap act has placed at least three albums concurrently in the top 10. The Billboard 200 began publishing on a regular, weekly basis in March 1956.

Trending on Billboard

The latest Billboard 200 chart reflects activity generated in the U.S. in the tracking week Feb. 7-13. The Feb. 22-dated Billboard 200 will be posted in full on Billboard‘s website on Feb. 19, one day later than usual, owed to the Presidents’ Day holiday in the U.S. on Feb. 17.

Before Lamar, the last act, overall, with at least three albums in the top 10 was Taylor Swift on the Dec. 9, 2023, chart, when she had five in the region.

Before Lamar, the last male artist — or anyone aside from Swift — to have at least three albums in the top 10 at the same time was Prince, following his death, in 2016. That year, on the May 14 chart, he logged five titles in the region; and on the May 7 chart, he had three in the top 10. Prince died on April 21, 2016.

Lamar is the first living male artist to have at least three albums concurrently in the top 10 since Herb Alpert on the Dec. 24, 1966-dated chart, when he, leading the Tijuana Brass, had three titles in the top 10.

Lamar’s GNX returns to No. 1, rising 4-1, for its second week on top. The album was also released on physical formats for the first time (on Feb. 7), helping spark Lamar’s best sales week since 2017. It was previously only available to stream, and to purchase as a digital download album. GNX debuted at No. 1 on the Dec. 7, 2024-dated chart.

Before Lamar, the last time a Super Bowl halftime performer was No. 1 on the Billboard 200 in the wake of their halftime performance was Justin Timberlake in 2018, when his Man of the Woods album debuted atop the chart dated Feb. 17. The set was released on Feb. 2, 2018 — two days before he headlined Super Bowl LII on Feb. 4 in Minneapolis.

There’s more Lamar action on the latest Billboard 200 outside the top 10, as his former leader To Pimp a Butterfly, released in 2015, jumps 167-54 and the chart-topping Mr. Morale & The Big Steppers, from 2022, vaults 185-75. Plus, the Lamar-curated Black Panther soundtrack, released in 2018, reenters at No. 42. The former No. 1 album includes a Lamar collaboration with SZA, “All the Stars,” which the pair performed during the halftime show.

Speaking of SZA, her own former No. 1 SOS rises 3-2 on the Billboard 200. This week marks the first time two performers from the year’s Super Bowl halftime show have been Nos. 1 and 2 in the wake of the big game.

Kendrick Lamar’s GNX jumps back to No. 1 on the Billboard 200 albums chart, for a second week atop the list (rising 4-1 on the survey dated Feb. 22), following his Super Bowl halftime show (Feb. 9) and the set’s release on physical formats. (It was previously only available to stream, and to purchase as a digital download album.)

Plus, two more Lamar albums return to the top 10 in the wake of the halftime show: 2017’s chart-topping DAMN. drives 29-9 and 2012’s good kid, m.A.A.d city vaults 27-10. The latest Billboard 200 reflects activity generated in the U.S. in the week ending Feb. 13.

With GNX, DAMN. and good kid, m.A.A.d city all in the top 10, Lamar is the first rap act with three albums in the top 10 of the Billboard 200 at the same time. The chart began publishing on a regular, weekly basis in March 1956.

Trending on Billboard

The Billboard 200 chart ranks the most popular albums of the week in the U.S. based on multi-metric consumption as measured in equivalent album units, compiled by Luminate. Units comprise album sales, track equivalent albums (TEA) and streaming equivalent albums (SEA). Each unit equals one album sale, or 10 individual tracks sold from an album, or 3,750 ad-supported or 1,250 paid/subscription on-demand official audio and video streams generated by songs from an album. The new Feb. 22, 2025-dated chart will be posted in full on Billboard‘s website on Feb. 19, one day later than usual, owed to the Presidents’ Day holiday in the U.S. on Feb. 17. For all chart news, follow @billboard and @billboardcharts on both X, formerly known as Twitter, and Instagram.

According to Luminate, of the 236,000 equivalent album units earned by GNX in the week ending Feb. 13 in the U.S., SEA units comprise 117,000 (up 86%; equaling 161.01 million on-demand official streams of the set’s songs; it jumps 4-1 on Top Streaming Albums), album sales comprise 116,000 (up 10,100%; it reenters at No. 1 on Top Album Sales for its first week at No. 1 on that chart) and TEA units comprise 3,000. The set’s 236,000 units earned mark its largest week since it debuted at No. 1 on the Dec. 7, 2024-dated chart with 319,000.

With GNX selling 116,000, that marks Lamar’s largest sales week for an album since DAMN. debuted with 353,000 sold in its first week (chart dated May 6, 2017). Of GNX’s 116,000 sold, vinyl sales comprise 87,000 — Lamar’s best week ever on vinyl. GNX was released on physical formats for the first time on Feb. 7, on CD, cassette and five vinyl variants.

As Lamar has three albums concurrently in the top 10 on the Billboard 200, he’s the first living male artist to achieve that feat since Herb Alpert on the Dec. 24, 1966-dated chart (when he, along with the Tijuana Brass, had three titles in the top 10). The most recent act, overall, with at least three albums in the top 10 was Taylor Swift on the Dec. 9, 2023, chart, when she had five in the region.

Before Lamar, the last male artist — or anyone aside from Swift — to have at least three albums in the top 10 at the same time was Prince, following his death, in 2016. That year, on the May 14 chart, he logged five titles in the region; and on the May 7 chart, he had three in the top 10. Prince died on April 21, 2016.

GNX is currently in its 12th consecutive week on the chart and has yet to depart the top five on the weekly tally.

Former No. 1 DAMN. drives 29-9 on the Billboard 200 with 39,000 equivalent album units earned (up 93%) and good kid, m.A.A.d city jumps 27-10 with 37,000 units (up 71%). DAMN. spent four weeks atop the list in 2017, and it was last in the top 10 on the March 17, 2018-dated chart, when it ranked at No. 9. The good kid album peaked at No. 2 in 2012 and was last in the top 10 on the Nov. 24, 2012-dated chart, when it placed at No. 9.

SZA, who was a special guest performer during Lamar’s halftime show, sees her former No. 1 SOS climb 3-2 on the latest Billboard 200 with 109,000 equivalent album units earned (up 33%). The album was reissued on Feb. 9 with four additional tracks.

The Weeknd’s Hurry Up Tomorrow falls 1-3 on the Billboard 200 in its second week (101,000 equivalent album units; down 79%), Bad Bunny’s chart-topping Debí Tirar Más Fotos descends 2-4 (78,000; down 17%) and Chappell Roan’s The Rise and Fall of a Midwest Princess climbs 6-5 (59,000; up 19%).

Billie Eilish’s Hit Me Hard and Soft falls 5-6 (56,000 equivalent album units earned; up 6%), Sabrina Carpenter’s former leader Short n’ Sweet is steady at No. 7 (51,000; up 5%) and Morgan Wallen’s chart-topping One Thing at a Time is a non-mover at No. 8 (41,000; down 8%).

Luminate, the independent data provider to the Billboard charts, completes a thorough review of all data submissions used in compiling the weekly chart rankings. Luminate reviews and authenticates data. In partnership with Billboard, data deemed suspicious or unverifiable is removed, using established criteria, before final chart calculations are made and published.

The Weeknd lands his fifth No. 1 on the Billboard 200 albums chart with the debut of Hurry Up Tomorrow atop the tally (dated Feb. 15). The set earned 490,500 equivalent album units in the U.S. in the week ending Feb. 6, according to Luminate. That marks the largest week for any album since Taylor Swift’s The Tortured Poets Department debuted at No. 1 on the May 4, 2024-dated chart with 2.61 million. Hurry Up Tomorrow logs the biggest week for an R&B/hip-hop album since Travis Scott’s Utopia debuted at No. 1 on the Aug. 12, 2023, chart with 496,000.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

The Weeknd previously topped the chart with After Hours (2020), My Dear Melancholy (2018), Starboy (2016) and Beauty Behind the Madness (2015).

Trending on Billboard

Also in the latest top 10, Chappell Roan’s The Rise and Fall of a Midwest Princess surges 14-6 following her best new artist win at the Grammy Awards (Feb. 2), while Billie Eilish’s Hit Me Hard and Soft (10-5) also climbs in the wake of Grammy exposure.

The Billboard 200 chart ranks the most popular albums of the week in the U.S. based on multi-metric consumption as measured in equivalent album units, compiled by Luminate. Units comprise album sales, track equivalent albums (TEA) and streaming equivalent albums (SEA). Each unit equals one album sale, or 10 individual tracks sold from an album, or 3,750 ad-supported or 1,250 paid/subscription on-demand official audio and video streams generated by songs from an album. The new Feb. 15, 2025-dated chart will be posted in full on Billboard‘s website on Feb. 11. For all chart news, follow @billboard and @billboardcharts on both X, formerly known as Twitter, and Instagram.

Of Hurry Up Tomorrow’s 490,500 first-week equivalent album units, album sales comprise 359,000 (it debuts at No. 1 on Top Album Sales), SEA units comprise 130,500 (equaling 171.5 million on-demand official streams of the songs on the streaming edition of the album; it debuts at No. 1 on Top Streaming Albums) and TEA units comprise 1,000.

Hurry Up Tomorrow’s launch of 490,500 units marks The Weeknd’s biggest week by units earned (since the chart began measuring in units in December 2014). The set’s sales of 359,000 claim The Weeknd’s largest sales week ever.

The set was released as a nine-song standard album, widely available through digital download retailers. It was alternatively available as an 11-song edition across all of its physical formats (CD, vinyl and cassette) and a 22-track digital download and streaming edition. It was also available in two further digital download editions, both exclusively sold via The Weeknd’s HurryUpTomorrow.Club site. Each sold for $4.99, boasted alternative cover art and had the 22 tracks available on the deluxe digital/streaming edition, but each had at least one additional track. One included “Closing Night,” with Swedish House Mafia. The other included “Runaway” and “Society,” which were also included on all of the physical formats, but not any of the other digital or streaming editions.

In total, the album generated 183,000 in digital album sales; 99,000 in CD sales; 77,000 in vinyl sales (The Weeknd’s best week on vinyl) and 1,000 in cassette sales.

Hurry Up Tomorrow’s first-week sales were aided by its availability across eight vinyl variants (including a signed edition), eight CD variants (including multiple signed editions), a cassette tape, and nine deluxe boxed sets containing a branded piece of clothing and a CD.

The album was preceded by the Billboard Hot 100-charting songs “Timeless” (with Playboi Carti, No. 3 peak last October) and “Sao Paulo” (with Anitta, No. 77 last November).

Bad Bunny’s Debí Tirar Más Fotos falls 1-2 on the Billboard 200 with 94,000 equivalent album units earned (down 20%). SZA’s chart-topping SOS slips 2-3 with 82,000 (down 6%), Kendrick Lamar’s GNX dips 3-4 with 65,000 (though up 9%) and Billie Eilish’s Hit Me Hard and Soft jumps 10-5 with 53,000 (up 47%).

Eilish was the first performer on the Feb. 2 Grammy Awards broadcast (on CBS), singing the album’s “Birds of a Feather.” Also on the show: The Weeknd performed (singing his new album’s “Cry for Me” and “Timeless,” with Playboi Carti), while SZA presented the best pop duo/group performance, and Lamar won two on-air trophies (for record of the year, and song of the year, both for “Not Like Us”).

Chappell Roan’s The Rise and Fall of a Midwest Princess surges 14-6 with a 56% gain — to 49,000 equivalent album units earned. The album vaults up the tally following Roan’s win for best new artist at the Grammys, along with her performance of the album’s “Pink Pony Club” on the show (and her buzzy acceptance speech which generated headlines).

Sabrina Carpenter’s former No. 1 Short n’ Sweet gaind 20% (up to 48,000 equivalent album units) but is pushed down a spot to No. 7. On the Grammy Awards, Carpenter won the best pop vocal album award, while also performing a medley of the album’s “Espresso” and “Please Please Please.” (She also won best pop solo performance for “Espresso,” but that category was presented before the television broadcast began.)

Morgan Wallen’s chart-topping One Thing at a Time drops 5-8 on the Billboard 200, despite an 11% gain (to 45,000 equivalent album units). Taylor Swift’s former No. 1 The Tortured Poets Department ascends 11-9 with 38,000 equivalent album units (up 8%) — also likely basking in some glow from the Grammy Awards, where the album and its “Fortnight” single were up for six awards (though did not win). Swift was a visible presence throughout the ceremony, cheering on winners and performers, and presented the best country album trophy to Beyoncé (for Cowboy Carter).

Rounding out the latest top 10 on the Billboard 200 is Gracie Abrams’ The Secret of Us, falling 8-10 with 36,000 equivalent album units earned (down 5%).

Luminate, the independent data provider to the Billboard charts, completes a thorough review of all data submissions used in compiling the weekly chart rankings. Luminate reviews and authenticates data. In partnership with Billboard, data deemed suspicious or unverifiable is removed, using established criteria, before final chart calculations are made and published.

Bad Bunny’s Debí Tirar Más Fotos develops a third straight week at No. 1 on the Billboard 200 albums chart (dated Feb. 8), earning 117,000 equivalent album units in the U.S. in the week ending Jan. 30 (down 22%), according to Luminate.

Also in the top 10 of the latest Billboard 200, new albums from Teddy Swims, Kane Brown and Central Cee all debut.

The Billboard 200 chart ranks the most popular albums of the week in the U.S. based on multi-metric consumption as measured in equivalent album units, compiled by Luminate. Units comprise album sales, track equivalent albums (TEA) and streaming equivalent albums (SEA). Each unit equals one album sale, or 10 individual tracks sold from an album, or 3,750 ad-supported or 1,250 paid/subscription on-demand official audio and video streams generated by songs from an album. The new, Feb. 8, 2025-dated chart will be posted in full on Billboard‘s website on Tuesday (Feb. 4). For all chart news, follow @billboard and @billboardcharts on both X, formerly known as Twitter, and Instagram.

Trending on Billboard

Of the 117,000 equivalent album units earned by Debí Tirar Más Fotos in the week ending Jan. 30, SEA units comprise 114,000 (down 22%; equaling 156.18 million on-demand official streams of the set’s songs; it’s No. 1 for a fourth week on Top Streaming Albums), album sales comprise 2,500 (down 45%; falling 11-48 on Top Album Sales) and TEA units comprise 500 (down 31%).

SZA’s former leader SOS is a non-mover at No. 2 on the Billboard 200 (87,000 equivalent album units; down 2%) and Kendrick Lamar’s chart-topping GNX rises 4-3 (60,000; up 1%).

Teddy Swims scores his highest-charting album and first top 10, as I’ve Tried Everything But Therapy (Part 2) debuts at No. 4. The set earned 50,000 equivalent album units, with album sales comprising 26,000 (it debuts at No. 1 on Top Album Sales), SEA units comprising 23,000 (equaling 30.38 million on-demand official streams of the set’s songs; it debuts at No. 17 on Top Streaming Albums) and TEA units totaling 1,000.

The album’s launch of 50,000 marks Swims’ biggest week yet by units earned, while his sales bow of 26,000 is also his best sales week ever. Plus, his streaming start (30.38 million) marks his best streaming week for an album.

The LP is the follow-up to the singer-songwriter’s I’ve Tried Everything But Therapy (Part 1), which spawned 2024’s year-end No. 1 on the Billboard Hot 100, “Lose Control.” That set topped out at No. 17 but has spent 69 weeks on the list (it slips 21-25 on the latest chart).

The new album was preceded by a pair of charting hits on the weekly Hot 100: “Bad Dreams” and “Are You Even Real” (the latter with Giveon).

The first-week sales of the new album were bolstered by its availability across eight vinyl variants (including a signed edition) and two CD variants (including a signed edition).

Morgan Wallen’s former leader One Thing at a Time climbs 8-5 on the latest Billboard 200 (41,000 equivalent album units; up 9%) while Sabrina Carpenter’s chart-topping Short n’ Sweet stays at No. 6 (just over 40,000; down 7%).

Kane Brown achieves his fifth top 10-charting album on the Billboard 200, as The High Road rides in at No. 7 with 40,000 equivalent album units earned. Of that sum, SEA units comprise 20,000 (equaling 26.76 million on-demand official streams of the set’s songs; it debuts at No. 21 on Top Streaming Albums), album sales comprise 19,000 (it debuts at No. 2 on Top Album Sales) and TEA units comprise 1,000.

The High Road was preceded by four entries on the Hot Country Songs chart: “I Can Feel It,” “Miles On It” (with Marshmello), “Backseat Driver” and “Gorgeous.”

The album’s first-week sales were aided by its availability across nine vinyl variants (including a signed edition), four CD variants (including a signed edition), and three digital download variants (a standard version, plus two with alternative cover art).

Gracie Abrams’ The Secret of Us falls 5-8 on the latest Billboard 200, with 37,000 equivalent album units earned (down 28%).

Rapper Central Cee scores his first top 10, with his first charting album, as Can’t Rush Greatness bows at No. 9 with nearly 37,000 equivalent album units earned. SEA units comprise 27,000 of that sum (equaling 36.91 million on-demand official streams of the set’s songs; it debuts at No. 14 on Top Streaming Albums), album sales comprise 10,000 (debuting at No. 5 on Top Album Sales) and TEA units comprise a negligible sum.

The album was preceded by two charting hits on both Hot Rap Songs and the all-genre Hot 100. On the former, “BAND4BAND” (with Lil Baby) hit No. 4, while “GBP” (featuring 21 Savage) has reached No. 16. On the Hot 100, the tracks hit Nos. 17 and 92, respectively, through the most recently published chart, dated Feb. 1.

Central Cee, who hails from London, scored his first U.S. chart hit with “Doja,” reaching No. 36 on Hot R&B/Hip-Hop Songs in 2022. He’s charted a total of seven hits on that ranking, including collabs with Drake, J. Cole and Ice Spice.

Can’t Rush Greatness debuted at No. 1 on the U.K. Official Albums Chart (his second leader there). Central Cee has notched eight top 10-charting hits on the U.K. Official Singles Chart, including the No. 1 “Sprinter” (with Dave). He also recently nabbed three BRIT Award nominations, including artist of the year.

Closing out the latest top 10 on the Billboard 200 is Billie Eilish’s Hit Me Hard and Soft, slipping 9-10 with 36,000 equivalent album units earned (down 2%).

Luminate, the independent data provider to the Billboard charts, completes a thorough review of all data submissions used in compiling the weekly chart rankings. Luminate reviews and authenticates data. In partnership with Billboard, data deemed suspicious or unverifiable is removed, using established criteria, before final chart calculations are made and published.

In his autobiography Q, Quincy Jones wrote, “Numbers 2, 6, and 11 are my least-favorite chart positions.” It doesn’t take a Jones-like genius to determine why. Each song that peaks at those ranks, despite a clear vote of public favor, can come with a sliver of disappointment as a song’s creators and performers just miss […]

Bad Bunny’s Debí Tirar Más Fotos captures a second week at No. 1 on the Billboard 200 albums chart (dated Feb. 1), earning 151,000 equivalent album units in the U.S. in the week ending Jan. 23 (down 26%), according to Luminate. Of Bad Bunny’s four chart-topping albums, it’s the second to spend more than a single week at No. 1; his 2022 set, Un Verano Sin Ti, has collected the most weeks atop the list, with 13 weeks, nonconsecutively.

Explore

See latest videos, charts and news

See latest videos, charts and news

Also in the top 10 of the latest Billboard 200, Mac Miller’s from-the-vaults release Balloonerism debuts at No. 3, marking the eighth top 10-charting set for the rapper, who died in 2018. The set’s songs date back to 2014, but the project was shelved in favor of other releases.

Trending on Billboard

The Billboard 200 chart ranks the most popular albums of the week in the U.S. based on multi-metric consumption as measured in equivalent album units, compiled by Luminate. Units comprise album sales, track equivalent albums (TEA) and streaming equivalent albums (SEA). Each unit equals one album sale, or 10 individual tracks sold from an album, or 3,750 ad-supported or 1,250 paid/subscription on-demand official audio and video streams generated by songs from an album. The new Feb. 1, 2025-dated chart will be posted in full on Billboard‘s website on Jan. 28. For all chart news, follow @billboard and @billboardcharts on both X, formerly known as Twitter, and Instagram.

Of the 151,000 equivalent album units earned by Debí Tirar Más Fotos in the week ending Jan. 23, SEA units comprise 146,000 (down 25%; equaling 198.78 million on-demand official streams of the set’s songs; it’s No. 1 for a third week on Top Streaming Albums), album sales comprise 4,000 (down 46%; falling 8-11 on Top Album Sales) and TEA units comprise 1,000 (down 30%).

SZA’s former No. 1 SOS rises 3-2 with 90,000 equivalent album units (down 12%).

Mac Miller’s Balloonerism bows at No. 3 with 81,000 equivalent album units earned. Of that sum, album sales comprise 41,000 (it debuts at No. 1 on Top Album Sales), SEA units comprise 40,000 (equaling 51.56 million on-demand official streams of the set’s songs; it debuts at No. 4 on Top Streaming Albums) and TEA units comprise a negligible sum. The set’s sales were bolstered by its availability across six vinyl variants, a CD, digital download album and cassette tape.

In total, Balloonerism is Miller’s eighth top 10-charting effort on the Billboard 200. It follows Faces (No. 3 in 2021), Circles (No. 3, 2020), Swimming (No. 3, 2018), The Divine Feminine (No. 2, 2016), GO:OD AM (No. 4, 2015), Watching Movies With the Sound Off (No. 2, 2013) and Blue Slide Park (No. 1, 2011).

Kendrick Lamar’s former leader GNX is a non-mover on the Billboard 200 at No. 4 (59,000 equivalent album units; down 8%) while Gracie Abrams’ The Secret of Us surges 10-5 (52,000; up 42% after the release of a deluxe version across three vinyl variants and a CD).

Three former No. 1s are next, with Sabrina Carpenter’s Short n’ Sweet steady at No. 6 (43,000 equivalent album units; down 9%), Lil Baby’s WHAM dipping 5-7 (39,000; down 30%) and Morgan Wallen’s One Thing at a Time rising a notch to No. 8 (37,000 down 3%).

Billie Eilish’s Hit Me Hard and Soft falls two rungs to No. 9 (nearly 37,000 equivalent album units; down 8%), and Taylor Swift’s The Tortured Poets Department climbs 12-10 (35,000; down 3%).

Luminate, the independent data provider to the Billboard charts, completes a thorough review of all data submissions used in compiling the weekly chart rankings. Luminate reviews and authenticates data. In partnership with Billboard, data deemed suspicious or unverifiable is removed, using established criteria, before final chart calculations are made and published.

Karol G is in a league of her own as “Si Antes Te Hubiera Conocido” adds a 26th week at No. 1 on Billboard’s overall Latin Airplay chart (dated Jan. 25), breaking the record for the most weeks among all songs since the list launched in 1994.

Explore

Explore

See latest videos, charts and news

See latest videos, charts and news

The merengue tune surpasses the 25-week domination by Shakira’s “La Tortura,” featuring Alejandro Sanz, a record the song held since Nov. 2005, when it outdid the 20-week mark by Son By Four’s “A Puro Dolor.”

“Si Antes Te Hubiera Conocido,” released June 21, 2024, also remains as the top performer on the Tropical Airplay chart, where it has led the list for 28 weeks (of its total 31 weeks on the chart). Karol G might also set a new record on the tropical ranking, as she is one week away from tying Prince Royce‘s record of 29 nonconsecutive weeks at No. 1 with “Carita de Inocente” in 2020. (It stepped aside for one week during its run atop the list, when Kyen?Es? sneaked-out one week atop the chart with “El Carnaval de Celia: A Tribute (La Vida Es Un Carnaval/ La Negra Tiene…)” in September 2020.

Trending on Billboard

“Si Antes Te Hubiera Conocido,” commands both Latin Airplay and Tropical Airplay despite a 13% decline in audience impressions, to 10 million, earned during the Jan. 10-16 tracking week in theU.S., according to Luminate. The global hit gave Karol her 18th No. 1 on the overall Latin radio ranking when it landed at the summit last July, the second-most among women, just behind Shakira who continues at the helm with 24 champs.

While “Si Antes” spent its last week on the multi-metric Hot Latin Songs chart on the Jan. 11-dated list (due to the colossal take over by Bad Bunny’s new album), it also left a mark in 2024, tying with Xavi’s “La Diabla” and FloyyMenor and Cris MJ’s “Gata Only” for the most weeks at No. 1, all with 14 weeks at the summit. Further, in addition to “Qlona,” with Peso Pluma (No. 5), Karol’s “Si Antes” became only the second song by a female artist to close in the top 10 on the year-end Hot Latin Songs chart in 2024, at No. 8.

The new Jan. 25, 2025-dated charts will be posted in full on Billboard‘s website on Jan. 22 (one day later than usual, owed to the Martin Luther King Jr. Day holiday in the U.S. on Jan. 20). For all chart news, follow @billboard and @billboardcharts on both X, formerly known as Twitter, and Instagram.

State Champ Radio

State Champ Radio