Business

Page: 60

Most cruise ships clear their top decks to fit as many passengers as possible in the pool, but on the Norwegian Gem, that valuable real estate is sacrificed for something a little more sacred: the blues.

That’s because the 965 foot-long vessel, part of the Norwegian Cruise Line (NCL) fleet, is currently the home of the Keeping the Blues Alive at Sea X cruise — a sold-out annual expedition for which the ship’s theaters, lounges and swimming pool are all repurposed for hi-fidelity performances of guitar-driven rock, rhythm and blues.

On the Norwegian Gem, what was once a swim-up bar and pool is now drained and filled with monitors, rigging and enough staging to accommodate a full-scale live show built for theaters and performing arts centers. On Keeping the Blues Alive, contemporary blues legend Joe Bonamassa headlines a lineup of more than a dozen artists that also includes Grammy-winning duo Larkin Poe; rock and blues veteran Big Head Todd and the Monsters; Grammy winner Christone “Kingfish” Ingram; and blues guitarist Eric Gales. Launching out of Miami with stops in Belize and Cancun, Mexico, the cruise is facilitated by the Atlanta-based company Sixthman, a subsidiary of NCL since 2009. This year, the five-night voyage is accommodating about 2,500 diehard Bonamassa fans who have spent approximately $2,500 per cabin to hit the seas with the blues legend and the rest of the lineup, curated by Bonamassa and manager Roy Weisman.

Trending on Billboard

Keeping the Blues Alive at Sea

Will Byington

“Initially, I was not interested in doing a blues cruise — I had done one before and hated it,” explains Bonamassa, cigar in hand, speaking on the open-air deck of his top-level suite aboard the Gem. “And then I got a call from Sixthman in 2015 and was pitched on an experience that was more artist-friendly and didn’t require me to be in it so much. So we tweaked my schedule a bit, gave it a shot and I just saw how much fun everyone was having. Not just the fans, but the interactions with the other bands.”

Each artist on the Keeping the Blues Alive cruises is paid a festival rate and contracted for three appearances: typically two large stage performances and then a smaller, more intimate engagement. For Bonamassa, that means two main stage performances and a live session of his podcast Welcome to Nerdville.

This edition of Keeping the Blues Alive at Sea, a nod to Bonamassa’s non-profit of the same name, sold out months in advance. When the cruise hit the seas on March 20, the blues man already had two more sold-out Sixthman cruises on the books, including one to Alaska that departs from Seattle.

“Our model is that we focus on passionate communities, and this is one of the most passionate communities out there,” says Jeff Cuellar, who has served as Sixthman’s CEO since Jan. 17. Prior to that, Cuellar worked at festival company AC Entertainment, founder of the famed Bonnaroo festival outside of Nashville.

Larkin Poe

Will Byington

Bonamassa fans are on the older side, averaging ages 55 to 60. Besides an affinity for Bonamassa’s live performances, they are generally interested in blues, rock and guitar-driven music. However, Sixthman and NCL’s music business goes beyond Bonamassa; the company services more than 35 cruises annually, with upcoming voyages planned for Creed, Lindsey Stirling, Michael Franti, and Coheed and Cambria. Sixthman has also seen success with non-music themed voyages, including several chef-driven food cruises, a true crime podcast cruise and a recently launched cruise celebrating the Hallmark Channel, which sold out hours after going on sale, breaking a company record.

Most cruises take off from Miami and by law are required to make one stop at a foreign port — for NCL, that typically means Nassau, Bahamas; Costa Maya, near Cancun; and Harvest Caye, a private island owned by NCL in Belize. Most cruises include all-inclusive food offerings — alcohol packages are sold separately, typically in advance — and a variety of amenities including outdoor basketball courts, rock climbing walls, full-service gyms, specialty restaurants and casinos with poker rooms that often feature appearances by talent.

Cuellar says Sixthman operates much like a traditional promoter: “For the longest time, music has been the core of what we do and will always be the core, but we have started to diversify and look at other passionate communities, whether it be [for baseball team] the Savannah Bananas or Jay and Silent Bob,” the cinematic duo from Kevin Smith’s cinematic universe. Prices for most cruises start at $1,172 per person for interior cabins and run as high as $2,937 per person for high-end suites with meet and greets. The Norwegian Gem has a total of 1,197 cabins, while larger ships like the Norwegian Encore boast 2,043.

Keeping the Blues Alive at Sea

Will Byington

“It’s a lot of inventory to sell, and while we can have conversations about VIP sales and merch sales, we want to dig even deeper,” says Cuellar. “We want to know where fans are talking about the artist. Is it on Reddit? Is it Facebook? Where are other conversations happening?”

That information becomes critical when it comes to selling and marketing cruises, Cuellar explains, noting that Sixthman heavily relies on the artist to help sell cruise packages. Drawing from data points like Spotify listens, merch and VIP sales, the Sixthman team creates an index for participating artists and then “put[s] out a couple of scores that we use for evaluation to determine how confident we feel that this engagement will be a success,” he says.

“We’ll actually survey a section of their audience so that we know who would be willing to participate,” Cuellar adds. “Sometimes, you get great responses, and we decide to book it immediately, and other times we find it’s not the experience fans are looking for.”

Sixthman’s success with Bonamassa is due to “his amazing connection to his fans,” Cuellar says. “When Joe talks about it, people respond. When he sends out an email, people respond because they know they’re going to get a top-quality experience.”

It’s an experience that Bonamassa and Weisman, his longtime manager and business partner, have spent the last 26 years cultivating, evolving Bonamassa’s live show into a global touring brand with around 100 performances a year. Bonamassa began his career in 1989 as a 12-year-old guitar prodigy opening for blues legend B.B. King and spent his early 20s working the blues nightclub circuit. Weisman, a longtime music executive whose father was Frank Sinatra‘s manager for the last few years of his career, met Bonamassa in 1999 and worked with the bluesman to elevate his live shows to theaters and performing arts centers.

Keeping the Blues Alive at Sea

Will Byington

Their company, J&R Adventures, is home to Bonamassa’s record label, artist management group and vertically integrated touring entities that promote, market and produce his live shows. Early on in their relationship, the men discovered the pathway to success “was super serving an underserved marketplace,” Weisman says. “The key was for us to approach the blues like we’re not afraid of it,” he adds. Instead of trying to mold Bonamassa into a AAA-radio-friendly artist, Weisman says he and Bonamassa had to “go into the blues like a house on fire. Walk right into it. Not be afraid or try to circumvent around it because there’s room as an independent to make a wave without being crushed by the majors.”

That means owning and controlling every part of Bonamassa’s business, from his label to concert promotion. J&R Adventures books the venues for Bonamassa’s tours, takes the risk on each show and handles everything from production to marketing. For Sixthman, Bonamassa’s familiarity and understanding of his audience make him a natural partner, says Cuellar. Bonamassa’s team books all of the support talent and helps curate some of the artist-to-fan activities, like poker tournaments, cooking demonstrations, fireside acoustic performances and meet and greets.

Neither Cuellar nor Weisman would say how much Bonamassa earns from the cruises, other than to note that the model is based on profit sharing and Bonamassa is one of the top-selling artists in the history of the company.

“And they give us this amazing suite,” Weisman says of his accommodations on the top floor of the 14-deck sea liner that’s located inside NCL’s luxury penthouse complex called The Haven, which is equipped with high-end furnishings, private balconies and a 24-hour concierge service, all roped off from the rest of the cruise.

“Norwegian makes it very easy for artists who are used to living out of a suitcase and a hotel room,” he continues. “Being on a cruise like this allows you to settle in a bit, even if it’s just for five days. The privacy and hospitality they facilitate makes a noticeable difference.”

In recent years, social media platforms have become a key battleground for copyright infringement disputes, with music rights holders targeting brands that use copyrighted tracks in social media posts.

This development can be traced, in part, to increasingly sophisticated software that major music labels and publishers use to monitor infringing uses of their songs online — a reaction to the “whack-a-mole” frustration that rights holders feel when they consistently find their songs being used on the Internet without permission. And with the risk of potential statutory damage awards for copyright infringement ranging from $200 to $150,000 per infringed work, rights holders can hold significant leverage in any ensuing legal action. Thus, whether a brand is incorporating music into posts on its social media channels or partnering with influencers who do the same, using music on social media has never been riskier.

Below, we examine the rising tide of recent lawsuits and other legal action taken against brands by music rightsholders and outline key takeaways to help avoid infringing uses and ensure that artists are properly compensated for their work.

Trending on Billboard

The Vital Pharmaceuticals Case

In 2021, UMG Recordings sued Vital Pharmaceuticals, the parent company of Bang Energy, for direct, contributory, and vicarious copyright infringement, alleging that videos posted by Bang and its influencers on TikTok used UMG’s copyrighted songs without permission. UMG argued that Bang was “well aware” that its conduct constituted copyright infringement because UMG had informed Bang of its unauthorized uses before bringing suit. UMG also argued that Bang had control over and financially benefited from its influencers’ infringing videos, which the influencers submitted to Bang for approval before posting.

Bang denied any knowledge of infringement, arguing that TikTok’s standard music license covered Bang’s use of UMG’s music. The court disagreed and granted summary judgment on UMG’s claim for direct copyright infringement, holding that UMG did not authorize TikTok to permit end users, such as Bang, to use the music for commercial (as opposed to personal) purposes. The court reasoned that because direct liability for copyright infringement does not require proof of intent, Bang’s belief that TikTok gave it permission to use UMG’s music was, at most, relevant to the amount of damages Bang owed, not whether it was liable for copyright infringement in the first instance.

The court ruled against UMG, however, on its vicarious and contributory infringement theories related to Bang’s influencers, concluding that UMG failed to prove that Bang had input regarding the selection of music included in influencers’ videos and did not point to any evidence that Bang received a direct financial benefit from the influencers’ videos.

The Growing Litigation Trend

Since UMG v. Vital Pharmaceuticals, music rights holders have ramped up enforcement efforts against other brands. Sony Music Entertainment launched its own copyright infringement lawsuit against Bang (as did Warner Music Group) and also filed claims against brands such as Gymshark, OFRA Cosmetics, Marriott International and the University of Southern California. In each case, the brands, and/or the influencers they hired, allegedly used Sony-owned sound recordings in posts promoting the companies’ products or services.

Similar to UMG’s argument in Vital Pharmaceuticals, Sony argued that each of the companies knew that their content infringed Sony’s copyrights prior to the lawsuits, and thus that the infringement was “willful,” entitling Sony to statutory damages as high as $150,000 per infringed work. In the Gymshark case, as in Vital Pharmaceuticals, it was alleged that Gymshark knew that the music was unlicensed because Gymshark previously approached Sony to discuss music licensing and then proceeded to use Sony’s music without securing commercial licenses. OFRA allegedly failed to take down infringing content after Sony sent a cease-and-desist letter and then posted new infringing content after learning of Sony’s claims. And Marriott allegedly did not take down its posts upon Sony’s request, was previously sued in 2021 for similar copyright infringement issue, and generally knew how to enter into music licenses.

As in Vital Pharmaceuticals, Sony also brought claims against alleged infringers, such as Gymshark and OFRA, for contributory and vicarious liability based on their influencers’ infringing content. Most recently, Warner Music Group (WMG) sued Crumbl and Designer Brands Inc., the parent company of DSW Shoe Warehouse, under similar theories.

While a number of these cases were just recently filed, and others ultimately settled out of court or appear to be moving towards settlement, there is no question that they are part of a fast-growing trend, and provide a glimpse into the mindset, and tactics, of rights holders with respect to unauthorized music use on social media platforms.

Navigating Platform Music Licenses

So what can brands do to avoid this type of legal action and ensure from the outset that artists are properly compensated for their copyrighted works? The best way to avoid copyright infringement when using music owned by a third party is, of course, to license the music directly from the third-party rights holders. This approach is often impractical, however, given the speed and volume with which brands need to publish content on social media.

Instead, many brands use music from the social media platforms’ respective “commercial music libraries” or “CMLs,” which contain different music options than those available for “personal” accounts. The CMLs, such as Meta’s Sound Collection and TikTok’s Commercial Music Library, allow companies and individuals to use music on the platform specifically for commercial purposes, so long as the brand also adheres to the platform’s other license terms.

Using CMLs can pose challenges, however, especially with respect to registering “business” accounts within each platform. Even with the proper registration, it is not always clear which music within the different libraries’ business or commercial accounts can use, and the scope of those rights may (and do) change over time. There are, however, a number of strategies brands can use to help ensure they are using permitted music.

For example, before using a platform’s CML, brands should review the CML’s terms of service and related policies, including terms that specify which commercial purposes the music can be used for and whether the songs can be used in videos on other platforms. It is equally important for brands to actively track the platforms’ evolving license terms in order to remain compliant. And for some brands, it may make sense to use software or external vendors to monitor and flag their brand and influencer posts for potential copyright violations across social media platforms. Of course, every brand’s business needs will be different. The key is finding the right combination of internal and external resources to help minimize the risk of copyright infringement.

Conclusion

The rising chorus of lawsuits from music rights holders is nothing to tune out. Brands using music as part of their social media strategies (which, practically speaking, is almost every brand) must take proactive steps to mitigate legal risks, and they will also be protecting artists’ rights in the process. This includes complying with and staying informed about changes to platform-specific licensing terms, ensuring that their influencers stay within the bounds of such terms, and considering tools to monitor, flag, and remove potentially infringing content. Failing to take these precautions can lead to costly litigation, reputational damage, and the forced removal of content.

Sarah Moses is an entertainment litigation partner with Manatt, Phelps & Phillips, LLP and focuses her practice on a variety of complex litigation and commercial disputes. She represents media, entertainment and technology clients in copyright, trademark, right of publicity, First Amendment, blockchain and artificial intelligence (AI) matters, among others.

Monica Kulkarni is an advertising, marketing and media associate with Manatt, Phelps & Phillips, LLP. She represents clients across a variety of industries and provides multidisciplinary legal counseling on transactional, compliance and regulatory matters in advertising, entertainment and media.

Jacob Geskin is a law clerk with Manatt, Phelps & Phillips, LLP based in the Firm’s New York office where he works across music, intellectual property and media law.

California-based regional Mexican music band Fuerza Regida made history this week with the debut of their new album, 111XPANTIA, at No. 2 on the Billboard 200. It’s the highest debut ever for a Mexican artist on the chart — and, had Bad Bunny not released the vinyl edition of his Debí Tirar Más Fotos the same week, 111XPANTIA would have debuted at No. 1, making the group only the third act in history to top the chart with an album in Spanish.

As it was, 111XPANTIA made double history, as it allowed two Spanish-language albums to place at Nos. 1 and No. 2 on the chart, also a first.

Trending on Billboard

While the name Fuerza Regida may still not ring bells for many in the mainstream, the group has been making serious waves since they launched in 2018, led by singer, composer and businessman Jesus Ortiz Paz, better known as JOP.

Part of a new wave of homegrown talent that’s doing a more contemporary, urban-leaning version of regional Mexican music, or música mexicana, the quintet has positioned itself as bold disruptors, delighting in making music that defies convention, veering into genres like dance and trap. Fuerza are also known for their unusual marketing strategies, from an impromptu concert on the 210 freeway near Los Angeles to a performance alongside street musicians on the Tijuana border to pop up murals to promote their album, Pero No Te Enamores, last year.

Those kinds of actions have yielded fruit. Fuerza has won Top Duo/Group of the year at the Billboard Latin Music Awards for two consecutive years already (2023 and 2024) and has placed six albums, going back to 2023, on the Billboard 200. On the Billboard Top Latin Albums chart, they’ve placed an impressive 12 albums dating back to 2019, and including nine top 10s and one No. 1, 2023’s Pa’ Las Baby’s y Belikeada. On Hot Latin Songs, they boast two No. 1s and 12 Top 10s.

But the Billboard 200 debut is their most impressive achievement to date. Fuerza is signed to a joint venture on their own Street Mob Records with indie Rancho Humilde, and is distributed by Sony Music Latin. But behind their marketing is Jesús Amezcua (aka Moska), the group’s manager (and friend), who is also head of marketing and strategy for Street Mob Records. Although “we’re synced with Sony for data and distribution, all creative direction and frontline marketing is led by us at Street Mob,” Amezcua says. “That independence is what gives us our edge and velocity.”

For pushing Fuerza to make history on the Billboard 200, Amezcua is Billboard’s Executive of the Week.

What exactly is your role with Fuerza Regida?

I manage and lead all strategic marketing, rollout execution and brand partnerships for Fuerza Regida. That covers everything from pre-release positioning and digital strategy to street-level activations, PR and long-term brand development. I work directly with JOP and the team to ensure every campaign feels authentic to the culture while breaking through in the mainstream.

The group has had many major releases, but never something of this magnitude. What made this one different?

This album was a perfect storm of timing, vision and intentionality. We knew the fans were ready for a bigger moment — and we built the campaign with that in mind from day one. What made the difference was the shift in scale: we elevated everything, from the sound to the visuals to the media approach. It was about crossing over without losing our identity.

One major turning point was this was Fuerza Regida’s first time ever releasing a physical album. Not only did we enter that market for the first time, we broke records, surpassing legendary acts like Selena and Maná for the most physical copies sold by a Mexican artist or any Latin duo or group. That milestone sent a loud message about the group’s growing cultural weight and the power of our fan base.

Was there one single action or moment that really moved the needle?

Yes — the pre-release digital campaign combined with JOP’s hands-on promotional push. We executed teaser drops, voice-of-the-streets-style content, and surprise fan moments that went viral, like a Paris Fashion Week performance, for example. Paired with a targeted mainstream media push, it became the perfect one-two punch.

Fuerza Regida is known for bold marketing stunts. Last time it was murals. What was the centerpiece this time?

We focused on emotional proximity and regional pride. Surprise activations in key markets, custom merch drops and physical memorabilia made fans feel seen. We also planted narrative Easter eggs in visuals and lyrics to spark fan theories. It wasn’t about shock — it was about depth.

What was the goal with this album release?

To make a statement: Fuerza Regida isn’t just a top-tier música mexicana act — we’re a cultural force. Yes, we wanted the numbers, but we also wanted to redefine what this genre looks like on a global stage.

How important is it to debut at No. 2 on the Billboard 200, especially as an all-genre chart?

It’s monumental. The Billboard 200 rarely reflects regional Mexican music. To be in the top two, competing with global pop giants, proves this movement is no longer niche — it’s mainstream. It feels incredible to break records and debut as the highest-charting Mexican duo or group in Billboard 200 history. We were going up against legends — and held our ground.

What makes Fuerza Regida different from other groups in música mexicana?

They’re fearless. From raw lyrics to unfiltered visuals and fan engagement, they bring a punk-rock edge. That energy has built a ride-or-die fanbase. They’re not following the blueprint — they’re rewriting it.

JOP was everywhere during this release. How intentional was the promo run?

Very intentional. We built a full content and press calendar around JOP as a brand. National TV, local media, viral content — it was all high-volume, high-authenticity. He delivered across the board.

I see Street Mob is growing and staffing up. You recently hired Gustavo López as president, for example, and he comes with longstanding label experience.

Absolutely. This is a family effort. Our president, Gustavo López, is an industry legend who leads with integrity and vision. Our COO and Street Mob partner is Cristian Primera, aka Toro, along with Cindy Gaxiola, our head of commercial affairs. Last but not least is our CFO Luis Lopez, aka Walks. They are all relentless execution machines. Every win is a reflection of this powerhouse team. Fuerza Regida is just getting started. We’re here to shift culture, not just drop records.

The broadly supported American Music Tourism Act passed in the U.S. Senate unanimously this week. Sponsored by Sens. Marsha Blackburn (R-TN) and John Hickenlooper (D-CO), the bipartisan bill, which was first introduced last year and revived in January, aims to further promote travel and tourism to music-related sites and events in the U.S.

According to Future Market Insights, the music tourism market is already valued at $6 billion dollars worldwide, and it is projected to grow to $11 billion by 2032. In a day when superfans are increasingly crossing state and country borders to catch marquee music events like Taylor Swift’s Eras Tour, concerts at The Sphere or Coachella, the American Music Tourism Act plans to fuel that trend even further.

Trending on Billboard

The bill plans to leverage the existing framework within the Department of Commerce to highlight and promote music tourism across the country. More specifically, this bill would require the assistant secretary to implement a plan to support and increase music tourism for both international and domestic music fans, and to send a report on the plan’s successes and vulnerabilities to Congress.

The AMTA defines music tourism as travel to a state or locality to experience music-related attractions—ranging from historic and contemporary museums, studios and venues of all sizes, to live performances such as concerts and festivals. If enacted, the legislation aims to boost the economic impact of these experiences.

“The Volunteer State is home to so many iconic musical landmarks for tourists to experience – from Graceland in Memphis to the Grand Ole Opry in Nashville to Dollywood in Pigeon Forge,” said Blackburn. “Music tourism has such a positive impact on Tennessee’s economy, and we need to ensure that fans from all over the world can continue to celebrate our state’s rich history of music for generations to come. The Senate’s passage of the American Music Tourism Act gets us closer to that by promoting and supporting the fast-growing music tourism industry.”

Added Hickenlooper: “Colorado’s vibrant music scene attracts artists and fans from around the world. Our bipartisan bill will help our local music venues thrive and expand.”

The bill is backed by a wide range of organizations, including the Recording Academy, Recording Industry Association of America, Nashville Songwriters Association International, ASCAP, National Music Publishers Association, Society of Composers and Lyricists, Live Nation Entertainment, National Independent Venue Association, BMI, American Alliance of Museums, Airbnb and several institutions such as the Rock and Roll Hall of Fame and the Memphis Music Hall of Fame.

Co-sponsors include Sens. Bill Hagerty (R-TN), Gary Peters (D-MI), Andy Kim (D-NJ), and Ted Budd (R-NC).

Legendary rappers Tupac Shakur and Notorious B.I.G. might have been rivals in life, but they’re now united in copyright litigation.

A pair of photographers who snapped separate photos of the late hip-hop stars are teaming up to sue Univision for copyright infringement, accusing the broadcaster of using the images without permission in a web article about “Unsolved” murders.

“Plaintiffs sent a letter to Univision, demanding that it cease and desist all publication and display of the Subject Photographs,” write lawyers for the photographers in their Wednesday suit. “Univision has failed to meaningfully respond, necessitating this action.”

The case was filed by the estate of Chi Modu, a well-known hip hop photographer, over a black and white picture of Biggie looking into the camera in his trademark Coogi sweater and sunglasses; and by Dana Lixenberg, another acclaimed photog who has snapped pictures of Iggy Pop and Steely Dan, over an image of Pac in a bandana and sports jersey.

Trending on Billboard

Attorneys for Modu’s estate and Lixenberg say Univision stitched the images together and used them as art for a 2018 article reporting that a trailer had been released for a USA Network documentary series called Unsolved: The Murders of Tupac and The Notorious B.I.G.

Though Biggie and Tupac have both been gone for nearly 30 years, Wednesday’s lawsuit is just one of many recent intellectual property battles over the two iconic rappers.

Modu’s estate filed one of them, suing Universal Music Group in 2022 for allegedly using a Tupac photo in a blog post. Then last year, Shakur’s own estate threatened to sue Drake for using an AI-generated version of the later rapper’s voice. And in February, Biggie’s estate filed a lawsuit against Target, Home Depot and other retailers over allegations that they sold unauthorized canvas prints of the famed “King of New York” photo. Coogi even got in on the action in 2018, suing the Brooklyn Nets after they released a multi-colored jersey that were “inspired by Biggie” and paid homage to the Brooklyn-born rapper.

In one case, Biggie’s estate sued Modu himself, claiming the photographer had illegally authorized the use of his photos on commercial products like skateboards and shower curtains. In 2022, a year after the famed photographer passed away, a judge ruled that such merch likely violated the rapper’s likeness rights. The case ended in a settlement last year.

Reps for Univision did not immediately return a request for comment on the new lawsuit on Friday.

In the first quarter of the year, a significant number of high-profile acts have made changes to their management teams.

At the top of 2025, Gigi Perez, known for her viral hit “Sailor Song,” parted ways with Laffitte Management Group and The Chainsmokers and longtime manager Adam Alpert dissolved their management deal though the chart-topping dance act is still represented by Alpert’s Disruptor Records and remain partners in several other ventures.

In February, Lil Nas X parted ways with Adam Leber‘s Rebel and signed with Crush Music for management. Then in March, Billboard’s Women In Music executive list revealed that Janelle Lopez Genzink, founder and CEO of Volara Management, the firm behind superstar Sabrina Carpenter, signed longtime free agent HAIM, which The Azoff Company’s Full Stop formerly represented. That same month, Noah Cyrus signed a management deal with Range Music, having formerly been represented by TaP.

And in the weeks following Q1’s close, Best Friends Music lost three high-profile clients: Billie Eilish and Finneas parted with Best Friends co-founders/co-managers Danny Rukasin and Brandon Goodman to sign with Sandbox Entertainment’s Jason Owen; and Rukasin’s rising star client Role Model departed, too. In late April, Chappell Roan’s new management team was finally announced — led by Foundations Music’s Drew Simmons — after the artist parted with State Of the Art last November. And at the top of May, Billboard reported that Camila Cabello and her longtime manager Roger Gold had split.

Trending on Billboard

Artists swapping managers is hardly a rare occurrence. As one 20-plus-year veteran of artist management says, “Working with high-profile pop artists can be incredibly stressful, especially when things start to go wrong — it can feel like you’re in a sinking ship and can’t find where the water is coming in.”

Having managed some of the biggest acts of the mid-2000s, the veteran manager has seen their fair share of shakeups. But they argue that what has changed in the field is the job’s visibility – and scrutiny. “Social media has made it much easier for a manager to position themselves as a public figure, and some, Scooter [Braun] being a good example, understood that world and navigated it in a really smart way. And I remember watching it over time — it was such a different approach to using persona as a way to complement the business that you’re trying to build.”

And now, the industry itself is giving the field a bigger platform. “You have places like ROSTR, which I think has made it really easy and accessible for a passive participant in the industry to be aware of information,” continues the source. “And the passive participant probably creates a much different echo chamber than historically the people who read [trade publications].” (To prove their point, the popular X account PopCrave, known for posting surface-level updates across pop culture, shared the news of Roan’s new management setup.)

The longtime manager/label executive agrees that social media has altered the playing field. “We’re constantly comparing and looking at how someone is doing better than us. Managers, writers, producers — we’re all looking at it. I have producer clients that see other producers posting cuts and then they’re [feeling] down. Artists do that as well, and I think the manager is typically the first to blame and the easiest to get out of a deal because we don’t have the contracts that a label or a publisher has. Agents and lawyers do, too, but they get fired all the time and no one knows about it.”

Given the recent spate of shake-ups, the veteran manager says his profession needs to consider a core question: “When society and consumer behavior changes and evolves, how quickly do industries reassess?”

Some contend that reassessment is happening right now, with one calling Eilish and FINNEAS’ departure from Best Friends — where they had been since the beginning of their careers — “this natural tipping point of like, ‘Huh. Why?’”

“It’s social media,” argues the manager/label executive. “Artists are quicker to move on. And I do think that’s just the nature of society today and this instant gratification culture. Artist empowerment is phenomenal, [but] maybe this is a small downside to it, that artists think they know everything.”

Another source points to the ongoing reevaluation of remuneration as an underlying reason for recent changes. Traditionally, a music manager will receive a commission on all business in which an artist engages. But the fast-changing field – and music industry at large — is why some believe more artists want to build “in-house teams like Taylor [Swift],” according to the boutique firm owner. “They don’t want to pay commissions. They want to structure it differently.”

But, such an arrangement is typically reserved for music’s upper echelon, with the artist manager-executive saying, “it takes a rare artist in the sense that, economically, it makes more sense when you’re at a certain level to carry that overhead. If you’re playing arenas and stadiums, then that is probably something you should be thinking about. But at the same time, if you started your career with a manager and you’re 10 years in, I think that’s a rough time for you to be like, ‘Hey, by the way, I think you should switch to salary.’”

Which is why the boutique firm owner argues that “really good managers who do so much should actually participate more — and have equity. The label, the rest of the team, it’s all really driven by management. Fifteen percent [commission] is not [enough] to cover all the overhead and everything that you do for an artist and everything that the label doesn’t do.” (In the case of a management deal ending, they insist sunset clauses, in which managers are entitled to continued pay for a set period after an artist fires them, are “crucial.”)

It all adds up to a climate in which the veteran pop manager can’t help but wonder: “In a world where it is so easy for you to search out what other people are doing or how to do something [yourself], how manageable can a person be?”

Welcome to another Executive Turntable, Billboard’s weekly compendium of promotions, hirings, exits and firings — and all things in between — across the music business. Later, carve out some time today to peruse our annual list of the industry’s top whippersnappers (aka 40 Under 40).

Matt O’Neil is now chief marketing officer of the combined Legends + ASM Global. A seasoned sports and entertainment marketing executive, O’Neil joined Legends in 2022 as chief content & experience officer and has since led successful strategies that expanded the company’s client base and revenue. In his new role, he’ll oversee all marketing, creative, content and event initiatives, focusing on enhancing customer experience and driving growth. O’Neil previously held key leadership roles with the Dallas Cowboys and New York Red Bulls, where he developed fan engagement and branding strategies. His appointment follows Legends’ 2024 acquisition of ASM Global from AEG and Onex, forming a powerhouse that now operates iconic venues including Crypto.com Arena, Soldier Field, and AO Arena. CEO Dan Levy praised O’Neil’s expertise in fan experience and storytelling, saying his background “makes him the right person to shape our unified identity and help our clients thrive in an increasingly competitive landscape.”

Trending on Billboard

Armada Music Group named industry veteran Maarten Steinkamp as interim president, a new gig designed to support the company’s next phase of growth. Previously serving as an interim board consultant, Steinkamp will now lead efforts to strengthen internal operations and prepare Armada for future expansion. He’ll report directly to CEO Maykel Piron and be based in the Netherlands. Steinkamp brings extensive global experience, having held top leadership roles at BMG and Sony BMG Europe, where he was president of BMG International and chairman/CEO of Sony BMG Europe. Founded in 2003 by Armin van Buuren, Maykel Piron and David Lewis, AMG encompasses Armada Music, BEAT Music Fund and Armada Music Publishing. Piron praised Steinkamp’s “leadership, strategic insight, and deep understanding of our industry,” adding, “with Maarten’s continued support, I’m confident we will unlock new opportunities together and take Armada Music Group to even greater heights.”

ALL IN THE FAMILY: Rolling Stone appointed Gus Wenner as executive chairman and Julian Holguin as CEO. Wenner, who has led the company since its 2017 sale to Penske Media, will now focus on strategic vision and new ventures. Under his leadership, RS expanded its digital presence, launched live events and film divisions, and earned prestigious awards, including National Magazine Awards and an Emmy. Holguin brings extensive experience from another Penske pub, Billboard, where he led major mergers and revenue growth across advertising, events and licensing. He also served as CEO of Doodles, a next-gen entertainment studio. As CEO, Holguin will oversee the brand’s business operations and report to Penske Media CEO Jay Penske. “Rolling Stone is poised for continued success leveraging Gus’ deep experience and vision for the brand and Julian’s keen business instincts and passion for innovation,” said Penske. “Rolling Stone will continue its rich legacy of world class journalism and culture shaping conversation while creating new avenues for growth” … Congrats to PMC vice chairman Gerry Byrne, who received the Ellis Island Medal of Honor, an award recognizing individuals for their leadership and service across diverse fields.

Matt Harmon is the new head of rights development at Exceleration Music, an investment fund supporting indie music artists and labels. In this role, he will oversee label operations, A&R development, marketing and catalog growth across Exceleration’s portfolio, which includes +1 Records, Kill Rock Stars, Yep Roc, and more. Harmon brings over 20 years of experience from Beggars Group US, where he rose from Head of Sales to President, helping expand labels like Matador, 4AD, and XL Recordings. Exceleration Partner John Burk praised Harmon as the “perfect leader to guide and support our rights development activities,” while Harmon, a lifelong New Yorker based in Brooklyn, said he’s “energized by the opportunity.”

Rock Paper Scissors hired Adam McHeffy as the agency’s first-ever chief creative officer. He will lead a new initiative to expand RPS’s marketing and creative services, including advertising, artist collaborations, video production, and web development. McHeffey brings a strong track record from his time as CMO at Artiphon, where he led product launches, helped sell over 250,000 instruments, and raised more than $3.6 million on Kickstarter. He has also directed major marketing campaigns for innovative instruments like the Demon Box and MyTRACKS, and contributed to platforms like Musio and Feeture. His creative work spans brands such as Slack and Rivian. A singer-songwriter and children’s book author, McHeffey is praised by RPS CEO Dmitri Vietze as a top-tier music tech marketer. “Adam’s skills make him the marketing Swiss army knife every music tech company should have on hand and make our team a formidable force,” Vietze said. “Combining his marketing expertise with our PR strategy and placement creates exponential results for our clients.”

Andrew Farwell has been named president of Outback Presents, the independent live promoter. Formerly vice president, Farwell worked closely with founder and co-CEO Mike Smardak, helping produce thousands of concerts and events across the U.S. and Canada. Based in Nashville, Farwell’s promotion coincides with his recognition in Billboard’s just-released 40 Under 40 list. Farwell also serves as vp of the International Entertainment Buyers Association (IEBA) and is a 2023 Leadership Music alumnus. He previously won IEBA’s Rookie of the Year Award and has been nominated for promoter of the year. “We all have built something we are ALL incredibly proud of, and had fun doing it together,” said Smardak. “Andrew’s ethics and class are what I am most proud of. It is a great day for Outback Presents.”

NASHVILLE NOTES: The Country Music Hall of Fame and Museum promoted Ed Schulte to senior director of facilities, operations and sustainability from director. He replaces Leigh Anne Wise, who is retiring after 41 years at the museum … Doug Montgomery, Townsquare Media‘s country format lead since 2017, will retire on July 31. He previously led country content and served as director of content in Grand Rapids. Prior to joining Townsquare, he spent over 20 years at iHeartMedia’s Country B93.7, where he was svp and format brand coordinator … and Empire Nashville svp of operations Heather Vassar parted with the company on May 2, six years after she joined the firm.

G Major Mgmt, known for a roster that includes ACM entertainer of the year winner Thomas Rhett, is bolstering its team. Led by founder/artist manager Virginia Bunetta, G Major Mgmt has added Emilie Gilbert as manager of insights & fan engagement strategy, and Madeline “Sledge” Lary as digital manager. Samantha Thornton has been promoted to senior director of marketing, while Harry Lyons has been promoted to senior director of business operations, leading G Major’s lineup of day-to-day managers, while leading touring and business expansion. Bunetta continues to guide the company, while also continuing management for Thomas Rhett. –Jessica Nicholson

Alternate Side has expanded its artist management team with key promotions and hires. Cory Hajde, a Clevelander who manages Hot Mulligan and Dayseeker, becomes the first partner outside the co-founders. He also leads BravoArtist and owns venues in Ohio. Mike Scrafford, based in Brooklyn, joins as a manager, bringing artists like Beach Bunny and Car Seat Headrest, and is known for his artist-first approach. L.A.-based Ally Ehasz, with the company since 2022, is promoted to manager, overseeing acts like Pastel Ghost. The company recently celebrated success with Sydney Rose’s viral hit “We Hug Now.” Co-founders Evange Livanos and Zack Zarrillo emphasized their commitment to intentional artist development. Founded in 2019, Alternate Side represents artists like Cavetown and Chloe Moriondo, continuing to grow with a DIY, artist-focused ethos.

Octavius “Doc Ock” Crouch launched Red Octave, an Atlanta-based R&D and label services company designed to streamline talent discovery and reduce risk for labels and investors. Leveraging proprietary software, automated outreach and deep data mapping, Red Octave delivers vetted, ownership-cleared artist opportunities. Operating like a real estate brokerage for music IP, it uses a commission-based model with no monthly overhead, in an appeal to catalog buyers and distributors. Beyond data, it offers full label services including marketing, tour support, and DSP distribution. Crouch aims to restore Atlanta’s music industry prominence by building infrastructure to match its creative talent. “We don’t just need reps—we need real estate from the majors,” he said. “It’s time to build the infrastructure to match the creativity. Red Octave is my blueprint to make that happen.”

Nice Life Recording Company promoted Becky Lopez to senior director of marketing and streaming strategy, recognizing her pivotal role in the label’s recent success. Becky joined Nice Life in 2021 and has led campaigns for artists like Lizzo, The Marías, and Tinashe — whose viral hit “Nasty” earned her first solo RIAA Gold certification. The Angeleno began her career at Power106 Los Angeles in 2014, rising from programming assistant to music director, where she supported artists like Cardi B and The Weeknd. She also contributed to programming at 93.5 KDAY and helped launch Cali 93.9. CEO Ricky Reed praised Lopez as a “driving force behind our growth for years. Her promotion… is a natural next step.”

PR firm Milestone Publicity rebranded as Milestone Collective, launching a new digital marketing division to accompany their existing publicity services. Leading the company’s new digital marketing efforts is Caylie Landerville, who previously was part of the team at Red Light Management/Silverback Music. Milestone was founded in 2019 by Mike Gowen and has worked with artists including Blues Traveler, Colt Ford, Bryan Martin, Jerry Douglas, Lonestar, Leftover Salmon, Michael Cleveland and more. –JN

Langham Hospitality Group appointed Andrew Grant as its first Group Director of Music, emphasizing the rising role of audio marketing in hospitality. With over 25 years of experience as a DJ, producer and event specialist, Grant will oversee the development of a global music strategy for Langham’s 40-plus hotels. His responsibilities include curating live performances, artist partnerships, and immersive soundscapes to elevate guest experiences and reinforce brand identity. Grant will also lead music programming and events, including special activations for Langham’s 160th anniversary, while continuing as director of music and radio at Eaton DC in the nation’s capital, where he’s based. Prior to joining Langham in 2019, Grant was a longtime talent buyer and producer for the Okeechobee Music and Arts Festival in Florida, and for years was a resident DJ at Ibiza’s DC10.

Industry veterans Alan Grunblatt and Dave Goldberg launched DNA MUSIC, a hip-hop entertainment company focused on signing talent, acquiring iconic catalogs, producing original TV content and distributing physical formats worldwide. Distributed by Hitmaker Distribution, DNA made a strong debut with Black Samson, the Bastard Swordsman by Mathematics and Wu-Tang Clan, which hit over 10 million streams in its first week. The label also found viral success with Eke’s “Ghetto” and is backing Memphis up/comer Flippa T.

ICYMI:

Jeremy Sirota

Merlin announced that Jeremy Sirota, the licensing organization’s CEO since 2020, is departing at year’s end … Candice Watkins is the new president of Capitol Records Nashville and executive vp of Capitol Christian Music Group … Verizon and Tyson Foods veteran Matt Ellis is the new chief financial officer of Universal Music Group. [Keep Reading]

Last Week’s Turntable: Country Hall Curator Retires After 51 Years

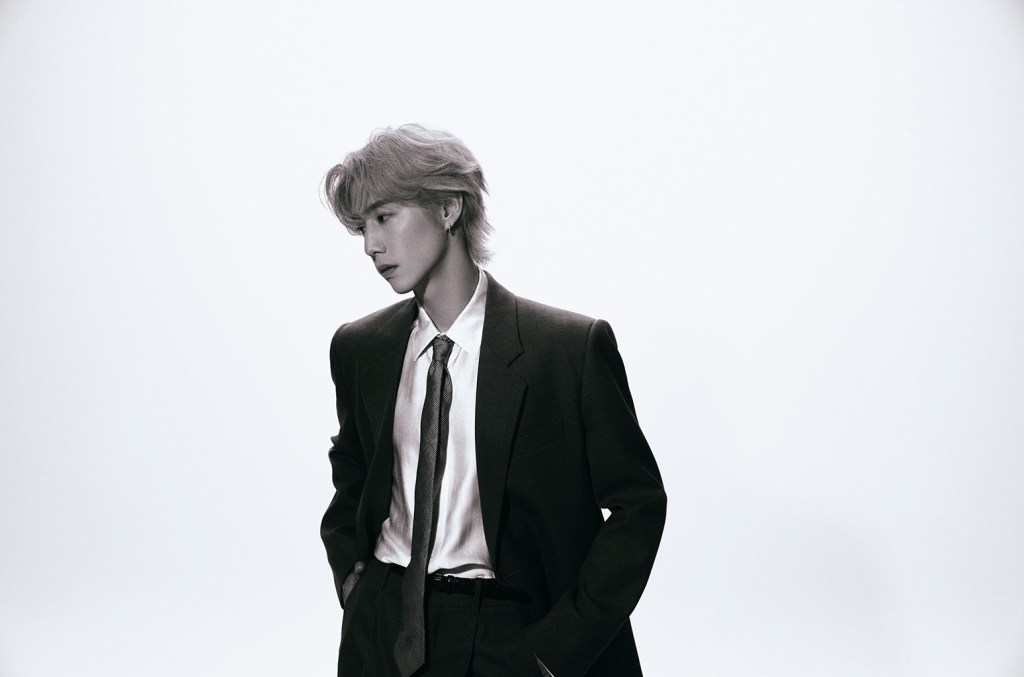

With a new single already announced for the end of the month, Mark Tuan embarks on a fresh chapter by signing a new management deal ahead of a new, “raw and intimate” era.

Billboard can exclusively reveal that the Los Angeles singer-songwriter-model is teaming up with with Transparent Arts for his music career and other projects. Mark will release his new single “High as You” on May 30, to start the joint venture with the Asian American entertainment powerhouse. According to a press release, the new, alt-rock track “captures the essence of an unforgettable love — the only high he ever knew. With seductive melodies and striking choreography, Mark is ready to showcase a raw and intimate side of himself like never before.”

After reuniting with his K-pop boy band GOT7 for a new EP earlier this year, “High as You” is Tuan’s first solo release of 2025 and previews more music on the way.

Trending on Billboard

“I’m thrilled to partner with Transparent Arts and to step into a new phase of my journey as an artist,” Mark says in a statement. “‘High As You’ is just the beginning, and I’m looking forward to sharing more of this side of me with my fans.”

James Roh, COO of Transparent Arts, adds, “We’re thrilled to welcome Mark to our roster. As a fellow LA native, we felt an instant connection with him. He brings a rare blend of professionalism, talent, and authentic kindness. Working with Mark has been creatively fulfilling, and we can’t wait for the world to hear what we’ve been working on.”

After GOT7 opted not to renew its contract with JYP Entertainment in 2021, Tuan returned to LA to launch his solo career via the independent label Dreamers N Achievers (DNA), which he acts as CEO. The 31-year-old has balanced his indie projects like 2022 full-length, The Other Side, and his Fallin’ EP, from 2023, with GOT7 activities and fashion collaborations including an ambassadorship with Saint Laurent and partnership with Calvin Klein.

Founded by Billboard Hot 100 chart-toppers Far East Movement, Transparent Arts is a 360-degree entertainment company dedicated to amplifying Asian culture and talent worldwide through management, production, branding, and live events. Tuan joins a roster that currently includes Korean indie breakthrough band The Rose, Filipino superstar singer-actor James Reid, LA-based DJ and producer Yultron and more. Through over 15 years in the business, TA collaborators include artists like Bruno Mars, Marshmello, and Awkwafina, with Universal Music, YouTube, McDonald’s, and SM Entertainment listed as brand partners.

Earlier this year, Mark teamed up with his GOT7 band mates to drop its first project in nearly three years, Winter Heptagon, through a new partnership with Kakao Entertainment. The EP peaked at No. 16 on Billboard’s World Albums chart, becoming the group’s 20th entry. Meanwhile, lead single “Python” climbed to No. 4 on the World Digital Song Sales chart — GOT7’s strongest showing since 2021. The group celebrated with concerts in Seoul’s SK Olympic Handball Gymnasium arena and Bangkok’s Rajamangala Stadium, reportedly selling out the 85,000 seats for the latter within a day.

Free music streaming service AccuRadio has filed for bankruptcy, citing $10 million in debts to SoundExchange and failed settlement talks in the organization’s lawsuit against the streamer over unpaid artist royalties.

AccuRadio, an ad-supported platform that describes itself as “the only online music streaming service curated by human beings, not algorithms,” sought bankruptcy protection in a Wednesday (May 14) petition to the federal court in its home city of Chicago.

The bankruptcy petition says AccuRadio owes $10 million to SoundExchange, the nonprofit that collects and distributes royalties to record labels and artists. SoundExchange sued AccuRadio last summer, alleging the streamer had an undisclosed amount of unpaid royalties dating back to 2018.

Trending on Billboard

AccuRadio contests those claims, saying it’s been a “consistently reliable SoundExchange licensee for the vast majority of the past two decades.” The company put out a press release Wednesday, blaming its bankruptcy on failed settlement talks in the litigation.

“We were led to believe that our latest proposal would be accepted by SoundExchange with only minor modifications,” wrote AccuRadio’s founder/CEO, Kurt Hanson. “However, eventually SoundExchange altered its position and rejected that proposal. We were extremely disappointed that we couldn’t reach a negotiated settlement.”AccuRadio’s bankruptcy petition says the company has less than $1 million in assets, while its liabilities total $10.5 million. In addition to the $10 million SoundExchange debt, AccuRadio says it owes more than $400,000 to royalty collectors BMI and ASCAP.

The streaming service has filed for Chapter 11 bankruptcy. This means that rather than fold completely, AccuRadio hopes to restructure, pay off its debts and continue operations in the future.

“Filing for bankruptcy protection wasn’t an easy decision, especially since our revenues have been consistently improving and we have returned to profitability,” says Hanson in the AccuRadio press release. “But we are confident that AccuRadio will emerge from it healthier and more resilient and will continue to be an outlet for human-curated music that our listeners desire and cherish.”

AccuRadio has been around since 2000. According to the company, it offers more than 1,400 ad-supported, curated music channels free of charge.

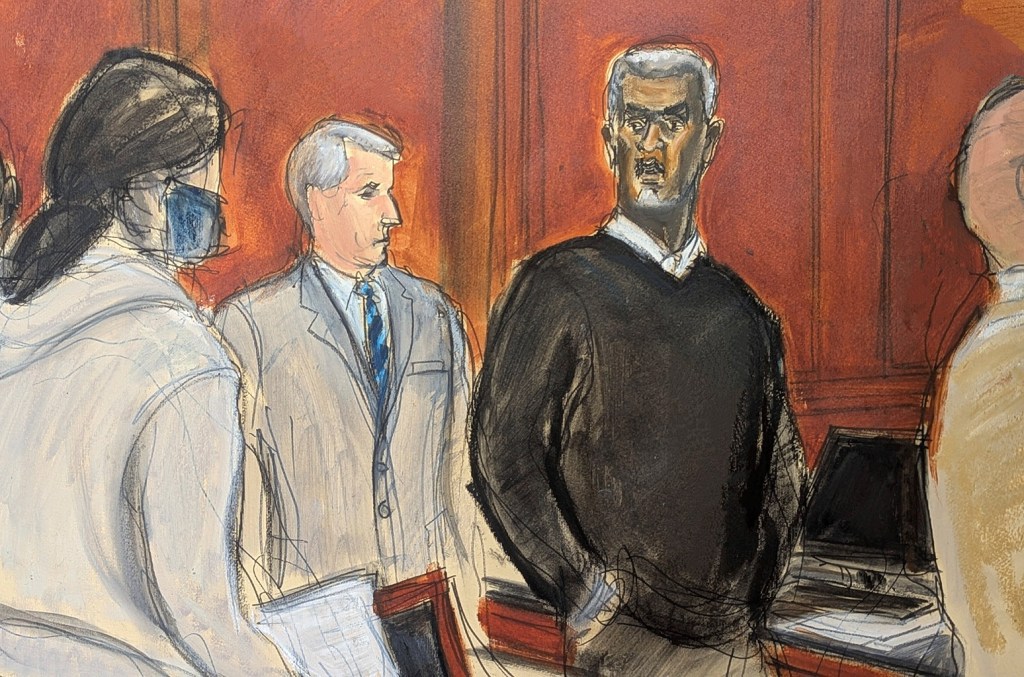

Sean “Diddy” Combs‘ ex-girlfriend Cassie Ventura faced cross-examination Thursday (May 15) from defense attorneys, who showed jurors huge numbers of her emails and text messages in an effort to prove she was a willing participant in so-called “freak-off” sex shows.

Ventura, an R&B singer who dated Combs for 11 years, is at the very core of the case against him, in which prosecutors say Combs physically abused her and coerced her to partake in the freak-offs — drug-fueled sex with male escorts for his entertainment.

After two days of direct testimony in which Ventura told jurors that she felt she had no choice but to take part, she took the stand Thursday to face questions from Combs’ lawyer Anna Estevao, according to the Associated Press and the New York Times.

Trending on Billboard

Much of the day was spent asking Ventura about emails and texts to and from Combs — some romantic, others sexually graphic. In one, she told Combs she was “always ready to freak off”; in another, she told him, “Wish we could have fo’d before you left.”

“Yes, at the time, I wanted to make him happy,” Ventura said at one point.

Combs was indicted in September, charged with running a sprawling criminal operation aimed at facilitating the freak-offs — elaborate events in which Combs and others allegedly coerced Ventura and other victims into having sex with escorts while he watched and masturbated. Prosecutors also say the star and his associates used violence, money and blackmail to keep victims silent and under his control.

It was Ventura’s civil lawsuit, filed in November 2023, that first raised allegations against Combs. Her case, which accused the star of rape and years of physical abuse, was quickly settled with a large payment from Combs, but it sparked a flood of additional suits from other alleged victims and set into motion the criminal probe that led to his indictment.

At opening statements on Monday (May 12), defense attorneys told jurors that Ventura and other women had consensually taken part in the sex parties. They admitted that Combs had committed domestic violence during their “toxic” relationship and had unusual sexual preferences, but that he had never coerced her into participating in his “swinger” lifestyle.

In questioning Cassie on Thursday, Estevao seemed intent on establishing that both she and Diddy had planned the elaborate events: “I’m too excited,” Ventura told Combs in one message from 2017, near the end of their long relationship.

When asked about those texts, Cassie seemed to push back on that suggestion, saying the things she said in the texts were “just words at that point.” That echoes her testimony from earlier in the week, in which she said the freak-offs left her feeling “humiliated” and “disgusting” but that she felt compelled to keep doing them.

The questions also focused on the complexity of Ventura’s relationship with Combs, including messages that seemed to show a loving relationship between the pair. In one, from 2010, she wrote: “Going to sleep now so it can be tomorrow faster and you can be home. Love you!!!”

Ventura confirmed as much in her answers: “I had fallen in love with him and cared about him very much.” She also admitted that she sometimes felt jealousy toward Combs over his numerous other romantic partners — another key message that the defense is seeking to relay to jurors about the couple’s relationship.

Ventura is expected to complete her testimony on Friday (May 16). After that, prosecutors will continue to call other witnesses, including a second alleged freak-off victim identified by the pseudonym “Jane” and an alleged employee victim identified by the pseudonym “Mia.” According to NBC News, prosecutor Maurene Comey said that Dawn Richard, formerly a member of the Combs-formed girl group Danity Kane who sued him for abuse in September, was expected to testify next. Defense attorneys will then have a chance to call their own witnesses. A verdict is expected by July 4.

State Champ Radio

State Champ Radio