Business

Page: 59

GTS (Global Talent Services), Universal Music’s Latin talent management and services company, has fully acquired respected music management company RLM (Rosa Lagarrigue Management).

As a result of the acquisition, RLM founder, veteran artist manager and promoter Rosa Lagarrigue, will join GTS as executive vice president global, reporting to Narcís Rebollo, president and CEO of GTS. Likewise, RLM’s team will also be integrated into the company.

Founded in 1980 by Lagarrigue as one of the first management companies owned by a woman, RLM has had a role in developing the careers of artists like Miguel Bosé, Alejandro Sanz and Mecano, among other Spanish icons. The company’s current roster includes Raphael and Rozalén among many others.

Trending on Billboard

Joining GTS is meant to maximize and improve the services provided to RLM’s artists in addition to bringing Lagarrigue and her team’s expertise to GTS.

Founded in 2011, GTS has grown to have presence in Spain, Portugal, the U.S., Mexico, Colombia, Argentina, Chile and Brazil and its roster includes Aitana, David Bisbal, Ela Tauber, Lola Indigo, Pablo Alborán and Vivir Quintana among many others.

“With her extensive experience, knowledge, and track record, Rosa is a key and respected figure in the management world, and this addition to our organization is a further investment in our position as a leading Talent Management and Services Company in Latin Music today,” said Rebollo in a statement. “I am convinced that the integration of our teams will provide each of our artists the best service and strategic support to achieve their goals across all markets.”

Added Lagarrigue: “I have always believed that every artist needs unique and personalized support; one that combines listening, intuition, strategy, and honest work. I’m excited to share this project with Narcís, undoubtedly one of the most brilliant executives in the industry, and with his team. What we started at RLM not only continues, but it is amplified and strengthened alongside them.”

LONDON — Events firm Brockwell Live have confirmed that a series of festivals set to take place in south London’s Brockwell Park will go ahead as planned.

On Friday (May 16), a high court in the capital ruled against Lambeth Council’s decision to approve events including Field Day and Mighty Hoopla over planning permission concerns.

The legal case originated with local residents group Protect Brockwell Park, which challenged regulations stipulating that festivals can only use public parks for 28 days annually without additional planning permission. Campaign leader Rebekah Shaman argued that the planned Brockwell Live events would occupy the park for 37 days in 2025.

Protect Brockwell Park raised over £40,000 ($53,589) last month for a judicial review of the approvals they called “unlawful.” They contended that yearly festivals keep the park closed for too long. They also called for “full public consultations, evidence-based impact assessments and proper evaluation of the long-term impact on the park.” The campaign was also backed by Oscar-winning actor Sir Mark Rylance.On Monday (May 19), however, Brockwell Live announced that the festivals will take place, insisting that the aforementioned ruling only dealt with “a particular point of law and whether an administrative process had been carried out correctly.”

Trending on Billboard

Wide Awake, the first event in the Brixton park this year, is scheduled for Friday (May 23). In a statement posted to Instagram, Brockwell Live said: “We wish to make it clear that no event will be cancelled as a result of the High Court’s decision.

“We take our stewardship of Brockwell Park seriously. As we prepare to deliver these much-loved, culturally significant events, we remain fully committed to its care, upkeep, and long-term wellbeing. With setup nearly complete, we look forward to opening the gates and welcoming festival goers later this week.”

In a further update this morning, Lambeth Council explained that an application for a new certificate of lawfulness had been submitted following the High Court ruling. A spokesperson said: “Summer Events Limited has applied to Lambeth Council for a new certificate of lawfulness, for 24 days, following the High Court ruling last week on the previous certificate. The council is urgently considering that application. That consideration does not stop the events proceeding.” Summer Events Limited manage the Lambeth County show, using infrastructure from Brockwell Live.

Irish hip-hop trio Kneecap will headline Wide Awake, before the program of events continues with electronic festival Field Day on May 24. Cross The Tracks, City Splash and Brockwell Bounce take place on May 25, 26 and 28 respectively.

Mighty Hoopla will take place over the weekend of May 31 and June 1, with Ciara, Kesha and JADE booked to perform. The Lambeth Country Show will round out the programme, with the festival taking place from June 7 until June 8.

Aubrey O’Day has confirmed she will not be taking the stand in Sean “Diddy” Combs‘ federal sex-trafficking trial.

The former Danity Kane member made the announcement on Friday (May 16) during the premiere episode of Amy Robach & T.J. Holmes Present: Aubrey O’Day, Covering the Diddy Trial, an iHeartRadio podcast recorded in New York City.

“I’m not here to testify for the Diddy trial, that I know of,” O’Day said, according to People.

The 41-year-old singer suggested her involvement could still evolve, revealing she had been “contacted by Homeland Security” and had a meeting with the agency, which led March raids on Diddy’s homes in Los Angeles and Miami.

Earlier in the week, O’Day — who appeared on MTV’s Making the Band under Diddy’s mentorship — sparked speculation about a possible court appearance after sharing a cryptic Instagram post from New York City.

“Hey New York!!! Where y’all think I should head first?” she wrote on May 14, including a scale emoji. Us Weekly also reported that a source claimed O’Day was subpoenaed to testify at the trial.

During the podcast episode, O’Day clarified the post’s intent. “I posted on my Instagram that I was here in New York and enjoying myself because I wanted to make it clear to everyone that I am not here testifying,” she said.

Diddy is currently facing multiple federal charges, including sex trafficking and racketeering. His trial is set to resume Monday (May 19). If convicted on all counts, he could face life in prison.

O’Day previously spoke out after Diddy’s September 2024 arrest. “The purpose of Justice is to provide an ending and allow us the space to create a new chapter. Women never get this. I feel validated. Today is a win for women all over the world, not just me. Things are finally changing,” she wrote on X at the time.

Danity Kane, the girl group formed in 2005 on Making the Band, was signed to Diddy’s Bad Boy Records. O’Day was removed from the group in 2008 and later claimed on the Call Her Daddy podcast in 2022 that her exit stemmed from her refusal to comply with non-music-related requests from the music mogul.

Cassie’s husband, Alex Fine, has spoken out in defense of his wife’s harrowing testimony recounting her alleged abuse at the hands of Diddy during the Bad Boy mogul’s trial.

Explore

See latest videos, charts and news

See latest videos, charts and news

Fine released a statement on Friday (May 16) as Cassie’s four-day stint on the stand came to a close via his wife’s attorney, Doug Wigdor.

“I have felt tremendous pride and overwhelming love for Cass,” he said. “I have felt profound anger that she has been subjected to sitting in front of a person who tried to break her. You did not break her spirit nor her smile.”

Fine continued: “I did not save Cassie, as some have said. To say that is an insult to the years of painful work my wife has done to save herself. Cassie saved Cassie. She alone broke free from abuse, coercion, violence, and threats. She did the work of fighting the demons that only a demon himself could have done to her.”

Alex Fine was present in court for all four days his wife was on the stand this week, as day five of the trial wrapped up on Friday.

“All I have done is love her as she has loved me. Her life is now surrounded by love, laughter and our family,” he added. “This horrific chapter is forever put behind us, and we will not be making additional statements. We appreciate all of the love and support we have received, and we ask that you respect our privacy as we welcome our son into a world that is now safer because of his mom.”

The first week of Diddy’s trial finished on Friday as Cassie was cross-examined by Combs’ attorneys and grilled about various horrifying events and alleged abuse she recalled throughout her four-day testimony.

Looking to put this chapter of her life behind her once and for all, Cassie also released a statement via her attorney about the “challenging” yet “empowering and healing” week she experienced on the stand while digging up painful memories.

“This week has been extremely challenging, but also remarkably empowering and healing for me. I hope that my testimony has given strength and a voice to other survivors, and can help others who have suffered to speak up and also heal from abuse and fear,” she said via Wigdor. “For me, the more I heal, the more I can remember. And the more I can remember, the more I will never forget.”

Cassie continued: “I want to thank my family and my advocates for their unwavering support, and am grateful for all the kindness and encouragement that I have received. I am glad to put this chapter of my life to rest as I turn to focus on the conclusion of my pregnancy, I ask for privacy for me and for my growing family.”

The “Me & U” singer’s testimony ended with Cassie sobbing as she thought about how life would be if she never participated in the alleged days-long “freak-offs” allegedly orchestrated by Diddy.

Cassie and Diddy started dating on and off in 2007 and broke up for good in 2018, bringing the tumultuous relationship to a close. Cassie married Alex Fine in 2019, and the couple is expecting their third child together in the coming weeks.

Diddy is facing charges of sex trafficking and racketeering. Combs’ trial will resume in court on Monday (May 19). If found guilty on all counts, he potentially faces life in prison.

Sean “Diddy” Combs’ ex-girlfriend, Cassie Ventura, faced probing questions about her financial motivations on her last day of testimony in the rapper’s sex-trafficking trial on Friday (May 16), while Danity Kane alum Dawn Richard also took the stand and said she witnessed Combs abusing Ventura.

Richard’s testimony closed out the first week of Combs’ much-awaited criminal trial, in which the music mogul is accused of coercing Ventura and other women into participating in drug-fueled sex shows known as “freak-offs.” R&B singer Ventura, the prosecution’s star witness, spent four days on the stand detailing how Combs allegedly controlled and physically abused her during their 11-year relationship.

Ventura faced her second and final day of cross-examination on Friday from Combs’ attorney Anna Estevao, according to the Associated Press and the New York Times. Defense lawyers had previously suggested they may want to keep questioning Ventura next week, but backed off the request after prosecutors flagged concerns that the very pregnant Ventura might go into labor over the weekend.

Trending on Billboard

Continuing a strategy from the first day of cross-examination, Estevao confronted Ventura with more seemingly loving text messages between her and Combs. Some appeared to support the defense’s theory that the pair’s sex life, while unconventional, was consensual.

“I don’t want to freak off for the last time,” Ventura wrote in one such text to Combs. “I want it to be the first time for the rest of our lives.”

Estevao also tried to imply that Ventura is motivated by money to lie about her experience with Combs, getting the witness to reveal for the first time that she’s getting a $10 million settlement from the Intercontinental Hotel in Los Angeles, where Combs was seen beating Ventura in infamous video footage from 2016.

The newly-revealed $10 million settlement is on top of a $20 million civil payout Ventura got from Combs himself after she sued the rapper in 2023. Estevao noted Friday that Ventura canceled an upcoming concert tour soon after inking that settlement.

“As soon as you saw that you were going to get the $20 million, you canceled the tour because you didn’t need it anymore, right?” Estevao asked Ventura.

“That wasn’t the reason why,” Ventura replied.

When prosecutors got another chance to question Ventura on re-direct examination later on Friday, she explained that she would give the money back if she could reverse Combs’ abuse. “If I never had to have freak-offs I would have agency and autonomy,” Ventura said.

After Ventura completed her testimony, her attorney, Douglas Wigdor, shared a statement from the singer: “This week has been extremely challenging, but also remarkably empowering and healing for me,” Ventura wrote. “I hope that my testimony has given strength and a voice to other survivors, and can help others who have suffered to speak up and also heal from abuse and fear. For me, the more I heal, the more I can remember, and the more I can remember, the more I will never forget.”

Another figure in the music world took the witness stand after Ventura departed Friday: Dawn Richard, whose girl group Danity Kane was launched by Combs’ MTV reality show Making the Band.

Richard has a pending civil lawsuit against Combs, in which she alleges he harassed and assaulted her during “years of inhumane working conditions.” But those claims aren’t part of the criminal trial; instead, Richard served as a corroborating witness for Ventura.

During her brief testimony, Richard told the jury she witnessed Combs physically assault Ventura on multiple occasions. In one 2009 encounter, Richard said she saw Combs punch, kick, drag and even try to hit Ventura on the head with a cooking skillet.

The trial is expected to pick up Monday (May 19) with testimony from Ventura’s longtime friend Kerry Morgan, followed by other alleged victims of Combs’ freak-offs. The jury could hear evidence for up to two months total.

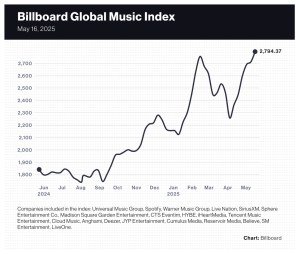

Music stocks — and stocks in general — had a terrific week as Sphere Entertainment Co., Tencent Music Entertainment and Cloud Music posted double-digit gains and the 20-company Billboard Global Music Index (BGMI) set a new high mark.

The BGMI rose 3.1% to an all-time high of 2,794.37, bringing its year-to-date gain to 31.5%. The index has overcome two downturns — one caused by an escalation of trade tensions, the other prompted by President Trump’s announcement of his tariff policy — to surpass the previous record of 2,755.53 set on Feb. 14.

Sphere Entertainment Co. gained 19.3% to $38.78. The company’s quarterly earnings, released on Monday (May 12), showed the Sphere venue was able to cut costs to offset a decline in event-related revenue. Investors cheered the result: flat operating income rather than a loss. As for tourism to Las Vegas, CEO James Dolan brushed aside concerns and said demand for Sphere concerts is strong enough to withstand a downturn should one arise.

Trending on Billboard

China’s Tencent Music Entertainment (TME) jumped 18.0% to $18.62 after the company reported on Tuesday (May 13) a 17% increase in music subscription revenue in the first quarter. Following earnings, CFRA upped its price target to $18 from $17 but downgraded its rating to “hold” from “buy.” TME, which operates Kugou Music, QQ Music and Kuwo Music, finished the quarter with 122.9 million subscribers, up 8.3% from the prior-year period.

Another Chinese music streamer, Netease Cloud Music, rose 12.6% to 203.40 HKD ($26.03) after the company’s financial results, released on Thursday (May 15), showed an 8.4% drop in revenue that the company attributed to a decline in its social entertainment business. The scant Q1 numbers didn’t provide details on the online music side of the business, but the two sides of the business are going in opposite directions. In 2024, social entertainment revenue fell 26% while online music revenue grew 23%.

Not only were TME and Cloud Music among the top performers of the week, they are among the biggest gainers in 2025. Year to date, TME shares are up 49.1% while Cloud Music has gained 81.3%. SM Entertainment’s 64.9% gain is the second-best amongst music stocks.

Live Nation improved 8.2% to $147.68 this week despite news that the company and AEG Presents are facing a criminal antitrust probe by the U.S. Department of Justice over pandemic-era refund policies. Live Nation shares are still well below the all-time high of $157.75 reached on Feb. 21, but they’ve gained 14.0% year to date and are up 52.9% over the last 52 weeks.

Spotify, the index’s most valuable component, rose 1.2% to $656.30. Guggenheim raised its price target to $725 from $675 on the heels of a judge’s favorable ruling in Epic Games v. Apple. Guggenheim sees the ruling, which allows Spotify to display pricing options within the iOS app, as helpful to audiobook monetization.

German concert promoter CTS Eventim gained 3.2% to 111.90 euros ($124.90). Barclays started covering the company with a 130 euro ($145.12) price target and an “overweight” rating.

Elsewhere in the index, Universal Music Group and Warner Music Group gained 0.9% and 1.2%, respectively, and HYBE improved 1.9%. SiriusXM jumped 5.4%.

Only four of the BGMI’s 20 stocks lost value this week. SM Entertainment was the week’s biggest loser with a 5.2% drop. Believe fell 1.3%, Deezer dipped 1.5% and iHeartMedia dropped 1.6.%.

Stocks were up globally but performed especially well in the U.S. The Nasdaq composite rose 7.2% and the S&P 500 improved 5.3%. In the U.K., the FTSE 100 was up 1.5%. South Korea’s KOSPI composite index gained 1.9%. China’s SSE Composite Index rose 0.8%.

Investors were encouraged by a reduction of U.S. tariffs on Chinese goods while the two countries continue to negotiate a trade deal. Goldman Sachs lifted its estimate for the S&P 500 on Tuesday as tensions over tariffs eased between the U.S. and China.

There is still uncertainty about the U.S. economy, however. Since last week, numerous reports have warned of a sharp slowdown at the Port of Los Angeles, the nation’s busiest port. This week, Walmart CFO John David Rainey said high tariffs could cause the company to raise prices by the end of the month. And on Friday (May 16), the University of Michigan’s closely watched index of consumer sentiment fell to its second-lowest level on record.

Billboard

Billboard

Billboard

In just a few years, Toronto-born rapper and actor Connor Price has built a global audience and over 2 billion streams entirely on his own terms.

“Staying independent means ownership, creative control and being able to do things my own way,” says Price. “I can put out music when I want. I can say what I want. I can work with who I want. I can market it how I want. I don’t have to wait for a label.”

That mindset has already helped him carve out a career many would envy. Using social media, online savvy, and some help from his family and friends, Price has found a way to reach a wide fan base all over the world. It’s a 21st-century DIY rise. Build the fanbase first, then go out on the road. Release 110 songs, then record your debut album.

Connor Price stars on Billboard Canada’s new Indie Issue digital cover — a look at artists making it work without a label. In the story, he talks about going from a career as an actor into music and content creation, and the viral Spin The Globe project that has resulted in millions of streams not just for him but for independent artists all over the world.

“Being on the independent side and working so closely with my wife [Breanna, his manager], I have to know how the business side works,” he says. “Some artists might be in a label situation with a big team where all they have to do is focus on the music, which is great, all the power to them. But I actually have a lot of pride and enjoyment in both the business side and the creative side.”

Trending on Billboard

It’s every starry-eyed artist’s dream to sign a record deal — or so the conventional wisdom goes.

The recorded music industry has been built on the label model from its earliest days, with record companies providing funding to artists in exchange for rights to the music.

As recording has become cheaper and more accessible, though, the whole paradigm is shifting. Now, many artists are choosing to remain independent — or, in the case of major Canadian breakouts like The Beaches and Nemahsis, seeing success as independent artists after leaving a label roster.

That dynamic has been changing for decades, with strong independent streaks in DIY-minded genres like punk and hip-hop, but the internet has upended the industry to such an extent that artists across all genres are weighing the benefits of independence.

When you don’t have a label fronting funds or tapping into established release strategies and promotional networks, you need to make sure you’ve got a strong community around.

Ontario indie artist Ruby Waters knows that firsthand. She’s become a major breakout Canadian indie rock act in the last five years, with two Juno nominations, international tours and millions of streams under her belt.

“The main force to my independence as an artist really comes down to the love and support I’ve had from my day one homies and fans throughout my whole musical journey starting from back when I was singing on the street,” she says in another Billboard Canada Indie Issue feature.

Read the whole feature, which looks at the tools artists have without label support, here.

Billboard Summit Brings Global Talent to Toronto This Summer

A major global initiative is coming to Canada.

The inaugural Billboard Summit will bring some of the world’s biggest artists to Toronto’s NXNE Festival for a series of dynamic, artist-led conversations in June.

The full-day event will go beyond industry panel conversations to centre musicians talking about what they’re most passionate about: their processes, collaborations and breakthroughs.

Charlotte Cardin is the first artist announced to join the summit. The Montreal-based singer and songwriter has had an international breakout over the last few years, charting on multiple Billboard charts and touring throughout Canada, Europe and the Middle East.

Her global rise led from Billboard Canada Women in Music, where she was named Woman of the Year in 2024, to the global Billboard Women in Music stage in Los Angeles this past March, where she represented Canada as Global Woman of the Year.

Cardin will speak on the topic of Breaking Through Barriers by sharing experiences and moments that have defined her career and offering inspiration to anyone striving to push boundaries.

Other soon-to-be-announced names will include artists from around the world — from trailblazing Canadians who’ve built influential brands that have resonated across borders to international artists who’ve set chart and live music records throughout the globe.

Stay tuned for the full programming announcement, featuring an exciting lineup of diverse voices and thought-provoking speakers.

More info here.

PUP Chart on Billboard Canadian Albums for the Fourth Straight Time with ‘Who Will Look After The Dogs?’

Punk is back on the charts this week.

Toronto band PUP have debuted their newest album Who Will Look After The Dogs? on the Billboard Canadian Albums chart this week, dated May 17. The album enters at No. 72 and marks the band’s fourth consecutive album on the chart since its sophomore effort, The Dream Is Over, first landed at No. 48 in 2016.

The album is fun and self-deprecating in ways we’ve come to expect from PUP, but also reflects the band’s major life changes: members got married or had kids, one expanded his home studio, and singer Stefan Babcock ended a decade-long relationship.

Although they have previously reached higher peaks on the chart, the band has some serious momentum. Following a stint playing arenas opening for Sum 41 on the band’s farewell tour, they’re now currently on tour in Europe and will also celebrate the record with a citywide summer tour in Toronto. The Mega-City Madness Tour is set to kick off in July, with dates at six venues in PUP’s hometown.

Elsewhere on the chart, legendary British rock band Pink Floyd earns this week’s top debut on the chart with Pink Floyd At Pompeii: MCMLXXII, which lands at No. 45. It is the first-ever soundtrack album for the band’s 1972 concert film Pink Floyd: Live at Pompeii, which was recently remastered in 4K and re-released in theatres. It is the only other debut on the May 17 chart.

Check out the whole Canadian Albums chart breakdown here. – Stefano Rebuli

The U.S. Department of Justice is conducting a criminal investigation into whether Live Nation and AEG illegally colluded in their concert refund policies at the beginning of the COVID-19 pandemic, Live Nation confirmed, though the concert giant is denying any wrongdoing.

Bloomberg first reported Thursday (May 15) that the Department of Justice (DOJ) is investigating whether Live Nation and AEG violated federal antitrust laws by coordinating their responses to mass concert cancellations via a task force when the pandemic first hit in 2020.

Prosecutors have weighed bringing charges against Live Nation and its CEO, Michael Rapino, according to Bloomberg. No such charges have yet been filed; the statute of limitations for federal antitrust prosecutions is five years, meaning that if a case is going to be brought, it will have to be soon.

Trending on Billboard

Live Nation’s regulatory chief, Dan Wall, confirmed the criminal probe in a statement to Billboard but says the company did nothing wrong.

“It is not illegal for artist agents, promoters and ticketing companies to work together to solve the unprecedented challenges of a global pandemic,” Wall says. “While Live Nation contributed to this industry effort in good faith, we set our own unique policies and refund terms to support fans and artists. We did not collude with AEG or anyone else. We are proud of our leadership during those trying times, and if any charges result from this investigation, we will defend them vigorously.”

A DOJ spokesperson declined to comment on the matter Friday (May 16). Reps for AEG did not immediately return a request for comment.

The criminal investigation comes on top of the DOJ’s civil antitrust action accusing Live Nation and its subsidiary Ticketmaster of illegally monopolizing the live music industry. The lawsuit, filed last May, seeks to break up the two live entertainment behemoths that merged in 2010.

Live Nation and Ticketmaster insist that they are in compliance with antitrust regulations and have said they plan to “vigorously defend” against the lawsuit at trial, currently scheduled for March 2026.

The Live Nation-Ticketmaster suit was brought by then-President Joe Biden’s DOJ, and Bloomberg reports that the criminal investigation into Live Nation and AEG also began when Biden was president. But both enforcement actions have continued under President Donald Trump, who has made a priority of cracking down on issues within the live entertainment business

Trump signed an executive order in March — with musician and political supporter Kid Rock in attendance — calling for greater transparency around ticket sales and directing regulators to look into possible instances of deceptive and anticompetitive conduct in the industry.

The DOJ and Federal Trade Commission (FTC) responded by launching an official inquiry into the event ticketing business on May 7. The agencies said the probe is aimed at increasing competition in order to lower ticket prices, as well as rooting out exploitative scalpers and bots.

Companies frequently urge investors not to read too much into any one quarter’s results. After all, even large, diversified businesses don’t always take a neat, linear path to consistent annual gains, and any single reporting period can contain oddities that skew the results favorably or unfavorably. But most public companies report results every quarter and, for better or worse, we onlookers read as much into the results as possible.

With that caveat in mind, here are some takeaways from the earnings releases through Thursday (May 15). Note that while most music companies, including the largest ones, have already issued earnings, there are a couple more to come: CTS Eventim will release some first-quarter figures on May 22 and Reservoir Media reports on May 28.

1. Some Margins Improved from Cost Savings

Music companies — like employers across the spectrum — have thinned their headcounts to retool, refocus and ultimately cut down on expenses. Q1 results showed some notable improvements in companies’ bottom lines.

Trending on Billboard

Spotify started seeing bottom-line growth in 2024 after cutting about a quarter of its headcount in 2023. The Stockholm-based music and podcast giant’s operating margin rose to 12.1% from 4.6% in the first quarter of 2024 — an improvement of 341 million euros ($380 million) — while gross margin (gross profit as a percentage of revenue) rose to 31.6% from 27.6%. Gross margin is a good proxy for what Spotify keeps after paying for content costs (it also includes some smaller expenses such as credit card transaction fees and hosting costs). After keeping prices flat for more than a decade, gross profit improved after Spotify began raising prices in 2023.

Operating profit, not gross profit, shows the impact of layoffs (salary expenses are deducted from gross profit to calculate operating profit). Spotify’s operating profit, as a percentage of revenue, improved to 12.1% from 4.6% in the first quarter of 2024. That’s a huge improvement in 12 months, but it’s more remarkable considering the company’s operating profit percentage was negative 5.1% in the first quarter of 2023. CEO Daniel Ek’s controversial decision to make Spotify “relentlessly resourceful” by eliminating thousands of jobs has paid dividends for the company.

Lower expenses also helped the Sphere venue in Las Vegas show improvement in operating margin. Sphere’s sales, general and administrative expenses fell 12% as the company identified costs to reduce, including corporate support functions, Sphere Entertainment Co. CFO Robert Langer said during the May 8 earnings call. That helped offset a 12.8% decline in revenue due to fewer events being hosted by the one-of-a-kind venue. The opposing growth rates cancelled each other out, and Sphere’s operating income was flat in the quarter. Investors apparently liked Sphere’s ability to reduce costs: The share price of its parent company, Sphere Entertainment Co., surged 6% the day of the earnings release.

Over at Universal Music Group (UMG), which embarked on a cost savings plan in early 2024, the company’s adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin was flat at 22.8%. Though the company’s global head count rose slightly to 10,346 on Dec. 31, 2024, from 10,290 on Dec. 31, 2023, according to its annual reports, the amount spent on salaries and benefits fell 14% to 1.79 billion euros ($1.94 billion) in 2024.

As for the other two majors, Sony’s operating margin improved to 18.0% from 16.9%, while the operating income before depreciation and amortization (OIBDA) margin at Warner Music Group (WMG) fell to 20.4% from 20.9%, due primarily to a change in revenue mix (meaning there was a higher proportion of low-margin physical sales compared to the prior-year period), though it was partially offset by savings from restructuring. WMG’s operating margin jumped to 11.3% from 8.0% due in part to a decrease in restructuring charges incurred in the prior year.

2. Subscriptions Lead the Way

Two companies had impressive subscriber gains in the quarter.

Spotify’s Premium revenue was up 16% year-over-year, and average revenue per user (ARPU) was up 4%. Subscription revenue was 90% of Spotify’s total revenue, the highest mark since Q3 2020 when advertising dried up — and subscription revenue exploded — at the onset of the pandemic. In fact, subscriptions have been Spotify’s workhorse in recent years, with subscription revenue growing 39.0% over the past two years compared to 27.4% for advertising revenue. After two rounds of price increases in the U.S. and U.K., plus hikes in many other countries, ARPU grew 9.5% in that two-year span.

Meanwhile, at Tencent Music Entertainment (TME), subscription revenue was up 16.6% and ARPU was up 7.5%. TME did not provide an updated subscriber count for its Super VIP tier — it’s still listed at 10 million-plus — but the company did disclose that high-quality audio and other perks are driving Super VIP conversions. Given that Super VIP costs five times the normal subscription price, it makes sense that it was the primary driver of the 7.5% jump in ARPU.

This is a case of the spoils going to the two largest music subscription services by subscriber count. MIDiA Research’s music subscription market shares for Q4 2024 put Spotify at No. 1 with 32% and TME at No. 2 with 15%. Spotify finished Q1 with 268 million paying customers (plus another 423 million ad-free listeners), while TME had 122.9 million.

Some other subscription services have been performing well, too, although only one other publicly traded music streaming company has released detailed financial statements for Q1. A revealing comment came from UMG, which saw double-digit revenue growth from four of its top 10 streaming partners and high single-digit growth at a fifth, the company said during its April 29 earnings call. Billboard believes two of the top four partners were likely Spotify and TME. The other double-digit growth services are anyone’s guess, but it probably wasn’t Deezer — the company’s total revenue rose just 1% in Q1 as its subscriber count fell 5.4%.

3. Advertising revenue was unsurprisingly mediocre but not terrible.

With the subscription business booming, there’s less pressure on the advertising side of music streaming to deliver value for platforms and rights owners. Good thing, too, because advertising hasn’t delivered much growth lately. In the U.S., advertising-based streaming royalties’ share of total recorded music revenues fell to 10.4% in 2024 from 10.9% in 2023 and 11.4% in both 2021 and 2022.

The numbers looked better in Q1 for Spotify, whose ad revenue rose 8% year-over-year (5% at constant currency). But because Spotify’s subscription business is faring better, advertising’s share of Spotify’s total revenue fell to 10.0% from 10.7% in the prior-year period. In fact, 10.0% was the lowest share for Spotify’s advertising since the early pandemic — 8.0%, 6.9%, and 9.4% in Q1, Q2, and Q3 of 2020, respectively.

Advertising is the lifeblood of the radio business. That explains why radio companies’ stock prices have fallen sharply over the last two years. iHeartMedia revenue rose 1% on the strength of a 16% gain in digital revenue, although the multi-sector segment that houses its broadcast radio business was down 4%. U.S. tariff policy has injected uncertainty into media companies’ outlooks, but iHeartMedia CEO Bob Pittman said on Monday (May 12) that iHeartMedia was seeing “generally stable ad spend.”

The same story played out at other radio companies: Total revenue change wasn’t bad because digital gains helped compensate for losses in broadcast ad revenue. Cumulus Media’s revenue fell 6.4% as broadcast dropped nearly 11% and digital gained 6.1%. Townsquare Media’s revenue fell 1% as gains in digital advertising (up 7.6%) and subscriptions (up 4.2%) almost offset a 9.1% decline in broadcast advertising.

Sugar Hill Records co-founder and longtime owner Barry Poss died Tuesday, May 13 at age 79 following a battle against cancer.

Poss was born in Brantford, Ontario, Canada on Sept. 7, 1945. After graduating from Toronto’s York University, he began studying sociology at North Carolina’s Duke University in 1968, as a James B. Duke Graduate Fellow. While still a graduate student at Duke, he attended the Union Grove Fiddler’s Gathering. He also learned traditional, old-time sounds from musicians including Fred Cockerham, Tommy Jarrell and Tommy Thompson.

Poss began working for David Freeman at Rebel Records and County Records, learning about the record business and later launched Sugar Hill Records with Freeman in 1978. That same year, Sugar Hill released its initial project, One Way Track, from the group Boone Creek, which featured Terry Baucom, Steve Bryant, Jerry Douglas, Wes Golding and Ricky Skaggs. Two years later, Poss took over control of the company and relocated it to Durham, North Carolina.

Sugar Hill Records became a home and championing label to scores of bluegrass, Americana and roots artists — including Jerry Douglas, Ricky Skaggs, Nickel Creek, The Seldom Scene, Tim O’Brien, Sam Bush, Sarah Jarosz, Doyle Lawson & Quicksilver, The Infamous Stringdusters, Robert Earl Keen, Hot Rize, Lonesome River Band, Bryan Sutton, Guy Clark, The Del McCoury Band, Ronnie Bowman, Guy Clark, Rodney Crowell, Robert Earl Keen, Lyle Lovett and Townes Van Zandt.

Trending on Billboard

The label was part of 12 Grammy-winning projects, including five projects that won a Grammy for best bluegrass album, from artists including Parton, Del McCoury Band and Nashville Bluegrass Band. Parton recorded albums like 2001’s best bluegrass album-winning The Grass Is Blue and 2002’s Halos & Horns for the label.

Poss sold the label to Welk Music Group in 1998 and became its chairman in 2002. In 2015, Concord Bicycle Music acquired the label.

Beyond his work at Sugar Hill Records, Poss was instrumental in the formation of the International Bluegrass Music Association (IBMA), and served as a founding board member of the Bluegrass Music Hall of Fame and Museum. He was also honored with the IBMA’s distinguished achievement award in 1998 and won the IBMA liner notes of the year honor alongside Jay Orr in 2007 for penning the liner notes for the project Sugar Hill Records, A Retrospective. He was also honored with a lifetime achievement award from the Americana Music Association in 2006.

IBMA Executive Director Ken White says in a statement, “Barry Poss was not just a champion of roots music and the artists that make it, but he was instrumental in the founding of our organization. For that and so much more, we will always be grateful.”

State Champ Radio

State Champ Radio